Retaliatory Tariffs and U.S. Agriculture

Certain foreign nations have targeted U.S. food and agricultural products with retaliatory tariffs since early 2018 in response to U.S. Section 232 tariffs on steel and aluminum imports and Section 301 tariffs levied on U.S. imports from China. Retaliatory tariffs have made imports of U.S. agricultural products relatively more expensive compared to similar products from competitor nations. In the short run, U.S. shipments of products to countries with retaliatory tariffs have declined, reducing overall global demand for affected U.S. agricultural products and driving down the prices of U.S. agricultural commodities. Depending on the length and depth of the tariffs and the range of products affected, some experts caution that the long-run trade impacts could inflict further harm as U.S. competitor countries have an incentive to expand their agricultural production.

In response to U.S. Section 232 and Section 301 actions, China levied retaliatory tariffs on almost all U.S. agricultural products, ranging from 5% to 50%. In response to U.S. Section 232 tariffs, Canada, Mexico, the European Union (EU), and Turkey retaliated with tariffs during the summer of 2018 on U.S. fruit, nuts, prepared vegetables and meats, pork, cheese, breakfast cereal, fruit juices, and whiskey. India implemented retaliatory tariffs on certain U.S. products after a Presidential Proclamation removed India from the U.S. Generalized System of Preferences program in May 2019. Canada and Mexico levied retaliatory tariffs in mid-2018, but these tariffs were removed in May 2019 after the Trump Administration announced an agreement with Canada and Mexico to remove the Section 232 tariffs on imports from both countries to facilitate ratification of the U.S.-Mexico-Canada Agreement—a proposed regional free trade agreement that is meant to supersede the North American Free Trade Agreement (NAFTA).

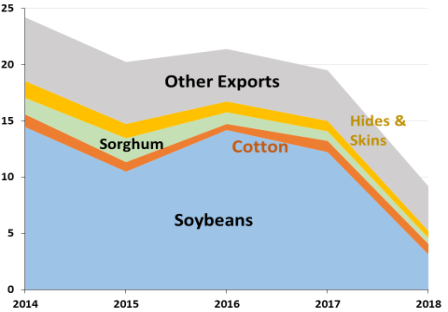

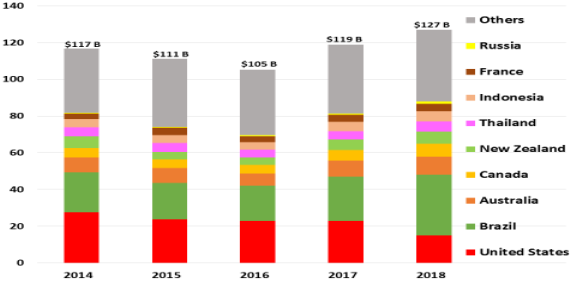

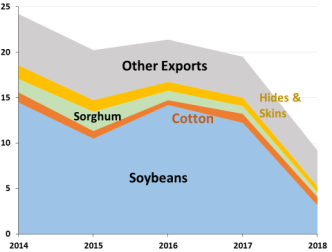

U.S. Agricultural Exports to China, 2014-2018

In Nominal Billions of U.S. Dollars

/

Source: U.S. Census Bureau trade data, accessed July 2019.

Note: Data are in calendar years, January to December.

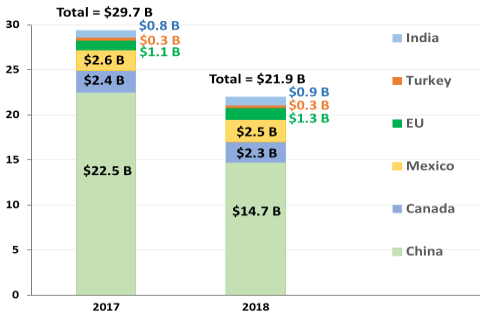

The total value of exports of U.S. food and agricultural products levied retaliatory tariffs in 2018 was $22 billion, down 27% from $30 billion in 2017. China accounted for about 80% of the total affected trade in both years. Despite the retaliatory tariffs, U.S. agricultural exports rose in 2018 to $140 billion from $138 billion in 2017, partly due to higher imports during the months leading up to the retaliatory tariffs and increased exports to other nonretaliating countries. With the continuation of retaliatory tariffs, U.S. Department of Agriculture (USDA) projects U.S. agricultural exports to decline about 4% in 2019.

In the short run, retaliatory tariffs contributed to declining prices for certain U.S. agricultural commodities and reduced exports, particularly for soybeans. Declining prices and exports sales combined with rising input and farm machinery costs contributed to a 16% decrease in U.S. net farm income in 2018, compared with 2017. China’s soybean imports are expected to resume growing over the next decade, but a USDA study expects the volume traded to be less than previously anticipated. Because of the retaliatory tariffs on U.S. soybeans, USDA projects that Brazil will account for two-thirds of the global growth in soybean exports to China. The United States accounted for 40% of China’s total soybean imports in 2016 and 35% in 2017, compared with Brazil’s 46% in 2016 and 53% in 2017. In 2018, the U.S. share of China’s soybean import market dropped to 19% and Brazil’s share was up at 76%.

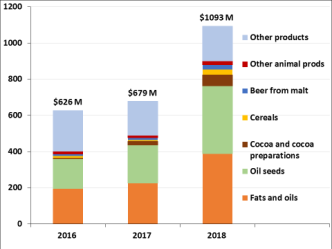

Chinese Imports of Russian Agricultural Products, 2016-2018

In Nominal Millions of U.S. Dollars

/

Source: China Customs Statistics accessed via Global Trade Atlas, July 2019.

Note: Other animal prods = Other animal products.

To help alleviate the financial loss incurred by U.S. farmers due to retaliatory tariffs, USDA announced $12 billion in financial assistance in 2018—referred to as a trade aid package—for certain U.S. agricultural commodities using Section 5 of the Commodity Credit Corporation (CCC) Charter Act (15 U.S.C. 714c). In 2019, USDA announced a second trade-aid package of $16 billion. Increased trade aid to U.S. farmers has generated questions from some World Trade Organization (WTO) members about whether the trade-aid package may violate U.S. WTO commitments.

While trade-aid packages may provide short-term financial assistance, some studies and critics of the President’s actions caution that the long-term consequences of the retaliatory tariffs may present more challenges. Even as China has raised tariffs on U.S. imports, it has improved access to its markets for other exporting countries. Brazil, Russia, and other countries are expanding their agricultural production to meet China’s import demand. For example, Russia’s investments during the past two decades have resulted in agricultural productivity growth ranging from 25% to 75%, with higher productivity growth along its southern region. Although still at relatively modest levels, China’s total food and agricultural imports from Russia increased 61% between 2017 and 2018.

The continuation of trade disputes and retaliatory tariffs may be of interest to Congress for the following reasons. Trade disputes have disrupted global markets and increased uncertainty in the farm input and output sectors. They may add to production costs, and they have dampened exports, impacted farm income, and triggered additional federal assistance for the farm sector. In the short run, there could be some transient benefits associated with various aspects of the agricultural sector. In the long run, other countries may expand agricultural production, potentially displacing U.S. agricultural exports to become larger food and agricultural suppliers to China.

Retaliatory Tariffs and U.S. Agriculture

Jump to Main Text of Report

Contents

- Introduction

- Report Objectives

- Retaliatory Tariffs on U.S. Agricultural Exports

- Chinese Retaliatory Tariffs

- Retaliatory Tariffs by Canada and Mexico

- Retaliatory Tariffs by the EU, Turkey, and India

- U.S. Agricultural Trade Affected by Tariff Hikes

- U.S. Agricultural Exports to Retaliating Countries

- U.S. Exports Under Chinese Retaliatory Tariffs

- Key Competitors for China's Agricultural Market

- China's Total Annual Agricultural Imports

- China's Imports of Soybeans

- China's Imports of Cotton

- China's Imports of Wheat

- China's Imports of Sorghum

- China's Imports of Pork and Pork Products

- China's Imports of Dairy Products

- China's Imports of Hides and Skins

- Retaliatory Partner Imports of Other Agricultural Products

- Economic Impact of Retaliatory Tariffs

- Short-Run Impacts

- Potential Long-Run Implications

- Estimated Economic Impacts

- Commodity Level

- State Level

- National-Level Effects of Retaliatory Tariffs

- Global-Level Effects

- Some Possible Benefits to U.S. Agriculture

- U.S. Stakeholder Views on Retaliatory Tariffs

- Issues for Congress

Figures

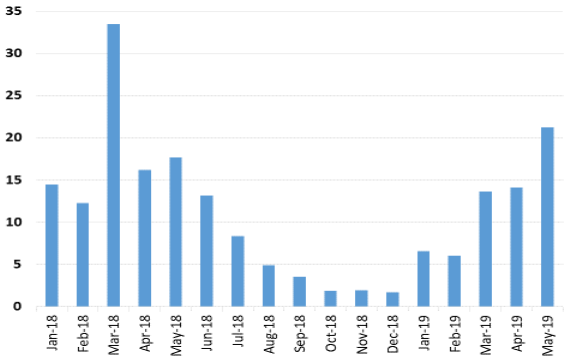

- Figure 1. Imports of U.S. Agricultural Products Affected by Retaliatory Tariffs

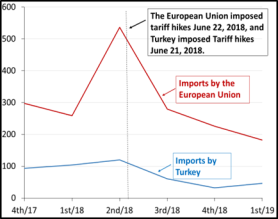

- Figure 2. EU and Turkey Imports of U.S. Products Subject To Retaliatory Tariffs

- Figure 3. U.S. Agricultural Exports to China, 2014 to 2018

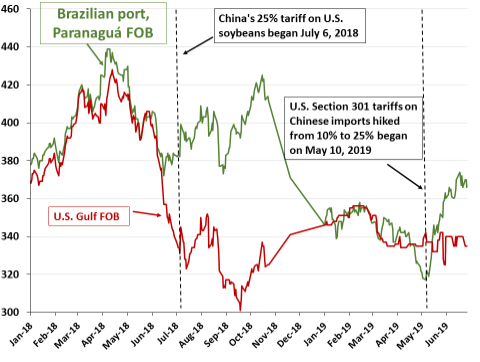

- Figure 4. U.S. and Brazilian Soybean Free on Board (FOB) Prices

- Figure 5. China's Imports of Agricultural Products, 2014 to 2018

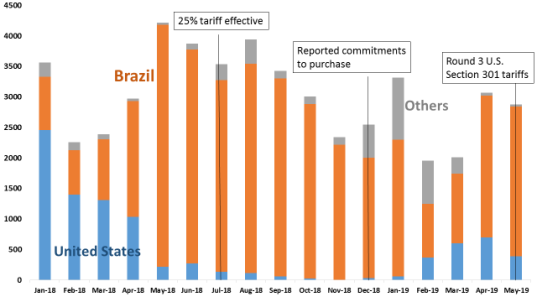

- Figure 6. China's Monthly Imports of Soybeans

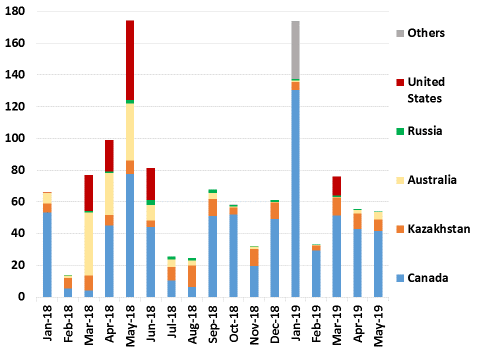

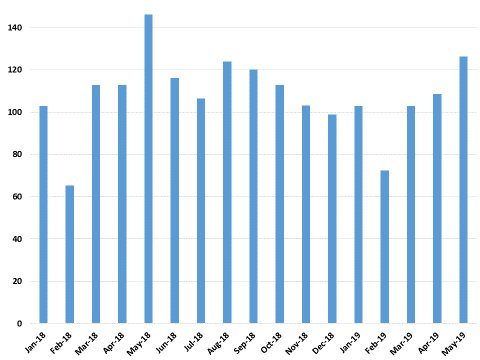

- Figure 7. China's Monthly Imports of Cotton

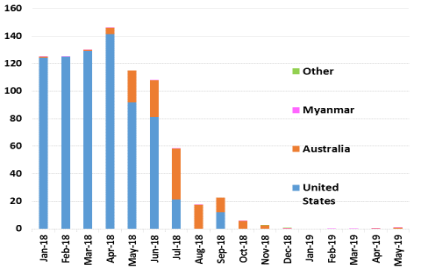

- Figure 8. China's Monthly Wheat Imports

- Figure 9. China's Monthly Sorghum Imports

- Figure 10. China's Monthly Imports of U.S. Pork

- Figure 11. China's Monthly Imports of Dairy Products

- Figure 12. China's Monthly Imports of Hides and Skins

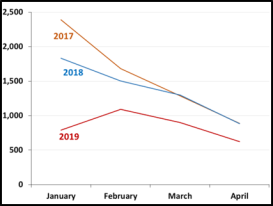

- Figure 13. U.S. Agricultural Exports to China, January to April

- Figure 14. U.S. Soybean Farm Prices

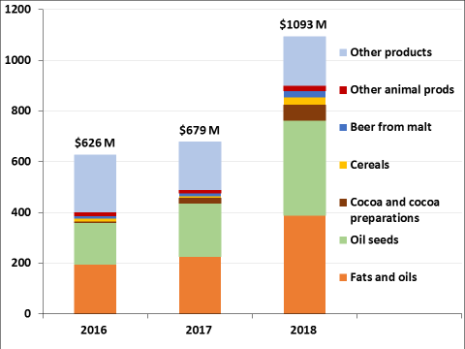

- Figure 15. China's Imports of Russian Agricultural Products

Tables

- Table 1. Comparison of Retaliatory Tariff Hikes on U.S. Agricultural Products: September 2018 versus June 2019

- Table 2. U.S. Agricultural Exports to Retaliating and Nonretaliating Countries

- Table 3. Selected U.S. Agricultural Exports to China, 2014-2018

- Table A-1. Summary of China's Retaliatory Tariffs on U.S. Agricultural Imports

Appendixes

Summary

Certain foreign nations have targeted U.S. food and agricultural products with retaliatory tariffs since early 2018 in response to U.S. Section 232 tariffs on steel and aluminum imports and Section 301 tariffs levied on U.S. imports from China. Retaliatory tariffs have made imports of U.S. agricultural products relatively more expensive compared to similar products from competitor nations. In the short run, U.S. shipments of products to countries with retaliatory tariffs have declined, reducing overall global demand for affected U.S. agricultural products and driving down the prices of U.S. agricultural commodities. Depending on the length and depth of the tariffs and the range of products affected, some experts caution that the long-run trade impacts could inflict further harm as U.S. competitor countries have an incentive to expand their agricultural production.

In response to U.S. Section 232 and Section 301 actions, China levied retaliatory tariffs on almost all U.S. agricultural products, ranging from 5% to 50%. In response to U.S. Section 232 tariffs, Canada, Mexico, the European Union (EU), and Turkey retaliated with tariffs during the summer of 2018 on U.S. fruit, nuts, prepared vegetables and meats, pork, cheese, breakfast cereal, fruit juices, and whiskey. India implemented retaliatory tariffs on certain U.S. products after a Presidential Proclamation removed India from the U.S. Generalized System of Preferences program in May 2019. Canada and Mexico levied retaliatory tariffs in mid-2018, but these tariffs were removed in May 2019 after the Trump Administration announced an agreement with Canada and Mexico to remove the Section 232 tariffs on imports from both countries to facilitate ratification of the U.S.-Mexico-Canada Agreement—a proposed regional free trade agreement that is meant to supersede the North American Free Trade Agreement (NAFTA).

|

U.S. Agricultural Exports to China, 2014-2018 In Nominal Billions of U.S. Dollars |

|

|

Source: U.S. Census Bureau trade data, accessed July 2019. Note: Data are in calendar years, January to December. |

The total value of exports of U.S. food and agricultural products levied retaliatory tariffs in 2018 was $22 billion, down 27% from $30 billion in 2017. China accounted for about 80% of the total affected trade in both years. Despite the retaliatory tariffs, U.S. agricultural exports rose in 2018 to $140 billion from $138 billion in 2017, partly due to higher imports during the months leading up to the retaliatory tariffs and increased exports to other nonretaliating countries. With the continuation of retaliatory tariffs, U.S. Department of Agriculture (USDA) projects U.S. agricultural exports to decline about 4% in 2019.

In the short run, retaliatory tariffs contributed to declining prices for certain U.S. agricultural commodities and reduced exports, particularly for soybeans. Declining prices and exports sales combined with rising input and farm machinery costs contributed to a 16% decrease in U.S. net farm income in 2018, compared with 2017. China's soybean imports are expected to resume growing over the next decade, but a USDA study expects the volume traded to be less than previously anticipated. Because of the retaliatory tariffs on U.S. soybeans, USDA projects that Brazil will account for two-thirds of the global growth in soybean exports to China. The United States accounted for 40% of China's total soybean imports in 2016 and 35% in 2017, compared with Brazil's 46% in 2016 and 53% in 2017. In 2018, the U.S. share of China's soybean import market dropped to 19% and Brazil's share was up at 76%.

|

Chinese Imports of Russian Agricultural Products, 2016-2018 In Nominal Millions of U.S. Dollars |

|

|

Source: China Customs Statistics accessed via Global Trade Atlas, July 2019. Note: Other animal prods = Other animal products. |

To help alleviate the financial loss incurred by U.S. farmers due to retaliatory tariffs, USDA announced $12 billion in financial assistance in 2018—referred to as a trade aid package—for certain U.S. agricultural commodities using Section 5 of the Commodity Credit Corporation (CCC) Charter Act (15 U.S.C. 714c). In 2019, USDA announced a second trade-aid package of $16 billion. Increased trade aid to U.S. farmers has generated questions from some World Trade Organization (WTO) members about whether the trade-aid package may violate U.S. WTO commitments.

While trade-aid packages may provide short-term financial assistance, some studies and critics of the President's actions caution that the long-term consequences of the retaliatory tariffs may present more challenges. Even as China has raised tariffs on U.S. imports, it has improved access to its markets for other exporting countries. Brazil, Russia, and other countries are expanding their agricultural production to meet China's import demand. For example, Russia's investments during the past two decades have resulted in agricultural productivity growth ranging from 25% to 75%, with higher productivity growth along its southern region. Although still at relatively modest levels, China's total food and agricultural imports from Russia increased 61% between 2017 and 2018.

The continuation of trade disputes and retaliatory tariffs may be of interest to Congress for the following reasons. Trade disputes have disrupted global markets and increased uncertainty in the farm input and output sectors. They may add to production costs, and they have dampened exports, impacted farm income, and triggered additional federal assistance for the farm sector. In the short run, there could be some transient benefits associated with various aspects of the agricultural sector. In the long run, other countries may expand agricultural production, potentially displacing U.S. agricultural exports to become larger food and agricultural suppliers to China.

Introduction

|

Box 1. Tariffs and Harmonized Tariff Schedules A tariff is a customs duty levied on imported goods and services. When a good enters a U.S. port of entry, merchandise is classified and tariffs are assessed using the U.S. Harmonized Tariff Schedule (HTS), a compendium of tariff rates based on a globally standardized nomenclature. At the global level, the Harmonized System (HS), established by the World Customs Organization, is the standardized nomenclature for the classification of products. It allows participating countries to classify traded goods on a common basis for customs purposes. The HS codes are standard up to 6 digits, the most detailed level that can be compared internationally. Beyond 6 digits, countries can introduce national distinctions for tariffs and for other purposes. The U.S. HTS code agrees with the HS code at the 6-digit level, but may vary from other countries at 8- or higher digit levels. |

Since early 2018, certain foreign nations have targeted U.S. food and agricultural products with retaliatory tariffs (for more on tariffs, see Box 1) in response to U.S. Section 232 tariffs on steel and aluminum imports and U.S. Section 301 tariffs levied on imports from China.1 The first U.S. trade action occurred on March 8, 2018, when President Trump imposed tariffs of 25% on steel and 10% on aluminum imports (with some flexibility on the application of tariffs by country) using presidential powers granted under Section 232 of the Trade Expansion Act of 1962.2 Section 232 authorizes the President to impose restrictions on certain imports based on an affirmative determination by the Department of Commerce that the targeted import products threaten national security. The targeted exporters, China, Canada, Mexico, the European Union (EU), and Turkey, responded by levying retaliatory tariffs on U.S. food and agricultural products, and other goods. India proposed retaliatory tariffs but did not implement them until June 2019.

A second action occurred in July 2018 when the Trump Administration used a Section 301 investigation to impose tariffs of 25% on $34 billion of selected imports from China, citing concerns over China's policies on intellectual property, technology, and innovation.3 In August 2018, the Administration levied a second round of Section 301 tariffs, also of 25%, on an additional $16 billion of imports from China. In September 2018, additional tariffs of 10% were applied to $200 billion of imports from China and, in May 2019, these were raised to 25%.4 On August 13, 2019, the Office of U.S. Trade Representative (USTR) published two lists of additional Chinese imports that would face 10% tariffs, effective September 1, 2019, and December 15, 2019.5 The imposition of the Section 301 tariffs on Chinese goods resulted in retaliatory tariffs by China. Additionally, in August 2019, China asked its state-owned enterprises to halt purchases of U.S. agricultural goods.6 On August 23, 2019, China further retaliated by levying two additional sets of tariffs: 5% or 10% tariffs on U.S. imports, including 695 different U.S. agricultural tariff lines effective September 1, 2019; and another 5% or 10% tariffs on U.S. imports including 184 different U.S. agricultural tariff lines effective December 15, 2019.7

During 2018, China, Canada, Mexico, the EU, and Turkey jointly levied retaliatory tariffs on more than 1,000 U.S. food and agricultural tariff lines. India prepared a list of U.S. products targeted for retaliatory tariffs in 2018 but refrained from implementing them. Then in 2019, India implemented retaliatory tariffs on certain U.S. lentils, apples, and tree nuts8 after the United States removed India from the U.S. Generalized System of Preferences (GSP) program on May 31, 2019.9 GSP provides duty-free tariff treatment for certain products from designated developing countries. India's removal from GSP is expected to raise duties valued at about $5 billion to $6 billion on goods the United States imports from India—or slightly more than 10% of India's total 2018 exports of $54 billion to the United States.10 In response to U.S. action, India implemented the retaliatory tariffs identified in 2018, with some changes, effective June 16, 2019.11

On May 17, 2019, the Trump Administration reached an agreement with Canada and Mexico to remove the Section 232 tariffs on steel and aluminum imports from those countries and to remove all retaliatory tariffs imposed on U.S. goods.12 The Administration reduced tariffs on Turkish steel imports, and Turkey responded on May 21, 2019, by halving its retaliatory tariffs on U.S. imports.13

Report Objectives

This report recaps the chronology and the effect of U.S. Section 232 and Section 301 actions on U.S. food and agricultural imports and the retaliatory tariffs imposed on U.S. agricultural exports by its trading partners during 2018 and the spring of 2019. As China is subjected to the largest set of U.S. tariff increases and has levied the most expansive set of retaliatory tariffs on U.S. agricultural products, this report largely focuses on the effects of Chinese retaliatory tariffs on U.S. agricultural trade. Because almost all U.S. food and agricultural tariff lines are affected by Chinese retaliatory tariffs, the report provides illustrative examples using selected agricultural products. Thus, the report is not a comprehensive review of the effect of Chinese retaliatory tariffs on every U.S. agricultural product exported to China.

Retaliatory tariffs have made U.S. products relatively more expensive in China, with the result that Chinese imports from other countries have increased in lieu of U.S. products. This report discusses the short- and long-run economic effects of the changes in trade flows, locally, nationally, and globally. The long-run effects may potentially be more problematic, as China and Russia have increased their agricultural productivity over the past two to three decades,14 and China has increased investments in other countries to develop potential future sources of imports.15 Additionally, China has improved market access for imports from other countries while it has increased tariffs on U.S. imports. Finally, the report presents the views of selected U.S. agricultural stakeholders on retaliatory tariffs, and it identifies issues that may be of interest for Congress.

Retaliatory Tariffs on U.S. Agricultural Exports

Except for China, which faces both Section 232 and Section 301 tariffs, other countries' retaliatory tariffs respond only to U.S. Section 232 tariffs on U.S. imports of certain steel and aluminum products. Higher retaliatory tariffs represent increases above the World Trade Organization (WTO) Most Favored Nation (MFN) tariff rates or beyond any existing preferential tariff rates. Retaliatory tariffs for Canada and Mexico are increases from the existing North American Free Trade Agreement (NAFTA) rates, most of which, at zero percent, are below the MFN rates.

Table 1 summarizes the retaliatory tariff increases on U.S. agricultural products by comparing tariff increases of September 2018 with the retaliatory tariffs in effect in June 2019.16 A potential reason for observed changes in applied tariffs rates is that some tariffs are levied based on quantity (such as per ton or per kilograms) and, for purposes of analyses, tariffs are converted to percentage of total import value, ad valorem rates (see Box 2). When the price of a traded product changes, the ad valorem tariff rate imposed on a product can change. Additionally, it is not always possible to match the U.S. Harmonized Tariff Schedule17 (HTS) with the retaliatory country's 8- or 10-digit tariff code (see Box 1). Thus, it may be difficult to link the U.S. Census Bureau trade data with the tariff codes of products affected by retaliatory tariffs. Therefore, this report makes use of both U.S. export data and partner country import data as appropriate to provide the most accurate measure of the magnitude of the affected U.S. trade. For U.S. retaliating trade partners, Table 1 provides the minimum, maximum, and simple (not trade-weighted) average retaliatory tariff hike rates.

Table 1. Comparison of Retaliatory Tariff Hikes on U.S. Agricultural Products: September 2018 versus June 2019

Percentage Increases Over World Trade Organization (WTO) Most Favored Nation (MFN) Tariff Rates or Rates Under the North American Free Trade Agreement (NAFTA)

|

Country |

Productsa |

Effective |

Tariffs increases as of September 2018 |

Tariff increases as of June 2019 |

||||

|

Minb |

Maxc |

Avgd |

Minb |

Maxc |

Avgd |

|||

|

Chinae |

Almost all products |

First of 5 tranches initiated April 2, 2018. |

5% |

50% |

20% |

5% |

50% |

24% |

|

Canadaf |

Coffee; prepared meats, fruit, vegetables and other products; whiskey |

July 1, 2018 |

10% |

10% |

10% |

0% |

0% |

0% |

|

Mexicof |

Pork; cheese; apples; prepared fruits and vegetables; whiskey |

June 5, 2018 |

7% |

25% |

18% |

0% |

0% |

0% |

|

European Union |

Prepared vegetables and legumes; grains; fruit juice; peanut butter; whiskey |

June 22, 2018 |

10% |

25% |

24% |

10% |

25% |

24% |

|

Turkeyg |

Tree nuts; rice; miscellaneous prepared foods; whiskey; tobacco |

June 21, 2018 |

20% |

140% |

58% |

10% |

70% |

29% |

|

Indiah |

Almonds; walnuts; apples; chickpeas; lentils |

June 16, 2019 |

0% |

0% |

0% |

10% |

29% |

18.5% |

Sources: USDA, Foreign Agricultural Service (FAS), various GAIN Reports: CH18034, June 21, 2018; CH18034, August 6, 2018; CH19030, May 17, 2019; E18045, June 21, 2018; TR8018, June 28, 2018; TR9012, May 22, 2019; MX8028, June 6, 2018; and IN8108, September 21, 2018; The Gazette of India, Customs Notification No. 16/2019, June 15, 2019; Department of Finance, Canada, "Notice of Intent to Impose Countermeasures Action Against the United States in Response to Tariffs on Canadian Steel And Aluminum Products," May 31, 2018; Toubia et al., "Canada and Mexico Eliminate Section 232 Steel/Aluminum Countermeasures as of May 20," International Trade Law, May 20, 2019.

Notes: MFN tariff rates are the tariff rates that WTO members levy on imports from other WTO members, excluding those with whom a preferential trade agreement may exist. Canada and Mexico have signed NAFTA with the United States and levy tariff rates lower than the MFN rates—zero on almost all U.S. imports.

a. Products include most of chapters 1-24 of the U.S. Harmonized Tariff Schedule, which cover meat, grains, animal feed, dairy, horticultural products, processed foods, unprocessed tobacco, alcoholic beverages; plus essential oils in chapter 33; animal hides and skins in chapters 41 and 43; and silk, cotton, and wool in chapters 50, 51, and 52. Fishery products (chapter 3 and parts of chapter 16) and forest products are not considered in the table.

b. Min = minimum retaliatory tariff levied by the country on the listed products.

c. Max = maximum retaliatory tariff levied by the country on the listed products.

d. Avg = Simple average (unweighted) tariff rates for the listed products. Within a category of traded products, trade may mostly occur for a few products' harmonized tariff lines rather than being evenly divided across all lines. Weighted averages are therefore considered as the "effective" average tariff rates.

e. China imposed the first set of retaliatory tariffs (in response to 232 tariffs) in April 2018, followed by the first round in response to 301 tariffs in July 2018, then successive rounds in August 2018, September 2018, and finally in June 2019.

f. Canada and Mexico removed their retaliatory tariffs effective May 20, 2019, and have in effect the zero NAFTA tariffs.

g. Turkey halved the retaliatory tariffs on U.S. imports on May 21, 2019, in response to U.S. action that reduced tariffs on Turkish steel imports.

h. India proposed retaliatory tariffs in June 2018, but implemented them effective June 16, 2019.

Chinese Retaliatory Tariffs18

China is subject to the largest set of U.S. tariff increases—both the U.S. Section 232 steel and aluminum tariffs and the Section U.S. 301 tariffs in response to unfair trade practices. As a result, China has countered with an expansive list of retaliatory tariffs. In particular, all U.S. products affected by Chinese retaliatory tariffs in response to the U.S. Section 232 action also faced additional retaliatory tariffs in response to U.S. Section 301 trade action.

China first retaliated against U.S. Section 232 action in April 2018, by raising tariffs on certain U.S. imports including agricultural products.19 During the first round of Chinese retaliatory tariffs, these products included pork, fruit, and tree nuts. In July 2018, China retaliated against U.S. Section 301 tariffs by raising tariffs on an expanded number of products, including most U.S. agricultural products exported to China.20 Tariffs were also raised on products affected by the earlier April 2018 retaliatory tariffs in response to U.S. Section 301 action, with most subject to an additional tariff of 25%.

China levied two more rounds of retaliatory tariff increases (against U.S. Section 301 action) in 2018—in August and September—expanding the coverage of the affected products. In September 2018, China imposed 5% and 10% tariff increases on certain products (including agricultural products) which had not been subject to any retaliatory tariffs in response to U.S. Section 301 action.21 In June 2019, China increased tariffs on some additional products that had not been previously targeted with retaliatory tariffs, as well as some products that had been hit with the 5% or 10% retaliatory tariff in September 2018.22 As a result, almost all U.S. agricultural products shipped to China face retaliatory tariffs, ranging from 5% to 50% above their MFN tariff rates through August 31, 2019,23 with a simple average tariff rate increase of 24% across all products as of July 2019. See Table A-1 for information on average Chinese retaliatory tariffs across different food and agricultural product categories.

Retaliatory Tariffs by Canada and Mexico

In June 2018, Mexico levied a 15% tariff on U.S. sausage imports; a 20% tariff on other pork products, certain cheeses, apples, potatoes, and cranberries; and a 25% tariff increase on whey, blue-veined cheese, and whiskies.24

Starting in July 2018, Canada imposed a retaliatory tariff of 10% on certain U.S. products including dairy, poultry, and beef products; coffee, chocolate, sugar, and confectionery; prepared food products; condiments; bottled water; and whiskies.25

To facilitate the ratification of the proposed U.S.-Mexico-Canada Agreement (USMCA) that the leaders of the three countries agreed to on September 30, 2018,26 the United States removed the Section 232 tariffs on steel and aluminum imports from Canada and Mexico on May 17, 2019, and, in turn, these countries removed their retaliatory tariffs on U.S. imports.27

Retaliatory Tariffs by the EU, Turkey, and India

In June 2018, in response to U.S. Section 232 tariffs, the EU imposed a 25% tariff on imports of U.S. corn, rice, sweetcorn, kidney beans, certain breakfast cereals, peanut butter, orange juice, cranberry juice, whiskies, cigars, and other tobacco products, and a 10% tariff on certain essential oils.28

In June 2018, Turkey also responded to U.S. Section 232 tariffs on Turkish steel imports by levying retaliatory tariffs on selected U.S. imports.29 On August 10, 2018, the United States doubled its tariffs on steel imports from Turkey to 50%, stating that the 25% tariffs did not reduce Turkish steel imports as much as anticipated.30 Turkey responded by doubling tariffs on certain U.S. imports including a 20% retaliatory tariff on U.S. tree nuts and certain prepared food, 25% and 50% tariffs on U.S. rice (depending on whether milled or unmilled), 60% tariff on U.S. tobacco, and 140% tariff on U.S. alcoholic beverages including whiskies.31 When the United States reduced its tariffs on Turkish steel imports on May 21, 2019, Turkey halved its retaliatory tariffs on U.S. imports.32

India identified certain U.S. food products for retaliatory tariffs in 201833 but did not levy them until June 16, 2019. Indian tariff hikes above the MFN rate are 10% for imports of U.S. chickpeas, 29% for over-quota shelled almonds (ad valorem rate), and 20% for U.S. walnuts, apples, and lentils.

U.S. Agricultural Trade Affected by Tariff Hikes

Foreign nations may target U.S. food and agricultural products with retaliatory tariffs for several reasons. First, the United States is the largest exporter of food and agricultural products, so many countries are able to retaliate against those goods. Second, agricultural commodities are often more easily substituted from among potential suppliers, so curbing imports from one country would not necessarily limit an importing country's access to the commodity. Third, several food and agricultural products are produced primarily in certain regions of the United States, and thus may be targeted with a view to negatively and disproportionately affecting the constituents of specific U.S. lawmakers.

The retaliatory tariffs imposed by U.S. trading partners affected many products exported by the United States, including meats, grains, dairy products, specialty and horticultural crops, and alcoholic beverages.34 As discussed in Box 3, "Tariffs Increase Import Prices," a number of factors affect trade, including tariffs that tend to increase the price of imported goods. In 2018, total imports of affected U.S. food and agricultural products by all retaliating countries amounted to almost $22 billion, based on customs data from these countries. This represents a 27% decline from the $29.7 billion in 2017 (Figure 1).35

|

Box 3. Tariffs Increase Import Prices Economic principles state that comparative advantage, based on available resources, enables some countries to produce an exportable surplus of certain goods while other countries may have a deficit in these same goods but may produce an exportable surplus of other goods. A nation may choose whether to import a good in which it has a deficit, based on the differential between the import price and the cost of producing the good domestically. Thus, the decision whether to import from a certain trading partner or produce the good domestically hinges on the relative prices of imported versus domestically produced goods. In a dynamic international market, a number of factors determine agricultural commodity prices. These include, for example, the existing level of stocks for a given commodity, annual production levels, the anticipated demand for both the commodity and potential substitutes, prices of substitutes, and exchange rates. Trade policy is another important factor. Trade barriers such as tariffs raise the price of an imported product, which in turn may lower the demand for certain products in the importing country. If new tariffs target imports from a particular supplier, imports from other suppliers become cheaper relative to imports from the country with higher tariffs. For more on this topic, see Houck, J. P., Elements of Agricultural Trade Policies, 1992, Waveland Press Inc, Prospect Heights, IL. |

Based on Chinese customs data, the total value of Chinese agricultural imports from the United States affected by retaliatory tariffs declined from $22.5 billion in 2017 to $14.7 billion in 2018.36

Canadian customs data show that imports of U.S. agricultural products declined to $2.3 billion in 2018 from $2.4 billion in 2017.37 Canadian retaliatory tariffs include certain tariff lines covering prepared product categories under beef, poultry, dairy, fruit, vegetables, drinks, coffee and spices, chocolate and confectionary, and whiskey. As noted earlier, Canada removed its retaliatory tariffs on U.S. imports in May 2019, in response to the U.S. removal of Section 232 tariffs on steel and aluminum imports from Canada.

A review of Mexican customs data finds that imports of U.S. agricultural products by Mexico also declined from $2.6 billion in 2017 to $2.5 billion in 2018,38 largely accounted for by sausage and pork products. Mexico's imports of these products declined from $2.3 billion in 2017 to $1.6 billion in 2018. In addition to pork products, Mexico had imposed retaliatory tariffs on cheeses, apples, prepared fruit, vegetables and other food, and whiskey. Mexico also removed its retaliatory tariffs on U.S. imports in May 2019, in response to U.S. removal of Section 232 tariffs on steel and aluminum imports from Mexico.

EU customs data show the import value of U.S. food and agricultural products affected by the EU retaliatory tariffs increased to $1.3 billion in 2018 from $1.1 billion in 2017.39 The EU imposed tariff hikes on certain prepared vegetables, pulses, breakfast cereals, fruit juices, peanut butter, tobacco products, whiskey, and essential oils. A temporary surge in sales in the months prior to the imposition of duties appears to have offset a slump in sales that coincided with the onset of retaliatory duties later in the year (Figure 2). Based on the quarterly import data, by the first quarter of 2019, the total value of EU imports of U.S. products affected by retaliatory tariffs was lower than during the last quarter of 2017 or the first quarter of 2018. Since the second quarter of 2018, EU imports of affected food and agricultural products from the United States declined. As discussed above, beyond the tariff increases, a number of factors may have contributed to this reduction in imports. For instance, when countries first released their proposed lists of products that they targeted for retaliation, some EU importers may have imported larger quantities of the affected products prior to the imposition of the duties, thus boosting EU imports of U.S. agricultural goods in 2018.

Similar to the EU, the total value of Turkish imports of U.S. food and agricultural products affected by retaliatory tariffs increased between 2017 ($299 million) and 2018 ($316 million), based on Turkish customs data.40 Turkey had imposed tariff hikes on certain tree nuts, prepared food, rice, tobacco, whiskey, and other alcoholic beverages. Imports in the months prior to the imposition of duties had increased (Figure 2), which may have offset the decline in imports during the second half of 2018. In the third and fourth quarter of 2018, Turkish imports of affected U.S. food and agricultural products declined. Since May 2019, Turkey halved its retaliatory tariffs on imports from the United States.41

During 2018, India did not levy any retaliatory tariffs on imports of U.S. food and agricultural products. Starting in June 16, 2019, India implemented retaliatory tariffs on imports of U.S. almonds, walnuts, chickpeas, lentils, and apples.42 Based on the Indian customs data, the total value of Indian imports of these products was $824 million in 2017 and $859 million in 2018.43

U.S. Agricultural Exports to Retaliating Countries

Table 2 presents U.S. agricultural exports to retaliating and nonretaliating countries, in nominal values, from 2014 to 2018. As discussed in Box 1, U.S. exports to trading partners and the reported import values in destination countries can differ due to differences in HS classification of goods in different countries. Canada, the EU, Mexico, and Turkey levied retaliatory tariffs in 2018 on selected U.S. agricultural products, while China imposed retaliatory tariffs on almost all U.S. food and agricultural products. During 2018, India did not levy any retaliatory tariffs. Thus, the changes in 2018 U.S. food and agricultural exports, compared to prior years, varied across these countries (Table 2).

Despite the retaliatory tariffs, U.S. agricultural exports grew from $138 billion in 2017 to $140 billion in 2018. Greater U.S. exports of products to nonretaliating countries ($76 billion in 2018, up from $66 billion in 2017) offset the value of trade lost to China and Turkey. In addition, increased U.S. exports of products without retaliatory tariffs and products targeted for retaliatory tariffs during the months prior to their implementation (to Canada, Mexico, and the EU) also helped to offset the decline in exports of products with retaliatory tariffs to these countries.44

Table 2. U.S. Agricultural Exports to Retaliating and Nonretaliating Countries

In Nominal Billions of U.S. Dollars, 2014 to 2018

|

2014 |

2015 |

2016 |

2017 |

2018 |

2018-2017 |

|

|

Total U.S. Global Agricultural Exports |

150 |

133 |

135 |

138 |

140 |

1% |

|

U.S. Exports to Countries With Retaliatory Tariffs in 2018 |

||||||

|

Canada |

22 |

21 |

20 |

21 |

21 |

1% |

|

Mexico |

19 |

18 |

18 |

19 |

19 |

3% |

|

European Union |

13 |

12 |

12 |

11 |

14 |

18% |

|

China |

24 |

20 |

21 |

19 |

9 |

-53% |

|

Turkey |

2 |

1 |

1 |

2 |

1 |

-19% |

|

U.S. Exports to Countries Without Retaliatory Tariffs in 2018 |

||||||

|

Other Countries |

70 |

61 |

63 |

66 |

76 |

15% |

Source: U.S. Census Bureau trade data, accessed August 2019.

Notes: Data are provided in calendar years. As India did not levy any retaliatory tariffs during 2018, it is excluded from the list of countries with retaliatory tariffs in 2018. USDA's definition of agriculture is used in the table, which includes products in Chapters 1-24 of the U.S. Harmonized Tariff Schedule (except for fishery products in Chapters 3 and 16, manufactured tobacco products like cigarettes and cigars in Chapter 24, and spirits in Chapter 22), essential oils (Chapter 33), raw rubber (Chapter 40), raw animal hides and skins (Chapter 41), and wool and cotton (Chapters 51-52).

Trade data for 2017 and 2018 in Table 2 differ from those presented in Figure 1, which only includes HS lines subject to retaliatory tariffs. Data in Table 2 also do not include alcoholic beverages that were subject to tariff hikes by all retaliatory countries, potentially understating the decline in U.S. exports to retaliating countries in 2018.

U.S. Exports Under Chinese Retaliatory Tariffs45

The Chinese market is important for several U.S. agricultural products. For example, in 2016 and 2017, the United States supplied over a third of China's total soybean imports, almost all of China's distillers' grain imports (primarily used as animal feed), and most of China's sorghum imports.46 In 2017, the Chinese market accounted for about 57% of global U.S. soybean exports, 17% of global U.S. cotton exports, 80% of global U.S. sorghum exports, 11% of global U.S. dairy product exports, 10% of global U.S. pork exports, 6% of global U.S. wheat exports, and 5% of global U.S. fruit exports.

In response to U.S. Section 232 and Section 301 tariffs on U.S. imports of Chinese goods imposed in 2018, China levied retaliatory tariffs on imports of almost all U.S. agricultural products. In 2017, China was the second-leading export market by value for U.S. agricultural products. However, after the imposition of retaliatory tariffs on U.S. imports beginning in April 2018, U.S. agricultural exports to China experienced a 53% decline from $19.5 billion in 2017 to $9.2 billion in 2018 (Figure 3).47 China thus moved down in rank to become the fourth-largest U.S. agricultural market, after Canada, Mexico, and Japan.

Among other goods, China imposed a 25% retaliatory tariff on U.S. soybeans in July 2018. Since 2000, China had been the top export market for U.S. soybeans. In 2017, China imported about $12 billion worth of U.S. soybeans, accounting for 57% of the total value of all U.S. soybean exports that year. With higher tariffs in place, China has been purchasing more soybeans from Brazil and other countries to meet its demand.48 Consequently, U.S. soybean exports to China in 2018 declined to $3 billion (Figure 3). U.S. Census Bureau trade data indicate China was still the top foreign destination for U.S. soybeans in 2018, followed by Mexico, which imported $1.8 billion of U.S. soybeans.

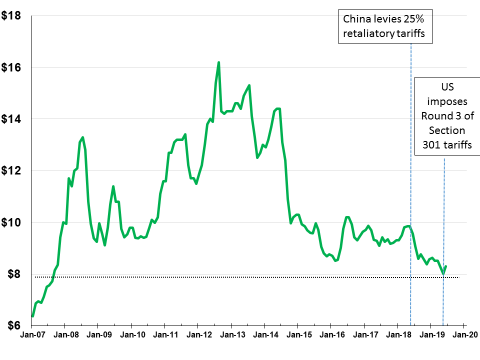

Reduced Chinese import demand in 2018 contributed to declining farm prices for affected commodities and lower U.S. agricultural exports to China for several commodities, including sorghum, soybeans, cotton, and pork.49 Consequently, U.S. soybean prices reached 10-year lows during July-October 2018 (Figure 4), weighing on prices of other agricultural commodities, such as corn, that compete with soybeans for acreage.50 Prices recovered some during the last quarter of 2018, coincident with reported commitments by China to purchase a "very substantial amount of U.S. agricultural" goods.51 However, Chinese purchases failed to materialize and U.S. commodity prices resumed their downward trend through the first quarter of 2019 before stabilizing.

As U.S. soybean prices declined in 2018, Brazilian soybean prices started to rise, indicative of a greater demand for Brazilian soybeans from China (Figure 4).52 Since 2007, Brazilian and U.S. soybean prices had tended to move together.53 Starting in April 2018, U.S. soybean prices started to fall and Brazilian soybean prices started to rise. China's imposition of a 25% tariff on U.S. soybeans in July 2018 initially precipitated a widening of the gap between the two prices. On October 23, 2018, U.S. soybean Free on Board (FOB) prices were $86 per metric ton lower than Brazilian (Paranaguá) FOB prices.54

|

Product |

2014 |

2015 |

2016 |

2017 |

2018 |

2018-2017 |

|

Total Agricultural Productsa |

24,219 |

20,230 |

21,394 |

19,507 |

9,186 |

-53% |

|

Soybeans |

14,476 |

10,489 |

14,203 |

12,253 |

3,145 |

-74% |

|

Cotton |

1,111 |

859 |

554 |

978 |

924 |

-6% |

|

Sorghum |

1,466 |

2,115 |

1,030 |

839 |

530 |

-37% |

|

Tobacco |

216 |

197 |

172 |

162 |

158 |

-3% |

|

Wheat |

194 |

160 |

205 |

351 |

105 |

-70% |

|

Corn |

84 |

163 |

40 |

142 |

50 |

-65% |

|

Pulses |

29 |

24 |

26 |

25 |

11 |

-56% |

|

Oilseeds (excluding soybean) |

5 |

2 |

3 |

5 |

1 |

-81% |

|

Pork & Pork Products |

474 |

427 |

713 |

662 |

571 |

-14% |

|

Dairy Products |

695 |

451 |

386 |

577 |

500 |

-13% |

|

Fresh Fruit |

102 |

137 |

186 |

226 |

177 |

-22% |

|

Processed Fruit |

69 |

95 |

100 |

134 |

116 |

-14% |

|

Wine & Beer |

80 |

63 |

91 |

86 |

68 |

-21% |

|

Breakfast Cereals |

11 |

29 |

32 |

30 |

21 |

-29% |

|

Hides & Skins |

1,497 |

1,268 |

948 |

945 |

607 |

-36% |

|

Hay |

255 |

331 |

355 |

341 |

274 |

-19% |

|

Feeds & Fodders, not elsewhere otherwise indicated |

366 |

377 |

379 |

267 |

232 |

-13% |

|

Distillers Grains |

1,247 |

1,632 |

470 |

62 |

44 |

-29% |

|

Soybean Oil |

132 |

13 |

104 |

24 |

2 |

-93% |

Source: U.S. Census Bureau trade data, Product Group BICO-HS10, accessed June 17, 2019, https://apps.fas.usda.gov/gats/default.aspx.

Notes: Products are selected for illustrative purpose based on the value of U.S. exports or the percentage change in trade between 2017 and 2018. The table is not comprehensive. Data are provided in calendar years, January through December. The table does not cover almost 700 food and agricultural HS lines with retaliatory tariffs in place since April 2018, nor does it cover over 200 fishery and seafood product HS lines and about 100 forest products HS lines. Note that while fishery and seafood products and forest products are eligible for USDA's export promotion programs, both the USDA and the WTO do not define seafood and forest products as agricultural products.

a. Total reported U.S. agricultural exports to China may not match with Chinese reported U.S. agricultural imports. The reasons for possible discrepancies are explained in Box 4, "Differences in Comparing U.S. Exports Data with Chinese Imports Data."

The Brazilian soybean price started to fall in late October in anticipation of a record-high South American soybean harvest. U.S. soybean prices started to climb at the same time, partly due to farmers' willingness to hold stocks and in response to larger exports to non-Chinese destinations.55 Anticipation of Chinese purchases also contributed to rebounding of U.S. prices. As Chinese purchases did not materialize, Brazilian and U.S. soybean prices started to diverge again in May 2019.

Although soybeans have been the agricultural commodity most affected by retaliatory tariffs (largely due to China's dominant role in the global soybean market), nearly all U.S. agricultural exports to China declined in 2018 relative to 2017 (see Table 3).

Key Competitors for China's Agricultural Market56

|

Box 4. Differences in Comparing U.S. Exports Data with Chinese Imports Data Among others, the following factors contribute to differences between U.S. exports data and Chinese imports data.

For more on this issue see, CRS Report RS22640, What's the Difference?—Comparing U.S. and Chinese Trade Data. |

With retaliatory tariffs making U.S. agricultural products more expensive for Chinese buyers, exports from other countries to China increased during 2018. Some studies suggest that Brazil could become China's primary soybean supplier.57 Another study concludes that U.S.-China tariff escalation would make suppliers in the rest of the world more competitive relative to U.S. and Chinese suppliers.58 Russia also contends that it may become a major U.S. competitor for China's agricultural import market,59 although market watchers expect Russia will need years to become a major agricultural supplier to China.60 To explore these assertions, CRS examined Chinese import data to identify foreign sources that may have partially replaced some of the 2018 U.S. agricultural exports to China. Note that various factors can result in data differences between U.S. exports from the U.S. Census Bureau and imports from Chinese customs data (Box 4).61

China's Total Annual Agricultural Imports

According to Chinese customs data, China's imports of agricultural products were $117 billion in 2014 as compared to $127 billion in 2018, in nominal terms (Figure 5). In 2014, the United States was the largest source of Chinese agricultural imports, accounting for nearly a quarter, or $28 billion, of China's total imports. Since 2017, Brazil and several other countries increased their shares of China's total imports, with Brazil overtaking the United States as China's largest agricultural supplier in 2017. Since the imposition of the retaliatory tariffs on U.S. imports in 2018, U.S. agricultural shipments to China declined to $15 billion, compared to $23 billion in 2017, even as overall Chinese imports increased to $127 billion. It is noteworthy that in 2016, when China's total agricultural imports were at the lowest point between 2014 and 2018, at $105 billion, U.S. market share was 21%, compared with 2018, when China's total agricultural imports were at $127 billion but U.S. market share was 12%. During the same period, Brazil's market share grew from 18% in 2016 to 26% in 2018. Additionally, China's imports from other countries increased, as indicated in Figure 5.

Brazil appears to be the primary beneficiary of Chinese retaliatory tariffs on U.S. imports, with increased exports to China in 2018 of soybeans, cotton, tobacco, pork, and oilseeds. Australia also registered growth in import market shares for cotton, sorghum, pulses, fruit and nuts, dairy, and hides and skins. Canada increased its exports to China of feed and fodder products, hides and skins, and wheat. New Zealand's share of China's import market saw gains in dairy, and hides and skins. Thailand increased its export shipments of fruit, nuts and starches, and malt to China, while increased shipments from Indonesia were largely fats and oils.

Additionally, Russia has stated that it is ready to step in to fill in the gaps created by reductions in U.S. food and agricultural exports to China, according to various news media reports,62 although market watchers expect Russia will need years to become a major agricultural supplier to China.63 In July 2018, Chinese Commerce Minister Zhong Shan agreed with his Russian counterparts to "deepen trade in soybeans and other agricultural products."64 China's imports of food and agricultural products from Russia increased 61%, from $679 million to nearly $1.1 billion, between 2017 and 2018, with strong import growth in oilseeds, wheat, fats and oils, cocoa and related products, beer, and animal products.

Various other countries from Central Asia, South and Southeast Asia, and Africa increased their exports of food and agricultural products to China during 2018 compared with 2017. Notably, China's wheat imports from Kazakhstan grew 34% and corn imports from Ukraine rose 20%. U.S. agricultural interests have reported concerns that the U.S.-China trade war in the form of tariffs and tariff retaliation could escalate further, potentially resulting in widespread, long-term damage, particularly for firms with complex international supply chains.65 For American farmers, the escalating conflict with China has contributed to declining soybean and related agricultural commodity prices in the short run, but studies indicate that the long-term consequences could be complex and have long-lasting impacts.66

The following section examines how major U.S. agricultural product market shares fared in the Chinese import market during 2018. It also presents China's imports of selected agricultural commodities on a monthly basis starting in January 2018, through the first trimester of 2019 when the different retaliatory tariffs became effective.

China's Imports of Soybeans

According to Census data, China has been the top export market for U.S. soybeans since 2000. China imported $12 billion worth (32 million metric tons) of U.S. soybeans in 2017, accounting for 57% of the total value and volume of all U.S. soybean exports that year. With higher tariffs on U.S. soybeans, China has been purchasing more soybeans from Brazil and other countries to meet its demand.67 Consequently, U.S. soybean exports to China declined to $3 billion (8 million metric tons) in 2018. Based on Census trade data, China was still the top destination for U.S. soybeans in 2018, followed by Mexico—which imported $1.8 billion worth of U.S. soybeans.

According to China's monthly customs data, China's import of U.S. soybeans in January 2018 was $2.5 billion (Figure 6).68 China's monthly imports of U.S. soybeans started to decline after China announced retaliatory tariffs in response to U.S. Section 232 tariffs in April 2018, which did not include U.S. soybeans. By the time China imposed retaliatory tariffs in response to U.S. Section 301 tariffs (which included U.S. soybeans) in July 2018, China's import of U.S. soybeans had decreased to about $140 million for that month (from $2.5 billion in January 2018). U.S. soybean shipments to China continued to decline until November 2018, when China did not import any U.S. soybeans. In December 2018, the White House announced that China had committed to purchase a "very substantial amount of agricultural" goods. Following this and other announcements, China purchased U.S. soybeans during the first trimester of 2019. The largest of these purchases, worth $700 million, occurred in April 2019. However, China's imports of U.S. soybeans declined in May 2019, coincident with the continued escalation of the U.S.-China trade dispute and the imposition of an increase in the third round of U.S. Section 301 tariffs on Chinese imports in May 2019.

During this tariff dispute, China has turned increasingly to Brazil to meet its demand for soybeans. In January 2018—prior to the tariff dispute—Chinese imports of Brazilian soybeans totaled less than $900 million, before increasing in May and June of 2018, when shipments of newly harvested soybeans from the Southern Hemisphere to China increased. By July 2018, Brazilian shipments were on the decline when China imposed 25% retaliatory tariffs on U.S. soybeans. Normally, newly harvested U.S. soybean shipments to China would have increased in the fall of 2018, whereas Chinese purchases of U.S. soybeans slowed to almost nil and were outpaced by Brazilian shipments to China. From February to May 2019, China expanded its purchases of U.S. soybeans, while also buying soybeans from Brazil, and increasing its soybean imports from Argentina, Russia, and Central Asian countries.

China's Imports of Cotton

According to Census trade data, U.S. cotton exports to China totaled over $1 billion in 2014.69 From 2017 to 2018, U.S. cotton exports to China declined 6%, from $978 million to $924 million.

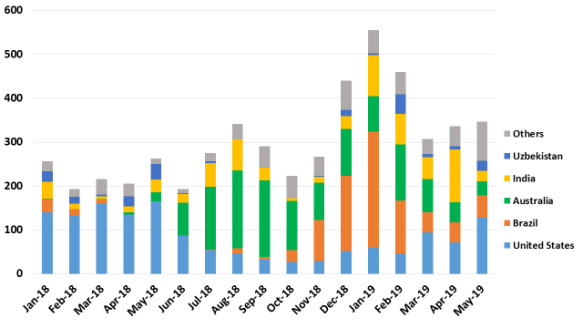

Monthly Chinese customs data indicate that China's imports of U.S. cotton have decreased since the imposition of retaliatory tariffs in July 2018 (Figure 7). During January 2018, China's cotton imports from the United States totaled $140 million. Following the announcement of retaliatory tariffs on some U.S. imports (in response to U.S. Section 232 action) in April 2018, China's imports of U.S. cotton shrank to $27 million in October 2018. While Chinese imports from the United States declined, China's imports from other countries have increased. Cotton shipments from Brazil and Australia posted the largest increases, followed by imports from India and Uzbekistan. Additionally China's imports of cotton from other Central Asian and West African countries have risen since June 2018 (Figure 7). On July 26, 2019, China reportedly approved some domestic textile mills to buy 50,000 metric tons of U.S. cotton without being subject to retaliatory tariffs.70 However, since President Trump's announcement to levy 10% Section 301 tariffs on the remaining Chinese imports that were not subject to Section 301 tariffs, China responded in August 2019 by asking its state-owned enterprises to halt purchases of U.S. agricultural goods.71

|

Figure 7. China's Monthly Imports of Cotton In Millions of U.S. Dollars, Since January 2018 |

|

|

Source: China Customs Data accessed from Global Trade Atlas, July 2019. |

China's Imports of Wheat

In 2016, the United States supplied 26% of China's wheat imports. This share increased to 40% in 2017, but declined to 14% in 2018. Canadian wheat exports have largely replaced U.S. wheat shipments to the Chinese market, with Canada's share of China's wheat imports rising from 27% in 2016 to 54% in 2018. Kazakhstan and Russia also have increased their wheat exports to China in the wake of 25% Chinese retaliatory tariffs on U.S. wheat imports, which have been in effect since July 2018.

From January to June 2018, the United States shipped a total of $113 million of wheat to China (Figure 8), compared with $256 million of U.S. wheat shipped during the same period in 2017.72 After China levied retaliatory tariffs on U.S. wheat in July 2018, U.S. wheat shipments to China were nil for the rest of the year. China imported $208 million of U.S. wheat in 2016 and $390 million of U.S. wheat in 2017.73 In March 2019, China imported $12 million of U.S. wheat. According to Chinese customs data, there have been no additional U.S. wheat shipments to China as of May 2019.

China's Imports of Sorghum

The United States accounted for nearly 90% of China's total sorghum imports in 2016 and 2017.74 The value of U.S. shipments of sorghum declined 24%, from close to $1 billion in 2017 to $726 million in 2018. China's monthly imports of U.S. sorghum have been negligible since China implemented retaliatory tariffs on them in July 2018 (Figure 9). U.S. imports started to decline after May 2018, following China's imposition of retaliatory tariffs on some agricultural products in response to U.S. Section 232 tariffs in April 2018.75 Later, China imposed a 25% retaliatory tariff on U.S. sorghum in July 2018, leading to declines in U.S. sorghum shipments to China.

China's imports of U.S. sorghum declined after retaliatory tariffs were imposed, but China continued to import limited quantities from Australia, Myanmar, and Argentina. However, in the absence of Chinese purchases of U.S. sorghum, China's total sorghum imports since October 2018 have been negligible (Figure 9). Therefore, despite the retaliatory tariffs, U.S. market share in 2018 was about 85% of China's total sorghum imports for the year.

On July 26, 2019, China reportedly allowed several domestic companies to buy U.S. sorghum without being subject to retaliatory tariffs.76 However, since President Trump's announcement to levy 10% Section 301 tariffs on remaining Chinese imports that do not yet have any Section 301 tariffs imposed on them, China responded in August 2019 by asking its state-owned enterprises to halt purchases of U.S. agricultural goods.77

China's Imports of Pork and Pork Products

The United States supplied 13% of China's total pork imports in 2016 ($400 million) and 2017 ($286 million).78 In 2018, U.S. pork shipments to China declined to $130 million and accounted for 6% of China's total pork imports. U.S. pork shipments to China began to decline in April 2018 following China's imposition of 25% retaliatory tariffs on U.S. pork (HS 0203 lines) in response to U.S. Section 232 tariffs on U.S. imports of Chinese steel and aluminum products (Figure 10). In July 2018, these HS lines were subject to an additional 25% retaliatory tariff. This coincided with a further decline in Chinese imports of U.S. pork products from July through December 2018.

Unlike the case of sorghum, China has continued to import some U.S. pork products, and import volumes generally increased from January through May 2019. Since the summer of 2018, China has suffered from a serious outbreak of African Swine Fever (ASF).79 Between September 2018 and May 2019, China reported over 2 million culled hogs. In March 2019, USDA reported that despite the retaliatory tariffs, because of ASF, U.S. pork products are entering China and USDA expects China's imports of U.S. pork to climb in 2019 due to the liquidation of some of China's hogs in an effort to control ASF. However, USDA reported that U.S. pork products still face Chinese retaliatory tariffs, which makes U.S. products relatively more expensive compared with pork from other countries.80 On July 26, 2019, China reportedly approved requests from several domestic companies to buy U.S. pork products without being subject to retaliatory tariffs.81 However, since President Trump's August 2019 announcement to levy 10% Section 301 tariffs on remaining Chinese imports that do not yet have any Section 301 tariffs levied on them, China responded by asking its state-owned enterprises to halt purchases of U.S. agricultural goods.82 On August 23, 2019, China imposed additional 10% tariffs on certain U.S. pork products, effective September 1, 2019, in response to new U.S. Section 301 tariffs on U.S. imports from China.83

China's Imports of Dairy Products

Since 2016, the United States has been the third-largest supplier of dairy products to China ($1.3 billion in 2018), among over 140 suppliers, behind New Zealand ($4.2 billion) and the Netherlands ($2 billion). China is a growing market for dairy products. Chinese imports of dairy products increased over 50% from $10 billion in 2016 to $15 billion in 2018.84 Given the diversity of dairy product tariff lines and the varying rates of Chinese retaliatory tariffs levied on them, the trade effects on the aggregate group are not as clear as they are for other individual commodities. Figure 11 presents China's monthly imports of U.S. dairy products, since the large number of suppliers and differences in market shares across the suppliers are difficult to present in a single chart.

China imposed retaliatory tariffs on U.S. dairy products in July 2018. Given the diversity of dairy tariff lines, there is no clear trend in China's monthly imports of U.S. dairy products during the second half of 2018 and early 2019 (Figure 11). Instead, annual U.S. dairy shipments to China increased 15% from $1.2 billion in 2017 to $1.3 billion in 2018.85 However, in China's growing market, imports from competitor countries grew faster from 2017 to 2018, with New Zealand's shipments increasing 15% from $3.7 billion to $4.2 billion; the Netherlands' shipments increasing 35% from $1.5 billion to $2 billion; and Australia's shipments increasing 32% from $1 billion to $1.3 billion. Although U.S. dairy shipments to China do not show any clear trend since January 2018, the retaliatory tariffs are likely contributing to faster market share growths for U.S. competitors in China than for the U.S. dairy sector, particularly since some dairy products are levied additional 5% retaliatory tariffs effective September 1, 2019.86

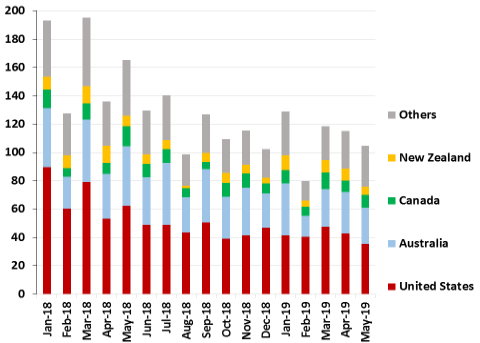

China's Imports of Hides and Skins

The United States is the largest supplier of hides and skins to China, accounting for about 41% of China's total imports from 2016 to 2018. In 2017, shipments of U.S. hides and skins to China amounted to $918 million. After the imposition of retaliatory tariffs in July 2018, Chinese imports of U.S. hides and skins declined, with China's 2018 U.S. hides and skins imports totaling $664 million.87

|

Figure 12. China's Monthly Imports of Hides and Skins In Million U.S. Dollars, Since January 2018 |

|

|

Source: China Customs Data accessed from Global Trade Atlas, July 2019. |

Major U.S. competitors in China's hides and skins import market are Australia, Canada and New Zealand (Figure 12). These countries have not been able to fill the gap created by the decline in U.S. shipments of hides and skins to China. Consequently, China's total hides and skins imports fell 25% in 2018, to $1.6 billion from $2.2 billion in 2017. U.S. shipments of hides and skins to China declined 28% during the same period. Notwithstanding the tariffs on U.S.-origin hides and skins, the decline in U.S. shipments largely mirrored the overall decline in China's imports, with the result that the United States continued to supply about 41% of China's total hides and skins imports in 2018, the same share as in the previous two years. U.S. shipments of hides and skins to China may further drop with the additional 10% retaliatory tariff on U.S. imports that became effective September 1, 2019.88

Retaliatory Partner Imports of Other Agricultural Products

Analysis conducted by economists from University of California, Davis (UC Davis) found that Chinese retaliatory tariffs decreased U.S. alfalfa exports to China in 2018 compared to the previous two years.89 From 2016 to 2018, the United States supplied the largest share of China's alfalfa imports, accounting for about 79% of China's total alfalfa import market share in 2016 ($417 million) and 72% ($534 million) in 2018.90 In January 2018, China purchased U.S. alfalfa valued at $40 million. Following the imposition of retaliatory tariffs, U.S. monthly shipments of alfalfa to China started to decline in the summer of 2018. In November 2018, China's monthly imports of U.S. alfalfa amounted to $16 million and totaled $17 million in December 2018.

Another study from UC Davis indicates that U.S. pistachio exports also declined due to retaliatory tariffs from China and Turkey.91 A third study from UC Davis estimated a combined short-run export loss for 2018 of $2.64 billion for almonds, apples, pistachios, walnuts, pecans, sweet cherries, oranges, table grapes, raisins, and sour cherries in four major import markets (China including Hong Kong, India, Mexico, and Turkey).92

It stands to reason that Chinese retaliatory tariffs may have also affected U.S. exports of certain other field crops, livestock and animal products, other specialty crops, and processed food products that are not covered in this report.

Economic Impact of Retaliatory Tariffs

U.S. agriculture, as a whole, is subject to intense competition, in both domestic and international markets. As a result, most commodity sectors operate with thin profit margins, making international sales an important component of revenue. Tariffs, by design, raise the cost of imported products (see Box 3).93 In general, an increase in import prices due to higher tariffs leads to a decrease in quantities purchased of the affected products as importers switch to other foreign suppliers or to alternate products within the domestic market. Thus, the trade impact of such a price increase will depend in large part on the number of available alternate foreign suppliers and the availability of substitutes within the domestic market. Furthermore, a decrease in exports will have an economy-wide effect as the supporting infrastructure—including farms, marketing cooperatives, warehousing and processing facilities, and transportation networks, for example—all lose business and revenues. This loss ripples further through the general economy and can cause decreases in employment and local, state, and federal tax revenues. This section of the report examines the short-term market impacts and selected economic analyses of longer-term impacts of the retaliatory tariffs.

|

Given the broad, multifaceted nature of markets, any economic analysis of the impact of a shock or unexpected event (such as new tariffs or other trade barriers) generally uses a number of simplifying assumptions to control for several of the moving market pieces. Thus, economic models of a market equilibrium—that is, where supply and demand of a commodity are in balance, and determine the price of a commodity—build certain limiting features into their structure. Two such features are the time frame being evaluated and the extent of overlap and feedback from other economic sectors. Time Frame: Short versus Long Run In evaluating a shock to a market equilibrium, the primary difference between the short run and the long run is the extent to which resources are allowed to adjust to the shock and provide feedback to the economic system being evaluated. This difference is fairly distinct for agricultural markets because producers of most temperate crops such as corn and soybeans are only able to produce a single crop each year. Thus, the time between the harvest of the current crop and the planting and harvesting of a new crop is the short run. All market adjustments that occur within this time frame—whether measured as a price change or a shift in domestic use or trade—are based on the existing supply of a commodity. In the long run, enough time has passed to provide producers the opportunity to make new crop production choices in response to the market shock, thus changing the supply of commodities in the market being studied. To produce long-run estimates, the underlying model and economic analysis assumes that the shock—if in the form of tariffs or trade barriers—is permanent and that no further shocks occur to the market. Cross-Sector: Partial versus General Equilibrium Analysis A partial equilibrium model examines a single market or sector—in isolation from other sectors of the economy—for its response to a shock. Thus, the partial equilibrium analysis considers the effects of a trade shock on an individual agricultural commodity, group of commodities, or the entire agricultural sector, but it does not consider other sectors of the economy. In contrast, general equilibrium (GE) models examine several sectors of the economy simultaneously for their interdependencies and interrelations to understand how the economy as a whole responds to a shock. Thus, GE analysis is able to evaluate the link between agricultural markets and nonagricultural markets in response to a trade shock. Scale of Impact: Local, National, Regional versus Global A price shock to major traded commodities such as U.S. agricultural products not only affects the economic well-being of producers, processors, and sellers of these commodities, but through multiplier effects also affects the well-being of U.S. rural communities. The length, breadth, and depth of shocks determines the ripple effects into the national economy. Given the dominant role of U.S. agricultural trade in the global market, the U.S. impacts of trade wars can influence agricultural production, consumption, and trade of other nations, leading to changes in foreign national strategies and investments affecting resources used. |

Short-Run Impacts

In the short run (see Box 5), retaliatory tariffs resulted in lower 2018 purchases of U.S. agricultural products by countries implementing these tariffs. The prospects for U.S. agricultural exports to China in 2019 appear to be along the same trajectory. As discussed earlier (Figure 2), U.S. food and agricultural imports by the EU and Turkey during the first quarter of 2019 were below the level of imports during the same period in 2017 and 2018.

Similarly, an examination of U.S. monthly exports to China from January to April 2019 demonstrates that the first quarter 2019 agricultural export levels have been below the export levels during the same period in 2017 and 2018 (Figure 13). Generally, fall harvested crops are exported during late fall and early winter months, and export levels decline during the spring.94

Note that no retaliatory tariffs were in effect during 2017 or the first quarter of 2018. China levied the first round of retaliatory tariffs on U.S. imports in April 2018, in response to U.S. Section 232 tariffs. Other retaliating countries followed China's action with retaliatory tariffs in June 2018. Additionally, China expanded the range of affected U.S. imports and increased tariffs in additional rounds of retaliatory actions during the summer and fall of 2018, in response to U.S. Section 301 tariffs. With the continuation of existing retaliatory tariffs on almost all U.S. agricultural HS lines, China's proclamation that its state-owned enterprises will halt purchases of U.S. agricultural goods,95 and the 5% or 10% additional increase in retaliatory tariffs effective September and December 2019,96 U.S. exports of agricultural products affected by retaliatory tariffs could potentially continue to lose some market share in China.

In addition to export losses, U.S. agriculture is facing other challenges in 2019. Abundant domestic and international supplies of grains and oilseeds in 2018 contributed to a fourth straight year of relatively weak agricultural commodity prices compared to previous years.97 U.S. soybean output and stocks were at record highs during 2018, putting downward pressure on soybean prices. Lower soybean prices contributed to lower corn prices during fall of 2018, as markets speculated that farmers would switch soybean acres to corn in 2019 (Figure 14).

|

Figure 14. U.S. Soybean Farm Prices In Nominal U.S. Dollars Per Bushels, January 2007-June 2019 |

|

|

Source: USDA, National Agricultural Statistics Service (NASS), August 2019. |

On December 1, 2018, the White House released a statement saying that China had agreed to purchase "substantial amount of agricultural" goods, among other goods.98 This statement was followed by press reports at different times stating that China had announced it would buy additional U.S. soybeans.99 The reported Chinese commitments to purchase U.S. soybeans did not materialize, and soybean prices, which had been on a downward trajectory since early 2018, declined further in early 2019. Soybean farm prices reached a 12-year low point in May 2019 at $8.02 per bushel. This coincided with President Trump's threat to raise Section 301 tariffs, on U.S. imports from China, from 10% to 25% and to impose additional tariffs on all remaining imports from China not currently covered by Sections 301 measures. The tariff increases from 10% to 25% were effective May 10, 2019.100 The Trump Administration announced its intent to impose additional tariff increases of 10% on all other products currently not covered by Section 301 tariffs.101 China responded by asking its state-owned enterprises to halt purchases of U.S. agricultural goods,102 and by levying two additional sets of tariffs: 5% or 10% tariffs on U.S. imports, including 695 different U.S. agricultural tariff lines effective September 1, 2019; and another 5% or 10% tariffs on U.S. imports including 184 different U.S. agricultural tariff lines effective December 15, 2019.103

In 2018, the U.S. farm sector faced the challenge of declining exports and commodity prices for certain major field crops, in addition to rising operational costs. Various studies predicted that the imposition of U.S. Sector 232 tariffs on steel and aluminum, in tandem with the domestic content provisions of the USMCA, could increase the cost of production for U.S. farmers.104 A report released by the Association of Equipment Manufacturers states that the Trump Administration's Section 232 and Section 301 tariffs could hurt the U.S. economy by increasing consumer prices, including a 6% increase in the cost of manufacturing agricultural and construction equipment.105 U.S. agro-chemical manufacturers have also stated that cost increases, resulting from escalating tariffs, "of pesticide products for crop and turf protection products ultimately will be passed on to American growers and businesses."106

In a sector with relatively thin profit margins, small increases in costs associated with tariffs can sometimes lead to postponed equipment purchases, causing a ripple effect through the farm input sector. In 2019, several agricultural commodity prices remain under pressure from a record soybean and near-record corn harvest in 2018, diminished export prospects due to the ongoing trade dispute with China, and high levels of carryover stocks from the previous year.107

Potential Long-Run Implications

A shift in trade patterns can become permanent if trade disruptions lead to new trade alliances or stimulate production in retaliating domestic markets or other competing foreign regions, thus increasing supplies from new sources. An example of such long-term impact of a disruption in trade on U.S. farm exports is the 1980 U.S. embargo on grain exports to the Soviet Union, which resulted in declines in U.S. commodity prices and export sales.108 A significant effect of the embargo was that the United States lost market share in sales to the Soviet Union.109

Additionally, during the early 1970s, the United States imposed a partial embargo on the exports of soybeans, cottonseed, and certain other products as an inflation fighting measure. The U.S. soybean export embargo and high prices during this period reportedly prompted greater Japanese investments in Brazil's soybean industry, which has since become the U.S. soybean industry's major export competitor.110