Debates over Exchange Rates: Overview and Issues for Congress

Exchange rates are among the most important prices in the global economy. They affect the price of every country’s imports and exports, as well as the value of every overseas investment. Over the past decade, some Members of Congress have been concerned that foreign countries are using exchange rate policies to gain an unfair trade advantage against other countries, or “manipulating” their currencies. Congressional concerns have focused on China’s foreign exchange interventions over the past decade to weaken its currency against the U.S. dollar, although concerns have also been raised about a number of other countries pursuing similar policies.

At the heart of disagreements is whether or not countries are using policies to undermine free markets and intentionally push down the value of their currency. A weak currency makes exports cheaper to foreigners, which can lead to higher exports and job creation in the export sector. There can also be implications for other countries. From the U.S. perspective, U.S exporters and U.S. firms producing import-sensitive goods may find it harder to compete in global markets. However, U.S. consumers and U.S. businesses that rely on inputs from abroad may benefit when other countries have weak currencies, because imports may become less expensive. When foreign countries intervene in foreign exchange markets, it may also help lower U.S. borrowing costs.

Through the International Monetary Fund (IMF), countries have committed to avoiding currency manipulation. There are also provisions in U.S. law to address currency manipulation by other countries. The IMF has never cited a country for currency manipulation, and the U.S. Department of the Treasury has not done so since it last cited China in 1994. There are differing views on why. Some argue that countries have not engaged in policies that violate international commitments on exchange rates or triggered provisions in U.S. law relating to currency manipulation. Others argue that currency manipulation has occurred, but the provisions do not effectively respond to exchange rate disputes.

Legislation in the 114th Congress

The 114th Congress responded to concerns about currency manipulation through Trade Promotion Authority (TPA) and customs legislation. TPA legislation signed into law in June 2015 (P.L. 114-26) included, for the first time, principal negotiating objectives addressing currency manipulation in trade agreements. Currency manipulation was also addressed in the Trade Facilitation and Trade Enforcement Act of 2015 (P.L. 114-125). It enhanced Treasury reporting and bilateral engagement on exchange rate issues, and led to the creation of a new Treasury “monitoring list” on currency manipulation.

Recent Developments

During the 2016 presidential campaign, combatting currency manipulation, particularly by China, was a key issue for Donald Trump. Since assuming office, President Trump has continued to express concerns about the exchange rate policies of other countries, although the Treasury Department has not formally labeled a country as a currency manipulator. In the renegotiation of the North American Free Trade Agreement (NAFTA), the Trump Administration has identified combatting currency manipulation as a negotiating objective. In March 2018, the Administration announced that, through negotiating modifications to the U.S.-South Korea Free Trade Agreement (KORUS FTA), the Treasury Department was finalizing a side agreement on currency with South Korea.

Debates over Exchange Rates: Overview and Issues for Congress

Jump to Main Text of Report

Contents

- Introduction

- The Importance of Exchange Rates in the Global Economy

- What is an Exchange Rate?

- Impact on International Trade and Investment

- International Trade

- International Investment

- Types of Exchange Rate Policies

- Exchange Rate Misalignments

- General Debates over "Currency Wars"

- Specific Debates over Exchange Rates

- Currency Interventions

- China

- Other Countries

- Debates

- Expansionary Monetary Policies

- Quantitative Easing in the United States, UK, and Eurozone

- Japan and "Abenomics"

- Debates

- U.S. Laws Addressing Currency Manipulation

- 1988 Trade Act

- Trade Promotion Authority Legislation

- Trade Facilitation and Trade Enforcement Act of 2015

- International Agreements on Exchange Rates

- International Monetary Fund

- Multilateral Coordination in the G-7 and G-20

- World Trade Organization

- Free Trade Agreements

- Continuing Debate and Policy Options for Congress

- Conclusion

Summary

Exchange rates are among the most important prices in the global economy. They affect the price of every country's imports and exports, as well as the value of every overseas investment. Over the past decade, some Members of Congress have been concerned that foreign countries are using exchange rate policies to gain an unfair trade advantage against other countries, or "manipulating" their currencies. Congressional concerns have focused on China's foreign exchange interventions over the past decade to weaken its currency against the U.S. dollar, although concerns have also been raised about a number of other countries pursuing similar policies.

At the heart of disagreements is whether or not countries are using policies to undermine free markets and intentionally push down the value of their currency. A weak currency makes exports cheaper to foreigners, which can lead to higher exports and job creation in the export sector. There can also be implications for other countries. From the U.S. perspective, U.S exporters and U.S. firms producing import-sensitive goods may find it harder to compete in global markets. However, U.S. consumers and U.S. businesses that rely on inputs from abroad may benefit when other countries have weak currencies, because imports may become less expensive. When foreign countries intervene in foreign exchange markets, it may also help lower U.S. borrowing costs.

Through the International Monetary Fund (IMF), countries have committed to avoiding currency manipulation. There are also provisions in U.S. law to address currency manipulation by other countries. The IMF has never cited a country for currency manipulation, and the U.S. Department of the Treasury has not done so since it last cited China in 1994. There are differing views on why. Some argue that countries have not engaged in policies that violate international commitments on exchange rates or triggered provisions in U.S. law relating to currency manipulation. Others argue that currency manipulation has occurred, but the provisions do not effectively respond to exchange rate disputes.

Legislation in the 114th Congress

The 114th Congress responded to concerns about currency manipulation through Trade Promotion Authority (TPA) and customs legislation. TPA legislation signed into law in June 2015 (P.L. 114-26) included, for the first time, principal negotiating objectives addressing currency manipulation in trade agreements. Currency manipulation was also addressed in the Trade Facilitation and Trade Enforcement Act of 2015 (P.L. 114-125). It enhanced Treasury reporting and bilateral engagement on exchange rate issues, and led to the creation of a new Treasury "monitoring list" on currency manipulation.

Recent Developments

During the 2016 presidential campaign, combatting currency manipulation, particularly by China, was a key issue for Donald Trump. Since assuming office, President Trump has continued to express concerns about the exchange rate policies of other countries, although the Treasury Department has not formally labeled a country as a currency manipulator. In the renegotiation of the North American Free Trade Agreement (NAFTA), the Trump Administration has identified combatting currency manipulation as a negotiating objective. In March 2018, the Administration announced that, through negotiating modifications to the U.S.-South Korea Free Trade Agreement (KORUS FTA), the Treasury Department was finalizing a side agreement on currency with South Korea.

Introduction

Some Members of Congress and policy experts allege that U.S. producers and U.S. jobs have been adversely affected by the exchange rate policies adopted by China, Japan, and a number of other countries. They maintain that some countries are purposefully using various policies to weaken the value of their currency to boost exports and create jobs, but that these policies come at the expense of other countries, including the United States. During the global financial crisis, some political leaders and policy experts argued that there was a "currency war" in the global economy, as countries competed against each other to weaken the value of their currencies and boost exports.1 Even as the global financial crisis has faded, some policymakers continue to express concerns that other countries are using exchange rate policies to gain an unfair trade advantage against the United States.

Some economists are skeptical about "currency manipulation" and whether it is a significant problem. They raise questions about whether government policies have long-term effects on exchange rates; whether it is possible to differentiate between "manipulation" and legitimate central bank activities; and the net effect of alleged currency manipulation on the U.S. economy.

Some Members of Congress have proposed taking additional measures to address concerns about the exchange rate policies of other countries, while other Members have cautioned against aggressive measures that could trigger retaliation, among other concerns. During the 114th Congress, two major pieces of legislation were enacted that contain provisions on currency. TPA legislation signed into law in June 2015 (P.L. 114-26) includes principal negotiating objectives addressing currency manipulation.2 Provisions to combat currency manipulation were also included in the Trade Facilitation and Trade Enforcement Act (P.L. 114-125), signed into law in February 2016.3 In the 115th Congress, debates about currency manipulation have surfaced in the context of renegotiations of the North American Free Trade Agreement (NAFTA) and modifications to the U.S.-South Korea Free Trade Agreement (KORUS FTA).

This report provides information on current debates over exchange rates in the global economy. It offers an overview of how exchange rates work; analyzes specific disagreements and debates; and examines existing frameworks for potentially addressing currency disputes. It also lays out some policy options available to Congress, should Members want to take action on exchange rate issues.

The Importance of Exchange Rates in the Global Economy

What is an Exchange Rate?

An exchange rate is the price of a country's currency relative to other currencies. In other words, it is the rate at which one currency can be converted into another currency. For example, at the beginning of January 2018, one U.S. dollar could be exchanged for 0.83 euros (€), 112 Japanese yen (¥), or 0.74 British pounds (£).4 Exchange rates are expressed in terms of dollars per foreign currency, or expressed in terms of foreign currency per dollar. The exchange rate between dollars and euros in early January 2016 can be quoted as 1.21 dollars per euro ($/€) or, equivalently, 0.83 euros per dollar (€/$).

Consumers use exchange rates to calculate the cost of goods produced in other countries. For example, U.S. consumers use exchange rates to calculate how much a bottle of French or Australian wine costs in U.S. dollars. Likewise, French and Australian consumers use exchange rates to calculate how much a bottle of U.S. wine costs in euros or Australian dollars.

How much a currency is worth in relation to another currency is determined by the supply and demand for currencies in the foreign exchange market (the market in which foreign currencies are traded). The foreign exchange market is substantial, and has expanded in recent years. Trading in foreign exchange markets averaged $5.1 trillion per day in April 2016 (latest data available), up from $3.3 trillion in April 2007.5

The relative demand for currencies reflects the underlying demand for goods and assets denominated in that currency, and large international capital flows can have a strong influence on the demand for various currencies. The government, typically the central bank, can use policies to shape the supply of its currency in international capital markets.

|

Different Measures of Exchange Rates Nominal vs. real exchange rate: The nominal exchange rate is the rate at which two currencies can be exchanged, or how much one currency is worth in terms of another currency. The real exchange rate measures the value of a country's goods against those of another country. Essentially, the real exchange rate adjusts the nominal exchange rate for differences in prices (and rates of inflation) across countries. Bilateral vs. effective exchange rate: The bilateral exchange rate is the value of one currency in terms of another currency. The effective exchange rate is the value of a currency against a weighted average of several currencies (a "basket" of foreign currencies). The basket can be weighted in different ways, such as by share of world trade or GDP. The Bank for International Settlements (BIS), for example, publishes data on effective exchange rates.6 |

Impact on International Trade and Investment

International Trade

Exchange rates affect the price of every export leaving a country and every import entering a country. As a result, changes in the exchange rate can impact trade flows. When the value of a country's currency falls, or depreciates, relative to another currency, its exports become less expensive to foreigners and imports from overseas become more expensive to domestic consumers.7 These changes in relative prices can cause the level of exports to rise and the level of imports to fall.8 For example, if the dollar depreciates against the British pound, U.S. exports become cheaper to UK consumers, and imports from the UK become more expensive to U.S. consumers. As a result, U.S. exports to the UK may rise, and U.S. imports from the UK may fall.

Likewise, when the value of a currency rises, or appreciates, the country's exports become more expensive to foreigners and imports become less expensive to domestic consumers. This can cause exports to fall and imports to rise. For example, if the dollar appreciates against the Australian dollar, U.S. exports become more expensive to Australian consumers, and imports from Australia become less expensive to U.S. consumers. Changes in prices may cause U.S. exports to Australia to fall and U.S. imports from Australia to rise.

International Investment

Exchange rates impact international investment in two ways. First, exchange rates determine the value of existing overseas investments. When a currency depreciates, the value of investments denominated in that currency falls for overseas investors. Likewise, when a currency appreciates, the value of investments denominated in that currency rises for overseas investors. For example, if a U.S. investor holds a German government bond denominated in euros, and the euro depreciates, the value of the bond in U.S. dollars falls, making the investment worth less to the U.S. investor. In contrast, if the euro appreciates, the value of the German bond in U.S. dollars rises, and the investment is worth more to the U.S. investor.

Second, exchange rates impact the flow of investment across borders. Changes in the value of a currency today can shape investors' future expectations about the value of the currency, which can have substantial impacts on capital flows. If investors expect a currency to depreciate, overseas investors may be reluctant to invest in assets denominated in that currency and may want to sell assets denominated in the currency, in fear that their investments will become less valuable over time. Likewise, if a currency is expected to rise over time, assets denominated in that currency become more attractive to overseas investors. For example, a depreciating euro may deter U.S. investment in the Eurozone, while an appreciating euro may increase U.S. investment in the Eurozone.9

Types of Exchange Rate Policies

There are two major types of exchange rate policies. First, some governments "float" their currencies. This means they allow the price of their currency to fluctuate depending on supply and demand for currencies in foreign exchange markets. Governments with floating exchange rates do not take policy actions to influence the value of their currencies.

Second, some countries "fix" or "peg" their exchange rate. This means they fix the value of their currency to another currency (such as the U.S. dollar or euro), a group (or "basket") of currencies, or a commodity, such as gold. The government (typically the central bank) then uses various policies to control the supply and demand for the currency in foreign exchange markets to maintain the set price for the currency. Often, central banks maintain exchange rate pegs by buying and selling currency in foreign exchange markets, or "intervening" in foreign exchange markets.

There are pros and cons to having a floating or fixed exchange rate. Fixed exchange rates provide more certainty in international transactions, but they can make it more difficult for the economy to adjust to economic shocks and can make the currency more susceptible to speculative attacks. Floating exchange rates introduce more unpredictability in international transactions and may deter international trade and investment, but make it easier for the economy to adjust to changes in economic conditions.

In order to take advantage of the benefits of both fixed and floating exchange rates, many countries do not adopt a purely fixed or floating exchange rate, but choose a hybrid policy: they let the currency's value fluctuate but take action to keep the exchange rate from deviating too far from a target value or zone. The degree to which they float or peg varies. The optimal choice for any given country will depend on its characteristics, including its size and interconnectedness to the country to which it would peg its currency.

Between the end of World War II and the early 1970s, most countries, including the United States, had fixed exchange rates.10 In the early 1970s, when international capital flows increased, the United States abandoned its peg to gold and floated the dollar. Other countries' currencies were pegged to the dollar, and after the dollar floated, some other countries decided to float their currencies as well.

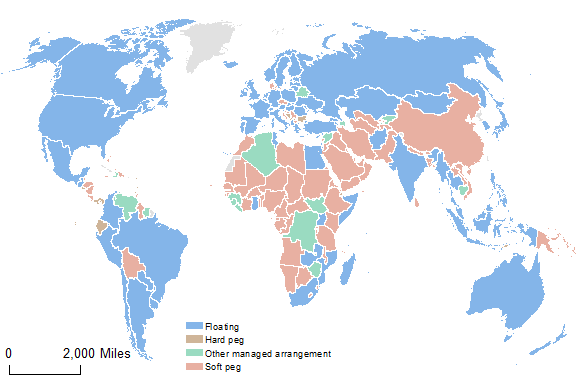

In 2016 (latest data available), 36% of countries had floating currencies.11 This includes several major currencies, such as the U.S. dollar, the euro, the Japanese yen, and the British pound, whose economies together account for half of global GDP.12 Many countries use policies to manage the value of their currencies, although some manage it more than others. This includes many small countries, such as Panama and Hong Kong, as well as a few larger economies, such as China and Saudi Arabia. In 2014, 42% of countries used a "soft" peg, which let the exchange rate fluctuate within a desired range, and 13% of countries used a "hard" peg, which anchors the currency's value more strictly, including the formal adoption of a foreign currency to use as a domestic currency (for example, Ecuador has adopted the U.S. dollar as its national currency).13 No large country uses a hard peg. Figure 1 depicts the exchange rate policies adopted by different countries.

|

|

Source: IMF, Annual Report on Exchange Arrangements and Exchange Restrictions, 2017. Note: See footnote 11. |

Exchange Rate Misalignments

Many economists believe that exchange rate levels can differ from the underlying "fundamental" or "equilibrium" value of the exchange rate. When an actual exchange rate differs from its fundamental or equilibrium value, the currency is said to be misaligned. More specifically, when the actual exchange rate is too high, the currency is said to be overvalued; when the actual rate is too low, the currency is said to be undervalued.

Considerable debate exists about what the fundamental or equilibrium value of a currency is and how to define or calculate currency misalignment.14 For example, some economists believe that a currency is misaligned when the exchange rate set by the government, or the official rate, differs from what would be set by the market if the currency were allowed to float. By this reasoning, governments that take policy actions to sustain an exchange rate peg, such as intervening in currency markets, most likely have misaligned currencies. Additionally, this view suggests that floating currencies, by definition, cannot be misaligned, since their values are determined by market forces.

For other economists, a currency can be misaligned even if it is a floating rate. This is the case if the exchange rate differs from its long-term equilibrium value, which is based on economic fundamentals and eliminates short-term factors that can cause the exchange rate to fluctuate. Defining or estimating an equilibrium exchange rate is not a straightforward process and is complex. Economists disagree on the factors that determine an equilibrium exchange rate, and whether the concept is a valid one, particularly when applied to countries with floating exchange rates. Economists have developed a number of models for calculating differences between actual exchange rates and equilibrium exchange rates. Estimates of whether a currency is misaligned, and if so, by how much, can vary widely depending on the model used.15

General Debates over "Currency Wars"

Amid heightened concerns about slow growth and high unemployment in many countries, disagreements over exchange rate policies broadened following the global financial crisis. In 2010, Brazil's finance minister, Guido Mantega, declared that a "currency war" had broken out in the global economy.16 Even as the global economy has recovered, many concerns about exchange rates persist.

At the heart of disagreements is whether or not countries are using policies to intentionally push down the value of their currency in order to gain a trade advantage at the expense of other countries. A weak currency makes exports cheaper to foreigners and imports more expensive to domestic consumers. This can lead to higher production of exports and import-competing goods, which could help spur export-led growth and job creation in the export sector.

However, if one country weakens its currency, there can be negative implications for certain sectors in other countries. In general, a weaker currency in one country can hurt exporters in other countries, since their exports become relatively more expensive and may fall as a result. Additionally, domestic firms producing import-competing goods may find it harder to compete with imports from countries with weak currencies, since weak currencies lower the cost of imports. Under certain circumstances, policies used to drive down the value of a currency in one country can cause other countries to run persistent trade deficits (imports exceed exports) that can be difficult to adjust and can be associated with the build-up of debt.

For these reasons, some economists view efforts to boost exports through a weaker exchange rate as "unfair" to other countries and a type of "beggar-thy-neighbor" policy—the benefit the country gets from the policy comes at the expense of other countries. These views are particularly rooted in the experience in the 1930s, during which, some economists argue, countries devalued their currencies to boost exports, in response to widespread high unemployment and negative economic conditions.17 The devaluations in the 1930s are referred to as "competitive devaluations," since a devaluation in one country was often offset by a devaluation in another country, making it difficult for any country to gain a lasting advantage.18 Some economists view the competitive devaluations of the 1930s as detrimental to international trade, and, in addition to protectionist trade policies, as exacerbating the Great Depression.

Some economists disagree that "currency wars" and competitive devaluations characterized the period following the global financial crisis of 2008-2009, and if they did, whether they are necessarily bad for the global economy. Because currency devaluations can often involve printing domestic currency, or implementing expansionary monetary policies, they can stimulate short-term economic growth.19 If enough countries engage in currency interventions, then there may be no net change in relative exchange rate levels and the simultaneous currency interventions may help reflate the global economy and boost global economic growth. Economists of this viewpoint argue that competitive devaluations of the 1930s did not cause the Great Depression and, in fact, actually helped end it.20

Additionally, a weak currency in one country does not have an unambiguous negative effect on other countries. Instead, consumers and certain sectors may benefit when other countries have weak currencies. In particular, consumers that purchase imports from abroad benefit when other countries have weak currencies, because imports become cheaper. Businesses that rely on inputs from overseas also benefit when other countries have weak currencies, by lowering the costs of inputs and thus the overall cost of production.

Specific Debates over Exchange Rates

In current debates about exchange rates and whether countries are engaged in unfair currency policies to weaken their currencies, two major types of concerns have been raised: first, concerns about countries engaged in interventions in foreign currency markets, and second, concerns about the effects of expansionary monetary policies in some developed countries on exchange rate levels.

Currency Interventions

Governments have various mechanisms they can use to weaken, or devalue, their currency, or sustain a lower exchange rate than would exist in the absence of government intervention. One way is intervening in foreign exchange markets or, more specifically, selling domestic currency in exchange for foreign currency. These interventions increase the supply of domestic currency relative to other currencies in foreign exchange markets, pushing the price of the currency down. The foreign currency is typically then invested in foreign assets, most commonly government bonds.

Concerns about currency interventions are not new. For nearly a decade, various policymakers and analysts have raised concerns about China's interventions in foreign exchange markets to maintain, in their view, an undervalued currency relative to the U.S. dollar. Since the global financial crisis, however, concerns about currency interventions have become more widespread, as more countries, including Switzerland and others, intervened in foreign exchange markets, in the view of some analysts, to lower the value of their currency.21

China22

Over the past decade, the Chinese government has tightly managed the value of its currency, the renminbi (RMB) or yuan, against the U.S. dollar.23 Some policymakers and analysts have argued that China's currency policies keep the RMB undervalued relative to the U.S. dollar, giving Chinese exports an "unfair" trade advantage against U.S. exports and contributing to the U.S. trade deficit with China. However, recent developments in exchange rate markets have led some economists to argue that China's currency is no longer undervalued against the U.S. dollar.

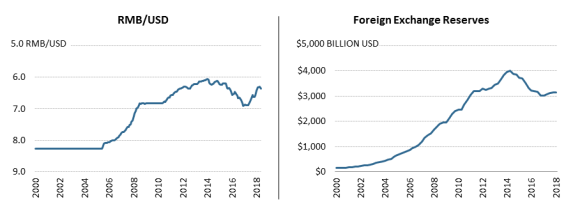

In 1994, China began to peg its currency to the U.S. dollar and kept it pegged to the U.S. dollar at a constant rate through 2005. In July 2005, it moved to a managed peg system, in which the government allowed the currency to fluctuate within a range, and the currency began to appreciate. In 2008, China halted appreciation of the RMB, due to concerns about the effects of the global financial crisis on Chinese exports. In 2012, China again allowed more flexibility in the value of the RMB against the U.S. dollar, and widened the trading band for the currency in 2014.24 Between 2005 and the end of 2015, the RMB appreciated by more than 20% against the dollar (Figure 2).25

The Chinese government used various policies to manage this appreciation of the RMB against the U.S. dollar. It printed yuan and sold it for U.S. currency and assets denominated in U.S. dollars, usually U.S. government bonds. It also manages the value of its exchange rate through capital controls that limit buying and selling of RMB.26 As China has engaged in currency interventions, its holdings of foreign exchange reserves increased, from $659 billion in the first quarter of 2005 to a peak of $3.9 trillion in the first quarter of 2014 (Figure 2).27 Some economists view the sustained, substantial increase in foreign exchange reserves as evidence that the Chinese government kept the value of the RMB below what it would be if the RMB were allowed to float freely.

With the gradual appreciation of the RMB against the dollar in recent years, some policymakers and analysts have questioned whether the yuan is still undervalued against the U.S. dollar when adjusting for differences in price levels (the real exchange rate), and if so, by how much, particularly as inflation has increased in China.28 In May 2015, the IMF stated that the currency is "no longer undervalued."29

In August 2015, the Chinese central bank announced that the daily RMB parity values would become more "market-orientated." China has also been selling foreign exchange reserves to prevent further depreciation of the currency, amid concerns about slower growth rates in China.30 China's currency depreciated in 2015 and 2016, although it resumed some appreciation in 2017. Although China does not disclose interventions in its foreign exchange market, the Treasury Department estimates that Chinese authorities significantly curtailed interventions in the second half of 2017 that they had been undertaking to support the value of the RMB.31

Other Countries

Other examples of interventions to weaken currencies in recent years include, among others, the following:

- Japan, which sold yen in foreign exchange markets in 2010 and 2011. Japan's interventions in March 2011 were unusual in that they were supported with corresponding interventions by the other G-7 countries to weaken the yen. A crisis in Japan (earthquake, tsunami, and threat of nuclear crisis) in March 2011 had sparked a sharp appreciation of the yen, which some feared would throw the world's third-largest economy back into recession, prompting the coordinated interventions;32

- New Zealand, whose central bank revealed in May 2013 that it had intervened in currency markets to stem appreciation of its currency, the New Zealand dollar (nicknamed the kiwi);33

- South Korea, which is believed to have intervened in currency markets to hold down the value of the won at various points in recent years, including estimated net purchases of $9 billion in 2017;34

- Switzerland, which intervened to limit appreciation of the Swiss franc between September 2011 and January 2015, as a result of increased demand for the currency as a "safe haven" during the Eurozone crisis.35 In January 2015, the central bank of Switzerland (the Swiss National Bank) resumed its previous policy of allowing the Swiss franc to float freely; and

- Taiwan, which Treasury believes intervenes on both sides of the market but, on net, intervenes more frequently to resist appreciation of its currency, the new Taiwan dollar.36

More generally, according to a June 2017 study by economists at the Peterson Institute of International Economics (PIIE), 20 countries intervened aggressively in at least one of the 11 years from 2003 to 2013 to keep their currencies undervalued, including Algeria, China, Hong Kong, Israel, Japan, Kuwait, Libya, Macao, Malaysia, Norway, Oman, Russia, Singapore, South Korea, Sweden, Switzerland, Taiwan, Thailand, Trinidad and Tobago, and the United Arab Emirates.37

Debates

A number of countries are actively intervening, or have recently intervened, in foreign exchange markets to lower the value of their currencies, and there are different views among economists about the consequences of these interventions for other countries. Some economists argue that currency interventions have helped countries give their exports a boost at the expense of other countries. A December 2012 study by economists at the PIIE estimates that currency interventions have caused the U.S. trade deficit to increase by $200 billion to $500 billion per year and the U.S. economy to lose between 1 million and 5 million jobs.38 Their updated study in 2017 found that that manipulation cost the United States 1 million jobs between 2009 and 2014, exacerbating the recovery from the global financial crisis.39

Other economists are skeptical that one country's interventions in foreign exchange markets have had adverse consequences for other countries. For example, some economists argue that interventions in foreign exchange markets by other countries change the composition of output in the United States (particularly the size of the export- and domestic-oriented sectors), but do not reduce the overall employment or output levels in the U.S. economy. Some economists also question whether currency interventions have long-lasting effects on exchange rate levels, particularly for countries with floating currencies. They argue that the large size of international capital flows overwhelms, in the long term, government purchases and sales of foreign currencies, and that other economic fundamentals, such as interest rates, inflation rates, and overall economic performance, have much greater effects on exchange rate levels.

Still other economists argue that it is hard to make generalizations about the effects of currency interventions, and that, depending on the specific circumstances, currency interventions may or may not be "fair" policies.40 For example, they argue that relevant factors can include the following:

- Does the government intervene in currency markets to sometimes strengthen and sometimes weaken its currency, or does it always intervene to weaken its currency? "Two-way" interventions (sometimes strengthening the currency, sometimes weakening the currency) may be evidence that the country is using currency interventions to sustain a pegged exchange rate that is close to its long-term fundamental or equilibrium value. Some economists argue that "one-way" interventions (always selling domestic currency) may be evidence that the government is using interventions to sustain a currency that is below the currency's fundamental or equilibrium value.

- Does the government intervene periodically, or on a continual basis? Periodic interventions may smooth potentially disruptive short-term fluctuations in the exchange rate and help the country build foreign exchange reserves, which can help it guard against economic crises. Sustained, or long-term, interventions may create negative distortions in the global economy.

- Does the government allow the intervention to increase its domestic money supply, or does the government "sterilize" the intervention to prevent an increase in its domestic money supply? When some governments intervene in currency markets by selling domestic currency, they allow the domestic money supply to increase. This is called an unsterilized intervention. When other countries (such as China) intervene, they do not allow their money supply to increase. Instead, when they sell domestic currency in exchange for foreign currency, they then sell a corresponding quantity of domestic government bonds to remove the extra domestic currency from circulation. This is called a sterilized intervention. It may matter to other countries whether the intervening country sterilizes the intervention or not. For example, increasing the money supply may help increase domestic demand, which in certain circumstances can cause consumers to buy more, not fewer, imports from other countries. Additionally, an increase in the money supply may cause prices to rise in the medium term. This may mean that the exchange rate adjusted for inflation (the real exchange rate) may not change in the medium term (after prices adjust), even if the nominal exchange rate (the exchange rate not adjusted for inflation) falls.

Expansionary Monetary Policies

In addition to intervening directly in foreign exchange markets, governments can weaken the value of their currency through expansionary monetary policies. Monetary policy is the process by which a government (usually the central bank) controls the supply of money in an economy, such as by changing the interest rates through buying and selling government bonds. Changes in the money supply can impact the value of the currency. For example, increasing the supply of British pounds can cause the price of the pound to fall.

Some emerging markets, particularly Brazil, were critical of the expansionary monetary policies adopted by the United States, the United Kingdom, and the Eurozone in response to the global financial crisis of 2008-2009. Some U.S. policymakers also raised concerns about Japan's monetary policies, following a major policy shift in late 2012 and early 2013.

Quantitative Easing in the United States, UK, and Eurozone41

The United States, the United Kingdom, and, to a lesser extent, the Eurozone adopted expansionary monetary policies to respond to the economic recession following the global financial crisis of 2008-2009. In addition to cutting interest rates, the Federal Reserve, the Bank of England, and the European Central Bank (ECB) used quantitative easing to provide further monetary stimulus. Quantitative easing is an unconventional form of monetary policy that expands the money supply through government purchases of assets, usually government bonds. Quantitative easing is typically used when more conventional monetary policy tools are no longer feasible, for example, when short-term interest rates cannot be cut because they are already near zero.

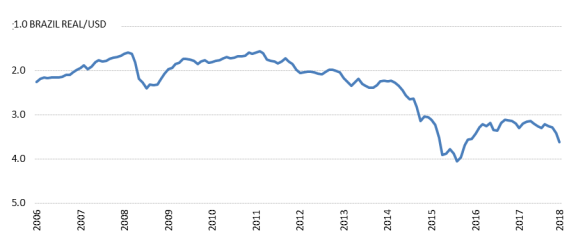

Some emerging markets have argued that because the U.S. dollar, the British pound, and the euro are floating currencies, expansionary policies in these countries have caused these currencies to depreciate against the currencies of emerging markets. For example, Brazil has argued that quantitative easing in developed countries was a key factor in causing its currency (the real) to appreciate by more than 25% against the dollar between the start of 2009 and the end of the third quarter of 2010 (Figure 3), when Brazil's finance minister, Guido Mantega, declared that a currency "war" had broken out in the global economy.42 Brazil imposed some short-term controls on inflows of capital into Brazil (capital controls) to stem appreciation of the real.43

In response to the concerns of emerging markets, many policymakers and analysts have argued that the Federal Reserve, the Bank of England, and the ECB adopted expansionary monetary policies for domestic purposes (combatting the recession), and that any effect on their currencies was a side effect or by-product of the policy.44 For example, during a Senate Banking Committee hearing in February 2013, the Chairman of the Federal Reserve, Ben Bernanke, stressed that the Federal Reserve is not engaged in a currency war or targeting the value of the U.S. dollar.45 Instead, he emphasized that monetary policy is being used to achieve domestic economic objectives (high employment and price stability). He also stressed that monetary policies to strengthen aggregate demand in the United States are not "zero-sum," because they raise the demand for the exports of other countries.

|

|

Source: Federal Reserve. Note: An increase represents an appreciation of the Brazilian real relative to the U.S. dollar. |

The concerns of emerging markets about the effects of quantitative easing have subsided. As developed countries have started rolling back expansionary monetary policies, the real has weakened substantially against the U.S. dollar (Figure 3). Brazil's government, in fact, has started expressing concerns about the real becoming too weak, and in August 2013, intervened in foreign currency markets to strengthen its currency.46 The concerns of emerging-market economies about the potential rollback of quantitative easing policies in developed countries, including the United States, were a major topic of discussion at the September 2013 G-20 summit in St. Petersburg, Russia.47

Japan and "Abenomics"

Concerns have also been recently raised about major changes in Japan's monetary policy and their effects on the value of the yen. Elected in December 2012, Prime Minister Shinzo Abe has made it a priority of his administration to grow Japan's economy and eliminate deflation (falling prices), which has plagued Japan for many years. His economic plan, nicknamed "Abenomics," relies on three major economic policies: expansionary monetary policies, fiscal stimulus, and structural reforms. To promote expansionary monetary policy, Japan's central bank (the Bank of Japan) unveiled a host of new measures in the first half of 2013, including goals to double the monetary base (commercial bank reserves plus currency circulating in the public) and to double its holdings of Japanese government bonds. By buying government bonds in exchange for yen, the Bank of Japan can increase Japan's money supply. Japan's central bank has had relatively loose monetary policy since 2013, although some believe it could tighten in early 2019.48

Expansionary monetary policies in Japan may have also contributed to a relatively sharp depreciation of the yen, which fell by almost 50% against the U.S. dollar between mid-2012 and the end of 2015 (Figure 4) to its 2007 level, even as Japan has not directly intervened in currency markets since 2011. Several countries expressed their concerns about a weakening of the yen. In 2013, an official from the Russian central bank reportedly warned that "Japan is weakening the yen and other countries may follow," and that "the world is on the brink of a fresh currency war."49 Additionally, the president of China's sovereign wealth fund reportedly warned Japan against using its neighbors as a "garbage bin" by deliberately devaluing the yen, and South Korea's finance minister argued that Japan's weakening yen hurts his country's economy more than threats from North Korea.50 Movements in Japan's currency have also created concerns for some Members of Congress, with concerns being raised about the currency policies in the context of the proposed TPP, where Japan is one of the negotiating parties.

Others argue that a weakening yen partially offset the slow, but continued, appreciation of the yen in the preceding several years (Figure 4). For example, in January 2012, the IMF estimated that the Japanese yen was "moderately overvalued from a medium-term perspective."51 Some also argue that, rather than targeting the value of the currency, Japan's monetary policies are targeting domestic objectives, namely, beating deflation that has plagued the economy for many years. Japan's finance minister, Taro Aso, reportedly stated that "monetary easing is aimed at pulling Japan out of deflation quickly. It is not accurate at all to criticize (us) for manipulating currencies."52 In 2016 and 2017, controversy surrounding Japan's exchange rate policies dissipated, as the yen started to strengthen and the government has not directly intervened in foreign exchange markets in over six years.

|

|

Source: Federal Reserve. Note: A decrease represents a depreciation of the yen relative to the U.S. dollar. |

Debates

There is debate over whether the expansionary monetary policies, including quantitative easing, implemented by some developed economies have been "beggar-thy-neighbor" policies. Some argue that expansionary monetary policies have unfairly caused the currencies of developed countries to depreciate against other countries, giving the exports of developed countries an "unfair" export boost. However, most economists agree that the expansionary policies in the United States, the UK, the Eurozone, and Japan have been designed to stimulate their domestic economies and will, in the medium term, cause prices to rise. As a result, they argue that there will be little effect on the real exchange rate (the exchange rate adjusted for differences in prices across countries) in the medium term (as prices increase), even if the nominal exchange rate (the exchange rate not adjusted for differences in prices across countries) falls in the short term. However, it should be noted that inflation in all these countries remains very low, to date.

Additionally, some argue that the expansionary policies stimulate domestic consumption and investment, which ordinarily leads to higher, not lower, imports from other countries, all else being equal.53 They argue that the net effect of quantitative easing and similar policies on trading partners is not necessarily negative and could be positive in some instances. For example, the IMF estimated that the first round of quantitative easing in the United States resulted in substantial output gains for the rest of the world, and that the second round generated modest output gains for the rest of the world.54

For some economists, then, a key question to evaluate whether expansionary monetary policies are "fair" or "unfair" in the context of claims about "currency wars" is as follows:

- Is it appropriate for countries to adopt expansionary monetary policies to combat a domestic economic recession, even if some sectors in other countries may be adversely affected in the short run?: Some economists argue that countries should use expansionary monetary policies to respond to economic recessions.55 Moreover, most central banks, including the Fed, are pursuing statutory mandates that do not include foreign exchange rate requirements and responsibilities. Other economists argue that countries have a number of policy tools to respond to economic recessions, not just monetary policy, and that in today's globalized economy, a country should consider the potential negative spillover effects on other countries in its decisionmaking process.

U.S. Laws Addressing Currency Manipulation

Some Members' concerns about currency manipulation and its impact on U.S. producers and workers have led to legislation over the past several decades. Key legislation seeking to address currency manipulation that has been signed into law is described below.

1988 Trade Act

In 1988, Congress enacted the "Exchange Rates and International Economic Policy Coordination Act of 1988" as part of the Omnibus Trade and Competitiveness Act of 1988 (the 1988 Trade Act),56 when many policymakers were concerned about the appreciation of the U.S. dollar and large U.S. trade deficits.57 A key component of this act requires the department to analyze on an annual basis the exchange rate policies of foreign countries, in consultation with the International Monetary Fund (IMF), and "consider whether countries manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade." If "manipulation" is occurring with respect to countries that have (1) global currency account surpluses and (2) significant bilateral trade surpluses with the United States, the Secretary of the Treasury is to initiate negotiations, through the IMF or bilaterally, to ensure adjustment in the exchange rate and eliminate the "unfair" trade advantage. The Secretary of the Treasury is not required to start negotiations in cases where they would have a serious detrimental impact on vital U.S. economic and security interests.

Additionally, the act requires the Treasury Secretary to submit a report annually to the Senate and House Banking Committees, on or before October 15, with written six-month updates, and the Secretary is expected to testify on the reports as requested.58 The reports are to address a host of issues related to exchange rate policies of major U.S. trade competitors, such as currency market developments; currency interventions undertaken to adjust the exchange rate of the dollar; the impact of the exchange rate on U.S. competitiveness; and the outcomes of Treasury negotiations on currency issues, among others.

Since the 1988 Trade Act was enacted, the Department of the Treasury has identified three countries as manipulating their currencies under the Trade Act's terms: China, Taiwan, and South Korea.59 These designations occurred in the late 1980s and early 1990s; Treasury has not determined that currency manipulation has occurred under the terms of the 1988 Trade Act since it last cited China in 1994.

Trade Promotion Authority Legislation

Given the impact that exchange rates can have on trade flows, Congress has sought to address currency manipulation in trade promotion authority (TPA) legislation. TPA is the authority Congress grants to the President to enter into certain reciprocal trade agreements and to have their implementing bills considered under expedited legislative procedures when certain conditions have been met.60 For example:

- The Omnibus Trade and Competitiveness Act of 1988 (P.L. 100-418), which granted "fast track" authority (a precursor to TPA) to the President, required the Administration, among other things, to submit a report to Congress with supporting information after entering a trade agreement. One part of this report was "describing the efforts made by the President to obtain international exchange rate equilibrium."

- The Trade Act of 2002 (P.L. 107-210), which renewed TPA in 2002, included exchange rate issues as a priority that the Administration should promote. The legislation stipulated that the Administration should "seek to establish consultative mechanisms among parties to trade agreements to examine the trade consequences of significant and unanticipated currency movements and to scrutinize whether a foreign government engaged in a pattern of manipulating its currency to promote a competitive advantage in international trade." While a number of free trade agreements (FTAs) were negotiated under the 2002 version of TPA, with Congress approving implementing legislation for FTAs with Chile, Singapore, Australia, Morocco, the Dominican Republic and the Central American countries (CAFTA-DR), Bahrain, Oman, Peru, Colombia, Panama, and South Korea, it is not clear to what extent currency issues were salient issues in the negotiations or in the final agreements.

- The Bipartisan Congressional Trade Priorities and Accountability Act of 2015 (P.L. 114-26), the most recent TPA legislation signed into law in June 2015, includes for the first time principal negotiating objectives addressing currency manipulation. The first states that it is a principal negotiating objective of the United States that parties to trade agreements should avoid manipulating their exchange rates over other parties to the agreement, with multiple possible remedies "as appropriate," such as cooperative mechanisms, enforceable rules, reporting, monitoring, transparency, or other means. The second states that it is a principal negotiating objective of the United States to establish accountability against unfair currency practices through multiple possible means, and particularly to address protracted, large-sale intervention in one direction in foreign exchange markets. The principal negotiating objectives on currency likely led to a side agreement on exchange rates among the parties negotiating the Trans-Pacific Partnership (TPP), discussed in greater detail below.

Trade Facilitation and Trade Enforcement Act of 2015

Currency manipulation is addressed in the Trade Facilitation and Trade Enforcement Act (P.L. 114-125), which was signed by the President in February 2016. Two sections of the law address currency manipulation. The first section outlines provisions to enhance engagement on exchange rate and economic policies with certain major trading partners of the United States. In particular, the law stipulates new reporting requirements for Treasury on the macroeconomic and currency exchange rate policies for major trading partners of the United States. If a country has a significant bilateral trade surplus with the United States, has a current account surplus, and has engaged in persistent one-sided intervention in foreign exchange markets, the Treasury Secretary is under certain circumstances to start bilateral engagement with the country on the issue, including urging implementation of policy reforms, among other measures. If a country has failed to adopt appropriate policies to correct the currency undervaluation and surplus after a year of enhanced bilateral engagement, the President is to take one or more of the following actions:

- Prohibit the Overseas Private Investment Corporation (OPIC) from approving any new financing for a project in that country;61

- Prohibit the federal government from procuring goods or services from that country, as long as it can be done in a manner that is consistent with U.S. obligations under international agreements and would not impose an unreasonable cost on U.S. taxpayers;

- Instruct the U.S. Executive Director of the IMF to call for additional rigorous surveillance of the macroeconomic and exchange rate policies of that country and, as appropriate, formal consultations on findings of currency manipulation; and/or

- Instruct the U.S. Trade Representative to take into account the extent to which the country has failed to adopt appropriate policies to correct undervaluation and surpluses in assessing whether to enter into bilateral or regional trade agreement with that country or participate in negotiations with respect to a bilateral or regional trade agreement with that country.

The requirement for the President to take remedial action is waived if it would have an adverse impact on the U.S. economy greater than the benefits of taking remedial action or would cause serious harm to U.S. national security. To date, Treasury has not found a country that meets all three criteria. However, it has developed a new "Monitoring List," which includes major trading partners that meet two of the three criteria currently or in the past year. The Monitoring List for April 2018 includes China, Japan, Germany, South Korea, Switzerland, and India.62

The second section on currency establishes a new Advisory Committee on International Exchange Rate Policy, responsible for advising the Treasury Secretary on the impact of international exchange rates and financial policies on the U.S. economy. The committee is to be composed of nine members all appointed by the President, none of which are federal government employees. Three are to be appointed upon the recommendation of the Senate Banking Committee, and three are appointed upon the recommendation of the House Ways and Means Committee. The committee is to terminate after two years, unless renewed by the President.

International Agreements on Exchange Rates

In addition to provisions in U.S. law that address currency manipulation, the United States is party to a number of international agreements and discussions that address exchange rate policies and currency manipulation.

International Monetary Fund

With a nearly universal membership of 188 countries, the IMF is focused on promoting international monetary stability.63 The IMF has engaged on the exchange rate policies of its member countries as part of its mandate, arguably motivated by the experience of competitive devaluations in the 1930s.64 Its role on exchange rates has evolved over time.65 Currently, members of the IMF, including the United States, have made commitments to refrain from manipulating their exchange rates to gain an unfair trade advantage. Specifically, IMF member countries have agreed to several obligations on exchange rates in the IMF's Articles of Agreement, the document that lays out the rules governing the IMF and establishes a "code of conduct" for IMF member countries.66 The Articles state that countries can use whatever exchange rate system they wish—fixed or floating—so long as they follow certain guidelines; that countries should seek, in their foreign exchange and monetary policies, to promote orderly economic growth and financial stability; and that the IMF should engage in "firm" surveillance over the exchange rate policies of its members.67

The Articles also state that IMF member countries are to "avoid manipulating exchange rates or the international monetary system in order to prevent effective balance of payments adjustment or to gain an unfair advantage over other members."68 An IMF Decision, issued in 1977 and updated in 2007 and 2012, provides further guidance that, among other things, "a member will only be considered to be manipulating exchange rates in order to gain an unfair competitive advantage over other members if the Fund determines both that: (a) the member is engaged in these policies for the purposes of securing fundamental exchange rate misalignment in the form of an undervalued exchange rate; and (b) the purpose of securing such misalignment is to increase net exports."69

If a member country were to be found to be in violation of its obligations to the IMF, under the rules laid out in the Articles, it could be punished through restrictions on its access to IMF funding, suspension of its voting rights at the IMF, or, ultimately, expulsion from the IMF.70 To date, the IMF has never publicly cited a member country for currency manipulation.71

Multilateral Coordination in the G-7 and G-20

The United States has also participated in more informal forums to coordinate economic policies, including exchange rate policies. For example, in 1985, France, West Germany, Japan, the United States, and the United Kingdom (the Group of 5, or G-5) signed the Plaza Accord, in which countries agreed to intervene in currency markets to depreciate the U.S. dollar in relation to the Japanese yen and the German deutsche mark to address the U.S. trade deficit. In 1987, six countries (the G-5, plus Canada) signed the Louvre Accord, in which they agreed to halt the depreciation of the U.S. dollar through a host of different policy measures, including taxes, public spending, and interest rates.

Additionally, small groups of countries have executed coordinated interventions in foreign exchange markets to shape the relative value of currencies. For example, the G-7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) have coordinated interventions a number of times: in 1995, to halt the dollar's fall against the yen; in 2000, to support the value of the euro after its introduction; and in 2011, to stem appreciation of the yen following a major crisis in Japan.72 This coordination has occurred on an ad hoc, voluntary basis. It is not based on any specific set of rules or commitments on exchange rates, and has been limited to a small group of advanced economies.

More recently, exchange rate policies have also been discussed at G-7 and G-20 meetings.73 During meetings in February 2013, for example, the G-7 nations reaffirmed their "long-standing commitment to market-determined exchange rates" and to "not target exchange rates."74 The G-20 countries pledged to "refrain from competitive devaluation" in February 2013,75 which was again reiterated in subsequent G-20 meetings.76 G-7 and G-20 commitments are nonbinding, although other enforcement mechanisms, including peer pressure, have been used to ensure compliance in the past.

World Trade Organization

Given the relationship between exchange rates and trade, some analysts and lawyers have examined whether World Trade Organization (WTO) provisions allow for recourse against countries that are unfairly undervaluing their currency. With 159 member countries, the WTO is the principal international organization governing world trade. It was established in 1995 as a successor institution to the General Agreement on Tariffs and Trade (GATT), a post-World War II institution intended to liberalize and promote nondiscrimination in trade among countries. Unique among the major international trade and finance organizations, the WTO has a mechanism for enforcing its rules through a dispute settlement process. However, there is a lot of debate about the extent to which WTO agreements address currency manipulation.77

One aspect of the debate is whether the WTO agreement on export subsidies applies to countries with undervalued currencies. The WTO Agreement on Subsidies and Countervailing Measures specifies that countries may not provide subsidies to help promote their national exports, and countries are entitled to levy countervailing duties on imported products that receive subsidies from their national government if such imports cause or threaten to cause material injury to U.S. producers.78 Some economists maintain that an undervalued currency is an indirect subsidy that lowers a firm's cost of production relative to world prices and therefore helps encourage exports. Some argue, then, that an undervalued currency should count as an export subsidy in countervailing measures. It is not clear, however, whether intentional undervaluation of a country's currency is an export subsidy under the WTO's specific definition of the term, and thus is eligible for recourse through countervailing duties under WTO agreements, because currencies and exchange rates are not mentioned in the WTO agreement on subsidies. Additionally, the subsidy must be, among other things, specific to an industry and not provided generally to all producers. Intentional undervaluation of a currency may not be industry specific because it applies to all producers.

Another aspect of the debate relates to a provision in the General Agreement on Tariffs and Trade (GATT, the WTO agreement on international trade in goods), which states that member countries "shall not, by exchange action, frustrate intent of the provisions" of the agreement.79 Some analysts argue that policies to undervalue a currency are protectionist policies, and thus should count as an exchange rate action that frustrates the intent of the GATT. Others argue that the language is too vague to apply to undervalued currencies.80 Specifically, they argue that the language was written to apply to an international system of exchange rates that no longer exists (the system of fixed exchange rates, combined with capital controls, that prevailed from the end of World War II to the early 1970s).

No dispute over exchange rates has been brought before the WTO,81 and whether currency disputes fall under the WTO's jurisdiction remains a contested issue.82

Free Trade Agreements

In some cases, the United States has started exploring addressing concerns about currency manipulation in free trade agreement (FTA) negotiations. Provisions relating to currency were first formally explored in the Trans Pacific Partnership (TPP), a proposed FTA among the United States and 11 other Asia-Pacific countries. Largely in response to the TPA legislation passed by Congress in 2015, the monetary authorities from the 12 TPP countries initiated negotiations and in November 2015 released a joint declaration to address unfair currency practices.83 While the declaration was released concurrently with the text of the TPP, it was a separate agreement from the TPP. The declaration focused on commitments to avoid manipulation, transparency and reporting about interventions in foreign exchange markets, and multilateral dialogue on exchange rates. It did not include enforceable rules against currency manipulation. The joint declaration was to take effect when TPP entered into force and was to apply to countries that accede to the TPP in the future, subject to additional transparency or other conditions determined by the existing TPP countries. President Trump withdrew the United States from the TPP in January 2017. The other 11 TPP countries forged ahead with a trade agreement (the Comprehensive and Progressive Agreement on Trans-Pacific Partnership, CPTPP) in March 2018, without the side agreement on currencies.84

In the renegotiation of the North American Free Trade Agreement (NAFTA), the Trump Administration has identified combatting currency manipulation as a negotiating objective.85 Although negotiations continue, news reports suggest that the countries are working on a nonbinding side agreement that pledges to avoid currency devaluation for competitive purposes.86 Concerns raised by U.S. policymakers about currency manipulation do not focus on Mexico and Canada, both of which have floating exchange rates, but the side agreement could send a signal globally and set precedent for provisions on currencies in future trade agreements with other countries.

In March 2018, the Administration announced that, through negotiating modifications to the U.S.-South Korea Free Trade Agreement (KORUS FTA), the Treasury Department was finalizing a side agreement on currency with South Korea. South Korea has periodically intervened in foreign exchange markets to weaken its currency. Likely in response to these negotiations, the South Korean government has indicated it will disclose more information about its interventions in foreign exchange markets.87

Continuing Debate and Policy Options for Congress

Concerns about the exchange rate policies of other countries persist. During the 2016 presidential campaign, combatting currency manipulation, particularly by China, was a key issue for Donald Trump. Since assuming office, President Trump has continued to express concerns about the exchange rate policies of other countries, although the Treasury Department has not formally labeled a country as a currency manipulator. Some Members of Congress have also proposed taking more assertive action on currency. There are a number of options for doing so, some of which Members have pursued through legislation. Policy options could include the following, among others:

Maintaining the Status Quo

Even though there may be concerns about supporting U.S. producers and jobs from "unfair" exchange rate policies adopted by other countries, some Members and policy experts have laid out a number of reasons to refrain from taking action on exchange rate dispute, such as the following:88

- There is debate among economists on how to calculate a currency's "equilibrium" or "fundamental" long-term value, making the classification of currencies as undervalued or overvalued complex and subject to much discussion, with different models at times yielding very different results.

- Although an undervalued currency could harm certain U.S. import-sensitive firms and exporters, it benefits other parts of the economy. U.S. imports from trading partners with weak currencies are less expensive than they would be otherwise. Lower-cost imports may benefit U.S. businesses that purchase inputs from abroad and U.S. consumers. Plus, some countries that may "manipulate" buy U.S. public debt, which may make U.S. borrowing costs cheaper than they might otherwise be.

- Unilaterally labeling a country as a currency manipulator ("naming and shaming") or leading a multilateral charge against currency manipulation could trigger retaliation by other countries. This could lead to a trade war or higher borrowing costs for the U.S. government.

- Some analysts have argued that stricter international rules on currency manipulation could place constraints on U.S. monetary policy, because monetary policy can indirectly impact the value of the U.S. dollar against other currencies. Others argue that the constraints could be minimized, depending on the precise definition of currency manipulation.89

Applying Countervailing Duties on Imports from Countries that Manipulate their Currency

Some argue that the United States should treat currency manipulation as an actionable subsidy under U.S. law. This means that the United States could apply countervailing duties on imports from countries that are found to be manipulating their exchange rates.90 In the 115th Congress, legislation has been introduced (the Currency Reform for Fair Trade Act, H.R. 2039) that would apply U.S. countervailing laws to imports from countries whose currencies are determined to be "fundamentally undervalued." In the 114th Congress, a similar bill (S. 433) was amended to the Senate version of the Trade Facilitation and Trade Enforcement Act of 2015 (S. 1269) during the Senate Finance Committee markup of the bill. However, it was not included in the final version of the legislation (P.L. 114-125). Similar legislation has been introduced and considered in previous Congresses.91

Applying countervailing duties on imports from countries that manipulate their currencies may be attractive because it would be a unilateral action that the United States could take that could apply to all countries. Others argue that it could be difficult to reach consensus on whether, and if so, by how much, a currency is undervalued or misaligned and thus how to measure the subsidy conferred through currency manipulation. There are also questions about whether such legislation if implemented would violate WTO rules and make the United States subject to recourse under the WTO's dispute resolution.

Applying Countervailing Interventions in Foreign Exchange Markets

Most analysts agree that the primary way countries "manipulate" the value of their currency is by intervening in foreign exchange markets, by selling domestic currency in exchange for foreign currency. These interventions increase the supply of domestic currency relative to other currencies in foreign exchange markets, pushing the price of the currency down. Congress could direct the Department of the Treasury and/or the Federal Reserve to conduct "countervailing currency interventions," that would effectively undo interventions by other countries in foreign currency markets.92

For example, if a country sells its domestic currency in exchange for 1 billion dollars in foreign exchange markets, this could have the effect of keeping its currency relatively weak and the dollar relatively strong. To offset the impact on the exchange rate, the United States could buy 1 billion dollars' worth of the other country's domestic currency in exchange for 1 billion U.S. dollars. So-called "countervailing interventions" or "remedial interventions" have been previously proposed in legislation, for example S. 1619 in the 112th Congress, which passed the Senate. Some experts also argue they could be implemented under existing law.93

Countervailing currency interventions may be an attractive policy option, because they seek to address concerns about exchange rate policies directly through exchange rate channels. These interventions in foreign exchange markets are unlikely to raise questions about WTO-compatibility that other policy options (particularly countervailing duties) might raise, and proponents argue there would be no budgetary costs to countervailing interventions. However, countervailing interventions would be less feasible for countries like China that restrict access to assets denominated in their domestic currency. If the United States were unable to purchase enough assets denominated in the other country's currency, it may not fully offset the other country's interventions in foreign exchange markets. Also, some countries do not publish data on their currency interventions, which could make countervailing interventions difficult.

Urging the Administration to Include Enforceable Provisions on Currency in Trade Agreements

In 2015, Congress actively debated whether to require enforceable provisions on currency in trade agreements in the context of the TPA. While the final 2015 TPA legislation lists enforceable provisions as one of the possible remedies U.S. negotiators should seek against currency manipulation in trade agreements, the legislation does not require it. However, Members of Congress could continue to urge the Administration to negotiate and include enforceable provisions in its trade negotiations with other countries, including NAFTA and KORUS negotiations. Including enforceable provisions in trade agreements could be complicated, however, as there may be disagreement over how exchange rate disputes would be adjudicated and they would only apply to negotiating parties to the agreement, not to countries in the global economy more broadly.

Urging the Administration to Address Currency Disputes at the IMF or WTO

The IMF and the WTO are typically identified as the international institutions best suited for dealing with exchange rate disputes, because the IMF has the clearest set of commitments relating to currency manipulation, and the WTO is unique among international institutions in that it has a clear enforcement mechanism. Congress could ask the Administration to push for action on currency issues at the IMF and WTO, as well as seek changes to IMF and/or WTO rules to allow currency disputes to be addressed more clearly under these organizations. For example in the 110th Congress, H.R. 2942 would have required, among other measures, the Administration to raise the issue at the IMF and the WTO.

Addressing currency disputes in formal international institutions may provide broad, multilateral support for decisions that are reached and would apply to their broad memberships. However, addressing disputes over exchange rates at the IMF and WTO may run into obstacles. For example, the IMF Executive Board may find it too politically sensitive to publicly cite a country for currency manipulation. Changes to IMF and/or WTO policies could be a complicated process that would require multilateral consensus.

Conclusion

Exchange rates are important prices in the global economy, and changes in exchange rates have potentially substantial implications for international trade and investment flows across countries. Following the global financial crisis of 2008-2009, tensions among countries over exchange rate policies arguably broadened. Some policymakers and analysts have expressed concerns that some governments are pursuing exchange rate policies to gain a trade advantage. Concerns have focused on both government interventions in currency markets in a number of other countries, including China, and expansionary monetary policies in some developed economies. However, some economists argue that the effects of exchange rate policies are nuanced, creating winners and losers, and that it is hard to make generalized claims about the negative effects of "currency wars."

To date, the most formal response to current tensions over exchange rates has been through discussions at G-7 and G-20 meetings. Although frameworks have been set up for addressing currency "manipulation" at the IMF and through U.S. law, neither the IMF nor the U.S. Department of the Treasury has taken formal action on current disputes over exchange rates. There are debates about why formal action has not been taken at these institutions. One general complicating factor in addressing currency disputes is that estimating a currency's "fundamental" or "true" value is extremely complex and subject to debate among economists.

The 114th Congress addressed currency manipulation through TPA and customs legislation. Members that continue to have concerns about currency manipulation may want to weigh the pros and cons of taking action on exchange rate disputes. If policymakers do want to take action, there are a number of policy options to consider, including countervailing duties, countervailing interventions in foreign exchange markets, provisions in trade agreements, and urging the Administration to press the issue more forcefully at international institutions.

Author Contact Information

Acknowledgments

Hannah Fischer provided assistance with the map for this report.

Footnotes

| 1. |

For example, see "Brazil Warns of World Currency War," Reuters, September 28, 2010; Fred Bergsten, "Currency Wars, the Economy of the United States, and Reform of the International Monetary System," Remarks at Peterson Institute for International Economics, May 16, 2013, http://www.iie.com/publications/papers/bergsten201305.pdf. |

| 2. |

For more information on TPA, see CRS In Focus IF10038, Trade Promotion Authority (TPA), by [author name scrubbed]; CRS Report RL33743, Trade Promotion Authority (TPA) and the Role of Congress in Trade Policy, by [author name scrubbed]; and CRS Report R43491, Trade Promotion Authority (TPA): Frequently Asked Questions, by [author name scrubbed] and [author name scrubbed]. |

| 3. |

For more on customs legislation, see CRS Report R43014, U.S. Customs and Border Protection: Trade Facilitation, Enforcement, and Security, by [author name scrubbed] and [author name scrubbed]. |

| 4. |

Exchange rate data in this report are from the Federal Reserve, unless otherwise noted. |

| 5. |

Bank for International Settlements, "Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets in 2016," https://www.bis.org/publ/rpfx16.htm. |

| 6. |

For example, see "BIS Effective Exchange Rate Indices," http://www.bis.org/statistics/eer/. |

| 7. |

This assumes that changes in the exchange rate are reflected in retail and consumer prices. In practice, there may be factors that limit the "pass through" of changes in the exchange rates to changes in prices. For example, contracts may lock in prices of imports and exports for a set amount of time. |

| 8. |

It may take time for changes in the exchange rate to result in changes in the volume of tradable goods and services. For example, if imports become more expensive, it may take time for domestic consumers to find suitable domestic or foreign substitutes. |

| 9. |

The Eurozone refers to the 19 European Union (EU) member states that use the euro as their currency: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The other 9 EU members have yet to adopt the euro or have chosen not to adopt the euro. |

| 10. |