Farm Policy: USDA’s 2019 Trade Aid Package

On May 23, 2019, Secretary of Agriculture Sonny Perdue announced that the U.S. Department of Agriculture (USDA) would undertake a second trade aid package in 2019 valued at up to $16 billion—similar to a trade aid package initiated in 2018 valued at $12 billion—to assist farmers in response to trade damage from continued tariff retaliation and trade disruptions.

Under the 2019 trade aid package, USDA will use its authority under the Commodity Credit Corporation (CCC) Charter Act to fund three separate programs to assist agricultural producers in 2019 while the Administration works to resolve the ongoing trade disputes with certain foreign nations, most notably China. The three programs are similar to the 2018 trade aid package but are funded at different levels:

The Market Facilitation Program (MFP) for 2019, administered by USDA’s Farm Service Agency, is to provide up to $14.5 billion in direct payments to producers of affected commodities (compared with up to $10 billion in 2018).

A Food Purchase and Distribution Program, administered through USDA’s Agricultural Marketing Service, will use $1.4 billion (compared with $1.2 billion in 2018) to purchase surplus commodities affected by trade retaliation, such as fruits, vegetables, some processed foods, beef, pork, lamb, poultry, and milk, for distribution by USDA’s Food and Nutrition Service to food banks, schools, and other outlets serving low-income individuals.

The Agricultural Trade Promotion Program, administered by USDA’s Foreign Agriculture Service, will be provided $100 million ($200 million in 2018) to assist in developing new export markets on behalf of U.S. agricultural producers.

The broad discretionary authority granted to the Secretary under the CCC Charter Act to implement the trade aid package also allows the Secretary to determine how the aid is to be calculated and distributed. Some important differences between the 2018 and 2019 trade aid packages include the following.

The 2019 package includes an expanded funding commitment of $16 billion versus $12 billion under the 2018 package.

The 2019 package focuses on the same three commodity groups—non-specialty crops (grains and oilseeds), specialty crops (nuts and fruit), and animal products (hogs and dairy)—but includes an expanded list of eligible commodities (41 eligible commodities in 2019 compared with nine in 2018).

The MFP payment formula for 2019 is modified for non-specialty crops to be a single county payment rate rather than commodity-specific rates that were applied in 2018. This is done to minimize influencing producer crop choices and avoid large payment-rate discrepancies across commodities.

MFP payments for non-specialty crops will be based on planted acres in 2019, not harvested production as in 2018. This change will avoid having MFP payments reduced by the lower yields that are expected across major growing regions due to the widespread wet spring and delayed plantings.

The 2019 package includes expanded payment limits per individual per commodity group ($250,000 versus $125,000 under the 2018 initiative) and an expanded maximum combined payment limit across commodity groups ($500,000 versus $375,000). It continues the expanded adjusted gross income (AGI) criteria (no restriction if at least 75% of AGI is from farming operations) adopted under the 2019 Supplemental Appropriations for Disaster Relief Act (P.L. 116-20) and applied to 2018 MFP payments retroactively.

Payments may be made in up to three tranches, with the second and third tranches dependent on market developments. The first payment started in August and consisted of the higher of either 50% of a producer’s calculated payment or $15 per acre. USDA announced on November 15, 2019, that the second tranche of payments would go out on November 18, 2019. The third tranche would depend on USDA’s evaluation of market and trade conditions. If deemed necessary, they would occur in January 2020. As of November 25, 2019, USDA had made $10.2 billion in 2019 MFP payments.

USDA’s use of CCC authority to initiate and fund agricultural support programs without congressional involvement is not without precedent, but the scope and scale of its use for the two trade aid packages—at $28 billion—has increased congressional and public interest. Some have questioned whether MFP payments have established a precedent that might persist as long as trade disputes remain unresolved. Others have questioned the equity of their distribution across commodity sectors and regions. Finally, some economists worry that large MFP payments might contribute to a violation of U.S. trade commitments to the World Trade Organization.

Farm Policy: USDA's 2019 Trade Aid Package

Jump to Main Text of Report

Contents

- Introduction

- 2019 Trade Aid Package Components

- Market Facilitation Program

- Payment Qualifications

- Covered Commodities and Payment Determination

- MFP Payment Start Dates

- MFP Payment Limits

- MFP Payment Distribution by State

- Food Purchase and Distribution Program

- Agricultural Trade Promotion Program

- Conclusion

Figures

Tables

- Table 1. Comparison of Trade Aid Package Funding Authority: 2018 versus 2019

- Table 2. National MFP Payment Rates for 2019

- Table A-1. Comparison of MFP Payment Rates, 2018 versus 2019

- Table A-2. 2019 MFP Payment Data as of November 25, 2019

- Table B-1. FPDP Estimated Purchases under the 2019 Trade Aid Package

- Table C-1. ATP Funding Allocations for 2018 and 2019 Trade Aid Packages

Summary

On May 23, 2019, Secretary of Agriculture Sonny Perdue announced that the U.S. Department of Agriculture (USDA) would undertake a second trade aid package in 2019 valued at up to $16 billion—similar to a trade aid package initiated in 2018 valued at $12 billion—to assist farmers in response to trade damage from continued tariff retaliation and trade disruptions.

Under the 2019 trade aid package, USDA will use its authority under the Commodity Credit Corporation (CCC) Charter Act to fund three separate programs to assist agricultural producers in 2019 while the Administration works to resolve the ongoing trade disputes with certain foreign nations, most notably China. The three programs are similar to the 2018 trade aid package but are funded at different levels:

- 1. The Market Facilitation Program (MFP) for 2019, administered by USDA's Farm Service Agency, is to provide up to $14.5 billion in direct payments to producers of affected commodities (compared with up to $10 billion in 2018).

- 2. A Food Purchase and Distribution Program, administered through USDA's Agricultural Marketing Service, will use $1.4 billion (compared with $1.2 billion in 2018) to purchase surplus commodities affected by trade retaliation, such as fruits, vegetables, some processed foods, beef, pork, lamb, poultry, and milk, for distribution by USDA's Food and Nutrition Service to food banks, schools, and other outlets serving low-income individuals.

- 3. The Agricultural Trade Promotion Program, administered by USDA's Foreign Agriculture Service, will be provided $100 million ($200 million in 2018) to assist in developing new export markets on behalf of U.S. agricultural producers.

The broad discretionary authority granted to the Secretary under the CCC Charter Act to implement the trade aid package also allows the Secretary to determine how the aid is to be calculated and distributed. Some important differences between the 2018 and 2019 trade aid packages include the following.

- The 2019 package includes an expanded funding commitment of $16 billion versus $12 billion under the 2018 package.

- The 2019 package focuses on the same three commodity groups—non-specialty crops (grains and oilseeds), specialty crops (nuts and fruit), and animal products (hogs and dairy)—but includes an expanded list of eligible commodities (41 eligible commodities in 2019 compared with nine in 2018).

- The MFP payment formula for 2019 is modified for non-specialty crops to be a single county payment rate rather than commodity-specific rates that were applied in 2018. This is done to minimize influencing producer crop choices and avoid large payment-rate discrepancies across commodities.

- MFP payments for non-specialty crops will be based on planted acres in 2019, not harvested production as in 2018. This change will avoid having MFP payments reduced by the lower yields that are expected across major growing regions due to the widespread wet spring and delayed plantings.

- The 2019 package includes expanded payment limits per individual per commodity group ($250,000 versus $125,000 under the 2018 initiative) and an expanded maximum combined payment limit across commodity groups ($500,000 versus $375,000). It continues the expanded adjusted gross income (AGI) criteria (no restriction if at least 75% of AGI is from farming operations) adopted under the 2019 Supplemental Appropriations for Disaster Relief Act (P.L. 116-20) and applied to 2018 MFP payments retroactively.

Payments may be made in up to three tranches, with the second and third tranches dependent on market developments. The first payment started in August and consisted of the higher of either 50% of a producer's calculated payment or $15 per acre. USDA announced on November 15, 2019, that the second tranche of payments would go out on November 18, 2019. The third tranche would depend on USDA's evaluation of market and trade conditions. If deemed necessary, they would occur in January 2020. As of November 25, 2019, USDA had made $10.2 billion in 2019 MFP payments.

USDA's use of CCC authority to initiate and fund agricultural support programs without congressional involvement is not without precedent, but the scope and scale of its use for the two trade aid packages—at $28 billion—has increased congressional and public interest. Some have questioned whether MFP payments have established a precedent that might persist as long as trade disputes remain unresolved. Others have questioned the equity of their distribution across commodity sectors and regions. Finally, some economists worry that large MFP payments might contribute to a violation of U.S. trade commitments to the World Trade Organization.

Introduction

On May 23, 2019, Secretary of Agriculture Sonny Perdue announced that USDA would undertake a second round of trade aid in 2019 to assist farmers in response to trade damage from continued tariff retaliation and trade disruptions.1 Partial details of the new initiative were announced on July 25, 2019.2 Final program details—such as calculation of the individual commodity-specific payment rates used in the formulation of the county-level payment rates for non-specialty crops—were released on August 23, 2019.3

The 2019 trade aid package builds on the 2018 trade aid package in that it is based on the same legislative authority: Section 5 of the Commodity Credit Corporation (CCC) Charter Act of 1948 (P.L. 80-806; 15 U.S.C. 714 et seq.), as amended.4 Specifically, the President has authorized USDA to provide up to $16 billion in new funding for the 2019 initiative. This new funding authority is in addition to the $12 billion in funding authority that was announced for the previous 2018 trade aid package.5

The 2019 trade aid package is to be implemented using the same three trade assistance programs that were used under the 2018 trade aid package—a Market Facilitation Program (MFP), a Food Purchase and Distribution Program (FPDP), and an Agricultural Trade Promotion (ATP) program—but at generally higher funding levels (Table 1), except for ATP.

Also similar to the 2018 initiative, the 2019 trade aid package funding authority corresponds with USDA's estimate of the trade damage to the U.S. agricultural sector from retaliatory tariffs—imposed on U.S. agricultural goods in response to previous U.S. trade actions—and other trade disruptions in 2019.6 The 2019 programs are intended to assist agricultural producers while the Administration works to resolve the ongoing trade disputes with certain foreign nations, most notably China.

This report describes the new trade aid package authorized for 2019, including its constituent parts, and identifies distinguishing differences from the 2018 trade aid package. An appendix provides additional details on USDA's implementation of the FPDP and ATP programs and on the evolution of USDA's formulation of the MFP payment rates under the 2018 and 2019 MFP programs.

2019 Trade Aid Package Components

Under the 2019 trade aid package, USDA is to use up to $16 billion to fund three programs to assist producers of affected commodities in 2019:

- 1. A Market Facilitation Program, administered by USDA's Farm Service Agency (FSA), to provide up to $14.5 billion in direct payments to producers of USDA-specified eligible commodities (described below).

- 2. A Food Purchase and Distribution Program, administered through USDA's Agricultural Marketing Service (AMS), to use $1.4 billion to purchase surplus commodities affected by trade retaliation, such as fruits, vegetables, some processed foods, beef, pork, lamb, poultry, and milk for distribution by the Food and Nutrition Service to food banks, schools, and other outlets serving low-income individuals.

- 3. An Agricultural Trade Promotion Program, administered by USDA's Foreign Agriculture Service (FAS), to use $100 million to assist in developing new export markets on behalf of U.S. agricultural producers.

|

Program |

2018 |

2019 |

||||

|

$ billions (announced) |

||||||

|

Market Facilitation Program |

|

|

||||

|

Food Purchase and Distribution Program |

|

|

||||

|

Agricultural Trade Promotion Program |

|

|

||||

|

Total |

|

|

||||

Source: For 2018, CCC, "Market Facilitation Program," 83 Federal Register 44173, August 30, 2018. For 2019, USDA, "USDA Announces Details of Support Package for Farmers," press release, July 25, 2019.

Notes: The values represent announced funds, not actual outlays, which may vary with producer participation and program implementation.

Some important differences between the 2018 and 2019 trade aid packages include the following:

- The 2019 package includes an expanded funding commitment of up to $16 billion versus $12 billion under the previous package.

- The 2019 package includes an expanded list of eligible commodities (41 eligible commodities in 2019 versus 9 in 2018).

- The MFP payment formula for 2019 is modified for non-specialty crops (field crops) to be a single county payment rate rather than commodity-specific rates. This is done to minimize influencing producer crop choices and avoid large payment-rate discrepancies across commodities.

- MFP payments for non-specialty crops in 2019 are to be based on planted acres, not harvested production as in 2018. This change would avoid having MFP payments reduced by the lower yields that are expected across major growing regions due to the widespread wet spring and delayed plantings.

- The 2019 package includes

- 1. expanded payment limits per individual per commodity group ($250,000 versus $125,000 for 2018 MFP payments);

- 2. an expanded maximum combined payment limit across commodity groups ($500,000 versus $375,000); and

- 3. adjusted gross income (AGI) eligibility criteria based on the average AGI for 2015, 2016, and 2017. AGI criteria used to assess eligibility for 2018 MFP payments were based on AGI for 2013, 2014, and 2015.

Initially, 2018 MFP payment recipients were subject to an AGI limit of $900,000 for eligibility. However, the 2019 Supplemental Appropriations for Disaster Relief Act (P.L. 116-20) included a provision that retroactively eliminated the AGI threshold if at least 75% of a farm's AGI came from farming operations. This expanded AGI interpretation is retained for 2019 MFP payments but based on the different three-year period described above.

Market Facilitation Program

The MFP program is authorized to make direct payments to producers of eligible commodities. Eligible producers must submit application forms as part of the signup for the MFP program. Signup runs from Monday, July 29, through Friday, December 6, 2019. Program information—including MFP application forms (CCC-913), program eligibility requirements, commodity coverage, and county-level payment rates—is available at USDA's MFP program website.7 Key program details are summarized below.

Payment Qualifications

Producers of MFP-eligible commodities (listed below) may apply for MFP payments,8 provided that they also

- have an ownership interest in the commodity and are actively engaged in the farming operation;9

- have an average AGI for tax years 2015, 2016, and 2017 of less than $900,000 per year or an AGI in excess of $900,000 with at least 75% of AGI derived from farming, ranching, or forestry-related activities;

- comply with the provisions of the "Highly Erodible Land and Wetland Conservation" regulations, often called the conservation compliance provisions;10 and

- have filed a 2019 acreage report with their county FSA offices.11

Producers are not required to have purchased crop insurance or coverage under the Noninsured Crop Disaster Assistance Program to be eligible for participation, nor are they required to participate in any other CCC programs.

Covered Commodities and Payment Determination

With respect to 2019 MFP payments, USDA has categorized the eligible commodities into three groups:

- 1. non-specialty crops (field crops including grains and oilseeds),

- 2. specialty crops (tree nuts and fruits), and

- 3. animal products (dairy and hogs).

Each of these three commodity groupings has different payment structures. In particular, producers of non-specialty crops will be eligible for a single county payment rate multiplied by their farms' total acres of MFP-eligible non-specialty crops planted in a county in 2019. In contrast, dairy, hogs, and specialty crops will each have a single national payment rate to be multiplied by their production history, inventory, or acres under cultivation in 2019, respectively (Table 2).

|

Commodity |

Payment Rate per Unita |

|

Non-specialty cropsb |

Single county payment rate ranging from $15 to $150 per acre. |

|

Dairy (milk) |

$0.20 per hundredweight (cwt.)c |

|

Hogs |

$11.00 per head |

|

Nutsd |

$146.00 per acre |

|

Cranberries |

$641.14 per acre = $0.03 per pound at 21,371 pounds per acre |

|

Ginsenge |

$340.00 per acre = $2.85 per pound at 2,000 pounds per acre |

|

Sweet cherries (fresh) |

$1,463.68 per acre = $0.17 per pound at 9,148 pounds per acre |

|

Table grapes |

$624.60 per acre = $0.03 per pound at 20,820 pounds per acre |

Source: USDA, "Market Facilitation Program," https://www.farmers.gov/manage/mfp.

Notes:

a. In 2018, MFP payment rates were $0.01/bushel for corn, $0.06/lb. for cotton, $0.86/bushel for sorghum, $1.65/bushel for soybeans, $0.14/bushel for wheat, $0.03/lb. for shelled almonds, $0.16/lb. for fresh sweet cherries, $8.00/head for hogs, and $0.12/cwt. for dairy.

b. Eligible non-specialty crops include alfalfa hay, barley, canola, corn, crambe, dried beans, dry peas, extra-long-staple cotton, flaxseed, lentils, long- and medium-grain rice, millet, mustard seed, oats, peanuts, rapeseed, rye, safflower, sesame seed, small and large chickpeas, sorghum, soybeans, sunflower seed, temperate japonica rice, triticale, upland cotton, and wheat.

c. A hundredweight (cwt.) equals 100 pounds.

d. Almonds, hazelnuts, macadamia nuts, pecans, pistachios, and walnuts. The MFP payment will be based on acres under production.

e. For ginseng, harvested acres will be used as the basis for calculating MFP payments.

Non-Specialty Crops

Eligible non-specialty crops include alfalfa hay, barley, canola, corn, crambe, dried beans, dry peas, extra-long-staple cotton, flaxseed, lentils, long- and medium-grain rice, millet, mustard seed, oats, peanuts, rapeseed, rye, safflower, sesame seed, small and large chickpeas, sorghum, soybeans, sunflower seed, temperate japonica rice, triticale, upland cotton, and wheat.

Unlike 2018, where MFP payment rates were specific for each eligible non-specialty crop, 2019 MFP payment rates are fixed at the county level and do not vary with a producer's mix of crops.12 This change in payment structure was done to minimize influencing producer crop choices (as the announcement was made before planting was finished) and avoid large payment-rate discrepancies across commodities. Thus, under the 2019 MFP payment format, producers of MFP-eligible non-specialty crops, within a particular county, are to receive MFP payments based on that county's MFP payment rate multiplied by the farms' total plantings to eligible crops in that county in 2019. USDA is requiring that a producer's total MFP-eligible plantings in 2019 may not exceed total 2018 plantings.

The MFP payment rate for non-specialty crops is fixed within each county. However, MFP payment rates will vary across counties based on each county's historical average share of eligible crops planted, average planted acres per eligible crop, and average yields of eligible crops. Within this construct, USDA has set minimum and maximum county MFP payment rates of $15 and $150 per acre.

Producers who were prevented from planting MFP-eligible crops due to adverse weather but filed prevented-planting claims under crop insurance and planted FSA-certified cover crops (with the potential to be harvested) on the unplanted acres are also eligible for the minimum $15 per acre payment rate. Acres that were never planted in 2019 are not eligible for MFP payments. Acreage of non-specialty crops and cover crops must have been planted by August 1, 2019, to be eligible for MFP payments.

Dairy and Hogs

Dairy producers who were in business as of June 1, 2019, are to receive a $0.20 per hundredweight payment on their milk production history as reported for the Dairy Margin Coverage program.13 Hog producers are to receive a payment of $11 per head based on the number of live hogs owned on a date to be selected by the producer between April 1 and May 15, 2019.

Specialty Crops

MFP payments are to also be made to producers of almonds, cranberries, cultivated ginseng, fresh grapes, fresh sweet cherries, hazelnuts, macadamia nuts, pecans, pistachios, and walnuts. Per-acre MFP payment rates will vary across specialty crops (Table 2) based on their 2019 acres of fruit- or nut-bearing plants or, in the case of ginseng, harvested acres in 2019.

MFP Payment Start Dates

Payments are to be made in up to three tranches. The first payment is to consist of the higher of either 50% of a producer's calculated payment or $15 per acre. On August 22, 2019, news media announced that USDA had begun to process the first tranche of MFP payments.14

USDA announced on November 15, 2019, that the second tranche of payments would go out on November 18, 2019.15 For producers with overall MFP payment rates equal to $15 per acre, there will be no second or third tranche payment. For producers with payment rates less than $30 per acre but greater than $15 per acre, the second tranche would equal the remaining unpaid balance. For producers with payment rates greater than $30 per acre, the second payment would be up to 75% of a producer's calculated payment (less the portion already received in the first tranche).16 As of November 25, 2019, USDA reported that $10.2 billion had been paid out under the first and second tranches.17

The third tranche would depend on USDA's evaluation of market and trade conditions. If deemed necessary, the third and final payment would be for the remainder of a producer's calculated payment and would begin in January 2020.

MFP Payment Limits

MFP payments are limited to a combined $250,000 for each crop year for non-specialty crops per person or legal entity. MFP payments are also limited to a combined $250,000 for dairy and hog producers and a combined $250,000 for specialty crop producers. However, no applicant can receive more than $500,000 across the three commodity groups.

MFP payments do not count against other 2018 farm bill payment limitations.18 There are no criteria in place to calculate whether MFP might duplicate losses covered under revenue support programs such as the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs of the 2018 farm bill.19 As a result, the same program acres that are eligible for ARC or PLC payments may be eligible for MFP payments.

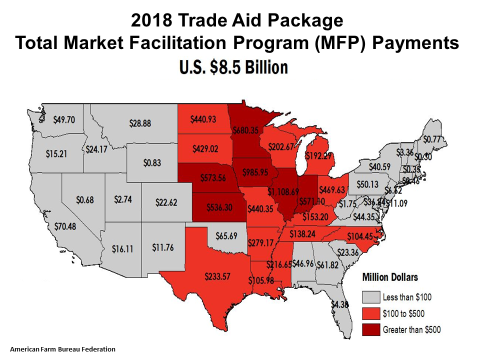

MFP Payment Distribution by State

Under the 2018 MFP program, payments were skewed toward major soybean producing states—particularly states in the Corn Belt20—as the payments were based on commodity-specific payment rates and soybeans were allocated the largest payment rate at $1.65 per bushel (Figure 1).21 When combined with a record soybean crop of over 4.5 billion in 2018, U.S. soybean producers received total outlays estimated at about $7 billion (or 82%) of 2018 MFP payments.

|

Figure 1. MFP Payments under the 2018 Trade Aid Package, as of May 13, 2019 |

|

|

Source: American Farm Bureau Federation, "Mapping $8.5 Billion in Trade Assistance," Market Intel, June 12, 2019, https://www.fb.org/market-intel. Notes: Data from USDA are not finalized but are as of May 13, 2019. USDA reported that Alaska producers had received $3,583 in MFP payments and Hawaii producers had received $51,232 as of May 13, 2019. |

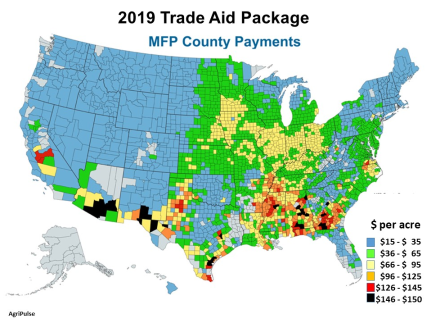

For the 2019 MFP program, USDA released the MFP county-level payment rates for nearly 3,000 counties in the United States on July 25, 2019.22 Unlike 2018, when MFP payments centered on soybean-producing regions, the areas with the highest payment rates in 2019 are regions with heavy cotton and sorghum production (Figure 2).23 Nationally, MFP payment rates range between $15 and $150 per acre. Some 22 counties are to receive the maximum payment—five counties each in Alabama, Georgia, and Texas; three counties in Mississippi and Arizona; and one county in New Mexico—while nearly 400 counties across the country are to receive the minimum $15 per acre payment.24 Some economists suggest that cotton acreage likely played a role in higher MFP payments rates in 2019 across southern states. In 2019, cotton acres averaged 52% of all MFP-eligible acres in counties with rates over $100 per acre. Peanut acreage could also play a role in higher payments.25

|

Figure 2. MFP County-Level Payment Rates under the 2019 Trade Aid Package |

|

|

Source: Hannah Pagel and Chloé Fowler, "Map: A Look at Where the MFP Payments are Going," AgriPulse, July 26, 2019, https://www.agri-pulse.com/. |

Food Purchase and Distribution Program

USDA is to use CCC Charter Act authority to implement a 2019 FPDP program, valued at up to $1.4 billion, through AMS.26 FPDP is to purchase surplus commodities affected by trade retaliation, such as fruits, vegetables, some processed foods, beef, pork, lamb, poultry, and milk, for distribution by USDA's Food and Nutrition Service to food banks, schools, and other outlets serving low-income individuals (Table B-1).27 The premise is that removing products from normal marketing channels helps to reduce supply and thereby increase prices and farm income.

Agricultural Trade Promotion Program

FAS will administer the ATP under authorities of the CCC.28 The ATP is to provide cost-share assistance to eligible U.S. organizations for activities—such as consumer advertising, public relations, point-of-sale demonstrations, participation in trade fairs and exhibits, market research, and technical assistance—to boost exports for U.S. agriculture, food, fish, and forestry products.29 On July 19, 2019, USDA awarded $100 million to 48 organizations through the ATP to help U.S. farmers and ranchers identify and access new export markets (Table C-1).30 Many of the 2019 ATP award recipients are among the cooperator organizations that had been awarded funding from the $200 million in 2018 ATP funds.31

Conclusion

The broad discretionary authority granted to the Secretary under the CCC Charter Act to implement the trade aid package also allows the Secretary to determine how the aid is to be calculated and distributed. In 2018, when the first trade aid package was announced with funding of $12 billion, USDA officials declared that it would be a temporary, one-time response to foreign tariffs imposed on selected U.S. commodities.32 However, on May 23, 2019, Secretary Perdue announced a second round of trade aid package valued at $16 billion in 2019. USDA's use of CCC authority to initiate and fund agricultural support programs without congressional involvement is not without precedent, but the scope and scale of its use for the two trade aid packages—at $28 billion—has increased congressional and public interest.

Some have suggested that the effects of tariffs and retaliatory tariffs could be long-lasting because they have created uncertainty about U.S. trade policy behavior and have called into question U.S. reliability as a trading partner.33 Furthermore, the use of CCC authority to mitigate tariff-related losses may establish a precedent for future situations. Some trade economists and market watchers have suggested that annual trade aid packages might continue as long as the trade disputes remain unresolved.

Most farm commodity and advocacy groups have been supportive of the trade aid package even as they have called for solutions that restore export activity.34 However, some stakeholders have questioned the equity of the distribution of 2018 MFP payments and the rationale for determining payments based on "trade damage" rather than a broader "market loss" measure.35 Some economists have suggested that, even under the 2019 formulation, USDA is overpaying farmers for trade losses and that USDA's calculations failed to fully incorporate last year's record soybean harvest or new trade patterns that have emerged following China's reluctance to buy U.S. soybeans.36

Due to their price tag ($12 billion in 2018 and $16 billion in 2019) and the coupled37 nature of the MFP payments to planted acres, there is considerable interest from policymakers, market observers, and trading partners about whether these payments will be fully compliant with World Trade Organization (WTO) commitments.38 In particular, there is some interest in whether large MFP payments might cause the United States to breach its $19.1 billion annual WTO spending limit on trade-distorting farm subsidies.39

Appendix A. MFP Payment Formula

On August 23, 2019, USDA published the details on the calculation of MFP payment rates for USDA-designated eligible commodities under the 2019 trade aid package—including county-level MFP rates for non-specialty crops and national MFP rates for hogs, dairy, and specialty crops.40

For both the 2018 and the 2019 trade aid packages, USDA defined economic losses due to foreign retaliatory trade actions narrowly in terms of gross trade damages rather than broadly as lost market value.41 Gross trade damages is defined as the total amount of expected export sales lost to the retaliating trade partner due to the additional tariffs. Gross trade damages were estimated for each of the major farm commodities affected by the retaliatory tariffs. The estimated trade damages were then used to derive both commodity-specific MFP payment rates and FPDP purchase targets for pork (hogs) and milk (dairy).

Both the 2018 and 2019 trade aid packages used the same methodology to estimate gross trade damages for USDA-designated commodities. However, the two estimates used different time frames to calculate the trade damages, thus producing different commodity-specific MFP payment rates (Table A-1). The 2018 calculations of gross trade damages compared trade data from 2017 (pre-retaliatory tariffs) with 2018 data (post-retaliatory tariffs). The 2019 calculations used a longer historical time series, extending the "look-back" over a 10-year period from 2009 through 2018 compared with 2019 trade.

In a further change from the 2018 methodology, the 2019 MFP payment rates for non-specialty crops combined commodity-specific MFP payments rates at the county level in a formula (weighted by historical county planted acres and yields) to derive a single county-level MFP payment rate rather than separate national commodity-specific rates. Hogs, dairy, and specialty crops retained their national MFP payment rates but at different values due to the longer "look-back" period used to estimate gross trade damages.

This appendix section briefly reviews the methodology used to derive the 2018 MFP commodity-specific payment rates. Then it discusses the adaptations made by USDA for 2019 to derive both the county-level payments for non-specialty crops and the national-level payment rates for specialty crops, hogs, and dairy.

|

Commodity |

$/Unit |

2018 |

2019 |

Change |

|||

|

Non-Specialty Crops |

County-specific $/Acre |

— |

$15 to $150 |

— |

|||

|

Corn |

$/bushel |

$0.01 |

$0.14 |

1300% |

|||

|

Sorghum |

$/bushel |

$0.86 |

$1.69 |

97% |

|||

|

Soybeans |

$/bushel |

$1.65 |

$2.05 |

24% |

|||

|

Wheat |

$/bushel |

$0.14 |

$0.41 |

193% |

|||

|

Cotton |

$/lb. |

$0.06 |

$0.26 |

333% |

|||

|

Rice |

$/cwt. |

— |

$0.63 |

— |

|||

|

Peanuts |

$/lb. |

— |

$0.01 |

— |

|||

|

Lentils |

$/cwt. |

— |

$3.99 |

— |

|||

|

Peas |

$/cwt. |

— |

$0.85 |

— |

|||

|

Alfalfa Hay |

$/tons |

— |

$2.81 |

— |

|||

|

Dried Beans |

$/cwt. |

— |

$8.22 |

— |

|||

|

Chickpeas |

$/cwt. |

— |

$1.48 |

— |

|||

|

Hogs |

$/head |

$8.00 |

$11.00 |

38% |

|||

|

Dairy (Milk) |

$/cwt. |

$0.12 |

$0.20 |

67% |

|||

|

Specialty Crops |

|

|

|

||||

|

Tree Nuts |

$/acre |

— |

$146.00 |

— |

|||

|

Shelled Almonds |

$/lb. |

$0.03 |

$0.07 |

127% |

|||

|

Fresh Sweet Cherries |

$/lb. |

$0.16 |

$0.17 |

6% |

|||

|

Grapes (fresh) |

$/lb. |

— |

$0.03 |

— |

|||

|

Cranberries |

$/lb. |

— |

$0.03 |

— |

|||

|

Ginseng |

$/lb. |

— |

$2.85 |

— |

Source: MFP payment rates for 2018 are from USDA, "USDA Announces Details of Assistance for Farmers Impacted by Unjustified Retaliation," press release, August 27, 2018; and USDA, "USDA Adds Shelled Almonds and Fresh Sweet Cherry to Market Facilitation Program," press release, September 21, 2018. MFP payment rates for 2019 are from USDA, "USDA Announces Details of Support Package for Farmers," press release," July 25, 2019; and USDA, "Market Facilitation Program," online website at https://www.farmers.gov/manage/mfp.

Notes:

a. The 2018 MFP payment rates are national, commodity-specific rates that are paid on harvested production of five non-specialty crops (corn, cotton, sorghum, soybeans, and wheat); hogs; milk; shelled almonds; and fresh sweet cherries.

b. The 2019 MFP payment rates for non-specialty crops are a county-specific, per-acre payment rates (paid on planted acres of USDA-designated non-specialty crops) that range from $15 to $150 per acre of USDA designated commodities as listed in note b of Table 2. The national commodity MFP payment rates that USDA used to derive the county-specific payment rates are included in this table to allow comparison with the 2018 rates.

2018 MFP Payment-Rate and Payment Methodology

USDA calculated a unique national MFP payment rate for each affected commodity (as determined by USDA). A producer's MFP payment calculation involved three steps:42

First, USDA estimated the level of direct trade-related damage caused by 2018 retaliatory tariffs—imposed by Canada, China, the European Union, Mexico, and Turkey—to U.S. exports for each affected commodity. Direct trade loss is the difference in expected trade value for each affected commodity with and without the retaliatory tariffs. To measure this, USDA compared U.S. exports for 2017 (the year prior to the imposition of retaliatory tariffs) with 2018 export levels when trade was subject to the retaliatory tariffs.

Much of the affected 2018 agricultural production had yet to be harvested and sold at the time the MFP payment rates were calculated. In addition, the final trade effect, with or without retaliatory tariffs, was not observable,43 and markets had yet to fully adjust to whatever new trade patterns would emerge from the trade dispute. As a result, USDA estimated both export values (with and without retaliatory tariffs) using a global trade model that accounted for the availability of both substitute supplies from export competitors and demand for U.S. agricultural exports from alternate importers. Indirect effects—such as any decline in market prices due to record 2018 soybean production and the build-up of domestic stocks, or resultant economy-wide "lost value" for non-producer owners of the affected commodities—were not included in the payment calculation.

Second, the estimated trade damage for each affected commodity was divided by the crop's production in 2017 to calculate a national commodity-specific, per-unit damage rate. This per-unit damage rate is the commodity-specific MFP payment rate. In the case of both pork and milk, FPDP purchases were subtracted from the estimated trade damage before the per-unit MFP payment rates for hogs and milk were calculated.

Finally, a producer's 2018 MFP payment was equal to the commodity-specific MFP payment rate multiplied by the producer's 2018 production for corn, cotton, sorghum, soybeans, wheat, fresh sweet cherries, and shelled almonds. For hog producers, the MFP payment rate was multiplied by a producer-selected hog inventory from July 15 to August 15, 2018. For milk producers, the MFP payment rate was multiplied by the farm's production history as reported for the Margin Protection Program of the 2014 farm bill.

2019 MFP Payment-Rate and Payment Methodology

To calculate the 2019 MFP payment rates, USDA made several adaptations to the 2018 methodology. As a result, a producer's MFP payment calculation in 2019 involved an additional fourth step.44

First, USDA again calculated the level of direct trade-related damage caused by retaliatory tariffs to U.S. exports for each commodity. However, USDA used 2019 retaliatory tariffs (not 2018) that were being imposed by China, the European Union, and Turkey. Canada and Mexico were removed from the calculations, as they were no longer imposing retaliatory tariffs on U.S. agricultural exports. In addition, USDA adjusted the calculation of direct trade damage by using 10 years of historical U.S. export data (2009-2018) rather than a single year. This larger period captured trade losses for certain commodities that experienced fluctuating trade patterns in recent years and where trade levels during the 2017 data period were unrepresentative of historical trade volumes.

Second, the estimated trade damage for each affected commodity was divided by the crop's average production during the three-year period 2015-2017 to calculate a national commodity-specific, per-unit damage rate. In the case of both pork and milk, FPDP purchases were subtracted from the estimated trade damage before the per-unit MFP payment rates for hogs and milk were calculated.

Third, the commodity-specific damage rates were then used to establish county-level, per-acre payment rates based on historical county data for average planted area and yields of the affected commodities. For each county, USDA multiplied three terms together to estimate the county-level trade damage for each MFP-eligible crop: (1) the three-year (2015-2017) average yield for each crop—taken from USDA's Risk Management Agency's (RMA) crop insurance data,45 (2) the four-year (2015-2018) average planted acres of each crop in the county—taken from FSA's database of crop acreage reports—and (3) the commodity-specific, per-unit damage rate for each crop (from step two above). Then, for each county, the crop damage estimates were added across all MFP-eligible crops produced in the county to generate an estimate of the county's total trade damages. The county's total trade damage estimate was then divided by total planted acres of MFP-eligible crops within the county.46 The result is a unique county-level MFP payment rate. Under this formulation, MFP county-level rates will vary across counties based on the average crop mix, the average planted acres per crop, and average crop yields.

Finally, a producer's 2019 MFP non-specialty-crop payment is equal to the county-level MFP non-specialty-crop payment rate (for the county where production occurs) multiplied by the total acreage of all non-specialty crops planted in that county by that producer. Thus, the 2019 MFP non-specialty-crop payment is independent of an individual farmer's crop mix (from among MFP-eligible non-specialty crops).

In 2019, many producers were prevented from planting acreage due to wet, cool conditions. These acres were not eligible for MFP non-specialty crop payments. However, if a USDA-approved cover crop was planted on the "prevent-plant" acres with the potential to be harvested, then those producers qualified for a $15-per-acre payment on "prevent-plant" acres.

USDA suggests that this independence from individual crop choices prevents the county-level MFP payment from distorting producer planting decisions that were ongoing at the time of the initial trade aid package announcement on May 23, 2019.47 However, planting of an MFP-eligible crop was a requirement for MFP eligibility. Thus, the 2019 MFP payments may be non-commodity-specific outlays, but they are coupled to the planting of an MFP-eligible crop. These distinctions, although subtle, are important considerations for how the resultant outlays may be notified under WTO domestic-support program disciplines.

|

States |

Livestock |

Non-SpecialtyCrops |

SpecialtyCrops |

GrandTotal |

||||

|

Alabama |

|

|

|

|

||||

|

Alaska |

|

|

|

|

||||

|

Arizona |

|

|

|

|

||||

|

Arkansas |

|

|

|

|

||||

|

California |

|

|

|

|

||||

|

Colorado |

|

|

|

|

||||

|

Connecticut |

|

|

|

|

||||

|

Delaware |

|

|

|

|

||||

|

Florida |

|

|

|

|

||||

|

Georgia |

|

|

|

|

||||

|

Hawaii |

|

|

|

|

||||

|

Idaho |

|

|

|

|

||||

|

Illinois |

|

|

|

|

||||

|

Indiana |

|

|

|

|

||||

|

Iowa |

|

|

|

|

||||

|

Kansas |

|

|

|

|

||||

|

Kentucky |

|

|

|

|

||||

|

Louisiana |

|

|

|

|

||||

|

Maine |

|

|

|

|

||||

|

Maryland |

|

|

|

|

||||

|

Massachusetts |

|

|

|

|

||||

|

Michigan |

|

|

|

|

||||

|

Minnesota |

|

|

|

|

||||

|

Mississippi |

|

|

|

|

||||

|

Missouri |

|

|

|

|

||||

|

Montana |

|

|

|

|

||||

|

Nebraska |

|

|

|

|

||||

|

Nevada |

|

|

|

|

||||

|

New Hampshire |

|

|

|

|

||||

|

New Jersey |

|

|

|

|

||||

|

New Mexico |

|

|

|

|

||||

|

New York |

|

|

|

|

||||

|

North Carolina |

|

|

|

|

||||

|

North Dakota |

|

|

|

|

||||

|

Ohio |

|

|

|

|

||||

|

Oklahoma |

|

|

|

|

||||

|

Oregon |

|

|

|

|

||||

|

Pennsylvania |

|

|

|

|

||||

|

Rhode Island |

|

|

|

|

||||

|

South Carolina |

|

|

|

|

||||

|

South Dakota |

|

|

|

|

||||

|

Tennessee |

|

|

|

|

||||

|

Texas |

|

|

|

|

||||

|

Utah |

|

|

|

|

||||

|

Vermont |

|

|

|

|

||||

|

Virginia |

|

|

|

|

||||

|

Washington |

|

|

|

|

||||

|

West Virginia |

|

|

|

|

||||

|

Wisconsin |

|

|

|

|

||||

|

Wyoming |

|

|

|

|

||||

|

Grand Total |

$355,758,229 |

$9,705,194,690 |

$107,926,321 |

$10,168,879,240 |

Source: FSA, "Market Facilitation Program," https://www.farmers.gov/manage/mfp.

Note: The MFP payment categories are as defined in the text.

Appendix B. FPDP Implementation

The Administration is allocating about $1.4 billion of its 2019 trade aid package to USDA's AMS for purchasing various agricultural commodities and distributing them through domestic nutrition assistance programs (Table B-1).48

|

Commodity |

Item ($ million) |

Subtotal ($ millions) |

|||

|

Poultry |

|

|

|||

|

Pork |

|

|

|||

|

Beef |

|

|

|||

|

Dairy |

|

|

|||

|

Lamb |

|

|

|||

|

Animal Products |

|

||||

|

Citrusa |

|

||||

|

Apples |

|

|

|||

|

Raisins |

|

|

|||

|

Potatoes |

|

|

|||

|

Plums/prunes |

|

|

|||

|

Sweetcorn |

|

|

|||

|

Blueberries |

|

|

|||

|

Pears |

|

|

|||

|

Strawberries |

|

|

|||

|

Onions |

|

|

|||

|

Figs |

|

|

|||

|

Apricots |

|

|

|||

|

Specialty Crops |

|

||||

|

Processed Foodsb |

|

|

|||

|

Total |

|

Under the 2019 FPDP program, AMS is to buy affected products in four phases, starting after October 1, 2019, with deliveries beginning in January 2020. The products purchased can be adjusted between phases to accommodate changes due to growing conditions, product availability, market conditions, trade negotiation status, and program capacity.

AMS maintains purchase specifications for a variety of commodities based on recipient needs. The products discussed in this plan are to be distributed to states for use in the network of food banks and food pantries that participate in the Emergency Feeding Assistance Program, elderly feeding programs such as the Commodity Supplemental Foods Program, and tribes that operate the Food Distribution Program on Indian Reservations. These outlets are in addition to child nutrition programs such as the National School Lunch Program, which may also benefit from these purchases.

Appendix C. ATP Program Implementation

USDA announced funding allocations under the ATP program for both the 2018 and 2019 trade aid packages in 2019 (Table C-1). A total of 59 organizations have received $300 million in awards under the two ATP programs, including 57 organization receiving $200 million under the 2018 ATP program and 48 organizations sharing $100 million under the 2019 program.

|

Participant |

January 2019a |

July 2019b |

Total |

|||

|

American Soybean Association |

|

|

|

|||

|

U.S. Meat Export Federation |

|

|

|

|||

|

U.S. Grains Council |

|

|

|

|||

|

Food Export USA Northeast |

|

|

|

|||

|

Food Export Association of the Midwest USA |

|

|

|

|||

|

Wine Institute |

|

|

|

|||

|

Cotton Council International |

|

|

|

|||

|

Southern U.S. Trade Association |

|

|

|

|||

|

U.S. Wheat Associates |

|

|

|

|||

|

Washington Apple Commission |

|

|

|

|||

|

U.S. Dairy Export Council |

|

|

|

|||

|

Western U.S. Agricultural Trade Association |

|

|

|

|||

|

Alaska Seafood Marketing Institute |

|

|

|

|||

|

USA Rice Federation/US Rice Producers Association |

|

|

|

|||

|

Blue Diamond Growers |

|

|

|

|||

|

California Table Grape Commission |

|

|

|

|||

|

Almond Board of California |

|

|

|

|||

|

National Potato Promotion Board |

|

|

|

|||

|

American Hardwood Export Council, Engineered Wood Association, Softwood Export Council, Southern Forest Products Association |

|

|

|

|||

|

California Walnut Commission |

|

|

|

|||

|

Northwest Wine Promotion Coalition |

|

|

|

|||

|

American Peanut Council |

|

|

|

|||

|

Cranberry Marketing Committee |

|

|

|

|||

|

American Pistachio Growers |

|

|

|

|||

|

Cal-Pure Produce |

|

|

|

|||

|

California Prune Board |

|

|

|

|||

|

Raisin Administrative Committee |

|

|

|

|||

|

USA Dry Pea and Lentil Council |

|

|

|

|||

|

USA Poultry and Egg Export Council |

|

|

|

|||

|

Pear Bureau Northwest |

|

|

|

|||

|

U.S. Dry Bean Council |

|

|

|

|||

|

U.S. Hide, Skin and Leather Association |

|

|

|

|||

|

National Confectioners Association |

|

|

|

|||

|

American Sheep Industry Association |

|

|

|

|||

|

American Seed Trade Association |

|

|

|

|||

|

U.S. Pecan Growers Council |

|

|

|

|||

|

National Renderers Association |

|

|

|

|||

|

Distilled Spirits Council |

|

|

|

|||

|

Washington State Fruit Commission |

|

|

|

|||

|

Ginseng Board of Wisconsin |

|

|

|

|||

|

Organic Trade Association |

|

|

|

|||

|

California Strawberry Commission |

|

|

|

|||

|

Brewers Association |

|

|

|

|||

|

U.S. Livestock Genetics Export |

|

|

|

|||

|

California Cherry Marketing and Research Board |

|

|

|

|||

|

U.S. Highbush Blueberry Council |

|

|

|

|||

|

Florida Department of Citrus |

|

|

|

|||

|

Sunkist Growers |

|

|

|

|||

|

California Fresh Fruit Association |

|

|

|

|||

|

National Assoc. of State Depts. of Agriculture |

|

|

|

|||

|

California Agricultural Export Council |

|

|

|

|||

|

New York Wine and Grape Foundation |

|

|

|

|||

|

Intertribal Agriculture Council |

|

|

|

|||

|

California Olive Committee |

|

|

|

|||

|

U.S. Apple Export Council |

|

|

|

|||

|

Popcorn Board |

|

|

|

|||

|

California Pear Advisory Board |

|

|

|

|||

|

National Watermelon Promotion Board |

|

|

|

|||

|

Pet Food Institute |

|

|

|

|||

|

Totals: |

|

|

|

Source: FAS, "ATP Funding Allocations," as of July 30, 2019; https://www.fas.usda.gov/atp-funding-allocations.

Notes:

a. USDA awarded ATP funding under the 2018 trade aid package in January 2019. USDA, "USDA Awards Agricultural Trade Promotion Program Funding," press release, January 31, 2019.

b. USDA awarded ATP funding under the 2019 trade aid package in July 2019. USDA, "USDA Awards Agricultural Trade Promotion Program Funding," press release, July 19, 2019.

Author Contact Information

Footnotes

| 1. |

USDA, "USDA Announces Support for Farmers Impacted by Unjustified Retaliation and Trade Disruption," press release, May 23, 2019. For details on the first round of trade aid, see CRS Report R45310, Farm Policy: USDA's 2018 Trade Aid Package, by Randy Schnepf et al. |

| 2. |

USDA, "USDA Announces Details of Support Package for Farmers," press release, July 25, 2019. |

| 3. |

USDA, "USDA Details Trade Damage Estimate Calculations," press release, August 23, 2019. |

| 4. |

See the discussion under "Trade Aid Package Authority" in CRS Report R45310, Farm Policy: USDA's 2018 Trade Aid Package. See also CRS Report R44606, The Commodity Credit Corporation: In Brief, by Megan Stubbs, for further details and historical perspective on USDA's authority under the CCC Charter Act. |

| 5. |

See CRS Report R45310, Farm Policy: USDA's 2018 Trade Aid Package, by Randy Schnepf et al. |

| 6. |

For information on the trade disputes underlying the trade aid package, see the discussion under "Tariffs as the Origin of the Trade Aid Package," in CRS Report R45310, Farm Policy: USDA's 2018 Trade Aid Package. |

| 7. |

FSA, "Market Facilitation Program," https://www.farmers.gov/manage/mfp. |

| 8. |

MFP applications (Form CCC-913) are available at https://www.farmers.gov/manage/mfp. |

| 9. |

See CRS Report R44656, USDA's Actively Engaged in Farming (AEF) Requirement, by Randy Schnepf. |

| 10. |

See CRS Report R42459, Conservation Compliance and U.S. Farm Policy, by Megan Stubbs. |

| 11. |

The acreage report is form FSA-578. On this form, a producer is to list the acreage planted to crops for the 2019 crop year. |

| 12. |

See Appendix A for details on how the county-level MFP payment rates were derived. |

| 13. |

For details on Dairy Margin Coverage and milk production history, see CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison. |

| 14. |

Jacqui Fatka, "First Round of 2019 MFP Payments Issued," Feedstuffs, August 22, 2019. |

| 15. |

USDA, "USDA Issues Second Tranche of Market Facilitation Program," November 15, 2019. |

| 16. |

FSA, "Payments Announced for 2nd Tranche of 2019 Market Facilitation Program (MFP)," November 15, 2019. |

| 17. |

FSA, Market Facilitation Program, Payment Report, accessed on November 26, 2019, https://www.farmers.gov/manage/mfp. |

| 18. |

See CRS Report R45659, U.S. Farm Program Eligibility and Payment Limits Under the 2018 Farm Bill (P.L. 115-334), by Randy Schnepf and Megan Stubbs. |

| 19. |

CRS Report R45730, Farm Commodity Provisions in the 2018 Farm Bill (P.L. 115-334), by Randy Schnepf. |

| 20. |

The Corn Belt encompasses the band of states running from Ohio westward to Nebraska and including southern Michigan, Indiana, Illinois, northern Missouri, Iowa, southern Wisconsin, southern Minnesota, eastern South Dakota, eastern North Dakota, and eastern Kansas. |

| 21. |

American Farm Bureau Federation, "Mapping $8.5 Billion in Trade Assistance," Market Intel, June 12, 2019, https://www.fb.org/market-intel. See this article for additional charts mapping MFP payments to all MFP-eligible commodities. |

| 22. |

FSA, "Market Facilitation Program: 2019 County Per Acre Payment Rates," https://www.farmers.gov/sites/default/files/documents/PaymentRates.pdf. |

| 23. |

Hannah Pagel and Chloé Fowler, "Map: A Look at Where the MFP Payments Are Going," AgriPulse, July 26, 2019, https://www.agri-pulse.com/. |

| 24. |

Pagel and Fowler, "Map: A Look at Where the MFP Payments Are Going." |

| 25. |

G. Schnitkey et al., "The 2019 Market Facilitation Program." farmdoc daily, July 30, 2019. |

| 26. |

AMS, "Food Purchase and Distribution Program," https://www.ams.usda.gov/selling-food-to-usda/trade-mitigation-programs. |

| 27. |

See Appendix B for details on 2019 FPDP implementation and USDA estimates of commodity purchases by value. |

| 28. |

FAS, "Agricultural Trade Promotion Program," https://www.fas.usda.gov/programs/agricultural-trade-promotion-program-atp. |

| 29. |

See Appendix C for details on 2019 ATP program implementation. |

| 30. |

FAS, "USDA Awards Agricultural Trade Promotion Funding," July 19, 2019, https://www.fas.usda.gov/newsroom/usda-awards-agricultural-trade-promotion-program-funding-0. |

| 31. |

USDA, "USDA Awards Agricultural Trade Promotion Program Funding," press release, January 31, 2019. |

| 32. |

Reuters, "U.S. Agriculture Chief Says No Plan to Extend Farm Aid to Offset Tariffs," October 29, 2018. |

| 33. |

Mario Parker et al., "Cargill CEO Sees Risk to U.S. Farmers as China Shuns Soybeans," Bloomberg News, September 25, 2018. |

| 34. |

Hagstrom, "Farm Groups Praise Trade Aid with Some Caveats," July 26, 2019. |

| 35. |

Hagstrom, "Summary of Trump Trade Aid: It's Not Enough," August 28, 2018. |

| 36. |

Darren Hudson, an economist at Texas Tech University, says that only 5%-8% of the drop in the price of cotton—which has fallen by about $0.30/lb. from a high of more than $0.90/lb. in June 2018—can be directly linked to China's tariff (Philip Brasher, "Bigger Trade Package Seen as a 'Bridge' to Better Times," AgriPulse, July 31, 2019). Also, a study by the Food and Policy Research Institute (FAPRI) found that Chinese tariffs led to a $0.78/bushel drop in U.S. soybean prices after accounting for the effect of trade-pattern shifts. This compares with the USDA MFP payment rate for soybeans of $1.65/bushel based on USDA's trade damage estimates for U.S. soybeans (Dan Charles, "Economists Say Trump Administration Overpaying Farmers for Trade Losses," National Public Radio, July 25, 2019). The FAPRI study (Pat Westhoff et al., "A Hybrid Model Approach to Estimating Impacts of China's Tariffs on U.S. Soybeans") was presented at the annual meeting of the American Agricultural Economics Association (AAEA) in Atlanta, GA, on July 22, 2019. |

| 37. |

Coupled means that payments are linked to current producer behavior such as planted acres or production of a program crop. In contrast, decoupled means that payments are not linked to current producer behavior and, instead, are based on some other measure outside of the producer's decisionmaking sphere, such as historical acres planted to program crops. Decoupling of payments is intended to minimize their incentives on producer behavior. |

| 38. |

CRS Report R45305, Agriculture in the WTO: Rules and Limits on U.S. Domestic Support, by Randy Schnepf. |

| 39. |

Tom Miles, "WTO Members Clamor for More Clarity on U.S. Farm Spending," Business News, September 20, 2018; Doug Palmer, "Other Nations Question New U.S. Trade Aid Payments for Farmers," Politico, June 17, 2019; and David Widmar and Brent Gloy, "U.S. Farmers and Ranchers Deserve Better," Agricultural Economic Insights, May 13, 2019. |

| 40. |

USDA, Office of the Chief Economist (OCE), "Trade Damage Estimation for the 2019 Market Facilitation Program and Food Purchases and Distribution Program," August 22, 2019. |

| 41. |

For a discussion of trade versus market losses see Appendix B of CRS Report R45310, Farm Policy: USDA's 2018 Trade Aid Package, by Randy Schnepf et al. |

| 42. |

OCE, "Trade Damage Estimation for the Market Facilitation Program and Food Purchase and Distribution Program," September 13, 2018, https://www.usda.gov/oce/trade/USDA_Trade_Methodology_Report.pdf. |

| 43. |

Once the retaliatory tariffs were put in place in 2018, final 2018 trade data without the influential effect of retaliatory tariffs is a hypothetical outcome that must be estimated using a model. Further, since the trade was still ongoing, final trade data in the presence of retaliatory tariffs would have to be estimated. |

| 44. |

OCE, "Trade Damage Estimation for the 2019 Market Facilitation Program and Food Purchases and Distribution Program," August 22, 2019. |

| 45. |

County yield data was sourced, based on availability, from a cascading priority list: (1) RMA, (2) USDA National Agricultural Statistics Service (NASS) if RMA data is unavailable, (3) RMA's T-yield for the county if data from (1) and (2) are unavailable, (4) NASS state yield if (1)-(3) are unavailable, and (5) NASS national yield if (1)-(4) are unavailable. |

| 46. |

The total planted acres of MFP-eligible crops within the county is estimated by summing across all of the four-year average planted acres from (2) above. |

| 47. |

USDA, "USDA Announces Support for Farmers Impacted by Unjustified Retaliation and Trade Disruption." |

| 48. |

USDA, "Food Purchase and Distribution Program," https://www.ams.usda.gov/selling-food-to-usda/trade-mitigation-programs. |