The farm bill is an omnibus, multi-year law that governs an array of agricultural and food programs. It provides an opportunity for policymakers to periodically address a broad range of agricultural and food issues. The farm bill has typically undergone reauthorization about every five years.1

From its beginning in the 1930s, farm bills have focused primarily on farm commodity programs to support a handful of staple commodities—corn, soybeans, wheat, cotton, rice, dairy, and sugar. In recent decades, farm bills have expanded in scope to include a Nutrition title since 1973 and since then Conservation, Horticulture, Bioenergy, Credit, Research, and Rural Development titles, among others.

Recent farm bills have been subject to various procedural hurdles, such as insufficient votes to pass the House floor, presidential vetoes, or—as in the case of 2008 and 2014 farm bills—short-term extensions.2 The current farm bill (the Agricultural Act of 2014, P.L. 113-79) has many provisions that expire in 2018.3

Farm Bill Status

The 115th Congress has begun but not finished a new farm bill. An initial House vote on H.R. 2 (the Agriculture and Nutrition Act of 2018) in May 2018 failed by vote of 198-213, but floor procedures allowed that vote to be reconsidered, and it passed in June by a second vote of 213-211. The Senate passed its bill as an amendment to H.R. 2 (the Agriculture Improvement Act of 2018) in June 2018 by a vote of 86-11. Conference proceedings officially began on September 5, 2018, but have not reached agreement.4

Farm Bills from a Budget Perspective

The farm bill provides an opportunity for Congress to choose how much support to provide for agriculture and nutrition and how to allocate it among competing constituencies. Generally, farm bills authorize spending in two categories: mandatory and discretionary. From a budgetary perspective, many programs are assumed to continue beyond the end of a farm bill, even though their authorizations may expire. That projection—for certain mandatory programs as explained below—provides funding to reauthorize programs, reallocate funding to other programs, or take offsets for deficit reduction. For new programs, those without baseline, or discretionary programs, funding must come from other means.

|

Types of Spending Authorized in the Farm Bill Mandatory spending. A farm bill authorizes outlays and pays for them with multiyear budget estimates when the law is enacted. Budget enforcement is through "baseline" projections under current law, "scores" of the effect of proposed bills, and "PayGo" budget rules that may prevent deficit increases. (See CRS Report R44763, Present Trends and the Evolution of Mandatory Spending.) Discretionary authorizations. A farm bill establishes parameters for discretionary programs and authorizes them to receive funding in subsequent appropriations acts but does not provide or assure actual funding. Budget enforcement is through future appropriations and budget resolutions. (See CRS Report R42388, The Congressional Appropriations Process: An Introduction.) |

Recent farm bills have faced various budget situations, including spending more under a budget surplus, cutting spending for deficit reduction, and remaining basically budget neutral—with or without offsets. For example

- The 2002 farm bill (the Farm Security and Rural Investment Act of 2002, P.L. 107-171) was enacted under a budget surplus that allowed it to make changes that were projected to increase spending by $73 billion over a 10-year budget window, more than half of which was for the farm commodity programs.5

- The 2008 farm bill (the Food, Conservation, and Energy Act of 2008, P.L. 110-246) was officially budget neutral, though it included $10 billion of offsets over 10 years from tax-related and other provisions that allowed it to increase spending on the Nutrition, Conservation, and Disaster titles.6

- The 2014 farm bill (the Agricultural Act of 2014, P.L. 113-79) was enacted under deficit reduction and budget sequestration that influenced its legislative development. It made changes that projected a net reduction of $16 billion over 10 years ($23 billion including sequestration).7

- The 2018 farm bill—the current bill under consideration (H.R. 2)—is being held to a budget-neutral position, though budget amounts may be reallocated across programs within issue areas and across titles of the farm bill (Table 1).

Mandatory spending is authorized throughout the farm bill, but four titles presently account for about 99% of the mandatory farm bill spending: Commodity, Nutrition, Crop Insurance, and Conservation.8 The Supplemental Nutrition Assistance Program (SNAP) and crop insurance have their own mandatory spending sources, but the farm commodity programs, conservation, and most other mandatory outlays are paid through the U.S. Department of Agriculture's (USDA) Commodity Credit Corporation (CCC).9

Discretionary spending is authorized throughout the farm bill, including most rural development, credit, and research programs, among others. Some smaller research, bioenergy, and rural development programs are authorized to receive both mandatory and discretionary funding. Most agency operations (salaries and expenses) are financed with discretionary funds. Discretionary appropriations are made through the annual Agriculture appropriations act.10

While both types of programs are significant, mandatory programs often dominate the farm bill debate. Therefore, the majority of this report focuses on mandatory spending.

Importance of Baseline to the Farm Bill

The Congressional Budget Office (CBO) baseline is a projection at a particular point in time of future federal spending on mandatory programs under current law. The baseline is the benchmark against which proposed changes in law are measured. The CBO develops the budget baseline under various laws and follows the supervision of the House and Senate Budget Committees.

When a new bill is proposed that would affect mandatory spending, the cost impact (score) is measured in relation to the baseline. Changes that increase spending relative to the baseline have a positive score; those that decrease spending relative to the baseline have a negative score.11

Having a baseline essentially gives programs built-in future funding if policymakers decide that the programs should continue—that is, straightforward reauthorization would not have a scoring effect (budget neutral). However, some programs do not have a continuing baseline beyond the expiration of a farm bill and do not have assured future funding. Their reauthorization would have a positive score that increases the bill's cost.

Development of the Baseline

CBO projects future government spending via its budget baselines and evaluates proposed bills via scoring estimates. The baseline incorporates domestic and international market conditions at the time the baseline is projected, government policies, and expectations for future economic conditions. Generally, a program with estimated mandatory spending in the last year of its authorization may be assumed to continue in the baseline as if there were no change in policy and it did not expire. This is the situation for most of the major, long-standing farm bill provisions such as the farm commodity programs or supplemental nutrition assistance.12 However, some programs may not be assumed to continue in the budget baseline beyond the end of a farm bill because they are either13

- programs with estimated mandatory spending less than a minimum $50 million scoring threshold in the last year of the farm bill, or

- new programs established after 1997 for which the Budget Committees have determined that the mandatory spending shall not extend beyond expiration. This decision may have been made in consultation with the Agriculture Committees for a number of reasons, such as to reduce the program's 10-year cost when a farm bill is written or to prevent the program from having a continuing baseline.

April 2018 CBO Baseline

The baseline for scoring the 2018 farm bill currently under consideration is the CBO baseline that was released in April 2018. This baseline is to be used until a new annual scoring baseline is released in the spring of 2019.

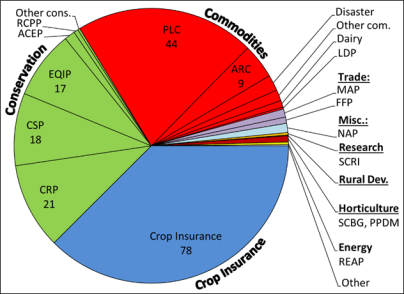

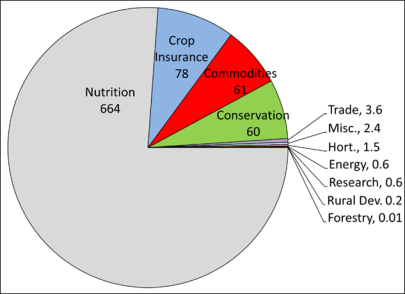

The April 2018 mandatory spending baseline for farm bill programs contains $867 billion over FY2019-FY2028, 77% of which is in the Nutrition title for SNAP ($664 billion). The remaining $203 billion baseline is for agricultural programs, mostly in the Crop Insurance, Farm Commodity Programs, and Conservation titles.14 Other titles contribute about 1% of the baseline because they are funded mostly with discretionary spending.

The April 2018 CBO baseline is the benchmark of available funding from which the House and Senate wrote bills for a new farm bill in 2018. The 5-year and 10-year columns in Table 1 show the CBO baseline for the titles of the 2014 farm bill over the next 10 years. (The score columns will be discussed later in "Scores of the 2018 Farm Bill Proposals".) Figure 1 illustrates the 10-year baseline by title. Table 2 adds details at the program level and with the annual projections, for the Farm Commodity Programs, Conservation, Trade, and Miscellaneous titles. Figure 2 illustrates the 10-year, program-level baseline for agriculture (non-nutrition) programs.15

Table 1. Budget for a 2018 Farm Bill: Baseline and Scores, by Title

(projected outlays in millions of dollars, 5- and 10-year totals)

|

5 years (FY2019-FY2023) |

10 years (FY2019-FY2028) |

|||||

|

Farm Bill Titles |

CBO Baseline |

CBO Score |

CBO Baseline |

CBO Score |

||

|

House-Passed |

Senate-Passed |

House-Passed |

Senate-Passed |

|||

|

Commodities |

31,340 |

+198 |

-23 |

61,151 |

+284 |

-408 |

|

Conservation |

28,715 |

+656 |

+290 |

59,754 |

-795 |

+0 |

|

Trade |

1,809 |

+235 |

+258 |

3,624 |

+470 |

+515 |

|

Nutrition |

325,922 |

+862 |

+224 |

663,828 |

-1,426 |

+94 |

|

Credit |

-2,205 |

+0 |

+0 |

-4,558 |

+0 |

+0 |

|

Rural Developmenta |

98 |

+0 |

-832 |

168 |

+0 |

-2,340 |

|

Research |

329 |

+168 |

+426 |

604 |

+250 |

+685 |

|

Forestry |

5 |

+0 |

+5 |

10 |

+0 |

+5 |

|

Energya |

362 |

-267 |

+311 |

612 |

-517 |

+375 |

|

Horticulture |

772 |

+10 |

+323 |

1,547 |

+10 |

+626 |

|

Crop Insurance |

38,057 |

-70 |

-1 |

78,037 |

-161 |

-2 |

|

Miscellaneous |

1,259 |

+553 |

+594 |

2,423 |

+566 |

+517 |

|

Subtotal |

426,462 |

+2,344 |

+1,573 |

867,200 |

-1,320 |

+68 |

|

Increase in Revenue |

- |

+115 |

+33 |

- |

+465 |

+68 |

|

Total |

426,462 |

+2,229 |

+1,540 |

867,200 |

-1,785 |

0 |

Source: CRS. Compiled from the CBO Baseline by Title (unpublished; April 2018), based on the CBO baseline, https://www.cbo.gov/about/products/baseline-projections-selected-programs, April 2018, and the CBO cost estimates for H.R. 2 as passed by the House of Representatives and the Senate Amendment to H.R. 2 as passed by the Senate, https://www.cbo.gov/publication/54284, July 24, 2018.

Note:

a. The House bill combined rural development and energy provisions into a Rural Infrastructure and Economic Development title. This table retains the separate titles, based on provisions, to maintain consistency with the 2014 farm bill, the CBO baseline, and the Senate bill.

|

Figure 1. CBO Baseline for Farm Bill Titles (10-year projected outlays under current law, FY2019-FY2028, billions of dollars) |

|

|

Source: CRS, using CBO Baseline by Title (unpublished; April 2018), based on the CBO baseline, https://www.cbo.gov/about/products/baseline-projections-selected-programs, April 2018. |

Table 2. CBO Baseline for the 2018 Farm Bill, by Title and Program

(projected outlays in millions of dollars, April 2018 baseline)

|

Fiscal year |

5 years |

10 years |

||||||||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

FY2019-23 |

FY2019-28 |

|

|

Title I: Farm Commodity Programs |

||||||||||||

|

Agricultural Risk Coverage |

2,627 |

2,155 |

464 |

430 |

479 |

431 |

463 |

482 |

505 |

492 |

6,155 |

8,529 |

|

Price Loss Coverage |

2,727 |

2,653 |

5,742 |

5,006 |

4,574 |

4,639 |

4,603 |

4,854 |

4,558 |

4,566 |

20,702 |

43,921 |

|

Marketing Loan Program |

58 |

51 |

51 |

48 |

45 |

44 |

43 |

47 |

48 |

50 |

254 |

486 |

|

Dairy |

186 |

161 |

160 |

177 |

173 |

177 |

191 |

128 |

134 |

137 |

857 |

1,624 |

|

Disaster assistance programs |

364 |

361 |

391 |

390 |

388 |

386 |

389 |

388 |

387 |

425 |

1,893 |

3,868 |

|

Other |

524 |

241 |

228 |

235 |

251 |

252 |

244 |

253 |

255 |

240 |

1,479 |

2,723 |

|

Subtotal, Title I |

6,487 |

5,621 |

7,035 |

6,286 |

5,910 |

5,930 |

5,934 |

6,151 |

5,886 |

5,910 |

31,340 |

61,151 |

|

Title II: Conservation |

||||||||||||

|

Conservation Reserve Program |

1,819 |

1,999 |

2,042 |

2,083 |

2,126 |

2,169 |

2,209 |

2,223 |

2,213 |

2,214 |

10,069 |

21,097 |

|

Emergency Forestry Conservation Reserve |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

5 |

10 |

|

CRP Technical Assistance |

100 |

37 |

77 |

72 |

147 |

106 |

169 |

91 |

94 |

85 |

433 |

978 |

|

Conservation Security/Stewardship Program |

1,607 |

1,822 |

1,743 |

1,772 |

1,820 |

1,771 |

1,768 |

1,810 |

1,808 |

1,808 |

8,764 |

17,729 |

|

Environmental Quality Incentives Program |

1,509 |

1,545 |

1,600 |

1,640 |

1,674 |

1,729 |

1,750 |

1,750 |

1,750 |

1,750 |

7,968 |

16,697 |

|

Agricultural Conservation Easement Program |

310 |

271 |

266 |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

1,347 |

2,597 |

|

Regional Conservation Partnership Program |

127 |

125 |

121 |

107 |

98 |

100 |

100 |

100 |

100 |

100 |

578 |

1,078 |

|

Agricultural Management Assistance |

9 |

9 |

9 |

10 |

10 |

10 |

10 |

10 |

10 |

10 |

47 |

97 |

|

Programs repealed in 2014 and user fees |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-20 |

-40 |

|

Other, incl. announced FY2019 sequestration |

-233 |

-75 |

-75 |

-51 |

-42 |

-27 |

15 |

-1 |

0 |

0 |

-476 |

-489 |

|

Subtotal, Title II |

5,245 |

5,730 |

5,780 |

5,880 |

6,080 |

6,105 |

6,268 |

6,230 |

6,222 |

6,214 |

28,715 |

59,754 |

|

Title III: Trade |

||||||||||||

|

Market Access Program |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

1,000 |

2,000 |

|

Food for Progress |

153 |

154 |

154 |

154 |

154 |

155 |

155 |

155 |

155 |

155 |

769 |

1,544 |

|

Emerging Markets Program |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

40 |

80 |

|

Subtotal, Title III |

361 |

362 |

362 |

362 |

362 |

363 |

363 |

363 |

363 |

363 |

1,809 |

3,624 |

|

Title IV: Nutrition |

65,817 |

65,268 |

65,033 |

64,857 |

64,947 |

65,477 |

66,247 |

67,151 |

68,720 |

70,311 |

325,922 |

663,828 |

|

Title V: Credit |

-435 |

-437 |

-440 |

-444 |

-449 |

-455 |

-462 |

-471 |

-478 |

-487 |

-2,205 |

-4,558 |

|

Title VI: Rural Development |

35 |

21 |

14 |

14 |

14 |

14 |

14 |

14 |

14 |

14 |

98 |

168 |

|

Title VII: Research |

82 |

78 |

59 |

55 |

55 |

55 |

55 |

55 |

55 |

55 |

329 |

604 |

|

Title VIII: Forestry |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

5 |

10 |

|

Title IX: Energy |

102 |

89 |

70 |

51 |

50 |

50 |

50 |

50 |

50 |

50 |

362 |

612 |

|

Title X: Horticulture |

153 |

154 |

155 |

155 |

155 |

155 |

155 |

155 |

155 |

155 |

772 |

1,547 |

|

Title XI: Crop Insurance |

7,230 |

7,471 |

7,684 |

7,811 |

7,860 |

7,903 |

7,942 |

8,006 |

8,047 |

8,082 |

38,057 |

78,037 |

|

Title XII: Miscellaneous |

||||||||||||

|

Noninsured Crop Disaster Assistance Program |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

223 |

1,114 |

2,229 |

|

Other |

71 |

37 |

12 |

12 |

12 |

10 |

10 |

10 |

10 |

10 |

145 |

195 |

|

Subtotal, Title XII |

294 |

259 |

235 |

235 |

235 |

233 |

233 |

233 |

233 |

233 |

1,259 |

2,423 |

|

Total |

85,372 |

84,617 |

85,989 |

85,263 |

85,221 |

85,831 |

86,800 |

87,938 |

89,268 |

90,901 |

426,462 |

867,200 |

|

Nutrition (Title IV) |

65,817 |

65,268 |

65,033 |

64,857 |

64,947 |

65,477 |

66,247 |

67,151 |

68,720 |

70,311 |

325,922 |

663,828 |

|

Non-nutrition (other titles) |

19,555 |

19,350 |

20,955 |

20,406 |

20,274 |

20,354 |

20,553 |

20,787 |

20,548 |

20,590 |

100,540 |

203,372 |

Source: CRS, compiled using the CBO Baseline by Title (unpublished; April 2018; in bold), and based on additional details for programs from the CBO baseline, https://www.cbo.gov/about/products/baseline-projections-selected-programs, April 2018 (in italics).

Note: Near-term amounts may include outlays for programs that expired before FY2019. Among titles without program detail, Nutrition includes SNAP, Credit includes receipts to FCS Insurance Fund. Research includes SCRI. Energy includes REAP, Horticulture includes SCBG, PPDM, and promotion orders, as noted in Figure 2.

Programs Without Baseline

As explained above, most of the major farm bill provisions are assumed to continue in the baseline. However, some programs may not be assumed to continue, because they had estimated mandatory spending below the minimum scoring threshold of $50 million or the Budget and/or Agriculture Committees determined that mandatory spending should not continue.

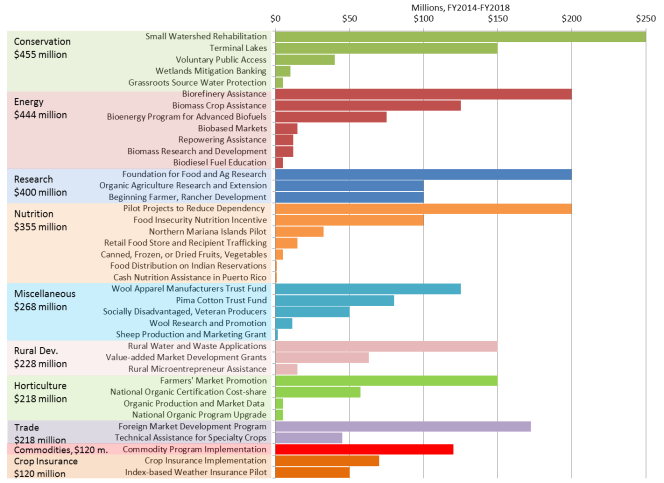

The 2014 farm bill contains 39 programs that received mandatory funding that do not have baseline beyond FY2018 (Figure 3). These programs had estimated mandatory spending totaling $2.824 billion over the five-year farm bill.16

Among this group are certain conservation programs; most of the Bioenergy, Rural Development, and Research title programs; various Nutrition title pilot programs and studies; organic agriculture and farmers' market programs; trade promotion; and outreach to farmers.17

|

Figure 3. 2014 Farm Bill Programs Without a Budget Baseline After FY2018 |

|

|

Sources: Compiled by CRS using the text of the 2014 farm bill (P.L. 113-79); the CBO score of the Agricultural Act of 2014, Table 4, "Detailed Effects on Direct Spending," January 28, 2014, https://www.cbo.gov/publication/45049; and the CBO Baseline Projection for USDA Mandatory Farm Programs, April 2018. |

Scores of the 2018 Farm Bill Proposals

The budgetary impact of the 2018 farm bill proposals (House-passed H.R. 2 and the Senate-passed amendment to H.R. 2) are measured relative to the CBO baseline—that is, what the 2014 farm bill (current law) would have spent had it continued. Budget enforcement uses the April 2018 baseline and these scores to follow an array of federal budget rules, such as "PayGo," that require budgetary offsets to balance new spending to avoid increasing the federal deficit.18

Although the farm bill is generally considered a 5-year authorization—the potential 2018 farm bill would cover FY2019-FY2023—budget rules require it to be scored over a 10-year budget window. Thus, when the legislation is discussed during its development, the farm bill may be presented more in terms of its effect over the 10-year budget window than the score of the bill over the intended 5-year duration of the law. Separately, other statements about the total cost of the farm bill may be in terms of its five-year baseline (i.e., projected spending over the five-year life of the farm bill). Both are appropriate measures depending on one's perspective, but the two can be very different in magnitude, so it is important to differentiate between them.

CBO has released several scores of the 2018 farm bill in the various stages of its development. The most recent is an update that was released jointly for both bills on July 24, 2018, for the versions of H.R. 2 as passed by the House and the Senate and is the basis for the analysis here.19

Prior to the July 24 scores, CBO released its analyses of the original House-introduced bill,20 the House-reported bill after it passed the full committee and was initially considered on the floor,21 and the Senate-reported bill.22 The July 24 scores incorporate floor amendments from both chambers' bills that caused the House bill to reduce spending compared with the House-reported bill—particularly in the Nutrition title—and the Senate bill to spend slightly more than the Senate-reported bill in the Nutrition, Farm Commodities, and Miscellaneous titles. Subsequent to the July 24 scores, CBO released a more detailed assessment of payment limit provisions in the House-passed bill that did not change the score but explained it in more detail.23

Summaries of the House- and Senate-Passed Bill Scores

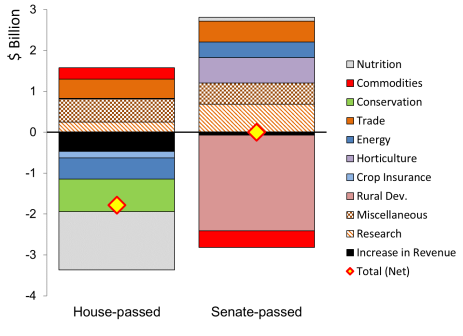

Relative to the 10-year $867 billion baseline (Table 1, Figure 1), the House-passed bill would reduce outlays by $1.8 billion over 10 years (-0.2%), and the Senate-passed bill would remain budget neutral (+0%) over the same 10-year period (as indicated by the diamonds in Figure 4).

The overall relatively small scores are the net result of sometimes relatively larger increases and reductions across titles (indicated by bar segments in Figure 4, Table 1).

- The House-passed bill would achieve its overall net reduction by reducing net outlays in four titles (Nutrition, Conservation, Energy, and Crop insurance) and by raising revenue from fees paid by contractors in the SNAP program. It would increase spending by less than the total of these reductions across five other titles (Miscellaneous, Trade, Commodities, Research, and Horticulture).

- The Senate-passed bill would achieve its budget-neutral outcome by reducing net spending in three titles (Rural Development, Commodities, and Crop insurance) and raising revenue for an oilheat program. It would increase spending across seven titles (Research, Horticulture, Miscellaneous, Trade, Energy, Nutrition, and Forestry).

|

Figure 4. CBO Scores of the House-Passed and Senate-Passed Farm Bills, by Title (projected change in 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, using the CBO cost estimates for H.R. 2 as passed by the House of Representatives and the Senate Amendment to H.R. 2 as passed by the Senate, https://www.cbo.gov/publication/54284, July 24, 2018. Note: Does not show amounts less than $50 million that are presented in Table 1. |

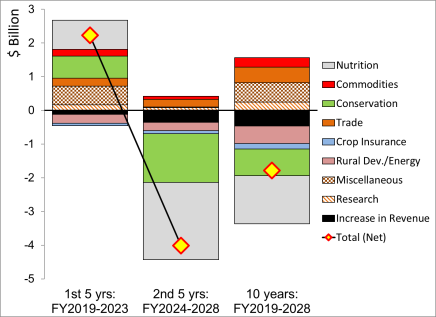

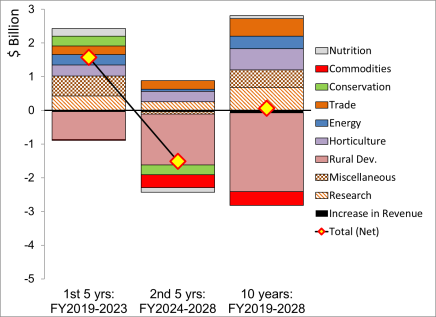

Net Increases in Five-Year Outlays Are Followed by Net Decreases

For the House-passed bill, the net reduction of $1.8 billion over 10 years may be disaggregated into 2 time periods. On a shorter-time-period basis, the five-year score for the authorized life of the bill (FY2019-FY2023) shows a net increase of $2.2 billion over the comparable baseline of $426 billion (Table 1). This projected increase is more than offset by planned reductions that would not be realized until the second five years of the budget window (Figure 5).

For the Senate-passed bill, when the budget-neutral 10-year score is disaggregated, the effect is similar. The five-year FY2019-FY2023 score of the Senate bill shows a net increase of $1.6 billion that is offset by net reductions that would occur during the second five years (Figure 6).

In both bills, some of the titles that have increases in the first five years have decreases in the second five years (e.g., the Nutrition and Conservation titles in both the House- and Senate-passed bills). This may occur because of the time needed to implement changes and may make provisions more appealing in the early years despite having less baseline for a future farm bill.

|

Figure 5. CBO Score of House-Passed H.R. 2, by Period and Title (projected change in 5- and 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, using the CBO cost estimates for H.R. 2 as passed by the House, https://www.cbo.gov/publication/54284, July 24, 2018. Note: Does not show amounts less than $50 million that are indicated in Table 1. |

|

Figure 6. CBO Score of the Senate-Passed Amendment to H.R. 2, by Period and Title (projected change in 5- and 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, using the CBO cost estimates for the Senate Amendment to H.R. 2 as passed by the Senate, https://www.cbo.gov/publication/54284, July 24, 2018. Note: Does not show amounts less than $50 million that are indicated in Table 1. |

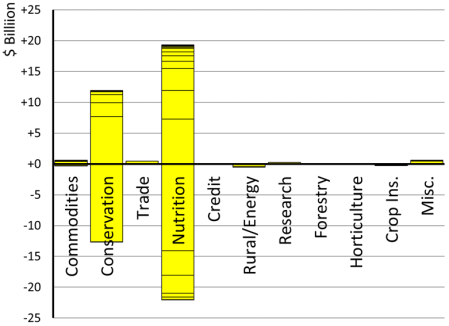

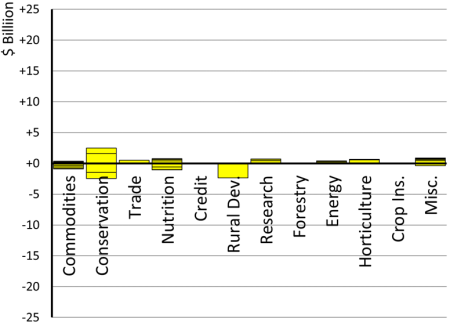

Section-by-Section Scores for Some Titles Exceed Net Scores

Some of the overall scores within a single title are the net result of increases in some sections (provisions) that are offset by reductions in other sections. Sometimes, these increases or decreases are relatively large compared to the net title-level effect. These budget effects may reflect the policy preferences of particular constituencies that may be less apparent in the net title-level scores. For example

- In the House-passed bill, the Nutrition title has six sections that sum to a $22.0 billion reduction over 10 years (including those for work requirements) and 18 sections that add to $20.6 billion in increased spending—for a relatively small $1.4 billion net decrease in the title-level score. Similarly, the Conservation title has two sections that sum to a $12.6 billion reduction over 10 years (including repealing the Conservation Stewardship Program) and eight sections that add to $11.8 billion in increased spending—for the relatively small net $0.8 billion decrease (Figure 7, Table 3).

- In the Senate-passed bill, none of the titles' section-by-section scores are as large as for the Nutrition and Conservation titles in the House-passed bill. Nonetheless, the section-by-section scores of the Senate-passed bill show both increases and decreases within some titles, such as Conservation, Nutrition, and Commodities (Figure 8, Table 4).

Programs Without Baseline

For some of the programs without baseline, both the House-passed and Senate-passed bills would provide continuing funding and, in some cases, permanent baseline. Permanent baseline for a program may be indicated by the continuation of funding in the FY2024-FY2028 period that is similar to FY2019-FY2023 (Table 3 and Table 4).

- In the House bill, programs that receive permanent baseline include Trade title programs that are combined into a new program ($470 million), and a food insecurity program in the Nutrition title ($472 million). Other affected programs that receive mandatory funding, but not permanent baseline, include organic research and beginning farmer programs in the Research title ($250 million), two organic programs in the Horticulture title ($10 million), and outreach for socially disadvantaged farmers and the wool and cotton trust funds in the Miscellaneous title ($150 million). In the Conservation title, small watershed rehabilitation, wetlands mitigation, voluntary public access, and grassroots source water protection programs receive over $500 million of mandatory funding.

- In the Senate bill, more programs receive permanent baseline than in the House bill, including Trade title programs ($515 million), organic research ($450 million), the beginning farmer program that would be combined with other outreach programs ($466 million), farmers market and value-added promotion programs that are combined ($558 million), and a food insecurity program in the Nutrition title ($401 million). Other affected programs that receive mandatory funding, but not permanent baseline, include an agricultural research foundation ($200 million); various bioenergy programs ($375 million); two other horticulture programs ($63 million); and the Pima cotton, wool, and citrus programs in the Miscellaneous title ($326 million).

|

Figure 7. CBO Score of House-Passed H.R. 2, by Section and Title (projected change in 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, sorted within titles using the CBO cost estimate for H.R. 2 as passed by the House, July 24, 2018. Note: Figure indicates magnitude of changes within titles. Details about individual sections are in Table 3. |

|

Figure 8. CBO Score of Senate-Passed Amendment to H.R. 2, by Section and Title (projected change in 10-year outlays relative to baseline, FY2019-FY2028) |

|

|

Source: CRS, sorted within titles using the CBO cost estimate for H.R. 2 as passed by the Senate, July 24, 2018. Note: Figure indicates magnitude of changes within titles. Details about individual sections are in Table 4. |

Table 3. CBO Score of House-Passed H.R. 2, by Section

(projected change in outlays relative to April 2018 baseline, millions of dollars)

|

Fiscal year |

5 years |

10 years |

||||||||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2019-23 |

2019-28 |

|

|

Title I—Commodity Programs |

||||||||||||

|

Agriculture Risk Coverage—Individuala |

+0 |

+0 |

-16 |

-17 |

-18 |

-18 |

-17 |

-19 |

-18 |

-20 |

-51 |

-143 |

|

Agriculture Risk Coverage—Countya |

+0 |

+0 |

+23 |

-34 |

-26 |

-17 |

-6 |

-15 |

-25 |

-11 |

-37 |

-111 |

|

Dairy Program |

-45 |

-2 |

+4 |

+3 |

-1 |

-3 |

-6 |

-4 |

+18 |

+17 |

-41 |

-20 |

|

Nonrecourse Marketing Assistance Loansa |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

|

Economic Adjustment Assistance Textile Mills |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+2 |

+11 |

+23 |

|

Implementation |

+24 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+25 |

+25 |

|

Payment Limitationsb |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+20 |

+40 |

|

Supplemental Agriculture Disaster Assistance |

+13 |

+6 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+6 |

+35 |

+62 |

|

Price Loss Coveragea |

+0 |

+0 |

+137 |

+55 |

+43 |

+50 |

+134 |

-59 |

-16 |

+64 |

+235 |

+408 |

|

Subtotal, Title I |

-3 |

+12 |

+160 |

+18 |

+10 |

+23 |

+115 |

-85 |

-30 |

+62 |

+198 |

+284 |

|

Title II—Conservation |

||||||||||||

|

Repeal Conservation Stewardship Program |

-28 |

-406 |

-725 |

-1,072 |

-1,422 |

-1,771 |

-1,768 |

-1,810 |

-1,808 |

-1,808 |

-3,653 |

-12,618 |

|

Conservation Reserve Program |

-21 |

+70 |

+98 |

+96 |

+83 |

+73 |

-43 |

-76 |

-137 |

-166 |

+326 |

-23 |

|

Grassroots Source Water Protectionc |

+2 |

+2 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Wetlands Mitigation Bankingc |

+2 |

+2 |

+2 |

+2 |

+2 |

+0 |

+0 |

+0 |

+0 |

+0 |

+10 |

+10 |

|

Voluntary Public Access and Habitat Protectionc |

+10 |

+10 |

+10 |

+10 |

+10 |

+0 |

+0 |

+0 |

+0 |

+0 |

+50 |

+50 |

|

Feral Swine Eradication and Control Pilot |

+20 |

+30 |

+25 |

+15 |

+10 |

+0 |

+0 |

+0 |

+0 |

+0 |

+100 |

+100 |

|

Small Watershed Rehabilitation Programc |

+3 |

+16 |

+38 |

+58 |

+74 |

+81 |

+73 |

+52 |

+32 |

+32 |

+189 |

+459 |

|

Regional Conservation Partnership Program |

+60 |

+106 |

+118 |

+131 |

+143 |

+150 |

+150 |

+150 |

+150 |

+150 |

+558 |

+1,308 |

|

Agricultural Conservation Easement Program |

+90 |

+187 |

+221 |

+234 |

+247 |

+247 |

+248 |

+248 |

+249 |

+250 |

+979 |

+2,221 |

|

Environmental Quality Incentives Program |

+55 |

+227 |

+424 |

+608 |

+777 |

+921 |

+1,056 |

+1,164 |

+1,217 |

+1,243 |

+2,092 |

+7,693 |

|

Subtotal, Title II |

+193 |

+244 |

+212 |

+82 |

-76 |

-299 |

-284 |

-272 |

-297 |

-299 |

+656 |

-795 |

|

Title III—Trade |

||||||||||||

|

International Development Programd |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+235 |

+470 |

|

Subtotal, Title III |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+47 |

+235 |

+470 |

|

Title IV—Nutrition |

||||||||||||

|

Workforce Solutions: Benefits |

+0 |

-300 |

-1,330 |

-1,350 |

-1,340 |

-1,370 |

-1,560 |

-1,920 |

-2,280 |

-2,650 |

-4,320 |

-14,100 |

|

Update to Categorical Eligibility |

+0 |

+0 |

-200 |

-525 |

-520 |

-530 |

-530 |

-540 |

-555 |

-565 |

-1,245 |

-3,965 |

|

Standard Utility Allowances Based on Receipt |

-130 |

-310 |

-310 |

-310 |

-300 |

-300 |

-310 |

-310 |

-320 |

-330 |

-1,360 |

-2,930 |

|

Duplicative Enrollment Database |

+0 |

-8 |

-25 |

-45 |

-60 |

-80 |

-90 |

-90 |

-95 |

-95 |

-138 |

-588 |

|

State Performance Indicators |

+0 |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-48 |

-192 |

-432 |

|

Disqualification of Certain Convicted Felons |

* |

* |

* |

-1 |

-2 |

-2 |

-3 |

-4 |

-5 |

-6 |

-3 |

-23 |

|

Benefit Recovery |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

|

Tolerance Level for Payment Errors |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

|

Administrative Flexibility for States |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

|

Multivitamin-Mineral Dietary Supplements |

* |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

* |

* |

|

Review of SNAP Operations |

* |

* |

* |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

* |

* |

|

Mobile Technologies |

+0 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+2 |

+2 |

+2 |

+4 |

+12 |

|

SNAP Benefit Transfer Data Report |

+4 |

+3 |

+2 |

+3 |

+3 |

+3 |

+3 |

+3 |

+3 |

+3 |

+15 |

+30 |

|

Interactions |

-2 |

-3 |

* |

+2 |

-4 |

-3 |

-2 |

+12 |

+10 |

+25 |

-7 |

+35 |

|

Simplified Homeless Housing Costs |

+4 |

+8 |

+8 |

+8 |

+8 |

+8 |

+8 |

+8 |

+8 |

+8 |

+36 |

+76 |

|

Percent Recovered Funds Retained by States |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+11 |

+11 |

+50 |

+102 |

|

Basic Allowance for Housing |

+8 |

+11 |

+11 |

+11 |

+11 |

+12 |

+12 |

+13 |

+13 |

+14 |

+52 |

+116 |

|

Implementation Funds |

+128 |

+17 |

+3 |

+3 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+150 |

+150 |

|

Prohibited Fees |

+0 |

+3 |

+7 |

+13 |

+20 |

+20 |

+20 |

+20 |

+25 |

+25 |

+43 |

+153 |

|

Asset Limits; Vehicle Allowance; Savings |

+1 |

-15 |

+5 |

+30 |

+30 |

+30 |

+30 |

+30 |

+30 |

+30 |

+51 |

+201 |

|

Food Insecurity Nutrition Incentive Programd |

+7 |

+17 |

+30 |

+46 |

+55 |

+59 |

+63 |

+65 |

+65 |

+65 |

+155 |

+472 |

|

Emergency Food Assistance |

+45 |

+46 |

+47 |

+48 |

+49 |

+50 |

+52 |

+53 |

+54 |

+55 |

+235 |

+499 |

|

National Gateway |

+8 |

+10 |

+10 |

+68 |

+70 |

+78 |

+81 |

+90 |

+95 |

+95 |

+165 |

+601 |

|

Nutrition Education |

+57 |

+58 |

+59 |

+61 |

+62 |

+64 |

+65 |

+67 |

+69 |

+70 |

+297 |

+632 |

|

Transitional Benefits |

+75 |

+90 |

+90 |

+90 |

+90 |

+90 |

+90 |

+90 |

+95 |

+95 |

+435 |

+895 |

|

Retailer-Funded Incentives Pilot |

+2 |

+182 |

+180 |

+120 |

+120 |

+120 |

+120 |

+120 |

+120 |

+120 |

+604 |

+1,204 |

|

Cooperation with Child Support Agencies |

+140 |

+304 |

+321 |

+335 |

+345 |

+355 |

+375 |

+396 |

+446 |

+476 |

+1,446 |

+3,494 |

|

Earned Income Deduction |

+350 |

+470 |

+470 |

+470 |

+470 |

+470 |

+470 |

+480 |

+490 |

+500 |

+2,230 |

+4,640 |

|

Workforce Solutions: Administration |

+0 |

+140 |

+600 |

+680 |

+740 |

+810 |

+920 |

+1,020 |

+1,140 |

+1,250 |

+2,160 |

+7,300 |

|

Subtotal, Title IV |

+707 |

+685 |

-59 |

-280 |

-190 |

-153 |

-223 |

-434 |

-628 |

-850 |

+862 |

-1,426 |

|

Title V—Credit |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

|

Title VI—Rural Infrastructure and Economic Developmente |

||||||||||||

|

Rural Energy for America Programe |

-10 |

-30 |

-45 |

-50 |

-50 |

-50 |

-50 |

-50 |

-50 |

-50 |

-185 |

-435 |

|

Biorefinery Assistancee |

-35 |

-31 |

-16 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

-82 |

-82 |

|

Subtotal, Title VIe |

-45 |

-61 |

-61 |

-50 |

-50 |

-50 |

-50 |

-50 |

-50 |

-50 |

-267 |

-517 |

|

Title VII—Research and Extension |

||||||||||||

|

Beginning Farmer and Rancher Developmentc |

+3 |

+10 |

+15 |

+19 |

+20 |

+17 |

+10 |

+5 |

+1 |

+0 |

+67 |

+100 |

|

Organic Agricultural Research and Extensionc |

+5 |

+15 |

+23 |

+29 |

+30 |

+26 |

+15 |

+8 |

+2 |

+0 |

+101 |

+150 |

|

Subtotal, Title VII |

+8 |

+25 |

+38 |

+48 |

+50 |

+43 |

+25 |

+13 |

+3 |

+0 |

+168 |

+250 |

|

Title VIII—Forestry |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

|

Title IX—Horticulture |

||||||||||||

|

National Organic Program Technology Updatec |

+1 |

+1 |

+1 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Organic Production and Market Data Initiativec |

+1 |

+1 |

+1 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Subtotal, Title IX |

+2 |

+2 |

+2 |

+2 |

+2 |

+0 |

+0 |

+0 |

+0 |

+0 |

+10 |

+10 |

|

Title X—Crop Insurance |

||||||||||||

|

Education and Risk Management Assistance |

-1 |

-11 |

-17 |

-13 |

-14 |

-14 |

-15 |

-15 |

-15 |

-15 |

-52 |

-125 |

|

Increase Catastrophic Administration Fee |

-1 |

-7 |

-8 |

-8 |

-8 |

-8 |

-8 |

-8 |

-8 |

-8 |

-32 |

-72 |

|

Research and Development Priorities |

-5 |

-5 |

-5 |

-5 |

-5 |

-5 |

-5 |

-5 |

-5 |

-5 |

-23 |

-45 |

|

Program Administration |

+0 |

-2 |

-2 |

-2 |

-2 |

-2 |

-2 |

-2 |

-2 |

-2 |

-8 |

-18 |

|

Whole Farm Application to Beginning Farmers |

+0 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+4 |

+9 |

|

Treatment of Forage and Grazing |

+1 |

+9 |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+10 |

+40 |

+90 |

|

Subtotal, Title X |

-6 |

-14 |

-16 |

-17 |

-17 |

-18 |

-18 |

-18 |

-18 |

-18 |

-70 |

-161 |

|

Title XI—Miscellaneous |

||||||||||||

|

Noninsured Crop Disaster Assistance |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-19 |

-37 |

|

Outreach to Socially Disadvantaged Producersc |

+5 |

+8 |

+10 |

+10 |

+10 |

+5 |

+2 |

+0 |

+0 |

+0 |

+43 |

+50 |

|

Textile Trust Fundc |

+1 |

+26 |

+25 |

+25 |

+25 |

+0 |

+0 |

+0 |

+0 |

+0 |

+103 |

+103 |

|

Animal Disease Preparedness and Response |

+150 |

+125 |

+50 |

+50 |

+50 |

+25 |

+0 |

+0 |

+0 |

+0 |

+425 |

+450 |

|

Subtotal, Title XI |

+152 |

+156 |

+82 |

+82 |

+82 |

+26 |

-2 |

-4 |

-4 |

-4 |

+553 |

+566 |

|

Total Changes in Direct Spending |

+1,055 |

+1,096 |

+406 |

-68 |

-142 |

-381 |

-390 |

-803 |

-977 |

-1,112 |

+2,344 |

-1,320 |

|

Increases in Revenue: Title IV—Nutrition |

+0 |

+0 |

+0 |

+55 |

+60 |

+60 |

+65 |

+70 |

+75 |

+80 |

+115 |

+465 |

|

Net Effect on the Deficit |

+1,055 |

+1,095 |

+405 |

-124 |

-203 |

-441 |

-455 |

-874 |

-1,052 |

-1,192 |

+2,229 |

-1,785 |

Source: CRS, sorted within titles using the CBO cost estimates for H.R. 2 as passed by the House, https://www.cbo.gov/publication/54284, July 24, 2018.

Notes: * denotes score between -$500,000 and +$500,000. + denotes additional spending or, in the case of revenue, additional revenue. – denotes reduced spending.

a. Details by commodity within these programs is available in Table 3 of the original CBO score of the House bill, at https://www.cbo.gov/publication/53760 (April 13, 2018). The total across commodities matches the score of these provisions (ARC, PLC, and marketing loan gains) in both the original CBO estimate and the July 24 score used in this table.

b. Details about CBO's score of the payment limits provision are explained in "Payment Limitations in H.R. 2, the Agriculture and Nutrition Act of 2018," https://www.cbo.gov/publication/54450, September 6, 2018.

c. Denotes a "program without baseline" after FY2018 from the 2014 farm bill (Figure 3) that received new funding in FY2019-2023 but not permanent baseline.

d. Denotes a "program without baseline" after FY2018 from the 2014 farm bill (Figure 3) that received new funding in FY2019-2028 and permanent baseline.

e. The House bill combined rural development and energy provisions (e.g., Titles VI and IX in the 2014 farm bill, respectively) into a single title, Title VI—Rural Infrastructure and Economic Development. Elsewhere in this report, such as in Table 1 and the figures, the two House provisions that scored in Title VI are assigned to an Energy title for comparison to the Senate bill and the CBO baseline.

Table 4. CBO Score of the Senate-Passed Amendment to H.R. 2, by Section

(projected change in outlays relative to April 2018 baseline, millions of dollars)

|

Fiscal year |

5 years |

10 years |

||||||||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2019-23 |

2019-28 |

|

|

Title I—Commodities |

||||||||||||

|

Economic Adjustment to Users of Upland Cotton |

+0 |

+0 |

+0 |

-46 |

-46 |

-47 |

-47 |

-47 |

-47 |

-47 |

-92 |

-328 |

|

AGI Limitation of $700,000 |

-2 |

-3 |

-38 |

-33 |

-31 |

-31 |

-31 |

-32 |

-31 |

-31 |

-107 |

-263 |

|

Actively Engaged in Farming Requirement |

+0 |

-2 |

-31 |

-27 |

-25 |

-25 |

-25 |

-26 |

-25 |

-25 |

-85 |

-211 |

|

Dairy Product Donation Program |

-5 |

-5 |

-6 |

-6 |

-5 |

-5 |

-6 |

-5 |

-5 |

-5 |

-27 |

-53 |

|

Producer Election (ARC Default Choice) |

+0 |

+0 |

-2 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-4 |

-9 |

|

Catastrophic Coverage $5.00 with 40% Cap |

+6 |

-3 |

+3 |

+3 |

+3 |

+5 |

-3 |

-5 |

-1 |

-12 |

+13 |

-3 |

|

Supplemental Agriculture Disaster Assistance |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+6 |

+11 |

|

Loss of Peach, Blueberry Crops Due to Cold |

+18 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+18 |

+18 |

|

Additional Assistance for Volcanic Activity |

+27 |

+3 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+30 |

+30 |

|

Milk Donation Program |

+8 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+5 |

+28 |

+53 |

|

Repayment Dairy Risk Coverage Premiums |

+78 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+78 |

+78 |

|

Dairy Risk Coverage |

+24 |

+14 |

+9 |

+6 |

+6 |

+7 |

+0 |

-1 |

+16 |

+16 |

+59 |

+97 |

|

Agriculture Risk Coverage (ARC) |

+0 |

+0 |

+23 |

+17 |

+20 |

+21 |

+21 |

+23 |

+22 |

+23 |

+61 |

+172 |

|

Subtotal, Title I |

+155 |

+10 |

-35 |

-81 |

-73 |

-70 |

-85 |

-88 |

-66 |

-76 |

-23 |

-408 |

|

Title II—Conservation |

||||||||||||

|

Environmental Quality Incentives Program |

-61 |

-120 |

-138 |

-149 |

-158 |

-171 |

-187 |

-176 |

-163 |

-158 |

-626 |

-1,481 |

|

Conservation Stewardship Program |

-3 |

-25 |

-46 |

-67 |

-88 |

-112 |

-133 |

-155 |

-175 |

-196 |

-229 |

-1,000 |

|

Conservation Reserve Program |

-11 |

+42 |

+47 |

+49 |

+15 |

+11 |

-22 |

-30 |

-50 |

-51 |

+142 |

+0 |

|

Regional Conservation Partnership Program |

+41 |

+71 |

+79 |

+87 |

+96 |

+100 |

+100 |

+100 |

+100 |

+100 |

+374 |

+874 |

|

Agricultural Conservation Easement Program |

+56 |

+115 |

+134 |

+149 |

+175 |

+188 |

+194 |

+197 |

+199 |

+200 |

+629 |

+1,607 |

|

Subtotal, Title II |

+22 |

+83 |

+76 |

+69 |

+40 |

+16 |

-48 |

-64 |

-89 |

-105 |

+290 |

+0 |

|

Title III—Trade |

||||||||||||

|

Trade Promotion, Development and Assistancea |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+258 |

+515 |

|

Subtotal, Title III |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+52 |

+258 |

+515 |

|

Title IV—Nutrition |

||||||||||||

|

Interstate Data Matching/Multiple Issuance |

+0 |

-8 |

-25 |

-45 |

-60 |

-80 |

-90 |

-90 |

-95 |

-95 |

-138 |

-588 |

|

Quality Control |

-42 |

-42 |

-42 |

-42 |

-42 |

-42 |

-42 |

-42 |

-42 |

-42 |

-210 |

-420 |

|

Assistance for Community Food Projects |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-4 |

-20 |

-40 |

|

Interactions |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

* |

|

Income Verification |

* |

+2 |

+4 |

+3 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+10 |

+10 |

|

Harvesting Health Pilot Projects |

+4 |

+4 |

+4 |

+4 |

+4 |

+0 |

+0 |

+0 |

+0 |

+0 |

+20 |

+20 |

|

Improvements to EBT System |

+0 |

+2 |

+5 |

+9 |

+8 |

+4 |

+0 |

+0 |

+0 |

+0 |

+24 |

+28 |

|

Food Distribution on Indian Reservations |

+3 |

+3 |

+3 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+4 |

+17 |

+37 |

|

Definition of Certification Period |

* |

* |

+5 |

+20 |

+30 |

+30 |

+30 |

+30 |

+30 |

+30 |

+55 |

+205 |

|

Emergency Food Assistance Programs |

+12 |

+24 |

+23 |

+23 |

+23 |

+19 |

+20 |

+20 |

+21 |

+21 |

+105 |

+206 |

|

Work Requirements for SNAP |

+5 |

+40 |

+55 |

+55 |

+55 |

+5 |

+5 |

+5 |

+5 |

+5 |

+210 |

+235 |

|

Food Insecurity Nutrition Incentivea |

+8 |

+18 |

+30 |

+45 |

+50 |

+50 |

+50 |

+50 |

+50 |

+50 |

+151 |

+401 |

|

Subtotal, Title IV |

-14 |

+39 |

+58 |

+72 |

+69 |

-14 |

-27 |

-27 |

-31 |

-31 |

+224 |

+94 |

|

Title V—Credit |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

|

Title VI—Rural Development |

||||||||||||

|

Cushion of Credit: No New, Reduce Rate |

-140 |

-140 |

-150 |

-190 |

-220 |

-260 |

-280 |

-300 |

-320 |

-350 |

-840 |

-2,350 |

|

Rural Electric Development Loan and Grants |

+0 |

+0 |

+0 |

+4 |

+4 |

+2 |

+0 |

+0 |

+0 |

+0 |

+8 |

+10 |

|

Subtotal, Title VI |

-140 |

-140 |

-150 |

-186 |

-216 |

-258 |

-280 |

-300 |

-320 |

-350 |

-832 |

-2,340 |

|

Title VII—Research and Extension |

||||||||||||

|

Biomass Research and Development |

+0 |

+1 |

+2 |

+3 |

+3 |

+3 |

+2 |

+1 |

+0 |

+0 |

+8 |

+15 |

|

Emerging Agricultural Production Research and Extension |

+2 |

+3 |

+4 |

+4 |

+4 |

+2 |

+1 |

+0 |

+0 |

+0 |

+17 |

+20 |

|

Foundation for Food and Agricultural Researchb |

+200 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

+200 |

+200 |

|

Organic Agricultural Research and Extension Initiativea |

+24 |

+36 |

+43 |

+48 |

+50 |

+50 |

+50 |

+50 |

+50 |

+50 |

+200 |

+450 |

|

Subtotal, Title VII |

+226 |

+40 |

+48 |

+54 |

+57 |

+55 |

+53 |

+51 |

+50 |

+50 |

+426 |

+685 |

|

Title VIII—Forestry |

+1 |

+1 |

+1 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Title IX—Energy |

||||||||||||

|

Carbon Utilization Education Program |

+2 |

+2 |

+2 |

+2 |

+2 |

0 |

0 |

0 |

0 |

0 |

+10 |

+10 |

|

Bio-based Market Programb |

+3 |

+3 |

+3 |

+3 |

+3 |

+0 |

+0 |

+0 |

+0 |

+0 |

+15 |

+15 |

|

Bioenergy Program for Advanced Biofuelsb |

+3 |

+9 |

+13 |

+14 |

+15 |

+12 |

+6 |

+2 |

+1 |

+0 |

+54 |

+75 |

|

Biomass Crop Assistance Programb |

+9 |

+16 |

+20 |

+22 |

+25 |

+16 |

+8 |

+5 |

+4 |

+0 |

+92 |

+125 |

|

Bio-refinery Assistanceb |

+0 |

+20 |

+40 |

+45 |

+35 |

+10 |

+0 |

+0 |

+0 |

+0 |

+140 |

+150 |

|

Subtotal, Title IX |

+17 |

+50 |

+78 |

+86 |

+80 |

+38 |

+14 |

+7 |

+5 |

+0 |

+311 |

+375 |

|

Title X—Horticulture |

||||||||||||

|

Organic Production and Market Datab |

+1 |

+1 |

+1 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Organic Certification/Trade Tracking/Data Collection |

+1 |

+1 |

+1 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

National Organic Certification Cost Shareb |

+9 |

+12 |

+12 |

+12 |

+12 |

+3 |

0 |

0 |

0 |

0 |

+55 |

+58 |

|

Local Agriculture Market Programa |

+33 |

+45 |

+60 |

+60 |

+60 |

+60 |

+60 |

+60 |

+60 |

+60 |

+258 |

+558 |

|

Subtotal, Title X |

+44 |

+59 |

+74 |

+74 |

+74 |

+63 |

+60 |

+60 |

+60 |

+60 |

+323 |

+626 |

|

Title XI—Crop Insurance |

||||||||||||

|

Enterprise Units Across County Lines |

+0 |

-3 |

-3 |

-3 |

-3 |

-3 |

-3 |

-3 |

-3 |

-3 |

-12 |

-27 |

|

Crop Production on Native Sod |

+0 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-3 |

-7 |

|

Funding for Information Technology |

+0 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+2 |

+2 |

|

Submission of Policies and Materials to Board |

+0 |

+0 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+3 |

+8 |

|

Whole Farm Revenue Agent Incentives |

+0 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+2 |

+3 |

+10 |

|

Pasture, Range, Forage Policy Indian Tribes |

+0 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+5 |

+12 |

|

Subtotal, Title XI |

+0 |

+0 |

+0 |

-1 |

-1 |

+0 |

+0 |

+0 |

+0 |

+0 |

-1 |

-2 |

|

Title XII—Miscellaneous |

||||||||||||

|

Extension of Merchandise Processing Fee |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

+0 |

-371 |

+0 |

+0 |

-371 |

|

Direct Operation Microloans |

+1 |

+1 |

+1 |

+1 |

+1 |

+0 |

+0 |

+0 |

+0 |

+0 |

+5 |

+5 |

|

Cattle Tick Inspection Emergency Livestock |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+4 |

+7 |

|

Administrative Units |

+0 |

+0 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+1 |

+3 |

+7 |

|

Wool Research and Promotion |

+0 |

+2 |

+2 |

+2 |

+2 |

+0 |

+0 |

+0 |

+0 |

+0 |

+9 |

+10 |

|

National Oilheat Research Alliance |

+5 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+33 |

+68 |

|

Pima Agriculture Cotton Trust Fundb |

+16 |

+16 |

+16 |

+16 |

+16 |

+0 |

+0 |

+0 |

+0 |

+0 |

+80 |

+80 |

|

Agriculture Wool Apparel Manufacturing Trust Fundb |

+0 |

+30 |

+30 |

+30 |

+30 |

+0 |

+0 |

+0 |

+0 |

+0 |

+120 |

+121 |

|

Emergency Citrus Trust Fundb |

+25 |

+25 |

+25 |

+25 |

+25 |

+0 |

+0 |

+0 |

+0 |

+0 |

+125 |

+125 |

|

Farming Opportunities Training and Outreacha |

+26 |

+40 |

+50 |

+50 |

+50 |

+50 |

+50 |

+50 |

+50 |

+50 |

+216 |

+466 |

|

Subtotal, Title XII |

+73 |

+122 |

+133 |

+133 |

+133 |

+59 |

+59 |

+59 |

-312 |

+59 |

+594 |

+517 |

|

Total Changes in Direct Spending |

+436 |

+314 |

+334 |

+273 |

+215 |

-61 |

-203 |

-250 |

-651 |

-341 |

+1,573 |

+68 |

|

Increases in Revenue: Title XII—Oilheat |

+5 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+7 |

+33 |

+68 |

|

Net Effect on the Deficit |

+431 |

+307 |

+327 |

+266 |

+208 |

-68 |

-210 |

-257 |

-658 |

-348 |

+1,540 |

+0 |

Source: CRS, sorted within titles using the CBO cost estimates for the Senate-passed amendment to H.R. 2, https://www.cbo.gov/publication/54284, July 24, 2018.

Notes: * denotes score between -$500,000 and +$500,000. + denotes additional spending or, in the case of revenue, additional revenue. - denotes reduced spending.

a. Denotes a "program without baseline" after FY2018 from the 2014 farm bill (Figure 3) that received new funding in FY2019-2028 and permanent baseline.

b. Denotes a "program without baseline" after FY2018 from the 2014 farm bill (Figure 3) that received new funding in FY2019-2023 but not permanent baseline.

Authorizations for Discretionary Appropriation

In addition to the mandatory spending figures above, the farm bill authorizes appropriations for a variety of existing and new USDA programs. The CBO scores include an estimate of the discretionary spending that would be needed to implement provisions that have authorizations of appropriations. As discussed before, these authorizations are not actual costs to the score of the farm bill (in terms of mandatory spending baseline and score) because such discretionary spending is ultimately determined in future annual appropriations acts.

For the House-passed farm bill, CBO estimated that implementing the provisions of H.R. 2 that specify authorizations of appropriations would cost $24.5 billion over the five-year period FY2019-FY2023, assuming appropriation of the specified amounts. For the Senate-passed version, the amount would be slightly smaller at $23.7 billion.24

For both of these estimates of chamber-passed authorized appropriations, the projection is for the total of the bill and is not disaggregated across titles or programs. However, the earlier committee-reported scores of the respective farm bills do estimate amounts by title, as shown in Table 5.25 The committee-reported totals are nearly the same as the chamber-passed totals, thus making the earlier title-level estimates relatively reliable indicators of the distribution across titles for the authorizations of appropriation that are made in each chamber-passed bill.

The title-level CBO estimate of discretionary spending that is authorized in the farm bill is similar between the House and Senate bills. Three titles account for about 85% of the discretionary authorizations: Trade, Research, and Rural Development.

The bill-level estimates that sum to between $2 billion and $6 billion per year do not reflect total annual appropriations for agencies or programs in the roughly $20 billion Agriculture appropriations act.26 Not all of the authorizations of appropriations that are funded in the Agriculture appropriations act are made in the farm bill. For example, the annual Agriculture appropriations act includes funding for (1) agencies or programs that are not in the jurisdiction of the farm bill authorizing committees (e.g., the roughly $6 billion Special Supplemental Nutrition Assistance Program for Women, Infants, and Children is not in the jurisdiction of the House Agriculture Committee or the farm bill) and (2) appropriations for salaries and expenses that may be permanently authorized or not necessarily reauthorized in the farm bill. CBO did not estimate the cost of implementing provisions that do not have a specific authorization amount.

|

Fiscal year |

Five years |

|||||

|

|

2019 |

2020 |

2021 |

2022 |

2023 |

FY2019-23 |

|

House |

|

|

|

|

|

|

|

Commodities |

na |

na |

na |

na |

na |

na |

|

Conservation |

106 |

144 |

157 |

165 |

165 |

737 |

|

Trade |

874 |

2,130 |

2,417 |

2,533 |

2,578 |

10,532 |

|

Nutrition |

74 |

79 |

80 |

80 |

80 |

393 |

|

Credit |

248 |

257 |

257 |

257 |

257 |

1,274 |

|

Rural Infrastructure and Economic Development |

179 |

490 |

826 |

1,159 |

1,292 |

3,945 |

|

Research |

756 |

1,183 |

1,479 |

1,479 |

1,479 |

6,374 |

|

Forestry |

56 |

81 |

94 |

102 |

105 |

437 |

|

Horticulture |

51 |

62 |

65 |

67 |

69 |

313 |

|

Crop Insurance |

na |

na |

na |

na |

na |

na |

|

Miscellaneous |

34 |

54 |

60 |

60 |

60 |

268 |

|

Subtotal (committee-reported score) |

2,378 |

4,479 |

5,433 |

5,900 |

6,084 |

24,273 |

|

Changes added after floor passage |

37 |

40 |

41 |

41 |

41 |

200 |

|

Total (House-passed score) |

2,415 |

4,519 |

5,474 |

5,941 |

6,125 |

24,473 |

|

Senate |

|

|

|

|

|

|

|

Commodities |

na |

na |

na |

na |

na |

na |

|

Conservation |

178 |

259 |

293 |

315 |

315 |

1,359 |

|

Trade |

878 |

2,139 |

2,427 |

2,544 |

2,589 |

10,577 |

|

Nutrition |

7 |

14 |

11 |

10 |

5 |

47 |

|

Credit |

172 |

173 |

173 |

173 |

173 |

862 |

|

Rural Development |

132 |

333 |

520 |

690 |

764 |

2,440 |

|

Research |

864 |

1,278 |

1,566 |

1,559 |

1,559 |

6,826 |

|

Forestry |

-24 |

-14 |

9 |

23 |

31 |

26 |

|

Energy |

31 |

78 |

126 |

159 |

176 |

570 |

|

Horticulture |

37 |

51 |

54 |

56 |

58 |

255 |

|

Crop Insurance |

na |

na |

na |

na |

na |

na |

|

Miscellaneous |

95 |

149 |

157 |

157 |

157 |

713 |

|

Subtotal (committee-reported score) |

2,370 |

4,461 |

5,334 |

5,685 |

5,825 |

23,675 |

|

Changes added after floor passage |

1 |

4 |

4 |

1 |

0 |

10 |

|

Total (Senate-passed score) |

2,371 |

4,465 |

5,338 |

5,686 |

5,825 |

23,685 |

Source: CRS, compiled from (1) title-level amounts in CBO, "H.R. 2, as Reported by the House Agriculture Committee," May 2, 2018; and CBO, S. 3042 as Reported by the Senate Agriculture Committee," June 21, 2018; and (2) the updated total in CBO, "Cost Estimates for H.R. 2 as Passed by the House and as Passed by the Senate," July 24, 2018.

Note: "na" indicates that CBO did not estimate a specific authorization amount.