Labor, Health and Human Services, and Education: FY2016 Appropriations

This report provides an overview of actions taken by Congress and the President to provide FY2016 appropriations for accounts funded by the Departments of Labor, Health and Human Services, and Education, and Related Agencies (LHHS) appropriations bill. This bill provides funding for all accounts funded through the annual appropriations process at the Departments of Labor (DOL) and Education (ED). It provides annual appropriations for most agencies within the Department of Health and Human Services (HHS), with certain exceptions (e.g., the Food and Drug Administration is funded via the Agriculture bill). The LHHS bill also provides funds for more than a dozen related agencies, including the Social Security Administration (SSA).

FY2016 Supplemental Appropriations: On September 29, 2016, President Obama signed into law H.R. 5325 (P.L. 114-223), a legislative vehicle that contained the Zika Response and Preparedness Appropriations Act, 2016, in Division B. The bill had been passed by the House and Senate one day earlier, on September 28, 2016. The Zika supplemental contained in this law provided $1.1 billion in emergency appropriations for domestic and international Zika response efforts. Of this, a total of $933 million was provided to HHS programs and activities. The budgetary totals in this report do not include these emergency appropriations.

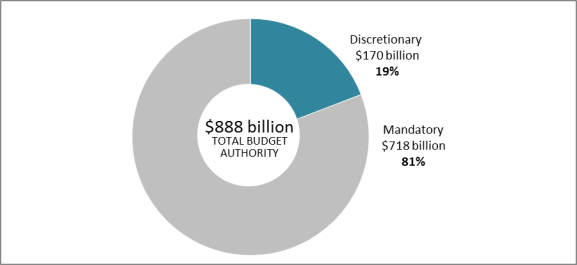

FY2016 Omnibus: On December 18, 2015, President Obama signed into law the Consolidated Appropriations Act, 2016 (P.L. 114-113), which provided FY2016 LHHS appropriations in Division H. This law appropriated $170 billion in discretionary funding for LHHS, which is roughly $6 billion (+4%) more than FY2015 enacted levels and $5 billion (-3%) less than the FY2016 President’s request. In addition, the FY2016 omnibus provided an estimated $718 billion in mandatory LHHS funding (pre-sequester), for a total of $888 billion for LHHS as a whole.

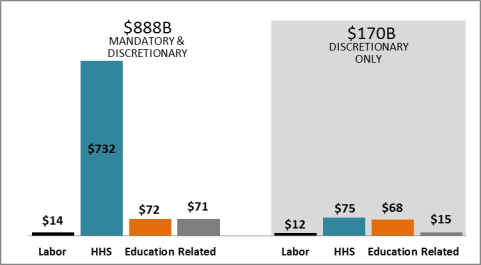

DOL: The FY2016 omnibus provided roughly $12 billion in discretionary funding for DOL, about 2% more than FY2015 enacted.

HHS: The FY2016 omnibus provided roughly $75 billion in discretionary funding for HHS, about 6% more than FY2015 enacted.

ED: The FY2016 omnibus provided roughly $68 billion in discretionary funding for ED, about 2% more than FY2015 enacted.

Related: The FY2016 omnibus provided roughly $15 billion in discretionary funding for LHHS related agencies, about 3% more than FY2015 enacted.

FY2016 Continuing Resolutions: The FY2016 omnibus followed three government-wide continuing resolutions (CRs), which had provided temporary funding earlier in the fiscal year (P.L. 114-53, P.L. 114-96, and P.L. 114-100). With limited exceptions, the CRs generally funded discretionary LHHS programs at FY2015 levels, minus a reduction of less than one percent (-0.2108%).

Earlier Senate LHHS Action: On June 25, 2015, the Senate Appropriations Committee approved its FY2016 LHHS appropriations bill by a vote of 16-14 (S. 1695; S.Rept. 114-74). This bill would have provided $162 billion in discretionary LHHS funds, which is about 1% less than FY2015 enacted levels. In addition, the Senate committee bill would have provided an estimated $718 billion in mandatory funding, for a total of $880 billion for LHHS as a whole.

Earlier House LHHS Action: On June 24, 2015, the House Appropriations Committee approved its FY2016 LHHS bill by a vote of 30-21 (H.R. 3020; H.Rept. 114-195). This bill would have provided $161 billion in discretionary LHHS funds, which is about 2% less than FY2015 enacted levels. In addition, the House committee bill would have provided an estimated $718 billion in mandatory funding, for a total of roughly $879 billion for LHHS as a whole.

President’s Budget Submission: On February 2, 2015, the Obama Administration released the FY2016 President’s budget. The President requested $175 billion in discretionary funding for accounts funded by the LHHS bill, which is about 6% more than FY2015 enacted levels. In addition, the President requested roughly $718 billion in annually appropriated mandatory funding, for a total of roughly $893 billion for LHHS as a whole.

Labor, Health and Human Services, and Education: FY2016 Appropriations

Jump to Main Text of Report

Contents

- Introduction

- Report Roadmap and Useful Terminology

- Scope of the Report

- Important Budget Concepts

- Mandatory vs. Discretionary Budget Authority

- Total Budget Authority Provided in the Bill vs. Total Budget Authority Available in the Fiscal Year

- FY2016 LHHS Appropriations Status

- Zika Response and Preparedness Appropriations Act, 2016

- FY2016 Omnibus Appropriations

- FY2016 Continuing Resolutions

- Congressional Action on a Stand-Alone LHHS Bill

- FY2016 LHHS Action in the Senate

- FY2016 LHHS Action in the House

- FY2016 President's Budget Request

- Conclusion of the FY2015 Appropriations Process

- Emergency Ebola Appropriations

- Summary of FY2016 LHHS Appropriations

- Department of Labor (DOL)

- About DOL

- FY2016 DOL Appropriations Overview

- Selected DOL Highlights

- Employment and Training Administration (ETA)

- Wage and Hour Division (WHD)

- Bureau of International Labor Affairs (ILAB)

- Labor-Related General Provisions

- Department of Health and Human Services (HHS)

- About HHS

- FY2016 HHS Appropriations Overview

- Special Public Health Funding Mechanisms

- Public Health Service Evaluation Tap

- Prevention and Public Health Fund

- Selected HHS Highlights by Agency

- HRSA

- CDC

- NIH

- SAMHSA

- AHRQ

- CMS

- ACF

- ACL

- Funding Restrictions Related to Certain Controversial Issues

- HHS Detail Tables

- Department of Education (ED)

- About ED

- FY2016 ED Appropriations Overview

- Selected ED Highlights

- Education for the Disadvantaged

- Innovation and Improvement

- Safe Schools and Citizenship Education

- Special Education

- Pell Grants

- Related Agencies

- FY2016 Related Agencies Appropriations Overview

- Selected Related Agencies Highlights

Figures

Tables

- Table 1. Status of Full-Year LHHS Appropriations Legislation, FY2016

- Table 2. LHHS Appropriations Overview by Bill Title, FY2015-FY2016

- Table 3. DOL Appropriations Overview

- Table 4. Detailed DOL Appropriations

- Table 5. HHS Appropriations Overview

- Table 6. HHS Appropriations Totals by Agency

- Table 7. HHS Discretionary Appropriations for Selected Programs or Activities, by Agency

- Table 8. ED Appropriations Overview

- Table 9. Detailed ED Appropriations

- Table 10. Related Agencies Appropriations Overview

- Table 11. Detailed Related Agencies Appropriations Table

- Table A-1. FY2016 LHHS Discretionary 302(b) Suballocations and FY2016 Enacted, Along with Comparable FY2015 Levels

- Table A-2. LHHS Appropriations Overview by Bill Title, FY2015-FY2016

Appendixes

Summary

This report provides an overview of actions taken by Congress and the President to provide FY2016 appropriations for accounts funded by the Departments of Labor, Health and Human Services, and Education, and Related Agencies (LHHS) appropriations bill. This bill provides funding for all accounts funded through the annual appropriations process at the Departments of Labor (DOL) and Education (ED). It provides annual appropriations for most agencies within the Department of Health and Human Services (HHS), with certain exceptions (e.g., the Food and Drug Administration is funded via the Agriculture bill). The LHHS bill also provides funds for more than a dozen related agencies, including the Social Security Administration (SSA).

FY2016 Supplemental Appropriations: On September 29, 2016, President Obama signed into law H.R. 5325 (P.L. 114-223), a legislative vehicle that contained the Zika Response and Preparedness Appropriations Act, 2016, in Division B. The bill had been passed by the House and Senate one day earlier, on September 28, 2016. The Zika supplemental contained in this law provided $1.1 billion in emergency appropriations for domestic and international Zika response efforts. Of this, a total of $933 million was provided to HHS programs and activities. The budgetary totals in this report do not include these emergency appropriations.

FY2016 Omnibus: On December 18, 2015, President Obama signed into law the Consolidated Appropriations Act, 2016 (P.L. 114-113), which provided FY2016 LHHS appropriations in Division H. This law appropriated $170 billion in discretionary funding for LHHS, which is roughly $6 billion (+4%) more than FY2015 enacted levels and $5 billion (-3%) less than the FY2016 President's request. In addition, the FY2016 omnibus provided an estimated $718 billion in mandatory LHHS funding (pre-sequester), for a total of $888 billion for LHHS as a whole.

- DOL: The FY2016 omnibus provided roughly $12 billion in discretionary funding for DOL, about 2% more than FY2015 enacted.

- HHS: The FY2016 omnibus provided roughly $75 billion in discretionary funding for HHS, about 6% more than FY2015 enacted.

- ED: The FY2016 omnibus provided roughly $68 billion in discretionary funding for ED, about 2% more than FY2015 enacted.

- Related: The FY2016 omnibus provided roughly $15 billion in discretionary funding for LHHS related agencies, about 3% more than FY2015 enacted.

FY2016 Continuing Resolutions: The FY2016 omnibus followed three government-wide continuing resolutions (CRs), which had provided temporary funding earlier in the fiscal year (P.L. 114-53, P.L. 114-96, and P.L. 114-100). With limited exceptions, the CRs generally funded discretionary LHHS programs at FY2015 levels, minus a reduction of less than one percent (-0.2108%).

Earlier Senate LHHS Action: On June 25, 2015, the Senate Appropriations Committee approved its FY2016 LHHS appropriations bill by a vote of 16-14 (S. 1695; S.Rept. 114-74). This bill would have provided $162 billion in discretionary LHHS funds, which is about 1% less than FY2015 enacted levels. In addition, the Senate committee bill would have provided an estimated $718 billion in mandatory funding, for a total of $880 billion for LHHS as a whole.

Earlier House LHHS Action: On June 24, 2015, the House Appropriations Committee approved its FY2016 LHHS bill by a vote of 30-21 (H.R. 3020; H.Rept. 114-195). This bill would have provided $161 billion in discretionary LHHS funds, which is about 2% less than FY2015 enacted levels. In addition, the House committee bill would have provided an estimated $718 billion in mandatory funding, for a total of roughly $879 billion for LHHS as a whole.

President's Budget Submission: On February 2, 2015, the Obama Administration released the FY2016 President's budget. The President requested $175 billion in discretionary funding for accounts funded by the LHHS bill, which is about 6% more than FY2015 enacted levels. In addition, the President requested roughly $718 billion in annually appropriated mandatory funding, for a total of roughly $893 billion for LHHS as a whole.

Introduction

This report provides an overview of FY2016 appropriations actions for accounts traditionally funded in the appropriations bill for the Departments of Labor, Health and Human Services, and Education, and Related Agencies (LHHS). This bill provides discretionary and mandatory appropriations to three federal departments: the Department of Labor (DOL), the Department of Health and Human Services (HHS), and the Department of Education (ED). In addition, the bill provides annual appropriations for more than a dozen related agencies, including the Social Security Administration (SSA).

Discretionary funds represent less than one-quarter of the total funds appropriated in the LHHS bill. Nevertheless, the LHHS bill is typically the largest single source of discretionary funds for domestic non-defense federal programs among the various appropriations bills (the Department of Defense bill is the largest source of discretionary funds among all federal programs). The bulk of this report is focused on discretionary appropriations because these funds receive the most attention during the appropriations process.

The LHHS bill typically is one of the more controversial of the regular appropriations bills because of the size of its funding total and the scope of its programs, as well as various related policy issues addressed in the bill such as restrictions on the use of federal funds for abortion and for research on human embryos and stem cells.

Congressional clients may consult the LHHS experts list in CRS Report R42638, Appropriations: CRS Experts for information on which analysts to contact at the Congressional Research Service (CRS) with questions on specific agencies and programs funded in the LHHS bill.

Report Roadmap and Useful Terminology

This report is divided into several sections. The opening section provides an explanation of the scope of the LHHS bill (and hence, the scope of this report), as well as an introduction to important terminology and concepts that carry throughout the report.

Next is a series of sections describing major congressional actions on FY2016 appropriations and (for context) a review of the conclusion of the FY2015 appropriations process.

This is followed by a high-level summary and analysis of proposed and enacted appropriations for FY2016, compared to FY2015 enacted funding levels.

The body of the report concludes with overview sections for each of the major titles of the bill: DOL, HHS, ED, and Related Agencies. These sections provide selected highlights from FY2016 proposed and enacted funding levels, compared to FY2015 enacted funding levels.

Finally, an Appendix provides a summary of budget enforcement activities for FY2016. This includes information on the Bipartisan Budget Act of 2015 (P.L. 114-74), the Budget Control Act of 2011 (BCA; P.L. 112-25), and sequestration, as well as efforts related to the budget resolution, subcommittee spending allocations, and the final enacted levels for FY2016.

Scope of the Report

This report is focused strictly on appropriations to agencies and accounts that are subject to the jurisdiction of the Labor, Health and Human Services, Education, and Related Agencies Subcommittees of the House and the Senate Appropriations Committees (i.e., accounts traditionally funded via the LHHS bill). Department "totals" provided in this report do not include funding for accounts or agencies that are traditionally funded by appropriations bills under the jurisdiction of other subcommittees.

The LHHS bill provides appropriations for the following federal departments and agencies:

- the Department of Labor;

- most agencies at the Department of Health and Human Services, except for the Food and Drug Administration (provided in the Agriculture appropriations bill), the Indian Health Service (provided in the Interior-Environment appropriations bill), and the Agency for Toxic Substances and Disease Registry (also funded through the Interior-Environment appropriations bill);

- the Department of Education; and

- more than a dozen related agencies, including the Social Security Administration, the Corporation for National and Community Service, the Corporation for Public Broadcasting, the Institute of Museum and Library Services, the National Labor Relations Board, and the Railroad Retirement Board.

Note also that funding totals displayed in this report do not reflect amounts provided outside of the annual appropriations process. Certain direct spending programs, such as Old-Age, Survivors, and Disability Insurance and parts of Medicare, receive funding directly from their authorizing statutes; such funds are not reflected in the totals provided in this report because they are not provided through the annual appropriations process (see related discussion in the "Important Budget Concepts" section).

Important Budget Concepts

Mandatory vs. Discretionary Budget Authority1

The LHHS bill includes both discretionary and mandatory budget authority. While all discretionary spending is subject to the annual appropriations process, only a portion of mandatory spending is provided in appropriations measures.

Mandatory programs funded through the annual appropriations process are commonly referred to as appropriated entitlements. In general, appropriators have little control over the amounts provided for appropriated entitlements; rather, the authorizing statute controls the program parameters (e.g., eligibility rules, benefit levels) that entitle certain recipients to payments. If Congress does not appropriate the money necessary to meet these commitments, entitled recipients (e.g., individuals, states, or other entities) may have legal recourse.2

Most mandatory spending is not provided through the annual appropriations process, but rather through budget authority provided by the program's authorizing statute (e.g., Old-Age, Survivors, and Disability Insurance). The funding amounts in this report do not include budget authority provided outside of the appropriations process. Instead, the amounts reflect only those funds, discretionary and mandatory, that are provided through appropriations acts.

Note that, as displayed in this report, mandatory amounts for the President's budget submission reflect current law (or current services) estimates; they generally do not include the President's proposed changes to a mandatory spending program's authorizing statute that might affect total spending. (In general, such proposals are excluded from this report, as they typically would be enacted in authorizing legislation.)

Note also that the report focuses most closely on discretionary funding. This is because discretionary funding receives the bulk of attention during the appropriations process. (As noted earlier, although the LHHS bill includes more mandatory funding than discretionary funding, the appropriators generally have less flexibility in adjusting mandatory funding levels than discretionary funding levels.)

Mandatory and discretionary spending is subject to budget enforcement processes that include sequestration. In general, sequestration involves largely across-the-board reductions that are made to certain categories of discretionary or mandatory spending. However, the conditions that trigger sequestration, and how it is carried out, differ for each type of spending. This is discussed further in the Appendix to this report.

Total Budget Authority Provided in the Bill vs. Total Budget Authority Available in the Fiscal Year

Budget authority is the amount of money a federal agency is legally authorized to commit or spend. Appropriations bills may include budget authority that becomes available in the current fiscal year, in future fiscal years, or some combination. Amounts that become available in future fiscal years are typically referred to as advance appropriations.

Unless otherwise specified, appropriations levels displayed in this report refer to the total amount of budget authority provided in an appropriations bill (i.e., "total in the bill"), regardless of the year in which the funding becomes available.3 In some cases, the report breaks out "current-year" appropriations (i.e., the amount of budget authority available for obligation in a given fiscal year, regardless of the year in which it was first appropriated).4

As the annual appropriations process unfolds, the amount of current-year budget authority is measured against 302(b) allocation ceilings (budget enforcement caps for appropriations subcommittees that traditionally emerge following the budget resolution process). The process of measuring appropriations against these spending ceilings takes into account scorekeeping adjustments, which are made by the Congressional Budget Office (CBO) to reflect conventions and special instructions of Congress.5 Unless otherwise specified, appropriations levels displayed in this report do not reflect additional scorekeeping adjustments.

FY2016 LHHS Appropriations Status

Table 1 provides a timeline of major legislative actions toward full-year FY2016 LHHS appropriations. The remainder of this section provides additional detail on these and other steps toward full-year LHHS appropriations. It also provides a summary of the supplemental appropriations for HHS that were enacted as part of the Zika Response and Preparedness Appropriations Act, 2016.

|

Subcommittee Markup |

Resolution of House and Senate Differences |

||||||||

|

House |

Senate |

House Report |

House Initial Passage |

Senate Report |

Senate Initial Passage |

Conf. Report |

House Final Passage |

Senate Final Passage |

Public Law |

|

6/17/15 voice vote |

6/23/15 voice vote |

6/24/15 30-21 |

6/25/15 16-14 |

Explanatory materials inserted in Congressional Recorda |

12/18/15 316-113 |

12/18/15 66-33 |

12/18/15 |

||

Source: CRS Appropriations Status Table.

a. Congressional Record, daily edition, vol. 161, no. 184, Book III, (December 17, 2015), pp. H10281-H10362, available at https://www.gpo.gov/fdsys/pkg/CREC-2015-12-17/pdf/CREC-2015-12-17-bk3.pdf.

Zika Response and Preparedness Appropriations Act, 2016

On September 29, 2016, President Obama signed into law H.R. 5325 (P.L. 114-223), a legislative vehicle that contained the Zika Response and Preparedness Appropriations Act, 2016, in Division B. The bill had been passed by the House and Senate one day earlier, on September 28, 2016. The Zika supplemental contained in this law provided $1.1 billion in emergency appropriations for domestic and international Zika response efforts. Of this, a total of $933 million was provided to the Department of Health and Human Services. These funds were distributed as follows:

- $394 million to the Centers for Disease Control and Prevention (CDC) for preventing, preparing for, and responding to the Zika virus and related health conditions. Of this amount, $44 million is intended to restore funds to the Public Health Emergency Preparedness cooperative agreement program that had previously been reprogrammed for Zika response activities.

- $152 million to the National Institute of Allergy and Infectious Diseases at the National Institutes of Health (NIH) for Zika-related research, as well as development of vaccines and other medical countermeasures for Zika.

- $387 million for the Public Health and Social Services Emergency Fund for preventing, preparing for, and responding to the Zika virus and related health conditions. Of this amount, $75 million is to be available for reimbursing the costs of Zika-related health care not covered by private health insurance, $20 million is to be transferred to the Maternal and Child Health Block Grant for projects of national significance in Puerto Rico and other territories, $40 million is to expand the delivery of primary health services provided by community health centers, and $6 million is to support the assignment of National Health Service Corps members to Puerto Rico and other territories.

The FY2016 budgetary totals in this report do not include these supplemental emergency appropriations, which were appropriated in the final week of FY2016.

For further information, see CRS Report R44460, Zika Response Funding: Request and Congressional Action, by Susan B. Epstein and Sarah A. Lister.

FY2016 Omnibus Appropriations

On December 18, 2015, President Obama signed into law the Consolidated Appropriations Act, 2016 (P.L. 114-113). The final version of this bill was agreed to by both the House and the Senate on the same day that it was enacted. The enacted version provided regular, full-year appropriations for all 12 of the annual appropriations acts, including LHHS (see Division H).

This law appropriated $170 billion in discretionary funding for LHHS, which is roughly $6 billion (+4%) more than FY2015 enacted levels and $5 billion (-3%) less than the FY2016 President's request. In addition, the FY2016 omnibus provided an estimated $718 billion in mandatory LHHS funding (pre-sequester), for a total of $888 billion for LHHS as a whole.

See Figure 1 for the breakdown of discretionary and mandatory LHHS appropriations in the FY2016 omnibus.6

|

Figure 1. FY2016 Omnibus Appropriations for Labor, HHS, ED, and Related Agencies |

|

|

Source: Amounts estimated based on data provided in the joint explanatory statement accompanying the FY2016 omnibus (P.L. 114-113). For consistency with source materials, amounts displayed here do not reflect sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities. Notes: Details may not add to totals due to rounding. Amounts in this figure (1) reflect all budget authority appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS Subcommittees of the House and the Senate Committees on Appropriations; and (4) do not include appropriations that occur outside of appropriations bills. |

FY2016 Continuing Resolutions

The FY2016 omnibus followed three government-wide continuing resolutions (CRs), which had provided temporary funding earlier in the fiscal year (P.L. 114-53, P.L. 114-96, and P.L. 114-100). With limited exceptions, these CRs generally funded discretionary LHHS programs at the same rate and under the same conditions as the LHHS title in the FY2015 omnibus (Division G, P.L. 113-235), minus an across-the-board reduction of less than one percent (-0.2108%). The CRs explicitly did not include funding based on Title VI of Division G, which had provided emergency-designated funding to HHS in FY2015 in response to the Ebola outbreak in Africa.

Mandatory programs covered by these CRs were generally continued at current law levels, less sequestration (where applicable).

The first FY2016 CR (P.L. 114-53) included several special provisions for LHHS appropriations. These provisions are summarized in CRS Report R44214, Overview of the FY2016 Continuing Resolution (H.R. 719), by Jessica Tollestrup. These provisions were continued in the two subsequent extensions of the first CR (listed above).

Congressional Action on a Stand-Alone LHHS Bill

FY2016 LHHS Action in the Senate

On June 25, the Senate Appropriations Committee approved its FY2016 LHHS appropriations bill by a vote of 16-14 (S. 1695; S.Rept. 114-74). Prior to this, on June 23, the Senate LHHS Subcommittee had approved a draft bill for full committee consideration.

As reported by the full committee, this bill would have provided $162 billion in discretionary LHHS funds. This is about 1% less than FY2015 enacted levels and 7% less than the FY2016 President's request. In addition, the Senate committee bill would have provided an estimated $718 billion in mandatory funding, for a combined total of $880 billion for LHHS as a whole.

FY2016 LHHS Action in the House

On June 24, the House Appropriations Committee approved its FY2015 LHHS bill by a vote of 30-21 (H.R. 3020; H.Rept. 114-195). Prior to this, on June 17, the House LHHS Subcommittee had approved a draft bill for full committee consideration.

As reported by the full committee, this bill would have provided $161 billion in discretionary LHHS funds. This is about 2% less than FY2015 enacted levels and 8% less than the FY2016 President's request. In addition, the House committee bill would have provided an estimated $718 billion in mandatory funding, for a combined total of $879 billion for LHHS as a whole.

FY2016 President's Budget Request

On February 2, 2015, the Obama Administration released the FY2016 President's budget. The President requested $175 billion in discretionary funding for accounts funded by the LHHS bill, which is about 6% more than FY2015 enacted levels. In addition, the President requested roughly $718 billion in annually appropriated mandatory funding, for a total of roughly $893 billion for the LHHS bill as a whole.

Conclusion of the FY2015 Appropriations Process

On December 16, 2014, President Obama signed into law the Consolidated and Further Continuing Appropriations Act, 2015 (P.L. 113-235). The final version of this bill was agreed to in the House on December 11, 2014, and in the Senate on December 13, 2014. The enacted law provided regular, full-year appropriations for 11 of the 12 annual appropriations bills, including LHHS (see Division G). This law appropriated $164 billion in discretionary funding for LHHS (not counting emergency Ebola funds), which is roughly comparable to amounts provided in FY2014 (+0.05%) and the FY2015 President's request (-0.1%). In addition, the FY2015 omnibus appropriated $681 billion in mandatory LHHS funding (pre-sequester), for a total of $846 billion for LHHS as a whole.

Emergency Ebola Appropriations

In addition to non-emergency LHHS appropriations, the FY2015 omnibus also provided $2.7 billion in emergency-designated funding to HHS in response to the Ebola outbreak in Africa (see Division G, Title VI).7 These funds were distributed as follows:

- $1.8 billion to the Centers for Disease Control and Prevention (CDC) for activities to enhance domestic preparedness, support overseas operations to end the Ebola epidemic, and prevent the spread of Ebola and other infectious diseases;

- $238 million to the National Institutes of Health (NIH) for clinical trials on experimental Ebola vaccines and treatments; and

- $733 million to the Public Health and Social Services Emergency Fund, which is administered within the HHS Office of the Secretary, for drug and vaccine development and domestic hospital preparedness.8

Summary of FY2016 LHHS Appropriations

|

Dollars and Percentages in this Report Amounts displayed in this report are typically rounded to the nearest million or billion (as labeled). Dollar and percent changes discussed in the text of this report are based on unrounded amounts. Funding levels are generally drawn from (or estimated based on) the following congressional documents: Amounts for FY2016 enacted are based on the joint explanatory statement accompanying the FY2016 omnibus (P.L. 114-113) and, as such, do not include supplemental emergency appropriations subsequently enacted in the Zika Response and Preparedness Appropriations Act, 2016 (P.L. 114-223, Division B). Amounts for FY2015 enacted, the FY2016 request, and the FY2016 House Appropriations Committee-reported LHHS bill (H.R. 3020) are generally based on data in H.Rept. 114-195. Amounts for the FY2016 Senate Appropriations Committee-reported LHHS bill (S. 1695) are generally based on data in S.Rept. 114-74. Throughout this report, the FY2016 House Appropriations Committee-reported LHHS bill and Senate Appropriations Committee-reported LHHS bill are commonly referred to as the House and Senate "committee bills." For consistency with source materials, amounts in this report generally do not reflect mandatory spending sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect transfers or reprogramming of funds pursuant to executive authorities, or any other adjustments for comparability.9 One exception is that estimated transfers from the Prevention and Public Health Fund, displayed in certain HHS tables, do reflect mandatory sequestration, per the convention of source materials. In addition, amounts for FY2015 generally exclude emergency Ebola funds appropriated to HHS by the FY2015 omnibus (Division G, Title VI), as well as Ebola-related funds provided by the first FY2015 CR (P.L. 113-164). |

Table 2 displays FY2016 discretionary and mandatory LHHS budget authority provided or proposed, by bill title, along with FY2015 enacted levels. The amounts shown in this table reflect total budget authority provided in the bill (i.e., all funds appropriated in the current bill, regardless of the fiscal year in which the funds become available), not total budget authority available for the current fiscal year. (For a comparable table showing current-year budget authority, see Table A-2 in the Appendix.)

Table 2. LHHS Appropriations Overview by Bill Title, FY2015-FY2016

(Total budget authority provided in the bill, in billions of dollars)

|

Bill Title |

FY2015 Enacted |

FY2016 Request |

FY2016 |

FY2016 Senate Cmte |

FY2016 Enacted |

|

Title I: Labor |

13.3 |

14.5 |

12.4 |

12.7 |

13.7 |

|

Discretionary |

11.9 |

13.2 |

11.7 |

11.4 |

12.2 |

|

Mandatory |

1.4 |

1.4 |

0.7 |

1.4 |

1.6 |

|

Title II: HHS |

691.7 |

732.8 |

728.9 |

728.1 |

732.2 |

|

Discretionary |

71.0 |

75.8 |

71.3 |

71.0 |

75.1 |

|

Mandatory |

620.7 |

657.1 |

657.6 |

657.1 |

657.1 |

|

Title III: Education |

70.5 |

74.1 |

67.8 |

69.2 |

71.7 |

|

Discretionary |

67.1 |

70.7 |

64.4 |

65.8 |

68.3 |

|

Mandatory |

3.3 |

3.4 |

3.4 |

3.4 |

3.4 |

|

Title IV: Related Agencies |

70.0 |

71.3 |

69.9 |

69.9 |

70.8 |

|

Discretionary |

14.2 |

15.1 |

13.8 |

13.7 |

14.6 |

|

Mandatory |

55.9 |

56.2 |

56.2 |

56.2 |

56.2 |

|

Total BA in the Bill |

845.6 |

892.8 |

879.0 |

879.9 |

888.4 |

|

Discretionary |

164.2 |

174.8 |

161.2 |

161.9 |

170.2 |

|

Mandatory |

681.3 |

718.0 |

717.8 |

718.0 |

718.2 |

|

Title VI: Ebola (emergency)a |

2.7 |

- |

- |

- |

- |

|

Memoranda: |

|||||

|

Advances for Future Years (provided in current bill)b |

160.8 |

158.5 |

158.5 |

158.5 |

158.5 |

|

Advances from Prior Years (for use in current year)b |

151.5 |

160.8 |

160.8 |

160.8 |

160.8 |

|

Additional Scorekeeping Adjustmentsc |

-6.0 |

-5.5 |

-6.6 |

-7.1 |

-6.6 |

Source: Amounts shown for FY2015 enacted, the FY2016 request, and the FY2016 House committee bill are generally drawn from (or estimated based on) H.Rept. 114-195, while amounts for the FY2016 Senate committee bill are generally drawn from S.Rept. 114-74. Amounts for FY2016 enacted were estimated based on data in the joint explanatory statement accompanying the FY2016 omnibus. For consistency with source materials, amounts in this report generally do not reflect sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities. FY2015 enacted totals do not include Ebola-related funds provided by the first FY2015 CR (P.L. 113-64) or in Division G, Title VI, of the FY2015 omnibus (P.L. 113-235).

Notes: BA = Budget Authority. Details may not add to totals due to rounding. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS Subcommittees of the House and the Senate Committees on Appropriations; and (4) do not include appropriations that occur outside of appropriations bills. No amounts are shown for Title V, because this title consists solely of general provisions.

a. Total does not include $88 million appropriated to HHS for Ebola-related activities in the first FY2015 CR.

b. Totals in this table are based on budget authority provided in the bill (i.e., they exclude advance appropriations from prior bills and include advance appropriations from this bill made available in future years). The calculation for total budget authority available in the current year is as follows: Total BA in the Bill minus Advances for Future Years plus Advances from Prior Years.

c. Totals in this table have generally not been adjusted for further scorekeeping. (To adjust for scorekeeping, add this line to the total budget authority.)

Figure 2 displays the FY2016 enacted discretionary and mandatory LHHS funding levels, by bill title. As this figure demonstrates, HHS accounts for the largest share of total FY2016 LHHS appropriations: $732 billion, or 82% of total LHHS appropriations. This is due to the large amount of mandatory funding included in the HHS appropriation, the majority of which is for Medicaid grants to states and payments to health care trust funds. After HHS, ED and the Related Agencies represent the next-largest shares of total LHHS funding, accounting for about 8% apiece. The majority of the ED appropriations are discretionary, while the bulk of funding for the Related Agencies goes toward mandatory payments and administrative costs of the Supplemental Security Income program at the Social Security Administration. Finally, DOL accounts for the smallest share of total LHHS funds: roughly 2%.

When looking only at discretionary appropriations, however, the overall composition of LHHS funding is noticeably different. HHS accounts for a comparatively smaller share of total discretionary appropriations (44%), while ED accounts for a relatively larger share (40%). Together, these two departments represent the majority (84%) of discretionary LHHS appropriations. Meanwhile, DOL and Related Agencies combine to account for a roughly even split of the remaining 16% of discretionary LHHS funds.

|

|

Source: Amounts estimated based on data provided in the joint explanatory statement accompanying the FY2016 omnibus (P.L. 114-113). For consistency with source materials, amounts displayed here do not reflect sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities. Notes: Details may not add to totals due to rounding. Amounts in this figure (1) reflect all budget authority appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS Subcommittees of the House and the Senate Committees on Appropriations; and (4) do not include appropriations that occur outside of appropriations bills. |

Department of Labor (DOL)

Note that all amounts in this section are based on regular LHHS appropriations only. Amounts in this section do not include mandatory funds provided outside of the annual appropriations process (e.g., direct appropriations for Unemployment Insurance benefits payments). All amounts in this section are rounded to the nearest million or billion (as labeled). The dollar changes and percentage changes discussed in the text are based on unrounded amounts. For consistency with source materials, amounts do not reflect sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect transfers or reprogramming of funds pursuant to executive authorities.

|

DOL Entities Funded via the Employment and Training Administration (ETA) Employee Benefits Security Administration (EBSA) Wage and Hour Division (WHD) Office of Federal Contract Compliance Programs (OFCCP) Office of Labor-Management Standards (OLMS) Office of Workers' Compensation Programs (OWCP) Occupational Safety and Health Administration (OSHA) Mine Safety and Health Administration (MSHA) Bureau of Labor Statistics (BLS) Office of Disability Employment Policy (ODEP) Departmental Management (DM)10 |

About DOL

DOL is a federal department comprised of multiple entities that provide services related to employment and training, worker protection, income security, and contract enforcement. Annual LHHS appropriations laws direct funding to all DOL entities (see box for all entities supported by the LHHS bill).11 The DOL entities fall primarily into two main functional areas—workforce development and worker protection. First, there are several DOL entities that administer workforce employment and training programs, such as the Workforce Innovation and Opportunity Act (WIOA) state formula grant programs, Job Corps, and the Employment Service, that provide direct funding for employment activities or administration of income security programs (e.g., for the Unemployment Insurance benefits program).12 Also included in this area is the Veterans' Employment and Training Service (VETS), which provides employment services specifically for the veteran population. Second, there are several agencies that provide various worker protection services. For example, the Occupational Safety and Health Administration (OSHA), the Mine Safety and Health Administration (MSHA), and the Wage and Hour Division (WHD) provide different types of regulation and oversight of working conditions. DOL entities focused on worker protection provide services to ensure worker safety, adherence to wage and overtime laws, and contract compliance, among other duties. In addition to these two main functional areas, DOL's Bureau of Labor Statistics (BLS) collects data and provides analysis on the labor market and related labor issues.

FY2016 DOL Appropriations Overview

The FY2016 omnibus provided roughly $13.7 billion in combined mandatory and discretionary appropriations for DOL. This is about $384 million (+3%) more than the FY2015 enacted level and $812 million (-6%) less than the FY2016 President's request. (See Table 3.) Of the total provided, roughly $12.2 billion (89%) is discretionary.

|

Funding |

FY2015 Enacted |

FY2016 Request |

FY2016 |

FY2016 Senate Cmte |

FY2016 Enacted |

|

Discretionary |

11.9 |

13.2 |

11.7 |

11.4 |

12.2 |

|

Mandatory |

1.4 |

1.4 |

0.7 |

1.4 |

1.6 |

|

Total BA in the Bill |

13.3 |

14.5 |

12.4 |

12.7 |

13.7 |

Source: Amounts shown for FY2015 enacted, the FY2016 request, and the FY2016 House committee bill are generally drawn from (or estimated based on) H.Rept. 114-195, while amounts for the FY2016 Senate committee bill are generally drawn from S.Rept. 114-74. Amounts for FY2016 enacted were estimated based on data in the joint explanatory statement accompanying the FY2016 omnibus. For consistency with source materials, amounts in this report do not reflect sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities.

Notes: BA = Budget Authority. Details may not add to totals due to rounding. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS Subcommittees of the House and the Senate Committees on Appropriations; and (4) do not include appropriations that occur outside of appropriations bills.

Selected DOL Highlights

The following sections present FY2016 appropriations highlights for selected DOL accounts and programs. Table 4 displays funding for DOL programs and activities discussed in this section.

Employment and Training Administration (ETA)

ETA administers the primary federal workforce development law, the Workforce Innovation and Opportunity Act (WIOA, P.L. 113-128). The WIOA, which replaced the Workforce Investment Act, was signed into law in July 2014, with most provisions going into effect in FY2015.

Title I of the WIOA includes three state formula grant programs serving Adults, Youth, and Dislocated Workers. The FY2016 omnibus matched the President's budget request by providing an increase of $86 million (+3%) to three state formula grant programs compared to the FY2015 enacted levels. The FY2016 House committee bill would have provided the same level of funding for these three formula grant programs as was provided in the FY2015 omnibus ($2.6 billion), while the FY2016 Senate committee bill would have decreased funding for the formula grant programs by $132 million (-5%) compared to FY2015.

The WIOA allows governors to reserve up to 15% of the funds received from the three state formula grants for a combination of required (e.g., evaluations of state workforce programs) and allowable (e.g., research and demonstration projects) workforce activities. However, the FY2015 omnibus superseded this provision, by lowering the governors' reserve limit to 10% of the WIOA state formula grants. The FY2016 omnibus returned the reserve to its statutory limit of 15%, which was consistent with provisions in the FY2016 Senate committee bill. This was in contrast to provisions in the FY2016 House committee bill, which would have changed the reserve limit to 11%.

The FY2016 omnibus provided the same funding ($221 million) as the FY2015 enacted level for the Dislocated Workers Activities National Reserve (DWA National Reserve). Similar to the President's FY2016 request and the Senate committee bill, the FY2016 omnibus directed $19 million of the DWA National Reserve toward employment and training activities for dislocated coal workers. The FY2016 President's budget requested an increase in funds for the DWA National Reserve from the FY2015 level of $221 million to $241 million to cover a $20 million set-aside to provide reemployment and training to workers dislocated from coal mines and coal-fired power plants. The FY2016 Senate committee bill would have decreased funding for the DWA National Reserve to $200 million but, like the FY2016 President's budget, would have directed $19 million for dislocated coal workers. The FY2016 House committee bill would have reduced funding for the DWA National Reserve to $74 million.

The FY2016 omnibus rejected the FY2016 Senate committed bill proposal that would have moved the Office of Disability Employment Policy (ODEP) into ETA. In addition, the FY2016 omnibus provided $38 million in appropriations for ODEP, compared to the Senate committee bill proposal of $24 million.

The FY2016 omnibus provided $90 million for the Apprentice Grant program. In FY2015, DOL used $90 million in funds from H-1B fees to support apprenticeship activities, which were similar to the activities funded in the FY2016 omnibus. While the FY2016 President's budget requested $100 million in LHHS appropriations to support this new Apprentice Grant program, neither the FY2016 Senate nor House committee bills would have funded this initiative.

Wage and Hour Division (WHD)

The FY2016 omnibus maintained the same funding for WHD ($228 million) as the FY2015 enacted level, despite the FY2016 President's budget request for an increase of $49 million (+22%) for WHD, in support of the WHD's strategic enforcement initiatives. The WHD administers and enforces a range of laws that provide labor standards (e.g., minimum wages, working hours), such as the Fair Labor Standards Act (FLSA), the Davis-Bacon Act (DBA), and the McNamara-O'Hara Service Contract Act (SCA). The FY2016 President's request reflected an emphasis on "strategic enforcement," which would involve proactive efforts to monitor and enforce compliance rather than complaint-driven, reactive enforcement. The FY2016 Senate and House committee bills would have reduced funding for the WHD by $18 million (-8%) and $12 million (-5%), respectively.

Bureau of International Labor Affairs (ILAB)

The explanatory statement on the FY2016 omnibus called for DOL to reserve $86 million for ILAB, which was $5 million (-5%) less than its FY2015 funding level of $91 million. The FY2016 President's budget requested an increase of $4 million (+4%) for ILAB, which provides research, advocacy, technical assistance, and grants to promote workers' rights in different parts of the world. The FY2016 Senate and House committee proposals would have reduced funding for ILAB by $61 million (-67%) and $59 million (-65%), respectively. Language in S.Rept. 114-74 and H.Rept. 114-195 indicated that the proposed reduction was intended to eliminate new international grants, which typically constitute about two-thirds of ILAB's expenditures.

Labor-Related General Provisions

Annual LHHS appropriations acts regularly contain general provisions related to certain labor issues. This section highlights two newly proposed general provisions from one or both of the FY2016 committee bills. (See also the "Selected Related Agencies Highlights" section of this report for a brief discussion of newly proposed restrictions on funding for the National Labor Relations Board contained in the FY2016 House and Senate committee bills.)

The FY2016 omnibus did not include provisions from the FY2016 Senate and House committee bills related to the proposed fiduciary rule. Briefly, DOL issued a proposed rule on April 20, 2015, that would expand the definition of "investment advice" within employer-sponsored private-sector pension plans and individual retirement accounts. Individuals who provide financial recommendations that meet the definition of "investment advice" must meet a higher "fiduciary" standard that requires acting solely in the interests of plan participants. As proposed, the rule may increase the number of individuals held to this higher standard.13 The comment period for this proposed rule ended in September 2015; DOL has not yet published a final rule. The FY2016 Senate and House committee bills contained new (identical) provisions that would have prohibited the use of DOL funds made available in the bill to finalize, implement, administer, or enforce a proposed fiduciary rule.14

The FY2016 omnibus adopted the language of the Senate committee bill regarding the use of private surveys in the H-2B wage determination process. The FY2016 Senate committee bill contained a new provision directing the Secretary of Labor to accept private wage surveys as part of the process of determining prevailing wages in the H-2B program, even in instances in which relevant wage data are available from the Bureau of Labor Statistics.15 The H-2B program allows for the temporary employment of foreign workers in non-agricultural sectors and requires these workers to be paid the "prevailing wage" (i.e., the average wage paid to similar workers in the local area). Under DOL regulations, private employer surveys may be considered only if the employer meets certain conditions. The House committee bill did not include a comparable provision.

|

Agency or Selected Program |

FY2015 Enacted |

FY2016 Request |

FY2016 |

FY2016 Senate Cmte |

FY2016 Enacted |

|

ETA—Mandatorya |

711 |

664 |

0 |

664 |

861 |

|

ETA—Discretionary |

9,014 |

9,902 |

8,864 |

8,683 |

9,203 |

|

Discretionary ETA Programs: |

|||||

|

Training and Employment Services: |

3,140 |

3,402 |

3,003 |

2,936 |

3,335 |

|

Adult Activities Grants to States |

777 |

816 |

777 |

737 |

816 |

|

Youth Activities Grants to States |

832 |

873 |

832 |

790 |

873 |

|

Dislocated Worker Activities (DWA) Grants to States |

1,016 |

1,021 |

1,016 |

965 |

1,021 |

|

Federally Administered Programs:b |

430 |

461 |

291 |

418 |

442 |

|

DWA National Reserve |

221 |

241 |

74 |

200 |

221 |

|

Native Americans |

46 |

50 |

50 |

41 |

50 |

|

Migrant and Seasonal Farmworkers |

82 |

82 |

82 |

73 |

82 |

|

Women in Apprenticeship |

1 |

0 |

0 |

0 |

1 |

|

YouthBuild |

80 |

85 |

82 |

80 |

85 |

|

Technical Assistance |

0 |

3 |

3 |

1 |

3 |

|

National Activities: |

86 |

232 |

88 |

26 |

184 |

|

Reintegration of Ex-Offenders |

82 |

95 |

82 |

22 |

88 |

|

Workforce Data Quality Initiative |

4 |

37 |

6 |

4 |

6 |

|

Apprenticeship Grantsc |

0 |

100 |

0 |

0 |

90 |

|

Job Corps |

1,688 |

1,716 |

1,688 |

1,683 |

1,689 |

|

Community Service Employment for Older Americans |

434 |

434 |

434 |

400 |

434 |

|

State Unemployment Insurance and Employment Service Operations (SUI/ESO): |

3,597 |

4,138 |

3,580 |

3,520 |

3,590 |

|

Unemployment Compensation |

2,791 |

2,898 |

2,760 |

2,738 |

2,760 |

|

Employment Service |

684 |

1,084 |

684 |

654 |

700 |

|

Foreign Labor Certification |

62 |

76 |

76 |

62 |

62 |

|

One-Stop Career Centers |

60 |

80 |

60 |

66 |

68 |

|

State Paid Leave Fund |

0 |

35 |

0 |

0 |

0 |

|

ETA Program Administration |

155 |

177 |

158 |

144 |

155 |

|

Employee Benefits Security Administration |

181 |

207 |

181 |

169 |

181 |

|

Pension Benefit Guaranty Corp, program level (non-add) |

(415) |

(432) |

(432) |

(432) |

(432) |

|

Wage and Hour Division |

228 |

277 |

216 |

210 |

228 |

|

Office of Labor-Management Standards |

39 |

47 |

42 |

36 |

41 |

|

Office of Federal Contract Compliance Programs |

106 |

114 |

101 |

96 |

105 |

|

Office of Workers' Compensation Programs—Mandatoryd |

691 |

698 |

698 |

698 |

698 |

|

Office of Workers' Compensation Programs—Discretionary |

113 |

120 |

115 |

110 |

116 |

|

Occupational Safety & Health Administration |

553 |

592 |

535 |

524 |

553 |

|

Mine Safety & Health Administration |

376 |

395 |

371 |

357 |

376 |

|

Bureau of Labor Statistics |

592 |

633 |

609 |

579 |

609 |

|

Office of Disability Employment Policy |

39 |

38 |

38 |

0 |

38 |

|

Departmental Management |

705 |

855 |

670 |

621 |

722 |

|

Salaries and Expenses |

338 |

376 |

285 |

259 |

334 |

|

International Labor Affairs (non-add) |

(91) |

(95) |

(32) |

(30) |

(86) |

|

Veterans Employment and Training |

270 |

271 |

271 |

270 |

271 |

|

IT Modernization |

15 |

120 |

30 |

13 |

30 |

|

Office of the Inspector General |

82 |

88 |

85 |

79 |

86 |

|

Total, DOL BA in the Bill |

13,347 |

14,542 |

12,439 |

12,748 |

13,730 |

|

Subtotal, Mandatory |

1,401 |

1,363 |

698 |

1,363 |

1,559 |

|

Subtotal, Discretionary |

11,945 |

13,180 |

11,741 |

11,385 |

12,171 |

|

Memoranda |

|

|

|

|

|

|

Total, BA Available in Fiscal Year (current year from any bill) |

13,350 |

14,544 |

12,582 |

12,750 |

13,732 |

|

Total, BA Advances for Future Years (provided in current bill) |

1,793 |

1,791 |

1,650 |

1,791 |

1,791 |

|

Total, BA Advances from Prior Years (for use in current year) |

1,796 |

1,793 |

1,793 |

1,793 |

1,793 |

Source: Amounts shown for FY2015 enacted, the FY2016 request, and the FY2016 House committee bill are generally drawn from (or estimated based on) H.Rept. 114-195, while amounts for the FY2016 Senate committee bill are generally drawn from S.Rept. 114-74. Amounts for FY2016 enacted were estimated based on data in the joint explanatory statement accompanying the FY2016 omnibus. For consistency with source materials, amounts in this report do not reflect sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities.

Notes: BA = Budget Authority. Details may not add to totals due to rounding. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS Subcommittees of the House and the Senate Committees on Appropriations; and (4) do not include appropriations that occur outside of appropriations bills. Non-add amounts are displayed in italics and parentheses; these amounts are not part of the appropriations totals.

a. Mandatory funding within ETA goes to Federal Unemployment Benefits and Allowances (FUBA). FUBA funds Trade Adjustment Assistance for Workers (TAA). At the time the FY2016 House committee bill was reported, authorization of appropriations for TAA had expired. The House committee-reported bill would not have appropriated funding for TAA. TAA was subsequently reauthorized by P.L. 114-27 on June 29, 2015.

b. The subtotal for "Federally Administered Programs" includes $24 million for the Office of Disability Employment Policy (ODEP), which reflects the FY2016 Senate committee-reported bill's proposed transfer of ODEP to ETA.

c. In FY2015, DOL used $90 million in funds from H-1B fees to support apprenticeship activities, which were similar to the activities funded in the FY2016 omnibus.

d. Mandatory programs in the Office of Workers' Compensation Programs include Special Benefits (comprising the Federal Employees' Compensation Benefits and the Longshore and Harbor Workers' Benefits), Special Benefits for Disabled Coal Miners, Energy Employees Occupational Illness Compensation (Administrative Expenses), and the Black Lung Disability Trust Fund.

Department of Health and Human Services (HHS)

Note that all figures in this section are based on regular LHHS appropriations only; they do not include funds for HHS agencies provided through other appropriations bills (e.g., funding for the Food and Drug Administration) or outside of the annual appropriations process (e.g., direct appropriations for Medicare or pre-appropriated mandatory funds provided by authorizing laws, such as the Patient Protection and Affordable Care Act (ACA, P.L. 111-148).16 All amounts in this section are rounded to the nearest million or billion (as labeled). The dollar changes and percentage changes discussed in the text are based on unrounded amounts. For consistency with source materials, amounts generally do not reflect sequestration (except in the case of transfers from the Prevention and Public Health Fund, as discussed below) or re-estimates of mandatory spending programs, where applicable, nor do they reflect transfers or reprogramming of funds pursuant to executive authorities.

About HHS

HHS is a large federal department composed of multiple agencies working to enhance the health and well-being of Americans. Annual LHHS appropriations laws direct funding to most (but not all) HHS agencies (see box for agencies supported by the LHHS bill).17 For instance, the LHHS bill directs funding to five Public Health Service (PHS) agencies: the Health Resources and Services Administration (HRSA), Centers for Disease Control and Prevention (CDC), National Institutes of Health (NIH), Substance Abuse and Mental Health Services Administration (SAMHSA), and Agency for Healthcare Research and Quality (AHRQ).18 These public health agencies support diverse missions, ranging from the provision of health care services and supports (e.g., HRSA, SAMHSA), to the advancement of health care quality and medical research (e.g., AHRQ, NIH), to the prevention and control of infectious and chronic diseases (e.g., CDC). In addition, the LHHS bill provides funding for annually appropriated components of CMS,19 which is the HHS agency responsible for the administration of Medicare, Medicaid, the State Children's Health Insurance Program (CHIP), and consumer protections and private health insurance provisions of the ACA. The LHHS bill also provides funding for two HHS agencies focused primarily on the provision of social services: the Administration for Children and Families (ACF) and the Administration for Community Living (ACL). ACF's mission is to promote the economic and social well-being of vulnerable children, youth, families, and communities. ACL was formed with a goal of increasing access to community supports for older Americans and people with disabilities. ACL is a relatively new agency within HHS—it was established in April 2012 by bringing together the Administration on Aging, the Office of Disability, and the Administration on Developmental Disabilities (renamed the Administration on Intellectual and Developmental Disabilities) into one agency.20 Finally, the LHHS bill also provides funding for the HHS Office of the Secretary (OS), which encompasses a broad array of management, research, oversight, and emergency preparedness functions in support of the entire department.

FY2016 HHS Appropriations Overview

The FY2016 omnibus provided roughly $732.2 billion in combined mandatory and discretionary appropriations for HHS. This is about $40.5 billion (+6%) more than FY2015 enacted and $619 million (-0.1%) less than the FY2016 President's request. (See Table 5.) Of the total provided, roughly $75.1 billion (10%) is discretionary.

|

Funding |

FY2015 Enacted |

FY2016 Request |

FY2016 |

FY2016 Senate Cmte |

FY2016 Enacted |

|

Discretionary |

71.0 |

75.8 |

71.3 |

71.0 |

75.1 |

|

Mandatory |

620.7 |

657.1 |

657.6 |

657.1 |

657.1 |

|

Total BA in the Bill |

691.7 |

732.8 |

728.9 |

728.1 |

732.2 |

|

Title VI Ebola (emergency) |

2.7 |

- |

- |

- |

- |

Source: Amounts shown for FY2015 enacted, the FY2016 request, and the FY2016 House committee bill are generally drawn from (or estimated based on) H.Rept. 114-195, while amounts for the FY2016 Senate committee bill are generally drawn from S.Rept. 114-74. Amounts for FY2016 enacted were estimated based on data in the joint explanatory statement accompanying the FY2016 omnibus. For consistency with source materials, amounts in this report generally do not reflect sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities. FY2015 enacted totals do not include Ebola-related funds provided by the first FY2015 CR (P.L. 113-64) or in Division G, Title VI, of the FY2015 omnibus (P.L. 113-235).

Notes: BA = Budget Authority. Details may not add to totals due to rounding. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS Subcommittees of the House and the Senate Committees on Appropriations; and (4) do not include appropriations that occur outside of appropriations bills.

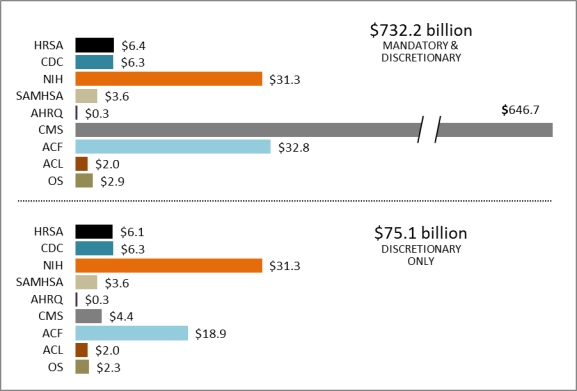

Figure 3 provides an agency-level breakdown of HHS appropriations in the FY2016 omnibus.

As this figure demonstrates, annual HHS appropriations are dominated by mandatory funding, the majority of which goes to CMS to provide Medicaid benefits and payments to health care trust funds. When taking into account both mandatory and discretionary funding, CMS accounts for $647 billion (88%) of total HHS appropriations in the FY2016 omnibus. ACF and NIH account for the next-largest shares of total HHS appropriations, receiving about 4% apiece.

By contrast, when looking exclusively at discretionary appropriations, funding for CMS constitutes only about 6% of HHS appropriations in the FY2016 omnibus. Instead, the bulk of discretionary appropriations go to the PHS agencies, which combine to account for 63% of discretionary appropriations in FY2016. NIH typically receives the largest share of all discretionary funding among HHS agencies (42% in the omnibus), with ACF accounting for the second-largest share (25% in the omnibus).

|

|

Source: Amounts estimated based on data provided in the joint explanatory statement accompanying the FY2016 omnibus (P.L. 114-113). For consistency with source materials, amounts displayed here do not reflect sequestration or re-estimates of mandatory spending programs, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities. Notes: Details may not add to totals due to rounding. Amounts in this figure (1) reflect all budget authority appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS Subcommittees of the House and the Senate Committees on Appropriations; and (4) do not include appropriations that occur outside of appropriations bills. |

Special Public Health Funding Mechanisms

Annual appropriations for HHS public health service agencies are best understood in the context of certain additional funding mechanisms: the Public Health Service Evaluation Set-Aside and the Prevention and Public Health Fund. In recent years, LHHS appropriations have used these funding mechanisms to direct additional support to certain programs and activities.

Public Health Service Evaluation Tap

The Public Health Service (PHS) Evaluation Set-Aside, also known as the PHS Evaluation Tap, is a unique feature of HHS appropriations. The Evaluation Tap, which is authorized by Section 241 of the Public Health Service Act (PHSA), allows the Secretary of HHS, with the approval of appropriators, to redistribute a portion of eligible PHS agency appropriations across HHS for program evaluation purposes.

The PHSA limits the set-aside to not less than 0.2% and not more than 1% of eligible program appropriations. However, LHHS appropriations acts have commonly established a higher maximum percentage for the set-aside and distributed specific amounts of "tap" funding to selected HHS programs. The FY2016 omnibus maintained the maximum set-aside level at 2.5% of eligible appropriations, the same percentage that has been in place since FY2010.21 The FY2016 President's budget had proposed increasing the set-aside to 3.0% of eligible appropriations, but this proposal was rejected in both the House and Senate committee bills for FY2016. The Senate committee bill proposed to retain the set-aside at 2.5%, while the House committee bill proposed to reduce the set-aside to 2.4% of eligible appropriations or $1.068 billion, whichever was less.22

Before FY2015, the PHS tap traditionally provided more than a dozen HHS programs with funding beyond their annual appropriations and, in some cases, was the sole source of funding for a program or activity. However, in both FY2015 and FY2016, LHHS appropriations directed tap funds to only about a half dozen programs or activities within just three HHS agencies (NIH, SAMHSA, and OS) and did not provide any tap transfers to AHRQ, CDC, and HRSA. This has been particularly notable for AHRQ, since the agency had been funded primarily through tap transfers from FY2003 to FY2014.23 In FY2015, however, AHRQ received a discretionary appropriation in an annual appropriations act for the first time in more than a decade, and this method of funding was continued in FY2016. In addition, unlike years past, LHHS appropriations for FY2015 and FY2016 directed the largest share of tap transfers ($715 million in FY2015 and $780 million in FY2016) to NIH. As a result, NIH went from being by far the largest net donor of tap funds to a net recipient of tap funds.24

Readers should note that, by convention, tables in this report show only the amount of PHS Evaluation Tap funds received by an agency (i.e., tables do not subtract the amount of the evaluation tap from donor agencies' appropriations). That is to say, tap amounts shown in the following tables are in addition to amounts shown for budget authority, but the amounts shown for budget authority have not been adjusted to reflect potential "transfer-out" of funds to the tap.

Prevention and Public Health Fund

The ACA both authorized and appropriated mandatory funding for three multi-billion dollar trust funds to support programs and activities within the PHS agencies.25 One of these, the Prevention and Public Health Fund (PPHF, ACA Section 4002, as amended), is intended to provide support each year to prevention, wellness, and related public health programs funded through HHS accounts.26 The ACA appropriated $2 billion in mandatory funds for the PPHF in FY2016, but this amount was later reduced to $1 billion by the Middle Class Tax Relief and Job Creation Act of 2012 (P.L. 112-96), which decreased total PPHF appropriations by $6.25 billion over the course of FY2013-FY2021. In addition, the FY2016 PPHF appropriation is subject to a 6.8% reduction due to sequestration of nonexempt mandatory spending (for more information on sequestration, see the budget enforcement discussion in the Appendix).

PPHF funds are intended to supplement (sometimes quite substantially) the funding that selected programs receive through regular appropriations, as well as to fund new programs, particularly those newly authorized by the ACA. The ACA instructs the Secretary to transfer amounts from the PPHF to agencies for prevention, wellness, and public health activities. The President's annual budget request sets out the intended distribution and use of PPHF funds for that fiscal year. The Secretary determined how to distribute these funds for FY2010 through FY2013. However, starting in FY2014, annual appropriations acts and their accompanying report language have explicitly directed the distribution of PPHF funds and prohibited the Secretary from making further transfers in those years.27

The CDC commonly receives the largest share of PPHF funds, and this practice was continued in FY2016, with the joint explanatory statement directing $892 million in PPHF funds to the CDC.

Readers should note that the PPHF transfer amounts displayed in the HHS tables below are in addition to amounts shown for budget authority provided in the bill. For consistency with source materials, the amounts shown for PPHF transfers in these tables reflect the estimated effects of mandatory spending sequestration; this is not true for other mandatory spending programs.

Selected HHS Highlights by Agency

This section begins with a limited selection of FY2016 discretionary funding highlights by HHS agency. The discussion is largely based on the FY2016 omnibus, compared to FY2015 enacted appropriations levels and proposed appropriations levels in the FY2016 House and Senate committee-reported bills and the FY2016 President's budget.28 These summaries are followed by a brief overview of significant provisions from annual HHS appropriations laws that restrict spending in certain controversial areas, such as abortion and stem cell research. Finally, the section concludes with two tables (Table 6 and Table 7) presenting more detailed information on FY2015 enacted, FY2016 proposed, and FY2016 enacted funding levels for HHS.

HRSA

The FY2016 omnibus provided $6.1 billion in discretionary budget authority for HRSA. This is $35 million (+1%) more than HRSA's FY2015 enacted funding level and $78 million (-1%) less than the FY2016 President's request.29 The FY2016 omnibus provided $286 million for the Title X Family Planning Program. This is the same amount the program received in FY2015, but represents a significant change from earlier proposals in the FY2016 House and Senate committee bills. The FY2016 House committee bill would have eliminated funding for the Title X Family Planning Program and would have included a new general provision (§229 of H.R. 3020) prohibiting any funds appropriated in the LHHS bill from being used to carry out Title X of the PHSA. Meanwhile, the FY2016 Senate committee bill would have continued to fund the Title X Family Planning program, but at a reduced level of $258 million (-10%) compared to FY2015.

CDC

The FY2016 omnibus provided $6.3 billion in discretionary budget authority for CDC. This amount is $303 million (+5%) more than CDC's FY2015 enacted funding level and $175 million (+3%) more than the FY2016 President's request. In addition, the FY2016 omnibus directed $892 million in PPHF transfers to the CDC, which is $5 million (+1%) more than FY2015. The omnibus did not direct any PHS tap funds to the CDC, continuing the practice started in FY2015. The omnibus increased discretionary budget authority for several CDC programs and activities, including Emerging and Zoonotic Infectious Diseases (+50%) and Injury Prevention and Control (+38%). By contrast, the omnibus decreased discretionary appropriations for Immunization and Respiratory Disease (-$114 million), but offset this decrease by a comparable increase in amounts to be transferred from the PPHF (+$114 million).

NIH

The FY2016 omnibus provided $31.3 billion in discretionary budget authority for NIH. This is $1.9 billion (+7%) more than NIH's FY2015 enacted funding level and $1.1 billion (+4%) more than the FY2016 President's request. In addition, the FY2016 omnibus directed $780 million in PHS tap transfers to NIH, an increase of $65 million (+9%) from FY2015. The omnibus directed the entirety of the tap transfer ($780 million) to the National Institute of General Medical Sciences (NIGMS). The omnibus paired the increase in tap transfers to NIGMS with an increase of $76 million (+5%) in discretionary appropriations. Of total funds provided to NIGMS, the omnibus required not less than $321 million be directed to the Institutional Development Awards (IDeA) program. The IDeA program broadens the geographic distribution of NIH biomedical research grants by building research capacities in states in which the aggregate success rate for applications to NIH has historically been low.

In general, the omnibus provided each of the NIH Institutes and Centers with a net increase of 4% or more compared to FY2015. The largest increase among NIH Institutes and Centers went to the National Institute on Aging (NIA), which received a total of $1.6 billion (+33%). Out of this amount, the explanatory statement calls for NIH to reserve $936 million for Alzheimer's disease research.30 A dollar reservation for a specific disease or area of research at NIH represents a fairly significant departure from past precedent.31 Earlier in the FY2016 process, the House committee report had called for NIH to reserve $886 million for Alzheimer's research.32 The Senate committee report, while identifying Alzheimer's disease as an area of key interest, would have retained the tradition of not reserving specific amounts for particular diseases or research areas, instead deferring to NIH and its scientific advisory panels on such decisions.33

Notably, the omnibus did not make any changes to the HHS Nonrecurring Expenses Fund (NEF), despite proposed changes in both the Senate and House committee bills. The NEF was established by the Consolidated Appropriations Act, 2008 (P.L. 110-161, Division G, Title II, §223) to enable the HHS Secretary to collect certain unobligated balances of expired discretionary funds appropriated to HHS from the General Fund.34 Funds transferred into the NEF are available to the Secretary for capital acquisitions across HHS, including facilities infrastructure and information technology. The Senate committee bill would instead have made NEF funds available only to the Office of the Director at NIH for purposes of carrying out NIH activities (see §220). The House committee bill would have terminated the NEF altogether, and rescinded remaining unobligated balances (see §225). Because the omnibus made no changes to the NEF, it remains available for HHS infrastructure and technology investments.

SAMHSA