Agriculture and Related Agencies: FY2019 Appropriations

The Agriculture appropriations bill funds the U.S. Department of Agriculture (USDA) except for the Forest Service. It also funds the Food and Drug Administration (FDA) and—in even-numbered fiscal years—the Commodity Futures Trading Commission (CFTC).

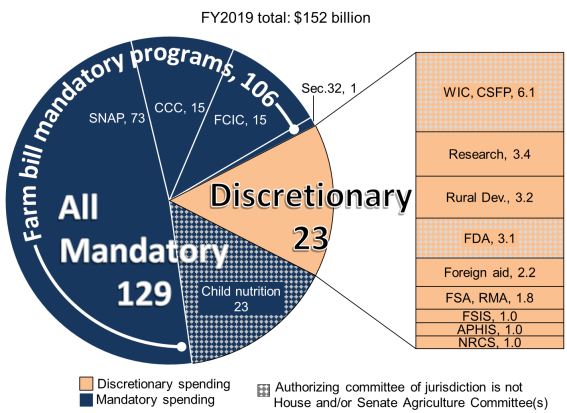

Agriculture appropriations include both mandatory and discretionary spending. Discretionary amounts, though, are the primary focus during the bill’s development. The largest discretionary spending items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); agricultural research; rural development; FDA; foreign food aid and trade; farm assistance program salaries and loans; food safety inspection; animal and plant health programs; and salaries and expenses for administering conservation programs.

On February 15, 2019, Congress passed and the President signed the FY2019 Consolidated Appropriations Act (P.L. 116-6, H.Rept. 116-9). This action, more than four months into the fiscal year, followed three continuing resolutions and a 34-day partial government shutdown.

The official discretionary total of the enacted FY2019 Agriculture appropriation is $23.03 billion, which is $35 million more than enacted in FY2018 (+0.2%) on a comparable basis that excludes the CFTC. The enacted total is $6.3 billion more than the Administration requested (+38%), $55 million more than was proposed in the House-reported bill (+0.2%), but $194 million less than in the Senate-passed bill (-0.8%).

Among the primary differences that account for the overall $35 million discretionary increase for FY2019 over FY2018 are an increase in agricultural research (mostly for construction) by $387 million (+13%) to $3.4 billion, an increase in FDA appropriations by $269 million (+10%) to $3.1 billion, an increase in WIC funding by a net $200 million (accounting for changes in the amount of carryover balances rescinded and in the base appropriation), an increase in five other program areas by a combined $78 million, and a decrease in rural development by reducing extra appropriations that were made in FY2018 for water and wastewater programs (-$425 million) and rural broadband (-$475 million).

The appropriation also carries $129 billion of mandatory spending that is largely determined in separate authorizing laws. The mandatory spending increased by $6 billion not because of congressional action this year but because of changing economic and program conditions. The annual change was mostly due to higher costs for crop insurance (+$6.5 billion), greater reimbursement for the Commodity Credit Corporation (+1.1 billion), and lower outlays for child nutrition (-$1.1 billion) and SNAP (-$0.5 billion). With mandatory and discretionary spending appropriations combined, the FY2019 agriculture total is nearly $152 billion.

The Consolidated Appropriations Act and its underlying bills also contain policy provisions that affect how the appropriation is delivered. These provisions affect disaster programs, rural definitions, industrial hemp, animal regulations, nutrition programs, dietary guidelines, CFTC, and tobacco products.

Sequestration on mandatory accounts—a process that reduces federal spending through automatic across-the-board reductions—also continues to affect agriculture spending.

Agriculture and Related Agencies: FY2019 Appropriations

Jump to Main Text of Report

Contents

- Status of FY2019 Agriculture Appropriations

- Scope of Agriculture Appropriations

- Recent Trends in Agriculture Appropriations

- Action on FY2019 Appropriations

- Administration's Budget Request

- Discretionary Budget Caps and Subcommittee Allocations

- House Action

- Senate Action

- Continuing Resolutions

- Government Shutdown

- Agency Exceptions to Maintain Operations

- Suspended Activities

- FY2019 Consolidated Appropriations Act

- Policy-Related Provisions

Figures

Tables

- Table 1. Status of FY2019 Agriculture Appropriations

- Table 2. Agriculture and Related Agencies Appropriations, by Title, FY2018-FY2019

- Table 3. Agriculture and Related Agencies Appropriations, by Agency, FY2016-FY2019

- Table 4. Selected Policy Provisions Considered in FY2019 Agriculture Appropriations

- Table A-1. Sequestration from Accounts in Agriculture Appropriations

- Table A-2. Sequestration of Mandatory Accounts in Agriculture Appropriations

- Table B-1. Congressional Action on Agriculture Appropriations Since FY1996

Summary

The Agriculture appropriations bill funds the U.S. Department of Agriculture (USDA) except for the Forest Service. It also funds the Food and Drug Administration (FDA) and—in even-numbered fiscal years—the Commodity Futures Trading Commission (CFTC).

Agriculture appropriations include both mandatory and discretionary spending. Discretionary amounts, though, are the primary focus during the bill's development. The largest discretionary spending items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); agricultural research; rural development; FDA; foreign food aid and trade; farm assistance program salaries and loans; food safety inspection; animal and plant health programs; and salaries and expenses for administering conservation programs.

On February 15, 2019, Congress passed and the President signed the FY2019 Consolidated Appropriations Act (P.L. 116-6, H.Rept. 116-9). This action, more than four months into the fiscal year, followed three continuing resolutions and a 34-day partial government shutdown.

The official discretionary total of the enacted FY2019 Agriculture appropriation is $23.03 billion, which is $35 million more than enacted in FY2018 (+0.2%) on a comparable basis that excludes the CFTC. The enacted total is $6.3 billion more than the Administration requested (+38%), $55 million more than was proposed in the House-reported bill (+0.2%), but $194 million less than in the Senate-passed bill (-0.8%).

Among the primary differences that account for the overall $35 million discretionary increase for FY2019 over FY2018 are an increase in agricultural research (mostly for construction) by $387 million (+13%) to $3.4 billion, an increase in FDA appropriations by $269 million (+10%) to $3.1 billion, an increase in WIC funding by a net $200 million (accounting for changes in the amount of carryover balances rescinded and in the base appropriation), an increase in five other program areas by a combined $78 million, and a decrease in rural development by reducing extra appropriations that were made in FY2018 for water and wastewater programs (-$425 million) and rural broadband (-$475 million).

The appropriation also carries $129 billion of mandatory spending that is largely determined in separate authorizing laws. The mandatory spending increased by $6 billion not because of congressional action this year but because of changing economic and program conditions. The annual change was mostly due to higher costs for crop insurance (+$6.5 billion), greater reimbursement for the Commodity Credit Corporation (+1.1 billion), and lower outlays for child nutrition (-$1.1 billion) and SNAP (-$0.5 billion). With mandatory and discretionary spending appropriations combined, the FY2019 agriculture total is nearly $152 billion.

The Consolidated Appropriations Act and its underlying bills also contain policy provisions that affect how the appropriation is delivered. These provisions affect disaster programs, rural definitions, industrial hemp, animal regulations, nutrition programs, dietary guidelines, CFTC, and tobacco products.

Sequestration on mandatory accounts—a process that reduces federal spending through automatic across-the-board reductions—also continues to affect agriculture spending.

Status of FY2019 Agriculture Appropriations

Congress passed and the President signed the FY2019 Consolidated Appropriations Act on February 15, 2019 (P.L. 116-6, H.Rept. 116-9). This action, more than four months into the fiscal year, followed three continuing resolutions (CRs) and a 34-day partial government shutdown (Table 1).

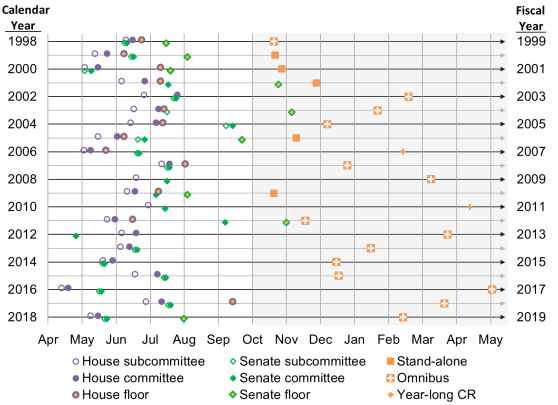

In 2018, both the House and Senate Appropriations Committees reported FY2019 Agriculture appropriations bills (H.R. 5961 on May 16, 2018, and S. 2976 on May 24, 2018). The Senate amended and passed its version as Division C of a four-bill minibus (H.R. 6147 on August 1, 2018). In January 2019, during the partial government shutdown, the House passed various combinations of agriculture appropriations bills in an attempt to reopen the government (H.R. 21, H.R. 265, H.R. 648). The Senate did not consider the measures until the Consolidated Appropriations Act moved in February 2019. See Figure 1 and Appendix B for more timeline context.

|

House Action |

Senate Action |

Continuing Resolutions |

Final Appropriation |

||||

|

Subcmte. |

Cmte. |

Floor |

Subcmte. |

Cmte. |

Floor |

||

|

5/9/2018 Drafta Voice vote |

5/16/2018 Vote 31-20 |

— |

5/22/2018 Draft Voice vote |

5/24/2018 Vote 31-0 |

8/1/2018 H.R. 6147 Division C Vote 92-6 |

1. 9/28/2018 P.L. 115-245, Division C, until 12/7/2018 2. 12/7/2018 P.L. 115-298 until 12/21/18 Funding gap 12/22/2019-01/26/2019 3. 1/25/2019 P.L. 116-5 |

2/15/2019 P.L. 116-6, Division B Vote 300-128 Vote 83-16 |

Source: CRS, compiled from Congress.gov.

a. The House subcommittee draft is at https://docs.house.gov/meetings/AP/AP01/20180509/108287/BILLS-115HR-SC-AP-FY2019-Agriculture-SubcommitteeDraft.pdf, and the committee report draft is at https://docs.house.gov/meetings/AP/AP00/20180516/108312/HRPT-115-HR-FY2019-Agriculture.pdf.

The higher discretionary budget caps in the Bipartisan Budget Act of 2018 (P.L. 115-123) facilitated development of the appropriation amounts. The official discretionary total of the enacted FY2019 Agriculture appropriation is $23.03 billion, $35 million more than was enacted in FY2018 (+0.2%; Table 2) on a comparable basis that excludes the Commodity Futures Trading Commission (CFTC).1 The enacted total is more than was proposed in the House-reported bill but less than in the Senate-passed bill.

The appropriation also carries mandatory spending—though that is largely determined in separate authorizing laws—that totals nearly $129 billion. Thus, the overall total of the FY2019 Agriculture appropriation is about $152 billion.

Table 2. Agriculture and Related Agencies Appropriations, by Title, FY2018-FY2019

(budget authority in millions of dollars)

|

FY2018 |

FY2019 |

|||||||

|

Title of Agriculture Appropriations Act |

Admin. Request |

House H.R. 5961 |

Senate |

Enacted P.L. 116-6 |

Change from FY2018 to FY2019 Enacted |

|||

|

I. Agricultural Programs: Discretionary |

5,622.8 |

4,752.9 |

5,704.5 |

5,587.8 |

6,033.9 |

+411.1 |

+7.3% |

|

|

Mandatory |

1,344.0 |

1,374.0 |

1,374.0 |

1,374.0 |

1,374.0 |

+30.0 |

+2.2% |

|

|

Subtotal |

6,966.8 |

6,126.9 |

7,078.5 |

6,961.8 |

7,407.9 |

+441.1 |

+6.3% |

|

|

II. Farm Production and Conservation Programs |

2,735.6 |

2,197.9 |

2,760.3 |

2,728.0 |

2,748.8 |

+13.2 |

+0.5% |

|

|

Mandatory |

23,198.3 |

24,097.5 |

24,097.5 |

24,097.5 |

30,821.1 |

+7,622.8 |

+32.9% |

|

|

Subtotal |

25,933.9 |

26,295.4 |

26,857.8 |

26,825.5 |

33,569.9 |

+7,636.0 |

+29.4% |

|

|

III. Rural Development |

3,000.9a |

2,022.5 |

3,078.5a |

3,000.9a |

3,011.7a |

+10.8 |

+0.4% |

|

|

IV. Domestic Food Programs: Discretionary |

6,709.8 |

5,990.1 |

6,528.5 |

6,696.1 |

6,620.3 |

-89.5 |

-1.3% |

|

|

Mandatory |

98,209.6 |

96,342.3 |

96,344.8 |

96,344.8 |

96,560.0 |

-1,649.6 |

-1.7% |

|

|

Subtotal |

104,919.4 |

102,332.3 |

102,873.3 |

103,040.9 |

103,180.3 |

-1,739.1 |

-1.7% |

|

|

V. Foreign Assistance |

2,021.0a |

205.0 |

1,925.8 |

2,152.3 |

1,938.0a |

-83.0 |

-4.1% |

|

|

VI. Related Agencies: |

||||||||

|

Food and Drug Administration |

2,811.9a |

3,183.7 |

3,119.6 |

2,970.9 |

3,080.5 |

+268.6 |

+9.6% |

|

|

Commodity Futures Trading Commission (CFTC) |

249.0 |

281.5 |

255.0 |

[281.5]b |

[268.0]b |

+19.0 |

+7.6% |

|

|

VII. General Provisions: |

||||||||

|

CHIMPS and rescissionsc |

-801.0 |

-1,197.8 |

-315.0 |

-395.0 |

-490.0 |

+311.0 |

-38.8% |

|

|

Other appropriations |

1,378.1 |

0.0 |

579.5 |

889.5 |

493.5 |

-884.6 |

-64.2% |

|

|

Scorekeeping adjustmentsd |

-481.0 |

-409.0 |

-404.0 |

-404.0 |

-404.0 |

+77.0 |

-16.0% |

|

|

Discretionary: Senate basis w/o CFTC |

[22,998.0] |

16,745.2 |

[22,977.8] |

23,226.5 |

23,032.7 |

+34.7 |

+0.2% |

|

|

Discretionary: House basis w/ CFTC |

23,247.0 |

17,026.7 |

23,232.8 |

[23,508.0] |

[23,300.7] |

+53.7 |

+0.2% |

|

|

Mandatory |

122,752.0 |

121,813.8 |

121,816.3 |

121,816.3 |

128,755.1 |

+6,003.1 |

+4.9% |

|

|

Total: Senate basis w/o CFTC |

[145,750.0] |

138,559.0 |

[144,794.0] |

145,042.8 |

151,787.8 |

+6,037.8 |

+4.1% |

|

|

Total: House basis w/ CFTC |

145,999.0 |

138,840.5 |

145,049.0 |

[145,324.3] |

152,055.8 |

+6,056.8 |

+4.1% |

|

Source: CRS, using appropriations text and reports and unpublished CBO tables.

Notes: Amounts are nominal discretionary budget authority in millions of dollars unless labeled otherwise. Excludes amounts in supplemental appropriations acts. Bracketed amounts are not in the Agriculture appropriations totals due to differing House-Senate jurisdiction for CFTC.

a. Excludes amounts for other appropriations that are provided separately in General Provisions.

b. The amount for CFTC is in the division for Financial Services and General Government appropriations.

c. Changes in mandatory program spending are reductions made to mandatory programs via appropriations. Rescissions are permanent cancellations of previously provided budget authority.

d. "Scorekeeping adjustments" are not necessarily appropriated but are part of the official CBO accounting.

|

Figure 1. Timeline of Action on Agriculture Appropriations, FY1999-FY2019 |

|

|

Source: CRS. |

Scope of Agriculture Appropriations

The Agriculture appropriations bill—formally known as the Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Appropriations Act—funds all of USDA, excluding the U.S. Forest Service. It also funds the Food and Drug Administration (FDA) in the Department of Health and Human Services (HHS) and, in even-numbered fiscal years, CFTC.

Jurisdiction is with the House and Senate Committees on Appropriations and their respective Subcommittees on Agriculture, Rural Development, Food and Drug Administration, and Related Agencies. The bill includes mandatory and discretionary spending, but the discretionary amounts are the primary focus during the bill's development. The scope of the bill is shown in Figure 2.

The federal budget process treats discretionary and mandatory spending differently:2

- Discretionary spending is controlled by annual appropriations acts and receives most of the attention during the appropriations process. The annual budget resolution3 process sets spending limits for discretionary appropriations. Agency operations (salaries and expenses) and many grant programs are discretionary.

- Mandatory spending4—though carried in the appropriation and usually advanced unchanged—is controlled by budget rules during the authorization process.5 Spending for so-called entitlement programs is set in laws such as the 2018 farm bill6 and 2010 child nutrition reauthorizations.7

In the FY2019 Agriculture appropriations act, discretionary appropriations are 15% ($23 billion) of the $152 billion total. Mandatory spending carried in the act comprised $129 billion, about 85% of the total. About $106 billion of the $129 billion mandatory amount is attributable to programs in the 2018 farm bill. Some programs are not in the authorizing jurisdiction of the House or Senate Agriculture Committees, such as FDA, WIC, or child nutrition (Figure 2).

Within the discretionary total, the largest discretionary spending items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); agricultural research; rural development; FDA; foreign food aid and trade; farm assistance program salaries and loans; food safety inspection; animal and plant health programs; and salaries and expenses for the conservation programs (Figure 2).

The main mandatory spending items are the Supplemental Nutrition Assistance Program (SNAP, and other food and nutrition act programs), child nutrition (school lunch and related programs), crop insurance, and farm commodity and conservation programs that are funded through USDA's Commodity Credit Corporation (CCC). SNAP is referred to as an "appropriated entitlement" and requires an annual appropriation.8 Amounts for the nutrition program are based on projected spending needs. In contrast, the CCC operates on a line of credit. The annual appropriation provides funding to reimburse the Treasury for the use of this line of credit.9

|

Key Budget Terms Budget authority is the main purpose of an appropriations act or a law authorizing mandatory spending. It provides the legal basis from which to obligate funds. It expires at the end of a period, usually after one year unless specified otherwise (e.g., two years or indefinite). Most funding amounts in this report are budget authority. Obligations are contractual agreements between an agency and its clients or employees. They occur when an agency proceeds to spend money from its budget authority. The Antideficiency Act prohibits agencies from obligating more budget authority than is provided in law, such as during a government shutdown. Outlays are the payments (cash disbursements) that satisfy a valid obligation. Outlays may differ from budget authority or obligations because payments from an agency may not occur until services are fulfilled, goods are delivered, or construction is completed, even though an obligation occurred. Program level represents the sum of the activities supported or undertaken by an agency. A program level may be higher than a budget authority if the program (1) receives user fees that can be used to pay for activities, (2) makes or guarantees loans that are leveraged on the expectation of repayment (more than $1 of loan authority for $1 of budget authority), or (3) receives transfers from other agencies. Rescissions are adjustments that reduce budget authority after enactment. They score budgetary savings. CHIMPS (changes in mandatory program spending) are adjustments in an appropriations act to mandatory budget authority. CHIMPS in appropriations usually reduce or limit spending by mandatory programs for one year and score budgetary savings. They do not change the underlying authority of the program in statute. For more background, see CRS Report 98-721, Introduction to the Federal Budget Process. |

Recent Trends in Agriculture Appropriations

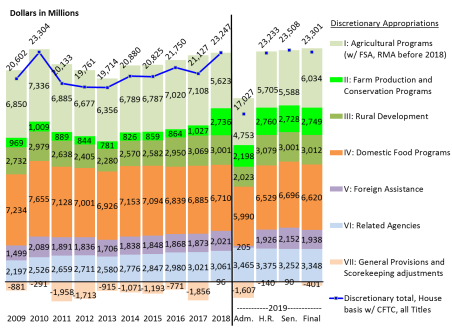

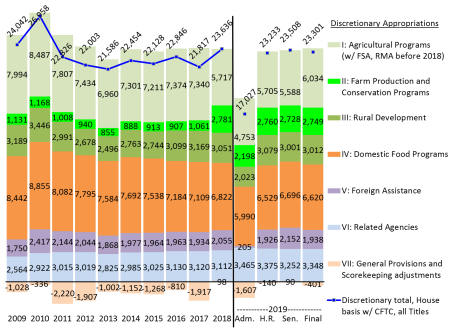

Over time, changes by title of the Agriculture appropriations bill have generally been proportionate to changes in the bill's total discretionary limit, though some activities have sustained relative increases and decreases. Agriculture appropriations peaked in FY2010, declined through FY2013, and have been higher since then (Figure 3). Comparisons to historical benchmarks, though, may be tempered by inflation adjustments (Figure 4). In FY2018, USDA reorganization affected the placement of some programs between Titles I and II of the bill.

The stacked bars in Figure 3 represent the discretionary authorization for each appropriations title. The total of the positive stacked bars is the budget authority in Titles I-VI. Prior to FY2018, it was higher than the official discretionary spending allocation (the blue line) because of the budgetary offset from negative amounts in Title VII (general provisions) and other scorekeeping adjustments that were negative, mostly due to limits on mandatory programs and rescissions.

|

Figure 3. Discretionary Agriculture Appropriations, by Title, FY2009-FY2019 |

|

|

Source: CRS. Note: For FY2019, Adm. is the Administration's request, H.R. is committee-reported H.R. 5961, Sen. is Senate-passed H.R. 6147, and Final is P.L. 116-6. For consistency, includes CFTC in Related Agencies in all columns. |

|

Figure 4. Inflation-Adjusted Agriculture Appropriations, FY2009-FY2019 |

|

|

Source: CRS. Note: For FY2019, Adm. is the Administration's request, H.R. is committee-reported H.R. 5961, Sen. is Senate-passed H.R. 6147, and Final is P.L. 116-6. For consistency, includes CFTC in Related Agencies in all columns. Budget authority is millions of dollars adjusted to FY2019 using the gross domestic product price deflator. |

Action on FY2019 Appropriations

Administration's Budget Request

The Trump Administration released its FY2019 budget request on February 12, 2018.10 USDA concurrently released its more detailed budget summary and justification,11 as did the FDA,12 and the independent agencies of the CFTC13 and the Farm Credit Administration (FCA).14 The Administration also highlighted some of the proposed reductions and eliminations separately.15

From these documents, the congressional appropriations committees evaluated the request and began to consider their own bills in the spring of 2018. For accounts in the jurisdiction of the Agriculture appropriations bill, the Administration's budget proposed $17 billion, a 25% reduction from FY2018 (Table 2, Figure 3).

The timing of the Administration's budget request for FY2019 preceded Congress enacting the final, omnibus FY2018 appropriation in March 2018. Therefore, amounts in the FY2018 column of the Administration's budget documents are based on FY2017 and the CR and are different from the enacted FY2018 levels that came later and as shown in this report.

Discretionary Budget Caps and Subcommittee Allocations

Budget enforcement for appropriations has both procedural and statutory elements.

The procedural elements are associated with the budget resolution and are enforced through points of order. Typically, each chamber's full Appropriations Committee receives a top-line procedural limit on discretionary budget authority, referred to as a "302(a)" allocation, from the Budget Committee via an annual budget resolution. The Appropriations Committees then in turn subdivide the allocation among their subcommittees, referred to as the "302(b)" allocations.16

The statutory elements impose limits on discretionary spending in FY2012-FY2021 and are enforced through discretionary budget caps and sequestration (2 U.S.C. 901(c)).17 The Budget Control Act of 2011 (BCA, P.L. 112-25) set discretionary budget caps through FY2021 as a way of reducing federal spending.18 Bipartisan Budget Acts (BBAs) in 2013, 2015, and 2018 (P.L. 113-67, P.L. 114-74, and P.L. 115-123, respectively) have avoided sequestration on discretionary spending—with the exception of FY2013—by raising those caps.19

In February 2018, the BBA raised the FY2019 cap on nondefense discretionary spending by $68 billion and the cap on defense spending by $85 billion.20 It also provided language to execute (or "deem") those higher caps for the appropriations process without following the usual procedures for an FY2019 budget resolution.21

Under these higher caps and authorities, the House and Senate Appropriations Committees proceeded to mark up the FY2019 appropriations bills. The Agriculture appropriations bills are receiving roughly the same subcommittee allocation ("302(b)" allocation) in each chamber that was used to complete the FY2018 appropriation under the BBA. For FY2019, the subcommittee allocations for agriculture appropriations are

- House: $23.273 billion (H.Rept. 115-710, May 23, 2018), including the CFTC.

- Senate: $23.235 billion (S.Rept. 115-260, May 24, 2018), excluding the CFTC.

Appendix A discusses budget sequestration and its effects on agriculture accounts. Sequestration of discretionary accounts occurred in FY2013. Sequestration on mandatory accounts began in FY2013, continues to the present, and has been extended by the Bipartisan Budget Acts.

House Action

The House Agriculture Appropriations Subcommittee marked up its FY2019 bill on May 9, 2018, by voice vote.22 On May 16, 2018, the full Appropriations Committee passed and reported an amended bill (H.R. 5961, H.Rept. 115-706) by a vote of 31-20 (Table 1, Figure 1).

The $23.23 billion discretionary total in the House-reported FY2019 Agriculture appropriation would have been $14 million less than enacted in FY2018 (-0.1%; Table 2, Figure 3). Generally speaking, the House-reported bill did not include most of the reductions proposed by the Administration and continued the trend of appropriations from prior years.

Table 3 provides details at the agency level. The primary changes from FY2018 that comprised the relatively flat $14 million overall decrease in the House-reported bill—recognizing that some amounts for certain program areas were in the General Provisions—would have done the following:

- Increased base FDA appropriations by $308 million (+11%). However, it did not continue to separate FDA funding for the opioid crisis that was in the General Provisions title of the FY2018 appropriation (-$94 million).

- Increased agricultural research (+$79 million, +2.6%) by raising appropriations for the Agricultural Research Service (ARS) and National Institute of Agriculture (NIFA).

- Increased the Animal and Plant Health Inspection Service (APHIS) by $16 million (+1.7%).

- Increased the Rural Utility Service by $82 million (+13%), mostly due to higher base funding for rural water and waste disposal programs. However, the bill did not continue separate funding for rural water that was in the General Provisions title last year (-$500 million) or for telemedicine for the opioid crisis (-$20 million). It would have reduced separate funding for a broadband pilot program while continuing to fund some of it through the General Provisions title (-$50 million).

- Decreased discretionary appropriations for domestic nutrition assistance programs by reducing WIC by $175 million (-2.8%) and the commodity assistance programs by $15 million (-4.7%). However, the reduction scored in the General Provisions title by rescinding WIC carryover balances was smaller in FY2019, retaining more budget authority (+$500 million).

- Decreased the base funding in international food assistance Food for Peace grants by $100 million (-6.2%) and would not have continued the extra funding that was in the General Provisions title of the FY2018 appropriations (-$116 million).

In addition to discretionary spending, the House-reported bill also carried funding for mandatory spending—largely determined in separate authorizing laws—that would have totaled $121.82 billion, about $936 million less than in FY2018 because of automatic changes in economic conditions and entitlement enrollment rather than any change from congressional action. Thus, the overall total of the House-reported bill was about $145 billion.

As the 116th Congress began in 2019 under a funding gap (see the heading "Government Shutdown"), the House passed various combinations of appropriations bills in an attempt to reopen the government. The Senate did not consider the measures and waited until a compromise for the Consolidated Appropriation Act moved in February 2019.

- On January 3, 2019, the House passed a six-bill full-year omnibus appropriation (H.R. 21), with agriculture appropriations in Division C. With few exceptions, the bill for agriculture was essentially identical to the Senate-passed Agriculture appropriations bill from the 115th Congress (Division C of H.R. 6147; see under the heading "Senate Action").23

- On January 10, 2019, the House passed H.R. 265, a stand-alone Agriculture appropriations bill.

- On January 23—two days before agreement for a third CR reopened the government—the House passed H.R. 648, another six-bill omnibus appropriation with Agriculture appropriations in Division A.

Senate Action

The Senate Agriculture Appropriations Subcommittee initially marked up a FY2019 bill on May 22, 2018, by voice vote. On May 24, the full committee passed and reported an amended bill (S. 2976, S.Rept. 115-259) by a vote of 31-0. On August 1, 2018, the Senate passed a four-bill minibus (H.R. 6147) by a vote of 92-6, with agriculture as Division C (Table 1, Figure 1).

The discretionary total of the Senate-passed bill was also $23.23 billion. However, the Senate bill's total would have been $229 million more than enacted in FY2018 (+1%) on a comparable basis that excludes the CFTC, since the latter was part of the enacted FY2018 appropriation. The Senate-passed bill would have provided about $250 million more than the House-reported bill on a comparable basis that subtracted CFTC from the House bill.

Table 3 provides details at the agency level. The primary changes from FY2018 at the agency level that comprised the Senate-passed bill's overall $228 million increase were the following:

- Increased base FDA appropriations by $159 million (+6%). Like the House bill, it would not have continued separate FDA funding for the opioid crisis that was in the General Provisions title of the FY2018 appropriation (-$94 million).

- Increased APHIS by $19 million (+1.9%), slightly more than the House bill.

- Decreased discretionary appropriations for domestic nutrition assistance programs by reducing WIC by $25 million (-0.4%). This was a smaller reduction than in the House bill. In the rescissions in the General Provisions title, the reduction was smaller than was rescinded in FY2018 (+$400 million). Nonetheless, the Senate bill's rescission was greater than in the House bill.

- Increased international nutrition assistance by raising the base funding for Food for Peace grants by $116 million (+7.2%). The extra funding that was in the General Provisions title of the FY2018 appropriations was not continued (-$116 million).

- Decreased funding for the four agricultural research agencies by $44 million (-1.4%), mostly by providing no funding for ARS building and facilities (-$141 million), while increasing ARS salaries and expenses (+$98 million).

- Decreased the extra funding for rural development compared to the amount provided in the FY2018 General Provisions (-$100 million for rural water, -$175 million for broadband). Base funding for rural development was unchanged overall.

The Senate-passed bill's mandatory spending was virtually identical to that of the House-reported bill ($121.82 billion). Its overall total of discretionary and mandatory appropriations was $145 billion.

Continuing Resolutions

In the absence of a final FY2019 agriculture appropriation at the end of FY2018, Congress enacted three CRs to continue government operations.24

- The first CR was from October 1, 2018, through December 7, 2018 (P.L. 115-245, Division C).

- The second CR continued temporary funding through December 21, 2018 (P.L. 115-298).

- A 34-day funding gap (partial government shutdown) occurred between the second and third CRs (see the heading "Government Shutdown" for more discussion of the funding lapse).

- To end the government shutdown, Congress passed and the President signed a third CR (P.L. 116-5) that covered the period from January 26, 2019, through February 15, 2019.

- At the end of the third CR, an omnibus appropriation was enacted to cover the rest of the fiscal year (see the heading "FY2019 Consolidated Appropriations Act").

In general, a CR continues the funding rates and conditions that were in the previous year's appropriation.25 The Office of Management and Budget (OMB) may prorate funding to the agencies on an annualized basis for the duration of the CR through a process known as apportionment.26 For the 81 days (22%) of FY2019 through December 21, 2018, and the 21 days of the third CR that preceded February 15, 2019, the CRs

- continued the terms of the FY2018 Agriculture appropriations act (Section 101 of P.L. 115-245) and excluded the FY2018 change in mandatory program spending (CHIMP) on the Biomass Crop Assistance Program, which was not authorized for FY2019; and

- provided sufficient funding to maintain mandatory program levels, including for nutrition programs (Section 110)—this is the standard approach taken in recent years' CRs, but it was additionally important for SNAP, because some authorizations in the 2014 farm bill began expiring after FY2018.27

CRs may adjust prior-year amounts through anomalies or make specific administrative changes. Five anomalies specifically applied to the agriculture appropriation during the CRs:

- Child Nutrition Programs: apportionment for a summer foods program that allowed it to be operational by May 2019 (Section 114 of P.L. 115-245).

- Rural Utilities Service: allowed a loan authorization level for the Rural Water and Waste Disposal program of $4.141 billion (Section 115).

- Commodity Credit Corporation (CCC): allowed CCC to receive its appropriation to reimburse the Treasury for a line of credit about a month earlier than usual, prior to a customary final report and audit. Many farm bill payments to farmers were due in October 2018 in addition to USDA's plan to make supplemental payments under a trade assistance program.28 Without the anomaly, CCC might have exhausted its $30 billion line of credit (Section 116).

- Agricultural Research Service: provided an additional $42 million for operations and maintenance at the National Bio and Agro-Defense Facility (NBAF) being built in Manhattan, Kansas, and its transfer to USDA from the Department of Homeland Security (Section 117).

- Department of Homeland Security (DHS): allowed DHS to transfer up to $15 million to USDA to support NBAF operations (Section 125).

Government Shutdown

When an appropriation (or CR) expires and no further budget authority has been provided, a funding gap exists, which may cause operations to cease at affected agencies. In general, the Antideficiency Act (31 U.S.C. 1341 et seq.) prohibits federal agencies from obligating funds before an appropriations measure has been enacted. Exceptions may allow certain activities to continue, such as for law enforcement, protection of human life or property, and activities funded by other means such as carryover funds or user fees. Programs that are funded by other authorities—such as entitlements or the mandatory programs in the farm bill—may also be affected if the program is executed using personnel whose salaries are funded by discretionary appropriations that are affected by the funding gap.29

For FY2019, a 34-day funding gap lasted from December 22, 2018, through January 25, 2019. It affected agencies within the jurisdiction of seven of the 12 appropriations bills, including Agriculture appropriations. On December 19, 2018, the Senate had passed H.R. 695, a CR that would have continued temporary funding through February 8, 2019, but the House-passed amendment to that bill on December 20 added homeland security funding for construction of physical barriers at borders and supplemental appropriations for natural disasters that the Senate did not accept.

Prior to FY2019, the previous shutdown was a two-day, weekend shutdown in January 2018, and before that a 16-day shutdown in October 2013. Before that, the next previous multiday shutdown occurred in FY1996, though agriculture appropriations were not affected that year because a stand-alone full-year Agriculture appropriation had been enacted.30

In general, a shutdown results in the furlough of many personnel and curtailment of affected agency activities and services. Agencies make their own determinations about activities and personnel that are "excepted" from furlough and publish their intentions in "contingency plans" that are supervised by OMB.31 For agencies in the Agriculture appropriations jurisdiction, shutdown or contingency plans were published for USDA,32 FDA,33 and the CFTC.34

Generally, government employees of affected agencies do not receive pay during a shutdown. Excepted employees may be required to report to work but do not receive their current pay. Exempt employees may receive paychecks during the shutdown from a separately authorized funding source that remains available.35 On January 16, 2019, the President signed P.L. 116-1 to guarantee back pay to furloughed and excepted employees after the government shutdown ended.

Agency Exceptions to Maintain Operations

USDA initially estimated on December 23, 2018, that 61% of its employees were excepted from furlough in the agencies that are funded by Agriculture appropriations (all of USDA except the Forest Service), which numbered 37,860 staff being excepted out of 62,288.36 In general, the number of excepted and furloughed personnel varies by agency and may change as a shutdown continues as funding availability changes and as new circumstances arise. A summary of how the shutdown affected the operation of different agencies between December 22, 2018, and January 25, 2019, follows:

- Nearly 90% of staff in the Food Safety and Inspection Service and Agricultural Marketing Service were initially retained to continue food safety inspections of meat and poultry at processing plants and to continue commodity grading and inspection services (8,434 and 3,944 staff, respectively).

- About 69% of the Animal and Plant Health Inspection Service was excepted (5,456 staff) to continue preclearance inspection for transportation between Hawaii and Puerto Rico and the mainland and to carry out quarantine and certification for imports and exports.

- Resources in research laboratories and facilities that could be damaged by inattention were protected by excepting 18% (1,116 staff) of the Agricultural Research Service.

- The Farm Service Agency (FSA) initially excepted 7,589 staff (72% out of 10,479) through December 28 but then closed county offices, thereby lowering the number of excepted employees to 27 (0.3%).37 As the shutdown continued, FSA announced on January 16, 2019, that it would recall about 2,500 employees to reopen FSA county offices for three days (January 17-18 and January 22). On these days, FSA provided administrative services to farmers mostly related to past activities that were obligated, including issuing tax documents, but was not to process new program applications.38 On January 22, USDA further announced that as the shutdown continued, FSA offices would remain open on a full-time basis (with excepted staff) from January 24 to February 8 and three days per week thereafter.39 This latter plan was not implemented because the shutdown ended on January 25.

- All 9,342 staff of the Natural Resources Conservation Service (NRCS) was exempted by using carryover funding and mandatory funding authorized in the 2014 farm bill.40 Near the end of the shutdown, NRCS had begun preparations to furlough much of its agency beginning on February 3, 2019, after having retained 100% of the agency since the beginning of the shutdown.41 By beginning to furlough some employees, NRCS intended to conserve carryover balances and focus exempted staff on carrying out certain mandatory farm bill programs.42 This plan was not implemented because the shutdown ended on January 25.

- Most of USDA's Food and Nutrition Service (FNS) programs, whether mandatory or discretionary, rely on funding provided in appropriations acts. FNS program operations during a government shutdown vary based on the different programs' available resources, determined by factors such as contingency or carryover funds and terms of the expired appropriations acts, as well as USDA's decisionmaking. Beginning in late December 2018, FNS released program-specific memoranda to states and program operators describing the status of different nutrition assistance programs during the current funding lapse.43 SNAP benefits for January were issued as scheduled, and on January 8 USDA announced that the expired CR allowed for an early distribution of February benefits so long as benefits were issued on or before January 20.44

Among the related agencies that are funded in Agriculture appropriations:

- FDA initially retained 59% of its employees in excepted status (10,344 staff out of 17,397) based on a combination of factors including carryover funding, the need to safeguard human life, and the protection of property.45 For food safety inspection specifically, FDA excepted 135 employees for inspection of food facilities deemed to have the highest risk to public health. Inspections of other facilities were postponed.46

- CFTC excepted 9% of its employees (61 staff out of 673) to address risks that could pose a threat to the functioning of the stock market and commodity markets and that could affect the safety of human life or the protection of property.47

Suspended Activities

While a number of selected USDA functions may have continued during the shutdown, many others ceased operations. Examples of USDA functions that were not performed by furloughed employees included data collection and analysis that informs the commodity markets; development of regulations to implement the new farm bill that was enacted in December 2018; completing the Administration's "trade aid" payments; approving loan guarantees for commercial banks; processing and funding direct farm loans, rural development loans, and grant programs (rural housing, community facilities, rural water, rural business, and broadband); agricultural research programs and grants; and many international assistance programs.

FY2019 Consolidated Appropriations Act

On February 15, 2019, Congress passed and the President signed the FY2019 Consolidated Appropriations Act (P.L. 116-6, H.Rept. 116-9). The agriculture portion is Division B of the act.

The official discretionary total of the Agriculture appropriation is $23.03 billion, which is $35 million more (+0.2%) than was enacted for FY2018 on a comparable basis that excludes the CFTC from the FY2018 total (Table 2). On that same comparable basis, the enacted total is $6.3 billion more than the Administration requested (+38%), $55 million more than was proposed in the House-reported bill (+0.2%) but $194 million less than in the Senate-passed bill (-0.8%).

The appropriation also carries mandatory spending that totals nearly $129 billion, which is determined in other authorizing laws. Thus, the overall total of the FY2019 Agriculture appropriation is about $152 billion (Figure 2).

Table 3 summarizes appropriations amounts at the agency level. The primary changes that account for the overall $35 million discretionary increase in the FY2019 Consolidated Appropriations Act are the following:

- Increase in the four agricultural research agencies in Title I by $387 million (+13%) to $3.4 billion, mostly by increasing ARS building and facilities by $241 million, ARS salaries and expenses by $100 million, and NIFA by $64 million.

- Increase in base FDA appropriations in Title VI by $269 million (+10%) to $3.1 billion (excluding user fees) while not renewing extra funding in general provisions (Title VII) that was in the FY2018 appropriation for opioid enforcement and surveillance (-$94 million reduction to the budget score).

- Increase in WIC funding by a net $200 million, accounting for changes in rescissions of carryover balances and in the base appropriation. In FY2019 $500 million is rescinded from carryover balances, smaller than the rescission of $800 million in FY2018, for a comparative $300 million increase. The base WIC appropriation in Title IV is reduced by $100 million to $6.075 billion. Also, appropriations for nutrition program administration is increased by $11 million.

- Increase in APHIS by $29 million (+3%) to $1.014 billion.

- Maintain Food for Peace appropriations effectively at $1.716 billion by decreasing the base appropriation in Title V by $100 million and increasing extra funding in Title VII by $100 million. Also, salaries and expenses for the Foreign Agricultural Service are increased (+14 million).

- Maintain overall discretionary farm production and conservation funding in Title II (+0.5%, +$13 million) while shifting some administrative funding from program agencies into a new administrative business center.

- Decrease in the effective amount for rural development by essentially maintaining its base appropriation in Title III (+0.4%, +$11 million) and reducing extra appropriations that were made in the FY2018 general provisions (Title VII) for water and wastewater programs (-$425 million) and rural broadband (-$475 million).

- Decrease in the budgetary offset provided by other scorekeeping adjustments, mostly from smaller negative subsidies that are provided by farm and rural development loan programs. In FY2018, $481 million was offset. In FY2019, $404 million is offset (+$77 million increase in the budget score). Also, mandatory spending (+$16 million) is increased by further reducing the effect of appropriations act CHIMPS.

Mandatory spending carried in the Consolidated Appropriations Act increased by $6 billion over FY2018 to $129 billion and was higher than estimated for the House and Senate bills. The annual change was mostly due to higher costs for crop insurance (+$6.5 billion), greater reimbursement for the CCC (+1.1 billion), and lower outlays for child nutrition (-$1.1 billion) and SNAP (-$0.5 billion).

Table 3. Agriculture and Related Agencies Appropriations, by Agency, FY2016-FY2019

(budget authority in millions of dollars)

|

FY2016 |

FY2017 |

FY2018 |

FY2019 |

|||||||

|

Agency or Major Program |

Admin. Request |

House H.R. 5961 |

Senate |

Enacted P.L. 116-6 |

Change from FY2018 |

|||||

|

Title I. Agricultural Programs |

||||||||||

|

Departmental Administration |

373.2 |

403.9 |

396.0 |

369.8 |

387.8 |

389.5 |

390.4 |

-5.6 |

-1.4% |

|

|

Research, Education and Economics |

||||||||||

|

Agricultural Research Service |

1,355.9 |

1,269.8 |

1,343.4 |

1,019.0 |

1,395.9 |

1,301.0 |

1,684.5 |

+341.1 |

+25.4% |

|

|

National Institute of Food and Agriculture |

1,326.5 |

1,362.9 |

1,407.8 |

1,257.7 |

1,452.6 |

1,423.2 |

1,471.3 |

+63.5 |

+4.5% |

|

|

National Agricultural Statistics Service |

168.4 |

171.2 |

191.7 |

165.0 |

173.7 |

174.8 |

174.5 |

-17.2 |

-9.0% |

|

|

Economic Research Service |

85.4 |

86.8 |

86.8 |

45.0 |

86.8 |

86.8 |

86.8 |

+0.0 |

+0.0% |

|

|

Under Secretary |

0.9 |

0.9 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

+0.0 |

+0.0% |

|

|

Marketing and Regulatory Programs |

||||||||||

|

Animal and Plant Health Inspection Service |

897.6 |

949.4 |

985.1 |

742.0 |

1,001.5 |

1,003.7 |

1,014.3 |

+29.2 |

+3.0% |

|

|

Agricultural Marketing Servicea |

82.5 |

86.2 |

152.8 |

119.7 |

154.3 |

157.1 |

160.3 |

+7.5 |

+4.9% |

|

|

Section 32 (M) |

1,303.0 |

1,322.0 |

1,344.0 |

1,374.0 |

1,374.0 |

1,374.0 |

1,374.0 |

+30.0 |

+2.2% |

|

|

Grain Inspection, Packers, Stockyards Admin.a |

43.1 |

43.5 |

moved into Agricultural Marketing Servicea |

|||||||

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.8 |

0.9 |

0.9 |

0.9 |

+0.0 |

+0.0% |

|

|

Food Safety |

||||||||||

|

Food Safety and Inspection Service |

1,014.9 |

1,032.1 |

1,056.8 |

1,032.3 |

1,049.3 |

1,049.3 |

1,049.3 |

-7.5 |

-0.7% |

|

|

Under Secretary |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

+0.0 |

+0.0% |

|

|

Farm and Commodity Programsa |

||||||||||

|

Farm Service Agencyb |

1,595.1 |

1,624.0 |

moved to Title II: Farm Production and Conservationa |

|||||||

|

FSA Farm Loans: Loan Authorityc |

6,402.1 |

8,002.6 |

moved to Title II: Farm Production and Conservationa |

|||||||

|

Risk Management Agency Salaries and Exp. |

74.8 |

74.8 |

moved to Title II: Farm Production and Conservationa |

|||||||

|

Federal Crop Insurance Corporation (M) |

7,858.0 |

8,667.0 |

moved to Title II: Farm Production and Conservationa |

|||||||

|

Commodity Credit Corporation (M) |

6,871.1 |

21,290.7 |

moved to Title II: Farm Production and Conservationa |

|||||||

|

Under Secretary |

0.9 |

0.9 |

moved to Title II: Farm Production and Conservationa |

|||||||

|

Subtotal |

||||||||||

|

Discretionary |

7,020.3 |

7,107.7 |

5,622.8 |

4,752.9 |

5,704.5 |

5,587.8 |

6,033.9 |

+411.1 |

+7.3% |

|

|

Mandatory (M) |

16,032.6 |

31,280.2 |

1,344.0 |

1,374.0 |

1,374.0 |

1,374.0 |

1,374.0 |

+30.0 |

+2.2% |

|

|

Subtotal |

23,052.9 |

38,387.9 |

6,966.8 |

6,126.9 |

7,078.5 |

6,961.8 |

7,407.9 |

+441.1 |

+6.3% |

|

|

Title II. Farm Production and Conservationa |

|

|

|

|

|

|

|

|

|

|

|

Business Center |

— |

— |

1.0 |

196.4 |

115.4 |

1.0 |

216.4 |

+215.3 |

— |

|

|

Farm Service Agencyb |

moved from Title Ia |

1,625.2 |

1,294.2 |

1,518.8 |

1,622.7 |

1,494.2 |

-131.1 |

-8.1% |

||

|

FSA Farm Loans: Loan Authorityc |

moved from Title Ia |

8,005.6 |

7,617.7 |

7,987.7 |

8,017.7 |

7,987.7 |

-17.9 |

-0.2% |

||

|

Risk Management Agency Salaries and Exp. |

moved from Title Ia |

74.8 |

37.9 |

75.4 |

74.8 |

58.4 |

-16.5 |

-22.0% |

||

|

Federal Crop Insurance Corporation (M) |

moved from Title Ia |

8,913.0 |

8,687.0 |

8,687.0 |

8,687.0 |

15,410.6 |

+6,497.6 |

+72.9% |

||

|

Commodity Credit Corporation (M) |

moved from Title Ia |

14,284.8 |

15,410.0 |

15,410.0 |

15,410.0 |

15,410.0 |

+1,125.2 |

+7.9% |

||

|

Conservation Operations |

850.9 |

864.5 |

874.1 |

669.0 |

890.3 |

879.1 |

819.5 |

-54.6 |

-6.2% |

|

|

Watershed and Flood Prevention |

— |

150.0 |

150.0 |

— |

150.0 |

150.0 |

150.0 |

+0.0 |

+0.0% |

|

|

Watershed Rehabilitation Program |

12.0 |

12.0 |

10.0 |

— |

10.0 |

— |

10.0 |

+0.0 |

+0.0% |

|

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

+0.0 |

+0.0% |

|

|

Subtotal |

||||||||||

|

Discretionary |

863.8 |

1,027.4 |

2,735.6 |

2,197.9 |

2,760.3 |

2,728.0 |

2,748.8 |

+13.2 |

+0.5% |

|

|

Mandatory (M) |

moved from Title Ia |

23,198.3 |

24,097.5 |

24,097.5 |

24,097.5 |

30,821.1 |

+7,622.8 |

+32.9% |

||

|

Subtotal |

moved from Title Ia |

25,933.9 |

26,295.4 |

26,857.8 |

26,825.5 |

33,569.9 |

+7,636.0 |

+29.4% |

||

|

Title III. Rural Development |

|

|

|

|

|

|

|

|

|

|

|

Salaries and Expenses (including transfers)d |

682.9 |

675.8 |

680.8 |

585.9 |

686.8 |

682.8 |

686.8 |

+6.0 |

+0.9% |

|

|

Rural Housing Service |

1,616.4 |

1,654.9 |

1,582.4 |

1,351.4 |

1,582.5 |

1,585.2 |

1,606.0 |

+23.6 |

+1.5% |

|

|

RHS Loan Authorityc |

27,496.8 |

28,083.4 |

28,390.1 |

27,760.0 |

28,345.5 |

28,590.1 |

28,293.8 |

-96.4 |

-0.3% |

|

|

Rural Business-Cooperative Servicee |

90.5 |

97.7 |

109.5 |

0.0 |

99.5 |

104.2 |

98.6 |

-10.9 |

-10.0% |

|

|

RBCS Loan Authorityc |

979.3 |

988.4 |

991.2 |

0.0 |

1,027.5 |

991.2 |

1,026.4 |

+35.2 |

+3.5% |

|

|

Rural Utilities Service |

559.3 |

639.9 |

628.1f |

85.2 |

709.6f |

628.7f |

620.2f |

-7.9 |

-1.3% |

|

|

RUS Loan Authorityc |

8,210.6 |

8,217.0 |

8,219.9 |

7,413.1 |

8,419.9 |

8,219.9 |

8,419.9 |

+200.0 |

+2.4% |

|

|

Under Secretary |

0.9 |

0.9 |

moved to Departmental Administration as an Assistant to the Secretarya |

|||||||

|

Subtotal, Discretionary |

2,950.0 |

3,069.2 |

3,000.9f |

2,022.5 |

3,078.5f |

3,000.9f |

3,011.7 |

+10.8 |

+0.4% |

|

|

Subtotal, RD Loan Authorityc |

36,686.7 |

37,288.9 |

37,601.2 |

35,173.1 |

37,792.9 |

37,801.2 |

37,740.0 |

+138.8 |

+0.4% |

|

|

Title IV. Domestic Food Programs |

|

|

|

|||||||

|

Child Nutrition Programs (M) |

22,149.7 |

22,794.0 |

24,254.1 |

23,146.9 |

23,183.5 |

23,184.0 |

23,140.8 |

-1,113.4 |

-4.6% |

|

|

WIC Program |

6,350.0 |

6,350.0 |

6,175.0 |

5,750.0 |

6,000.0 |

6,150.0 |

6,075.0 |

-100.0 |

-1.6% |

|

|

SNAP, Food and Nutrition Act Programs (M) |

80,849.4 |

78,480.7 |

74,013.5 |

73,218.3 |

73,219.3 |

73,219.3 |

73,476.9 |

-536.6 |

-0.7% |

|

|

Commodity Assistance Programs |

296.2 |

315.1 |

322.1 |

55.5 |

306.9 |

322.1 |

322.1 |

+0.0 |

+0.0% |

|

|

Nutrition Programs Administration |

150.8 |

170.7 |

153.8 |

160.8 |

162.8 |

164.7 |

164.7 |

+10.8 |

+7.1% |

|

|

Under Secretary |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

+0.0 |

+0.0% |

|

|

Subtotal |

||||||||||

|

Discretionary |

6,838.9 |

6,884.7 |

6,709.8 |

5,990.1 |

6,528.5 |

6,696.1 |

6,620.3 |

-89.5 |

-1.3% |

|

|

Mandatory (M) |

102,958.1 |

101,226.7 |

98,209.6 |

96,342.3 |

96,344.8 |

96,344.8 |

96,560.0 |

-1,649.6 |

-1.7% |

|

|

Subtotal |

109,797.0 |

108,111.3 |

104,919.4 |

102,332.3 |

102,873.3 |

103,040.9 |

103,180.3 |

-1,739.1 |

-1.7% |

|

|

Title V. Foreign Assistance |

|

|

|

|

|

|

|

|

|

|

|

Foreign Agricultural Service |

191.6 |

196.6 |

199.7 |

193.1 |

204.1 |

212.2 |

213.9 |

+14.2 |

+7.1% |

|

|

Food for Peace Title II, and admin. expenses |

1,468.5f |

1,466.1f |

1,600.1f |

0.1 |

1,500.1 |

1,716.1 |

1,500.1f |

-100.0 |

-6.2% |

|

|

McGovern-Dole Food for Education |

201.6 |

201.6 |

207.6 |

0.0 |

207.6 |

210.3 |

210.3 |

+2.6 |

+1.3% |

|

|

CCC Export Loan Salaries |

6.7 |

8.5 |

8.8 |

7.1 |

9.2 |

8.8 |

8.8 |

+0.0 |

+0.0% |

|

|

Office of Codex Alimentarius |

— |

— |

3.8 |

3.8 |

3.8 |

4.0 |

4.0 |

+0.2 |

+4.7% |

|

|

Under Secretary |

— |

— |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

+0.0 |

+0.0% |

|

|

Subtotal |

1,868.5 |

1,872.9 |

2,021.0 |

205.0 |

1,925.8 |

2,152.3 |

1,938.0 |

-83.0 |

-4.1% |

|

|

Title VI. Related Agencies |

|

|

|

|||||||

|

Food and Drug Administration |

2,729.6 |

2,771.2 |

2,811.9 |

3,183.7 |

3,119.6 |

2,970.9 |

3,080.5 |

+268.6 |

+9.6% |

|

|

Commodity Futures Trading Commissiong |

250.0 |

[250.0]h |

249.0 |

281.5 |

255.0 |

[281.5]h |

[268.0]h |

+19.0 |

+7.6% |

|

|

Subtotal |

2,979.6 |

[3,021.2] |

3,060.9 |

3,465.2 |

3,374.6 |

[3,252.4]h |

[3,348.5] |

+287.6 |

+9.4% |

|

|

Title VII. General Provisions |

|

|

|

|||||||

|

Reductions in Mandatory Programsi |

||||||||||

|

a. Environmental Quality Incentives Program |

-209.0 |

-179.0 |

— |

-136.3 |

— |

— |

— |

— |

— |

|

|

b. Watershed Rehabilitation Program |

-68.0 |

-54.0 |

— |

-46.2 |

— |

— |

— |

— |

— |

|

|

c. Fresh Fruit and Vegetable Program |

-125.0 |

-125.0 |

— |

-125.0 |

— |

— |

— |

— |

— |

|

|

d. Biorefinery Assistance Program |

-19.0 |

-20.0 |

— |

— |

— |

— |

— |

— |

— |

|

|

e. Biomass Crop Assistance Program |

-20.0 |

-20.0 |

-21.0 |

— |

— |

— |

— |

+21.0 |

-100.0% |

|

|

f. Cushion of Credit (Rural Development)e |

-179.0 |

-132.0 |

— |

-225.0 |

-50.0 |

— |

— |

— |

— |

|

|

g. Section 32 |

-216.0 |

-231.0 |

— |

-342.0 |

— |

— |

— |

— |

— |

|

|

h. Other CHIMPS and mandatory rescissions |

+5.0 |

+17.0 |

+20.0 |

-36.4 |

+35.0 |

+5.0 |

+15.0 |

-5.0 |

-25.0% |

|

|

Subtotal, CHIMPS |

-831.0 |

-744.0 |

-1.0 |

-910.8 |

-15.0 |

+5.0 |

+15.0 |

+16.0 |

-1600.0% |

|

|

Rescissions (discretionary) |

-34.0 |

-854.0 |

-800.0 |

-287.0 |

-300.0 |

-400.0 |

-505.0 |

+295.0 |

-36.9% |

|

|

Other appropriations |

||||||||||

|

a. Disaster/emergency programs |

273.0 |

234.8 |

— |

— |

— |

— |

— |

— |

— |

|

|

b. Water and Waste Water |

— |

— |

+500.0 |

— |

— |

+400.0 |

+75.0 |

-425.0 |

-85.0% |

|

|

c. Broadband pilot |

— |

— |

+600.0 |

— |

+550.0 |

+425.0 |

+125.0 |

-475.0 |

-79.2% |

|

|

d. Opioid Enforcement and Surveillance |

— |

— |

+94.0 |

— |

— |

— |

— |

-94.0 |

-100.0% |

|

|

e. Food for Peace |

250.0 |

134.0 |

+116.0 |

— |

— |

— |

+216.0 |

+100.0 |

+86.2% |

|

|

f. Other appropriations |

33.1 |

103.4 |

68.1 |

— |

+29.5 |

+64.5 |

77.5 |

+9.4 |

+13.8% |

|

|

Subtotal, Other appropriations |

556.1 |

472.2 |

1,378.1 |

— |

579.5 |

889.5 |

493.5 |

-884.6 |

-64.2% |

|

|

Total, General Provisions |

-308.9 |

-1,125.8 |

577.1 |

-1,197.8 |

264.5 |

494.5 |

3.5 |

-573.6 |

-99.4% |

|

|

Scorekeeping Adjustmentsj |

|

|

|

|

|

|

|

|

|

|

|

Disaster declaration in this bill |

-130.0 |

-206.1 |

— |

— |

— |

— |

— |

— |

— |

|

|

Other scorekeeping adjustments |

-332.0 |

-524.0 |

-481.0 |

-409.0 |

-404.0 |

-404.0 |

-404.0 |

+77.0 |

-16.0% |

|

|

Subtotal, Scorekeeping adjustments |

-462.0 |

-730.1 |

-481.0 |

-409.0 |

-404.0 |

-404.0 |

-404.0 |

+77.0 |

-16.0% |

|

|

Totals |

|

|

|

|

|

|

|

|

|

|

|

Discretionary: Senate basis w/o CFTC |

[21,500.0] |

20,877.0 |

[22,998.0] |

16,745.2 |

[22,977.8] |

23,226.5 |

23,032.7 |

+34.7 |

+0.2% |

|

|

Discretionary: House basis w/ CFTC |

21,750.0 |

[21,127.0] |

23,247.0 |

17,026.7 |

23,232.8 |

[23,508.0] |

[23,300.7] |

+53.7 |

+0.2% |

|

|

Mandatory (M) |

118,990.7 |

132,506.9 |

122,752.0 |

121,813.8 |

121,816.3 |

121,816.3 |

128,755.1 |

+6,003.1 |

+4.9% |

|

|

Total: Senate basis w/o CFTC |

[140,490.7] |

153,383.9 |

[145,750.0] |

138,559.0 |

[144,794.0] |

145,042.8 |

151,787.8 |

+6,037.8 |

+4.1% |

|

|

Total: House basis w/ CFTC |

140,740.7 |

[153,633.9] |

145,999.0 |

138,840.5 |

145,049.0 |

[145,324] |

[152,055.8] |

+6,056.8 |

+4.1% |

|

Source: CRS, using appropriations text and report tables, and unpublished CBO tables.

Notes: Amounts are nominal discretionary budget authority in millions of dollars unless labeled otherwise. (M) indicates that the account is mandatory authority (or primarily mandatory authority). Excludes amounts in supplemental appropriations acts. Bracketed amounts are not in the Agriculture appropriations totals due to differing House-Senate jurisdiction for CFTC but are shown for comparison.

a. Row headings reflect recent USDA reorganization. The Farm Service Agency and Risk Management Agency were moved from Title I to Title II, as was the Commodity Credit Corporation and Federal Crop Insurance Corporation in mandatory spending. Grain Inspection, Packers, and Stockyards Administration was moved into the Agricultural Marketing Service.

b. Includes regular FSA salaries and expenses, plus transfers for farm loan program salaries and administrative expenses. Also includes farm loan program loan subsidy, State Mediation Grants, Dairy Indemnity Program (mandatory funding), and Grassroots Source Water Protection Program. Does not include appropriations to the Foreign Agricultural Service for export loans and P.L. 480 administration that are transferred to FSA.

c. Loan authority is the amount of loans that can be made or guaranteed with a loan subsidy. This amount is not added in the budget authority subtotals or totals.

d. Includes Rural Development salaries and expenses and transfers from the three rural development agencies for salaries and expenses. Amounts for the agencies thus reflect program funds for loans and grants.

e. Amounts for the Rural Business-Cooperative Service (RBCS) are before the rescission in the Cushion of Credit account, unlike in Appropriations Committee tables. The rescission is included with the CHIMPS as classified by CBO, which allows the RBCS subtotal to remain positive.

f. Excludes a portion of the other appropriations that are provided separately in General Provisions.

g. Jurisdiction for CFTC is in the House Agriculture Appropriations Subcommittee and the Senate Financial Services Appropriations Subcommittee. After FY2008, CFTC is carried in the enacted Agriculture appropriations in even-numbered fiscal years. It is always carried in House Agriculture subcommittee markup but never in Senate Agriculture subcommittee markup. Bracketed amounts are not in the Agriculture appropriations totals due to differing House-Senate jurisdiction for CFTC but are shown for comparison.

h. The amount for CFTC is in the division for Financial Services and General Government appropriations.

i. Includes reductions (limitations and rescissions) to mandatory programs that may also be known as CHIMPS.

j. "Scorekeeping adjustments" are not necessarily appropriated items and may not be shown in appropriations committee tables but are part of the official CBO score (accounting) of the bill. They predominantly include "negative subsidies" in loan program accounts and adjustments for disaster designations in the bill.

Policy-Related Provisions

In addition to setting budgetary amounts, the Agriculture appropriations bill has also been a vehicle for policy-related provisions that direct how the executive branch should carry out the appropriation. These provisions may have the force of law if they are included in the text of the appropriation, usually in the General Provisions, but their effect is generally limited to the current fiscal year. In some instances, the provisions may amend the U.S. Code and have long-standing effects.

The explanatory statement in the conference report that accompanies the final appropriation (H.Rept. 116-9), and the House and Senate report language that accompanies the committee-reported bills (H.Rept. 115-706, S.Rept. 115-259), may also provide additional policy instructions. These documents do not have the force of law but often explain congressional intent, which the agencies are expected to follow. Indeed, the committee and conference reports may need to be read together to capture all of the congressional intent for the fiscal year:

Congressional Directives. The explanatory statement is silent on provisions that were in both the House Report (H.Rept. 115-706) and Senate Report (S.Rept. 115-259) that remain unchanged by this conference agreement, except as noted in this explanatory statement. The conference agreement restates that executive branch wishes cannot substitute for Congress's own statements as to the best evidence of congressional intentions, which are the official reports of the Congress.... The House and Senate report language that is not changed by the explanatory statement is approved and indicates congressional intentions. The explanatory statement, while repeating some report language for emphasis, does not intend to negate the language referred to above unless expressly provided herein.48

Table 4 compares some of the major policy provisions that have been identified in the General Provisions (Title VII) of the FY2019 Agriculture appropriations bills and act. It excludes policies that may have been addressed in the report language or explanatory statement. Many of these provisions have been included in past years' appropriations laws.

|

House-reported H.R. 5961 |

Senate-passed H.R. 6147, Division C |

Enacted P.L. 116-6, Division B |

|

Disaster payments. In general, prohibits the use of Section 32, clause (3), to reestablish farmers' purchasing power by making payments to farmers. However, allows an exception to use up to $350 million of carryover for this purpose, with congressional notification. (§715) |

Same as House provision. (§715) |

Same as House provision. (§714) |

|

Rural definition. Defines rural for the water and waste disposal guaranteed loan program as a city, town, or unincorporated area with no more than 20,000 people. (§728) |

No comparable provision. |

No comparable provision. |

|

Directs that eligibility for rural development programs shall not include incarcerated prison populations. (§744) |

Same as House provision. (§744) |

Same as House provision. (§721) |

|

No comparable provision. |

REAP Zones. Sets aside funding for Rural Economic Area Partnership (REAP) Zones for several programs, in amounts that were most recently obligated in REAP Zones from such programs. (§743) |

Same as Senate provision. (§745) |

|

Persistent poverty counties. Requires that at least 10% of the funds in certain rural development programs shall be allocated to persistent poverty counties, defined as any county that has had 20% or more of its population living in poverty over the past 30 years. (§750) |

No comparable provision. |

Same as House provision. (§752) |

|

Income verification. Provides USDA access to Social Security and Internal Revenue Service data to verify the income of individuals participating in certain rural housing programs. (§747) |

Same as House provision. (§748) |

No comparable provision. |

|

American steel. Prohibits funding for the rural water, wastewater, waste disposal, and solid waste management projects unless all of the iron and steel products are produced in the United States. (§743) |

Same as House provision. (§742) |

Same as House provision. (§744) |

|

No comparable provision. |

Agriculture risk coverage (ARC) pilot. Directs USDA to conduct a pilot program to make payments for the ARC program that addresses disparities in the calculation of yields among counties. (§747) |

Same as Senate provision. (§748) |

|

No comparable provision. |

Industrial hemp. Prohibits funding in contravention of the 2014 farm bill provision for research on industrial hemp or the transportation, processing, sale, or use of industrial hemp or seeds that are grown in accordance with the farm bill provision. (§729) |

Same as Senate provision. (§728) |

|

No comparable provision. |

National Bio- and Agro-defense Facility (NBAF). Authorizes ARS and APHIS to appoint up to 50 employees annually in FY2019-2025 for NBAF at a rate of pay that exceeds the General Schedule. (§738) |

Same as Senate provision but with further limitation for the higher rate of pay. (§738) |

|

No comparable provision. |

Horse slaughter. Prohibits USDA from conducting horse slaughter inspection. (§758) |

Same as Senate provision. (§750) |

|

Animal Welfare Act. Prohibits funding to issue or renew licenses to class B dealers who sell dogs and cats for use in research, experiments, teaching, or testing. (§741) |

No comparable provision. |

Same as House provision. (§742) |

|

Cell-cultured meat. Directs USDA to regulate products that are made from cells of amenable species of livestock that are grown under controlled conditions for human food to prevent adulteration and misbranding. Applies to FY2018 and thereafter. (§736) |

No comparable provision. |

No comparable provision. |

|

Poultry from China. Prohibits funds to buy raw or processed poultry products from China for the National School Lunch Program, School Breakfast Program, Child and Adult Care Food Program, and Summer Food Service Program. (§748) Prohibits funding to finalize the proposed rule, "Eligibility of the People's Republic of China to Export to the United States Poultry Products," until USDA verifies certain conditions. (§751) |

No comparable provisions. |

Same as House provisions. (§§749, 753) |

|

Grain Inspection. Restores exceptions that were revoked after reauthorization of the U.S. Grain Standards Act in 2015. (§756) |

Same as House provision. (§759) |

Same as House provision. (§759) |

|

School meal prices. Exempts certain school food authorities (those without a negative balance in their school food service accounts as of December 31, 2018) from paid meal equity requirements in school year 2019-2020. (§757) |

No comparable provision. |

Same as House provision. (§760) |

|

Vegetables in school breakfast. Prohibits funding to implement or enforce the portion of a School Breakfast Program regulation that limits substituting fruits with certain vegetables. (§767) |

No comparable provision. |

Same as House provision. (§768) |

|

No comparable provision. |

No comparable provision. |

Entitlement purchases. Changes a date related to entitlement purchases for the child nutrition programs to ensure that trade aid purchases do not count toward the required level for commodity assistance. (§775) |

|

SNAP retailer standards. Prohibits funding to administer the "variety requirements" in the final rule "Enhancing Retailer Standards in SNAP" until the Secretary amends the definition of variety to increase the number of items that qualify as acceptable varieties in each staple food category. (§727) |

Same as House provision. (§728) |

Same as House provision. (§727) |

|

SNAP disclosure. Exempts from Freedom of Information Act disclosure SNAP transaction data that contain information specific to a store, store location, person, or other entity. (§768) |

No comparable provision. |

No comparable provision. |

|

Human embryos. Prohibits FDA from using funds to accept any investigational new drug application for "research in which a human embryo is intentionally created or modified to include a heritable genetic modification." (§732) |

Same as House provision. (§733) |

Same as House provision. (§731) |

|

Partially hydrogenated oils. Directs FDA that no food containing partially hydrogenated oils shall be considered to be adulterated on that basis so long as it enters interstate commerce before June 18, 2018. (§740) |

Similar to House provision. (§736) |

Similar to House provision with different reference to effective dates. (§737) |

|

Sodium. Prevents FDA from developing regulations or issuing final guidance for population-wide sodium reduction actions until a dietary reference intake report is completed. (§752) |

Same as House provision. (§750) |

Same as House provision. (§755) |

|

Grapes for wine. Prohibits FDA funds to enforce the final rule "Standards for the Growing, Harvesting, Packing, and Holding of Produce for Human Consumption" with respect to grape varietals used solely for wine. (§755) |

Same as House provision. (§753) |

Same as House provision. (§758) |

|

Dietary guidelines. Directs USDA to submit a report to Congress within 180 days about the process used to establish the 2020-2025 Dietary Guidelines for Americans, including the recommendations from the National Academies of Science report, "Redesigning the Process for Establishing the Dietary Guidelines for Americans." (§763) |

No comparable provision. |

Same as House provision. (§766) |

|

Added sugars. Prohibits funds to administer the final rule "Food Labeling: Revision of the Nutrition and Supplement Facts Labels" to the extent that it requires added sugars labeling for single-ingredient foods to which sugars or sweeteners are not added (e.g., honey or maple syrup). (§764) |

Similar to House provision. (§768) |

Same as House provision. (§767) |

|

Genetically engineered salmon. Directs that disclosure requirements for genetically engineered salmon or finfish follow the National Bioengineered Food Disclosure Standard and subsequent USDA regulations. (§766) |