U.S. Trade with Free Trade Agreement (FTA) Partners

During the Obama Administration, the United States negotiated two mega-regional free trade agreements that its participants argued were comprehensive and high-standard: the Trans-Pacific Partnership (TPP) among the United States and 11 other countries, and the U.S.-European Transatlantic Trade and Investment Partnership (T-TIP). The 12 TPP countries signed the agreement in February 2016, but the agreement required ratification by each country before it could enter into force. In the United States, this required implementing legislation by Congress. Upon taking office, President Trump withdrew the United States from the TPP and halted further negotiations on the T-TIP, but may reengage in the TPP under different terms. The remaining 11 partners to the TPP concluded, without U.S. participation, a revised TPP, now identified as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The Trump Administration is also attempting to revise the two largest existing U.S. FTAs, through the ongoing renegotiation of the North American Free Trade Agreement (NAFTA), and modification talks regarding the U.S.-South Korea (KORUS) FTA.

President Trump has addressed trade broadly and trade agreements more directly through an assertive trade enforcement agenda and vocal skepticism of past U.S. trade agreements and the potential benefits of trade. The Trump Administration has characterized U.S. trade agreements as unfair and detrimental to the economy, a viewpoint that is not shared by U.S. trading partners, established economic analysis, and various business and consumer groups. For some observers, the growing globalization of the economy raises concerns that the cost of U.S. leadership in the global arena is outstripping the benefits of U.S. global engagement. Others argue that the United States needs to renegotiate its role and require others to share more of the costs. The Trump Administration’s approach does not rule out the possibility that some countries are not fully abiding by international trade agreements and rules. Such actions may distort market performance and erode public support for the international trade system.

Discussions of FTAs often focus on trade balances, particularly U.S. bilateral merchandise trade balances with its FTA partner countries, as one way of measuring the success of the agreements. Although bilateral merchandise trade balances can provide a quick snapshot of the U.S. trade relationship with a particular country, most economists argue that such balances serve as incomplete measures of the comprehensive nature of the trade and economic relationship between the United States and its FTA partners. Indeed, current trade agreements include trade in services, provisions for investment, and trade facilitation, among others that are not reflected in bilateral merchandise trade balances.

This report presents data on U.S. merchandise (goods) trade with its Free Trade Agreement (FTA) partner countries. The data are presented to show bilateral trade balances for individual FTA partners and groups of countries representing such major agreements as the North America Free Trade Agreement (NAFTA) and the Central American Free Trade Agreement and Dominican Republic (CAFTA-DR) relative to total U.S. trade balances. This report also discusses the issues involved in using bilateral merchandise trade balances as a standard for measuring the economic effects of a particular FTA.

U.S. Trade with Free Trade Agreement (FTA) Partners

Jump to Main Text of Report

Contents

- Background

- U.S. Trade with FTA Partner Countries

- Bilateral Trade Balances

- Global Value Chains

- Issues for Congress

Figures

- Figure 1. U.S. Merchandise Trade: Exports, Imports, and Balances, 1980-2017

- Figure 2. Global Trade, Percentage Change, Volume and Value, 2000-2018

- Figure 3. U.S. Merchandise Trade Deficit With FTA Partners as a Share of Total U.S. Merchandise Trade Deficit, 2007-2017

- Figure 4. U.S. Merchandise and Services Balances With Major Partner Groups, 2016

- Figure 5. U.S. Merchandise Exports and Imports by Principal End-Use Category, 2017

- Figure 6. Share of Foreign Value Added in Exports, by Country or Region, 2010

- Figure A-1. U.S. Trade With Canada, China, and Mexico (Select years1990-2017)

Tables

- Table 1. U.S. Free Trade Agreements and Date of Congressional Approval

- Table 2. U.S. Merchandise and Services Trade with FTA Partner Countries, 2016

- Table 3. U.S. Merchandise Trade Balances with FTA Partner Countries, 2003-2017

- Table 4. Estimated U.S. Trade Balance of Crude Oil and Products With FTA Partners

- Table 5. International Trade Commission Estimates of the Economic Effects of U.S. Trade Agreements

- Table 6. U.S. Long-run Export and Import Elasticities

- Table B-1. U.S. Trade with Australia: Top 10 Products, 2014

- Table B-2. U.S. Trade with Bahrain: Top 10 Products, 2014

- Table B-3. U.S. Trade with Canada: Top 10 Products, 2014

- Table B-4. U.S. Trade with Chile: Top 10 Products, 2014

- Table B-5. U.S. Trade with Colombia: Top 10 Products, 2014

- Table B-6. U.S. Trade with Costa Rica: Top 10 Products, 2014

- Table B-7. U.S. Trade with Dominican Republic: Top 10 Products, 2014

- Table B-8. U.S. Trade with El Salvador: Top 10 Products, 2014

- Table B-9. U.S. Trade with Guatemala: Top 10 Products, 2014

- Table B-10. U.S. Trade with Honduras: Top 10 Products, 2014

- Table B-11. U.S. Trade with Israel: Top 10 Products, 2014

- Table B-12. U.S. Trade with Jordan: Top 10 Products, 2014

- Table B-13. U.S. Trade with South Korea: Top 10 Products, 2014

- Table B-14. U.S. Trade with Mexico: Top 10 Products, 2014

- Table B-15. U.S. Trade with Morocco: Top 10 Products, 2014

- Table B-16. U.S. Trade with Nicaragua: Top 10 Products, 2014

- Table B-17. U.S. Trade with Oman: Top 10 Products, 2014

- Table B-18. U.S. Trade with Panama: Top 10 Products, 2014

- Table B-19. U.S. Trade with Peru: Top 10 Products, 2014

- Table B-20. U.S. Trade with Singapore: Top 10 Products, 2014

Summary

During the Obama Administration, the United States negotiated two mega-regional free trade agreements that its participants argued were comprehensive and high-standard: the Trans-Pacific Partnership (TPP) among the United States and 11 other countries, and the U.S.-European Transatlantic Trade and Investment Partnership (T-TIP). The 12 TPP countries signed the agreement in February 2016, but the agreement required ratification by each country before it could enter into force. In the United States, this required implementing legislation by Congress. Upon taking office, President Trump withdrew the United States from the TPP and halted further negotiations on the T-TIP, but may reengage in the TPP under different terms. The remaining 11 partners to the TPP concluded, without U.S. participation, a revised TPP, now identified as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The Trump Administration is also attempting to revise the two largest existing U.S. FTAs, through the ongoing renegotiation of the North American Free Trade Agreement (NAFTA), and modification talks regarding the U.S.-South Korea (KORUS) FTA.

President Trump has addressed trade broadly and trade agreements more directly through an assertive trade enforcement agenda and vocal skepticism of past U.S. trade agreements and the potential benefits of trade. The Trump Administration has characterized U.S. trade agreements as unfair and detrimental to the economy, a viewpoint that is not shared by U.S. trading partners, established economic analysis, and various business and consumer groups. For some observers, the growing globalization of the economy raises concerns that the cost of U.S. leadership in the global arena is outstripping the benefits of U.S. global engagement. Others argue that the United States needs to renegotiate its role and require others to share more of the costs. The Trump Administration's approach does not rule out the possibility that some countries are not fully abiding by international trade agreements and rules. Such actions may distort market performance and erode public support for the international trade system.

Discussions of FTAs often focus on trade balances, particularly U.S. bilateral merchandise trade balances with its FTA partner countries, as one way of measuring the success of the agreements. Although bilateral merchandise trade balances can provide a quick snapshot of the U.S. trade relationship with a particular country, most economists argue that such balances serve as incomplete measures of the comprehensive nature of the trade and economic relationship between the United States and its FTA partners. Indeed, current trade agreements include trade in services, provisions for investment, and trade facilitation, among others that are not reflected in bilateral merchandise trade balances.

This report presents data on U.S. merchandise (goods) trade with its Free Trade Agreement (FTA) partner countries. The data are presented to show bilateral trade balances for individual FTA partners and groups of countries representing such major agreements as the North America Free Trade Agreement (NAFTA) and the Central American Free Trade Agreement and Dominican Republic (CAFTA-DR) relative to total U.S. trade balances. This report also discusses the issues involved in using bilateral merchandise trade balances as a standard for measuring the economic effects of a particular FTA.

Background

During the Obama Administration, the United States considered two mega-regional free trade agreements that its participants argued were comprehensive and high-standard: the Trans-Pacific Partnership (TPP) among the United States and 11 other countries, and the U.S.-European Transatlantic Trade and Investment Partnership (T-TIP). The 12 TPP countries signed the agreement in February 2016, but the agreement required ratification by each country before it could enter into force. In the United States, this required implementing legislation by Congress. The agreements aimed to reduce and eliminate barriers to trade, enhance trade rules and disciplines, and develop closer economic and strategic ties among the negotiating parties. Upon taking office, however, President Trump withdrew the United States from the TPP and halted further negotiations on the T-TIP. The remaining 11 partners to the TPP concluded, without U.S. participation, a revised TPP, now identified as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The Trump Administration is also attempting to revise the two largest existing U.S. FTAs, through the ongoing renegotiation of the North American Free Trade Agreement (NAFTA), and modification talks regarding the U.S.-South Korea (KORUS) FTA.

President Trump has addressed trade broadly and trade agreements more directly through an assertive trade enforcement agenda and vocal skepticism of past U.S. trade agreements and the potential benefits of trade. For the Trump Administration, the U.S. trade deficit often serves as a proxy for evaluating the success or failure of U.S. trade policy and is viewed as the source of a number of ills afflicting the U.S. economy, including the rate of unemployment, slow gains in wages, and income inequality. The Trump Administration also has characterized U.S. trade agreements as unfair and detrimental to the economy, a viewpoint that is not shared by U.S. trading partners, established economic analysis, and various business and consumer groups. For some observers, the growing globalization of the economy raises concerns that the cost of U.S. leadership in the global arena is outstripping the benefits of U.S. global engagement. Others argue that the United States needs to renegotiate its role and require others to share more of the costs.

Trade agreement negotiations have sparked a debate over the impact of FTAs on the U.S. economy and on U.S. trade with its FTA partners, particularly the impact of FTAs on bilateral trade balances.1 At times, data on U.S. trade with FTA partner countries are provided by various groups in different formats, which present various conclusions about U.S. trade balances with FTA partners. This report presents U.S. trade data with its FTA partners in different ways in order to demonstrate the effect these differences have on conclusions about U.S. trade balances. It also provides some basic information on the nature of U.S. bilateral trade with its 20 FTA partner countries. In particular, the data indicate U.S. total trade balances, trade balances with all FTA partners, and trade balances with the 17 FTA partners with agreements signed after 2000, which excludes Israel, Canada, and Mexico.

Between 1985 and 2011, the United States entered into 14 FTAs with 20 countries. The countries and the year in which the agreement received congressional approval are listed in Table 1.

|

Israel (1985) |

Canada (1987) |

|

Canada FTA subsumed with Mexico under the North American Free Trade Agreement (NAFTA) (1994) |

Jordan (2001) |

|

Australia (2004) |

Chile (2004) |

|

Singapore (2004) |

Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and the Dominican Republic under the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) (2005) |

|

Morocco (2006) |

Bahrain (2006) |

|

Oman (2006) |

Peru (2007) |

|

Colombia (2011) |

Panama (2011) |

|

South Korea (2011) |

Source: Office of the United States Trade Representative.

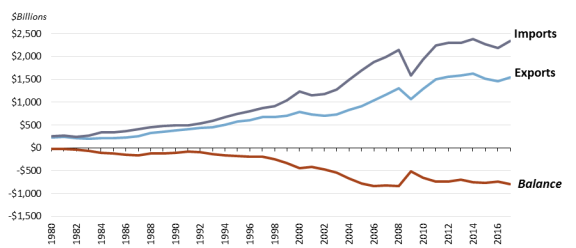

The U.S. Census Bureau is the official source for data on U.S. import and export statistics for goods and services. In this memorandum, U.S. merchandise trade data are represented by Census Bureau data on U.S. total merchandise exports and U.S. total merchandise imports. Data on services for recent years reflect expanded data on services for countries with which the United States has negotiated an FTA. The merchandise trade data reported by the Census Bureau are comparable to the types of data that are reported by other countries. U.S. merchandise trade, or trade in goods, with FTA partner countries represents nearly 70% of all U.S. exports in goods and services, and more than 80% of all U.S. imports of goods and services.2 As indicated in Figure 1, the United States consistently has experienced a deficit in its merchandise goods trade account since at least 1980. U.S. merchandise exports and imports, and global trade generally, dropped sharply in 2009 as a result of the global financial crisis, which limited the amount of funds that were available for trade financing, and the economic recession that negatively affected consumer spending and business investment.

|

Figure 1. U.S. Merchandise Trade: Exports, Imports, and Balances, 1980-2017 |

|

|

Source: U.S. Census Bureau. Figure created by CRS. |

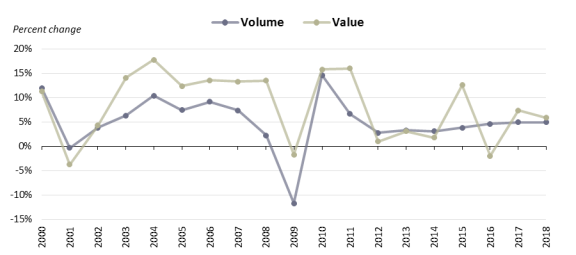

Global trade also slowed in both volume and value terms after 2010. Since 2012, trade volumes have recovered, reflecting an increase in global and major area GDP, while trade values reflect volatility in commodity prices and exchange rates, as indicated in Figure 2. In part, the slowdown likely reflects legacy issues associated with the 2008-2009 global financial crisis and recession. The value of trade has varied, likely due to the drop and subsequent rise in commodity and oil prices, especially since 2014, reflecting changes in the direction of China's economic policies, among other factors.3 The slowdown and subsequent increase in trade volumes likely reflects the progressive increase in economic growth since 2012 in both developed and developing economies.

|

Figure 2. Global Trade, Percentage Change, Volume and Value, 2000-2018 |

|

|

Source: International Monetary Fund. Figure created by CRS. |

U.S. Trade with FTA Partner Countries

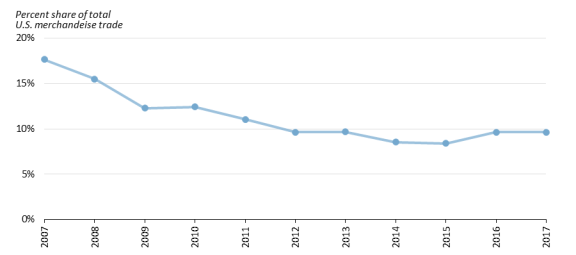

As Table 2 indicates, the United States experienced an overall merchandise trade deficit in 2016 of $734.3 billion and a surplus in services trade of $247.7 billion, for a combined total of -$486.6 billion. During the same year, the United States ran a merchandise trade deficit of -$71.3 billion with the 20 FTA partner countries and a services surplus of $68.9 billion, or a goods and services deficit of -$2.5 billion. The share of the U.S. trade deficit with FTA partners, however, has fallen by nearly half over the 2007-2017 period, from 18% to about 10% of the total U.S. merchandise trade deficit, as indicated in Figure 3.

|

Figure 3. U.S. Merchandise Trade Deficit With FTA Partners as a Share of Total U.S. Merchandise Trade Deficit, 2007-2017 |

|

|

Source: U.S. Census Bureau. Figure created by CRS. |

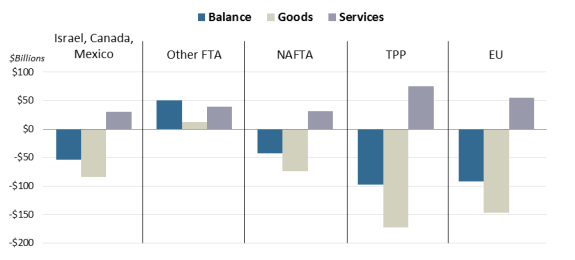

In trade with the European Union in 2016, the United States ran a goods deficit of -$146 billion and a services surplus of $54.8 billion, or a combined goods and services deficit of -$91.5 billion, as indicated in Figure 4. With proposed TPP countries, the United States experienced a deficit in goods trade in 2016 of -$172 billion, mostly with Japan, Mexico, and Vietnam, and a services surplus of $75 billion, or a combined total of -$97 billion.

|

Figure 4. U.S. Merchandise and Services Balances With Major Partner Groups, 2016 |

|

|

Source: U.S. Census Bureau. Figure created by CRS. |

In 2016, the 20 FTA partner countries accounted for $677 billion in U.S. goods exports, or 47% of total U.S. goods exports, and $749 billion in goods imports, or 34% of total U.S. goods imports. U.S. merchandise trade data with FTA partners has been expressed in various ways, including the total for all 20 FTA partners, and various subgroups of these 20 partners, as indicated in Table 2, which lists FTA partners in the order in which the trade agreement was implemented. For instance, U.S. trade with FTA partners has been expressed by some as trade with only 17 of the FTA partners, or trade with those countries that implemented an FTA after 2000, thereby excluding U.S. trade with Israel, Canada, and Mexico. The data indicate that in 2016, the United States had an overall merchandise trade deficit with Israel, Canada, and Mexico of -$83 billion and a services surplus of $30 billion. The United States also ran a merchandise trade surplus of $12 billion and a services surplus of $38.8 billion with the other 17 FTA partners, or a combined goods and services surplus of $51 billion. U.S. FTA partners as a group accounted for 9.7% of the total U.S. merchandise trade deficit, although, as indicated, the largest share of that deficit is in trade with Israel, Canada, and Mexico. U.S. trade surpluses and deficits with the other 17 FTA partners are small relative to total U.S. trade.

Table 2. U.S. Merchandise and Services Trade with FTA Partner Countries, 2016

(in billions of dollars)

|

Goods |

Services |

Total Balance |

|||||

|

Balance |

Exports |

Imports |

Balance |

Exports |

Imports |

Exports + Imports |

|

|

Total All Countries |

$-734.3 |

$1,454.6 |

$2,188.9 |

$247.7 |

$752.4 |

$504.7 |

$-486.6 |

|

Total FTA countries |

$-71.3 |

$677.5 |

$748.8 |

$68.9 |

$176.1 |

$107.2 |

$-2.5 |

|

Israel, Canada, Mexico |

$-83.4 |

$511.0 |

$594.4 |

$30.0 |

$91.1 |

$61.1 |

$-53.4 |

|

17 FTA Partners |

$12.1 |

$166.5 |

$154.4 |

$38.8 |

$84.9 |

$46.1 |

$50.9 |

|

Israel |

$-9.0 |

$13.2 |

$22.2 |

$-1.4 |

$5.1 |

$6.6 |

$-10.5 |

|

NAFTA |

$-74.4 |

$497.8 |

$572.2 |

$31.5 |

$86.0 |

$54.5 |

$-42.9 |

|

Canada |

$-11.2 |

$266.8 |

$278.1 |

$24.0 |

$54.0 |

$30.0 |

$12.8 |

|

Mexico |

$-63.2 |

$231.0 |

$294.2 |

$7.5 |

$32.0 |

$24.6 |

$-55.7 |

|

Jordan |

$-0.1 |

$1.5 |

$1.6 |

$0.1 |

$0.7 |

$0.6 |

$0.0 |

|

Australia |

$12.7 |

$22.2 |

$9.5 |

$14.7 |

$22.0 |

$7.3 |

$27.4 |

|

Chile |

$4.1 |

$12.9 |

$8.8 |

$2.6 |

$4.3 |

$1.7 |

$6.7 |

|

Singapore |

$9.1 |

$26.9 |

$17.8 |

$9.7 |

$16.9 |

$7.3 |

$18.7 |

|

CAFTA-DR |

$5.5 |

$28.9 |

$23.4 |

$-2.2 |

$8.2 |

$10.4 |

$3.3 |

|

Costa Rica |

$1.6 |

$5.9 |

$4.3 |

$-0.8 |

$2.1 |

$2.9 |

$0.8 |

|

Dominican Republic |

$3.1 |

$7.8 |

$4.7 |

$-2.8 |

$1.8 |

$4.6 |

$0.3 |

|

El Salvador |

$0.5 |

$3.0 |

$2.5 |

$0.4 |

$1.1 |

$0.7 |

$0.9 |

|

Guatemala |

$2.0 |

$5.9 |

$3.9 |

$0.6 |

$1.6 |

$1.0 |

$2.6 |

|

Honduras |

$0.2 |

$4.8 |

$4.6 |

$0.5 |

$1.2 |

$0.6 |

$0.7 |

|

Nicaragua |

$-1.8 |

$1.5 |

$3.3 |

$-0.2 |

$0.4 |

$0.6 |

$-2.0 |

|

Morocco |

$0.8 |

$1.9 |

$1.0 |

$-0.1 |

$0.6 |

$0.6 |

$0.8 |

|

Bahrain |

$0.1 |

$0.9 |

$0.8 |

$-0.8 |

$0.3 |

$1.0 |

$-0.6 |

|

Oman |

$0.7 |

$1.8 |

$1.1 |

$0.2 |

$0.5 |

$0.3 |

$0.8 |

|

Peru |

$1.8 |

$8.0 |

$6.2 |

$1.1 |

$2.7 |

$1.6 |

$2.9 |

|

Colombia |

$-0.7 |

$413.1 |

$13.8 |

$3.2 |

$6.2 |

$3.0 |

$2.5 |

|

Panama |

$5.7 |

$6.1 |

$0.4 |

$0.3 |

$1.5 |

$1.3 |

$6.0 |

|

Korea, South |

$-27.7 |

$42.3 |

$69.9 |

$10.1 |

$21.1 |

$11.0 |

$-17.6 |

|

Proposed FTAs |

|||||||

|

Trans-Pacific Partnership (TPP) |

$-172.4 |

$657.3 |

$829.7 |

$75.2 |

$184.0 |

$108.8 |

$-97.2 |

|

European Union (T-TIP) |

$-146.3 |

$270.3 |

$416.7 |

$54.8 |

$231.2 |

$176.5 |

$-91.5 |

Source: U.S. Census Bureau.

Note. Countries are listed in the order in which the FTA was implemented, or proposed.

The U.S. trade surplus with the 17 FTA partners, excluding Israel, Canada, and Mexico, is a relatively recent phenomenon, as indicated in Table 3, which shows U.S. trade balances with all 20 FTA partners and subgroups of the FTA partners from 2003 to 2017 listed in the order in which the FTA was implemented.

Over the 2002-2016 period, the U.S. merchandise trade deficit with all 20 FTA partners fell by about half as a share of the total U.S. merchandise trade deficit: from 20.7% of the total merchandise trade deficit in 2002 to 9.7% in 2016. Trade deficits with Canada and Mexico have generally declined in recent years, despite the fact that oil imports from Canada and Mexico have remained steady or increased slightly, even as U.S. production of shale oil has increased.

Census Bureau trade data also indicate that of the 20 FTA partner countries, the U.S. deficit in trade in crude oil and products is the largest with Canada, in part reflecting the close trade relationship between Canada and the United States and the U.S. trade deficit with Canada in petroleum trade. As indicated in Table 4, Canada accounted for $48 billion of the $80 billion U.S. trade deficit in oil and petroleum products in 2015 and Mexico accounted for $1.2 billion of the energy trade deficit. Canada also accounted for 60% of the U.S. crude oil trade deficit in 2015, up from 20% in 2008. The sharp decline in the U.S. oil trade deficit largely reflects the sharp drop in petroleum prices in 2014 and 2015

Table 3. U.S. Merchandise Trade Balances with FTA Partner Countries, 2003-2017

(in billions of dollars)

|

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

|

Total All Countries |

-547.6 |

-665.4 |

-782.7 |

-838.3 |

-794.5 |

-816.2 |

-503.6 |

-634.9 |

-727.4 |

-729.6 |

-688.7 |

-722.5 |

-762.6 |

-752.5 |

-796.1 |

|

Total FTA |

-108.2 |

-132.4 |

-144.9 |

-146.7 |

-140.4 |

-126.6 |

-61.9 |

-79.0 |

-80.5 |

-70.5 |

-66.6 |

-61.8 |

-64.0 |

-72.6 |

-76.7 |

|

Israel, Canada, Mexico |

-92.3 |

-111.5 |

-128.2 |

-136.1 |

-142.8 |

-143.1 |

-69.4 |

-95 |

-98.9 |

-93 |

-85.4 |

-87.9 |

-76.2 |

-75.3 |

-88.6 |

|

17 FTA Partners |

-15.9 |

-20.9 |

-16.7 |

-10.6 |

2.4 |

16.5 |

7.5 |

16 |

18.4 |

22.5 |

18.8 |

26.1 |

12.2 |

2.7 |

11.9 |

|

Israel |

-5.9 |

-5.4 |

-7.1 |

-8.2 |

-7.8 |

-7.8 |

-9.2 |

-9.7 |

-9.1 |

-7.9 |

-9.1 |

-8.0 |

-10.9 |

-9.0 |

-9.4 |

|

NAFTA |

-92.3 |

-111.5 |

-128.2 |

-136.1 |

-142.8 |

-143.1 |

-69.4 |

-95.0 |

-98.9 |

-93.0 |

-85.4 |

-87.9 |

-76.2 |

-75.3 |

-88.6 |

|

Canada |

-51.7 |

-66.5 |

-78.5 |

-71.8 |

-68.2 |

-78.3 |

-21.6 |

-28.5 |

-34.5 |

-31.4 |

-30.9 |

-34.0 |

-15.5 |

-11.0 |

-17.6 |

|

Mexico |

-40.6 |

-45.1 |

-49.7 |

-64.3 |

-74.6 |

-64.7 |

-47.8 |

-66.4 |

-64.5 |

-61.6 |

-54.4 |

-53.8 |

-60.7 |

-64.4 |

-71.1 |

|

Jordan |

-0.2 |

-0.5 |

-0.6 |

-0.8 |

-0.5 |

-0.2 |

0.3 |

0.2 |

0.4 |

0.6 |

0.9 |

0.7 |

-0.1 |

-0.1 |

0.3 |

|

Australia |

6.7 |

6.7 |

8.5 |

9.6 |

10.6 |

11.6 |

11.6 |

13.2 |

17.3 |

21.6 |

16.9 |

16.0 |

14.1 |

12.6 |

14.6 |

|

Chile |

-1.0 |

-1.1 |

-1.4 |

-2.8 |

-0.7 |

3.7 |

3.4 |

3.9 |

6.9 |

9.4 |

7.1 |

7.1 |

6.7 |

4.1 |

3.1 |

|

Singapore |

1.4 |

4.2 |

5.5 |

6.9 |

7.9 |

12.0 |

6.5 |

11.6 |

12.1 |

10.3 |

12.8 |

14.1 |

10.2 |

8.9 |

10.4 |

|

CAFTA-DR |

-1.8 |

-1.9 |

-1.2 |

1.0 |

3.7 |

6.0 |

1.1 |

0.6 |

1.5 |

-1.0 |

-0.5 |

2.9 |

5.0 |

5.4 |

7.1 |

|

Costa Rica |

0.0 |

0.0 |

0.2 |

0.3 |

0.6 |

1.7 |

-0.9 |

-3.5 |

-4.1 |

-4.8 |

-4.7 |

-2.5 |

1.6 |

1.5 |

1.7 |

|

Dom. Rep. |

-0.2 |

-0.2 |

0.1 |

0.8 |

1.9 |

2.6 |

1.9 |

2.9 |

3.1 |

2.6 |

2.9 |

3.4 |

2.4 |

3.1 |

3.0 |

|

El Salvador |

-0.2 |

-0.2 |

-0.1 |

0.3 |

0.3 |

0.2 |

0.2 |

0.2 |

0.9 |

0.5 |

0.8 |

1.0 |

0.7 |

0.4 |

0.6 |

|

Guatemala |

-0.7 |

-0.6 |

-0.3 |

0.4 |

1.0 |

1.3 |

0.7 |

1.3 |

1.4 |

1.3 |

1.4 |

1.8 |

1.7 |

1.9 |

3.0 |

|

Honduras |

-0.5 |

-0.6 |

-0.5 |

0.0 |

0.5 |

0.8 |

0.0 |

0.7 |

1.6 |

1.1 |

0.8 |

1.3 |

0.5 |

0.2 |

0.5 |

|

Nicaragua |

-0.3 |

-0.4 |

-0.6 |

-0.8 |

-0.7 |

-0.6 |

-0.9 |

-1.0 |

-1.5 |

-1.6 |

-1.7 |

-2.1 |

-1.9 |

-1.8 |

-1.7 |

|

Morocco |

0.1 |

0.0 |

0.1 |

0.4 |

0.7 |

0.6 |

1.2 |

1.3 |

1.8 |

1.2 |

1.5 |

1.1 |

0.6 |

0.9 |

0.9 |

|

Bahrain |

0.1 |

-0.1 |

-0.1 |

-0.2 |

0.0 |

0.3 |

0.2 |

0.8 |

0.7 |

0.5 |

0.4 |

0.1 |

0.4 |

0.1 |

-0.1 |

|

Oman |

-0.4 |

-0.1 |

0.0 |

-0.1 |

0.0 |

0.5 |

0.2 |

0.3 |

-0.8 |

0.4 |

0.5 |

1.0 |

1.4 |

0.7 |

1.0 |

|

Peru |

-0.7 |

-1.6 |

-2.8 |

-3.0 |

-1.2 |

0.4 |

0.7 |

1.7 |

1.7 |

2.9 |

2.0 |

4.0 |

3.7 |

1.7 |

1.4 |

|

Colombia |

-2.6 |

-2.8 |

-3.4 |

-2.6 |

-0.9 |

-1.7 |

-1.9 |

-3.6 |

-8.8 |

-8.3 |

-3.2 |

2.1 |

2.2 |

-0.7 |

-0.3 |

|

Panama |

1.5 |

1.5 |

1.8 |

2.3 |

3.4 |

4.5 |

4.0 |

5.7 |

7.9 |

9.3 |

10.1 |

10.0 |

7.3 |

5.7 |

6.0 |

|

Korea, South |

-13.2 |

-19.8 |

-16.0 |

-13.4 |

-12.9 |

-13.4 |

-10.6 |

-10.0 |

-13.2 |

-16.6 |

-20.7 |

-25.1 |

-28.3 |

-27.6 |

-22.9 |

|

Total FTA (% share) |

19.8% |

21.5% |

18.5% |

17.5% |

17.7% |

15.5% |

12.3% |

12.4% |

11.1% |

9.7% |

9.6% |

8.9% |

8.4% |

9.7% |

9.6% |

Source: U.S. Census Bureau.

Notes: Countries are listed by the order in which the FTA was implemented.

Table 4. Estimated U.S. Trade Balance of Crude Oil and Products With FTA Partners

(in billions of dollars)

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

|

Total All Countries |

$-272.97 |

$-220.71 |

$-168.66 |

$-81.26 |

$-63.16 |

$-62.61 |

|

Total FTA |

-102.83 |

-93.31 |

-77.19 |

-41.00 |

-28.61 |

-34.09 |

|

Australia |

0.15 |

0.28 |

0.43 |

-0.02 |

0.13 |

0.42 |

|

Bahrain |

-0.04 |

0.00 |

-0.17 |

-0.03 |

-0.03 |

-0.03 |

|

Canada |

-93.42 |

-91.76 |

-85.85 |

-48.47 |

-37.48 |

-53.40 |

|

Chile |

5.39 |

4.95 |

4.80 |

2.54 |

2.02 |

2.58 |

|

Colombia |

-13.22 |

-9.66 |

-5.93 |

-3.85 |

-4.40 |

-4.18 |

|

Costa Rica |

1.77 |

1.66 |

1.60 |

0.91 |

0.74 |

1.02 |

|

Dominican Republic |

1.51 |

1.49 |

1.60 |

1.12 |

1.00 |

1.22 |

|

El Salvador |

0.26 |

0.42 |

0.63 |

0.38 |

0.42 |

0.54 |

|

Guatemala |

1.29 |

1.06 |

1.30 |

0.97 |

1.05 |

1.85 |

|

Honduras |

1.66 |

1.59 |

1.86 |

1.00 |

0.66 |

0.92 |

|

Israel |

0.48 |

0.53 |

0.50 |

0.22 |

0.16 |

0.20 |

|

Jordan |

0.26 |

0.32 |

0.00 |

0.00 |

0.03 |

0.02 |

|

Korea, South |

-1.55 |

-1.91 |

-0.47 |

-0.64 |

0.00 |

1.22 |

|

Mexico |

-17.35 |

-13.69 |

-9.42 |

-1.17 |

2.78 |

6.37 |

|

Morocco |

0.89 |

1.17 |

1.33 |

0.62 |

0.47 |

0.77 |

|

Nicaragua |

0.00 |

0.04 |

0.03 |

0.05 |

0.12 |

0.23 |

|

Oman |

-0.30 |

-0.11 |

0.00 |

0.05 |

-0.37 |

-0.15 |

|

Panama |

4.65 |

5.10 |

5.89 |

2.66 |

1.46 |

2.00 |

|

Peru |

0.52 |

0.88 |

0.90 |

0.88 |

0.94 |

1.11 |

|

Singapore |

4.21 |

4.32 |

3.76 |

1.78 |

1.69 |

3.19 |

Source: Estimated by CRS from data published by the United States Energy Information Administration.

The United States International Trade Commission (ITC) is tasked by Congress to provide the official U.S. government assessment of the economic effects of U.S. trade agreements. In June 2016, the ITC published a congressionally mandated4 report on the estimated economic effects of U.S. FTAs.5 The ITC's analysis considered industry-specific agreements and bilateral, regional, and multilateral agreements.6

The commission's economic analysis, as indicated in Table 5, indicates that in 2012 U.S. bilateral and regional trade agreements increased U.S. aggregate trade by about 3% and U.S. real GDP and U.S. employment by less than 1%, $32.2 billion and 159,300 fulltime equivalent employees, respectively, and increased bilateral trade with partner countries by 26.3%. The ITC's analysis also indicated that agreements that focus on specific industries have had larger impacts on trade in their targeted industries than do bilateral agreements that cover many sectors. The ITC also estimated that FTAs provided

- gains to consumers through lower prices to the extent that the lower-priced items were present in consumers' budgets;

- greater product variety;

- increased receipts for intellectual property; and

- a positive effect, on average, on U.S. bilateral merchandise trade balances with partner countries.

|

Type of economic impact |

Findings |

|

Effects on bilateral trade |

The bilateral and regional trade agreements increased bilateral trade with partner countries by 26.3% in 2012. |

|

Effects on total exports and imports |

The bilateral and regional trade agreements increased total U.S. exports by 3.6% in 2012. They increased total U.S. imports by 2.3%. |

|

Effects on real GDP |

The bilateral and regional trade agreements increased real GDP by $32.2 billion (0.2%) in 2012. |

|

Effects on U.S. labor markets |

The bilateral and regional trade agreements increased total employment by 159,300 fulltime equivalent employees (0.1%) and increased real wages by 0.3% in 2012. |

|

Effects on U.S. receipts for intellectual property |

Increases in patent protection since the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) entered into force increased U.S. international receipts for the use of intellectual property by $10.3 billion (12.6%) in 2010. |

|

Effects on international investment |

The bilateral and regional trade agreements had a mixed effect on foreign direct investment, in some cases increasing and in other cases decreasing inbound and outbound investment flows. |

|

Effects on bilateral trade balances |

The bilateral and regional trade agreements had a positive effect, on average, on U.S. bilateral merchandise trade balances with the partner countries, increasing trade surpluses or reducing trade deficits by a total of $87.5 billion (59.2%) in 2015. |

|

Effects on U.S. consumers |

The bilateral and regional trade agreements resulted in tariff savings of up to $13.4 billion in 2014, with a significant part of these savings benefiting U.S. consumers, and also increased the variety of products imported by the United States. |

|

Effects of the Information Technology Agreement (ITA) on U.S. information technology exports |

The ITA increased annual U.S. exports of covered information technology products by $34.4 billion (56.7%) in 2010. |

|

Effects of the Uruguay Round and NAFTA tariff reductions on U.S. steel imports |

These agreements are estimated to have increased annual U.S. steel imports by $1.2 billion (14.7%) in 2000. |

|

Effects on U.S. employment in the textile and apparel industries |

Rising imports, due in part to the Agreement on Textiles and Clothing (ATC), accounted for most of the reduction in U.S. employment in the apparel industry between 1998 and 2014. |

Source: Economic Impact of Trade Agreements Implemented Under Trade Authorities Procedures, 2016 Report, Publication number 4614, United States International Trade Commission, June 2016, p. 21.

Bilateral Trade Balances

In most cases, economists question the usefulness of using bilateral trade balances as indicators of trade relations, of the effectiveness of a trade agreement, or of the costs and benefits of a trade agreement. In general terms, viewing trade balances in isolation or as a measure of a trade agreement represents an approach that is fundamentally different from general economic arguments concerning the costs and benefits of trade and trade agreements. Economists generally argue that from the perspective of a large open economy with liberalized capital flows and floating exchange rates, such as the United States, broad macroeconomic forces, particularly domestic saving and investment levels, determine the overall trade deficit or surplus. They argue that, with floating exchange rates (most developed economies have floating exchange rates, while many smaller developing economies do not have fully floating currencies) and highly liberalized flows of capital across national borders, domestic macroeconomic forces determine the demand for and supply of capital that, in turn, drive cross-border capital flows, which are a major factor in determining the international exchange value of the dollar and, therefore, the overall U.S. trade balance. Factors external to the U.S. economy often are particularly important in determining the value of the dollar, which serves as the international reserve currency.

While many of the economic arguments can be arcane at times, economists generally contend that from this overall economic perspective both consumers and producers benefit as a result of liberalized trade and that the gains for the economy as a whole outweigh the costs, irrespective of the bilateral trade deficit or surplus. Most economists argue that the economy as a whole operates more efficiently as a result of competition through international trade and that consumers throughout the economy experience a wider variety of goods and services at varying levels of quality and price than would be possible in an economy closed to international trade. They also contend that trade may have a long-term positive dynamic effect on an economy that enhances both production and employment. In addition, U.S. trade agreements comprise a broad range of issues that may affect trade and commercial relations over the long run between the negotiating parties, particularly for developing and emerging economies.

At the same time, bilateral trade balances are influenced by a seemingly innumerable list of economic activities at the micro level, or at the level of the individual firm or consumer, that are as diverse as the trading partners themselves. These activities can include, but are not limited to, the overall level of economic development; the abundance of raw materials; relative rates of economic growth; rates of technological change; changes in productivity; differences in rates of inflation; changes in commodity prices (especially the price of oil); and changes in exchange rates.

Most economists also recognize that a broad range of activities can affect national economies and trade balances overall to a greater degree than even the most robust bilateral or international trade agreement. Generally, it is very difficult to unravel the complicated linkages that exist within the economy in order to derive cause and effect relationships, that is, attempting to link a specific trade agreement with movements in bilateral trade balances. For instance, movements in international exchange rates, such as the decline in the value of the peso in late 1994, followed by a financial crisis in Mexico and severe economic recession,7 had a major impact on U.S.-Mexico trade that arguably was greater than anything that could have been anticipated by the completion of NAFTA. More recently, the appreciation of the dollar relative to most other currencies is expected to reduce U.S. exports overall, if the appreciation is sustained, but it would also reduce the costs of U.S. imports, which would tend to lower the overall U.S. merchandise trade deficit—at least in the short run. In addition, large changes in the price of crude oil, similar to that which occurred in 2009, are expected to lower the overall U.S. trade deficit, given the significant role that crude oil plays in U.S. imports. Also, global trade has been affected by such macroeconomic events as the 2008-2009 financial crisis and associated economic recession in the United States and elsewhere, which caused global trade to decline by 30% in 2009 from the previous year. (For additional information, see Appendix A.)

On a bilateral basis, trade balances are shaped by a host of factors, as indicated above. Indeed, U.S. FTA partners display a great deal of variation in their economies, ranging from Canada, which is a highly developed open economy that is within close proximity to the United States, to small, Central American developing economies that are different in structure from the U.S. economy and are at some physical distance from the United States. In addition, many U.S. FTA partners represent economies that are substantially smaller than the U.S. economy and often are limited in what they produce. As a result, U.S. trade with these countries often is concentrated in a small number of items and often is comprised of trade in raw materials and intermediate processed goods, as indicated in Appendix B. In most of the countries that have an FTA with the United States, the top 10 export and import commodities account for significant shares of total bilateral trade: more than 90% in some cases. In some cases, bilateral trade is reliant on trade in raw materials and agricultural commodities; in other cases, bilateral trade is based on trade in energy items, particularly U.S. trade with Canada and Mexico. Such differences in the underlying structure of trade with particular trading partners, however, complicate efforts to compare the performance of one trade agreement with another and to derive cause and effect relationships between the implementation of an FTA and bilateral trade balances.

Another factor that can affect bilateral trade relations and trade balances is the composition of trade relationships, which are distinct from one country to another. While trade agreements determine the rules by which nations conduct trade and provide incentives to consumers in the form of lower tariff rates and firms in the form of lower trade barriers, behavioral characteristics of consumers and firms determine how those incentives affect bilateral trade. Economists often attempt to estimate the impact of a trade agreement on bilateral trade based on estimates of the strength of the responsiveness by consumers and firms to the incentives provided by the agreement. The responsiveness of consumers and firms to the incentives associated with trade agreements seems to vary by different types of goods, or by major end-use categories. Consumer purchases of luxury goods, for instance, are highly responsive to changes in prices and consumers' incomes, while consumer consumption of agricultural products is less responsive.

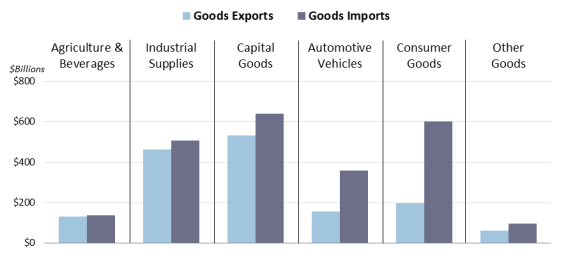

The U.S. Census Bureau provides summary information concerning U.S. trade by grouping U.S. merchandise trade into six major end-use categories, including (1) foods, feeds, and beverages; (2) industrial supplies, including petroleum; (3) capital goods, or machinery and equipment that are used in manufacturing of other items; (4) automotive vehicles and parts; (5) consumer goods; and (6) other goods. As indicated in Figure 5, trade in food and agricultural commodities, industrial supplies (including petroleum products), capital goods and other goods are greater as a share of U.S. exports than of U.S. imports, but U.S. imports of automotive vehicles and parts and consumer goods are a greater share of U.S. imports compared with U.S. exports.

|

Figure 5. U.S. Merchandise Exports and Imports by Principal End-Use Category, 2017 |

|

|

Source: U.S. Census Bureau. Figure created by CRS. |

The structural composition of U.S. trade, or the role of the six categories listed above as shares of U.S. trade, plays a role in shaping bilateral trade relationships. This structural composition of U.S. trade also has important implications for the persistence of the annual U.S. merchandise trade deficit, despite significant changes in the global growth in merchandise trade, major multinational trade liberalization, and the various FTAs the United States has implemented. This subject is of continuing interest to academic economists, who have focused on the way U.S. trade flows respond to changes in national incomes and in prices, specified by economists as the price and income elasticity of trade.8

Trade elasticities measure how much a country's imports or exports will change in response to changes in national incomes or the relative price of imported goods and services to domestically produced ones.9 While economists have developed varied estimates of the elasticities, depending on the particular study, one result common among the various studies covering different time periods and using different econometric methods is that U.S. demand for foreign imports is estimated to be more sensitive to changes in income and prices than is foreign demand for U.S. exports.

The estimated price and income elasticities in Table 6 indicate that for every 1% increase in U.S. GDP, U.S. consumers increase their purchases of imports by 2.11%. Similarly, for every 1% increase in GDP among U.S. trading partners, the consumers in those countries would increase their consumption of U.S. goods by 1.86%. While this difference seemingly is not large, the difference in size between the U.S. economy and the economies of other countries, especially those of developing economies, can magnify the differences in responsiveness to the growth in national GDP. The disparity in responsiveness likely stems from the relatively larger share that consumer consumption plays in the U.S. economy. This also implies that with constant prices and similar rates of economic growth in both the United States and among its trading partners, the U.S. merchandise trade deficit would be expected to worsen over time, in part due to the way the various components of U.S. trade are affected differently by changes in incomes and prices. One notable difference is in the U.S. and foreign demand for services. Since U.S. demand for imported services is less sensitive to changes in income compared with foreign demand for U.S. services exports, the U.S. surplus in services would be expected to increase over time, assuming constant prices and similar rates of economic growth between the United States and its trading partners.

|

Exports |

Imports |

|||

|

Income |

Prices |

Income |

Prices |

|

|

Total |

1.86% |

-5.07% |

2.11% |

-0.62% |

|

Goods |

1.91 |

-8.56 |

2.18 |

-0.69 |

|

Industrial goods |

1.65 |

-0.07 |

1.82 |

-0.41 |

|

Industrial durables |

1.78 |

0.30 |

2.11 |

-0.04 |

|

Industrial nondurables |

1.57 |

-0.18 |

1.56 |

-0.79 |

|

Agriculture |

1.10 |

0.07 |

||

|

Petroleum |

1.23 |

-0.03 |

||

|

Capital goods |

-5.94 |

-63.07 |

-1.20 |

-2.39 |

|

Autos |

2.53 |

-0.82 |

2.03 |

0.11 |

|

Consumer goods |

2.76 |

-0.49 |

1.76 |

-1.78 |

|

Durable consumer goods |

2.91 |

-0.59 |

2.56 |

-0.87 |

|

Nondurable consumer goods |

2.59 |

-0.41 |

3.68 |

1.34 |

|

Services |

1.87 |

-0.61 |

1.64 |

0.06 |

|

Nonpetroleum goods |

1.96 |

-10.14 |

1.82 |

-1.07 |

Source: Crane, Leland, Meredith A. Crowley, and Saad Quayyum, Understanding the Evolution of Trade Deficits: Trade Elasticities of Industrialized Countries, Economic Perspectives, 4Q/2007, Federal Reserve Bank of Chicago, 2007, pp. 13-14.

Notes: Values represent percentage changes in demand relative to a 1% change in national income (gross national income) or prices, based on data from 1988-2006. Income elasticities are expected to be positive, since changes in the demand for goods and services are positively related to changes in income; price elasticities are expected to be negative, since changes in the demand for goods and services are inversely related to changes in prices. A higher value represents a stronger change in demand to a change in income or relative prices; a lower value represents a weaker change in demand to a change in income or relative prices.

Global Value Chains

In addition, the proliferation of global value chains, or complex cross-border production networks in which goods and services can cross national borders multiple times through various stages of production, is blurring the distinction between the domestic content value of exports and imports and raising questions about how accurately bilateral trade balances reflect actual trade relationships. Additionally, most economists argue that both exports and imports benefit the economy, because nations export in order to import those goods and services they either do not produce, or cannot produce as efficiently as another country. As a result, trade allows the economy to specialize in producing those goods and services in which it has an international competitive advantage, thereby maximizing the total amount of goods and services that are available to its citizens.

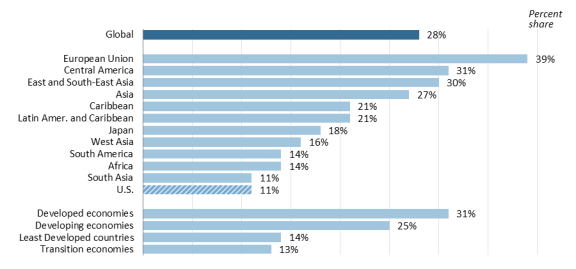

Current trade data treat exports and imports as though the full value of an export was produced domestically and the full value of an import was produced abroad. However, the rapid growth of global value chains and intra-industry trade (importing and exporting goods in the same industry) has significantly increased the amount of trade in intermediate goods in ways that can blur the distinction between domestic and foreign firms and goods. For instance, foreign value added accounts for about 28% of the content on average of global exports, as indicated in Figure 6, but this share can vary considerably by country and industry. Foreign value added in the exports of developed countries accounts for about 31% of the content of exports and about 11% of U.S. exports. This value for developed countries likely is inflated due to the highly integrated economies within the EU, which accounts for 70% of the exports from EU countries. In developing countries, the highest foreign value added shares in exports occurs in countries in East and South-East Asia and in Central America, where processing industries account for large shares of exports.10

As a result of the growth in value chains, traditional methods of measuring trade may obscure the actual sources of goods and services and the allocation of resources that are used in producing those goods and services. Trade in intermediate goods also means that imports may be essential for exports. As a result, countries that impose trade measures that restrict imports may negatively affect their own exports.11 This complex process of cross-border production and trade in intermediate goods also uses a broad range of services that has greatly expanded and redefined the role that services play in international trade and increased the number of jobs in the economy that are tied directly and indirectly to international trade in ways that are not captured fully by traditional trade data.

|

Figure 6. Share of Foreign Value Added in Exports, by Country or Region, 2010 |

|

|

Source: UNCTAD-Eora GVC Database. Figure created by CRS. |

Issues for Congress

In discussing proposed FTAs, both advocates and opponents of such agreements often focus on the U.S. merchandise trade balance with existing FTA partners as one way of measuring the success of such agreements. Economists generally argue, however, that due to the nature of recent FTAs, bilateral trade balances serve as incomplete measures of the comprehensive nature of the trade and economic relationships that often exist between the United States and its FTA partners. For instance, recent trade agreements include trade in services, provisions for investment, and trade facilitation, among other areas that are not reflected in bilateral merchandise trade balances.

Instead of focusing exclusively on merchandise trade balances as a key measure of a bilateral trade relationship, most economists argue that liberalized trade creates a broad set of costs and benefits for the economy. They argue that, over the long run, the benefits will outweigh the costs, or that the net effect on the economy is positive, regardless of the overall U.S. trade balance or a bilateral trade balance. According to this approach, the economy as a whole tends to operate more efficiently as a result of competition through international trade, and consumers throughout the economy experience a wider variety of goods and services at varying levels of quality and price than would be possible in an economy closed to international trade.

Economists generally also contend that international trade may have a long-term positive dynamic effect on an economy that enhances both production and employment. In addition, trade agreements of the type currently being negotiated by the United States comprise a broad range of issues that could have significant economic effects on trade and commercial relations over the long run between the negotiating parties, particularly for developing and emerging economies. Economists and others also acknowledge that the negative effects of international trade and trade agreements, particularly potential job losses and lower wages, often are distributed disproportionately with the effects falling more heavily on some workers and on some firms. As a consequence, governments often have implemented programs to provide benefits to those negatively affected by trade agreements to ease their transition to other economic activities.

Most economists also argue that bilateral merchandise trade balances do not serve well as a basis for comparing the relative merits of particular FTAs, because each bilateral trade relationship is unique to the particular trading partners and is subject to a great number of factors. These unique bilateral trade relationships reflect underlying fundamentals that shape the composition of the particular trade relationship. As a consequence of the underlying composition of bilateral trade relationships, bilateral trade and trade balances respond differently to trade liberalization, which makes it difficult to compare the U.S. experience with individual FTA partners.

Furthermore, the growth of global value chains and inter-industry trade are blurring the distinction between exports and imports and fundamentally changing the meaning of bilateral trade balances. Cross-border trade in intermediate goods not only has increased as a share of total trade in the economy, but it has expanded the role of services in international trade in ways that are not fully credited in bilateral trade data. As a consequence of the growth in global value chains, exports and imports are growing less distinct: policies that affect a nation's imports ultimately affect its exports and vice versa. Trade in intermediate goods also means that imports are essential inputs into the production of exports. As a result, countries that impose trade measures that restrict imports invariably negatively affect their own exports. This loss of distinction between exports and imports as strictly domestic or foreign activities further complicates efforts to distinguish between exports and imports on a bilateral basis.

Congress has considered, and may again consider, two mega-regional free trade agreements that its participants argue are comprehensive and high-standard: the concluded Trans-Pacific Partnership (TPP) among the United States and 11 other countries, and the U.S.-European Transatlantic Trade and Investment Partnership (T-TIP). Since the two agreements could have potentially economy-wide effects, Congress may choose to examine the current methods that are used to collect data on U.S. exports and imports and the potential costs and benefits of improving the data to have them more fully reflect the resource costs they may imply for the economy. Congress may also choose to examine the state of data collection and analysis on workers and industries and the states where they are located in order to determine those that may be the most vulnerable to economic dislocations as one way of anticipating the costs and benefits of the proposed agreements to the economy as a whole. Congress may also choose to examine the role that global value chains are playing in the economy and the impact they are having on the nation's ability to assess the impact of exports and imports on the allocation of resources in the economy.

NAFTA is often cited as an example of a trade agreement that performed differently than some had anticipated, because the United States continued to experience a merchandise trade deficit with the two NAFTA partners. For some, however, the agreement is seen as an example of the impact that broad economic events can have on trading partners in ways that that are not anticipated at the time an FTA is negotiated, but can outweigh the impact of the agreement. In particular, China's accession to the WTO in 2001 affected U.S. trade relations and those of its NAFTA partners in a number of ways. China's accession to the WTO reduced China's barriers to trade and investment, which tended to increase trade between the United States and China and boosted U.S. investment in China. As a result of the increased amount of U.S. trade with China, U.S. trade with other countries, including Canada and Mexico, were affected. In particular, U.S. imports from China of computer equipment, apparel, and semiconductors reduced imports of such items from other countries.

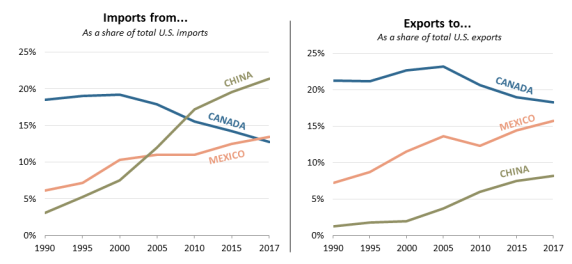

These various events played out differently with U.S. trade partners, as indicated in Figures A-1 and A-2, which show the average share of U.S. imports and exports with Canada, Mexico, and China in five-year periods from 1989 to 2017.12 In 1989, total U.S. imports were $473 billion, with Canada, Mexico, and China accounting for $88 billion, $27 billion, and $12 billion, respectively. In terms of shares, these three countries accounted for 18.6%, 5.7%, and 2.5%, respectively, of total U.S. imports.

By 2000, total U.S. imports had grown to $1.2 trillion, with imports from Canada ($231 billion), Mexico ($136 billion), and China ($100 billion) accounting for shares of 19%, 11.5%, and 8.2%, respectively. During the period 1990-2000, Canada's share of total U.S. imports rose slightly, while shares of imports from Mexico doubled and shares of imports from China nearly quadrupled. Between 2000 and 2017, however, Canada's share of total U.S. imports fell to account for 12.8%, while Mexico's share rose slightly to 13.4%, and China's share more than doubled to account for 21.4% of total U.S. imports. The data reflect the average share of U.S. imports over five-year periods, except for the data for 1990, which reflect the share in 1990, and the share in 2017, which reflects the average share over the two-year 2016-2017 period.

The data indicate that Canada's share of U.S. imports grew little under the NAFTA agreement (implemented in 1994) until 2000, after which that share has fallen, while imports from Mexico experienced their greatest average rate of growth as a share of U.S. imports between 1995 and 2000. On the other hand, imports from China grew steadily as a share of U.S. total imports over the entire period, but they grew at a faster rate after China was admitted into the WTO in 2001. A similar trend holds for shares of U.S. exports, with the share of U.S. exports with Canada declining after 2000, while the share of U.S. exports with China experiencing a steady increase in total U.S. exports. The share of U.S. exports going to Mexico dipped during the period just before and during the 2008-2009 recession, but rebounded as a modest pace after 2010. As previously indicated, bilateral trade balances are influenced by a broad range of factors. As a result, it is very difficult to unravel the complicated linkages that exist within the economy in order to derive cause and effect relationships between a trade agreement and the impact that agreement might have on bilateral trade balances.

|

|

Source: U.S. Census Bureau. Figure created by CRS. Notes: Values represent five-year averages, except for 1990 and 2017. |

Appendix B. U.S. Trade with FTA Partner Countries, Top 10 Export and Import Commodities, 2014

This Appendix presents 2014 data on the top 10 U.S. export and import commodities by value and share of total bilateral exports and imports, respectively, for the 20 countries with which the United States currently has an FTA.

Table B-1. U.S. Trade with Australia: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$26,668 |

100.0% |

Total |

$10,670 |

100.0% |

|

Aerospace products and parts |

2,364 |

8.9% |

Meat products and meat packaging products |

2,750 |

25.8% |

|

Motor vehicles |

2,294 |

8.6% |

Nonferrous metal and processing |

1,033 |

9.7% |

|

Agriculture and construction machinery |

1,986 |

7.4% |

Goods returned |

681 |

6.4% |

|

Special classification provisions |

1,385 |

5.2% |

Aerospace products and parts |

510 |

4.8% |

|

Navigational, measuring, electromedical, and control instruments |

1,171 |

4.4% |

Metal ores |

483 |

4.5% |

|

Other general purpose machinery |

1,108 |

4.2% |

Beverages |

460 |

4.3% |

|

Medical equipment and supplies |

1,101 |

4.1% |

Medical equipment and supplies |

432 |

4.0% |

|

Motor vehicle parts |

887 |

3.3% |

Miscellaneous manufactured commodities |

411 |

3.9% |

|

Pharmaceuticals and medicines |

869 |

3.3% |

Pharmaceuticals and medicines |

335 |

3.1% |

|

Engines, turbines, and power transmission equipment |

853 |

3.2% |

Navigational, measuring, electromedical, and control instruments |

303 |

2.8% |

|

Subtotal |

$14,018 |

52.6% |

Subtotal |

$7,399 |

69.3% |

Source: United States International Trade Commission.

Table B-2. U.S. Trade with Bahrain: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$1,060 |

100.0% |

Total |

$965 |

100.0% |

|

Motor vehicles |

263 |

24.8% |

Alumina and aluminum and processing |

254 |

26.3% |

|

Special classification provisions |

221 |

20.8% |

Petroleum and coal products |

164 |

17.0% |

|

Aerospace products and parts |

120 |

11.3% |

Pesticides, fertilizers and other agricultural chemicals |

150 |

15.5% |

|

Other general purpose machinery |

47 |

4.4% |

Apparel |

133 |

13.8% |

|

Navigational, measuring, electromedical, and control instruments |

34 |

3.2% |

Textile furnishings |

69 |

7.1% |

|

Agriculture and construction machinery |

30 |

2.8% |

Goods returned |

67 |

6.9% |

|

Dairy products |

27 |

2.5% |

Basic chemicals |

43 |

4.5% |

|

Miscellaneous manufactured commodities |

24 |

2.3% |

Plastics products |

31 |

3.2% |

|

Resin, synthetic rubber & artificial & synthetic fibers & filament |

22 |

2.1% |

Miscellaneous manufactured commodities |

24 |

2.5% |

|

Other fabricated metal products |

17 |

1.6% |

Other general purpose machinery |

8 |

0.8% |

|

Subtotal |

$804 |

75.8% |

Subtotal |

$944 |

97.8% |

Source: United States International Trade Commission.

Table B-3. U.S. Trade with Canada: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$312,032 |

100.0% |

Total |

$346,063 |

100.0% |

|

Motor vehicles |

26,932 |

8.6% |

Oil and gas |

96,128 |

27.8% |

|

Motor vehicle parts |

25,958 |

8.3% |

Motor vehicles |

44,249 |

12.8% |

|

Oil and gas |

16,796 |

5.4% |

Petroleum and coal products |

15,756 |

4.6% |

|

Petroleum and coal products |

15,086 |

4.8% |

Motor vehicle parts |

14,630 |

4.2% |

|

Agriculture and construction machinery |

11,179 |

3.6% |

Goods returned |

12,006 |

3.5% |

|

Special classifications |

10,562 |

3.4% |

Nonferrous metal and processing |

10,496 |

3.0% |

|

Other general purpose machinery |

9,821 |

3.1% |

Aerospace products and parts |

10,351 |

3.0% |

|

Computer equipment |

8,723 |

2.8% |

Basic chemicals |

8,247 |

2.4% |

|

Basic chemicals |

8,114 |

2.6% |

Pulp, paper, and paperboard mill products |

7,316 |

2.1% |

|

Iron and steel and ferroalloy |

7,853 |

2.5% |

Resin, synthetic rubber, & artificial & synthetic fibers & filament |

6,171 |

1.8% |

|

Subtotal |

$141,023 |

45.2% |

Subtotal |

$225,350 |

65.1% |

Source: United States International Trade Commission.

Table B-4. U.S. Trade with Chile: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$16,631 |

100.0% |

Total |

$9,491 |

100.0% |

|

Petroleum and coal products |

5,107 |

30.7% |

Nonferrous metal and processing |

2,393 |

25.2% |

|

Aerospace products and parts |

1,635 |

9.8% |

Fruits and tree nuts |

1,527 |

16.1% |

|

Agriculture and construction machinery |

925 |

5.6% |

Farmed fish and related products |

1,000 |

10.5% |

|

Basic chemicals |

694 |

4.2% |

Fish, fresh, chilled or frozen and other marine products |

638 |

6.7% |

|

Special classification provisions |

648 |

3.9% |

Rubber products |

395 |

4.2% |

|

Computer equipment |

606 |

3.6% |

Fruit and vegetable preserves and specialty goods |

391 |

4.1% |

|

Motor vehicles |

527 |

3.2% |

Basic chemicals |

339 |

3.6% |

|

Oil and gas |

439 |

2.6% |

Veneer, plywood, and engineered wood products |

317 |

3.3% |

|

Other general purpose machinery |

430 |

2.6% |

Beverages |

301 |

3.2% |

|

Resin, synthetic rubber, & artificial & synthetic fibers & filament |

420 |

2.5% |

Other wood products |

300 |

3.2% |

|

Subtotal |

$11,432 |

68.7% |

Subtotal |

$7,601 |

80.1% |

Source: United States International Trade Commission.

Table B-5. U.S. Trade with Colombia: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$20,317 |

100.0% |

Total |

$18,234 |

100.0% |

|

Petroleum and coal products |

6,342 |

31.2% |

Oil and gas |

10,312 |

56.6% |

|

Basic chemicals |

1,289 |

6.3% |

Nonferrous metal and processing |

1,790 |

9.8% |

|

Oilseeds and grains |

1,270 |

6.3% |

Fruits and tree nuts |

1,298 |

7.1% |

|

Communications equipment |

882 |

4.3% |

Petroleum and coal products |

1,014 |

5.6% |

|

Computer equipment |

849 |

4.2% |

Mushrooms, nursery and related products |

662 |

3.6% |

|

Aerospace products and parts |

834 |

4.1% |

Coal and petroleum gases |

648 |

3.6% |

|

Resin, synthetic rubber, & artificial & synthetic fibers & filament |

681 |

3.4% |

Miscellaneous manufactured commodities |

263 |

1.4% |

|

Agriculture and construction machinery |

612 |

3.0% |

Special classification provisions |

252 |

1.4% |

|

Special classification provisions |

550 |

2.7% |

Goods returned |

185 |

1.0% |

|

Other general purpose machinery |

549 |

2.7% |

Apparel |

183 |

1.0% |

|

Subtotal |

$13,857 |

68.2% |

Subtotal |

$16,607 |

91.1% |

Source: United States International Trade Commission.

Table B-6. U.S. Trade with Costa Rica: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$7,026 |

100.0% |

Total |

$9,508 |

100.0% |

|

Petroleum and coal products |

1,964 |

28.0% |

Semiconductors and other electronic components |

5,592 |

58.8% |

|

Semiconductors and other electronic components |

593 |

8.4% |

Fruit and tree nuts |

1,116 |

11.7% |

|

Aerospace products and parts |

345 |

4.9% |

Medical equipment and supplies |

1,004 |

10.6% |

|

Communications equipment |

344 |

4.9% |

Navigational, measuring, electromedical, and control instruments |

263 |

2.8% |

|

Resin, synthetic rubber, & artificial & synthetic fibers & filament |

329 |

4.7% |

Fruit and vegetable preserves and specialty foods |

163 |

1.7% |

|

Oilseeds and grains |

294 |

4.2% |

Motor vehicle parts |

114 |

1.2% |

|

Special classification provisions |

260 |

3.7% |

Plastics products |

104 |

1.1% |

|

Medical equipment and supplies |

227 |

3.2% |

Electrical equipment and components |

97 |

1.0% |

|

Pulp, paper, and paperboard mill products |

227 |

3.2% |

Rubber products |

87 |

0.9% |

|

Computer equipment |

210 |

3.0% |

Fish, fresh, chilled or frozen and other marine products |

84 |

0.9% |

|

Subtotal |

$4,793 |

68.2% |

Subtotal |

$8,624 |

90.7% |

Source: United States International Trade Commission.

Table B-7. U.S. Trade with Dominican Republic: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$7,955 |

100.0% |

Total |

$4,519 |

100.0% |

|

Petroleum and coal products |

1,408 |

17.7% |

Apparel |

725 |

16.0% |

|

Oil and gas |

485 |

6.1% |

Medical equipment and supplies |

710 |

15.7% |

|

Grain and oilseed milling products |

403 |

5.1% |

Tobacco products |

522 |

11.6% |

|

Motor vehicles |

323 |

4.1% |

Electrical equipment |

329 |

7.3% |

|

Oilseeds and grains |

312 |

3.9% |

Miscellaneous manufactured commodities |

257 |

5.7% |

|

Fibers, yarns, and threads |

308 |

3.9% |

Footwear |

256 |

5.7% |

|

Special classification provisions |

304 |

3.8% |

Navigational, measuring, electromedical, and control instruments |

215 |

4.8% |

|

Miscellaneous manufactured commodities |

267 |

3.4% |

Plastics products |

185 |

4.1% |

|

Plastics products |

231 |

2.9% |

Goods returned |

113 |

2.5% |

|

Medical equipment and supplies |

227 |

2.9% |

Oil and gas |

105 |

2.3% |

|

Subtotal |

$4,269 |

53.7% |

Subtotal |

$3,419 |

75.7% |

Source: United States International Trade Commission.

Table B-8. U.S. Trade with El Salvador: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$3,347 |

100.0% |

Total |

$2,396 |

100.0% |

|

Petroleum and coal products |

815 |

24.4% |

Apparel |

1,634 |

68.2% |

|

Oilseeds and grains |

234 |

7.0% |

Knit apparel |

262 |

10.9% |

|

Special classification provisions |

217 |

6.5% |

Sugar and confectionary products |

88 |

3.7% |

|

Resin, synthetic rubber, & artificial & synthetic fibers & filament |

205 |

6.1% |

Fruits and tree nuts |

46 |

1.9% |

|

Fabrics |

182 |

5.4% |

Waste and scrap |

41 |

1.7% |

|

Fibers, yarns, and threads |

166 |

5.0% |

Motor vehicle parts |

37 |

1.5% |

|

Aerospace products and parts |

122 |

3.6% |

Goods returned |

33 |

1.4% |

|

Grain and oilseed milling products |

111 |

3.3% |

Footwear |

27 |

1.1% |

|

Computer equipment |

102 |

3.0% |

Semiconductors and other electronic components |

23 |

1.0% |

|

Knit apparel |

88 |

2.6% |

Other nonmetallic mineral products |

21 |

0.9% |

|

Subtotal |

$2,241 |

67.0% |

Subtotal |

$2,212 |

92.3% |

Source: United States International Trade Commission.

Table B-9. U.S. Trade with Guatemala: Top 10 Products, 2014

(in millions of dollars and percentage shares)

|

U.S. Total Exports |

U.S. Total Imports |

||||

|

Product |

Value |

Share |

Product |

Value |

Share |

|

Total |

$6,057 |

100.0% |

Total |

$4,217 |

100.0% |

|

Petroleum and coal products |

1,789 |

29.5% |

Apparel |

1,335 |

31.7% |

|