Introduction

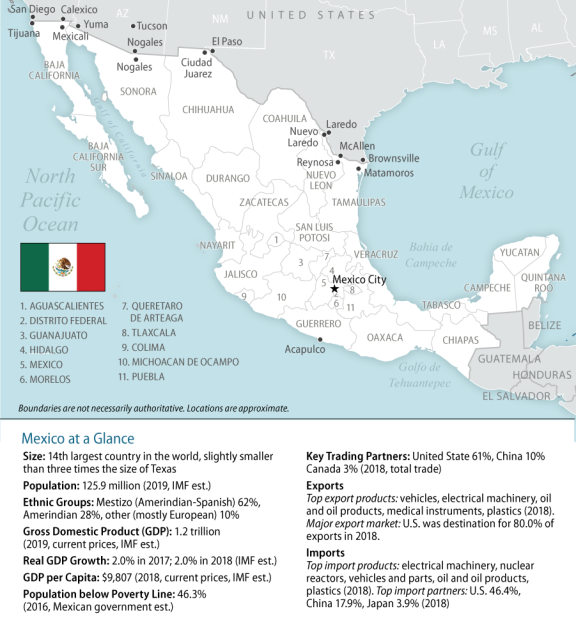

Congress has demonstrated renewed interest in Mexico, a top trade partner and energy supplier with which the United States shares a nearly 2,000-mile border and strong cultural, familial, and historical ties (see Figure 1). Economically, the United States and Mexico are interdependent, and Congress closely followed efforts to renegotiate NAFTA, which began in August 2017, and ultimately resulted in a proposed United States-Mexico-Canada Agreement (USMCA) signed in November 2018. Similarly, security conditions in Mexico and the Mexican governments' ability to manage U.S.-bound migration flows affect U.S. national security, particularly at the Southwest border.

Five months into his six-year term, Mexican President Andrés Manuel López Obrador enjoys an approval ratings of 78%, even as his government is struggling to address rising insecurity and sluggish growth.1 Discontent with Mexico's traditional parties and voters' desire for change led them to elect López Obrador president with 53% of the vote. Some fear that López Obrador, whose National Regeneration Movement (MORENA) coalition captured legislative majorities in both chambers of the Congress, will reverse the reforms enacted in 2013-2014. Others predict that pressure from business groups, civil society, and some legislators and governors may constrain López Obrador's populist tendencies.

This report provides an overview of political and economic conditions in Mexico, followed by assessments of selected issues of congressional interest in Mexico: security and foreign aid, extraditions, human rights, trade, migration, energy, education, environment, and water issues.

Background

Over the past two decades, Mexico has transitioned from a centralized political system dominated by the Institutional Revolutionary Party (PRI), which controlled the presidency from 1929-2000, to a true multiparty democracy. Since the 1990s, presidential power has become more balanced with that of Mexico's Congress and Supreme Court. Partially as a result of these new constraints on executive power, the country's first two presidents from the conservative National Action Party (PAN)—Vicente Fox (2000-2006) and Felipe Calderón (2006-2012)—struggled to enact some of the reforms designed to address Mexico's economic and security challenges.

The Calderón government pursued an aggressive anticrime strategy and increased security cooperation with the United States. Mexico arrested and extradited many drug kingpins, but some 60,000 people died due to organized crime-related violence. Mexico's security challenges overshadowed some of the government's achievements, including its economic stewardship during the global financial crisis, health care expansion, and efforts on climate change.

In 2012, the PRI regained control of the presidency 12 years after ceding it to the PAN with a victory by Enrique Peña Nieto over López Obrador of the leftist Democratic Revolutionary Party (PRD). López Obrador then left the PRD and founded the MORENA party. Voters viewed the PRI as best equipped to reduce violence and hasten economic growth, despite concerns about its reputation for corruption. In 2013, Peña Nieto shepherded structural reforms through a fragmented legislature by forming a "Pact for Mexico" agreement among the PRI, PAN, and PRD. The reforms addressed a range of issues, including education, energy, telecommunications, access to finance, and politics (see Table A-1 in the Appendix). The energy reform led to foreign oil and gas companies committing to invest $160 billion in the country.2

|

|

Sources: Graphic created by the Congressional Research Service (CRS). Map files from Map Resources. Trade data from Global Trade Atlas and Ethnicity data from CIA, The World Factbook. Other data are from the International Monetary Fund (IMF). |

Despite that early success, Peña Nieto left office with extremely low approval ratings (20% in November 2018) after presiding over a term that ended with record levels of homicides, moderate economic growth (averaging 2% annually), and pervasive corruption and impunity.3 Peña Nieto's approval rating plummeted after his government botched an investigation into the disappearance of 43 students in Ayotzinapa, Guerrero in September 2014.4 Reports that surfaced in 2014 of how Peña Nieto, his wife, and his foreign minister benefitted from ties to a firm that won lucrative government contracts, further damaged the administration's reputation.5 In 2017, reports emerged that the Peña Nieto government used spyware to monitor its critics, including journalists.6

López Obrador Administration

July 1, 2018, Election7

On July 1, 2018, Andrés Manuel López Obrador and his MORENA coalition dominated Mexico's presidential and legislative elections. Originally from the southern state of Tabasco, López Obrador is a 65-year-old former mayor of Mexico City (2000-2005) who ran for president in the past two elections. After his loss in 2012, he left the center-left Democratic Revolutionary Party (PRD) and established MORENA.

MORENA, a leftist party, ran in coalition with the socially conservative Social Encounter Party (PES) and the leftist Labor Party (PT). López Obrador won 53.2% of the presidential vote, more than 30 percentage points ahead of his nearest rival, Ricardo Anaya, of the PAN/PRD/Citizen's Movement (MC) alliance who garnered 22.3% of the vote. López Obrador won in 31 of 32 states (see Figure 2). The PRI-led coalition candidate, José Antonio Meade, won 16.4% of the vote followed by Jaime Rodríguez, Mexico's first independent presidential candidate, with 5.2%.

Andrés Manuel López Obrador's victory signaled a significant change in Mexico's political development. López Obrador won in 31 of 32 states, demonstrating that he had broadened his support from his base in southern Mexico.The presidential election results have prompted soul-searching within the traditional parties and shown the limits of independent candidates. Anaya's defeat provoked internal struggles within the PAN. Meade's performance demonstrated voters' deep frustration with the PRI.

In addition to the presidential contest, all 128 seats in the Mexican senate and 500 seats in the chamber of deputies were up for election. Senators serve for six years, and deputies serve for three. Beginning this cycle, both senators and deputies will be eligible to run for reelection for a maximum of 12 years in office. MORENA's coalition won solid majorities in the Senate and the Chamber which convened on September 1, 2018. As of April 2019, the ruling coalition controls 70 of 128 seats in the Senate and 316 of 500 seats in the Chamber.8 The MORENA coalition lacks the two-thirds majority it needs to make constitutional changes or overturn reforms passed in 2013. The PAN is the second-largest party in each chamber.

|

|

Source: Graphic created by Congressional Research Service (CRS). Data from Mexico's National Electoral Institute |

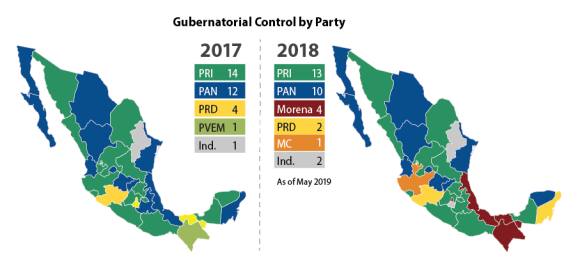

Mexican voters gave López Obrador and MORENA a mandate to change the course of Mexico's domestic policies. Nevertheless, López Obrador's legislative coalition may face opposition if it seeks to enact policies that would shift the balance of power between federal and state offices. López Obrador proposed having a federal representative in each state to liaise with his office and to oversee distribution of all federal funds, but governors opposed this proposal. As shown in Figure 3, MORENA and allied parties control four of 32 governorships, including that of Mexico City.

|

|

Source: Graphic created by Congressional Research Service (CRS). Data from Mexico's National Electoral Institute. Notes: Morelos: Morelos Governor Cuauhtémoc Blanco, who was a Social Encounter Party (PES) candidate during the 2018 elections, is now an independent. According to Mexican law, political parties must meet a voting threshold after each electoral cycle to remain active. Parties that do not meet the threshold must disband. The PES, which originally formed part of López Obrador's coalition, failed to meet the specified 3% voting threshold in the 2018 elections. As a consequence, the National Electoral Institute dissolved the party. |

President López Obrador: Priorities and Early Actions

In 2018, López Obrador promised to bring about change by governing differently than recent PRI and PAN administrations. He focused on addressing voters' concerns about corruption, poverty and inequality, and escalating crime and violence.Although some of his advisers endorse progressive social policies, López Obrador personally has opposed abortion and gay marriage.9

López Obrador has set high expectations for his government and promised many things to many different constituencies, some of which appear to conflict with each other. Upon taking office, López Obrador pledged to bring about a "fourth transformation" that would make Mexico a more just and peaceful society, but observers question whether his ambitious goals are attainable, given existing fiscal constraints. 10 As an example, he has promised to govern austerely but has started a number of new social programs. His finance minister has promised that existing contracts with private energy companies will be respected, but his energy minister has halted new auctions and is seeking to rebuild the heavily indebted state oil company (Petróleos de México or Pemex).11

President López Obrador's distinct brand of politics has given him broad support. 12 López Obrador has dominated the news cycle by convening daily, early morning press conferences. His decision to cut his own salary and public sector salaries generally have prompted high-level resignations among senior bureaucrats, but proven popular with the public. His government has started a new youth scholarship program and pensions for the elderly, while also promising to create jobs with infrastructure investments (including a new oil refinery and a railroad in the Yucatán) in southern Mexico regardless of their feasibility.13 Voters have given the government the benefit of the doubt even when its policies have caused inconveniences, such as fuel shortages that occurred after security forces closed some oil pipelines in an effort to combat theft.14

Investors have been critical of some of the administration's early actions. Many expressed concern after López Obrador cancelled a $13 billion airport project already underway after voters in a MORENA-led referendum rejected its location. Investors were somewhat assuaged, however, after the administration unveiled a relatively austere budget in late 2018 and then decided to allow energy contracts signed during Peña Nieto's presidency to proceed while halting new ones. With López Obrador's support, the Congress has enacted reforms to strengthen the protection of labor rights and workers' salaries, in part to comply with its domestic commitments related to the USMCA.15 On the other hand, it is unclear whether legislators' revisions will water down, or completely undo, education reforms passed in 2013 that were deemed a step forward toward raising education standards by many, but have been opposed by unions and ordered repealed by López Obrador.16

Critics maintain that President López Obrador has shunned reputable media outlets that have questioned his policies and cut funding for entities that could provide checks on his presidential power.17 He has dismissed data collected on organized crime-related violence by media outlets as "fake news" even as government data corroborate their findings that violence is escalating.18 His government has cut the budget for the national anticorruption commission, newly independent prosecutor general's office, and several regulatory agencies.

Security Conditions

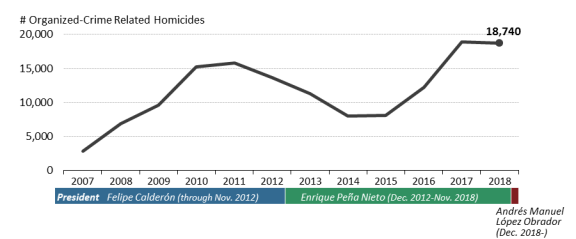

Endemic violence, much of which is related to organized crime, has become an intractable problem in Mexico (see Figure 4). Organized crime-related violence has been fueled by U.S. drug demand, as well as bulk cash smuggling and weapons smuggling from the United States.19 Organized crime-related homicides in Mexico rose slightly in 2015 and significantly in 2016. In 2017, total homicides and organized crime-related homicides reached record levels.20 During Mexico's 2018 campaign, more than 150 politicians reportedly were killed.21 The homicide rate reached record levels in 2018 and rose even higher during the first three months of 2019 as fighting among criminal organizations intensified.22

Infighting among criminal groups has intensified since the rise of the Jalisco New Generation, or CJNG, cartel, a group that shot down a police helicopter in 2016. The January 2017 extradition of Joaquín "El Chapo" Guzmán prompted succession battles within the Sinaloa Cartel and emboldened the CJNG and other groups to challenge Sinaloa's dominance.23 Crime groups are competing to supply surging U.S. demand for heroin and other opioids. Mexico's criminal organizations also are fragmenting and diversifying away from drug trafficking, furthering their expansion into activities such as oil theft, alien smuggling, kidnapping, and human trafficking.24 Although much of the crime—particularly extortion—disproportionately affects localities and small businesses, fuel theft has become a national security threat, costing Mexico as much as $1 billion a year and fueling violent conflicts between the army and suspected thieves.25

|

Figure 4. Estimated Organized Crime-Related Violence in Mexico (2007-2018) |

|

|

Source: Lantia Consultores, a Mexican security firm. Graphic prepared by CRS. |

Many assert that the Peña Nieto administration maintained Calderón's reactive approach of deploying federal forces—including the military—to areas in which crime surges rather than proactively strengthening institutions to deter criminality. These deployments led to a swift increase in human rights abuses committed by security forces (military and police) against civilians (see "Human Rights " below).26 High-value targeting of top criminal leaders also continued. As of August 2018, security forces had killed or detained at least 110 of 122 high-value targets identified as priorities by the Peña Nieto government; nine of those individuals received sentences.27 In August 2018, the Mexican government and the U.S. Drug Enforcement Administration (DEA) announced a new bilateral effort to arrest the leader of the CJNG.28 Even as many groups have developed into multifaceted illicit enterprises, government efforts to seize criminal assets have been modest and attempts to prosecute money laundering cases have had "significant shortcomings."29

With violence reaching historic levels during the first quarter of 2019 and high-profile massacres occurring, President López Obrador is under increasing pressure to refine his security strategy.30 As a candidate, López Obrador emphasized anticorruption initiatives, social investments, human rights, drug policy reform, and transitional justice for nonviolent criminals. In line with those priorities, Mexico's security strategy for 2018-2024 includes a focus on addressing the socioeconomic drivers of violent crime.31 The administration has launched a program to provide scholarships to youth to attend university or to complete internships. Allies in the Mexican Congress are moving toward decriminalizing marijuana production and distribution.32

At the same time, President López Obrador has backed constitutional reforms to allow military involvement in public security to continue for five more years, despite a 2018 Supreme Court ruling that prolonged military involvement in public security violated the constitution.33 He secured congressional approval of a new 80,000-strong National Guard (composed of military police, federal police, and new recruits) to combat crime, a move that surprised many in the human rights community.34 After criticism from human rights groups, the Congress modified López Obrador's original proposal to ensure the National Guard will be under civilian command.

Corruption, Impunity, and Human Rights Abuses

Corruption and the Rule of Law

Corruption is an issue at all levels of government in Mexico: 84% of Mexicans identify corruption as among the most pressing challenge facing the country.35 In Mexico, the costs of corruption reportedly reach as much as 5% of gross domestic product each year.36 Mexico fell 33 places in Transparency International's Corruption Perceptions Index from 2012 to 2018. At least 14 current or former governors (many from the PRI) are under investigation for corruption, including collusion with organized crime groups that resulted in violent deaths.37 A credible case against the chair of Peña Nieto's 2012 campaign (and former head of Pemex) for receiving $10.5 million in bribes from Odebrecht, a Brazilian construction firm, stalled after the prosecutor investigating the case was fired.38 Even though López Obrador has called for progress and transparency in anticorruption cases, his government has not unsealed information on investigations related to the Odebrecht case.39

New Criminal Justice System. By the mid-2000s, most Mexican legal experts had concluded that reforming Mexico's corrupt and inefficient criminal justice system was crucial for combating criminality and strengthening the rule of law. In June 2008, Mexico implemented constitutional reforms mandating that by 2016, trial procedures at the federal and state level had to move from a closed-door process based on written arguments presented to a judge to an adversarial public trial system with oral arguments and the presumption of innocence. These changes aimed to help make a new criminal justice system that would be more transparent, impartial, and efficient (through the use of alternative means of dispute settlement). Federal changes followed advances made in early adopters of the new system, including states such as Chihuahua.40

Under Peña Nieto, Mexico technically met the June 2016 deadline for adopting the new system, with states that have received technical assistance from the United States showing, on average, better results than others.41 Nevertheless, s problems in implementation occurred and public opinion turned against the system as many criminals were released by judges due to flawed investigations by police and/or weak cases presented by prosecutors. 42 On average, fewer than 20% of homicides have been successfully prosecuted, suggesting persistently high levels of impunity.43 According to the World Justice Project, the new system has produced better courtroom infrastructure, more capable judges, and faster case resolution than the old system, but additional training for police and prosecutors is needed.44 It is unclear whether López Obrador will dedicate the resources necessary to strengthen the system.

Reforming the Attorney General's Office. Analysts who study Mexico's legal system highlight the inefficiency of the attorney general's office (PGR). For years, the PGR's efficiency has suffered because of limited resources, corruption, and a lack of political will to resolve high-profile cases, including those involving high-level corruption or emblematic human rights abuses. Three attorneys general resigned from 2012 to 2017; the last one stepped down over allegations of corruption. Many civil society groups that pushed for the new criminal justice system in the mid-2000s also lobbied the Mexican Congress to create an independent prosecutor's office to replace the PGR.45 Under constitutional reforms adopted in 2014, Mexico's Senate would appoint an independent individual to lead the new prosecutor general's office.

President Andrés Manuel López Obrador downplayed the importance of the new office during his presidential campaign, but Mexico's Congress established the office after he was inaugurated in December 2018. In January 2019, Mexico's Senate named Dr. Alejandro Gertz Manero, a 79-year old associate and former security advisor to López Obrador, as Prosecutor General. Gertz Manero's nomination and subsequent appointment has raised concerns about his capacity to remain independent, given his ties to the president. Many wonder if he will take up cases against the president and his administration.46 Gertz Manero is to serve a nine-year term.

Making Electoral Fraud and Corruption Grave Crimes. In December 2018, López Obrador proposed constitutional changes that would expand the list of grave crimes for which judges must mandate pretrial detention to include corruption and electoral fraud. The proposal passed the Senate in December and the lower chamber in February 2019.47 Critics, such as the UN High Commissioner for Human Rights (OHCHR), noted that the change violates the presumption of innocence, an international human right under the UN's Universal Declaration of Human Rights. Increasing pretrial detention also goes against one of the stated goals of the NCJS. The president, however, welcomed the outcome.

National Anticorruption System. In July 2016, Mexico's Congress approved legislation to fully implement the national anticorruption system (NAS) created by a constitutional reform in April 2015. The legislation reflected several of the proposals put forth by Mexican civil society groups. It gave the NAS investigative and prosecutorial powers and a civilian board of directors; increased administrative and criminal penalties for corruption; and required three declarations (taxes, assets, and conflicts of interest) from public officials and contractors.48 During the Peña Nieto government, federal implementation of the NAS lagged and state-level implementation varied significantly. In December 2017, members of the system's civilian board of directors maintained that the government had thwarted its efforts by denying requests for information.49

Although he campaigned on an anticorruption platform, President López Obrador has questioned the necessity of the NAS.50 Since taking office, López Obrador has not prioritized implementing the system. Nevertheless, Prosecutor General Gertz Manero named a special anticorruption prosecutor in February 2019. The 18 judges required to hear corruption cases are still to be named. In addition, many states have not fulfilled the constitutional requirements for establishing a local NAS.

Human Rights

Criminal groups, sometimes in collusion with public officials, as well as state actors (military, police, prosecutors, and migration officials), have continued to commit serious human rights violations against civilians, including extrajudicial killings. 51 The vast majority of those abuses have gone unpunished, whether prosecuted in the military or civilian justice systems.52 The government also continues to receive criticism for not adequately protecting journalists and human rights defenders, migrants, and other vulnerable groups.

For years, human rights groups and U.S. State Department Country Reports on Human Rights Practices have chronicled cases of Mexican security officials' involvement in extrajudicial killings, "enforced disappearances," and torture.53 In October 2018, the outgoing Peña Nieto government estimated that more than 37,000 people who had gone missing since 2006 remained unaccounted for. States on the U.S.-Mexico border (Tamaulipas, Nuevo León, and Sonora) have among the highest rates of disappearances.54 The National Human Rights Commission estimates that "more than 3,900 bodies have been found in over 1,300 clandestine graves since 2007."55

|

Extrajudicial Killings, Enforced Disappearances, and Torture Two emblematic human rights cases have received international attention: Tlatlaya, State of Mexico. In October 2014, Mexico's National Human Rights Commission (CNDH) issued a report concluding that the Mexican military killed between 12 and 15 people in Tlatlaya on July 1, 2014. The military claimed that the victims were criminals killed in a confrontation. The CNDH also documented claims of the torture of witnesses to the killings by state officials. The last three soldiers in custody for killing eight people that day have been released, but four state prosecutors were convicted of torture. Concerns about the adequacy of the attorney general's investigation prompted a federal judge to order the case to be reopened in May 2018.56 Ayotzinapa, Guerrero. The unresolved case of 43 missing students who disappeared in Ayotzinapa, Guerrero, in September 2014—which allegedly involved the local police and authorities—galvanized global protests. The Peña Nieto government's investigation has been widely criticized, and experts from the Inter-American Commission on Human Rights (IACHR) disproved much of its findings. The government worked with those experts to reinvestigate the case in 2015-April 2016 but denied their requests to interview soldiers who were in the area of the incident. In July 2016, the government formed a follow-up mechanism with the IACHR to help ensure follow up on the experts' lines of investigation, but it made little progress. In May 2018, a federal judge ruled that the attorney general's investigation had not been "impartial or independent" and called for the creation of a creation of a truth commission to take over the case.57 President López Obrador has established a truth commission to reinvestigate the case that will receive assistance from the United Nations. |

In 2017, the Mexican Congress enacted a law against torture. After an April 2019 visit to Mexico, the U.N. Committee against Torture welcomed the passage of the 2017 law, but stated that torture by state agents occurred in a "generalized manner" in Mexico and found the use of torture to be "endemic" in detention centers.58 They also maintained that impunity for the crime of torture must be addressed: 4.6% of investigations into torture claims resulted in convictions.59

During a recent visit to Mexico, Michelle Bachelet, the United Nations High Commissioner for Human Rights recognized President López Obrador's efforts to put human rights at the center of his government. Bachelet highlighted the President's willingness to "unveil the truth, provide justice, give reparations to victims and guarantee the nonrepetition" of human rights violations. She commended the creation of the Presidential Commission for Truth and Access to Justice for the Ayotzinapa case and acknowledged the government's broader commitment to search for the disappeared. The commissioner welcomed the government's presentation of the Plan for the Implementation of the General Law on Disappearances (approved in 2017), the reestablishment of the National Search System, and the announcement of plans to create a Single Information System and a National Institute for Forensic Identification.60

In recent years, international observers have expressed alarm as Mexico has become one of the most dangerous countries for journalists to work outside of a war zone. From 2000 to 2018, some 120 journalists and media workers were killed in Mexico and many more have been threatened or attacked, according to Article 19 (an international media rights organization).61 A more conservative estimate from the Committee to Protect Journalists (CPJ) is that 41 journalists have been killed in Mexico since 2000. In addition, Mexico ranks among the top 10 countries globally with the highest rates of unsolved journalist murders as a percentage of population in CPJ's Global Impunity Index.

Mexico is also a dangerous country for human rights defenders. During the first three months of the López Obrador government, at least 17 journalists and human rights defenders were killed, at least one of whom was receiving government protection.62 Although López Obrador has been critical of some media outlets and reporters, his government has pledged to improve the mechanism intended to protect human rights defenders and journalists.63

Foreign Policy

President Peña Nieto prioritized promoting trade and investment in Mexico as a core goal of his administration's foreign policy. During his term, Mexico began to participate in U.N. peacekeeping efforts and spoke out in the Organization of American States on the deterioration of democracy in Venezuela, a departure for a country with a history of nonintervention. Peña Nieto hosted Chinese Premier Xi Jinping for a state visit to Mexico, visited China twice, and in September 2017 described the relationship as a "comprehensive strategic partnership."64 The Peña Nieto government negotiated and signed the proposed Trans-Pacific Partnership (TPP) trade agreement with other Asia-Pacific countries (and the United States and Canada). Even after President Trump withdrew the United States from the TPP agreement, Mexico and the 10 other signatories of the TPP concluded their own trade agreement, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Mexico also prioritized economic integration efforts with the pro-trade Pacific Alliance countries of Chile, Colombia, and Peru and focused on expanding markets for those governments.65

In contrast to his predecessor, President López Obrador generally has maintained that the best foreign policy is a strong domestic policy. His foreign minister, Marcelo Ebrard (former mayor of Mexico City), is leading a return to Mexico's traditional, noninterventionist approach to foreign policy (the so-called Estrada doctrine). Many analysts predict, however, that Mexico may continue to engage on global issues that it deems important. López Obrador reversed the active role that Mexico had been playing during the Peña Nieto government in seeking to address the crises in Venezuela. Mexico has not recognized Juan Guaidó as Interim President of Venezuela despite pressure from the United States and others to do so. As of January 2019, U.N. agencies estimated that some 39,000 Venezuelan migrants and refugees were sheltering in Mexico.66

Despite these changes, Mexico continues to participate in the Pacific Alliance, promote its exports and seek new trade partners, and support investment in the Northern Triangle countries (Guatemala, El Salvador, and Honduras). The Mexican government has long maintained that the best way to stop illegal immigration from Central America is to address the insecurity and lack of opportunity there. Nevertheless, fiscal limitations limit the Mexican government's ability to support Central American efforts to address those challenges.

Economic and Social Conditions67

Mexico has transitioned from a closed, state-led economy to an open market economy that has entered into free trade agreements with 46 countries.68 The transition began in the late 1980s and accelerated after Mexico entered into NAFTA in 1994. Since NAFTA, Mexico has increasingly become an export-oriented economy, with the value of exports equaling more than 38% of Mexico's gross domestic product (GDP) in 2016, up from 10% of GDP 20 years prior. Mexico remains a U.S. crude oil supplier, but its top exports to the United States are automobiles and auto parts, computer equipment, and other manufactured goods. Reports have estimated that 40% of the content of those exports contain U.S. value added content.69

Despite attempts to diversify its economic ties and build its domestic economy, Mexico remains heavily dependent on the United States as an export market (roughly 80% of Mexico's exports in 2018 were U.S.-bound) and as a source of remittances, tourism revenues, and investment. Studies estimate that a U.S. withdrawal from NAFTA, could cost Mexico more than 950,000 low-skilled jobs and lower its GDP growth by 0.9%.70 In recent years, remittances have replaced oil exports as Mexico's largest source of foreign exchange. According to Mexico's central bank, remittances reached a record $33.0 billion in 2018. Mexico remained the leading U.S. international travel destination in 2017 (the most recent year calculated by the U.S. Department of Commerce). U.S. travel warnings regarding violence in resort areas such as Playa del Carmen, Los Cabos, and Cancún could result in declining arrivals.71

The Mexican economy grew by 2% in 2018, but growth may decline to 1.6% in 2019, due, in part, to lower projected private investment.72 Mexico's Central Bank has also cited slowing investment, gasoline shortages, and strikes as reasons for revising its growth forecast for 2019 downward to a range of 1.1% to 2.1% for 2019.73 Some observers believe that investor sentiment and the country's growth prospects could worsen if López Obrador continues to promote government intervention in the economy and to rely on popular referendums to make economic decisions.74

Economic conditions in Mexico tend to follow economic patterns in the United States. When the U.S. economy is expanding, as it is now, the Mexican economy tends to grow. However, when the U.S. economy stagnates or contracts, the Mexican economy also tends to contract, often to a greater degree. The negative impact of protectionist U.S. trade policies and a projected U.S. economic slowdown in 2020 could hurt Mexico's growth prospects.75 President Trump has threatened to close the U.S.-Mexico border in response to his concerns about illegal immigration and illicit drug flows. Closing the border could have immediate and serious economic consequences. As an example, the U.S. auto industry stated that U.S. auto production would stop after a week due to the deep interdependence of the North American auto industry.76

Sound macroeconomic policies, a strong banking system, and structural reforms backed by a flexible line of credit with the International Monetary Fund (IMF) have helped Mexico weather recent economic volatility.77 Nevertheless, the IMF has recommended additional steps to deal with potential external shocks. These steps include improving tax collection, reducing informality, reforming public administration, and improving governance.

Factors Affecting Economic Growth

Over the past 30 years, Mexico has recorded a somewhat low average economic growth rate of 2.6%. Some factors—such as plentiful natural resources, a young labor force, and proximity to markets in the United States—have been counted on to help Mexico's economy grow faster in the future. Most economists maintain that those factors could be bolstered over the medium to long term by continued implementation of some of the reforms described in Table A-1.

At the same time, continued insecurity and corruption, a relatively weak regulatory framework, and challenges in its education system may hinder Mexico's future industrial competitiveness. Corruption costs Mexico as much as $53 billion a year (5% of GDP).78 A lack of transparency in government spending and procurement, as well as confusing regulations and red tape, has likely discouraged some investment. Deficiencies in the education system, including a lack of access to vocational education, have led to firms having difficulty finding skilled labor.79

Another factor affecting the economy is the price of oil. Because oil revenues make up a large, if lessening, part of the country's budget (32% of government revenue in 2017), low oil prices since 2014 and a financial crisis within Pemex have proved challenging.80 The Peña Nieto government raised other taxes to recoup lost revenue from oil, but the López Obrador administration has pledged to make budget cuts in order to maintain fiscal targets.81

Many analysts predict that Mexico will have to combine efforts to implement its economic reforms with other actions to boost growth. A 2018 report by the Organisation for Economic Co-operation and Development suggests that Mexico will need to enact complementary reforms to address issues such as corruption, weak governance, and lack of judicial enforcement to achieve its full economic growth potential.82

Combating Poverty and Inequality

Mexico has long had relatively high poverty rates for its level of economic development (43.6% in 2016), particularly in rural regions in southern Mexico and among indigenous populations.83 Some assert that conditions in indigenous communities have not measurably improved since the Zapatistas launched an uprising for indigenous rights in 1994.84 Traditionally, those employed in subsistence agriculture or small, informal businesses tend to be among the poorest citizens. Many households rely on remittances to pay for food, clothing, health care, and other basic necessities.

Mexico also experiences relatively high income inequality. According to the 2014 Global Wealth Report published by Credit Suisse, 64% of Mexico's wealth is concentrated in 10% of the population. Mexico is among the 25 most unequal countries in the world included in the Standardized World Income Inequality Database. According to a 2015 report by Oxfam Mexico, this inequality is due in part to the country's regressive tax system, oligopolies that dominate particular industries, a relatively low minimum wage, and a lack of targeting in some social programs.85

Economists have maintained that reducing informality is crucial for addressing income inequality and poverty, while also expanding Mexico's low tax base. The 2013-2014 reforms sought to boost formal-sector employment and productivity, particularly among the small- and medium-sized enterprises (SMEs) that employ some 60% of Mexican workers, mostly in the informal sector. Although productivity in Mexico's large companies (many of which produce internationally traded goods) increased by 5.8% per year between 1999 and 2009, productivity in small businesses fell by 6.5% per year over the same period.86 To address that discrepancy, the financial reform aimed to increase access to credit for SMEs and the fiscal reform sought to incentivize SMEs' participation in the formal (tax-paying) economy by offering insurance, retirement savings accounts, and home loans to those that register with the national tax agency.

The Peña Nieto administration sought to complement economic reforms with social programs, but corruption within the Secretariat for Social Development likely siphoned significant funding away from some of those programs.87 It expanded access to federal pensions, started a national anti-hunger program, and increased funding for the country's conditional cash transfer program.88 Peña Nieto renamed that program Prospera (Prosperity) and redesigned it to encourage its beneficiaries to engage in productive projects. In addition to corruption, some of Peña Nieto's programs, namely the anti-hunger initiative, were criticized for a lack of efficacy.89

Despite his avowed commitment to austerity, López Obrador has endorsed state-led economic development and promised to rebuild Mexico's domestic market as part of his National Development Plan 2018-2024, which he presented on May 1, 2019.90 In addition to revitalizing Pemex, the president has promised to build a "Maya Train" to connect five states in the southeast and facilitate tourism (see Figure 5). In December 2018, López Obrador announced a plan to invest some $25 billion in southern Mexico to accompany an estimated $4.8 billion in potential U.S. public and private investments to promote job growth, infrastructure, and development in that region, including jobs for Central American migrants.91

|

|

Source: Graphic prepared by CRS as adapted from an official project plan available at https://lopezobrador.org.mx/2018/09/11/proyecto-tren-maya/. |

López Obrador's pledges related to social programs include (1) doubling monthly payments to the elderly; (2) providing regular financial assistance to a million disabled people; (3) giving a monthly payment to students in 10th to 12th grades to lower the dropout rate, and (4) offering paid apprenticeships for 2.3 million young people. While some of these programs have already gotten underway, their ultimate scale and impacts will take time to evaluate. Some observers are concerned about his plan to decouple monthly support to families provided through the program formerly known as Prospera with requirements that children attend school and receive regular health checkup.92

U.S. Relations and Issues for Congress

Mexican-U.S. relations generally have grown closer over the past two decades. Common interests in encouraging trade flows and energy production, combating illicit flows (of people, weapons, drugs, and currency), and managing environmental resources have been cultivated over many years. A range of bilateral talks, mechanisms, and institutions have helped the Mexican and U.S. federal governments—as well as stakeholders in border states, the private sector, and nongovernmental organizations—find common ground on difficult issues, such as migration and water management. U.S. policy changes that run counter to Mexican interests in one of those areas could trigger responses from the Mexican government on other areas where the United States benefits from Mexico's cooperation, such as combating illegal migration.93

Despite predictions to the contrary, U.S.-Mexico relations under the López Obrador administration have thus far remained friendly. Nevertheless, tensions have emerged over several key issues, including trade disputes and tariffs, immigration and border security issues, and Mexico's decision to remain neutral in the crisis in Venezuela. The new government has generally accommodated U.S. migration and border security policies, but has protested recent policies that have resulted in extended border delays.94 President López Obrador has also urged the U.S. Congress to consider the USMCA.95

Security Cooperation: Transnational Crime and Counternarcotics96

Mexico is a significant source and transit country for heroin, marijuana, and synthetic drugs (such as methamphetamine) destined for the United States. It is also a major transit country for cocaine produced in the Andean region.97 Mexican-sourced heroin now accounts for nearly 90% of the total weight of U.S.-seized heroin analyzed in the U.S. Drug Enforcement Administration's (DEA's) Heroin Signature Program. In addition to Mexico serving as a transshipment point for Chinese fentanyl (a powerful synthetic opioid), the DEA suspects labs in Mexico may use precursor chemicals smuggled over the border from the United States to produce fentanyl.

Mexican drug trafficking organizations pose the greatest crime threat to the United States, according to the DEA's 2018 National Drug Threat Assessment. These organizations engage in drug trafficking, money laundering, and other violent crimes. They traffic heroin, methamphetamine, cocaine, marijuana, and, increasingly, the powerful synthetic opioid fentanyl.

Mexico is a long-time recipient of U.S. counterdrug assistance, but cooperation was limited between the mid-1980s and mid-2000s due to U.S. distrust of Mexican officials and Mexican sensitivity about U.S. involvement in the country's internal affairs. Close cooperation resumed in 2007, when Mexican President Felipe Calderón requested U.S. assistance to combat drug trafficking organizations, and worked with President George W. Bush to develop the Mérida Initiative. While initial U.S. funding for the initiative focused heavily on training and equipping Mexican security forces, U.S. assistance shifted over time to place more emphasis on strengthening Mexican institutions.

In 2011, the U.S. and Mexican governments agreed to a revised four-pillar strategy that prioritized (1) combating transnational criminal organizations through intelligence sharing and law enforcement operations; (2) institutionalizing the rule of law while protecting human rights through justice sector reform and forensic assistance; (3) creating a "21st century border" while improving immigration enforcement in Mexico; and (4) building strong and resilient communities with pilot programs to address the root causes of violence and reduce drug demand. The Mérida Initiative has continued to evolve along with U.S. and Mexican security concerns. Recent programs have focused on combating opioid production and distribution, improving border controls and interdiction, training forensic experts, and combating money laundering. Nevertheless, organized crime-related homicides in Mexico and opioid-related deaths in the United States have surged, leading some critics to question the efficacy of bilateral efforts.

The future of the Mérida Initiative is unclear. Some observers predict López Obrador may seek to emphasize anticorruption initiatives, social investments in at-risk youth, human rights, and drug policy reform as he did during his presidential campaign. Others maintain that López Obrador has thus far accommodated the Trump Administration's emphasis on combating Central American migration and may back other U.S. priorities, such as combating the fentanyl trade. Other common interests may include countering human rights violations, combating weapons trafficking, and accelerating efforts against money laundering and corruption.98

There has been bipartisan support in Congress for the Mérida Initiative, which has accounted for the majority of U.S. foreign assistance to Mexico provided over the past decade (see Table 1). The FY2019 Consolidated Appropriations Act (P.L. 116-6) provided some $145 million for accounts that fund the initiative ($68 million above the budget request). The increased resources are primarily for addressing the flow of U.S.-bound opioids. The joint explanatory statement accompanying the act (H.Rept. 116-9) requires a State Department strategy on international efforts to combat opioids (including efforts in Mexico) and a report on how the Mérida Initiative is combating cocaine and methamphetamine flows. The Administration's FY2020 budget request asks Congress to provide $76.3 million for the Mérida Initiative.

|

Account |

ESF |

INCLE |

FMF |

Total |

||||||||

|

FY2008 |

|

|

|

|

||||||||

|

FY2009 |

|

|

|

|

||||||||

|

FY2010 |

|

|

|

|

||||||||

|

FY2011 |

|

|

|

|

||||||||

|

FY2012 |

|

|

Not Applicable |

|

||||||||

|

FY2013 |

|

|

Not Applicable |

|

||||||||

|

FY2014 |

|

|

Not Applicable |

|

||||||||

|

FY2015 |

|

|

Not Applicable |

|

||||||||

|

FY2016 |

|

|

Not Applicable |

|

||||||||

|

FY2017 |

|

|

Not Applicable |

|

||||||||

|

FY2018 |

|

|

|

|

||||||||

|

FY2019 (est). |

|

|

|

|

||||||||

|

Total |

|

|

|

|

||||||||

|

FY2020 request |

|

|

Not Applicable |

|

Sources: U.S. Agency for International Development (USAID) budget office, November 3, 2016; U.S. Department of State, November 18, 2016; P.L. 115-141; P.L. 116-6; U.S. Department of State, Congressional Budget Justification for Foreign Operations, FY2020.

Notes: ESF = Economic Support Fund; INCLE = International Narcotics Control and Law Enforcement; FMF = Foreign Military Financing. FY2008-FY2010 included supplemental funding.

a. For FY2017, Mérida programs administered by the U.S. Agency for International Development (USAID) were funded through the Development Assistance account rather than ESF.

b. Of the $45 million in funds appropriated for ESF, some $6 million supported non-Mérida Initiative programs.

c. The Trump Administration has proposed merging the Economic Support Fund and Development Assistance accounts in its budget requests, but Congress has kept the accounts separate through FY2019.

Department of Defense Assistance

In contrast to Plan Colombia, the Department of Defense (DOD) did not play a primary role in designing the Mérida Initiative and is not providing assistance through Mérida accounts. However, DOD oversaw the procurement and delivery of equipment provided through the FMF account. Despite DOD's limited role in the Mérida Initiative, bilateral military cooperation has been increasing. DOD assistance aims to support Mexico's efforts to improve security in high-crime areas, track and capture suspects, strengthen border security, and disrupt illicit flows.

A variety of funding streams support DOD training and equipment programs. Some DOD equipment programs are funded by annual State Department appropriations for FMF, which totaled $5.0 million in FY2018. International Military Education and Training (IMET) funds, which totaled $1.5 million in FY2018, support training programs for the Mexican military, including courses in the United States. Apart from State Department funding, DOD provides additional training, equipping, and other support to Mexico that complements the Mérida Initiative through its own accounts. Individuals and units receiving DOD support are vetted for potential human rights issues in compliance with the Leahy Law. DOD programs in Mexico are overseen by U.S. Northern Command, which is located at Peterson Air Force Base in Colorado. DOD counternarcotics support to Mexico totaled approximately $63.3 million in FY2018.

Policymakers may want to receive periodic briefings on DOD efforts to guarantee that DOD programs are being adequately coordinated with Mérida Initiative efforts, complying with U.S. vetting requirements, and not reinforcing the militarization of public security in Mexico.

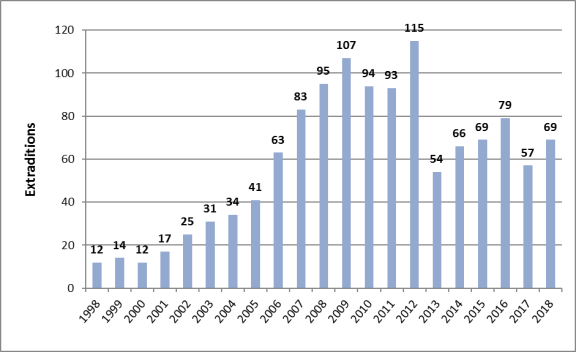

Extraditions

During the Calderón government, extraditions were another indicator that the State Department used as an example of the Mérida Initiative's success. During the final years of the Calderón government, Mexico extradited an average of 98 people per year to the United States, an increase over the prior administration. When President Peña Nieto took office, extraditions fell to 54 in 2013 but rose to a high of 76 in 2016 (see Figure 6).

|

Figure 6. Extraditions from Mexico to the United States: 1998-2018 |

|

|

Sources: U.S. Department of Justice and U.S. Department of State. |

Human Rights99

The U.S. Congress has expressed ongoing concerns about human rights conditions in Mexico. Congress has continued to monitor adherence to the Leahy vetting requirements that must be met under the Foreign Assistance Act (FAA) of 1961, as amended (22 U.S.C. 2378d), which pertains to State Department aid, and 10 U.S.C. 2249e, which guides DOD funding. DOD reportedly suspended assistance to a brigade based in Tlatlaya, Mexico, due to concerns about the brigade's potential involvement in the extrajudicial killings previously described.100 From FY2008 to FY2015, Congress made conditional 15% of U.S. assistance to the Mexican military and police until the State Department sent a report to appropriators verifying that Mexico was taking steps to comply with certain human rights standards. In FY2014, Mexico lost $5.5 million in funding due to human rights concerns.101 For FY2016-FY2019, human rights reporting requirements applied to FMF rather than to Mérida Initiative accounts.102

U.S. assistance to Mexico has supported the Mexican government's efforts to reform its judicial system and to improve human rights conditions in the country.103 Congress has provided funding to support Mexico's transition from an inquisitorial justice system to an oral, adversarial, and accusatory system that aims to strengthen human rights protections for victims and the accused. The State Department has established a high-level human rights dialogue with Mexico. The U.S. Agency for International Development (USAID) supported Mexico's 2014-2018 human rights plan, including the development of legislation in compliance with international standards, prevention efforts, improved state responses to abuses, and expanded assistance to victims.104 One recent project addressed the way the Mexican government addresses cases of torture and enforced disappearances, another sought to help the government protect journalists and resolve crimes committed against them.105 In many of these areas, U.S. technical assistance to the government is complemented by support to think tanks and civil society organizations, including in the area of providing forensic assistance to help search for missing people.106

Congress may choose to augment Mérida Initiative funding for human rights programs, such as ongoing training programs for military and police, or to fund new efforts to support human rights organizations. Human rights conditions in Mexico, as well as compliance with conditions included in the FY2019 Consolidated Appropriations Act (P.L. 116-6) are likely to be closely monitored.107 Some Members of Congress have written letters to U.S. and Mexican officials regarding human rights concerns, including allegations of extrajudicial killings by security forces, abuses of Central American migrants, and the use of spyware against human rights activists.

U.S. policymakers may question how the López Obrador administration moves to punish past human rights abusers, how it intends to prevent new abuses from occurring, and how the police and judicial reforms being implemented are bolstering human rights protections.

Economic and Trade Relations108

The United States and Mexico have a strong economic and trade relationship that has been bolstered through NAFTA. Since 1994, NAFTA has removed virtually all tariff and nontariff trade and investment barriers among partner countries and provided a rules-based mechanism to govern North American trade. Most economic studies show that the net economic effect of NAFTA on the United States and Mexico has been relatively small but positive, though there have been adjustment costs to some sectors in both countries. Further complicating assessments of NAFTA, not all trade-related job gains and losses since NAFTA entered into force can be entirely attributed to the agreement. Numerous other factors have affected trade trends, such as Mexico's trade-liberalization efforts, economic conditions, and currency fluctuations.

Mexico is the United States' third-largest trading partner. Mexico ranks third as a source of U.S. merchandise imports and second as an export market for U.S. goods. The United States is Mexico's most important export market for goods, with 80% of Mexican exports destined for the United States. Merchandise trade between the two countries in 2018 was six times higher (in nominal terms) than in 1993, the year NAFTA entered into force. The merchandise trade balance went from a U.S. surplus of $1.7 billion in 1993 (the year before NAFTA entered into force) to a widening deficit that reached $81.5 billion in 2018.109 In services, the United States had a trade surplus with Mexico of $7.4 billion in 2017 (latest available data); it largely consists of travel, transportation, business, and financial services.110

Total trade (exports plus imports) amounted to $561.3 billion in 2018. Much of that bilateral trade occurs in the context of supply chains, as manufacturers in each country work together to create goods. The expansion of trade has resulted in the creation of vertical supply relationships, especially along the U.S.-Mexican border. The flow of intermediate inputs produced in the United States and exported to Mexico and the return flow of finished products increased the importance of the U.S.-Mexican border region as a production site.

Foreign direct investment (FDI) is also an integral part of the bilateral economic relationship. The stock of U.S. FDI in Mexico increased from $15.2 billion in 1993 to $109.7 billion in 2017. Although the stock of Mexican FDI in the United States is much lower, it has also increased significantly since NAFTA, from $1.2 billion in 1993 to $18.0 billion in 2017.

The Obama Administration worked with Mexico to balance border security with facilitating legitimate trade and travel, promote economic competitiveness, and pursue energy integration. The U.S.-Mexican High-Level Economic Dialogue, launched in 2013, was a bilateral initiative to advance economic and commercial priorities through annual Cabinet meetings. The High-Level Regulatory Cooperation Council launched in 2012 helped align regulatory principles. Trilateral (with Canada) cooperation occurred under the aegis of the North American Leadership Summits.

While those mechanisms have not continued under the Trump Administration, the bilateral Executive Steering Committee (ESC), which guides broad efforts along the border, and the Bridges and Border Crossings group on infrastructure have continued to meet.111 The U.S.-Mexico CEO Dialogue has also continued to convene biannual meetings to produce joint recommendations for the two governments. Mexican business leaders reportedly worked with U.S. executives, legislators, and governors to encourage the Trump Administration to back the proposed USMCA rather than just abandoning NAFTA.112

Trade Disputes

Despite positive advances on many aspects of bilateral and trilateral economic relations, trade disputes continue. The United States and Mexico have had a number of trade disputes over the years, many of which have been resolved. Some of them have involved: country-of-origin labeling, dolphin-safe tuna labeling, and NAFTA trucking provisions.113 In 2017, Mexico and the United States concluded a suspension agreement on a U.S. antidumping and countervailing duty investigation on Mexican sugar exports to the United States in which Mexico agreed to certain limitations on its access to the U.S. sugar market.114

In recent years, new trade disputes have emerged. In January 2018, President Trump announced new tariffs on imported solar panels and washing machines under the Trade Act of 1974 that included products coming from Mexico. In February 2019, U.S. Commerce Secretary Wilbur Ross announced that the United States intends to withdraw from a 2013 suspension agreement on fresh tomato exports from Mexico.115 The agreement effectively suspends an investigation by the U.S. International Trade Commission (USITC) into whether Mexican producers are dumping fresh tomatoes into the U.S. market. Mexico's ambassador to the United States has stated she is "cautiously optimistic" the United States and Mexico will agree to a new arrangement before a U.S. withdrawal.116

The United States and Mexico are in another trade dispute over U.S. actions to impose tariffs on imports of steel and aluminum under Section 232 of the Trade Expansion Act of 1962, which authorizes the President to impose restrictions on certain imports based on national security threats. Using these authorities, on May 31, 2018, the United States imposed a 25% duty on steel imports and a 10% duty on aluminum imports from Mexico and Canada. 117 In response, Mexico applied retaliatory tariffs of 5% to 25% on U.S. exports valued at approximately $3.6 billion on pork, apples, potatoes, and cheese, among other items.

On May 23, 2018, the Trump Administration initiated a Section 232 investigation into the imports of motor vehicles and automotive parts (83 FR 24735) to determine if those imports threaten to impair U.S. national security.118

The Proposed USMCA119

On November 30, 2018, the United States, Canada, and Mexico signed the proposed USMCA, which, if approved by Congress and ratified by Mexico and Canada, would replace NAFTA. The proposed USMCA would retain many of NAFTA's chapters, while making notable changes to others, including market access provisions for autos and agriculture products, and new rules on investment, government procurement, and intellectual property rights (IPR). It would add new chapters on digital trade, state-owned enterprises, and currency misalignment.

The USMCA would tighten rule of origin requirements for duty-free treatment of U.S. motor vehicle imports from Mexico. Under NAFTA, motor vehicles must contain 62.5% North American content, while all other vehicles and motor parts must contain 60% North American content to qualify for duty-free treatment. The new rules would require that 75% of a motor vehicle and 70% of its steel and aluminum originate in North America and that 40%-45% of auto content be made by workers earning at least $16 per hour. Side letters would exempt up to 2.6 million vehicles from Canada and Mexico annually from potential Section 232 auto tariffs.

USMCA would maintain the NAFTA state-to-state mechanism for resolving most disputes, as well as NAFTA's binational mechanism for reviewing and settling trade remedy disputes. However, it would maintain an investor-state dispute settlement (ISDS) process only between the United States and Mexico, without Canada, but limit its scope to government contracts in oil, natural gas, power generation, infrastructure, and telecommunications sectors. It would also maintain U.S.-Mexico ISDS in other sectors provided the claimant exhausts national remedies first, among other changes and new limitations.120

Policymakers may consider numerous issues related to U.S.-Mexico trade as they debate the proposed USMCA. Some issues could include the timetable for congressional consideration under Trade Promotion Authority (TPA), whether the proposed USMCA meets TPA's negotiating objectives and other requirements, and the impact of the agreement on U.S.-Mexico trade relations.121 In April 2019, the USITC completed a required study on the possible economic impact of a USMCA on the United States. The report estimates that the agreement would have a very small but positive impact on the U.S. economy, potentially raising U.S. real GDP by "0.35% and U.S. employment by 176,000 jobs (0.12 %)."122 Other policymakers contend that the United States lift steel and aluminum tariffs on imports from Canada and Mexico before the agreement is considered by Congress and state that the tariffs act as a barrier hindering Mexican and Canadian ratification of the proposed USMCA.123

Congressional objectives and concerns are likely to shape timing of congressional consideration of the proposed USMCA. Some policymakers view the agreement as vital for U.S. firms, workers, and farmers, and believe that the updated agreement would benefit U.S. economic interests. Other issues of concern include a lack of worker rights protection in Mexico and the enforceability of labor provisions, the scaling back of ISDS provisions, which could affect U.S. investors, and possible adverse effects of auto rules of origin on U.S. automakers. Although USMCA would revise NAFTA labor provisions and provide the same dispute mechanism as other parts of the agreement, some critics contend that USMCA has the same limitations as NAFTA; they allege that the proposed USMCA enforcement tools do not go far enough to ensure the protection of worker rights to organize and bargain collectively. It is unclear whether labor reforms that have passed the Mexican Congress will be enough to assuage those concerns.

Migration and Border Issues

Mexican-U.S. Immigration Issues

Immigration policy has been a subject of congressional concern over many decades, with much of the debate focused on how to prevent unauthorized migration and address the large population of unauthorized migrants living in the United States. Mexico's status as both the largest source of migrants in the United States and a continental neighbor means that U.S. migration policies—including stepped-up border and interior enforcement—have primarily affected Mexicans.124 Beginning in FY2012, foreign nationals from countries other than Mexico began to comprise a growing percentage of total apprehensions.125 Due to a number of factors, more Mexicans have been leaving the United States than arriving.126 Nevertheless, protecting the rights of Mexicans living in the United States, including those who are unauthorized, remains a top Mexican government priority.

Since the mid-2000s, successive Mexican governments have supported efforts to enact immigration reform in the United States, while being careful not to appear to be infringing upon U.S. authority to make and enforce immigration laws. Mexico has made efforts to combat transmigration by unauthorized migrants and worked with U.S. law enforcement to combat alien smuggling and human trafficking.127 In FY2018, the Trump Administration removed (deported) some 141,045 Mexicans, as compared to 128,765 removals in FY2017.128 During the Obama Administration, some of Mexico's past concerns about U.S. removal policies, including nighttime deportations and issues concerning the use of force by some U.S. Border Patrol officials, were addressed through bilateral migration talks and letters of agreement.129

President Trump's shifts in U.S. immigration policies have tested U.S.-Mexican relations. His repeated assertions that Mexico will pay for a border wall resulted in President Peña Nieto canceling a White House meeting in January 2017 and continued to strain relations throughout his term.130 The Mexican government expressed regret after the Administration's decision to rescind the Deferred Action for Childhood Arrivals (DACA) initiative, which has provided work authorization and relief from removal for migrants brought to the United States as children, but pledged to assist DACA beneficiaries who return to Mexico.131 In June 2018, Mexico criticized U.S. "zero tolerance" immigration policies.132 Despite these developments, Mexico has continued to work with the United States on migration management and border issues.

In E.O. 13678, the Trump Administration broadened the categories of authorized immigrants prioritized for removal. As a result, the profile of Mexican deportees now include more individuals who have spent many decades in the United States than in recent years (when the Obama Administration had focused on recent border crossers and those with criminal records).133 The potential for large-scale removal of Mexican nationals present in the United States without legal status is an ongoing concern of the Mexican government that reportedly has been expressed to Trump Administration officials.134 Mexico's consular network in the United States has bolstered the services offered to Mexicans in the United States, including access to identity documents and legal counsel.135 It has launched a 24-hour hotline and mobile consultants to provide support, both practical and psychological, to those who may have experienced abuse or are facing removal.

The Mexican government has expressed hope that the U.S. Congress will develop a solution to resolve the phased ending of the DACA initiative. As of July 2018, some 561,400 Mexicans brought to the United States as children had received work authorizations and relief from removal through DACA.136 Many DACA recipients born in Mexico have never visited the country, and some do not speak Spanish.

Dealing with Unauthorized Migration, Including from Central America137

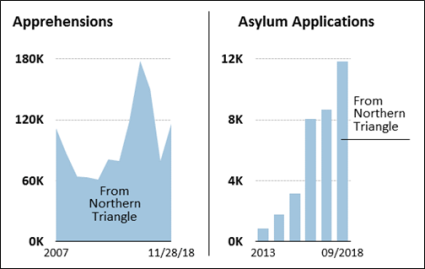

Since 2014, Mexico has helped the United States manage a surge in unauthorized migration from the "Northern Triangle" (El Salvador, Guatemala, and Honduras). Collectively, those countries have overtaken Mexico as the primary source for migrants apprehended at the U.S.-Mexico border. From 2015 to November 2018, Mexico reported apprehending almost 524,000 migrants and asylum seekers from the Northern Triangle. As U.S. asylum policies have tightened, Mexico also has absorbed more Central Americans in need of humanitarian protection (see Figure 7).

|

Figure 7. Mexico: Reported Apprehensions from Northern Triangle Countries and Asylum Applications |

|

|

Source: Created by CRS with information from Mexico's Secretary of the Interior. |

Mexico has received U.S. assistance for its immigration control efforts through the Mérida Initiative. Mexico has received support for its humanitarian protection efforts through global U.S. Migration and Refugee Assistance (MRA) implemented by the U.N. High Commissioner for Refugees (UNHCR) and others. Some U.S. policymakers have praised Mexico's management of these migration flows, whereas others have questioned Mexico's ability to protect migrants from abuse and to provide asylum to those in need of protection.

The López Obrador administration has a broad vision of addressing immigration by protecting human rights, decriminalizing migration, and cooperating with Central America. Implementing this vision has thus far proved difficult in an environment of increased flows from the Northern Triangle and pressure from the United States to limit them.138 The Mexican government has long maintained that the best way to stop illegal immigration from Central America is to address the insecurity and lack of opportunity there, but fiscal limitations limit its ability to support Central American efforts to address those challenges. As previously mentioned, the U.S. and Mexican governments issued a joint statement in December 2018 pledging to boost public and private investment in Central America.139 On March 29, 2019, the Trump Administration announced that it intends to end foreign assistance programs for the Northern Triangle countries for failing to combat unauthorized migration, appearing to reverse its prior pledge. The State Department has indicated that the decision will affect approximately $450 million in FY2018 funding.140

The López Obrador administration has provided humanitarian relief to Central American migrants in Mexico, but not increased funding for the migration agency or asylum system. Under pressure from the United States and with its migration stations overcapacity, the Mexican government has recently limited protections and increased deportations, particularly for those traveling in large groups or caravans, to discourage future flows. From April 1-22, 2019, Mexico removed nearly 11,800 people, up from 9,650 removed in the month of April 2018.141 Mexico's asylum system is underfunded and overwhelmed; it received 29,000 applications in 2018 even as 80% of applications from 2017 still awaited resolution.142

President López Obrador's desire to maintain positive relations with the U.S. government has prompted domestic criticism and may cause strain in its relations with some Central American governments. His government's decision to allow Central American asylum seekers to be returned to Mexico under the U.S. Migrant Protection Protocols (MPP) to obtain humanitarian visas—rather than challenging the MPP—has put pressure on local governments and aid organizations to assist the migrants.143 Many state it may also be putting migrants' lives at risk; many Mexican border cities are among the countries most dangerous.

Modernizing the U.S.-Mexican Border

Since the terrorist attacks of September 11, 2001, there have been significant delays and unpredictable wait times at the U.S.-Mexican border.144 The majority of U.S.-Mexican trade passes through a port of entry along the southwestern border, often more than once, due to the increasing integration of manufacturing processes in the United States and Mexico. Past bilateral efforts discussed below have contributed to reductions in wait times at some points of entry, but infrastructure and staffing issues remain on both the U.S. and Mexican sides of the border.145 One effort that has continued is the use of public-private partnerships to address those issues.146

On May 19, 2010, the United States and Mexico declared their intent to collaborate on enhancing the U.S.-Mexican border as part of pillar three of the Mérida Initiative.147 A Twenty-First Century Border Bilateral Executive Steering Committee (ESC) has met since then, most recently in November 2017, to develop binational action plans and oversee implementation of those plans. The plans set goals within broad objectives: coordinating infrastructure development, expanding trusted traveler and shipment programs, establishing pilot projects for cargo preclearance, improving cross-border commerce and ties, and bolstering information sharing among law enforcement agencies. In 2015, the two governments opened the first railway bridge in 100 years at Brownsville-Matamoros and launched three cargo pre-inspection test locations where U.S. and Mexican customs officials are working together.148 A Mexican law allowing U.S. customs personnel to carry arms in Mexico hastened these bilateral efforts.

In recent months, wait times have lengthened as a result of U.S. efforts to deal with an influx of Central American asylum seekers and to hasten construction of additional border barriers.149 Businesses have been concerned that unless López Obrador speaks out, President Trump may adopt policies that could exacerbate the delays at the border resulting from his decision to transfer customs personnel from ports of entry to perform migration management duties.150 As an example, President Trump has recently threatened to close the U.S.-Mexico border or to impose 25% tariffs on Mexican motor vehicle exports to the United States if the Mexican government does not increase its efforts to stop U.S.-bound migrants over the coming year.151 Mexico has recently urged the U.S. government to reconsider policies resulting in extended border delays.152

As Congress carries out its oversight function on U.S.-Mexican migration and border issues, questions that may arise include the following: How well is Mexico fulfilling its pledges to increase security along its northern and southern borders and to enforce its immigration laws? What is Mexico doing to address Central American migration through its territory? What is the current level of bilateral cooperation on border security and immigration and border matters, and how might that cooperation be improved? How well are the U.S. and Mexican governments balancing security and trade concerns along the U.S.-Mexican border? To what extent would the construction of a new border wall affect trade and migration flows in the region?

Energy153

The future of energy production in Mexico is important for Mexico's economic growth and for the U.S. energy sector. Mexico has considerable oil and gas resources, but its state oil company (Pemex), has struggled to counter declining production and postponed needed investments due to fiscal challenges. Mexico's 2013 constitutional reforms on energy opened up oil, electricity, gas, transmission, production, and sales to private and foreign investment while keeping ownership of Mexico's hydrocarbons under state control, as established in its 1917 constitution.

The 2013 reforms created opportunities for U.S. businesses in exploration, pipeline construction and ownership, natural gas production, and commercial gasoline sales. Although the reforms did not privatize Pemex, they did expose the company to competition and hastened its entrance into joint ventures. Because of the reforms, Mexico has received more than $160 billion in promised investment. 154 However, the reforms ended subsidies that kept gasoline prices low for Mexican consumers and failed to reverse production declines and ongoing problems within Pemex. Pemex's debt increased by more than 60% from 2013 to 2017. While analysts still predict that the reforms will bring long-term benefits to the country, the Peña Nieto administration oversold their short-term impacts, which has emboldened those within the López Obrador government who have opposed private involvement in the sector.155

The United States sought to help lock in Mexico's energy reforms through the NAFTA renegotiations. NAFTA includes some reservations for investment in Mexico's energy sector. The proposed USMCA would reinforce Mexico's 2013 constitutional reforms and the current legal framework for private energy projects in Mexico. It also would apply similar investor-state dispute settlement mechanisms that currently exist in NAFTA to the oil and gas, infrastructure, and other energy sectors.156 In addition, the free trade agreement would allow for expedited exports of U.S. natural gas to Mexico, which have increased about 130% since the 2013 reforms.

Private sector trade, innovation, and investment have created a North American energy market that is interdependent and multidirectional, with cross-border gas pipelines and liquefied natural gas (LNG) shipments from the United States to Mexico surging. In 2018, the value of U.S. petroleum products exports to Mexico totaled $30.6 billion, nearly double the value of U.S. energy imports from Mexico ($15.8 billion).157 Some experts estimate that the United States, Mexico, and Canada represent 20% of global oil and gas supply, as well as 20%-25% of the expected additions to international supply over the next 25 years. They believe that deepened energy cooperation with Mexico will give North America an industrial advantage.158

López Obrador's plans for Mexico's energy sector are still developing. He opposed the 2013 reforms, but he and his top officials have said that his government will honor existing contracts that do not involve any corruption. Despite that commitment, the new government has halted future rounds of auctions and plans to upgrade existing refineries and construct a new refinery in Tabasco rather than importing U.S. natural gas.159 López Obrador's energy plans also focus on revitalizing Pemex, although the company's financial problems have already become a financial burden for the government and its credit rating has been downgraded.160 The government's decision to halt new auctions in wind and solar energy, which had also attracted significant investment as a result of the reforms, has led some environmentalists to challenge López Obrador's commitment to a clean energy future for Mexico.161

Opportunities exist for continued U.S.-Mexican energy cooperation in the hydrocarbons sector, but the future of those efforts may depend on the policies of the López Obrador government. Leases have been awarded in the Gulf of Mexico under the U.S.-Mexico Transboundary Agreement, which was approved by Congress in December 2013 (P.L. 113-67). Bilateral efforts to ensure that hydrocarbon resources are developed without unduly damaging the environment could continue, possibly through collaboration between Mexican and U.S. regulatory entities. Educational exchanges and training opportunities for Mexicans working in the petroleum sector could expand. The United States and Mexico could build upon efforts to provide natural gas resources to help reduce energy costs in Central America and connect Mexico to the Central American electricity grid, as discussed during conferences on Central America cohosted by both governments in 2017 and in 2018. Analysts also have urged the United States to provide more technical assistance to Mexico—particularly in deepwater and shale exploration.