COVID-19: Consumer Loan Forbearance and Other Relief Options

Changes from May 14, 2020 to June 2, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

COVID 19: Consumer Loan Forbearance and

Other Relief Options

Updated June 2, 2020

Congressional Research Service

https://crsreports.congress.gov

R46356

SUMMARY

COVID 19: Consumer Loan Forbearance and

Other Relief Options

A growing number of reported Coronavirus Disease 2019 (COVID-19) cases have been

identified in the United States, significantly impacting many communities. This situation

is evolving rapidly, and the economic impact has been large due to illnesses,

quarantines, social distancing, local stay-at-home orders, and other business disruptions.

Consequently, many Americans will lose income and face financial hardship due to the

Other Relief Options

Contents

- Overview of Loan Forbearance and Other Relief Options for Consumers

- Loan Forbearance

- Other Relief Options Available to Consumers

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136)

- Mortgage Forbearance

- Federal Student Loan Forbearance

- Consumer Credit Reporting

- Bank and Credit Union Loan Loss Related Provisions

- Policy Issues

- Non-Legislative Federal COVID-19 Responses

- Consumer Regulatory Guidance

- Financial Institution Regulatory Guidance

- Guidance for Depository Institutions

- Guidance for the Housing Finance System

- Policy Issues

- Forbearance Implications for the Financial System

- Consumer Loans Owners

- Mortgages

- Nonmortgage Consumer Loans

- Potential Impacts on Banks and Mortgage Servicers

- Potential Impacts on Banks

- Potential Impacts on Mortgage Servicers

- Consumer Awareness and Education Issues

- Consumer Awareness of Their Relief Options

- Consumer Scams

- Conclusion

Figures

Summary

A growing number of reported Coronavirus Disease 2019 (COVID-19) cases have been identified in the United States, significantly impacting many communities. This situation is evolving rapidly, and the economic impact has been large due to illnesses, quarantines, social distancing, local stay-at-home orders, and other business disruptions. Consequently, many Americans will lose income and face financial hardship due to the COVID-19 pandemic.

COVID-19 pandemic.

Many consumers may have trouble paying their loan obligations, such as mortgages,

student loans, auto loans, and credit cards. Due to increasing hardship, loan forbearance loan forbearance

has become a common form of consumer relief during the COVID-19 pandemic. Loan Loan

forbearance plans are agreements that allow borrowers to reduce or suspend payments

for a short period of time, providing extended time for consumers to become current on

their payments and repay the amounts owed. These plans do not forgive unpaid loan

payments and tend to be appropriate for borrowers experiencing temporary hardship.

Loan forbearance may become a less viable option to deal with the financial

ramifications of COVID-19 if the pandemic causes prolonged disruptions, such as

persistent elevated levels of unemployment or permanent business closures.

A consumer'’s ability to get a forbearance and under what terms may be significantly

influenced by what type of institution owns the loan. These various institutions—

including banks and credit unions, private nonbank financial institutions, government-sponsoredgovernmentsponsored enterprises (GSEs), and the federal government—are subject to different

laws, regulations, and business considerations.

R46356

June 2, 2020

Cheryl R. Cooper,

Coordinator

Analyst in Financial

Economics

Darryl E. Getter

Specialist in Financial

Economics

Raj Gnanarajah

Analyst in Financial

Economics

David W. Perkins

Specialist in

Macroeconomic Policy

Andrew P. Scott

Analyst in Financial

Economics

In response to the COVID-19 pandemic, the President signed the Coronavirus Aid, Relief, and Economic Security

Act (CARES Act; P.L. 116-136) on March 27, 2020. The act establishes consumer rights to be granted

forbearance for federally insured mortgages (Section 4022) and federal student loans (Section 3513). The law also

protects the credit histories of consumers with forbearance agreements (Section 4021).

The CARES Act establishes consumer rights to be granted forbearance for many types of mortgages and federal

student loans, but the act does not grant consumers these rights for other types of consumer loan obligations, such

as auto loans, credit cards, private student loans, and bank-owned mortgages. In these cases, financial institutions

have discretion about when and how to offer loan forbearance or other relief options to consumers. Therefore, a consumer'

consumer’s ability to access these options may vary.

On May 15, 2020, the House passed the Health and

Economic Recovery Omnibus Emergency Solutions Act (HEROES Act; H.R. 6800), which among its many

provisions would expand consumer rights to loan forbearance and other payment relief during the COVID-19

pandemic.

In addition to legislative responses, financial regulatory agencies have responded to the COVID-19 pandemic

using existing authorities to encourage loan forbearance and other financial relief options for impacted consumers.

Many financial regulatory agencies have updated their guidance to help financial firms support consumer needs

during this time. Regulatory guidance does not force financial institutions to take any particular action for

consumers (such as offering loan forbearance), but it can encourage them to offer various forms of support. In

recent weeks, many banks and credit unions have announced measures to offer various forms of assistance to

affected consumers.

.

Congressional Research Service

COVID 19: Consumer Loan Forbearance and Other Relief Options

The economic effects of the COVID-19 pandemic impact the financial system in important ways. Large numbers

of missed consumer loan payments can have significant negative consequences for financial institutions. Because

of the potential strain on the financial system, it might be challenging for institutions to provide consumer relief,

and financial relief efforts may be insufficient to provide widespread assistance to impacted consumers without

direct government intervention.

Many consumers having trouble paying their loans may not realize that the CARES Act gives consumers a right

to be granted loan forbearance in certain circumstances, and that their financial institutions can provide loan

forbearance, access to credit, or other assistance. If consumers are not aware of these existing relief options, it is

possible that relief might not reach the most in need. In addition, increasing fraud schemes relating to COVID-19 seem to be occurring, which can drive consumer confusion. Both government agencies and financial institutions can play an important role in communicating with financially impacted consumers.

A growing number of reported Coronavirus Disease 2019 (COVID-19) cases have been

Congressional Research Service

COVID 19: Consumer Loan Forbearance and Other Relief Options

Contents

Overview of Loan Forbearance and Other Relief Options for Consumers ..................................... 2

Loan Forbearance ...................................................................................................................... 2

Other Relief Options Available to Consumers .......................................................................... 3

Mortgage Forbearance .............................................................................................................. 5

Federal Student Loan Forbearance ............................................................................................ 5

Consumer Credit Reporting ...................................................................................................... 6

Bank and Credit Union Loan Loss Related Provisions ............................................................. 7

Policy Issues .............................................................................................................................. 8

Non-Legislative Federal COVID-19 Responses ............................................................................. 9

Consumer Regulatory Guidance ............................................................................................... 9

Financial Institution Regulatory Guidance .............................................................................. 11

Guidance for Depository Institutions ................................................................................. 11

Guidance for the Housing Finance System ....................................................................... 13

Policy Issues ............................................................................................................................ 15

Forbearance Implications for the Financial System ...................................................................... 15

Consumer Loans Owners ........................................................................................................ 16

Mortgages ......................................................................................................................... 16

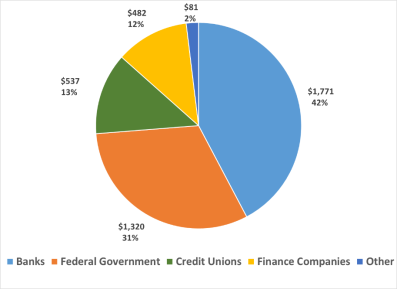

Nonmortgage Consumer Loans ........................................................................................ 17

Potential Impacts on Banks and Mortgage Servicers .............................................................. 18

Potential Impacts on Banks ............................................................................................... 19

Potential Impacts on Mortgage Servicers ......................................................................... 19

Consumer Awareness and Education Issues .................................................................................. 20

Consumer Awareness of Their Relief Options ........................................................................ 21

Consumer Scams ..................................................................................................................... 22

Conclusion ..................................................................................................................................... 23

Figures

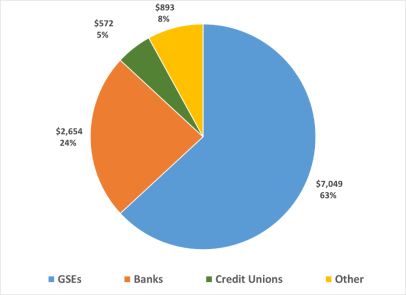

Figure 1. Amounts of Mortgages Outstanding, by Holder ............................................................ 17

Figure 2. Amounts of Consumer Loans Outstanding, by Holder .................................................. 18

Tables

Table 1. Relevant CARES Act Provisions and Consumer Protections,

by Consumer Credit Type............................................................................................................. 4

Contacts

Author Information........................................................................................................................ 23

Congressional Research Service

COVID 19: Consumer Loan Forbearance and Other Relief Options

growing number of reported Coronavirus Disease 2019 (COVID-19) cases have been

identified in the United States, significantly impacting many communities.1 As this

identified in the United States, significantly impacting many communities.1 As this situation rapidly evolves, the economic impact due to illnesses, quarantines, social

distancing, local stay-at-home orders, and other business disruptions will be large.22 Consequently,

many Americans will lose income and face financial hardship due to the impact of the COVID-19

pandemic.3

3

A

In response, four pieces of COVID-19-related legislation have been enacted—most relevant for

this report is the Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136) )

enacted on March 27, 2020. The act establishes consumer rights to be granted forbearance for

many types of mortgages (Section 4022) and for most federal student loans (Section 3513). The

law also protects the credit histories of consumers with forbearance agreements (Section 4021). In

addition, financial regulatory agencies have updated their guidance to provide clarity to financial

institutions responding to these events.

For loan obligations where the CARES Act does not guarantee a right to loan forbearance, such

as auto loans, credit cards, private student loans, and bank-owned mortgages, a consumer'’s ability

to access this option may vary. Reports suggest that many consumers have requested payment

relief for these types of loans not covered by the CARES Act.44 Different financial institutions

may be subject to different laws and incentives to handle consumer relief requests. For this

reason, an individual consumer may find a range of responses from different financial institutions

when requesting relief options.

On May 15, 2020, the House passed the Health and Economic

Recovery Omnibus Emergency Solutions Act (HEROES Act; H.R. 6800). Provisions in Division

K, Title IV of the act expand consumer rights to loan forbearance and other payment relief during

the COVID-19 pandemic.

This report focuses on policy responses relating to the financial services industry for consumers

who may have trouble paying their loan obligations, such as mortgages, student loans, auto loans,

and credit cards.55 First, it provides an overview of loan forbearance and other possible relief

options for consumers. Then, the report discusses relevant CARES Act provisions and federal

financial regulatory responses. Lastly, the report describes the impact this pandemic and the

proceeding policy responses have had on financial institutions and consumers.

Overview of Loan Forbearance and Other Relief Options for Consumers

During previous natural disasters, government shutdowns, or other similarly destabilizing events, the financial industry has provided financial assistance to some affected consumers, particularly

1

For background on the Coronavirus Disease 2019 (COVID-19), see CRS In Focus IF11421, COVID-19: Global

Implications and Responses, by Sara M. Tharakan et al.

2 For background on the potential economic effects of the COVID-19 pandemic in the United States, see CRS Insight

IN11388, COVID-19: U.S. Economic Effects, by Rena S. Miller and Marc Labonte.

3 For more information on financial industry policy issues during the COVID-19 pandemic for consumers having

trouble paying their bills, see CRS Insight IN11244, COVID-19: The Financial Industry and Consumers Struggling to

Pay Bills, by Cheryl R. Cooper.

4 Kevin Wack, “Plenty of takers for offers to skip credit card, student loan payments,” American Banker, April 23,

2020, at https://www.americanbanker.com/news/plenty-of-takers-for-offers-to-skip-credit-card-student-loan-payments?

; Kevin Wack, “Ally girds for surge in auto loan defaults,” American Banker, April 20, 2020, at

https://www.americanbanker.com/news/ally-girds-for-surge-in-auto-loan-defaults.

5 Other policies outside of the financial services industry might also help consumers with their finances during the

pandemic. For example, social insurance programs or government support to businesses may provide a consumer with

unemployment insurance or job security. These policies and others are outside of the scope of this report. For more

information, see CRS In Focus IF11447, COVID-19: Social Insurance and Other Income-Support Options for Those

Unable to Work, coordinated by Laura Haltzel; and CRS Report R46284, COVID-19 Relief Assistance to Small

Businesses: Issues and Policy Options, by Robert Jay Dilger, Bruce R. Lindsay, and Sean Lowry.

Congressional Research Service

1

COVID 19: Consumer Loan Forbearance and Other Relief Options

Overview of Loan Forbearance and Other Relief

Options for Consumers

During previous natural disasters, government shutdowns, or other similarly destabilizing events,

the financial industry has provided financial assistance to some affected consumers, particularly

those having temporary difficulties repaying their mortgages, credit cards, or other loans.6 For

those having temporary difficulties repaying their mortgages, credit cards, or other loans.6 For example, financial institutions have agreed to defer payments, limit late or other fees, and extend

credit to ease consumer financial struggles. In response to the coronavirus pandemic, many banks

have recently announced measures to offer various forms of assistance to affected consumers.7 7

However, the COVID-19 pandemic is more widespread than previous events, affecting

consumers across the country; therefore, financial industry responses may differ from the past.

This section begins with a discussion of loan forbearance, a common form of consumer relief. It

then describes other types of assistance that financial institutions could provide to impacted

consumers.

Loan Forbearance

consumers.

Loan Forbearance

Loan forbearance plans are agreements allowing borrowers to reduce or suspend payments for a

short period of time, providing extended time for consumers to become current on their payments

and repay the amounts owed. These plans do not forgive unpaid loan payments. Loan forbearance

plans between consumers and financial institutions usually include a repayment plan, which is an an

agreement allowing a defaulted borrower to repay the amount in arrears and become current on

the loan according to an agreed upon schedule. Repayment plans take many shapes. For example,

these plans may include a requirement that all suspended payments are to be due at the end of the

loan forbearance period; the past due amount is to be added to the regular payment amount over

the year after loan forbearance ends; or payments are to be added to the end of the loan'’s term.

Interest or fees may or may not accrue during the loan forbearance period.

As loan forbearance and repayment plans are generally offered to consumers experiencing a

temporary hardship, they have become a common form of consumer relief during the COVID-19

pandemic. During this pandemic, many businesses might be closed either by mandate (e.g.,

restaurants, concerts, or sporting event venues) or facing significant revenue declines due to

social distancing efforts (e.g., more space between people at open stores or restaurants) or

changes in consumer behavior (e.g., airlines, hotels, and the travel industry). Many of these

disruptions may be temporary, lasting only for the duration of the pandemic. Many financial

institutions offer loan forbearance plans as an option for consumers who have experienced job

loss or temporary income loss but may be able to continue to repay their credit obligations after

the disruption ends. In addition, financial institutions may see loan forbearance plans as a good

option for consumers at this time because these plans often do not involve renegotiating

contracts.88 Loan forbearance may be a less viable option to deal with the financial ramifications of the pandemic if it causes prolonged disruptions, such as persistent elevated levels of

6

Some of these efforts that require changes in credit contracts may be more difficult for institutions to implement.

For example, Amanda Dixon, “List of Banks Offering Help to Customers Impacted by the Coronavirus,” Bankrate,

April 8, 2020, at https://www.bankrate.com/banking/coronavirus-list-of-banks-offering-help-to-customers-financialhardship/.

8 Many mortgage services can offer workouts that do not involve renegotiations of the original mortgage contract. See

Fannie Mae’s servicing guide’s section on loan forbearance at https://servicing-guide.fanniemae.com/THESERVICING-GUIDE/Part-D-Providing-Solutions-to-a-Borrower/Subpart-D2-Assisting-a-Borrower-Who-is-FacingDefault-or/Chapter-D2-3-Fannie-Mae-s-Home-Retention-and-Liquidation/Section-D2-3-2-Home-Retention-Workout7

Congressional Research Service

2

COVID 19: Consumer Loan Forbearance and Other Relief Options

of the pandemic if it causes prolonged disruptions, such as persistent elevated levels of

unemployment or permanent business closures.

unemployment or permanent business closures.

Other Relief Options Available to Consumers

Loss mitigation

Loss mitigation (or workout options) refers to a menu of possible options financial institutions

may offer to help a distressed borrower become and stay current with loan payments and avoid

default. Loan forbearance is one type of loss mitigation. Loan modifications are another type of

loss mitigation that renegotiates the contract with concessions to the borrower. These concessions

can take the form of principal balance reductions, interest rate reductions, term to maturity

extensions, or some combination of such options.

Financial institutions or loan servicers generally weigh the costs and benefits of the various loss

mitigation options and offer borrowers the least costly option from a business perspective.99 Loan

forbearance can be the least costly option when the duration of consumer hardship is temporary

and short, and the lender can be paid back quickly. Loan modifications may also be beneficial to

the lender under circumstances when the costs to modify and retain the loan are lower than the

costs of default. If a borrower'’s circumstances, such as becoming disabled or long-term

unemployed, make it difficult for servicers to offer a workout option, the lender may find options

such as debt collection, auto repossession, foreclosure, or wage garnishment a less costly way to

resolve the default. Finally, various contractual arrangements that loan servicers are obligated to

follow may dictate servicer actions from the time the loan became distressed until resolution.

These arrangements may limit servicers'’ authorities and options.

Financial institutions can provide other types of relief to consumers, such as agreeing to limit late

or other fees and offering new credit or loan products. For example, a consumer can refinance out

of a distressed mortgage into a new mortgage contract, potentially pulling equity out of their

home to repay arrears and accumulated penalties.1010 Generally financial institutions would choose

to extend new credit only if they determine that the borrower is in a good position to pay the loan

back in the future. During the COVID-19 pandemic, some banks have decided to limit new credit

to consumers due to increased economic risk.11

11

Loss mitigation procedures provided by financial institutions or loan servicers are regulated in

order to help protect consumers. For example, during the 2008 financial crisis, many consumers

had trouble paying their mortgages due to unemployment and decreasing house prices. When

mortgage delinquency and foreclosure rates rose, federal regulators identified pervasive

documentation issues at many mortgage servicers, which became an issue when a large number

of consumers defaulted.1212 In response, the Consumer Financial Protection Bureau (CFPB), using

Options/D2-3-2-01-Forbearance-Plan/1042399011/D2-3-2-01-Forbearance-Plan-09-18-2018.htm. See Freddie Mac’s

servicing guide’s section on loan forbearance at https://guide.freddiemac.com/app/guide/content/a_id/1001217.

9 Loan servicers receive fees to manage loans for owners (e.g., lenders or investors) after origination, such as billing

and other loan services. Loan servicers are often responsible for administering loss mitigation on behalf of the owner if

full payment is paid.

10 The availability of refinance options depends on the market value of the home at the time of borrower default. The

market value of the home, which would be used as collateral, would need to be high enough to cover the outstanding

balance of the new loan. The new mortgage may also have an interest rate that is higher than current market rates to

better reflect the greater credit risk of the recently defaulted borrower.

11 For example, see Kate Berry, “JPMorgan halts home equity loans due to coronavirus,” American Banker, April 16,

2020, at https://www.americanbanker.com/news/jpmorgan-halts-home-equity-loans-due-to-coronavirus.

12 U.S. Government Accountability Office, Mortgage Foreclosures: Documentation Problems Reveal Need for

Ongoing Regulatory Oversight, GAO-11-433, May 2011, at https://www.gao.gov/assets/320/317923.pdf.

Congressional Research Service

3

COVID 19: Consumer Loan Forbearance and Other Relief Options

its authority under the Real Estate Settlement Procedures Act (RESPA; P.L. 93-533, implemented

by Regulation X),1313 issued the RESPA Mortgage Servicing Rule in January 2013. Among other

things, the rule created an obligation for mortgage servicers to establish consistent policies and

procedures to contact delinquent borrowers, provide information about mortgage loss mitigation

options, and evaluate borrower applications for loss mitigation in a timely manner.14

14

Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136)

)

This section of the report discusses various relief provisions of the CARES Act for borrowers and

consumer lenders. Table 1 presents a summary of CARES Act provisions that pertain to loan

forbearance by consumer credit type.1515 In addition, other provisions of the CARES Act, which

help financial institutions cope financially when experiencing increased loan losses, will be

discussed. Lastly, this section discusses legislative policy issues relating to consumers missing

loan payments.

|

Type of Consumer Credit |

Owner of Loan |

CARES Act Section |

CARES Act Consumer Protection |

|

Mortgages |

by Consumer Credit Type

Type of

Consumer

Credit

Mortgages

Student Loans

Owner of Loan

CARES Act

Section

CARES Act Consumer Protection

Government-backed (e.g., held by |

Section 4022 |

Right to request forbearance for up to |

Not government-backed (e.g., held |

N/A |

N/A

No consumer forbearance right, up to | |

|

Student Loans |

Federally owned (i.e., loans made |

Section 3513 |

Right to request forbearance and no |

|

Private |

N/A |

No consumer forbearance right, up to | |

|

Auto Loans, Credit Cards, and Other Types of Consumer Credit |

All |

N/A |

|

Mortgage Forbearance

).

Mortgage Forbearance

The CARES Act includes some measures16measures16 to provide temporary forbearance relief for certain

affected mortgage borrowers—those with "“federally backed"” mortgages.1717 Section 4022 allows

borrowers with federally backed mortgages to request forbearance from their mortgage servicers

(the entities that collect payments and manage the mortgage on behalf of the lender/investor) due

to a financial hardship caused directly or indirectly by COVID-19. The borrower must attest to

such hardship, but no additional documentation is required. Servicers must grant forbearance for

up to 180 days and must extend the forbearance up to an additional 180 days at the borrower's ’s

request. Either period can be shortened at the borrower'’s request. The servicer may not charge

fees, penalties, or interest beyond what would have accrued if the borrower had made payments

as scheduled.

The CARES Act mortgage provisions potentially raise the question of what happens after the

forbearance period. The act does not address how repayment should occur. Servicers are to

negotiate repayment terms with borrowers, subject to existing requirements or any additional

guidance provided by the entity backing the mortgage.

Federal Student Loan Forbearance18

Forbearance18

Federal loans to support students'’ postsecondary educational pursuits are currently available

under the William D. Ford Federal Direct Loan (Direct Loan) program and the Federal Perkins Loan program. Loans were previously available through the Federal Family Education Loan (FFEL) . Loans were previously

16 Section

4022 provides for forbearance and a foreclosure moratorium for federally backed single-family mortgages.

Section 4023 allows multifamily borrowers with federally backed multifamily mortgage loans to request a forbearance

from their lender for a period up to 30 days, which can be extended for two more 30-day periods. To qualify for this

option, the borrower must have been current on their mortgage as of February 1, 2020, and must contact the loan

servicer to access the forbearance. Also, a multifamily borrower who enters into a forbearance is prohibited from

evicting a tenant for the duration of the forbearance.

17 The forbearance provisions in the CARES Act apply to federally backed mortgages. Several federal agencies insure

or guarantee single-family mortgages, multifamily mortgages, or both, including the Department of Housing and Urban

Development (HUD) through the Federal Housing Administration (FHA) and the Section 184 and Section 184A

programs for Native Americans and Native Hawaiians, respectively; the Department of Veterans Affairs (VA); and the

U.S. Department of Agriculture (USDA) (which also directly originates some mortgages). Additionally, the

government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac purchase eligible single-family and

multifamily mortgages and guarantee securities backed by those mortgages. The CARES Act provisions cover all of

these, including FHA-insured reverse mortgages.

18 For more information about federal student loan debt relief in the context of COVID-19, see CRS Report R46314,

Federal Student Loan Debt Relief in the Context of COVID-19, by Alexandra Hegji.

Congressional Research Service

5

COVID 19: Consumer Loan Forbearance and Other Relief Options

available through the Federal Family Education Loan (FFEL) program and the Perkins Loan

program, and some of those loans remain outstanding.19

program, and some of those loans remain outstanding.19

Due to the current economic situation, many consumers may have trouble repaying their federal

student loans. In response, Section 3513 of the CARES Act suspends all payments due and

interest accrual for all loans made under the Direct Loan program and for FFEL program loans

held by the Department of Education through September 30, 2020.2020 A suspended payment is to

be treated as if it were a regularly scheduled payment made by a borrower for the purpose of

reporting information about the loan to a consumer reporting agency and toward specified loan

forgiveness (e.g., public service loan forgiveness) or loan rehabilitation programs. In addition,

involuntary collections on defaulted loans are suspended through September 30, 2020.

Consumer Credit Reporting

Consumers can harm their credit scores when they miss consumer loan payments, and lower

credit scores can impact their access to credit in the future.2121 Section 4021 of the CARES Act

requires financial institutions to report to the credit bureaus that consumers are current on their

credit obligations if they enter into an agreement to defer, forbear, modify, make partial payments,

or get any other assistance on their loan payments from a financial institution and fulfil those

requirements.2222 The covered period for this section starts on January 31, 2020, and extends to the

later of 120 days after enactment or 120 days after the national emergency declared by the

President on March 13, 2020, terminates. Before this law was enacted, lenders could choose

whether to report loans in forbearance as paid on time; with this law, these options are no longer

voluntary for the lender.23

23

Some affected consumers may still experience harm to their credit record because the CARES

Act does not give consumers a right to be granted forbearance for many types of consumer loans

(such as auto loans, credit cards, and mortgages and student loans not covered by the CARES

Act; see Table 1). Although many financial institutions have announced efforts to provide

assistance to affected consumers, lenders have discretion whether to enter into an assistance agreement with an individual consumer. Therefore, the ability of consumers to protect their credit

19

Part B, part D, and part E of Title IV of the Higher Education Act of 1965 (20 U.S.C. §1087a et seq.; §1071 et seq.;

§1087aa et seq.).

20 For March 13, 2020, through September 30, 2020, the Administration has set interest rates on federally held student

loans (including Perkins Loan program loans) to 0%, and borrowers will not be required to make payments due on their

loans.

21 For more information on the credit reporting industry, see CRS Report R44125, Consumer Credit Reporting, Credit

Bureaus, Credit Scoring, and Related Policy Issues, by Cheryl R. Cooper and Darryl E. Getter.

22 If the consumer were delinquent before the covered period, then the furnisher would maintain the delinquent status

unless the consumer brings the account or obligation current. The covered period starts on January 31, 2020, and

extends to the later of 120 days after enactment or 120 days after the national emergency declared by the President on

March 13, 2020, terminates. For more information, see CFPB, Statement on Supervisory and Enforcement Practices

Regarding the Fair Credit Reporting Act and Regulation V in Light of the CARES Act, April 1, 2020, at

https://files.consumerfinance.gov/f/documents/cfpb_credit-reporting-policy-statement_cares-act_2020-04.pdf.

23 Before the CARES Act passed, lenders had various options to mitigate the impact on consumers’ credit scores and

future credit access following disasters or catastrophic events. For example, furnishers may use special codes to report

delinquencies due to special circumstances. See CFPB, Natural Disasters and Credit Reporting: Quarterly Consumer

Credit Trends, November 2018, at https://files.consumerfinance.gov/f/documents/bcfp_quarterly-consumer-credittrends_report_2018-11_natural-disaster-reporting.pdf. In addition, if lenders and consumers enter into loan forbearance

agreements, then furnishers have the option to report to the credit bureaus that these consumers are current on their

credit obligations.

Congressional Research Service

6

COVID 19: Consumer Loan Forbearance and Other Relief Options

agreement with an individual consumer. Therefore, the ability of consumers to protect their credit

scores could vary.

scores could vary.

Bank and Credit Union Loan Loss Related Provisions

Other provisions in the CARES Act are intended to reduce or remove potential disincentives

related to accounting and capital requirements that banks may face when deciding whether to

grant a forbearance for non-federally backed loans. When the inflow of payments on loans

unexpectedly decreases, as happens when unanticipated forbearances are granted, banks must

account for this by writing down the value of the loans. The lost value must be reflected with a

reduction in income or value of the bank'’s capital, which can be thought of as the bank'’s net

worth. Banks face a number of requirements to hold minimum levels of capital; if the value were

reduced, the bank eventually would fail to comply with those requirements.2424 Thus, these

accounting and capital requirements may make a bank hesitant to grant a forbearance (if it judges

that the borrower will ultimately be able to make payment) or cause a bank to put off accounting

for realized losses at a later date. Sections 4012, 4013, and 4014 of the CARES Act may mitigate

these concerns.

Certain small banks can elect to be subject to a single, relatively simple—but relatively high—

capital rule called the Community Bank Leverage Ratio (CBLR).2525 Bank regulators are

authorized to set the CBLR between 8% and 10%. Prior to the enactment of the CARES Act, it

was set at 9%. Section 4012 directs regulators to lower it to 8% and give banks that fall below

that level a reasonable grace period to come back into compliance with the CBLR. As a result,

qualifying banks are to be able to write down the value of more loans before they reach the

minimum CBLR level. This relief expires the earlier of (1) the date the public health emergency

ends or (2) the end of 2020.

When a lender grants a loan forbearance, it may be required to record it as troubled debt restructuring

restructuring (TDR) in its accounting.2626 Generally Accepted Accounting Principles (GAAP)27 27

require the lender to reflect in its financial records any potential loss as a result of a TDR.28 28

Section 4013 requires federal bank and credit union regulators to allow lenders to determine if

they should suspend the GAAP requirements for recognizing any potential COVID-19-related

losses from a TDR related to a loan modification. This relief expires the earlier of (1) 60 days

after the public health emergency declaration is lifted or (2) the end of 2020.

Another feature of bank and credit union accounting is determining the amount of credit loss reserves

reserves, which help mitigate the income overstatement on loans and other assets by adjusting for

expected future losses on related loans and other assets.2929 In response to banks' financial challenges during and after the 2007-2009 financial crisis, the Financial Accounting Standards Board30 promulgated a new credit loss standard—Current Expected Credit Loss (CECL)—in June 2016.31 CECL requires earlier recognition of losses than the current methodology. All public companies were required to issue financial statements that incorporated CECLs for reporting periods, beginning on December 15, 2019. Section 4014 gives banks and credit unions the option to temporarily delay CECL implementation until the earlier of (1) the date the public health ’ financial

24

For more information, see CRS In Focus IF10809, Introduction to Bank Regulation: Leverage and Capital Ratio

Requirements, by David W. Perkins.

25 For more information, see CRS Report R45989, Community Bank Leverage Ratio (CBLR): Background and Analysis

of Bank Data, by David W. Perkins.

26 Shannon M. Beattie, “Accounting News: Trouble Debt Restructuring,” FDIC Supervisory Insights, Summer 2012,

pp. 26-38, at https://www.fdic.gov/regulations/examinations/supervisory/insights/sisum12/sisummer12-article4.pdf.

27 For more information, see Corporate Finance Institute, What is GAAP?, at https://corporatefinanceinstitute.com/

resources/knowledge/accounting/gaap/.

28 Financial Accounting Standards Board (FASB), FASB Accounting Update: Receivables—Troubled Debt

Restructurings by Creditors (Subtopic 310-40), Financial Accounting Series: No. 2014-14, August 2014, at

https://asc.fasb.org/imageRoot/90/52428090.pdf.

29 Federal Deposit Insurance Corporation (FDIC), Proposed Interagency Policy Statement on Allowances for Credit

Losses, Financial Institution Letter, FIL-59-2019, October 17, 2019, at https://www.fdic.gov/news/news/financial/2019/

Congressional Research Service

7

COVID 19: Consumer Loan Forbearance and Other Relief Options

challenges during and after the 2007-2009 financial crisis, the Financial Accounting Standards

Board30 promulgated a new credit loss standard—Current Expected Credit Loss (CECL)—in June

2016.31 CECL requires earlier recognition of losses than the current methodology. All public

companies were required to issue financial statements that incorporated CECLs for reporting

periods, beginning on December 15, 2019. Section 4014 gives banks and credit unions the option

to temporarily delay CECL implementation until the earlier of (1) the date the public health

emergency ends or (2) the end of 2020.

emergency ends or (2) the end of 2020.

Consumer Loans From Individuals

Individuals can save for retirement by investing in certain retirement accounts with tax advantages, such as |

Policy Issues

Policy Issues

Some consumer advocates argue that during the COVID-19 pandemic, Congress could do more

to help consumers experiencing financial hardship. Some consumers may not receive loan

forbearance for credit obligations outside of those with rights under the CARES Act. In addition,

consumers may continue to incur bank fees and face issues relating to debt collection and

negative credit reporting. For this reason, other legislative proposals

Provisions in Division K, Title IV of the House-passed HEROES Act, would expand consumer

rights to loan forbearance and other payment relief during the COVID-19 pandemic.32 The act

would prevent creditors and debt collectors from collecting on delinquent loans, charging fees

and interest, or reporting negative information to the credit bureaus during the coronavirus

pandemic period. It would also compensate financial institutions for their losses to implement

these policies.

Although the HEROES Act would expand payment relief for consumers facing financial hardship

during the COVID-19 pandemic, these provisions could contrarily encourage some consumers to

choose not to pay their loan payments because there are limited consequences for doing so.

Moreover, although the credit reporting provisions would protect consumers from harming their

credit scores, the removal of information may reduce the predictability of credit scores in the

future, which may harm some consumers in the long-term.33 In addition, whereas the HEROES

Act would help financially affected consumers with their credit obligations directly, other types of

fil19059.html.

30 The FASB is an independent, private not-for-profit organization that sets accounting and reporting standards. See,

FASB, About the FASB, at https://www.fasb.org/facts/index.shtml.

31 For more information, see CRS Report R45339, Banking: Current Expected Credit Loss (CECL), by Raj Gnanarajah.

32 For more information, see CRS Insight IN11405, HEROES Act (H.R. 6800): Selected Consumer Loan Provisions, by

Cheryl R. Cooper.

33 For more information about the policy options and consequences of different credit reporting approaches during the

COVID-19 pandemic, see FinRegLab, Disaster-Related Credit Reporting Options, May 2020, https://finreglab.org/wpcontent/uploads/2020/05/FinRegLab-Disaster-Related-Credit-Reporting.pdf.

Congressional Research Service

8

COVID 19: Consumer Loan Forbearance and Other Relief Options

pandemic period.32 Some financial institutions would likely incur significant costs under these proposals. Some proponents of these proposals argue that the federal government may consider compensating financial institutions for these losses in order to implement these policies.33 On the other hand, other types of government policies outside of the financial industry, such as unemployment insurance or small

business aid to keep people employed, can also target impactedaffected Americans.

Non-Legislative Federal COVID-19 Responses

In addition to legislative responses, financial regulatory agencies have taken other steps to

respond to the COVID-19 pandemic by encouraging loan forbearance and other financial relief

options for impacted consumers. On March 9, 2020, federal and state financial regulators

coordinated a guidance statement to the financial industry, encouraging it to help meet the needs

of consumers affected by the virus outbreak.3434 The regulators stated that "“financial institutions

should work constructively with borrowers and other consumers in affected communities,"” as

long as they employ "“prudent efforts that are consistent with safe and sound lending practices." ”

This statement was similar to financial regulators'’ past statements during disruptive events, such

as natural disasters and government shutdowns.35

35

Beyond this statement, financial regulatory agencies have used existing authorities to issue new

COVID-19 guidance to help financial firms support consumer needs during this time. Regulatory

guidance does not force a financial institution to take any particular action for consumers (such as

offering loan forbearance), but it can increase the incentives or reduce the disincentives of taking

such actions.

Consumer Regulatory Guidance

When processing these loan forbearance or other consumer relief requests, financial institutions

must ensure that they are acting fairly and complying with the law. For mortgage loan

forbearance requests, financial institutions must comply with RESPA mortgage servicing

standards.3636 In addition, for all consumer loan forbearance or relief requests, financial institutions

must also ensure that they are complying with fair lending laws. The main federal consumer

financial regulator in the United States is the CFPB, which implements and enforces federal

consumer financial law while ensuring that consumers can access financial products and

services.37

37

In response to the COVID-19 pandemic, the CFPB issued new guidance about complying with legal requirements during this period of increased loan forbearance requests. The CFPB released additional guidance on regulatory compliance with Regulation X

legal requirements during this period of increased loan forbearance requests and other

Federal Reserve et al. “Agencies Encourage Financial Institutions to Meet Financial Needs of Customers and

Members Affected by Coronavirus,” press release, March 9, 2020, at https://www.federalreserve.gov/newsevents/

pressreleases/bcreg20200309a.htm. Since this statement was released, two updates to this guidance have been

announced. See Federal Reserve et al., “Interagency Statement on Loan Modifications and Reporting for Financial

Institutions Working with Consumers Affected by the Coronavirus,” press release, March 22, 2020, at

https://www.federalreserve.gov/newsevents/pressreleases/files/bcreg20200322a1.pdf; and Federal Reserve et al.,

“Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Consumers

Affected by the Coronavirus (Revised),” press release, April 7, 2020, at https://www.federalreserve.gov/newsevents/

pressreleases/files/bcreg20200407a1.pdf (hereinafter cited as Federal Reserve et al., Revised Interagency Statement,

April 7, 2020).

35 Federal Reserve et al., “Regulators Encourage Institutions to Work with Borrowers Affected by Government

Shutdown,” press release, January 11, 2019, at https://www.occ.gov/news-issuances/news-releases/2019/nr-ia-20194.html.

36 For more information on Regulation X, §1024.41, Loss mitigation procedures, see

https://www.consumerfinance.gov/policy-compliance/rulemaking/regulations/1024/41/.

37 P.L. 111-203. For more information on the CFPB, see CRS In Focus IF10031, Introduction to Financial Services:

The Bureau of Consumer Financial Protection (CFPB), by Cheryl R. Cooper and David H. Carpenter.

34

Congressional Research Service

9

COVID 19: Consumer Loan Forbearance and Other Relief Options

disruptions. The CFPB released additional guidance on regulatory compliance with Regulation X

during the mortgage loan transfer process.38during the mortgage loan transfer process.38 In addition, the CFPB announced a new joint

initiative with the Federal Housing Finance Agency (FHFA) to share mortgage servicing

information to protect borrowers.3939 The FHFA is to share information with the CFPB about

forbearances, modifications, and other loss mitigation initiatives undertaken by Fannie Mae and

Freddie Mac. In combination with CFPB consumer complaints, these data would help the CFPB

monitor whether mortgage servicers are complying with the law when they offer these relief

options to impacted customers. In addition to mortgage servicing guidance, federal and state

financial regulatory agencies also instructed financial institutions that for all consumer credit

products, "“when working with borrowers, lenders and servicers should adhere to consumer

protection requirements, including fair lending laws, to provide the opportunity for all borrowers

to benefit from these arrangements."40

”40 Outside of mortgage servicing, the CFPB released

additional guidance on complying with other consumer credit and payments laws during the

COVID-19 pandemic.41

The CFPB has also issued guidance to temporarily reduce regulatory burden by delaying industry

reporting requirements for mandatory data collections41collections42 and providing flexibility on timing

requirements.4243 The agency also stated that while continuing to do its supervisory work,43 it 44 it

would work with affected financial institutions in scheduling examinations and other supervisory

activities to minimize disruption and burden as a result of operational challenges due to the

pandemic.4445 These efforts to reduce regulatory burden aim to allow financial institutions more

bandwidth to work with impacted consumers and provide them with financial relief during the

pandemic.

Financial institutions can also provide other types of relief to consumers, such as offering new

credit or loan products, so a consumer can pay their loan payments, medical bills, or other

expenses to maintain their standard of living during the pandemic period. For this reason,

financial regulators have encouraged financial institutions to provide small-dollar loans to

affected consumers.4546 However, financial institutions generally would choose to extend new credit only if they were to determine that the borrower is in a good position to pay the loan back in the future, and there may be a significant amount of uncertainty in making such a determination during this pandemic. Therefore, it is unclear whether this guidance will encourage

CFPB, “Bulletin 2020-02 - Compliance Bulletin and Policy Guidance: Handling of Information and Documents

During Mortgage Servicing Transfers,” April 24, 2020, at https://files.consumerfinance.gov/f/documents/cfpb_policyguidance_mortgage-servicing-transfers_2020-04.pdf.

39 CFPB, “CFPB and FHFA Announce Borrower Protection Program,” press release, April 15, 2020, at

https://www.consumerfinance.gov/about-us/newsroom/cfpb-fhfa-announce-borrower-protection-program/.

40 Federal Reserve et al., Revised Interagency Statement, April 7, 2020, p. 5.

41 CFPB, “Consumer Financial Protection Bureau Outlines Responsibilities of Financial Firms During Pandemic,”

press release, May 13, 2020, at https://www.consumerfinance.gov/about-us/newsroom/cfpb-outlines-responsibilitiesfinancial-firms-during-pandemic/.

42 CFPB, “CFPB Provides Flexibility During COVID-19 Pandemic,” press release, March 26, 2020, at

https://www.consumerfinance.gov/about-us/newsroom/cfpb-provides-flexibility-during-covid-19-pandemic/.

43 CFPB, CFPB Paves Way for Consumers Facing Financial Emergencies to Obtain Access to Mortgage Credit More

Quickly, April 29, 2020, at https://www.consumerfinance.gov/about-us/newsroom/cfpb-paves-way-consumers-facingfinancial-emergencies-access-mortgage-credit-quickly/; CFPB, Statement on Supervisory and Enforcement Practices

Regarding the Fair Credit Reporting Act and Regulation V in Light of the CARES Act, April 1, 2020, at

https://files.consumerfinance.gov/f/documents/cfpb_credit-reporting-policy-statement_cares-act_2020-04.pdf.

44 Bryan Schneider, Supervisory Work Continues with a Commitment to Protecting Consumers, CFPB, April 1, 2020, at

https://www.consumerfinance.gov/about-us/blog/supervisory-work-continues-commitment-protecting-consumers/.

45 CFPB, “Statement on Bureau Supervisory and Enforcement Response to COVID-19 Pandemic,” press release,

March 26, 2020, at https://files.consumerfinance.gov/f/documents/cfpb_supervisory-enforcement-statement_covid19_2020-03.pdf.

46 Federal Reserve et al., “Federal Agencies Encourage Banks, Savings Associations and Credit Unions to Offer

38

Congressional Research Service

10

COVID 19: Consumer Loan Forbearance and Other Relief Options

credit only if they were to determine that the borrower is in a good position to pay the loan back

in the future, and there may be a significant amount of uncertainty in making such a

determination during this pandemic. Therefore, it is unclear whether this guidance will encourage

financial institutions to provide small-dollar loans to many consumers.47

financial institutions to provide small-dollar loans to many consumers.46

Financial Institution Regulatory Guidance

A variety of financial institutions make different types of credit available to consumers. In

particular, bank and mortgage institutions are subject to various regulatory controls to ensure they

are operating in a safe and sound manner while complying with relevant laws.4748 In response to

COVID-19, regulators have issued guidance to signal to financial institutions that it is acceptable

to take certain actions that may temporarily weaken their financial positions without facing

regulatory actions.48

49

Guidance for Depository Institutions

The banking regulators—the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), the

Office of the Comptroller of the Currency (OCC), and the National Credit Union Administration

(NCUA)—have worked together to issue guidance and updates to the financial institutions they

regulate about how those institutions should work with customers who are negatively impacted by COVID-19.

Regulators' efforts to deal with the potential effects of COVID-19 began in early March with attempts to ensure that depository institutions were adequately planning for potential risks. On

by COVID-19.

Responsible Small-Dollar Loans to Consumers and Small Businesses Affected by COVID-19,” press release, March

26, 2020, at https://www.federalreserve.gov/newsevents/pressreleases/bcreg20200326a.htm; Federal Reserve et al.,

“Interagency Lending Principles for Offering Responsible Small-Dollar Loans,” May 2020, at

https://www.occ.treas.gov/news-issuances/news-releases/2020/nr-ia-2020-65a.pdf.

47 Banks have demonstrated interest in providing certain small-dollar financial services, such as direct deposit

advances, subprime credit cards, and overdraft protection services. In these cases, banks may face regulatory

disincentives to providing these services because bank regulators and legislators have sometimes demonstrated

concerns about banks providing these products. For example, before 2013, some banks offered deposit advance

products to consumers with bank accounts, which were short-term loans paid back automatically out of the borrower’s

next qualifying electronic deposit. Because of this sustained use and concerns about consumer default risk, in 2013, the

Office of the Comptroller of the Currency (OCC), FDIC, and Federal Reserve issued supervisory guidance, advising

banks to make sure deposit advance products complied with consumer protection and safety and soundness regulations.

See OCC, “Guidance on Supervisory Concerns and Expectations Regarding Deposit Advance Products” 78 Federal

Register 70624, November 26, 2013; FDIC, “Guidance on Supervisory Concerns and Expectations Regarding Deposit

Advance Products,” 78 Federal Register 70552, November 26, 2013; and Federal Reserve, “Statement on Deposit

Advance Products,” CA 13-7, April 25, 2013. Many banks subsequently discontinued offering deposit advances. More

recently, financial regulators have taken steps to encourage banks to reenter the small-dollar lending market. In October

2017, the OCC rescinded the 2013 guidance and issued a new bulletin to encourage their banks to enter this market in

May 2018. See OCC, Core Lending Principles for Short-Term, Small-Dollar Installment Lending, May 23, 2018; and

OCC, “Rescission of Guidance on Supervisory Concerns and Expectations Regarding Deposit Advance Products,” 82

Federal Register 196, October 12, 2017. In November 2018, the FDIC solicited advice about how to encourage more

banks to offer small-dollar credit products, see FDIC, “Request for Information on Small-Dollar Lending,” 83 Federal

Register 58566, November 20, 2018. It is unclear whether these efforts will encourage banks to enter the small-dollar

market with a product similar to deposit advance.

48 For more on financial regulators and the institutions they regulate, see CRS Report R44918, Who Regulates Whom?

An Overview of the U.S. Financial Regulatory Framework, by Marc Labonte.

For more information on bank regulators’ responses to COVID-19, see CRS Insight IN11278, Bank and Credit

Union Regulators’ Response to COVID-19, by Andrew P. Scott and David W. Perkins. In addition, the Federal Reserve

has provided liquidity to financial markets in response to COVID-19. For more information, see CRS Insight IN11259,

Federal Reserve: Recent Actions in Response to COVID-19, by Marc Labonte.

49

Congressional Research Service

11

COVID 19: Consumer Loan Forbearance and Other Relief Options

Regulators’ efforts to deal with the potential effects of COVID-19 began in early March with

attempts to ensure that depository institutions were adequately planning for potential risks. On

March 6, 2020, the Federal Financial Institutions Examination Council (FFIEC)50 updated its

March 6, 2020, the Federal Financial Institutions Examination Council (FFIEC)49 updated its influenza pandemic guidance to minimize the potentially adverse effects of COVID-19.5051 The

guidance identifies business continuity plans as key tools to address pandemics and provides a

comprehensive framework to ensure the continuation of critical operations. Since then, regulators

have built on this guidance to encourage financial institutions to take actions to continue to serve

customers financially affected by the virus. On March 13, 2020, the Federal Reserve, the OCC,

and the FDIC issued guidance identifying ways to assist customers, including waiving fees,

offering repayment accommodations, extending payment due dates, increasing credit card limits,

and increasing ATM withdrawal limits.5152 Repayment accommodations include allowing

borrowers to defer or skip payments or extending payment due dates to help consumers avoid

delinquencies, which is a form of forbearance.52

53

Regulators can also use incentives to encourage financial institutions to work with consumers and

offer repayment accommodations. Recent regulatory guidance signaled to financial institutions

that certain activities with consumers would be eligible to earn credit toward their performance

assessments under the Community Reinvestment Act (CRA; 12 U.S.C. §2901), which encourages

banks to extend credit to the communities from which they accept deposits by considering this

factor in applications to bank regulators to expand operations, such as through mergers and

acquisitions.5354 On March 19, 2020, banking regulators issued a new statement encouraging

depository institutions to continue working with affected customers and communities—

particularly those that are low- and moderate-income—by providing favorable CRA consideration

for activities including "“offering payment accommodations, such as allowing borrowers to defer

or skip payments or extending the payment due date, which would avoid delinquencies and

negative credit bureau reporting, caused by COVID-19-related issues."54

”55

50

The Federal Financial Institutions Examination Council (FFIEC) is a formal U.S. government interagency body

comprising financial regulators “empowered to prescribe uniform principles, standards, and report forms for the federal

examination of financial institutions.” For more, see http://www.ffiec.gov.

51 FFIEC, “Interagency Statement on Pandemic Planning,” March 6, 2020, at https://www.ffiec.gov/press/PDF/

FFIEC%20Statement%20on%20Pandemic%20Planning.pdf.

52 For more, see Federal Reserve, “Supervisory Practices Regarding Financial Institutions Affected by Coronavirus,”

SR 20-4 / CA 20-3, March 13, 2020, at https://www.federalreserve.gov/supervisionreg/srletters/SR2004.htm; OCC,

“Pandemic Planning: Working With Customers Affected by Coronavirus and Regulatory Assistance,” OCC Bulletin

2020-15, March 13, 2020, at https://www.occ.gov/news-issuances/bulletins/2020/bulletin-2020-15.html; and FDIC,

“Regulatory Relief: Working with Customers Affected by the Coronavirus,” Financial Institution Letter (FIL) 17-2020,

March 13, 2020, at https://www.fdic.gov/news/news/financial/2020/fil20017.pdf.

53 Regulators also encouraged financial institutions to offer loan repayment accommodations through more explicit

regulatory relief. On March 22, 2020, the financial regulators issued an interagency statement to allow banks to provide

certain modifications to loans without designating them as troubled debt restructurings (TDRs). Under accounting

principles, a TDR designation could have negative consequences for a bank’s financial and regulatory reporting

requirements. On April 7, 2020, the agencies issued revised guidance that included information about Section 4013 of

the CARES Act, which allows banks flexibility in accounting related to TDRs. For more, see FDIC, “Interagency

Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the

Coronavirus,” March 22, 2020, at https://www.fdic.gov/news/news/press/2020/pr20038a.pdf.

54 For more on the Community Reinvestment Act, see CRS Report R43661, The Effectiveness of the Community

Reinvestment Act, by Darryl E. Getter.

55 Federal Reserve, FDIC, and OCC, “Joint Statement on CRA Consideration for Activities in Response to COVID19,” March 19, 2020, at https://www.fdic.gov/news/news/financial/2020/fil20019a.pdf.

Congressional Research Service

12

COVID 19: Consumer Loan Forbearance and Other Relief Options

Guidance for the Housing Finance System

Guidance for the Housing Finance System

The many federal agencies involved in housing finance have taken actions to encourage or

authorize financial institutions to offer forbearance to mortgage borrowers affected by COVID-19.55

COVID19.56 Government-Sponsored Enterprises

Fannie Mae and Freddie Mac, commonly referred to as government-sponsored enterprises

(GSEs), provide liquidity to the housing finance market by purchasing mortgages from lenders

and subsequently guaranteeing the default risk linked to their issuances of mortgage-backed

securities (MBS, a process known as securitization).5657 In 2008, Fannie Mae and Freddie Mac

were placed under conservatorship by their primary regulator, FHFA. The FHFA also regulates

the Federal Home Loan Bank (FHLB) system, which is also a GSE, and comprises 11 regional

banks that provide wholesale funding to its members—mortgage lenders, such as banks, credit

unions, and insurance companies.

On March 18, 2020, Fannie Mae issued guidance signaling to Fannie Mae single-family

mortgages borrowers affected by COVID-19 that they could request mortgage assistance by

contacting their mortgage servicer—this guidance was updated with the enactment of the CARES

Act and includes forbearance for up to 12 months with no late fees.5758 Similarly, Freddie Mac

issued guidance to provide mortgage relief options in line with the CARES Act that include loan

modifications and mortgage forbearance for up to 12 months.58

Federal Housing Agencies

59 In addition, on May 13, 2020,

both Fannie Mae and Freddie Mac announced that missed payments can be deferred to the end of

the loan term.60

56

The banking regulators mentioned above (the Federal Reserve, OCC, FDIC, and NCUA) influence the mortgage

market through their oversight of banks. For example, regulators influence the underwriting standards that banks use

and set capital requirements that apply to mortgages and mortgage-backed securities (MBS) held by banks. The

Securities and Exchange Commission (SEC) oversees, among other things, the selling of securities to the public. The

SEC has disclosure and registration standards that, in some cases, apply to MBS. Additionally, the CFPB regulates

certain bank and nonbank participants in the mortgage market and administers certain rules intended to protect

consumers, including requirements that lenders verify a borrower’s ability to repay the mortgage and standards related

to mortgage servicing. The CFPB also has authority under additional federal consumer laws to regulate parts of the

mortgage market.

57 For more on securitization and the housing finance system, see CRS Report R42995, An Overview of the Housing

Finance System in the United States, by N. Eric Weiss and Katie Jones.

58 Fannie Mae, “Fannie Mae Assistance Options for Homeowners Impacted by COVID-19,” March 18, 2020, at

https://www.fanniemae.com/portal/media/corporate-news/2020/covid-homeowner-assistance-options-7000.html.

59 Freddie Mac, “Our COVID-19 Response,” at http://www.freddiemac.com/about/covid-19.html.

60 Fannie Mae, “Fannie Mae Announces COVID-19 Payment Deferral,” press release, May 13, 2020, at

https://www.fanniemae.com/portal/media/corporate-news/2020/covid-payment-deferral-7018.html; and Freddie Mac,

“Freddie Mac Announces COVID-19 Payment Deferral,” press release, May 13, 2020, at https://freddiemac.gcsweb.com/news-releases/news-release-details/freddie-mac-announces-covid-19-payment-deferral?_ga=

2.67975761.1910262207.1590166889-2140408437.1583431397.

Congressional Research Service

13

COVID 19: Consumer Loan Forbearance and Other Relief Options

Federal Housing Agencies

The Federal Housing Administration (FHA)61The Federal Housing Administration (FHA)59—an agency within the Department of Housing and

Urban Development (HUD)—as well as the Department of Veterans Affairs (VA)6062 and the

Department of Agriculture (USDA),6163 each have loan programs that insure or guarantee loans for

certain mortgages. Ginnie Mae is a federal government agency that issues MBS linked to

mortgages whose default risks are guaranteed by the FHA, VA, and USDA. Ginnie Mae

guarantees its MBS investors timely principal and interest payments.

On April 1, 2020, HUD instructed mortgage servicers for mortgages with FHA insurance to

extend deferred or reduced mortgage payment options (forbearance) for up to six months. In

addition, they must provide an additional six months of forbearance if requested by the borrower.

This mandate implements provisions contained in the CARES Act.6264 On April 8, 2020, the VA

issued a circular that similarly aligns with CARES Act provisions. Through its home loan

program, the VA stated that borrowers may request forbearance from their servicer on VA-guaranteedVAguaranteed loans or VA-held loans, including Native American Direct Loans or Vendee loans, if

they are facing financial hardship from COVID-19.63

Mortgage Servicers

65

Mortgage Servicers

After the passage of the CARES Act, the federal banking agencies and state bank regulators

issued a joint statement encouraging mortgage servicers to continue to work with homeowners

affected by COVID-19.6466 Much of this guidance aligns with the CARES Act provisions for

federally backed mortgages, but many banks issue mortgages that are not federally backed;

therefore, they are not required to offer mortgage forbearance. This guidance, while not binding,

encourages financial institutions to consider ways to work with consumers through short-term

forbearance programs similar to the ones established in the CARES Act.

Policy Issues

Some observers argue that the federal financial regulators could do more to promote fair access to consumer relief options during the COVID-19 pandemic.65 Although recent guidance from financial regulators mentioned fair lending concerns,66 some commentators argue that to ensure fair treatment when consumers apply for loan relief options or become delinquent, additional more detailed guidance to financial institutions about how to comply with consumer protection and fair lending laws during the COVID-19

61

FHA, an agency within HUD, provides mortgage insurance on loans that meet its requirements (including a

minimum down payment requirement and an initial principal balance below a certain threshold) in exchange for fees,

or premiums, paid by borrowers. If a borrower defaults on an FHA-insured mortgage, FHA will repay the lender the

entire remaining principal amount it is owed. FHA is the largest provider of government mortgage insurance. For more

on FHA-insured mortgages, see CRS Report RS20530, FHA-Insured Home Loans: An Overview, by Katie Jones.

62 VA provides a guaranty on certain mortgages made to veterans. If a borrower defaults on a VA-guaranteed mortgage,

VA will repay the lender a portion (but not all) of the remaining principal amount owed. Because it is limited to

veterans, the VA loan guaranty program is smaller and more narrowly targeted than FHA. For more on VA-guaranteed

mortgages, see CRS Report R42504, VA Housing: Guaranteed Loans, Direct Loans, and Specially Adapted Housing

Grants, by Libby Perl.

63 USDA administers a direct loan program for low-income borrowers in rural areas and a loan guarantee program for

low- and moderate-income borrowers in rural areas. If a borrower defaults on a USDA-guaranteed loan, USDA repays

the lender a portion (but not all) of the remaining principal amount owed. The USDA program is more narrowly

targeted than FHA in that it has income limits and is limited to rural areas. For more on USDA-guaranteed mortgages,

see CRS Report RL31837, An Overview of USDA Rural Development Programs, by Tadlock Cowan.

64 HUD, “HUD Issues New CARES Act Mortgage Payment Relief for FHA Single Family Homeowners,” April 1,

2020, at https://www.hud.gov/press/press_releases_media_advisories/HUD_No_20_048.

65 Veterans Benefits Administration, “Extended Relief Under the CARES Act for those Affected by COVID-19,” April

8, 2020, at https://www.benefits.va.gov/HOMELOANS/documents/circulars/26_20_12.pdf.

66 Federal Reserve et al., “Federal agencies encourage mortgage servicers to work with struggling homeowners affected

by COVID-19,” April 3, 2020, at https://www.federalreserve.gov/newsevents/pressreleases/bcreg20200403a.htm;

CFPB, “The Bureau’s Mortgage Servicing Rules FAQs related to the COVID-19 Emergency,” April 3, 2020, at

https://files.consumerfinance.gov/f/documents/cfpb_mortgage-servicing-rules-covid-19_faqs.pdf.

Congressional Research Service

14

COVID 19: Consumer Loan Forbearance and Other Relief Options

Policy Issues

Some observers argue that the federal financial regulators could do more to promote fair access to

consumer relief options and prevent consumer protection violations during the COVID-19

pandemic.67 Although recent guidance from financial regulators mentioned fair lending

concerns,68 some commentators argue that to ensure fair treatment when consumers apply for loan

relief options or become delinquent, additional more detailed guidance to financial institutions

about how to comply with consumer protection and fair lending laws during the COVID-19

pandemic would be helpful. 69 Moreover, some critics argue that during the COVID-19 pandemic,

the CFPB has focused too much on regulatory flexibility for industry, and not enough on

preventing consumer protection violations.70pandemic would be helpful. 67 In addition, with its data partnership with FHFA,

some argue that the CFPB could compile and make public information on how many consumers

are accessing relief options and how the frequency of use varies based on type of financial

institution.6871 These types of data could help policymakers determine whether relief requests are

allocated appropriately or whether additional measures should be considered to help those in

need.

Forbearance Implications for the Financial System

The large economic impact of the COVID-19 pandemic affects the financial system in many

important ways. For example, if many consumers were to miss loan payments, this would have

negative consequences on banks and other financial institutions.6972 These institutions have worked

to comply with the CARES Act and relevant regulatory guidance during the COVID-19 pandemic

period to provide loan forbearance and other flexibilities to distressed consumers. However, the

potential strain on the financial system might make it challenging for institutions to provide this

support, and these efforts may be insufficient to provide widespread assistance without direct

government intervention.70

73

This section of the report describes which types of financial institutions hold different types of

consumer loans and how the CARES Act or different financial regulatory regimes may impact consumer'

consumer’s access to loan forbearance. It also discusses how private sector institutions may be

significantly impacted by missed consumer loan payments and the economic impact of the COVID-19 pandemic.

COVID-19 pandemic.

Kate Berry, “CFPB Urged to Take More Active Role in Coronavirus Response,” American Banker, March 30, 2020,

at https://www.americanbanker.com/news/cfpb-urged-to-take-more-active-role-in-coronavirus-response (hereinafter

cited as Berry, “CFPB Urged to Take More Active Role in Coronavirus Response”).

68 Federal Reserve et al., Revised Interagency Statement, April 7, 2020, p. 5.

69 Rich Cordray, “White Paper: Immediate Actions For CFPB To Address COVID-19 Crisis,” Medium, April 6, 2020,

at https://medium.com/@RichCordray/cfpbwhitepaper-193a5aed0d75; and Jon Hill, “Pandemic’s Fallout May Include

Heightened Fair Lending Risk,” Law 360, March 30, 2020, at https://www.law360.com/banking/articles/1258333/

pandemic-s-fallout-may-include-heightened-fair-lending-risk? (hereinafter cited as Cordray, “Immediate Actions for

CFPB to Address COVID-19”).

70 Katy O'Donnell, “Consumer Bureau Draws Fire for Pro-Business Tilt During Crisis,” Politico, May 16, 2020.

71 Cordray, “Immediate Actions for CFPB to Address COVID-19.”

72 Banks are also exposed to business loan delinquencies and defaults. For more information, see CRS Insight IN11348,

Bank Exposure to COVID-19 Risks: Business Loans, by David W. Perkins and Raj Gnanarajah.

73 House Financial Services Committee Chairwoman Maxine Waters has introduced H.R. 6321, which would

reimburse creditors for incurred costs due to consumer loan forbearance.

67

Congressional Research Service

15

COVID 19: Consumer Loan Forbearance and Other Relief Options

Consumer Loans Owners

A consumer’Consumer Loans Owners

A consumer's ability to get a forbearance and under what terms may be significantly influenced

by what type of institution owns the loan. These various institutions—including banks and credit

unions, private nonbank financial institutions, GSEs, and the federal government—are subject to

different laws, regulations, and business considerations.7174 In addition, different types of loans—

such as mortgages, student loans, and other consumer debt—are subject to different regulations

and legal mandates related to forbearance.

Mortgages72

Mortgages75

Of the $11.2 trillion dollars of mortgages outstanding on one-to-four-family homes at the end of

2019, 63% of mortgage loans in the United States were held or insured by the federal government

and therefore covered by the CARES Act'’s consumer right to be granted loan forbearance, as

shown in Figure 1.73.76 Most of these "“federally backed"” mortgages were held by GSEs or in

mortgage pools backed by GSEs or other agencies (such as Fannie Mae, Freddie Mac, and Ginnie

Mae). Banks held almost $2.7 trillion in mortgage loans, nearly 24% of the total, and credit

unions held over $572 billion, making up 5%. The remaining 8% are mostly held by a variety of