U.S. Farm Income Outlook: February 2020 Forecast

This report uses the U.S. Department of Agriculture’s (USDA) farm income projections (as of February 5, 2020) to describe the U.S. farm economic outlook for 2020. Two major indicators of U.S. farm well-being are net farm income and net cash income. Net farm income represents an accrual of the value of all goods and serviced produced on the farm during the year—similar in concept to gross domestic product. In contrast, net cash income uses a cash flow concept to measure farm well-being: Only cash transactions for the year are included. Thus, crop production is recorded as net farm income immediately after harvest, whereas net cash income records a crop’s value only after it has been sold in the marketplace.

According to USDA’s Economic Research Service (ERS), national net farm income is forecast at $96.7 billion in 2020, up $3.1 billion (+3.3%) from 2019. The forecast rise in 2020 net farm income stands in contrast with a projected decline of over $10.8 billion in net cash income (-9.0%). Last year’s (2019) net cash income forecast included $14.7 billion in sales of on-farm crop inventories, which helped to inflate the 2019 net cash income value to $120.4 billion. The 2020 net cash income forecast includes a much smaller amount ($0.5 billion) in sales from on-farm inventories, thus contributing to the decline from 2019.

Government direct support payments to the agricultural sector are expected to continue to play an important role in farm income projections. USDA projects $15 billion in farm support outlays for 2020, including the $3.7 billion of 2019 Market Facilitation Program (MFP) payments—the third and final tranche of payments under the $14.5 billion program. If realized, the 2020 government payments of $15 billion would represent a 36.6% decline from 2019 but would still be the second largest since 2006. The $23.6 billion in federal payments in 2019 was the largest taxpayer transfer to the agriculture sector (in absolute dollars) since 2005. The surge in federal subsidies in 2019 was driven by large payments (estimated at $14.3 billion) under the MFP initiated by USDA in response to the U.S.-China trade dispute. The Administration has not announced a new MFP for 2020.

Weather conditions and planting prospects for 2020 are unknown this early in the year. Commodity prices are under pressure from abundant global supplies and uncertain export prospects. Despite the signing of a Phase I trade agreement with China on January 15, 2020, it is unclear how soon—if at all—the United States may resume normal trade with China or how international demand may evolve in 2020.

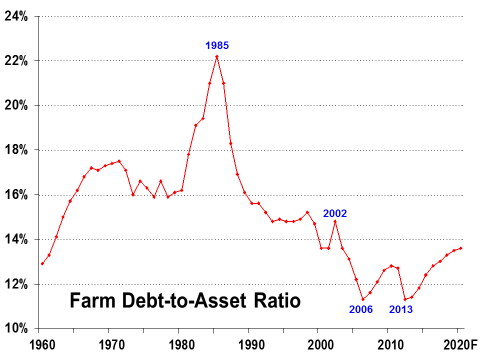

Farm asset value in 2020 is projected up year-to-year at $3.1 trillion (+1.3%). Farm asset values reflect farm investors’ and lenders’ expectations about long-term profitability of farm sector investments. Another critical measure of the farm sector’s well-being is aggregate farm debt, which is projected to be at a record $425.3 billion in 2020—up 2.3% from 2019. Both the debt-to-asset and the debt-to-equity ratios have risen for eight consecutive years, potentially suggesting a continued slow erosion of the U.S. farm sector’s financial situation.

At the farm household level, average farm household incomes have been well above average U.S. household incomes since the late 1990s. However, this advantage derives primarily from off-farm income as a share of farm household total income. Since 2014, over half of U.S. farm operations have had negative income from their agricultural operations.

USDA Farm Income Projections as of February 5, 2020

This report discusses aggregate national net farm income projections for calendar year 2020 as forecast by ERS on February 5, 2020. It is the first of three ERS forecasts for 2020: The second farm income forecast is expected on September 2, 2020, and the third is expected in November.

U.S. Farm Income Outlook: February 2020 Forecast

Jump to Main Text of Report

Contents

- Introduction

- USDA's February 2020 Farm Income Forecast

- Highlights

- USDA Projects Corn, Soybean, and Wheat Stocks Lower in 2019

- Livestock Outlook for 2020

- Background on the U.S. Cattle-Beef Sector

- Robust Production Growth Projected Across the Livestock Sector

- Livestock-Price-to-Feed-Cost Ratios Signal Lower Profitability Outlook

- Gross Cash Income Highlights

- Crop Receipts

- Livestock Receipts

- Government Payments

- Dairy Margin Coverage Program Outlook

- Production Expenses

- Farm Asset Values and Debt

- Average Farm Household Income

- Total vs. Farm Household Average Income

Figures

- Figure 1. Annual U.S. Farm Sector Nominal Income, 1940-2020F

- Figure 2. U.S. Farm Sector Inflation-Adjusted Income, 1940-2020F

- Figure 3. Stocks-to-Use Ratios and Farm Prices: Corn, Soybeans, Wheat, and Cotton

- Figure 4. U.S. Beef Cattle Inventory (Including Calves) Since 1960

- Figure 5. Livestock Farm-Price-to-Feed Ratios, Indexed

- Figure 6. Farm Gross Cash Receipts by Source, 2008-2020F

- Figure 7. Crop Cash Receipts by Source, 2008-2020F

- Figure 8. Cash Receipts for Selected Crops, 2015-2020F

- Figure 9. U.S. Livestock Product Cash Receipts by Source, 2008-2020F

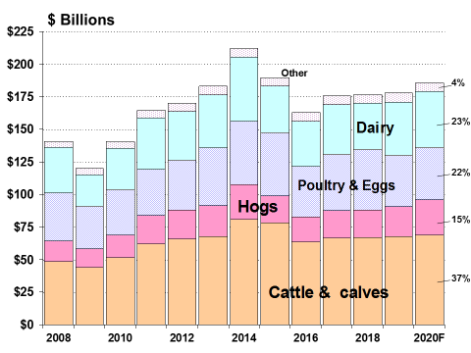

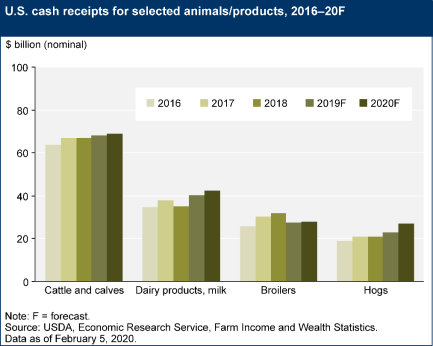

- Figure 10. Cash Receipts for Selected Animal Products, 2016-2020F

- Figure 11. Net Cash Income by Source, 1996-2020F

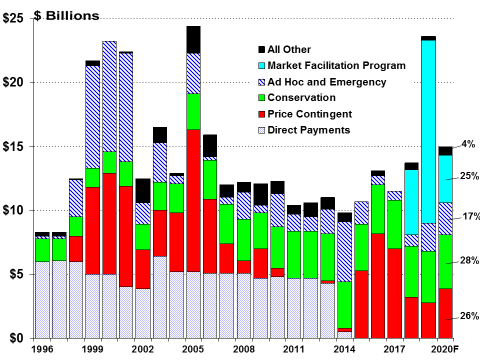

- Figure 12. U.S. Government Farm Support, Direct Outlays, 1996-2020F

- Figure 13. The Dairy Output-to-Input Margin Is Above $9.50/cwt. in 2019

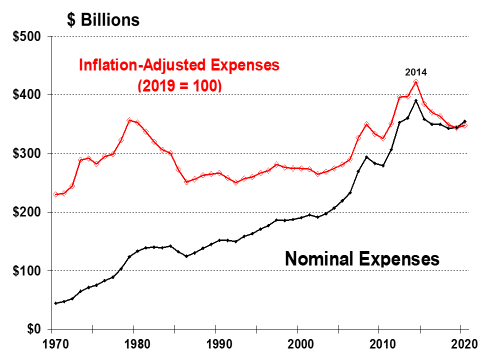

- Figure 14. Total Annual Farm Production Expenses, 1970-2020F

- Figure 15. Farm Production Expenses for Selected Items, 2019 and 2020F

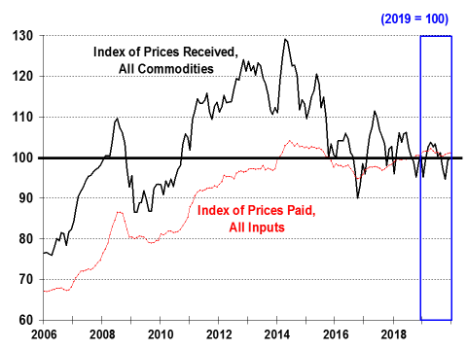

- Figure 16. Index of Monthly Prices Received vs. Prices Paid, 2006-2019

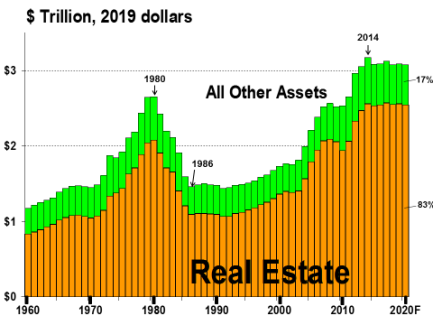

- Figure 17. Real Estate Share Estimated at 83% of Total Farm Sector Assets in 2020

- Figure 18. U.S. Average Farm Land Values, 1985-2019

- Figure 19. U.S. Farm Debt-to-Asset Ratio, 1960-2020F

- Figure 20. U.S. Average Farm Household Income, by Source, 1960-2020F

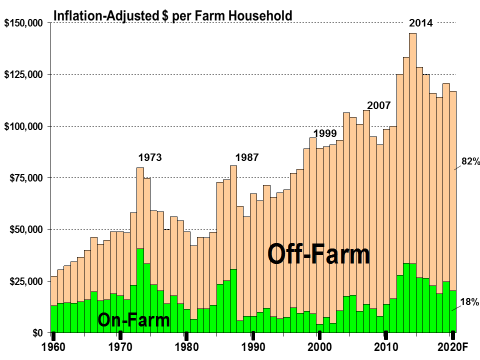

- Figure 21. Farm Household Income Has Been Above U.S. Average Since 1996

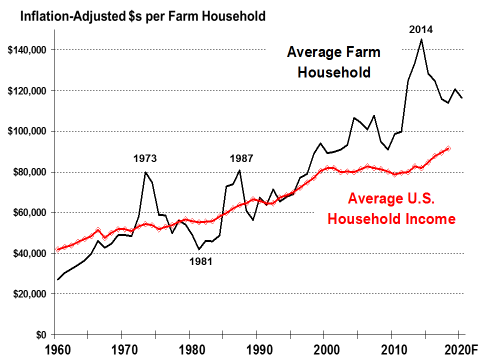

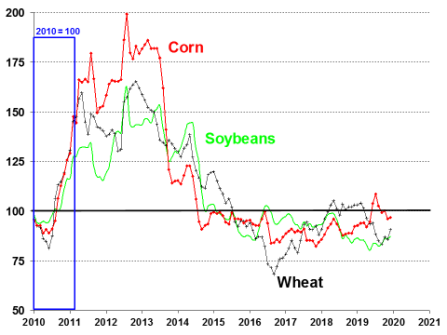

- Figure A-1. Monthly Farm Prices for Corn, Soybeans, and Wheat, Indexed Dollars

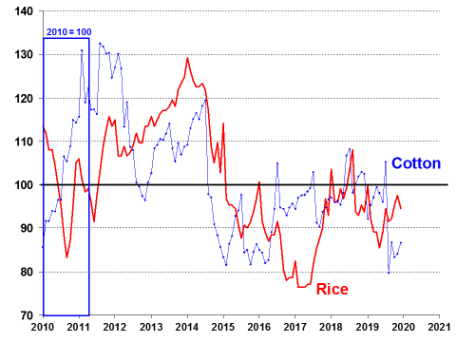

- Figure A-2. Monthly Farm Prices for Cotton and Rice, Indexed Dollars

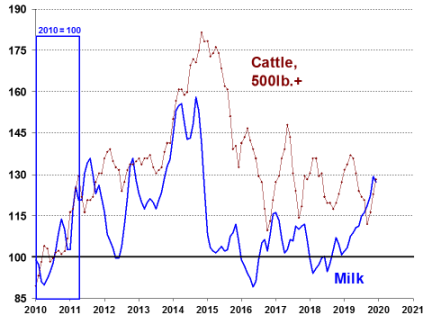

- Figure A-3. Monthly Farm Prices for All-Milk and Cattle (500+ lbs.), Indexed Dollars

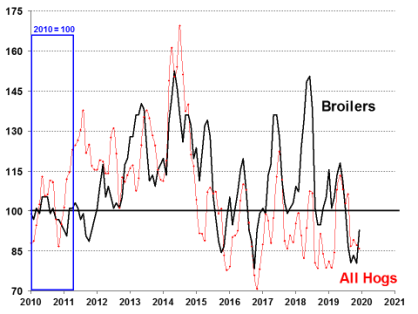

- Figure A-4. Monthly Farm Prices for All Hogs and Broilers, Indexed Dollars

Tables

- Table A-1. Annual U.S. Farm Income ($ Billions) Since 2015 Including 2020 Forecasts

- Table A-2. Average Annual Income per U.S. Household, Farm vs. All, 2013-2020 Forecasts

- Table A-3. Average Annual Farm Sector Debt-to-Asset Ratio, 2013-2020 Forecasts

- Table A-4. U.S. Farm Prices and Support Rates for Selected Commodities Since 2014-2015 Marketing Year

Appendixes

Summary

This report uses the U.S. Department of Agriculture's (USDA) farm income projections (as of February 5, 2020) to describe the U.S. farm economic outlook for 2020. Two major indicators of U.S. farm well-being are net farm income and net cash income. Net farm income represents an accrual of the value of all goods and serviced produced on the farm during the year—similar in concept to gross domestic product. In contrast, net cash income uses a cash flow concept to measure farm well-being: Only cash transactions for the year are included. Thus, crop production is recorded as net farm income immediately after harvest, whereas net cash income records a crop's value only after it has been sold in the marketplace.

According to USDA's Economic Research Service (ERS), national net farm income is forecast at $96.7 billion in 2020, up $3.1 billion (+3.3%) from 2019. The forecast rise in 2020 net farm income stands in contrast with a projected decline of over $10.8 billion in net cash income (-9.0%). Last year's (2019) net cash income forecast included $14.7 billion in sales of on-farm crop inventories, which helped to inflate the 2019 net cash income value to $120.4 billion. The 2020 net cash income forecast includes a much smaller amount ($0.5 billion) in sales from on-farm inventories, thus contributing to the decline from 2019.

Government direct support payments to the agricultural sector are expected to continue to play an important role in farm income projections. USDA projects $15 billion in farm support outlays for 2020, including the $3.7 billion of 2019 Market Facilitation Program (MFP) payments—the third and final tranche of payments under the $14.5 billion program. If realized, the 2020 government payments of $15 billion would represent a 36.6% decline from 2019 but would still be the second largest since 2006. The $23.6 billion in federal payments in 2019 was the largest taxpayer transfer to the agriculture sector (in absolute dollars) since 2005. The surge in federal subsidies in 2019 was driven by large payments (estimated at $14.3 billion) under the MFP initiated by USDA in response to the U.S.-China trade dispute. The Administration has not announced a new MFP for 2020.

Weather conditions and planting prospects for 2020 are unknown this early in the year. Commodity prices are under pressure from abundant global supplies and uncertain export prospects. Despite the signing of a Phase I trade agreement with China on January 15, 2020, it is unclear how soon—if at all—the United States may resume normal trade with China or how international demand may evolve in 2020.

Farm asset value in 2020 is projected up year-to-year at $3.1 trillion (+1.3%). Farm asset values reflect farm investors' and lenders' expectations about long-term profitability of farm sector investments. Another critical measure of the farm sector's well-being is aggregate farm debt, which is projected to be at a record $425.3 billion in 2020—up 2.3% from 2019. Both the debt-to-asset and the debt-to-equity ratios have risen for eight consecutive years, potentially suggesting a continued slow erosion of the U.S. farm sector's financial situation.

At the farm household level, average farm household incomes have been well above average U.S. household incomes since the late 1990s. However, this advantage derives primarily from off-farm income as a share of farm household total income. Since 2014, over half of U.S. farm operations have had negative income from their agricultural operations.

|

USDA Farm Income Projections as of February 5, 2020 This report discusses aggregate national net farm income projections for calendar year 2020 as forecast by ERS on February 5, 2020. It is the first of three ERS forecasts for 2020: The second farm income forecast is expected on September 2, 2020, and the third is expected in November. |

This report uses the U.S. Department of Agriculture's (USDA) farm income projections (as of February 5, 2020) to describe the U.S. farm economic outlook for 2020. Two major indicators of U.S. farm well-being are net farm income and net cash income. Net farm income represents an accrual of the value of all goods and serviced produced on the farm during the year—similar in concept to gross domestic product. In contrast, net cash income uses a cash flow concept to measure farm well-being: Only cash transactions for the year are included. Thus, crop production is recorded as net farm income immediately after harvest, whereas net cash income records a crop's value only after it has been sold in the marketplace.

According to USDA's Economic Research Service (ERS), national net farm income is forecast at $96.7 billion in 2020, up $3.1 billion (+3.3%) from 2019. The forecast rise in 2020 net farm income stands in contrast with a projected decline of over $10.8 billion in net cash income (-9.0%). Last year's (2019) net cash income forecast included $14.7 billion in sales of on-farm crop inventories, which helped to inflate the 2019 net cash income value to $120.4 billion. The 2020 net cash income forecast includes a much smaller amount ($0.5 billion) in sales from on-farm inventories, thus contributing to the decline from 2019.

Government direct support payments to the agricultural sector are expected to continue to play an important role in farm income projections. USDA projects $15 billion in farm support outlays for 2020, including the $3.7 billion of 2019 Market Facilitation Program (MFP) payments—the third and final tranche of payments under the $14.5 billion program. If realized, the 2020 government payments of $15 billion would represent a 36.6% decline from 2019 but would still be the second largest since 2006. The $23.6 billion in federal payments in 2019 was the largest taxpayer transfer to the agriculture sector (in absolute dollars) since 2005. The surge in federal subsidies in 2019 was driven by large payments (estimated at $14.3 billion) under the MFP initiated by USDA in response to the U.S.-China trade dispute. The Administration has not announced a new MFP for 2020.

Weather conditions and planting prospects for 2020 are unknown this early in the year. Commodity prices are under pressure from abundant global supplies and uncertain export prospects. Despite the signing of a Phase I trade agreement with China on January 15, 2020, it is unclear how soon—if at all—the United States may resume normal trade with China or how international demand may evolve in 2020.

Farm asset value in 2020 is projected up year-to-year at $3.1 trillion (+1.3%). Farm asset values reflect farm investors' and lenders' expectations about long-term profitability of farm sector investments. Another critical measure of the farm sector's well-being is aggregate farm debt, which is projected to be at a record $425.3 billion in 2020—up 2.3% from 2019. Both the debt-to-asset and the debt-to-equity ratios have risen for eight consecutive years, potentially suggesting a continued slow erosion of the U.S. farm sector's financial situation.

At the farm household level, average farm household incomes have been well above average U.S. household incomes since the late 1990s. However, this advantage derives primarily from off-farm income as a share of farm household total income. Since 2014, over half of U.S. farm operations have had negative income from their agricultural operations.

|

USDA Farm Income Projections as of February 5, 2020 This report discusses aggregate national net farm income projections for calendar year 2020 as forecast by ERS on February 5, 2020. It is the first of three ERS forecasts for 2020: The second farm income forecast is expected on September 2, 2020, and the third is expected in November. |

Introduction

The U.S. farm sector is vast and varied. It encompasses production activities related to traditional field crops (such as corn, soybeans, wheat, and cotton) and livestock and poultry products (including meat, dairy, and eggs), as well as fruits, tree nuts, and vegetables. In addition, U.S. agricultural output includes greenhouse and nursery products, forest products, custom work, machine hire, and other farm-related activities. The intensity and economic importance of each of these activities, as well as their underlying market structure and production processes, vary regionally based on the agro-climatic setting, market conditions, and other factors. As a result, farm income and rural economic conditions may vary substantially across the United States.

Annual U.S. net farm income is the single most-watched indicator of farm sector well-being, as it captures and reflects the entirety of economic activity across the range of production processes, input expenses, and marketing conditions that have prevailed during a specific time period (see box "Measuring Farm Profitability" for a definition of net farm income). When national net farm income is reported together with a measure of the national farm debt-to-asset ratio, the two summary statistics provide a quick and widely referenced indicator of the economic well-being of the national farm economy.

|

Measuring Farm Profitability Two different indicators measure farm profitability: net cash income and net farm income. Net cash income compares cash receipts to cash expenses. As such, it is a cash flow measure representing the funds that are available to farm operators to meet family living expenses and make debt payments. For example, crops that are produced and harvested but kept in on-farm storage are not counted in net cash income. Farm output must be sold before it is counted as part of the household's cash flow. Net farm income is a more comprehensive measure of farm profitability. It measures value of production, indicating the farm operator's share of the net value added to the national economy within a calendar year independent of whether it is received in cash or non-cash form. As a result, net farm income includes the value of home consumption, changes in inventories, capital replacement, and implicit rent and expenses related to the farm operator's dwelling that are not reflected in cash transactions. Thus, once a crop is grown and harvested, it is included in the farm's net income calculation, even if it remains in on-farm storage. Key Concepts Behind Farm Income

National vs. State-Level Farm Household Data Aggregate data often obscure or understate the diversity and regional variation that occurs across America's agricultural landscape. For insights into the differences in American agriculture, visit the ERS websites on "Farm Structure and Organization" and "Farm Household Well-Being."1 |

USDA's February 2020 Farm Income Forecast

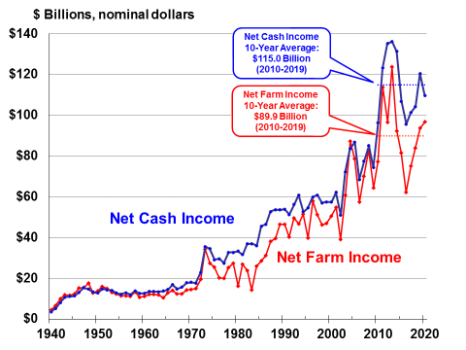

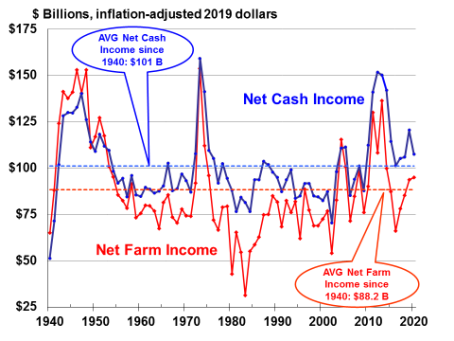

In the first of three official U.S. farm income outlook releases scheduled for 2020 (see box "ERS's Annual Farm Income Forecasts" below), the U.S. Department of Agriculture's (USDA) Economic Research Service (ERS) projects that U.S. net farm income will rise 3.3% year-over-year in 2020 to $96.7 billion, up $3.1 billion from last year (Figure 1 and Table A-1).2 The February forecast of $96.7 billion is 6.3% above the 10-year average of $89.9 billion (in nominal dollars) but is well below 2013's record high of $123.7 billion. In contrast, net cash income (calculated on a cash-flow basis) is projected lower in 2020 (down 10.8% from 2019) at $109.6 billion—4.7% below the 10-year average of $115.0 billion.

|

ERS's Annual Farm Income Forecasts ERS releases three farm income forecasts each calendar year. The first forecast is generally released in February as part of the President's budget process and coincides with USDA's annual outlook forum, which convenes toward the end of every February. The initial forecast consists primarily of trend projections for the year, since it precedes most agricultural activity, which occurs later in the spring and summer. The initial projections rely heavily on assumptions of trend yields and USDA's baseline forecasts for market conditions. ERS's second farm income forecast is generally released in late August as part of what USDA refers to as the mid-session budget review. However, in 2020 the second forecast is to be released on September 2. By late August, most planting of major program crops is finished and crop growing conditions are better known, thus contributing to improved yield estimates. Domestic and international market conditions and trade patterns have also been established, thus improving forecasts for most commodity prices. It is not unusual for large variations in farm income projections to occur between the first and second farm income forecasts. ERS's third farm income forecast is generally released in late November and represents a tightening up of the data: Preliminary forecasts of planted acres and yields are gradually replaced with estimates based on actual field surveys and crop reporting by farmers to USDA. In most years, only small variations in farm income estimates occur between the second and third forecasts. The farm income forecast cycle then begins anew in the succeeding year. However, changes to estimates from previous years continue to occur for several years as more complete data become available. This report discusses aggregate national net farm income projections for calendar year 2020 as reported by ERS on February 5, 2020.3 It is the first of three USDA farm income forecasts for 2020. |

The divergence in year-to-year changes between the two measures of net income is due to their different treatment of harvested crops. Net farm income includes a crop's value after harvest even if it remains in on-farm storage. In contrast, net cash income includes a crop's value only when it is sold. Thus, crops placed in on-farm storage are included in net farm income but not net cash income.

In 2018, U.S. farmers harvested a record soybean crop and the third-largest corn crop on record. That same year the U.S.-China trade dispute emerged as an impediment to trade and contributed to a widespread drop in soybean prices.4 However, the Administration assured producers that the trade dispute was temporary and would soon be resolved in their favor. As a result, many producers of soybeans and other crops held on to their crops in the hopes of capturing higher prices after the trade dispute was resolved. However, by mid-2019 there was no end in sight to the trade dispute, and farmer cash flows necessitated selling from on-farm inventories to meet household and farm operation needs. As a result, the net cash farm income forecast for 2019 included $14.7 billion in sales from on-farm crop inventories, whereas the 2020 forecast includes a much smaller amount ($0.5 billion) in sales from on-farm inventories. This difference accounts for much of the decline in the 2020 net cash farm income projection.

Highlights

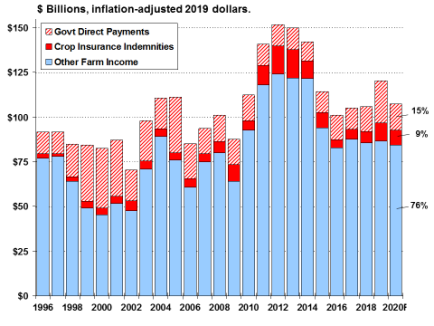

- When adjusted for inflation and represented in 2019 dollars (Figure 2), both the net farm income and net cash income for 2019 are projected to be above their average values since 1940 of $88.2 billion and $101 billion, respectively.

- For historical perspective, both net cash income and net farm income achieved record nominal highs in 2013 but fell to recent lows in 2016 (Figure 1) before trending higher during 2017-2019.

- Government farm subsidies are projected at $15 billion in 2020—down nearly 37% from 2019 but still the second-highest since 2006 (Figure 12). In 2019, support from traditional farm programs was bolstered by large direct government payments in response to trade retaliation under the trade dispute with China.5 Direct government payments of $23.6 billion in 2019 represented 25.2% of net farm income—the largest share since a 27.6% share in 2006.6 The share of net farm income from government sources in 2020 is projected to decline to 15.5% (Figure 11).

- Farm asset values and debt levels are projected to reach record levels in 2020—asset values at $3.1 trillion (+1.3% year-over-year) and farm debt at $425.3 billion (+2.3%)—pushing the projected debt-to-asset ratio up to 13.5%, the highest level since 2003 (Figure 19).

- For the 2019-2020 marketing year for crops and the 2020 calendar year for livestock, USDA forecasts a mixed outlook for major commodity prices: Corn, soybeans, sorghum, oats, rice, hogs, and milk will be up slightly from 2019, while prices for barley, cotton, wheat, choice steers, broilers, and eggs are expected to be lower (Table A-4).

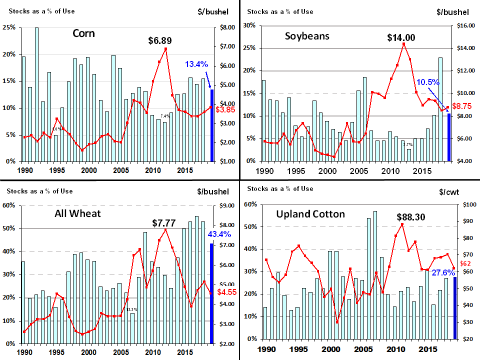

Abundant domestic and international supplies of grains and oilseeds contributed to a fifth-straight year of relatively weak commodity prices in 2019 (Figure A-1 through Figure A-4, and Table A-4). However, the commodity price projections for 2020 are subject to substantial uncertainty associated with as-yet-unknown domestic production and international commodity market developments. Three major factors dominated U.S. agricultural markets during 2019 and have contributed to uncertainty over the supply, demand, and price prospects for most major commodities heading into 2020: surplus stocks, wet weather, and international trade disputes.

First, large corn and soybean stocks kept pressure on commodity prices throughout the grain and feed complex in 2019 (Figure 3). Second, adverse weather conditions during the spring planting and fall harvesting periods contributed to market uncertainty regarding the size of the 2019 corn and soybean crops. Third, the U.S.-China trade dispute led to declines in U.S. exports to China—a major market for U.S. agricultural products—and added to market uncertainty.7 In particular, the United States was displaced by Brazil as the world's preeminent exporter of soybeans to China.

Weather conditions and planting prospects for 2020 are unknown this early in the year. Also, despite the signing of a Phase I trade agreement with China on January 15, 2020, it is unclear how soon—if at all—the United States may resume normal trade with China or how international demand may evolve heading in 2020.8

USDA Projects Corn, Soybean, and Wheat Stocks Lower in 2019

Corn and soybeans are the two largest U.S. commercial crops in terms of both value and acreage. For the past several years, U.S. corn and soybean crops have experienced strong growth in both productivity and output, thus helping to build stockpiles at the end of several successive marketing years through the 2018 season.

In 2018, U.S. farmers produced a record U.S. soybean harvest of 4.4 billion bushels and record-ending stocks (909 million bushels or a 22.9% stocks-to-use ratio) that year (Figure 3).9 The record soybean harvest in 2018, combined with the sudden loss of the Chinese soybean market, kept downward pressure on U.S. soybean prices. Despite a smaller crop and lower stocks in 2019, the reduction in volume of U.S. soybean exports to China has prevented a major price recovery.

Similarly, several consecutive years of bumper U.S. corn crops have built domestic corn supplies. U.S. corn ending stocks in 2019 are projected down slightly to 1.8 billion bushels after three consecutive years of above 2-billion-bushel ending stock totals. U.S. wheat and cotton supplies are also expected to decline relative to use levels in 2019 but remain high relative to the historical average thus limiting price recovery.

Livestock Outlook for 2020

Because the livestock sectors (particularly dairy and cattle but hogs and poultry to a lesser degree) have longer biological lags and often require large capital investments up front, they are slower to adjust to changing market conditions than is the crop sector. As a result, USDA projects livestock and dairy production and prices an extra year into the future (compared with the crop sector) through 2020, and market participants consider this expanded outlook when deciding their market interactions (e.g., buy, sell, expand herd sizes).

Background on the U.S. Cattle-Beef Sector

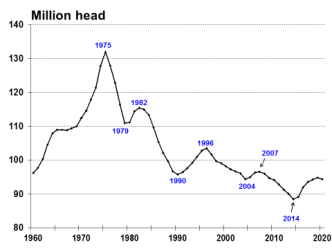

During the 2007-2014 period, high feed and forage prices plus widespread drought in the Southern Plains—the largest U.S. cattle production region—resulted in an 8% contraction of the U.S. cattle inventory. Reduced beef supplies led to higher producer and consumer prices and record profitability among cow-calf producers in 2014. This was coupled with a subsequent improvement in forage conditions, all of which helped to trigger the slow rebuilding phase in the cattle cycle that started in 2014 (Figure 4). The expansion continued through 2019 despite weakening profitability, primarily due to the lag in the biological response to the strong market price signals of late 2014.10

|

Figure 4. U.S. Beef Cattle Inventory (Including Calves) Since 1960 |

|

|

Source: NASS, Cattle, January 31, 2020. Note: Inventory data are for January 1 of each year. |

However, the cattle expansion appears to show the first signs of contraction in USDA's January 2020 U.S. cattle inventory report.11 The estimated cattle and calf population was down slightly from a year earlier at 94.4 million (compared with 94.8 million in January 2019). A factor working against continued expansion in cattle numbers is that producers are now producing more beef with fewer cattle as a result of heavier weights for marketed cattle.

Robust Production Growth Projected Across the Livestock Sector

Similar to the cattle sector, U.S. hog and poultry flocks have been growing in recent years, but unlike cattle they are expected to continue to expand in 2020.12 USDA projects production of beef (+1.2%), pork (+4.5%), broilers (+4.3%), and eggs (+1.8%) to expand robustly through 2020. A key uncertainty for the meat-producing sector is whether demand will expand rapidly enough to absorb the continued growth in output or whether surplus production will begin to pressure prices lower. USDA projects that combined domestic and export demand for 2020 will flatten for red meat (+0.0%) but expand for poultry (+3.9%).

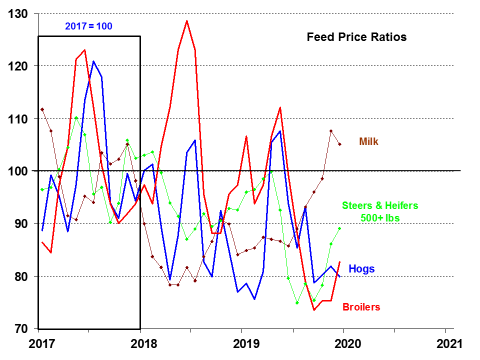

Livestock-Price-to-Feed-Cost Ratios Signal Lower Profitability Outlook

The changing conditions for the U.S. livestock sector may be tracked by the evolution of the ratios of livestock output prices to feed costs (Figure 5). A higher ratio suggests greater profitability for producers.13 The cattle-, hog-, and broiler-to-feed ratios have all exhibited significant volatility during the 2017-2019 period but in general have trended downward during 2018 and 2019, suggesting eroding profitability.14 The milk-to-feed price ratio has trended upward since mid-2018 into 2020. This result varies widely across the United States. Many marginally profitable cattle, hog, broiler, and milk producers face continued financial difficulties.

Continued strong production growth of between 1% and 5% for red meat and poultry suggests that prices are vulnerable to weakness in demand. USDA projects that the price increase for hogs will slow in 2020, up 2.2% after 4.4% growth in 2019 (Table A-4). Similarly, U.S. milk production is projected to continue growing in 2020 (+1.7%). Despite this production growth, USDA projects U.S. milk prices up slightly in 2020 (+1.3%).15

Gross Cash Income Highlights

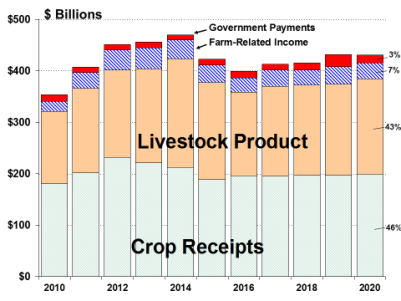

Projected farm-sector revenue sources in 2020 include crop revenues (46% of sector revenues), livestock receipts (43%), government payments (3%), and other farm-related income (7%), including crop insurance indemnities, machine hire, and custom work. Total farm sector gross cash income for 2020 is projected down (-0.3%) to $430.9 billion, driven by declines in both direct government payments (-36.6%) and other farm-related income (-8.0%). Cash receipts from crop receipts (+1.0%) and livestock product (+4.6%) are up a combined (+4.6%) (Figure 6).

Crop Receipts

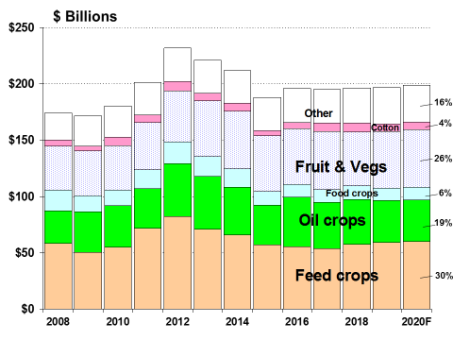

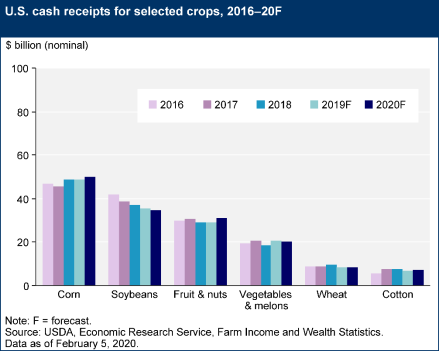

Total crop sales peaked in 2012 at $231.6 billion when a nationwide drought pushed commodity prices to record or near-record levels. In 2020, crop sales are projected at $198.6 billion, up 1.0% from 2019 (Figure 7 and Figure 8). Projections for 2020 and percentage changes from 2019 include

- Feed crops—corn, barley, oats, sorghum, and hay: $60.1 billion (+2.0%);

- Oil crops—soybeans, peanuts, and other oilseeds: $36.8 billion (-2.3%);

- Fruits and nuts: $31.0 billion (+6.3%);

- Vegetables and melons: $20.1 billion (-1.8%);

- Food grains—wheat and rice: $11.3 billion (+1.4%);

- Cotton: $7.1 billion (+2.1%); and

- Other including tobacco, sugar, greenhouse, and nursery: $31.2 billion (-0.6%).

Livestock Receipts

The livestock sector includes cattle, hogs, sheep, poultry and eggs, dairy, and other minor activities. Cash receipts for the livestock sector grew steadily from 2009 to 2014, when it peaked at a record $212.3 billion. However, the sector turned downward in 2015 (-10.7%) and again in 2016 (-14.1%), driven largely by projected year-over-year price declines across major livestock categories (Table A-4, Figure 9, and Figure 10).

In 2017, livestock sector cash receipts recovered with year-to-year growth of 8.1% to $175.6 billion. Cash receipts increased slightly in 2018 (+0.5%) and 2019 (+0.6%). In 2020, cash receipts are projected up strongly (+4.6%) for the sector at $185.8 billion as increased cattle, hogs, and dairy sales offset declines in poultry. Projections for 2020 (and percentage changes from 2019) include

- Cattle and calf sales: $69.0 billion (+1.6%),

- Poultry and egg sales: $40.1 billion (+1.7%),

- Dairy sales: $42.5 billion (+5.2%),

- Hog sales: $27.1 billion (+18.4%), and

- Miscellaneous livestock:16 $7.1 billion (+2.0%).

|

|

Source: ERS, "2020 Farm Income Forecast," February 5, 2020. All values are nominal—that is, not adjusted for inflation. Values for 2019 and 2020 are forecasts. Gross farm income percentage shares (right-hand side) are for 2020. Notes: Farm-related income includes income from custom work, machine hire, agro-tourism, forest product sales, crop insurance indemnities, and cooperative patronage dividend fees. |

|

|

Source: ERS, "2020 Farm Income Forecast," February 5, 2020. All values are nominal—not adjusted for inflation. Values for 2019 and 2020 are forecasts. Percentage shares of crop receipts (right-hand side) are for 2020. |

|

|

Source: ERS, "2020 Farm Income Forecast," February 5, 2020. All values are nominal—that is, not adjusted for inflation. Values for 2019 and 2020 are forecasts. |

Government Payments

Historically, direct government farm program payments have included17

- Direct payments (decoupled payments based on historical planted acres);18

- Price-contingent payments (both coupled and decoupled program outlays linked to market conditions);

- Conservation payments (including the Conservation Reserve Program and other environmental-based outlays);

- Ad hoc and emergency disaster assistance payments (including emergency supplemental crop and livestock disaster payments and market loss assistance payments for relief of low commodity prices); and

- Other miscellaneous outlays, including payments under ad hoc programs initiated by the Administration such as the Market Facilitation Program (MFP) or the cotton ginning cost-share programs but also legislatively authorized programs such as the biomass crop assistance program, peanut quota buyout, milk income loss, tobacco transition, and other miscellaneous programs.

Projected government payments of $15.0 billion in 2020, if realized, would represent a 36.6% decline from 2019 but would still be the second-largest since 2006. The $23.6 billion in federal payments in 2019 was the largest taxpayer transfer to the agriculture sector (in absolute dollars) since 2005 (Figure 12 and Table A-1). The surge in federal subsidies in 2019 was driven by large "trade-damage" payments made under the MFP initiated by USDA in response to the U.S.-China trade dispute.19 MFP payments (reported to be $14.6 billion) in 2019 include outlays from the 2018 MFP program that were not received by producers until 2019, as well as payments under the first and second tranches of the 2019 MFP program. In 2020, MFP payments are projected to decline to $3.7 billion representing the third and final tranche of payments from the 2019 MFP program. No new MFP program has been announced for 2020 by the Administration.

USDA permanent disaster assistance20 is projected higher year-over-year in 2020 at $2.5 billion (+14.2%). Most of the $2.5 billion comes from a new, temporary program, the Wildfire and Hurricane Indemnity Program Plus, enacted through the Disaster Relief Act of 2019 (P.L. 116-20). Payments under the Price Loss Coverage program are projected at $3.9 billion in 2020, up from $1.9 billion in 2019. In contrast, Agricultural Risk Coverage outlays are projected to decline to $39 million, down from $641 million in 2019 (see "Price Contingent" in Figure 12).21

|

|

Source: Compiled by CRS from ERS, "2020 Farm Income Forecast," February 5, 2020. Sources of net farm income, expressed as percentage shares (right-hand side), are for 2020. Values for 2019 and 2020 values are forecasts. |

Conservation programs include all conservation programs operated by USDA's Farm Service Agency and the Natural Resources Conservation Service that provide direct payments to producers. Estimated conservation payments of $4.2 billion are forecast for 2020, up (+4.4%) from $4.0 billion in 2019.

Total government payments of $15.0 billion represents a 3.5% share of projected gross cash income of $432.2 billion in 2020 (Figure 6). In contrast, government payments are expected to represent 15.5% of the projected net cash income of $109.6 billion (Figure 11). The government share of net farm income reached a peak of 65.2% in 1984 during the height of the farm crisis of the 1980s. The importance of government payments as a percentage of net farm income varies nationally by crop and livestock sector and by region.

Dairy Margin Coverage Program Outlook

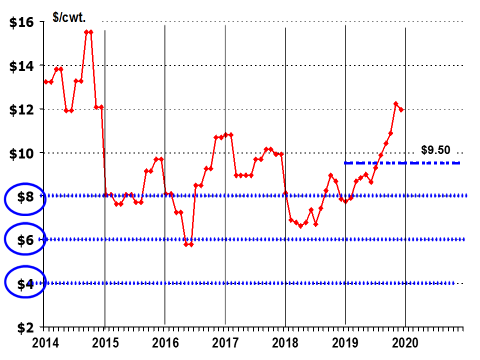

The 2018 farm bill (P.L. 115-334) made several changes to the previous Margin Protection Program (MPP) for dairy, including a new name—the Dairy Margin Coverage (DMC) program—and expanded margin coverage choices from the original range of $4.00-$8.00 per hundredweight (cwt.).22 Under the 2018 farm bill, as a cushion against low milk prices, producers have the option of buying coverage to insure a margin between the national farm price of milk and the cost of feed up to a threshold of $9.50/cwt. on the first 5 million pounds of milk coverage.

|

Figure 13. The Dairy Output-to-Input Margin Is Above $9.50/cwt. in 2019 (The dairy margin equals the national average farm price of milk less average feed costs per 100 pounds.) |

|

|

Source: NASS, Agricultural Prices, January 31, 2020; calculations by CRS. All values are nominal. Note: The margin equals the All Milk price minus a composite feed price based on the formula used by the DMC of the 2018 farm bill starting January 2019 and, for all prior months, the MPP of the 2014 farm bill (P.L. 113-79). See CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison. |

The DMC margin differs from the USDA-reported milk-to-feed ratio (shown in Figure 5) but reflects the same market forces. In August 2019, the formula-based milk-to-feed margin used to determine government payments rose to $9.85/cwt., thus exceeding the newly instituted $9.50/cwt. payment threshold (Figure 13) and decreasing the likelihood of DMC payments in the near future. Since then, the DMC margin continued its rise to $12.21 in November 2019. These increases in the DMC margin decrease the likelihood that DMC payments will be available during the first half of 2020. Despite these price movements, USDA projects that the DMC program will make $637 million in payments in 2020, up from $279 million in 2019.

Production Expenses

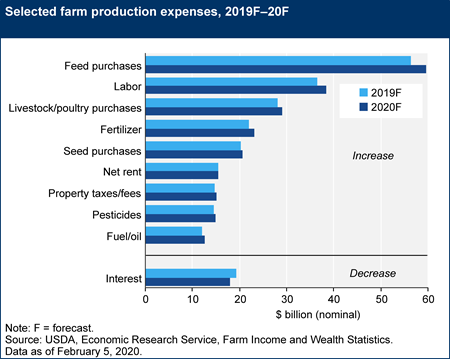

Total production expenses for 2020 for the U.S. agricultural sector are projected to be up by $10.4 billion (+3.0%) from 2019 in nominal dollars at $354.7 billion (Figure 14). Production expenses peaked in both nominal and inflation-adjusted dollars in 2014 then declined for five consecutive years in inflation-adjusted dollars but are projected to turn up again in 2020.

Production expenses affect crop and livestock farms differently. The principal expenses for livestock farms are feed costs, purchases of feeder animals and poultry, and hired labor. In contrast, fuel, seed, pesticides, interest, and fertilizer costs are major crop production expenses. USDA projects that all expense categories with the exception of interest rates will be up in 2020 (Figure 15). But how have production expenses moved relative to revenues? A comparison of the indexes of prices paid (an indicator of expenses) versus prices received (an indicator of revenues) reveals that the prices received index generally declined from 2014 through 2016, rebounded in 2017, then trended lower through 2019 (Figure 16). Farm input prices (as reflected by the prices paid index) showed a similar pattern but with a smaller decline from their 2014 peak and have climbed steadily since mid-2016, suggesting that farm sector profit margins have been squeezed since 2016.

|

Figure 15. Farm Production Expenses for Selected Items, 2019 and 2020F |

|

|

Source: ERS, "2020 Farm Income Forecast," February 5, 2020. Values are nominal. Values for 2019 and 2020 are forecast. |

Farm Asset Values and Debt

A measure of the farm sector's financial well-being is net worth as measured by farm assets minus farm debt. A summary statistic that captures this relationship is the debt-to-asset ratio.

The U.S. farm income and asset-value situation and outlook suggest a slowly eroding financial situation heading into 2020 for the agriculture sector as a whole. Considerable uncertainty clouds the economic outlook for the sector, reflecting the mixed outlook for prices and market conditions, an increasing dependency on international markets to absorb domestic surpluses, and an increasing dependency on federal support to offset lost trade opportunities due to ongoing trade disputes.

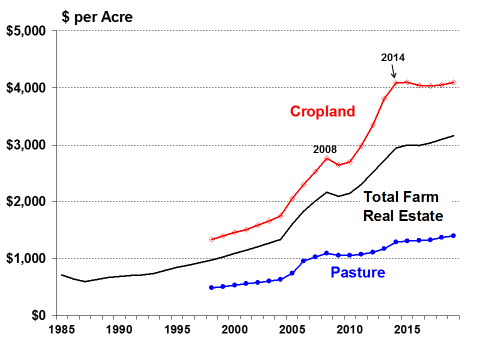

- Farm asset values (see box "Measuring Farm Wealth: The Debt-to-Asset Ratio" below for details)—which reflect farm investors' and lenders' expectations about long-term profitability of farm sector investments—are projected to be up 1.3% in 2020 to a nominal $3.1 trillion (Table A-3). The projected rise in asset value is due to increases in both real estate values (+1.5%) and non-real-estate values (+0.6%). Real estate is projected to account for 83% of total farm sector asset value.

- Inflation-adjusted farm asset values (using 2019 dollars) are projected lower in 2020 (-0.6%). In inflation-adjusted terms, farm asset values peaked in 2014 (Figure 17).

- Crop land values are closely linked to commodity prices. The leveling off of crop land values since 2015 reflects stagnant commodity prices (Figure 18).

|

|

Source: NASS, Land Values 2019 Summary, August 2019. Notes: Farm real estate value measures the value of all land and buildings on farms. Separate cropland and pasture values are available only since 1998. All values are nominal. |

|

Measuring Farm Wealth: The Debt-to-Asset Ratio Farm assets include both physical and financial farm assets. Physical assets include land, buildings, farm equipment, on-farm inventories of crops and livestock, and other miscellaneous farm assets. Financial assets include cash, bank accounts, and investments such as stocks and bonds. Farm debt includes both business and consumer debt linked to real estate and non-real-estate assets (e.g., financial assets, inventories of agricultural products, and the value of machinery and motor vehicles) of the farm sector. The debt-to-asset ratio compares the farm sector's outstanding debt related to farm operations relative to the value of the sector's aggregate assets. Change in the debt-to-asset ratio is a critical barometer of the farm sector's financial performance, with lower ratios indicating greater financial resiliency. A lower debt-to-asset ratio suggests that the sector is better able to withstand short-term increases in debt related to interest rate fluctuations or changes in the revenue stream related to lower output prices, higher input prices, or production shortfalls. The largest single component in a typical farmer's investment portfolio is farmland. As a result, real estate values affect the financial well-being of agricultural producers and serve as the principal source of collateral for farm loans. |

- Total farm debt is forecast to rise to a record $425.3 billion in 2020 (+2.3%) (Table A-3). Farm equity—or net worth, defined as asset value minus debt—is projected to be up slightly (+1.1%) at $2.7 trillion in 2020 (Table A-3).

- The farm debt-to-asset ratio is forecast up in 2020 at 13.6%, the highest level since 2003 but still relatively low by historical standards (Figure 19). If realized, this would be the eighth consecutive year of increase in the debt-to-asset ratio.

|

|

Source: ERS, "2020 Farm Income Forecast," February 5, 2020. Values for 2019 and 2020 are forecasts. |

Average Farm Household Income

A farm can have both an on-farm and an off-farm component to its income statement and balance sheet of assets and debt.23 Thus, the well-being of farm operator households is not equivalent to the financial performance of the farm sector or of farm businesses because of the inclusion of nonfarm investments, jobs, and other links to the nonfarm economy.

- Average farm household income (sum of on- and off-farm income) is projected at $118,908 in 2020 (Table A-2), down 1.5% from 2019 and 11.4% below the record of $134,165 in 2014.

- About 18% ($20,926) of total farm household income in 2020 is projected to be from farm production activities, while the overwhelming majority, at 82% ($97,982), is earned off the farm (including financial investments).

- The share of farm income derived from off-farm sources had increased steadily for decades but peaked at about 95% in 2000 (Figure 20).

- Since 2014, over half of U.S. farm operations have had negative income from their agricultural operations.

Total vs. Farm Household Average Income

Since the late 1990s, farm household incomes have surged ahead of average U.S. household incomes (Figure 21). In 2018 (the last year for which comparable data were available), the average farm household income of $112,211 was about 25% higher than the average U.S. household income of $90,021 (Table A-2).

Appendix. Supporting Charts and Tables

Figure A-1 to Figure A-4 present USDA data on monthly farm prices received for several major farm commodities—corn, soybeans, wheat, upland cotton, rice, milk, cattle, hogs, and chickens. The data are presented in an indexed format where monthly price data for year 2010 = 100 to facilitate comparisons.

Table A-1 to Table A-3 present aggregate farm income variables that summarize the financial situation of U.S. agriculture. In addition, Table A-4 presents the annual average farm price received for several major commodities, including the USDA forecast for the 2019-2020 marketing year for major program crops and 2020-2021 for livestock products.

|

2020 Forecasts |

2019 to 2020 |

||||||||||||||||||||||||

|

Item |

2015 |

2016 |

2017 |

2018 |

2019 |

2-5-20 |

9-02-20 |

Nov. 20 |

Change (%)a |

||||||||||||||||

|

1. Cash receipts |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Cropsb |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Livestock |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

2. Government paymentsc |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

CCP-PLC-ARCd |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Marketing loan benefitse |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Conservation |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Ad hoc and emergencyf |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

All otherg |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

3. Farm-related incomeh |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

4. Gross cash income (1+2+3) |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

5. Cash expensesi |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

6. NET CASH INCOME |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

7. Total gross revenuesj |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

8. Total production expensesk |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

9. NET FARM INCOME |

|

|

|

|

|

|

|

|

|

||||||||||||||||

Source: ERS, Farm Income and Wealth Statistics; U.S. and State Farm Income and Wealth Statistics, updated as of February 5, 2020. NA = not applicable.

Notes:

a. Change represents year-to-year projected change between 2019 and the February 5, 2020, forecast for 2020.

b. Includes Commodity Credit Corporation loans under the farm commodity support program.

c. Government payments reflect payments made directly to all recipients in the farm sector, including landlords. The nonoperator landlords' share is offset by its inclusion in rental expenses paid to these landlords and thus is not reflected in net farm income or net cash income.

d. CCP = counter-cyclical payments. PLC = Price Loss Coverage. ARC = Agricultural Risk Coverage.

e. Includes loan deficiency payments, marketing loan gains, and commodity certificate exchange gains.

f. Includes payments made under the Average Crop Revenue Election program, which was eliminated by the 2014 farm bill (P.L. 113-79).

g. Market facilitation payments, cotton ginning cost-share, biomass crop assistance program, milk income loss, tobacco transition, and other miscellaneous payments.

h. Income from crop insurance indemnities, custom work, machine hire, agri-tourism, forest product sales, and other farm sources.

i. Excludes depreciation and perquisites to hired labor.

j. Gross cash income plus inventory adjustments, the value of home consumption, and the imputed rental value of operator dwellings.

k. Cash expense plus depreciation and perquisites to hired labor.

Table A-2. Average Annual Income per U.S. Household, Farm vs. All, 2013-2020 Forecasts

($ per household)

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|||||||||

|

Average U.S. farm income by source |

|

|

|

|

|

|

|

|

||||||||

|

On-farm income |

|

|

|

|

|

|

|

|

||||||||

|

Off-farm income |

|

|

|

|

|

|

|

|

||||||||

|

Total farm income |

|

|

|

|

|

|

|

|

||||||||

|

Average U.S. household income |

|

|

|

|

|

|

NA |

NA |

||||||||

|

Farm household income as share of U.S. avg. household income (%) |

161% |

177% |

151% |

142% |

129% |

125% |

NA |

NA |

Source: ERS, Farm Household Income and Characteristics, principal farm operator household finances, data set updated as of February 5, 2020, http://www.ers.usda.gov/data-products/farm-household-income-and-characteristics.aspx.

Notes: NA = not available. Data for 2019 and 2020 are USDA forecasts.

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|||||||||||||||||

|

Farm assets |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Farm debt |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Farm equity |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Debt-to-asset ratio (%) |

|

|

|

|

|

|

|

|

Source: ERS, Farm Income and Wealth Statistics; U.S. and State Farm Income and Wealth Statistics, updated as of February 5, 2020, http://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics.aspx.

Notes: Data for 2019 and 2020 are USDA forecasts.

Table A-4. U.S. Farm Prices and Support Rates for Selected Commodities Since 2014-2015 Marketing Year

|

Commoditya |

Unit |

Market Year |

2014-2015 |

2015-2016 |

2016-2017 |

2017-2018 |

2018-2019 |

2019-2020b |

% Change 18/19-19/20 |

2020-2021b |

% Change 19/20-20/21 |

Loan Ratec |

Ref. Price |

||||||||||||||||||

|

Wheat |

$/bu |

Jun-May |

|

|

|

|

|

|

|

— |

— |

|

|

||||||||||||||||||

|

Corn |

$/bu |

Sep-Aug |

|

|

|

|

|

|

|

— |

— |

|

|

||||||||||||||||||

|

Sorghum |

$/bu |

Sep-Aug |

|

|

|

|

|

|

|

— |

— |

|

|

||||||||||||||||||

|

Barley |

$/bu |

Jun-May |

|

|

|

|

|

|

|

— |

— |

|

|

||||||||||||||||||

|

Oats |

$/bu |

Jun-May |

|

|

|

|

|

|

|

— |

— |

|

|

||||||||||||||||||

|

Rice |

$/cwt |

Aug-Jul |

|

|

|

|

|

|

|

— |

— |

|

|

||||||||||||||||||

|

Soybeans |

$/bu |

Sep-Aug |

|

|

|

|

|

|

|

— |

— |

|

|

||||||||||||||||||

|

Soybean Oil |

¢/lb |

Oct-Sep |

|

|

|

|

|

|

|

— |

— |

— |

— |

||||||||||||||||||

|

Soybean Meal |

$/st |

Oct-Sep |

|

|

|

|

|

|

|

— |

— |

— |

— |

||||||||||||||||||

|

Cotton, Upland |

¢/lb |

Aug-Jul |

|

|

|

|

|

|

|

— |

— |

45-52 |

none |

||||||||||||||||||

|

Livestock Products |

Calendar |

|

|

|

|

|

|

|

|

|

— |

— |

|||||||||||||||||||

|

Choice Steers |

$/cwt |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

||||||||||||||||||

|

Barrows/Gilts |

$/cwt |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

||||||||||||||||||

|

Broilers |

¢/lb |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

||||||||||||||||||

|

Eggs |

¢/doz |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

||||||||||||||||||

|

Milk |

$/cwt |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

||||||||||||||||||

Source: Various USDA agency sources as described in the notes below.

Notes: Ref. = reference, bu = bushels, cwt = 100 pounds, lb = pound, st = short ton (2,000 pounds), doz = dozen.

a. Price for grains and oilseeds are from USDA, World Agricultural Supply and Demand Estimates (WASDE), February 11, 2020. "—" = no value. USDA's out-year 2020-2021 crop price forecasts will first appear in the May 2020 WASDE. Soybean and livestock product prices are from USDA, Agricultural Marketing Service: soybean oil—Decatur, IL, cash price, simple average crude; soybean meal—Decatur, IL, cash price, simple average 48% protein; choice steers—Nebraska, direct 1,100-1,300 lbs.; barrows/gilts—national base, live equivalent 51%-52% lean; broilers—wholesale, 12-city average; eggs—Grade A, New York, volume buyers; and milk—simple average of prices received by farmers for all milk.

b. Data for 2019-2020 are USDA forecasts. Data for 2020-2021 are USDA projections.

c. Loan rate and reference prices are for the 2019-2020 market year as defined under the 2018 farm bill (P.L. 115-334). The loan rate for upland cotton equals the average market-year-average price for the two preceding crop years but within the range of 45 cents/lb. and 52 cents/lb. See CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison.

Author Contact Information

Footnotes

| 1. |

Economic Research Service (ERS), "Farm Structure and Organization," http://www.ers.usda.gov/topics/farm-economy/farm-structure-and-organization.aspx; and "Farm Household Well-Being," http://www.ers.usda.gov/topics/farm-economy/farm-household-well-being.aspx. |

| 2. |

See the box "ERS's Annual Farm Income Forecast" for a description of ERS's farm income forecast schedule. ERS's 2020 farm sector income forecasts are available at https://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances/farm-sector-income-forecast/. |

| 3. |

For both national and state-level farm income, see ERS, "U.S. and State Farm Income and Wealth Statistics," http://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics.aspx. |

| 4. |

CRS Report R45929, China's Retaliatory Tariffs on U.S. Agriculture: In Brief, by Anita Regmi. |

| 5. |

See CRS Report R45865, Farm Policy: USDA's 2019 Trade Aid Package, by Randy Schnepf. |

| 6. |

Indirect federal subsidies such as crop insurance premium subsidies—valued at a projected $10.2 billion in 2019—are not included in the $23.6 billion federal subsidy amount. |

| 7. |

See CRS Report R45903, Retaliatory Tariffs and U.S. Agriculture, by Anita Regmi. |

| 8. |

See CRS In Focus IF11412, U.S.-China Phase I Deal: Agriculture, by Anita Regmi. |

| 9. |

USDA, World Agricultural Outlook Board (WAOB), World Agricultural Supply and Demand Estimates (WASDE), January 10, 2020. |

| 10. |

J. Mintert, "Cattle Inventory Growth Slowing Down, but Beef Production Still Increasing," farmdoc daily, vol. 8, no. 18 (February 5, 2018). |

| 11. |

USDA, National Agricultural Statistics Service (NASS), Cattle, January 31, 2020. |

| 12. |

WAOB, WASDE, Table—U.S. Quarterly Animal Product Production, January 10, 2020, pp. 31 and 32. |

| 13. |

The ratio is calculated as the farm price for milk, cattle (steers and heifers), hogs, and broilers compared to their major feed source: Cattle and hog feed cost is 100% corn; broilers feed cost is 58% corn and 42% soybeans; dairy feed cost is a mix of corn, soybean meal, and alfalfa hay. Feed costs—at 30%-80% of variable costs—are generally the largest cost component in livestock operations. |

| 14. |

Broilers are chickens raised for meat. Layers are chickens retained for egg production. |

| 15. |

WAOB, WASDE, Table—U.S. Quarterly Prices for Animal Products, February 11, 2020, p. 31. |

| 16. |

Miscellaneous livestock includes aquaculture, sheep and lambs, honey, mohair, wool, pelts, and other animal products. |

| 17. |

Government farm payments do not include premium subsidies or indemnities paid under the federal crop insurance program—indemnity payments are included as "farm-related income" (Table A-1). Also, government payments do not include USDA loans, which are listed as a liability in the farm sector's balance sheet. |

| 18. |

Decoupled means that payments are not linked to current producer behavior and, instead, are based on some other measure outside of the producer's decisionmaking sphere, such as historical acres planted to program crops. Decoupling of payments is intended to minimize their incentives on producer behavior. |

| 19. |

USDA has initiated two trade aid packages with up to $28 billion of financial support designed to partially offset the negative price and income effects of lost commodity sales to major markets. The 2018 trade aid package was valued at up to $12 billion (see CRS Report R45310, Farm Policy: USDA's 2018 Trade Aid Package), while the 2019 trade aid package was valued at up to $16 billion (see CRS Report R45865, Farm Policy: USDA's 2019 Trade Aid Package). |

| 20. |

Fiscal year payments generally involve outlay commitments incurred during the previous crop year. For example, FY2019 disaster assistance payments are primarily related to disasters for crops that were grown and harvested in 2018. See CRS Report RS21212, Agricultural Disaster Assistance, for information on available farm disaster programs. |

| 21. |

For details see CRS Report R43448, Farm Commodity Provisions in the 2014 Farm Bill (P.L. 113-79). |

| 22. |

The margin equals the All Milk price minus a composite feed price based on the formula used by the DMC of the 2018 farm bill starting January 2019 and, for all prior months, the MPP of the 2014 farm bill (P.L. 113-79). See CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison, and CRS In Focus IF10195, U.S. Dairy Programs After the 2014 Farm Bill (P.L. 113-79). |

| 23. |

ERS, "Farm Household Well-Being," http://www.ers.usda.gov/topics/farm-economy/farm-household-well-being.aspx. |