COVID-19 Disrupts U.S. Meat Supply; Producer Prices Tumble

U.S. livestock and poultry producers entered 2020 with an optimistic outlook for prices and income. Then in mid-March the food service sector, which accounts for a substantial share of meat consumption, was largely shut down as most states closed all but essential businesses. A temporary surge in retail meat purchases offset some of the reduction in food service demand. However, in early April, the situation worsened for producers as COVID-19 outbreaks began spreading in meatpacking plants around the United States, disrupting meat processing and leading to some shortages of meat products in grocery stores. The reduction in slaughter is weighing on livestock prices, reflecting shrinking meatpacker demand for slaughter-ready livestock and poultry.

On April 12, 2020, Smithfield Foods, the largest pork processor in the United States, indefinitely closed its Sioux Falls, SD, pork processing plant because of the spread of COVID-19 among plant workers. With an estimated daily slaughter capacity of 19,500 head, the Sioux Falls plant accounts for 4% of estimated daily U.S. hog slaughter. More pork slaughter capacity has been lost since then because of COVID-19 outbreaks in plants operated by other processors. On April 13, JBS USA announced it was closing its Greeley, CO, beef plant until April 24 because of an outbreak of COVID-19 among plant workers. Cattle Buyers Weekly estimates daily slaughter capacity of 6,000 head at the Greeley plant, which would be 4%-5% of daily national cattle slaughter capacity. Other beef plants have had to close due to COVID-19 outbreaks among workers. Outbreaks of COVID-19 have hit beef, pork, and poultry plants across the country. As of April 27, at least 15 meatpacking plants were reported closed. Some plants have shut down temporarily to clean and reconfigure work stations; others have not set reopening dates.

Reportedly, some plants have implemented onsite temperature monitoring of employees, spread out workers within plants, set up plexiglass dividers between workers who normally operate in tight spaces, and spread the work of one shift over two shifts, thus slowing operating speed. Even so, some meat plant employees have asserted that packers have not implemented adequate protective measures in their plants. On April 26, 2020, the Occupational Safety and Health Administration updated guidelines to address workplace conditions for meat plant workers. On April 28, 2020, President Trump announced that he plans to sign an executive order that would use the Defense Production Act to classify meat processing as critical infrastructure to keep production plants open.

Production Shortfall

The Commodity Futures Trading Commission reported in its April 22, 2020, Agricultural Advisory Committee meeting that U.S. meat plants were operating at about 60% of capacity. The estimate is based on plant closures combined with open plants that are running at 50%-75% of normal capacity as plants slow operations to protect workers. Steve Meyer of Kerns and Associates has estimated that nearly 30% of pork processing capacity will be offline as of April 24 because of COVID-19 outbreaks. The shutdown of some meat slaughter plants may have a cascading effect on consumer products, because slaughter plants often supply intermediate products to food plants for further processing, thus leading to a sequence of supply disruptions.

Estimated meat production (beef, pork, and chicken) for the week ending April 25 declined 13%, compared with the same week a year ago, while during the three weeks since April 4, meat production was 10% lower than the same period last year. As long as COVID-19 disruptions continue, there may be shortages of meat products in some grocery stores. However, there are ample numbers of cattle, hogs and broiler chickens to meet demand, especially given reduced demand from institutional markets such as schools and restaurants. As of April 9, the U.S. Department of Agriculture (USDA) forecasts record U.S. meat and poultry production of 108 billion pounds in 2020, or 3% more than in 2019. USDA also reported that stocks of beef, pork, and chicken in cold storage warehouses exceeded 2 billion pounds at the end of March. This quantity amounts to about one to two weeks of meat supply. The industry operates on a "just in time" delivery system, and this quantity is about 6% more than a year ago. If the shutdown of livestock processing facilities spreads to additional plants, or if shutdown periods are extended, then both meat supplies and livestock prices could be further reduced.

Price Declines

At the farm level, the disruptions at meat plants have triggered rapid declines in livestock and poultry prices to producers over the past few weeks, lowering returns that were originally projected to increase compared with 2019. In February 2020, USDA forecast a 5% increase to $136 billion in cash receipts for livestock and poultry producers in 2020 compared with 2019. With prices falling since February, USDA will likely significantly reduce the cash receipts forecast later in the year. Cash market prices for cattle, hogs, and broilers have fallen during April by between 10% and nearly 30% (Table 1).

|

2019 |

Jan |

Feb |

Mar |

April 1-23 |

% change, March to April |

||

|

5-Area Steer, $/cwt |

116.78 |

123.89 |

118.59 |

112.48 |

101.00 |

-10% |

|

|

National Hog Carcass, $/cwt |

47.95 |

58.69 |

54.81 |

58.86 |

48.00 |

-18% |

|

|

Broilers, Wholebird, ¢/lb. |

88.60 |

90.56 |

80.64 |

79.35 |

56.00 |

-29% |

|

Source: USDA's benchmark prices for cattle, hogs, and broilers as reported monthly in the World Agriculture Supply and Demand Estimates. The price data are from USDA's Agricultural Marketing Service.

Notes: Reported annual average for 2019 and reported monthly prices for January-March 2020. CRS compiled the April estimates from average daily prices for steers and hogs and average weekly prices for broilers available from April 1-23. cwt=100 pounds.

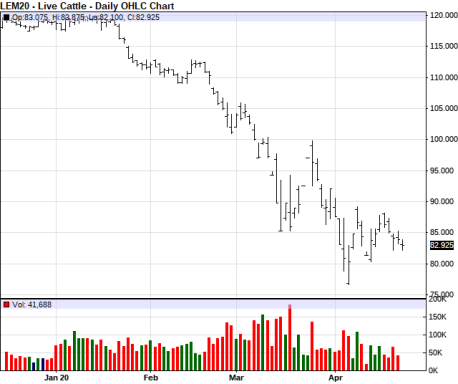

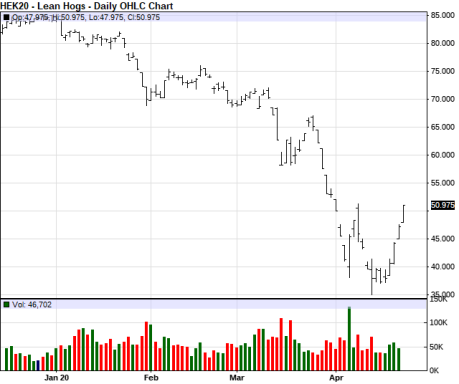

Based on cattle and hog futures prices on the Chicago Mercantile Exchange (CME), the outlook for producer prices have trended down since January 2020, with the June cattle contract price falling more than 30% and the May hog contract falling by 38% (see Figure 1 and Figure 2). The outlook for fall prices (as of April 24), based on CME October contracts, are 20% lower for cattle and nearly 30% lower for hogs than at the beginning of the year.

|

|

Source: RBM Group, CME, Contract LEM20, April 23, 2020. |

|

|

Source: RBM Group, CME, HEK20 contract, April 23, 2020. |

Producer Losses

In April 2020, the Food and Agricultural Policy Research Institute, which provides analysis of agricultural markets and policies to Congress, estimated a decline of $20 billion in cash receipts for the livestock industry in 2020 due to COVID-19. Of this total, cattle comprised $9.5 billion, hogs $2.2 billion, and poultry $4.1 billion. Trade groups representing the cattle and hog industries have released higher estimates of income losses this year, amounting to $13.6 billion and $5 billion, respectively. The sheep industry has estimated its losses at more than $300 million.

USDA Assistance

On April 17, 2020, USDA announced the Coronavirus Food Assistance Program (CFAP), which is to provide $19 billion in emergency aid to farmers and ranchers to address ongoing market disruptions. CFAP includes $16 billion in direct payments to producers and $3 billion in purchases of fresh produce, meat, and dairy products for food banks and other feeding programs. In its announcement, USDA states that it will begin purchasing an estimated $100 million per month each for livestock (pork and chicken), dairy products, and fresh produce. USDA has indicated that the purchase and distribution of these commodities could begin by mid-May.

USDA has not provided operational details about the direct payments to producers. However, on April 17, Senator Hoeven issued a statement that USDA would provide a total of $9.6 billion to livestock and dairy producers, of which $5.1 billion is for cattle, $2.9 billion for dairy, and $1.6 billion for hogs. The remaining $6.4 billion would be distributed to other agricultural producers. According to Senator Hoeven's statement, agricultural producers would receive a payment based on 85% of price losses that occurred between January 1 and April 15, 2020, and a second payment for 30% of losses occurring from April 15 through the following two quarters. Producers would be subject to a payment limit of $125,000 per commodity and an overall limit of $250,000 per individual. The statement notes that USDA is expediting its rulemaking to begin signup in early May and distribute initial payments by the end of May and early June.

Producer Response

Industry groups have expressed appreciation for the aid that USDA announced but note that the amounts fall short of industry loss estimates for cattle and hogs. Some industry stakeholders assert that the $125,000 payment limit will severely restrict needed aid to individual producers. On April 23, 28 Senators sent a letter to the President Trump requesting that these limits be removed for livestock, dairy, and specialty crop producers. A group of 126 Members of the House sent a similar letter.