Section 232 Investigations: Overview and Issues for Congress

Changes from November 21, 2018 to April 2, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction

- Overview of Section 232

- Key Provisions and Process

- Section 232 Investigations to Date

- Relationship to WTO

- Recent Section 232 Actions on Steel and Aluminum

- Commerce Findings and Recommendations

- Presidential Actions

- Country Exemptions

- Product Exclusions

- Tariffs Collected to Date

- U.S. Steel and Aluminum Industries and International Trade

- Domestic Steel and Aluminum Manufacturing and Employment

- Global Production Trends

- International Efforts to Address Overcapacity

- Policy and Economic Issues

- Retaliation

- Domestic Court Challenges

- WTO Cases

- Additional Section 232 Investigations

- Automobiles and Parts

- Uranium

- Titanium Sponge

WTO Implications- International Efforts to Address Overcapacity

- Potential Economic Impact

- Economic Dynamics of the Tariff Increase

- Assessing the Overall Economic Impact

- Section 232 Auto Investigation

- Issues for Congress

- Appropriate Delegation of Constitutional Authority

- Legislative Responses to Retaliatory Tariffs

- Establishing Threshold

Interpreting National Security- Establishing New International Rules

- Effects on Trade Liberalization Efforts

- Impact on the Multilateral Trading System

- Impact on Broader International Relationships

Figures

- Figure 1. Section 232 Investigation Process

- Figure 2. Section 232 Investigations

- Figure 3. U.S. Steel and Aluminum Imports Subject to Section 232 Tariffs

- Figure 4. Steel and Aluminum Manufacturing Employment

- Figure 5.

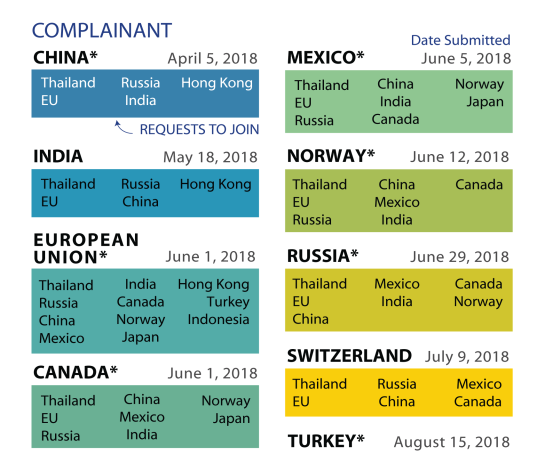

WTO Cases Related to the U.S. Section 232 ActionsRetaliatory Actions by U.S. Trading Partners

- Figure 6. WTO Cases Regarding Section 232 Actions

- Figure 7. U.S. Exports to EU, Canada, and Mexico subject to Section 232 Retaliation

Tables

- Table B-1. Section 232 Investigations and Presidential Actions, 1962-2018

1. Retaliatory Actions by U.S. Trading Partners - Table

B-1. Section 232 Investigations and Presidential Actions, 1962-2018 Table CC-1. Select Proposals to Amend Section 232: 116th Congress- Table C-2. Select Proposals Concerning Section 232: 115th Congress

Table D-1. Top U.S. Import Suppliers of Products Covered under Section 232 Proclamations

Summary

President Trump has used Section 232 authority to apply new tariffs to steel and aluminum imports and potentially on automobile and automobile parts and other sectors currently under investigation. These actions have raised a number of policy issues and some Members of Congress have introduced legislation to revise various Section 232 authorities. Section 232 of the Trade Expansion Act of 1962 (19 U.S.C. §1862) provides the President with the ability to impose restrictions on certain imports based on an affirmative determination by the Department of Commerce (Commerce) that the product under investigation "is being imported into the United States in such quantities or under such circumstances as to threaten to impair the national security." Section 232 actions are of interest to Congress because they are a delegation of Congress's constitutional authority "To lay and collect … Duties" and "To regulate Commerce with foreign Nations." They also have important potential economic and policy implications for the United States.

Global overcapacity in steel and aluminum production, mainly driven by China, has been an ongoing concern of Congress. The George W. Bush, Obama, and Trump Administrations each engaged in multilateral discussions to address global steel capacity reduction through the Organisation for Economic Co-operation and Development (OECD). While the United States has extensive antidumping and countervailing duties on Chinese steel imports to counter China's unfair trade practices, steel industry and other experts argue that the magnitude of Chinese production acts to depress prices globally.

Based on concerns about global overcapacity and certain trade practices, in April 2017 the Trump Administration initiated Section 232 investigations on U.S. steel and aluminum imports. Effective March 23, 2018, President Trump applied 25% and 10% tariffs, respectively, on certain steel and aluminum imports. The President temporarily exempted several countries from the tariffs pending negotiations on potential alternative measures. Permanent tariff exemptions in exchange for quantitative limitations on U.S. imports were eventually announced covering steel for Brazil and South Korea, and both steel and aluminum for Argentina. Australia was permanently exempted from both tariffs with no quantitative restrictions. In August 2018, President Trump raised the tariff to 50% on steel imports from Turkey, and the President announced in a tweet he would increase the tariff to 20% on certain aluminum imports from Turkey. The proposed United States-Mexico-Canada Agreement (USMCA) didwould not resolve or address the Section 232 tariffs on imported steel and aluminum from Canada and Mexico.

Commerce is also managing a process for potential product exclusions in order to limit potential negative domestic effects the tariff may haveof the tariffs on U.S. businesses and consumers. Over 38Of the nearly 70,000 steel exclusion requests have been received, of which about 12,600, over 16,000 have been granted, and about 4,40046,000 have been denied to date. Commerce also received about 6,50010,000 aluminum exclusion requests, of which, with 830with 3,000 exclusions granted and 142 denied. 500 denied. Several Members have raised issues and concerns about the exclusionary process.

U.S. trading partners are challenging the tariffs under World Trade Organization (WTO) dispute settlement rules and have threatened or enacted retaliatory measures, risking potential escalation of retaliatory tariffs. Some analysts view the U.S. unilateral actions as potentially undermining WTO rules, which generally prohibit parties from acting unilaterally, but provide exceptions, including when parties act to protect "essential security interests."

Congress enacted Section 232 during the Cold War when national security issues were at the forefront of national debate. The Trade Expansion Act of 1962 sets clear steps and timelines for Section 232 investigations and actions, but allows the President to make a final determination over the appropriate action to take following an affirmative finding by Commerce that the relevant imports threaten to impair national security. Prior to the Trump Administration, there have beenwere 26 Section 232 investigations, resulting in nine affirmative findings by Commerce. In six of those cases the President imposed a trade action.

On May 23, 2018, the Trump Administration initiated an additional Section 232The Trump Administration has launched three additional Section 232 investigations. On May 23, 2018, Commerce initiated an investigation on U.S. automobile and automobile part imports, and; on July 18, 2018, Commerce launched a Section 232 investigation into uranium ore and product imports; and on March 4, 2019, Commerce began an investigation into titanium sponge imports. The latter two investigations were in response to petitions by U.S. firms. These investigations, as well as the Administration's decision to apply the steel and aluminum tariffs on imports from Canada, Mexico, and the EU—all major suppliers of the affected imports—have prompted further questions by some Members of Congress and trade policy analysts on the appropriate use of the trade statute and the proper interpretation of threats to national security on which Section 232 investigations are based. These actions have also intensified debate over potential legislation to constrain the President's authority with respect to Section 232.

The steel and aluminum tariffs are affecting various stakeholders in the U.S. economy, prompting reactions from several Members of Congress, some in support of the measures and others voicing concerns. In general, the tariffs are expected to benefit some domestic steel and aluminum manufacturers, leading to potentially higher domestic steel and aluminum prices and expansion in production in those sectors, while potentially negatively affecting consumers and many end users (e.g., auto manufacturing and construction) through higher costs. To date, Congress has held hearings on the potential economic and broader policy effects of the tariffs, and legislation hadhas been introduced to override the tariffs that have already been imposed, or to revokerevise or potentially limit the authority it previously delegated to the President in future investigations.

Introduction

On March 8, 2018, President Trump issued two proclamations imposing tariffs on U.S. imports of certain steel and aluminum products, respectively, using presidential powers granted under Section 232 of the Trade Expansion Act of 1962.1 Section 232 authorizes the President to impose restrictions on certain imports based on an affirmative determination by the Department of Commerce (Commerce) that the targeted products are being imported into the United States "in such quantities or under such circumstances as to threaten to impair the national security." Section 232 investigations and actions are important for Congress, as the Constitution gives it primary authority over international trade matters. In the case of Section 232, Congress has delegated to the President broad authority to impose limits on imports in the interest of U.S. national security. The statute does not require congressional approval of any presidential actions that fall within its scope. In the Crude Oil Windfall Profit Tax Act of 1980, however, Congress amended Section 232 by creating a joint disapproval resolution provision under which Congress can override presidential actions in the case of adjustments to petroleum or petroleum product imports.2

Section 232 is one of several tools the United States has at its disposal to address trade barriers and other foreign trade practices. These include investigations and actions to address import surges that are a "substantial cause of serious injury" or threat thereof to a U.S. industry (Section 201 of the Trade Act of 1974), those that address violations or denial of U.S. benefits under trade agreements (Section 301 of the Trade Act of 1974), and antidumping and countervailing duty laws (Title VII of the Tariff Act of 1930).

Trade is an important component of the U.S. economy, and Members often hear from constituents ifwhen factories and other businesses are hurt by competing imports, or if exporters face trade restrictions and other market access barriers overseas. Section 232 actions may affect industries, workers, and consumers in congressional districts and states (both positively and negatively). Following the steel and aluminum Section 232 actions, Commerce initiated Section 232 investigations into imports of automobiles and automobile parts in May 2018 and into, uranium ore and product imports in July 2018. Based on the 270-day period to conduct the investigation as provided in the Act, Commerce's report on auto imports is due in mid-February 2019, and the uranium report is expected by mid-August, and titanium sponges in March 2019. Commerce submitted the auto investigation report to the President on February 17, 2019, but the report has not been made public or shared with Congress; the uranium report is expected by mid-April 2019, and the titanium sponges report is due in late November 2019. The current investigations have raised a number of economic and broader policy issues for Congress.

This report provides an overview of Section 232, analyzes the Trump Administration's Section 232 investigations and actions, and considers potential policy and economic implications and issues for Congress. To provide context for the current debate, the report also includes a discussion of previous Section 232 investigations and a brief legislative history of the statute.

Overview of Section 232

The Trade Act of 1962, including Section 232, was enacted during the Cold War when national security issues were at the forefront. Section 232 has been used periodically in response to industry petitions, as well as through self-initiation by the executive branch. The Trade Expansion Act establishes a clear process and sets timelines for a Section 232 investigation, but the executive branch's interpretation of "national security" and the potential scope of any investigation can be expansive.

Key Provisions and Process

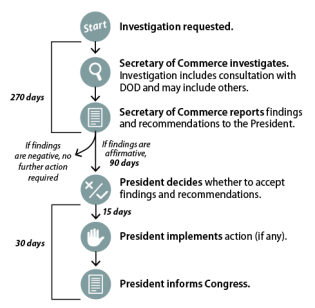

Upon request by the head of any U.S. department or agency, by application by an interested party, or by self-initiation, the Secretary of Commerce must commence a Section 232 investigation. The Secretary of Commerce conducts the investigation in consultation with the Secretary of Defense and other U.S. officials, as appropriate, to determine the effects of the specified imports on national security. Public hearings and consultations may also be held in the course of the investigation. Commerce has 270 days from the initiation date to prepare a report advising the President whether or not the targeted product is being imported "in such quantities or under such circumstances as to threaten to impair" U.S. national security, and to provide recommendations for action or inaction based on the findings. Any portion of the report that does not contain classified or proprietary information must be published in the Federal Register. See Figure 1 for the Section 232 process and timeline.

While there is no specific definition of national security in the statute, it states that the investigation must consider certain factors, such as: domestic production needed for projected national defense requirements; domestic capacity; the availability of human resources and supplies essential to the national defense; and potential unemployment, loss of skills or investment, or decline in government revenues resulting from displacement of any domestic products by excessive imports.3

Once the President receives the report, he has 90 days to decide whether or not he concurs with the Commerce Department's findings and recommendations, and to determine the nature and duration of the action he views as necessary to adjust the imports so they no longer threaten to impair the national security (generally, imposition of some trade-restrictive measure). The President may implement the recommendations suggested in the Commerce report, take other actions, or decide to take no action. After making a decision, the President has 15 days to implement the action and 30 days to submit a written statement to Congress explaining the action or inaction; he must also publish his findings in the Federal Register. Presidential actions may stay in place … "for such time, as he deems necessary to adjust the imports of such article and its derivatives so that such imports will not so threaten to impair the national security."4

|

|

Source: CRS graphic based on 19 U.S.C. §1862. |

Section 232 Investigations to Date

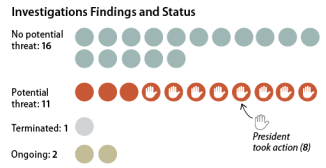

The Commerce Department (or the Department of the Treasury before it) initiated a total of 3031 Section 232 investigations between 1962 and 20182019, including twothree investigations that remain ongoing (see Table B-1). In 16 of these cases, Commerce determined that the targeted imports did not threaten to impair national security. In 11 cases, Commerce determined that the targeted imports threatened to impair national security and made recommendations to the President. The President took action eight times. One case was terminated at the petitioner's request before Commerce completed its investigation. Prior to the Trump Administration, 10 Section 232 investigations had beenwere self-initiated by the Administration. (For a full list of cases to date, see Appendix B.)

In eight investigations dealing with crude oil and petroleum products, Commerce decided that the subject imports threatened to impair national security. The President took action in five of these cases. In the first three cases on petroleum imports (1973-1978), the President imposed licensing fees and additional supplemental fees on imports, which are no longer in effect, rather than adjusting tariffs or instituting quotas. In two cases, the President imposed oil embargoes, once in 1979 (Iran) and once in 1982 (Libya). Both were superseded by broader economic sanctions in the following years.5

In the three most recent crude oil and petroleum investigations (from 1987 to 1999), Commerce determined that the imports threatened to impair national security, but did not recommend that the President use his authority to adjust imports. In the first of these reports (1987), Commerce recommended a series of steps to increase domestic energy production and ensure adequate oil supplies rather than imposing quotas, fees, or tariffs because any such actions would not be "cost beneficial and, in the long run, impair rather than enhance national security."6 In the latter two investigations (1994 and 1999), Commerce found that existing government programs and activities related to energy security would be more appropriate and cost effective than import adjustments. By not acting, the President in effect followed Commerce's recommendation.

Prior to the Trump Administration, a President arguably last acted under Section 232 in 1986. In that case, Commerce determined that imports of metal-cutting and metal-forming machine tools threatened to impair national security. In this case, the President sought voluntary export restraint agreements with leading foreign exporters, and developed domestic programs to revitalize the U.S. industry.7 These agreements predate the founding of the World Trade Organization (WTO), which established multilateral rules prohibiting voluntary export restraints (see "WTO ImplicationsCases ").

In addition to the two recent cases on steel and aluminum, on May 23, 2018, after consultations with President Trump, Commerce Secretary Wilbur Ross announced the initiation of a Section 232 investigation to determine whether imports of automobiles, including SUVs, vans and light trucks, and automotive parts threaten to impair national security.8 Commerce held a public hearing and requested public comments to inform the ongoing auto investigation.9 In January 2018, two U.S. mining companies petitioned for the investigation into uranium imports.10 On July 18In January 2018, two U.S. mining companies petitioned for the investigation into uranium imports.9 On July 18, Commerce announced the initiation of a Section 232 investigation on these imports and informed the Secretary of Defense.10 In September 2018, a U.S. titanium company petitioned for the investigation into titanium sponge imports. In March 2019, Commerce announced the initiation of a Section 232 investigation on these imports and informed the Secretary of Defense.11

|

|

Source: CRS Graphic based on BIS data (https://www.bis.doc.gov/). Note: For a detailed list of cases, see Appendix B. |

Relationship to WTO

While unilateral trade restrictions may appear to be counter to U.S. trade liberalization commitments under the WTO agreements, Article XXI of the General Agreement on Tariffs and Trade (GATT), which predates and was one of the foundational agreements of the WTO, allows WTO members to take measures to protect "essential security interests." Broad national security exceptions are also included in international trade obligations at the bilateral and regional levels, and could potentially limit the ability of countries to challenge such actions by trade partners. Historically, exceptions for national security have been rarely invoked and multiple trading partners have challenged recent U.S. actions under the WTO agreements (see "WTO ImplicationsCases ").

Recent Section 232 Actions on Steel and Aluminum

In April 2017, two presidentialpresidential memoranda instructed Commerce to give priority to two self-initiated investigations into the national security threats posed by imports of steel and aluminum.12 In conducting its investigation, Commerce held public hearings and solicited public comments via the Federal Register and consulted with the Secretary of Defense and other agencies, as required by the statute.13 In addition to the hearings, stakeholders submitted approximately 300 comments regarding the Section 232 investigation and potential actions. Some parties (mostly steel producers) supported broad actions to limit steel imports, while others (mostly users and consuming industries such as automakers) opposed any additional tariffs or quotas on imports. The U.S. aluminum industry held differing views of the global aluminum tariff, with most parties opposing it.14 Some stakeholders in the steel and aluminum industries sought a middle ground, endorsing limited actions to target the underlying issues of overcapacity and unfair trade practices. Still others focused on the process, voicing caution in the use of Section 232 authority and warning against an overly broad definition of "national security" for protectionist purposes.15

The Commerce investigations analyzed the importance of certain steel and aluminum products to national security, using a relatively broad definition of "national security," defining it to include "the general security and welfare of certain industries, beyond those necessary to satisfy national defense requirements, which are critical for minimum operations of the economy and government."16 The scope of the investigations extended to current and future requirements for national defense and to 16 specific critical infrastructure sectors, such as electric transmission, transportation systems, food and agriculture, and critical manufacturing, including domestic production of machinery and electrical equipment. The reports also examined domestic production capacity and utilization, industry requirements, current quantities and circumstances of imports, international markets, and global overcapacity. Commerce based its definition of national security on a 2001 investigation on iron ore and semi-finished steel.17 Section 232 investigations prior to 2001 generally used a narrower definition considering U.S. national defense needs or overreliance on foreign suppliers.

Commerce Findings and Recommendations

The final reports, submitted to the President on January 11 and January 22, 2018, respectively, concluded that imports of certain steel mill products18 and of certain types of primary aluminum and unwrought aluminum19 "threaten to impair the national security" of the United States. The Secretary of Commerce asserted that "the only effective means of removing the threat of impairment is to reduce imports to a level that should ... enable U.S. steel mills to operate at 80 percent or more of their rated production capacity" (the minimum rate the report found necessary for the long-term viability of the U.S. steel industry and, separately, for the aluminum industry). The Secretary further recommended the President "take immediate action to adjust the level of these imports through quotas or tariffs" and identified three potential courses of action for both steel and aluminum imports, including tariffs or quotas on all or some steel imports from specific countries.

The Secretary of Defense, while concurring with Commerce's "conclusion that imports of foreign steel and aluminum based on unfair trading practices impair the national security," recommended targeted tariffs and that "an inter-agency group further refine the targeted tariffs, so as to create incentives for trade partners to work with the U.S. on addressing the underlying issue of Chinese transshipment" in which Chinese producers ship goods to another country to reexport.20 He also noted, however, that "the U.S. military requirements for steel and aluminum each only represent about three percent of U.S. production."21

Presidential Actions

On March 8, 2018, President Trump issued two proclamations imposing duties on U.S. imports of certain steel and aluminum products, based on the Secretary of Commerce's findings.22 The proclamations outlined the President's decisions to impose tariffs of 25% on steel and 10% on aluminum imports effective March 23, 2018, but provided for flexibility in regard to country and product applicability of the tariffs (see below). The new tariffs were to be imposed in addition to any duties already in place, including antidumping and countervailing duties.

In the proclamations, the President established a bifurcated approach, instructing Commerce to establish a process for domestic parties to request individual product exclusions and a U.S. Trade Representative (USTR)-led process to discuss "alternative ways" through diplomatic negotiations to address the threat with countries having a "security relationship" with the United States.

The President officially notified Congress of his actions in a letter dated April 6, 2018, though several Members have been. Several Members actively engaged in voicing their views since the investigations were launched, including through hearings and letters to the President.23

Country Exemptions

Initially, the President temporarily excluded imports of steel and aluminum products from Mexico and Canada from the new tariffs, and the Administration had implicitly and explicitly linked a successful outcome of the North American Free Trade Agreement (NAFTA) renegotiation to maintaining the exemptions. With regard to other countries, the President expressed a willingness to be flexible, stating that countries with which the United States has a "security relationship" may discuss "alternative ways" to address the national security threat and gain an exemption from the tariffs. The President charged the USTR with negotiating bilaterally with trading partners on potential exemptions.

On March 22, after discussions with multiple countries, the President issued proclamations temporarily excluding Australia, Argentina, Brazil, South Korea, the European Union (EU), Canada and Mexico, from the Section 232 tariffs.24 The President gave a deadline of May 1, 2018, by which time each trading partner had to negotiate "a satisfactory alternative means to remove the threatened impairment to the national security by imports" for steel and aluminum in order to maintain the exemption. On April 30, 2018, the White House extended negotiations and tariff exemptions with Canada, Mexico, and the EU for an additional 30 days, until June 1, 2018, and exempted Argentina, Australia, and Brazil from the tariffs indefinitely pending final agreements.25 South Korea, which pursued a resolution over the tariffs in the context of discussions to modify the U.S.-South Korea (KORUS) Free Trade Agreement, agreed to an absolute annual quota for 54 separate subcategories of steel and was permanently exempted from the steel tariffs.26 South Korea did not negotiate an agreement on aluminum and hasits exports to the United States have been subject to the aluminum tariffs since May 1, 2018.

On May 31, 2018, the President proclaimed Argentina and Brazil, in addition to South Korea, permanently exempt from the steel tariffs, having reached final quota agreements with the United States on steel imports.27 Brazil, like South Korea, did not negotiate an agreement on aluminum and is now subject to the aluminum tariffs. The Administration also proclaimed aluminum imports from Argentina permanently exempt from the aluminum tariffs subject to an absolute quota.28 The Administration proclaimed imports of steel and aluminum from Australia permanently exempt from the tariffs as well, but did not set any quantitative restrictions on Australian imports.

As of June 1, 2018, imports of steel and aluminum from Canada, Mexico, and the European Union are subject to the Section 232 tariffs. These countries are among the largest suppliers of U.S. imports of the targeted goods, accounting for nearly 50% by value in 20172018 (see Appendix CD). The imposition of tariffs on these major trading partners increases the economic significance of the tariffs and prompted criticism from several Members of Congress, including the chairs of the House Ways and Means and Senate Finance Committees.29

The Trump Administration completed negotiations on the proposed United States-Mexico-Canada Agreement (USMCA) on September 30, 2018, to replace the NAFTA. The USMCA did not resolve or address the Section 232 tariffs on imported steel and aluminum from Canada and Mexico, but it includes a requirement that motor vehicles contain 70% or more of North American steel and aluminum content to qualify for duty-free treatment.30 The three parties continue to discuss the steel and aluminum tariffs, which some analysts speculate could result in quotas on imports of Mexican and Canadian steel and aluminum, possibly before a ceremonial signing of the USMCA.31 Some. Some U.S., Canadian, and Mexican policymakers have suggested that the parties will not ratifynot sign the new agreement until the Section 232 tariffs are removed.32

With respect to the EU, on July 27, 2018, after meeting with EU President Juncker, President Trump announced plans for "high-level trade negotiations" to eliminate tariffs, including those on steel and aluminum, among other objectives. The two sides agreed to not impose further tariffs on each other's trade products while negotiations are active.3332 It is unclear what those negotiations may seek in terms of alternative measures, but the United States could seek some type of quantitative restriction seems likely given the agreements the Administration has negotiated to date with most exempted countries.3433 In addition to seeking quantitative restrictions, the Trump Administration may also pursue increasing traceability and reporting requirements, which may help limit transshipments of steel or aluminum originating from nonexempt countries.

|

Tariff Increase on U.S. Steel and Aluminum Imports from Turkey On August 10, 2018, President Trump issued a proclamation raising the Section 232 tariff to 50% on covered steel imports from Turkey. The President justified the action by stating "imports have not declined as much as anticipated and capacity utilization has not increased to [the] target level." |

Product Exclusions

To limit potential negative domestic impacts of the tariffs on U.S. consumers and consuming industries, Commerce published an interim final rule for how parties located in the United States may request exclusions for items that are not "produced in the United States in a sufficient and reasonably available amount or of a satisfactory quality."3837 Requests for exclusions and objections to requests have been and will continue to be posted on regulations.gov.3938 The rule went into effect the same day as publication to allow for immediate submissions.

Exclusion determinations are to be based upon national security considerations. To minimize the impact of any exclusion, the interim rule allows only "individuals or organizations using steel articles ... in business activities ... in the United States to submit exclusion requests," eliminating the ability of larger umbrella groups or trade associations to submit petitions on behalf of member companies.4039 Any approved product exclusion will beis limited to the individual or organization that submitted the specific exclusion request. Parties may also submit objections to any exclusion within 30 days after the exclusion request is posted. The review of exclusion requests and objections will not exceed 90 days, creating a period of uncertainty for petitioners. Exclusions will generally last for one year from the date of signature.4140

As of November 15, 2018March 4, 2019, Commerce received over 38almost 70,000 steel product exclusion requests and had processed 17,051 of them, with 12,616 granted and 4,435 exclusions denied.42

, with 16,500 exclusions granted and 500 denied.41 As of the same date, Commerce received 6,50410,000 aluminum exclusion requests and made decisions regarding 972 of them, with 830, with 3,000 exclusions granted and 142500 denied.43

Companies have complained about the intensive, time-consuming process to submit exclusion requests; the lengthy waiting period to hear back from Commerce, which has exceeded the 90 days in some cases; what some view as an arbitrary nature of acceptances and denials; and that all exclusion requests to date have been rejected when a U.S. steel or aluminum producer has objected.4443 Alcoa, the largest U.S. aluminum maker, requested an exemption for all aluminum imported from Canada, where it operates three aluminum smelters. While the company benefits from higher aluminum prices as a result of the tariffs, it is also seeing increased costs in its own supply chain.45

Several Members of Congress have raised concerns about the exclusion process. For example, in a letter to Commerce Secretary Ross, and at a hearing, Senate Finance Committee Chairman Orrin Hatch and Ranking Member Ron Wyden urged improvements to the product exclusion procedures on the basis that the detailed data required placed an undue burden on petitioners and objectors. They also suggested that the process appeared to bar small businesses from relying on trade associations to consolidate data and make submissions on behalf of multiple businesses. The letter further stated that Commerce had not instituted a clear process for protecting business proprietary information.46 A bipartisan group of House Members44 In addition, the Cause of Action Institute filed a series of Freedom of Information Act (FOIA) requests to gain insight into the exclusion process. Commerce did not respond, leading the organization to file a lawsuit against the agency.45

Several Members of Congress have raised concerns about the exclusion process. A bipartisan group of House Members, for example, raised concerns about the speed of the review process and the significant burden it places on manufacturers, especially small businesses.4746 The Members included specific recommendations, such as allowing for broader product ranges to be included in a single request, allowing trade associations to petition, grandfathering in existing contracts to avoid disruptions, and regularly reviewing the tariffs' effects and sunsetting them if they have a "significant negative impact."48 In addition, the Cause of Action Institute filed a series of Freedom of Information Act (FOIA) requests to gain insight into the exclusion process. As of October 19, 2018, Commerce had not responded, leading the organization to file a lawsuit against the agency.49

Commerce asserted thatasserts it has taken several steps to improve the exclusion process, including increasing and organizing its staff "to efficiently process exclusion requests," and "expediting the grant of properly filed exclusion requests that receive no objections." The agency's International Trade Administration (ITA) also became involved in the exclusion process by analyzing exclusion requests and objections to determine whether there is sufficient domestic production available to meet the requestor's product needs.5048 BIS remains the lead agency involved in making final decisions regarding whether the requests are granted or denied.

Some Members have questioned the Administration's processes and ability to pick winners and losers through granting or denying exclusion requests. On August 9, 2018, Senator Ron Johnson requested that Commerce provide specific statistics and information on the exclusion requests and process and provide a briefing to the Committee on Homeland Security and Governmental Affairs. Senator Elizabeth Warren requested that the Commerce Inspector General investigate the implementation of the exclusion process, including a review of the processes and procedures Commerce has established; how they are being followed; and if exclusion decisions are made on a transparent, individual basis, free from political interference. She also requested evidence that the exclusions granted meet Commerce's stated goal of "protecting national security while also minimizing undue impact on downstream American industries," and that the exclusions granted to date strengthen the national security of the United States.51 49 Pending legislation to revise Section 232 also addresses the process for excluding products (e.g., S. 287).

On September 6, 2018, Commerce announced a new rule to allow companies to rebut objections to petitions.5250 The new rule, published September 11, 2018, includes new rebuttal and counter-rebuttal processesprocedures, more information about the exclusion submission requirements and process, the criteria Commerce uses in deciding whether to grant an exclusion request, and revised estimates of the total number of exclusion requests and objections that Commerce expects to receive.53

51 On October 29, 2018, the Commerce Inspector General's office (IG) initiated an audit of the agency's processes and procedures for reviewing and adjudicating product exclusion requests.54

Tariffs Collected to Date

As of November 7, 2018, the U.S. Customs and Border Protection assessed $2.87 billion and $829.4 million52 The audit is ongoing.

To ensure that Commerce follows through with improving the exclusion process, in the Consolidated Appropriations Act, 2019 (P.L. 116-6), signed on February 15, 2019, Congress provided funding for "contractor support to implement the product exclusion process for articles covered by actions taken under section 232."53 To ensure improvements to the exclusion process, Congress indicated that the additional money is to be "devoted to an effective Section 232 exclusion process" and required that Commerce submit quarterly reports to Congress.54 Congress mandated that the reports identify

Tariffs Collected to Date

As of March 28, 2019, U.S. Customs and Border Protection assessed $4.7 billion and $1.5 billion from the Section 232 tariffs on steel and aluminum, respectively. The tariffs collected are put in the general fund of the U.S. Treasury and are not allocated to a specific fund. Based on 2017 U.S. import values, annual tariff revenue from the Section 232 tariffs could be as high as $5.8 billion and $1.7 billion for steel and aluminum, respectively, but such estimates do not account for dynamic effects that may impact import flows.

Generally, higher import prices resulting from the tariffs should cause both import demand and tariff revenue to decrease over time, provided that U.S. production increases and sufficient domestic alternatives become available. Tariff revenue is also likely to decline as the Commerce Department grants additional product exclusions.

According to the President's proclamations implementing the Section 232 tariffs, one of the objectives of the tariffs is to "reduce imports to a level that the Secretary assessed would enable domestic steel (and aluminum) producers to use approximately 80 percent of existing domestic production capacity and thereby achieve long-term economic viability through increased production."55

U.S. Steel and Aluminum Industries and International Trade

The United States competes for domestic and global market share with other major steel and aluminum producers. The most direct competition comes from China, the world's largest raw steel and primary aluminum producing country.56 China's capacity to make both metals influences the world market most directly by lowering steel and aluminum prices and thereby the profitability of domestic U.S. producers. The Organisation for Economic Co-operation and Development (OECD) began monitoring global steel production in the 1960s and tracks new capacity additions as well as plant and capacity closures. It notes that steel demand is weak globally but production continues to increase, driven by new investments around the world.57 So far, no similar effort is underway to monitor or address aluminum overcapacity globally; however, the Aluminum Association, a U.S. industry trade group, and other national aluminum associations, have requested that the G-20 create a global multilateral and governmental forum on aluminum overcapacity, similar to the forum on steel.58

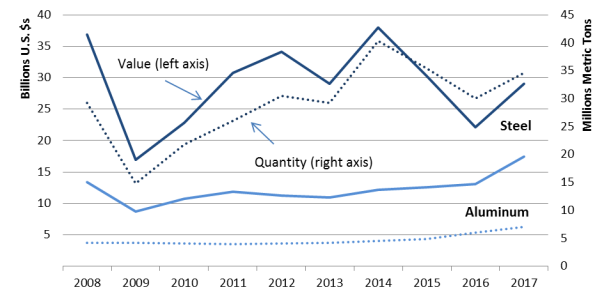

In 2017, U.S. imports of steel and aluminum products covered by the Section 232 tariffs totaled $29.0 billion and $17.4 billion, respectively (see Figure 3). Over the past decade, steel imports have fluctuated significantly, by value and quantity, while imports of aluminum have increased steadily. The expiration of temporary exclusions from the tariffs for Canada, Mexico, and the EU are economically significant for U.S. trade in both products. In 2017, these trading partners were the top three suppliers of U.S. steel imports facing the import tariff, together accounting for 47% of relevant U.S. steel imports.59 Canada alone accounted for 41% of relevant U.S. aluminum imports in 2017, followed by China (11%) and Russia (9%). The countries with permanent exclusions from the tariff accounted for 20% of U.S. steel imports in 2017 and less than 5% of U.S. aluminum imports (see Appendix C)In 2018, U.S. imports of steel and aluminum products covered by the Section 232 tariffs totaled $29.5 billion and $17.6 billion, respectively (see Appendix D).56 Over the past decade, steel imports have fluctuated significantly, by value and quantity, while imports of aluminum have generally increased. U.S. imports of both metals increased slightly by value from 2017 to 2018 (Section 232 tariffs became effective at different times for different countries), but imports of both decreased by more than 10% in quantity terms (-3.8 million metric tons for steel and -0.9 million metric tons for aluminum).57 U.S. imports from individual countries fluctuated to an even greater degree over the past year (Figure 3). The largest declines in U.S. steel imports, by value, were from South Korea (-$430 million, -15%), Turkey (-$413 million, -35%), and India (-$372 million, -49%), with significant increases from the EU (+$567 million, +22%), Mexico (+$508 million, +20%), and Canada (+$404 million, +19%). The largest declines in aluminum imports were from China (-$729 million, -40%), Russia (-$676 million, -42%), and Canada (-$294 million, -4%), with major increases from the EU (+$395 million, 9%), India (+$221 million, 58%), and Oman ($186 million, +200%). The countries with permanent exclusions from the tariffs (all except Australia are instead subject to quotas) accounted for 18.4% of U.S. steel imports in 2018 and 4.4% of U.S. aluminum imports.

|

Figure 3. U.S. Steel and Aluminum Imports Subject to Section 232 Tariffs |

|

|

Source: Created by CRS using data from Census Bureau on HTS products included in the Section 232 proclamations. |

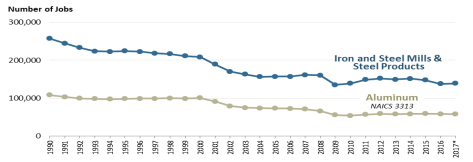

Domestic Steel and Aluminum Manufacturing and Employment

In 2018In 2017, U.S. steelmakers employed 139,900140,100 workers (Figure 4), accounting for 1.1% of the nation's 12.47 million factory jobs. Employment in the steel industry has been decliningdeclined for many years as new technology, particularly the increased use of electric arc furnaces to make steel, has reduced the demand for workers.6058 According to the Bureau of Labor Statistics, labor productivity in steelmaking nearly tripled since 1987 and rose 1520% over the past decade.6159 Hence, even a significant increase in domestic steel production is likely to result in a relatively small number of additional jobs.

Aluminum manufacturers employed 58,100 workers in 20172018, a figure that has changed little since the 2007-2009 recession. Domestic smelting of aluminum from bauxite ore, which requires large amounts of electricity, has been in long-term decline, and secondary aluminum produced from recycled scrap melted in a smelter now accounts for the majority of domestic aluminum production.6260 Imports of secondary unwrought aluminum are not covered by the Section 232 aluminum trade action.6361

|

|

Source: Bureau of Labor Statistics, Current Employment Survey for North American Industry Classification System (NAICS) 3311 (iron and steel mills), 3312 (steel products), and NAICS 3313 (aluminum). Notes: * 2017 figures are estimated. |

Steelmaking and aluminum smelting are both extremely capital intensive. As a result, even small changes in output can have major effects on producers' profitability. Domestic steel producers have operated at 7880% or less of production capacity in recent years, with a shift in recent months to a capacity utilization rate at U.S. steel mills of more than 80%.62 Primary aluminum producers.64 Aluminum smelters in the United States have operated at about 3778% of production capacity in December 2018, up from around 43% in December 2017.632017.65 A stated aim of the metals tariffs is to enable U.S. producers in both sectors to use an average of 80% of their production capacity, which the Section 232 reports deem necessary to sustain adequate profitability and continued capital investment.6664

Global Production Trends

The OECD Global Forum on Steel Excess Capacity estimates global steel overcapacity to be at more than 700 million metric tons, with more than half (425 million metric tons) accounted for by China.67 Relatively little Chinese steel and aluminum enterwas at 595 million metric tons in 2017.65 While China is the world's largest steel producer, accounting for roughly 45% of global capacity, relatively little Chinese steel enters the U.S. market directly, due to extensive U.S. dumping and subsidy determinations, but the large amount of Chinese production acts to depress prices globally. China has indicated that it plans to reduce its crude steelmaking capacity by 100-150 million metric tons over the five-year period from 2016 to 2020.68

No OECD or other multinational forum has been established to monitor global aluminum overcapacity, though aluminum industry groups have called for such a forum.68 Although China accounted for more than half of the world's primary aluminum production in 2017, it does not export aluminum in commodity form to the United States. China ships semi-finished aluminum such as bars, rods, and wire to the United States. These are subject to the Section 232 tariffs.69 OECD analysis has found that ongoing global steel overcapacity and excess production are largely caused by government intervention, subsidization, and other market-distorting practices, although these are not the only factors.73 Other reasons for excess capacity include cyclical market downturns. The situation is similar in the aluminum industry, where government financial support for large aluminum stockpiles has delayed the response to lower demand. Past Administrations worked to address the issue of steel overcapacity. President George W. Bush, for example, initiated international discussions on global capacity reduction and improved trade discipline in the steel industry as part of his general steel announcement of 2001.74 Other governments agreed to join the Bush Administration in discussing overcapacity and trade issues at the OECD in a process that started in mid-2001. The industrial, steel-producing members of the OECD were joined by major non-OECD steel producers, such as India, Russia, and, during later stages of the talks, China. Negotiations were suspended indefinitely in 2004, and by 2005, the OECD had abandoned this effort to negotiate an agreement among all major steel-producing countries to ban domestic subsidies for steel mills. The Obama Administration also participated in international efforts to curb steel imports, including the launch of the G-20 Global Forum on Steel Excess Capacity in 2016, another venue that sought to address the challenges of excess capacity in steel worldwide.75 In December 2016, the G-20 convened its first meeting of more than 30 economies—all G-20 members plus interested OECD members—as a global platform to discuss steel issues among the world's major producers.76 The same year, as part of the U.S.-China Strategic and Economic Dialogue (SE&D) established in 2009, the Obama Administration agreed to address excess steel production and also to communicate and exchange information on surplus production in the aluminum sector.77 In September 2018, the OECD Forum agreed on a process to identify and remove subsidies and take other measures to reduce the global steel overcapacity. The OECD issued a consensus report outlining six principles and specific policy recommendations to address excess steel capacity.78 The USTR, while supportive of the recommendations, questioned the Forum's ability to pursue effective implementation and did not rule out unilateral action.79 The aluminum industry argues it is also suffering because of China's excess production of primary aluminum. According to the aluminum associations of Japan, Europe, Canada, and the United States, global overcapacity amounted to 11 million metric tons in 2017. Akin to the global steel industry, aluminum producers contend that excess production has been largely caused by government intervention, subsidization, and other market-distorting practices, among other factors.80 As noted, the U.S. Aluminum Association and some of its international counterparts seek to establish a global forum to address aluminum excess capacity. The Trump Administration's Section 232 actions have led multiple U.S. trading partners, such as the EU, the UK, and Canada, to initiate their own safeguard investigations and quota restrictions to prevent dumping of steel and aluminum exports and protect domestic industries. Unlike the OECD efforts, the individual country safeguard actions are uncoordinated.Metals imports should be put in the context of U.S. production. In 201766 According to the Chinese government, the country's crude steel capacity has fallen by more than 120 million metric tons since it announced its steel reduction goal in 2016.67

6970 Some segments of the domestic steel industry, such as slab converters, import a sizable share of their semi-finished feedstock from foreign suppliers, totaling nearly 87.5 million tons in 2017.702018.71 In the primary aluminum market, U.S. net import reliance rose to 6150% in 20172018 from 2133% in 20132014, according to the U.S. Geological Survey.7172 Most U.S. foreign trade in steel and aluminum is with Canada (see Appendix C).

International Efforts to Address Overcapacity

Most U.S. foreign trade in steel and aluminum is with Canada (see Appendix C).

Policy and Economic Issues

The Section 232 tariffs on steel and aluminum imports into the United States raise a number of issues for Congress. The economic repercussions of U.S. and foreign actions may be felt not only by domestic steel and aluminum producers, but by downstream manufacturers or other industries targeted for retaliation, orand consumers. The response by other countries can have implications for the U.S. economy and multilateral world trading system. Also, other countries may be hesitant in the future to cooperate with the United States to address broader global issues, including steel and aluminum overcapacity, if their exports are subject to U.S. tariffs.

U.S. trading partners' responses to the Section 232 actions have varied based on the country's relationship with the United States. Some countries are pursuing direct negotiations, while keeping other countermeasures in reserve, and raising actions at the WTO (see below). Others have proposed or pursued retaliation with their own tariffs. Some companies have pursued litigation,7287 and may also seek alternative markets for their own products to avoid U.S. tariffs.

Retaliation

Several major U.S. trading partners have proposed or are currently imposing retaliatory tariffs in in response to the U.S. actions (see Table 1Figure 5 below).88 In total, retaliatory tariffs are in effect on products accounting for approximately $23.2 billion of U.S. exports in 2018. below). The process of retaliation is complex given multiple layers of relevant international rules and the potential for unilateral action, which may or may not adhere to those existing rules. Both through agreements at the WTO and in bilateral and regional free trade agreements (FTAs), the United States and its trading partners have agreed to maintain certain tariff levels. Those same agreements include rules on potential responses, including formal dispute settlement procedures and in some cases commensurate tariffs, when one party increases its tariffs above agreed-upon limits.73 Other exceptions, such as antidumping tariffs, countervailing duties, and safeguards, are addressed in WTO agreements.74

Most of the retaliatory actions of U.S. trading partners to date have been notified to the WTO pursuant to the Agreement on Safeguards. These retaliatory notifications listed below (see Table 1) are in addition to requests for consultations that are the first step in WTO dispute settlement proceedings (see "WTO Implications"). In addition, Japan submitted a notification to the WTO, but has yet to announce a list of specific products. Notifications by other countries may follow.

|

Trading Partner |

Estimated Value of Targeted U.S. Exports |

Effective Date |

Example Products Targeted |

|

China |

$3.0 billion |

April 2, 2018 |

fruits, vegetables, wine, meats, steel products, aluminum waste, and other items |

|

Turkey |

$1.8 billion |

|

foodstuffs, paper, plastic, structural steel, machinery, vehicles, and other items |

|

European Union (EU) 1st Set |

$3.2 billion |

June 22, 2018 |

steel and aluminum products, bourbon whiskey, motorcycles, tobacco products, pleasure boats, and other items |

|

EU 2nd Set |

$4.2 billion |

2021 |

cranberries, denim jeans, footwear, washing machines, and other items |

|

Canada |

$12.7 billion |

July 1, 2018 |

steel, aluminum, coffee, ketchup, orange juice, paper products, and other consumer goods |

|

Mexico |

$3.7 billion |

|

pork, apples, potatoes, bourbon, cheeses, and other items |

|

Russia 1st Set |

$0.35 billion |

|

road construction equipment, oil and gas equipment, tools and other items |

|

Russia 2nd Set |

TBD |

2021 |

TBD |

|

India |

$1.4 billion |

December 17, 2018 |

nuts, apples, steel products, motorcycles, and other items |

Source: Global Trade Atlas, compiled from partner countries' 2017 import data for U.S. products; products targeted by retaliatory tariffs were identified in countries' World Trade Organization notifications (China (G/L/1218, March 29, 2018); India (G/L/1237/Rev 1, June 13, 2018); EU (G/L/1237; May 18, 2018); Turkey (G/L/1242, May 21, 2018); Russia (G/L/1241, May 22, 2018), and in the notices published by Canada, Mexico, Russia, and Turkey on their own government websites. Canada: Department of Finance (Canada), "Countermeasures in Response to Unjustified Tariffs on Canadian steel and aluminum products," June 29, 2018, https://www.fin.gc.ca/access/tt-it/cacsap-cmpcaa-1-eng.asp; Mexico: Ministry of Finance (Mexico), Diario Oficial de la Federacion, June 5, 2018, http://www.dof.gob.mx/nota_detalle.php?codigo=5525036&fecha=05/06/2018; Russia: Russian Federation, "Approval of rates of import duties in respect to certain goods from the United States," Decision no. 788. July 6, 2018, http://www.pravo.fso.gov.ru/laws/acts/53/555656.html; Turkey: Government of Turkey, "American merchandise subject to additional import tariffs," Decision no. 21, Official Gazette of Turkey, August 14, 2018, http://www.resmigazete.gov.tr/eskiler/2018/08/20180815-6.pdf. India: Rajendra Jadhav, "India delays imposition of retaliatory tariffs on U.S. goods till December 17," Reuters, November 1, 2018.

Notes: Under WTO rules on safeguards, countries facing new safeguard tariffs may impose their own retaliatory tariffs that would result in an equivalent amount of tariff collection. These retaliatory tariffs (which the WTO refers to as the suspension of trade concessions) must be delayed three years if the safeguard tariffs were a result of an absolute increase in imports. The EU retaliation list split into two lists is an example.

a. Turkey announced on August 18, 2018, an increase in its retaliatory tariff rates, in response to the Trump Administration's decision to increase the U.S. tariffs on Turkish steel to 50%. It is unclear from the notice when these additional tariff rates went fully into effect.

b. One commodity code listed on Mexico's notice is newly established and does not have any reported data for 2017; to estimate the amount of trade, CRS used the higher-level 6-digit version of the code (160100).

c. A Russian government notice states retaliation will target $87.6 million in duty collection initially, with an additional $450 million in duty collection in 2021. (Ministry of Economic Development of the Russian Federation, "Russia introduced compensatory measures in connection with the application of the US additional import duties on steel and aluminum," July 7, 2018, available [in Russian] at http://economy.gov.ru/minec/press/news/201806072, and "Russia Hits Back at U.S. Trade Tariffs by Increasing Import Duties on American Goods," Independent, July 6, 2018.)

d. Russia published its list of retaliatory tariffs rates and products on July 6, 2018. The tariffs appear to go into effect within 30 days of the publication.

FTA partner countries may also claim that the increase in U.S. tariff rates violates U.S. FTA commitments and seek recourse through those agreements. For example, Canada and Mexico, U.S. partners in NAFTA, claimed that the U.S. actions violate commitments in both NAFTA and the WTO agreements. Canada is launching a dispute under the FTA's dispute settlement provisions in addition to actions at the WTO, and began imposing tariffs on up to $12.7 billion of U.S. exports of steel, aluminum, and other products in July.75 Mexico also published its list of retaliatory tariffs on agricultural and other products that affect approximately $3.75 billion in U.S. exports.76

The prospect of escalating tariffs by U.S. trading partners in retaliation to the Section 232 tariff actions by the Trump Administration magnifies the potential effects of the Section 232 tariffs. From an economic perspective, retaliation increases the scope of industries affected by the tariffs. U.S. farmers, for example, have consistently voiced concern that agriculture exports are being targeted for retaliation and fear losing market share abroad if they are displaced by suppliers from other countries.77 Some economic models also estimate that retaliation could significantly increase the potential drag on economic growth, while some show minimal impact.

Retaliatory actions may also heighten concerns over the potential strain the Section 232 tariffs place on the international trading system. Many U.S. trading partners view the Section 232 actions as protectionist and in violation of U.S. commitments at the WTO and in U.S. FTAs, while the Trump Administration views the actions within its rights under those same commitments.78 If the dispute settlement process in those agreements cannot satisfactorily resolve this conflict, it could lead to further unilateral actions and a tit-for-tat process of increasing retaliation.

WTO Implications

The President's imposition of tariffs on certain imports of steel and aluminum products,79 as well as Commerce's exemption of certain WTO members' products from such tariffs, may have implications for the United States under WTO agreements. On April 9, 2018, China took the first step in challenging the executive branch's actions as violating U.S. obligations under the WTO agreements (particularly the Agreement on Safeguards) by requesting consultations with the United States.80 Under WTO dispute settlement rules, members must first attempt to settle their disputes through consultations. If these fail, the member initiating a dispute may request the establishment of a dispute settlement panel composed of trade experts to determine whether a country has violated WTO rules.81 In October, China requested the formation of a panel.82 Other WTO members have requested consultations with the United States, or joined existing requests, with some also requesting to move to the panel stage (see Figure 5).

In its request, China alleged that the U.S. tariff measures and exemptions are contrary to U.S. obligations under several provisions of the GATT, the foundational WTO agreement that sets forth binding international rules on international trade in goods.83 In particular, China alleged that the measure violates GATT Article II, which generally prohibits members from imposing duties on imported goods in excess of upper limits to which they agreed in their Schedules of Concessions and Commitments.84 It further alleged that Commerce's granting of exemptions from the import tariffs to some WTO member countries, but not to China, violates GATT Article I, which obligates the United States to treat China's goods no less favorably than the goods of other WTO members (i.e., most-favored-nation treatment).85 China also maintained that the Section 232 tariff measures are "in substance" a safeguards measure intended to alleviate injury to a domestic industry from increased quantities of imported steel that competes with domestic steel, but that the United States did not make the proper findings and follow the proper procedures for imposing such a measure as required by the GATT and WTO Safeguards Agreement.86

As of August 20, 2018 |

|

|

Source: CRS based on WTO filings. Notes: * indicates request for establishment of dispute settlement panel. |

Source: CRS analysis of Global Trade Atlas IHS Markit trade data. Retaliatory tariff lists sourced from WTO notifications and partner country notifications. See footnote footnote 88 for complete sourcing. Notes: U.S. exports approximated by using partner country import data. U.S. Section 232 actions target steel and aluminum imports, and steel and aluminum are among the top exports facing retaliation by several U.S. trading partners as highlighted above. (*) June 5, 2018, for the majority of products, with remaining effective July 5, 2018. (**) Turkey announced on August 18, 2018, an increase in its retaliatory tariff rates, in response to the Trump Administration's decision to increase the U.S. tariffs on Turkish steel to 50%. It is unclear from the notice when these additional tariff rates went fully into effect. (***) Russia published its list of retaliatory tariffs rates and products on July 6, 2018. The tariffs appear to have gone into effect within 30 days of the publication. The retaliatory actions of U.S. trading partners to date have been notified to the WTO pursuant to the Agreement on Safeguards. These retaliatory notifications are in addition to ongoing WTO dispute settlement proceedings (see "WTO Cases "). FTA partner countries may also claim that the increase in U.S. tariff rates violates U.S. FTA commitments and seek recourse through those agreements. For example, Canada and Mexico, U.S. partners in NAFTA, claim that the U.S. actions violate commitments in both NAFTA and the WTO agreements. Canada initially announced its intent to launch a dispute under the NAFTA's dispute settlement provisions in addition to actions at the WTO, although it appears Canada has taken no such action to date.91 U.S. trading partners' retaliation to the Trump Administration's Section 232 tariff actions has magnified the effects of the Section 232 tariffs. From an economic perspective, retaliation increases the scope of industries affected by the tariffs. U.S. agriculture exports, for example, are among the largest categories of U.S. exports targeted for retaliation, which may have contributed to reduced sales of certain U.S. farm products.92 Given the scale of U.S. motor vehicle and parts imports, if the Trump Administration moves forward with Section 232 tariffs on that sector and U.S. trading partners respond with retaliation of a similar magnitude, it could have significant negative effects on U.S. exporters. For example, the United States imported more than $50 billion of motor vehicles and parts from the EU in 2018,93 and the EU has announced it has prepared potential retaliatory tariffs on a commensurate value of U.S. exports.94 Retaliatory actions may also heighten concerns over the potential strain the Section 232 tariffs place on the international trading system. Many U.S. trading partners view the Section 232 actions as protectionist and in violation of U.S. commitments at the WTO and in U.S. FTAs, while the Trump Administration views the actions within its rights under those same commitments.95 Furthermore, the Trump Administration argues that retaliation to its Section 232 tariffs, which U.S. trading partners have imposed under WTO safeguard commitments, violates WTO rules because it has imposed Section 232 tariffs pursuant to WTO national security exceptions. If the dispute settlement process in those agreements cannot satisfactorily resolve this conflict, it could lead to further unilateral actions and increasing retaliation. The President's actions under Section 232 have resulted in legal challenges in the U.S. domestic court system. Specifically, the Section 232 actions on steel and aluminum have been challenged in cases before the U.S. Court of International Trade (CIT). In one case, Severstal Export Gmbh, a U.S. subsidiary of a Russian steel producer, sought a preliminary injunction from the United States Court of International Trade to prevent the United States from collecting the import tariffs on certain steel products.96 The company and its Swiss affiliate argued that the President acted outside of the authority that Congress had delegated to him because the tariffs were not truly imposed for national security purposes.97 The court denied the motion, determining that the plaintiffs were unlikely to prevail on the merits of their challenge.98 According to the case docket, the parties agreed to dismiss the case in May 2018. In another case, which was heard by a three-judge panel of the court, the American Institute for International Steel (AIIS), a trade association, challenged the constitutionality of Congress's delegation of authority to the President under Section 232.99 The plaintiffs in the case argued that "Congress created an unconstitutional regime in section 232, in which there are essentially no limits or guidelines on the trigger or the remedies available to the President, and no alternative protections to assure that the President stays within the law, instead of making the law himself."100 On March 25, 2019, the court issued an opinion rejecting the plaintiffs' arguments that Congress delegated too much of its legislative power to the President in Section 232, in violation of the separation of powers established in the Constitution.101 In granting the United States' motion for judgment on the pleadings, the court held that it was bound by a 1976 Supreme Court precedent determining that Section 232 did not amount to an unconstitutional delegation because it established an "intelligible principle" to guide presidential action.102 One member of the three-judge panel, Judge Katzmann, wrote separately to express his significant concerns about the ruling without openly dissenting.103 Katzmann wrote that he was bound to follow Supreme Court precedent and uphold the delegation but questioned whether the nondelegation doctrine retained any significant meaning if a delegation as broad as that in Section 232 was permissible.104 The case is currently under appeal. Most recently, U.S. importers of Turkish steel have initiated a case arguing that the President's increase of the Section 232 steel tariffs from 25% to 50% on U.S. imports from Turkey did not have a sufficient national security rationale, did not follow statutory procedural mandates, and violates the plaintiffs' Fifth Amendment Due Process rights because the action "creates an arbitrary distinction between importers of steel products from Turkey and importers of steel products from all other sources."105 The case remains pending before the CIT. In its request, China alleged that the U.S. tariff measures and exemptions are contrary to U.S. obligations under several provisions of the GATT, the foundational WTO agreement that sets forth binding international rules on international trade in goods.110 In particular, China alleged that the measure violates GATT Article II, which generally prohibits members from imposing duties on imported goods in excess of upper limits to which they agreed in their Schedules of Concessions and Commitments.111 It further alleged that Commerce's granting of exemptions from the import tariffs to some WTO member countries, but not to China, violates GATT Article I, which obligates the United States to treat China's goods no less favorably than the goods of other WTO members (i.e., most-favored-nation treatment).112 China also maintained that the Section 232 tariff measures are "in substance" a safeguards measure intended to alleviate injury to a domestic industry from increased quantities of imported steel that competes with domestic steel, but that the United States did not make the proper findings and follow the proper procedures for imposing such a measure as required by the GATT and WTO Safeguards Agreement.113

Source: CRS based on WTO filings.The United States has invoked the so-called national security exception in GATT Article XXI in defense of the steel and aluminum tariffs. GATT Article XXI states, in relevant part, that the GATT8789 In addition to the national security considerations the Trump Administration has cited as justification for its Section 232 actions, increased tariffs are permitted under these agreements, under specific circumstances, including for example, antidumping tariffs, countervailing duties, and safeguard tariffs.90

The United States has invoked the so-called national security exception in GATT Article XXI in defense of the steel and aluminum tariffs. GATT Article XXI states, in relevant part, that the GATT114 will not

be construed . . . (b) to prevent any [member country] from taking any action which it considers necessary for the protection of its essential security interests

(i) relating to fissionable materials or the materials from which they are derived; (ii) relating to the traffic in arms, ammunition and implements of war and to such traffic in other goods and materials as is carried on directly or indirectly for the purpose of supplying a military establishment; [or]

(iii) taken in time of war or other emergency in international relations. . .

While some analysts argue that a WTO panel may evaluate whether a WTO member's use of the national security exception falls within one of the three provisions listed above, historically, the United States has taken the position that this exception is self-judging—or, in other words, once a WTO member has invoked the exception to justify a measure potentially inconsistent with its WTO obligations, a WTO panel may not proceed to the merits of the dispute and cannot evaluate whether the WTO member's use of the exception is proper.88115 Though this exception has been invoked several times throughout the history of the WTO and its predecessor agreement, the GATT 1947, it has yet to be interpreted by a WTO dispute settlement panel.89116 Accordingly, there is little guidance as to (1) whether a WTO panel would decide, as a threshold matter, that it had the authority to evaluate whether the United States' invocation of the exception was proper; and (2) how a panel might apply the national security exception, if invoked, in any dispute before the WTO involving the new steel and aluminum tariffs.117 In the past, however, WTO members have expressed concern that overuse of the exception will undermine the world trading system because countries might enact a multitude of protectionist measures under the guise of national security.90

If the dispute over steel and aluminum tariffs proceeds to a WTO panel, as some members have requested, and the panel118

If one of the WTO panels renders an adverse decision against the United States, the United States would be expected to remove the tariffs, generally within a reasonable period of time, or face the possibility of paying compensation to the complaining member or being subject to sanctions.91 Such sanctionscountermeasures allowed under the rules.119 Such countermeasures might include the complaining member imposing higher duties on imports of selected products from the United States.92120 However, China has already begun imposing its own duties on selected U.S. exports without awaiting the outcome of a dispute settlement proceeding,93121 perhaps because it often takes years before the WTO's Dispute Settlement Body authorizes a prevailing WTO member to retaliate.94122

In turn, the United States has argued that unilateral imposition of tariffs in response to the U.S. Section 232 measures cannot be justified under WTO rules.95123 On July 16, 2018, the United States filed its own WTO complaints over the retaliatory tariffs imposed by five countries (Canada, China, EU, Mexico, and Turkey) in response to U.S. actions, and in late August filed a similar case against Russia.96

International Efforts to Address Overcapacity

OECD analysis has found that ongoing global steel overcapacity and excess production have been largely caused by government intervention, subsidization, and other market-distorting practices, although these are not the only factors.97 Other reasons for excess capacity include cyclical market downturns. The situation is similar in the aluminum industry, where government financial support for large aluminum stockpiles has delayed the response to lower demand.

Past Administrations have worked to address the issue of steel overcapacity. President George W. Bush, for example, initiated international discussions on global capacity reduction and improved trade discipline in the steel industry as part of his general steel announcement of 2001.98 Other governments agreed to join the Bush Administration in discussing overcapacity and trade issues at the OECD in a process that started in mid-2001. The industrial, steel-producing members of the OECD were joined by major non-OECD steel producers, such as India, Russia, and, during later stages of the talks, China. Negotiations were suspended indefinitely in 2004, and by 2005, the OECD had abandoned its efforts to negotiate an agreement among all major steel-producing countries to ban domestic subsidies for steel mills.

The Obama Administration also participated in international efforts to curb steel imports, including the launch of the G-20 Global Forum on Steel Excess Capacity in 2016, another venue that sought to address the challenges of excess capacity in steel worldwide.99 In December 2016, the G-20 convened its first meeting of more than 30 economies—all G-20 members plus interested OECD members—as a global platform to discuss steel issues among the world's major producers.100 The same year, as part of the U.S.-China Strategic and Economic Dialogue (SE&D) established in 2009, the Obama Administration agreed to address excess steel production and also to communicate and exchange information on surplus production in the aluminum sector.101

In September 2018, the OECD Forum agreed on process that to identify and remove subsidies and take other measures to reduce the global steel overcapacity. The OECD issued a consensus report outlining six principles and specific policy recommendations to address excess steel capacity.102 The USTR, while supportive of the recommendations, questioned the Forum's ability to pursue effective implementation and did not rule out unilateral action.103

The aluminum industry argues it is also suffering because of China's excess production of primary aluminum. According to the aluminum associations of Japan, Europe, Canada, and the United States, global overcapacity amounted to 11 million metric tons in 2017. Akin to the global steel industry, aluminum producers contend that excess production has been largely caused by government intervention, subsidization, and other market-distorting practices, among other factors.104 As noted, the U.S. Aluminum Association and some of its international counterparts seek to establish a global forum to address aluminum excess capacity.

The Trump Administration's Section 232 actions have led multiple U.S. trading partners such as the EU and Canada to initiate their own safeguard investigations to prevent dumping of steel and aluminum exports and protect domestic industries. Unlike the OECD efforts, the individual country safeguard actions are uncoordinated.

In addition to the Section 232 action, the Trump Administration is pursuing joint action on industrial overcapacity in other forums. The USTR, Ambassador Lighthizer, met with his EU and Japanese counterparts in Paris in May 2018, and the three countries agreed to concrete steps to address "nonmarket-oriented policies and practices that lead to severe overcapacity, create unfair competitive conditions for our workers and businesses, hinder the development and use of innovative technologies, and undermine the proper functioning of international trade."105 The ministers agreed to work toward negotiation of new international rules on subsidies and state-owned enterprises and improved compliance with WTO transparency commitments.106 The parties also agreed to cooperate on their concerns with third parties' technology transfer policies and practices107 and issued a joint statement containing a list of factors that identify if market conditions for competition exist.108 The parties continue to work together, aiming to identify signals for nonmarket policies, enhance information sharing, and work with third parties to ensure market economy conditions exist and discussion potential new rules and means of enforcement.109 In addition, in November 2018, the United States, EU, Japan, Argentina and Costa Rica put forward a joint proposal to increase transparency, proposing incentives for compliance or penalties for noncompliance with WTO notification reporting requirements.110 U.S. unilateral actions, however, may limit other countries' willingness to participate in multilateral forums.

Potential Economic Impact