COVID-19, U.S. Agriculture, and USDA’s Coronavirus Food Assistance Program (CFAP)

As COVID-19 has spread throughout the United States, it has reduced domestic economic activity and disrupted domestic and international supply chains for goods and services, including food and agricultural products. These disruptions have produced an immediate and very strong demand shock on the U.S. food supply chain that has sent many commodity prices sharply lower.

The food supply chain refers to the path that raw agricultural commodities take from the farm where they are produced, through the food processing and distribution network to the consumer where they are used. Supply chain disruptions have been primarily due to two factors: widespread shutdowns of all but essential businesses; and uncertainty about the availability of labor for the food distribution network—whether from illness, fear of illness, or immigration status. The food supply chain has been deemed essential; however, many institutional purchasers (including restaurants, hotels, schools, and entertainment venues) have been closed. According to the U.S. Department of Agriculture (USDA), U.S. consumers normally spend 54% of their food and drink dollars on away-from-home food purchases. Thus, prior to the COVID-19 pandemic a large share of U.S. food products traveling through the food supply chain was going to institutional buyers, often in bulk or vendor-ready form, for away-from-home consumption. In order to redirect this food product flow towards retail outlets and at-home consumption, much of this food would require processing into more consumer-usable forms, repackaging, and relabeling. This requires some level of retooling by food packagers and processors. In addition, several plants in the food processing industry, including meat processing plants, have experienced severe COVID infection outbreaks among workers and been forced to shut (at least temporarily).

Several industry groups from the U.S. agricultural sector have released estimates of the economic damage experienced by producers and ranchers. Most of these early assessments are limited to evaluating the effect of the price decline on any unsold production of crops or livestock remaining under farmer’s control, and the unexpected marketing costs of unsold products due to the shutdown of most institutional buying of agricultural products. Cumulatively, industry estimates of COVID-related losses approach $40 billion (this would represent over 10% of annual cash receipts). The effect on farm net income is expected to be similarly negative.

In response to the COVID-19 pandemic, Congress has passed and the President has signed four supplemental appropriations acts (P.L. 116-123, P.L. 116-127, P.L. 116-136, and P.L. 116-139) that have included both direct and indirect funding for the U.S. agricultural sector. On April 17, 2020, Secretary of Agriculture Sonny Perdue announced the Coronavirus Food Assistance Program (CFAP), valued at $19 billion, to provide immediate financial relief to farmers, ranchers, and consumers in response to the COVID-19 national emergency. According to Secretary Perdue, CFAP will include $16 billion in direct payments to producers that have been impacted by the sudden drop in commodity prices and the disruption in food supply chains that has occurred since the outbreak, and $3 billion in commodity purchases for distribution through food banks, faith-based organizations, and other nonprofit organizations.

CFAP direct payments are intended to partially offset the loss of market revenue from the price decline, and the unexpected carry-cost of unsold commodities for producers and ranchers of products that have been negatively affected by COVID-19. USDA has released limited information on the specifics of how CFAP’s direct payment program will be implemented. Many of the program specifics are expected to be delineated in an expedited rulemaking process. CFAP direct payments are expected to go out to producers by the end of May or early June.

CFAP’s commodity purchase and distribution program serves the dual roles of supporting commodity market prices by temporarily increasing demand, and of expanding the availability of food distribution to consumers that have lost their jobs or have limited resources. Expectations are that it will be operated differently than, and separate from, existing USDA commodity purchase programs such as Section 32 or Food and Nutrition Service (FNS) food distribution programs in two major ways. First, USDA plans to purchase about $100 million per month of fresh produce, $100 million per month of dairy products, and $100 million per month of meat products (chicken and pork). Second, the CFAP purchase program intends for vendors to deliver household-ready boxes—potentially a diversified mix of the previously mentioned produce, meat and dairy products—which are ready for more convenient and immediate distribution (“off the truck and into the trunk”) that is consistent with social distancing. Initial program delivery may be as early as May 15. The program is expected to operate through the end of 2020. Potential congressional concerns include how to channel assistance to industries affected by COVID-19, long-term effects of the pandemic, and the capacity of rural banks to help with recovery. Several issues related to CFAP and the U.S. agricultural sector in a post-COVID economy that could be of potential interest to Congress are presented at the end of this report.

COVID-19, U.S. Agriculture, and USDA's Coronavirus Food Assistance Program (CFAP)

Jump to Main Text of Report

Contents

- Introduction

- U.S. Agricultural Sector Vulnerability to COVID-19

- Temporarily Empty Grocery Store Shelves

- The U.S. Food Supply Is Ample

- Disruption of Food Supply Chains Impact Commodity Prices

- Loss of Institutional Buyers

- Uncertainty over Labor Availability

- Many Meat and Food Processing Plants Slow Operations or Close

- Commodity Prices Plummet

- International Market Export Restrictions

- Current Assessments of Economic Damage

- U.S. and Global GDP Outlook Revised Downward

- Major Agricultural Commodity Sectors Suffer Substantial Harm

- U.S. Farm Income Projections Revised Downward

- Potential Impact on Farm Household Cash Flow

- On-Farm Revenue, Expenses, and Federal Payments All Impacted

- Off-Farm Income Impacted by Rural Economic Situation

- Federal Response to COVID-19 for Agriculture

- Supplemental Agriculture Appropriations

- Funds Directly Targeting Agriculture

- Funds Indirectly Targeting Agriculture and the Rural Economy

- USDA's Coronavirus Food Assistance Program (CFAP)

- CFAP Direct Payment Program

- CFAP Purchase and Distribution Program

- Next Steps

- More USDA Assistance

- Rural COVID-19 Task Force Proposed

- U.S. Agricultural Stakeholders

- Issues for Congress

Figures

Summary

As COVID-19 has spread throughout the United States, it has reduced domestic economic activity and disrupted domestic and international supply chains for goods and services, including food and agricultural products. These disruptions have produced an immediate and very strong demand shock on the U.S. food supply chain that has sent many commodity prices sharply lower.

The food supply chain refers to the path that raw agricultural commodities take from the farm where they are produced, through the food processing and distribution network to the consumer where they are used. Supply chain disruptions have been primarily due to two factors: widespread shutdowns of all but essential businesses; and uncertainty about the availability of labor for the food distribution network—whether from illness, fear of illness, or immigration status. The food supply chain has been deemed essential; however, many institutional purchasers (including restaurants, hotels, schools, and entertainment venues) have been closed. According to the U.S. Department of Agriculture (USDA), U.S. consumers normally spend 54% of their food and drink dollars on away-from-home food purchases. Thus, prior to the COVID-19 pandemic a large share of U.S. food products traveling through the food supply chain was going to institutional buyers, often in bulk or vendor-ready form, for away-from-home consumption. In order to redirect this food product flow towards retail outlets and at-home consumption, much of this food would require processing into more consumer-usable forms, repackaging, and relabeling. This requires some level of retooling by food packagers and processors. In addition, several plants in the food processing industry, including meat processing plants, have experienced severe COVID infection outbreaks among workers and been forced to shut (at least temporarily).

Several industry groups from the U.S. agricultural sector have released estimates of the economic damage experienced by producers and ranchers. Most of these early assessments are limited to evaluating the effect of the price decline on any unsold production of crops or livestock remaining under farmer's control, and the unexpected marketing costs of unsold products due to the shutdown of most institutional buying of agricultural products. Cumulatively, industry estimates of COVID-related losses approach $40 billion (this would represent over 10% of annual cash receipts). The effect on farm net income is expected to be similarly negative.

In response to the COVID-19 pandemic, Congress has passed and the President has signed four supplemental appropriations acts (P.L. 116-123, P.L. 116-127, P.L. 116-136, and P.L. 116-139) that have included both direct and indirect funding for the U.S. agricultural sector. On April 17, 2020, Secretary of Agriculture Sonny Perdue announced the Coronavirus Food Assistance Program (CFAP), valued at $19 billion, to provide immediate financial relief to farmers, ranchers, and consumers in response to the COVID-19 national emergency. According to Secretary Perdue, CFAP will include $16 billion in direct payments to producers that have been impacted by the sudden drop in commodity prices and the disruption in food supply chains that has occurred since the outbreak, and $3 billion in commodity purchases for distribution through food banks, faith-based organizations, and other nonprofit organizations.

CFAP direct payments are intended to partially offset the loss of market revenue from the price decline, and the unexpected carry-cost of unsold commodities for producers and ranchers of products that have been negatively affected by COVID-19. USDA has released limited information on the specifics of how CFAP's direct payment program will be implemented. Many of the program specifics are expected to be delineated in an expedited rulemaking process. CFAP direct payments are expected to go out to producers by the end of May or early June.

CFAP's commodity purchase and distribution program serves the dual roles of supporting commodity market prices by temporarily increasing demand, and of expanding the availability of food distribution to consumers that have lost their jobs or have limited resources. Expectations are that it will be operated differently than, and separate from, existing USDA commodity purchase programs such as Section 32 or Food and Nutrition Service (FNS) food distribution programs in two major ways. First, USDA plans to purchase about $100 million per month of fresh produce, $100 million per month of dairy products, and $100 million per month of meat products (chicken and pork). Second, the CFAP purchase program intends for vendors to deliver household-ready boxes—potentially a diversified mix of the previously mentioned produce, meat and dairy products—which are ready for more convenient and immediate distribution ("off the truck and into the trunk") that is consistent with social distancing. Initial program delivery may be as early as May 15. The program is expected to operate through the end of 2020. Potential congressional concerns include how to channel assistance to industries affected by COVID-19, long-term effects of the pandemic, and the capacity of rural banks to help with recovery. Several issues related to CFAP and the U.S. agricultural sector in a post-COVID economy that could be of potential interest to Congress are presented at the end of this report.

Introduction

Since the novel coronavirus—designated Coronavirus Disease 2019, or COVID-19—first appeared in the United States in mid-January, it has contributed to substantial economic upheaval across the U.S. economy, including the agricultural sector.

In response to the COVID-19 pandemic, Congress has passed and the President has signed four supplemental appropriations acts (P.L. 116-123, P.L. 116-127, P.L. 116-136, and P.L. 116-139) that have included both direct and indirect funding for the U.S. agricultural sector.1 Using funds from these acts and from other authorities, the U.S. Department of Agriculture (USDA) announced, on April 17, 2020, the Coronavirus Food Assistance Program (CFAP), valued at $19 billion, to provide immediate financial relief to farmers, ranchers, and consumers in response to the COVID-19 national emergency.2 USDA could provide additional financial assistance for the U.S. agricultural sector beyond CFAP later in the summer when a replenishment payment of $14 billion for the Commodity Credit Corporation becomes available. Congress is also considering providing additional support.3

This report describes some of the actions that USDA has taken in response to the COVID-19 emergency, including CFAP—in particular, how CFAP is funded and how USDA intends to use the funds. The description of USDA COVID-19 response efforts is preceded by: first, a brief review of food supply chain issues where the U.S. agricultural sector has experienced economic harm or is potentially vulnerable to the effects of the COVID-19 pandemic; and second, a review of current assessments of the economic harm to U.S. farm income, as well as to individual commodity sectors, resulting from COVID-19.

The report then describes the emergency funds that have been allocated to address the U.S. agricultural sector, and how USDA plans on using those funds, including a detailed description of CFAP producer payments, and USDA's food purchase and distribution efforts. This is followed by a review of the announced positions for selected U.S. agricultural stakeholders in regard to how the COVID-19 pandemic has affected their industries, what their anticipated losses might be, and what their expectations are vis-à-vis congressional funding and USDA's announced program response.

Finally, several issues related to CFAP and the U.S. agricultural sector in a post-COVID economy that could be of potential interest to Congress are presented at the end of this report.

An appendix at the end of the report includes a table (Table A-1) that summarizes estimates—from selected studies—of the economic damage to several major agricultural sectors of the United States due to the COVID-19 emergency.

|

The Coronavirus Disease 2019 (COVID-19) COVID-19's Global Spread The novel coronavirus—designated Coronavirus Disease 2019, or COVID-19—began sickening patients in Wuhan, China, in early December 2019. By mid-January the virus had spread to Europe and the United States. The World Health Organization (WHO) declared the outbreak a "pandemic" on March 11, 2020.4 By mid-April 2020, it had spread across the globe.5 The first known case of COVID-19 on U.S. soil was confirmed on January 20, 2020.6 The Trump Administration announced a national emergency declaration on March 13.7 By May 1, nearly 3.3 million people worldwide had been infected, resulting in a death toll of over 234,000; the United States had nearly 1.1 million confirmed infections and over 63,000 confirmed deaths.8 CRS Coverage: COVID-19 In order to cover the many aspects of the COVID-19 pandemic, the Congressional Research Service has established a Coronavirus Resources web page that displays current CRS reports on COVID-19, the federal response, and its effect across various subsectors of the U.S. economy.9 In addition, CRS has established an "experts list" to help identify coverage for specific subject areas.10 This report focuses on the potential effects of COVID-19 on the U.S. agricultural sector. As such, a list of CRS experts for major agricultural issue areas is included here. CRS Coverage of COVID-19 Agriculture-related Issues

|

U.S. Agricultural Sector Vulnerability to COVID-19

As COVID-19 has spread throughout the United States, it has reduced domestic economic activity and disrupted domestic and international supply chains for goods and services, including food and agricultural products. These disruptions have produced an immediate and very strong demand shock on the U.S. food supply chain. In particular, the abrupt shutdown of much food service and institutional buying has affected commodity prices throughout the food supply chain.

On the supply side, there is no food shortage in the United States. Supplies for most commodities remain relatively abundant; however, inflexibilities in the food supply chain (from food product specialization targeting food service and institutional markets that have closed, to pandemic outbreaks at processing plants) have resulted in bottlenecks that have left many farmers with unmarketable surpluses, while some retail outlets have experienced temporary shortages of various food and agricultural products.

Temporarily Empty Grocery Store Shelves

During the early weeks of shutdown in March and April, many grocery stores had empty shelves for basic staples such as pasta, rice, sugar, and flour, as well as frozen ready-to-eat foods, household cleaning products, and toilet paper. This was the result of a temporary surge in consumer food stockpiling—much of it in the form of panic buying and potential hoarding—that occurred in March when consumers worried that they might be locked down in their houses for weeks or months.11 This type of shortage is temporary. Eventually the existing supplies of foodstuffs and other household products work their way through the food supply chain and restock the grocery store shelves.

The temporary shortage occurred due to two primary factors. First, consumers had been getting a significant share (54%) of their food from restaurants and other away-from-home venues.12 All of this demand was suddenly diverted to grocery stores and retail outlets almost overnight.13 This switch is not simply a matter of redirecting truckloads of products away from institutional buyers towards retail outlets, but also of transforming many products from bulk or vendor-ready forms to consumer-ready forms in smaller packages with new product labelling. Furthermore, truckers would now be making many stops for smaller deliveries to retail outlets along their routes, rather than a few stops to large buyers. All of this would require re-engineering of the food supply networks that ultimately may be temporary once the pandemic eases.

Second, much of the food supply chain operates on a "just-in-time" principle to minimize costs associated with storage and waste of products. Under this principle, many processing plants and transportation routes are designed to operate near full capacity on a routine basis in expectation of slow, steady demand and to avoid the cost of idled resources—this is particularly true for food products and other items like toilet paper that normally do not experience large fluctuations in demand over time.14

Thus, not all production processes can ramp up on short notice to meet unexpected surges in demand for their products, or to suddenly alter the product form, packaging, labeling, and shipping methods. As a result, shortages due to consumer stockpiling create bulges in the supply chain that may take weeks or months to eliminate as the food supply chain re-engineers itself in response.

The U.S. Food Supply Is Ample

U.S. and global supplies of major agricultural commodities are in a state of relative abundance—thanks to large harvests over the past several years—which has kept market prices at relatively low levels for the past five years. The surplus supply situation has been compounded by the ongoing trade dispute between the United States and China, which disrupted traditional trade patterns and contributed to lower trade levels (and greater than expected U.S. stock levels) for several major commodities in the second half of 2018 and 2019.15

Globally, the Food and Agriculture Organization (FAO) of the United Nations reports that stocks for many major agricultural commodities—including wheat, rice, corn, barley, coffee, sugar, butter, cheese, palm oil, soybean oil, poultry, and pork—are at or near 20-year highs.16 A similar situation exists within the United States. On April 9, 2020, USDA reported that the major U.S. grain and oilseed crops, as well as upland cotton, all had relatively large end-of-year stocks levels last fall (2019) to carry into this year.17 On April 22, 2020, USDA reported abundant supplies of meat, dairy, fruit, vegetable, and tree nut products in cold storage.18 Similarly, USDA reports that hog and poultry populations in the United States are historically large, while the cattle population has rebounded from its low point in 2014.19 In addition, USDA reported that for 2020, U.S. farmers intended to increase corn and soybean planted acres by 8% and 10%, respectively, while adjusting wheat (1%) and cotton acres (<1%) down slightly from 2019.20 If such large planted acres are realized, under normal weather conditions, they could produce bumper crops and further expand domestic supplies.

According to news reports, Secretary of Agriculture Sonny Perdue has said that consumers should not worry about a shortage of food, saying the supply chain is just mismatched.21 Although demand has surged at the retail level in response to the pandemic, demand from restaurants, cafeterias, sports venues, and tourism has plummeted.

Disruption of Food Supply Chains Impact Commodity Prices

The food supply chain refers to the path that raw agricultural commodities take from the farm where they are produced, through the food processing and distribution network to the consumer where they are used. The domestic food supply chain has the potential to break down at any of a number of different points: availability of inputs and labor for agriculture production; trucks and truck drivers for transporting raw and finished products; food processing plants, plant workers, and food safety inspectors; packaging, warehousing, and storage capacity; and wholesale and retail outlets and their workers. For exported products, the supply chain includes containers, ships, crew, and port workers.

There is a finite supply of trucks, railcars, and shipping containers, and they may not be situated where they are needed when a temporary surge in demand occurs. Labor shortages at any point along the supply chain can lead to bottlenecks, delays, and regional shortages. Similarly, there is a finite supply of warehousing and cold storage (i.e., refrigerated and frozen) space, which may contribute to temporary regional shortages.

With respect to COVID-19's impact, supply chain disruptions have been primarily due to two factors: widespread shutdowns of all but essential businesses; and uncertainty about the availability of labor for the food distribution network, from farms to retail outlets—whether from illness, fear of illness, or immigration status.

Loss of Institutional Buyers

The first effect of the COVID-19 pandemic on agricultural producers occurred when many states and municipalities closed schools and instituted economy-wide shutdowns of all but essential businesses. The wholesale and retail food distribution network has been deemed essential; however, many institutional purchasers of agricultural products (often referred to as the food services sector, including restaurants, hotels, schools, and entertainment venues) have been closed.22

According to USDA, U.S. consumers normally spend 54% of their food and drink dollars on away-from-home food purchases.23 Thus, a large share of U.S. food products traveling through the food supply chain was going to the food services sector, often in bulk or vendor-ready form, for away-from-home consumption. In order to redirect this food product flow towards retail outlets and at-home consumption, much of it would require processing into consumer-usable quantities and forms, requiring repackaging, and relabeling. This requires some level of retooling by food packagers and processors.

As a result, the near total stoppage of institutional food purchases contributed to sharp declines in the prices of affected commodities (Figure 1), and led to unanticipated conditions of oversupply from commodities that could no longer move through the food supply chain and were, instead, backing up to the farms that produced them. This left many agricultural producers with excess supplies of perishable products—including fruit, vegetables, milk, and market-ready livestock—that are not easily diverted to alternate uses or retail outlets.24 In the interim, the temporary glut of perishable products with nowhere to go has led to news reports of producers dumping fresh milk, burying truckloads of raw onions, plowing fields of ripe vegetables back into the ground, and more disturbingly, depopulating millions of market-ready hogs and poultry.25

The surplus of perishable, unsold commodities worsened starting in mid-April, when a surge in COVID-19 infections among workers in meat packing plants and other food processing plants led to multiple plant closures, and contributed to both animal surpluses on farms and public concerns about the reliability of the nation's food supply.26

Uncertainty over Labor Availability

Agriculture has been classified by the federal government as a critical industry that must remain operating, even as much of the rest of the country shuts down to help contain the virus' spread.27 However, labor shortages at any stage of the supply chain can create temporary food product shortages in affected markets. If labor shortages become severe, they could lead to wider multi-state, and possibly national, food shortages of affected products.

Many fruit and vegetable production activities are labor-intensive and require an adequate work force at key points in the products cycle—particularly at harvest—to successfully bring the crop to market. In addition, the U.S. agricultural sector relies on a large workforce to operate the production lines in food processing plants, including meat packing plants, as well as fruit and vegetable wholesale and distribution networks. This labor force performs supply chain activities including production, transportation, processing, warehousing, packaging, and retailing. Many of these supply chain activities cannot be automated or done remotely, but rely on workers being on site. For example, USDA reports that more than 1.5 million people worked in food processing in the United States in 2016.28 Meat processing, which tends to be more labor intensive than other parts of the food sector, accounted for 500,000 of those employees.29 Workers that are still planting and harvesting crops, or standing on an assembly line in a meat packing plant, during the coronavirus outbreak have a high risk of being infected with the disease given that they live, work, and travel in crowded conditions, and most do not have health care or paid sick leave.30

Another labor-intensive component of the food supply chain is federal safety inspection, which is undertaken by about 8,000 USDA safety inspectors stationed at every agricultural manufacturing facility throughout the country, as well as about 3,800 safety inspectors from the Food and Drug Administration (FDA).31

As the food distribution network shifts more food products away from institutional outlets to grocery stores, labor at the retail level has come under greater stress.32 Many grocery stores have begun implementing preventative measures, like reducing hours to give staff time to rest, clean, and stock shelves, while limiting exposure to customers.33 All of these COVID-19 related measures tend to slow the food supply chain's throughput rate and thus have prolonged the period of empty or partially filled grocery store shelves.

Many Meat and Food Processing Plants Slow Operations or Close

Starting in mid-April, a surge in infections among workers in meat packing plants and other food processing plants led to multiple plant closures and contributed to unexpected surpluses of ready-for-market hogs, cattle, and poultry at the farm level.34 As of May 1, news sources reported that at least 20 meatpacking and 5 food processing plants had been closed.35 Due to a high degree of consolidation in the meat processing industry, a shutdown of four or five big plants could impact retail supplies.36 On May 1, the Centers for Disease Control and Prevention (CDC) reported that 115 meat and poultry processing plants (with over 130,000 workers) had a combined 4,913 workers with confirmed cases of COVID-19, including 20 that had died from COVID-19.37

Meat processing plant closures have two opposing effects: on the one hand, demand for livestock in the surrounding region is reduced and this tends to depress cash and futures prices, lowering prices that producers receive and that packers pay for market-ready livestock; on the other hand, the supply of consumer-ready product is reduced, which tends to raise wholesale and retail prices for the affected products. As evidence of this, USDA has reported a widening price gap between farm and wholesale prices for beef.38

On April 22, news sources reported that, with the closure of Tyson's pork processing plant in Waterloo, IA, about 15% of total U.S. pork processing capacity was off line.39 According to an official with the Commodity Futures Trading Commission's (CFTC's) Livestock Marketing Task Force, most plants that were still open during this same period were operating at only 50% to 75% of normal production due to employee absenteeism.40 Furthermore, the CFTC official noted that U.S. pork processing plants normally handled about 2.5 million hogs per week, but that slower operating line speeds had reduced that number to 2.1 million hogs, implying that an additional 400,000 market-ready hogs had to stay on the farm each week. By May 1, weekly hog slaughter had fallen to 1.5 million, implying that nearly a million hogs per week were backing up to the farm.41

On April 28, President Trump signed an executive order using authority under the Defense Production Act (DPA) of 1950, as amended (50 U.S.C. 4501 et seq.), and Section 301 of title 3, United States Code, to order the Secretary of Agriculture to take all appropriate action to ensure that meat and poultry processors continue operations consistent with the guidance for their operations jointly issued by the CDC and Occupational Safety and Health Administration (OSHA).42 Two issues associated with the reopening of closed plants are the availability of personal protective equipment (PPE) for plant workers, and the liability associated with hospitalization costs and/or deaths of infected plant workers.

On April 30, Secretary Perdue stated that USDA will ask meat processors to submit written plans to safely operate packing plants and review them in consultation with local officials.43 Perdue said that USDA will work collaboratively with companies and state and local officials to set safety standards based on guidelines for workers released by the CDC and OSHA, and that USDA was working to insure the availability of the necessary PPE for plants to operate safely. The Secretary also said that President Donald Trump's executive order to open the plants will not remove legal liability, but that the CDC protection guidelines will give meat plants "a defensible answer" should they be sued, as long as they follow the guidance.44

Commodity Prices Plummet

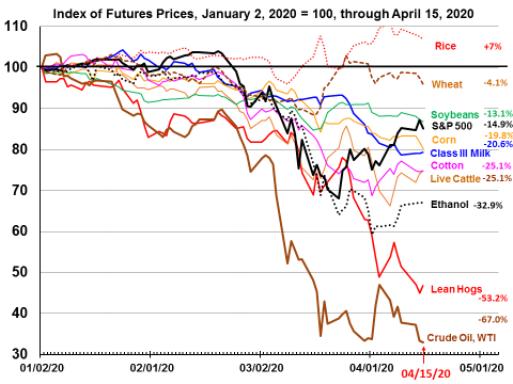

Since mid-February, prices for many major agricultural commodities have plummeted (Figure 1). Commodity market price declines have been led, in part, by a precipitous fall in the price of crude oil (down 67% between January 2 and April 15), which feeds back into the U.S. market for ethanol and corn, and subsequently through the expanded market for livestock feedstuffs.

Prices for the livestock sector—cattle, hogs, poultry, and dairy—were hit particularly hard by the sudden economic shutdown and the associated dilemma of what to do with market-ready livestock, and because of the difficulty in diverting product from restaurants to retail outlets. During the January 2 to April 15 period, prices for lean hogs were down by 53.2%, live cattle 25.1%, and milk 20.6%.

The cotton and textile industries were negatively impacted by the widespread shutdown of retail businesses. Demand for clothing and apparel dropped precipitously with the economic closure.45 This fed back into a collapse of demand that affects manufacturers, which affects cotton mills, and finally to contracts for cotton being canceled. U.S. cotton prices dropped by over 25% between January 2 and April 15 (Figure 1). USDA's Foreign Agricultural Service (FAS) reduced its forecast for global cotton consumption for 2020 by 6.4%.46 According to FAS, spending on clothing is highly correlated to changes in GDP, and most economic forecasters are expecting strong declines in global GDP in the first half of 2020.

Reduced travel, slowing economic activity, and petroleum-product demand suppression related to the COVID-19 outbreak, combined with announced plans to increase crude oil supplies by Saudi Arabia and Russia in mid-April, contributed to the severe decline in crude oil prices.47 Low oil prices contribute to lower agricultural prices via a strong biofuels link between the two sectors. Corn is both the world's foremost livestock feed grain and the principal feedstock in the production of the biofuel ethanol. Ethanol is blended with gasoline in the United States (at about a 10% share) for use in automobiles and light trucks. Thus, declining fuel demand contributes directly to falling prices for gasoline, ethanol, and corn.

Ethanol prices fell by nearly 33% from January 2 to April 15 (Figure 1). As of April 21, news sources report that nearly 30% of the nation's 204 biofuel plants have been idled since March 1, while many others have reduced their production volumes.48 By April 25, the Renewable Fuels Association reported that about 46% of ethanol production capacity was idled.49 Furthermore, the prices of nearly all feed grains and oilseeds produced in the United States move in tandem with corn prices since they all compete for the same feed markets in consumption and farmland in production. Thus, this combination of the COVID-induced sudden disruption of normal agricultural demand and use, slowing U.S. and global economic activity, and sharply lower oil prices have placed strong downward pressure on commodity prices in international markets since the start of 2020.

|

|

Source: Data are as of April 20, 2020. Indexes have been compiled by CRS from daily closing prices for nearby futures contracts on the Chicago Board of Trade (CBOT) under the CME Group as reported by RMBGroup.com/quotes for all commodities, except cotton which is traded on the ICE Futures U.S. exchange. Prices include live cattle and Class III Milk futures contracts for April 2020; corn, soybeans, cotton, wheat, rough rice, lean hogs, ethanol, and West Texas Intermediate (WTI) crude oil, contracts for May 2020; and S&P 500 E-Mini contracts for June 2020. Notes: Class III milk is used primarily for cheese. Lean hogs are priced in carcass-weight equivalents. WTI crude oil is West Texas Intermediate (WTI) grade crude oil. It is unlikely that the entire downward price movement for all commodities is uniquely the result of the COVID-19 outbreak; there are other market factors that have contributed to the decrease in prices over this period as explained in the text. |

International Market Export Restrictions

On top of these domestic disruptive factors, international markets for some major food items, such as rice and wheat, have experienced trade disruptions due to threats or actual imposition of protectionist policies on exports of major food products in certain important producer countries—including Russia (the world's leading wheat exporter), Kazakhstan, and Vietnam.50 According to the World Trade Organization (WTO), 80 countries and customs territories so far have introduced export prohibitions or restrictions as a result of the COVID-19 pandemic.51 In response, the United States, China, the European Union, and other members of the WTO representing over 60% of world agricultural exports pledged to refrain from imposing restrictions on the free flow of food out of their countries.52

By threatening to limit supplies to international markets, these protective policies have actually been supportive of rice and wheat prices in international markets (Figure 1). Since January, the nearby futures contract price for rough rice on the Chicago Board of Trade has actually risen by 7%, while the contract for wheat has fallen by 4%, unlike corn and soybean prices that have fallen 20% and 13%, respectively.

Current Assessments of Economic Damage

U.S. policymakers and business interests are concerned that the COVID-19 pandemic will inflict widespread economic harm on the U.S. and global economies.53 It is still too early to make any definitive statements about what the eventual economic impacts will be on the U.S. economy or the agricultural sector, since it is unknown how long the disease will persist and what shape the economic recovery might take. For example, will the overall impact be V-shaped with a quick outbreak followed by a quick recovery, or will it be L-shaped with an elongated tail representing a slow recovery and a gradual reopening of businesses and retail outlets? Or be W-shaped if the virus recycles and re-emerges later in the summer or fall in a more virulent form—as did the H1N1 pandemic in 2009, or the 1918 flu pandemic—thus, causing a new round of shutdowns and economic closures?54

U.S. and Global GDP Outlook Revised Downward

As commerce slows, economic output is expected to follow with projections of a significant contraction in U.S. gross domestic product (GDP).55 On April 29, the Bureau of Economic Analysis (BEA) reported the U.S. GDP (adjusted for inflation) had decreased by 4.8% during the first quarter of 2020.56

Many major financial institutions have also issued preliminary assessments of the economic impact of the COVID-19 pandemic with dire predictions. For example, in March, JP Morgan predicted a 25% decline in 2nd quarter U.S. GDP.57 The International Monetary Fund (IMF), in early April projected that the U.S. GDP would decline by 5% during 2020 (down 7.9 points from its January 2020 pre-COVID forecast of 2.9% growth).58 The IMF also forecast that global GDP would decline by 3% (-6.3 points from January), and major economies would also see strong declines in GDP including the Euro-zone (-7.5%, -8.8 point from January), and Japan (-5.2%, -4.8 points from January).

On April 24, the Congressional Budget Office (CBO) released an update to its long-run baseline projection for the U.S. economic outlook that included a preliminary assessment of the economic impact of the COVID-19 pandemic.59 CBO projected that the U.S. economy will experience a sharp contraction in the 2nd quarter of 2020—inflation-adjusted GDP is expected to decline by about 12% during the 2nd quarter, equivalent to a decline at an annual rate of -40% for that quarter. CBO also projected a 2.8% increase in real GDP in 2021. In addition, the U.S. unemployment rate is expected to average 11.4% for 2020 and 10.1% for 2021, consistent with CBO's current projection for a slow economic recovery.

Between March 14 and May 7, over 33 million American workers have filed first-time claims for unemployment benefits, according to the seasonally adjusted numbers of the U.S. Department of Labor.60 According to news sources, numbers at that level indicate that over 20% of the U.S. labor force is suffering from layoffs, furloughs, or reduced hours during the coronavirus pandemic. In addition to reflecting the strong likelihood for high unemployment and impactful declines in consumer incomes through 2020, these forecasts also have important implications for the rural, off-farm economy that so many farm households depend on (as described below).

Major Agricultural Commodity Sectors Suffer Substantial Harm

Several industry groups from the U.S. agricultural sector have released estimates of the economic damage experienced by producers and ranchers. Most of these early assessments are limited to evaluating the effect of the price decline on any unsold production of crops or livestock remaining under farmers' control, and the unexpected marketing costs of unsold products due to the shutdown of most institutional buying of agricultural products. Several of these damage assessments are summarized in Table A-1.

The livestock sector appears to be the hardest hit, as hog and cattle prices have dropped by 53% and 25% from January into mid-April, thus generating large sectoral losses estimated at $13.6 billion to $14.6 billion for the cattle/beef sector, and $5 billion for the hog sector. Early estimates of dairy sector losses exceed $8 billion, while the fresh produce sector losses are estimated at $5 billion. Other major commodity sector losses include corn ($4.7 billion to $6 billion), soybeans ($2 billion), cotton ($610 million to $3.5 billion), and the sheep and wool sector ($300 million).

The ethanol sector has not reported an overall dollar loss estimate, but reports that nearly 46% of its production capacity is offline (the United States produced 15.8 billion gallons of ethanol in 2019) and the price of ethanol has fallen by almost 33% (Figure 1).

Prices for several, but not all, of the affected commodities have turned upward slightly since mid-April when USDA's assistance program was announced. Corn prices are the most notable exception as they have continued their decline through the end of April. The corn price decline is partially driven by the catastrophic near collapse of the U.S. ethanol sector. Corn is the primary feedstock for U.S. ethanol production—nearly 38% of annual U.S. corn production is consumed by the ethanol sector.

U.S. Farm Income Projections Revised Downward

USDA's most recent U.S. farm economic outlook for 2020 (released on February 5, 2020) did not include the market effects of the COVID-19 pandemic.61 USDA is not expected to release its next U.S. farm income projections until September 2, 2020. However, the Food and Agricultural Policy Research Institute (FAPRI), at the University of Missouri, released a preliminary assessment of the impact of COVID-19 on the U.S. farm income outlook in April.62 FAPRI's preliminary projections assume a V-shaped recession where the market recovers quickly; market outcomes are driven largely by GDP and commodity price declines, and the supply chain disruptions described earlier in this report are not included in the analysis.63 Macro factors include an inflation-adjusted 5% decline in consumer expenditures from FAPRI's January pre-COVID baseline projections, and a 10% decline in gasoline use.

Under these assumptions, FAPRI projects substantial price declines for all major grain, oilseed, and livestock commodities in 2019/20 and 2020/21, which result in large declines in farm revenue—including -$11.9 billion in crop and -$20.2 billion in livestock cash receipts (Table A-1). The revenue declines are partially offset by declines in production expenses (-$11.3 billion) and an increase in farm program payments (+$2.3 billion) under the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs. However, the sum of the projected changes is for a large decline in U.S. net farm income of -$20 billion for 2020 (down from FAPRI's January forecast of $99 billion in 2020 net farm income, and compared to $95.3 billion in 2019).64 FAPRI does not include any payments under USDA's proposed CFAP. Although preliminary, FAPRI's early projections are indicative of the potentially large impact that COVID-19 may have on the U.S. agricultural sector.

Potential Impact on Farm Household Cash Flow

The COVID-19's economic impact is expected to vary across commodity sectors and regions based on the extent of price declines across commodities, the seasonality of production cycles, and off-farm work opportunities, as well as each household's level of near-term debt, tenure status, asset valuations, and other economic factors. Thus, each farm household's situation may be unique. This section briefly describes where COVID-19's economic impact may be felt most immediately. The potential impact on the farm household credit situation is not discussed here.65 If the economic impact of COVID-19 persists into 2021, a broader range of economic factors are likely to be impacted, such as asset valuations and bankruptcies.

On-Farm Revenue, Expenses, and Federal Payments All Impacted

The principal market effects to date of COVID-19 have been the commodity price declines experienced in early 2020 (Figure 1), as well as lost sales and the costs associated with unexpected surplus animals, grains, and oilseeds held by farmers. The price declines, in particular, can have several potential effects on farm household income, including66

- the selling prices for 2019 crops still held in on-farm inventory;

- farm program payments for the 2019 crops under the marketing assistance loan (MAL), ARC, and PLC programs;

- prices and crop insurance payments for the 2020 crop;

- farm program payments for the 2020 crops under MAL, ARC, and PLC; and

- changes in input prices.

The sharp drop in commodity prices is expected to result in reduced farm household revenue. Revenue losses are expected to be partially offset by both increases in government payments under traditional farm revenue support programs (which are available for about two dozen designated program crops) and crop insurance, and by reductions in input expenses. However, the net effect is expected to be an overall decline in farm revenue compared with 2019. For farm operations carrying above average levels of debt, the restricted cash flow can cause severe financial stress. The emergency-response payment and purchase program announced by USDA (described below) is intended to help address, at least partially, the revenue decline and tightening cash flow situation for a wider array of farm households than usually receive government payments.

Off-Farm Income Impacted by Rural Economic Situation

The drop in prices for major farm commodities in early 2020 (Figure 1) suggests that farm revenues are likely to decline. However, of perhaps greater consequence to farm households has been the blow to off-farm income from the widespread economic shutdown and increases in unemployment. On average, 82% of farm household income comes from off-farm revenue sources.67 As a result, the cash flows of farm households have been diminished from both the on-farm and off-farm effects of the COVID-19 pandemic.

Another blow to the rural economy is the strong decline in tax revenues, fees, and other sources of income, which hampers the ability of state and local governments to respond to the developing crisis through local programs and initiatives.68

Federal Response to COVID-19 for Agriculture

This section reviews federal supplementary funding appropriated for assistance to the U.S. agricultural sector in response to the COVID emergency, and the USDA programs that were initiated with that supplementary funding. In addition to the supplementary funding, USDA announced that it was increasing certain flexibilities and extensions in several of USDA's farm programs—many authorized by the 2018 farm bill (P.L. 115-334)—as part of its effort to support the food supply chain.69

Also, USDA has established a "Coronavirus Disease (COVID-19)" web page that assembles information from a broad range of agriculture-related topics and issues, including the expanded program flexibilities.70 The website includes "Frequently Asked Questions (FAQs)" for several prominent issues and agencies, links to additional resources, and a USDA COVID-19 Federal Rural Resource Guide.71

Supplemental Agriculture Appropriations

In March and April 2020, Congress passed and the President signed four supplemental appropriations acts in response to the COVID-19 pandemic:

- Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 (P.L. 116-123);

- Families First Coronavirus Response Act (FFCRA, P.L. 116-127);

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act, P.L. 116-136); and

- Paycheck Protection Program and Health Care Enhancement Act (P.L. 116-139).

These acts provide over $36 billion of new appropriations and policy changes in the jurisdiction of the Agriculture appropriations subcommittees,72 including nearly $10 billion for agricultural assistance, about $26 billion for nutrition assistance programs, and $163 million for the Food and Drug Administration.73

Funds Directly Targeting Agriculture

The CARES Act provides $9.5 billion for USDA to "support agricultural producers impacted by coronavirus, including producers of specialty crops, producers that supply local food systems, including farmers' markets, restaurants, and schools, and livestock producers, including dairy producers."74 This approach provides funding to the Secretary of Agriculture with general authority to respond to a crisis, and therefore is similar to emergency appropriations for wildfires and hurricanes in 2018 and 2019 in which USDA was tasked to develop a payment program from a general appropriation.75

The CARES Act also replenishes up to $14 billion of funding availability for the Commodity Credit Corporation (CCC). The CCC operates with a $30 billion line of credit with the U.S. Treasury.76 In April 2020, USDA said that the CCC's borrowing authority was becoming low and that about $6 billion remained after having paid regular farm bill obligations and the final tranche of the 2019 Market Facilitation Program.77 The $14 billion in the CARES Act is not new spending; rather, it would reimburse the CCC for past spending. After the funds are transferred, which requires waiting for a June 2020 financial statement, the CCC would have renewed access to more funding for future obligations.

For flexibility in the regular farm commodity support programs, the CARES Act allows Marketing Assistance Loans in FY2020 to be repaid over 12 months (rather than the usual nine months) to provide producers with flexibility in responding to disruptions.78

Funds Indirectly Targeting Agriculture and the Rural Economy

Access to food has been a concern during the pandemic, particularly in light of school closures. Rising unemployment may increase participation in the Supplemental Nutrition Assistance Program (SNAP) and other food assistance programs such as The Emergency Food Assistance Program (TEFAP), which provides aid to food banks and other emergency feeding organizations. Financial assistance through SNAP benefits or in-kind assistance through TEFAP may increase demand for agricultural products.

- The FFCRA and the CARES Act provide a total of $26 billion for various nutrition assistance programs and give USDA certain temporary flexibilities to increase program access and accommodate social distancing.79 This includes $850 million for TEFAP, which is to increase USDA commodity purchases for food distribution.

- The FFCRA has language that, "During fiscal year 2020, the Secretary of Agriculture may purchase commodities for emergency distribution in any area of the United States during a public health emergency designation" (§1101(g)). CBO did not score this provision. USDA is using this authority for a $3 billion commodity purchase and distribution ("Farmers to Families Food Box") program (described later in this report).

- CBO estimated that SNAP policies in the FFCRA will increase mandatory spending by more than $21 billion over FY2020-FY2021, which is subject to appropriation and for which the CARES Act provides some funding.80

For rural development, the CARES Act provides $146 million, including $100 million for rural broadband grants, $25 million for rural telemedicine and distance learning, and $20.5 million to support rural business loans.81

For USDA agency operations, the CARES Act provides $141 million to six USDA agencies or offices. This includes $55 million for the Animal and Plant Health Inspection Service (APHIS), $45 million for the Agricultural Marketing Service (AMS), $33 million Food Safety and Inspection Service (FSIS), $4 million for the Foreign Agricultural Service (FAS), $3 million for the Farm Service Agency (FSA), and $750,000 for the Office of the Inspector General (OIG). The APHIS and AMS amounts are to replace user fee revenues that are expected to decline due to reduced air passenger traffic (APHIS) and because of reduced grading, inspections and audit services (AMS). The amounts for FSIS and FSA are to support temporary employees and adjustments to respond to COVID-19 workload demands. FAS received funding to repatriate staff from foreign postings during the pandemic.

Other provisions in the CARES Act outside the jurisdiction of agriculture appropriations may have provided loans and grants to certain agriculture-related businesses, such as through the Small Business Administration (SBA),82 or to individuals through stimulus checks.83 Prior to enactment of P.L. 116-139, the SBA reported that agricultural, forestry, fishing, and hunting businesses received $4.37 billion of Paycheck Protection Loans.84

USDA's Coronavirus Food Assistance Program (CFAP)

On April 17, 2020, Secretary of Agriculture Perdue announced the Coronavirus Food Assistance Program (CFAP), valued at $19 billion, to provide immediate financial relief to farmers, ranchers, and consumers in response to the COVID-19 national emergency.85 According to Secretary Perdue, CFAP will include $16 billion in direct payments to producers that have been impacted by the decline in commodity prices and the disruption in food supply chains related to COVID-19, and $3 billion in commodity purchases for distribution through food banks, faith-based organizations, and other nonprofit organizations. Direct payments are intended to partially offset the loss of market revenue from the price decline, and the unexpected carry-cost of unsold commodities for producers and ranchers of products that have been negatively affected by COVID-19. Commodity purchase and distribution programs serve the dual roles of supporting commodity market prices by temporarily increasing demand, and of expanding the availability of food to consumers who have lost their jobs or have limited resources.

CFAP funding is from three primary sources: the FFCRA, the CARES Act, and existing USDA authorities under the Commodity Credit Corporation (CCC) Charter Act.86 In particular, Senator Hoeven, Chairman of the Senate Agriculture Appropriations Committee, stated that the $16 billion designated for the direct payments program derives from the $9.5 billion emergency program spending authorized by the CARES Act and an existing $6.5 billion balance in the CCC.87 The $3 billion for the commodity purchase portion of CFAP derives from the FFCRA (§1101(g)) that authorizes USDA to purchase commodities for emergency distribution in the United States.88

CFAP Direct Payment Program

USDA has released limited information to date on the specifics of how CFAP will be implemented; however, information released by Senator Hoeven's office, coupled with news sources that have gleaned pieces of program information from USDA sources, could provide some context for understanding how CFAP's direct payments program may unfold.

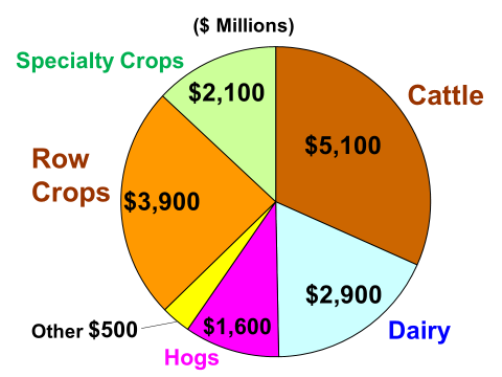

Senator Hoeven's press release says that the $16 billion is to be allocated across four different commodity groupings as follows: livestock ($9.6 billion or 60%); row crops ($3.9 billion, 24.4%); specialty crops ($2.1 billion, 13.1%); and "other" crops ($500 million, 3.1%) (Figure 2). Direct payment spending under the livestock category would be further delineated as $5.1 billion for cattle, $2.9 billion for dairy, and $1.6 billion for hogs.

To be eligible for CFAP direct payments, farmers and ranchers must produce commodities that have experienced at least a 5% price decrease between January and April of 2020. The specific prices and dates to be used for this calculation have not yet been announced, but using nearby futures contract prices as a guide would suggest that many commodities—including hogs, cattle, cotton, milk, corn, and soybeans—would relatively easily meet the 5%-decline threshold (Figure 1). Also, the "other" category was not specifically defined, but is expected to include commodities such as horticulture, hemp, sheep and goats, or any other commodity where a producer can show a revenue loss associated with at least a 5% price drop since January.

USDA has said the direct payments to producers will be based on estimated losses as measured by both: (a) market price declines, and (b) additional marketing costs associated with the unexpected oversupply of unsold production in calendar 2020. Under this structure, CFAP direct payments would be directly proportional, or "coupled," to actual production.89

Determination of the payment amounts and delivery mechanisms may develop similarly to the three tranches associated with payments under the Market Facilitation Programs (MFPs) in 2018 and 2019.90 The payments are to represent the summation of the two different loss measures described above:

- First, payments, according to Senator Hoeven's news release, are to cover the market price declines of greater than 5% that occurred between January 1, 2020, and April 15, 2020.91 The payment is to equal 85% of the loss—some policy analysts think that the loss could be calculated using some measure of the price decline times the normal volume of the commodity marketed during that period.92

- Second, payments to cover future marketing losses from unsold product. This additional cost is valued as 30% of the expected losses from April 15 through the next two quarters (i.e., six months) or until mid-October. Again, the expected loss would most likely be calculated using some measure of the price decline times the normal volume of the commodity marketed during that period.

For its part, USDA has not provided details on: which prices will be used in the formula (such as local elevator prices, regional wholesale prices, or nearby futures contract prices); how the price decline will be measured (that is, will two specific dates be used, or will representative averages of prices in January and April be used); or how the share of production, characterized as "routine marketing for the relevant period" and eligibility for payments, will be measured.

Many of the program specifics are expected to be delineated in rulemaking. Since enforcement of social distancing remains in effect for the foreseeable future, producers may be asked to self-certify their losses.93 If so, producers will need to save records and paperwork to demonstrate losses, especially producers that have destroyed their product (e.g., dumping of milk or plowing under specialty crops). It is expected that producers will be compensated for "dumped" milk, but whether compensation may be provided for depopulated (i.e., euthanized) livestock and poultry is uncertain. Furthermore, CFAP direct payments are expected to be limited to cover producers who own the commodity or product, thus animals raised under contact are not expected to be covered.94

USDA is expediting the rulemaking process for the direct payment program and expects to begin sign-up for the new program in early May. CFAP direct payments are expected to be issued to producers by the end of May or early June.95

According to the Senator Hoeven press release, payment limits are expected at $125,000 per commodity grouping (livestock, row crops, and specialty crops), with an overall limit of $250,000 per individual or entity. Neither the CARES Act nor the underlying CCC authority requires payment limits. Applying payment limits at this point would be at USDA's discretion, as it chose to do when establishing the MFP and Wildfire and Hurricane Indemnity Program (WHIP) programs that were undertaken at the Secretary's discretion. The American Farm Bureau Federation expects that benefits received under traditional farm support programs such as ARC and PLC will not be added to CFAP payments when evaluating payment limits.96 In other words, payment limits for CFAP are expected to be independent of other farm program benefits received by a farm.

CFAP Purchase and Distribution Program

In the press release that announced the CFAP, USDA designated $3 billion for a commodity purchase and distribution program. In subsequent announcements, the program has been called the USDA Food Box Distribution Program, and the USDA Farmers to Families Food Box Program.97 The intention is to capture some of the supply chain and market disruption caused by the closure of restaurants, hotels, and other food service entities. Under the program, agricultural products are to be purchased from farmers and processors to support agricultural markets and reduce food waste. Products are to be distributed to food banks and other nonprofit organizations that serve those in need. This program is operated differently than, and separately from, existing USDA commodity purchase programs such as Section 32, TEFAP, and other Food and Nutrition Service (FNS) food distribution programs.98 However, food banks, school food authorities, and other nonprofits that participate in other FNS programs are to be eligible to receive food boxes through the USDA Farmers to Families Food Box Program.

USDA plans to purchase about $100 million per month of fresh produce, $100 million per month of dairy products, and $100 million per month of meat products (chicken and pork).99 Because of the potential for food waste (lack of marketing options for ripe produce, dumping expressed milk, and euthanizing market-ready livestock) and high demand for food bank distribution during this pandemic discussed earlier in this report, USDA is expediting this purchase program relative to its usual commodity procurement and distribution timeline. Usually, the procurement-to-distribution timeline is two to five months, starting with product selection and identification and/or thorough analysis of market conditions for individual commodities, a solicitation period, review of applications, and manufacturing and delivery from producers to processors (vendors) and intermediaries that may reassemble or briefly store products for distribution and recipients. The current food box program shortens the procurement-to-delivery to as little as one month, with an expected one week interval for each of the bidding, approval, and delivery stages. Solicitation for bids began on April 24, with bids due to USDA on May 1. Contracts are expected to be awarded on May 8, and initial program delivery may be as early as May 15.100 The program is expected to operate through the end of 2020.

Another significant change is the product format. Under normal circumstances, products are often delivered from vendors (who sell to USDA) to recipient organizations in bulk formats that may require re-packaging before distribution to households. The CFAP purchase program intends for vendors to deliver household-ready boxes of the previously mentioned produce, meat and dairy products, or combinations thereof—ready for more convenient and immediate distribution ("off the truck and into the trunk") in order to support social distancing.101

In addition to the $3 billion CFAP purchase and distribution program, USDA announced on May 4, 2020, a plan to purchase $470 million of commodities with Section 32 authority that is at the discretion of the department.102 USDA's initial press release for the CFAP had mentioned availability of $873 million in the Section 32 account.103 The plan for this initial tranche is to solicit bids from vendors in June 2020 and begin deliveries as soon as July. In this purchase, USDA intends to buy $170 million of produce, $120 million of dairy products, $80 million of poultry, $70 million of fish, and $30 million of pork.

Next Steps

In addition to the $9.5 billion in funding to assist U.S. agricultural producers and ranchers with COVID-related losses, the CARES Act also provided $14 billion to replenish the CCC—this additional CCC spending authority is expected to be available in July after CCC prepares its June financial statement. The CCC borrows from the U.S. Treasury to finance its programs consistent with its permanent, indefinite authority to borrow up to $30 billion. Congress usually replenishes the CCC borrowing authority by annually appropriating funding to cover the CCC's net realized losses.104 The supplemental reimbursement in the CARES Act could increase opportunities for USDA to use its executive authority in CCC to provide further direct support payments, as it did with trade aid payments in 2018 and 2019.105

The CCC's annual borrowing authority has been fixed at $30 billion since 1987. On April 21, 2020, the American Farm Bureau released a report showing that, if adjusted for inflation, the CCC's borrowing authority would be $67.5 billion in 2020. In Congress, Senator John Hoeven has called for increasing the CCC's borrowing authority to $50 billion,106 while H.R. 6728 would raise CCC's borrowing authority to $68 billion.107 Increases in CCC's borrowing authority could be permanent or temporary (for certain fiscal years, or the duration of the public health emergency). While farm bills designate CCC to make various types of congressionally directed payments,108 it is USDA's use of its discretionary authority in recent years that has put pressure on the CCC borrowing limit.109

More USDA Assistance

At present, USDA appears to have used nearly all of its available borrowing authority in the CCC in composing the CFAP payments. By July, USDA may be expected to use some of the $14 billion in supplemental CCC funding in the CARES Act, and its general CCC authority, to provide additional support to the agriculture sector. However, the nature and timing of any further support has not yet been announced by USDA.

After it completes the $470 million Section 32 purchase described above, USDA would be expected to have about $400 million remaining in the Section 32 account for the rest of the fiscal year, based on the $873 million that USDA mentioned in its initial CFAP announcement.

USDA may also be directed by Congress to provide certain future support to agriculture. Representative Austin Scott has introduced a bill (H.R. 6611) that would provide an additional $50 billion of funding (separate from the CCC, and similar to the $9.5 billion in the CARES Act) for COVID-related agricultural assistance programs.

Rural COVID-19 Task Force Proposed

Many Members of Congress have expressed concerns that rural America is not well prepared to handle the COVID-19 emergency, and that rural problems feed over into agriculture.110 For example, in April, Senate Democrats released a report warning that more isolated rural areas of the United States "face disproportional challenges that put them at high risk," and that laid out their own rural policy ideas.111 Several U.S. Representatives and Senators have asked USDA to establish a Rural COVID-19 Task Force to help identify rural needs and tailor the allocation of resources to address them.112 They suggest that the Task Force could consist of a diverse group of experts and representatives from all sectors of rural areas, including agriculture, health care including mental health, and the private sector. In particular, the Rural COVID-19 Task Force would help to identify rural challenges, develop strategies and policy recommendations, assemble a guide of available federal programs and resources, consult with the USDA and congressional committees, and provide oversight on the distribution of funding.

In their letter, the Members noted that people living in rural America are more likely to be uninsured, advanced in age, and have pre-existing medical conditions. Rural hospitals and health systems often have fewer ICU beds and resources available to handle an increased demand on rural health care infrastructure during a pandemic. According to the letter, one in five Americans living in rural areas are people of color, who have been disproportionately affected by the current crisis. Many rural areas are without reliable internet access, which limits their ability to work or attend school remotely.

U.S. Agricultural Stakeholders

In March and early April, prior to USDA's announcement of CFAP, many industry groups from the U.S. agricultural sector had written public letters to Secretary Perdue and USDA detailing their concerns and the need for federal assistance in response to the economic damage that has hit their different industries as a result of the COVID-19-related emergency. Many of these letters included industry estimates of their sectoral economic losses due to COVID-19 (several of these estimates have been compiled by CRS and are presented in Table A-1).

Following the announcement of CFAP, most industry groups that are targeted for CFAP assistance have expressed appreciation for the aid that USDA has announced. At the same time, several agriculture-related industries do not appear to be eligible for support under the CFAP—including ethanol, poultry, sheep and lamb, specialty livestock such as mink, or horticultural products.113 Also, agriculture industry groups almost universally note that CFAP can be only the first step in the federal response, as the amounts provided fall well short of industry loss estimates for most sectors.

Another industry concern involves the announced payment limits associated with CFAP direct payments. Industry groups have stated that a $125,000 payment limit would severely restrict needed aid to individual producers. Some Senators and Representatives have followed up on industry concerns about payment limits by sending a letter to the Administration asking that the limits be removed for livestock, dairy, and specialty crop producers.114 The issue of payment limits may be addressed in the next round of USDA COVID-19 assistance or related bills (e.g., H.R. 6611).

Issues for Congress

Immediate congressional concerns involve how to channel assistance to those industries affected by COVID-19. This involves identifying affected industries, as well as measuring the extent of their losses, and providing some measure of compensation to help foster survival and recovery. Another immediate concern may be monitoring and oversight of the large sums of taxpayer money that will be flowing out through the CCC. Producer self-certification of losses may create a moral hazard and an incentive to over-report losses.

Congress may consider using its investigative authority to better understand the nature and institutional rigidities inherent in the current food supply chain, and to ascertain whether there is a role for the federal government to help facilitate food supply chain management. Such considerations may include an evaluation of whether there is a need to facilitate less reliance by the private sector on low-cost, just-in-time supply chains. This model has proven to be inflexible in responding to the COVID-19 emergency, which requires rapid product transition from bulk institutional buyers to consumer-ready retail outlets, and greater regional storage capacity to hold temporary surges in unsold product. The potential costs to taxpayers of supporting a more flexible supply chain could include expanded regional warehousing, cold storage, food bank storage, etc. Expediting the food assistance supply chain is also being proposed through "farm-to-food bank" programs (S. 3605). These actions could be coupled with new federal programs designed to increase demand by temporarily expanding SNAP benefits and/or federal food purchases when certain market or economic conditions are triggered.

Congress may also want to consider whether the current farm safety net programs authorized by the farm bill's Title I—targeting of program crops—are sufficiently flexible and responsive when confronted with sudden, widespread price declines and an abrupt cessation of institutional purchases. For example, payments under the current ARC and PLC programs are delayed nearly 13 months after the program crop's harvest and reflect a 12-month average price that may not fully capture the potential short-term price drop related to the COVID outbreak. Program modifications—such as the inclusion of an early partial payment for ARC and PLC—could offer greater flexibility in responding to short-term cash flow problems for farm households.115

As one alternative, ARC and PLC could be supplemented or replaced by a new payment program that would be: short-term in nature; would better reflect local market conditions to capture disparities in regional economic harm; and would rely on market conditions both to trigger payments and to determine the size of those payments. The payment triggers could be set at catastrophic levels such that they would only be triggered under unique circumstances such as a major price plunge sparked by an event of the magnitude of COVID-19. The payment formula could be designed such that USDA could make payments under such a program before or shortly after harvest.

In addition, Congress may also consider the long-term effects that might result from the COVID-19 emergency, particularly if the economic recovery is slow and lengthy. Such long-term effects may include heightened indebtedness and potential bankruptcies by farm households across the agricultural sector, as well as accelerated industry consolidation and altered consumption patterns. Without robust agricultural production to serve as the engine of growth, rural America might experience a slower recovery than the rest of the country. Prolonged depressed market conditions due to widespread layoffs, limited employment opportunities, and sustained reductions to rural wages and incomes would provide a weak background to foster agriculture's eventual recovery.

Congress may also consider that rural banks tend to be smaller and less well-capitalized than banks catering to urban and suburban markets. Farm loan debt forgiveness (e.g., S. 3602) and loan repayment flexibilities116 are also in discussion. A slow rural economic recovery might reduce business and consumer confidence, leading to a reduction in spending and investment, and a tightening of financial conditions that could further slow the return to economic normalcy in rural areas.

Appendix. Assessing the Economic Impact of COVID-19 on U.S. Agriculture

Studies Project Deep Losses Across Major Commodity Sectors

Several universities, think tanks, and commodity groups have released early assessments of COVID-19's potential impact on selected commodity sectors (Table A-1). Most of these early assessments are limited to evaluating the effect of the price decline on any unsold production remaining under farmers' control, and the unexpected surplus of unsold products due to the shutdown of most institutional buying of agricultural products.

Table A-1. Estimates of COVID-19 Economic Impact, Various Commodity Sectors

(Changes from Pre-COVID scenario; $M = $ Millions)

|

Category |

Sector Loss ($M) |

Subsector Loss ($M) |

Loss Period Covered |

Source # |

||

|

U.S. Cattlemen's Association (4/17/20) |

1 |

|||||

|

Cattle / Beef |

|

|

2020 |

|||

|

Cow/calf |

|

|

2020 |

|||

|

Stocker/Background |

|

|

2020 |

|||

|

Feedlot |

|

|

2020 |

|||

|

National Cattlemen's Beef Association (4/14/20) |

2 |

|||||

|

Cattle / Beef |

|

|

2020/2021 |

|||

|

Cow/calf |

|

|

2020/2021 |

|||

|

Stocker/Background |

|

|

2020 |

|||

|

Feedlot |

|

|

2020 |

|||

|

National Pork Producers Council (4/14/20) |

3 |

|||||

|

Hog Sector |

|

2020 |

||||

|

National Milk Producers Federation (4/10/20) |

4 |

|||||

|

Dairy Sector |

|

2020 |

||||

|

American Sheep Industry Association (3/27/20) |

5 |

|||||

|

Sheep & Wool Sector |

-$125 to -$350 |

March to May |

||||

|

National Cotton Council (4/16/20) |

6 |

|||||

|

Cotton Sector |

-$3,000 to -$3,500 |

2020 |

||||

|

Ninety Fresh Produce Organizations (4/6/20) |

7 |

|||||

|

Fresh Produce Sector |

-$5,000 (-$1,000/week) |

Late March-Early May |

||||

|

Colorado State University (3/31/20) |

8 |

|||||

|

U.S. Local & Regional Food Markets |

|

March to May |

||||

|

Renewable Fuels Association (4/25/20) |

9 |

|||||

|

Ethanol: Lost sales |

~46% of plants offline |

As of April 24 |

||||

|

Ethanol: Price decline |

~33% decline |

Jan. 2–Apr.15 |

||||

|

FarmDoc Webinar Forecast (4/25420) |

10 |

|||||

|

Corn Sector |

|

2020 |

||||

|

Cotton Sector |

|

2020 |

||||

|

Soybeans Sector |

|

2020 |

||||

|

Food and Policy Research Institute: (FAPRI) Farm Income Projections with COVID-19 (4/13/20) |

11 |

|||||

|

Change from FAPRI January Baseline |

2020 |

|||||

|

U.S. Crop Receipts |

|

|

2020 |

|||

|

Corn |

|

|

2020 |

|||

|

Soybeans |

|

|

2020 |

|||

|

Wheat |

|

|

2020 |

|||

|

Cotton |

|

|

2020 |

|||

|

Other crops |

|

|

2020 |

|||

|

U.S. Livestock Receipts |

|

|

2020 |

|||

|

Cattle |