Bank Exposure to COVID-19 Risks: Business Loans

The COVID-19 (coronavirus) pandemic has caused financial hardship across the country. If COVID-19 causes borrowers to miss loan payments, it could have negative consequences for banks. This Insight examines the exposure banks have to business loan repayments, such as commercial and industrial (C&I) loans and commercial real estate (CRE) loans. For exposure to household debt, such as mortgages and consumer loans, see CRS Insight IN11336, Bank Exposure to COVID-19 Risks: Mortgages and Consumer Loans, by David W. Perkins and Raj Gnanarajah.

The main business of a bank is to make loans and buy securities using funding it raises by taking deposits. A bank earns money largely through borrowers making payment on those loans and securities issuers making payment on securities, along with charging fees for certain services. In addition to accepting deposits, a bank also raises funding by issuing debt (such as bonds) and capital (such as stock). Unlike deposits and debt that place specific payment obligations on a bank, payments on capital can generally be reduced, delayed, or cancelled and the value of capital can be written down. Thus, if incoming payments unexpectedly stop, capital allows a bank to withstand losses to a point. However, if a bank exhausts its capital reserves, it could face financial distress and potentially fail.

Business Loans

A significant portion of a typical bank's assets consists of loans to businesses, which individuals or companies use to start or expand an enterprise, purchase CRE or equipment, or pay wages to support ongoing operations. CRE loans are secured by the land and building in which the business operates, such as a small-town shop or restaurant, a commercial park, a factory, or a skyscraper. These may be owner occupied (i.e., wherein the owner operates the business) or non-owner occupied (i.e., the business pays rent to the owner). C&I loans, another category of loans to businesses, are unsecured or secured by collateral other than real estate, such as equipment. In all these cases, loan repayment depends on a sufficient inflow of cash to the underlying businesses.

Noncurrent Rates

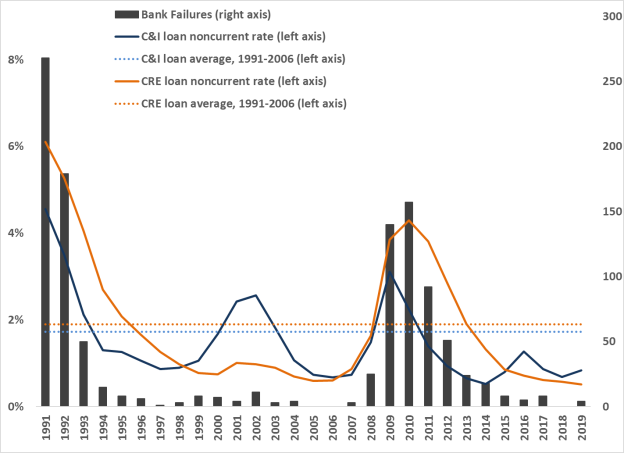

When businesses stop making payments on their loans, it can cause banks to become distressed and potentially fail. For example, during and after the 2007-2009 financial crisis, the noncurrent rates (the percentage of loans for which payment is at least 30 days past due) on business loans greatly increased, see Figure 1:

- C&I loan noncurrent rates increased from 0.7% in 2006 to 3.1% in 2009. The noncurrent rate at the end of 2019 was 0.8%.

- CRE loan noncurrent rates increased from 0.6% in 2006 to 4.3% in 2010. The noncurrent rate at the end of 2019 was 0.5%.

Subsequent to the dramatic rise in noncurrent rates, bank failures rose from zero in 2006 to a peak of 157 in 2010. Between 2008 and 2014, there were 507 bank failures.

|

Figure 1. Business Loan Noncurrent Rates and Bank Failures, 1991-2019 |

|

|

Source: FDIC Quarterly Banking Profile Fourth quarter 2019 and FDIC Bank Failures In Brief. Notes: All rate and failure numbers are year-end. |

Banks failed for numerous reasons and defaults on business debt was not solely responsible for the post-crisis failures. Nevertheless, the correlation between business loan missed payments and bank failures is illustrative of the stress placed on banks when business conditions deteriorate.

Exposure Statistics

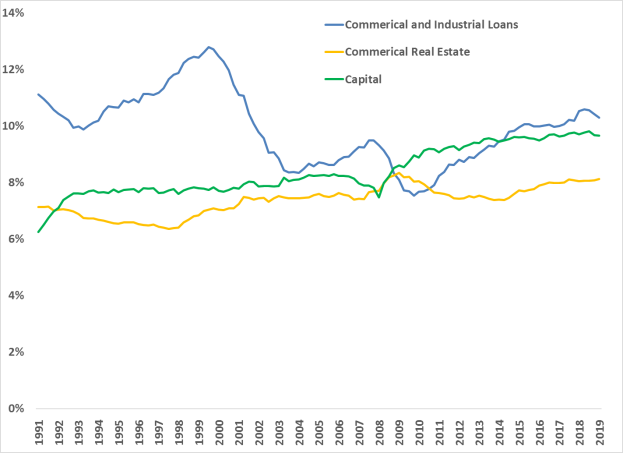

The U.S. banks hold about $18.6 trillion dollars in assets, with more than $1.9 trillion in C&I loans and more than $1.5 trillion in CRE loans, equaling 10.3% and 8.1% of total assets, respectively (see Figure 2). Meanwhile, banks held more than $1.7 trillion in Tier 1 capital, an important regulatory capital measure, giving a Tier 1-to-total asset ratio of 9.3%. This level of capitalization indicates that banks are well above regulatory minimum requirements. (This ratio is not precisely the same as the Tier 1 leverage ratio, one of the official regulatory ratios banks must report to regulators, because banks are allowed to make certain accounting adjustments. In general, the difference between the two numbers are relatively small.)

C&I exposure (i.e., C&I loans-to-total-asset ratio) has grown steadily since the post-financial crisis low in 2010, although compared to recent history, this is about an average C&I exposure. CRE exposures represent a slightly higher than average exposure compared to recent history. These conditions suggest the banking industry may have average to slightly higher than average exposure to business loans, but with the current high levels of capitalization, banks may be well positioned to withstand losses.

|

Figure 2. C&I Loans, CRE Loans, and Tier 1 Capital as % of Total Assets |

|

|

Source: FDIC Quarterly Banking Profile, Fourth quarter 2019. |

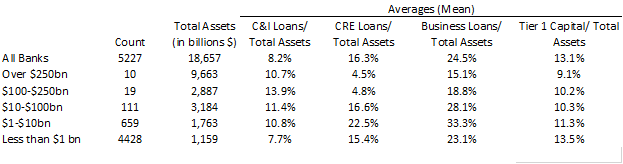

Although it is informative to examine the industry as a whole, the numbers are skewed by a small number of extremely large banks. Thus, it is useful to examine banks of different sizes to see if particular sectors of the industry may be relatively more susceptible to business loan losses.

Figure 3 groups banks based on asset size. In general, smaller banks—especially banks with $1 billion to $10 billion in assets—are more exposed to business loans than large banks. In terms of the two types of business loans, smaller banks are less exposed to C&I loans, but more exposed to CRE loans, and the CRE loan disparity is large enough to result in the greater overall business loan exposure. Whereas the average large bank has less than 20% of assets in business loans, the smaller banks have 23% to 33% in business loans. Smaller banks are better capitalized, so while they may face greater losses on business loans, they may be better situated to absorb the losses.

|

Figure 3. Business Debt and Capital: Banks Grouped by Asset Size |

|

|

Source: CRS calculations based on Federal Financial Institution Examination Council bank call report data for December 31, 2019. |

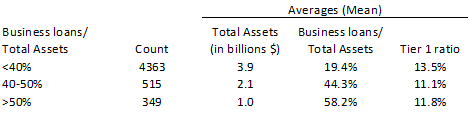

Banks differ across business models as well. Whereas some choose not to concentrate in any one asset type, other banks choose to specialize to serve a particular market or credit need. For example, whereas a typical bank might have about 25% of assets as business loans, another may have nearly twice that exposure or more. As Figure 4 shows, 515 banks have business loan concentrations of between 40% to 50%, and 349 banks are over 50%. These banks are smaller than average and hold less capital than banks not concentrated in business loans, although they still have a higher ratio compared to large banks as shown in the previous table. If the business loan noncurrent rate rises sharply, these could be the first banks to become distressed.

|

Figure 4. Bank Assets, Commercial Exposures, and Capital: Grouped by Concentration |

|

|

Source: CRS calculations based on Federal Financial Institutions Examination Council bank call report data for December 31, 2019. |