Profiles and Effects of Retaliatory Tariffs on U.S. Agricultural Exports

Countries have imposed tariffs on U.S. agricultural products to retaliate against actions the Trump Administration took in spring 2018 to protect U.S. steel and aluminum producers and in response to Chinese intellectual property rights and technology policies. Since then, more than 800 U.S. food and agricultural products have been subject to retaliatory tariffs from China, the European Union (EU), Turkey, Canada, and Mexico. U.S. exports of those products to the retaliating countries totaled $26.9 billion in 2017, according to USDA export data. The choice of agricultural and food products for retaliatory tariffs likely reflects the large volume of agricultural trade involved and that many of these products can be sourced from non-U.S. trading partners. Such tariff hikes threaten to reduce U.S. agricultural exports.

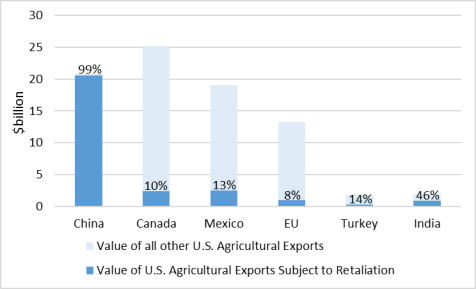

China, which is subject to both the U.S. Section 232 steel and aluminum tariffs and separate Section 301 tariffs aimed as punishment for its handling of U.S. intellectual property rights, has placed retaliatory tariffs on the largest number and highest value of U.S. agricultural and food products. More than 800 products—including soybeans, pork, dairy products, fruits and nuts, seafood, and processed products—accounting for almost all U.S. agricultural and food exports to China in value terms in 2017 (the last full year without retaliatory tariffs) are now subject to additional tariffs of 5%, 10%, 15%, 25%, or a combination of those amounts. U.S. exports to China of those products that are subject to retaliatory tariffs were worth about $20.6 billion in 2017. China has fallen from the leading export market for U.S. agricultural products in FY2017 to the third-leading export market in FY2018 due to the retaliatory tariffs, according to the U.S. Department of Agriculture (USDA). USDA forecasts that China will fall to the fifth-leading market for those products in FY2019.

Canada and Mexico are each targeting about 20 U.S. food and agricultural products, which accounted for approximately $2.6 billion and $2.5 billion in exports to each respective country in 2017. The EU and Turkey have each put retaliatory tariffs on about 40 U.S. agricultural and food products that were valued at about $1 billion and $250 million, respectively, in 2017. India has threatened to impose tariffs on seven U.S. agricultural and food products, which accounted for about $857 million in exports in 2017. U.S. agricultural exports account for about 20% of U.S. farm income, according to USDA. Thus any loss in exports could have negative economic consequences for U.S. farmers.

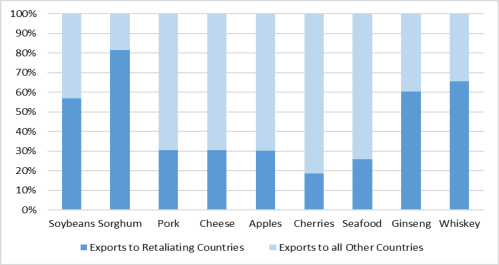

Commodities that are highly dependent on exports to the retaliating markets may be more severely affected than others by any loss of markets from the tariffs. For instance, commodities for which U.S. exports to the retaliating countries represent 30% or more of its total exports include soybeans, sorghum, pork, cheese, apples, cherries, seafood, ginseng, whiskey, and some processed foods. U.S. soybean exports to China for January through October 2018 are 63% lower than during the same time period in 2017—a change due in large part to the tariffs.

USDA is attempting to ease the downside effects of the retaliatory tariffs on farmers and ranchers through a $12 billion trade aid package. Under this initiative, USDA has committed to making direct payments to farmers of selected commodities subject to the tariffs, as well as buying up surplus quantities of some commodities and providing funding for additional trade promotion efforts. In addition, legislation that was introduced in the 115th Congress sought to provide more trade assistance funding for farmers and ranchers, though none of the bills passed.

Profiles and Effects of Retaliatory Tariffs on U.S. Agricultural Exports

Jump to Main Text of Report

Contents

- Overview of Retaliatory Tariffs on U.S. Agricultural and Food Products

- Potential Effects on U.S Agricultural Exports

- The Targeting of Agricultural and Food Products

- Retaliation on U.S. Agricultural Products

- China

- Canada

- Mexico

- European Union

- Turkey

- India

- Key Products Targeted by Retaliatory Tariffs

- Soybeans

- Sorghum

- Pork

- Cheese

- Apples

- Cherries

- Seafood

- Ginseng

- Whiskey

- Processed Products

- Federal Government Response

- U.S. Agriculture's Concerns and Government Response

- Congressional Interest

Figures

Tables

- Table 1. Retaliatory Tariffs on U.S. Agricultural Products in Response to Section 232 Tariffs

- Table 2. China's Retaliatory Tariffs on Top 10 U.S. Agricultural Exports by Value

- Table 3. Canada's Retaliatory Tariffs on Top 10 U.S. Agricultural Exports by Value

- Table 4. Top 10 Mexico's Retaliatory Tariffs on U.S. Agricultural Exports by Value

- Table 5. EU Retaliatory Tariffs on Top 10 U.S. Agricultural Exports by Value

- Table 6. Turkey's Retaliatory Tariffs on Top 10 U.S. Agricultural Exports by Value

- Table 7. India's Proposed Retaliatory Tariffs on U.S. Agricultural Exports by Value

Summary

Countries have imposed tariffs on U.S. agricultural products to retaliate against actions the Trump Administration took in spring 2018 to protect U.S. steel and aluminum producers and in response to Chinese intellectual property rights and technology policies. Since then, more than 800 U.S. food and agricultural products have been subject to retaliatory tariffs from China, the European Union (EU), Turkey, Canada, and Mexico. U.S. exports of those products to the retaliating countries totaled $26.9 billion in 2017, according to USDA export data. The choice of agricultural and food products for retaliatory tariffs likely reflects the large volume of agricultural trade involved and that many of these products can be sourced from non-U.S. trading partners. Such tariff hikes threaten to reduce U.S. agricultural exports.

China, which is subject to both the U.S. Section 232 steel and aluminum tariffs and separate Section 301 tariffs aimed as punishment for its handling of U.S. intellectual property rights, has placed retaliatory tariffs on the largest number and highest value of U.S. agricultural and food products. More than 800 products—including soybeans, pork, dairy products, fruits and nuts, seafood, and processed products—accounting for almost all U.S. agricultural and food exports to China in value terms in 2017 (the last full year without retaliatory tariffs) are now subject to additional tariffs of 5%, 10%, 15%, 25%, or a combination of those amounts. U.S. exports to China of those products that are subject to retaliatory tariffs were worth about $20.6 billion in 2017. China has fallen from the leading export market for U.S. agricultural products in FY2017 to the third-leading export market in FY2018 due to the retaliatory tariffs, according to the U.S. Department of Agriculture (USDA). USDA forecasts that China will fall to the fifth-leading market for those products in FY2019.

Canada and Mexico are each targeting about 20 U.S. food and agricultural products, which accounted for approximately $2.6 billion and $2.5 billion in exports to each respective country in 2017. The EU and Turkey have each put retaliatory tariffs on about 40 U.S. agricultural and food products that were valued at about $1 billion and $250 million, respectively, in 2017. India has threatened to impose tariffs on seven U.S. agricultural and food products, which accounted for about $857 million in exports in 2017. U.S. agricultural exports account for about 20% of U.S. farm income, according to USDA. Thus any loss in exports could have negative economic consequences for U.S. farmers.

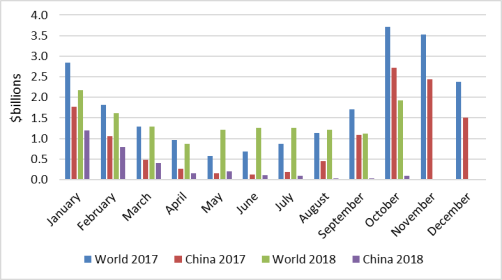

Commodities that are highly dependent on exports to the retaliating markets may be more severely affected than others by any loss of markets from the tariffs. For instance, commodities for which U.S. exports to the retaliating countries represent 30% or more of its total exports include soybeans, sorghum, pork, cheese, apples, cherries, seafood, ginseng, whiskey, and some processed foods. U.S. soybean exports to China for January through October 2018 are 63% lower than during the same time period in 2017—a change due in large part to the tariffs.

USDA is attempting to ease the downside effects of the retaliatory tariffs on farmers and ranchers through a $12 billion trade aid package. Under this initiative, USDA has committed to making direct payments to farmers of selected commodities subject to the tariffs, as well as buying up surplus quantities of some commodities and providing funding for additional trade promotion efforts. In addition, legislation that was introduced in the 115th Congress sought to provide more trade assistance funding for farmers and ranchers, though none of the bills passed.

Several countries have placed tariffs on U.S. agricultural and food products in 2018 to retaliate against trade actions taken by the Trump Administration earlier in the year to protect U.S. aluminum and steel producers from imports and in response to China's intellectual property rights (IPR) and technology policies. China, Canada, Mexico, the European Union (EU), and Turkey have each placed tariffs on a range of U.S. agricultural and food products in response to the decision to levy tariffs on U.S. imports of steel and aluminum. China has also imposed tariffs on additional U.S. agricultural products in retaliation against tariffs the United States imposed on Chinese goods that were in response to concerns about China's treatment of IPR.

In total, the retaliatory tariffs imposed by the five trading partners apply to more than 800 U.S. agricultural and food products, including meats, grains, dairy products, specialty and horticultural crops, seafood, and alcohol.1 The export value of the targeted U.S. agricultural products to the retaliating countries amounted to $26.9 billion in 2017,2 representing 18% of the value of U.S. agricultural and food exports globally.3 Any loss of agricultural exports would be a concern, since about 20% of U.S. farm income stems from exports, according to the U.S. Department of Agriculture (USDA).4

These retaliatory tariffs may adversely impact U.S. farmers, ranchers, and food producers by eroding the competitiveness of U.S. commodities in these important markets. Mexico, Canada, China, and the EU are among the top five export markets for agricultural products in value terms. Increased tariffs on U.S. exports to those markets—even for a short period of time—could mean reduced sales for U.S. farmers, ranchers, and food producers. Should the tariffs remain in place for the long term, U.S. producers could lose market share as buyers seek new suppliers in other countries.

While the retaliating countries have placed tariffs on a wide range of U.S. products, this report focuses only on agricultural and food products.

|

Differences Between This Report and USDA and USTR's Value for Retaliation USDA and the Office of the U.S. Trade Representative (USTR) have calculated that U.S. agricultural exports subject to retaliatory tariffs totaled $29.7 billion in 2017. This amount differs from the value of products subject to retaliation detailed in this report—$26.9 billion—for several reasons. Chief among these is that USDA and USTR have used import data from the retaliating countries to arrive at the total value of products subject to retaliation. Moreover, the $29.7 billion figure issued by USDA and USTR employs the World Trade Organization definition of agriculture, which differs somewhat from the list of food and agricultural products that is used in this report, which is detailed in footnote 2. The $26.9 billion figure referenced in this report is based on USDA export data to allow for consistency in comparing the value of U.S. exports to retaliating countries with total U.S. exports. |

Overview of Retaliatory Tariffs on U.S. Agricultural and Food Products

On March 23, 2018, the Trump Administration applied a 25% tariff to all U.S. steel imports and a 10% tariff to all U.S. aluminum imports, citing an investigation under Section 232 of the Trade Expansion Act of 19625 that showed national security concerns (see text box below). Canada, China, Mexico, the EU, and Turkey retaliated with tariffs on imports of U.S. agricultural and food products and other goods (see Table 1). India has proposed retaliatory tariffs on U.S. apples, almonds, walnuts, chickpeas, and lentils, but it has delayed implementation pending ongoing negotiations with the Trump Administration.6

|

Section 232 and Section 301 Trade Actions Retaliatory tariffs on U.S. agricultural and food products are in response to actions by the Trump Administration under Section 232 of the Trade Expansion Act of 1962 and Section 301 of the Trade Act of 1974. Section 232 allows the President to adjust imports of products the U.S. Department of Commerce finds to be a potential threat to U.S. national security. In April 2017, the Trump Administration initiated Section 232 investigations on U.S. steel and aluminum imports following long-standing concerns about global overcapacity. Effective March 23, 2018, President Trump applied 25% and 10% tariffs, respectively, on certain steel and aluminum imports. Brazil, South Korea, Argentina, and Australia have been granted exemptions to the tariffs. Section 301 allows USTR to suspend trade agreement concessions or impose import restrictions if it determines that a U.S. trading partner is violating trade agreement commitments or engaging in discriminatory or unreasonable practices that burden or restrict U.S. commerce. On July 6, 2018, the United States imposed 25% ad valorem tariffs on $34 billion worth of Chinese goods after finding four Chinese intellectual property and innovation policies harmful to the U.S. economy. On August 23, 2018, it raised tariffs on an additional $16 billion worth of Chinese products. Subsequently, on September 18, 2018, additional tariffs were announced on another $200 billion worth of Chinese imports. China retaliated by levying tariffs on $60 billion of U.S. exports, including nonagricultural products. Sources: CRS In Focus IF10708, Enforcing U.S. Trade Laws: Section 301 and China; CRS Report R45249, Section 232 Investigations: Overview and Issues for Congress. |

|

Country |

Approximate number of HTSa codes Targeted |

Retaliatory Tariff Range |

Effective Date |

Products Affected |

|

China |

90 510 360 |

15% or 25% 25% 5%, 10%, 15%, 20%, 25% |

July 6, 2018 September 24, 2018 |

All agricultural product categories |

|

Canada |

24 |

10% |

July 1, 2018 |

Roasted coffee, prepared meats and poultry, sugar products, prepared fruits and vegetables, miscellaneous prepared foods, whiskey |

|

Mexico |

16 |

15%-25% |

June 5, 2018 |

Pork, cheese, apples, prepared fruits and vegetables, whiskey |

|

EU |

40 |

25% |

June 22, 2018 |

Prepared vegetables and legumes, grains, fruit juice, peanut butter, whiskey |

|

Turkey |

40 |

20%-140% |

June 21, 2018 |

Tree nuts, rice, miscellaneous prepared foods, whiskey, tobacco |

|

India |

7 |

10%-25% |

Proposed implementation on January 31, 2018 |

Legumes, tree nuts, apples |

Source: FAS, China Responds to U.S. 301 Announcement with Revised Product List, GAIN Report CH18034, June 21, 2018; FAS, China Announces Supplemental Tariffs in Response to U.S. 301 Tariffs, GAIN Report CH18034, August 6, 2018; FAS, EU Imposes Additional Tariffs on U.S. Products, GAIN Report E18045, June 21, 2018; FAS, Turkey Introduces New Additional Levy on U.S. Products, GAIN Report TR8018, June 28, 2018; Department of Finance, Canada, Notice of Intent to Impose Countermeasures Action Against the United States in Response to Tariffs on Canadian Steel And Aluminum Products, May 31, 2018; FAS, Mexico Announces Retaliatory Tariffs, GAIN Report MX8028, June 6, 2018; and India, Immediate Notification Under Article 12.5 of the Agreement on Safeguards to the Council for Trade in Goods of Proposed Suspension of Concessions and other Obligations Referred to in Paragraph 2 of Article 8 of the Agreement on Safeguards, May 18, 2018.

Notes: Mexico had a phase-in period for its retaliatory tariffs on fresh and chilled pork and some cheese products. Tariffs of 10% on fresh and chilled pork meat, 15% on fresh cheeses, and 10% on grated and other cheeses went into effect on June 5, 2018. They were increased to the full tariff rates of either 20% or 25% on July 5, 2018.

China also placed retaliatory tariffs on more than 800 U.S. agricultural and food products in response to U.S. tariffs on hundreds of Chinese products stemming from the Section 301 investigation into China's IPR policies. China's first retaliatory tariff list in response to the Section 301 trade actions targeted about 510 U.S. food and agricultural products and became effective on July 6, 2018.7 An additional list of retaliatory tariffs on more than 360 U.S. food and agricultural products went into effect on September 24, 2018.8

All told, across the five retaliating trading partners, retaliatory tariffs have targeted more than 800 U.S. agricultural and food products. Exports of those products to these trading partners amounted to $26.9 billion in 2017, or about 18% of global U.S. agricultural and food product exports of $150.8 billion that year.9

Potential Effects on U.S Agricultural Exports

Tariff rates are only one of numerous variables affecting agricultural exports. These variables include production of traded commodities in both exporting and importing countries and market prices for these commodities; exchange rates, GDP, and economic growth in importing countries; and the availability of alternative suppliers.

USDA forecasts a decrease in the value of total U.S. agricultural exports for FY2019 of $1.9 billion from FY2018 exports of $143.4 billion.10 The forecast decrease compared with FY2018 reflects mainly reduced soybean exports due to the retaliatory tariffs and reduced cotton exports due to slowing global demand.

A study from Purdue University that aims to estimate the effects of the U.S.-Mexico-Canada Agreement found that U.S. agricultural exports could be reduced by as much as $8 billion after markets have adjusted to the retaliatory tariffs in the near future. The study uses 2014 data as the base case and assumes the long-term continuation of all of the retaliatory tariffs but does not include time frames for losses.11 The study also projects that the reduction in U.S. agricultural exports could also lower agricultural land prices and result in the reallocation of 45,000 farm, ranch, and processing workers. Additionally, the authors suggest that soybean producers will see the most change in the wake of tariff retaliation, with exports potentially falling by 21% and land prices declining by about 18%.12

The Targeting of Agricultural and Food Products

The retaliating trade partners may have targeted U.S. agricultural and food products for several reasons. For one, the United States exports a large amount of agricultural and food products to the retaliating countries. Also, U.S. agricultural exports account for about 20% of U.S. farm income, according to the USDA. Further, many of the targeted agricultural and food products are produced in other exporting countries, giving importing countries alternative sources for those products. For example, while the United States is a leading soybean exporter, Brazil, Argentina, and Paraguay also produce significant exportable quantities of that crop. Thus, China can turn to these alternative suppliers for soybeans.

Retaliation on U.S. Agricultural Products

The retaliating countries are also some of the leading U.S. agricultural and food export markets.13 Canada is the leading export market by value for U.S. agricultural and food products, while China ranks second, Mexico third, and the EU fifth. While Canada is forecast to remain the top export market for U.S. agricultural and food products by value in FY2019, USDA expects that China's rank will drop from second to fifth. Mexico, the EU, and Japan are forecast to rank, respectively, as the second-, third-, and fourth-leading export markets in FY2019, according to USDA.14

The targeted countries and the EU are retaliating largely in proportion to the total value of their exports that have been subjected to Section 232 and Section 301 tariff actions of the Trump Administration.15 China, which is subject to the largest number of new tariffs, has countered by placing tariffs on almost all of its agricultural and food imports from the United States (see Figure 1). Turkey, Canada, and Mexico have each levied tariffs on between 10% and 14% of U.S. agricultural and food exports.16 Thus far, the EU has fixed retaliatory tariffs on 8% of U.S. agricultural and food exports.

China

China is subject to both the U.S. Section 232 and Section 301 tariffs and has responded with the most expansive list of retaliatory tariffs of all of the retaliating countries. China has levied tariffs of 5%, 10%, 15%, 20%, 25%, or a combination of those amounts on more than 800 U.S. food and agricultural products that were worth about $20.6 billion in calendar year (CY) 2017. These products accounted for almost all of the $20.8 billion worth of food and agricultural imports from the United States that year.17 The products subject to retaliatory tariffs span all agricultural and food categories, including grains, meat and animal products, fruits and vegetables, seafood, and processed foods.

On December 1, 2018, President Trump met with Chinese President Xi Jinping, and, according to the White House, the two heads of state agreed to halt any escalation of trade tensions for 90 days, delaying another round of expected U.S. tariffs on Chinese products. As part of the agreement, China committed to immediately begin purchasing "very substantial" quantities of U.S. agricultural products, including soybeans.18 While details for most of those purchases have not been made public, on December 13, 2018, USDA reported the sale of 1.1 million metric tons of soybeans to China, followed by two more sales later that month, marking the first U.S. soybean sales to China since the tariffs went into effect in July.19

A list of the 10 leading U.S. food and agricultural exports to China in 2017 is provided in Table 2, along with the prior tariff rate for each product or products and the new overall tariff rate.

|

Listed HTS Code |

Product Description |

2017 Exports to China |

Total 2017 U.S. Exports |

Share of 2017 U.S. Exports |

Prior Tariffa |

New Tariff Rate |

|

in $thousands |

Percent |

|||||

|

12019010, 12019020 |

Yellow soybeans and black soybeans |

12,252,668 |

21,582,206 |

57 |

3 |

28 |

|

52010000 |

Cotton, not carded or combed |

971,297 |

5,828,263 |

17 |

1 IQ, 40 OQb |

26 IQ, 65 OQ |

|

10079000 |

Grain sorghum |

835,656 |

1,026,657 |

81 |

2 |

27 |

|

41015019 |

Whole raw hides and skins of bovine animals, not having undergone a reversible tanning process, of a weight >16kg |

801,946 |

1,336,643 |

60 |

5 |

10 |

|

12149000 |

Forage products, nesoic |

377,210 |

1,393,158 |

27 |

7 |

32 |

|

10019900 |

Other wheat and meslin |

348,727 |

5,990,891 |

6 |

1 IQ, 65 OQ |

26 IQ, 90 OQ |

|

03031200 |

Frozen other Pacific salmon |

274,906 |

426,787 |

64 |

7 |

32 |

|

02064900 |

Other edible offal of swine, frozen |

250,637 |

804,083 |

31 |

12 |

62 |

|

04041000 |

Whey and modified whey |

235,154 |

624,065 |

38 |

2 |

27 |

|

05040011, 05040012, 05040029, 05040021 |

Hog and sheep casings, salted, and gizzard of other animals |

182,953 |

526,453 |

35 |

18-20, 1 CNY per kg |

43-45, 1 CNY per kg + 25% |

Source: Export values from USDA Global Agricultural Trade System, complied by CRS. Tariff information from USDA Global Agricultural Information Network reports: "China Responds to U.S. 301 Announcement with Revised Product List" (June 21, 2018), and "China Announces Supplemental Tariffs in Response to U.S. 301 Tariffs" (August 6, 2018).

Notes: The products listed account for 81% of the value of all of the U.S. agricultural and food products subject to China's retaliatory tariffs.

a. Some products have a per-unit tariff.

b. IQ= in quota, OQ=out of quota, CNY= Chinese yuan.

c. Nesoi is an acronym for "not elsewhere specified or included."

In November 2018, USDA forecast that U.S. agricultural and food exports to China would decline to $9 billion in FY2019 from $16.3 billion in FY2018 and $21.8 billion in FY2017, citing reduced exports due to the "trade tensions" between the United States and China.20

Canada

Canada, which ranked as the leading export market by value for U.S. agricultural and food products in 2017, has levied retaliatory tariffs of 10% on more than 20 U.S. agricultural and food products.21 These products, most of which are processed food items, previously had duty-free status under the terms of the North American Free Trade Agreement (NAFTA).22 U.S. exports of the retaliatory-tariff-affected products to Canada were valued at $2.6 billion in 2017, representing 10% of the $25.4 billion in total U.S. exports of agricultural and food products to Canada that year. U.S. exports to Canada of roasted coffee, ketchup, various beverage waters, liquorice and toffee, and orange juice accounted for 50% or more of the total value of U.S. exports for each product that year (see Table 3).

|

Listed HTS Code |

Product Description |

2017 Exports to Canada |

Total 2017 U.S. Exports |

Share of 2017 U.S. Exports |

Prior Tariff |

New Tariff Rate |

|

in $thousands |

Percent |

|||||

|

09012100 |

Roasted coffee, not decaffeinated |

423,866 |

637,686 |

66 |

0 |

10 |

|

21039000 |

Mayonnaise, salad dressing, mixed condiments and mixed seasonings, other sauces |

423,204 |

1,225,868 |

35 |

0 |

10 |

|

21032000 |

Tomato ketchup and other tomato sauces |

217,658 |

365,936 |

59 |

0 |

10 |

|

22021000 |

Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavored |

202,581 |

377,640 |

54 |

0 |

10 |

|

21041000 |

Soups and broths and preparations |

163,802 |

446,226 |

37 |

0 |

10 |

|

17049020 |

Liquorice candy, toffee |

148,131 |

295,735 |

50 |

0 |

10 |

|

20091200 |

Orange juice, not frozen, of a Brix value <20 |

143,718 |

173,155 |

83 |

0 |

10 |

|

17049090 |

Other sugar confectionery (including white chocolate) not containing cocoa |

140,205 |

210,377 |

67 |

0 |

10 |

|

16025099 |

Other prepared or preserved meat of bovine, other than in cans or glass jars |

136,017 |

178,623 |

76 |

0 |

10 |

|

16023211, 16023292 |

Other prepared chicken |

127,582 |

300,668 |

42 |

0 |

10 |

Source: Department of Finance, Canada, Notice of intent to impose countermeasures action against the United States in response to tariffs on Canadian steel and aluminum products, May 31, 2018. USDA GATS.

Notes: These products account for 82% of the value of all of the U.S. agricultural and food products subject to Canada's retaliatory tariffs.

Despite the retaliatory tariffs, USDA projects that U.S. agricultural and food exports to Canada will increase by about $1 billion in FY2019 from $20.5 billion in FY2018.23

Mexico

Mexico ranked as the third-leading export market for U.S. agricultural and food products by value in 2017. Mexico has placed retaliatory tariffs of 15%, 20%, and 25% on a range of U.S. products (see Table 4)24 that are otherwise duty-free under NAFTA. U.S. exports to Mexico of agricultural and food products that are subject to tariff retaliation amounted to approximately $2.5 billion in 2017, representing 13% of total U.S. agricultural exports to Mexico of $19 billion that year.25

|

Listed HTS Code |

Product Description |

2017 Exports to Mexico |

Total 2017 U.S. Exports |

Share of 2017 U.S. Exports |

Prior Tariff |

New Tariff Rate |

|

in $thousands |

Percent |

|||||

|

02031201 |

Hams, shoulders and cuts thereof, with bone in, fresh or chilled |

777,245 |

822,257 |

95 |

0 |

20 |

|

21069099 |

Prepared foods, other |

440,191 |

4,693,746 |

9 |

0 |

15 |

|

08081001 |

Apples |

274,795 |

969,499 |

28 |

0 |

20 |

|

02031999 |

Other meat of swine, fresh or chilled |

211,027 |

1,596,785 |

13 |

0 |

20 |

|

04062001 |

Grated or powdered cheese |

181,158 |

432,624 |

42 |

0 |

20 |

|

Cheese, nesoi |

164,876 |

457,513 |

36 |

0 |

20, 25 |

|

|

20041001 |

Potatoes, frozen, prepared |

146,172 |

1,133,842 |

13 |

0 |

20 |

|

02032999 |

Other meat of swine, frozen |

110,600 |

1,925,653 |

6 |

0 |

20 |

|

16010002 |

Pork sausage casings |

47,921 |

388,926 |

12 |

0 |

15 |

|

02032201 |

Frozen ham shoulders |

47,091 |

201,550 |

23 |

0 |

20 |

Source: FAS, Mexico Announces Retaliatory Tariffs, GAIN Report MX8028, June 6, 2018; GATS.

Notes: These products account for 96% of the value of all of the U.S. agricultural and food products subject to Mexico's retaliatory tariffs.

a. Products under Mexico HTS code 04069004 that are subject to a 20% retaliatory tariff include Grana or Parmegiano-Reggiano Danbo, Edam, Fontal, Fontina, Fynbo, Gouda, Havarti, Maribo, Samsoe, Esrom, Italic, Kernhem, SaintNectaire, Saint-Paulin, or Taleggio. All other U.S. cheeses are subject to a 25% tariff.

b. Products under Mexico HTS code 04069099 include other cheeses. These products are subject to a 20% retaliatory tariff.

Mexico ranked as the top export market by value for U.S. cheese overall and the second-leading foreign market for U.S. pork exports. About 95% by value of U.S. fresh or chilled ham shoulder exports were shipped to Mexico in 2017, as was 42% of U.S. grated and powdered cheese exports that year. U.S. exports of these two products to Mexico were worth almost $1 billion in 2017.

Despite the decline in exports of pork, cheese, and other products since the retaliatory tariffs took effect in June, USDA projects that total U.S. agricultural exports to Mexico in FY2019 will register an increase of $900 million over FY2018 exports of $18.8 billion, reflecting expected increases in sales of wheat and soybeans.26

European Union

The EU has levied a 25% tariff on a small number of U.S. exports of prepared vegetables and legumes, grains, fruit juice, peanut butter, and whiskey, which together amounted to $1 billion of the $13.2 billion of total U.S. agricultural and food exports to the EU in 2017.27 U.S. exports of whiskey to the EU, which totaled $667 million in 2017, topped the list of affected products (see Table 5). Exports of U.S. whiskey to the EU comprised 59% of the $1.1 billion in total U.S. bourbon and nonbourbon whiskey exports. The new tariff on U.S. whiskey is 25%, compared with a zero tariff rate prior to the Administration's trade actions. U.S. kidney bean and cranberry juice exports are among the tariff-affected products for which the EU has been a major export market and could be negatively affected by the tariffs. In 2017, the EU absorbed 44% of all U.S. kidney bean exports and 65% of total U.S. cranberry juice exports in value terms.

|

Listed HTS Code |

Product Description |

2017 Exports to EU |

Total 2017 U.S. Exports |

Share of 2017 U.S. Exports |

Prior Tariff |

New Tariff Rate |

|

in $thousands |

Percent |

|||||

|

22083082, 22083088 |

Whisky, excluding bourbon |

512,950 |

768,724 |

67 |

0 |

25 |

|

22083011, 22083019 |

Bourbon whiskey |

154,192 |

361,602 |

43 |

0 |

25 |

|

10059000 |

Feed corn |

113,159 |

9,118,803 |

1 |

0 |

25 |

|

07133390 |

Kidney beans |

97,680 |

219,751 |

44 |

0 |

25 |

|

20098100 |

Cranberry juice |

41,051 |

63,314 |

65 |

14-34 |

39-59 |

|

10063000 |

Rice, semi-milled |

39,002 |

1,108,495 |

4 |

0 |

25 |

|

20081110 |

Peanut butter |

26,121 |

140,341 |

19 |

13 |

38 |

|

19041030 |

Prepared foods obtained by the swelling or roasting of cereals or cereal products |

10,989 |

481,895 |

2 |

5 |

30 |

|

20019030 |

Sweet corn, prepared or preserved by vinegar or acetic acid |

3,676 |

74,238 |

5 |

5 |

30 |

|

20058000 |

Sweet corn, prepared or preserved otherwise than by vinegar or acetic acid, not frozen |

3,534 |

109,693 |

3 |

5 |

30 |

Source: FAS, EU Imposes Additional Tariffs on U.S. Products, GAIN Report E18045, June 21, 2018; GATS.

Notes: The products listed account for 99.6% of the value of all of the U.S. agricultural and food products subject to the EU's retaliatory tariffs.

Despite the new tariffs, USDA projects that overall U.S. agricultural and food exports to the EU will rise to $13.4 billion in FY2019—an increase of about $700 million over FY2018—due to expected stronger demand for soybeans, soybean meal, and tree nuts.28

Turkey

Turkey has put retaliatory tariffs of 5%, 10%, 20%, 25%, and 40% on about $250 million of U.S. exports, representing about 15% of the total $1.8 billion of U.S. agricultural and food exports to Turkey in 2017.29 Turkey has imposed retaliatory tariffs on tree nuts, rice, prepared foods, whiskey, and unmanufactured tobacco. The majority of the U.S. agricultural products subject to Turkey's retaliatory tariffs are exported there in limited quantities compared with total U.S. exports, but unshelled walnut exports to Turkey represented 23% of total U.S. unshelled walnut exports of $511 million in 2017 (see Table 6).

|

Listed HTS Code |

Product Description |

2017 Exports to Turkey |

Total 2017 U.S. Exports |

Share of 2017 U.S. Exports |

Prior Tariff |

New Tariff Rate |

|

in $thousands |

Percent |

|||||

|

08023100 |

Walnuts, in shell |

115,456 |

511,175 |

23 |

15 |

20 |

|

08025100 |

Pistachios, in shell |

23,094 |

1,352,234 |

2 |

43 |

48 |

|

21069066 |

Edible preparations, not containing sugar, not canned or frozen |

19,255 |

3,247,180 |

1 |

9 |

19 |

|

24012080 |

Cigarette leaf tobacco, burley, threshed or similarly processed, partly/wholly stemmed/stripped |

16,584 |

121,636 |

14 |

25 |

50 |

|

24012080 |

Cigarette leaf tobacco, flue-cured, threshed or similarly processed, partly/wholly stemmed/stripped |

14,019 |

558,125 |

3 |

25 |

50 |

|

22083090 |

Whiskies, excluding bourbon |

13,668 |

768,724 |

2 |

0 |

40 |

|

08025200 |

Pistachios, shelled |

11,285 |

65,254 |

17 |

43 |

48 |

|

10063090 |

Rice, medium grain, milled |

10,665 |

481,961 |

2 |

15 |

35 |

|

08023200 |

Walnuts, shelled |

9,735 |

858,435 |

1 |

15 |

20 |

|

10061000 |

Rice, in husk |

9,493 |

433,089 |

2 |

5 |

25 |

Source: FAS, Turkey Introduces New Additional Levy on U.S. Products, GAIN Report TR8018, June 28, 2018; GATS.

Notes: The products listed account for 97% of the value of all of the U.S. agricultural and food products subject to Turkey's retaliatory tariffs.

In November 2018, USDA projected that total U.S. agricultural and food exports to Turkey would amount to $1.5 billion in FY2019, which reflects a decline of $200 million from FY2018.30

India

In response to the tariffs the Trump Administration levied on U.S. imports of steel and aluminum from India earlier this year, India has threatened to impose retaliatory tariffs on a handful of U.S. agricultural and food products (see Table 7). The date for imposing these tariffs has been pushed back several times, and they are currently set to become effective on January 31, 2019.31 U.S. exports of the targeted products were valued at $857 million in 2017, comprising 54% of the $1.8 billion of total U.S. agricultural exports to India. U.S. almond growers, in particular, could feel the effects of India's threatened tariffs should they enter into force. Of the $1 billion in U.S. unshelled almond exports to all destinations in 2017, $584 million were shipped to India. Under the proposed tariffs, India would raise its existing tariff on U.S. unshelled almonds by 20%.

|

Listed HTS Code |

Product Description |

2017 Exports to India |

Total 2017 U.S. Exports |

Share of 2017 U.S. Exports |

Current Tariffa |

Proposed Tariff Rate |

|

in $thousands |

Percent |

|||||

|

08021100 |

Almonds, in shell |

583,868 |

1,079,181 |

54 |

35 INR per kg |

42 INR per kg |

|

08081000 |

Apples |

96,798 |

969,499 |

10 |

50 |

75 |

|

08021200 |

Almonds, shelled |

74,331 |

3,262,286 |

2 |

100 INR per kg |

120 INR per kg |

|

08023100 |

Walnuts, in shell |

58,627 |

511,175 |

11 |

100 |

120 |

|

07132000 |

Chickpeas, dried and shelled |

27,110 |

168,972 |

16 |

60 |

70 |

|

07134000 |

Lentils, dried and shelled |

16,169 |

218,307 |

7 |

30 |

40 |

Source: India, Immediate Notification Under Article 12.5 of the Agreement on Safeguards to the Council for Trade in Goods of Proposed Suspension of Concessions and other Obligations Referred to in Paragraph 2 of Article 8 of the Agreement on Safeguards, June 14, 2018; GATS. USDA, Tariff Hike on U.S. Agricultural Products Deferred to November 2, GAIN Report IN8108, September 21, 2018. INR= Indian rupee.

Notes:

Key Products Targeted by Retaliatory Tariffs

Some of the retaliatory tariffs have been placed on U.S. products that have not been exported to the retaliating country for the past several years or have been exported in small amounts. For example, China has put a 50% retaliatory tariff on U.S. watermelons, even though it did not import more than $1,000 of U.S. watermelons in 2016 or 2017.32 In other cases, the effects have the potential to be more significant, as the retaliating markets represent leading export markets for certain U.S. products that are subject to new tariffs. For example, in 2017 China, Canada, Mexico, the EU, and Turkey accounted for about 20% or more by value of U.S. exports of pork, soybeans, sorghum, cheese, apples, cherries, seafood, ginseng, and whiskey (see Figure 2). This section highlights some of the U.S. agricultural and food product exports subject to retaliatory tariffs.

|

Figure 2. Percentage of Total U.S. Exports for Selected Products to Retaliating Countries, CY2017 |

|

|

Source: Compiled by CRS from GATS, accessed September 5, 2018. |

Soybeans

China has levied retaliatory tariffs of 25% on U.S. soybeans,33 raising the total tariff rate to 27%, effectively curbing access to what was the largest U.S. export market for that crop in 2017. More than half of U.S. soybean exports that year—about $12 billion worth—were destined for China, where they were used largely for animal feed.

About one-half of U.S. soybeans are exported, with China the largest foreign buyer. U.S. soybean exports for January through October 2018 are 63% lower than during that time period in 2017. After China hiked its tariff on U.S. soybeans in early July 2018, U.S. exports to China essentially halted, even as USDA was forecasting a record U.S. soybean crop.34 Meanwhile, China has increased its soybean purchases from Brazil and elsewhere.35 U.S. soybean prices have declined since China's retaliatory tariff took effect, with the reduction in U.S. exports likely contributing to the decline, along with other factors, such as the estimated record U.S. soybean harvest. Between June and late September 2018, the price of U.S. soybeans for export from the Port of New Orleans dropped from $10.89 to $8.68 per bushel due to the tariffs, according to the American Soybean Association (ASA), while the price farmers received could be even lower.36 ASA has expressed "extreme disappointment" at USTR for the escalating tariffs on imports from China which, in turn, led to China's retaliatory tariff on U.S. soybeans.37 In December 2018, China made its first purchases of U.S. soybeans since July following a meeting between President Trump and President Xi.

USDA projects that total U.S. soybean exports in FY2019 may decline by $800 million from the $21 billion in FY2018.38 While U.S. soybean exports to China had all but ceased until December, shipments increased to the EU, Mexico, and Egypt, among other markets. Increased exports to these markets are not expected to entirely offset the loss of sales to China.39 USDA projects an average farm price of soybeans of $7.35-$9.85 per bushel for the 2018/2019 marketing year, which began on October 1, 2018. That would compare with $9.33 per bushel in 2017/2018.40 The midpoint of the 2018/2019 price range is 8% lower than the average price farmers received in 2017/2018, while the lower end of the USDA's price projection for 2018/2019 would amount to a decline of 21%.

Sorghum

China has placed retaliatory tariffs of 25% on U.S. sorghum,41 raising the total tariff rate to 27% and potentially curbing a market that has absorbed about 80% of U.S. sorghum exports in recent years. U.S. sorghum exports to China amounted to $836 million in 2017. Total U.S. sorghum exports for FY2018 were valued at $759 million and are forecast to decline to $500 million in FY2019.42 China imports U.S. sorghum for animal feed, among other uses.

Pork

Mexico and China have each levied retaliatory tariffs on U.S. fresh and frozen pork, potentially impacting up to 30% of U.S. pork exports by value.43 Mexico and China are the second- and fifth-leading markets for U.S. pork exports by value, at $1.1 billion and $237 million in 2017,44 respectively, compared with total U.S. pork exports of $4.6 billion that year. The National Pork Producers Council (NPPC) estimates that exports to China are higher, reflecting the inclusion of reexports from Hong Kong and other factors.45 Some U.S. pork exports to China are subject to an additional 25% retaliatory tariff following the imposition of U.S. Section 232 tariffs on steel and aluminum and an additional 25% retaliatory tariff in response to the U.S. Section 301 tariffs. As a result, Chinese tariffs on some U.S. pork products, such as bone-in hams, now reach 70%. U.S. pork exports to Mexico, which were duty-free under NAFTA, are now subject to a 20% tariff.

U.S. pork exports to both countries have declined since the tariffs were applied. The value of U.S. pork exports to Mexico between January and October 2018 was 9% lower than in the same time period the year before, while U.S. pork exports to China declined by 13% over the same period.46

China is also a leading export market for frozen edible pork offal.47 These products have little value in the U.S. market but command a premium price in China. U.S. pork producers exported $251 million worth of frozen edible pork offal to China in 2017, accounting for 31% of the $805 million in total exports of those products. U.S. frozen pork offal exports to China are now subject to a 50% retaliatory tariff, which is in addition to a preexisting tariff of 12%.

Cheese

Mexico and China have each applied retaliatory tariffs on imports of U.S. cheese, affecting almost one-third of total U.S. cheese exports by value.48 Mexico is the leading export market by value for U.S. cheese, but in the wake of the Trump Administration's trade actions, Mexico replaced its zero duty on U.S. cheese with tariffs of 20% and 25%, depending on the type of cheese. U.S. cheese exports to Mexico of $390 million in 2017 accounted for 27% of the value of all U.S. cheese exports that year. U.S. exports of the tariff-affected cheese to Mexico—including fresh, grated, and certain other cheese products—totaled $379 million in 2017. China has applied a 25% retaliatory tariff to imports of all U.S. cheese types, raising the total tariff rate to 33% for grated cheese, processed cheese, blue veined cheese, and other cheeses and to 37% for fresh cheese. In 2017, China was the destination for $63 million worth of U.S. cheese.

The retaliatory tariffs have contributed to a decline in cheese exports to Mexico and China, according to USDA. The value of U.S. cheese exports to Mexico between July 2018—the month the tariffs took effect—and October 2018 declined by 7% compared with the same period in 2017. The value of U.S. cheese exports to China fell by 51% during this period in 2018 as compared to 2017.49

Apples

U.S. apple exports to Mexico and China are now subject to additional retaliatory tariffs of 20% and 40%, respectively, raising the total tariff rates to 20% and 50%, respectively. The two countries accounted for about 30% of the $969 million of total U.S. apple exports in 2017.50 Mexico was the leading export market by value for U.S. fresh apples, importing $275 million in 2017, or 28% of total U.S. apple exports that year. Under NAFTA, U.S. apples were not subject to import tariffs in Mexico. China opened its market to U.S. apples in 2015, and the U.S. apple industry considers it to be a potential growth market. China imported about $18 million worth of U.S. apples in 2017 when the tariff rate was 10%.

India ranked third as a destination for U.S. apple exports in 2017, purchasing $97 million of U.S. apples, or 10% of total exports. The Indian government proposes to apply a 30% retaliatory tariff on imports of U.S. apples on January 31, 2019.

Cherries

China has imposed a retaliatory tariff of 40% on U.S. cherries, raising the total tariff rate to 50%.51 Demand for cherries has increased in China in recent years, and the United States has been a key source for filling that demand.52 U.S. producers exported $123 million worth of cherries to China in 2017—an increase of 68% over 2016 exports—accounting for 19% of total U.S. cherry exports that year. The steep retaliatory tariff may spur Chinese importers to look for alternative suppliers.53 The value of U.S. cherry exports contracted by 19% in FY2018 from the prior year due in part to China's retaliatory tariff, among other factors.54

Seafood

China has added a retaliatory tariff of 25% to more than 150 varieties of U.S. seafood and seafood products, affecting nearly all of the $1.2 billion U.S. seafood exports to China in 2017.55 China was the destination for about one-quarter of all U.S. seafood exports in 2017 and has been the leading export market for U.S. seafood since 2011. Domestic consumption of higher-value seafood—including such products as salmon, cod, shrimp, and lobster—is increasing in China.56 That trend is expected to continue, but whether U.S. seafood will remain competitive under the weight of China's retaliatory tariff remains to be seen.

Ginseng

Tariffs have also been placed on certain niche agricultural products, such as American Ginseng, that have few markets beyond the retaliating markets, leaving that industry with few foreign market alternatives. China has applied a retaliatory tariff of 25% on imports of U.S. American Ginseng, raising the tariff rate to 32.5% on a product that is largely dependent on export sales.57 In 2017, China purchased 60% of U.S. American Ginseng exports, valued at $22 million. Ginseng is a root that is used in teas and certain other food and medicinal products in Asia. As much as 95% of American Ginseng grown in the United States is produced in Wisconsin, and growers have expressed concern that the tariffs could be detrimental to the industry as China turns to Canadian suppliers.58

Whiskey

U.S. whiskey is the only agricultural and food product to be subject to retaliatory tariffs by all of the retaliating trade partners (see Table 1).59 The EU, which is the destination for $667 million of U.S. whiskey exports, comprising 59% of total exports, has levied a retaliatory tariff of 25% on imports of U.S. whiskey, which were previously duty-free. China has placed a retaliatory tariff of 25% on all U.S. whiskeys, while Turkey has imposed a retaliatory tariff of 40%, and Canada has applied a 10% tariff. Mexico has placed a 25% retaliatory tariff on bourbon whiskey specifically.60 U.S. whiskey exports to the retaliating countries amounted to $742 million in 2017, accounting for 66% of total U.S. whiskey exports of $1.1 billion that year.

Processed Products

U.S. food companies could also see effects from the retaliatory tariffs. Almost all of the retaliating trading partners have levied tariffs on U.S. processed foods, such as juices, candy, preserved fruits and vegetables, jams, soups, and other prepared foods. Canada's tariffs, in particular, have the potential to negatively affect U.S. food manufacturers. All of the $2.6 billion worth of products targeted by Canada's retaliatory tariffs are processed foods, and the Canadian market accounts for more than 50% of total exports for many of those products.

Federal Government Response

On July 24, 2018, Secretary of Agriculture Sonny Perdue announced that USDA would be taking several temporary actions to assist farmers in response to what the Trump Administration has called "unjustified retaliation."61 Specifically, USDA authorized up to $12 billion in financial assistance—referred to as the "trade aid" package—for certain agricultural commodities under Section 5 of the Commodity Credit Corporation Charter Act (15 U.S.C. 714c).62 Most of the money will go to those farm sectors most directly impacted by the trade retaliation—that is, corn, cotton, soybeans, sorghum, wheat, hogs, and dairy—but some funding will also be used for the purchase, distribution, and trade promotion of affected commodities.63

USDA estimates that approximately $9.6 billion would be distributed in MFP payments for corn, cotton, sorghum, soybeans, wheat, dairy, hogs, fresh sweet cherries, and shelled almonds, with over three-fourths ($7.3 billion) of direct payments provided to soybean producers. It also plans to use $1.2 billion to purchase excess supplies of 29 different commodities. Another $200 million will be spent on trade promotion efforts similar to the existing Market Access and Foreign Market Development programs.64 Those programs provide money to eligible groups to help develop foreign markets for various commodity and food products.65 For details on the amounts for the payments and purchases under the trade aid package, see CRS Report R45310, Farm Policy: USDA's Trade Aid Package.

U.S. Agriculture's Concerns and Government Response

Many agricultural groups have expressed concerns about the retaliatory tariffs. Exports account for about 20% of U.S. farm income, according to USDA, so U.S. farmers and ranchers have an interest in both maintaining and expanding export markets.66 Farm groups are concerned about the immediate loss of export sales and the prospect of losing access to markets, or losing market share, over the long term. Over time, importers may identify new suppliers for a given product, as China has done for soybeans. Compounding that problem are new trade deals that are being discussed by the countries retaliating against the United States. The EU-Canada free trade agreement (FTA) went into force in 2017, and the EU has finalized an FTA with Mexico. Mexico and Canada are signatories to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. If this FTA goes into force, Mexico and Canada would have improved access to nine other Pacific Rim markets. This means U.S. agricultural exports could face stiffer competition on its exports to Mexico and Canada.

The ASA has expressed "extreme disappointment" over USTR's escalating tariffs on China that have led to retaliation on soybeans.67 The NPPC has stated that the retaliatory tariffs are "threatening the livelihoods of thousands of U.S. pig farmers."68 The U.S. Dairy Export Council has warned that the retaliatory tariffs that China and Mexico have imposed could result in billions of dollars of lost sales for U.S. dairy producers.69 Farmers for Free Trade—a coalition led by former Senators Max Baucus and Richard Lugar that advocates for free trade and opposes tariffs that injure farmers, ranchers, and rural communities—has run radio, print, and television ads in key markets across the country expressing concern about the Administration's trade policies and the potential economic fallout they may have on U.S. agriculture.

While President Trump and members of his Administration have met with officials from many of the retaliating markets, including Chinese President Xi Jinping and European Commission President Jean-Claude Junker, USDA's trade aid package is the Trump Administration's short-term effort to ease the retaliatory tariffs on U.S. agricultural products. A number of producer groups have indicated that the trade aid package is inadequate to compensate growers for lost export sales. For example, Western Growers, an association that represents specialty crop producers, has stated that the $12 billion plan falls "substantially short" of what many producers affected by the retaliatory tariffs need.70 The American Farm Bureau Federation, the largest general farm organization, concluded that the package provides "some breathing room" for farmers and ranchers but added that it will likely only help producers through a few months.71 In general, numerous farmer and rancher organizations have urged the Administration to resolve the trade concerns that have led to tariff retaliation against U.S. agriculture and food products in order to facilitate the removal of these tariffs.

Congressional Interest

Because of the broad scope of farm products subject to the retaliatory tariffs and the importance of some of the markets involved, many farmers and ranchers are likely to experience some negative effects, such as lower prices or potentially lost market opportunities for their products. The trade aid package that USDA has introduced to help producers mitigate the potential loss of exports due to the tariffs is a limited set of initiatives that are not designed to address potential longer-term downside consequences that may arise, such as lower commodity prices and reduced farm income from lower export sales. Some agriculture industry stakeholders have suggested that the potential effects of the retaliatory tariffs could be longer lasting, because they have created uncertainty about U.S. trade policy behavior and because U.S. actions have called into question the reliability of the United States as a trading partner.72

Several bills introduced in the 115th Congress in both the House and the Senate would have provided more export promotion money and additional adjustment assistance to farmers affected by the retaliatory tariffs, though none passed. Legislation that sought to address the effects of the retaliatory tariffs on agriculture included the following:

- S. 3258 (Heitkamp) and H.R. 6483 (Blunt/Rochester) would have provided trade adjustment assistance to farmers adversely affected by reduced exports resulting from retaliatory tariffs.

- S. 3407 (Heitkamp) and H.R. 6699 (Bustos) would have required that any duties collected as part of the Section 232 or Section 301 tariffs on U.S. imports be provided to the Foreign Market Development Program, the Market Access Program, and the Technical Assistance for Specialty Crops program.

As U.S. farmers and ranchers look to regain or expand existing markets and establish new ones, Members of Congress may consider engaging the Administration through their oversight activities to identify actions that would facilitate additional sales of agricultural products in domestic and export markets and enhance the long-term economic vitality of U.S. food and agricultural interests.

Author Contact Information

Footnotes

| 1. |

A complete list of products subject to retaliatory tariffs is available from the author of this report. |

| 2. |

Unless otherwise specified, agricultural and food product exports for 2017 covered in this report includes most of chapters 1-24 of the U.S. Harmonized Tariff Schedule (HTS), which cover meat, grains, animal feed, dairy, horticultural products, processed foods, unprocessed tobacco, seafood, and alcoholic beverages. The report also includes essential oils in chapter 33; animal hides and skins in chapters 41 and 43; and silk, cotton, and wool in chapters 50, 51, and 52. The data are sourced from the U.S. Department of Agriculture (USDA) Global Agricultural Trade System (GATS). |

| 3. |

Trade data in this report are for the calendar year cited unless otherwise noted. USDA quarterly trade forecasts are reported on a fiscal year basis. |

| 4. |

USDA Foreign Agricultural Service, "U.S. Farm Exports Hit Third-Highest Level on Record," press release, November 16, 2017. |

| 5. |

19 U.S.C. §1862 |

| 6. |

Kirtika Suneja, "India Again Postpones Levying Retaliatory Tariffs on US Goods to Jan 31," Economic Times, December 16, 2018. |

| 7. |

USDA Foreign Agricultural Service (FAS), China Responds to U.S. 301 Announcement with Revised Product List, GAIN Report CH18034, June 21, 2018. |

| 8. |

FAS, China Announces Supplemental Tariffs in Response to U.S. 301 Tariffs, GAIN Report CH18034, August 6, 2018. |

| 9. |

U.S. Census Bureau. Accessed December 12, 2018. |

| 10. |

This export value reflects USDA's FATUS product grouping and does not include all of the food and agricultural products referenced in this report. USDA Economic Research Service (ERS), Outlook for U.S. Agricultural Trade, November 29, 2018. USDA forecasts agricultural trade on a fiscal year basis. |

| 11. |

Maksym Chepeliev et al., "How U.S. Agriculture Will Fare Under the USMCA and Retaliatory Tariffs," Purdue University, Department of Agricultural Economics, October 2018. |

| 12. |

Chepeliev et al., "How U.S. Agriculture Will Fare Under the USMCA and Retaliatory Tariffs." |

| 13. |

This ranking reflects USDA's FATUS product grouping, which does not include seafood and liquor products. |

| 14. |

USDA Economic Research Service (ERS), Outlook for U.S. Agricultural Trade, November 29, 2018. |

| 15. |

The value of U.S. exports that are subject to retaliation in this report reflect tariffs on food and agricultural products. They do not include the value of nonagricultural U.S. exports subject to retaliatory tariffs. |

| 16. |

For this report, CRS compiled a list of all of the products subject to retaliatory tariffs on U.S. agricultural products stemming from the Trump Administration's trade actions. The data comprise HTS codes and product descriptions from retaliation lists produced by China, Turkey, Mexico, Canada, and India or translations of those lists produced by USDA. HTS codes are harmonized among countries to only six digits, while tariffs are commonly set at the eight- or 10-digit levels. As such, some products have been grouped to better reflect USDA export values or to better align with U.S. product descriptions. |

| 17. |

FAS, China Announces Supplemental Tariffs in Response to U.S. 301 Tariffs, GAIN Report CH18043, August 6, 2018. |

| 18. |

The White House, "Statement from the Press Secretary Regarding the President's Working Dinner with China," press release, December 1, 2018, https://www.whitehouse.gov/briefings-statements/statement-press-secretary-regarding-presidents-working-dinner-china/. |

| 19. |

USDA, "Private Exporters Report Sales Activity for China," December 13, 2018. |

| 20. |

ERS, Outlook for U.S. Agricultural Trade, November 29, 2018. USDA's trade forecasts express export values in fiscal years as opposed to calendar years. The trade forecasts also use USDA's definition of agricultural products, which differs from the definition used in this report to quantify U.S. agricultural and food exports in CY2017, as the USDA forecasts do not include seafood and spirits, among other differences. |

| 21. |

For the full list of 229 products—which include more than 200 nonfood and agricultural goods—subject to Canadian retaliatory tariffs, see https://www.fin.gc.ca/activty/consult/cacsap-cmpcaa-eng.asp. |

| 22. |

While the United States, Canada, and Mexico have reached a proposed agreement that would replace NAFTA if Congress approves it, known as the U.S.-Mexico-Canada Agreement (USMCA), it does not remove Section 232 tariffs on Canada and Mexico or retaliatory tariffs levied by those countries on U.S. products. USMCA was signed by the three governments on November 30, 2018, but has not yet entered into force. |

| 23. |

ERS, Outlook for U.S. Agricultural Trade, November 29, 2018. USDA's trade forecasts express export values in fiscal years as opposed to calendar years. The trade forecasts also use USDA's definition of agricultural products, which differs from the definition used in this report to quantify U.S. agricultural and food exports in CY2017, as the USDA forecasts do not include seafood and spirits, among other differences. |

| 24. |

FAS, Mexico Announces Retaliatory Tariffs, GAIN Report MX8028, June 6, 2018. |

| 25. |

GATS. |

| 26. |

ERS, Outlook for U.S. Agricultural Trade, November 29, 2018. USDA's trade forecasts express export values in fiscal years as opposed to calendar years. The trade forecasts also use USDA's definition of agricultural products, which differs from the definition used in this report to quantify U.S. agricultural and food exports in CY2017, as the USDA forecasts do not include seafood and spirits, among other differences. |

| 27. |

FAS, EU Imposes Additional Tariffs on U.S. Products, GAIN Report E18045, June 21, 2018. |

| 28. |

ERS, Outlook for U.S. Agricultural Trade, November 29, 2018. USDA's trade forecasts express export values in fiscal years as opposed to calendar years. The trade forecasts also use USDA's definition of agricultural products, which differs from the definition used in this report to quantify U.S. agricultural and food exports in CY2017, as the USDA forecasts do not include seafood and spirits, among other differences. |

| 29. |

FAS, Turkey Introduces New Additional Levy on U.S. Products, GAIN Report TR8018, June 28, 2018. |

| 30. |

ERS, Outlook for U.S. Agricultural Trade, November 29, 2018. USDA's trade forecasts express export values in fiscal years as opposed to calendar years. The trade forecasts also use USDA's definition of agricultural products, which differs from the definition used in this report to quantify U.S. agricultural and food exports in CY2017, as the USDA forecasts do not include seafood and spirits, among other differences. |

| 31. |

Suneja, "India Again Postpones Levying Retaliatory Tariffs on US Goods to Jan 31." |

| 32. |

GATS, accessed August 20, 2018. |

| 33. |

For the purposes of this section, soybeans refers to products under HTS code 120290. |

| 34. |

USDA National Agricultural Statistics Service, Crop Production, November 8, 2018. |

| 35. |

Karl Plume, "U.S. Soybean Exports Scrapped as China Shifts to Brazilian Beans," Reuters, May 18, 2018. |

| 36. |

ASA, "Escalating Trade War with China Will Increase Damage to American Soybean Farmers," press release, September 24, 2018. |

| 37. |

ASA, "Soy Growers Disappointed in Additional Tariffs, Continue to Seek Export Stability with Largest Customer," press release, July 12, 2018. |

| 38. |

ERS, Outlook for U.S. Agricultural Trade, November 29, 2018. USDA's trade forecasts express export values in fiscal years as opposed to calendar years. The trade forecasts also use USDA's definition of agricultural products, which differs from the definition used in this report to quantify U.S. agricultural and food exports in CY2017, as the USDA forecasts do not include seafood and spirits, among other differences. |

| 39. |

ERS, Oil Crops Outlook; Soybean Growers Face Mounting Storage Issues, October 15, 2018. |

| 40. |

USDA, World Agricultural Outlook Board, World Agricultural Supply and Demand Estimates, October 11, 2018. |

| 41. |

For the purposes of this section, sorghum refers to products under HTS code 100790. |

| 42. |

ERS, Outlook for U.S. Agricultural Trade, November 29, 2018. USDA's trade forecasts express export values in fiscal years as opposed to calendar years. The trade forecasts also use USDA's definition of agricultural products, which differs from the definition used in this report to quantify U.S. agricultural and food exports in CY2017, as the USDA forecasts do not include seafood and spirits, among other differences. |

| 43. |

Unless distinguished otherwise, pork discussed in this section applies to fresh and frozen cuts covered in HTS 0203. The HTS codes for pork subject to the tariffs from Mexico are 020312, 020319, 020322, and 020329. The HTS codes subject to the tariffs from China are 020311, 020312, 020319, 020321, 020322, and 020329. |

| 44. |

GATS, September 5, 2018. |

| 45. |

NPPC, "Chinese Retaliation on U.S. Pork Exports Will Harm the Rural Economy," press release, March 23, 2018. NPPC has said the value of pork products exports to China is about $1.1 billion. Such discrepancies in export values can be due to differences in product classifications and data sources. USDA's classification for pork includes fresh and chilled meat as well as bacon and other preserved and prepared meats and is based on values reported by the U.S. Census Bureau. NPPC used year-to-date Chinese and Hong Kong import data for pork products, which included meat, processed meat, variety meats, and sausage casings. |

| 46. |

GATS. Accessed December 7, 2018. |

| 47. |

For the purposes of this section, frozen swine offal refers to products under HTS code 020649. |

| 48. |

Mexico's retaliatory tariffs on U.S. cheese apply to HTS codes 040610, 040620, and 040690. China's retaliatory tariffs on U.S. cheese apply to HTS codes 040610, 040620, 040630, 040640, and 040690. |

| 49. |

GATS, accessed December 6, 2018. |

| 50. |

For the purposes of this section, apples refer to products under HTS code 080810. |

| 51. |

For the purposes of this section, cherries refers to products under HTS codes 080921 and 080929. |

| 52. |

FAS, China Stone Fruit Annual 2018, GAIN Report CH 18037, June 29, 2018. |

| 53. |

FAS, China Stone Fruit Annual 2018. |

| 54. |

ERS, Fruit and Tree Nuts Outlook, September 27, 2018. |

| 55. |

For the purposes of this section, seafood applies to any product listed in chapter 3, Fish and Crustaceans, Molluscs and Other Aquatic Invertebrates, of the HTS. |

| 56. |

FAS, 2017 China's Fishery Annual, GAIN Report CH17057, December 30, 2017. |

| 57. |

For the purposes of this section, ginseng means any product under HTS code 12112010. |

| 58. |

Ginseng Board of Wisconsin, "Tariff Threatens Strength of Wisconsin Ginseng Industry," press release, April 5, 2018. |

| 59. |

For the purposes of this section, whiskey means any product under HTS code 220830. |

| 60. |

Bourbon whiskey is a corn-based whiskey. About 95% of all Bourbon whiskey is produced in Kentucky, according to the Kentucky Distillers' Association. |

| 61. |

USDA, "USDA Assists Farmers Impacted by Unjustified Retaliation," press release, July 24, 2018. |

| 62. |

The Commodity Credit Corporation (CCC) is a wholly government-owned entity that exists solely to finance authorized programs that support U.S. agriculture. It is subject to the supervision and direction of the Secretary of Agriculture. The CCC funds a broad array of programs, including export and commodity programs, resource conservation, disaster assistance, agricultural research, and bioenergy development. |

| 63. |

For more on the trade aid package, see CRS Report R45310, Farm Policy: USDA's Trade Aid Package. |

| 64. |

For information on these programs, see CRS Report R44985, USDA Export Market Development and Export Credit Programs: Selected Issues. |

| 65. |

See CRS Report R44985, USDA Export Market Development and Export Credit Programs: Selected Issues. |

| 66. |

FAS, "U.S. Farm Exports Hit Third-Highest Level on Record," press release, November 16, 2017. |

| 67. |

ASA, "Soy Growers Disappointed in Additional Tariffs, Continue to Seek Export Stability with Largest Customer," press release, July 12, 2018. |

| 68. |

NPPC, "China Tariffs on U.S. Pork Now Tops 60 Percent; American Pork Producers Face Financial Crisis," press release, July 6, 2018. |

| 69. |

U.S. Dairy Export Council, "Chinese and Mexican Tariffs Will Cost Dairy Industry Billions If Left Unchecked," press release, August 27, 2018. |

| 70. |

Western Growers, "Western Growers Statement on USDA Trade Mitigation Plan," press release, August 28, 2018. |

| 71. |

American Farm Bureau Federation, "Tariff Relief Welcome, Farmers Still Need Open Markets," press release, August 27, 2018. |

| 72. |

Mario Parker et al., "Cargill CEO Sees Risk to U.S. Farmers as China Shuns Soybeans," Bloomberg News, September 25, 2018. |