Major Agricultural Trade Issues in 2020

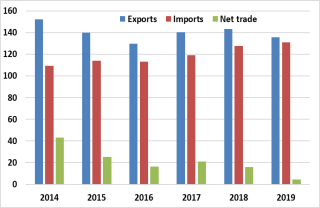

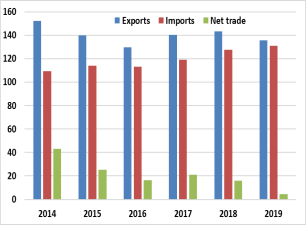

Sales of U.S. agricultural products to foreign markets absorb about one-fifth of U.S. agricultural production, thus contributing significantly to the health of the farm economy. Farm product exports, which totaled $136 billion in FY2019 (see chart), make up about 8% of total U.S. exports and contribute positively to the U.S. balance of trade. The economic benefits of agricultural exports also extend across rural communities, while overseas farm sales help to buoy a wide array of industries linked to agriculture, including transportation, processing, and farm input suppliers.

U.S. Agricultural Trade, Fiscal Years, 2014-19

Billion U.S. Dollars

/

Source: USDA, Economic Research Service (ERS), January 2020.

A major area of interest for the 116th Congress during its first session was the loss of export demand for agricultural products in the wake of tariff increases imposed by the Trump Administration on U.S. imports of steel and aluminum from certain countries and other imported products from China. Some of the affected countries levied retaliatory tariffs on U.S. agricultural products, contributing to a 53% decline in value of U.S. agricultural exports to China in 2018 and a broader decline in exports across countries imposing retaliatory tariffs in 2019. To help mitigate the economic impact from export losses, the U.S. Department of Agriculture (USDA) authorized two short-term assistance (“trade aid”) programs to producers of affected agricultural commodities, valued at up to $12 billion in 2019 and $16 billion in 2019.

Other major agricultural trade developments in 2019 included efforts to ratify the U.S.-Mexico-Canada Agreement (USMCA), trade negotiations with China, Japan, and the European Union, and continued review of U.S. participation in the World Trade Organization (WTO). The USMCA was ratified by Mexico and the U.S. Congress, and awaits ratification by Canada before it can enter into force. The United States and Japan signed an agreement increasing market access for many U.S. agricultural exports to Japan. This agreement, which does not require congressional approval, excludes provisions pertaining to non-tariff measures that could become future trade barriers for U.S. agricultural exporters. A second-stage negotiation toward a more comprehensive pact could commence in 2020.

In January 2020, President Trump signed a “Phase One” executive agreement (that also does not require congressional approval) with the Chinese government on trade and investment issues, including agriculture. Under the agreement, China is not required to repeal any tariffs, but it has reduced certain retaliatory tariffs and is granting tariff exclusions for various agricultural products in order to reach a target level of U.S. imports—$32 billion (relative to a 2017 base of $24 billion) over a two-year period. The coronavirus outbreak since January 2020 may affect China’s ability to meet these commitments.

In addition to further negotiations with Japan and China, the Administration has stated its intent to pursue trade agreements with the European Union, India, Kenya, the United Kingdom, and possibly other countries. The Trump Administration has also indicated that reforming the WTO is a priority for 2020. The WTO Ministerial Conference in June 2020 presents an opportunity to address pressing concerns over agricultural reform efforts.

Among other agricultural trade issues that may arise in the 116th Congress are proposed changes to U.S. trade remedy laws to address imports of seasonal produce affecting growers in the Southeast, the establishment of a common international framework for approval, trade, and marketing of the products of agricultural biotechnology, and foreign restrictions on U.S. exports of meat that are inconsistent with international trade protocols. Additionally, U.S. beef and pork face trade barriers in several markets because of U.S. producers’ use of growth promotants and the feed additive ractopamine.

Major Agricultural Trade Issues in 2020

Jump to Main Text of Report

Contents

- Introduction

- Overview of U.S. Agricultural Trade

- Trump Administration Trade Priorities for 2020

- Trade Agreement Implementation and Monitoring

- Ongoing and Proposed Negotiations

- Multilateral Trading System Reforms

- Agricultural Trade Disputes and Negotiations

- Negotiations with China

- Negotiations with Canada and Mexico

- "Stage One" U.S. Japan Trade Agreement (USJTA)

- U.S.-EU Agricultural Trade

- Limited Expected Role of Agricultural Issues in Upcoming Trade Talks

- Limited Expected Role of Agricultural Issues in Upcoming Trade Talks

- Trade Aid in Response to Trade Retaliation

- Future Trade Negotiations

- India

- Kenya

- United Kingdom (UK)

- WTO and U.S. Agriculture

- 2018 Farm Bill, Trade Aid, and WTO Compliance

- U.S. Challenges to Farm Support Spending of WTO Members

- Foreign Challenges to U.S. Farm Support

- Non-Tariff Trade Barriers

- Sanitary and Phytosanitary (SPS) and Other Non-Tariff Barriers

- Ongoing Trade Issues Involving SPS Measures

- Agricultural Biotechnology

- Geographical Indications (GIs)

- U.S.-EU Beef Hormone Dispute

- U.S.-EU Dispute Over Pathogen Reduction Treatments (PRTs)

- Trade Restrictions on Ractopamine Use

- Selected Trade Issues Involving Specialty Crops

- Import Competition of Seasonal Produce from Mexico

- U.S.-Mexico Tomato Suspension Agreements

- Regulatory Requirements Regarding Retail Wine Sales in Canada

- Issues Related to Livestock and Meat Trade

- Export Bans on U.S. Meat and Poultry

- U.S. Meat and Poultry Imports

- Issues in Dairy Product Trade

- U.S. Dairy Exports to Canada

- Dairy Exports under U.S.-Japan Trade Agreement (USJTA)

- U.S.-China Phase One Trade Agreement: Dairy

- U.S.-Mexico Sugar Suspension Agreements

Summary

Sales of U.S. agricultural products to foreign markets absorb about one-fifth of U.S. agricultural production, thus contributing significantly to the health of the farm economy. Farm product exports, which totaled $136 billion in FY2019 (see chart), make up about 8% of total U.S. exports and contribute positively to the U.S. balance of trade. The economic benefits of agricultural exports also extend across rural communities, while overseas farm sales help to buoy a wide array of industries linked to agriculture, including transportation, processing, and farm input suppliers.

|

U.S. Agricultural Trade, Fiscal Years, 2014-19 Billion U.S. Dollars |

|

|

Source: USDA, Economic Research Service (ERS), January 2020. |

A major area of interest for the 116th Congress during its first session was the loss of export demand for agricultural products in the wake of tariff increases imposed by the Trump Administration on U.S. imports of steel and aluminum from certain countries and other imported products from China. Some of the affected countries levied retaliatory tariffs on U.S. agricultural products, contributing to a 53% decline in value of U.S. agricultural exports to China in 2018 and a broader decline in exports across countries imposing retaliatory tariffs in 2019. To help mitigate the economic impact from export losses, the U.S. Department of Agriculture (USDA) authorized two short-term assistance ("trade aid") programs to producers of affected agricultural commodities, valued at up to $12 billion in 2019 and $16 billion in 2019.

Other major agricultural trade developments in 2019 included efforts to ratify the U.S.-Mexico-Canada Agreement (USMCA), trade negotiations with China, Japan, and the European Union, and continued review of U.S. participation in the World Trade Organization (WTO). The USMCA was ratified by Mexico and the U.S. Congress, and awaits ratification by Canada before it can enter into force. The United States and Japan signed an agreement increasing market access for many U.S. agricultural exports to Japan. This agreement, which does not require congressional approval, excludes provisions pertaining to non-tariff measures that could become future trade barriers for U.S. agricultural exporters. A second-stage negotiation toward a more comprehensive pact could commence in 2020.

In January 2020, President Trump signed a "Phase One" executive agreement (that also does not require congressional approval) with the Chinese government on trade and investment issues, including agriculture. Under the agreement, China is not required to repeal any tariffs, but it has reduced certain retaliatory tariffs and is granting tariff exclusions for various agricultural products in order to reach a target level of U.S. imports—$32 billion (relative to a 2017 base of $24 billion) over a two-year period. The coronavirus outbreak since January 2020 may affect China's ability to meet these commitments.

In addition to further negotiations with Japan and China, the Administration has stated its intent to pursue trade agreements with the European Union, India, Kenya, the United Kingdom, and possibly other countries. The Trump Administration has also indicated that reforming the WTO is a priority for 2020. The WTO Ministerial Conference in June 2020 presents an opportunity to address pressing concerns over agricultural reform efforts.

Among other agricultural trade issues that may arise in the 116th Congress are proposed changes to U.S. trade remedy laws to address imports of seasonal produce affecting growers in the Southeast, the establishment of a common international framework for approval, trade, and marketing of the products of agricultural biotechnology, and foreign restrictions on U.S. exports of meat that are inconsistent with international trade protocols. Additionally, U.S. beef and pork face trade barriers in several markets because of U.S. producers' use of growth promotants and the feed additive ractopamine.

Introduction

This report identifies selected current major trade issues for U.S. agriculture that may be of interest in the second session of the 116th Congress. It provides background on individual trade issues and attempts to bring perspective on the significance of each for U.S. agricultural trade. Each trade issue summary concludes with an assessment of its status.

The report begins by examining a series of overarching issues. These include U.S. agricultural trade and its importance to the sector; a brief description of the trade policy being pursued by the Trump Administration in 2020 and its ramifications for U.S. agricultural exports; an update on the Administration's 2019 trade policy actions; a discussion of the ongoing and proposed new trade negotiations planned for 2020; and an update on World Trade Organization (WTO) agricultural issues related to the United States—including the Administration's 2020 plans to engage in reforming the institution. The report then reviews a number of ongoing trade policy concerns to U.S. agriculture, including non-tariff measures, and trade barriers and disputes involving specialty crops, livestock, and dairy issues. The format for these trade issues is similar, consisting of background and perspective on the issue at hand and an assessment of their current status.

Overview of U.S. Agricultural Trade1

|

Figure 1. U.S. Agricultural Trade, 2014-19 Billion U.S. Dollars |

|

|

Source: USDA, Economic Research service (ERS), U.S. Agricultural Trade Data Update, updated January 8, 2020, https://www.ers.usda.gov/data-products/foreign-agricultural-trade-of-the-united-states-fatus/us-agricultural-trade-data-update/. Notes: Data are not adjusted for inflation and pertain to fiscal years. 'Net trade' denotes the trade surplus, which is the difference between U.S. exports and U.S. imports. |

U.S. agricultural exports have long been a bright spot in the U.S. balance of trade, with exports exceeding imports in every year since 1960.2 In recent years, the value of farm exports has remained below the record level of $152 billion reached in FY2014. The U.S. Department of Agriculture (USDA) reports U.S. agricultural exports in FY2019 of $136 billion (see Figure 1).3 The FY2019 export total represents an $8 billion decline from FY2018.4 The decline in the value of farm exports since FY2014 initially reflected lower market prices for bulk commodities, such as soybeans and corn. Agricultural prices and U.S. exports of certain commodities, such as soybeans, were further affected by retaliatory tariffs imposed on U.S. agricultural imports by China and some other countries since 2018 in response to the Trump Administration's imposition of tariffs on certain imports from China and on U.S. imports of steel and aluminum from selected countries.5

In FY2019, U.S. agricultural imports were $131 billion, up $3 billion from FY2018, resulting in an agricultural trade surplus of $5 billion. This is below the surplus of $16 billion in FY2018 and below the record high in nominal dollars of $43 billion in FY2014.

Agricultural exports are important both to farmers and to the U.S. economy. During the calendar years 2017 and 2018, the value of U.S. agricultural exports accounted for 8% and 9% of total U.S. exports, respectively.6 USDA's Economic Research Service (ERS) estimates that in 2017 U.S. agricultural exports generated about 1,161,000 full-time civilian jobs, including 795,000 jobs outside the farm sector.7 Exports account for around 20% of total farm production by value8 and are a major outlet for many farm commodities, absorbing over three-fourths of U.S. output of cotton and about half of total U.S. production of wheat and soybeans.9 Although feed crops and wheat account for most exports by volume, the high value product (HVPs) category—which includes live animals, meat, dairy products, fruits and vegetables, nuts, fats, hides, manufactured feeds, sugar products, processed fruits and vegetables, and other processed food products—accounted for 68% of the value of agricultural exports in FY2019.10

All states export agricultural commodities, but a minority of states account for a majority of farm export sales. In calendar year 2018, the 10 leading agricultural exporting states based on value—California, Iowa, Illinois, Minnesota, Texas, Nebraska, Kansas, Indiana, North Dakota, and Missouri—accounted for 58% of the total value of U.S. agricultural exports that year.11

In December 2018, Congress reauthorized major agricultural export promotion programs through FY2023 with the 2018 farm bill (P.L. 115-334).12 Title III of the farm bill includes provisions covering export credit guarantee programs, export market development programs, and international science and technical exchange programs designed to develop agricultural export markets in emerging economies. Among other provisions, the 2018 farm bill permits funding to operate two U.S. agricultural export promotion programs in Cuba—the Market Access Program and the Foreign Market Development Cooperator Program.13

Trump Administration Trade Priorities for 202014

In establishing policy for U.S. participation in international trade, the Trump Administration has emphasized reducing U.S. bilateral trade deficits;15 focusing on renegotiating existing trade agreements that it viewed as being "unfair;" initiating new bilateral agreements; and responding to the trade practices of U.S. trading partners that it viewed as unfair, in violation of international trading commitments, or threatening to U.S. industry.16 Under various provisions of law, the Administration imposed punitive tariffs on U.S. imports of steel and aluminum from certain countries and on U.S. imports of selected products from China.17 These countries in turn, responded with retaliatory tariffs on U.S. exports, particularly agricultural products.18

During the second session of the 116th Congress, the Trump Administration's agenda may focus on the following priorities:

Trade Agreement Implementation and Monitoring

U.S.-Mexico-Canada Agreement (USMCA)

Legislation implementing a new trade agreement among the United States, Mexico, and Canada was enacted on January 29, 2020. The agreement awaits ratification by Canada, and certification by the United States that all parties have completed the necessary steps for entry into force. The U.S.-Mexico-Canada agreement replaces the North American Free Trade Agreement (NAFTA), which took effect in 1994.

"Stage One" U.S.-Japan Trade Agreement (USJTA)

On October 7, 2019, the Trump Administration signed the "Stage One" trade agreement with Japan, which included significant market access improvements in Japan for U.S. agricultural exports. The agreement took effect on January 1, 2020. Because it dealt only with tariffs and other market access issues, pursuant to P.L. 114-26, the agreement did not require congressional approval.19 The Administration has indicated that it hopes to negotiate a second trade agreement with Japan that addresses a broader range of issues. Such an agreement might require congressional approval.

U.S.-China Phase One Agreement

On January 15, 2020, President Trump signed a "Phase One" executive agreement with China on trade and investment issues, including agriculture.20 This agreement, which entered into force on February 14, 2020, did not require congressional approval as it consisted largely of commitments by China. The Administration has stated its intent to negotiate a second phase of the agreement with China.21 Depending on the scope of such a negotiation, the Administration could be required under law to consult with Congress in advance and to submit an eventual agreement for congressional approval.

Ongoing and Proposed Negotiations

The Office of the U.S. Trade Representative (USTR) has indicated that the United States may also pursue new trade agreements with the European Union (EU), India, Kenya, the United Kingdom (UK), and a number of other countries. The Administration has stated that the U.S.-Kenya and the U.S.-UK negotiations will be "comprehensive," dealing with other trade-related issues in addition to market access.22 In those cases, the Administration might be required to consult with Congress in advance of negotiations and to submit any agreements for congressional approval.

Multilateral Trading System Reforms

USTR has indicated interest in WTO institutional reform.23 The upcoming WTO Ministerial Conference in June 2020 in Kazakhstan presents the United States and WTO members with an opportunity to address reform efforts, which are expected to include consideration of the WTO's treatment of agricultural trade.24 Some Members of Congress have indicated WTO reform to be a priority for 2020.25

Agricultural Trade Disputes and Negotiations26

Since early 2018, Canada, China, the EU, India, Mexico, and Turkey targeted U.S. food and agricultural products with retaliatory tariffs in response to tariffs imposed by the United States on imports of steel and aluminum and certain imports from China. To facilitate ratification of USMCA, the United States removed tariffs on steel and aluminum imports from Canada and Mexico and these countries removed their retaliatory tariffs on U. S. agricultural imports in May 2019. The retaliatory tariffs made imports of U.S. agricultural products relatively more expensive compared to similar products from competitor nations.

Initially, the announcements of retaliatory tariffs led to an increase in U.S. agricultural exports as importing countries built stocks in anticipation of the tariffs. U.S. agricultural exports increased slightly in 2018. In 2019, however, U.S. agricultural exports declined about 2%, due to lower global demand for affected U.S. agricultural products and downward pressure on prices of some commodities.27

In the short run, retaliatory tariffs contributed to price declines for certain U.S. agricultural commodities and to a reduction in exports, particularly for soybeans. Declining prices and export sales, combined with rising input and farm machinery costs, contributed to a 16% decrease in U.S. net farm income in 2018, which prompted USDA to provide trade aid payments to the farm sector in 2018 and 2019.

Negotiations with China

Imports from China have been subject to U.S. tariff increases on steel and aluminum under Section 232 of the Trade Expansion Act, which allows the President to impose tariffs on imports that "threaten to impair the national security." Additionally, U.S. imports of certain other Chinese products are subject to tariff increases under Section 301 of the Trade Act of 1974, which allows tariffs in response to trade practices that are determined to be unfair and injurious to a U.S. industry. China first retaliated in April 2018, by raising tariffs on certain U.S. imports, including agricultural products such as pork, fruit, and tree nuts.28 These retaliatory tariffs are in addition to existing Most Favored Nation (MFN) tariffs that China levies on imports from all countries including the United States.29 By September 2019, China had levied retaliatory tariffs on almost all U.S. agricultural products, ranging from 5% to 60%.30

After the imposition of retaliatory tariffs on U.S. products, U.S. agricultural exports to China experienced a 53% decline from $19.5 billion in 2017 to $9.2 billion in 2018. The Chinese market is important for several U.S. agricultural products. For example, in 2016 and 2017, the United States supplied over one-third of China's total soybean imports, almost all of China's distillers' grain imports (primarily used as animal feed), and most of China's sorghum imports.31 With the retaliatory tariffs in effect, U.S. soybean exports to China in 2018 declined in value to $3 billion (8 billion metric tons [MT]) from $12 billion (32 billion MT) in 2017. Similarly, the value of U.S. exports of sorghum and distillers dry grain declined about 40% and 30% respectively from 2017 to 2018. Most other U.S. agricultural exports to China also declined in 2018.32

Negotiations to resolve the U.S.-China dispute began in the fall of 2019 and resulted in a "Phase One" executive agreement (that does not require congressional approval) on trade and investment issues, including agriculture, signed in January 2020.33 Under the agreement, China is to import $32 billion worth of additional U.S. agricultural products over a two-year period. This implies an average annual increase of two-thirds from a 2017 base of $24 billion.34 Products mentioned in the agreement include oilseeds, meat, cereals, cotton, and seafood. China has not committed to tariff exemptions or import levels for any specific products, but it may grant tariff exclusions on U.S. imports on a case-by-case basis. On February 18, 2020, China released a list indicating that it may be willing to grant one-year tariff exemptions on most agricultural products.35

China agreed to improve its administration of tariff-rate quotas (TRQs) on wheat, corn, and rice to comply with a WTO ruling in favor of the United States in a dispute case regarding China's TRQ administration.36 Changes in China's TRQ administration would be expected to improve market access for these U.S. grains.

Other Provisions of the Phase One agreement

Domestic support: China agreed to improve the transparency of its domestic agricultural support measures.

Sanitary and phytosanitary measures: China agreed to implement science- and risk-based food safety regulations. China also agreed to finalize phytosanitary protocols for U.S. avocadoes, blueberries, potatoes, barley, alfalfa pellets and cubes, almond meal pellets and cubes, hay, and California nectarines, and to implement a transparent, predictable, efficient, science- and risk-based regulatory process for the evaluation and authorization of products of agricultural biotechnology. In exchange, the United States agreed to complete its regulatory notice process for imports of Chinese fragrant pears, citrus, and jujube, and to complete a phytosanitary protocol for bonsai.

Livestock and fish: China agreed to improve access for U.S. beef products, including eliminating age restrictions on cattle slaughtered for export, eliminating traceability requirements, and establishing maximum residue levels for three hormones that are approved for use in livestock in the United States. It agreed to engage in technical discussions to import U.S. live cattle for breeding. China agreed to broaden the list of pork products that are eligible for importation, and to conduct a risk assessment for the veterinary drug ractopamine, which is allowed in U.S. beef and pork production. With respect to poultry, after having lifted a five-year ban on imports of U.S. poultry in November 2019, China agreed to adopt import regulations consistent with the World Organization for Animal Health Terrestrial Animal Health Code; this would potentially limit future import bans imposed due to avian influenza to poultry from the affected U.S. region rather than the entire country. China also agreed to approve for importation 26 aquatic species from the United States, and to streamline its procedures for registering U.S. seafood facilities and products.

Technical Barriers to Trade: China agreed to implement the USDA Public Health Information System, an electronic system to provide export health certificates to an importing country in advance of shipment arrival. It also made commitments to provide regulatory certainty and market stability regarding U.S. dairy and infant formula products, rice, distillers' dried grains with solubles, feed additives, and pet foods. It agreed not to undermine market access for U.S. exports that use trademarks and generic terms by recognizing geographical indications (GI) in international agreements. GIs are place names used to identify products that come from certain regions or locations.

Status and Outlook: The U.S.-China Phase One agreement is expected to improve opportunities for certain U.S. exporters; however, it may not create notable new market demand. Instead, it may produce a rearrangement of trading patterns between China and its various import suppliers, in which case the market price effects may be limited. Additionally, the coronavirus outbreak is expected to slow China's economic growth in the near-term, and may reduce Chinese overall import demand for agricultural products. It has also been disrupting global supply chains going in and out of China.37 Therefore, U.S. agricultural exports to China could fall short of the target of $32 billion additional exports to the 2017 base over a two-year period. The agreement provides China some flexibility to meet its purchase commitment. Both the United States and China "acknowledge that purchases will be made at market prices based on commercial considerations and that market conditions, particularly in the case of agricultural goods, may dictate the timing of purchases within any given year" (Chapter 6, Article 6.2.1 of the Phase One agreement).

Under the agreement, China is not required to repeal any tariffs, but it has reduced certain retaliatory tariffs and will grant one-year tariff exclusions for various agricultural products in order to reach a target level of U.S. imports.38 Effective February 14, 2020, China halved the additional 5% and 10% retaliatory tariffs that it had imposed on U.S. products in August 2019.39 Nevertheless, tariffs imposed in April and July 2018, ranging from 2.5% to 55%, remain in place.40 USDA and USTR have stated that China has also taken a number of other actions to begin implementing its agriculture related commitments.41 Both China and the United States have indicated they expect to engage in further negotiations on trade during 2020.

Negotiations with Canada and Mexico42

Soon after taking office in January 2017, the Trump Administration announced its desire to renegotiate the North America Free Trade Agreement (NAFTA) among the three countries. Nonetheless, the United States imposed tariffs on steel and aluminum imports from Canada and Mexico in 2017. The United States also threatened tariffs on imported passenger vehicles, an action that would have a significant impact on both Canada and Mexico. In June 2018, Mexico retaliated against the steel and aluminum tariffs with a 15% tariff on U.S. sausage imports; a 20% tariff on other pork products, certain cheeses, apples, potatoes, and cranberries; and a 25% tariff on whey, blue-veined cheese, and whiskies.43 The following month, Canada imposed a retaliatory tariff of 10% on certain U.S. products, including dairy, poultry and beef products; coffee, chocolate, sugar and confectionery; prepared food products; condiments; bottled water; and whiskies.44

A new trade agreement, referred to as the United States-Mexico-Canada Agreement (USMCA), was announced in 2018. The U.S. implementing legislation was enacted on January 29, 2020. Mexico has ratified the USMCA and the Canadian Parliament has begun deliberations on the agreement.45 After ratification by all three countries, and certification by the United States that all parties have taken actions required under the agreement, the agreement would enter into force. The agricultural provisions of USMCA are summarized below.46

- All food and agricultural products that had zero tariffs under NAFTA is to remain at zero under USMCA. This includes all agricultural imports from Mexico and almost all from Canada—excepting certain dairy and poultry products.

- Canada is to increase market access for U.S. dairy products via TRQs. U.S. dairy imports within a TRQ is to enter Canada duty-free, while imports beyond the quota level face higher over-quota tariff rates of over 200% in many cases.

- Canada is to replace poultry TRQs under NAFTA with new TRQs. These are expected to lead to greater imports of U.S. eggs, turkey meat, and eggs, but reduce the quantity of U.S. chicken meat that can be imported into Canada duty free. Imports of U.S. poultry products above the set quotas is to face tariffs exceeding 200%.

- The United States, agreed to provide additional access to Canadian dairy products, sugar, peanuts and peanut products.

- Canada is to provide treatment and price to U.S. wheat equivalent to those of Canadian wheat if the U.S. wheat variety is registered as being similar to a Canadian variety. Currently, U.S. wheat exports to Canada are graded as feed wheat, and as such command a lower price. Four Members of Congress have requested USTR to work closely with Canada, through the Consultative Committee on Agriculture, to expedite the process for the registration of U.S. wheat varieties in Canada.47

- The United States, Canada, and Mexico are required to treat the distribution of each other's spirits, wine, beer, and other alcoholic beverages as they do for products of national origin. The agreement establishes listing requirements for a product to be sold, along with specific limits on cost markups.

- Regarding sanitary and phytosanitary measures (SPS), USMCA requires greater transparency in rules and regulatory alignment among the three countries. It also would establish a new mechanism for technical consultations to resolve SPS issues.

- USMCA includes procedural safeguards for recognition of new geographical indications. USMCA would protect the GIs for food products that Canada and Mexico have already agreed to in trade negotiations with the EU, and would lay out transparency and notification requirements for recognition of any proposed new GIs. In a side letter accompanying the agreement, Mexico confirmed a list of 33 terms for cheese that would remain available as common names for U.S. cheese producers to use in exporting cheeses to Mexico. The list includes some terms that are protected as GIs by the EU. USMCA provisions also would protect certain U.S., Canadian, and Mexican spirits as distinctive products.

- USMCA signatories agreed to protect the confidentiality of proprietary formula information in the same manner for domestic and imported products.

- USMCA includes provisions for a Working Group for Cooperation on Agricultural Biotechnology to facilitate information exchange on policy and trade-related matters associated with agricultural biotechnology, an issue that was not covered under NAFTA.

Status: The United States removed the tariffs it had imposed on steel and aluminum imports from Canada and Mexico on May 17, 2019, and, in turn, these countries removed their retaliatory tariffs on U.S. imports.48 USMCA requires ratification by Canada to enter into force.

"Stage One" U.S. Japan Trade Agreement (USJTA)49

On October 7, 2019, the United States and Japan signed the U.S.-Japan Trade Agreement (USJTA), which provides for limited tariff reductions and quota expansions to improve U.S. access to Japan's market, including for agricultural products. The agreement, which entered into force January 1, 2020, also provides for reciprocal U.S. tariff reductions, largely on industrial goods. Japan previously negotiated agricultural market access provisions with the United States in the context of the Trans-Pacific Partnership (TPP), a 2016 agreement among 12 Pacific-facing nations50 that the United States did not ratify. Those provisions were folded into the agreement that the remaining TPP countries agreed upon—TPP-11—that went into force for Japan on December 30, 2018.51 As Japan began to improve market access for TPP-11 countries, various U.S. agricultural exports to Japan became less competitive compared to products from TPP-11 countries.

Under the USJTA, Japan provides the same level of market access to U.S. products included in the USJTA as it provides to exports from TPP-11 member countries. Japan agreed to eliminate or reduce tariffs for certain U.S. agricultural exports and to provide preferential quotas for other U.S. agricultural products. Some products included in TPP-11 such as rice and certain dairy products are not included in the USJTA. Key agricultural provisions of USJTA are provided below.

- Japan is to reduce tariffs on meat products such as beef and pork or gradually eliminate them.

- Upon entry into force, tariffs were eliminated for certain products, including almonds, walnuts, blueberries, cranberries, corn, sorghum, and broccoli.52

- Japan is to phase out tariffs in stages for products such as cheeses, processed pork, poultry, beef offal, ethanol, wine, frozen potatoes, oranges, fresh cherries, egg products, and tomato paste.

- Japan agreed to provide country-specific quotas (CSQ) to all products that the United States had negotiated CSQs for under TPP, excepting for rice. Products covered by CSQs include wheat, wheat products, malt, whey, processed cheese, glucose, fructose, corn starch, potato starch, and inulin.

- Japan agreed to reduce the mark-ups on U.S. products that Japanese state trading enterprises import under quotas and sell in the domestic market with an additional price mark-up that makes them more expensive that the domestic product.

- Under Japan's WTO market access schedule, it reserves the right to temporarily increase tariffs on imports of sensitive agricultural products when they exceed a set threshold, or when the price of the imported product is below a set threshold. Under USJTA, Japan agreed to restrict the use of these additional tariffs (known as safeguards) on U.S. beef, pork, whey, oranges and race horses.

- Under TPP, the United States had negotiated market access under TRQs that were open to all TPP members, for barley and barley products other than malt; butter; skim and other milk powder; cocoa products; evaporated and condensed milk; edible fats and oils; vegetable preparations; coffee, tea and other preparations; chocolate, candies and confectionary; and sugar. No corresponding U.S. access to these TPP-wide TRQs is included in USJTA.

- The United States agreed to reduce tariffs on imports of certain perennial plants and cut flowers, persimmons, green tea, chewing gum, certain confectionary products, and soy sauce. The United States also agreed to provide Japan the opportunity to export more beef by folding a country-specific quota for Japan of 200 MT into a larger TRQ designated for "other countries."

Status: The Administration took a staged approach to U.S. negotiations with Japan in order to facilitate expedited market access improvements for U.S. agricultural products in Japan. The first stage agreement (USJTA) is much more limited than a traditional U.S. free trade agreement, allowing the USJTA (P.L. 114-26) to take effect without approval by Congress.53 In consequence, the text does not address non-tariff issues such as sanitary and phytosanitary measures, agricultural biotechnology, technical barriers to trade, or geographical indications. These issues are expected to be covered in a further negotiation, which may commence in 2020.

In February 2019, after the USJTA entered into force, Japan reached a trade agreement with the EU under which Japan agreed to recognize more than 200 EU GIs. If USTR were to determine that any of these European GIs poses a barrier to U.S. agricultural exports to Japan, the lack of legal text regarding geographical indications and the absence of a formal dispute settlement mechanism could limit U.S. ability to challenge such a barrier under the USJTA. Both the United States and Japan are members of the WTO, so the United States could challenge potential new trade barriers as inconsistent with Japan's WTO commitments.

U.S.-EU Agricultural Trade54

The Trump Administration's decision to impose tariffs on steel and aluminum affected imports from the EU. In June 2018, the EU responded to the steel and aluminum tariffs by imposing a 25% tariff on imports of U.S. corn, rice, sweetcorn, kidney beans, certain breakfast cereals, peanut butter, orange juice, cranberry juice, whiskies, cigars, and other tobacco products, and a 10% tariff on certain essential oils.55 The EU also could be affected if the United States were to impose tariffs on passenger vehicles, and could respond with further punitive tariffs against U.S. exports.

On October 18, 2019, the United States imposed additional tariffs on $7.5 billion worth of U.S. imports from the EU. The action, authorized by WTO dispute settlement procedures, came after USTR determined that the EU and certain EU member states had not complied with a WTO Dispute Settlement Body ruling recommending the withdrawal of subsidies on the manufacture of large civil aircraft.56

USTR has indicated that additional tariffs initially will be limited to 10% of the product value on large civil aircraft and 25% on agricultural and other products from the EU. In total, 561 agricultural tariff lines are affected,57 including cheeses, biscuits, pork products, fish products, fruit products, olives, whiskies, liquors, and wine. The UK, which left the EU in January 2020, is included among the affected countries, and 56 tariff lines of UK products are subject to additional 25% tariffs.

Limited Expected Role of Agricultural Issues in Upcoming Trade Talks

Against this background, in October 2018, USTR officially notified the Congress of the Trump Administration's plans to enter into formal trade negotiations with the EU.58 This action followed a July 2018 U.S.-EU Joint Statement by President Trump and then-European Commission President Jean-Claude Juncker announcing that they would work to reduce tariffs and other trade barriers, address unfair trading practices, and increase U.S. exports of soybeans and certain other products. Previously, in 2016, U.S.-EU negotiations to create a Transatlantic Trade and Investment Partnership (T-TIP) under the Obama Administration stalled after 15 rounds. Among the areas of contention were certain regulatory and administrative differences between the United States and the EU on issues of food safety, public health, and product naming schemes for some types of food and agricultural products.

The United States and the EU are the world's largest trade and investment partners.59 While food and agricultural trade between the United States and the EU2760 accounts for less than 1% of the value of overall trade in total goods and services, the EU27 remains a leading export market for U.S. agricultural exports. It accounted for about 8% of the value of all U.S. exports and ranked as the fifth largest market for U.S. food and farm exports in 2019—after Canada, Mexico, China, and Japan. In 2019, U.S. exports of agricultural and related product exports to the EU27 totaled $12.4 billion, while U.S. imports of agricultural and related product imports from the EU27 totaled $29.7 billion, resulting in a U.S. trade deficit of approximately $17.3 billion.61 This is the reverse of U.S. trade surpluses with the EU27 during the 1990s. Leading U.S. agricultural exports to the EU27 were corn and soybeans, tree nuts, distilled spirits, fish products, wine and beer, planting seeds, tobacco products, and processed foods. Leading U.S. agricultural imports from the EU27 were wine, distilled spirits, beer, drinking waters, olive oil, cheese, baked goods, processed foods, and cocoa products.

In January 2019, USTR announced its negotiating objectives for the agricultural portion of a U.S.-EU trade agreement following a public comment period and a hearing involving several leading U.S. agricultural trade associations.62 The objectives include greater market access, changes to EU administration of tariff-rate quotas, and changes to a variety of EU regulations. Among regulatory issues, key U.S. objectives include harmonizing regulatory processes and standards to facilitate trade, including sanitary and phytosanitary standards, and establishing specific commitments for trade regarding agricultural biotechnologies. The U.S. objectives also include addressing geographical indications by protecting generic terms for common use.63 U.S. agricultural interests generally support including agriculture as part of the U.S. negotiating objectives for a U.S.-EU trade agreement. The EU negotiating mandate, however, states that a key EU goal is "a trade agreement limited to the elimination of tariffs for industrial goods only, excluding agricultural products."64 Several Members of Congress have stated their opposition to the EU's decision to exclude agricultural policies in their negotiating mandate.65

The U.S.-EU trade negotiations come amid heightened U.S.-EU trade frictions. In response to U.S. Section 232 tariffs on steel and aluminum imports, the EU had retaliated in June 2018 by imposing a tariff increase of 25% on imports of certain U.S. food and beverage products.66 The value of U.S. agricultural exports to the EU28 (included the UK) targeted by these additional tariffs is approximately $1.2 billion in 2018, or about 9% of total U.S. agricultural exports to the EU28. In October 2019, U.S.-EU trade tensions escalated further when the United States imposed additional tariffs on $7.5 billion worth of certain U.S. imports from the EU, including food products. This action—authorized by the WTO—followed a USTR investigation initiated in April 2019 under Section 301 of the Trade Act of 1974.67

Aside from ongoing trade tension, some of the same issues that stalled U.S.-EU agricultural talks in the T-TIP negotiations could prove to be equally intractable today. For food and agricultural products, a series of non-tariff issues stem in part from commercial and cultural practices often enshrined in EU laws and regulations that vary from those of the United States—namely differences involving SPS and technical barriers to trade, broadly covering laws and regulations measures intended to protect public health—as well as differences involving GIs.68

Status: The outlook for the new U.S.-EU trade talks remains uncertain, given ongoing trade tensions. Whether or not the talks will include food and agriculture is also uncertain, as there continues to be disagreement between the two trading partners about the scope of the negotiations, particularly the EU's intent to exclude agriculture from the talks. Perhaps the overarching goal for the U.S. side is addressing the U.S. trade deficit in agricultural products with the EU.69

Public statements by U.S. and EU officials in early 2020 signaled that the U.S.-EU trade talks might include SPS and regulatory barriers to agricultural trade. It is not clear, however, that both sides agree which specific types of non-tariff trade barriers might actually be part of the talks. Some press reports indicate that USDA officials have said that selected SPS barriers as well as GIs would need to be addressed.70 Specific SPS issues important to the U.S. side include the EU's prohibitions on the use of hormones in meat production (see "U.S.-EU Beef Hormone Dispute") and pathogen reduction treatments for poultry (see section "U.S.-EU Dispute Over Pathogen Reduction Treatments (PRTs)"), and EU restrictions on the use of biotechnology (see section "Agricultural Biotechnology"). Other press reports, however, indicate that some EU officials have downplayed the extent that certain non-tariff barriers—such as biotechnology product permits, approval of certain pathogen rinses for poultry, regulations on pesticides or food standards—would be part of the talks.71 The United States continues to push for additional concessions from the EU.72 More formal discussions are expected in spring 2020.73

Limited Expected Role of Agricultural Issues in Upcoming Trade Talks

Against this background, in October 2018, USTR officially notified the Congress of the Trump Administration's plans to enter into formal trade negotiations with the EU.74 This action followed a July 2018 U.S.-EU Joint Statement by President Trump and then-European Commission President Jean-Claude Juncker announcing that they would work to reduce tariffs and other trade barriers, address unfair trading practices, and increase U.S. exports of soybeans and certain other products. Previously, in 2016, U.S.-EU negotiations to create a Transatlantic Trade and Investment Partnership under the Obama Administration stalled after 15 rounds. Among the areas of contention were certain regulatory and administrative differences between the United States and the EU on issues of food safety, public health, and product naming schemes for some types of food and agricultural products.

The United States and the EU are the world's largest trade and investment partners.75 While food and agricultural trade between the United States and the EU27 accounts for less than 1% of the value of overall trade in total goods and services, the EU27 remains a leading export market for U.S. agricultural exports. It accounted for about 8% of the value of all U.S. exports and ranked as the fifth largest market for U.S. food and farm exports in 2019—after Canada, Mexico, China, and Japan. In 2019, U.S. exports of agricultural and related product exports to the EU27 totaled $12.4 billion, while U.S. imports of agricultural and related product imports from the EU27 totaled $29.7 billion, resulting in a U.S. trade deficit of approximately $17.3 billion.76 This is the reverse of U.S. trade surpluses with the EU27 during the 1990s. Leading U.S. agricultural exports to the EU27 were corn and soybeans, tree nuts, distilled spirits, fish products, wine and beer, planting seeds, tobacco products, and processed foods. Leading U.S. agricultural imports from the EU27 were wine, distilled spirits, beer, drinking waters, olive oil, cheese, baked goods, processed foods, and cocoa products.

In January 2019, USTR announced its negotiating objectives for the agricultural portion of a U.S.-EU trade agreement following a public comment period and a hearing involving several leading U.S. agricultural trade associations.77 The objectives include greater market access, changes to EU administration of tariff-rate quotas, and changes to a variety of EU regulations. Among regulatory issues, key U.S. objectives include harmonizing regulatory processes and standards to facilitate trade, including sanitary and phytosanitary standards, and establishing specific commitments for trade regarding agricultural biotechnologies. The U.S. objectives also include addressing geographical indications by protecting generic terms for common use.78 U.S. agricultural interests generally support including agriculture as part of the U.S. negotiating objectives for a U.S.-EU trade agreement. The EU negotiating mandate, however, states that a key EU goal is "a trade agreement limited to the elimination of tariffs for industrial goods only, excluding agricultural products."79 Several Members of Congress have stated their opposition to the EU's decision to exclude agricultural policies in their negotiating mandate.80

The U.S.-EU trade negotiations come amid heightened U.S.-EU trade frictions. In response to U.S. Section 232 tariffs on steel and aluminum imports, the EU had retaliated in June 2018 by imposing a tariff increase of 25% on imports of certain U.S. food and beverage products.81 The value of U.S. agricultural exports to the EU28 (included the UK) targeted by these additional tariffs is approximately $1.2 billion in 2018, or about 9% of total U.S. agricultural exports to the EU28. In October 2019, U.S.-EU trade tensions escalated further when the United States imposed additional tariffs on $7.5 billion worth of certain U.S. imports from the EU, including food products. This action—authorized by the WTO—followed a USTR investigation initiated in April 2019 under Section 301 of the Trade Act of 1974.82

Aside from ongoing trade tension, some of the same issues that stalled U.S.-EU agricultural talks in the T-TIP negotiations could prove to be equally intractable today. For food and agricultural products, a series of non-tariff issues stem in part from commercial and cultural practices often enshrined in EU laws and regulations that vary from those of the United States—namely differences involving SPS and technical barriers to trade, broadly covering laws and regulations measures intended to protect public health—as well as differences involving GIs.83

Status: The outlook for the new U.S.-EU trade talks remains uncertain, given ongoing trade tensions. Whether or not the talks will include food and agriculture is also uncertain, as there continues to be disagreement between the two trading partners about the scope of the negotiations, particularly the EU's intent to exclude agriculture from the talks. Perhaps the overarching goal for the U.S. side is addressing the U.S. trade deficit in agricultural products with the EU.84

Public statements by U.S. and EU officials in early 2020 signaled that the U.S.-EU trade talks might include SPS and regulatory barriers to agricultural trade. It is not clear, however, that both sides agree which specific types of non-tariff trade barriers might actually be part of the talks. Some press reports indicate that USDA officials have said that selected SPS barriers as well as GIs would need to be addressed.85 Specific SPS issues important to the U.S. side include the EU's prohibitions on the use of hormones in meat production (see "U.S.-EU Beef Hormone Dispute") and pathogen reduction treatments for poultry (see section "U.S.-EU Dispute Over Pathogen Reduction Treatments (PRTs)"), and EU restrictions on the use of biotechnology (see section "Agricultural Biotechnology"). Other press reports, however, indicate that some EU officials have downplayed the extent that certain non-tariff barriers—such as biotechnology product permits, approval of certain pathogen rinses for poultry, regulations on pesticides or food standards—would be part of the talks.86 The United States continues to push for additional concessions from the EU.87 More formal discussions are expected in spring 2020.88

Trade Aid in Response to Trade Retaliation89

During 2018 and 2019, the Secretary of Agriculture used his authority under the Commodity Credit Corporation Charter Act90 to initiate two ad hoc trade assistance programs in response to foreign trade retaliation targeting U.S. agricultural products. The trade aid packages were part of the Administration's effort to provide short-term assistance to farmers for the temporary loss of important international markets.91 On July 24, 2018, USDA announced the first "trade aid" package, which targeted production of selected agricultural commodities in 2018 and was valued at up to $12 billion. On May 23, 2019, USDA announced a second package, which targeted production of an expanded list of commodities and was valued at up to an additional $16 billion. Thus, the two years of combined trade assistance were valued at up to $28 billion.

Both trade aid packages included (1) a Market Facilitation Program (MFP) of direct payments to producers of commodities most affected by the trade retaliation, (2) a Food Purchase and Distribution Program (FPDP) designed to partially offset lost export sales of affected commodities, and (3) an Agricultural Trade Promotion (ATP) program to expand foreign markets. The largest part of the aid is two years of MFP payments initially valued at a combined $24.5 billion (up to $10 billion in 2018 and $14.5 billion in 2019).

Status: As of February 10, 2020, USDA estimates that it has spent $8.6 billion under the 2018 MFP and $14.2 billion under the 2019 MFP.92 Payments of this magnitude could attract international attention about whether they are consistent with WTO rules and U.S. commitments on domestic support,93 as some WTO member countries are questioning whether this additional aid violates U.S. spending limits under the WTO.94 The trade aid packages raise other potential questions as well. For instance, if the U.S.-China Phase One trade agreement does not produce the commodity purchases promised by China, or if commodity prices remain relatively low, should another trade aid package, or some alternative compensatory measure, be provided in 2020, and possibly beyond? If MFP payments are provided in the future, should USDA revise its payment formulation to provide a broader distribution of payments across the U.S. agricultural sector?

Future Trade Negotiations95

India

India is the world's second most populous country after China. Since 2000, its economy has been the fastest growing in the world. Given the rapid growth in population and income among a large segment of the population, demand for higher-value food products such as fruits, nuts, dairy products, and other livestock products, is expected to increase among Indian consumers. While India is among the world's largest producers and consumers of a range of crop and livestock commodities, USDA projects India will continue to be an important importer of dairy products, vegetable oils, pulses, tree nuts, and fruit, and that it will continue to be a major exporter of rice, cotton and buffalo meat.96

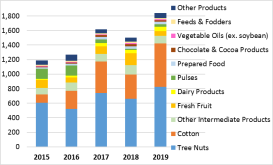

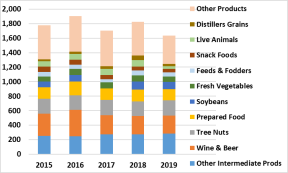

U.S. agricultural exports to India have increased since 2015, reaching $1.6 billion in 2017 (Figure 2). In 2018, U.S. exports declined to $1.5 billion, coinciding with India's imposition of retaliatory tariffs on imports of U.S. almonds, walnuts, apples, chickpeas, and lentils, but U.S. exports rebounded to $1.8 billion in 2019 due to increased sales of cotton and tree nuts (largely pecans, pistachios, and dried coconut). Tree nuts (mainly almonds), cotton, and fresh fruit are key U.S. exports to India. However, other U.S. high-value products are registering rapid growth. For example, U.S. dairy exports to India grew by almost 300% from $16 million in 2015 to $60 million in 2019.

|

Figure 2. U.S. Exports to India Millions of U.S. Dollars |

|

|

Source: U.S. Census Bureau trade data, accessed via U.S. Department of Agriculture (USDA), Foreign Agricultural Service (FAS), BICO-HS-10 grouping, February 2019, https://apps.fas.usda.gov/gats/default.aspx. Notes: Based on USDA's definition of agriculture. |

In 2019, the United States imported agricultural products valued at $2.6 billion from India.97 Spices, rice, essential oils, tea, processed fruit and vegetables, and other vegetable oils are the leading U.S. imports from India.

U.S.-India trade negotiations follow a period of trade tensions. In March 2018, the United States levied additional tariffs on steel and aluminum imports from India. India responded by identifying certain U.S. food products for retaliatory tariffs98 but did not levy them until June 16, 2019, after the United States terminated preferential treatment for India under the Generalized System of Preferences (GSP).99 India's retaliatory tariffs range from 10% to 25% on imports of U.S. chickpeas, shelled almonds, walnuts, apples, and lentils.100 Both countries' tariffs are likely to become an issue if the United States and India undertake a major trade negotiation, as USTR has proposed.

Trade Policy Issues

India's tariffs and non-tariff barriers have prevented greater market penetration of U.S. agricultural products. India maintains very high tariffs on many products, for example 60% on flowers, 100% on raisins, and 150% on alcoholic beverages.101 Since 2017, a system of annual import quotas on pulses has restricted U.S. exports of pulses to India.102 U.S. exports of wheat and barley to India are currently restricted due to its zero-tolerance standard for certain pests and weeds, and restrictions also exist on imports of livestock genetic material.

Similarly, processed products, including ethanol, are subject to various restrictions that prevent U.S. exports to India. India bans imports of tallow, fat, and oils of animal origin. India's complex requirements for U.S. dairy products have been a barrier for expanding U.S. exports. In 2015, India revised its health certificate requirement for pork imports. Since then, the United States has been seeking approval to export pork to India.

USTR asserts that India's customs regulations are not transparent or predictable.103 India's approval process for genetically engineered products are slow and not transparent.104

India maintains a large and complex program for public food stockholding, both to distribute food to poor consumers and to stabilize market prices, essentially subsidizing domestic production. India provides a broad range of support to its agricultural sector. In May 2018, the United States argued at the WTO that India was under-reporting its price supports for rice and wheat.105 In November 2018, the United States questioned India's price support for cotton,106 while Australia has questioned India's price support for sugarcane.107

Status: In 2019, in response to various U.S. concerns over India's trade barriers, the United States revoked India's eligibility for preferential tariff treatment under the U.S. GSP.108 Total value of U.S. imports of agricultural products from India were down 1% in 2019 from $2.7 billion in 2018 to $2.6 billion in 2019. USTR has stated that it hopes to reach an agreement in 2020 that will, among other things, provide greater access to the Indian market for U.S. agricultural products, potentially in exchange for U.S. restoration of India's eligibility under GSP.109

Kenya

On February 6, 2020, the Trump Administration announced that the United States intends to negotiate a comprehensive trade agreement with Kenya using the authority under P.L. 114-26.110 The Administration asserts that such a trade agreement will complement Africa's regional integration efforts, including as part of the African Continental Free Trade Area (AfCFTA), to which the United States has pledged support.111

|

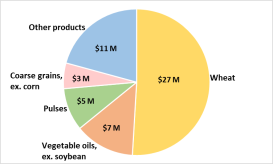

Figure 3. U.S. Agricultural Exports to Kenya $53 Million in 2019 |

|

|

Source: U.S. Census Bureau Trade Data, BICO-10 grouping, accessed from FAS, USDA, February 7, 2020, https://apps.fas.usda.gov/gats/ExpressQuery1.aspx. Notes: USDA definition of agriculture is used; 'ex.'=excluding. |

Kenya hosts three international agricultural research centers that focus on innovations, including agricultural biotechnology, to sustainably improve global food security. These institutions are the International Livestock Research Institute, the World Agroforestry Center, and the International Centre of Insect Physiology and Ecology.

Kenya is an emerging middle-income country, home to more than 47 million people with an estimated population growth rate of 2.5% in 2017.112 USDA projects Kenya's real GDP per capita to grow at an annual rate of about 4% though 2031.113 With anticipated growth in population and per capita income, Kenya has the potential to increase its imports of food and other agricultural products. Kenya's top five agricultural imports are wheat, palm oil, sugar, corn and rice. Its top exports from the United States are wheat, vegetable oils excluding soybean oil, pulses, coarse grains, and other products that include many prepared food products (Figure 3).

Trade Policy Issues

Kenya is a beneficiary of the African Growth and Opportunity Act, most recently extended in P.L. 114-27, under which it has duty-free access to the U.S. market for 6,400 products including agricultural products. In 2019, the United States imported agricultural products valued at $126 million from Kenya,114 with major products being macadamia and cashew nuts, coffee, tea, roses, and non-edible vegetable and nut oils.115

Kenya's MFN tariffs—rates that apply to imports from the United States—are relatively high. For example, simple average MFN tariffs for animal products are 23.1%, dairy products are 51.7%, fruit and vegetables are 22%, cereals and preparations are 22.2%, sugar is 40%, and fish products are 24.8%.116 Other concerns raised by USDA include a Kenyan ban on imports of genetically engineered (GE) agricultural products (although it has approved field trials for GE cotton117 and drought and insect resistant corn), bans on imports of U.S. whole peas and lentils,118 and had a ban on wheat from the U.S. Pacific Northwest over concerns regarding a certain fungus. In February 2020, Kenya adopted a phytosanitary protocol that allows wheat growers in Washington State, Oregon, and Idaho access to Kenya's wheat market, potentially allowing increased U.S. wheat exports to Kenya.119

Status: USTR has said it plans to officially notify Congress of its intent to start negotiations following consultations with Congress as required by the Bipartisan Congressional Trade Priorities and Accountability Act of 2015 (P.L. 114-26). Subsequently, USTR is to publish notices in the Federal Register requesting public comment on the direction, focus, and content of the trade negotiations with Kenya. USTR is to publish objectives for the negotiations at least 30 days before trade negotiations begin. Some Members of Congress have expressed their support for a free trade agreement with Kenya.120

United Kingdom (UK)

|

Figure 4. U.S. Agricultural Exports to the UK Millions of U.S. Dollars |

|

|

Source: U.S. Census Bureau Trade Data, BICO-10 grouping, accessed from FAS, USDA, February 7, 2020, https://apps.fas.usda.gov/gats/ExpressQuery1.aspx. Notes: USDA definition of agriculture is used. |

In January 2020, the UK left the EU. It remains a member of the EU customs union, so U.S.-UK trade continues to be governed by agreements between the United States and the EU in addition to WTO rules. However, the UK has announced its intention to withdraw from the EU customs union on December 31, 2020. Thereafter, U.S.-UK trade will occur under WTO rules unless a separate agreement is reached between the United States and the UK. The UK entered the WTO as a member of the EU, and does not have its own schedule of commitments under the WTO.121 U.S.-UK trade would thus continue to be governed by the EU WTO schedule, with some confusion regarding what share of quota and subsidy commitments made by the EU will henceforth apply to the UK. Therefore, some Members of Congress have indicated that a comprehensive U.S.-UK trade agreement should be a priority for the United States.122

The UK has accounted for about 1.3% of total U.S. agricultural exports from 2015 to 2019. Major U.S. exports are wine and beer, tree nuts, prepared food, soybeans, live animals and other products (Figure 4). The United States does not export notable quantities of meat products to the UK, and the Trump Administration and some Members of Congress and U.S. agricultural industry would like to expand exports of these products in the post-Brexit environment.123

As a member of the EU, the UK posed the same set of trade barriers to U.S. agricultural exports as those discussed under "U.S.-EU Agricultural Trade". In particular, hormone treated beef, chlorine-washed poultry, and bio-engineered food products have faced restrictions in accessing EU markets. The UK has sent mixed signals regarding these issues and has hinted that it may allow imports of genetically engineered U.S. agricultural products.124 At the same time, some reports indicate the UK will not allow imports of chlorine-washed chicken meat.125

Among other goals for U.S. agricultural trade, USTR has identified reducing or eliminating tariffs, providing adjustment periods for U.S. import-sensitive products before initiating tariff reduction, eliminating non-tariff barriers that discriminate against U.S. agricultural goods, improving UK's TRQ administration, promoting regulatory compatibility, and establishing commitments for trade in agricultural biotechnology products.126 USTR has also articulated specific goals regarding sanitary and phytosanitary provisions, customs and trade facilitation, rules of origin, and technical barriers to trade. Some Members of Congress have requested that improved market access for U.S. rice be an objective of U.S. negotiators.127

Status: On October 16, 2018, the Trump Administration notified Congress of proposed trade agreement negotiations with the UK. The UK could not formally negotiate or conclude a new agreement until it exited the EU, which occurred on January 31, 2020, and any agreement could not take effect until the UK exits the EU single market and customs union. Given the proposed scope of the negotiations, any resulting agreement would likely be subject to ratification by Congress.

WTO and U.S. Agriculture128

The World Trade Organization is an international organization that administers the rules and agreements negotiated among its 164 members to eliminate trade barriers and govern trade.129 It also serves as an important forum for resolving trade disputes through its committee structures and its Dispute Settlement Body, which approves reports issued by panels of legal experts and a separate Appellate Body. The United States was a major force behind the establishment of the WTO in 1995.

Under the WTO's Agreement on Agriculture (AoA), agreed in 1995, national agricultural policies—including domestic farm support, agricultural export subsidies, and restrictive import controls—were placed under a multilaterally agreed-upon set of disciplines for the first time.130 WTO members agreed to reform their domestic agricultural support policies, increase access to imports, and reduce export subsidies. The disciplines on these three "pillars" of agricultural policy involved freezing (or "binding") protective measures and subsidies at base period levels, then instituting annual reductions from the bound levels. Article 15 of the AoA granted developing and least-developed countries special rights or extra leniency—termed "special and differential treatment"—in the implementation of their policy commitments. Specifically, they had longer periods over which to reduce subsidies and to improve market access. They were also allowed to retain certain subsidies that were prohibited for other countries.

During the AoA's early years, Article 13, known as the Peace Clause or "due restraint" clause, provided additional impetus for reform. The Peace Clause provided temporary protection for market-distorting domestic support and export subsidy measures from challenges under other WTO provisions, as long as these measures complied with certain requirements.131 However, such subsidies would be open to challenge after the Peace Clause expired around January 2004.132

The AoA was envisioned as a first step in the process of global market liberalization in the agricultural sector. The impending expiration of the Peace Clause coupled with Article 20's directive to continue the reform process led WTO members to launch the Doha Round of negotiations in 2001. But, the Doha Round failed to reach consensus on formulas to reduce tariffs and agricultural subsidies, due in part to disagreements among developing countries that wished to retain their special and differential treatment under the AoA and wealthier countries that wanted to limit such preferences. The Doha Round has been at an impasse since 2009.133

The WTO's effectiveness as a negotiating body for broad-based trade liberalization and its role in resolving trade disputes therefore have come under intensified scrutiny in recent years. The WTO has struggled to address newer issues, such as digital trade and regulations affecting services. In addition, the Appellate Body is effectively non-functional due to the United States' decision to block the nomination of members, which prevents it from having a quorum needed to resolve disputes.

Status: USTR has stated that WTO institutional reform is a priority in 2020.134 Some Mof Congress have voiced their agreement.135 The WTO's chair for agricultural negotiations may circulate a negotiating framework for the June 2020 meeting of WTO trade ministers in Kazakhstan that includes rules designed to increase sustainable agricultural production.136 The meeting may also consider a proposal by a group representing 19 countries, known as the Cairns Group, to "cap and reduce by at least half the current sum of global agricultural trade- and production-distorting domestic support entitlements by 2030."137

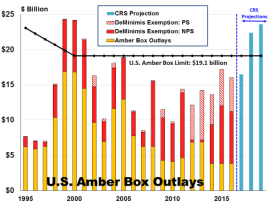

2018 Farm Bill, Trade Aid, and WTO Compliance138

|

Figure 5. U.S. Amber Box Compliance, Historical and Projected |

|

|

Source: PS=product specific; NPS=non-product-specific. Compiled by CRS from U.S. notification to the WTO for 1995-2016. Years 2017-2019 are compiled by CRS from USDA payment and farm income data and Congressional Budget Office May 2019 baseline projections for farm program outlays. Notes: The United States has yet to notify domestic support outlays beyond 2016. Thus, it is unknown how USDA will categorize new spending programs such as the Market Facilitation Program (MFP). As a result, CRS does not distinguish between amber box and de minimis spending for the projected years 2017, 2018, and 2019; for a projected breakout, see CRS Report R45940, U.S. Farm Support: Compliance with WTO Commitments. |

Under the AoA, the United States has committed to limit its domestic support program spending deemed most trade-distorting (referred to as "amber box" outlays) to $19.1 billion per year. The AoA spells out the rules for countries to determine whether their policies are potentially trade-distorting, how to calculate the costs of any distortion using a specially defined indicator, the "Aggregate Measure of Support" (AMS), and how to report those costs to the WTO in a public and transparent manner.139 While the AMS is subject to a spending limit, the AoA provides four potential exemptions from the AMS spending limit.

First, if a program's outlays are considered to be minimally trade distorting or non-trade distorting (in accordance with specific criteria listed in Annex 2 of the AoA), then they may qualify as "green box" programs and not be included in the AMS. Second, if program spending is trade-distorting but has offsetting features that limit the production associated with support payments, then they may qualify as "blue box" programs and not be included in the AMS. Third, if AMS outlays for a specific commodity are sufficiently small relative to the output value of that commodity (product-specific de minimis), they may be exempted. Finally, if aggregate AMS outlays are small relative to the value of total agricultural production (non-product-specific de minimis)—then they may be exempted. Any AMS left over after applying these four exemptions constitutes the amber box.

Since the WTO's establishment, the United States has generally met its WTO amber box spending commitment. However, in some years U.S. compliance has hinged on judicious use of de minimis exemptions, which permit it to exclude certain spending from being considered under its amber box limit (see Figure 5). To date, no WTO member has challenged these exemptions.

Since 2010, U.S. outlays on potentially market-distorting farm programs have been trending upward (Figure 5). From 2011 through 2016, AMS outlays (amber box plus de minimis exemptions) averaged $14.6 billion per year.140 However, several policy developments since 2016 have created uncertainty about whether the United States will remain in compliance with the rules and spending limits for domestic support programs that it has agreed to in the WTO. These developments are, first, farm program changes under both the 2018 farm bill (P.L. 115-334), which expanded payment eligibility and eliminated certain programs from payment limits,141 and, second, USDA trade aid programs implemented in 2018 and 2019 under other statutory authorities in response to foreign trade retaliation targeting U.S. agricultural products (see "Trade Aid in Response to Trade Retaliation").142

U.S. AMS spending is estimated to have been higher in 2017 through 2019, based on CRS compilation of USDA program data. Outlays in 2017 are estimated to have been $16.5 billion; however, the classification of $10.1 billion in program spending as de minimis exemptions would limit amber box outlays to $6.3 billion. The addition of the Administration's two MFP "trade aid" payments, valued at $8.6 billion in 2018 and approximately $10.7 billion in 2019, are estimated to push total AMS outlays above the U.S. amber box spending limit—to $22.4 billion in 2018 and $23.6 billion in 2019. Whether the United States will violate its spending commitment or not would be expected to depend on the extent that de minimis exemptions apply for those two years.143

The United States has yet to notify spending to the WTO under any of the trade assistance programs, so the exact WTO spending classification is currently unknown. However, past practice can serve as a guide for the likely notification. The FPDP and ATP programs for 2018 and 2019 are expected to have been implemented in a similar manner during both years. USDA outlays under food purchase and distribution programs have historically been notified to the WTO as green box compliant and thus not subject to any spending limit. Trade promotion programs, such as ATP, are not notified under domestic support, because they do not involve direct payments to producers. Thus, the FPDP and ATP programs are not expected to affect the United States' ability to meet its WTO commitments.

Payments under the two MFP programs were structured differently during 2018 and 2019. As a result, they are likely to be notified under different WTO classifications. The specific manner of determining how payments are made to individual producers is likely to determine their WTO status. Potential AMS classifications are:144

- USDA's MFP payments for 2018 were based on each farm's harvested production of eligible crops during 2018 times a fixed per-unit payment rate. Payments to dairy were based on historical production, while hog payments used mid-year inventory data. Under this specification, 2018 MFP payments are likely to be notified as coupled, product-specific AMS and would count against the U.S. annual spending limit of $19.1 billion (unless they are exempted under the product-specific de minimis exemption).

- USDA's MFP payments for 2019 were coupled to a producer having planted at least one eligible commodity within the county, but they are independent of which commodity or commodities were planted. Under this specification, the 2019 MFP payments would appear to be coupled to planted acres—a producer has to plant an eligible crop to get a payment—but are non-product-specific, thus possibly notifiable as non-product-specific AMS.

Status: Most recent studies suggest that, for U.S. program spending to exceed the $19.1 billion cumulative spending limit, even with the addition of large MFP payments and higher traditional program support levels, a combination of events would have to occur that would broadly depress commodity prices. Perhaps more relevant to U.S. agricultural trade is the concern that, because the United States plays such a prominent role in most international markets for agricultural products, any distortion resulting from U.S. policy could be both visible and potentially vulnerable to challenge under WTO rules.145

U.S. Challenges to Farm Support Spending of WTO Members146

Since the inception of the WTO in 1995, the United States has initiated 46 WTO dispute cases related to agriculture. Of these cases, 34 were fully or partially decided in favor of the United States by the WTO panel hearing the case.147

U.S. Challenges of China's Agricultural Domestic Support

In September 2016, USTR filed a dispute settlement case (DS511) at the WTO over China's domestic agricultural support policies, alleging they were inconsistent with WTO rules and commitments.148 USTR contended that the level of support that China provided for rice, wheat, and corn had exceeded—by nearly $100 million from 2012 through 2015—the level to which China had committed to when it joined the WTO. USTR also asserted that China's price support for domestic production had been above the world market prices since 2012, thereby creating an incentive for Chinese farmers to increase production of the subsidized crops, which in turn displaced imports from the United States and elsewhere.149 In December 2016, USTR requested that the WTO establish a dispute settlement panel to examine China's domestic support levels for these crops.

On February 28, 2019, the WTO dispute settlement panel found that China had exceeded its domestic support limits for wheat and rice in each year between 2012 and 2015 and therefore was not in compliance with its WTO commitment. The panel made recommendations that China change its calculations of reference prices and domestic support in order to comply with its WTO commitments. The panel did not make a ruling on corn because China had already made changes to its support for corn that were found to be less trade distorting than the method used prior to 2015.

Status: Under the U.S.-China Phase One trade agreement, China stated that it will respect its WTO obligations and publish in its official journal its laws, regulations and other measures pertaining to its domestic support programs and policies.