International Trade and Finance: Overview and Issues for the 116th Congress

Changes from January 28, 2019 to January 17, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

International Trade and Finance: Overview and Issues for the 116th Congress

Contents

- Overview

- The United States in the Global Economy

- The Role of Congress in International Trade and Finance

- Trade Promotion Authority (TPA)

- Key

U.S. Trade PolicyInternational Economic and Trade Debates - Trade and U.S. Employment

- U.S. Trade Deficit

- Core Provisions in U.S. Trade Agreements

- Managed Trade

- Trade and Technology

- Economics and National Security

- Policy Issues for Congress

- Tariff Actions by the Trump Administration

- Tariffs on U.S. Imports from China (Section 301)

- Tariffs on U.S. Imports of Aluminum and Steel Products (Section 232)

- Tariffs on U.S. Imports of Washing Machines and Solar Products (Section 201)

- Trading Partner Retaliation and Countermeasures

- U.S.-China Trade and Key Issues

- Industrial Policies and Made in China 2025

- China's Policies on Technology, Innovation, and Intellectual Property

- Belt and Road Initiative (BRI)

U.S. Bilateral and RegionalTrading Partner Retaliation and Countermeasures- U.S.-China Economic Issues

- China's Trade Practices

- China's Global Expansion

- U.S. Policy Response

- U.S. Trade Agreements and Negotiations

- Core Provisions in U.S. Trade Agreements

- U.S.-Mexico-Canada Agreement (USMCA)

U.S.-JapanTrade Agreements and Negotiations- U.S.-Mexico-Canada Agreement (USMCA)

- U.S.-South Korea (KORUS) FTA Modifications

U.S.-European UnionTrade Negotiations- U.S.-

JapanEuropean Union Trade Negotiations - U.S.-United Kingdom Trade Negotiations

- Proliferation of Non-U.S. Trade Agreements

- The World Trade Organization (WTO)

- Multilateral and Plurilateral Negotiations

- Dispute Settlement

- Challenges and Future Direction

- Intellectual Property Rights

- Labor and Environment

- Select U.S. Import Policies

- Trade Preferences

- Trade Remedies

- Miscellaneous Tariff Bills (MTBs)

- International Investment

- Committee on Foreign Investment in the United States (CFIUS)

- International Investment Agreements (IIAs)

- U.S. Trade Finance and Promotion Agencies

- Export-Import Bank of the United States (Ex-Im Bank)

- Overseas Private Investment Corporation (OPIC) and the BUILD Act

- Export Controls and Sanctions

- Dual-Use Products and Export Controls

- Economic Sanctions

- International Financial Institutions (IFIs) and Markets

- International Economic Cooperation (G-7 and G-20)

- International Monetary Fund (IMF)

- Multilateral Development Banks (MDBs)

- Exchange Rates and Currency Manipulation

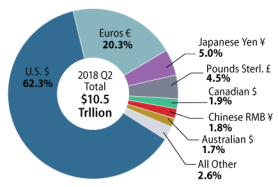

- Role of the U.S. Dollar

- Ongoing and Potential Economic Crises

- Looking Forward

Figures

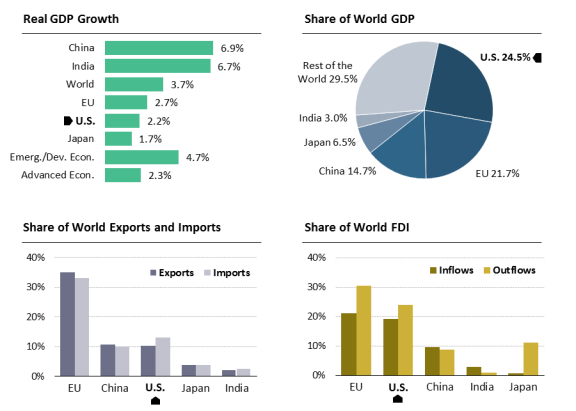

- Figure 1. Snapshot of the World Economy in

20172018

- Figure 2. U.S. Employment Supported by Exports

- Figure 3.

Annual U.S. Trade Affected by Recent Tariff Actions - Figure 4. Three Rounds of Implemented Tariffs Hikes

- Figure 4. Annual U.S. Trade Affected by Recent Tariff Actions

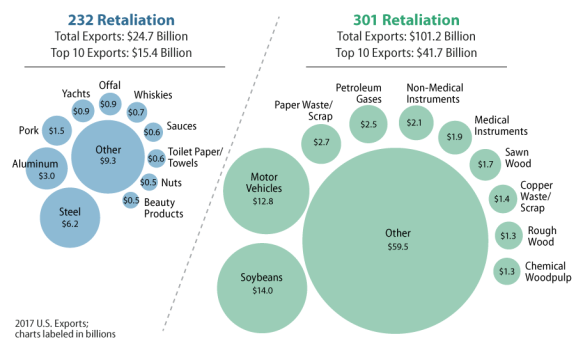

- Figure 5. U.S. Exports Facing

Retaliatory TariffsRetaliation

- Figure 6. U.S.-China

Merchandise Trade Balance: 2001-Trade in 2018 - Figure 7. U.S.-China Trade in 2018 and 2019

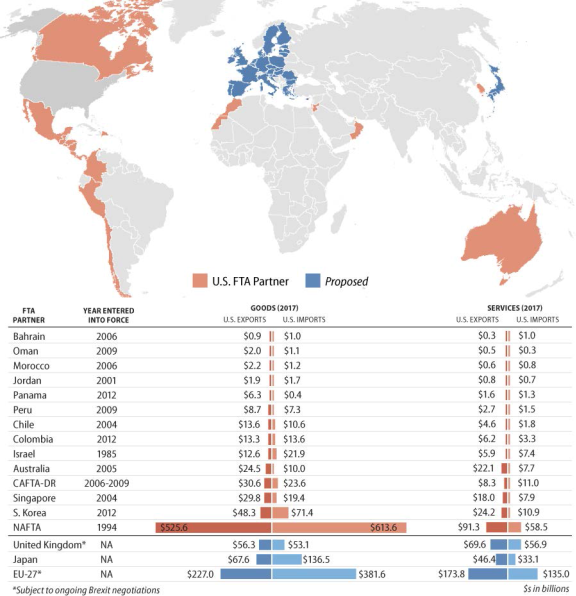

Trade with Current and Proposed FTA Partners - Figure 8. U.S.

-South Korea Trade Trade with Current and Proposed FTA Partners

- Figure 9. U.S.-

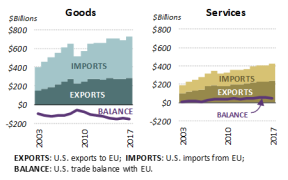

EUJapan Bilateral Trade - Figure 10. U.S.

Top Trading Partners in 2017-EU Trade

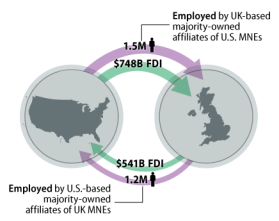

- Figure 11. U.S.-UK

Direct InvestmentTrade and Direct Investment (Stock)

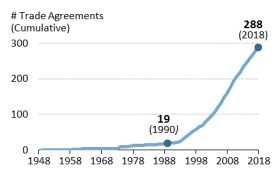

- Figure 12. Trade Agreements Worldwide

- Figure

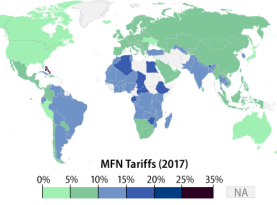

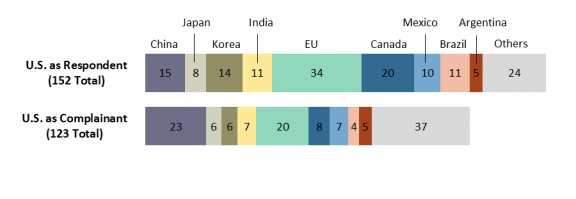

1313. Average Applied Most-Favored Nation (MFN) Tariffs - Figure 14. WTO Disputes Involving the United States

- Figure 15.

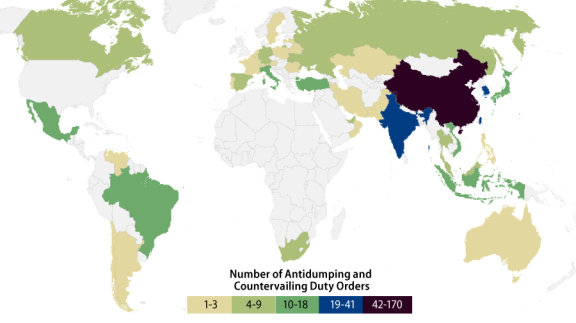

U.S. Antidumping and Countervailing Duty Orders by CountryRegulatory Exclusivity in USMCA Countries

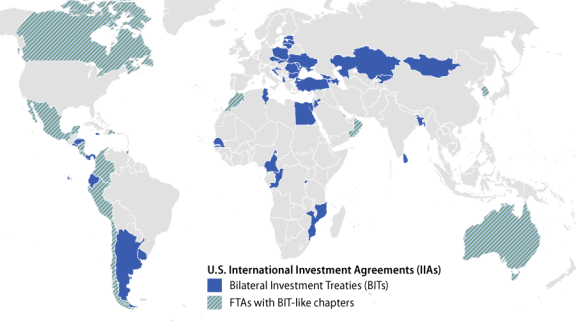

- Figure 16. U.S. International Investment Agreements

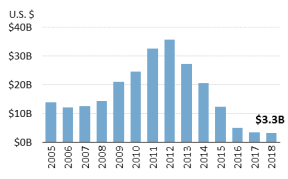

- Figure 17. Ex-Im Bank Authorizations of Finance and Insurance Transactions

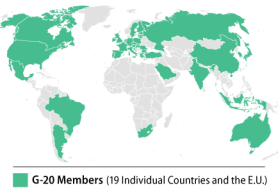

- Figure 18. G-20 Members

- Figure 19. Chinese Yuan per U.S. Dollar

- Figure 20. Central Bank Reserves

Summary

The U.S. Constitution grants authority to Congress to lay and collect duties and regulate foreign commerce. Congress exercises this authority in numerous ways, including through oversight of trade policy and consideration of legislation to implement trade agreements and authorize trade programs. Policy issues cover areas such as U.S. trade negotiations, U.S. trade and economic relations with specific regions and countries, international institutions focused on trade, tariff and nontariff barriers, worker dislocation due to trade liberalization, enforcement of trade laws and trade agreement commitments, import and export policies, international investment, economic sanctions, and other trade-related functions of the federal government. Congress also has authority over U.S. financial commitments to international financial institutions and oversight responsibilities for trade- and finance-related agencies of the U.S. government.

Issues in the 116th Congress

During his first two years in office, President Trump has focused on reevaluating many U.S. international trade and economic policies and relationships. The President's focus on these issues could continue over the next two years. Broad policy debates during the 116th Congress may include the impact of trade and trade agreements on the U.S. economy, including U.S.To date, the 116th Congress has considered and passed legislation relating to a number of international trade and finance issues, in addition to conducting numerous hearings and other oversight of a wide variety of policy issues in this area. The House passed in December 2019, and the Senate passed in January 2020, the implementing legislation for the United States-Mexico Canada Trade Agreement (USMCA), a free trade agreement which would revise and modernize the North American Free Trade Agreement (NAFTA). The 116th Congress also reauthorized the Export-Import Bank, the U.S. export credit agency that helps finance U.S. exports, for a record seven years; funded the new U.S. Development Finance Corporation, which promotes private investment in developing countries, allowing the DFC to launch operations in January 2020; and approved U.S. participation in a capital increase at the World Bank. Congress also passed legislation to expand U.S. sanctions to advance a number of U.S. foreign policy objectives.

Broad policy debates during the 116th Congress have included the impact of trade and trade agreements on the U.S. economy and jobs; the causes and consequences of the U.S. trade deficit; the implications of technological developments for U.S. trade policy; and the intersection of economics and national security. Among many others, the potentially more prominent issues in this area that the 116th Congress may consider arecontinue focus on during its second session include:

- the use and impact of unilateral tariffs imposed by the Trump Administration under various U.S. trade laws, as well as potential legislation that alters the authority granted by Congress to the President to do so;

- legislation to implement the proposed United States-Mexico-Canada Trade Agreement (USMCA), which would revise and modernize the North American Free Trade Agreement (NAFTA);

the Administration's launch of bilateralthe expiration of trade promotion authority (TPA) in 2021 and the terms under which it might be renewed;- U.S. engagement with the World Trade Organization (WTO) and its dispute settlement body, proposals for WTO reform, and the future direction of the multilateral trading system;

the Administration's trade negotiations with the European Union, Japan, and the United Kingdom, as well as key provisions in trade agreements, including on intellectual property rights, labor, the environment, and dispute settlement;- U.S.

engagement with the World Trade Organization (WTO), proposals for WTO reform, and the future direction of the multilateral trading system; U.S.-China trade relations, including investment issues-China trade and economic relations and ongoing bilateral trade talks to address U.S. trade concerns, including with respect to investment, intellectual property rights protection, forced technology transfer, currency issues, and market access liberalization;- the future of U.S.-Asia trade and economic relations, given President Trump's withdrawal of the United States from the proposed Trans-Pacific Partnership (TPP) and China's expanding Belt and Road Initiative and trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP);

- the Administration's use of quotas to achieve some of its trade objectives, and whether these actions represent a shift in U.S. policy towards "managed trade

"; - monitoring the implementation of legislation passed by the 115th Congress, including changes to the Committee on Foreign Investment in the United States (CIFUS) and export controls, as well as the creation of a new U.S. International Development Finance Corporation;

- re-authorization of the Export-Import Bank, the U.S. export credit agency that helps finance U.S. exports;

- oversight of international trade and finance policies to support foreign policy goals, including sanctions on Iran, North Korea, Russia, and other countries;

- shifts in U.S. leadership of international economic policy coordination at the Group of 7 (G-7) and the Group of 20 (G-20) under the Trump Administration;

- legislation to fund the Administration's commitment to increase U.S. contributions to the World Bank, as well as potential U.S.-led reforms to the institution; and

major developments in financial markets, including the impact of other countries' exchange rate polices on the U.S. economy, high levels of debt in emerging markets, potential economic crises, and the role of the U.S. dollar in the global economy;" and major developments in the global economy and shifts in U.S. leadership of the global economy under the Trump Administration.

Overview1

Members of Congress may address numerous ongoing and new policy issues in the second session of the 116th Congress. The changing dynamics and composition of international trade and finance can affect the overall health of the U.S. economy, the success of U.S. businesses and workers, and the U.S. standard of living. They also have implications for U.S. geopolitical interests. Conversely, geopolitical tensions, risks, and opportunities can have major impacts on international trade and finance. These issues are complex and at times controversial, and developments in the global economy often make policymaking more challenging. Congress is in a unique position to address these and other issues given its constitutional authority for legislating and overseeing international commerce.

TheA major focus of the 115116th Congress during its first session was overseeing the Trump Administration's evolving trade policy. The Trump Administration's approach to international trade arguably represents a significant shift from the approaches of prior administrations, in that it questions the benefits of U.S. leadership in the rules-based global trading system and expresses concern over the potential limits that this system may place on U.S. sovereignty. As such, the Administration's withdrawal from the proposed Trans-Pacific Partnership (TPP), imposition of unilateral trade restrictions on various U.S. imports, renegotiation of the North American Free Trade Agreement (NAFTA), modification of certain provisions in the U.S.-South Korea (KORUS) free trade agreement (FTA), and launch of an extensiveeffectiveness of this system. As such, the Administration's imposition of unilateral trade restrictions on various U.S. imports—particularly from China, efforts to ratify the U.S.-Mexico-Canada Agreement (USMCA), trade negotiations with China, Japan, and the European Union, and continued review of U.S. participation in the World Trade Organization (WTO) were among the most notable developments in U.S. trade policy inover the past two yearsyear. Other issues before Congress included approvingoverseeing the implementation of legislation to (1) strengthen the process used to review the national security implications of foreign direct investment transactions in the United States; (2), as well as to modernize U.S. development finance tools tothat help advance U.S. national security and economic interests and global influence; and (3) provide temporary tariff suspensions and reductions—through Miscellaneous Tariff Bills—on certain products not available domestically. Continued focus on economic sanctions against Turkey, Russia, North Korea, Iran, Cuba, and other countries were also of interest to many in Congress.

The Trump Administration has displayed a more critical view than past administrations of U.S. trade agreements, made greater use of various U.S. trade laws with the potential to restrict U.S. imports, and focused on bilateral trade balances as a key metric of the health of U.S. trading relationships. As part of this shift in focus, the Administration has placed a greater emphasis on "fair" and "reciprocal" trade. China has also been a center of attention as the Administration has soughtseeks to address longstanding concerns over its policies on intellectual property (IP), forced technology transfer, and innovation. Citing these concerns and others, the President has unilaterally imposed trade restrictions on a number of U.S. imports under U.S. laws and authorities—most of which have been used infrequently since the establishment of the WTO in 1995. During the 115th Congress' secondfirst session, many Members weighedcontinued to weigh in on the President's trade actions. While some supported his use of unilateral trade measures, others raised concerns about potential negative economic implications of these actions for U.S. firms, farmers and workers, and the risks they may pose to the rules-based international trading system. Several Members introduced bills to amend some of the President's trade authorities—for example, to require congressional consultation or approval before imposing new trade barriers on imports for national security reasons.

The implications of changes in the U.S. trade policy landscape for the 116th Congressnext year will depend on a number of factors, including the impact of the Administration's trade actions—particularly increased tariffs—on U.S. industries, firms, workers, and supply chains; the reaction of U.S. trading partners; and the extent to which future actions are in line with core U.S. commitments and obligations under the WTO and other trade agreements. The U.S.-China trade and economic relationship is complex and wide-ranging, and it will likelymay entail continued close examination by Congress. In addition to specific trade practices of concern, Congress may continue to scrutinize the economic and geopolitical implications of China's Belt and Road Initiative (BRI), which finances and develops infrastructure projects across a number of countries and regions. Congress may also examine the U.S.-China Phase One trade deal and next steps, and the ongoing economic implications of China's industrial policies in high technology sectors, which could potentially challenge U.S. firms and disrupt global markets.

How these issues play out, combined with the evolving global economic landscape, raise potentially significant legislative and policy questions for Congress. The 116th CongressMembers may consider (1) legislation to implement the U.S.-Mexico-Canada Agreement; (2the implementation of the USMCA, once it is ratified by the government of Canada; (2) next steps in future U.S.-China trade talks and the next phase of the U.S.-Japan trade agreement negotiations; (3) measures to reassert its constitutional authority over tariffs and other trade restrictions or to narrow the scope of how the president can use delegated authorities to impose such restrictions; (34) the extent to which past U.S. FTAs should be modernized or revised and, if so, in what manner; (45) what priority should be given to negotiating new U.S. FTAs with the European Union, the United Kingdom, Japan, and other trading partners, as well as the scope of negotiations; and (56) the impact of FTAs excluding the United States on U.S. economic and broader interests, and the appropriate U.S. response to the proliferation of such agreements. Another major issue is the role of the United States in the multilateral, rules-based trading system underpinned by the WTO. Historically, U.S. leadership in the global trading system has enabled the United States to shape the international trade agenda in ways that both advance and defend U.S. interests. The growing debate over the role and future direction of the WTO may raise important issues for Congress, such as how current and future WTO agreements affect the U.S. economy, the value of U.S. membership and leadership in the WTO, and the need to update or adapt WTO rules to reflect 21st century realities. Such updates might address the proliferation of global supply chains, advances in technology, new forms of trade barriers, and market-distorting government policies.

This report provides a broad overview of select topics in international trade and finance. It is not an exhaustive look at all issues, nor is it a detailed examination of any one issue. Rather, it provides concise background information of certain prominent issues that have been the subject of recent discussion and debate, and that may come before the 116th Congress. However, it does during its second session. It also include references to more in-depth CRS products on the issues.

The United States in the Global Economy2

In 20172018, the global economy began to display signs of a synchronized recovery from the 2008-2009 global financial crisis and deep economic recession.slowdown, which some analysts contend continued into 2019.3 The International Monetary Fund (IMF) estimates that real global gross domestic product (GDP) rosefell from 3.38% in 20162017 to 3.76% in 20172018—the most recent year for which annual data are available (Figure 1). As a group, advanced economies grew 2.3% (updown from 1.72.5% in 2016),32017),4 while emerging market and developing economies grew 4.7% (up5% (down from 4.48% in 20162017). The growth performance of major U.S. trading partners diverged widely in 20172018, affecting both their bilateral trade and investment relations with the United States and their exchange rates against the U.S. dollar. Canada more than doubled itsThe European Union (EU)'s real GDP growth rate, fell from 1.42.5% in 2016 to 3.1% in 2017. China also continued to grow, albeit at a pace of 6.9% in 2017. Among the United States' top trading partners, India and Mexico experienced lower growth in 2017 than in 20162017 to 1.9% in 2018, while that of Canada dropped to 1.9% (from 3.0% in 2017). Other top U.S. trading partners, including China, Mexico, Japan, South Korea, India, and Taiwan experienced lower growth in 2018 than in 2017.

| 2018 |

|

|

Source: Figure created by CRS with data from the International Monetary Fund, World Economic Outlook Database, October Notes: |

The IMF forecasts improvedweaker performance in the short-term fromfor both advanced economies—2.11.7% for 2019—and emerging market and developing economies—4.73.9% in 2019.45 This growth is projected to slowimprove in the medium term, however, as output gaps close and advanced economies return to their potential output paths.56 Beyond the short term, growth rates are expected to fall below pre-recession levels, as the aging populations and shrinking labor forces in advanced economies are expected to act as a drag on expansion. Overall fiscal policy is expected to remain expansionary in 2019, but begin to turn contractionary by 2020. Monetary policy may remain supportive in the Eurozone and Japan, but may continue to tighten in the United States—although the speed of U.S. monetary tightening has been thrown into question by recent2020. In addition, monetary policy may remain supportive in the Eurozone and Japan. In early 2019, the U.S. Federal Reserve reversed its policy of slight monetary tightening due to U.S. and global economic and financial market developments. More broadly, global financial conditions are expected to remain generally accommodative.

Emerging markets (EMs) as a group face growing vulnerabilities to their economies due to uncertainties about global trade, depreciating currencies and risks of capital flight, volatile equity markets, large debts denominated in foreign currencies, and, in certain areas, the lack of deeper economic reform. Increased uncertainty over political and policy direction could continue to constrain the rate of growth in Argentina, Brazil, Pakistan, Turkey, and South Africa. Additionally, China is expected to experience slower growth rates in the coming years, as the economy continues to rebalanceis affected by U.S.-China trade tensions and rebalances away from investment toward private consumption, and from industry to services. The rise in China's nonfinancial debt as a share of GDP is likely to contribute to this downward trend. In Venezuela, the economy has collapsed, with the inflation rate forecast by the IMF to have exceeded 1,000reach 200,000% in 20182019. In addition, declininglow commodity prices, particularly oil, could increase concerns in commodity-producing economies—many of them EMs—and destabilize national incomes. These and other developments could add to uncertainties in global financial markets, raise risks for U.S. banks of nonperforming loans, complicate the efforts of some banks to rebuild their capital bases, and potentially dampen prospects for long-term gains in productivity and higher rates of economic growth.

The United States continues to experience strong economic fundamentals and remains a relatively bright spot within the global economy, which could help it sustain its position as a main driverone of the main drivers of global economic growth. With close to 54% of the world's population, it accounted for almost 2524% of the world's output in nominal U.S. dollars, more thanclose to 10% of its exports (goods and services), and 16approximately 21% of its growth in 2017.62018.7 The U.S. economy grew faster in 20172018 than in 20162017: U.S. real GDP increased 2.29% in 20172018, up from 1.56% in 2016 and 2.4% in 2017. The latest U.S. data show signs of continuing relative strong performance in 20182019, with the IMF forecasting 2.94% growth and the U.S. Federal Reserve estimating growth between 2.91% and 2.4%.8 (According to the most recent official estimate, in the third quarter of 2019, real U.S. GDP increased at an annual rate of 2.1%, up from 2.0% in the second quarter.9) Some forecasts indicate that U.S. growth could decelerate in the coming years, for reasons such as% and 3.2%.7 Some forecasts indicate that U.S. growth could stop accelerating by 2019 due to higher commodity prices, upward inflationary pressures, a return to monetary policy tightening by the U.S. Federal Reserve, trade policy uncertainties, and global risks.810 Labor market data indicate that the United States is at—or close to—might be at full employment, as the jobless rate reached 4.13.5% at the end of 20172019 and is projected to have fallenremain below 4.0% in 2018. The decline in the price of oil 2020. The relatively low price of oil (and fluctuations thereof) is affecting not only the global economy, but also the U.S. economy. While the dropdrops in energy prices may raise U.S. consumers' real incomes and improve the competitive position of some U.S. industries, these positive effects may be offset to some extent by a drop in employment and investment in the U.S. energy sector.

With the improving global economic outlookAmid potential downside risks in the global economy, the IMF and the WTO had projected a rebound inhave downgraded their forecasts for trade growth for 2018 and 2019. However, amid several downside risks, including risingin 2019 and 2020. Risks include continued trade tensions between major economies like the United States and China, and heightenedcontinued trade policy uncertainty, the IMF and WTO now expect global trade growth to slow.9.11 Restrictive trade policy measures imposed by the United States and some of its major trading partners may be affectingcontinue to affect trade flows and prices in targeted sectors. Analysts claim that some recent policy announcements also have harmed business outlooks and investment plans, due to heightened concern over possible disruptions to supply chains and the risks of potential increases in the scope or intensity of trade restrictions.1012 The Organization for Economic Cooperation and Development (OECD) projects that a further rise in trade tensions may have additional adverse effects on global investment and jobs.11

In addition, exchange rates continue to experiencein 2018, exchange rates experienced volatility, with a number of currencies depreciating against the U.S. dollar, including the Chinese renminbi, Argentine peso, Turkish lira, and South African randand Brazilian real. Volatile currency and equity markets—combined with uncertainties over global trade and rates of inflation that remain below the target levels of a number of central banks—could further complicate current efforts ofby the U.S. Federal Reserve to continue tighteningnormalize monetary policy.14 Other major economies, such as Eurozone and Japan, may continue to pursue unconventional monetary policies. Uncertainties in global financial markets could put additional upward pressure on the U.S. dollar, as investors may seek "safe haven" currencies and dollar-denominated investments. For some economies, volatile currencies and continued low commodity prices could add to debt issues, raising the prospect of defaults and potential economic crises.

The Role of Congress in International Trade and Finance12

15

The U.S. Constitution assigns authority over foreign trade to Congress. Article I, Section 8, of the Constitution gives Congress the power to "lay and collect Taxes, Duties, Imposts, and Excises" and to "regulate Commerce with foreign Nations." For the first 150 years of the United States, Congress exercised its power to regulate foreign trade by setting tariff rates on all imported products. Congressional trade debates in the 19th century often pitted Members from northern manufacturing regions, who benefitted from high tariffs, against those from largely southern raw material exporting regions, who gained from and advocated for low tariffs.

A major shift in U.S. trade policy occurred after Congress passed the highly protective "Smoot-Hawley" Tariff Act of 1930, which significantly raised U.S. tariff levels and led U.S. trading partners to respond in kind. As a result, world trade declined rapidly, exacerbating the impact of the Great Depression. Since the passage of the Tariff Act of 1930, Congress has delegated certain trade authority to the executive branch. First, Congress enacted the Reciprocal Trade Agreements Act of 1934, which authorized the President to enter into reciprocal agreements to reduce tariffs within congressionally pre-approved levels, and to implement the new tariffs by proclamation without additional legislation. Congress renewed this authority periodically until the 1960s. Subsequently, Congress enacted the Trade Act of 1974, aimed at opening markets and establishing nondiscriminatory international trade norms for nontariff barriers as well. Because changes in nontariff barriers in reciprocal bilateral, regional, and multilateral trade agreements may involve amending U.S. law, the agreements require congressional approval and implementing legislation. Congress has renewed or amended the 1974 Act five times, which includes granting "fast-track" trade negotiating authority. Since 2002, "fast track" has been known as trade promotion authority (TPA). In 2015, Congress authorized a new TPA through July 1, 2021 (see "Trade Promotion Authority (TPA)" below).

Congress also exercises trade policy authority through the enactment of laws authorizing trade programs and measures to address unfair and other trade practices. It alsoAdditionally, it conducts oversight of the implementation of trade policies, programs, and agreements. These include such areas as U.S. trade agreement negotiations, tariffs and nontariff barriers, trade remedy laws, import and export policies, economic sanctions, and the trade policy functions of the federal government.

Over the years, Congress has authorized a number of trade laws that delegate a range of authorities to the President to investigate and take actions on imported goods for national security purposes (Section 232, Trade Expansion Act of 1962), trade remedies to counter dumping and subsidy practices by other countries, unfair trade practices (Section 301, Trade Act of 1974), or safeguard measures (Section 201, Trade Act of 1974). The Trump Administration is using these actsprovisions to impose steel and aluminum tariffs on major trading partners and for possible tariffs on vehicles and auto parts for national security purposes,16 and on a range of Chinese products for what the Administration deems as unfair trading practices, including intellectual property theft and other practices. Some Members of Congress have opposed the use of these tariffs and in the 116thits second session, Congress may seek to revisit or curtail these statutes.

Additionally, Congress has an important role in international investment and finance policy. Under its treaty powers, the U.S. Senate considers bilateral investment treaties (BITs), and Congress sets the level of U.S. financial commitments to the multilateral development banks (MDBs), including the World Bank and the International Monetary Fund (IMF). It also funds the Office of the U.S. Trade Representative (USTR) and other trade agencies, and authorizes the activities of various agencies, such as the Export-Import Bank (Ex-Im Bank) and the newly operational U.S. International Development Finance Corporation (DFC), which is the successor to the Overseas Private Investment Corporation (OPIC). Congress also has oversight responsibilities over these institutions, as well as the Federal Reserve and the U.S. Department of the Treasury, whose activities can affect international capital flows and short-term movements in the international exchange value of the U.S. dollar. Congress also closely monitors developments in international financial markets that could affect the U.S. economy.

Trade Promotion Authority (TPA)13

17

Trade Promotion Authority (TPA) is a primary means by which Congress asserts its constitutional authority over trade policy, particularly U.S. trade agreements. TPA—the Bipartisan Congressional Trade Priorities and Accountability Act of 2015 (P.L. 114-26)—which was signed by President Obama on June 29, 2015, is in place until July 1, 2021. Any agreement signedentered in by that date, such aswhich includes the United States-Mexico-Canada (USMCA)Agreement, is eligible for consideration under TPA. TPA allows implementing bills submitted to Congress by the President for specific authorizes qualifying implementing legislation for trade agreements to be considered under expedited legislative procedures—limited debate, no amendments, and an up or down vote—provided the President observes certain statutory obligations in negotiating trade agreements. These obligations include achieving progress in meeting congressionally defined U.S. trade policy negotiating objectives, as well as congressional notification and consultation requirements before, during, and after the completion of the negotiation process.

|

TPA: Key Facts

|

The primary purpose of TPA is to preserve the constitutional role of Congress with respect to the consideration of implementing legislation for trade agreements that require changes in domestic law, which includes tariffs, while also bolstering. Another rationale for TPA has been to bolster the negotiating credibility of the executive branch by ensuring that trade agreements will not be changed once concluded. However, more recent FTAs, including the USMCA, have undergone additional negotiation after conclusion, perhaps eroding some of this rationale for TPA. Since the authority was first enacted in the Trade Act of 1974 (P.L. 93-618), Congress has renewed or amended TPA fiveTPA four times (1979, 1984, 1988, 2002, and 2015) and amended it in 1984 to allow for the negotiation of bilateral agreements. In addition, TPA legislative procedures are considered rules of the House and Senate, and, as such, can be changed at any time. Precedent exists for implementing legislation to have its eligibility for expedited treatment under TPA removed by Congress. In 20192020, Congress may use TPA to consider the USMCA or other agreements negotiated by the Administration.

Key U.S. Trade Policy Debates14

trade agreements negotiated by the Administration. It may also begin debate and examine future prospects for renewing and potentially revising the authority in light of its expiration in 2021.

Key International Economic and Trade Debates18

The United States has been a driving force in breaking down trade and investment barriers across the globe and constructing an open and rules-based global trading system through a wide range of international institutions and agreements. Since 1934, U.S. policymakers across political parties have recognized the importance of pursuing trade policies that promote more open, rules-based, and reciprocal international commerce, while being cognizant of potential costs to specific segments of the population, particularly through greater competition.1519 Although there is a general consensus that, in the aggregate, the overall economic benefits of reducing barriers to trade and investment outweigh the costs, the processes of trade and financial liberalization, and of globalization more broadly, have presented both opportunities and challenges for the United States. Many U.S. consumers, workers, farmers, firms, and industries have benefited from increased trade. On the consumption side, U.S. households have enjoyed lower product prices and a broader variety of goods and services—some of which the United States does not produce in large quantities. On the production side, stronger linkages to the global economy force U.S. industries and firms to focus on areas in which they have a comparative advantage, provide them with export and import opportunities, enable them to realize economies of scale, and encourage them to innovate.

At the same time, some stakeholders argue that globalization is not inclusive, benefiting some more than others. They point to job losses, stagnant wages, and rising income inequality among some groups—as well as to environmental degradation—as indicators of the negative impact of globalization on the U.S. economy, although the causes of these trends are highly contested. Some policymakers also perceive growing bilateral U.S. trade deficits as evidence that U.S. trade with other nations is "uneven" or that foreign countries engage in "unfair" trade practices. Others view many of the existing global trade rules as outdated, since they do not reflect the realities of the 21st century—particularly when it comes to technological advances, new forms of trade (such as digital trade), and threats that international trade may pose to U.S. national securitymarket-distorting government policies. Finally, some experts argue that the 2008-2009 financial crisis caused painful adjustment and costs for some segments of the population, which have exacerbated concerns related to U.S. trade policy and have led to increased domestic nationalism.

A longstanding objective of some Members of Congress and administrations has been to achieve a "level playing field" for U.S. industries, firms,farmers and workers, and to preserve the United States' high standard of living—all while remaining innovative, productive, and internationally competitive, as well as safeguarding those stakeholders who otherwise may be left behind in a fast-changing global economy. Given Congress' constitutional authority over U.S. trade policy, Members are in a unique to position to influence, legislate, and oversee responses that support these goals and that reduce or soften the hardships and costs from international trade.

Trade and U.S. Employment16

20

|

|

Source: Figure created by CRS with data from the U.S. Department of Commerce's International Trade Administration. |

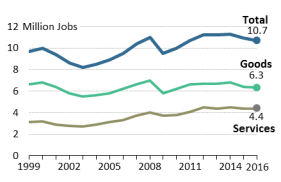

A key question in policy debates over international trade is its impact on U.S. jobs. Trade is one among a number of forces that drive changes in employment, wages, the distribution of income, and ultimately the U.S. standard of living. Most economists argue that macroeconomic forces within an economy, including technological and demographic changes, are the dominant factors that shape trade and foreign investment relationships and complicate efforts to disentangle the distinct impact that trade has on the economy. In a dynamic economy like that of the United States, jobs are constantly being created and replaced as some economic activities expand, while others contract. Various measures are used to estimate the role and impact of trade in the economy and of trade on employment. One measure developed by the U.S. Department of Commerce concludes that, as of 2016 (the most recent year for which data is available), exports support, directly and indirectly, 10.7 million jobs in the U.S. economy: 6.3 million in the goods-producing sectors and 4.4 million in the services sector (Figure 2). According to these estimates, jobs associated with international trade, especially jobs in export-intensive manufacturing industries, earn 18% more on a weighted average basis than comparable jobs in other manufacturing industries.17

Trade and trade liberalization can have a differential effect on workers and firms in the same industry. Some estimates indicate that the short-run costs to workers who attempt to switch occupations or switch industries in search of new employment opportunities may experience substantial effects. One study concluded that workers who switched jobs as a result of trade liberalization generally experienced a reduction in their wages, particularly in occupations where workers performed routine tasks.1822 These negative income effects were especially pronounced in occupations exposed to imports from low-income countries. In contrast, occupations associated with exports experienced a positive relationship between rising incomes and growth in export shares. As a result of the differing impact of trade liberalization on workers and firms, Congress created Trade Adjustment Assistance (TAA) programs to mitigate the potential adverse effects of trade liberalization on workers, firms, and farmers (see text box below).

|

Trade Adjustment Assistance Trade Adjustment Assistance (TAA) is a group of programs that provide federal assistance to parties that have been adversely affected by foreign trade. TAA programs are authorized by the Trade Act of 1974, as amended, and were last reauthorized by the Trade Adjustment Assistance Reauthorization Act of 2015 (TAARA; Title IV of P.L. 114-27). The largest TAA program, TAA for Workers (TAAW), provides federal assistance to workers who have been separated from their jobs because of increases in directly competitive imports or because their jobs moved to a foreign country. The largest components of the TAAW program are (1) funding for career services and training to prepare workers for new occupations and (2) income support for workers who are enrolled in an eligible training program and have exhausted their unemployment compensation. In most cases, the benefits available to TAAW-eligible workers are more robust than those available to other unemployed workers. The TAAW program is administered at the federal level by the U.S. Department of Labor and In addition to the workers program, TAA programs are also authorized for firms and farmers that have been adversely affected by international competition. TAA for Firms is administered by the U.S. Department of Commerce and the TAA programs have historically been reauthorized in conjunction with other expansionary trade policies. For example, TAARA was enacted alongside renewal of the Trade Promotion Authority in 2015. Supporters of TAA view it as a means of offsetting some of the negative domestic effects of increased imports and increased offshoring that may result from expansionary trade policy. Some TAA supporters have proposed further expanding TAAW eligibility, such as including domestic workers who are adversely affected by reduced exports due to tariffs. Opponents of TAA typically view the program as duplicative, noting that trade-affected workers can be served by more general workforce programs that serve all unemployed workers. |

U.S. Trade Deficit20

24

The overall U.S. trade deficit, or more broadly the current account balance, represents an accounting principle that expresses the difference between the country's exports and imports of goods and services. The United States has experienced annual current account deficits since the mid-1970s. Congressional interest in the trade deficit has been heightened by the Trump Administration's approach to international trade. The Administration has used the U.S. trade deficit as a barometer for evaluating the success or failure of the global trading system, U.S. trade policy, and U.S. trade agreements. It has characterized the trade deficit as a major factor in a number of perceived ills afflicting the U.S. economy—including the rate of unemployment in some sectors and slow gains in wages—and partially as the result of unfair trade practices by foreign competitors.

Many economists, however, argue that this characterization misrepresents the nature of the trade deficit and the role of trade in the U.S. economy.25 In general, traditional economic theory holds that the overall size of the U.S. trade deficit stems largely from U.S. macroeconomic policies and an imbalance between saving and investment in the U.S. economy. Currently, the demand for capital in the U.S. economy outstrips the amount of gross savings supplied by households, firms, and the government (a savings-investment imbalance). Therefore, many observers argue that attempting to alter the trade deficit without addressing the underlying macroeconomic issues would be counterproductive and create distortions in the economy. A concern expressed by some analysts and policymakers is the debt accumulation associated with sustained trade deficits. They argue that the long-term impact on the U.S. economy of borrowing to finance imports depends on whether those funds are used for greater investments in productive capital with high returns that raise future standards of living, or whether they are used for current consumption. These concerns and the various policy approaches that have been used to alter the savings-investment imbalance in the economy are beyond the scope of this report.

Core Provisions in U.S. Trade Agreements21

U.S. free trade agreements (FTAs) generally are negotiated on the basis of U.S. trade negotiating objectives established by Congress under Trade Promotion Authority (TPA). U.S. FTAs have evolved in the scope and depth of their commitments since the 1980s.22 Since the first bilateral U.S. FTA with Israel, which is only 14 pages in length and focused primarily on the elimination of tariffs, the United States has pursued increasingly comprehensive and enforceable commitments. The North American Free Trade Agreement (NAFTA), which entered into force in 1994, was the first FTA that incorporated many of the rules in more recent U.S. FTAs. It initiated a new generation of U.S. trade agreements in the Western Hemisphere and other parts of the world, influencing negotiations in areas such as market access, rules of origin, intellectual property rights (IPR), foreign investment, and dispute resolution. It was the first trade agreement to include provisions on IPR protection, labor, and the environment. Although not all FTAs are exactly the same, core provisions incorporated into most U.S. FTAs include the following:

- Tariffs and Market Access. Elimination of most tariffs and nontariff barriers on goods, services, and agriculture over a period of time, and specific rules of origin requirements.

- Services. Commitments on national treatment, most-favored nation (MFN) treatment, and prohibition of local presence requirements.

- IPR Protection. Minimum standards of protection and enforcement for patents, copyrights, trademarks, and other forms of IPR. FTAs after NAFTA have new commitments reflecting standard protection similar to that found in U.S. law.

- Foreign Investment. Removal of investment barriers, basic protections for investors, with exceptions, and mechanisms for dispute settlement.

- Labor and Environmental Provisions. Commitments to enforce one's own laws in NAFTA evolved to commitments in later FTAs to adopt, maintain, and not derogate from laws incorporating specific standards, among other provisions.

- Government Procurement. Commitments to provide certain levels of access to and nondiscriminatory treatment in parties' government procurement markets.

- Dispute Settlement. Provisions for dispute settlement mechanism to resolve disputes regarding each party's adherence to agreement obligations.

- Other Provisions. Other core provisions have included those related to competition policy, monopolies, and state enterprises, sanitary and phytosanitary standards, safeguards, technical barriers to trade, transparency, and good governance.

Before an FTA can enter into force, it must be ratified by the governments of parties involved. In the United States, Congress must approve an FTA before it can enter into force. Before voting on an agreement, Congress may review whether the objectives it set out in TPA legislation were followed in the negotiation of the agreement, evaluate the overall economic effect on the U.S. economy, including through a mandated report by the U.S. International Trade Commission (ITC), determine whether the agreement would promote U.S. standards such as IPR, labor, and the environment in other countries, or consider the enforceability of the agreement and its rules.

Managed Trade23

.

Managed Trade26

During 2018 and 2019, the Trump Administration turned to quotas and quota-like arrangements to achieve some of its trade objectives. It negotiated potential quotas on autos through side letters to the proposed United States-Mexico-Canada Agreement (USMCA)27, as well as quota arrangements that allowed South Korea, Brazil, and Argentinacertain U.S. trading partners to avoid U.S. tariff increases on steel and aluminum imports. In addition, in trade negotiations, the Administration has demanded that China increase its purchases of U.S. agricultural products by specific amounts. Some Members of Congress Some Members of Congress and analysts have questioned whether these actions represent an undesirable shift in U.S. trade policy—towards one that some analysts have labeled managed trade. Managed trade generally refers to government efforts to achieve measurable results by establishing—through quantitative restrictions on trade and other numerical targeted approaches—specific market shares or targets for certain products. These are met through mutual agreement or under threat of trade action (e.g., increased tariffs). TheDuring the second session, the 116th Congress may wish to examine the extent to which the Administration is adopting such an approach, including its effectiveness and impact on U.S. and international trade.

Advocates of managed trade policies contend that, by negotiating results-oriented agreements and using the size of the U.S. economy as leverage, the United States can ensure that trade with certain trading partners is "fair," "balanced," and "reciprocal." In addition, they argue, it will force countries to change their distortive economic policies, decrease the size of the U.S. trade deficit and, by reducing U.S. imports, help strengthen certain U.S. industries and boost U.S. employment. Other policymakers view these measures as protectionist and harmful to the economy. Many economists question the efficacy of prodding U.S. trading partners into negotiating or accepting quotas or numerical targets, as well as the ability of the state, rather than market forces, to provide the most efficient allocation of scarce resources—even when attempting to respond to trade-distorting measures by trading partners. They also note that policies that restrict U.S. imports and boost U.S. exports may not decrease the overall size of the U.S. trade deficit, as it is primarily the result of macroeconomic forces—namely the low level of U.S. savings relative to total investment. According to some observers, a move away from a market-driven, multilateral rules-based system to one driven by numerical outcomes and targets could lead to increasing trade restrictions, retaliation or replication by other countries, higher prices, lower global economic growth, and the erosion of the international trading system.

Trade and Technology24

28

The rapid growth of digital technologies has created new opportunities for U.S. consumers and businesses but also new challenges in international trade. For example, consumers today access e-commerce, social media, telemedicine, and other offerings not available thirty years ago. Businesses use advanced technology to reach new markets, track global supply chains, analyze big data, and create new products and services. New technologies facilitate economic activity but also create new trade policy questions and concerns.

No comprehensive agreement on digital trade exists in the WTO nor is there a single set of international rules or disciplines that govern key digital trade issues. The lack of multilateral rules governing the digital economy has led, on the one hand, to countries establishing diverging national policies that may create discriminatory and trade distorting barriers and, on the other hand, to efforts to establish common global rules through trade negotiations.

Recent international negotiations have sought to improve and remove barriers to market access for trade in digital goods and services and also address other concerns, such as cybersecurity and privacy protection. Internationally-tradedTraditional trade barriers such as tariffs or export controls can hinder trade in information and communication technologies (ICT) products, whether physical goods (e.g., laptops) or emerging technologies, including algorithms and artificial intelligence, may be subject to traditional trade barriers such as tariffs or export controls. Nontariff barriers impede U.S. firms' market access by limiting what companies can offer or how they can operate in a foreign market, such as requiring local content or partners. Internet sovereignty is a challenge for firms who seek market access in countries where the government strictly controls what digital data is permitted within its borders, such as what information people can access online. Another often-cited digital trade barrier is data localization requirements or cross-border data flows restrictions that policymakers may enact to promote safety, security, privacy or favor domestic firms but that raise costs and risks for foreign firms.2529 Technology transfer requirements and cybersecurity issues include the infringement of intellectual property and theft of trade secrets, economic espionage, and may touch on national security concerns.

Source: U.N. population statistics, Statista.com, Internetworldstats.com.TheChina, in particular, presents a number of significant opportunities and challenges for the United States in digital trade. The Chinese retail e-commerce is expected to grow 70% from 2018 to 2023, compared to 45% U.S. growth over the same time period, making it an attractive market for U.S. businesses (Figure 3).30 However, China's trade and internet policies reflect state direction and industrial policy and discriminate against foreign companies. For example, under its concept of "internet sovereignty," China seeks to control what digital data is permitted within its borders and how it is used, limiting the free flow of information and individual privacy as well as market access by U.S. firms.

During its second session, the 116th Congress may consider a variety of issues related to technology and trade. These include provisions in the

proposed United States-Mexico-Canada Agreement (USMCA), U.S. participation in e-commerce negotiations at the World Trade Organization (WTO), evolving online privacy policies in the United States and other countries, such as the implementation of the European Union's privacy regulation and pending digital legislation. Additional issues involve technology trade issuesas well as concerns about trade with China, such as those outlined in the Trump Administration's investigation under Section 301 of the Trade Act of 1974 (see section on Tariff Actions by the Trump Administration).

Economics and National Security26

31

U.S. officials have long recognized that U.S. economic interests are vital to national security concerns and have considered the concepts of "geoeconomics"2732 and "economic statecraft" in relation to national security strategy.2833 Broadly speaking, these terms refer to the political consequences of economic decisions or the economic consequences of political trends and the dynamics of national power.

In recent years, a combination of domestic and international forces are challenging the U.S. leadership role in ways that are unprecedented in the post-World War II era. For some observers, these challenges are not just about economic growth and international economic engagement, but directly affect U.S. national security. In their view, China's growing economic competition for leading-edge technologies, in particular, challenges not only U.S. commercial interests, but potentially threatens U.S. national security interests.

According to some observers, since taking office, the Trump Administration has promoted a form of national security that mixes trade and economic relationships with national security, defense, and foreign policy objectives in ways that seem more confrontational than cooperative, more unilateral than multilateral, and more central to its overall agenda than in previous administrations. For example, the Trump Administration has used the U.S. trade deficit and import tariffs to support the defense industrial base by placing tariffs on the imports of strategic security partners as a form of national economic security. Despite existing National Security Strategy (NSS) reports and previous executive branch efforts, there is a view that the United States lacks a holistic, whole-of-government approach for thinking about economic challenges and opportunities in relation to U.S. national security.29 To that end, on April 25, 2018, Senators Young, Merkley, Rubio and Coons introduced S. 2757 , the National Economic Security Strategy Act of 201834 In 2018, Congress adopted and President Trump signed the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA) to expand the scope of national reviews by the Committee on Foreign Investment in the United States (CFIUS) to determine if foreign investment transactions "threaten to impair the national security" of the United States. On January 13, 2020, the U.S. Treasury issued final regulations concerning implementation of various provisions of FIRRMA, which are to become effective on February 13, 2020. Also, on November 7, 2019, Senators Todd Young, Christopher Coons, Jeff Merkley, and Marco Rubio introduced S. 2826, the Global Economic Security Strategy of 2019 to "ensure Federal policies, statutes, regulations, procedures, data gathering, and assessment practices are optimally designed and implemented to facilitate the competitiveness, prosperity, and security of the United States." This and similar legislation may be introduced in the considered in the second session of the 116th Congress.

Policy Issues for Congress

Policy debates duringin the coming year the 116th Congress may include the use and impact of unilateral tariffs imposed by the Trump Administration under various U.S. trade laws, as well as potential legislation that alters the authority granted by Congress to the President to do so; U.S.-China trade relations; legislation to implementimplementation of the proposed United States-Mexico-Canada Trade Agreement (USMCA), which awaits ratification by the government of Canada; and the Administration's launch of bilateral trade negotiations with the European Union, Japan, and the United Kingdom, among many others. The following section provides a broad overview of the potentially more prominent issues in international trade and finance that the 116th Congress may consider during its second session.

Tariff Actions by the Trump Administration30

35

The President also proposed increasing tariffs on imports from Mexico, due to concerns over Mexico's immigration policies, using authorities delegated by Congress under the International Emergency Economic Powers Act (IEEPA),41 but subsequently suspended the proposed tariffs citing an agreement reached with Mexico.42ConcernsThe Trump Administration has focused on concerns over trading partner trade practices, the U.S. trade deficit, and potential negative effects of U.S. imports have been a focus of the Trump Administration. Citing these concerns and others, the President has unilaterally imposed increased tariffs under three U.S. laws:(1) Section 20136 of the Trade Act of 1974 on U.S. imports of washing machines and solar products; due to concerns over their effects on U.S. domestic industry;

(2) Section 23237(2) Section 232 of the Trade Expansion Act of 1962 on U.S. imports of steel and aluminum, and potentially autos and uranium, and motor vehicles/parts and titanium sponge due to concerns over their effects on U.S. national security;38 and

(3) Section 30139(3) Section 301 of the Trade Act of 1974 on U.S. imports from China. due to concerns over its intellectual property rights practices, on U.S. imports from the EU due to the EU's WTO-inconsistent subsidies on the manufacture of large civil aircraft (and the EU's failure to implement WTO Dispute Settlement Body recommendations), and potentially on U.S. imports from France due to concerns over its digital services tax (DST).40 (WTO) and its dispute settlement system.

Table 1. U.S. Laws Related to Trump Administration Tradeand its dispute settlement system. The Administration argues the unilateral tariffs are a necessary U.S. response to challenges in the global trading system, which the WTO has been unable to address effectively, and that they provide the United States with leverage for broader trade negotiations with affected trading partners, such as China, Japan, and the EU. While the tariffs benefit some import-competing U.S. firms, they also increase costs for downstream users of imported products and consumers and may have broader negative effects on the U.S. economy, as well as several policy implications.

Table 1. U.S. Laws Related to Proposed and Implemented Unilateral Tariff Actions

|

Section 201 Trade Act of 1974 |

Allows the President to impose temporary duties and other trade measures if the U.S. International Trade Commission (ITC) determines a surge in imports is a substantial cause or threat of serious injury to a U.S. industry. |

|

Section 232 Trade Expansion Act of 1962 |

Allows the President to take action to adjust imports of products the U.S. Department of Commerce finds to be imported into the United States in such quantities or under such circumstances as to threaten to impair U.S. national security. |

|

Section 301 Trade Act of 1974 |

Allows the U.S. Trade Representative (USTR) to suspend trade agreement concessions or impose import restrictions if it determines a U.S. trading partner is violating trade agreement commitments or engaging in discriminatory or unreasonable practices that burden or restrict U.S. commerce. |

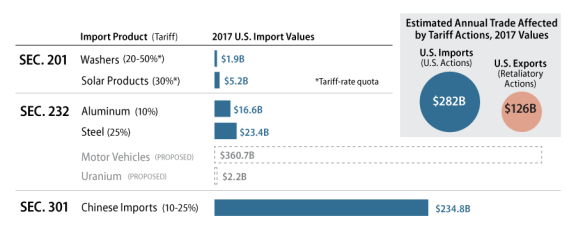

Annual U.S. imports of goods subject to the additional tariffs, which range from 10% to 50%, totaled $282 billion in 2017 (Figure 3).31 All formally proposed tariffs are now in effect. The President has informally raised the prospect of tariffs on an additional $267 billion of U.S. annual imports from China, and, pending a Section 232 investigation expected to be finalized in early 2019, additional tariffs on approximately $361 billion of U.S. auto and parts imports. While the tariffs benefit import-competing U.S. producers, they also increase costs for downstream users of imported products (e.g., auto producers using steel in cars) and consumers. In response to the U.S. actions, several U.S. trading partners have initiated WTO dispute settlement proceedings and imposed retaliatory tariffs on goods accounting for $126 billion of annual U.S. exports in 2017, causing export declines in targeted industries.32

Congressional views on the tariffs differ, but many Members have raised concerns over their potential negative economic implications and the process for seeking exclusions to tariffs. Some also question whether the President's actions adhere to the intent of the trade laws used. The 115th Congress held a number of hearings on the effects and implementation of the tariffs, and several Members introduced legislation that would have altered the President's current authorities. The issue may be the subject of further debate and possible legislative activity in the 116th Congress.

International Emergency Economic Powers Act (IEEPA) of 1977 Allows the President to regulate the importation of any property in which any foreign country or a national thereof has any interest if the President declares a national emergency to deal with an unusual and extraordinary threat, which has its source in whole or substantial part outside the United States, to the national security, foreign policy, or economy of the United States. Source: Trade Act of 1974 (P.L. 93-618, as amended), Trade Expansion Act of 1962 (P.L. 87-794, as amended), and International Emergency Economic Powers Act (P.L. 95-223, as amended).

|

||

|

||

|

Source: CRS calculations based on U.S. import data from the U.S. Department of Commerce's Census Bureau and partner country import data from Global Trade Atlas (U.S. exports). Notes: |

Tariffs on U.S. Imports from China (Section 301)33

Sections 301 of the Trade Act of 1974, as amended, is one of the principal statutory means by which the United States addresses "unfair" foreign barriers to U.S. exports. Concerns over China's policies on intellectual property (IP), technology, and innovation led the Trump Administration to launch a "Section 301" investigation in August 2017. In March 2018, President Trump signed a memorandum justifying U.S. action against China under Section 301. In its justification, the Administration focused on: 1) various Chinese policies that force or pressure technology transfers from U.S. companies to a Chinese entity; 2) China's unfair technology licensing practices that prevent U.S. firms from achieving market-based returns for their IP; 3) China's investments and acquisitions which generate large-scale technology and IP transfer to support China's industrial policy goals; and 4) China's cyber intrusions into U.S. computer networks to gain access to valuable business information.

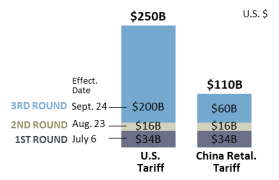

On June 15, the U.S. Trade Representative (USTR) announced a two-stage plan to impose 25% ad valorem tariffs on $50 billion worth of Chinese imports. On June 16, China issued its own two-stage retaliation plan against the United States. In response, on June 18, President Trump directed the USTR to propose a new list of products worth $200 billion that would be subject to increased 10% tariffs if China retaliated (stage 3). The first two stages of U.S. 25% tariff hike measures went into effect on July 6 and August 23. China implemented comparable countermeasures on U.S. products. On September 24, the Trump Administration imposed 10% increased tariffs on additional Chinese imports (stage 3), which were to increase to 25% on January 1, 2019 (now on hold). In response, China raised tariffs (by 5% and 10%) on $60 billion worth of imports from the United States (Figure 4). The Trump Administration created a process to enable affected U.S. firms to petition for an exclusion from some of the tariff increases.

|

|

|

Source: Figure created by CRS with data from the Office of the U.S. Trade Representative and China's Ministry of Commerce. Note: Tariff rates vary. |

A bilateral meeting between Presidents Trump and Xi at the conclusion of the December 2018 G-20 summit in Argentina may have laid groundwork for addressing the tariff escalation. The two leaders agreed to begin negotiations on "structural changes" on IP and technology issues, along with agriculture services, with the goal of achieving an agreement in 90 days. The White House reported that China agreed to make "very substantial" (though unspecified) purchases of U.S. agricultural, energy, and industrial products.34 President Trump agreed to suspend the tariff rate increases planned for January 1, 2019, unless no agreement is reached in 90 days. On December 13, the U.S. Department of Agriculture reported that China had agreed to purchase 1.13 million metric tons of U.S. soybeans.35

While some policymakers and many business representatives have expressed support for the Administration's goals of improving China's IP and technology policies, they question whether tariff hikes against China can achieve those goals. Several Members of Congress have raised concerns over the impact the current trade conflict is having on their constituents in terms of higher-priced imports from China and lost U.S. export sales.

Tariffs on U.S. Imports of Aluminum and Steel Products (Section 232)36

Section 232 of the Trade Expansion Act of 1962 (as amended) is sometimes called the "national security clause," because it provides the President with the ability to impose restrictions on certain imports that the U.S. Department of Commerce determines threaten to impair the national security.37 If requested, or upon self-initiation, Commerce investigates the import of specific product(s) and, if it determines in the affirmative, and if the President concurs, he may adjust the subject imports using tariffs, quotas, or other measures to offset the adverse effect. Section 232 sets out timelines and procedures for the investigation and that the President must follow once a decision is made. The executive branch has broad discretion in Section 232 cases to define the scope of the investigation, and the World Trade Organization (WTO) allows members to take measures in order to protect "essential security interests."38

Based on concerns about ongoing global overcapacity and certain trade practices, in April 2017, the Trump Administration initiated Section 232 investigations on U.S. steel and aluminum imports. Effective March 23, 2018, President Trump applied 25% and 10% tariffs, respectively, on certain steel and aluminum imports.39 In order to limit potential negative domestic effects of the tariffs on U.S. businesses and consumers, Commerce established a process for product exclusions requests and has received over 49,000 requests (including resubmissions) as of October 28, 2018.40 While the President negotiated tariff exemptions and quota arrangements with Brazil, South Korea, Argentina, and Australia, the proposed United States-Mexico-Canada Agreement (USMCA) did not resolve or address the Section 232 tariffs on imported steel and aluminum from Canada and Mexico. Multiple U.S. trading partners are challenging the tariffs under WTO dispute settlement rules and have threatened or enacted retaliatory measures, risking potential escalation of retaliatory tariffs. In turn, the United States has argued that trading partners' counter tariffs in response to the U.S. Section 232 measures cannot be justified under WTO rules, and the United States filed its own WTO complaints over the retaliatory tariffs by at least six countries.41

As Congress continues to debate the Administration's Section 232 actions, it may consider multiple issues including potential amendments to the delegation of constitutional authority that Congress gave to the President through Section 232, examining the investigation and implementation processes, and exploring opportunities to address specific market-distorting practices that are the root causes of steel and aluminum overcapacity through international forums and trade negotiations.

Tariffs on U.S. Imports of Washing Machines and Solar Products (Section 201)42

Section 201 of the Trade Act of 1974 grants authority to the President to provide temporary import relief (e.g., through additional tariffs or quotas on imports) in order to facilitate positive adjustment of a U.S. industry to import competition. The President may provide this relief if, as a result of an investigation based on industry petitions or self-initiated by the President, the U.S. International Trade Commission (ITC) makes a recommendation for relief based on a finding that increased U.S. imports of these products are a "substantial cause of serious injury"—or threat thereof—to U.S. manufacturers. Section 201 investigations are unlike other trade remedy tools, such as antidumping (AD) and countervailing duty (CVD) cases that investigate "material injury" (or threat thereof) based on sales of imported products at less than fair value (AD) or that are subsidized by a foreign government or other public entity (CVD).43 Rather, Section 201 cases investigate import surges of fairly-traded goods.44

On January 23, 2018, based on affirmative findings of serious injury by the ITC and recommended actions, President Trump announced that he would impose temporary new tariffs on imports of large residential washing machines45 and solar photovoltaic (PV) cells and modules,46 effective February 7, 2018. When initiating the actions on January 23, the President said, "My administration is committed to defending American companies, and they've been very badly hurt from harmful import surges that threaten the livelihood of their workers, of jobs, actually, all over this country." While such actions may benefit some U.S. domestic producers, they could also raise prices for U.S. consumers and domestic industries that use these imports to manufacture downstream products. The Section 201 measures could also increase tensions with various U.S. trading partners. Prior to the ITC affirmative findings, several Members wrote to the ITC commissioners to caution that imposing tariffs could have unintended consequences, including by raising prices and potentially costing jobs at foreign-run facilities in the United States.47

Trading Partner Retaliation and Countermeasures48

Increasing U.S. tariffs or imposing other import restrictions potentially opens the United States to complaints it is violating its World Trade Organization (WTO) and free trade agreement (FTA) commitments. In response to the recent U.S. tariff actions, several U.S. trading partners, including Canada, China, Mexico, and the European Union (EU), have initiated dispute settlement proceedings, which are now at various stages in the WTO dispute settlement process.49 Several countries have also imposed retaliatory tariffs and the United States has similarly responded by initiating additional disputes at the WTO, arguing that the retaliatory measures do not adhere to WTO commitments. Some analysts fear this escalating series of unilateral tariff actions, retaliations, and resulting WTO disputes may threaten the stability of the multilateral trading system, given the political sensitivity of a potential WTO panel ruling on issues related to national security (Section 232) and the possibility of countries potentially disregarding WTO rulings not in their favor.50

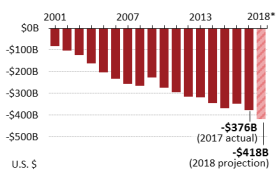

Economically, retaliation amplifies the potential negative effects of the U.S. tariff measures. It broadens the scope of U.S. industries potentially harmed by making targeted U.S. exports less competitive in foreign markets. To date, six trading partners have imposed retaliatory tariffs in response to Section 232 actions affecting approximately $25 billion of U.S. annual exports, and China has imposed retaliatory tariffs in response to Section 301 actions affecting approximately $101 billion of U.S. annual exports (Figure 5). The products affected cover a range of industries, but the largest export categories include soybeans, motor vehicles, steel, and aluminum.51 Lost market access resulting from the retaliatory tariffs may compound concerns that U.S. exporters increasingly face higher tariffs than some competitors in foreign markets, as other countries proceed with trade liberalization agreements, such as the EU-Japan FTA, which do not include the United States.

U.S.-China Trade and Key Issues52