Budget Issues That Shaped the 2018 Farm Bill

The farm bill is an omnibus, multiyear law that governs an array of agricultural and food programs. The farm bill has typically undergone reauthorization about every five years. The current farm bill—the Agriculture Improvement Act of 2018 (P.L. 115-334), often called the “2018 farm bill”—was enacted in December 2018 and expires in 2023. Budget for the 2018 Farm Bill (dollars in millions, FY2019-FY2023, mandatory outlays) Farm bill titlesApril 2018 baselineScore of P.L. 115-334Projected outlays at enactment

Commodities 31,340 +101 31,440

Conservation 28,715 +555 29,270

Trade 1,809 +235 2,044

Nutrition 325,922 +98 326,020

Credit -2,205 +0 -2,205

Rural Development 98 -530 -432

Research 329 +365 694

Forestry 5 +0 5

Energy 362 +109 471

Horticulture 772 +250 1,022

Crop Insurance 38,057 -47 38,010

Miscellaneous 1,259 +685 1,944

Subtotal 426,462 +1,820 428,282

Increase revenue

+35 35

Total 426,462 +1,785 428,247

Source: CRS, compiled using the CBO Baseline by Title (unpublished; April 2018), and the CBO cost estimate of the conference agreement for H.R. 2 (December 11, 2018).

The farm bill provides an opportunity for Congress to choose how much support, if any, to provide for various agriculture and nutrition programs and how to allocate it among competing constituencies. Under congressional budgeting rules, many programs are assumed to continue beyond the end of a farm bill. From a budgetary perspective, this provides a baseline for comparing future spending reauthorizations, reallocations to other programs, and reductions to projected spending. Since 2000, congressional goals for the farm bill’s budget have varied: The 2002 farm bill increased spending over 10 years, the 2008 farm bill was essentially budget neutral, the 2014 farm bill reduced spending, and the 2018 farm bill is budget neutral, according to the Congressional Budget Office (CBO). The farm bill authorizes programs in two spending categories: mandatory spending and discretionary spending. Mandatory spending is not only authorized but also actually provided via budget enforcement rules. Discretionary spending may be authorized in a farm bill but is not actually provided until budget decisions are made in a future annual appropriations act. The CBO baseline is a projection at a particular point in time of future federal spending on mandatory programs under current law. When a new bill is proposed that would affect mandatory spending, the cost impact (score) is measured in relation to the baseline. Changes that increase spending relative to the baseline have a positive score; those that decrease spending relative to the baseline have a negative score. Federal budget rules such as “PayGo” may require budgetary offsets to balance new spending so that there is no increase in the federal deficit. The April 2018 CBO baseline was the official benchmark to measure changes made by the 2018 farm bill. The five-year baseline was $426 billion over FY2019-FY2023 (what the 2014 farm bill would have spent had it been continued). The budgetary impact of the 2018 farm bill is measured relative to that baseline. Among its impacts are these four points: The enacted farm bill increases net outlays in the first five years by $1.8 billion, which is offset by the same amount of net reductions in outlays during the second five years. Therefore, over 10 years, the net impact is budget neutral. Eight titles in the enacted law have increased outlays over the five-year period, including Farm Commodities, Conservation, Trade, Nutrition, Research, Energy, Horticulture, and Miscellaneous. Two of those titles—Conservation and Nutrition—have reductions in the second five years of the budget window that make them budget neutral over 10 years. Most of the budget reductions at the title level that provide offsets for the increases above, especially in the 10-year budget window, are from changes in the rural development title. The 2018 farm bill provides continuing funding and, in some cases, permanent baseline, for 23 of the 39 so-called programs without baseline from the 2014 farm bill. Projected outlays for the 2018 farm bill at enactment are $428 billion over the FY2019-FY2023 five-year life of the act. The Nutrition title and its largest program, the Supplemental Nutrition Assistance Program (SNAP), account for $326 billion (76%) of those projected outlays. The remaining 24%, $102 billion, is for agricultural programs, mostly in crop insurance (8.9%), farm commodity programs (7.3%), and conservation (6.8%). Other titles of the farm bill account for 1% of the mandatory spending, some of which are funded primarily with discretionary spending. Historical trends in farm bill spending show increased SNAP outlays after the 2009 recession, increased crop insurance outlays based on insurable coverage, farm commodity programs outlays that vary inversely with markets, and steadily increasing conservation program outlays that have leveled off in recent years. Actual and Projected Spending by Major Farm Bill Mandatory Programs / Source: CRS. Notes: Darker shades of each color are actual outlays based on USDA data. Lighter shades are CBO data, including estimates for FY2017-FY2018 and CRS analysis of CBO data for projections at enactment of the 2018 farm bill.

Budget Issues That Shaped the 2018 Farm Bill

Jump to Main Text of Report

Contents

- Farm Bills from a Budget Perspective

- Recent Historical Perspective

- Types of Spending Authorizations

- Summary of Projected Outlays in the 2018 Farm Bill

- Importance of Baseline to the Farm Bill

- Development of the Baseline

- CBO Baseline: April 2018

- Scores of the 2018 Farm Bill

- Summary of Title-Level Scores

- Net Increases in Five-Year Outlays Are Followed by Net Decreases

- Section-by-Section Scores for Some Titles Exceed Their Net Scores

- Outcome for the Programs Without Baseline

- Projected Outlays at Enactment

Figures

- Figure 1. Projected Outlays in the Agriculture Improvement Act of 2018, by Title

- Figure 2. Projected Agriculture Outlays in the Agriculture Improvement Act of 2018

- Figure 3. CBO Scores of the House, Senate, and Enacted 2018 Farm Bills, by Title

- Figure 4. CBO Score of Enacted 2018 Farm Bill, by Period and Title

- Figure 5. CBO Score of House-Passed H.R. 2, by Period and Title

- Figure 6. CBO Score of the Senate-Passed Amendment to H.R. 2, by Period and Title

- Figure 7. CBO Score of Enacted 2018 Farm Bill, by Section and Title

- Figure 8. CBO Score of House-Passed H.R. 2, by Section and Title

- Figure 9. CBO Score of Senate-Passed Amendment to H.R. 2, by Section and Title

- Figure 10. Actual and Projected Spending by Major Farm Bill Mandatory Programs

Tables

- Table 1. Budget for the 2018 Farm Bill: Baseline, Scores, and Projected Outlays

- Table 2. CBO Baseline to Develop the 2018 Farm Bill, by Title and Program

- Table 3. CBO Score of the Agriculture Improvement Act of 2018, as Enacted, by Section

- Table 4. Projected Outlays Under the Agriculture Improvement Act of 2018, at Enactment, by Title and Program

- Table A-1. CBO Score of House-Passed H.R. 2, by Section

- Table A-2. CBO Score of the Senate-Passed Amendment to H.R. 2, by Section

- Table B-1. Farm Bill Authorizations That Are Subject to Appropriation

Summary

The farm bill is an omnibus, multiyear law that governs an array of agricultural and food programs. The farm bill has typically undergone reauthorization about every five years. The current farm bill—the Agriculture Improvement Act of 2018 (P.L. 115-334), often called the "2018 farm bill"—was enacted in December 2018 and expires in 2023.

|

Budget for the 2018 Farm Bill (dollars in millions, FY2019-FY2023, mandatory outlays)

Source: CRS, compiled using the CBO Baseline by Title (unpublished; April 2018), and the CBO cost estimate of the conference agreement for H.R. 2 (December 11, 2018). |

The farm bill provides an opportunity for Congress to choose how much support, if any, to provide for various agriculture and nutrition programs and how to allocate it among competing constituencies. Under congressional budgeting rules, many programs are assumed to continue beyond the end of a farm bill. From a budgetary perspective, this provides a baseline for comparing future spending reauthorizations, reallocations to other programs, and reductions to projected spending. Since 2000, congressional goals for the farm bill's budget have varied: The 2002 farm bill increased spending over 10 years, the 2008 farm bill was essentially budget neutral, the 2014 farm bill reduced spending, and the 2018 farm bill is budget neutral, according to the Congressional Budget Office (CBO).

The farm bill authorizes programs in two spending categories: mandatory spending and discretionary spending. Mandatory spending is not only authorized but also actually provided via budget enforcement rules. Discretionary spending may be authorized in a farm bill but is not actually provided until budget decisions are made in a future annual appropriations act.

The CBO baseline is a projection at a particular point in time of future federal spending on mandatory programs under current law. When a new bill is proposed that would affect mandatory spending, the cost impact (score) is measured in relation to the baseline. Changes that increase spending relative to the baseline have a positive score; those that decrease spending relative to the baseline have a negative score. Federal budget rules such as "PayGo" may require budgetary offsets to balance new spending so that there is no increase in the federal deficit.

The April 2018 CBO baseline was the official benchmark to measure changes made by the 2018 farm bill. The five-year baseline was $426 billion over FY2019-FY2023 (what the 2014 farm bill would have spent had it been continued). The budgetary impact of the 2018 farm bill is measured relative to that baseline. Among its impacts are these four points:

- 1. The enacted farm bill increases net outlays in the first five years by $1.8 billion, which is offset by the same amount of net reductions in outlays during the second five years. Therefore, over 10 years, the net impact is budget neutral.

- 2. Eight titles in the enacted law have increased outlays over the five-year period, including Farm Commodities, Conservation, Trade, Nutrition, Research, Energy, Horticulture, and Miscellaneous. Two of those titles—Conservation and Nutrition—have reductions in the second five years of the budget window that make them budget neutral over 10 years.

- 3. Most of the budget reductions at the title level that provide offsets for the increases above, especially in the 10-year budget window, are from changes in the rural development title.

- 4. The 2018 farm bill provides continuing funding and, in some cases, permanent baseline, for 23 of the 39 so-called programs without baseline from the 2014 farm bill.

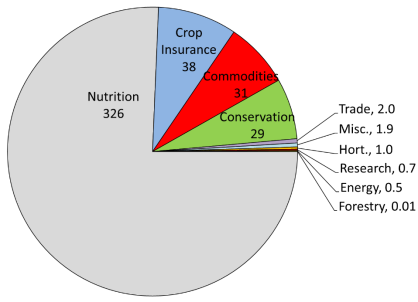

Projected outlays for the 2018 farm bill at enactment are $428 billion over the FY2019-FY2023 five-year life of the act. The Nutrition title and its largest program, the Supplemental Nutrition Assistance Program (SNAP), account for $326 billion (76%) of those projected outlays. The remaining 24%, $102 billion, is for agricultural programs, mostly in crop insurance (8.9%), farm commodity programs (7.3%), and conservation (6.8%). Other titles of the farm bill account for 1% of the mandatory spending, some of which are funded primarily with discretionary spending.

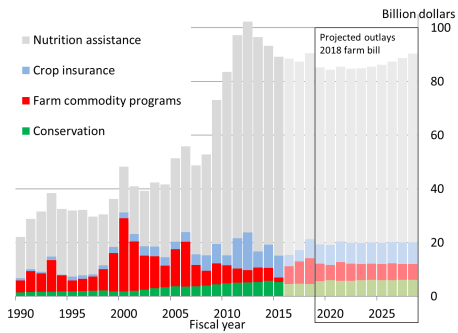

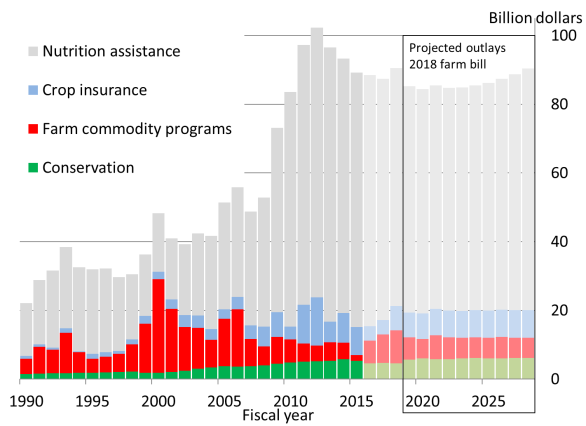

Historical trends in farm bill spending show increased SNAP outlays after the 2009 recession, increased crop insurance outlays based on insurable coverage, farm commodity programs outlays that vary inversely with markets, and steadily increasing conservation program outlays that have leveled off in recent years.

|

Actual and Projected Spending by Major Farm Bill Mandatory Programs |

|

|

Source: CRS. Notes: Darker shades of each color are actual outlays based on USDA data. Lighter shades are CBO data, including estimates for FY2017-FY2018 and CRS analysis of CBO data for projections at enactment of the 2018 farm bill. |

The farm bill is an omnibus, multiyear law that governs an array of agricultural and food programs. It provides an opportunity for Congress to choose how much support to provide for agriculture and nutrition and how to allocate it among competing constituencies. The farm bill has typically undergone reauthorization about every five years. The current farm bill—the Agriculture Improvement Act of 2018 (P.L. 115-334, H.R. 2), often called the "2018 farm bill"—was enacted in December 2018 and expires in 2023.1

From its beginning in the 1930s, farm bills have focused primarily on farm commodity programs to support a handful of staple commodities—corn, soybeans, wheat, cotton, rice, dairy, and sugar. In recent decades, farm bills have expanded in scope to include a Nutrition title since 1973 and since then Conservation, Horticulture, Bioenergy, Credit, Research, and Rural Development titles.2

Budget matters increasingly influence the development of the farm bill. While other reports discuss policy issues,3 this report focuses on the budgetary effects across the whole farm bill.

Farm Bills from a Budget Perspective

One way to compare the activities covered by a farm bill is by the allocation of federal spending and, more specifically, by how much is spent in total and how a new law changes allocations or policy. Congressional Budget Office (CBO) estimates are the official measures when bills are considered and are grounded in long-standing budget laws and rules.4

Recent Historical Perspective

Recent farm bills have faced various budget situations, including spending more under a budget surplus, cutting spending for deficit reduction, and remaining budget neutral. For example

- The 2002 farm bill (the Farm Security and Rural Investment Act of 2002, P.L. 107-171) was enacted under a budget surplus that allowed it to make changes that were projected to increase spending by $73 billion, or 22%, over a 10-year budget window—more than half of which was for the farm commodity programs.5

- The 2008 farm bill (the Food, Conservation, and Energy Act of 2008, P.L. 110-246) was officially budget neutral, though it included $10 billion of offsets over 10 years from tax-related and other provisions that allowed it to increase spending on the Nutrition, Conservation, and Disaster titles.6

- The 2014 farm bill (the Agricultural Act of 2014, P.L. 113-79) was enacted under deficit reduction and budget sequestration that influenced its legislative development. It made changes that projected a net reduction of $17 billion, or 1.7%, over 10 years ($23 billion including sequestration).7

- The 2018 farm bill (the Agriculture Improvement Act of 2018, P.L. 115-334) was held to a budget-neutral position over its 10-year budget window. Some budget amounts were reallocated across programs within issue areas and across titles of the farm bill, as discussed throughout this report.

Types of Spending Authorizations

Generally, farm bills authorize spending in two categories: mandatory and discretionary. From a budgetary perspective, many of the larger programs are assumed to continue beyond the end of a farm bill, even though their authorizations to operate may expire. That projection for mandatory programs, as explained below, provides funding to reauthorize programs, reallocate funding to other programs, or take offsets for deficit reduction. For other programs, funding must come by other means. This includes new programs, those without baseline, or discretionary programs.

|

Types of Spending Authorized in the Farm Bill Mandatory spending. A farm bill authorizes outlays and pays for them with multiyear budget estimates when the law is enacted. Budget enforcement is through "baseline" projections under current law, "scores" of the effect of proposed bills, and "PayGo" budget rules that may prevent deficit increases. (See CRS Report R44763, Present Trends and the Evolution of Mandatory Spending.) Discretionary authorizations. A farm bill establishes parameters for discretionary programs and authorizes them to receive funding in subsequent appropriations acts but does not provide or assure actual funding. Budget enforcement is through future appropriations and budget resolutions. (See CRS Report R42388, The Congressional Appropriations Process: An Introduction.) |

The Supplemental Nutrition Assistance Program (SNAP) and crop insurance have their own mandatory spending sources, but most other mandatory outlays are paid through the U.S. Department of Agriculture's (USDA) Commodity Credit Corporation (CCC).8

Discretionary spending is authorized throughout the farm bill, including most rural development, credit, and research programs, among others. Some smaller research, bioenergy, and rural development programs are authorized to receive both mandatory and discretionary funding. Most agency operations (salaries and expenses) are financed with discretionary funds. Discretionary appropriations are made separately through an annual agriculture appropriations act.9

While both types of programs are significant, mandatory programs often dominate the farm bill debate. Therefore, the majority of this report focuses on mandatory spending

Summary of Projected Outlays in the 2018 Farm Bill

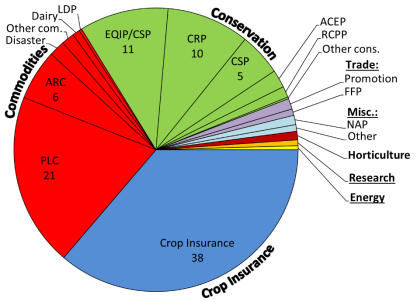

Figure 1 illustrates the distribution of the $428 billion five-year total of projected mandatory outlays at enactment for the life of the 2018 farm bill (FY2019-FY2023). Figure 2 shows program-level detail for agriculture-specific programs, particularly the Farm Commodity and Conservation titles. Table 1 presents these outlays (the fifth and 10th columns), and how budgetary resources were reallocated across titles of the farm bill, for both the five- and 10-year budget windows. The terms baseline and score are explained in later sections of this report.

Mandatory spending is authorized throughout the farm bill, but four titles presently account for about 99% of the mandatory farm bill spending: Commodities (7.3%), Nutrition (76%), Crop Insurance (8.9%), and Conservation (6.8%).

Table 1. Budget for the 2018 Farm Bill: Baseline, Scores, and Projected Outlays

(millions of dollars, 5- and 10-year totals, mandatory spending)

|

5 years (FY2019-FY2023) |

10 years (FY2019-FY2028) |

|||||||||

|

CBO score |

CBO score |

|||||||||

|

Farm bill titles |

CBO baseline |

House passed |

Senate passed |

Enacted |

Projected outlays |

CBO baseline |

House passed |

Senate passed |

Enacted |

Projected outlays |

|

Commodities |

31,340 |

+198 |

-23 |

+101 |

31,440 |

61,151 |

+284 |

-408 |

+263 |

61,414 |

|

Conservation |

28,715 |

+656 |

+290 |

+555 |

29,270 |

59,754 |

-795 |

+0 |

-6 |

59,748 |

|

Trade |

1,809 |

+235 |

+258 |

+235 |

2,044 |

3,624 |

+470 |

+515 |

+470 |

4,094 |

|

Nutrition |

325,922 |

+862 |

+224 |

+98 |

326,020 |

663,828 |

-1,426 |

+94 |

+0 |

663,828 |

|

Credit |

-2,205 |

+0 |

+0 |

+0 |

-2,205 |

-4,558 |

+0 |

+0 |

+0 |

-4,558 |

|

Rural Development |

98 |

+0 |

-832 |

-530 |

-432 |

168 |

+0 |

-2,340 |

-2,530 |

-2,362 |

|

Research |

329 |

+168 |

+426 |

+365 |

694 |

604 |

+250 |

+685 |

+615 |

1,219 |

|

Forestry |

5 |

+0 |

+5 |

+0 |

5 |

10 |

+0 |

+5 |

+0 |

10 |

|

Energy |

362 |

-267 |

+311 |

+109 |

471 |

612 |

-517 |

+375 |

+125 |

737 |

|

Horticulture |

772 |

+10 |

+323 |

+250 |

1,022 |

1,547 |

+10 |

+626 |

+500 |

2,047 |

|

Crop Insurance |

38,057 |

-70 |

-1 |

-47 |

38,010 |

78,037 |

-161 |

-2 |

-104 |

77,933 |

|

Miscellaneous |

1,259 |

+553 |

+594 |

+685 |

1,944 |

2,423 |

+566 |

+517 |

+738 |

3,161 |

|

Subtotal |

426,462 |

+2,344 |

+1,573 |

+1,820 |

428,282 |

867,200 |

-1,320 |

+68 |

+70 |

867,270 |

|

- Increase revenue |

- |

+115 |

+33 |

+35 |

35 |

- |

+465 |

+68 |

+70 |

70 |

|

Total |

426,462 |

+2,229 |

+1,540 |

+1,785 |

428,247 |

867,200 |

-1,785 |

+0 |

+0 |

867,200 |

Source: CRS. Compiled from the CBO Baseline by Title (unpublished; April 2018); CBO Baseline, April 2018, https://www.cbo.gov/about/products/baseline-projections-selected-programs; CBO cost estimates for H.R. 2 as passed by the House of Representatives and the Senate Amendment to H.R. 2 as passed by the Senate, https://www.cbo.gov/publication/54284, July 24, 2018; and CBO cost estimate of the conference agreement for H.R. 2, https://www.cbo.gov/publication/54880, December 11, 2018.

Note: Baseline for the Credit title is negative because of receipts to the Farm Credit System Insurance Fund. Baseline for the Rural Development "cushion of credit" is accounted for outside of the farm bill.

Importance of Baseline to the Farm Bill

The Congressional Budget Office (CBO) baseline is a projection at a particular point in time of future federal spending on mandatory programs under current law. The baseline is the benchmark against which proposed changes in law are measured. The CBO develops the budget baseline under various laws and follows the supervision of the House and Senate Budget Committees.

When a new bill is proposed that would affect mandatory spending, the score (cost impact) is measured in relation to the baseline. Changes that increase spending relative to the baseline have a positive score; those that decrease spending relative to the baseline have a negative score.

Having a baseline essentially gives programs built-in future funding if policymakers decide that the programs should continue—that is, straightforward reauthorization would not have a scoring effect (budget neutral).

Once a new law is passed, the projected outlays at enactment equal the baseline plus the score. This sum becomes the budget foundation of the new law.

Development of the Baseline

CBO periodically projects future government spending via its budget baselines, and evaluates proposed bills via scoring estimates. The baseline incorporates domestic and international economic conditions at the time the baseline is projected.

Generally, a program with estimated mandatory spending in the last year of its authorization may be assumed to continue in the baseline as if there were no change in policy and it did not expire. This is the situation for most of the major, long-standing farm bill provisions such as the farm commodity programs or supplemental nutrition assistance.10 However, some programs do not continue in the baseline beyond the end of a farm bill because they are either11

- programs with estimated mandatory spending less than a minimum $50 million scoring threshold in the last year of the farm bill, or

- new programs established after 1997 for which the Budget Committees have determined that mandatory spending shall not extend beyond expiration. This decision may have been made in consultation with the Agriculture Committees for a number of reasons, such as to reduce the program's 10-year cost when a farm bill is written or to prevent the program from having a continuing baseline.

The 2014 farm bill had 39 programs without baseline beyond FY2018 that received $2.824 billion in mandatory funding over five years.12

CBO Baseline: April 2018

The CBO baseline that was used to develop the 2018 farm bill was released in April 2018 (the first and sixth data columns in Table 1).13 It projected that if the 2014 farm bill were extended, as amended as of April 2018, farm bill programs would cost $426 billion over the next five years (FY2019-FY2023) and $867 billion over the next 10 years (FY2019-2028).14

Most of the 10-year amount, 77%, was in the Nutrition title for the Supplemental Nutrition Assistance Program (SNAP). The remaining 23%, $203 billion baseline, was for agricultural programs, mostly in crop insurance, farm commodity programs, and conservation. Other titles of the farm bill contributed about 1% of the baseline, some of which are funded primarily with discretionary spending. Table 2 presents the April 2018 baseline by farm bill title with some program-level details for select titles.

Table 2. CBO Baseline to Develop the 2018 Farm Bill, by Title and Program

(projected outlays in millions of dollars, April 2018 baseline)

|

Fiscal year |

5 years |

10 years |

||||||||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

FY2019-23 |

FY2019-28 |

|

|

Title I—Farm Commodity Programs |

||||||||||||

|

Price Loss Coverage |

2,727 |

2,653 |

5,742 |

5,006 |

4,574 |

4,639 |

4,603 |

4,854 |

4,558 |

4,566 |

20,702 |

43,921 |

|

Agricultural Risk Coverage |

2,627 |

2,155 |

464 |

430 |

479 |

431 |

463 |

482 |

505 |

492 |

6,155 |

8,529 |

|

Disaster assistance programs |

364 |

361 |

391 |

390 |

388 |

386 |

389 |

388 |

387 |

425 |

1,893 |

3,868 |

|

Other |

524 |

241 |

228 |

235 |

251 |

252 |

244 |

253 |

255 |

240 |

1,479 |

2,723 |

|

Dairy |

186 |

161 |

160 |

177 |

173 |

177 |

191 |

128 |

134 |

137 |

857 |

1,624 |

|

Marketing Loan Program |

58 |

51 |

51 |

48 |

45 |

44 |

43 |

47 |

48 |

50 |

254 |

486 |

|

Subtotal, Title I |

6,487 |

5,621 |

7,035 |

6,286 |

5,910 |

5,930 |

5,934 |

6,151 |

5,886 |

5,910 |

31,340 |

61,151 |

|

Title II—Conservation |

||||||||||||

|

Conservation Reserve Program |

1,819 |

1,999 |

2,042 |

2,083 |

2,126 |

2,169 |

2,209 |

2,223 |

2,213 |

2,214 |

10,069 |

21,097 |

|

Conservation Security/Stewardship Program |

1,607 |

1,822 |

1,743 |

1,772 |

1,820 |

1,771 |

1,768 |

1,810 |

1,808 |

1,808 |

8,764 |

17,729 |

|

Environmental Quality Incentives Program |

1,509 |

1,545 |

1,600 |

1,640 |

1,674 |

1,729 |

1,750 |

1,750 |

1,750 |

1,750 |

7,968 |

16,697 |

|

Agricultural Conservation Easement Program |

310 |

271 |

266 |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

1,347 |

2,597 |

|

Regional Conservation Partnership Program |

127 |

125 |

121 |

107 |

98 |

100 |

100 |

100 |

100 |

100 |

578 |

1,078 |

|

CRP Technical Assistance |

100 |

37 |

77 |

72 |

147 |

106 |

169 |

91 |

94 |

85 |

433 |

978 |

|

Agricultural Management Assistance |

9 |

9 |

9 |

10 |

10 |

10 |

10 |

10 |

10 |

10 |

47 |

97 |

|

Emergency Forestry Conservation Reserve |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

5 |

10 |

|

Programs repealed in 2014 and user fees |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-20 |

-40 |

|

Other, incl. announced FY2019 sequestration |

-233 |

-75 |

-75 |

-51 |

-42 |

-27 |

15 |

-1 |

0 |

0 |

-476 |

-489 |

|

Subtotal, Title II |

5,245 |

5,730 |

5,780 |

5,880 |

6,080 |

6,105 |

6,268 |

6,230 |

6,222 |

6,214 |

28,715 |

59,754 |

|

Title III—Trade |

||||||||||||

|

Market Access Program |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

1,000 |

2,000 |

|

Food for Progress |

153 |

154 |

154 |

154 |

154 |

155 |

155 |

155 |

155 |

155 |

769 |

1,544 |

|

Emerging Markets Program |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

40 |

80 |

|

Subtotal, Title III |

361 |

362 |

362 |

362 |

362 |

363 |

363 |

363 |

363 |

363 |

1,809 |

3,624 |

|

Title IV—Nutrition |

65,817 |

65,268 |

65,033 |

64,857 |

64,947 |

65,477 |

66,247 |

67,151 |

68,720 |

70,311 |

325,922 |

663,828 |

|

Title V—Credit |

-435 |

-437 |

-440 |

-444 |

-449 |

-455 |

-462 |

-471 |

-478 |

-487 |

-2,205 |

-4,558 |

|

Title VI—Rural Development |

35 |

21 |

14 |

14 |

14 |

14 |

14 |

14 |

14 |

14 |

98 |

168 |

|

Title VII—Research |

82 |

78 |

59 |

55 |

55 |

55 |

55 |

55 |

55 |

55 |

329 |

604 |

|

Title VIII—Forestry |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

5 |

10 |

|

Title IX—Energy |

102 |

89 |

70 |

51 |

50 |

50 |

50 |

50 |

50 |

50 |

362 |

612 |

|

Title X—Horticulture |

153 |

154 |

155 |

155 |

155 |

155 |

155 |

155 |

155 |

155 |

772 |

1,547 |

|

Title XI—Crop Insurance |

7,230 |

7,471 |

7,684 |

7,811 |

7,860 |

7,903 |

7,942 |

8,006 |

8,047 |

8,082 |

38,057 |

78,037 |

|

Title XII—Miscellaneous |

||||||||||||

|

Noninsured Crop Disaster Assistance Program |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

1,114 |

2,229 |

|

Other |

71 |

37 |

12 |

12 |

12 |

10 |

10 |

10 |

10 |

10 |

145 |

195 |

|

Subtotal, Title XII |

294 |

259 |

235 |

235 |

235 |

233 |

233 |

233 |

233 |

233 |

1,259 |

2,423 |

|

Total |

85,372 |

84,617 |

85,989 |

85,263 |

85,221 |

85,831 |

86,800 |

87,938 |

89,268 |

90,901 |

426,462 |

867,200 |

Source: CRS. Compiled using CBO, "Baseline Projections for Selected Programs," April 2018, https://www.cbo.gov/about/products/baseline-projections-selected-programs (in italics). The total baseline for the farm bill is published in the table notes in CBO, "Cost Estimates for H.R. 2 as passed by the House of Representatives and as passed by the Senate," https://www.cbo.gov/publication/54284, July 24, 2018, and at the title level in an unpublished CBO table, April 2018. (in bold).

Note: Near-term amounts may include outlays for programs that expired before FY2019 but still make outlays that have been obligated. For the titles without program detail: Nutrition includes SNAP; Credit includes receipts to Farm Credit System Insurance Fund; Research includes the Specialty Crop Research Initiative; Energy includes the Rural Energy for America Program; Horticulture includes Specialty Crop Block Grants, Plant Pest and Disease Management, and promotion orders.

Scores of the 2018 Farm Bill

The CBO score measures the budgetary impact of changes made by the 2018 farm bill. It is measured relative to its benchmark—the CBO baseline. Budget enforcement procedures follow an array of federal budget rules, such as "PayGo," which required budgetary offsets to balance new spending to avoid increasing the federal deficit.15

Although the farm bill is a five-year authorization—the 2018 farm bill covers FY2019-FY2023—budget rules required it to be scored over a 10-year budget window. Thus, when the farm bill is discussed during legislative development, it may be more often presented by its effect over the 10-year budget window than the five-year duration of the law. Separately, statements about the total cost of the farm bill may be in terms of its five-year outlays (i.e., projected spending over the five-year life of the farm bill). Both can be accurate measures of the farm bill budget depending on the context.

CBO released several interim scores of the 2018 farm bill during the various stages of its development. These include scores of the effects of the

- House-introduced bill (H.R. 2),16

- House-reported bill (H.R. 2),17

- Senate-reported bill (S. 3042),18

- House-passed bill (H.R. 2) and the Senate-passed Amendment to H.R. 2 (the second, third, seventh and eighth columns in Table 1; see also the more detailed section-level scores in Appendix A),19

- Conference agreement for H.R. 2 (the fourth and ninth columns in Table 1; see also the more detailed section-level scores in Table 3).20

Subsequent to the House-passed score, CBO released a more detailed assessment of the farm commodity program payment limit provisions in the House-passed bill. This score did not change the amounts but explained background for the score of those provisions in greater detail.21

Summary of Title-Level Scores

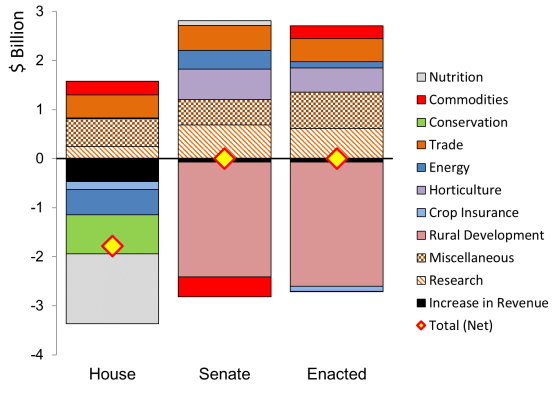

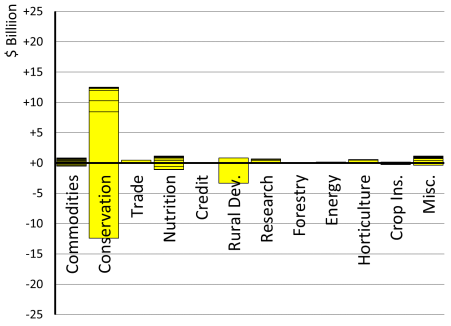

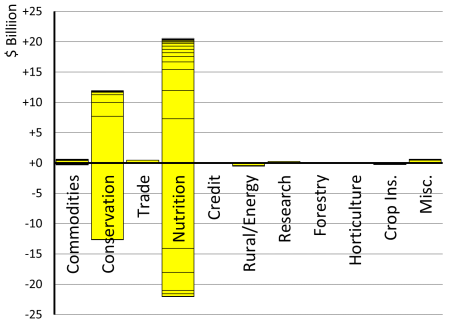

Figure 3 shows the distribution of the title-level changes (scores) in the 2018 farm bill conference agreement and the House- and Senate-passed bills that preceded it.

- Relative to the baseline, the overall score of the 2018 farm bill is budget neutral over a 10-year period.

- The House-passed bill would have decreased 10-year outlays by $1.8 billion, and the Senate-passed bill was budget neutral.

The overall relatively small or budget-neutral net scores are the result of sometimes relatively larger increases and reductions across titles.

- Generally, the enacted farm bill follows the scoring approach of the Senate bill more closely than the House bill.

- In the new law, as in the Senate-passed bill, most of the reductions are from the Rural Development title.

- Six titles in the law have increased outlays over the 10-year period, including Commodities, Trade, Research, Energy, Horticulture, and Miscellaneous.

- The House-passed bill would have made 10-year reductions in outlays in the Conservation, Nutrition, Energy, and Crop Insurance titles that the conference agreement did not adopt.

|

Figure 3. CBO Scores of the House, Senate, and Enacted 2018 Farm Bills, by Title (projected change in 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Sources: CRS, using the CBO cost estimates for H.R. 2 as passed by the House of Representatives and the Amendment to H.R. 2 as passed by the Senate, https://www.cbo.gov/publication/54284, July 24, 2018, and CBO cost estimate of the conference agreement for H.R. 2, https://www.cbo.gov/publication/54880, December 11, 2018. Note: Does not show amounts less than $50 million that are presented in Table 1. |

Table 3. CBO Score of the Agriculture Improvement Act of 2018, as Enacted, by Section

(projected change in outlays relative to April 2018 baseline, millions of dollars)

|

Fiscal year |

5 years |

10 years |

||||||||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2019-23 |

2019-28 |

|

|

Title I—Commodities |

||||||||||||

|

Dairy Risk Management Payments |

-19 |

-15 |

-26 |

-11 |

-15 |

+20 |

-39 |

-49 |

-39 |

-64 |

-86 |

-257 |

|

ARC—Countya |

+0 |

+0 |

-24 |

-28 |

-28 |

-20 |

-23 |

-20 |

-22 |

-20 |

-81 |

-186 |

|

Repeal Dairy Product Donation Program |

-5 |

-5 |

-6 |

-6 |

-6 |

-5 |

-6 |

-6 |

-5 |

-5 |

-28 |

-54 |

|

ARC—Individuala |

+0 |

+0 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-2 |

-5 |

|

Tree Assistance Program |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+2 |

+4 |

|

Cattle Tick Fever Inspections |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+4 |

+7 |

|

Administrative Units for Large Counties |

+0 |

+0 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+3 |

+7 |

|

Livestock Indemnity Payments |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+4 |

+8 |

|

Modified Sugar Loan Rates |

+0 |

+0 |

+0 |

+0 |

+0 |

+1 |

+1 |

+2 |

+2 |

+3 |

+1 |

+9 |

|

Payment Limitations for Supplemental Disaster |

+2 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+8 |

+15 |

|

Implementationb |

+15 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+16 |

+16 |

|

Payment Limitations—Family Definition |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+20 |

+40 |

|

Milk Donation Program |

+9 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+29 |

+54 |

|

Margin Protection Premium Refund Credit 75% |

+58 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+58 |

+58 |

|

Dairy Risk Management, Livestock Gross Margin |

+1 |

+10 |

+13 |

+14 |

+14 |

+13 |

+14 |

+14 |

+16 |

+14 |

+52 |

+123 |

|

Modified Marketing Assistance Loan Ratesa |

+0 |

+27 |

+22 |

+16 |

+16 |

+13 |

+12 |

+10 |

+10 |

+10 |

+81 |

+136 |

|

PLCa |

+0 |

+0 |

-65 |

+23 |

+38 |

+26 |

+26 |

+26 |

+36 |

+28 |

-4 |

+137 |

|

Annual ARC/PLC Enrollmenta |

+0 |

+0 |

+0 |

+0 |

+25 |

+25 |

+26 |

+26 |

+25 |

+26 |

+25 |

+153 |

|

Subtotal, Title I |

+67 |

+30 |

-74 |

+21 |

+57 |

+84 |

+24 |

+16 |

+36 |

+2 |

+101 |

+263 |

|

Title II—Conservation |

||||||||||||

|

Conservation Stewardship Program |

-25 |

-358 |

-796 |

-1,103 |

-1,387 |

-1,562 |

-1,768 |

-1,810 |

-1,808 |

-1,808 |

-3,669 |

-12,426 |

|

Conservation Reserve Program |

+38 |

-52 |

-110 |

-80 |

+15 |

+119 |

+33 |

+37 |

-0 |

+1 |

-189 |

-0 |

|

Grassroots Source Water Protection Programb |

+2 |

+2 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Voluntary Public Access and Habitat Incentiveb |

+10 |

+10 |

+10 |

+10 |

+10 |

+0 |

+0 |

+0 |

+0 |

+0 |

+50 |

+50 |

|

Feral Swine Eradication and Control Pilotc |

+15 |

+25 |

+20 |

+10 |

+5 |

+0 |

+0 |

+0 |

+0 |

+0 |

+75 |

+75 |

|

Watershed Rehabilitation/Operationsd |

+2 |

+8 |

+19 |

+29 |

+37 |

+42 |

+45 |

+45 |

+45 |

+45 |

+95 |

+317 |

|

Regional Conservation Partnership Program |

+80 |

+141 |

+157 |

+174 |

+191 |

+200 |

+200 |

+200 |

+200 |

+200 |

+742 |

+1,742 |

|

Agricultural Conservation Easement Program |

+73 |

+151 |

+177 |

+187 |

+198 |

+197 |

+198 |

+199 |

+199 |

+200 |

+786 |

+1,779 |

|

EQIP and CSP |

+170 |

+356 |

+539 |

+692 |

+903 |

+1,019 |

+1,100 |

+1,184 |

+1,233 |

+1,257 |

+2,660 |

+8,451 |

|

Subtotal, Title II |

+365 |

+283 |

+17 |

-81 |

-29 |

+15 |

-192 |

-146 |

-131 |

-106 |

+555 |

-6 |

|

Title III—Trade |

||||||||||||

|

Agricultural Trade Promotion and Facilitationd |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+235 |

+470 |

|

Subtotal, Title III |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+235 |

+470 |

|

Title IV—Nutrition |

||||||||||||

|

Interstate Data Matching Multiple Issuances |

+0 |

-6 |

-25 |

-40 |

-60 |

-75 |

-90 |

-90 |

-95 |

-95 |

-131 |

-576 |

|

Quality Control Improvements |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-240 |

-480 |

|

Assistance for Community Food Projects |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-20 |

-40 |

|

Child Support Enforcement Cooperation |

+1 |

+3 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Food Distribution on Indian Reservations |

+0 |

+3 |

+3 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+14 |

+34 |

|

Longitudinal Data for Research |

+0 |

+11 |

+11 |

+1 |

+3 |

+5 |

+5 |

+5 |

+5 |

+5 |

+26 |

+51 |

|

Improvements to EBT System |

+0 |

+3 |

+8 |

+14 |

+21 |

+15 |

+8 |

+1 |

+2 |

+2 |

+46 |

+74 |

|

Simplified Homeless Housing Costs |

+3 |

+8 |

+8 |

+8 |

+8 |

+8 |

+8 |

+8 |

+8 |

+8 |

+35 |

+75 |

|

Emergency Food Assistance Program |

+12 |

+24 |

+23 |

+23 |

+23 |

+19 |

+20 |

+20 |

+21 |

+21 |

+105 |

+206 |

|

Employment and Training for SNAP |

+19 |

+24 |

+24 |

+24 |

+24 |

+24 |

+24 |

+24 |

+24 |

+24 |

+115 |

+234 |

|

Schumacher Nutrition Incentive Programd |

+6 |

+16 |

+28 |

+43 |

+50 |

+52 |

+54 |

+56 |

+56 |

+56 |

+143 |

+417 |

|

Subtotal, Title IV |

-12 |

+33 |

+29 |

+26 |

+21 |

-0 |

-19 |

-24 |

-27 |

-27 |

+98 |

+0 |

|

Title V—Credit |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

|

Title VI—Rural Development |

||||||||||||

|

Reduction in Interest to Cushion of Credit |

-50 |

-150 |

-350 |

-380 |

-400 |

-400 |

-400 |

-400 |

-400 |

-400 |

-1,330 |

-3,330 |

|

Modify Loans Under Rural Electrification |

+800 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+800 |

+800 |

|

Subtotal, Title VI |

+750 |

-150 |

-350 |

-380 |

-400 |

-400 |

-400 |

-400 |

-400 |

-400 |

-530 |

-2,530 |

|

Title VII—Research and Extension |

||||||||||||

|

Emerging Agricultural Production Researchc |

+2 |

+2 |

+2 |

+2 |

+2 |

+0 |

+0 |

+0 |

+0 |

+0 |

+10 |

+10 |

|

Scholarships for Students at 1890 Institutionsc |

+0 |

+10 |

+10 |

+10 |

+10 |

+0 |

+0 |

+0 |

+0 |

+0 |

+40 |

+40 |

|

Foundation for Food and Agriculture Researchb |

+0 |

+185 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+185 |

+185 |

|

Organic Agriculture Research and Extensiond |

+17 |

+19 |

+23 |

+29 |

+43 |

+50 |

+50 |

+50 |

+50 |

+50 |

+130 |

+380 |

|

Subtotal, Title VII |

+19 |

+216 |

+35 |

+41 |

+55 |

+50 |

+50 |

+50 |

+50 |

+50 |

+365 |

+615 |

|

Title VIII—Forestry |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

|

Title IX—Energy |

||||||||||||

|

Biobased Market Programb |

+2 |

+3 |

+3 |

+3 |

+3 |

+1 |

+0 |

+0 |

+0 |

+0 |

+14 |

+15 |

|

Bioenergy Program for Advanced Biofuelsb |

+2 |

+4 |

+5 |

+7 |

+7 |

+5 |

+3 |

+2 |

+0 |

+0 |

+25 |

+35 |

|

Biorefinery Assistanceb |

+0 |

+10 |

+20 |

+23 |

+18 |

+5 |

+0 |

+0 |

+0 |

+0 |

+70 |

+75 |

|

Subtotal, Title IX |

+4 |

+17 |

+28 |

+32 |

+28 |

+11 |

+3 |

+2 |

+0 |

+0 |

+109 |

+125 |

|

Title X—Horticulture |

||||||||||||

|

Multiple Crop and Pesticide Use Surveyc |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+1 |

+1 |

|

Organic Production and Market Data Initiativesb |

+1 |

+1 |

+1 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Organic Certification/Trade Tracking and Datab |

+1 |

+1 |

+1 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

National Organic Certification Cost Shareb |

+0 |

+0 |

+8 |

+8 |

+8 |

+0 |

+0 |

+0 |

+0 |

+0 |

+24 |

+24 |

|

Local Agriculture Market Programd |

+28 |

+38 |

+50 |

+50 |

+50 |

+50 |

+50 |

+50 |

+50 |

+50 |

+215 |

+465 |

|

Subtotal, Title X |

+30 |

+40 |

+60 |

+60 |

+60 |

+50 |

+50 |

+50 |

+50 |

+50 |

+250 |

+500 |

|

Title XI—Crop Insurance |

||||||||||||

|

Increase CAT Coverage Administrative Fee |

-1 |

-12 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-55 |

-125 |

|

Funding for Research and Development |

-0 |

-4 |

-5 |

-5 |

-5 |

-5 |

-5 |

-5 |

-5 |

-5 |

-18 |

-40 |

|

Enterprise Units Across County Lines |

-0 |

-3 |

-3 |

-3 |

-3 |

-3 |

-3 |

-3 |

-3 |

-3 |

-12 |

-27 |

|

Program Administration |

-0 |

-2 |

-2 |

-2 |

-2 |

-2 |

-2 |

-2 |

-2 |

-2 |

-8 |

-18 |

|

Crop Production on Native Sod |

-0 |

-0 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-2 |

-4 |

|

Submission of Policies and Materials to Board |

+0 |

+0 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+3 |

+8 |

|

Research and Development Authority |

+0 |

+1 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+6 |

+13 |

|

Treatment of Forage and Grazing |

+1 |

+9 |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+40 |

+90 |

|

Subtotal, Title XI |

-1 |

-10 |

-12 |

-12 |

-12 |

-12 |

-12 |

-12 |

-12 |

-11 |

-47 |

-104 |

|

Title XII—Miscellaneous |

||||||||||||

|

Extension of Merchandise Processing Fee |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

-371 |

+0 |

+0 |

-371 |

|

Sheep Production and Marketing Grantsb |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+2 |

+2 |

|

Wool Research and Promotionb |

+0 |

+2 |

+2 |

+2 |

+2 |

+0 |

+0 |

+0 |

+0 |

+0 |

+9 |

+10 |

|

National Oilheat Research Alliance |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+35 |

+70 |

|

Pima Agriculture Cotton Trust Fundb |

+16 |

+16 |

+16 |

+16 |

+16 |

+0 |

+0 |

+0 |

+0 |

+0 |

+80 |

+80 |

|

Wool Apparel Manufacturers Trust Fundb |

+0 |

+30 |

+30 |

+30 |

+30 |

+0 |

+0 |

+0 |

+0 |

+0 |

+120 |

+120 |

|

Emergency Citrus Trust Fundc |

+25 |

+25 |

+25 |

+25 |

+25 |

+0 |

+0 |

+0 |

+0 |

+0 |

+125 |

+125 |

|

Animal Disease Prevention and Management |

+60 |

+48 |

+6 |

+6 |

+29 |

+30 |

+30 |

+30 |

+30 |

+30 |

+149 |

+299 |

|

Farming Opportunities Training and Outreachd |

+27 |

+30 |

+33 |

+35 |

+41 |

+45 |

+48 |

+48 |

+49 |

+50 |

+166 |

+404 |

|

Subtotal, Title XII |

+136 |

+159 |

+119 |

+122 |

+149 |

+82 |

+85 |

+85 |

-285 |

+87 |

+685 |

+738 |

|

Total Changes in Direct Spending |

+1,406 |

+664 |

-101 |

-124 |

-25 |

-73 |

-365 |

-333 |

-672 |

-307 |

+1,820 |

+70 |

|

Increases in Revenue: Title XII—Oilheat |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+35 |

+70 |

|

Net Effect on the Deficit |

+1,399 |

+657 |

-108 |

-131 |

-32 |

-80 |

-372 |

-340 |

-679 |

-314 |

+1,785 |

-0 |

Source: CRS, sorted within titles using the CBO cost estimate of the conference agreement for H.R. 2, https://www.cbo.gov/publication/54880, December 11, 2018.

Notes: + denotes additional spending or, in the case of revenue, additional revenue. – denotes reduced spending.

a. The scoring effect is delayed because the farm commodity programs operate by "crop year" (when the crop is harvested), and some payments are delayed by statute into a later fiscal year. For example, ARC and PLC payments for the 2019 crop year (the first covered by the 2018 farm bill) do not occur by statue until FY2021. Payments under the marketing loan program are delayed generally by one fiscal year.

b. Denotes a 2014 farm bill "program without baseline" that received new funding in the 2018 farm bill over FY2019-FY2023 but not permanent baseline. (The complete list of programs without baseline prior to the farm bill is identified in CRS Report R44758, Farm Bill Programs Without a Budget Baseline Beyond FY2018.)

c. Denotes a new "program without baseline" created in the 2018 farm bill.

d. Denotes a 2014 farm bill "program without baseline" that received new funding in the 2018 farm bill over FY2019-FY2028 and permanent baseline. The six provisions noted here cover nine programs from the list of programs without baseline because of consolidation within (1) trade programs; (2) farmers market, local food, and rural entrepreneurship programs; and (3) beginning farmer and outreach programs.

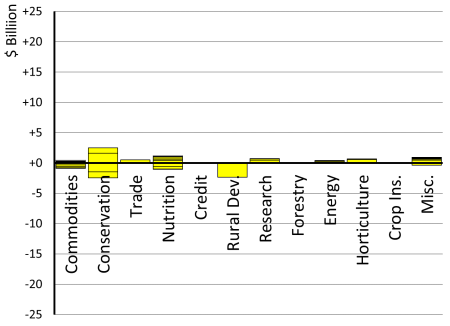

Net Increases in Five-Year Outlays Are Followed by Net Decreases

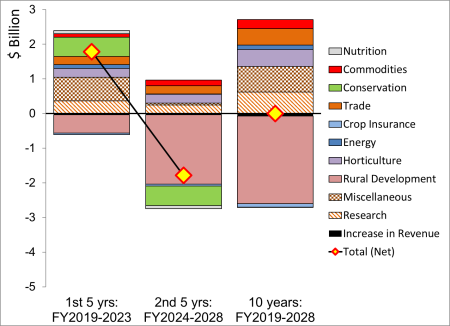

When separated into the five- and 10-year budget windows, each version of the 2018 farm bill shows a similar pattern of changes in projected outlays. Figure 4 show the scores for the first five years, the second five years, and the 10-year total for the enacted conference agreement.

- The enacted farm bill increases net outlays in the first five years by $1.8 billion, which is offset by the same amount of net reductions in outlays during the second five years. Therefore, the 10-year net score is budget neutral.

- In the enacted law, the Conservation and Nutrition titles—which have increases in outlays over the first five years—have decreases during the second five years. Both titles are budget-neutral over the 10-year period. This may occur because of the time needed to implement changes or to make provisions more appealing in the early years despite having less baseline for a future farm bill.

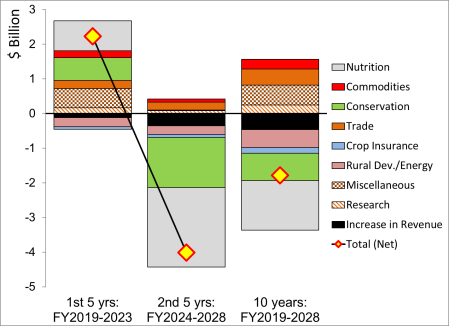

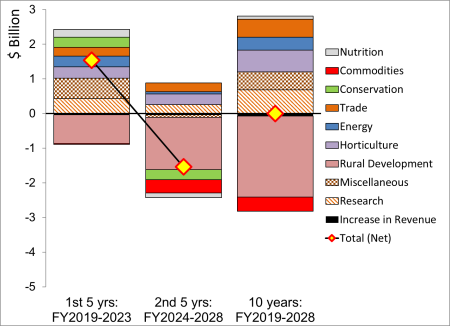

A similar pattern held for the House-passed bill (Figure 5) and the Senate-passed bill (Figure 6). In both of those versions, the Conservation and Nutrition titles had increases in the first five years followed by decreases in the second five years. The House-passed bill had reductions in the Nutrition title that were not retained in the conference agreement. The Senate-passed bill would have reduced baseline for the Commodities title, whereas the conference agreement is projected to increase it.

|

Figure 4. CBO Score of Enacted 2018 Farm Bill, by Period and Title (projected change in five- and 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, using the CBO cost estimate of the conference agreement for H.R. 2, December 11, 2018. Note: Does not show amounts less than $50 million that are indicated in Table 1. |

|

Figure 5. CBO Score of House-Passed H.R. 2, by Period and Title (projected change in five- and 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, using the CBO cost estimates for H.R. 2 as passed by the House, July 24, 2018. Note: Does not show amounts less than $50 million that are indicated in Table 1. |

|

Figure 6. CBO Score of the Senate-Passed Amendment to H.R. 2, by Period and Title (projected change in five- and 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, using the CBO cost estimates for the Senate Amendment to H.R. 2, July 24, 2018. Note: Does not show amounts less than $50 million that are indicated in Table 1. |

Section-by-Section Scores for Some Titles Exceed Their Net Scores

Some of the net scores for single titles presented above are the net result of increases and decreases by provisions within the same title. Sometimes, these increases or decreases are relatively large compared to the net title-level effect. These budget effects may reflect policy proposals that may not be apparent in the net title-level scores that are shown in the previous figures. For example

- In the enacted law, the Conservation title has one section with a $12.4 billion reduction over 10 years (reducing the Conservation Stewardship Program) and seven sections that add to $12.4 billion in increased spending (Figure 7).

- In the House-passed bill, the Nutrition title had six sections that summed to a $22.0 billion reduction over 10 years (including those for work requirements) and 18 sections that added to $20.6 billion in increased spending. Similarly, the Conservation title had two sections that summed to a $12.6 billion reduction and eight sections that added to $11.8 billion in increased spending (Figure 8).

- In the Senate-passed bill, none of the titles' section-by-section scores were as large as for the Nutrition and Conservation titles in the House bill. Nonetheless, the section-by-section scores of the Senate-passed bill showed both increases and decreases in the Conservation, Nutrition, Commodities and Miscellaneous titles (Figure 9).

|

Figure 7. CBO Score of Enacted 2018 Farm Bill, by Section and Title (projected change in 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, sorted within titles using the CBO cost of the conference agreement for H.R. 2, December 11, 2018. Notes: Figure indicates magnitude of changes within titles. Details about individual sections are in Table 3. |

|

Figure 8. CBO Score of House-Passed H.R. 2, by Section and Title (projected change in 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, sorted within titles using the CBO cost estimate for H.R. 2 as passed by the House, July 24, 2018. Notes: Figure indicates magnitude of changes within titles. Details about individual sections are in Table A-1. |

|

Figure 9. CBO Score of Senate-Passed Amendment to H.R. 2, by Section and Title (projected change in 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, sorted within titles using the CBO cost estimate for H.R. 2 as passed by the Senate, July 24, 2018. Notes: Figure indicates magnitude of changes within titles. Details about individual sections are in Table A-2. |

Outcome for the Programs Without Baseline

For 23 of the 39 of the "programs without baseline" from the 2014 farm bill,22 the 2018 farm bill provides continuing funding and, in some cases, permanent baseline for future farm bills (see the footnotes in Table 3).

- Fourteen of the programs without baseline received mandatory funding during FY2019-FY2023 but no baseline beyond the end of the farm bill.

- Nine of the programs without baseline received mandatory funding and permanent baseline beyond the end of the farm bill. Three of these programs were combined with six others into six provisions in the 2018 farm bill.

In addition, five provisions in the 2018 farm bill created new programs without baseline for the next farm bill.

Projected Outlays at Enactment

When a new law is passed, the projected cost at enactment equals the baseline plus the score. This sum becomes the foundation of the new law and may be compared to future CBO baselines as an indicator of how actual costs develop as the law is implemented and conditions change.23

Table 4 shows the result of this calculation by updating the farm bill baseline (Table 2) by adding the score for programs that were changed by the farm bill (Table 3). The $428 billion projected five-year total for the life of the 2018 farm bill (FY2019-FY2023) is illustrated in Figure 1. Agriculture program-level detail is illustrated in Figure 2.

Table 1 summarizes these amounts by title for the five- and 10-year budget windows (the fifth and 10th columns). SNAP accounts for 76% of the $428 billion five-year total. The remaining 24%, $102 billion of projected outlays, is for agricultural programs, mostly in crop insurance (8.9%), farm commodity programs (7.3%), and conservation (6.8%).

Relative to historical farm bill spending, Figure 10 shows mandatory outlays for the four largest titles—Nutrition, Crop Insurance, Farm Commodity Programs, and Conservation—that account for 99% of projected spending in the 2018 farm bill. The figure shows the following trends:

- SNAP outlays, which compose most of the Nutrition title, increased markedly after the recession in 2009 and have been gradually decreasing since 2012.24

- Crop insurance outlays increased steadily over the period, especially as higher market prices and program participation over the past decade have raised the value of insurable commodities.25

- Farm commodity programs outlays generally rise and fall inversely with commodity markets. They were high after losses in the early 2000s, generally trended lower under the direct payment program, and tended to increase after a return to counter-cyclical programs in the 2014 farm bill.26

- Conservation program outlays have grown steadily but have leveled off in recent years.27

|

Figure 10. Actual and Projected Spending by Major Farm Bill Mandatory Programs |

|

|

Source: CRS. Notes: Darker shades of each color are actual outlays based on USDA data. Lighter shades are CBO data (actuals for FY2016, estimates for FY2017-FY2018, and CRS analysis of CBO data for projections at enactment of the 2018 farm bill for FY2019-FY2028). Compiled using USDA Farm Service Agency, Agricultural Outlook, Table 35; USDA Risk Management Agency, "Program Costs and Outlays by Fiscal Year"; J. Glauber, "Crop Insurance Reconsidered," American Journal of Agricultural Economics, 2004; USDA Farm Service Agency, "Output 3," Commodity Estimates Book; USDA Natural Resources Conservation Service, "Soil and Water Conservation Expenditures, 1935-2010," 2011; and USDA Food and Nutrition Service, "National Level Annual Summary, Participation and Costs," CBO Baseline, various issues, https://www.cbo.gov/about/products/baseline-projections-selected-programs; and CBO cost estimate of the conference agreement for H.R. 2, https://www.cbo.gov/publication/54880, December 11, 2018. |

Table 4. Projected Outlays Under the Agriculture Improvement Act of 2018, at Enactment, by Title and Program

(projected outlays in millions of dollars)

|

Fiscal year |

5 years |

10 years |

||||||||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

FY2019-23 |

FY2019-28 |

|

|

Title I—Farm Commodity Programs |

||||||||||||

|

Price Loss Coverage |

2,727 |

2,653 |

5,676 |

5,029 |

4,637 |

4,690 |

4,655 |

4,906 |

4,619 |

4,619 |

20,722 |

44,211 |

|

Agricultural Risk Coverage |

2,627 |

2,155 |

439 |

401 |

450 |

410 |

440 |

461 |

482 |

471 |

6,073 |

8,337 |

|

Disaster Payments |

368 |

364 |

394 |

393 |

391 |

390 |

392 |

391 |

390 |

428 |

1,910 |

3,901 |

|

Dairy |

230 |

156 |

146 |

179 |

171 |

210 |

165 |

92 |

112 |

86 |

883 |

1,548 |

|

Marketing loans |

58 |

78 |

73 |

64 |

61 |

57 |

55 |

57 |

58 |

60 |

334 |

622 |

|

Other |

543 |

245 |

233 |

240 |

257 |

258 |

250 |

259 |

262 |

248 |

1,518 |

2,795 |

|

Subtotal, Title I |

6,554 |

5,651 |

6,962 |

6,307 |

5,967 |

6,014 |

5,957 |

6,167 |

5,923 |

5,912 |

31,440 |

61,414 |

|

Title II—Conservation |

||||||||||||

|

Environmental Quality Incentives Program/ Conservation Stewardship Program |

1,679 |

1,901 |

2,138 |

2,333 |

2,577 |

2,748 |

2,850 |

2,934 |

2,983 |

3,007 |

10,627 |

25,148 |

|

Conservation Reserve Program |

1,857 |

1,947 |

1,932 |

2,003 |

2,141 |

2,288 |

2,242 |

2,260 |

2,213 |

2,215 |

9,880 |

21,097 |

|

Conservation Security/Stewardship Program |

1,582 |

1,464 |

947 |

669 |

433 |

209 |

0 |

0 |

0 |

0 |

5,095 |

5,303 |

|

Agricultural Conservation Easement Program |

383 |

422 |

443 |

437 |

448 |

447 |

448 |

449 |

449 |

450 |

2,133 |

4,376 |

|

Regional Conservation Partnership Program |

207 |

266 |

278 |

281 |

289 |

300 |

300 |

300 |

300 |

300 |

1,320 |

2,820 |

|

Other |

-98 |

13 |

58 |

77 |

164 |

128 |

236 |

142 |

146 |

137 |

214 |

1,003 |

|

Subtotal: Title II |

5,610 |

6,013 |

5,797 |

5,799 |

6,051 |

6,120 |

6,076 |

6,084 |

6,091 |

6,108 |

29,270 |

59,748 |

|

Title III—Trade |

||||||||||||

|

Agricultural Trade Promotion and Facilitation |

255 |

255 |

255 |

255 |

255 |

255 |

255 |

255 |

255 |

255 |

1,275 |

2,550 |

|

Food for Progress |

153 |

154 |

154 |

154 |

154 |

155 |

155 |

155 |

155 |

155 |

769 |

1,544 |

|

Subtotal, Title III |

408 |

409 |

409 |

409 |

409 |

410 |

410 |

410 |

410 |

410 |

2,044 |

4,094 |

|

Title IV—Nutrition |

65,805 |

65,301 |

65,062 |

64,883 |

64,968 |

65,477 |

66,228 |

67,127 |

68,693 |

70,284 |

326,020 |

663,828 |

|

Title V—Credit |

-435 |

-437 |

-440 |

-444 |

-449 |

-455 |

-462 |

-471 |

-478 |

-487 |

-2,205 |

-4,558 |

|

Title VI—Rural Development |

785 |

-129 |

-336 |

-366 |

-386 |

-386 |

-386 |

-386 |

-386 |

-386 |

-432 |

-2,362 |

|

Title VII—Research |

101 |

294 |

94 |

96 |

110 |

105 |

105 |

105 |

105 |

105 |

694 |

1,219 |

|

Title VIII—Forestry |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

5 |

10 |

|

Title IX—Energy |

106 |

106 |

98 |

83 |

78 |

61 |

53 |

52 |

50 |

50 |

471 |

737 |

|

Title X—Horticulture |

183 |

194 |

215 |

215 |

215 |

205 |

205 |

205 |

205 |

205 |

1,022 |

2,047 |

|

Title XI—Crop Insurance |

7,229 |

7,461 |

7,672 |

7,799 |

7,849 |

7,892 |

7,931 |

7,995 |

8,035 |

8,070 |

38,010 |

77,933 |

|

Title XII—Miscellaneous |

||||||||||||

|

Noninsured Crop Disaster Assistance Program |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

1,114 |

2,229 |

|

Other, including revenue offset for Oilheat |

200 |

189 |

124 |

127 |

155 |

85 |

88 |

88 |

-282 |

90 |

795 |

862 |

|

Subtotal, Title XII |

423 |

412 |

347 |

350 |

377 |

307 |

310 |

310 |

-60 |

313 |

1,909 |

3,091 |

|

Total |

86,770 |

85,275 |

85,881 |

85,132 |

85,189 |

85,751 |

86,428 |

87,598 |

88,589 |

90,586 |

428,247 |

867,200 |

|

Nutrition (Title IV) |

65,805 |

65,301 |

65,062 |

64,883 |

64,968 |

65,477 |

66,228 |

67,127 |

68,693 |

70,284 |

326,020 |

663,828 |

|

Non-nutrition (other titles) |

20,965 |

19,974 |

20,819 |

20,249 |

20,220 |

20,274 |

20,200 |

20,472 |

19,896 |

20,302 |

102,227 |

203,372 |

Source: CRS. Compiled by adding the CBO score of the 2018 farm bill (Table 3) to the CBO baseline (Table 2).

Note: Near-term amounts may include outlays for programs that expired before FY2019 but still make outlays that have been obligated. The Credit title includes receipts to Farm Credit System Insurance Fund. The Rural Development title includes farm bill changes to the "cushion of credit" account for which baseline exists elsewhere in government and was not included in the original farm bill baseline.

Appendix A. Scores of House-Passed and Senate-Passed Versions of H.R. 2

Table A-1. CBO Score of House-Passed H.R. 2, by Section

(projected change in outlays relative to April 2018 baseline, millions of dollars)

|

Fiscal year |

5 years |

10 years |

||||||||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2019-23 |

2019-28 |

|

|

Title I—Commodity Programs |

||||||||||||

|

Agriculture Risk Coverage—Individuala |

+0 |

+0 |

-16 |

-17 |

-18 |

-18 |

-17 |

-19 |

-18 |

-20 |

-51 |

-143 |

|

Agriculture Risk Coverage—Countya |

+0 |

+0 |

+23 |

-34 |

-26 |

-17 |

-6 |

-15 |

-25 |

-11 |

-37 |

-111 |

|

Dairy Program |

-45 |

-2 |

+4 |

+3 |

-1 |

-3 |

-6 |

-4 |

+18 |

+17 |

-41 |

-20 |

|

Nonrecourse Marketing Assistance Loansa |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

|

Economic Adjustment Assistance Textile Mills |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+11 |

+23 |

|

Implementation |

+24 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+25 |

+25 |

|

Payment Limitationsb |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+20 |

+40 |

|

Supplemental Agriculture Disaster Assistance |

+13 |

+6 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+6 |

+35 |

+62 |

|

Price Loss Coveragea |

+0 |

+0 |

+137 |

+55 |

+43 |

+50 |

+134 |

-59 |

-16 |

+64 |

+235 |

+408 |

|

Subtotal, Title I |

-3 |

+12 |

+160 |

+18 |

+10 |

+23 |

+115 |

-85 |

-30 |

+62 |

+198 |

+284 |

|

Title II—Conservation |

||||||||||||

|

Repeal Conservation Stewardship Program |

-28 |

-406 |

-725 |

-1,072 |

-1,422 |

-1,771 |

-1,768 |

-1,810 |

-1,808 |

-1,808 |

-3,653 |

-12,618 |

|

Conservation Reserve Program |

-21 |

+70 |

+98 |

+96 |

+83 |

+73 |

-43 |

-76 |

-137 |

-166 |

+326 |

-23 |

|

Grassroots Source Water Protectionc |

+2 |

+2 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Wetlands Mitigation Bankingc |

+2 |

+2 |

+2 |

+2 |

+2 |

+0 |

+0 |

+0 |

+0 |

+0 |

+10 |

+10 |

|

Voluntary Public Access and Habitat Protectionc |

+10 |

+10 |

+10 |

+10 |

+10 |

+0 |

+0 |

+0 |

+0 |

+0 |

+50 |

+50 |

|

Feral Swine Eradication and Control Pilot |

+20 |

+30 |

+25 |

+15 |

+10 |

+0 |

+0 |

+0 |

+0 |

+0 |

+100 |

+100 |

|

Small Watershed Rehabilitation Programc |

+3 |

+16 |

+38 |

+58 |

+74 |

+81 |

+73 |

+52 |

+32 |

+32 |

+189 |

+459 |

|

Regional Conservation Partnership Program |

+60 |

+106 |

+118 |

+131 |

+143 |

+150 |

+150 |

+150 |

+150 |

+150 |

+558 |

+1,308 |

|

Agricultural Conservation Easement Program |

+90 |

+187 |

+221 |

+234 |

+247 |

+247 |

+248 |

+248 |

+249 |

+250 |

+979 |

+2,221 |

|

Environmental Quality Incentives Program |

+55 |

+227 |

+424 |

+608 |

+777 |

+921 |

+1,056 |

+1,164 |

+1,217 |

+1,243 |

+2,092 |

+7,693 |

|

Subtotal, Title II |

+193 |

+244 |

+212 |

+82 |

-76 |

-299 |

-284 |

-272 |

-297 |

-299 |

+656 |

-795 |

|

Title III—Trade |

||||||||||||

|

International Development Programd |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+235 |

+470 |

|

Subtotal, Title III |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+235 |

+470 |

|

Title IV—Nutrition |

||||||||||||

|

Workforce Solutions: Benefits |

+0 |

-300 |

-1,330 |

-1,350 |

-1,340 |

-1,370 |

-1,560 |

-1,920 |

-2,280 |

-2,650 |

-4,320 |

-14,100 |

|

Update to Categorical Eligibility |

+0 |

+0 |

-200 |