Agriculture and Related Agencies: FY2020 Appropriations

The Agriculture appropriations bill funds the U.S. Department of Agriculture (USDA) except for the U.S. Forest Service. It also funds the Food and Drug Administration (FDA) and—in even-numbered fiscal years—the Commodity Futures Trading Commission (CFTC).

Agriculture appropriations include both mandatory and discretionary spending. Discretionary amounts, though, are the primary focus during the bill’s development. The largest discretionary spending items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); agricultural research; rural development; FDA; foreign food assistance and trade; farm assistance loans and salaries; food safety inspection; animal and plant health programs; and technical assistance for conservation programs.

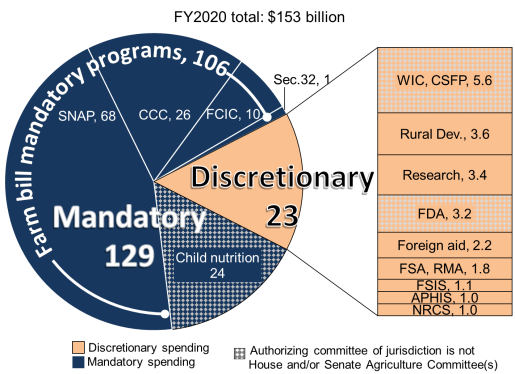

Congress passed and the President signed a full-year FY2020 appropriation on December 20, 2019—the Further Consolidated Appropriations Act (P.L. 116-94, Committee Print 38-679)—that included Agriculture appropriations in Division B. The discretionary total of the FY2020 Agriculture appropriations act is $23.5 billion. This is $183 million more than the comparable amount for FY2019 (+0.8%) that includes the Commodity Futures Trading Commission (CFTC). The appropriation also carries about $129 billion of mandatory spending that is largely determined in authorizing laws. Thus, the overall total of the agriculture portion is $153 billion.

In addition to these amounts, the FY2020 Further Consolidated Appropriations Act includes budget authority that is designated as emergency spending and does not count against discretionary spending caps. These include $535 million to FDA for Ebola prevention and treatment, and $1.5 billion to USDA for the Wildfires and Hurricanes Indemnity Program (WHIP). The latter amount was offset by a $1.5 billion rescission of unobligated WHIP funding from a prior appropriation and emergency designation.

The primary components of the $183 million overall increase in the regular appropriation from FY2019 include increases to foreign agricultural assistance (+$235 million), rural development (+$229 million), rural broadband (+$175 million, separate from the rural development increase), agricultural research salaries and grants (+$167 million), FDA (+$91 million), departmental administration (+$82 million), Farm Service Agency (+$47 million), CFTC (+$47 million), the Natural Resources Conservation Service (+$35 million), Animal and Plant Health Inspection Service (+$32 million) and the Agricultural Marketing Service (+$28 million), and miscellaneous appropriations (+$63 million). Most of these increases are offset by decreases such as for construction for agricultural research facilities (-$189 million), Food and Nutrition Service discretionary appropriations (-$54 million), increasing a rescission of carryover balances in WIC (-$500 million), and not renewing temporary appropriations for Food for Peace and rural water and waste disposal grants (-$291 million).

The Trump Administration had requested $19.2 billion for discretionary-funded accounts within the jurisdiction of Agriculture appropriations subcommittees. The request would have been a reduction of $4.1 billion from FY2019 (-18%).

Policy provisions are also included that affect how the appropriation is delivered. This year, these provisions include issues such as the relocation of USDA agencies, disaster programs, rural definitions, livestock regulations, nutrition programs, and dietary guidelines.

Budget sequestration continues to affect mandatory agricultural spending accounts. Sequestration refers to automatic across-the-board reductions in spending authority. In FY2020, sequestration on mandatory spending accounts is 5.9% and totals about $1.4 billion for agriculture accounts. Recent budget acts have extended sequestration through FY2029.

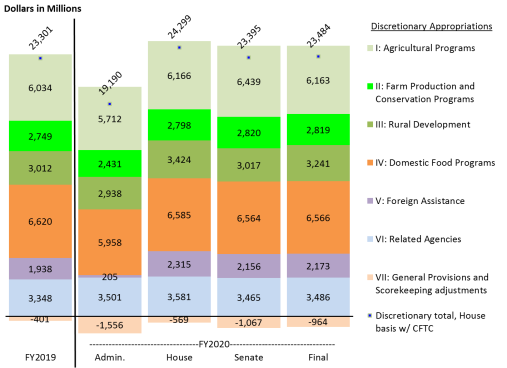

Discretionary Agriculture Appropriations, by Title, FY2019-FY2020

/

Source: CRS, using P.L. 116-6 (Division B), House-passed H.R. 3055 (Division B), Senate-passed H.R. 3055 (Division B), and P.L. 116-94 (Division B).

Note: FDA = Food and Drug Administration, CFTC = Commodity Futures Trading Commission. For comparability, includes CFTC in Related Agencies in all columns regardless of jurisdiction.

Agriculture and Related Agencies: FY2020 Appropriations

Jump to Main Text of Report

Contents

- Status of FY2020 Agriculture Appropriations

- Scope of Agriculture Appropriations

- Recent Trends in Agriculture Appropriations

- Action on FY2020 Appropriations

- Administration's Budget Request

- Discretionary Budget Caps and Subcommittee Allocations

- Budget Resolution

- Budget Caps

- Discretionary Spending Allocations

- Budget Sequestration on Mandatory Spending

- House Action

- Comparison of Discretionary Authority: House-Passed Bill to FY2019

- Comparison of Mandatory Spending: House-Passed Bill to FY2019

- Senate Action

- Comparison of Discretionary Authority: Senate-Passed to House-Passed Bill

- Comparison of Mandatory Spending: Senate-Passed to House-Passed Bill

- Continuing Resolutions

- FY2020 Further Consolidated Appropriations Act

- Comparison of Discretionary Authority

- Comparison of Mandatory Spending

- Policy-Related Provisions

Figures

Tables

- Table 1. Status of FY2020 Agriculture Appropriations

- Table 2. Agriculture and Related Agencies Appropriations, by Title, FY2019-FY2020

- Table 3. Agriculture and Related Agencies Appropriations, by Agency, FY2017-FY2020

- Table 4. Selected Policy Provisions Considered in FY2020 Agriculture Appropriations

- Table A-1. USDA Departmental Administration Appropriations

- Table B-1. General Provisions: Changes in Mandatory Program Spending (CHIMPS)

- Table B-2. General Provisions: Rescissions from Discretionary Accounts

- Table B-3. General Provisions: Other Appropriations

- Table B-4. General Provisions: Scorekeeping Adjustments

- Table C-1. Summary of Sequestration on Agriculture Accounts

- Table C-2. Sequestration of Mandatory Accounts

- Table D-1. Congressional Action on Agriculture Appropriations Since FY1996

Summary

The Agriculture appropriations bill funds the U.S. Department of Agriculture (USDA) except for the U.S. Forest Service. It also funds the Food and Drug Administration (FDA) and—in even-numbered fiscal years—the Commodity Futures Trading Commission (CFTC).

Agriculture appropriations include both mandatory and discretionary spending. Discretionary amounts, though, are the primary focus during the bill's development. The largest discretionary spending items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); agricultural research; rural development; FDA; foreign food assistance and trade; farm assistance loans and salaries; food safety inspection; animal and plant health programs; and technical assistance for conservation programs.

Congress passed and the President signed a full-year FY2020 appropriation on December 20, 2019—the Further Consolidated Appropriations Act (P.L. 116-94, Committee Print 38-679)—that included Agriculture appropriations in Division B. The discretionary total of the FY2020 Agriculture appropriations act is $23.5 billion. This is $183 million more than the comparable amount for FY2019 (+0.8%) that includes the Commodity Futures Trading Commission (CFTC). The appropriation also carries about $129 billion of mandatory spending that is largely determined in authorizing laws. Thus, the overall total of the agriculture portion is $153 billion.

In addition to these amounts, the FY2020 Further Consolidated Appropriations Act includes budget authority that is designated as emergency spending and does not count against discretionary spending caps. These include $535 million to FDA for Ebola prevention and treatment, and $1.5 billion to USDA for the Wildfires and Hurricanes Indemnity Program (WHIP). The latter amount was offset by a $1.5 billion rescission of unobligated WHIP funding from a prior appropriation and emergency designation.

The primary components of the $183 million overall increase in the regular appropriation from FY2019 include increases to foreign agricultural assistance (+$235 million), rural development (+$229 million), rural broadband (+$175 million, separate from the rural development increase), agricultural research salaries and grants (+$167 million), FDA (+$91 million), departmental administration (+$82 million), Farm Service Agency (+$47 million), CFTC (+$47 million), the Natural Resources Conservation Service (+$35 million), Animal and Plant Health Inspection Service (+$32 million) and the Agricultural Marketing Service (+$28 million), and miscellaneous appropriations (+$63 million). Most of these increases are offset by decreases such as for construction for agricultural research facilities (-$189 million), Food and Nutrition Service discretionary appropriations (-$54 million), increasing a rescission of carryover balances in WIC (-$500 million), and not renewing temporary appropriations for Food for Peace and rural water and waste disposal grants (-$291 million).

The Trump Administration had requested $19.2 billion for discretionary-funded accounts within the jurisdiction of Agriculture appropriations subcommittees. The request would have been a reduction of $4.1 billion from FY2019 (-18%).

Policy provisions are also included that affect how the appropriation is delivered. This year, these provisions include issues such as the relocation of USDA agencies, disaster programs, rural definitions, livestock regulations, nutrition programs, and dietary guidelines.

Budget sequestration continues to affect mandatory agricultural spending accounts. Sequestration refers to automatic across-the-board reductions in spending authority. In FY2020, sequestration on mandatory spending accounts is 5.9% and totals about $1.4 billion for agriculture accounts. Recent budget acts have extended sequestration through FY2029.

|

Discretionary Agriculture Appropriations, by Title, FY2019-FY2020 |

|

|

Source: CRS, using P.L. 116-6 (Division B), House-passed H.R. 3055 (Division B), Senate-passed H.R. 3055 (Division B), and P.L. 116-94 (Division B). Note: FDA = Food and Drug Administration, CFTC = Commodity Futures Trading Commission. For comparability, includes CFTC in Related Agencies in all columns regardless of jurisdiction. |

Status of FY2020 Agriculture Appropriations

On December 20, 2019, Congress passed and the President signed into law a full-year FY2020 appropriation—the Further Consolidated Appropriations Act (P.L. 116-94, Committee Print 38-679)—that included Agriculture appropriations in Division B (Table 1).

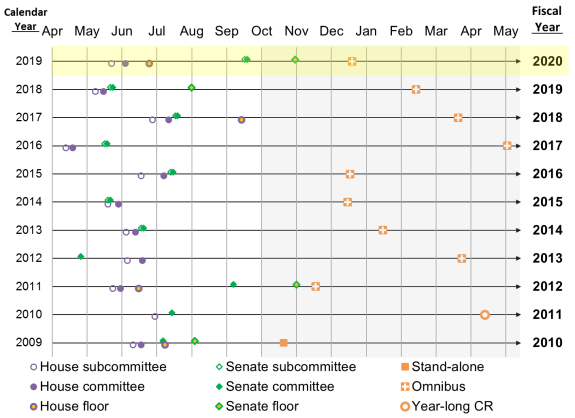

During the regular appropriations cycle, the House passed a five-bill minibus appropriation on June 25, 2019 (H.R. 3055), and the Senate passed a four-bill minibus on October 31, 2019 (H.R. 3055). In both cases, Agriculture was in Division B. To develop these bills, the House and Senate Appropriations Committees reported Agriculture subcommittee bills (H.R. 3164 and S. 2522, respectively) with their own more detailed reports (H.Rept. 116-107 and S.Rept. 116-110, respectively). See Figure 1 for a comparison of timelines and Appendix D for more details.

The Administration released its budget request in two parts: an overview on March 11, 2019, and more detailed documents on March 18, 2019. In the absence of an enacted appropriation at the beginning of the fiscal year, FY2020 began with two continuing resolutions (CRs).

For overall spending levels, the House set its subcommittee allocations on May 14, 2019 (H.Rept. 116-59). The Senate set its subcommittee allocation on September 12, 2019 (S.Rept. 116-104), after the Bipartisan Budget Act of 2019 (P.L. 116-37) raised caps on discretionary spending.

|

Administration Request |

House Action |

Senate Action |

Continuing Resolutions |

Final Appropriation |

||||

|

Subcmte. |

Cmte. |

Floor |

Subcmte. |

Cmte. |

Floor |

|||

|

3/11/2019 3/18/2019 |

5/23/2019 Voice vote |

6/4/2019 Vote 29-21 |

6/25/2019 Vote |

9/17/2019 Voice vote |

9/19/2019 Vote 31-0 |

10/31/2019 Vote |

9/27//2019 P.L. 116-59, 11/21/2019 P.L. 116-69,a |

12/20/2019 P.L. 116-94, Division B Report: Cmte. Print 38-679b Vote: |

Source: CRS, compiled from Congress.gov, OMB, and agency websites.

Note: OMB = Office of Management and Budget, USDA = U.S. Department of Agriculture, FDA = Food and Drug Administration, CFTC = Commodity Futures Trading Commission, and FCA = Farm Credit Administration.

a. H.R. 3055 was introduced as a Commerce-Justice-Science Appropriations bill. It became the vehicle for a House-passed minibus appropriation. The Senate amended it for its version of a minibus appropriation. Later, H.R. 3055 was used to carry the second CR, but without any of the minibus text.

b. Congressional Record, Book III, December 17, 2019, pp. H11061–H11484.

The discretionary total of the FY2020 Agriculture appropriations act is $23.5 billion. This is $183 million more than the comparable amount for FY2019 (+0.8%) that includes the Commodity Futures Trading Commission (CFTC).1 The appropriation also carries about $129 billion of mandatory spending that is largely determined in authorizing laws (Table 2).

Table 2. Agriculture and Related Agencies Appropriations, by Title, FY2019-FY2020

Budget authority in millions of dollars

|

FY2019 |

FY2020 |

Change from FY2019 |

||||||

|

Title of Agriculture Appropriations Act |

Admin. request |

House-passed H.R. 3055 |

Senate-passed |

$ |

% |

|||

|

I. Agricultural Programs: Discretionary |

6,033.9 |

5,712.3 |

6,165.6 |

6,439.2 |

6,163.1 |

+129.2 |

+2.1% |

|

|

Mandatory |

1,374.0 |

1,404.0 |

1,404.0 |

1,404.0 |

1,404.0 |

+30.0 |

+2.2% |

|

|

Subtotal |

7,407.9 |

7,116.3 |

7,569.6 |

7,843.2 |

7,567.1 |

+159.2 |

+2.1% |

|

|

II. Farm Production and Conservation Programs |

2,748.8 |

2,430.6 |

2,798.0 |

2,819.9 |

2,819.0 |

+70.2 |

+2.6% |

|

|

Mandatory |

30,821.1 |

34,489.6 |

34,489.6 |

34,489.6 |

36,268.5 |

+5,447.4 |

+17.7% |

|

|

Subtotal |

33,569.9 |

36,920.2 |

37,287.6 |

37,309.5 |

39,087.5 |

+5,517.6 |

+16.4% |

|

|

III. Rural Development |

3,011.7a |

2,938.1 |

3,423.8a |

3,016.7 |

3,240.6a |

+228.9 |

+7.6% |

|

|

IV. Domestic Food Programs: Discretionary |

6,620.3 |

5,958.3 |

6,584.8 |

6,563.5 |

6,566.0 |

-54.3 |

-0.8% |

|

|

Mandatory |

96,560.0 |

93,013.1 |

95,049.8 |

92,708.3 |

91,436.3 |

-5,123.7 |

-5.3% |

|

|

Subtotal |

103,180.3 |

98,971.4 |

101,634.6 |

99,271.8 |

98,002.3 |

-5,178.0 |

-5.0% |

|

|

V. Foreign Assistance |

1,938.0a |

205.0 |

2,315.2 |

2,156.3 |

2,172.7 |

+234.7 |

+12.1% |

|

|

VI. Food and Drug Administration |

3,080.5 |

3,251.3 |

3,265.7 |

3,160.5 |

3,171.5 |

+91.0 |

+3.0% |

|

|

Commodity Futures Trading Commission |

[268.0]b |

250.0 |

315.0 |

[305.0]b |

315.0 |

+47.0 |

+17.5% |

|

|

VII. General Provisions: |

||||||||

|

CHIMPS and rescissionsc |

-490.0 |

-1,153.0 |

-799.8 |

-810.1 |

-1,006.1 |

-516.1 |

+105.3% |

|

|

Emergency appropriations |

— |

— |

— |

— |

535.0d |

+535.0 |

— |

|

|

Other appropriations |

493.5 |

0.0 |

628.8 |

141.5 |

440.3 |

-53.2 |

-10.8% |

|

|

Scorekeeping adjustmentse |

-404.0 |

-403.0 |

-398.0 |

-398.0 |

-398.0 |

+6.0 |

-1.5% |

|

|

Emergency designation in this bill |

— |

— |

— |

— |

-535.0d |

-535.0 |

— |

|

|

Discretionary: Senate basis w/o CFTC |

23,032.7 |

18,939.6 |

[23,984.0] |

23,089.6 |

[23,169.1] |

+136.4 |

+0.6% |

|

|

Discretionary: House basis w/ CFTC |

[23,300.7] |

19,189.6 |

24,299.0 |

[23,394.6] |

23,484.1 |

+183.4 |

+0.8% |

|

|

Mandatory |

128,755.1 |

128,906.7 |

130,943.4 |

128,601.9 |

129,108.8 |

+353.7 |

+0.3% |

|

|

Total: Senate basis w/o CFTC |

151,787.8 |

147,846.4 |

154,927.4 |

151,691.5 |

152,278.0 |

+490.1 |

+0.3% |

|

|

Total: House basis w/ CFTC |

152,055.8 |

148,096.4 |

155,242.4 |

151,996.5 |

152,593.0 |

+537.1 |

+0.4% |

|

Source: CRS, using appropriations text and reports, and unpublished CBO tables.

Notes: Amounts are nominal discretionary budget authority unless labeled otherwise. Excludes amounts in supplemental appropriations acts. Bracketed amounts are not in the Agriculture appropriations totals due to differing House-Senate jurisdiction for the Commodity Futures Trading Commission (CFTC).

a. Excludes amounts for other appropriations that are provided separately in General Provisions.

b. This amount for CFTC is from the Financial Services and General Government (FSGG) appropriation.

c. Changes in Mandatory Program Spending (CHIMPS) are revisions made to mandatory programs via appropriations. Rescissions are permanent cancellations of previous authorizations (see Appendix B).

d. Appropriations designated as emergency in FY2020 include $535 million for Ebola, and $1.5 billion for the Wildfires and Hurricane Indemnity Program, which was offset with $1.5 billion in rescissions (Table B-3).

e. "Scorekeeping adjustments" are not necessarily appropriated but are part of the official CBO accounting.

|

Figure 1. Timeline of Action on Agriculture Appropriations, FY2010-FY2020 |

|

|

Source: CRS. For specific dates and links to bills, see Appendix D. |

|

Other CRS Resources for Agricultural Appropriations In addition to the agency-level amounts presented in Table 3, the following CRS reports provide more detail and analysis about various agencies and programs within the Agriculture appropriations act:

|

Scope of Agriculture Appropriations

The Agriculture appropriations bill—formally known as the Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Appropriations Act—funds all of the U.S. Department of Agriculture (USDA), excluding the U.S. Forest Service.2 It also funds the Food and Drug Administration (FDA) in the Department of Health and Human Services and, in even-numbered fiscal years, CFTC.

Jurisdiction is with the House and Senate Committees on Appropriations and their Subcommittees on Agriculture, Rural Development, Food and Drug Administration, and Related Agencies. The bill includes mandatory and discretionary spending, but the discretionary amounts are the primary focus (Figure 2). Some programs are not in the authorizing jurisdiction of the House or Senate Agriculture Committees, such as FDA, Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), or child nutrition (checkered regions in Figure 2).

The federal budget process treats discretionary and mandatory spending differently:3

- Discretionary spending is controlled by annual appropriations acts and receives most of the attention during the appropriations process. The annual budget resolution4 process sets spending limits for discretionary appropriations. Agency operations (salaries and expenses) and many grant programs are discretionary.

- Mandatory spending5 is carried in the appropriation and usually advanced unchanged, since it is controlled by budget rules during the authorization process.6 Spending for so-called entitlement programs is determined in laws such as the 2018 farm bill7 and 2010 child nutrition reauthorizations.8

In the FY2020 appropriation (P.L. 116-94), the discretionary amount is 15% ($23 billion) of the $153 billion total. Mandatory spending carried in the act comprised $129 billion, about 85% of the total, of which about $106 billion is attributable to programs in the 2018 farm bill.

Within the discretionary total, the largest spending items are WIC; agricultural research; rural development; FDA; foreign food aid and trade; farm assistance loans and salaries; food safety inspection; animal and plant health programs; and technical assistance for conservation program.

The main mandatory spending items are the Supplemental Nutrition Assistance Program (SNAP) and other food and nutrition act programs, child nutrition (school lunch and related programs), crop insurance, and farm commodity and conservation programs that are funded through USDA's Commodity Credit Corporation (CCC). SNAP is referred to as an "appropriated entitlement" and requires an annual appropriation.9 Amounts for the nutrition program are based on projected spending needs. In contrast, the CCC appropriations reimburse spending from a line of credit.10

|

Key Budget Terms Budget authority is the main purpose of an appropriations act or a law authorizing mandatory spending. It provides the legal basis from which to obligate funds. It expires at the end of a period, usually after one year unless specified otherwise (e.g., two years or indefinite). Most funding amounts in this report are budget authority. Obligations are contractual agreements between a government agency and its clients or employees. These occur when an agency agrees to spend money from its budget authority. The Antideficiency Act prohibits agencies from obligating more budget authority than is provided in law, such as during a government shutdown. Outlays are the payments (cash disbursements) that satisfy a valid obligation. Timing of outlays may differ from budget authority or obligations because payments from an agency may not occur until services are fulfilled, goods are delivered, or construction is completed, even though an obligation occurred. Program level represents the sum of the activities undertaken by an agency. A program level may be higher than a budget authority if the program (1) receives user fees, (2) includes loans that are leveraged by an expectation of repayment (loan authority may exceed budget authority), or (3) receives transfers from other agencies. Rescissions are actions that reduce budget authority after enactment. They generally score budgetary savings. CHIMPS (Changes in Mandatory Program Spending) are adjustments via an appropriations act that can change available funding for mandatory programs. CHIMPS usually change spending for one year and may score either as an increase or decrease to outlays. They do not change the underlying authority of the program in law. For more background, see CRS Report 98-721, Introduction to the Federal Budget Process. |

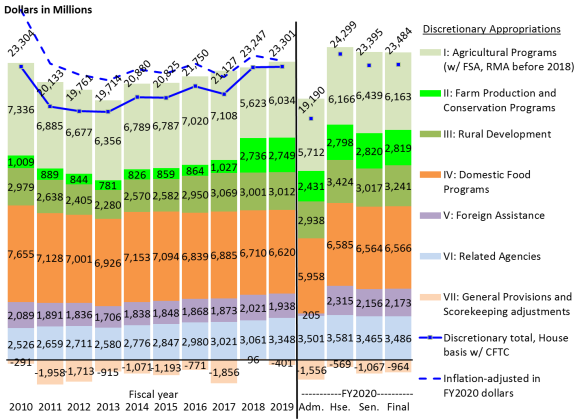

Recent Trends in Agriculture Appropriations

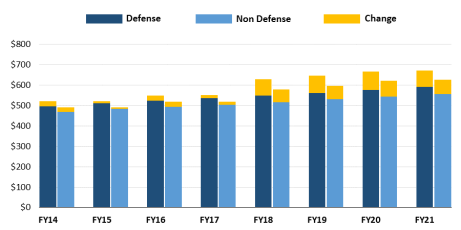

Discretionary Agriculture appropriations were at an all-time high in FY2010, declined through FY2013, and have gradually increased since then. Changes within titles have generally been proportionate to changes in the overall bill, though some areas have sustained relative increases, such as FDA and rural development.

The stacked bars in Figure 3 represent the discretionary authorization for each appropriations title. The total of the positive stacked bars is the budget authority in Titles I-VI. In FY2018, USDA reorganization affected the placement of some programs between Titles I and II of the bill (most noticeably, the Farm Service Agency). In most years, the cumulative appropriation for the agencies is higher than the official discretionary total in the spending allocation (the blue line) because of the budgetary offset from negative amounts in Title VII (general provisions) and other negative scorekeeping adjustments. These negative offsets are mostly due to rescissions of prior-year unobligated funds and, before FY2018, limits placed on mandatory programs.

Historical trends may be tempered by inflation adjustments, as shown in the dotted line. The inflation-adjusted totals from FY2011-FY2017 had been fairly steady until increases in the FY2018-FY2020 appropriations.

|

Figure 3. Discretionary Agriculture Appropriations, by Title, FY2010-FY2020 |

|

|

Source: CRS. Note: For FY2020, Adm. is the Trump Administration's request; Hse. and Sen. are chamber-passed versions of H.R. 3055, Division B, and Final is P.L. 116-94, Division B. For comparability, includes CFTC in Related Agencies in all columns regardless of jurisdiction. The inflation-adjusted line was calculated using the gross domestic product price deflator. Amounts printed diagonally indicate the solid line, which is the subcommittee allocation. |

Action on FY2020 Appropriations

Administration's Budget Request

The Trump Administration released a general overview of its FY2020 budget request on March 11, 2019,11 and a detailed budget proposal to Congress on March 18, 2019.12 USDA released its more detailed budget summary and justification,13 as did the FDA,14 and the independent agencies of the CFTC15 and the Farm Credit Administration.16 The Administration also highlighted separately some of its proposed reductions and eliminations.17

For accounts in the jurisdiction of the Agriculture appropriations bill, the Administration's budget requested $19.2 billion, a $4.1 billion reduction from FY2019 (-18%; Table 2, Figure 3). The Administration released its budget request for FY2020 after Congress had enacted the omnibus FY2019 appropriation in February 2019 (P.L. 116-6). Amounts in the FY2019 column of the Administration's budget documents are based on FY2018 levels, not enacted FY2019 amounts.

Discretionary Budget Caps and Subcommittee Allocations

Budget enforcement has procedural and statutory elements. The procedural elements relate to a budget resolution and are enforced with points of order. The statutory elements impose discretionary spending limits and are enforced with budget caps and sequestration.18

Budget Resolution

Typically, each chamber's Appropriations Committee receives a top-line limit on discretionary budget authority, referred to as a "302(a)" allocation, from the Budget Committee via an annual budget resolution. The Appropriations Committees then in turn subdivide the allocation among their subcommittees, referred to as the "302(b)" allocations.19

For FY2020, the House did not report or pass a budget resolution. The Senate Budget Committee reported S.Con.Res. 12, though it received no further action.

Budget Caps

The Budget Control Act of 2011 (BCA, P.L. 112-25) set discretionary budget caps through FY2021 as a way of reducing federal spending.20 Sequestration is an across-the-board backstop to achieve budget reductions if spending exceeds the budget caps (2 U.S.C. §901(c)).21

Bipartisan Budget Acts (BBAs) have avoided sequestration on discretionary spending—with the exception of FY2013—by raising those caps four times in two-year increments in 2013, 2015, 2018, and 2019 (Figure 4).22 Most recently, the BBA of 2019 (P.L. 116-37) raised the cap on nondefense discretionary spending by $78 billion for FY2020 (to $621 billion) and by $72 billion for FY2021 (to $627 billion). The amount for FY2020 is 4.1% greater than the nondefense cap in FY2019. The BBA also provides language to execute (or "deem") those higher caps for the appropriations process without a budget resolution.23

|

Figure 4. BCA Discretionary Limits, FY2014-FY2021 Budget authority in billions of nominal dollars |

|

|

Source: CRS Insight IN11148, The Bipartisan Budget Act of 2019: Changes to the BCA and Debt Limit. |

Discretionary Spending Allocations

In the absence of a budget resolution and before the BBA that occurred in August, the House Appropriations Committee on May 14, 2019, set an overall discretionary target and provided subcommittee allocations (H.Rept. 116-59). The allocation for Agriculture appropriations was $24.3 billion, $1 billion greater (+4.3%) than the comparable amount for FY2019 (Table 2).

The Senate waited for the overall budget agreement in the BBA of 2019 before setting subcommittee allocations or proceeding to mark up appropriations bills. On September 12, 2019, the Senate Appropriations Committee set its subcommittee allocations (S.Rept. 116-104). The subcommittee allocation was $23.1 billion, $0.1 billion greater (+0.3%) than FY2019.

Without Congress having agreed on a joint budget resolution, different subcommittee allocations between the chambers further necessitated reconciliation in the final appropriation.

Budget Sequestration on Mandatory Spending

Despite the BBA agreements that raise discretionary spending caps and avoid sequestration on discretionary accounts, sequestration still impacts mandatory spending through FY2029. Sequestration on mandatory accounts began in FY2013, continues to the present, and has been extended five times beyond the original FY2021 sunset of the BCA. See Appendix C for effects.

House Action

The House Agriculture Appropriations Subcommittee marked up its FY2020 bill on May 23, 2019, by voice vote.24 On June 4, 2019, the full Appropriations Committee passed and reported an amended bill (H.R. 3164, H.Rept. 116-107) by a vote of 29-21. The committee adopted four amendments by voice vote.25

On June 25, 2019, the House passed a five-bill minibus appropriation (H.R. 3055) with the Agriculture bill as Division B (Table 1, Figure 1).26 Under a structured rule,27 the Rules Committee allowed 35 amendments for floor debate (H.Res. 445, H.Rept. 116-119). The House considered 33 of those amendments, of which 31 were adopted and two were rejected. Of the 31 amendments that were adopted, 28 were adopted en bloc by voice vote, two were adopted by recorded votes, and another was adopted separately by voice vote. Of the 31 amendments that were adopted, 14 revised funding amounts with offsets,28 three added policy statements, and 14 made no substantive changes but were for the purposes of discussion.

The $24.3 billion discretionary total in the House-passed FY2020 Agriculture appropriation would have been $1 billion more than (+4%) the comparable amount enacted for FY2019 that includes the CFTC (Table 2, Figure 3). Generally speaking, the House-passed bill did not include most of the reductions proposed by the Administration.

Comparison of Discretionary Authority: House-Passed Bill to FY2019

Table 3 provides details of the House-passed bill at the agency level. The primary changes from FY2019 that comprised the $1 billion increase, ranked by increases and decreases, include the following:

- Increase Rural Development accounts by $412 million (+14%), including a $144 million increase for the Rural Housing Service (+9%) and a $238 million increase for the Rural Utilities Service (+38%) to support rural water and waste disposal and rural broadband. In addition, the General Provisions title included a $393 million increase for the ReConnect Broadband Pilot Program (+314%).

- Increase foreign agricultural assistance by $377 million (+19%), including increasing Food for Peace humanitarian assistance by $350 million and McGovern-Dole Food for Education by $25 million. In FY2019, Food for Peace had received a temporary increase of $216 million in the General Provisions title. The larger FY2020 amount would have been to the program's base appropriation rather than the FY2019 approach that used the General Provisions.

- Increase related agencies appropriations by $232 million, including raising FDA appropriations by $185 million (+6%) and the CFTC by $47 million (+18%).

- Increase other agricultural program appropriations by $151 million, including the following:

- Increase departmental administration accounts by a net $205 million (+53%), including funding most of the Administration's request for a $271 million increase for construction to renovate USDA headquarters.

- Increase USDA regulatory programs by $56 million, including increasing the Animal and Plant Health Inspection Service by $23 million (+2%) and the Agricultural Marketing Service by $33 million (+20%).

- Decrease agricultural research by a net $134 million (-4%). Agricultural Research Service (ARS) construction would have been reduced by $331 million from FY2019 (-87%), while salaries and expenses would have increased for ARS (+$44 million, +3%) and the National Institute of Food and Agriculture (NIFA) (+$146 million, +10%).

- Some of these increases would have been offset by a net change of -$175 million in budget authority through the General Provisions title. This was mostly a combination of greater rescissions of carryover balances in WIC (-$300 million) and the absence of continuing the FY2019 appropriations in the General Provisions for Food for Peace (-$216 million, as mentioned above) and rural water and waste disposal (-$75 million). The General Provisions would have provided increases in funding for rural broadband (+$393 million, as mentioned above) and several appropriations for miscellaneous programs (+$33 million).

Comparison of Mandatory Spending: House-Passed Bill to FY2019

In addition to discretionary spending, the House-passed bill also carried mandatory spending that totaled $131 billion. This was about $2 billion more than in FY2019 generally because of automatic changes from economic conditions and expectations about enrollment in entitlement programs. Reimbursement for the CCC was projected to increase by $10 billion, mostly due to the cost of the first year of the Trump Administration's trade aid assistance package.29 Estimates for child nutrition programs would have increased by $0.9 billion. Crop insurance spending would have decreased by $6.4 billion, and SNAP spending decreased by about $2.4 billion.

Senate Action

The Senate Agriculture Appropriations Subcommittee marked up its FY2020 bill on September 17, 2019. On September 19, 2019, the full Appropriations Committee passed and reported an amended bill (S. 2522, S.Rept. 116-110) by a vote of 31-0. The committee adopted a manager's amendment with three additions to bill text and 19 additions to report language.30

On October 31, 2019, the Senate passed a four-bill minibus appropriation (H.R. 3055, after adopting S.Amdt. 948, which was composed of four Senate-reported bills and amended by floor amendments).31 The Agriculture bill is Division B (Table 1, Figure 1). The Senate adopted 16 amendments to Division B, of which 14 were adopted en bloc by unanimous consent and two were adopted by recorded votes. Of these 16 amendments, eight revised funding amounts with offsets,32 three revised funding amounts within an existing appropriation, three changed the terms of an appropriation, and two required reports or studies.

The $23.1 billion discretionary total in the Senate-passed FY2020 Agriculture appropriation would have been $57 million more than (+0.2%) the amount enacted for FY2019 (Table 2, Figure 3). The Senate bill was $894 million less than (-3.7%) the House-passed bill on a comparable basis without CFTC. Generally speaking, the Senate-passed bill did not include most of the reductions proposed by the Administration. Table 3 provides details of the Senate-passed bill at the agency level.

Comparison of Discretionary Authority: Senate-Passed to House-Passed Bill

Compared to the House-passed bill and ranked by increases and decreases, the primary changes in the Senate-passed bill that comprised the -$894 million difference from the House bill included the following:

- Agricultural research would have been $193 million greater in the Senate-passed bill than in the House-passed bill. ARS buildings and facilities would have been $255 million greater than in the House-passed bill, ARS salaries and expenses $77 million greater, and NIFA $132 million less.

- Departmental administration accounts would have been $97 million greater in the Senate bill than in the House bill, mostly by maintaining appropriations for the Chief Information Officer, General Counsel, and Departmental Administration that would have been reduced as offsets to pay for floor amendments that were adopted in the House bill.

- Rural Development would have been $407 million less in the Senate-passed bill than in the House-passed bill, mostly by a $300 million less for the Rural Utilities Service ($233 million less for rural water and waste disposal grants, $41 million less for distance learning and telemedicine, and $25 million less for existing non-pilot rural broadband programs), $70 million less for Rural Housing Service, and $22 million less for the Rural Business-Cooperative Service.

- In addition, for the separate ReConnect Broadband Pilot Program, the General Provisions title in the Senate-passed bill would not have provided for any of the $518 million that the House bill contained.

- Foreign agricultural assistance would have been $159 million less in the Senate bill than in the House bill, mostly by not increasing Food for Peace as much as in the House bill, and maintaining the McGovern-Dole program at a constant level.

- FDA appropriations would have been $105 million less in the Senate-passed bill than in the House-passed bill.

Comparison of Mandatory Spending: Senate-Passed to House-Passed Bill

In addition to discretionary spending, the Senate-passed bill also carried mandatory spending that totaled $129 billion. This was $153 million less than in FY2019 and $2.3 billion less than in the House-passed bill. Compared to the House-passed bill, amounts for CCC and crop insurance were the same. Mandatory amounts for the child nutrition programs were about $400 million less than the House bill, and the amount for SNAP was about $1.9 billion less than in the House bill.

Continuing Resolutions

In the absence of a final Agriculture appropriation at the beginning of FY2020 on October 1, 2019, Congress passed a CR to continue operations and prevent a government shutdown (P.L. 116-59, Division A).33 The first CR lasted nearly eight weeks until November 21, 2019. On November 21, a second CR (P.L. 116-69) was enacted to last until December 20, 2019.34 On December 20, Congress passed and the President signed a full-year FY2020 appropriation.

In general, a CR continues the funding rates and conditions that were in the previous year's appropriation.35 The Office of Management and Budget (OMB) may prorate funding to the agencies on an annualized basis for the duration of the CR through a process known as apportionment.36 For the first 52 days (about 14% of FY2020) through November 21, 2019, and the next 29 days (about 8% of FY2020) through December 20, 2019, the CRs

- continued the terms of the FY2019 Agriculture appropriations act (§101) with a proviso for rural development in the anomalies below; and

- provided sufficient funding to maintain mandatory program levels, including for nutrition programs (§111).37 This is similar to the approach taken in recent years.

CRs may adjust prior-year amounts through anomalies or make specific administrative changes. Five anomalies applied specifically to the Agriculture appropriation during the first CR:

- Rural Water and Waste Disposal Program (§101(1)). Allowed the CR to cover the cost of direct loans in addition to loan guarantees and grants. In FY2019, direct loans did not require appropriation because they had a negative subsidy rate (i.e., fees and repayments more than covered the cost of loan making). In FY2020, OMB estimated a need for a positive subsidy rate.

- Disaster Assistance for Sugar Beet Processors (§116). Amended the list of eligible losses that may be covered under the Additional Supplemental Appropriations for Disaster Relief Act of FY2019 (P.L. 116-20, Title I) to include payments to cooperative processors for reduced sugar beet quantity and quality. The FY2019 supplemental provided $3 billion to cover agricultural production losses in 2018 and 2019 from natural disasters.38

- Agricultural Research (§117). Allowed USDA to waive the nonfederal matching funds requirement for grants made under the Specialty Crop Research Initiative (7 U.S.C. §7632(g)(3)). The requirement was added in the 2018 farm bill.

- Summer Food for Children Demonstration Projects (§118). Allocated funding for the Food and Nutrition Service summer food for children demonstration projects at a rate so that projects could fully operate by May 2020 (prior to summer service, which typically starts in June). Similar provisions have been part of previous CRs. These projects, which include the Summer Electronic Benefit Transfer (EBT) demonstration, have operated in selected states since FY2010.39

- Commodity Credit Corporation (§119). Allowed CCC to receive its appropriation about a month earlier than usual so that it could reimburse the Treasury for a line of credit prior to a customary final report and audit.40 Many payments to farmers were due in October 2019, including USDA's plan to make supplemental payments under its trade assistance program.41 Without the anomaly, CCC might have exhausted its $30 billion line of credit in October or November 2019 before the audit was completed, which could have suspended payments. A similar provision was part of a CR in FY2019. In addition, the FY2020 CR required USDA to submit a report to Congress by October 31, 2019, with various disaggregated details about Market Facilitation Program payments, trade damages, and whether commodities were purchased from foreign-owned companies under the program.

- Hemp (§120). Provided $16.5 million on an annualized basis to the USDA Agricultural Marketing Service to implement the Hemp Production Program (P.L. 115-334, §10113), which was created in the 2018 farm bill.42

The second CR continued the terms of the first CR until December 20, 2019. It added one new anomaly for Agriculture appropriations:

- Commodity Assistance Program (§146). Allowed funding for the Commodity Supplemental Food Program (CSFP) to be apportioned at a rate to maintain current program caseload. This meant that funding available under the second CR could exceed amounts that would otherwise would have been available.

FY2020 Further Consolidated Appropriations Act

On December 20, 2019, Congress passed and the President signed a full-year FY2020 appropriation—the Further Consolidated Appropriations Act (P.L. 116-94, Committee Print 38-679)43—that included Agriculture appropriations in Division B. This was the second of two consolidated appropriations acts that were passed in tandem: P.L. 116-93, which covered four appropriations subcommittee bills, and P.L. 116-94, which covered eight appropriations subcommittee bills.

The official discretionary total of the FY2020 Agriculture appropriation is $23.5 billion. This is $183 million more than (+0.8%) the comparable amount for FY2019 that includes CFTC. The appropriation also carries about $129 billion of mandatory spending that is largely determined in authorizing laws. Thus the overall total of the agriculture portion is $153 billion.

In addition to these amounts, the appropriation includes budget authority that is designated as emergency spending and does not count against discretionary spending caps. These include $535 million to FDA for Ebola prevention and treatment, and $1.5 billion to USDA for the Wildfires and Hurricanes Indemnity Program (WHIP). The latter amount was offset by a $1.5 billion rescission of unobligated WHIP funding from a prior appropriation and emergency designation.

Comparison of Discretionary Authority

Table 3 provides details of the enacted FY2020 Agriculture appropriation at the agency level, and compared with the House- and Senate-passed bills, the Administration's request, and three prior years. The primary changes from FY2019 that comprised the overall $183 million increase, ranked by increases and decreases, include the following:

- Increase foreign agricultural assistance by $235 million (+12%), including increasing Food for Peace humanitarian assistance by $225 million and McGovern-Dole Food for Education by $10 million. In FY2017-FY2019, Food for Peace had received temporary increases in the General Provisions title, including $216 million in FY2019. The larger FY2020 amount replaces the temporary amount with an increase in the program's base appropriation.

- Increase Rural Development accounts by $229 million (+8%), including a $130 million increase for the Rural Utilities Service (+21%) to support rural water and waste disposal and telemedicine and an $81 million increase for the Rural Housing Service (+5%). In addition, the General Provisions title included a $175 million increase for a rural broadband pilot program (+140%).44

- Increase related agencies appropriations by $138 million, including raising FDA appropriations by $91 million (+3%) and the CFTC by $47 million (+18%).

- Increase other agricultural program appropriations by $199 million, including the following:

- Increase departmental administration accounts by a net $82 million (+21%), including funding for construction to renovate USDA headquarters.

- Increase USDA regulatory programs by $59 million, including increasing the Animal and Plant Health Inspection Service by $32 million (+3%) and the Agricultural Marketing Service by $28 million (+17%).

- Decrease agricultural research by a net $18 million (-0.5%). Agricultural Research Service (ARS) construction is reduced by $189 million compared with FY2019 (-49%), while salaries and expenses are increased for ARS (+$111 million, +9%) and grants for the National Institute of Food and Agriculture (NIFA) (+$56 million, +4%).

- Increase Farm Service Agency salaries and expenses by $47 million (+3%).

- Increase Natural Resources Conservation Service appropriations by $35 million, including Watershed and Flood Prevention by $25 million (+17%), and Conservation Operations by $10 million (+1%).

- Decrease Food and Nutrition Service discretionary appropriations by $54 million, including decreasing WIC by $75 million (-1%) and increasing Commodity Assistance Programs by $22 million (+7%).

- Some of these increases are offset by a net change of -$570 million in budget authority through the General Provisions title. This was mostly a combination of greater rescissions of carryover balances in WIC (-$500 million) and the absence of continuing the FY2019 appropriations in the General Provisions for Food for Peace (-$216 million, as mentioned above) and rural water and waste disposal grants (-$75 million). The General Provisions provides increases in funding for rural broadband (+$175 million, as mentioned above) and several appropriations for miscellaneous programs (+$63 million over FY2019).

- Not included above is emergency funding that is not subject to discretionary budget caps. This includes funding for Ebola ($535 million) and the Wildfires and Hurricanes Indemnity Program (WHIP, $1.5 billion). The latter emergency authorization was offset by an identically sized rescission of prior-year emergency funding for WHIP.

Comparison of Mandatory Spending

In addition to discretionary spending, the House-passed bill also carried mandatory spending—largely determined in separate authorizing laws—that totals $129 billion. This is about $354 million more than (+0.3%) FY2019, generally due to automatic changes from economic conditions and expectations about enrollment in entitlement programs. Reimbursement to the Treasury for the CCC increased by $10.9 billion (+71%), mostly due to the cost of the Trump Administration's trade aid assistance that was announced in 2018.45 Child nutrition programs increase by $0.5 billion (+2%). Crop insurance spending decreases by $5.5 billion (-35%), and SNAP spending decreases by about $5.6 billion (-8%).

Table 3. Agriculture and Related Agencies Appropriations, by Agency, FY2017-FY2020

Budget authority in millions of dollars

|

FY2017 |

FY2018 |

FY2019 |

FY2020 |

Change from FY2019 |

|||||||

|

Agency or major program |

Admin. request |

House H.R. 3055 |

Senate |

$ |

% |

||||||

|

Title I. Agricultural Programs |

|||||||||||

|

Departmental Administration (Table A-1) |

403.9 |

396.0 |

390.4 |

695.1 |

595.3 |

691.9 |

472.8 |

+82.4 |

+21.1% |

||

|

Research, Education and Economics |

|||||||||||

|

Agricultural Research Service |

1,269.8 |

1,343.4 |

1,684.5 |

1,253.5 |

1,397.5 |

1,729.8 |

1,607.1 |

-77.4 |

-4.6% |

||

|

National Institute of Food and Agriculture |

1,362.9 |

1,407.8 |

1,471.3 |

1,391.7 |

1,617.1 |

1,484.7 |

1,527.4 |

+56.1 |

+3.8% |

||

|

National Agricultural Statistics Service |

171.2 |

191.7 |

174.5 |

163.0 |

180.8 |

175.3 |

180.3 |

+5.8 |

+3.3% |

||

|

Economic Research Service |

86.8 |

86.8 |

86.8 |

60.5 |

87.8 |

86.8a |

84.8 |

-2.0 |

-2.3% |

||

|

Under Secretary |

0.9 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

+0.0 |

+0.0% |

||

|

Marketing and Regulatory Programs |

|||||||||||

|

Animal and Plant Health Inspection Service |

949.4 |

985.1 |

1,014.3 |

984.6 |

1,037.2 |

1,031.1 |

1,045.9 |

+31.6 |

+3.1% |

||

|

Agricultural Marketing Serviceb |

86.2 |

152.8 |

160.3 |

116.3 |

193.1 |

182.8 |

188.2 |

+27.8 |

+17.4% |

||

|

Section 32 (M) |

1,322.0 |

1,344.0 |

1,374.0 |

1,404.0 |

1,404.0 |

1,404.0 |

1,404.0 |

+30.0 |

+2.2% |

||

|

Grain Inspection, Packers, Stockyards Admin.b |

43.5 |

moved into Agricultural Marketing Serviceb |

|||||||||

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.8 |

0.8 |

0.9 |

0.8 |

-0.1 |

-11.2% |

||

|

Food Safety |

|||||||||||

|

Food Safety and Inspection Service |

1,032.1 |

1,056.8 |

1,049.3 |

1,045.3 |

1,054.3 |

1,054.3 |

1,054.3 |

+5.0 |

+0.5% |

||

|

Under Secretary |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

+0.0 |

+0.0% |

||

|

Farm and Commodity Programsb |

|||||||||||

|

Farm Service Agencyc |

1,624.0 |

moved to Title II: Farm Production and Conservationb |

|||||||||

|

FSA Farm Loans: Loan Authorityd |

8,002.6 |

moved to Title II: Farm Production and Conservationb |

|||||||||

|

Risk Management Agency |

74.8 |

moved to Title II: Farm Production and Conservationb |

|||||||||

|

Federal Crop Insurance Corporation (M) |

8,667.0 |

moved to Title II: Farm Production and Conservationb |

|||||||||

|

Commodity Credit Corporation (M) |

21,290.7 |

moved to Title II: Farm Production and Conservationb |

|||||||||

|

Under Secretary |

0.9 |

moved to Title II: Farm Production and Conservationb |

|||||||||

|

Subtotal, Title I |

|||||||||||

|

Discretionary |

7,107.7 |

5,622.8 |

6,033.9 |

5,712.3 |

6,165.6 |

6,439.2 |

6,163.1 |

+129.2 |

+2.1% |

||

|

Mandatory (M) |

31,280.2 |

1,344.0 |

1,374.0 |

1,404.0 |

1,404.0 |

1,404.0 |

1,404.0 |

+30.0 |

+2.2% |

||

|

Subtotal |

38,387.9 |

6,966.8 |

7,407.9 |

7,116.3 |

7,569.6 |

7,843.2 |

7,567.1 |

+159.2 |

+2.1% |

||

|

Title II. Farm Production and Conservationb |

|

|

|

|

|

|

|

|

|

||

|

Business Center |

— |

1.0 |

216.4 |

206.5 |

206.5 |

206.5 |

203.9 |

-12.5 |

-5.8% |

||

|

Farm Service Agencyc |

—b |

1,625.2 |

1,494.2 |

1,412.7 |

1,536.1 |

1,544.4 |

1,541.7 |

+47.5 |

+3.2% |

||

|

FSA Farm Loans: Loan Authorityd |

—b |

8,005.6 |

7,987.7 |

7,674.3 |

7,997.8 |

8,037.8 |

8,431.0 |

+443.3 |

+5.6% |

||

|

Risk Management Agency |

—b |

74.8 |

58.4 |

56.0 |

58.4 |

58.4 |

58.4 |

+0.0 |

+0.0% |

||

|

Federal Crop Insurance Corporation (M) |

—b |

8,913.0 |

15,410.6 |

8,936.0 |

8,936.0 |

8,936.0 |

9,959.0 |

-5,451.6 |

-35.4% |

||

|

Commodity Credit Corporation (M) |

—b |

14,284.8 |

15,410.0 |

25,553.1 |

25,553.1 |

25,553.1 |

26,309.0 |

+10,899.0 |

+70.7% |

||

|

Conservation Operations |

864.5 |

874.1 |

819.5 |

755.0 |

829.6 |

835.2 |

829.6 |

+10.1 |

+1.2% |

||

|

Watershed and Flood Prevention |

150.0 |

150.0 |

150.0 |

— |

155.0 |

175.0 |

175.0 |

+25.0 |

+16.7% |

||

|

Watershed Rehabilitation Program |

12.0 |

10.0 |

10.0 |

— |

12.0 |

— |

10.0 |

+0.0 |

+0.0% |

||

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

+0.0 |

+0.0% |

||

|

Subtotal, Title II |

|||||||||||

|

Discretionary |

1,027.4 |

2,735.6 |

2,748.8 |

2,430.6 |

2,798.0 |

2,819.9 |

2,819.0 |

+70.2 |

+2.6% |

||

|

Mandatory (M) |

—b |

23,198.3 |

30,821.1 |

34,489.6 |

34,489.6 |

34,489.6 |

36,268.5 |

+5,447.4 |

+17.7% |

||

|

Subtotal |

—b |

25,933.9 |

33,569.9 |

36,920.2 |

37,287.6 |

37,309.5 |

39,087.5 |

+5,517.6 |

+16.4% |

||

|

Title III. Rural Development |

|

|

|

||||||||

|

Salaries and Expenses (including transfers)e |

675.8 |

680.8 |

686.8 |

622.2 |

705.8 |

692.0 |

697.8 |

+11.0 |

+1.6% |

||

|

Rural Housing Service |

1,654.9 |

1,582.4 |

1,606.0 |

1,467.0 |

1,749.7 |

1,678.8 |

1,686.7 |

+80.7 |

+5.0% |

||

|

RHS Loan Authorityd |

28,083.4 |

28,390.1 |

28,293.8 |

27,260.0 |

28,423.0 |

28,645.5 |

28,646.0 |

+352.2 |

+1.2% |

||

|

Rural Business-Cooperative Service |

97.7f |

109.5 |

98.6 |

27.5 |

109.3 |

87.0 |

105.0 |

+6.4 |

+6.5% |

||

|

RBCS Loan Authorityd |

988.4 |

991.2 |

1,026.4 |

1,000.0 |

1,288.9 |

1,038.9 |

1,088.9 |

+62.5 |

+6.1% |

||

|

Rural Utilities Service |

639.9 |

628.1a |

620.2a |

821.3 |

858.1a |

558.1 |

750.3a |

+130.0 |

+21.0% |

||

|

RUS Loan Authorityd |

8,217.0 |

8,219.9 |

8,419.9 |

7,390.0 |

8,419.9 |

8,419.9 |

8,401.2 |

-18.7 |

-0.2% |

||

|

Under Secretaryg |

0.9 |

temporarily moved to Dept. Admin.g |

0.8 |

0.8 |

0.8 |

+0.0 |

+0.0% |

||||

|

Subtotal, Title III |

3,069.2 |

3,000.9a |

3,011.7a |

3,016.7 |

3,423.8a |

3,016.7 |

3,240.6a |

+228.9 |

+7.6% |

||

|

Subtotal, RD Loan Authorityd |

37,288.9 |

37,601.2 |

37,740.0 |

38,104.2 |

38,131.7 |

38,104.2 |

38,136.1 |

+396.0 |

+1.0% |

||

|

Title IV. Domestic Food Programs |

|

|

|

||||||||

|

Child Nutrition Programs (M) |

22,794.0 |

24,254.1 |

23,140.8 |

23,943.2 |

24,041.6 |

23,602.6 |

23,615.1 |

+474.3 |

+2.0% |

||

|

WIC Program |

6,350.0 |

6,175.0 |

6,075.0 |

5,750.0 |

6,000.0 |

6,000.0 |

6,000.0 |

-75.0 |

-1.2% |

||

|

SNAP, Food and Nutrition Act Programs (M) |

78,480.7 |

74,013.5 |

73,476.9 |

69,069.9 |

71,093.9 |

69,163.3 |

67,886.3 |

-5,590.6 |

-7.6% |

||

|

Commodity Assistance Programs |

315.1 |

322.1 |

322.1 |

55.5 |

344.2 |

344.2 |

344.2 |

+22.1 |

+6.9% |

||

|

Nutrition Programs Administration |

170.7 |

153.8 |

164.7 |

152.0 |

154.0 |

160.9 |

155.9 |

-8.8 |

-5.3% |

||

|

Under Secretary |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

+0.0 |

+0.0% |

||

|

Subtotal, Title IV |

|||||||||||

|

Discretionary |

6,884.7 |

6,709.8 |

6,620.3 |

5,958.3 |

6,584.8 |

6,563.5 |

6,566.0 |

-54.3 |

-0.8% |

||

|

Mandatory (M) |

101,226.7 |

98,209.6 |

96,560.0 |

93,013.1 |

95,049.8 |

92,708.3 |

91,436.3 |

-5,123.7 |

-5.3% |

||

|

Subtotal |

108,111.3 |

104,919.4 |

103,180.3 |

98,971.4 |

101,634.6 |

99,271.8 |

98,002.3 |

-5,178.0 |

-5.0% |

||

|

Title V. Foreign Assistance |

|

|

|

||||||||

|

196.6 |

199.7 |

213.9 |

192.8 |

215.5 |

217.9 |

215.5 |

+1.6 |

+0.8% |

|||

|

Food for Peace Title II, and admin. expenses |

1,466.1a |

1,600.1a |

1,500.1a |

0.1 |

1,850.1 |

1,716.1 |

1,725.1 |

+225.0 |

+15.0% |

||

|

McGovern-Dole Food for Education |

201.6 |

207.6 |

210.3 |

0.0 |

235.0 |

210.3 |

220.0 |

+9.7 |

+4.6% |

||

|

CCC Export Loan Salaries |

8.5 |

8.8 |

8.8 |

6.4 |

8.8 |

6.4 |

6.4 |

-2.5 |

-27.9% |

||

|

Office of Codex Alimentarius |

— |

3.8 |

4.0 |

4.8 |

4.8 |

4.8 |

4.8 |

+0.8 |

+20.1% |

||

|

Under Secretary |

— |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

+0.0 |

+0.0% |

||

|

Subtotal, Title V |

1,872.9 |

2,021.0 |

1,938.0 |

205.0 |

2,315.2 |

2,156.3 |

2,172.7 |

+234.7 |

+12.1% |

||

|

Title VI. Related Agencies |

|

|

|||||||||

|

Food and Drug Administration |

2,771.2 |

2,811.9 |

3,080.5 |

3,251.3 |

3,265.7 |

3,160.5 |

3,171.5 |

+91.0 |

+3.0% |

||

|

Commodity Futures Trading Commissionh |

[250.0]i |

249.0 |

[268.0]i |

250.0 |

315.0 |

[305.0]i |

315.0 |

+47.0 |

+17.5% |

||

|

Subtotal, Title VI |

[3,021.2] |

3,060.9 |

[3,348.5] |

3,501.3 |

3,580.7 |

[3,465.5] |

3,486.5 |

+138.0 |

+4.1% |

||

|

Title VII. General Provisions |

|

|

|

||||||||

|

Changes in Mandatory Programs (CHIMPS)j |

|||||||||||

|

a. Conservation programs |

-235.0 |

[-0.1]k |

[-60.2]k |

-60.2 |

-60.2 |

-60.2 |

-60.2 |

+0.0 |

+0.0% |

||

|

b. Nutrition programs |

-106.0 |

+5.0 |

+5.0 |

— |

+6.0 |

+5.0 |

+9.0 |

+4.0 |

+80.0% |

||

|

c. Energy programs |

-40.0 |

-21.0 |

— |

— |

— |

— |

— |

— |

— |

||

|

d. Rural Development (Cushion of Credit) |

-132.0 |

— |

— |

— |

— |

— |

— |

— |

— |

||

|

e. Section 32 |

-231.0 |

— |

— |

— |

— |

— |

— |

— |

— |

||

|

f. Farm Production & Conservation Bus. Ctr. |

— |

[+0.1]k |

[+60.2]k |

+60.2 |

+60.2 |

+60.2 |

+60.2 |

+0.0 |

+0.0% |

||

|

g. Other CHIMPS and mandatory rescissions |

— |

+15.0 |

+10.0 |

— |

— |

— |

— |

-10.0 |

-100.0% |

||

|

Subtotal, CHIMPS (Table B-1) |

-744.0 |

-1.0 |

+15.0 |

+0.0 |

+6.0 |

+5.0 |

+9.0 |

-6.0 |

-40.0% |

||

|

-854.0 |

-800.0 |

-505.0 |

-1,153.0 |

-805.8 |

-815.1 |

-1,015.1 |

-510.1 |

+101.0% |

|||

|

Other appropriations (Table B-3) |

|||||||||||

|

a. Emergency/disaster programs |

234.8 |

— |

— |

— |

— |

— |

535.0m |

+535.0 |

— |

||

|

b. Water and Waste Water |

— |

500.0 |

75.0 |

— |

— |

— |

— |

-75.0 |

-100.0% |

||

|

c. Broadband pilotn |

— |

600.0 |

125.0 |

— |

518.0 |

— |

300.0 |

+175.0 |

+140.0% |

||

|

d. Opioid Enforcement and Surveillance |

— |

94.0 |

— |

— |

— |

— |

— |

— |

— |

||

|

e. Food for Peace |

134.0 |

116.0 |

216.0 |

— |

— |

— |

— |

-216.0 |

-100.0% |

||

|

f. Other appropriations |

103.4 |

68.1 |

77.5 |

— |

110.8 |

141.5 |

140.3 |

+62.8 |

+81.0% |

||

|

Subtotal, Other appropriations |

472.2 |

1,378.1 |

493.5 |

— |

628.8 |

141.5 |

975.3 |

+481.8 |

+97.6% |

||

|

Subtotal, Title VII |

-1,125.8 |

577.1 |

3.5 |

-1,153.0 |

-171.0 |

-668.6 |

-30.8 |

-34.3 |

-980.2% |

||

|

|

|

|

|||||||||

|

Emergency declaration in this bill |

-206.1 |

— |

— |

— |

— |

— |

-535.0m |

-535.0 |

— |

||

|

Other scorekeeping adjustments |

-524.0 |

-481.0 |

-404.0 |

-403.0 |

-398.0 |

-398.0 |

-398.0 |

+6.0 |

-1.5% |

||

|

Subtotal, Scorekeeping adjustmentso |

-730.1 |

-481.0 |

-404.0 |

-403.0 |

-398.0 |

-398.0 |

-933.0 |

-529.0 |

+130.9% |

||

|

Totals |

|

|

|

|

|

||||||

|

Discretionary: Senate basis w/o CFTCh |

20,877.0 |

[22,998.0] |

23,032.7 |

18,939.6 |

[23,984.0] |

23,089.6 |

[23,169.1] |

+136.4 |

+0.6% |

||

|

Discretionary: House basis w/ CFTCh |

[21,127.0] |

23,247.0 |

[23,300.7] |

19,189.6 |

24,299.0 |

[23,394.6] |

23,484.1 |

+183.4 |

+0.8% |

||

|

Mandatory (M) |

132,506.9 |

122,752.0 |

128,755.1 |

128,906.7 |

130,943.4 |

128,601.9 |

129,108.8 |

+353.7 |

+0.3% |

||

|

Total: Senate basis w/o CFTC |

153,383.9 |

[145,750.0] |

151,787.8 |

147,846.4 |

[154,927.4] |

151,691.5 |

[152,278.0] |

+490.1 |

+0.3% |

||

|

Total: House basis w/ CFTC |

[153,633.9] |

145,999.0 |

[152,055.8] |

148,096.4 |

155,242.4 |

[151,996.5] |

152,593.0 |

+537.1 |

+0.4% |

||

Source: CRS, using appropriations text, report tables, and unpublished CBO tables. H.R. 3055 refers to Division B of the June 25, 2019 (House-passed), and October 31, 2019 (Senate-passed) minibus bills, respectively. Subsequently, H.R. 3055 became the vehicle to carry the second CR without the minibus text.

Notes: Amounts are nominal discretionary budget authority in millions of dollars unless labeled otherwise. "(M)" indicates that the account is mandatory authority (or primarily mandatory authority). Excludes amounts in supplemental appropriations acts. Bracketed amounts are not in the Agriculture appropriations totals due to differing House-Senate jurisdiction for CFTC but are shown for comparison.

a. Excludes a portion of the other appropriations that are provided separately in General Provisions (see Table B-3).

b. Row headings reflect recent USDA reorganization. The Farm Service Agency and Risk Management Agency were moved from Title I to Title II, as was the Commodity Credit Corporation and Federal Crop Insurance Corporation in mandatory spending. Grain Inspection, Packers, and Stockyards Administration was moved into the Agricultural Marketing Service.

c. Includes regular FSA salaries and expenses, plus transfers for farm loan program salaries and administrative expenses. Also includes farm loan program loan subsidy, State Mediation Grants, Dairy Indemnity Program (mandatory funding), and Grassroots Source Water Protection Program. Does not include appropriations to the Foreign Agricultural Service for export loans and P.L. 480 administration that are transferred to FSA.

d. Loan authority is the amount of loans that can be made or guaranteed with a loan subsidy. This amount is not added in the budget authority subtotals or totals.

e. Rural Development salaries and expenses include a base amount plus transfers from the three rural development agencies. Amounts presented for the agencies therefore include program funds for loans and grants.

f. The FY2017 amount for the Rural Business-Cooperative Service (RBCS) is before the rescission in the Cushion of Credit account, which is different from the Appropriations Committee tables. The rescission was classified by CBO as a CHIMP (see Table B-1).

g. The USDA-initiated reorganization in 2017 created an "Assistant to the Secretary for Rural Development" as part of the Office of the Secretary rather than the previously Senate-confirmed undersecretary position. The 2018 farm bill reinstated the undersecretary position, and the FY2020 appropriation funds it as such.

h. Jurisdiction for the Commodity Futures Trading Commission (CFTC) is in the House Agriculture Appropriations Subcommittee and the Senate Financial Services Appropriations Subcommittee. After FY2008, CFTC is carried in the enacted Agriculture appropriations in even-numbered fiscal years. It is always carried in House Agriculture subcommittee markup but never in Senate Agriculture subcommittee markup. Bracketed amounts are not in the Agriculture appropriations totals due to differing House-Senate jurisdiction for CFTC but are shown for comparison.

i. The amounts for CFTC in FY2017 and FY2019 are from the Financial Services and General Government (FSGG) division of the respective consolidated appropriations act, and for FY2020 Senate bill from the markup for FSGG (S. 2524).

j. Includes reductions (limitations and rescissions) and increases to mandatory programs that are known as CHIMPS.

k. These bracketed amounts were not in the official CBO scoring of CHIMPS. Appropriations acts in FY2018 and FY2019 transferred mandatory conservation funding into the Farm Production and Conservation Business Center, but the official CBO scoring of appropriations at that time did not record it as a CHIMP the way that the FY2020 scoring reflects. For more background, see CRS Report R46011, FY2020 Appropriations for Agricultural Conservation, by Megan Stubbs.

l. Rescissions are actions that reduce a budget authority subsequent to an enacted appropriation. They score budgetary savings. Any rescissions from mandatory programs are included with the CHIMPS.

m. Appropriations designated as emergency in FY2020 include $535 million for Ebola, and $1.5 billion for the Wildfires and Hurricane Indemnity Program, which was offset with $1.5 billion in rescissions (Table B-3).

n. Refers to the ReConnect Broadband Pilot Program that was created in the FY2018 appropriation (see CRS In Focus IF11262, The ReConnect Broadband Pilot Program, by Alyssa R. Casey). The program has been funded by a direct appropriation in the General Provisions title, and has been augmented in FY2019 and FY2020 by a transfer from the Cushion of Credit account that is available outside the appropriations caps. In FY2020, appropriators are directing $555 million to ReConnect: a $300 million appropriation and $255 million from the Cushion of Credit account.

o. "Scorekeeping adjustments" are not necessarily appropriated items and may not be shown in Appropriations Committee tables but are part of the official CBO score (accounting) of the bill. They predominantly include "negative subsidies" in loan program accounts (mostly from receipt of fees) and adjustments for emergency designations in the bill.

Policy-Related Provisions

Besides setting spending authority, appropriations acts are also a vehicle for policy-related provisions that direct executive branch actions.46 These provisions, limitations, or riders may have the force of law if they are included in the act's text, but their effect is generally limited to the current fiscal year unless they amend the U.S. Code, which is rare in appropriations acts.

Table 4 compares some of the primary policy provisions that are included directly in the FY2020 Agriculture appropriations act, and its development in the House and Senate bills.

Report language may also provide policy instructions. Although report language does not carry the force of text in an act, it often explains congressional intent, which the agencies may be expected to follow. Statements in the joint explanatory statement and the committee reports47 are not included in Table 4.

In the past, Congress has said that committee reports and the joint explanatory statement need to be read together to capture all of the congressional intent for a fiscal year. For example, the explanatory statement for the FY2020 Further Consolidated Appropriations act instructs that the House and Senate reports should be read together with the conference agreement:

Congressional Directives. The statement is silent on provisions that were in both the House Report (H.Rept. 116-107) and Senate Report (S.Rept. 116-110) that remain unchanged by this agreement, except as noted in this statement.

The House and Senate report language that is not changed by the statement is approved and indicates congressional intentions. The statement, while repeating some report language for emphasis, does not intend to negate the language referred to above unless expressly provided herein.48

|

House H.R. 3055 |

Senate H.R. 3055 |

|

|

Relocation and restructuring |

||

|

Economic Research Service (ERS). Appropriation states that "necessary expenses" do not provide funds to relocate ERS outside the National Capital Region. (Title I) |

No comparable provision in Title I. Provides $15.5 million for relocation. (§762) |

No comparable provision. |

|

National Institute of Food and Agriculture (NIFA). Appropriation states that "necessary expenses" do not provide funds to relocate NIFA outside the National Capital Region. (Title I) |

No comparable provision in Title I. Provides $9.5 million for relocation. (§762) |

No comparable provision. |

|

Farm Service Agency. None of the funds may be used to close a county office or to permanently relocate county-based employees that results in an office with two or fewer employees without congressional notification. (Title I)a |

Same as House provision. (Title I)a |

Same as House provision. (Title I)a |

|

Program reorganization—USDA. No funds may be used to create or eliminate programs, relocate offices or employees, reorganize offices, or privatize functions. (§716)b |

See Senate §716 of the Senate bill below. |

Program reorganization. Similar approach to §716 of the FY2019 enacted bill. (§716) |

|

Program reorganization—CFTC and FDA. No funds may be used to create or eliminate programs, relocate offices or employees, reorganize offices, or privatize functions unless notice is provided and approval is received from the Appropriations Committees. (§717)b |

Program reorganization—USDA and FDA. Similar approach to §717 of the House bill. Specifies USDA and FDA, but not CFTC. (§716)b |

See enacted §716 above. |

|

Relocation. None of the funds may be used to relocate an agency to outside the National Capital Region without enactment of appropriation that is specific for that relocation. (§758) |

No comparable provision. |

No comparable provision. |

|

Restructuring. None of the funds may be used to restructure an agency into another mission area or office without specific appropriation for that restructuring. (§759) |

No comparable provision. |

Same as House provision. (§789) |

|

Disaster Programs |

||

|

Disaster payments. In general, prohibits the use of Clause (3) of Section 32 (Funds for Strengthening Markets, Income and Supply, 7 U.S.C. §612c) to reestablish farmers' purchasing power by making payments to farmers. However, allows an exception to use up to $350 million of carryover for this purpose with congressional notification. (§714)c |

Same as House provision. (§714)c |

Same as House provision. (§714)c |

|

No comparable provision. |

Disaster assistance for sugar beet processors. Amends the list of eligible losses that may be covered under the Disaster Relief Act of FY2019 (P.L. 116-20, Title I) to include payments to cooperative processors for reduced sugar beet quantity and quality. (§764) |

Provision was included in the first continuing resolution for FY2020 (P.L. 116-59, Division A, §116). |

|

Agricultural Research |

||

|

Climate change. Prohibits USDA from removing the term "climate change" from any publication by any entity that receives USDA funding. (§784) |

No comparable provision. |

No comparable provision. |

|

Matching requirement. Allows USDA to waive the matching funds requirement for the Specialty Crops Research Initiative. (§762) |

No comparable provision. |

Same as House provision. (§762) |

|

National Bio and Agro-Defense Facility (NBAF). Directs that NBAF shall be transferred from the Department of Homeland Security to USDA. (§766) |

Same as House provision. (§735) |

Same as House provision. (§766) |

|

Nutrition Assistance Programs |

||

|

SNAP retailer standards. Prohibits funding to administer the "variety requirements" in the final rule "Enhancing Retailer Standards in SNAP" until the Secretary amends the definition of variety to increase the number of items that qualify as acceptable varieties in each staple food category. (§728) |

Same as House provision. (§726) |

Same as House provision. (§727) |

|

Vegetables in school breakfast. Prohibits funding to implement or enforce the portion of a School Breakfast Program regulation that limits substituting fruits with certain vegetables. (§750) |

Same as House provision. (§751) |

Same as House provision. (§749) |

|

School meal prices. Exempts certain school food authorities (those without a negative balance in their school food service accounts as of December 31, 2019) from paid meal equity requirements in school year 2020-2021. (§747) |

No comparable provision. |

Same as House provision. (§747) |

|