The Bipartisan Budget Act of 2019: Changes to the BCA and Debt Limit

The Bipartisan Budget Act of 2019 (BBA 2019; P.L. 116-37) was enacted on August 2, 2019. BBA 2019 raised the discretionary spending limits (caps) implemented by the Budget Control Act of 2011 (BCA; P.L. 112-25) for FY2020 and FY2021; made other BCA-related changes, including an extension of the mandatory sequester through FY2029; and suspended the statutory debt limit until August 1, 2021.

Changes to FY2020 and FY2021 Discretionary Spending Caps

The BCA created annual statutory discretionary spending caps for defense and nondefense spending that are in effect through FY2021. If appropriations are enacted that exceed a limit for a fiscal year, across-the-board reductions (i.e., sequestration) are triggered to eliminate the excess spending within that spending category. For more information on the BCA, see CRS Report R44874, The Budget Control Act: Frequently Asked Questions.

Previously enacted legislation increased these discretionary spending caps for each year from FY2014 through FY2019.

Section 101(a) of BBA 2019 increased the caps on defense and nondefense budget authority for FY2020 and FY2021, the final two years for which discretionary spending caps are scheduled to be in effect under the BCA. For FY2020, BBA 2019 raised the defense discretionary cap to $666.5 billion (a $90 billion increase) and the nondefense cap to $621.5 billion (a $78 billion increase). For FY2021, BBA 2019 raised the discretionary defense cap to $671.5 billion (an $81 billion increase) and the nondefense cap to $626.5 billion (a $72 billion increase). Table 1 shows the changes made by BBA 2019.

Table 1. Discretionary Cap Changes Resulting from the BBA 2019

(in billions of dollars of budget authority)

|

Fiscal Year |

Category |

Current Law |

BBA 2019 Change |

Post-BBA 2019 |

|

FY2020 |

Defense |

$576.2 |

+$90.3 |

$666.5 |

|

Nondefense |

$543.2 |

+$78.3 |

$621.5 |

|

|

FY2021 |

Defense |

$590.2 |

+$81.3 |

$671.5 |

|

Nondefense |

$554.9 |

+$71.6 |

$626.5 |

Sources: H.R. 3877 and Congressional Budget Office, Updated Budget Projections: 2019 to 2029, May 2019, p. 16.

Note: Based on BBA 2019 (P.L. 116-37).

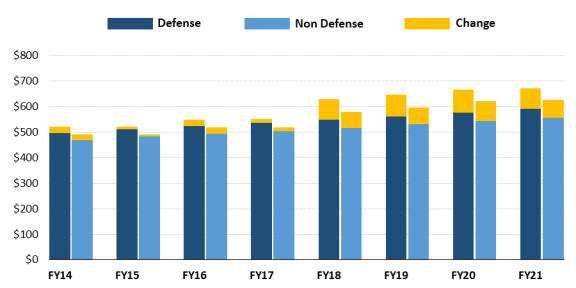

The combined increases to the FY2020 and FY2021 discretionary caps included in BBA 2019 ($322 billion) are marginally larger than the combined FY2018 and FY2019 cap increases ($296 billion) and much larger than the two-year cap increases agreed to for FY2016 and FY2017 ($80 billion combined) and FY2014 and FY2015 ($63 billion combined). Figure 1 shows the cap increases enacted for FY2014-FY2019 and the increases that will occur as a result of BBA 2019 compared to the caps established under the BCA.

|

Figure 1. BCA Discretionary Limits, FY2014-FY2021 Budget authority in billions of nominal dollars |

|

|

Sources: H.R. 3877 and Congressional Budget Office, Updated Budget Projections: 2019 to 2029, May 2019, p. 16. Notes: Based on BBA 2019 (P.L. 116-37). BBA 2019 made the changes in yellow in FY2020 and FY2021. |

Other Changes Related to the BCA

Overseas Contingency Operations (OCO) Spending Targets

The BCA stipulates that certain discretionary spending—such as appropriations designated as emergency requirements or for overseas contingency operations (OCO)—are effectively exempt from the limits. There is no statutory limit on the amount of spending that may be designated as emergency or for OCO, meaning that Congress and the President can together designate any amount that they agree upon in law. Section 101(b) of BBA 2019 established spending targets for OCO levels of $79.5 billion in FY2020 and $77 billion in FY2021.

Exemption for Spending on the 2020 Census

As stated above, the BCA stipulates that certain discretionary spending is effectively exempt from the spending caps. The largest categories of this "exempt" spending are OCO and emergency spending but smaller limited exemptions are permitted for other categories such as disaster relief and wildfire suppression. Section 101(c) of BBA 2019 created a similar exemption of up to $2.5 billion for the 2020 Census.

Extension of Automatic Direct Spending Reductions Through FY2029

The BCA also established a sequester of certain mandatory spending programs, including Medicare service payments (also known as the "Joint Committee" sequester), which took effect in FY2013 and was initially scheduled to end in FY2021. Subsequent legislation has extended the mandatory sequester through FY2027. Many large programs, such as Social Security and Medicaid, are exempt from the Joint Committee sequester.

Section 402 of BBA 2019 extended the mandatory sequester for another two years, for FY2028 and FY2029. The Congressional Budget Office (CBO) has estimated that the extension would reduce FY2019-FY2029 budget authority by a combined $61.8 billion.

Provisions Related to a Budget Resolution

Title II of BBA 2019 includes provisions related to a congressional budget resolution for FY2020 and FY2021. These provisions direct the House and Senate Budget Committee chairs to file statements of budgetary levels, which would have the same effect in the respective chamber as if they had been included in a budget resolution. The BBA 2019 requires that (1) for discretionary spending, the filed levels be consistent with the statutory limits on discretionary spending (as amended by the BBA 2019) and (2) for mandatory spending and revenue levels, the filed levels be consistent with the most recent baseline projections made by the CBO. These provisions, however, would not preclude Congress from acting on a traditional budget resolution for those years. For more information, see CRS Report R44296, Deeming Resolutions: Budget Enforcement in the Absence of a Budget Resolution.

Suspension of the Debt Limit Until August 2021

Treasury is currently utilizing "extraordinary measures" to stay under the statutory debt limit since its reinstatement in March 2019. In July 2019, Treasury informed Congress that those extraordinary measures could be exhausted before September 2019.

Section 301 of BBA 2019 suspended the debt limit until August 1, 2021 and required that upon reinstatement, the limit should exactly accommodate any increases in federal borrowing that were undertaken during the suspension period. CBO projects continued growth in federal debt levels through the debt suspension period.