Agricultural Conservation in the 2018 Farm Bill

The Agriculture Improvement Act of 2018 (2018 farm bill, P.L. 115-334, Title II) included a number of changes to agricultural conservation programs, including reauthorizing and amending existing programs, directing existing program activities to specific resource concerns, shifting funds within the title, and authorizing a budget-neutral level of funding.

Debate over the conservation title in the 2018 farm bill focused on a number of issues in the different versions in the House- and Senate-passed bills (H.R. 2). These differences were resolved in a House-Senate conference to create the enacted bill, which is a mix of both versions that were passed by both chambers. The enacted bill reauthorizes and amends portions of most all conservation programs; however, the general focus is on the larger programs, namely the Conservation Reserve Program (CRP), Environmental Quality Incentives Program (EQIP), and Conservation Stewardship Program (CSP).

Most farm bill conservation programs are authorized to receive mandatory funding and are not subject to appropriation. According to the Congressional Budget Office (CBO), the conservation title of the 2018 farm bill makes up 7% of the bill’s total projected mandatory spending over 10 years, which is $60 billion of the total $867 billion. The conservation title is budget neutral over the 10-year baseline; however, the 2018 farm bill is projected to increase funding in the first five years (+$555 million over FY2019-FY2023) and decrease funding in the last five years (-$561 million over FY2024-FY2028). Generally, the 2018 farm bill reallocates mandatory funding within the conservation title among the larger programs.

The two largest working lands programs—EQIP and CSP—were reauthorized and amended under the enacted bill, but in different ways. The House-passed bill would have repealed CSP and created a stewardship contract within EQIP, whereas the Senate-passed bill would have reauthorized CSP and reduced program enrollment. The enacted bill creates a mix of both the House- and Senate-passed bills by reauthorizing CSP and reducing program enrollment, as well as creating a new incentive contract within EQIP. Funding for CSP is shifted away from an acreage limitation under prior law to limits based on funding. EQIP is expanded and reauthorized with increased funding levels.

The largest land retirement program—CRP—is reauthorized and expanded by increasing the CRP enrollment limit in annual increments from 24 million acres in FY2019 to 27 million by FY2023. To offset this increased enrollment level, the enacted bill reduces payments to participants, including cost-share payments, annual rental payments, and incentive payments. The 2018 farm bill also reauthorized and amended the Agricultural Conservation Easement Program (ACEP). Most of the changes to ACEP focus on the agricultural land easements by providing additional flexibilities to ACEP-eligible entities and authorize an increase in overall funding.

The Regional Conservation Partnership Program (RCPP) is reauthorized and amended by shifting the program away from enrolling land through existing conservation programs to a standalone program with separate contracts and agreements. Under the revised program, USDA is to continue to enter into agreements with eligible partners, and these partners are to continue to define the scope and location of a project, provide a portion of the project cost, and work with eligible landowners to enroll in RCPP contracts.

While the 2018 farm bill does not create new conservation programs, it does require that a number of existing programs direct a dollar amount or percentage of a program’s funding to a resource-specific issue, initiative, or subprogram. Through these directed policies Congress has established a level of support, or required investment, to be carried out through implementation to target specific issues such as nutrient runoff or groundwater protection. The directed policy may also reduce the implementing agency’s flexibility to allocate funding based on need, as well as reducing the amount available for activities under the larger program that may not meet a resource-specific provision.

High commodity prices in years past, changing land rental rates, and new conservation technologies have led over time to a shift in farm bill conservation policy away from programs that retire land from production (CRP) toward programs that provide assistance to lands still in production (EQIP and CSP). Much of this shift occurred following the 2008 farm bill (FY2009-FY2013) and continued under the 2014 farm bill (FY2014-FY2018) as the level of total mandatory program funding for CRP was reduced relative to EQIP and CSP. Funding for easement programs (ACEP) also declined somewhat under the 2014 farm bill, but is projected to level off under the 2018 farm bill. Partnership program (RCPP) funding has also increased in recent farm bills, but remains relatively small compared to the other categories of programs.

Agricultural Conservation in the 2018 Farm Bill

Jump to Main Text of Report

Contents

- Conservation Program Changes

- Land Retirement

- Conservation Reserve Program (CRP)

- Conservation Reserve Enhancement Program (CREP)

- Farmable Wetlands (FW) program

- CRP Grassland Contracts

- Other CRP Initiatives

- Working Lands Programs

- Environmental Quality Incentives Program (EQIP)

- Conservation Stewardship Program (CSP)

- Other EQIP and CSP Initiatives and Subprograms

- Easement Programs

- Agricultural Conservation Easement Program (ACEP)

- Other Conservation Programs and Provisions

- Regional Conservation Partnership Program (RCPP)

- Watershed and Flood Prevention Operations (WFPO)

- Conservation Compliance

- Policy Issues That Shaped the Conservation Title

- Directed Policies Within Existing Programs

- Budget and Baseline

- Historical and Programmatic Shifts in Conservation Funding

- Environmental Regulation and Voluntary Conservation

Figures

Tables

- Table 1. Directed Policies in the 2018 Farm Bill

- Table 2. Budget Projections for the Conservation Title of the 2018 Farm Bill

- Table A-1. Subtitle A—Wetland Conservation (Swampbuster)

- Table A-2. Subtitle B—Conservation Reserve Program

- Table A-3. Subtitle C—Environmental Quality Incentives Program

- Table A-4. Subtitle C—Conservation Stewardship Program

- Table A-5. Subtitle D—Other Conservation Programs

- Table A-6. Subtitle E—Funding and Administration

- Table A-7. Subtitle F—Agricultural Conservation Easement Program

- Table A-8. Subtitle G—Regional Conservation Partnership Program

- Table A-9. Subtitle H—Repeals and Technical Amendments

Summary

The Agriculture Improvement Act of 2018 (2018 farm bill, P.L. 115-334, Title II) included a number of changes to agricultural conservation programs, including reauthorizing and amending existing programs, directing existing program activities to specific resource concerns, shifting funds within the title, and authorizing a budget-neutral level of funding.

Debate over the conservation title in the 2018 farm bill focused on a number of issues in the different versions in the House- and Senate-passed bills (H.R. 2). These differences were resolved in a House-Senate conference to create the enacted bill, which is a mix of both versions that were passed by both chambers. The enacted bill reauthorizes and amends portions of most all conservation programs; however, the general focus is on the larger programs, namely the Conservation Reserve Program (CRP), Environmental Quality Incentives Program (EQIP), and Conservation Stewardship Program (CSP).

Most farm bill conservation programs are authorized to receive mandatory funding and are not subject to appropriation. According to the Congressional Budget Office (CBO), the conservation title of the 2018 farm bill makes up 7% of the bill's total projected mandatory spending over 10 years, which is $60 billion of the total $867 billion. The conservation title is budget neutral over the 10-year baseline; however, the 2018 farm bill is projected to increase funding in the first five years (+$555 million over FY2019-FY2023) and decrease funding in the last five years (-$561 million over FY2024-FY2028). Generally, the 2018 farm bill reallocates mandatory funding within the conservation title among the larger programs.

The two largest working lands programs—EQIP and CSP—were reauthorized and amended under the enacted bill, but in different ways. The House-passed bill would have repealed CSP and created a stewardship contract within EQIP, whereas the Senate-passed bill would have reauthorized CSP and reduced program enrollment. The enacted bill creates a mix of both the House- and Senate-passed bills by reauthorizing CSP and reducing program enrollment, as well as creating a new incentive contract within EQIP. Funding for CSP is shifted away from an acreage limitation under prior law to limits based on funding. EQIP is expanded and reauthorized with increased funding levels.

The largest land retirement program—CRP—is reauthorized and expanded by increasing the CRP enrollment limit in annual increments from 24 million acres in FY2019 to 27 million by FY2023. To offset this increased enrollment level, the enacted bill reduces payments to participants, including cost-share payments, annual rental payments, and incentive payments. The 2018 farm bill also reauthorized and amended the Agricultural Conservation Easement Program (ACEP). Most of the changes to ACEP focus on the agricultural land easements by providing additional flexibilities to ACEP-eligible entities and authorize an increase in overall funding.

The Regional Conservation Partnership Program (RCPP) is reauthorized and amended by shifting the program away from enrolling land through existing conservation programs to a standalone program with separate contracts and agreements. Under the revised program, USDA is to continue to enter into agreements with eligible partners, and these partners are to continue to define the scope and location of a project, provide a portion of the project cost, and work with eligible landowners to enroll in RCPP contracts.

While the 2018 farm bill does not create new conservation programs, it does require that a number of existing programs direct a dollar amount or percentage of a program's funding to a resource-specific issue, initiative, or subprogram. Through these directed policies Congress has established a level of support, or required investment, to be carried out through implementation to target specific issues such as nutrient runoff or groundwater protection. The directed policy may also reduce the implementing agency's flexibility to allocate funding based on need, as well as reducing the amount available for activities under the larger program that may not meet a resource-specific provision.

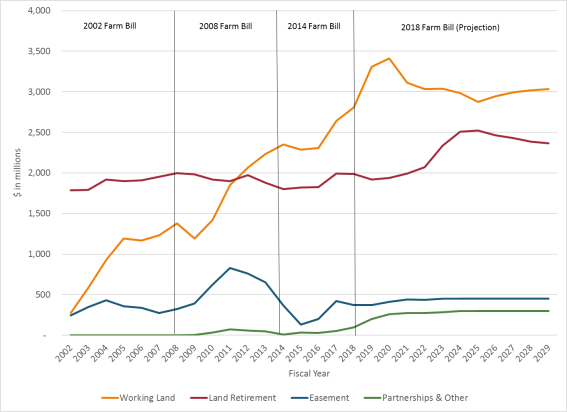

High commodity prices in years past, changing land rental rates, and new conservation technologies have led over time to a shift in farm bill conservation policy away from programs that retire land from production (CRP) toward programs that provide assistance to lands still in production (EQIP and CSP). Much of this shift occurred following the 2008 farm bill (FY2009-FY2013) and continued under the 2014 farm bill (FY2014-FY2018) as the level of total mandatory program funding for CRP was reduced relative to EQIP and CSP. Funding for easement programs (ACEP) also declined somewhat under the 2014 farm bill, but is projected to level off under the 2018 farm bill. Partnership program (RCPP) funding has also increased in recent farm bills, but remains relatively small compared to the other categories of programs.

Federal agricultural conservation assistance began in the 1930s with a focus on soil and water issues associated with production and environmental concerns on the farm. During the 1980s, agricultural conservation policies were broadened to include environmental issues beyond soil and water concerns, especially issues related to production, such as erosion and wetlands loss that had effects beyond the farm. Many of the current agricultural conservation programs were enacted as part of the Food Security Act of 1985 (1985 farm bill; P.L. 99-198, Title XII). These programs have been reauthorized, modified, and expanded, and several new programs have been created, particularly in subsequent omnibus farm bills. While the number of programs has increased and new techniques to address resource challenges continue to emerge, the basic federal approach has remained unchanged—voluntary farmer participation encouraged by financial and technical assistance, education, and basic and applied research. The U.S. Department of Agriculture (USDA) administers the suite of agricultural conservation programs through two primary agencies—the Natural Resources Conservation Service (NRCS) and the Farm Service Agency (FSA).

|

|

Source: CRS. |

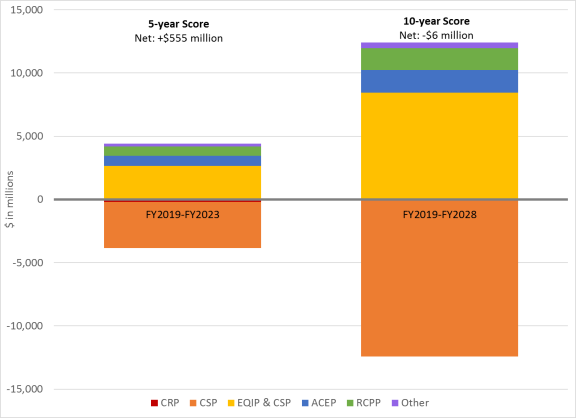

The conservation title of the Agriculture Improvement Act of 2018 (2018 farm bill; P.L. 115-334, Title II)1 reauthorized and amended many of the largest conservation programs and created a number of new pilot programs, carve-outs, and initiatives. The House- and Senate-passed farm bills (H.R. 2) each included a number of amendments to existing conservation programs, many of which did not overlap. This generally resulted in the inclusion of a mix of amendments from each chamber being in the enacted bill.2 The Congressional Budget Office (CBO) projects that total mandatory spending for the title will increase by $555 million during the first five years of the 2018 farm bill (FY2019-FY2023), compared to a continuation of funding levels authorized in the Agricultural Act of 2014 (2014 farm bill; P.L. 113-79). Mandatory spending for the title over 10 years (FY2019-FY2028) is projected by CBO to be reduced by $6 billion, relative to the 2014 farm bill authorized levels. Generally, the bill reallocates funding within the conservation title among the larger programs and pays for increases in the short term with reductions in the long term.3

Conservation Program Changes

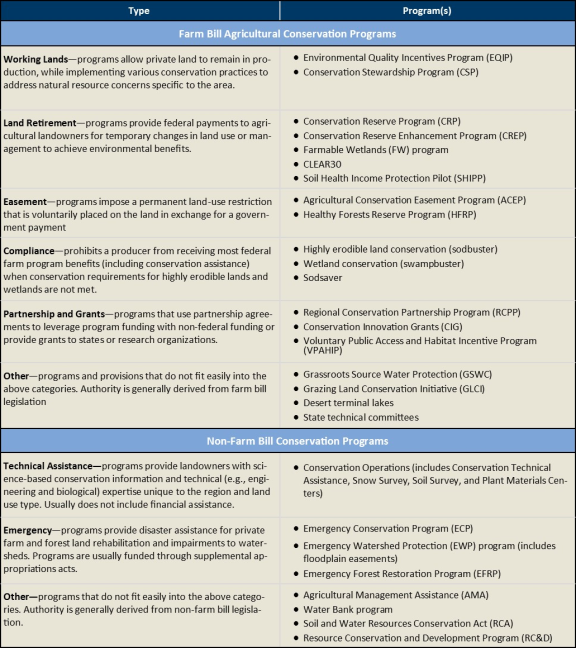

The 2018 farm bill reauthorized and amended all of the major USDA agricultural conservation programs. Generally, farm bill conservation programs can be grouped into the following types based on similarities: working lands, land retirement, easement, conservation compliance, and partnership and grants (see Figure 1 and Figure 2 for a list of conservation programs). Most of these programs are authorized to receive mandatory funding (i.e., they do not require an annual appropriation), and include funding authorities that expire with most other farm bill programs at the end of FY2023.

Other types of conservation programs—such as watershed programs, emergency programs, and technical assistance—are authorized in legislation other than the farm bill. Most of these programs have permanent authorities and receive appropriations annually through the discretionary appropriations process. These programs are not generally addressed in the context of a farm bill and are not covered in detail in this report, except for cases where the 2018 farm bill made amendments to the program.

This section provides a general discussion of programmatic-specific amendments made to various conservation programs and subprograms. For a detailed section-by-section analysis of amendments in the 2018 farm bill, including statutory and U.S. Code citations, see Appendix.4 Unless otherwise noted, conservation programs discussed in this section are authorized to receive mandatory funding through the borrowing authority of the Commodity Credit Corporation (CCC).5 For additional analysis of conservation program funding, see the "Budget and Baseline" section.

Land Retirement

Land retirement programs authorize USDA to make payments to private landowners to voluntarily retire land from production for less-resource intensive uses. The primary land retirement program is the Conservation Reserve Program (CRP). CRP includes a number of subprograms, many of which were codified or reauthorized in the 2018 farm bill. The farm bill also authorizes a number of initiatives and pilot programs.

Conservation Reserve Program (CRP)

CRP was originally authorized in the 1985 farm bill and has been reauthorized and amended a number of times since. The program provides financial compensation for landowners, through an annual rental rate, to voluntarily remove land from agricultural production for an extended period (typically 10 to 15 years) to improve soil and water quality and wildlife habitat. CRP operates under two types of enrollment—general and continuous. General enrollment provides an opportunity for landowners to enroll in CRP through a nationwide competition during a specific period of time. Continuous enrollment is designed to enroll the most environmentally desirable land into CRP through specific conservation practices or resource needs. Unlike general enrollment, under continuous enrollment, land is typically enrolled at any time and is not subject to competitive bidding. Many of the 2018 farm bill amendments apply to continuous enrollment contracts, including the creation of new pilot programs and amendments to existing subprograms. A detailed analysis of amendments to CRP may be found in Table A-2.

Congressional debate over CRP in the 2018 farm bill centered on how to increase enrollment limits, while not increasing overall cost. As such, the enacted bill incrementally increases the enrollment cap while reducing various rental rates, cost-share payments, and incentive payments. The 2018 farm bill increases the enrollment limit in annual increments from 24 million acres in FY2019 to 27 million acres in FY2023.6 This increase in enrollment is partly offset by reducing rental rates for general contracts to 85% of the county average rental rate and to 90% of the county average rental rate for continuous contracts. Cost-share payments are limited to the actual cost of establishing the approved practices, including not more than 50% for seed mix costs. The enacted bill also establishes minimum enrollment levels for continuous contracts (8.6 million acres by FY2022) and grassland contracts (2 million acres by FY2021).

Conservation Reserve Enhancement Program (CREP)

CREP was originally created as a CRP initiative in 1997, but was not codified into statute as a CRP subprogram until the 2018 farm bill. The provision in the 2018 farm bill is similar to the original version of CREP in that it authorizes USDA to enter into agreements with states to target designated project areas with continuous CRP enrollment contracts. Projects are designed to address specific environmental objectives through targeted continuous, noncompetitive, CRP enrollment that typically provides additional financial incentives beyond annual rental payments and cost-share assistance.

The new language in the 2018 farm bill allows existing CREP agreements to remain in force, but allows them to be modified if mutually agreed upon. CREP agreements are generally with states, but the 2018 farm bill expands eligible partners to include nongovernmental organizations (NGO). The enacted bill formalizes agreement requirements with partners, including matching fund contributions (previously not less than 20% of the project cost) and possible waiver of such contributions. The enacted bill requires the matching fund contribution to be a negotiated part of the agreement, or not less than 30% if most of the funds are provided by an NGO. Payments from an eligible partner may be in cash, in-kind, or through technical assistance. Additional requirements for select cost-share payments, incentive payments, and maintenance payments are also included. Specific requirements are included related to grazing, forested riparian buffers, and drought and water conservation agreements.

Farmable Wetlands (FW) program

The FW program was created in the Farm Security and Rural Investment Act of 2002 (2002 farm bill; P.L. 107-171) as a pilot within CRP to enroll farmable or prior converted wetlands into CRP in exchange for additional financial incentives. The 2018 farm bill reauthorized FW program at the current 750,000 acre enrollment limit.

CRP Grassland Contracts

The 2014 farm bill authorized grassland contracts under CRP, which enrolls grassland, rangeland, and pastureland into 14 to 15 year CRP contracts. Only select grazing practices are allowed under the contract in exchange for annual and cost-share payments. The 2018 farm bill reauthorizes the contracts and increases the enrollment limit to not less than 2 million acres by FY2021 from the previous limit of not more than 2 million acres. USDA may not use unenrolled grassland acres for other types of CRP enrollment. The enacted bill also prioritizes the enrollment of expiring CRP land, land at risk of development, or land of ecological significance.

Other CRP Initiatives

CLEAR 30

The 2018 farm bill creates a new pilot program referred to as CLEAR 30, which enrolls expiring CRP land into 30-year contracts devoted to practices that improve water quality. CLEAR refers to the Clean Lakes, Estuaries, And Rivers initiative that is authorized to enroll land in continuous contracts that would reduce sediment and nutrient loading, and harmful algal blooms. Under a CLEAR 30 contract, the landowner must maintain the land in accordance with an approved plan and adhere with the terms and conditions of the contract. Contract holders receive compensation in thirty annual cash payments similar to those calculated under general CRP contracts. Technical assistance is required for each contract and agreement. USDA must create the CRP plan for a contract, but management, monitoring, and enforcement may be delegated to another federal agency, state, or local government, or to a conservation organization.

Soil Health and Income Protection Pilot (SHIPP)

The 2018 farm bill also creates a new SHIPP pilot program under CRP to remove less productive farm land from production in exchange for annual rental payments and to plant low-cost perennial cover crops. Eligible land is limited to (1) land in states selected by the Secretary within the prairie pothole region, (2) land that has a cropping history in the three years prior to enrollment, but which was not enrolled in CRP during that time period, and (3) land that is considered to be less productive than other land on the farm. No more than 15% of a farm may be enrolled in the pilot and no more than 50,000 acres of the CRP may be used for the pilot. Under a SHIPP contract, a participant would be required to plant a USDA-approved, low-cost, perennial, conserving-use cover crop at the participant's expense. In return the participant would receive an annual rental payment that is 50% of the general CRP annual rental payment, or higher for beginning, limited-resource, socially disadvantaged or veteran participants. Contracts are three to five years in duration, but can be terminated early if considered necessary by USDA; or if the participant agrees to pay back the annual rental payments. Harvesting, haying, and grazing are allowed outside of the local nesting and brood-rearing period, subject to additional conditions.

Working Lands Programs

Working lands conservation programs allow private land to remain in production, while implementing various conservation practices to address natural resource concerns specific to the area. Program participants receive some form of conservation planning and technical assistance to guide the decision on the most appropriate practices to apply, given the natural resource concerns and land condition. Participants receive federal financial support to defray a portion of the cost to install or maintain the vegetative, structural, or management practices agreed to in the terms of the contract.

The two main working lands programs are the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP). Combined, both programs account for more than half of all conservation program funding. The 2018 farm bill amended both programs, but in different ways and to different degrees. A detailed analysis of amendments to EQIP and CSP is provided in Table A-3 and Table A-4, respectively.

Environmental Quality Incentives Program (EQIP)

EQIP is reauthorized and expanded in the enacted bill. The program provides financial and technical assistance to producers and private landowners to plan and install structural, vegetative, and land management practices on eligible lands to alleviate natural resource problems. Eligible producers enter into contracts with USDA to receive payment for implementing conservation practices. Approved activities are carried out according to an EQIP plan approved by USDA and developed with the producer that identifies the appropriate conservation practice(s) to address identified resource concerns on the eligible land. The program is reauthorized through FY2023 with a graduating level of mandatory funding—$1.75 billion in FY2019 and FY2020; $1.8 billion in FY2021; $1.85 billion in FY2022; and $2.025 billion in FY2023.

The new law includes a number of amendments to EQIP that focus on water quality and quantity-related practices, soil health improvement, and wildlife habitat improvement. The law also reduces the funding allocation for livestock-related practices from 60% to 50%, and increases the allocation for wildlife-related practices from 5% to 10%.

One of the larger changes the 2018 farm bill makes to EQIP is that water conservation system payments are expanded to include irrigation and drainage entities that were previously ineligible. Eligible entities may be states, irrigation districts, groundwater management districts, acequias, land-grant mercedes, or similar entities. Practices must be implemented on eligible land of the producer, land adjacent to a producer's eligible land, or land under the control of the eligible entity. Adjusted Gross Income (AGI) and payment limits may be waived for eligible entities, but USDA may impose additional payment and eligibility limits. Priority is given to applications that reduce water use. It is unclear how this expansion in eligibility, compared with the previous producer-only policy, may affect implementation of the program.

Conservation Stewardship Program (CSP)

CSP provides financial and technical assistance to producers to maintain and improve existing conservation systems and to adopt additional conservation activities in a comprehensive manner on a producer's entire operation. CSP contracts must meet or exceed a stewardship threshold for at least two priority resource concern at the time of application and meet or exceed at least one additional priority resource concern by the end of the contract. The House-passed bill would have repealed CSP and created a stewardship contract within EQIP, whereas the Senate-passed bill would have reauthorized CSP and reduced program enrollment. The enacted 2018 farm bill creates a mix of both the House- and Senate-passed bills with amendments. The enacted bill reauthorizes CSP, but amends how the program limits future enrollment. The new law shifts CSP from a program limited by acres (10 million acres annually under prior law; approximately $1.4 billion in FY2018) to one limited by total funding ($700 million in FY2019 in mandatory funding, increasing to $1 billion in FY2023). CBO projects this change from prior law will reduce the program by more than $12.4 billion total over ten years (see Table 2) for a total cost of $5.1 billion. Reduced spending from this reduction offset increased mandatory spending in other conservation programs (see Figure 3).

In addition to the amended funding structure of CSP, the enacted bill also made a number of amendments to the program. CSP's ranking criteria is amended to focus on an application's actual and expected increase of conservation benefits, and to add a cost competitive selection criteria for similar applications. Contract renewal options are amended to require renewal applicants to compete with new applications, whereas previously their acceptance was guaranteed. Additionally, payments for adopting cover crops, grazing management, and comprehensive conservation plan development are amended to include higher and more comprehensive payment options.

Other EQIP and CSP Initiatives and Subprograms

Conservation Innovation Grants (CIG)

CIG is a subprogram under EQIP that awards competitive grants to state and local agencies, nongovernmental organizations, tribes, and individuals to implement innovative conservation techniques and practices. The 2018 farm bill expands project eligibility to include community colleges, urban farming, and monitoring practices. A new on-farm conservation innovation trial is authorized at $25 million annually from total EQIP funding. The new on-farm trial funds projects through producers or eligible entities that test new or innovative conservation approaches, such as those related to precision agriculture technologies, nutrient management, soil health, water management, crop rotations, cover crops, irrigation systems, and other USDA approved approaches.

EQIP Conservation Incentive Contract

The House-passed farm bill would have repealed CSP and created a stewardship contract within EQIP. While the 2018 farm bill retained CSP and also authorized a new Conservation Incentive Contract under EQIP. The new EQIP incentive contracts are limited to select priority resource concerns within specific geographic regions. No more than three priority resource concerns may be identified in each geographic region. EQIP incentive contracts extend for five to ten years and provide annual payments to incentivize increased conservation stewardship and the adoption, installation, management, and maintenance of conservation practices. In determining payment amounts, USDA is required to consider the level and extent of the practice being adopted, the cost of adoption, income forgone due to adoption, and compensation ensuring the longevity of the practice.

The new EQIP incentive contracts exhibit some similarities with CSP contracts, including addressing priority resource concerns; and providing annual payments for adopting, maintaining, and improving practices. The EQIP incentive contracts also include notable differences from CSP, including a no stewardship threshold for entry;7 no comprehensive requirement for addressing resource concerns; no whole-farm enrollment; and no limit on payments. Pending implementation of EQIP incentive contracts, it is unclear what impact they may have on CSP enrollment or on general EQIP contracts.

CSP Grassland Conservation Initiative

Amendments under the commodities title (Title I) of the 2018 farm bill changed how base acres are used to calculate eligibility for certain commodity support programs.8 Base acres not planted to a commodity program-eligible crop within the last ten years are ineligible for select commodity support programs. Under the 2018 farm bill, these acres are now eligible for a one-time enrollment into a new Grassland Conservation Initiative under CSP.

While the new grassland initiative is within CSP, it has separate requirements from other CSP contracts. Unlike CSP, the grassland initiative would not require whole-farm enrollment. The initiative has no required stewardship threshold for entry, requiring the participant to only meet or exceed one priority resource concern by the end of the contract. Whereas CSP contracts must meet or exceed a stewardship threshold for at least two priority resource concern at the time of application and meet or exceed at least one additional priority resource concern by the end of the contracts. Grassland initiative contracts are short term—five years with no renewal or reenrollment option, and a participant may terminate the contract without penalty at any time. Payments under the initiative are not subject to the CSP payment limit, but cannot provide more than $18 per acre.

Easement Programs

Easement programs impose a permanent land-use restriction that is voluntarily placed on the land in exchange for a government payment. The primary conservation easement program is the Agricultural Conservation Easement Program, which provides financial and technical assistance through two types of easements (1) agricultural land easements (ALE) that limit nonagricultural uses on productive farm or grass lands, and (2) wetland reserve easements (WRE) that protect and restore wetlands. The other conservation easement program—the Healthy Forests Reserve Program (HFRP)—was reauthorized in the forestry title (Title VIII) of the 2018 farm bill and is not covered in this report.9

Agricultural Conservation Easement Program (ACEP)

The 2018 farm bill reauthorizes and amends ACEP. Most of the changes made to ACEP in the 2018 farm bill focus on the ALE. Under ALE, USDA enters into partnership agreements with eligible entities to purchase agricultural land easements from willing landowners to protect the agricultural use and conservation values of the land. The enacted bill provides additional flexibilities to ACEP-eligible entities, including the eligibility of "buy-protect-sell" transactions in which an eligible entity purchases land prior to the acquisition of an ALE, agrees to hold an ALE on the land, and then transfer the land within a select time period to a farmer or rancher. The bill also amends the nonfederal cost share requirements by removing the requirement that an eligible entity's contribution be equal to the federal share, or at least 50% of the federal share if the entity includes contributions from the private landowner. The nonfederal portion contributed by the eligible entity may include cash, a landowner's donation, costs associated with the easement, or other costs as determined by USDA. Other flexibilities provided eligible entities include the consideration of geographical differences, terms and conditions of easements, and certification criteria of eligible entities. Several amendments reduce the roll of USDA in the administration of ALE, including amendments to the certification of eligible entities, the right of easement enforcement, and planning requirements. For a detailed analysis of amendments to ACEP see Table A-7.

By comparison, the 2018 farm bill made fewer changes to WRE. Most of the amendments to WRE center on compatible use and vegetative cover requirements. Compatible use authorization is expanded to include consultation with the state technical committee, consideration of land management requirements, and improving the functions and values of the easement. Requirements for a WRE plan were amended to allow for the establishment or restoration of an alternative vegetative community that is hydraulically appropriate on the entirety of the WRE if it would benefit wildlife or meet local resource needs.

In other amendments to ACEP, Congress specified new directions regarding USDA's handling of the subordination, exchange, modification, or termination of any ACEP easement. The enacted farm bill increases mandatory funding for ACEP from the FY2018 authorized level to $450 million annually for FY2019 through FY2023.10

Other Conservation Programs and Provisions

Regional Conservation Partnership Program (RCPP)

The 2014 farm bill created RCPP from four repealed programs. The 2018 farm bill reauthorized RCPP and made a number of amendments to the program (see Table A-8 for a detailed analysis of RCPP amendments). Prior the 2018 farm bill, RCPP utilized 7% of existing conservation programs (referred to as covered programs11) through RCPP projects that were defined by eligible partners. Eligible partners would define the project's area, goals, and resource concerns to be addressed through the use of covered programs. Partners would enter into project agreements with USDA, in which they would provide a "significant portion" of the overall cost of the project. USDA issued no regulations for RCPP and instead utilized funding notices and operated it with the regulations of the covered programs.

Amendments enacted in the 2018 farm bill shift RCPP away from using contracts from covered programs to establishing RCPP as a stand-alone program with its own contracts. Prior to the 2018 farm bill, USDA would enter into agreements with a partner on a project that would target covered program contracts in an agreed upon area for a defined resource goal. The actual contract with the farmer or rancher, however, would be an EQIP, CSP, ACEP, or HFRP contract. The enacted bill no longer uses this framework; instead it requires USDA to use a contract specific to RCPP that will fund eligible activities similar to those available under covered programs, but not using the funds of those programs. The list of covered programs is also expanded under the bill to include EQIP, ACEP, CSP, HFRP, CRP, and Watershed and Flood Prevention Operations (WFPO).12

The 2018 farm bill maintains RCPP's broad partner-focused goal of creating opportunities to leverage federal conservation funding for partner-defined projects. Additionally, the revised program provides additional flexibilities to partners, including the make-up of a partner's project contribution, guidance and reporting requirements, agreement renewals, and in the application process.

Mandatory funding for the program is increased to $300 million annually for FY2019 through FY2023 from $100 million annually under prior law. However, RCPP no longer receives a percentage of funding from covered programs, which could change the overall scale of RCPP depending on how this change is implemented. The allocation of funding is also amended to provide 50% to state and multi-state projects and 50% to projects in critical conservation areas (CCA) as selected by USDA.13

Watershed and Flood Prevention Operations (WFPO)

The WFPO program provides technical and financial assistance to state and local organizations to plan and install measures to prevent erosion, sedimentation, and flood damage and to conserve, develop, and utilize land and water resources.14 Project costs are shared with local partners. Smaller projects may be authorized by the Chief of the NRCS, whereas larger projects must be approved by Congress. The 2018 farm bill made few amendments to WFPO, the most substantial being the authorization of permanent mandatory funding of $50 million annually. Historically, the program received discretionary funding through the annual appropriations process—most recently $150 million in FY2018.15

Conservation Compliance

Two farm bill provisions require that in exchange for certain USDA program benefits, a producer agrees to maintain a minimum level of conservation on highly erodible land and not to convert wetlands to crop production. These provisions were originally authorized in the 1985 farm bill as highly erodible land conservation (Sodbuster) and wetland conservation (Swampbuster). They are collectively referred to as conservation compliance.16 The 2018 farm bill amends wetland conservation provisions to specify that (1) benefits cannot be denied if an exemption applies and (2) affected landowners must have the opportunity to be present during an on-site inspection. The enacted bill also authorizes annual discretionary appropriations for wetland mitigation banking. For a detailed analysis of amendments to the wetland conservation provisions, see Table A-1.

A third type of compliance requirement introduced in the Food, Conservation, and Energy Act of 2008 (2008 farm bill; P.L. 110-246) addressed crop production on native sod (Sodsaver). While Sodsaver is not included in the conservation title of the farm bill, it operates in a manner similar to conservation compliance requirements in that benefits are reduced if production occurs on native sod.17

Policy Issues That Shaped the Conservation Title

Beginning with the Agriculture and Food Act of 1981 (1981 farm bill; P.L. 97-98), agricultural conservation has been a stand-alone title in all farm bills. The breadth of the conservation title has grown with each passing omnibus farm bill. Debate over the 2018 farm bill focused on the differences within the conservation title of the House- and Senate-passed bills (H.R. 2). The conference agreement resolved these differences to create a final version of the title in the enacted law that represents a mix of proposals from the two versions. Overarching themes of the conservation title include (1) targeting of funds or acres in existing programs, (2) a shifting of funds among the different types of conservation programs, including a continued emphasis on working lands programs, and (3) provisions that address environmental regulations through voluntary conservation measures.

Directed Policies Within Existing Programs

The 2014 farm bill focused on simplifying and consolidating programs within the conservation title. Conversely, the 2018 farm bill does not create new programs, but it does require that a number of existing programs direct a specific level of funding or acres, or percentage of a program's funding, to a resource- or interest-specific issue, initiative, or subprogram. Table 1 highlights some of the directed policies created by the 2018 farm bill and compares them with prior law. Some of these policies existed prior to the 2018 farm bill, but did not include a specified funding or acreage level. Through these directed policies Congress has specified a level of support or required investment that USDA is to achieve through program implementation. One potential consequence of these directed policies may be reduced flexibility of the implementing agency to allocate funding based on need, as well as reduced total funds or acres available for activities of the larger program that may not meet a resource-specific provision. Most of the conservation programs in the 2018 farm bill are authorized to receive mandatory funding, so these directed policies also have funding, unless Congress subsequently directs otherwise.

|

Provision |

Prior Law (U.S. Code citation) |

Enacted 2018 Farm Bill (section) |

|

Conservation Reserve Program |

||

|

Grassland Contracts |

No more than 2 million acres of total CRP enrollment (16 U.S.C. 3831(d)(2)(A)). |

No less than 2 million acres of total CRP enrollment by FY2021. Prohibits uses of these acres for other CRP contracts (§2201(c)(2)). |

|

CLEAR initiative |

NA |

40% of continuous enrollment contracts (§2201(c)(3)). |

|

Continuous enrollment |

None |

No less than 8.6 million acres of total CRP enrollment by FY2022 (§2201(c)(3)). |

|

FWP |

No more than 750,000 acres of total CRP enrollment (16 U.S.C. 3831b(c)(1)). |

No more than 750,000 acres of total CRP enrollment (§2203). |

|

SHIPP program |

NA |

No more than 50,000 acres of total CRP enrollment (§2204). |

|

Environmental Quality Incentives Program |

||

|

EQIP livestock practices |

At least 60% of total EQIP funds to be used for payments related to livestock practices (16 U.S.C. 3839aa-2(f)(1)). |

At least 50% of total EQIP funds to be used for payments related to livestock practices (§2304(c)). |

|

EQIP wildlife practices |

At least 5% of total EQIP funds to be used for payments to benefit wildlife habitat (16 U.S.C. 3839aa-2(f)(2)). |

At least 10% of total EQIP funds to be used for payments to benefit wildlife habitat (§2304(c)). |

|

EQIP air quality |

Requires $25 million of EQIP funds annually be used to address air quality concerns (16 U.S.C. 3839aa-8(b)). |

Requires $37 million of EQIP funds annually be used to address air quality concerns (§2307(2)). |

|

CIG on-farm trials |

NA |

Requires $25 million annually be used for an on-farm conservation innovation trial (§2307(c)) |

|

Other Programs |

||

|

ECP |

None |

Require 25% of available discretionary funding be set aside until April 1st to repair and replace fencing (§2403(e)(6)). |

|

VPAHIP |

None |

Requires $3 million of total funding provided be used to encourage public access on land covered by WRE under ACEP (§2406(4)). |

|

Source water protection |

NA |

Requires 10% of all farm bill conservation program's funding each fiscal year (except CRP) be used to encourage conservation practices related to water quality and quantity that protect source waters for drinking (§2503(d)). |

|

RCPP |

Requires USDA to reserve 7% of EQIP, CSP, ACEP, and HFRP funds and acres for RCPP projects. (16 U.S.C. 3877d(c)) |

None. |

Source: CRS based on provisions in P.L. 115-334.

Notes: NA indicates 'not applicable' because the provision did not exist under prior law. None indicates that while the program or provision was, or is, in existence that no carve-out of funding was, or is, required in law. For additional discussion on programs and provision in the table see the "Conservation Program Changes" section as well as Appendix.

Budget and Baseline

Most farm bill conservation programs are authorized to receive mandatory funding. According to CBO, the conservation title makes up 7% of the total projected 2018 farm bill spending over 10 years, which is $60 billion of the total $867 billion (see Table 2 and Figure 3).18 Historically, funding for the conservation title has experienced both increases and decreases within farm bills. The 2018 farm bill conservation title is budget neutral over the 10-year baseline; however, it is projected to increase funding in the first five years (+$555 million over FY2019-FY2023) and decrease funding in the last five years (-$561 million over FY2024-FY2028).19 While most titles received an increase in authorized mandatory funding over the projected 10-year baseline, three titles, including conservation, did not.20

|

Conservation Baseline & Score Most conservation programs receive an authorization (budget authority) for mandatory funding in omnibus farm bills. Generally, the bill authorizes and pays for the mandatory funding (expressed as outlays) with a multiyear budget estimate when the law is enacted. The Congressional Budget Office (CBO) determines the official cost/savings estimate when bills are considered based on long-standing budget laws and rules.21 The budgetary impact of mandatory spending proposals is measured relative to an assumption that certain programs continue beyond the end of the farm bill. The benchmark is the CBO baseline—a projection at a particular point in time of future federal spending on mandatory programs under current law. The baseline provides funding for reauthorization, reallocation to other programs, or offsets for deficit reduction. Generally, most large conservation programs, such as CRP and EQIP, are assumed to continue in the baseline as if there were no change in policy and it did not expire. However, some of the smaller conservation programs are not assumed to continue beyond the end of a farm bill, such as VPAHIP. The baseline used to develop the 2018 farm bill was the CBO baseline that was released in April 2018.22 It projected that if the 2014 farm bill were extended, farm bill conservation programs would cost $60 billion over the next 10 years (FY2019-FY2028). Most of that amount, 93%, was in three programs—EQIP, CSP, and CRP. When a new bill is proposed that would affect mandatory spending, CBO estimates the score (cost impact) in relation to the baseline. Changes that increase spending relative to the baseline have a positive score; those that decrease spending relative to the baseline have a negative score. Budget enforcement rules use these baselines and scores to follow various budget rules. When a new law is passed, the projected cost at enactment equals the baseline plus the score. This sum becomes the foundation of the new law, and may be compared to future CBO baselines as an indicator of how actual spending transpires as the law is implemented and market conditions change. |

Table 2. Budget Projections for the Conservation Title of the 2018 Farm Bill

(outlays in millions of dollars, five- and ten-year totals)

|

Five years (FY2019-FY2023) |

Ten years (FY2019-FY2028) |

|||||

|

Program (Section Number) |

April 2018 CBO baseline |

Score of P.L. 115-334 |

Projected cost at enactment |

April 2018 CBO baseline |

Score of P.L. 115-334 |

Projected cost at enactment |

|

CRP (2201) |

10,507 |

-189 |

10,318 |

22,085 |

0 |

22,085 |

|

CSP (2301)a |

8,764b |

-3669 |

5,095 |

17,729b |

-12,426 |

5,303 |

|

EQIP (2302) & CSP (2308)a |

7,968c |

2660 |

10,628 |

16,697c |

8,451 |

25,148 |

|

Watershed pgms. (2401)d |

0 |

95 |

95 |

0 |

317 |

317 |

|

GSWP (2405) |

0 |

5 |

5 |

0 |

5 |

5 |

|

VPAHIP |

0 |

50 |

50 |

0 |

50 |

50 |

|

Feral Swine (2408) |

0 |

75 |

75 |

0 |

75 |

75 |

|

ACEP (2601) |

1,347 |

786 |

2,133 |

2,597 |

1,779 |

4,376 |

|

RCPP (2701) |

578 |

742 |

1,320 |

1,078 |

1,742 |

2,820 |

|

Othere |

-485 |

NA |

-485 |

-497 |

NA |

-497 |

|

Conservation Title Total |

28,679 |

555 |

29,234 |

59,689 |

-6 |

59,682 |

Source: CRS. Compiled from CBO, "Baseline Projections," April 2018, https://www.cbo.gov/about/products/baseline-projections-selected-programs, and at the title level in the table notes in CBO, "Cost Estimates for H.R. 2," https://www.cbo.gov/publication/54284, July 24, 2018.; and CBO cost estimate of the conference agreement for H.R. 2, https://www.cbo.gov/publication/54880, Dec. 11, 2018.

a. The CBO Score of the 2018 farm bill includes two entries for CSP; one for the CSP contracts entered into before enactment (under §2301) and those entered into after enactment (combined with EQIP; §2308).

b. The baseline for CSP in this table is reflected on the same line as the standalone CSP score (§2301) and not with the combined EQIP & CSP line (§2308).

c. The baseline for the combined EQIP and CSP score (§§2302 and 2308, respectively) only reflects the EQIP baseline. See table note a, above, for additional explanation.

d. New, permanent, mandatory funding is authorized under section 2401 for the Watershed Protection and Flood Prevention Act (16 U.S.C. 1001 et seq.), as amended. This section can fund multiple watershed programs, including WFPO and Watershed Rehabilitation.

e. The April 2018 CBO baseline includes other small programs (e.g., AMA) and adjustments (e.g., sequestration) which are combined as Other in this table. These provisions did not affect the score of the 2018 farm bill and are not discussed in this report.

|

Figure 3. 2018 Farm Bill Conservation Title Score (by program, dollars in millions) |

|

|

Source: CRS using CBO cost estimate of the conference agreement for H.R. 2, https://www.cbo.gov/publication/54880, Dec. 11, 2018. Notes: The chart includes the Conservation Reserve Program (CRP), Conservation Stewardship Program (CSP), Environmental Quality Incentives Program (EQIP), Agricultural Conservation Easement Program (ACEP), and Regional Conservation Partnership Program (RCPP). Other includes funding for Watershed Protection and Flood Prevention Operations (§2401), Grassroots Source Water Protection (§2405), Voluntary Public Access and Habitat Incentive Program (§2406), and Feral swine eradication and control pilot program (§2408). The CBO Score of the 2018 farm bill includes two entries for CSP; one for the CSP contracts entered into before enactment (under §2301) and those entered into after enactment (combined with EQIP; §2308). |

Historical and Programmatic Shifts in Conservation Funding

The bulk of mandatory spending for conservation is authorized for working lands and land retirement activities. While recent farm bills have increased funding for easement and partnership programs, they remain relatively small compared to three main programs—EQIP, CSP, and CRP (see Table 2 and Figure 4). The 2018 farm bill conservation title is considered budget neutral over the ten-year baseline and generally reallocates funding among the larger existing programs.

Over time, periods of high commodity prices, changing land rental rates, and new conservation technologies have led to a shift in farm bill conservation policy away from land retirement and toward an increased focus on working lands programs. Much of this shift occurred following the 2008 farm bill and continued in the 2014 farm bill as the level of total mandatory program funding for land retirement programs declined relative to working lands programs (see Figure 4). Increasingly, the separation between land retirement programs and working lands programs has become blurred by an increase in compatible use allowances for grazing and pasture use under land retirement programs. Most conservation and wildlife organizations support both land retirement and working lands programs; however, the appropriate "mix" continues to be a subject of debate.

Additionally, some conservation program supporters are divided over the relative benefits of shorter-term land retirement programs (CRP) versus longer-term easement programs (ACEP). Unlike land retirement programs, easement programs impose a permanent or longer-term land-use restriction that the land owner voluntarily places on the land in exchange for a government payment. Supporters of easement programs cite a more cost-effective investment in sustainable ecosystems for long-term wildlife and land preservation benefits. Supporters of short-term land retirement programs cite the increased flexibility and broader participation compared with permanent or long-term easement programs. The 2018 farm bill did not amend the duration of ACEP easements, but did create two new subprograms under CRP that would provide additional options for longer-term CRP contracts (30 years under CLEAR30) and shorter-term CRP contracts (3-5 years under SHIPP).23

In recent years, Congress has placed greater emphasis on programs that partner with state and local communities to target conservation funding to local resource concerns. These partnership programs leverage private funding with federal funding to multiply the level of assistance in a selected area. The 2014 farm bill repealed a number of these partnership programs and replaced them with RCPP. The 2018 farm bill amends and expands the number of partnering opportunities under RCPP, CREP, and CIG. However, based on available funding, these programs remain relatively small compared to others in the conservation title.

Environmental Regulation and Voluntary Conservation

USDA has cited voluntary conservation practices as a way to address environmental concerns and potentially reduce the need for traditional regulatory programs.24 A number of provisions in the conservation title speak to the relationship between voluntary conservation measures and environmental regulation. One such provision is regulatory certainty. Regulatory certainty refers to using voluntary measures to address a specific resource concern in exchange for the "certainty" that additional measures will not be required under future regulations.25 A new regulatory certainty section in the 2018 farm bill (§2503(f)) authorizes USDA to provide technical assistance under the farm bill conservation programs to support regulatory assurances for producers and landowners, under select conditions.

The 2018 farm bill also makes existing regulatory certainty measures permanent, including the Working Lands for Wildlife Initiative, which was created in 2012 as a partnership between NRCS and the U.S. Fish and Wildlife Service (FWS). Under this partnership agreement, private landowners who voluntarily make wildlife habitat improvements on their land through NRCS conservation programs, and agree to maintain them for 15-30 years, receive in return a level of certainty they will be exempted from potential future regulatory actions related to at-risk species under the Endangered Species Act.26 The 2018 farm bill makes this partnership agreement permanent and allows for the initiative to be expanded to include CRP.

Another environmental regulatory-related provision in the enacted 2018 farm bill (§2410) is a sense of Congress statement encouraging watershed-level partnerships between nonpoint sources and regulated point sources to advance the goals of the Federal Water Pollution Control Act (Clean Water Act, 33 U.S.C. §1251 et seq.).

Appendix. Comparison of Conservation Provisions Enacted in the 2018 Farm Bill to Prior Law

This appendix includes a series of tables, arranged by subtitle, included in Title II of the Agriculture Improvement Act of 2018 (P.L. 115-334). U.S. Code citations are included in brackets in the "Prior Law" column. Corresponding section numbers in the 2018 farm bill are included in brackets in the "Enacted 2018 Farm Bill" column. Funding for most Title II programs is covered in the "Funding and Administration" subtitle (Subtitle E, see Table A-6). Where appropriate, funding levels are repeated within a program's corresponding subtitle table. Tables are generally organized by section number of the 2018 farm bill, except where it is appropriate to cross-references relevant amendments to provide a complete picture of the program.

|

Prior Law |

Enacted 2018 Farm Bill (P.L. 115-334) |

|

Section 2101—Wetland Conversion |

|

|

The wetland conservation or "swampbuster" provision denies various USDA program benefits to producers who plant program crops on wetlands converted after December 23, 1985, or who convert wetlands, making agricultural commodity production possible, after November 28, 1990. For a producer to be found out of compliance, crop production does not actually have to occur; production only needs to be made possible through activities such as draining, dredging, filling, or leveling the wetland. Exemptions for compliance violators may be granted following a review. (16 U.S.C. 3821 et seq.) |

Requires that a producer cannot be denied program benefits if an exemption applies to that producer. (§2101) |

|

Section 2102—Wetland conservation |

|

|

The Secretary is required to conduct an on-site visit before program benefits may be withheld for noncompliance. (16 U.S.C. 3821(c)) |

Requires that the on-site inspection be conducted in the presence of the affected person, except when a reasonable effort was made to include the affected person. (§2102) |

|

Section 2103—Mitigation banking |

|

|

One option violators of wetland conservation have to mitigate the violation is through wetland mitigation banking. Wetland mitigation banking is a type of wetlands mitigation whereby a wetland is created, enhanced, or restored, and "credit" for those efforts is sold to others as compensation for the loss of impacted wetlands elsewhere. The 2014 farm bill created a permanent wetland mitigation banking program exclusively for farmers to comply with swampbuster. The program has a onetime authorization for $10 million in mandatory funding. (16 U.S.C. 3822(k)) |

Authorizes the appropriation of $5 million annually for FY2019 through FY2023. (§2103) |

Source: CRS.

|

Prior Law |

Enacted 2018 Farm Bill (P.L. 115-334) |

|

Section 2201—Conservation Reserve |

|

|

Authority. Conservation Reserve Program (CRP) is authorized through FY2018 to provide annual rental payments to producers to replace crops on highly erodible and environmentally sensitive land with long-term resource conserving plantings. (16 U.S.C. 3831(a)) |

Reauthorizes CRP through FY2023. (§2201(a)) |

|

Eligible land. Highly erodible land is considered eligible for enrollment in CRP if (1) left untreated could substantially reduce the land's future agricultural production capability or (2) it cannot be farmed in accordance with a conservation plan; and has a cropping history or was considered to be planted for four of the six years preceding February 7, 2014 (except for land previously enrolled in CRP). Eligible land also includes marginal pastureland, grasslands, cropland, and land devoted to buffer or filterstrips. (16 U.S.C. 3831(b)) |

Extends the six-year cropping history to include land planted for four of the six years preceding enactment of the bill. Adds land that would have a positive impact on water quality if devoted to water quality practices. Amends land established to new buffer practices to include salt tolerant vegetation or practices that benefit wellhead protection areas. Adds other expired CRP land. (§2201(b)) |

|

Maximum enrollment. CRP is authorized to enroll up to 27.5 million acres in FY2014, 26 million acres in FY2015, 25 million acres in FY2016, and 24 million acres in both FY2017 and FY2018. (16 U.S.C. 3831(d)(1)) |

Incrementally increases enrollment limits from 24 million acres in FY2019, to 24.5 million acres in FY2020, 25 million acres in FY2021, 25.5 million acres in FY2022, and 27 million acres in FY2023. (§2201(c)(1)) |

|

Grasslands enrollment. CRP grassland enrollment is capped at 2 million acres total for FY2014-FY2018. Priority is given to expiring CRP contracts and enrollment is continuous. (16 U.S.C. 3831(d)(2)) |

Requires a minimum CRP grassland enrollment of 2 million acres by the end of FY2021. Incrementally increases the minimum enrollment of grassland acres from 1 million acres in FY2019, 1.5 million acres in FY2020, and 2 million acres in FY2021 through FY2023. Allows CRP grassland enrollment to prioritize expiring CRP land, land at risk of development, or land of ecological significance. Enrollment is required on an annual basis. Includes a limit on using unenrolled grassland acres for other types of CRP enrollment. (§2201(c)(2)) |

|

No comparable provision. |

Clean Lakes, Estuaries, and Rivers (CLEAR) initiative. Creates a new water quality incentive that gives priority under continuous enrollment to land that would reduce sediment and nutrient loading, and harmful algal blooms. Requires 40% of continuous enrollment contracts to be used to enroll land that would have a positive impact on water quality if devoted to water quality practices (not including grassland contracts). Includes monthly report requirements. (§2201(c)(3)) |

|

No comparable provision. CRP acres are enrolled based on the relative environmental benefits of the land offered. |

Minimum enrollment by state. Requires USDA to annually allocate 60% of the available number of CRP acres to states based on historical enrollment. Enrollment rates must consider the average number of acres enrolled in each state during FY2007 through FY2016, the average number of acres enrolled in CRP during FY2007 through FY2016, and the acres available for enrollment for FY2019 through FY2023. Also requires that at least one noncontinuous sign-up be held every year. (§2201(c)(3)) |

|

No comparable provision. There are two types of enrollment into CRP: general sign-up and continuous sign-up. A general sign-up is a specific period of time during which USDA accepts offers and competitively enrolls acres. Land offered under continuous sign-up may be enrolled at any time and is not subject to competitive bidding. CRP grassland offers are accepted on a continuous basis with periodic ranking periods. All sign-ups are subject to available acres within the authorized limits. (7 C.F.R. 1410.30) |

Continuous enrollment procedures. Requires CRP enrollment to be continuous for marginal pastureland, land that would have a positive impact on water quality if enrolled, select cropland, and Conservation Reserve Enhancement Program (CREP) contracts. Adds minimum enrollment targets for these continuous contracts of not fewer than 8 million acres by FY2019, 8.25 million acres by FY2020, 8.5 million acres by FY2021, and 8.6 million of acres by FY2022 and FY2023. (§2201(c)(3)) |

|

Reenrollment of expired land. All expiring CRP land is eligible for reenrollment in the program. (16 U.S.C. 3831(h)) |

Limits reenrollment for land devoted to hardwood trees to only one reenrollment, unless the land includes riparian forested buffers, forested wetlands, and shelterbelts. (§2201(d)) |

|

Section 2202—Conservation Reserve Enhancement Program |

|

|

No directly comparable provision. The Conservation Reserve Enhancement Program (CREP) is a subprogram of CRP in which USDA enters into agreements with states to target select areas and resource concerns in exchange for continuous CRP sign-ups and higher payments for enrollment. CREP was administratively established in 1997 and is regulated at 7 C.F.R. 1410.50. |

Adds a new provision codifying CREP as a permanent subprogram under CRP. Provisions are similar to the existing CREP. Limits eligible partners to a state, political subdivision of a state, Indian tribe, and nongovernmental organization. Allows USDA to enter into agreements with eligible entities to carry out CREP. Existing CREP agreements remain in force, but may be modified. Agreement requirements are further defined, including matching fund contributions and possible temporary waiver of matching funds. Payments from an eligible partner may be in cash, in-kind, or through technical assistance. Includes additional requirements for select cost-share payments, incentive payments, and maintenance payments. Includes drought and water conservation agreements that may enroll land critical to the purpose of the agreement, permit dryland farming, and ensure regionally consistent payment rates. Status reports are required 180 days after the end of each fiscal year following enactment. (§2202) |

|

Section 2203—Farmable Wetland Program |

|

|

The Farmable Wetland Program (FW) is a subprogram under CRP authorized through FY2018 to enroll up to 750,000 acres of wetland and buffer acreage in CRP. USDA may, after a review, increase the number of acres enrolled in FW by 200,000 additional acres. (16 U.S.C. 3831b(a)-(c)) |

Reauthorizes FW through FY2023. Makes clarifying amendments. (§2203) |

|

Section 2204—Pilot Programs |

|

|

No comparable provision. |

Creates a new pilot program referred to as CLEAR 30, that enrolls expiring CRP land into 30-year contracts (see the CLEAR initiative in §2201(c)(3)). Enrollment is restricted by the overall CRP enrollment limit. Under a CLEAR 30 contract the landowner must maintain the land in accordance with an approved plan and the terms and conditions of the contract, including the temporary suspension of base acres (used to calculate farm program payments). Terms and conditions are outlined for use and for prohibited activities. Compensation is made in thirty annual cash payments similar to those calculated under general CRP. Technical assistance is required for each contract and agreement. USDA must create the CRP plan for a contract, but management, monitoring, and enforcement may be delegated to another federal, state, or local government, or conservation organization. (§2204) |

|

No comparable provision. |

Creates a Soil Health and Income Protection Pilot (SHIPP) program under CRP to remove less productive farm land from production in exchange for annual rental payments and to plant low-cost perennial cover crops. Eligible land is limited to states selected in the prairie pothole region, was cropped but not enrolled in CRP in the previous three crop years, and is considered to be the least productive on the farm. Limits enrollment to no more than 15% of a farm and no more than 50,000 acres of total CRP. Participants are required to plant a USDA-approved, low-cost perennial conservation use cover crop at their own expense in return for an annual rental payment of 50% of the CRP rental rate. Higher annual rental rates of 75%, and cost-share assistance is available for beginning, small, socially disadvantaged, young, or veteran farmers and ranchers. Contracts are limited to 3-5 years, but can terminate early under certain conditions. Harvesting, haying, and grazing are allowed outside of the local nesting periods and subject to additional conditions. Requires annual reports to Congress. (§2204) |

|

Section 2205—Duties of owners and operators |

|

|

In exchange for payments under CRP, owners and operators agree to a number of requirements and restrictions on the land under contract. These requirements are outlined in the CRP contract and conservation plan. (16 U.S.C. 3832) |

Adds a requirement for hardwood and other trees, excluding windbreaks and shelterbelts, to carry out thinning and forest management practices. (§2205) |

|

Section 2206—Duties of the Secretary |

|

|

In return for a CRP contract, landowners are compensated for a percentage of the cost (cost-share) of carrying out conservation measures within the contract and an annual rental payment for 1) the conversion of highly erodible land and other agricultural land to less intensive uses, 2) permanent retirement of base history, and 3) development and management of grasslands. (16 U.S.C. 3833(a)) |

Adds the cost of fencing and water distribution practices to the list of possible cost-share assistance. Amends annual rental payments by adding marginal pastureland to the list of land converted to less intensive uses, and removes payments to permanently retire base history. (§2206(a)) |

|

Specified permitted activities. Certain specified activities (e.g., harvesting, grazing, or other commercial uses of the forage) are permitted on CRP land under select conditions. These activities are allowed without a reduction in the annual rental rate when in response to drought, flooding, or other emergency. Managed harvesting is allowed if it is consistent with soil conservation, water quality, and wildlife habitat (including primary nesting seasons) and in exchange for not less than a 25% reduction in annual rental rates for acres covered by the activity. Managed harvesting may occur at least every five years but not more than once every three years. Routine grazing is also permitted in exchange for not less than a 25% reduction in annual rental rate, subject to nesting season restrictions, vegetation management requirements and stocking rates, and routine grazing is limited to not more than once every two years (taking into consideration regional differences). (16 U.S.C. 3833(b)) |

Requires USDA to coordinate with state technical committees on the permitted uses of CRP land for certain activities or commercial uses. Permitted activities would not have a reduction in rental rate for emergency uses, mid-contract management practices, select uses of vegetative buffers, and grazing by beginning farmers or ranchers. A 25% reduction in annual rental rates may be approved for limited grazing and haying activities, and wind turbine installation subject to select limitations. Adds a new provision allowing USDA to determine years in which harvesting and grazing shall not be permitted if it would cause long-term damage to vegetative cover on that land. State Acres for wildlife Enhancement (SAFE) program and CREP acres may be grazed if permitted under the related agreement. (§2206(b)) |

|

No comparable provision. |

Adds a new provision providing that when a natural disaster or adverse weather event has the same effect as a management practice required under a conservation plan, USDA cannot require a similar management practice if the natural disaster or adverse weather event achieved the same effect. (§2206(c)) |

|

Section 2207—Payments |

|

|

Cost-share payments. Land enrolled in CRP is eligible to receive cost-share assistance for practices implemented. Cost-share payments are limited to 50% of the actual or average cost of establishing the practice and no more than 100% of the total cost. Hardwood trees, windbreaks, shelterbelts, and wildlife corridors are eligible for additional cost-share payments. Owners are ineligible from receiving cost-share payments if assistance is provided under other federal programs (16 U.S.C. 3834(b)) |

Limits cost-share payments to the actual cost of establishing the practice. Cost-share for seed is limited to 50% of the actual seed mixture cost. No cost-share is available for contract management activities. Adds an exception to ineligibility for cost-share for CREP contracts. Adds a 50% limit on practice incentives for continuous enrollment practices. (§2207(a)) |

|

Incentive payments. Incentive payments are allowed for up to 150% of the total cost of thinning and other practices to promote forest management or enhance wildlife habitat. (16 U.S.C. 3834(c)) |

Reduces incentive payments to not more than 100% of the total cost of thinning and other practices to promote forest management or enhance wildlife habitat. (§2207(b)) |

|

Annual rental payments. Land enrolled in CRP is eligible to receive an annual rental payment. In determining the amount to be paid, the Secretary has discretion in determining the amount necessary to encourage enrollment. (16 U.S.C. 3834(d)(1)) |

Adds a requirement that when determining the amount of annual rental payments the Secretary must consider the impact on the local farmland rental market and other factors as determined by the Secretary. (§2207(c)(1)) |

|

CRP enrollment is conducted through the submission of bids by owners and operators of eligible land. Annual rental payments under CRP contracts are determined by the Secretary in accordance with the rental rate criteria (see below). (16 U.S.C. 3834(d)(2)) |

Reduces annual rental payments based on enrollment type. General enrollment contracts and continuous enrollment contracts are limited to not more than 85% and 90% of the average county rental rate, respectively. The reduction may be waived for CREP contracts. Adds a sign-up incentive for continuous enrollment of 32.5% of the first annual rental payment. (§2207(c)(2)) |

|

Enrollment of hardwood tree acres are to be considered on a continuous basis. (16 U.S.C. 3834(d)(4)) |

Deletes provision. (§2207(c)(3)) |

|

Rental rates. CRP rental rates are based on soil productivity and the county average rental rate. USDA may use the National Agricultural Statistics Service's (NASS) survey estimates relating to dryland cash rental rates when determining annual rental rates. NASS is required to conduct a survey no less than once a year on county average market dryland and irrigated cash rental rates. (16 U.S.C. 3834(d)(5)) |

Requires NASS to conduct a county average rental rate survey annually and publish the survey estimate not later than September 15 each year. Adds a requirement that USDA post the current and previous soil rental rates for each county online. Requires the Secretary to use the NASS survey estimates relating to dryland rental rates when determining annual rental rates. Creates a new provision allowing FSA state committees and CREP partners to propose alternative soil rental rates with acceptable documentation and with notification to congressional authorizing committees. The county average soil rental rate is limited to 85% of the estimated rental rate for general enrollment or 90% of the estimated rental rate for continuous enrollment. (§2207(c)(5)) |

|

Limits on rental payments. The total amount of rental payments received directly or indirectly may not exceed $50,000. Additional payments received under a CREP contract is not subject to the payment limit. USDA is allowed to enter into CREP agreements with states. (16 U.S.C. 3834(g)) |

Maintains the $50,000 rental payment limit. Authorizes USDA to waive payment limits and adjusted gross income (AGI) requirements for rural water district or association land enrolled for the purpose of protecting a wellhead. Deletes reference to CREP agreements. (§2207(d)) |

|

Section 2208—Contracts |

|

|

Transition Incentives Program. The transition option under CRP facilitates the transfer of CRP acres from a retiring owner to a beginning/socially disadvantaged/veteran producer to return land to production, and it allows the new owner to begin land improvements or start the organic certification process one year before the CRP contract expires. In exchange, the retiring owner receives up to two additional years of annual CRP rental payments following the expiration of the CRP contract. (16 U.S.C. 3835(f)) |

Amends the program to authorize the transfer of land from any CRP contract holder (not limited to retiring or retired farmer or rancher) to a beginning/socially disadvantaged/veteran producer. Extends the time available for the new owner to begin land improvements or start the organic certifications contract from one year to two years before the CRP contract expires. Amends participation requirements to allow short-term leases (less than 5 years) with an option to purchase. In addition, gives land enrollment priority into EQIP, CSP, and ACEP. Allows the new owners to reenroll a portion of the land into select practices under a continuous contracts. (§2208(a)) |

|

End of contract. Landowners may enroll in CSP and conduct activities required under CSP in the final year of the CRP contract without violating the terms of the contract. (16 U.S.C. 3835(g)) |

Amends the provision to allow for enrollment in EQIP or CSP and conduct EQIP or CSP practices in the final year of the CRP contract without violating the terms of the contract. Adds that landowners may begin the organic certification process three years prior to the end of a contract without violating the terms of the contract. (§2208(b)) |

|

Section 2209—Eligible Land; State Law Requirements |

|

|

Land is considered ineligible for CRP if the landowner has received written notice that the land is required to have a resource concern or environmental protection measure or practices in place in accordance with tribal, state, or other local law, ordinances, or other regulation. (7 C.F.R. 1410.6(d)(4)) |