Who Regulates Whom? An Overview of the U.S. Financial Regulatory Framework

Changes from August 17, 2017 to March 10, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Who Regulates Whom? An Overview of the U.S. Financial Regulatory Framework

Contents

- Introduction

- The Financial System

- The Role of Financial Regulators

- Regulatory Powers

- Goals of Regulation

- Types of Regulation

- Regulated Entities

- The Federal Financial Regulators

- Depository Institution Regulators

- Office of the Comptroller of the Currency

- Federal Deposit Insurance Corporation

- The Federal Reserve

- National Credit Union Administration

- Consumer Financial Protection Bureau

- Securities Regulation

- Securities and Exchange Commission

- Commodity Futures Trading Commission

- Standard-Setting Bodies and Self-Regulatory Organizations

- Regulation of Government-Sponsored Enterprises

- Federal Housing Finance Agency

- Farm Credit Administration

- Regulatory Umbrella Groups

- Financial Stability Oversight Council

- Federal Financial Institution Examinations Council

- Nonfederal Financial Regulation

- Insurance

- Other State Regulation

- International Standards and Regulation

Figures

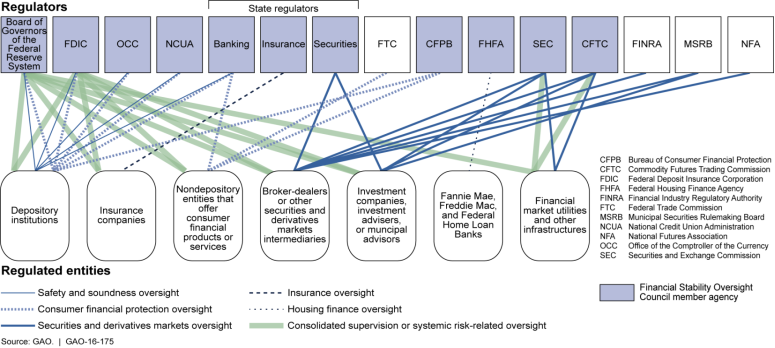

- Figure 1. Regulatory Jurisdiction by Agency and Type of Regulation

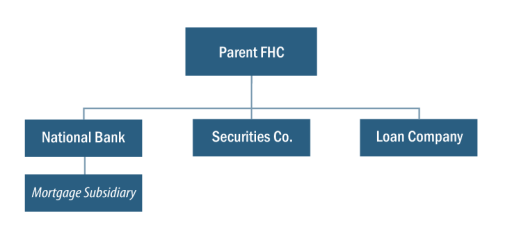

- Figure 2. Stylized Example of a Financial Holding Company

- Figure 3. Jurisdiction Among Depository Regulators

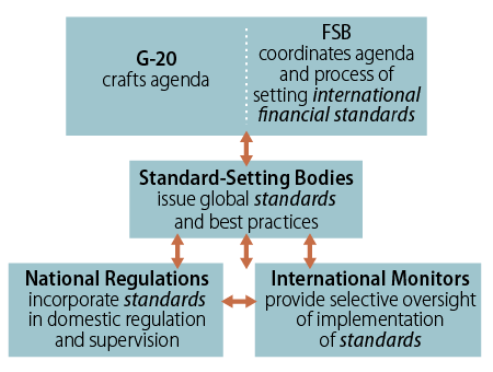

- Figure 4. International Financial Architecture

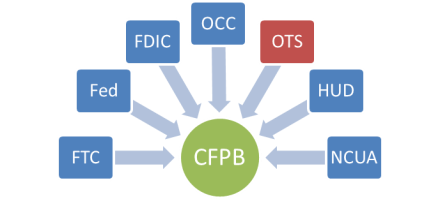

- Figure A-1. Changes to Consumer Protection Authority in the Dodd-Frank Act

- Figure A-2. Changes to the Oversight of Thrifts in the Dodd-Frank Act

- Figure A-3. Changes to the Oversight of Housing Finance in HERA

Tables

Summary

The financial regulatory system has been described as fragmented, with multiple overlapping regulators and a dual state-federal regulatory system. The system evolved piecemeal, punctuated by major changes in response to various historical financial crises. The most recent financial crisis also resulted in changes to the regulatory system through the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 (Dodd-Frank Act; P.L. 111-203) and the Housing and Economic Recovery Act of 2008 (HERA; P.L. 110-289). To address the fragmented nature of the system, the Dodd-Frank Act created the Financial Stability Oversight Council (FSOC), a council of regulators and experts chaired by the Treasury Secretary.

At the federal level, regulators can be clustered in the following areas:

- Depository regulators—Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), and Federal Reserve for banks; and National Credit Union Administration (NCUA) for credit unions;

- Securities markets regulators—Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC);

- Government-sponsored enterprise (GSE) regulators—Federal Housing Finance Agency (FHFA), created by HERA, and Farm Credit Administration (FCA); and

- Consumer protection regulator—Consumer Financial Protection Bureau (CFPB), created by the Dodd-Frank Act.

These regulators regulate financial institutions, markets, and products using licensing, registration, rulemaking, supervisory, enforcement, and resolution powers.

Other entities that play a role in financial regulation are interagency bodies, state regulators, and international regulatory fora. Notably, federal regulators generally play a secondary role in insurance markets. Regulators regulate financial institutions, markets, and products using licensing, registration, rulemaking, supervisory, enforcement, and resolution powers. In practice, regulatory jurisdiction is typically based on charter type, not function. In other words, how and by whom a firm is regulated depends more on the firm's legal status than the types of activities it is conducting. This means that a similar activity being conducted by two different types of firms can be regulated differently by different regulators. Financial firms may be subject to more than one regulator because they may engage in multiple financial activities. For example, a firm may be overseen by an institution regulator and by an activity regulator when it engages in a regulated activity and by a market regulator when it participates in a regulated market.

Financial regulation aims to achieve diverse goals, which vary from regulator to regulator:

- market efficiency and integrity,

- consumer and investor protections,

- capital formation or access to credit,

- taxpayer protection,

- illicit activity prevention, and

- financial stability.

Policy debate revolves around the tradeoffs between these various goals. Different types of regulation—prudential (safety and soundness), disclosure, standard setting, competition, and price and rate regulations—are used to achieve these goals.

Many observers believe that the structure of the regulatory system influences regulatory outcomes. For that reason, there is ongoing congressional debate about the best way to structure the regulatory system. As background for that debate, this report provides an overview of the U.S. financial regulatory framework. It briefly describes each of the federal financial regulators and the types of institutions they supervise. It also discusses the other entities that play a role in financial regulation.

Introduction

Federal financial regulation encompasses vastlyvaried and diverse markets, participants, and regulators. As a result, regulators' goals, powers, and methods differ between regulators and sometimes within each regulator's jurisdiction. This report provides background on the financial regulatory structure in order to help Congress evaluate specific policy proposals to change financial regulation.

Historically, financial regulation in the United States has coevolved with a changing financial system, in which major changes are made in response to crises. For example, in response to the financial turmoil beginning in 2007, the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 (Dodd-Frank Act; P.L. 111-203) was the last act to makemade significant changes to the financial regulatory structure (see Appendix A).1 Congress continues to debate proposals to modify parts of the regulatory system established by the Dodd-Frank Act. In the 115th Congress, proposals to change the regulatory structure include the Financial CHOICE Act of 2017 (H.R. 10), which would modify and rename the Consumer Financial Protection Bureau (CFPB) and the Federal Insurance Office (FIO), change the relationship between the Financial Stability Oversight Council (FSOC) and the regulators, eliminate the Office of Financial Research (OFR, which supports FSOC), and make other changes to how financial regulators promulgate rules and are funded.2

This report attempts to set out the basic frameworks and principles underlying U.S. financial regulation and to give some historical context for the development of that system. The first section briefly discusses the various modes of financial regulation. The next section identifies the major federal regulators and the types of institutions they supervise (see Table 1). It then provides a brief overview of each federal financial regulatory agency. Finally, the report discusses other entities that play a role in financial regulation—interagency bodies, state regulators, and international standards. For information on how the regulators are structured and funded, see CRS Report R43391, Independence of Federal Financial Regulators: Structure, Funding, and Other Issues, by [author name scrubbed], [author name scrubbed], and [author name scrubbed]Henry B. Hogue, Marc Labonte, and Baird Webel.

The Financial System

The financial system matches the available funds of savers and investors with borrowers and others seeking to raise funds in exchange for future payouts. Financial firms link individual savers and borrowers together. Financial firms can operate as intermediaries that issue obligations to savers andand use those funds to make loans or investments for the firm's profits. Financial firms can also operate as agents playing a custodial role, investing the funds of savers on their behalf in segregated accounts. The products, instruments, and markets used to facilitate this matching are myriad, and they are controlled and overseen by a complex system of regulators.

To help understand how the financial regulators have been organized, financial activities can be separated into distinct markets:3

- 2Banking—accepting deposits and making loans to businesses and households;

- Insurance—collecting premiums from and making payouts to policyholders triggered by a predetermined event;

- Securities—issuing

contracts that pledge to make payments from the issuer to the holder, and trading those contracts on markets. Contractsfinancial instruments that represent financial claims on companies or assets. Securities, which are often traded in financial markets, take the form of debt (a borrower and creditor relationship) and equity (an ownership relationship). One special class of securities is derivatives, which are financialcontractsinstruments whose value is based on an underlying commodity, financial indicator, or financial instrument; and - Financial Market Infrastructure—the "plumbing" of the financial system, such as trade data dissemination, payment, clearing, and settlement systems, that underlies transactions.

A distinction can be made between formal and functional definitions of these activities. Formal activities are those, as defined by regulation, exclusively permissible for entities based on their charter or license. By contrast, functional definitions acknowledge that from an economic perspective, activities performed by types of different entities can be quite similar. This tension between formal and functional activities is one reason why the Government Accountability Office (GAO), and others, has called the U.S. regulatory system fragmented, with gaps in authority, overlapping authority, and duplicative authority.43 For example, "shadow banking" refers to activities, such as lending and deposit taking, that are economically similar to those performed by formal banks, but occur in the securities markets. The activities described above are functional definitions. However, because this report focuses on regulators, it mostly concentrates on formal definitions.

The Role of Financial Regulators

Financial regulation has evolved over time, with new authority usually added in response to failures or breakdowns in financial markets and authority trimmed back during financial booms. Because of this piecemeal evolution, powers, goals, tools, and approaches vary from market to market. Nevertheless, there are some common overarching themes across markets and regulators, which are highlighted in this section.

The following provides a brief overview of what financial regulators do, specifically answering four questions:

- 1. What powers do regulators have?

- 2. What policy goals are regulators trying to accomplish?

- 3. Through what means are those goals accomplished?

- 4. Who or what is being regulated?

Regulatory Powers

Regulators implement policy using their powers, which vary by agency. Powers can be grouped into a few broad categories:

- Licensing, Chartering, or Registration. A starting point for understanding the regulatory system is that most activities cannot be undertaken unless a firm, individual, or market has received the proper credentials from the appropriate state or federal regulator. Each type of charter, license, or registration granted by the respective regulator governs the sets of financial activities that the holder is permitted to engage in. For example, a firm cannot accept federally insured deposits unless it is chartered as a bank, thrift, or credit union by a depository institution regulator. Likewise, an individual generally cannot buy and sell securities to others unless licensed as a broker-dealer.4 To be granted a license, charter, or registration, the recipient must accept the terms and conditions that accompany it. Depending on the type, those conditions could include regulatory oversight, training requirements, and a requirement to act according to a set of standards or code of ethics. Failure to meet the terms and conditions could result in fines, penalties, remedial actions, license or charter revocation, or criminal charges.

- Rulemaking. Regulators issue rules (regulations) through the rulemaking process to implement statutory mandates.5 Typically, statutory mandates provide regulators with a policy goal in general terms, and regulations fill in the specifics. Rules lay out the guidelines for how market participants may or may not act to comply with the mandate.

- Oversight and Supervision. Regulators ensure that their rules are adhered to through oversight and supervision. This allows regulators to observe market participants' behavior and instruct them to modify or cease improper behavior. Supervision may entail active, ongoing monitoring (as for banks) or investigating complaints and allegations ex post (as is common in securities markets). In some cases, such as banking, supervision includes periodic examinations and inspections, whereas in other cases, regulators rely more heavily on self-reporting. Regulators explain supervisory priorities and points of emphasis by issuing supervisory letters and guidance.

- Enforcement. Regulators can compel firms to modify their behavior through enforcement powers. Enforcement powers include the ability to issue fines, penalties, and cease and desist orders; to undertake criminal or civil actions in court, or administrative proceedings or arbitrations; and to revoke licenses and charters. In some cases, regulators initiate legal action at their own bequest or in response to consumer or investor complaints. In other cases, regulators explicitly allow consumers and investors to sue for damages when firms do not comply with regulations, or provide legal protection to firms that do comply.

- Resolution. Some regulators have the power to resolve a failing firm by taking control of the firm and initiating conservatorship (i.e., the regulator runs the firm on an ongoing basis) or receivership (i.e., the regulator winds the firm down).

In other markets, failingOther types of failing financial firms are resolved through bankruptcy, a judicial process.

Goals of Regulation

Financial regulation is primarily intended to achieve the following underlying policy outcomes:6

- Market Efficiency and Integrity. Regulators are to ensure that markets operate efficiently and that market participants have confidence in the market's integrity. Liquidity, low costs, the presence of many buyers and sellers, the availability of information, and a lack of excessive volatility are examples of the characteristics of an efficient market. Regulation can also improve market efficiency by addressing market failures, such as principal-agent problems,7 asymmetric information,8 and moral hazard.9 Regulators contribute to market integrity by ensuring that activities are transparent, contracts can be enforced, and the "rules of the game" they set are enforced. Integrity generally

also leads to greater efficiency. Regulation can also address market failures, such as principal-agent problems,7 asymmetric information,8 and moral hazard,9 that would otherwise reduce market efficiency.leads to greater efficiency.

- Consumer and Investor Protection. Regulators are to ensure that consumers or investors do not suffer from fraud, discrimination, manipulation, and theft. Regulators try to prevent exploitative or abusive practices intended to take advantage of unwitting consumers or investors. In some cases, protection is limited to enabling consumers and investors to understand the inherent risks when they enter into a contract. In other cases, protection is based on the principle of suitability—efforts to ensure that more risky products or product features are only accessible to financially sophisticated or

financiallysecure consumers and investors. - Capital Formation and Access to Credit. Regulators are to ensure that firms and consumers are able to access credit and capital to meet their needs such that credit and economic activity can grow at a healthy rate. Regulators try to ensure that capital and credit are available to all worthy borrowers, regardless of personal characteristics, such as race, gender, and location.

- Illicit Activity Prevention. Regulators are to ensure that the financial system cannot be used to support criminal and terrorist activity. Examples are policies to prevent money laundering, tax evasion, terrorism financing, and the contravention of financial sanctions.

- Taxpayer Protection. Regulators are to ensure that losses or failures in financial markets do not result in federal government payouts or the assumption of liabilities that are ultimately borne by taxpayers. Only certain types of financial activity are explicitly backed by the federal government or by regulator-run insurance schemes that are backed by the federal government, such as the Deposit Insurance Fund (DIF) run by the Federal Deposit Insurance Corporation (FDIC). Such schemes are self-financed by the insured firms through premium payments, unless the losses exceed the insurance fund, and then taxpayer money is used temporarily or permanently to fill the gap. In the case of a financial crisis, the government may decide that the "least bad" option is to provide funds in ways not explicitly promised or previously contemplated to restore stability. "Bailouts" of large failing firms in 2008 are the most well-known examples. In this sense, there may be implicit taxpayer backing of parts or all of the financial system.

- Financial Stability. Financial regulation is to maintain financial stability through

preventativepreventive and palliative measures that mitigate systemic risk. At times, financial markets stop functioning well—markets freeze, participants panic, credit becomes unavailable, and multiple firms fail. Financial instability can be localized (to a specific market or activity) or more general. Sometimes instability can be contained and quelled through market actions or policy intervention; at other times, instability metastasizes and does broader damage to the real economy. The most recent example of the latter was the financial crisis of 2007-2009. Traditionally, financial stability concerns have centered on banking, but the recent crisis illustrates the potential for systemic risk to arise in other parts of the financial system as well.

These regulatory goals are sometimes complementary, but at other times conflict with each other. For example, without an adequate level of consumer and investor protections, fewer individuals may be willing to participate in thefinancial markets, and efficiency and capital formation could suffer. But, at some point, too many consumer and investor safeguards and protections could make credit and capital prohibitively expensive, reducing market efficiency and capital formation. Regulation generally aims to seek a middle ground between these two extremes, where regulatory burden is as small as possible and regulatory benefits are as large as possible. As a result, when taking any action, regulators balance the tradeoffs between their various goals.

Types of Regulation

The types of regulation applied to market participants are diverse and vary by regulator, but can be clustered in a few categories for analytical ease:

- Prudential. The purpose of prudential regulation is to ensure an institution's safety and soundness. It focuses on risk management and risk mitigation. Examples are capital requirements for banks. Prudential regulation may be pursued to achieve the goals of taxpayer protection (e.g., to ensure that bank failures do not drain the DIF), consumer protection (e.g., to ensure that insurance firms are able to honor policyholders' claims), or financial stability (e.g., to ensure that firm failures do not lead to bank runs).

- Disclosure and Reporting. Disclosure and reporting requirements are meant to ensure that all relevant financial information is accurate and available to the public and regulators so that the former can make well-informed financial decisions and the latter can effectively monitor activities. For example, publicly held companies must file disclosure reports, such as 10-Ks. Disclosure is used to achieve the goals of consumer and investor protection, as well as market efficiency and integrity.

- Standard Setting. Regulators prescribe standards for products, markets, and professional conduct. Regulators set permissible activities and behavior for market participants. Standard setting is used to achieve a number of policy goals. For example, (1) for market integrity, policies governing conflicts of interest, such as insider trading; (2) for taxpayer protection, limits on risky activities; (3) for consumer protection, fair lending requirements to prevent discrimination; and (4) for suitability, limits on the sale of certain sophisticated financial products to accredited investors and verification that borrowers have the ability to repay mortgages.

- Competition. Regulators ensure that firms do not exercise undue monopoly power, engage in collusion or price fixing, or corner specific markets (i.e., take a dominant position to manipulate prices). Examples include antitrust policy (which is not unique to finance), antimanipulation policies, concentration limits, and the approval of takeovers and mergers. Regulators promote competitive markets to support the goals of market efficiency and integrity and consumer and investor protections. Within this area, a special policy concern related to financial stability is ensuring that no firm is "too big to fail."

- Price and Rate Regulations. Regulators set maximum or minimum prices, fees, premiums, or interest rates. Although price and rate regulation is relatively rare in federal regulation, it is more common in state regulation. An example at the federal level is the Durbin Amendment, which caps debit interchange fees for large banks.10 State-level examples are state usury laws, which cap interest rates, and state insurance rate regulation. Policymakers justify price and rate regulations on grounds of consumer and investor protections.

Prudential and disclosure and reporting regulations can be contrasted to highlight a basic philosophical difference in the regulation of securities versus banking. For example, prudential regulation is central to banking regulation, whereas securities regulation generally focuses on disclosure. This difference in approaches can be attributed to differences in the relative importance of regulatory goals. Financial stability and taxpayer protection are central to banking because of taxpayer exposure and the potential for contagion when firms fail, whereas they are not primary goals of securities markets because the federal government has made few explicit promises to make payouts in the event of losses and failures.11 Prudential regulation relies heavily on confidential information —in contrast to disclosure—that supervisors gather and formulate through examinations. Federal securities regulation is not intended to prevent failures or losses; instead, it is meant to ensure that investors are properly informed about the risks that investments pose.12 Ensuring proper disclosure is the main way to ensure that all relevant information is available to any potential investor.

Regulated Entities

How financial regulation is applied varies, partly because of the different characteristics of various financial markets and partly because of the historical evolution of regulation. The scope of regulators' purview falls into several different categories:

- 1. Regulate Certain Types of Financial Institutions. Some firms become subject to federal regulation when they obtain a particular business charter, and several federal agencies regulate only a single class of institution. Depository institutions are a good example: a new banking firm chooses its regulator when it decides which charter to obtain—national bank, state bank, credit union, etc.—and the choice of which type of depository charter may not greatly affect the institution's business mix. The Federal Housing Finance Authority (FHFA) regulates only three government-sponsored enterprises (GSEs): Fannie Mae, Freddie Mac, and the Federal Home Loan Bank system. This type of regulation gives regulators a role in overseeing all aspects of the firm's behavior, including which activities it is allowed to engage in. As a result, "functionally similar activities are often regulated differently depending on what type of institution offers the service."13

- 2. Regulate a Particular Market. In some markets, all activities that take place within that market (for example, on a securities exchange) are subject to regulation. Often, the market itself, with the regulator's approval, issues codes of conduct and other internal rules that bind its members. In some cases, regulators may then require that specific activities can be conducted only within a regulated market. In other cases, similar activities take place both on and off a regulated market (e.g., stocks can also be traded off-exchange in "dark pools"). In some cases, regulators have different authority or jurisdiction in primary markets (where financial products are initially issued) than secondary markets (where products are resold).

- 3. Regulate a Particular Financial Activity. If activities are conducted in multiple markets or across multiple types of firms, another approach is to regulate a particular type or set of transactions, regardless of where the business occurs or which entities are engaged in it. For example, on the view that consumer financial protections should apply uniformly to all transactions, the Dodd-Frank Act created the

CFPBConsumer Financial Protection Bureau (CFPB), with authority (subject to certain exemptions) over financial products offered to consumers by an array of firms.

Because it is difficult to ensure that functionally similar financial activities are legally uniform, all three approaches are needed and sometimes overlap in any given area. Stated differently, risks can emanate from firms, markets, or products, and if regulation does not align, risks may not be effectively mitigated. Market innovation also creates financial instruments and markets that fall between industry divisions. Congress and the courts have often been asked to decide which agency has jurisdiction over a particular financial activity.

The Federal Financial Regulators

Table 1 sets out the current federal financial regulatory structure. Regulators can be categorized into the three main areas of finance—banking (depository), securities, and insurance (where state, rather than federal, regulators play a dominant role). There are also targeted regulators for specific financial activities (consumer protection) and markets (agricultural finance and housing finance). The table does not include interagency-coordinating bodies, standard-setting bodies, international organizations, or state regulators, which are described later in the report. Appendix A describes changes to this table since the 2008 financial crisis.

|

Regulatory Agency |

Institutions Regulated |

Other Notable Authority |

|

Depository Regulators |

||

|

Federal Reserve |

Bank holding companies and certain subsidiaries (e.g., foreign subsidiaries), financial holding companies, securities holding companies, and savings and loan holding companies Primary regulator of state banks that are members of the Federal Reserve System, foreign banking organizations operating in the United States, Edge Corporations, and any firm or payment system designated as systemically significant by the FSOC |

Operates discount window ("lender of last resort") for depositories; operates payment system; conducts monetary policy |

|

Office of the Comptroller of the Currency (OCC) |

|

|

|

Federal Deposit Insurance Corporation (FDIC) |

Federally insured depository institutions Primary regulator of state banks that are not members of the Federal Reserve System and state-chartered thrift institutions |

Operates deposit insurance for banks; resolves failing banks |

|

National Credit Union Administration (NCUA) |

Federally chartered or federally insured credit unions |

Operates deposit insurance for credit unions; resolves failing credit unions |

|

Securities Markets Regulators |

||

|

Securities and Exchange Commission (SEC) |

Securities exchanges Nationally recognized statistical rating organizations Security-based swap (SBS) dealers, major SBS participants, and SBS execution facilities

|

Approves rulemakings by self-regulated organizations |

|

Commodity Futures Trading Commission (CFTC) |

Futures exchanges, futures commission merchants, commodity pool operators, commodity trading advisors, derivatives Swap dealers, major swap participants, swap execution facilities, and swap data repositories |

Approves rulemakings by self-regulated organizations |

|

Government-Sponsored Enterprise Regulators |

||

|

Federal Housing Finance Agency (FHFA) |

Fannie Mae, Freddie Mac, and Federal Home Loan Banks |

Acting as conservator (since Sept. 2008) for Fannie and Freddie |

|

Farm Credit Administration (FCA) |

Farm Credit System , Farmer Mac |

|

|

Consumer Protection Regulator |

||

|

Consumer Financial Protection Bureau (CFPB) |

Nonbank mortgage-related firms, private student lenders, payday lenders, and larger "consumer financial entities" determined by the CFPB Statutory exemptions for certain markets Rulemaking authority for consumer protection for all banks; supervisory authority for banks with over $10 billion in assets |

|

Source: Congressional Research Service (CRS).

Financial firms may be subject to more than one regulator because they may engage in multiple financial activities, as illustrated in Figure 1. For example, a firm may be overseen by an institution regulator and by an activity regulator when it engages in a regulated activity and a market regulator when it participates in a regulated market. The complexity of the figure illustrates the diverse roles and responsibilities assigned to various regulators.

|

Figure 1. Regulatory Jurisdiction by Agency and Type of Regulation |

|

|

Source: Government Accountability Office (GAO), Financial Regulation, GAO-16-175, February 2016, Figure 2. |

Furthermore, financial firms may form holding companies with separate legal subsidiaries that allow subsidiaries within the same holding company to engage in more activities than is permissible within any one subsidiary. Because of charter-based regulation, certain financial activities must be segregated in separate legal subsidiaries. However, as a result of the Gramm-Leach-Bliley Act in 1999 (GLBA; P.L. 106-102) and other regulatory and policy changes that preceded it, these different legal subsidiaries may be contained within the same financial holding companies (i.e., conglomerates that are permitted to engage in a broad array of financially related activities). For example, a banking subsidiary is limited to permissible activities related to the "business of banking," but is allowed to affiliate with another subsidiary that engages in activities that are "financial in nature."14 As a result, each subsidiary is assigned a primary regulator, and firms with multiple subsidiaries may have multiple institution regulators. If the holding company is a bank holding company or thrift holding company (with at least one banking or thrift subsidiary, respectively), then the holding company is regulated by the Fed.15

Figure 2 shows a stylized example of a special type of bank holding company, known as a financial holding company. This financial holding company would be regulated by the Fed at the holding company level. Its national bank would be regulated by the OCCOffice of the Comptroller of the Currency (OCC), its securities subsidiary would be regulated by the SECSecurities and Exchange Commission (SEC), and its loan company might be regulated by the CFPB. These are only the primary regulators for each box in Figure 2; as noted above, it might have other market or activity regulators as well, based on its lines of business.

|

|

Source: CRS. |

Depository Institution Regulators

Regulation of depository institutions (i.e., banks and credit unions) in the United States has evolved over time into a system of multiple regulators with overlapping jurisdictions.16 There is a dual banking system, in which each depository institution is subject to regulation by its chartering authority: state or federal. Even if state chartered, virtually all depository institutions are federally insured, so both state and federal institutions are subject to at least one federal primary regulator (i.e., the federal authority responsible for examining the institution for safety and soundness and for ensuring its compliance with federal banking laws). Depository institutions have three broad types of charter—commercial banks, thrifts17 (also known as savings banks or savings associations, and previously known as savings and loans), and credit unions.18, and credit unions.17 For any given institution, the primary regulator depends on its type of charter. The primary federal regulator for

- national banks and thrifts

18(also known as savings and loans)is the OCC, their chartering authority; - state-chartered banks that are members of the Federal Reserve System is the Federal Reserve;

- state-chartered thrifts and banks that are not members of the Federal Reserve System is the FDIC;

- foreign banks operating in the United States is the Fed or OCC, depending on the type;

- credit unions—if federally chartered or federally insured—is the National Credit Union Administration (NCUA), which administers a deposit insurance fund separate from the FDIC's.

National banks, state-chartered banks, and thrifts are also subject to the FDIC regulatory authority, because their deposits are covered by FDIC deposit insurance. Primary regulators' responsibilities are illustrated in Figure 3.

|

|

Source: Federal Reserve, Purposes and Functions, October 2016, Figure 5.3. |

Whereas bank and thrift regulators strive for consistency among themselves in how institutions are regulated and supervised, credit unions are regulated under a separate regulatory framework from banks.

Because banks receive deposit insurance from the FDIC and have access to the Fed's discount window, they expose taxpayers to the risk of losses if they fail.19 Banks also play a central role in the payment system, the financial system, and the broader economy. As a result, banks are subject to safety and soundness (prudential) regulation that most other financial firms are not subject to at the federal level.20 Safety and soundness regulation uses a holistic approach, evaluating (1) each loan, (2) the balance sheet of each institution, and (3) the risks in the system as a whole. Each loan creates risk for the lender. The overall portfolio of loans extended or held by a bank, in relation to other assets and liabilities, affects that institution's stability. The relationship of banks to each other, and to wider financial markets, affects the financial system's stability.

Banks are required to keep capital in reserve against the possibility of a drop in value of loan portfolios or other risky assets. Banks are also required to be liquid enough to meet unexpected funding outflows. Federal financial regulators take into account compensating assets, risk-based capital requirements, the quality of assets, internal controls, and other prudential standards when examining the balance sheets of covered lenders.

When regulators determine that a bank is taking excessive risks, or engaging in unsafe and unsound practices, they have a number of powerful tools at their disposal to reduce risk to the institution (and ultimately to the federal DIF). Regulators can require banks to reduce specified lending or financing practices, dispose of certain assets, and order banks to take steps to restore sound balance sheets. Banks must comply because regulators have "life-or-death" options, such as withdrawing their charter or deposit insurance or seizing the bank outright.

The federal banking agencies are briefly discussed below. Although these agencies are the banks' institution-based regulators, banks are also subject to CFPB regulation for consumer protection, and to the extent that banks are participants in securities or derivatives markets, those activities are also subject to regulation by the SEC and the Commodity Futures Trading Commission (the CFTC).

Office of the Comptroller of the Currency

The OCC was created in 1863 as part of the Department of the Treasury to supervise federally chartered banks ("national" banks; 13 Stat. 99). The OCC regulates a wide variety of financial functions, but only for federally chartered banks. The head of the OCC, the Comptroller of the Currency, is also a member of the board of the FDIC and a director of the Neighborhood Reinvestment Corporation. The OCC has examination powers to enforce its responsibilities for the safety and soundness of nationally chartered banks. The OCC has strong enforcement powers, including the ability to issue cease and desist orders and revoke federal bank charters. Pursuant to the Dodd-Frank Act, the OCC is the primary regulator for federally chartered thrift institutions.

Federal Deposit Insurance Corporation

Following bank panics during the Great Depression, the FDIC was created in 1933 to provide assurance to small depositors that they would not lose their savings if their bank failed (P.L. 74-305, 49 Stat. 684). The FDIC is an independent agency that insures deposits (up to $250,000 for individual accounts), examines and supervises financial institutions, and manages receiverships, assuming and disposing of the assets of failed banks. The FDIC is the primary federal regulator of state banks that are not members of the Federal Reserve System and state-chartered thrift institutions. In addition, the FDIC has broad jurisdiction over nearly all banks and thrifts, whether federally or state chartered, that carry FDIC insurance.

Backing deposit insurance is the DIF, which is managed by the FDIC and funded by risk-based assessments levied on depository institutions. The fund is used primarily for resolving failed or failing institutions. To safeguard the DIF, the FDIC uses its power to examine individual institutions and to issue regulations for all insured depository institutions to monitor and enforce safety and soundness. Acting under the principles of "prompt corrective action" and "least cost resolution," the FDIC has powers to resolve troubled banks, rather than allowing failing banks to enter the bankruptcy process. The Dodd-Frank Act also expanded the FDIC's role in resolving other types of troubled financial institutions that pose a risk to financial stability through the Orderly Liquidation Authority.

The Federal Reserve

The Federal Reserve System was established in 1913 as the nation's central bank following the Panic of 1907 to provide stability in the banking sector (P.L. 63-43, 38 Stat. 251).21 The system consists of the Board of Governors in Washington, DC, and 12 regional reserve banks. In its regulatory role, the Fed has safety and soundness examination authority for a variety of lending institutions, including bank holding companies; U.S. branches of foreign banks; and state-chartered banks that are members of the Federal Reserve System. Membership in the system is mandatory for national banks and optional for state banks. Members must purchase stock in the Fed.

The Fed regulates the largest, most complex financial firms operating in the United States. Under the GLBA, the Fed serves as the umbrella regulator for financial holding companies. The Dodd-Frank Act made the Fed the primary regulator of all nonbank financial firms that are designated as systemically significant by the Financial Stability Oversight Council (of which the Fed is a member). All bank holding companies with more than $50 billion in assets and designated nonbanks are subject to enhanced prudential regulation by the Fed. In addition, the Dodd-Frank Act made the Fed the principal regulator for savings and loan holding companies and securities holding companies, a new category of institution formerly defined in securities law as an investment bank holding company.

The Fed's responsibilities are not limited to regulation. As the nation's central bank, it conducts monetary policy by targeting short-term interest rates. The Fed also acts as a "lender of last resort" by making short-term collateralized loans to banks through the discount window. It also operates some parts and regulates other parts of the payment system. Title VIII of the Dodd-Frank Act gave the Fed additional authority to set prudential standards for payment systems that have been designated as systemically important.

National Credit Union Administration

The NCUA, originally part of the Farm Credit Administration, became an independent agency in 1970 (P.L. 91-206, 84 Stat. 49). The NCUA is the safety and soundness regulator for all federal credit unions and those state credit unions that elect to be federally insured. It administers a Central Liquidity Facility, which is the credit union lender of last resort, and the National Credit Union Share Insurance Fund, which insures credit union deposits. The NCUA also resolves failed credit unions. Credit unions are member-owned financial cooperatives, and they must be not-for-profit institutions.22

Consumer Financial Protection Bureau

Before the financial crisis, jurisdiction over consumer financial protection was divided among a number of agencies (see Figure A-1). Title X of the Dodd-Frank Act created the CFPB to enhance consumer protection and bring the consumer protection regulation of depository and nondepository financial institutions into closer alignment.23 The bureau is housed within—but independent from—the Federal Reserve. The director of the CFPB is also on the FDIC's board of directors. The Dodd-Frank Act granted new authority and transferred existing authority from a number of agencies to the CFPB over an array of consumer financial products and services (including deposit taking, mortgages, credit cards and other extensions of credit, loan servicing, check guaranteeing, consumer report data collection, debt collection, real estate settlement, money transmitting, and financial data processing). The CFPB administers rules that, in its view, protect consumers by setting disclosure standards, setting suitability standards, and banning abusive and discriminatory practices.

The CFPB also serves as the primary federal consumer financial protection supervisor and enforcer of federal consumer protection laws over many of the institutions that offer these products and services. However, the bureau's regulatory authority varies based on institution size and type. Regulatory authority differs for (1) depository institutions with more than $10 billion in assets, (2) depository institutions with $10 billion or less in assets, and (3) nondepositories. The CFPB can issue rules that apply to depository institutions of all sizes, but can only supervise institutions with more than $10 billion in assets. For depositories with less than $10 billion in assets, the primary depository regulator continues to supervise for consumer compliance. The Dodd-Frank Act also explicitly exempts a number of different entities and consumer financial activities from the bureau's supervisory and enforcement authority. Among the exempt entities are

- merchants, retailers, or sellers of nonfinancial goods or services, to the extent that they extend credit directly to consumers exclusively for the purpose of enabling consumers to purchase such nonfinancial goods or services;

- automobile dealers;

- real estate brokers and agents;

- financial intermediaries registered with the SEC or the CFTC; and

- insurance companies.

In some areas where the CFPB does not have jurisdiction, the Federal Trade Commission (FTC) retains consumer protection authority. State regulators also retain a role in consumer protection.24

Securities Regulation

For regulatory purposes, securities markets can be divided into derivatives and other types of securities. Derivatives, depending on the type, are regulated by the CFTC or the SEC. Other types of securities fall under the SEC's jurisdiction. Standard-setting bodies and other self-regulatory organizations (SROs) play a special role in securities regulation, and they are overseen by the SEC or the CFTC. In addition, banking regulators oversee the securities activities of banks. Banks are major participants in some parts of securities markets.

Securities and Exchange Commission

The New York Stock Exchange dates from 1793. Following the stock market crash of 1929, the SEC was created as an independent agency in 1934 to enforce newly written federal securities laws (P.L. 73-291, 48 Stat. 881). Thus, when Congress created the SEC, stock and bond market institutions and mechanisms were already well-established, and federal regulation was grafted onto the existing structure.25

The SEC has jurisdiction over the following:

- Participants in securities markets

- issuers—firms that issue

sharessecurities (e.g., equity and bonds), - asset managers—investment advisers and investment companies (e.g., mutual funds and private funds) that are custodial agents investing on behalf of clients,

- intermediaries (e.g., broker-dealers, securities underwriters, and securitizers)

- experts who are neither issuing nor buying securities (e.g., credit rating agencies and research analysts);

- Securities markets (e.g., stock exchanges) and market utilities (e.g., clearinghouses) where securities are traded, cleared, and settled; and

- Securities products (e.g., money market accounts and security-based swaps).

The SEC is not primarily concerned with ensuring the safety and soundness of the firms it regulates, but rather with "protect[ing] investors, maintain[ing] fair, orderly, and efficient markets, and facilitat[ing] capital formation."26 This distinction largely arises from the absence of government guarantees for securities investors comparable to deposit insurance. The SEC generally does not have the authority to limit risks taken by securities firms,27 nor the ability to prop up a failing firm.

Firms that sell securities—stocks and bonds—to the public are required to register with the SEC. Registration entails the publication of detailed information about the firm, its management, the intended uses for the funds raised through the sale of securities, and the risks to investors. The initial registration disclosures must be kept current through the filing of periodic financial statements: annual and quarterly reports (as well as special reports when there is a material change in the firm's financial condition or prospects).

Beyond these disclosure requirements, and certain other rules that apply to corporate governance, the SEC does not have any direct regulatory control over publicly traded firms. Bank regulators are expected to identify unsafe and unsound banking practices in the institutions they supervise, and they have the power to intervene and prevent banks from taking excessive risks. The SEC has no comparable authority; the securities laws simply require that risks be disclosed to investors. Registration with the SEC, in other words, is in no sense a guarantee that a security is a good or safe investment.

Besides publicly traded corporations, a number of securities market participants are also required to register with the SEC (or with one of the industry SROs that the SEC oversees). These include stock exchanges, securities brokerages (and numerous classes of their personnel), mutual funds, auditors, investment advisers, and others. To maintain their registered status, all these entities must comply with rules meant to protect public investors, prevent fraud, and promote fair and orderly markets. The degree of protection granted to investors depends on their level of sophistication. For example, only "accredited investors" that have, for example, high net worth, can invest in riskier hedge funds and private equity funds. Originally, de minimis exemptions to regulation of mutual funds and investment advisers created space for the development of a trillion-dollar hedge fund industry. Under the Dodd-Frank Act, private advisers, including hedge funds and private equity funds, with more than $150 million in assets under management must register with the SEC, but maintain other exemptions.

Several provisions of law and regulation protect brokerage customers from losses arising from brokerage firm failure. The Securities Investor Protection Corporation (SIPC), a private nonprofit created by Congress in 1970 and overseen by the SEC, operates an insurance scheme funded by assessments on brokers-dealers (and with a backup line of credit with the U.S. Treasury). SIPC guarantees customer accounts up to $500,000 for losses arising from brokerage failure or fraud. Unlike the FDIC, however, SIPC does not protect accounts against market losses or examine broker-dealers, and it has no regulatory powers.

Some securities markets are exempted from parts of securities regulation. Prominent examples include the following:

- Foreign exchange. Buying and selling currencies is essential to foreign trade and investment, and the exchange rate determined by traders has major implications for a country's macroeconomic policy. The market is one of the largest in the world, with trillions of dollars of average daily turnover.28 Nevertheless, no U.S. agency has regulatory authority over the foreign exchange market.

Trading in currencies takes place among large global banks, central banks, hedge funds and other currency speculators, commercial firms involved in imports and exports, fund managers, and retail brokers. There is no centralized marketplace, but rather a number of proprietary electronic platforms that have largely supplanted the traditional telephone broker market.

- Treasury securities. Treasury securities were exempted from SEC regulation by the original securities laws of the 1930s. In 1993, following a successful cornering of a Treasury bond auction by Salomon Brothers, Congress passed the Government Securities Act Amendments of 1993 (P.L. 103-202

, 107 Stat. 2344), which required brokers and dealers that were not already registered with the SEC to register as government securities dealers, extended antifraud and antimanipulation provisions of the federal securities laws to government securities brokers and dealers, and gave the U.S. Treasury authority to promulgate rules governing transactions. (Existing broker-dealer registrants were simply required to notify the SEC that they were in the government securities business.) Nevertheless, the government securities market remains much more lightly regulated than the corporate securities markets. Regulatory jurisdiction over various aspects of the Treasury market is fragmented across multiple regulators. The SEC has no jurisdiction over the primary market.29 Since 2017, the Financial Industry Regulatory Authority (FINRA) has required broker-dealers to report Treasury market transactions to a central (nonpublic) repository.

- Municipal securities. Municipal securities were initially exempted from SEC regulation. In 1975, the Municipal Securities Rulemaking Board was created and firms transacting in municipal securities were required to register with the SEC as broker-dealers. The Dodd-Frank Act required municipal advisors to register with the SEC. However, issuers of municipal securities remain exempt from SEC oversight, partly because of federalism issues.30

- Private securities. The securities laws provide for the private sales of securities, which are

notsubject tothereduced registration andextensivedisclosure requirements that apply to public securities. However, private securities are subject to antifraud provisions of federal securities laws.PrivateGenerally, private placements of securities cannot be sold to the general public and may only be offered to limited numbers of "accredited investors" who meet certain asset tests.(Most purchasers are life insurers and other institutional investors.)There are also restrictions on the resale of private securities.

The size of the private placement market is subject to considerable variation from year to year, but at times the value of securities sold privately exceeds what is sold into the public market. In recent decades, venture capitalists and private equity firms have come to play important roles in corporate finance. The former typically purchase interests in private firms, which may be sold later to the public, whereas the latter often purchase all the stock of publicly traded companies and take them private.

Commodity Futures Trading Commission

The CFTC was created in 1974 to regulate commodities futures and options markets, which at the time were poised to expand beyond their traditional base in agricultural commodities to encompass contracts based on financial variables, such as interest rates and stock indexes.31 The CFTC was given "exclusive jurisdiction" over all contracts that were "in the character of" options or futures contracts, and such instruments were to be traded only on CFTC-regulated exchanges. In practice, exclusive jurisdiction was impossible to enforce, as off-exchangeover-the-counter derivatives contracts, such as swaps —that were not exchange-traded—proliferated. In the Commodity Futures Modernization Act of 2000 (P.L. 106-554), Congress exempted swaps from CFTC regulation, but this exemption was repealed by the Dodd-Frank Act following problems with derivatives in the financial crisis, including large losses at the American International Group (AIG) that led to its federal rescue.

The Dodd-Frank Act greatly expanded the CFTC's jurisdiction by eliminating exemptions for certain over-the-counter derivatives.32 As a result, swap dealers, major swap participants, swap clearing organizations, swap execution facilities, and swap data repositories are required to register with the CFTC. These entities are subject to reporting requirements and business conduct standards contained in statute or promulgated as CFTC rules. The Dodd-Frank Act required swaps to be cleared through a central clearinghouse and traded on exchanges, where possible.

The CFTC's mission is to prevent excessive speculation, manipulation of commodity prices, and fraud. Like the SEC, the CFTC oversees SROs—the futures exchanges and the National Futures Association—and requires the registration of a range of industry firms and personnel, including futures commission merchants (brokers), floor traders, commodity pool operators, and commodity trading advisers.

Like the SEC, the CFTC does not directly regulate the safety and soundness of individual firms, with the exception of a net capital rule for futures commission merchants and capital standards pursuant to the Dodd-Frank Act for swap dealers and major swap participants.

Standard-Setting Bodies and Self-Regulatory Organizations

Self-regulatory organizations play important roles in the regulation of securities and derivatives. National securities exchanges (e.g., the New York Stock Exchange) and clearing and settlement systems may register as SROs with the SEC or CFTC, making them subject to SEC or CFTC oversight.33 According to the SEC, "SROs must create rules that allow for disciplining members for improper conduct and for establishing measures to ensure market integrity and investor protection. SRO proposed rules are published for comment before final SEC review and approval."34 Title VIII of the Dodd-Frank Act gave the SEC and CFTC additional prudential regulatory authority over clearing and settlement systems that have been designated as systemically important (exchanges, contract markets, and other entities were exempted).35

One particularly important type of SRO in the regulatory system is the group of standard-setting bodies. Most securities or futures markets participants must register and meet professional conduct and qualification standards. The SEC and CFTC have delegated responsibility for many of these functions to official standard-setting bodies, such as the following:

- FINRA—The Financial Industry Regulatory Authority writes and enforces rules for brokers and dealers and examines them for compliance.

- MSRB—The Municipal Securities Rulemaking Board establishes rules for municipal advisors and dealers in the municipal securities market; conducts required exams and continuing education for municipal market professionals; and provides guidance to SEC and others for compliance with and enforcement of MSRB rules.

- NFA—The National Futures Association develops and enforces rules in futures markets, requires registration, and conducts fitness examinations for a range of derivatives markets participants, including futures commission merchants, commodity pool operators, and commodity trading advisors.

- FASB—The Financial Accounting Standards Board establishes financial accounting and reporting standards for companies and nonprofits.

- PCAOB—The Public Company Accounting Oversight Board oversees private auditors of publicly held companies and broker-dealers.

These standard-setting bodies are typically set up as private nonprofits overseen by boards and funded through member fees or assessments. Although their authority may be enshrined in statute, they are not governmental entities. Regulators delegate rulemaking powers to them and retain the right to override their rulemakings.

Regulation of Government-Sponsored Enterprises

Congress created GSEs as privately owned institutions with limited missions and charters to support the mortgage and agricultural credit markets. It also created dedicated regulators—currently, the Federal Housing Finance Agency (FHFA) and the Farm Credit Administration (FCA)—exclusively to oversee the GSEs.

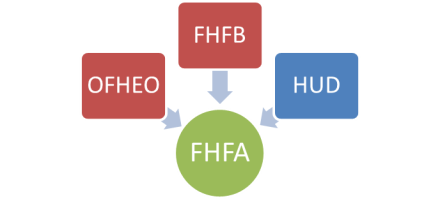

Federal Housing Finance Agency

The Housing and Economic Recovery Act of 2008 (P.L. 110-289, 122 Stat. 2654) created the FHFA during the housing crisis in 2008 to consolidate and strengthen regulation of a group of housing finance-related GSEs: Fannie Mae, Freddie Mac, and the Federal Home Loan Banks.36 The FHFA succeeded the Office of Federal Housing Enterprise Oversight (OFHEO), which regulated Fannie and Freddie, and the Federal Housing Finance Board (FHFB), which regulated the Federal Home Loan Banks. The act also transferred authority to set affordable housing and other goals for the GSEs from the Department of Housing and Urban Development to the FHFA.

Facing concerns about the GSEs' ongoing viability, the impetus to create the FHFA came from concerns about risks—including systemic risk—posed by Fannie and Freddie. These two GSEs were profit-seeking, shareholder-owned corporations that took advantage of their government-sponsored status to accumulate undiversified investment portfolios of more than $1.5 trillion, consisting almost exclusively of home mortgages (and securities and derivatives based on those mortgages).37

OFHEO was seen as lacking sufficient authority and independence to keep risk-taking at the GSEs in check. The FHFA was given enhanced safety and soundness powers resembling those of the federal bank regulators. These powers included the ability to set capital standards, to order the enterprises to cease any activity or divest any asset that posed a threat to financial soundness, and to replace management and assume control of the firms if they became seriously undercapitalized.

One of the FHFA's first actions was to place both Fannie and Freddie in conservatorship to prevent their failure. Fannie and Freddie continue to operate, under agreements with FHFA and the U.S. Treasury, with more direct involvement of the FHFA in the enterprises' decisionmaking. The Treasury has provided capital to the GSEs (a combined $187 billion to date), by means of preferred stock purchases, to ensure that each remains solvent. In return, the government received warrants equivalent to a 79.9% equity ownership position in the firms and sweeps the firms' retained earnings above a certain level of net worth.38

Farm Credit Administration

The FCA was created in 1933 during a farming crisis that was causing the widespread failure of institutions lending to farmers. Following another farming crisis, it was made an "arm's length" regulator with increased rulemaking, supervision, and enforcement powers by the Farm Credit Amendments Act of 1985 (P.L. 99-205). The FCA oversees the Farm Credit System, a group of GSEs made up of the cooperatively owned Farm Credit Banks and Agricultural Credit Banks, the Funding Corporation, which is owned by the Credit Banks, and Farmer Mac, which is owned by shareholders.3938 Unlike the housing GSEs, the Farm Credit System operates in both primary and secondary agricultural credit markets. For example, the FCA regulates these institutions for safety and soundness, through capital requirements.

Regulatory Umbrella Groups

The need for coordination and data sharing among regulators has led to the formation of innumerable interagency task forces to study particular market episodes and make recommendations to Congress. Three interagency organizations have permanent status: the Financial Stability Oversight Council, the Federal Financial Institution Examination Council, and the President's Working Group on Financial Markets. The latter is composed of the Treasury Secretary and the Fed, SEC, and CFTC Chairmen; because the working group has not been active in recent years, it is not discussed in detail.

Financial Stability Oversight Council

Few would argue that regulatory failure was solely to blame for the financial crisis, but it is widely considered to have played a part. In February 2009, then-Treasury Secretary Timothy Geithner summed up two key problem areas:

Our financial system operated with large gaps in meaningful oversight, and without sufficient constraints to limit risk. Even institutions that were overseen by our complicated, overlapping system of multiple regulators put themselves in a position of extreme vulnerability. These failures helped lay the foundation for the worst economic crisis in generations.40

One definition of systemic risk is that it occurs when each firm manages risk rationally from its own perspective, but the sum total of those decisions produces systemic instability under certain conditions. Similarly, regulators charged with overseeing individual parts of the financial system may satisfy themselves that no threats to stability exist in their respective sectors, but fail to detect systemic risk generated by unsuspected correlations and interactions among the parts of the global system. The Federal Reserve was for many years a kind of default systemic regulator, expected to clean up after a crisis, but with limited authority to take ex ante preventive measures. Furthermore, the Fed's authority was mostly limited to the banking sector. The Dodd-Frank Act created the FSOC to assume a coordinating role, with the single mission of detecting systemic stress before a crisis can take hold (and identifying firms whose individual failure might trigger cascading losses with system-wide consequences).

FSOC is chaired by the Secretary of the Treasury, and the other voting members are the heads of the Fed, FDIC, OCC, NCUA, SEC, CFTC, FHFA, and CFPB, and a member appointed by the President with insurance expertise. Five nonvoting members serve in an advisory capacity—the director of the Office of Financial Research (OFR, which was created by the Dodd-Frank Act to support the FSOC), the head of the Federal Insurance Office (FIO, created by the Dodd-Frank Act), a state banking supervisor, a state insurance commissioner, and a state securities commissioner.

The FSOC is tasked with identifying risks to financial stability and responding to emerging systemic risks, while promoting market discipline by minimizing moral hazard arising from expectations that firms or their counterparties will be rescued from failure. The FSOC's duties include

- collecting information on financial firms from regulators and through the OFR;

- monitoring the financial system to identify potential systemic risks;

- proposing regulatory changes to Congress to promote stability, competitiveness, and efficiency;

- facilitating information sharing and coordination among financial regulators;

- making regulatory recommendations to financial regulators, including "new or heightened standards and safeguards";

- identifying gaps in regulation that could pose systemic risk;

- reviewing and commenting on new or existing accounting standards issued by any standard-setting body; and

- providing a forum for the resolution of jurisdictional disputes among council members. The FSOC may not impose any resolution on disagreeing members, however.

In addition, the council is required to provide an annual report and testimony to Congress.

In contrast to some proposals to create a systemic risk regulator, the Dodd-Frank Act did not give the council authority (beyond the existing authority of its individual members) to respond to emerging threats or close regulatory gaps it identifies. In many cases, the council can only make regulatory recommendations to member agencies or Congress—it cannot impose change.

Although the FSOC does not have direct supervisory authority over any financial institution, it plays an important role in regulation because it designates firms and financial market utilities as systemically important. Designated firms come under a consolidated supervisory safety and soundness regime administered by the Fed that may be more stringent than the standards that apply to nonsystemic firms. (FSOC is also tasked with making recommendations to the Fed on standards for that regime.) In a limited number of other cases, regulators must seek FSOC advice or approval before exercising new powers under the Dodd-Frank Act.

Federal Financial Institution Examinations Council

The Federal Financial Institutions Examination Council (FFIEC) was created in 1979 (P.L. 95-630, 92 Stat. 3641) as a formal interagency body to coordinate federal regulation of lendingdepository institutions. Through the FFIEC, the federal banking regulators issue a single set of reporting forms for covered institutions. The FFIEC also attempts to harmonize auditing principles and supervisory decisions. The FFIEC is made up of the Fed, OCC, FDIC, CFPB, NCUA, and a representative of the State Liaison Committee,4140 each of which employs examiners to enforce safety and soundness regulations for lendingdepository institutions.

Federal financial institution examiners evaluate the risks of covered institutions. The specific safety and soundness concerns common to the FFIEC agencies can be found in the handbooks employed by examiners to monitor lenders. Each subject area of the handbook can be updated separatelydepositories. Examples of safety and soundness subject areas include important indicators of risk, such as capital adequacy, asset quality, liquidity, and sensitivity to market risk.

Nonfederal Financial Regulation

Insurance42

41

Insurance companies, unlike banks and securities firms, have been chartered and regulated solely by the states for the past 150 years.4342 There are no federal regulators of insurance akin to those for securities or banks, such as the SEC or the OCC, respectively.

The limited federal role stems from both Supreme Court decisions and congressional action. In the 1868 case Paul v. Virginia, the Court found that insurance was not considered interstate commerce, and thus not subject to federal regulation. This decision was effectively reversed in the 1944 decision U.S. v. South-Eastern Underwriters Association. In 1945, Congress passed the McCarran-Ferguson Act (15 U.S.C. §1011 et seq.) specifically preserving the states' authority to regulate and tax insurance and also granting a federal antitrust exemption to the insurance industry for "the business of insurance."

Each state government has a department or other entity charged with licensing and regulating insurance companies and those individuals and companies selling insurance products. States regulate the solvency of the companies and the content of insurance products as well as the market conduct of companies. Although each state sets its own laws and regulations for insurance, the National Association of Insurance Commissioners (NAIC) acts as a coordinating body that sets national standards through model laws and regulations. Models adopted by the NAIC, however, must be enacted by the states before having legal effect, which can be a lengthy and uncertain process. The states have also developed a coordinated system of guaranty funds, designed to protect policyholders in the event of insurer insolvency.

Although the federal government's role in regulating insurance is relatively limited compared with its role in banking and securities, its role has increased over time. Various court cases interpreting McCarran-Ferguson's antitrust exemption have narrowed the definition of the business of insurance, whereas Congress has expanded the federal role in GLBA and the Dodd-Frank Act through federal oversight. For example, the Federal Reserve has regulatory authority over bank holding companies with insurance operations as well as insurers designated as systemically important by FSOC. In addition, the Dodd-Frank Act created the FIO to monitor the insurance industry and represent the United States in international fora relating to insurance. Various federal laws have also exempted aspects of state insurance regulation, such as state insurer licensing laws for a small category of insurers in the Liability Risk Retention Act of 1986 (15 U.S.C. §§3901 et seq.) and state insurance producer licensing laws in the National Association of Registered Agents and Brokers Reform Act of 2015 (P.L. 114-1, Title II).

Other State Regulation

In addition to insurance, there are state regulators for banking and securities markets. State regulation also plays a role in nonbank consumer financial protection, although that role has diminished as the federal role has expanded.

As noted above, banking is a dual system in which institutions choose to charter at the state or federal level. A majority of community banks are state chartered. There are more than four times as many state-chartered as there are nationally chartered commercial banks, but state-chartered commercial banks had less than one-half as many assets as nationally chartered banks at the end of 2016. For thrifts, nationally chartered thrifts make up less than half of all thrifts, but have 65% of thrift assets.44

Although state-chartered banks have state regulators as their primary regulators, federal regulators still play a regulatory role. Most depositories have FDIC deposit insurance; to qualify, they must meet federal safety and soundness standards, such as prompt corrective action ratios. In addition, many state banks (and a few state thrifts) are members of the Fed, which gives the Fed supervisory authority over them. State banks that are not members of the Federal Reserve System are supervised by the FDIC. However, even nonmember Fed banks must meet the Fed's reserve requirements.

In securities markets, "The federal securities acts expressly allow for concurrent state regulation under blue sky laws. The state securities acts have traditionally been limited to disclosure and qualification with regard to securities distributions. Typically, the state securities acts have general antifraud provisions to further these ends."4543 Blue sky laws are intended to protect investors against fraud. Registration is another area where states play a role. In general, investment advisers who are granted exemptions from SEC registration based on size are overseen by state regulators. Broker-dealers, by contrast, are typically subject to both state and federal regulation. The National Securities Markets Improvement Act of 1996 (P.L. 104-290, 110 Stat. 3416) invalidated state securities law in a number of other areas (including capital, margin, bonding, and custody requirements) to reduce the overlap between state and federal securities regulation.

States also play a role in enforcement by taking enforcement actions against financial institutions and market participants. This role is large in states with a large financial industry, such as New York.

Federal regulation plays a central role in determining the scope of state regulation because of federal preemption laws (that apply federal statute to state-chartered institutions) and state "wild card" laws (that allow state-chartered institutions to automatically receive powers granted to federal-chartered institutions).4644 For example, firms, products, and professionals that have registered with the SEC are not required to register at the state level.47

International Standards and Regulation

Financial regulation must also take into account the global nature of financial markets. More specifically, U.S. regulators must account for foreign financial firms operating in the United States and foreign regulators must account for U.S. firms operating in their jurisdictions. Sometimes regulators grant each other equivalency (i.e., leaving regulation to the home country) when firms wish to operate abroad, and other times foreign firms are subjected to domestic regulation.

If financial activity migrates to jurisdictions with laxer regulatory standards, it could undermine the effectiveness of regulation in jurisdictions with higher standards. To ensure consensus and consistency across jurisdictions, U.S. regulators and the Treasury DepartmentDepartment of the Treasury participate in international fora with foreign regulators to set broad international regulatory standards or principles that members voluntarily pledge to follow. Given the size and significance of the U.S. financial system, U.S. policymakers are generally viewed as playing a substantial role in setting these standards. Although these standards are not legally binding, U.S. regulators generally implement rulemaking or Congress passes legislation to incorporate them.4846 There are multiple international standard-setting bodies, including one corresponding to each of the three main areas of financial regulation:

- the Basel Committee on Banking Supervision for banking regulation,

- the International Organization of Securities Commissions (IOSCO) for securities and derivatives regulation, and

- the International Association of Insurance Supervisors (IAIS) for insurance regulation.

49

47In addition, the G-20, an international body consisting of the United States, the European Union, and 18 other economies, spearheaded international coordination of regulatory reform after the financial crisis. It created the Financial Stability Board (FSB), consisting of the finance ministers and financial regulators from the G-20 countries, four official international financial institutions, and six international standard-setting bodies (including those listed above), to formulate agreements to implement regulatory reform. There is significant overlap between the FSB's regulatory reform agenda and the Dodd-Frank Act.

The relationship between these various entities is diagrammed in Figure 4.

|

|

Source: CRS In Focus IF10129, Introduction to Financial Services: International Supervision, by |

Appendix A. Changes to Regulatory Structure Since 2008

TheIn 2010, the Dodd-Frank Act of 2010 created four new federal entities related to financial regulation—the Financial Stability Oversight Council (FSOC), Office of Financial Research (OFR), Federal Insurance Office (FIO), and Consumer Financial Protection Bureau (CFPB). OFR and FIO are offices within the Treasury DepartmentDepartment of the Treasury, and are not regulators.

The Dodd-Frank Act granted new authority to the CFPB and transferred existing authority to it from other regulators, as shown in Figure A-1 (represented by the arrows). (With the exception of the OTS, the agencies shown in the figure retained all authority unrelated to consumer protection, as well as some authority related to consumer protection.) The section above entitled "Consumer Financial Protection Bureau" has more detail on the authority granted to the CFPB and areas where the CFPB was not granted authority.

|

Figure A-1. Changes to Consumer Protection Authority in the Dodd-Frank Act |

|

|

Source: CRS. Notes: Blue = existing agency, |

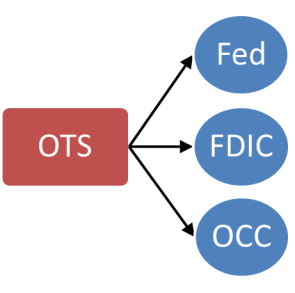

In addition, the Dodd-Frank Act eliminated the Office of Thrift Supervision (OTS) and transferred its authority to the banking regulators, as shown in Figure A-2.

|

Figure A-2. Changes to the Oversight of Thrifts in the Dodd-Frank Act |

|

|

Source: CRS. Notes: Blue = existing agency, |

The Housing and Economic Recovery Act of 2008 (HERA) created the Federal Housing Finance Agency (FHFA) and eliminated the Office of Federal Housing Enterprise Oversight (OFHEO) and Federal Housing Finance Board (FHFB). As shown in Figure A-3, HERA granted the FHFA new authority, the existing authority of the two eliminated agencies (shown in orangered), and transferred limited existing authority from the Department of Housing and Urban Development (HUD).

|

Figure A-3. Changes to the Oversight of Housing Finance in HERA |

|

|

Source: CRS. Notes: Blue = existing agency, |

|

Author |