Introduction

On December 20, 2018, President Trump signed into law a new five-year omnibus farm bill, the Agricultural Improvement Act of 2018 (P.L. 115-334; the 2018 farm bill). The U.S. Department of Agriculture (USDA) will implement the provisions, most of which take effect in calendar year 2019. The 2018 farm bill includes 12 titles covering different program areas.1 The first title, Title I—Commodities, authorizes several major revenue support and disaster assistance programs (see shaded box below).

|

2018 Farm Bill: Title I—Commodities Subtitle A—Commodity Policy (See Table A-1 for provisions) Section 1101. Definition of effective reference price. Section 1102. Base acres. Section 1103. Payment yields. Section 1104. Payment acres. Section 1105. Producer election. Section 1106. Price loss coverage (PLC). Section 1107. Agriculture risk coverage (ARC). Section 1108. Repeal of transition assistance for producers of upland cotton. Subtitle B—Marketing Loans (See Table A-2 for provisions) Section 1201. Extensions. Section 1202. Loan rates for nonrecourse marketing assistance loans (MAL). Section 1203. Economic adjustment assistance for textile mills. Section 1204. Special competitive provisions for extra-long staple cotton. Section 1205. Availability of recourse loans. Subtitle C—Sugar (Provisions not included) Section 1301. Sugar policy. Subtitle D—Dairy Margin Coverage and Other Dairy Related Provisions (Provisions not included) Section 1401. Dairy margin coverage. Section 1402. Reauthorizations. Section 1403. Class I skim milk price. Section 1404. Dairy product donation. Subtitle E—Supplemental Agricultural Disaster Assistance (See Table A-3 for provisions) Section 1501. Supplemental agricultural disaster assistance. Subtitle F—Noninsured Crop Assistance (See Table A-4 for provisions) Section 1601. Noninsured crop assistance program. Subtitle G—Administration (See Table A-5 for provisions) Section 1701. Regulations. Section 1702. Suspension of permanent price support authority. Section 1703. Payment limitations. Section 1704. Adjusted gross income limitations. Section 1705. Farm Service Agency accountability. Section 1706. Implementation. Section 1707. Exemption from certain reporting requirements for certain producers. |

This report briefly describes the major revenue support programs in Title I of the 2018 farm bill. In addition, it reviews changes to key administrative provisions such as program eligibility and signup, payment acres and yields, payment limits, and cost projections. Appendixes at the end of this report (Table A-1 to Table A-5) provide side-by-side comparisons of the provisions for five of the subtitles of Title I with prior law (as indicated in the shadow box above—Subtitle C, sugar, and Subtitle D, dairy, are discussed elsewhere).2

Background on Title I Support Programs

Aside from dairy and sugar, which have their own specific programs, most grain and oilseed crops produced in the United States are eligible for two tiers of revenue support under Title I of the 2018 farm bill. Specialty crops such as fruits, vegetables, and tree nuts are not covered.3 The first tier of support is provided by the Marketing Assistance Loan (MAL) program, which offers a minimum price guarantee for production of "loan" commodities in the form of a short-term loan at statutorily set prices (Table 1). The MAL program may be supplemented by a higher, second tier of revenue support comprised of two other programs: (1) the Price Loss Coverage (PLC) program, which provides price protection via statutory fixed "reference" prices for eligible crops, or (2) the Agricultural Risk Coverage (ARC) program, which provides revenue protection via historical moving average revenue guarantees based on the five most recent years of crop prices and yields.4 PLC and ARC are available for producers that own or rent historical "base" acres of "covered" commodities.

The sugar and dairy sectors are supported by separate federal farm programs that are tailored more specifically to the physical differences associated with each of their products—refined sugar and liquid fresh milk—and their respective markets. Disaster assistance is available for producers of most tree crops and livestock. The Noninsured Crop Assistance Program is available for all agricultural commodities that are not covered by a federal crop insurance policy.

All of these Title I programs existed under the previous 2014 farm bill. The 2018 farm bill extends their authority through crop year 2023 but with some modifications to most of them.5

Occasionally, agricultural producers may receive federal support under programs authorized outside of the farm bill. The Secretary of Agriculture has broad latitude under the authority of the Commodity Credit Corporation (CCC) Charter Act6 to make direct payments in support of U.S. agriculture. Two such programs implemented in recent years under CCC authority are the Cotton Ginning Cost Share program and the Market Facilitation Program.7

Separately, under the federal crop insurance program, Title I program commodities—along with more than 100 other crops including fruits and vegetables—are also eligible for subsidized crop insurance, which provides within-year yield (or revenue) protection. The federal crop insurance program is permanently authorized outside of the omnibus farm bill by the Federal Crop Insurance Act (7 U.S.C. §1501 et seq.).8 The 2018 farm bill includes Title XI—Crop Insurance, which makes minor adjustments to program implementation but does not alter the underlying authority of the federal crop insurance program. Neither the federal crop insurance program nor programs authorized under the CCC Charter Act are discussed in this report.

|

What Is a Marketing Year and How Does It Compare to a Fiscal Year? A marketing year is the 12-month period that begins after a crop is harvested. It represents the 12 months prior to the next harvest, during which a harvested crop is either sold into domestic or international markets or kept on the farm to be used as feedstuffs or stored for future sale or use. Crops with different planting and harvesting schedules have different marketing years. For example, the marketing year for the U.S. wheat, barley, and oat crops starts on June 1; the marketing year for cotton and rice starts on August 1; and the marketing year for corn, soybeans, and sorghum starts on September 1. The marketing year may be identified jointly as 2019/20 for crops harvested in 2019 or simply as the 2019 marketing year (MY2019). The PLC and ARC programs rely on marketing year data in their payment formulations. A crop year is generally the year that a program crop is planted and harvested.9 For example, the corn crop planted and harvested in 2019 is referred to as the 2019 crop year. The marketing year for this same crop (as described above) is also referred to as the 2019 marketing year even though it spans parts of 2019 and 2020. Thus, the crop year corresponds directly with the marketing year for program crops, and the two are often used synonymously. A fiscal year is the 12-month period starting with October 1 of one year and running through September 30 of the following year. The fiscal year may be identified by both years jointly, for example, as fiscal year 2019/20, or by the second year as fiscal year 2020 (FY2020). A fiscal year is the budget year for calculating federal program budget authorities and their respective outlays. The Congressional Budget Office (CBO) reports its federal program spending projections on a fiscal-year basis (Table 2). |

Policy Rationale for Farm Commodity Subsidies

Federal farm support began in the 1930s through Depression-era efforts to raise farm household income when commodity prices were low because of prolonged weak consumer demand. While initially intended to be a temporary effort, the commodity support programs have continued. However, several of them have been modified away from supply control and management of commodity stocks (which was designed to prop up prices) that directly linked support payments to farm production activities into decoupled revenue support10 that makes payments on historical program acres—referred to as base acres.11

Proponents of farm revenue support programs argue that federal involvement in the sector is needed to stabilize and support farm incomes by shifting some of the production risks to the federal government. These risks include short-term market price instability often due to weather or international events—both of which are outside the farmer's control. Proponents see the goal of farm policy as maintaining the economic health of the nation's farm sector so that it can use its comparative advantage in supplying domestic demand and competing in the global market for food and fiber. Critics argue that farm revenue support programs waste taxpayer dollars, distort producer behavior in favor of certain crops, capitalize benefits to the owners of the resources, encourage concentration of production, and comparatively harm smaller domestic producers and farmers in lower-income foreign nations.

Authorizing Legislation

The authority for USDA to operate farm revenue support programs comes from three permanent laws, as amended: the Agricultural Adjustment Act of 1938 (P.L. 75-430), the Agricultural Act of 1949 (P.L. 81-439), and the CCC Charter Act of 1948 (P.L. 80-806). Congress typically alters these laws through multi-year omnibus farm bills to address current market conditions, budget constraints, or other concerns.

If a new farm bill is not enacted when an old one expires, farm programs would revert to the permanent laws mentioned above for most of the major program crops. Under permanent law, eligible commodities would be supported under a parity-price formula at levels much higher than they are now, and many of the currently supported commodities might not be eligible.12 Since reverting to permanent law is incompatible with current national economic objectives, global trading rules, and federal budgetary policies, pressure builds at the end of each farm bill for policymakers to enact another.

The 2018 farm bill (P.L. 115-334) contains the most recent version of the farm commodity support programs. It supersedes the commodity provisions of previous farm bills and includes a provision (Section 1702) that suspends the relevant price support provisions of permanent law for the crop (and marketing) years 2019-2023.

Eligible Commodities

Federal support exists for about two dozen farm commodities representing about one-third of gross farm sales. During the five marketing years of 2014 through 2018, six crops (corn, wheat, soybeans, peanuts, cotton, and rice) accounted for an estimated 92% of farm commodity program payments.13

Covered Commodities

The 2018 farm bill continues to define covered commodities as the crops eligible for the farm revenue support programs PLC and ARC: wheat, oats, barley (including wheat, oats, and barley used for haying and grazing), corn, grain sorghum, long-grain rice, medium-grain rice, seed cotton (unginned upland cotton that contains both lint and seed), pulse crops (dry peas, lentils, small chickpeas, and large chickpeas), soybeans, other oilseeds (including sunflower seed, rapeseed, canola, safflower, flaxseed, mustard seed, crambe, and sesame seed), and peanuts (7 U.S.C. §9011). Each of these commodities has a statutorily defined PLC reference price (listed in Table 1).

Upland cotton was removed from eligibility as a covered commodity by the 2014 farm bill (P.L. 113-79). However, it indirectly regained its status as a covered commodity, via seed cotton, under the Bipartisan Budget Act of 2018 (P.L. 115-113).14

Loan Commodities

"Loan commodities" include all of the "covered commodities" plus upland cotton, extra-long-staple cotton, wool, mohair, and honey. These commodities have statutory loan rates (Table 1) and are eligible for the MAL program.

Fresh Milk

Support for milk production is available in the form of subsidized protection for producer milk margins (milk prices minus feed costs) under the Dairy Margin Coverage program.15

Sugar Cane and Sugar Beets

Sugar support is indirect through import quotas, processor price guarantees, and domestic marketing allotments. No direct payments are made to sugar growers or processors.16

Agricultural Products Without a Title I Revenue Support Program

Livestock, poultry, fruits, vegetables, nuts, hay, and nursery products (about two-thirds of U.S. farm sales) are not eligible to participate in a Title I revenue support program under the 2018 farm bill. However, livestock and fruit tree producers may qualify for partial relief from losses related to natural disasters under one of the four permanently authorized agricultural disaster assistance programs under Title I of the 2018 farm bill.17

Also, subsidized federal crop insurance is available for more than 100 crops, including fruits, vegetables, and selected livestock activities that are not supported by Title I farm programs. Crop insurance is designed primarily to cover losses from natural disasters or disease and within-season price or revenue declines.18 Another Title I farm bill program—the Noninsured Crop Disaster Assistance Program—is available for crops not currently covered by crop insurance.19

Definition of Farm

The definition of farm used to administer the revenue support programs is different from common perception or statistical definitions of farm based on size or output. Under USDA's Farm Service Agency (FSA) regulations, a "farm" for program payment purposes is one or more tracts of land considered to be a separate operation.20 A producer must register each farm operation with USDA and identify the resources (land, labor, equipment, capital, and management) associated with it.21 Land in a farm does not need to be contiguous. However, all tracts within a farm must have the same operator and the same owner (unless all owners agree to combine multiple tracts into a single FSA farm). Thus, one producer may be operating several "farms" if he or she is renting land from several landlords or has purchased land in several tracts.

Base Acres

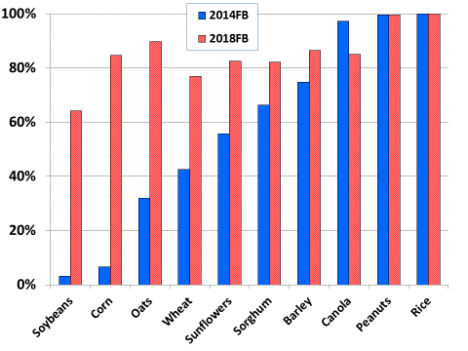

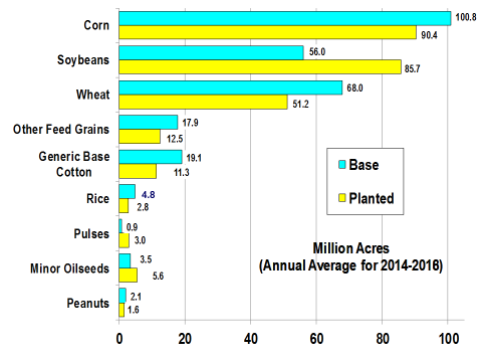

Base acres describes the historical planted acreage on each FSA farm using a multi-year average from as far back as the 1980s, for purposes of calculating program payments under one of the two revenue support programs—PLC or ARC.22 As of crop year 2015, USDA reported 273 million base acres, of which 254 million acres were enrolled in either ARC or PLC (Figure 1).

|

|

Source: Compiled by CRS from FSA data. The most recent crop year with published base acre data is 2015 (as of March 1, 2019) at https://www.fsa.usda.gov/programs-and-services/arcplc_program/index. Notes: Base acres are historical average acres on a farm that have been planted to program crops, which are defined under the 2002 farm bill (P.L. 107-171, §1101). Each base acre is associated with a particular program crop. Not all base acres are enrolled in ARC and PLC programs. In 2015, 254.3 million base acres were enrolled. **Generic base is former upland cotton base that was removed from eligibility for the ARC and PLC programs under the 2014 farm bill. In 2018, seed cotton was added as a covered commodity but not as a loan commodity by the Bipartisan Budget Agreement (BBA) of 2018 (P.L. 115-123). Under the BBA, producers were given a choice of how to allocate their generic base acres—either as base acres assigned to seed cotton or to another covered commodity and thus eligible for either ARC or PLC payments or into an unassigned pool where they would be ineligible for ARC or PLC program payments. However, USDA data on the BBA allocation of generic base acres are not yet available. For details see CRS Report R45143, Seed Cotton as a Farm Program Crop: In Brief, by Randy Schnepf. |

Base acres are calculated for each covered commodity and remain with the land when real estate is sold, thus making the new landowner eligible for farm programs. A farm's base acres may increase from year to year if base acres expire from a conservation contract or easement23 or a producer has eligible oilseed acreage as a result of the Secretary of Agriculture designating a new oilseed eligible as a covered commodity. Similarly, base acres may decline from year to year if some base acres are enrolled in a conservation easement; are converted to certain nonfarm or residential uses and are unlikely to return to agriculture; or are planted to fruits, vegetables, or wild rice in excess of certain planting flexibility rules.

Under the PLC and ARC program payment-acre provisions (7 U.S.C. 9014; Table A-1), planting flexibility rules allow crops other than the program crop to be grown, but eligible payment acreage is reduced when fruits, vegetables (other than mung beans and pulse crops), or wild rice are planted in excess of 15% of base acres (or 35% depending upon a farmer's program choice discussed below). The reduction to payment acres is one-for-one for every acre in excess of these percentages for that year.

A farm with base acres is not obligated to participate in farm programs. For those farms that do participate, once a farm's base acres are enrolled in either ARC or PLC, the farm does not have to plant a particular program crop to be eligible for a program payment. This is because ARC and PLC payments are decoupled from actual crop plantings.24 However, all participating producers must maintain conservation compliance, which requires planting a cover crop on highly erodible land.25

Under both the 2014 farm bill (P.L. 113-79) and the Bipartisan Budget Act of 2018 (P.L. 115-113), the calculation of base acres underwent several changes. These are briefly discussed next.

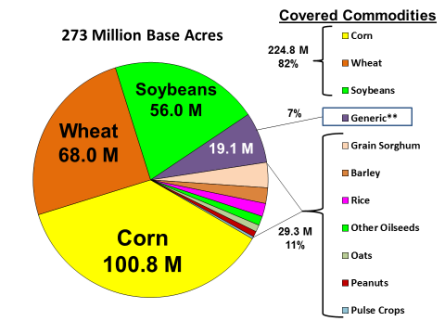

2014 Farm Bill: Updating Base Acres, Creation of Generic Base

Because a farmer's actual plantings may differ from farm base acres, program payments may not necessarily align with financial losses associated with market prices or crop revenue. To better match program payments with farm risk, the 2014 farm bill provided farmers with a one-time opportunity to update individual crop base acres by reallocating acreage within their current base portfolio to match their actual crop mix (plantings) during the crop years 2009-2012. Farmers could also choose to not reallocate their base acres if they expected payments to be maximized under their then-current base acres. Even after the opportunity to update base acres to better match actual farm plantings, disparities remained between base and planted acres (Figure 2).

The 2014 farm bill also removed upland cotton from eligibility for the ARC and PLC programs due to a ruling from a World Trade Organization dispute settlement case successfully brought by Brazil against U.S. cotton support programs.26 Former cotton base acres were renamed "generic base" and added to a producer's base for potential payments if a covered commodity (now excluding upland cotton) was planted on the farm.27 However, upland cotton remained eligible for the MAL program.

|

|

Source: Compiled by CRS from Farm Service Agency data on base acres as reported for 2014 and 2015 and National Agricultural Statistics Service data on planted acres as reported for crop years 2014-2018. |

Bipartisan Budget Agreement of 2018: Seed Cotton as a Covered Commodity

In 2018, seed cotton was added as a covered commodity, but not as a MAL loan commodity, by the Bipartisan Budget Agreement (BBA) of 2018 (P.L. 115-123).28 Under the BBA, producers were given a choice of how to allocate their generic base acres—either as base acres assigned to seed cotton or to another covered commodity and thus eligible for either ARC or PLC payments or into an unassigned pool where they would be ineligible for ARC or PLC program payments.29

2018 Farm Bill: Base Acres Retained from Prior Law with Potential Reduction

The 2018 farm bill retained base acres as defined on September 30, 2018, under the 2014 farm bill and inclusive of the BBA changes. Thus, upland cotton remains ineligible for PLC or ARC but is so indirectly via seed cotton. The 2018 farm bill also added a provision (Section 1102(b)) regarding base-acre eligibility for ARC or PLC program payments. If base acres were planted continuously to grass or pasture (including fallow acres) during the nine-year period extending from January 1, 2009, through December 31, 2017, then those affected base acres are not eligible for ARC or PLC payments during the life of the 2018 farm bill—that is, during crop years 2019-2023. However, these acres would remain eligible to be counted as base acres for a future farm bill.30

Eligible Producers

The 2018 farm bill defines producer (for purposes of revenue support program benefits) as an owner-operator, landlord, tenant, or sharecropper who shares in the risk of producing a crop and is entitled to a share of the crop produced on the farm. Participation in revenue support programs is free. However, an individual must comply with certain requirements to be eligible for most program payments.31 These requirements include:

- Actively engaged in farming (AEF). Each individual must provide a significant contribution of capital (land or equipment) and personal labor or active personal management to the farm operation, share in the risk of loss from the farm operation, and receive a share of the output as compensation.32 Legal entities can be actively engaged if members collectively contribute personal labor or active personal management. Special classes allow landowners to be considered actively engaged if they receive income based on the farm's operating results without providing labor or management (as described below).

- Conservation compliance. A producer agrees to maintain a minimum level of conservation on highly erodible land and not to convert or make production possible on wetlands.33

- Adjusted gross income (AGI) threshold. Persons with combined farm and nonfarm AGI in excess of $900,000 are ineligible for most program benefits. Average AGI is measured from the three tax years prior to the most recent taxable year. The AGI limit may be waived on a case-by-case basis to protect environmentally sensitive land of special significance.

- Minimum farm size. A producer on a farm may not receive farm program payments if the sum of the base acres on the farm is 10 acres or less. Two producer groups are excluded from this prohibition: beginning farmers and ranchers and veteran farmers and ranchers.

Eligibility and Tenancy

A farm operation usually involves some combination of owned and rented land. The amount of total land in farms rented by farm operators has ranged between 34% and 43% of farmland during 1964-2012.34 In 2014, an estimated 39% of farmland was rented—80% of rented farmland is owned by non-operator landlords. Two types of rental arrangements are common: cash rent and share rent.

Cash Renting Base Acres

Under cash rental contracts, the tenant pays a fixed cash rent to the landlord. The landlord receives the same rent irrespective of market conditions, bears no risk in production, and thus fails to meet the AEF criteria and is not eligible to receive program payments. The tenant bears all of the risk, takes all of the harvest, and receives all of the program payment.

Even though tenants might receive all of the government payments under cash rent arrangements, they might not keep all of the benefits if landlords demand higher rent. Economists widely agree that a large portion of government farm payments passes through to landlords, since government payments boost the rental value of land.35

Share Cropping Base Acres

Under share rental contracts, the tenant usually supplies most or all of the labor and machinery, while the landlord supplies land and perhaps some machinery or management. Both the landlord and the tenant bear risk in producing a crop and receive a portion of the harvest.36 In most cases, both meet the AEF criteria and are eligible to share in the government subsidy.

Farm Commodity Revenue Support Programs

The farm revenue support program provisions from Title I of the 2014 farm bill are largely preserved under the 2018 farm bill but with some modifications, as identified below.37

The Marketing Assistance Loan (MAL) Program

The MAL program has been in existence, in one form or another, since the 1930s. Its longevity as a farm program derives from its utility at providing both short-term financing and a guaranteed floor price.38 This is done by offering producers a nonrecourse nine-month loan—valued at a commodity-specific, statutorily-fixed loan rate—for all harvested production of qualifying crops. These qualifying crops are referred to as loan commodities (Table 1).39 Because MAL benefits are directly linked to the harvested output, benefits are said to be "coupled."

No Signup, but Participation Requires a Harvested Crop

No pre-planting signup is necessary to participate in the MAL program, and a producer does not need to own or rent base acres to be eligible. However, a producer must have a harvested crop to use as collateral for the loan. Thus, if a producer suffers a crop failure due to a natural disaster and has no marketable crop, the MAL program is not available as a program option.

How the MAL Program Works

At harvest time, crop prices are usually at their lowest point for the year because of the large supply of harvested crops entering the marketplace at the same time. To avoid selling into a weak market, the MAL program offers producers the option to put a harvested loan commodity under a nine-month nonrecourse loan valued at a statutorily fixed, per-unit commodity loan rate (Table 1) using the crop as collateral. Thus, MAL benefits are coupled to the harvested crop.40 Nonrecourse means that USDA must accept the pledged crop (i.e., the collateral) as full payment of an outstanding loan if the collateral is forfeited.41

During the nine-month loan period, producers will consider whether market prices are above or below the MAL loan rate. If they are above the loan rate, producers will pay off their loans and reclaim their collateral crops to sell into the higher priced marketplace. However, if market prices are below the loan rate, then producers may consider forfeiting their crop to USDA and keeping the loan value as payment. Thus, the statutory loan rate, in effect, establishes a price guarantee. Under the 2018 farm bill a producer has additional choices besides forfeiture in claiming MAL benefits when market prices are low (see "Policy Evolution of the MAL Program" section below).

Policy Evolution of the MAL Program

In the 1960s, 1970s, and 1980s, during extended periods when commodity prices were below the MAL loan rates, many producers chose to forfeit their crops to USDA rather than repay their MAL loans at the higher loan rate. These forfeitures led to large accumulations of grain and oilseed stocks by USDA. These government-held stocks were costly to taxpayers and contributed to market conditions of oversupply.

In the 1980s and 1990s, Congress redesigned the MAL program to avoid government stock accumulation by offering alternative repayment prices to the statutory loan rates (see box below). Under current law, prior to loan maturity, producers may compare the repayment prices announced by USDA for their localities with the statutory MAL loan rates for each eligible commodity before selecting from among several potential MAL program benefits.

|

USDA regularly announces alternative MAL loan repayment prices that may vary with market conditions above or below the statutory loan rates.42 The periodicity varies with the loan commodities. For example, for most grain and oilseed crops, USDA announces daily the alternative loan repayment rate as a posted county price—that is, average wholesale terminal prices adjusted for transportation costs from the terminal to the county. For upland cotton and rice, USDA collects international reference prices, which are converted to a U.S. location by adjusting for transportation costs. These "adjusted world prices" are announced weekly for operating the cotton and rice MAL repayment provisions. USDA announces a weekly national posted price for peanuts, wool, and mohair and a weekly national or regional posted price for pulse crops. For honey, a monthly survey prices is announced. |

A Producer Has Four Potential Repayment Choices Under an MAL Loan

Under current law (as continued by the 2018 farm bill), a producer with a commodity under an MAL loan has several repayment options. If the USDA-announced repayment rate is at or above the loan rate, the farmer repays the loan principal and interest and reclaims the commodity. In contrast, when the announced repayment rate is below the loan rate, the farmer may choose from among four potential options:

Loan deficiency payment (LDP). Rather than putting the harvested crop under an MAL, a farmer may request an LDP with the per-unit payment rate equal to the difference between the loan rate and loan repayment rate. The farmer receives the LDP payment and keeps the crop to sell or use on farm.

Marketing loan gain (MLG). A participating farmer with a crop under an MAL loan can repay the loan at the USDA-announced repayment price and pocket the difference (between the loan rate and the repayment rate) as an MLG. The farmer keeps the MLG and the crop to sell or use on farm.

Commodity certificate exchange. A farmer may use commodity certificates—paper certificates with a dollar denomination that may be exchanged for commodities in USDA inventory—to repay an MAL loan at the lower USDA-announced price and keep the associated price gain. The farmer keeps the gain and the crop to sell or use on farm.

Forfeiture. A producer can forfeit the pledged crop to USDA at the end of the loan period. The producer may keep any price gains associated with forfeiture but relinquishes access to the crop.

Higher MAL Loan Rates for Some Commodities Under the 2018 Farm Bill

The level of revenue support provided by the MAL program varies with market conditions and the relationship between MAL loan rates and market prices. The 2018 farm bill raised MAL loan rates for several loan commodities, including barley, corn, grain sorghum, oats, extra-long-staple cotton, sugar, rice, soybeans, dry peas, lentils, and small and large chickpeas.43 The MAL program's usefulness as a risk management and marketing tool varies widely across program crops depending on the relationship between farm prices and the statutory loan rates.

Under the 2018 farm bill (Section 1703):

- MAL benefits are no longer subject to annual payment limits (this includes MLG and LDP benefits, as well as any gains under commodity certificates and forfeiture).44

Under the previous 2014 farm bill:

- MLG and LDP benefits combined with payments under PLC and ARC were subject to a payment limit of $125,000 per person for all covered commodities (except peanuts, which has a separate limit of $125,000).

- However, MAL gains under commodity certificates and forfeiture were excluded from payment limits.

Table 1. Farm Prices, Marketing Assistance Loan Rates, and PLC Reference Prices

(2014 farm bill versus 2018 farm bill)

|

Program Commoditiesa |

Unit |

Recent Farm Price (FP)b |

Market Assistance Loan Rate |

PLC Reference Price |

||||||||||||||||||||||

|

2014FB |

2018FB |

2014FB + 2018FB |

||||||||||||||||||||||||

|

$/unit |

$/unit |

% FP |

$/unit |

$/unit |

% FP |

|||||||||||||||||||||

|

Corn |

bu. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Soybeans |

bu. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Wheat, all |

bu. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Peanuts |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Sorghum |

bu. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Barley |

bu. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Oats |

bu. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Rice, long-grain |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Rice, medium-grain |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Dry peas |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Lentils |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Chickpeas, large |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Chickpeas, small |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Cotton, uplandc |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Cotton, extra-long-staple |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Seed Cottone |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Sugar, refined beet |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Sugar, raw cane |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Wool, graded |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Wool, nongraded |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Mohair |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Honey |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Minor oilseedsi |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Sunflower |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Flaxseed |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Canola |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Rapeseed |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Mustard |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Safflower |

cwt. |

|

|

|

|

|

|

|

|

|||||||||||||||||

Source: Compiled by CRS. MAL loan rates and PLC reference prices are from the 2014 and 2018 farm bills; monthly price data are from National Agricultural Statistics Service (NASS) and ERS.

Notes: FB = farm bill, n.a. = not applicable, bu. = bushel, cwt. = hundredweight or 100 lbs.

a. Commodities with MAL loan rates are referred to as "loan" commodities; commodities with PLC reference prices are known as "covered" commodities.

b. The Olympic average (excluding high and low data years) for crop years 2014-2018 of market-year average farm prices (MYAPs). Average adjusted world prices are used for comparison of upland cotton and rice MAL loan rates instead of farm prices.

c. Upland cotton was removed from eligibility for the ARC and PLC programs by the 2014 farm bill due to a ruling from a World Trade Organization dispute settlement case successfully brought by Brazil against U.S. cotton support programs (see CRS In Focus IF10193, The WTO Brazil-U.S. Cotton Case, by Randy Schnepf). However, upland cotton remains eligible for the MAL program.

d. The loan rate for upland cotton is the average MYAP for the preceding two years but within a range of $45/cwt. and $52/cwt.

e. Seed cotton was added as a covered commodity, but not a loan commodity, by the Bipartisan Budget Act of 2018 (P.L. 115-123).

f. U.S. wholesale refined beet sugar price, Midwest markets, Milling and Baking News, as reported by ERS.

g. U.S. raw sugar price, Contract No. 14/16, duty fee paid New York, as reported by ERS.

h. Average farm price received, with no distinction for graded or ungraded, as reported by NASS.

i. Minor oilseeds include the six listed oilseeds (sunflower, flaxseed, canola, rapeseed, mustard, and safflower), as well as crambe and sesame—but these latter two are excluded from the price calculation due to insufficient data.

j. Weighted average based on 2018 production as reported by NASS.

PLC and ARC Programs

A second tier of revenue support is available under the PLC and ARC programs. PLC and ARC provide income support to covered commodities at levels above the price protection offered by the MAL program's loan rates.

ARC and PLC were first authorized under the 2014 farm bill (P.L. 113-79). The 2018 farm bill extends both programs but with several modifications intended to increase producer flexibility in their use. Participation is free. However, a producer must own or rent base acres to participate. In addition, a producer must elect ARC or PLC for the farm's historical base acres and enroll his or her farm operation in the elected program.45 Unlike MAL payments, which are coupled to harvested crops, PLC and ARC payments are decoupled and made proportional to base acres.

Producer Election

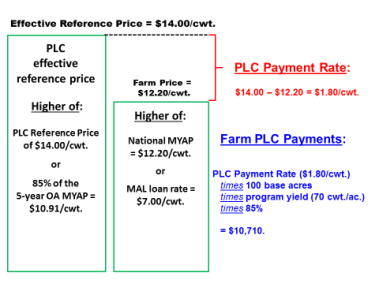

Producers choose between PLC and ARC depending on their preference for protection against a decline in (a) crop prices or (b) crop revenue, respectively. Payments under the PLC program are triggered when the national market-year average farm price (MYAP) for a covered commodity is below its "effective reference price" (Figure 3). In contrast, ARC payments are triggered when crop revenue is below its guaranteed level based on a multi-year moving average of historical crop revenue (Figure 5). Producers can elect ARC at either the county (ARC-CO) or individual farm (ARC-IC) level. PLC and ARC-CO choices can vary by "covered" commodities (for a list of covered commodities, see Table 1), whereas ARC-IC includes all "covered" commodities on a farm under a single whole-farm revenue guarantee.

Under the 2014 farm bill, producers had a one-time choice between ARC and PLC, on a commodity-by-commodity basis that lasted for five crop years (2014-2018). In contrast, the 2018 farm bill allows producers to alter their program choices more frequently. In 2019, producers may select ARC or PLC coverage, on a commodity-by-commodity basis, effective for both crop years 2019 and 2020. If no initial choice is made, then the default is whichever program was in effect during crop years 2015 through 2018 under the 2014 farm bill. Then, beginning in 2021, producers may again choose (i.e., make a new election) between ARC and PLC annually by covered commodity for each of crop year 2021, 2022, and 2023. In addition, producers now may remotely and electronically sign annual or multi-year contracts for ARC and PLC.

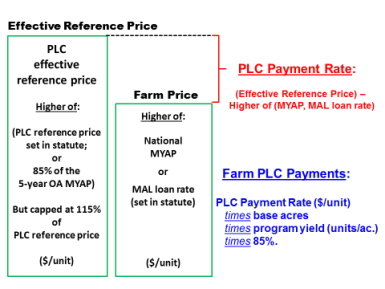

Price Loss Coverage (PLC)

PLC price protection is based on a statutorily fixed reference price (Table 1) that may be temporarily increased under certain conditions. Under the 2014 farm bill version of the PLC program, producers received payments on a portion of their enrolled base acres when the national MYAP for the enrolled covered commodity was below its reference price set in statute. This option was attractive if farmers expected farm prices to drop below the reference price for a covered commodity.

The 2018 farm bill added a provision (Section 1101) that replaced the statutory reference price with an "effective reference price" that may increase to as much as 115% of the statutory PLC reference price based on market conditions. The effective reference price is determined by a formula as the higher of the statutory reference price or 85% of the five-year Olympic average46 of the national MYAP for the five preceding years.

PLC Payment Formula

Under the 2018 farm bill, the PLC program will make a payment when the MYAP for a covered commodity is less than the effective reference price. See Figure 3 for a graphical interpretation of the formula and Figure 4 for a hypothetical example for rice. The farm's total PLC payments for a covered commodity may be calculated as follows:

- The PLC per-unit payment rate equals the difference between the effective PLC reference price and the higher of the MYAP or the MAL loan rate.

- The PLC per-acre payment rate equals the PLC per-unit payment rate times the program yield (described below).

- The PLC total payment equals the PLC per-acre payment rate times 85% of base acres signed up for the respective covered commodity.47

PLC Payment Yield

PLC payment yields are similar to base acres in that they are historical farm-level, crop-specific measures that are used to determine program payments under the PLC program.48 Producers were given the option of updating their payment yields under the 2002, 2014, and 2018 farm bills.49

|

Figure 3. The Price Loss Coverage (PLC) Program Formula (makes payment when national MYAP drops below the effective reference price) |

|

|

Source: Compiled by CRS based on the 2018 farm bill (P.L. 115-334). Note: MYAP = market-year average farm price; MAL = Marketing Assistance Loan program; OA = Olympic average (excluding the high and low years). In a declining market, the per-bushel payment rate increases until the farm price drops below the loan rate, when benefits under the MAL program may become available. |

|

|

Source: Compiled by CRS based on the 2018 farm bill (P.L. 115-334). Notes: MYAP = market-year average farm price; MAL = Marketing Assistance Loan program; OA = Olympic average (excluding the high and low years). This example assumes a farm with 100 base acres enrolled in the rice PLC program, a program yield for rice of 70 cwt./acre, and national OA for MYAP for 2013-2018 of $12.20 per cwt. In a declining market, the per-unit payment rate increases until the farm price drops below the loan rate ($7.00/cwt. for rice), at which point the PLC payment rate is fixed at $14.00 - $7.00 = $7.00/cwt. If market prices decline further, benefits under the MAL program may become available. |

Under the 2014 farm bill, producers were given an opportunity to update payment yields, on a covered-commodity-by-covered-commodity basis, using 90% of average yields for the 2008-2012 crop years—excluding any year in which acreage planted to the covered commodity was zero. Producers could also use a "plug" yield in the update calculation, equal to 75% of the five-year average county yield for a covered commodity, if the farm-level yield for any of the 2008-2012 crop years was less than 75% of the average county yield during that period. The yield update election had to be made so as to be in effect beginning with the 2014 crop year.

Under the 2018 farm bill, producers could again update program yields, on a covered-commodity-by-covered-commodity basis, using 90% of the average of the yield per planted acre for the 2013-2017 crop years. However, unlike the 2014 farm bill yield update which used the simple average for the data period, the 2018 farm bill yield update was subject to a commodity-specific adjustment factor to account for any national increase in trend yield.50

Producers could again use a "plug" yield in the update calculation, equal to 75% of the average county yield for a covered commodity during the 2013-2017 crop years, if the farm-level yield for any year was less than 75% of the average county yield during that period. Any year in which planted acreage to the covered commodity was zero could be excluded from the calculation. The yield update election must be made so as to be in effect beginning with the 2020 crop year.

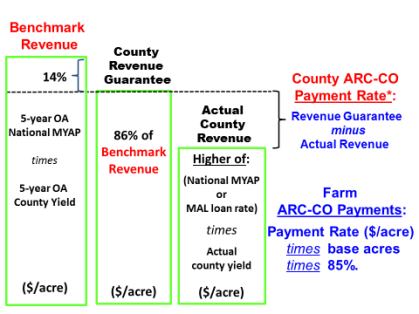

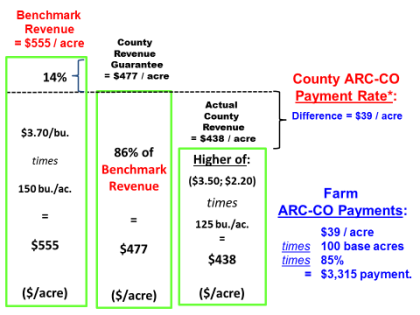

Agriculture Risk Coverage (ARC)

Producers more concerned about declines in crop revenue (i.e., yield times price) than price can select the county ARC program (ARC-CO) as an alternative to PLC for each covered commodity. Under ARC-CO, payments are triggered when the annual county revenue for a covered commodity is less than 86% of its recent five-year average revenue.51 If farmers prefer farm-level revenue protection based on farm-level yields, then they could choose to combine all covered commodities into a single, whole-farm revenue guarantee under the farm-level "individual" ARC (ARC-IC) program.

County ARC (ARC-CO)

The ARC-CO program has a county revenue guarantee, and only a crop revenue loss at the county level triggers a payment. The ARC-CO crop revenue guarantee equals 86% of the county benchmark revenue (Figure 5). The benchmark revenue is the product of the five-year Olympic average of county yields (measured as units of output per acre) and the five-year Olympic average of the higher of the national MYAP or the PLC effective reference price. An ARC-CO payment is made if the current-year county revenue (calculated as the product of county yield and national MYAP) is below the ARC-CO revenue guarantee. The ARC-CO payment rate, which equals the difference between the per-acre county revenue guarantee and the actual county per-acre crop revenue, is capped at 10% of benchmark revenue.

With the revenue guarantee set at 86% of the benchmark revenue, the producer absorbs the first 14% of any shortfall, and the government absorbs the next 10% of revenue shortfall.52 Remaining losses may be backstopped by crop insurance if purchased at sufficient coverage levels by the producer and by the MAL program.

Similar to PLC, the ARC-CO payment formula for a particular covered commodity is the ARC-CO payment rate times 85% times the number of base acres enrolled in ARC-CO. See Figure 5 for a graphical interpretation of the formula and Figure 6 for a hypothetical example for corn.

County Yield Data Changes

Under the 2014 farm bill, USDA's National Agricultural Statistics Service (NASS) was the primary source for the county yield estimates used in the ARC-CO formulas. However, when USDA announced its first ARC-CO payments under the then-new program in 2015, significant discrepancies in county-level payments were discovered. These discrepancies appeared to be due, in part, to how average county yield calculations were being made. If a county lacked sufficient NASS data, then USDA would use Risk Management Agency (RMA) yield data based on crop insurance program participation. A comparison of the two estimates suggested that RMA yields were frequently higher than NASS yields at the county level. As a result, payments to producers in counties where RMA yields were used could be substantially lower than payments in counties using NASS yields. Congress showed interest in minimizing such discrepancies.53 Since RMA yield data were more widely available at the county level than NASS yield data, there was considerable debate about switching yield data prioritization for ARC-CO calculations to the RMA data.

Under the 2018 farm bill (Section 1107), yield data from RMA are made the primary source for county average yield calculations for the ARC-CO benchmark revenue. Where RMA data are not available, USDA is to determine the data source considering data from NASS or the yield history of representative farms in the state, region, or crop-reporting district. Also, ARC-CO is to use a trend-adjusted yield to calculate the benchmark revenue, as is done by RMA for the federal crop insurance program. Finally, the five-year Olympic average county yield calculations are to include a yield plug (equal to 80% of the 10-year average county yield) for each year where actual county yield is lower than the estimated plug.

Other 2018 farm bill (Section 1107) modifications to ARC-CO include allowing yields used in ARC-CO revenue calculations to be calculated separately for irrigated and non-irrigated land in each county and basing ARC-CO payments on the physical location of the farm—farms that cross multiple counties are prorated for each county. Finally, up to 25 counties nationwide may subdivide for ARC-CO yield calculations to reflect significant yield deviations within a county. Such subdivision is to be based on certain criteria: A county must be larger than 1,400 square miles and have more than 190,000 base acres.

|

Figure 5. Agriculture Risk Coverage, County (ARC-CO) Formula Payment triggered when actual county revenue drops below 86% of county revenue guarantee |

|

|

Source: Compiled by CRS based on the 2018 farm bill (P.L. 115-334). Notes: MYAP = market-year average farm price; MAL = Marketing Assistance Loan program; OA = Olympic average (excluding high and low years). The ARC-CO payment rate is capped at 10% of the benchmark revenue. |

|

|

Source: Compiled by CRS based on the 2018 farm bill (P.L. 115-334). Notes: Assumes five-year average price (excluding high and low years) is $3.70 per bushel and five-year average yield (excluding high and low years) is 150 bushels per acre. In this example, the maximum potential ARC-CO payment rate is $55.50 per acre (10% of the benchmark revenue of $555 per acre). |

Individual ARC (ARC-IC)

Instead of an ARC-CO revenue guarantee on a crop-by-crop basis, farmers could select a farm-level guarantee that includes all covered commodities on a farm under one revenue guarantee. The farm-level revenue guarantee is again based on a five-year moving average of farm-level yields for each crop year, multiplied by the higher of the reference price or the MYAP, that aggregates all crop revenue into a single, whole-farm guarantee.

The individual ARC payment formula is 65% times the number of total base acres for the farm times the difference between the whole-farm revenue guarantee and the actual whole-farm crop revenue. The calculation for the guarantee and actual revenue are based on the aggregation of all covered commodities on the farm using individual farm yields instead of county yields.54

Decoupled Payments Made on Base Acres

A participating farmer does not have to plant or harvest a covered commodity to receive a PLC or ARC payment. However, a portion of the farm's base acres must be enrolled in either PLC or ARC for that covered commodity. This is because ARC-CO, ARC-IC, and PLC payments are decoupled: Payments are made on a portion of a crop's enrolled base acres rather than actual production. If ARC-CO or PLC program payments are triggered, then they are made on 85% of the producer's base acres that were enrolled for that covered commodity irrespective of actual plantings. ARC-IC payments are made on a reduced 65% of base acres.

Payments are made with a lag of approximately one year, as a full 12-month marketing year must be completed to compile the annual price and yield data necessary for USDA's calculations. According to statute (Section 1106 for PLC, Section 1107 for ARC), USDA is to announce payments no later than 30 days after the end of each marketing year. However, the actual payments may not be made prior to October 1 after the end of the applicable marketing year for the covered commodity. The marketing year varies by crop. For example, the marketing year for corn or soybeans harvested in fall 2019 ends on August 31, 2020. Thus, corn and soybean payments must be announced by September 30, 2020, but may not be made before October 1, 2020.

Payment Limits

The enacted 2018 farm bill sets a $125,000 per-person cap on the total combined payments of PLC and ARC for all covered commodities on a farming operation except peanuts, which has a separate $125,000 limit. In addition, a provision in the 2018 farm bill (Section 1603) specifies that any reductions in PLC and ARC payments due to sequestration must be applied before evaluating payment limit criteria.55 The 2018 farm bill (Section 1703) removed MAL program payments from any payment limit criteria.

Payment limits may be doubled if the farm operator has a spouse. On family farming operations, all family members ages 18 or older are deemed to meet AEF criteria and are eligible for a separate payment limit. Prior to the 2018 farm bill, family membership was based on lineal ascendants or descendants but was also extended to siblings and spouses. The 2018 farm bill (Section 1703(a)(1)(B)) expands the definition of family farm to include cousins, nephews, and nieces.56

Miscellaneous Payment Programs

Producers of upland cotton may also benefit from payments under two 2018 farm bill provisions: Section 1203(b), which provides economic adjustment assistance to users of upland cotton, and Section 1201(b)(2), which authorizes cotton storage cost reimbursements under certain market conditions.

Economic adjustment assistance payments are made to domestic users for all documented use of upland cotton on a monthly basis, regardless of the origin of the upland cotton (imported or domestic). The payment rate is $0.03 per pound. Although the payments are made to cotton users, at least a portion of the payment is likely returned to producers in the form of higher prices associated with the increased demand from domestic users.

The cotton storage cost reimbursement is generally referred to as a storage credit, since it is used to reduce the loan repayment rate by a portion of the accrued storage costs for upland cotton that has been placed under a MAL loan. It does not involve any actual CCC budgetary outlay but rather is a reduction in potential receipts from the CCC budget. The availability of a cotton storage credit is determined by the relationship between the MAL rate for upland cotton, the weekly announced average world price, and the accrued interest and storage charges specific to each bale of cotton placed under the MAL program.

Interaction with Federal Crop Insurance

Federal crop insurance directly intersects with farm programs when producers choose between the ARC and PLC programs. For producers who select the PLC, additional price protection is available by purchasing Supplemental Coverage Option (SCO). SCO is a crop insurance product that was permanently authorized under the 2014 farm bill (Section 11003). SCO is designed to cover part of the deductible on a producer's underlying crop insurance policy. SCO is not available for base acres enrolled in ARC.

Dairy and Sugar Programs

The sugar (Subtitle C) and dairy (Subtitle D) programs are essential parts of Title I of the 2018 farm bill. However, their programs differ markedly from the MAL, PLC, and ARC programs. Neither dairy nor sugar program benefits are subject to any per-person payment limit. In addition, the commodities themselves differ from the other Title I commodities (primarily grain and oilseed crops) in the nature of their output—fluid milk and refined sugar, how these commodities are processed and stored, and the markets that they are sold into. As a result, the dairy and sugar programs are briefly discussed below but are described in more detail in other reports.57

The Dairy Margin Coverage Program

The current U.S. dairy program—known as the Dairy Margin Coverage (DMC) program—was first authorized by the 2014 farm bill under the previous name of Margin Protection Program (MPP). The DMC offers milk producers a range of milk price margin protection levels based on their historical milk production. The milk margin is defined as the difference between the farm price per hundred pounds (cwt) of milk and the price of a representative feed ration based on USDA-announced prices for milk and major feed ingredients (corn, soymeal, and alfalfa hay). The DMC pays participating dairy producers the difference (when positive) between a producer-selected DMC margin protection level and the actual national milk margin. Producers must sign up for the program and pay an administrative fee of $100. Producers choose coverage either at the free $4.00/cwt margin or pay a premium that increases for higher milk production coverage levels and higher margin protection thresholds.

The 2018 farm bill significantly revised the margin program, including renaming it as the DMC. Premium rates for the first 5 million pounds of milk coverage were lowered; the range of margin protection for the first 5 million pounds of production was expanded (the previous range was $4.50/cwt to $8.00/cwt; the new range is $4.50/cwt to $9.50/cwt); the range of margin protection available for the production beyond the first 5 million pounds retains the previous $4.50-$8.00/cwt range of choices but with slightly higher premiums; and producers may now cover a larger quantity of milk production (up to 95% of their historical base production). DMC is authorized through December 31, 2023.58

Also, under the 2018 farm bill, dairy producers may receive a 25% discount on their premiums if they select and lock in their margin and production coverage levels for the entire five years (calendar years 2019-2023) of the DMC program. Otherwise, producers may select coverage levels annually. Also under DMC, dairy producers may apply to USDA for reimbursement of MPP premiums paid, less any payments received, during calendar years 2014-2017.

Unlike MPP, the DMC program allows dairy producers to participate in both margin coverage and the Livestock Gross Margin-Dairy insurance program that insures the margin between feed costs and a designated milk price.59

The Sugar Program

Current law mandates that raw cane and refined beet sugar prices are supported through a combination of limits on domestic output that can be sold (marketing allotments), nonrecourse marketing assistance loans for domestic sugar (but at the processor level), quotas that limit imports, and a sugar-to-ethanol backstop program (Feedstock Flexibility Program).60 These sugar program features result in essentially no federal outlays. The only change to the sugar program under the 2018 farm bill was a 5% increase in the MAL rate for raw cane and refined beet sugar (Table 1).

U.S. producers of both sugar and milk receive important price support via import protection from international competitor products under tariff-rate quotas (TRQs).61 Such TRQ support does not incur a direct cost to the federal government. Instead, domestic consumers bear the costs. For example, despite incurring no federal outlays, the U.S. government notifies sugar TRQ protection annually to the World Trade Organization as market price support (valued at over $1.4 billion in 2014).

Agricultural Disaster Assistance Programs

Four disaster assistance programs that focus primarily on livestock and tree crops were permanently authorized in the 2014 farm bill. These disaster assistance programs provide federal assistance to help farmers and ranchers recover financially from natural disasters, including drought and floods.62 Participation is free.

- The Livestock Indemnity Program (LIP) compensates producers at a rate of 75% of market value for livestock mortality or livestock sold at a loss. Eligible loss conditions may include (1) extreme or abnormal damaging weather that is not expected to occur during the loss period for which it occurred, (2) disease that is caused or transmitted by a vector and is not susceptible to control by vaccination, and (3) an attack by animals reintroduced into the wild by the federal government or protected by federal law.

- The Livestock Forage Disaster Program (LFP) provides payments to eligible livestock producers who have suffered grazing losses on drought-affected pastureland (including cropland planted specifically for grazing) or on rangeland managed by a federal agency due to a qualifying fire.

- The Tree Assistance Program (TAP) provides payments to eligible orchardists and nursery growers to replant or rehabilitate trees, bushes, and vines damaged by natural disasters, disease, and insect infestation. Eligible losses must exceed 15% after adjustment for normal mortality. Payments cover 65% of the cost of replanting trees or nursery stock and 50% of the cost of rehabilitation (e.g., pruning and removal).63

- The Emergency Assistance for Livestock, Honey Bees, and Farm-Raised Fish Program (ELAP) provides payments to producers of livestock, honey bees, and farm-raised fish as compensation for losses due to disease, adverse weather, feed or water shortages, or other conditions (such as wildfires) that are not covered under LIP or LFP.

The 2018 farm bill amended the permanent agricultural disaster assistance programs by expanding the definition of eligible producer to include Indian tribes or tribal organizations. It also expanded payments under LIP for livestock losses caused by disease and for losses of unweaned livestock that occur before vaccination. It increased replanting and rehabilitation payment rates for orchardists who are beginning farmers or veterans under TAP. Finally, it removed payment limits on ELAP. Of the four disaster assistance programs, only the LFP is now subject to the $125,000 per-person payment limit.

Noninsured Crop Disaster Assistance Program (NAP)

NAP is available for production of all agricultural commodities that are not covered by a federal crop insurance policy.64 NAP was permanently authorized by the 1996 farm bill (Federal Agriculture Improvement and Reform Act; P.L. 104-127). The 2018 farm bill (Section 1601) amended NAP by increasing the per-crop signup fee to $325 per crop, or $825 per producer per county, but not to exceed $1,950 per producer. Also, NAP eligibility was expanded to include crops that may be covered by select forms of crop insurance but only under whole farm plans or weather index policies. The 2018 farm bill also amended the payment calculation to consider the producer's share of the crop.

NAP offers both catastrophic coverage (a crop loss of at least 50% valued at 55% of the average market price) and additional buy-up coverage (ranging from 50% to 65% of established yields and 100% of the average market price). The 2018 farm bill made buy-up coverage permanent, added data collection and program coordination requirements, and created separate payment limits for catastrophic ($125,000 per person) and buy-up ($300,000 per person) coverage.

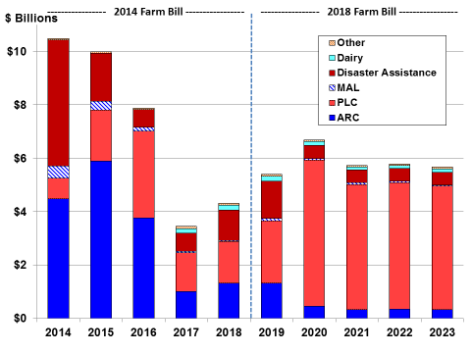

Estimated Cost of the Commodity Title

CBO projects USDA spending for Title I farm commodity and disaster programs under the 2018 farm bill at $31.3 billion for the five-year 2019-2023 period.65 This translates to $6.3 billion annually, including projected annual outlays of $4.1 billion for PLC and $1.2 billion for ARC (Table 2). This contrasts with estimated annual outlays on Title I programs under the 2014 farm bill of $7.2 billion, including $1.8 billion for PLC and $3.3 billion for ARC.

Under the 2014 farm bill, most acres of corn, soybeans, and wheat—the three largest crops produced annually in the United States—were enrolled in ARC (93%, 97%, and 56%, respectively). This preference for enrollment in ARC contributed to larger annual payment outlays under ARC ($3.3 billion per year on average) than PLC ($1.8 billion per year) under the 2014 farm bill. CBO's spending projections assume that a large proportion of producers will switch from participating in ARC to PLC under the 2018 farm bill (Figure 7). The assumed shift in participation between the two programs is driven by projections of farm prices for major program crops to track near or below PLC reference prices throughout the 10-year projection period, thus implying greater potential for PLC payments.

The substantial projected shift in participation from ARC to PLC is projected to result in significantly larger annual outlays under the PLC program ($4.1 billion per year) than under the ARC program ($1.2 billion per year) under the five-year life of the 2018 farm bill, crop years 2019-2023 (Table 2 and Figure 8). Annual program outlays can be highly variable. This is because spending on the farm revenue support programs—MAL, PLC, and ARC—is market-driven, and disaster assistance payments are associated with unpredictable acts of nature. Given the counter-cyclical design of the PLC and ARC programs, if commodity prices turn out to be higher than projected, then outlays will be lower than projected levels (and vice versa).

Table 2. Historic and Projected Annual Outlays for Title I: 2014 and 2018 Farm Bills

Annual averages in millions of dollars

|

Title I Program Category |

2014 Farm Bill: 2014-2018 |

2018 Farm Bill: 2019-2023 |

||

|

Price Loss Coverage Program |

|

|

||

|

Agricultural Risk Coverage Program |

|

|

||

|

Nonrecourse Marketing Assistance Loan Program |

|

|

||

|

Dairy Margin Coverage program |

|

|

||

|

Agriculture Disaster Assistance |

|

|

||

|

Other |

|

|

||

|

Total Cost of Title I |

|

|

Source: Data for the 2014 farm bill are compiled by CRS from FSA. Data projections for the 2018 farm bill are from the CBO January 2019 baseline for farm programs.

Note: Farm program outlays under the 2014 farm bill are not finalized (as of April 19, 2019), in part, due to the long delay associated with collecting the full marketing year of data needed for the calculations of both PLC and ARC payments.

|

Figure 8. Annual Outlays for Title I Farm Revenue Support Programs, 2014-2023 |

|

|

Source: Compiled by CRS, using historical data (2014-2018) from ERS farm income and projections (2019-2023) from CBO, baseline for USDA mandatory programs, January 2019. Notes: Farm program outlays under the 2014 farm bill are not finalized (as of May 13, 2019). Also, the timing of payments complicates year-to-year comparisons. For example, the large disaster assistance payments ($4.8 billion) paid in 2014 were associated with production losses from previous crop years and prior to implementation of the 2014 farm bill. The "other" category includes economic adjustment assistance to users of upland cotton, general program implementation costs, and miscellaneous programs. It does not include payments made by USDA under CCC authority (see CRS Report R44606, The Commodity Credit Corporation: In Brief, by Megan Stubbs) such as Cotton Ginning Cost-Share payments and Market Facilitation Program payments (see CRS Report R45310, Farm Policy: USDA's Trade Aid Package, by Randy Schnepf et al.). |

Appendix. Comparison of Major Title I Provisions in Prior Law and the Enacted 2018 Farm Bill, by Subtitle

This appendix provides a side-by-side comparison of provisions from Title I (the Commodity title) of the 2018 farm bill with prior law—that is, provisions from Title I of the 2014 farm bill (P.L. 113-79) as amended by subsequent law including the Bipartisan Budget Agreement (BBA) of 2018 (P.L. 115-123).

The BBA made substantial changes to both the dairy program and the treatment of cotton under the PLC and ARC programs.66

Each subtitle (A-G) is individually examined in a separate table with the exception of Subtitle C (Sugar) and Subtitle D (Dairy), which are examined in more detail by other CRS products. This appendix includes the following tables by subtitle.

- Table A-1. Subtitle A—Commodity Policy

- Table A-2. Subtitle B—Marketing Loans

- Table A-3. Subtitle E—Supplemental Agricultural Disaster Assistance

- Table A-4. Subtitle F—Noninsured Crop Assistance

- Table A-5. Subtitle G—Administration

For information on the dairy and sugar programs and their explicit legislative text, see:

- CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison, coordinated by Mark A. McMinimy;

- CRS In Focus IF10750, Farm Bill Primer: Dairy Safety Net, by Joel L. Greene;

- CRS In Focus IF10833, Dairy Provisions in the Bipartisan Budget Act (P.L. 115-123), by Joel L. Greene;

- CRS In Focus IF10223, Fundamental Elements of the U.S. Sugar Program, by Mark A. McMinimy; and

- CRS Report R43998, U.S. Sugar Program Fundamentals, by Mark A. McMinimy.

|

Prior Law: 2014 Farm Bill (P.L. 113-79), as Amended |

Current Law: 2018 Farm Bill (P.L. 115-334) |

||

|

|

|

||

|

Actual crop revenue. The amount determined by the Secretary under the Agriculture Risk Coverage program for each covered commodity for a crop year. (7 U.S.C. §9011(1)) |

Continues prior law. |

||

|

Agriculture Risk Coverage (ARC): "shallow loss" revenue coverage provided under the ARC program. (7 U.S.C. §9011(2)) |

Continues prior law. |

||

|

ARC guarantee. The amount determined by the Secretary under the ARC program for each covered commodity for a crop year. (7 U.S.C. §9011(3)) |

Continues prior law. |

||

|

Base acres. For purposes of calculating farm program payments, individual crop-specific base acreages are the number of historical program acres of a specific covered commodity on a farm as established under the 2008 farm bill as in effect on September 30, 2013 (except upland cotton), subject to adjustments (see 7 U.S.C. §9012 below). The term base acres includes any generic base acres planted to a covered commodity (see 7 U.S.C. §9012 below). (7 U.S.C. §9011(4)) |

Continues prior law. |

||

|

County coverage. Type of coverage under the ARC program to be obtained by the producer at the county level. (7 U.S.C. §9011(5)) |

Continues prior law. |

||

|

Covered commodities. Wheat, oats, barley (including wheat, oats, and barley used for haying and grazing), corn, grain sorghum, long-grain rice, medium-grain rice, pulse crops, soybeans, other oilseeds, and peanuts. Effective beginning with the 2018 crop year, the term covered commodity includes seed cotton. (7 U.S.C. §9011(6)) |

Continues prior law. |

||

|

Effective price. The price calculated by the Secretary under the Price Loss Coverage (PLC) program for each covered commodity for a crop year to determine whether PLC payments are required to be provided for that crop year. (7 U.S.C. §9011(7)) The effective price is the higher of (1) the national market-year average price (MYAP) received by producers during the 12-month marketing year for the covered commodity, as determined by the Secretary, or (2) the national average loan rate for a marketing assistance loan. The effective price for barley is the all-barley price. |

Continues prior law. |

||

|

No comparable definition. |

Effective reference price. The term effective reference price, with respect to a covered commodity for a crop year, means the lesser of the following: (A) 115% of the reference price for such covered commodity or (B) the greater of (i) the reference price for such covered commodity or (ii) 85% of the average of the MYAP of the covered commodity for the most recent five crop years, excluding each of the crop years with the highest and lowest MYAP. (§1101) |

||

|

Extra-long-staple (ELS) cotton. Cotton that is (A) produced from pure strain varieties of the Barbadense species or any hybrid of the species, or other similar types of ELS cotton, designated by the Secretary, having characteristics needed for various end uses for which U.S. upland cotton is not suitable, and grown in irrigated or other designated U.S. cotton-growing regions; and (B) ginned on a roller-type gin or other authorized gin for experimental purposes. (7 U.S.C. §9011(8)) |

Continues prior law. |

||

|

Generic base acres. The number of cotton base acres in effect under Section 1001 of the Food, Conservation, and Energy Act of 2008 (7 U.S.C. §8702), as adjusted pursuant to Section 1101 of such act (7 U.S.C. 8711), as in effect on September 30, 2013 (7 U.S.C. 9011(9)), subject to any adjustment or reduction. (7 U.S.C. 9012(d)). |

Continues prior law. |

||

|

Individual coverage. Type of coverage under the ARC program to be obtained by the producer at the farm (not county) level. (7 U.S.C. §9011(10)) |

Continues prior law. |

||

|

Medium-grain rice: Includes short-grain rice and temperate japonica rice. (7 U.S.C. §9011(11)) |

Continues prior law. |

||

|

Other oilseed. A crop of sunflower seed, rapeseed, canola, safflower, flaxseed, mustard seed, crambe, sesame seed, or, if designated by the Secretary, another oilseed. (7 U.S.C. §9011(12)) |

Continues prior law. |

||

|

Payment acres. The number of acres determined for a farm, as determined under 7 U.S.C. 9014, that are eligible for payments under the PLC or ARC programs. (7 U.S.C. §9011(13)) |

Continues prior law. |

||

|

Payment yield. For a covered commodity, the yield used to make counter-cyclical payments under the 2008 farm bill as in effect on September 30, 2013, or the yield established under the PLC program. (7 U.S.C.9011(14)) |

Continues prior law, but with a one-time option to update payment yields (see (7 U.S.C. §9013) for details). |

||

|

Price Loss Coverage (PLC). Coverage provided under the PLC program. (7 U.S.C. 9011(15)) |

Continues prior law. |

||

|

Producer. Generally, an owner, operator, landlord, tenant, or sharecropper who shares in the risk of producing a crop and is entitled to share in the crop available for marketing from the farm or would have shared had the crop been produced. For a grower of hybrid seed, the existence of a hybrid seed contract and other program rules shall not adversely affect the ability to receive a payment. (7 U.S.C. §9011(16)) |

Continues prior law. |

||

|

Pulse crop. Dry peas, lentils, small chickpeas, and large chickpeas. (7 U.S.C. §9011 (17)) |

Continues prior law. |

||

|

Reference prices. With respect to a covered commodity for a crop year:

(7 U.S.C. §9011(18)) |

Continues prior law. |

||

|

Secretary. The Secretary of Agriculture. (7 U.S.C. §9011(19)) |

Continues prior law. |

||

|

Seed cotton. Unginned upland cotton that includes both lint and seed. (7 U.S.C. §9011(20)) |

|||

|

State. Each of the U.S. states, the District of Columbia, the Commonwealth of Puerto Rico, and any other U.S. territory or possession. (7 U.S.C. §9011(21)) |

Continues prior law. |

||

|

Temperate japonica rice. Rice that is grown in high altitudes or temperate regions of high latitudes with cooler climate conditions in the Western United States, as determined by the Secretary, for the purpose of the reallocation of base acres, the establishment of a reference price and an effective price, and the determination of the actual crop revenue and ARC guarantee. (7 U.S.C. §9011(22)) |

Continues prior law. |

||

|

Transitional yield. Defined in Section 502(b) of the Federal Crop Insurance Act (7 U.S.C. §1502(b)(11)) as the maximum average production per acre or equivalent measure that is assigned to acreage for a crop year by the Federal Crop Insurance Corporation whenever the producer fails to certify that acceptable documentation of production and acreage for the crop year is in the possession of the producer or present the acceptable documentation. (7 U.S.C. §9011(23)) |

Continues prior law. |

||

|

United States. When used in a geographical sense, all of the states. (7 U.S.C. §9011(24)) |

Continues prior law. |

||

|

United States premium factor. The percentage by which the difference in the U.S. loan schedule premiums for Strict Middling 1 1/8-inch upland cotton and for Middling 1 3/32-inch upland cotton exceeds the difference in the applicable premiums for comparable international qualities. (7 U.S.C. §9011(25)) |

Continues prior law. |

||

|

Base Acres |

|||

|

One-time reallocation of base acres among covered commodities. Crop-specific base acres were subject to a producer's one-time choice to retain base acres or undertake a reallocation of total farm base acres among covered commodities based on average shares of planted base by commodity during the 2009-2012 period. Generic base acres are retained and may not be reallocated. (7 U.S.C. §9012(a)) |

No comparable provision. Base acres are included through the retention of crop-specific base acres under prior law. |

||

|

Seed cotton base acres. Not later than May 10, 2018, the Secretary shall require the owner of a farm to allocate all generic base acres based on whether the farm has a recent history of covered commodities (including seed cotton) being planted or prevented from being planted during the 2009-2016 crop years. If a farm has no such recent history, then the farm owner allocates the farm's generic base to unassigned crop base for which no ARC or PLC payments may be made. If a farm has such a recent history, then the farm owner allocates the farm's generic base among seed cotton and other covered commodities as (A) to seed cotton base acres in a quantity equal to the greater of 80% of generic base acres or the average of seed cotton acres planted or prevented from being planted on the farm during the 2009-2012 crop years (not to exceed the farm's total generic base acres) or (B) to commodity-specific base acres in proportion to each crop's share of planted (or prevented from being planted) acreage during 2009-2012. Following the base allocation under either (A) or (B), any residual generic base acres shall be allocated to unassigned crop base for which no ARC or PLC payments may be made. If a farm owner fails to make an election for generic base, then the farm owner shall be deemed to have elected to allocate all generic base acres in accordance with formulation (A) above. (7 U.S.C. §9014(b)(4)) |

Continues prior law. |

||

|

Adjustments to base. Base acres are increased/decreased when land leaves/enters conservation programs. (7 U.S.C. §9012(b)) |

Continues prior law. |

||

|