USDA Domestic Food Assistance Programs: FY2019 Appropriations

The Consolidated Appropriations Act, 2019 (P.L. 116-6) was enacted on February 15, 2019. This omnibus bill included appropriations for the U.S. Department of Agriculture (USDA), of which USDA’s domestic food assistance programs are a part. Prior to its enactment, the federal government had continued to operate for the first six months of the fiscal year under continuing resolutions (CRs). This report focuses on the enacted appropriations for USDA’s domestic food assistance programs and, in some instances, policy changes provided by the omnibus law. CRS Report R45230, Agriculture and Related Agencies: FY2019 Appropriations provides an overview of the entire FY2019 Agriculture and Related Agencies portion of the law as well as a review of the reported bills and CRs preceding it. USDA experienced a 35-day lapse in FY2019 funding and partial government shutdown prior to the enactment of P.L. 116-6.

Domestic food assistance funding is primarily mandatory but also includes discretionary funding. Most of the programs’ funding is for open-ended, appropriated mandatory spending—that is, terms of the authorizing law require full funding and funding may vary with program participation (and in some cases inflation). The largest mandatory programs include the Supplemental Nutrition Assistance Program (SNAP, formerly the Food Stamp Program) and the child nutrition programs (including the National School Lunch Program and School Breakfast Program). Though their funding levels are dictated by the authorizing law, in most cases, appropriations are needed to make funds available for obligation and expenditure. The three largest discretionary budget items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); the Commodity Supplemental Food Program (CSFP); and federal nutrition program administration.

The domestic food assistance funding is, for the most part, administered by USDA’s Food and Nutrition Service (FNS). The enacted FY2019 appropriation provides over $103 billion for domestic food assistance (Table 1). This is a decrease of approximately $1.7 billion from FY2018. Declining participation in SNAP is responsible for most of the difference. Approximately 94% of the FY2018 appropriations for domestic food assistance are for mandatory spending. Highlights of the associated appropriations accounts are summarized below.

For SNAP and other programs authorized by the Food and Nutrition Act, such as The Emergency Food Assistance Program (TEFAP) commodities, the FY2019 appropriations law provides approximately $73.5 billion. Certain provisions of the law affect SNAP policies. For example, it continues a policy in the FY2017 and FY2018 appropriations laws that limited USDA’s implementation of December 2016 regulations regarding SNAP retailers’ inventory requirements. USDA must amend its final rule to define “variety” more expansively and must “apply the requirements regarding acceptable varieties and breadth of stock.”

For the child nutrition programs (the National School Lunch Program and others), the enacted law provides approximately $23.1 billion. This includes discretionary funding for school meals equipment grants ($30 million) and Summer Electronic Benefit Transfer (EBT) demonstration projects ($28 million), and a general provision that provides an additional $5 million for farm-to-school grants. The law includes policy provisions related to processed poultry from China, requirements for schools’ paid lunch pricing, vegetables in school breakfasts, and the use of commodities in child nutrition programs.

For the WIC program, the law provides nearly $6.1 billion while also rescinding $500 million in prior-year carryover funding. The law includes new funding for telehealth grants.

For the Commodity Assistance Program account, which includes funding for the Commodity Supplemental Food Program (CSFP), TEFAP administrative and distribution costs, and other programs, the law provides over $322 million. The law increases discretionary funding for TEFAP administrative and distribution costs through the annual appropriation and through a $30 million transfer of prior-year CSFP funds.

For Nutrition Programs Administration, the law provides nearly $165 million.

USDA Domestic Food Assistance Programs: FY2019 Appropriations

Jump to Main Text of Report

Contents

- Overview of FY2019 USDA-FNS Funding

- President's FY2019 Budget Request

- Domestic Food Assistance Appropriations Accounts and Related General Provisions

- Office of the Under Secretary for Food, Nutrition, and Consumer Services

- SNAP and Other Programs under the Food and Nutrition Act

- SNAP Account: Other General Provisions and Committee Report Language

- Child Nutrition Programs

- Child Nutrition Programs: General Provisions

- WIC Program

- Commodity Assistance Program

- Nutrition Programs Administration

- Other Nutrition Funding Support

Summary

The Consolidated Appropriations Act, 2019 (P.L. 116-6) was enacted on February 15, 2019. This omnibus bill included appropriations for the U.S. Department of Agriculture (USDA), of which USDA's domestic food assistance programs are a part. Prior to its enactment, the federal government had continued to operate for the first six months of the fiscal year under continuing resolutions (CRs). This report focuses on the enacted appropriations for USDA's domestic food assistance programs and, in some instances, policy changes provided by the omnibus law. CRS Report R45230, Agriculture and Related Agencies: FY2019 Appropriations provides an overview of the entire FY2019 Agriculture and Related Agencies portion of the law as well as a review of the reported bills and CRs preceding it. USDA experienced a 35-day lapse in FY2019 funding and partial government shutdown prior to the enactment of P.L. 116-6.

Domestic food assistance funding is primarily mandatory but also includes discretionary funding. Most of the programs' funding is for open-ended, appropriated mandatory spending—that is, terms of the authorizing law require full funding and funding may vary with program participation (and in some cases inflation). The largest mandatory programs include the Supplemental Nutrition Assistance Program (SNAP, formerly the Food Stamp Program) and the child nutrition programs (including the National School Lunch Program and School Breakfast Program). Though their funding levels are dictated by the authorizing law, in most cases, appropriations are needed to make funds available for obligation and expenditure. The three largest discretionary budget items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); the Commodity Supplemental Food Program (CSFP); and federal nutrition program administration.

The domestic food assistance funding is, for the most part, administered by USDA's Food and Nutrition Service (FNS). The enacted FY2019 appropriation provides over $103 billion for domestic food assistance (Table 1). This is a decrease of approximately $1.7 billion from FY2018. Declining participation in SNAP is responsible for most of the difference. Approximately 94% of the FY2018 appropriations for domestic food assistance are for mandatory spending. Highlights of the associated appropriations accounts are summarized below.

For SNAP and other programs authorized by the Food and Nutrition Act, such as The Emergency Food Assistance Program (TEFAP) commodities, the FY2019 appropriations law provides approximately $73.5 billion. Certain provisions of the law affect SNAP policies. For example, it continues a policy in the FY2017 and FY2018 appropriations laws that limited USDA's implementation of December 2016 regulations regarding SNAP retailers' inventory requirements. USDA must amend its final rule to define "variety" more expansively and must "apply the requirements regarding acceptable varieties and breadth of stock."

For the child nutrition programs (the National School Lunch Program and others), the enacted law provides approximately $23.1 billion. This includes discretionary funding for school meals equipment grants ($30 million) and Summer Electronic Benefit Transfer (EBT) demonstration projects ($28 million), and a general provision that provides an additional $5 million for farm-to-school grants. The law includes policy provisions related to processed poultry from China, requirements for schools' paid lunch pricing, vegetables in school breakfasts, and the use of commodities in child nutrition programs.

For the WIC program, the law provides nearly $6.1 billion while also rescinding $500 million in prior-year carryover funding. The law includes new funding for telehealth grants.

For the Commodity Assistance Program account, which includes funding for the Commodity Supplemental Food Program (CSFP), TEFAP administrative and distribution costs, and other programs, the law provides over $322 million. The law increases discretionary funding for TEFAP administrative and distribution costs through the annual appropriation and through a $30 million transfer of prior-year CSFP funds.

For Nutrition Programs Administration, the law provides nearly $165 million.

The Consolidated Appropriations Act, 2019 (P.L. 116-6) was enacted on February 15, 2019.This omnibus bill included appropriations for the U.S. Department of Agriculture (USDA), of which USDA's domestic food assistance is a part. Prior to its enactment, the government had continued to operate for the first six months of the fiscal year under continuing resolutions (CRs). USDA experienced a 35-day lapse in FY2019 funding and partial government shutdown prior to the enactment of the Further Additional Continuing Appropriations Act, 2019 (P.L. 116-5), a continuing resolution enacted prior to the Omnibus bill. (See the Appendix.)

This report focuses on USDA's domestic food assistance programs; their funding; and, in some instances, policy changes provided by the enacted FY2018 appropriations law. USDA's domestic food assistance programs include the Supplemental Nutrition Assistance Program (SNAP, formerly the Food Stamp Program), Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), and the child nutrition programs (such as the National School Lunch Program). The domestic food assistance funding is, for the most part, administered by USDA's Food and Nutrition Service (FNS).1 CRS Report R45230, Agriculture and Related Agencies: FY2019 Appropriations provides an overview of the entire FY2019 Agriculture and Related Agencies appropriations law as well as a review of the reported bills and CRs preceding its enactment.

With its focus on appropriations, this report discusses programs' eligibility requirements and operations minimally. See CRS Report R42353, Domestic Food Assistance: Summary of Programs for more background.

Overview of FY2019 USDA-FNS Funding

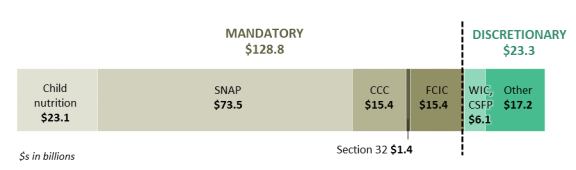

Domestic food assistance—SNAP and child nutrition programs in the mandatory spending accounts, and WIC and other programs in the discretionary spending accounts—represents over two-thirds of the FY2018 Agriculture appropriations act (Figure 1).

The federal budget process treats discretionary and mandatory spending differently.2

- Discretionary spending is controlled by annual appropriations acts and receives most of the attention during the appropriations process. The annual budget resolution3 process sets spending limits for discretionary appropriations. Agency operations (salaries and expenses) and many grant programs are discretionary.

- Mandatory spending—though carried in the appropriation—is controlled by budget rules during the authorization process.4 Appropriations acts then provide funding to match the parameters required by the mandatory programs' authorizing laws. For the domestic food assistance programs, these laws are typically reauthorized in farm bill5 and child nutrition reauthorizations.6

|

Figure 1. Scope of Agriculture and Related Agencies Appropriations FY2019 budget authority total: $152.1 billion |

|

|

Source: Congressional Research Service (CRS) (see CRS Report R45230, Agriculture and Related Agencies: FY2019 Appropriations. Does not show some agencies under $0.5 billion. Includes General Provisions with agency. Notes: SNAP = Supplemental Nutrition Assistance Program; CCC = Commodity Credit Corporation; FCIC = Federal Crop Insurance Corporation; Section 32 = Funds for Strengthening Markets, Income and Supply; WIC = Special Supplemental Nutrition Program for Women, Infants, and Children; CSFP = Commodity Supplemental Food Program. |

Domestic food assistance funding (Table 1) largely consists of open-ended, appropriated mandatory programs—that is, it varies with program participation (and in some cases inflation) under the terms of the underlying authorization law. The largest mandatory programs include SNAP and the child nutrition programs (including the National School Lunch Program and School Breakfast Program). Though their funding levels are dictated by the authorizing law, in most cases appropriations are needed to make funds available.

The three largest discretionary budget items are WIC, the Commodity Supplemental Food Program (CSFP), and federal nutrition program administration.

The enacted FY2019 appropriation would provide over $103 billion for domestic food assistance (Table 1). This is a decrease of approximately $1.7 billion from FY2018. Declining participation in SNAP is responsible for most of the difference. Over 95% of the FY2019 appropriations are for mandatory spending.

Table 1 summarizes funding for the domestic food assistance programs, comparing FY2019 levels to those of prior years. In addition to the accounts' appropriations language, the enacted appropriation's general provisions include additional funding, rescissions, and/or policy changes. These are summarized in this report.

Table 1. Domestic Food Assistance Appropriations, P.L. 116-6

(Budget authority in millions of dollars)

|

FY2016 |

FY2017 |

FY2018 |

FY2019 |

|||||||

|

Program |

Mand. (M) or Disc. (D) |

Admin. Requesta |

H. Cmte. H.R. 5961 |

S. Passed H.R. 6147 |

Enacted P.L. 116-6 |

Change: |

||||

|

Child Nutrition Programsb |

||||||||||

|

Account Totalc (including transfers) |

22,149.7 |

22,794.0 |

24,254.1 |

23,146.9 |

23,183.5 |

23,184.0 |

23,140.8 |

-1,113.3 |

-4.6% |

|

|

National School Lunch Program |

M |

12,154.7 |

12,339.8 |

13,133.2 |

11,713.0 |

11,713.0 |

11,713.0 |

12,091.8 |

-1,041.4 |

-7.9% |

|

School Breakfast Program |

M |

4,338.6 |

4,470.2 |

4,807.4 |

5,081.8 |

5,081.8 |

5,081.8 |

4,816.2 |

+8.8 |

+0.2% |

|

Child and Adult Care Food Program |

M |

3,340.1 |

3,490.9 |

3,832.7 |

3,933.4 |

3,933.4 |

3,933.4 |

3,815.3 |

-17.4 |

-0.5% |

|

Special Milk Program |

M |

9.4 |

9.2 |

8.8 |

8.8 |

8.8 |

8.8 |

8.1 |

-0.7 |

-8.0% |

|

Summer Food Service Program |

M |

555.7 |

627.1 |

563.8 |

519.5 |

519.5 |

519.5 |

519.5 |

-44.3 |

-7.9% |

|

State Administrative Expenses |

M |

270.9 |

279.1 |

297.3 |

302.9 |

302.9 |

302.9 |

302.6 |

+5.3 |

+1.8% |

|

Commodity Procurement for Child Nutrition |

M |

1,350.7 |

1,428.1 |

1,461.8 |

1,473.9 |

1,473.9 |

1,473.9 |

1,436.5 |

-25.3 |

-1.7% |

|

School Meals Equipment, Breakfast Grants |

D |

30.0d |

25.0 |

30.0 |

0.0 |

30.0 |

30.0 |

30.0 |

0.0 |

0.0% |

|

Summer EBT Demonstration |

D |

23.0d |

23.0 |

28.0 |

23.0 |

28.0 |

28.0 |

28.0 |

0.0 |

0.0% |

|

Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) |

D |

6,350.0e |

6,350.0f |

6,175.0g |

5,750.0h |

6,000.0i |

6,150.0i |

6,075.0i |

-175.0 |

-2.8% |

|

Supplemental Nutrition Assistance Program (SNAP)b |

||||||||||

|

Account Totalc |

80,849.4 |

78,480.7 |

74,013.5 |

73,218.3j |

73,219.3 |

73,219.3 |

73,476.9 |

-536.6 |

-0.7% |

|

|

SNAP Benefits |

M |

70,124.3 |

67,754.4 |

63,039.0 |

62,065.7 |

62,065.7 |

n/a |

62,299.4 |

-739.6 |

-1.2% |

|

Contingency Reserve Fund |

M |

3,000.0 |

3,000.0 |

3,000.0 |

3,000.0 |

3,000.0 |

3,000.0 |

3,000.0 |

0.0 |

0.0% |

|

State Administrative Costs |

M |

4,222.0 |

4,230.5 |

4,483.4 |

4,604.5 |

4,604.5 |

n/a |

4,617.9 |

+134.5 |

+3.0% |

|

Employment and Training (E&T) |

M |

455.7 |

456.0 |

476.7 |

486.6 |

486.6 |

n/a |

487.7 |

+11.0 |

+2.3% |

|

Nutrition Education and Obesity Prevention |

M |

408.0 |

414.0 |

421.0 |

428.0 |

428.0 |

n/a |

433.0 |

+12.0 |

+2.9% |

|

TEFAP Commodities |

M |

318.0 |

316.0k |

289.5 |

294.0 |

294.0 |

n/a |

294.5 |

+5.0 |

+1.7% |

|

Food Distribution Program on Indian Reservations |

Ml |

145.2 |

151.0 |

153.0 |

153.0 |

153.0 |

n/a |

153.0 |

0.0 |

0.0% |

|

Commonwealth of Northern Mariana Islands |

M |

12.2 |

12.2 |

12.1 |

12.1 |

12.1 |

n/a |

12.1 |

0.0 |

0.0% |

|

Puerto Rico and American Samoa |

M |

1,967.0 |

1,956.9 |

1,937.4 |

1,969.8 |

1,969.8 |

n/a |

1,973.7 |

+36.3 |

+1.9% |

|

Commodity Assistance Program |

||||||||||

|

Account Totalc |

296.2 |

315.1 |

322.1 |

55.4 |

306.9 |

322.1 |

322.1 |

0.0 |

0.0% |

|

|

Commodity Supplemental Food Program |

D |

222.2 |

236.1 |

238.1 |

0.0 |

222.9 |

238.1 |

222.9m |

-15.2 |

-6.8% |

|

WIC Farmers' Market Nutrition Program |

D |

18.5 |

18.5 |

18.5 |

0.0 |

18.5 |

18.5 |

18.5 |

0.0 |

0.0% |

|

TEFAP Administrative Costs |

D |

54.4 |

59.4 |

64.4 |

54.4 |

64.4 |

64.4 |

109.6m |

+45.2 |

+70.2% |

|

Nutrition Program Administration |

D |

150.8 |

170.7 |

153.8 |

160.8 |

162.8 |

164.7 |

164.7 |

+10.9 |

+7.1% |

|

Office of the Under Secretary |

D |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.0 |

0.0% |

|

Total, Domestic Food Assistance |

109,797.0 |

108,111.3 |

104,919.4 |

102,873.3 |

102,873.3 |

103,040.1 |

103,180.3 |

-1,739.1 |

-1.6% |

|

Source: CRS, compiled from tables in the joint explanatory statements or committee reports for the referenced appropriations acts or bills.

a. The FY2019 Administration request reflected in this column is from the FNS budget request submitted to Congress in February 2018.

b. FNS programs that are open-ended mandatory programs (e.g., SNAP and the child nutrition programs), the programs do not necessarily have the authority to spend all of the appropriated funds. For such programs' historical spending, see also FNS expenditure data at http://www.fns.usda.gov/data-and-statistics.

c. "Account Total" includes amounts for the programs listed below as well as other programs not listed.

d. FY2016 figures include additional funds from the general provisions (§741) of the enacted law: $5 million for equipment/breakfast grants; $7 million for Summer EBT.

e. The FY2016 law's Section 751 provided $220 million for management information systems and WIC EBT by rescinding FY2015 carryover and recovery funding.

f. The FY2017 enacted law (§745) rescinded $850 million in WIC carryover funds.

g. The FY2018 enacted law rescinded $800 million in WIC carryover funding. Both reported bills would also have rescinded carryover funds: H.R. 3268 (§741) would have rescinded $600 million; S. 1603 (§741) would have rescinded $800 million.

h. The Administration also requested a rescission of $215 million in WIC carryover funding.

i. The enacted law (§723) also rescinds $500 million in WIC carryover funding. The House-reported and Senate-passed bills also would have rescinded carryover funds: H.R. 5961 (§723) would have rescinded $300 million; H.R. 6147 (§724) would have rescinded $400 million.

j. This is the Administration's FY2019 SNAP request for current law at the time of the request. The Administration also proposed 14 SNAP legislative proposals. If these proposals were enacted, the Administration estimated it would reduce the SNAP request by approximately $17 million.

k. The enacted FY2017 law provides $297 million required by the Food and Nutrition Act and an additional $19 million for TEFAP commodities provided in general provisions (§748).

l. A portion of FDPIR funding (nutrition education) is discretionary.

m. The enacted law transferred $30.0 million in CSFP prior-year funds to TEFAP for administrative expenses. This transfer is included in the TEFAP Administrative Costs total.

n. Title IV totals do not include additions and rescissions provided in bills' general provisions.

President's FY2019 Budget Request

Table 1 compares the enacted funding to the House- and Senate-reported bills, prior years' enacted funding, and the President's FY2019 budget request. The President's budget request includes the Administration's forecast for programs with open-ended funding such as SNAP and the child nutrition programs; this assists the appropriations committees in providing funding levels expected to meet obligations. The budget also includes the Administration's requests for discretionary programs. Additionally, it is a place for the Administration to include legislative requests. The FY2019 request did include SNAP legislative proposals.

Most significantly for the FNS programs, the President's FY2019 budget request did the following:

- It included 14 legislative proposals pertaining to SNAP.7 The majority of these would have restricted SNAP eligibility and made changes to the benefit calculation. This request also proposed to replace a portion of the SNAP benefit with a box of USDA-purchased foods and to limit federal funding for states' administrative costs, nutrition education, and performance bonuses. Together, these proposals were estimated by both the Administration and Congressional Budget Office (CBO) to reduce program spending in FY2019 and over the 10-year budget window.8 None of these policies were enacted as part of the FY2019 appropriation. Some of these policies were debated in the formulation of the 2018 farm bill (Agriculture Improvement Act of 2018, P.L. 115-334), but ultimately only the elimination of performance bonus funding was enacted in the December 2018 law.9

- It requested no funding for a number of discretionary spending programs, including the following:

- school meals equipment grants, which have received discretionary funding since FY2009;

- the WIC Farmers' Market Nutrition Program (FMNP), which has received annual discretionary funding since 1992; and

- the Commodity Supplemental Food Program (CSFP), which has received annual discretionary funding since 1969.

Domestic Food Assistance Appropriations Accounts and Related General Provisions

Office of the Under Secretary for Food, Nutrition, and Consumer Services

For the Under Secretary's office, the enacted FY2019 appropriation provides approximately $0.8 million. This office received approximately equal funding in FY2018.

The enacted appropriation (§734) continues to require the coordination of FNS research efforts with USDA's Research, Education and Economics mission area. This is to include a research and evaluation plan submitted to Congress.

SNAP and Other Programs under the Food and Nutrition Act

Appropriations under the Food and Nutrition Act (formerly the Food Stamp Act) support (1) SNAP (and related grants); (2) a nutrition assistance block grant for Puerto Rico and nutrition assistance block grants to American Samoa and the Commonwealth of the Northern Mariana Islands (all in lieu of SNAP); (3) the cost of food commodities as well as administrative and distribution expenses under the Food Distribution Program on Indian Reservations (FDPIR); (4) the cost of commodities for TEFAP, but not administrative/distribution expenses, which are covered under the Commodity Assistance Program budget account; and (5) Community Food Projects.

The enacted appropriation provides approximately $73.5 billion for programs under the Food and Nutrition Act. This FY2019 level is approximately $540 million less than FY2018 appropriations. This difference is largely due to a forecasted reduction in SNAP participation.10 The enacted appropriation provides $3 billion for the SNAP contingency reserve fund.11

The SNAP account also includes mandatory funding for TEFAP commodities. The enacted appropriation provides nearly $295 million, according to the terms of the Food and Nutrition Act. This is an increase ($5.0 million, 1.7%) over $289.5 million provided in FY2018. (TEFAP also receives discretionary funding for storage and distribution costs, as discussed later in "Commodity Assistance Program.")

SNAP Account: Other General Provisions and Committee Report Language

SNAP-Authorized Retailers. The FY2017 and FY2018 appropriations law limited USDA's implementation of December 2016 regulations regarding SNAP retailers' inventory requirements, and the enacted FY2019 appropriation (§727) continues those limits.

Only SNAP-authorized retailers may accept SNAP benefits. On December 15, 2016, FNS published a final rule to change retailer requirements for SNAP authorization.12 The final rule would have implemented the 2014 farm bill's changes to inventory requirements for SNAP-authorized retailers (P.L. 113-79, §4002). Namely, the 2014 farm bill increased both the varieties of "staple foods" and the perishable items within those varieties that SNAP retailers must stock. In addition to codifying the farm bill's changes, the final rule would have changed how staple foods are defined, clarified limitations on retailers' sale of hot foods, and increased the minimum number of stocking units.13

Section 727 in the enacted appropriation continues to require that USDA amend its final rule to define "variety" more expansively and that USDA "apply the requirements regarding acceptable varieties and breadth of stock" that were in place prior to P.L. 113-79 until such regulatory amendments are made. In the meantime, USDA-FNS implemented other aspects of the 2016 final rule, such as increased stocking units.14 On April 5, 2019, USDA did publish a proposed rule, proposing amendments to the definition of "variety".15

Child Nutrition Programs16

Appropriations under the child nutrition account fund a number of programs and activities authorized by the Richard B. Russell National School Lunch Act and the Child Nutrition Act. These include the National School Lunch Program (NSLP), School Breakfast Program (SBP), Child and Adult Care Food Program (CACFP), Summer Food Service Program (SFSP), Special Milk Program (SMP), assistance for state administrative expenses, procurement of commodities (in addition to transfers from separate budget accounts within USDA), state-federal reviews of the integrity of school meal operations ("Administrative Reviews"), "Team Nutrition" and education initiatives to improve meal quality and food safety, and support activities such as technical assistance to providers and studies/evaluations. (Child nutrition efforts are also supported by permanent mandatory appropriations and other funding sources discussed in the section "Other Nutrition Funding Support.")

The enacted FY2019 appropriation provides approximately $23.1 billion for child nutrition programs. This is approximately $1.1 billion less (-4.6%) than the amount provided in FY2018, and reflects a transfer of more than $9.1 billion from the Section 32 account.

The enacted appropriation funds certain child nutrition discretionary grants. These include the following:

- School Meals Equipment Grants.17 The law provides $30 million, the same amount as FY2018.

- Summer EBT (Electronic Benefit Transfer) Demonstration Projects. These projects provide electronic food benefits over summer months to households with children in order to make up for school meals that children miss when school is out of session and as an alternative to Summer Food Service Program meals. The projects were originally authorized and funded in the FY2010 appropriations law (P.L. 111-80). The enacted appropriation provides $28 million, the same amount as FY2018.

The child nutrition programs and WIC were up for reauthorization in 2016, but it was not completed.18 Many provisions of the operating law nominally expired at the end of FY2015, but nearly all operations continued via funding provided in appropriations laws since that time, including the enacted FY2018 appropriation. The enacted appropriation also continued to extend, through September 30, 2019, two expiring provisions: mandatory funding for an Information Clearinghouse and food safety audits. (See the Appendix for information about the child nutrition programs during the partial government shutdown.)

Child Nutrition Programs: General Provisions

One general provision in the enacted FY2019 appropriation included additional funding for child nutrition programs:

- Farm to School Grants. Section 754 of the enacted appropriation provides $5 million for competitive grants to assist schools and nonprofit entities in establishing farm-to-school programs. The same amount was provided in FY2018. This is in addition to $5 million in permanent mandatory funding (provided annually by Section 18 of the Richard B. Russell National School Lunch Act), for a total of $10 million available in FY2019.

FY2019 general provisions also included policy provisions:

- Processed Poultry from China. The enacted appropriation includes a policy provision (§749) to prevent any processed poultry imported from China from being included in the National School Lunch Program, School Breakfast Program, Child and Adult Care Food Program, and Summer Food Service Program. This policy has been included in enacted appropriations laws since FY2015.19

- Paid Lunch Pricing. For school year 2019-2020, Section 760 of the enacted appropriation changes federal policy on the pricing of paid (full-price) meals. Included in the 2010 child nutrition reauthorization, and first implemented in the 2011-2012 school year, this policy required schools annually to review their revenue from paid lunches and to determine, using a calculation specified in law and regulation, whether paid prices had to be increased.20 The purpose of the calculation was to ensure that federal funding intended for F/RP meals was not instead subsidizing full-price meals. For school year 2019-2020, the enacted appropriation requires a smaller subset of schools—only those with a negative balance in their nonprofit school food service account as of December 31, 2018—to be subject to this calculation and potentially to be required to raise prices. The same provision was included in the FY2018 enacted appropriation for school year 2018-2019.

- Vegetables in School Breakfasts. Section 768 of the enacted appropriation increases the frequency with which starchy vegetables can be substituted for fruits in the School Breakfast Program. Under current regulations, schools are allowed to substitute vegetables for the required servings of fruits (at least one cup daily, and at least five cups weekly) in school breakfasts. The regulations also specify that, "the first two cups per week of any such substitution must be from the dark green, red/orange, beans and peas (legumes) or 'Other vegetables'21 subgroups."22 This excludes the starchy vegetable subgroup, which includes corn, plantains, and white potatoes. The enacted appropriation specifies that FY2019 funds cannot be used to enforce this requirement, thereby allowing schools to substitute any type of vegetables for any or all of the required daily and weekly servings of fruits.

- Child Nutrition Program Commodities. Section 775 of the enacted appropriation changes the calculation of commodity assistance in child nutrition programs. Under current law, commodity assistance in child nutrition programs must comprise at least 12% of total funding provided under Sections 4 and 11 (reimbursements for school lunches) and Section 6 (commodity assistance) of the Richard B. Russell National School Lunch Act. Section 775 eliminates the inclusion of bonus commodities in this calculation as of September 30, 2018, thereby ensuring that only appropriated funds inform the required level of commodity assistance.23

WIC Program24

Although WIC is a discretionary funded program, since the late 1990s the practice of the appropriations committees has been to provide enough funds for WIC to serve all projected participants.25

The enacted FY2019 appropriation provides $6.075 billion for WIC; however, the law also rescinds available carryover funds from past years. This funding level is $175 million less than the FY2018 appropriation. The enacted appropriation also includes set-asides for WIC breastfeeding peer counselors and related activities ("not less than $60 million") and infrastructure ($19.0 million). The peer counselor set-aside is equal to FY2018 levels. The infrastructure set-aside is an increase of $5 million from FY2018, and further sets aside $5 million for telehealth competitive grants to increase WIC access as specified in the law.26

The enacted law (§723) rescinds $500 million in prior-year (or carryover) WIC funds. The House-reported and Senate-passed bills also would have rescinded carryover funds: H.R. 5961 (§723) would have rescinded $300 million; H.R. 6147 (§724) would have rescinded $400 million.

Commodity Assistance Program

The Commodity Assistance Program budget account supports several discretionary programs and activities: (1) Commodity Supplemental Food Program (CSFP), (2) funding for TEFAP administrative and distribution costs, (3) the WIC Farmers' Market Nutrition Program (FMNP), and (4) special Pacific Island assistance for nuclear-test-affected zones in the Pacific (the Marshall Islands) and areas affected by natural disasters.

The enacted appropriation provides over $322 million for this account, no change from FY2018. Within the account,

- CSFP receives just below $223 million (a decrease of approximately $15 million or 6.8%);

- TEFAP Administrative Costs receives nearly $110 million—this includes $79.6 million in FY2019 funding (+$15.2 million compared to FY2018) as well as a transfer of $30.0 million in prior-year (carryover) CSFP funds; in addition to this discretionary TEFAP funding, the law allows the conversion of up to 15% of TEFAP entitlement commodity funding (included in the SNAP account discussed above) to administrative and distribution costs; and

- WIC FMNP receives $18.5 million, the same level as FY2018.

Nutrition Programs Administration

This budget account funds federal administration of all the USDA domestic food assistance program areas noted previously; special projects for improving the integrity and quality of these programs; and the Center for Nutrition Policy and Promotion, which provides nutrition education and information to consumers (including various dietary guides).

The enacted appropriation provides nearly $165 million for this account, an increase of approximately $11 million from FY2018.27 As in FY2018 and prior years, the law sets aside $2 million for the fellowship programs administered by the Congressional Hunger Center.

Other Nutrition Funding Support

Domestic food assistance programs also receive funds from sources other than appropriations:

- In addition to appropriated funds from the child nutrition account for commodity foods (which provides over $1.4 billion), USDA purchases commodity foods for the child nutrition programs using "Section 32" funds—a permanent appropriation.28 For FY2019, the enacted appropriation specifies that up to $485 million from Section 32 is to be available for child nutrition entitlement commodities, compared to $465 million in FY2018.29

- The Fresh Fruit and Vegetable Program (FFVP) for selected elementary schools nationwide is financed with permanent, mandatory funding from Section 32. The underlying law (Section 19 of the Richard B. Russell National School Lunch Act) provides funds at the beginning of every school year (July). For FY2019, there is $171.5 million available for FFVP, which is consistent with the FY2018 base amount adjusted for inflation.30

- The Food Service Management Institute (technical assistance to child nutrition providers, also known as the Institute of Child Nutrition) is funded through a permanent annual appropriation of $5 million.

- The Senior Farmers' Market Nutrition program receives nearly $21 million of mandatory funding per year (FY2002-FY2023) outside of the regular appropriations process.31

Appendix. USDA-FNS Programs during the FY2019 Partial Government Shutdown

USDA was one of the departments affected by a lapse in FY2019 funding and the resulting 35-day partial government shutdown (during parts of December 2018 and January 2019).

Most of USDA's Food and Nutrition Service (FNS) programs, whether mandatory or discretionary, rely on funding provided in appropriations acts. As a result, the lapse in FY2019 appropriations required the execution of contingency plans, including staff furloughs, and at times the operating status of programs was in flux.

FNS program operations during a government shutdown vary based on the different programs' available resources, determined by factors such as contingency or carryover funds and terms of the expired appropriations acts as well as USDA's decisionmaking. Beginning in late December 2018, FNS released program-specific memoranda to states and program operators describing the status of different nutrition assistance programs during the funding lapse.32

In addition to the impact on programs' funding discussed below, furloughs of FNS staff during this time period may have affected program operations (for example, the availability of technical assistance) on a case-by-case basis.

This appendix summarizes some of the key issues and impacts on the SNAP, Child Nutrition, and WIC programs during this partial government shutdown. Further detail can be found in the FNS documents referenced above. It is important to note that because circumstances during a lapse in appropriations and executive-branch decisionmaking can vary, operations during this partial shutdown are not necessarily how a future shutdown would proceed.

SNAP Benefits

States issue SNAP benefits on a monthly basis. As in the FY2019 appropriations law, the FY2018 appropriations law (P.L. 115-141) provided one year of SNAP funding as well as a contingency fund of $3 billion that can be spent in FY2018 or FY2019. The $3 billion is less than the cost of one month of SNAP benefits, so the contingency fund alone would not fund a month of SNAP benefits in the case of a lapse of funding.33

At the start of the partial shutdown, when a continuing resolution (P.L. 115-298) expired after December 21, 2018, December 2018 benefits had already been provided. In addition, during the shutdown period, a provision of the continuing resolution allowed for payments to be made 30 days after the continuing resolution's expiration; this allowed states to issue January 2019 benefits.34 On January 8, 2019, USDA interpreted the provision to authorize issuance of February 2019 benefits as well, so long as states conducted early issuance—before January 20, 2019.35

By the end of the partial shutdown, recipients had received their December 2018, January 2019, and February 2019 benefits. However, at the beginning of the shutdown, it was not clear that benefits would be provided for these months. USDA-FNS provided a series of memoranda to states during the shutdown that included answers to frequently asked questions.

Child Nutrition and WIC

Unlike SNAP, the appropriations language for the child nutrition programs (National School Lunch Program and others) and WIC accounts provides funding that can be obligated over a two-year period. WIC also has a contingency fund. In addition, the child nutrition programs may have more flexibility to continue operating during a shutdown because federal funds are generally provided retroactively (on a reimbursement basis).

During the FY2019 lapse in funding, the Administration had carryover and contingency funds to maintain program operations. This includes FY2018 appropriations that are available for spending through FY2019 and contingency funds (in the case of WIC). Programs with this source of funding potentially available are those with two-year funding from the Child Nutrition Programs account36 and the WIC account.37 How long these operations could continue would depend on (1) the funding lapse's duration and (2) the amount of carryover or contingency funding available.

Ultimately, for child nutrition and WIC programs,

- USDA continued operating the child nutrition programs "with funding provided under the terms and conditions of the prior continuing resolution [P.L. 115-245]"; USDA stated that the programs had enough funding to continue operating at least through March 2019 if the shutdown were to continue;38 and

- USDA continued WIC and WIC FMNP operations using funding that had already been allocated to states and, for WIC, prior-year carryover funding.39

Author Contact Information

Footnotes

| 1. |

Nutrition Programs Administration funding funds USDA's Center for Nutrition Policy and Promotion (CNPP), and the bill also provides some funding initially to FNS that is routinely transferred to other federal agencies. |

| 2. |

See CRS Report R44582, Overview of Funding Mechanisms in the Federal Budget Process, and Selected Examples. |

| 3. |

See CRS Report R42388, The Congressional Appropriations Process: An Introduction. |

| 4. |

See CRS Report 98-560, Baselines and Scorekeeping in the Federal Budget Process. |

| 5. |

P.L. 113-79. See CRS In Focus IF10783, Farm Bill Primer: Budget Issues. |

| 6. |

P.L. 111-296. See CRS Report R44373, Tracking the Next Child Nutrition Reauthorization: An Overview. |

| 7. |

USDA-FNS FY2019 Congressional Budget Justification, pp. 32-81 through 32-87, http://www.obpa.usda.gov/32fns2019notes.pdf. |

| 8. |

Congressional Budget Office (CBO), Proposals for the Supplemental Nutrition Assistance Program—CBO's Estimate of the President's Fiscal Year 2019 Budget, May 24, 2018, https://www.cbo.gov/publication/53911. |

| 9. |

See CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison. The Administration has also proposed or has announced that it will propose regulatory changes to the time limit for able-bodied adults without dependents and categorical eligibility; related changes were proposed in the FY2019 President's budget and the FY2018 President's budget. |

| 10. |

See also USDA-FNS Congressional Budget Justification, p. 32-77, http://www.obpa.usda.gov/32fns2019notes.pdf. As an appropriated, open-ended mandatory program, SNAP funding is not the same as SNAP spending. SNAP regularly receives annual appropriations that are greater than the amount the program spends. Better measures for SNAP program spending can be found in USDA-FNS's costs data, available at http://www.fns.usda.gov/pd/SNAPmain.htm. |

| 11. |

These funds, held in reserve, are available for a two year period, whereas the majority of SNAP funds are available for one-year. These reserve funds are available for spending if the other SNAP appropriations are exhausted. |

| 12. |

USDA-FNS, "Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP)," 81 Federal Register 90675-90699, December 15, 2016. For further information on this rulemaking and implementation following the FY2017 appropriations law, see CRS Report R44650, Updated Standards for SNAP-Authorized Retailers. |

| 13. |

The proposed rule's preamble states that, aside from the farm bill change, FNS is "using existing authority in [SNAP's authorizing statute] and feedback from a Request for Information that included five listening sessions in urban and rural locations across the nation and generated 233 public comments." |

| 14. |

See USDA-FNS website, "Is My Store Eligible?" https://www.fns.usda.gov/snap/my-store-eligible. |

| 15. |

USDA-FNS, "Providing Regulatory Flexibility for Retailers in the Supplemental Nutrition Assistance Program (SNAP)," 84 Federal Register 13555-13562, April 5, 2019. |

| 16. |

Further background on these programs and related funding is provided in CRS Report R43783, School Meals Programs and Other USDA Child Nutrition Programs: A Primer. |

| 17. |

For more information about these grants, see USDA-FNS's resources for the FY2018 grants, https://www.fns.usda.gov/nslp/fy-2018-nslp-equipment-assistance-grants-school-food-authorities. |

| 18. |

Committees of jurisdiction marked up bills in the 114th Congress, but Congress did not complete reauthorization. As of the date of this report, the 115th Congress has not resumed reauthorization activity. Current operations and legislative activity are discussed in CRS Report R44373, Tracking the Next Child Nutrition Reauthorization: An Overview.) |

| 19. |

In 2017, China exported nearly 500 pounds of processed chicken that was sourced from other countries. China did not export any poultry to the United States in 2018. USDA's Food Safety and Inspection Service issued a proposed rule in June 2017 that recognizes the equivalency of China's poultry slaughter system. Once finalized, China would be able to export processed poultry that is domestically raised. For more information, see CRS In Focus IF10148, Chicken Imports from China. |

| 20. |

Section 205 of the Healthy, Hunger-free Kids Act of 2010 (P.L. 111-296) (an amendment to the Richard B. Russell National School Lunch Act codified at 42 U.S.C. 1760(p)). For more information on paid lunch pricing requirements, see CRS Report R45486, Child Nutrition Programs: Current Issues. |

| 21. |

The "Other vegetables" subgroup includes "all other fresh, frozen, and canned vegetables, cooked or raw, such as artichokes, asparagus, avocado, bean sprouts, beets, Brussels sprouts, cabbage, cauliflower, celery, cucumbers, eggplant, green beans, green peppers, iceberg lettuce, mushrooms, okra, onions, parsnips, turnips, wax beans, and zucchini." (7 C.F.R. §210.10(c)(2)(iii)(E)). |

| 22. |

7 C.F.R. §220.8(c), footnote c. |

| 23. |

"Appropriated funds" refer to funds appropriated in the child nutrition account and appropriated Section 32 transfer funds for child nutrition programs. "Bonus commodities" refer to commodities purchased by USDA using Commodity Credit Corporation (CCC) and post-transfer Section 32 funds. In recent years, few bonus commodities have been distributed to the child nutrition programs. However, starting in FY2018 and through FY2019, child nutrition programs are receiving an increased amount of bonus commodities through USDA's trade aid package. For example, in FY2017, there was $90,342 in bonus commodities delivered through child nutrition programs. In FY2018, there was $7,960,335. |

| 24. |

Further background on this program and related funding is provided in CRS Report R44115, A Primer on WIC: The Special Supplemental Nutrition Program for Women, Infants, and Children. |

| 25. |

ERS, "Anecdotal Evidence Suggest That WIC Became Fully Funded Sometime in the Late 1990s," in The WIC Program: Background, Trends, and Economic Issues, 2015 Edition, EIB-134, January 2015, p. 19. |

| 26. |

The law specifies "telehealth competitive grants to supplement the nutrition education and breastfeeding support offered in the WIC clinic, and to decrease barriers to access to WIC services, particularly in rural communities, and other populations facing barriers to accessing support." The law's explanatory statement further adds, "Funding can be used to support a variety of telehealth interventions, including but not limited to the use of telehealth tools by WIC staff as well as clinical services and technologies provided by third-party vendors." |

| 27. |

In FY2017, the appropriations law provided a $17.7 million set-aside for FNS's relocation and related expenses. These funds are available until expended. |

| 28. |

For further background, see CRS Report RL34081, Farm and Food Support Under USDA's Section 32 Program. |

| 29. |

Explanatory statement for the Consolidated Appropriations Act, 2019 (H.J.Res. 31), Division B, Funds for Strengthening Markets, Income, and Supply (Section 32), p. 14, https://docs.house.gov/billsthisweek/20190211/116hrpt9-JointExplanatoryStatement.pdf. |

| 30. |

In FY2017 and prior years, appropriations laws have delayed a portion of the funds (generally $125 million) to the start of the next fiscal year (October 1). In the FY2018 appropriations law, this delay was not included, so for FY2018 USDA received both the full amount for the fiscal year ($172 million) on July 1, 2018, and $125 million that FY2017 appropriations had delayed until October 1, 2017. Therefore, funding for FFVP in FY2018 was higher than in previous fiscal years. |

| 31. |

Authorizing language at Section 4402 of the 2002 farm bill (P.L. 107-171), most recently amended by Section 4201 of the 2018 farm bill (P.L. 115-334), codified at 7 U.S.C. §3007. |

| 32. |

USDA-FNS, "Information on Program Operations in Light of Lapse in Fiscal Year 2019 Appropriations for the Food and Nutrition Service," https://www.fns.usda.gov/pressrelease/FY19Lapse. |

| 33. |

In FY2018, according to USDA-FNS data, total funding for SNAP benefits was approximately $60.6 billion, averaging over $5.0 billion per month. |

| 34. |

P.L. 115-245, Division C, Section 101, as amended by P.L. 115-298. |

| 35. |

USDA-FNS, "USDA Announces Plan to Protect SNAP Participants' Access to SNAP in February." |

| 36. |

The two-year funding (available through September 30, 2019) in the Child Nutrition Programs account includes funding for all of the major child nutrition programs (NSLP, SBP, CACFP, SFSP, Special Milk) and various support functions (including State Administrative Expenses, Team Nutrition). See P.L. 115-141, Division A, Title IV, "child nutrition programs"; see also P.L. 115-141's Joint Explanatory Statement (Congressional Record, daily edition, vol. 164 (March 22, 2018), pp. H2050-H2051). |

| 37. |

The two-year funding in the WIC account includes WIC and a few related support functions. WIC also maintains a contingency fund that can be spent in any year. Note that WIC FMNP is a one-year appropriation (available through September 30, 2018) funded in a different account. |

| 38. |

USDA-FNS, Memo to State Child Nutrition Agencies—January 8, 2019, https://www.fns.usda.gov/pressrelease/FY19Lapse. |

| 39. |

See USDA-FNS, communications on WIC and WIC FMNP, https://www.fns.usda.gov/pressrelease/FY19Lapse. |