The Annual Sequester of Mandatory Spending through FY2029

The Budget Control Act of 2011 (BCA; P.L. 112-25) included two parts: discretionary spending caps, plus a “Joint Committee process” to achieve an additional $1.2 trillion in budgetary savings over FY2013-FY2021.

For the initial tranche of savings, the BCA placed statutory limits on discretionary spending for each fiscal year from FY2012 through FY2021. At the time of enactment, the BCA discretionary spending caps were projected to save $917 billion.

For the second, and larger, tranche of savings, the BCA established a bipartisan, bicameral Joint Select Committee on Deficit Reduction (“Joint Committee”) to negotiate a broad deficit reduction package to save another $1.5 trillion through FY2021. As a fallback, the BCA provided that automatic spending reductions would be triggered if Congress did not enact at least $1.2 trillion in budget savings by January 15, 2012.

The deadline was not met, which triggered the BCA’s $1.2 trillion in automatic spending reductions. The automatic reductions were designed to achieve $1.2 trillion in budgetary savings by reducing both discretionary and mandatory spending in each year through FY2021.

The largest share of the $1.2 trillion in additional savings was to be achieved by reducing the discretionary spending caps and the remainder through annual across-the-board cuts (sequestration) in all nonexempt mandatory spending.

The mandatory spending portion of the automatic reductions (referred to in this report as the “Joint Committee sequester”) has been fully implemented in each year since FY2013. It has been extended five times and is now, under current law, effective for each fiscal year through FY2029.

This report explains

the BCA provisions that established and triggered the Joint Committee sequester,

the annual sequester calculations by OMB,

the extension and calculation of the Joint Committee sequester through FY2029,

the broad scope of the sequester across the federal budget, and

sequester exemptions and special rules.

The appendixes include a table summarizing each sequester since FY2013, a summary of the FY2020 sequester reductions, the text of the FY2020 sequester order, the text of the OMB sequester calculation, a list of mandatory sequester exemptions, and additional CRS resources on sequestration.

The Annual Sequester of Mandatory Spending through FY2029

Jump to Main Text of Report

Contents

- Introduction

- Budget Authority and Budgetary Resources

- The BCA and the Joint Committee Sequester

- Calculating the Joint Committee Sequester

- FY2020 Defense Calculations

- FY2020 Nondefense Calculations

- Extension of the Joint Committee Sequester

- Calculation of the Joint Committee Sequester in the Extension Years

- Scope, Exemptions, and Special Rules

- Scope of the Mandatory Sequester

- Mandatory Sequester Exemptions

- 2% Sequester Limit for Medicare

- Special Rule for Student Loans

- Other Special Rules

Figures

Tables

Appendixes

- Appendix A. Mandatory Sequester by Fiscal Year

- Appendix B. FY2020 Programmatic Impact of the Joint Committee Sequester

- Appendix C. Sequestration Order for FY2020

- Appendix D. OMB Description of Sequester Calculations

- Appendix E. List of Federal Programs Exempt from the Mandatory Sequester

- Appendix F. Additional CRS Resources on Sequestration

Summary

The Budget Control Act of 2011 (BCA; P.L. 112-25) included two parts: discretionary spending caps, plus a "Joint Committee process" to achieve an additional $1.2 trillion in budgetary savings over FY2013-FY2021.

For the initial tranche of savings, the BCA placed statutory limits on discretionary spending for each fiscal year from FY2012 through FY2021. At the time of enactment, the BCA discretionary spending caps were projected to save $917 billion.

For the second, and larger, tranche of savings, the BCA established a bipartisan, bicameral Joint Select Committee on Deficit Reduction ("Joint Committee") to negotiate a broad deficit reduction package to save another $1.5 trillion through FY2021. As a fallback, the BCA provided that automatic spending reductions would be triggered if Congress did not enact at least $1.2 trillion in budget savings by January 15, 2012.

The deadline was not met, which triggered the BCA's $1.2 trillion in automatic spending reductions. The automatic reductions were designed to achieve $1.2 trillion in budgetary savings by reducing both discretionary and mandatory spending in each year through FY2021.

The largest share of the $1.2 trillion in additional savings was to be achieved by reducing the discretionary spending caps and the remainder through annual across-the-board cuts (sequestration) in all nonexempt mandatory spending.

The mandatory spending portion of the automatic reductions (referred to in this report as the "Joint Committee sequester") has been fully implemented in each year since FY2013. It has been extended five times and is now, under current law, effective for each fiscal year through FY2029.

This report explains

- the BCA provisions that established and triggered the Joint Committee sequester,

- the annual sequester calculations by OMB,

- the extension and calculation of the Joint Committee sequester through FY2029,

- the broad scope of the sequester across the federal budget, and

- sequester exemptions and special rules.

The appendixes include a table summarizing each sequester since FY2013, a summary of the FY2020 sequester reductions, the text of the FY2020 sequester order, the text of the OMB sequester calculation, a list of mandatory sequester exemptions, and additional CRS resources on sequestration.

Introduction

Budget Authority and Budgetary Resources

The Constitution reserves to Congress the power of the purse, exercised through legislation that grants federal agencies legal authority to enter into financial obligations that will result in outlays of federal funds.

When Congress enacts authority for agencies to enter into financial obligations for particular purposes, it is called "budget authority." Newly enacted budget authority and unspent balances of prior year budget authority are referred to collectively as "budgetary resources."

Budgetary resources include two types of spending. The first, "discretionary spending," refers to budget authority provided in annual appropriations funding bills. Discretionary spending makes up about 30% of federal spending but receives the largest share of budgetary scrutiny, because appropriations bills are subject to congressional decisionmaking each fiscal year.

The other 70% of federal spending is called "mandatory" or "direct" spending, because the budget authority flows directly from multiyear authorizing laws enacted outside the annual appropriations process. Examples of mandatory spending are entitlement programs, supplemental nutrition assistance, and multiyear highway bills enacted by authorizing committees.

Sequestration is a budgetary mechanism that requires automatic cancellation of budgetary resources through across-the-board reductions to programs, projects, and activities. Since the creation of the sequester mechanism in the Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA),1 it has been used to enforce a variety of fiscal policy goals.

The BCA and the Joint Committee Sequester

The Budget Control Act of 2011 (BCA) included two parts: discretionary spending caps for an initial tranche of budgetary savings and a "Joint Committee process" to achieve broader budgetary savings.

For the initial tranche of budgetary savings, the BCA placed statutory limits on discretionary spending for each fiscal year from FY2012 through FY2021. At the time of enactment, the BCA discretionary spending caps were projected to save $917 billion over the ensuing decade.

To accomplish the second, and larger, tranche of savings, the BCA established a bipartisan, bicameral Joint Select Committee on Deficit Reduction (Joint Committee). The committee was to negotiate a deficit reduction package to save another $1.5 trillion through FY2021. As a fallback, the BCA provided that automatic spending reductions would be triggered if Congress did not enact at least $1.2 trillion in budget savings by January 15, 2012.

The deadline was not met, and this triggered the BCA's $1.2 trillion in automatic spending reductions. The automatic reductions were designed to achieve $1.2 trillion in budgetary savings by reducing both discretionary and mandatory spending each year through FY2021:

- Most of the $1.2 trillion in additional budgetary savings was to be achieved by reducing the discretionary spending caps. Subsequent legislation has partially or fully rolled back these additional discretionary spending reductions.2

- The remainder of the $1.2 trillion in savings was to be achieved through annual across-the-board cuts (sequestration) in all nonexempt mandatory spending. This portion of the automatic reductions has been fully implemented—and extended for an additional eight years through FY2029 (see below, "Extension of the Joint Committee Sequester").

Calculating the Joint Committee Sequester

The BCA includes detailed statutory directions for the Office of Management and Budget (OMB) to calculate, and the President to implement, the Joint Committee reductions for each fiscal year through 2021. As summarized below, the calculation of the discretionary cap reductions and the across-the-board cuts in mandatory spending are interdependent even though the discretionary spending caps have been revised by subsequent legislation. OMB must still calculate the annual spending cap reductions—as set forth in the 2011 statute—in order to arrive at the mandatory spending cuts.

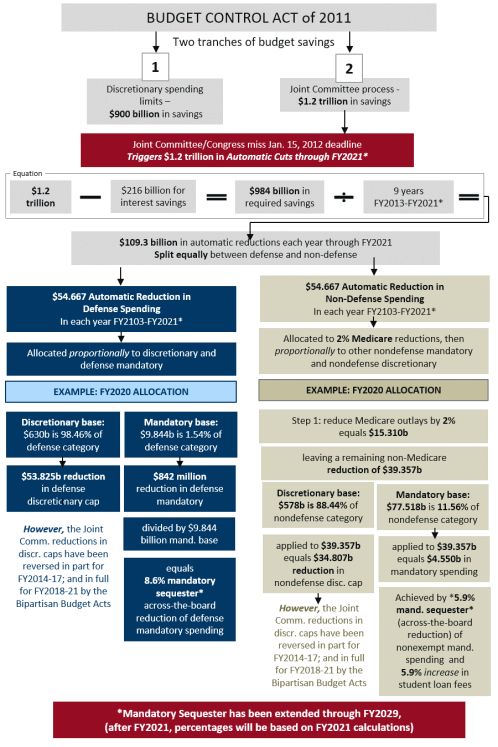

The Joint Committee reductions are calculated as follows (see Figure 1):

- In order to achieve the required $1.2 trillion of deficit reduction, the BCA first subtracts 18% ($216 billion) for debt service savings associated with the required deficit reduction. It then divides the remainder ($984 billion) over the nine years of the BCA to arrive at a required annual reduction of $109.3 billion for each fiscal year from FY2013 through FY2021.

- The BCA required the annual reduction of $109.3 billion to be split evenly between defense spending and nondefense spending so that each category is reduced by $54.667 billion in each fiscal year through FY2021.

- The required reductions of $54.667 billion were allocated between discretionary spending and mandatory spending within each category subject to exemptions and special rules for particular programs.

- The required reductions in discretionary spending were implemented by lowering the BCA discretionary spending limits, although the required cap reductions have been superseded by legislation revising the caps.3

- The required reductions in mandatory spending were achieved through the mandatory sequester—automatic across-the-board cuts in nonexempt mandatory spending.

FY2020 Defense Calculations

Step 1. Under the BCA, total spending in the defense category must be reduced by $54.667 billion, allocated proportionally between discretionary appropriations and mandatory spending. OMB calculates how much of the defense spending base is discretionary versus mandatory.

The BCA calculates the discretionary-to-mandatory ratio for the defense category as follows:

- defense discretionary spending is set by the BCA defense spending limit for FY2020, which is $630 billion; and

- mandatory spending is set by OMB's baseline estimate of (nonexempt) mandatory spending, which is $9.844 billion.

This calculation results in a ratio of 98.46% for defense discretionary spending and 1.54% for defense mandatory spending.

Step 2. To achieve the required overall defense category reduction of $54.667 billion, these percentages result in a defense discretionary reduction of $53.825 billion and a defense mandatory reduction of $842 million.

Step 3. The required defense discretionary reduction lowers the spending cap to the adjusted cap level of $576.175 billion. This cap level is now superseded by the revised level enacted in the Bipartisan Budget Act (BBA) of 2019, which is $666.5 billion.

Step 4. The defense mandatory reduction of $842 million is achieved by dividing that amount into the nonexempt mandatory spending base of $9.844 billion. This results in an 8.6% across-the-board cut (sequestration) to be applied to all nonexempt defense budget accounts with mandatory spending.4

Once this uniform percentage is determined, Section 256(k)(2) of BBEDCA requires that sequestration be applied equally to all programs, projects, and activities (PPAs) within the affected budget accounts.5

FY2020 Nondefense Calculations

The BCA calculations for the nondefense category have more steps than the defense calculations due to special requirements for Medicare and student loans that are explained below.

Step 1. Under the BCA, total spending in the nondefense category must be reduced by $54.667 billion—with reductions in discretionary and mandatory spending. The largest portion of the mandatory sequestration comes from the Medicare program, which is subject to 2% across-the-board cuts.

|

Figure 1. FY2020 Joint Committee Reduction Calculations (Sequestration of defense and nondefense mandatory spending) |

|

|

Source: Calculations as required by the Budget Control Act of 2011 and as applied to FY2020 by the Office of Management and Budget in Report to the Congress on the Joint Committee Reductions for Fiscal Year 2020. |

For FY2020, the portion of Medicare subject to the 2% sequester is estimated by OMB to have outlays of $765.495 billion,6 so a 2% reduction would reduce Medicare outlays by $15.310 billion. This leaves a required non-Medicare reduction of $39.357 billion from the remaining nondefense category.

Step 2. The remaining reduction of $39.357 billion is allocated proportionally between nondefense discretionary appropriations and nondefense (non-Medicare) mandatory spending.

The BCA calculates the discretionary-to-mandatory ratio for the nondefense category as follows:

- nondefense discretionary spending is set by the BCA nondefense spending limit for FY2020, which is $578 billion; and

- nondefense mandatory spending is set by OMB's baseline estimate of (nonexempt, non-Medicare) mandatory spending, which is $75.518 billion.

This calculation results in a ratio of 88.44% for nondefense discretionary spending and 11.56% for nondefense, non-Medicare nonexempt mandatory spending.

To achieve the required non-Medicare nondefense reduction of $39.357 billion, these percentages result in a nondefense discretionary reduction of $34.807 billion and a nondefense (non-Medicare) mandatory reduction of $4.550 billion.

Step 3. The nondefense discretionary reduction is implemented by lowering the BCA spending cap by $34.807 billion to the adjusted cap level of $543.193 billion (although this cap level is now superseded by the revised level enacted in the BBA of 2019, which is $621.5 billion).

Step 4: Under OMB's calculation, the remaining reduction ($4.550 billion) to direct spending is achieved by applying a 5.9% uniform percentage reduction to non-Medicare nonexempt mandatory spending and increasing student loan fees by the same 5.9%.7

Once this uniform percentage is determined, Section 256(k)(2) of BBEDCA requires that sequestration be applied equally to all PPAs within the affected budget accounts.8

Extension of the Joint Committee Sequester

As discussed above, the BCA established statutory limits on discretionary spending for FY2013-FY2021 to achieve about $900 billion in budgetary savings. The BCA triggered an additional tranche of automatic budgetary savings—$1.2 trillion over FY2013-FY2021—when Congress's Joint Committee did not report, and Congress did not enact, at least $1.2 trillion in budget savings by January 15, 2012.

The automatic Joint Committee reductions include changes in the discretionary spending limits and sequestration (across-the-board cuts) in mandatory spending.

The requirement for a Joint Committee (mandatory) sequester in FY2013-FY2021 has been extended on five occasions—to offset9 increases in discretionary spending and other legislation—and is now required for each fiscal year through FY2029:

- The BBA of 2013 (H.J.Res. 59, P.L. 113-67) amended BBEDCA to increase the discretionary spending limits for FY2014 and FY2015 and added two years to the Joint Committee mandatory sequester (FY2022 and FY2023).

- P.L. 113-82 (S. 25, an Act relating to cost of living adjustments for military retirees, February 15, 2014) amended BBDECA to add one year to the Joint Committee mandatory sequester (FY2024).

- The BBA of 2015 (H.R. 1314, P.L. 114-74) amended BBEDCA to increase the discretionary spending limits for FY2016 and FY2017 and added one year to the Joint Committee mandatory sequester (FY2025).

- The BBA of 2018 (H.R. 1892, P.L. 115-123) amended BBEDCA to increase the discretionary spending limits for FY2018 and FY2019 and added two years to the Joint Committee mandatory sequester (FY2026 and FY2027).

- The BBA of 2019 (H.R. 3877, P.L. 116-37) amended BBEDCA to increase the discretionary limits for FY2020 and FY2021 and added two years to the Joint Committee mandatory sequester (FY2028 and FY2029).

Calculation of the Joint Committee Sequester in the Extension Years

As explained above, the Joint Committee mandatory sequester is calculated based on the statutory requirement to save $109.3 billion in each fiscal year from FY2013 through FY2021, with half of the savings coming from defense and half from nondefense programs. The defense and nondefense reductions of $54.667 billion per year are apportioned between discretionary and mandatory programs according to the formulas explained in the FY2020 illustrations above.

After FY2021, there is no statutory requirement to achieve $54.667 billion in budgetary savings in defense and nondefense spending and, consequently, no specific amounts to apportion to mandatory (or discretionary) savings. Therefore, the statutes extending the Joint Committee mandatory sequester have tied the defense and nondefense mandatory savings for FY2022-FY2029 to the uniform percentage reductions to be calculated by OMB for FY2021 in the Report on the Joint Committee Reduction that is to be released concurrent with the President's budget in February 2020.

This means that for FY2022-FY2029

- the percentage reduction for nonexempt direct spending for the defense category is the same percent as the percentage reduction for the defense category for FY2021, and

- the percentage reduction for nonexempt direct spending for the nondefense category is the same percent as the percentage reduction for the nondefense category for FY2021.10

Scope, Exemptions, and Special Rules

Scope of the Mandatory Sequester

Sequestration is a cancellation of budgetary resources by the President—required by statute—in all nonexempt programs and accounts. While many programs and activities are fully or partially exempted from the mandatory sequester, the mechanism nevertheless has a broad reach.

In addition to the sequestration of Medicare payments, the Joint Committee sequester automatically reduces more than 200 budget accounts11 impacting a broad array of programs, including Affordable Care Act cost-sharing reduction subsidies and risk adjustment; farm price and income supports; compensation and services for crime victims; citizenship and immigration services; agricultural marketing services and conservation programs; animal and plant health inspection; Federal Deposit Insurance Corporation orderly liquidation operations; vocational rehabilitation services; mineral leasing payments; Centers for Medicare and Medicaid Services (CMS) program management; social services block grants; Departments of Justice and the Treasury law enforcement activities; student loan origination fees; highway performance; school construction bonds; spectrum relocation activities; Trade Adjustment Assistance; Consumer Financial Protection Bureau; Drug Enforcement Administration operations; Tennessee Valley Authority; fish and wildlife restoration and conservation; affordable housing; the maternal, infant, and early childhood home visiting program; and Gulf Coast restoration.

Mandatory Sequester Exemptions

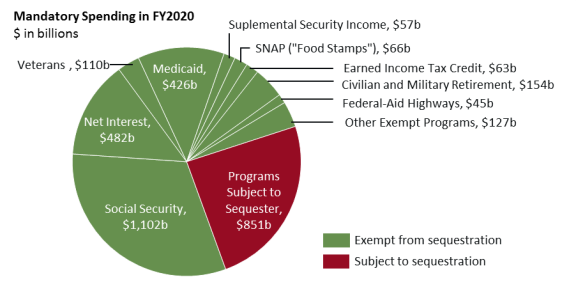

Many programs and activities are exempt from sequestration under Section 255 of BBEDCA (2 U.S.C. §905; see Appendix E for a complete list of exemptions).12 In dollar terms, three-quarters of all mandatory spending is exempt from the mandatory sequester as illustrated in Figure 2.13

In addition to program exemptions, several programs are subject to special rules, including a 2% limit on sequestration reductions to Medicare, explained below.

|

Figure 2. Three-Quarters of Mandatory Spending Is Exempt from Sequestration |

|

|

Source: Office of Management and Budget: Budget of the United States Fiscal Year 2020, Analytical Perspectives, Table 26-12; and FY2020 Report on the Joint Committee Reductions for FY2020. |

2% Sequester Limit for Medicare

Medicare is the federal health insurance program for people who are 65 or older, for younger people with permanent disabilities, and for people of any age with end-stage renal disease.14 It is the largest mandatory spending program subject to sequestration, although special rules limit the sequestration of Medicare benefit payments to 2% rather than the uniform percentage applied to other nonexempt mandatory spending programs (5.9% in FY2020).15

Most Medicare spending—$765.5 billion in FY2020—is subject to the 2% sequester including payments to health care providers for hospitalizations, physician services, prescription drugs, skilled nursing facility care, home health visits, and hospice care.

Generally, Medicare's provider payment and benefit structure remains unchanged under a mandatory sequestration order, and beneficiaries see few direct impacts.16 However, the indirect impact on particular health care providers and beneficiaries is more complex—particularly for Medicare Advantage and Part D prescription drug coverage.

In "traditional Medicare," the program pays providers on a fee-for-service basis, and the 2% sequester reduction is applied directly to provider payments.17 Under Medicare Advantage, by contrast, private health plans are paid a per-person ("capitated") monthly amount to provide nearly all Medicare-covered benefits to beneficiaries who enroll in their plans. The Joint Committee 2% sequester is applied to Medicare's monthly capitation payment and the Medicare Advantage Organizations (MAOs) administering the plans determine how the reduced capitation payments are to be distributed among medical providers, administrative expenses, risk adjustments, and plan rebates to beneficiaries.18

Similarly, under Medicare Part D, the optional outpatient prescription drug benefit plans are paid through capitated monthly payments (the "direct subsidy") to private plans. The 2% Medicare sequester reduces these monthly direct subsidy amounts.

A key consequence of the 2% Medicare sequester limit is that it increases the uniform percentage reduction applied to non-Medicare mandatory programs. For example, in FY2020, if there were no 2% limit on the Medicare sequester, a uniform percentage reduction applied to all nonexempt mandatory spending (including Medicare) would be 3.9% rather than the 5.9% reduction applied in the October 1, 2019, sequester order.19

Medicare sequester special rules follow:20

- Part D low-income subsidies,21 Part D catastrophic subsidies (reinsurance),22 and Qualifying Individuals Part B premium assistance are exempted from sequestration.

- Medicare administrative expenses, if classified as mandatory spending, are subject to the full Joint Committee mandatory sequester (5.9% in FY2020) rather than protected by the 2% limit.23

- Special rules determine whether Health Care Fraud and Abuse Control Program (HCFAC) funds are subject to the 2% limit.24

- After a sequester order is issued, Medicare payments are sequestered beginning on the first day of the following month and remain in effect during the following one-year period, even if there is an intervening sequester order.25

- The total amount sequestered from Medicare depends on actual Medicare spending in a given year rather than an amount based on OMB's estimate. (For example, if actual Medicare outlays exceed the estimated amount included in a sequestration order, the additional outlays would be subject to the sequester.)

- Medicare sequestration in FY2029 is subject to a special rule—4% during the first six months and 0% for the second six months of the order.26

Special Rule for Student Loans27

Sequestration impacts federal student loans differently than it does other programs. For federal student loans, sequestration is applied to student loan origination fees.

The origination fee is money the borrower (that is, the student or the student's parents) pays to the federal government to offset the costs of issuing the loan. The fee is calculated as a percentage of the loan's total and is subtracted from the loan amount. Direct Subsidized Loans and Direct Unsubsidized Loans generally have a fee of about 1%, and Direct PLUS loans generally have a fee of about 4%.28

For example, if a student's parents take out a federal PLUS loan of $16,450, with an origination fee of 4.248%, about $15,750 of the loan would go to the school and $700 to the federal government for the origination fee.29

Special sequestration rules (BBEDCA §256, 2 U.S.C. §906) for student loans provide that the federal budgetary savings are achieved by increasing the origination fee—the money going to the federal Treasury—rather than reducing the overall loan amount.

For example, for FY2020, the 5.9% uniform sequester percentage is to be applied as an increase to federal student loan origination fees. In the above example, the result would be that the $700 origination fee would be increased by 5.9% or about $41—the effect of which would be to reduce the amount of the loan going to the school.30

Other Special Rules

- Community and migrant health centers providing primary care to people who have financial, geographic or other barriers to health care are supported by discretionary and mandatory funding under the Affordable Care Act. In years when mandatory spending is estimated, at the time OMB calculates a sequester, the spending reductions are limited to a 2% sequester.31

- Indian Health Service (IHS) provides health services to 2.6 million American Indians and Alaska Natives. While most IHS funding is provided through discretionary appropriations, IHS receives mandatory appropriations for programs including treatment of diabetes. In years when mandatory spending is estimated at the time OMB calculates a sequester, the spending reductions are limited to a 2% sequester.32

- Administrative expenses: Federal administrative expenses are subject to sequestration—even if they are incurred in connection with a program that is exempt or subject to a special rule. However, this special rule applies only to administrative expenses classified as mandatory spending.33

- Defense unobligated balances: Unobligated balances of budget authority carried over from prior fiscal years in the defense category are subject to the mandatory sequester pursuant to Section 255(e) of BBEDCA.34

- Intragovernmental payments: For intragovernmental payments, sequestration is applied to the paying account. The funds are generally exempt in the receiving account in accordance with Section 255(g)(1)(A) of BBEDCA so that the same dollars are not sequestered twice.35

- Revolving, trust, and special fund accounts and offsetting collections: Budgetary resources in revolving, trust, and special fund accounts and offsetting collections reduced by a mandatory sequester are not available for obligation during the fiscal year in which the sequestration occurs but are available in subsequent years to the extent otherwise provided.36

Appendix A. Mandatory Sequester by Fiscal Year

|

Links to OMB Sequester Reports |

Nondefense |

Defense |

|

FY2013 OMB Report:a |

7.9%: $0.052 billion |

|

|

Medicare 2% non-administrative sequester |

2.0%: $11,347 billion |

|

|

Other health programs 2% sequesterb |

2.0%: $0.027 billion |

|

|

Uniform Mandatory Sequester |

5.1%: $5.38 billion |

|

|

Student Loan Fee increase |

5.1%: $0.082 billion |

|

|

FY2014 OMB Report:c |

9.8%: $0.749 billion |

|

|

Medicare 2% non-administrative sequester |

2.0%: $11.157 billion |

|

|

Other health programs 2% sequesterb |

2.0%: $0.025 billion |

|

|

Uniform Mandatory Sequester |

7.2%: $6.777 billion |

|

|

Student Loan Fee increase |

7.2%: $0.122 billion |

|

|

FY2015 OMB Report:d |

9.5%: $0.702 billion |

|

|

Medicare 2% non-administrative sequester |

2.0%: $11.169 billion |

|

|

Other health programs 2% sequesterb |

2.0%: $0.054 billion |

|

|

Uniform Mandatory Sequester |

7.3%: $5.945 billion |

|

|

Student Loan Fee increase |

7.3%: $0.074 billion |

|

|

9.3%: $0.758 billion |

||

|

Medicare 2% non-administrative sequester |

2.0%: $12.021 billion |

|

|

Uniform Mandatory Sequester |

6.8%: $6.062 billion |

|

|

Student Loan Fee increase |

6.8%: $0.075 billion |

|

|

FY2017 OMB Report:f |

9.1%: $0.728 billion |

|

|

Medicare 2% non-administrative sequester |

2.0%: $12.612 billion |

|

|

Other health programs 2% sequesterb |

2.0%: $0.064 billion |

|

|

Uniform Mandatory Sequester |

6.9%: $5.254 billion |

|

|

Student Loan Fee increase |

6.9%: .$0.069 billion |

|

|

8.9%: $0.720 billion |

||

|

Medicare 2% non-administrative sequester |

2.0%: $12.76 billion |

|

|

Uniform Mandatory Sequester |

6.6%: $4.6 billion |

|

|

Student Loan Fee increase |

6.6%: $0.070 billion |

|

|

FY2019 OMB Report:h |

8.7%: $0.809 billion |

|

|

Medicare 2% non-administrative sequester |

2.0%: $13.958 billion |

|

|

Uniform Mandatory Sequester |

6.2%: $4.990 billion |

|

|

Student Loan Fee increase |

6.2%: $0.062 billion |

|

|

FY2020 OMB Report: i |

8.6%: $0.842 billion |

|

|

Medicare 2% non-administrative sequester |

2.0%: $15.31 billion |

|

|

Uniform Mandatory Sequester |

5.9%: $4.491 billion |

|

|

Student Loan Fee increase |

5.9%: $0.059 billion |

Notes:

a. OMB, OMB Report to the Congress on the Joint Committee Sequestration for Fiscal Year 2013, https://obamawhitehouse.archives.gov/sites/default/files/omb/assets/legislative_reports/fy13ombjcsequestrationreport.pdf.

b. Under Section 256(e)(2) of BBEDCA, mandatory funds for community and migrant health centers and Indian Health Services are subject to a 2% sequester but only when mandatory funds are estimated for those accounts at the time OMB calculates the sequester (which occurred in FY2013, FY2014, FY2015, and FY2017). See the "Other Special Rules" section above.

c. OMB, OMB Sequestration Preview Report to the President and Congress for Fiscal Year 2014 and OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2014, April 10, 2013, https://obamawhitehouse.archives.gov/sites/default/files/omb/assets/legislative_reports/fy14_preview_and_joint_committee_reductions_reports_05202013.pdf.

d. OMB, OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2015, March 10, 2014, https://obamawhitehouse.archives.gov/sites/default/files/omb/assets/legislative_reports/sequestration_order_report_march2014.pdf.

e. OMB, OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2016, February 2, 2015, https://obamawhitehouse.archives.gov/sites/default/files/omb/assets/legislative_reports/sequestration/2016_jc_sequestration_report_speaker.pdf.

f. OMB, OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2017, February 9, 2016, https://obamawhitehouse.archives.gov/sites/default/files/omb/assets/legislative_reports/sequestration/jc_sequestration_report_2017_house.pdf.

g. OMB, OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2018, May 23, 2017, https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/sequestration_reports/2018_jc_sequestration_report_may2017_potus.pdf.

h. OMB, OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2019, February 12, 2018, https://www.whitehouse.gov/wp-content/uploads/2018/02/Sequestration_Report_February_2018.pdf.

i. OMB, OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2020, March 18, 2019, https://www.whitehouse.gov/wp-content/uploads/2019/03/2020_JC_Sequestration_Report_3-18-19.pdf.

Appendix B. FY2020 Programmatic Impact of the Joint Committee Sequester

On March 18, 2019, OMB, as part of its annual budget transmittal to Congress and as required by the BCA, released the OMB Report to Congress on the Joint Committee Reductions for Fiscal Year 2020. In addition to setting forth the calculations of the upcoming fiscal year's sequester as required by statute, the report includes account-by-account detail of the amount by which each mandatory spending account is required by statute to be reduced at the beginning of the new fiscal year. Specifically, the report identifies

- four mandatory spending accounts to be reduced by the 2% Medicare sequester,

- six mandatory spending accounts to be reduced by the 8.6% defense sequester, and

- 208 mandatory spending accounts to be reduced by the 5.9% nondefense sequester.

For illustrative purposes, the table below displays the FY2020 mandatory sequester reductions of $20 million or more, with brief descriptions of the programs. For a complete list of mandatory spending accounts subject to sequester for FY2020, see the Appendix of the OMB Report to Congress.

|

Program |

Mandatory Spending |

Explanation |

|

Medicarea |

$15.313 billion |

2% sequestration estimates: |

|

Affordable Care Actc |

$1.298 billion |

Cost-sharing reductions: $0.471 billion |

|

Commodity Credit Corporation (CCC) Farm Price and Income Supports |

$0.939 billion |

The CCC conducts programs to support and stabilize farm income and prices for agricultural commodities. It also supports various other farm bill programs. The sequester impacts program outlays and spending authority. |

|

Concurrent Receipt Accrual |

$0.804 billion |

Reflects a reduction in "concurrent receipt" accrual payments to the Military Retirement Fund for veterans eligible for simultaneous receipt of military retired pay and Department of Veterans Affairs disability compensation. |

|

Crime Victims Fund |

$0.518 billion |

The Crime Victims Fund provides grants to states, territories, and nonprofit organizations to support compensation and services for victims of crime. |

|

Citizenship and Immigration Services (USCIS) |

$0.278 billion |

The mission of USCIS is to adjudicate and grant immigration and citizenship benefits and approve millions of immigration benefit applications each year, ranging from work authorization and lawful permanent residency to asylum and refugee status. USCIS is funded primarily through fees on the applications and petitions it adjudicates. Sequestration reduces authority to use the fees. |

|

Farm Security and Rural Investment Programs |

$0.252 billion |

Supports the Natural Resources Conservation Service's efforts to protect the natural resource base on private lands by providing technical assistance to farmers, ranchers, and other private landowners to support the development of conservation plans and by providing financial assistance to partially offset the costs to safeguard natural resources and improve wildlife habitat. |

|

Federal Deposit Insurance Corporation (FDIC) Orderly Liquidation Fund (however, FDIC deposit insurance protection is exempt from sequestration) |

$0.242 billion |

Title II of the Dodd-Frank Wall Street Reform and Consumer Protection Act (P.L. 111-203) established an Orderly Liquidation Authority permitting the appointment of the FDIC as receiver of financial companies where failure is determined to have serious adverse effects on financial stability of the United States. |

|

Build America Bond Payments |

$0.223 billion |

American Recovery and Reinvestment Act of 2009 allows state and local governments to issue Build America tax credit bonds where interest paid is taxable and a portion of the interest paid takes the form of a federal tax credit. This account reflects the continuing interest payments over time.d |

|

Department of Education |

$0.213 billion |

State grants program provides federal matching funds to state vocational rehabilitation agencies to assist individuals with physical or mental impairments to become gainfully employed. Vocational rehabilitation state grants is a core program of the workforce development system under the Workforce Innovation and Opportunity Act and a partner in the one-stop service delivery system for accessing employment and training services.e |

|

Mineral Leasing and Associated Payments |

$0.166 billion |

Under the Mineral Leasing Act, states generally receive 50% (except 90% to Alaska) of federal revenues generated from mineral production occurring on federal lands within that state's boundaries (less 2% for administrative costs). These payments are subject to the FY2020 5.9% nondefense sequester reduction.f |

|

Centers for Medicare |

$0.141 billion |

Program management activities include funding for program operations, survey and certification, the Clinical Laboratory Improvement Amendments, Medicare Advantage, Medicare Part D coordination of benefits, recovery audit contracts, and other administrative costs.g |

|

Social Services Block Grant (SSBG) |

$0.100 billion |

Federal law establishes several broad goals for the SSBG: promoting self-sufficiency, eliminating dependency, preventing child abuse, supporting community-based care for the elderly and disabled, and supporting institutional care when necessary. The SSBG is an annually appropriated capped entitlement to states. In FY2016, the largest expenditures for services under the SSBG were for foster care, child protective services, child care, and special services for the disabled.h |

|

Agricultural Marketing Service |

$0.072 billion |

Funds for strengthening markets, income, and supply—also known as the "Section 32" account.i |

|

Assets Forfeiture Fund |

$0.061 billion |

Sequestration reduces the availability of spending authority from the Assets Forfeiture Fund—a Department of Justice repository for forfeited cash and proceeds of sales of forfeited property.j |

|

Student Loan fee increase |

$0.059 billion |

Special sequestration rules (BBEDCA, §256(b)) apply to federal student loans made under the Federal Direct Loan program during a period when a sequestration order is in effect. Origination fees made during a period of sequestration must be increased by the uniform percentage specified in the sequestration order. Loan origination fees are deducted proportionately from each disbursement of the loan proceeds to the borrower.k |

|

Animal and Plant Health Inspection Service |

$0.051 billion |

Animal and Plant Health Inspection Service salaries and expenses, from customs user fee collections.l |

|

Federal Aid in Wildlife Restoration |

$0.047 billion |

The Federal Aid in Wildlife Restoration Act, also known as the Pittman-Robertson Wildlife Restoration Act, created a program to fund the selection, restoration, rehabilitation, and improvement of wildlife habitat, hunter education and safety, and wildlife management research.m |

|

National Highway Performance Program |

$0.044 billion |

The National Highway Performance Program is a formula-based program that applies federal resources to support the performance of and construction of new facilities on the National Highway System and the achievement of performance targets.n |

|

Payment to Issuer of Qualified School Construction Bonds |

$0.043 billion |

Sequestration limits direct interest payment subsidies to issuers of certain qualified school construction bonds.o |

|

Spectrum Relocation Fund |

$0.043 billion |

The fund reimburses federal agencies for relocation costs incurred due to the reallocation of frequencies from federal to nonfederal (commercial) use or the sharing of their federal frequencies.p |

|

Trade Adjustment Assistance |

$0.040 billion |

Sequestration reduces the federal unemployment benefits and allowances account that funds the Trade Adjustment Assistance for Workers program, which provides income support and job training for workers adversely impacted by increased international trade.q |

|

Treasury Forfeiture Fund |

$0.032 billion |

Sequestration reduces the availability of spending authority from the Treasury Forfeiture Fund to disrupt and dismantle criminal enterprises.r |

|

Bureau of Consumer Financial Protection Fund (CFPB) |

$0.030 billion |

Sequestration reduces budgetary resources available to CFPB to conduct rulemaking, supervision, and enforcement of federal consumer financial laws.s |

|

Drug Enforcement Administration (DEA) |

$0.026 billion |

Sequestration reduces the availability of spending authority from the DEA's Diversion Control Fee Account, which was set up to ensure that adequate supplies of controlled drugs are available to meet legitimate medical, scientific, industrial, and export needs while preventing, detecting, and eliminating diversion of these substances to illicit traffic.t |

|

Tennessee Valley Authority Fund |

$0.026 billion |

Sequestration reduces funds available to the Tennessee Valley Authority, which is charged with improving the quality of life in the Tennessee Valley through integrated management of the region's resources.u |

|

Sport Fish Restoration |

$0.026 billion. |

The Federal Aid in Sport Fish Restoration Act, also known as the Dingell-Johnson Sport Fish Restoration Act (16 U.S.C. §777 et seq.), created a fishery resources, conservation, and restoration program funded by excise taxes on fishing equipment and other sport-fish-related products and fuel.v |

|

National Defense Stockpile |

$0.025 billion |

The National Defense Stockpile program is managed under the authority of the Strategic and Critical Materials Stockpiling Act. The purpose is to decrease or preclude U.S. dependence on foreign sources for supplies of strategic and critical materials. Revenues from the sales of excess commodities are either deposited into the Transaction Fund or transferred to the Treasury.w |

|

Affordable Housing Program |

$0.024 billion |

Sequestration reduces funds available to the Affordable Housing Program, which uses contributions from each of the Federal Home Loan Banks to subsidize the cost of affordable homeownership and rental housing.x |

|

Maternal, Infant, and Early Childhood Home Visiting Program (Health Resources and Services Administration, HRSA) |

$0.024 billion |

The Maternal, Infant and Early Childhood Home Visiting Program provides comprehensive services to support families of children under the age of five who are in at-risk communities or have selected risk factors. These activities are administered by HRSA.y |

|

Surcharge Collections, |

$0.021 billion |

This fund was established in 1992 as a result of the consolidation of Defense commissaries. The trust fund pays commissary costs to acquire, construct, and maintain the physical infrastructure of commissary stores and central processing facilities.z |

|

Gulf Coast Restoration Trust Fund |

$0.020 billion |

Reduces the availability of budgetary resources authorized to restore the Gulf Coast after the Deepwater Horizon oil spill.aa |

|

A complete list of budget accounts subject to sequestration in FY2020, including those estimated to be reduced by less than $20 million, is available in OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2020, March 18, 2019. |

||

Notes:

a. For an in-depth explanation of how a BCA sequester impacts Medicare, see CRS Report R45106, Medicare and Budget Sequestration, by Patricia A. Davis.

b. Part C Medicare Advantage reductions are reflected in the Parts A, B, and D reductions.

c. For background on ACA sequestration reductions see OMB, Budget of the United States, FY2020, Budget Appendix, pp. 450-51 on cost-sharing; pp. 447-448 for Centers for Medicare and Medicaid Innovation, which is tasked with testing innovative payment and service delivery models to reduce expenditures; and p. 451 for Risk Adjustment Program Payments for non-grandfathered plans in the individual and small group markets. For additional background, see CRS Report R45334, The Patient Protection and Affordable Care Act's (ACA's) Risk Adjustment Program: Frequently Asked Questions, by Bernadette Fernandez; and CRS Insight IN10786, Payments for Affordable Care Act (ACA) Cost-Sharing Reductions, by Bernadette Fernandez.

d. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 953.

e. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 339.

f. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 661. See also CRS Report R43891, Mineral Royalties on Federal Lands: Issues for Congress, by Marc Humphries.

g. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 446.

h. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 467. See also CRS In Focus IF10115, Social Services Block Grant, by Karen E. Lynch.

i. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 78. See also CRS Report RL34081, Farm and Food Support Under USDA's Section 32 Program, coordinated by Jim Monke.

j. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 701. See also CRS Report R43890, Asset Forfeiture: Selected Legal Issues and Reforms, by Richard M. Thompson II.

k. For background on the sequester treatment of student loan fees, see CRS Report R42050, Budget "Sequestration" and Selected Program Exemptions and Special Rules, coordinated by Karen Spar.

l. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 73. See also CRS In Focus IF10953, Agriculture Appropriations: Animal and Plant Health, by Sahar Angadjivand.

m. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 636. See also the Fish and Wildlife Service (FWS) FY2020 Budget Justification at https://www.fws.gov/budget/2020/FY2020-FWS-Budget-Justification.pdf#page=261; and a February 19, 2019 FWS letter regarding sequestered funds at https://wsfrprograms.fws.gov/Subpages/GrantPrograms/WR/WRFinalApportionment2019.pdf.

n. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 877. See also FHWA Notice, Sequestration of Highway Funds for Fiscal Year 2019.

o. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 957.

p. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 1068. Spectrum Relocation Fund created in the Commercial Spectrum Enhancement Act, P.L. 108-494, Title II, Section 202, which amends Section 113(g) of the National Telecommunications and Information Administration Organization Act (47 U.S.C. §923(g)). The rules have been codified at Title 47, Section 928, of the United States Code.

q. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 733. See also CRS In Focus IF10570, Trade Adjustment Assistance for Workers (TAA), by Benjamin Collins.

r. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 923.

s. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 1150. The CFPB was established under Title X of the Dodd-Frank Wall Street Reform and Consumer Protection Act (P.L. 111-203) as an independent bureau in the Federal Reserve System. Funding required to support the CFPB's operations is obtained primarily through transfers from the Board of Governors of the Federal Reserve System. See also CRS In Focus IF10031, Introduction to Financial Services: The Bureau of Consumer Financial Protection (CFPB), by Cheryl R. Cooper and David H. Carpenter; and CRS Report R43391, Independence of Federal Financial Regulators: Structure, Funding, and Other Issues, by Henry B. Hogue, Marc Labonte, and Baird Webel.

t. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 709.

u. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 1251.

v. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 638. See also the FWS FY2020 Budget Justification at https://www.fws.gov/budget/2020/FY2020-FWS-Budget-Justification.pdf#page=251 and a February 19, 2019 FWS letter regarding sequestered funds at https://wsfrprograms.fws.gov/Subpages/GrantPrograms/SFR/SFRFinalApportionment2019.pdf

w. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 282.

x. See OMB, Budget of the United States, FY2020, Budget Appendix, pp. 1259-1260.

y. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 424.

z. See OMB, Budget of the United States, FY2020, Budget Appendix, p. 293.

aa. See OMB, Budget of the United States, FY2020, Budget Appendix, pp. 943-44. See also CRS Report R43380, Gulf Coast Restoration: RESTORE Act and Related Efforts, by Charles V. Stern, Pervaze A. Sheikh, and Jonathan L. Ramseur.

Appendix C. Sequestration Order for FY2020

EXECUTIVE ORDERS

Sequestration Order for Fiscal Year 2020

Issued on: March 18, 201937

By the authority vested in me as President by the laws of the United States of America, and in accordance with section 251A of the Balanced Budget and Emergency Deficit Control Act (the "Act"), as amended, 2 U.S.C. 901a, I hereby order that, on October 1, 2019, direct spending budgetary resources for fiscal year 2020 in each non-exempt budget account be reduced by the amount calculated by the Office of Management and Budget in its report to the Congress of March 18, 2019.

All sequestrations shall be made in strict accordance with the requirements of section 251A of the Act and the specifications of the Office of Management and Budget's report of March 18, 2019, prepared pursuant to section 251A(9) of the Act.

DONALD J. TRUMP

THE WHITE HOUSE

March 18, 2019.

Appendix D. OMB Description of Sequester Calculations

Each year through FY2021, concurrent with transmittal of the President's budget, OMB transmits to Congress a report explaining the Joint Committee reductions for the upcoming fiscal year. Relevant portions of the OMB report for FY202038 are included below to illustrate how OMB calculates the mandatory sequester percentages. (The footnotes appearing in this Appendix are from the OMB report.)

OMB Report to the Congress on the Joint Committee Reductions for Fiscal Year 2020—March 18, 2019

The Balanced Budget and Emergency Deficit Control Act (BBEDCA) requires the Office of Management and Budget (OMB) to calculate reductions of fiscal year (FY) 2020 budgetary resources and provide them to the Congress with the transmittal of the Budget. This report provides OMB's calculations of the reductions to the discretionary spending limits ("caps") specified in section 251(c) of BBEDCA for FY 2020 and a listing of the FY 2020 reductions required through sequestration for each nonexempt budget account with direct spending.

OMB calculates that the Joint Committee reductions will lower the discretionary cap for the revised security (defense) category by $54 billion and for the revised nonsecurity (nondefense) category by $35 billion. Additionally, the Joint Committee reductions require sequestration reductions to nonexempt direct spending of 2.0 percent to Medicare, 5.9 percent to other nonexempt nondefense mandatory programs, and 8.6 percent to nonexempt defense mandatory programs.

Calculation of Annual Reduction by Function Group

Under section 251A of BBEDCA, the failure of the Joint Select Committee on Deficit Reduction to propose, and the Congress to enact, legislation to reduce the deficit by $1.2 trillion triggers automatic reductions in FY 2020 through adjustments in the discretionary spending limits and sequestration of direct spending. As shown in Table D-1, the total amount of deficit reduction required is specified by formula in section 251A(1), starting with the total reduction of $1.2 trillion required for FY 2013 through FY 2021, deducting a specified 18 percent for debt service savings, and then dividing the result by nine to calculate the annual reduction of $109 billion for each year from FY 2013 to FY 2021.39 Section 251A(2) requires the annual reduction to be split evenly between budget accounts in function 050 (defense function) and in all other functions (nondefense function), so that each function group will be reduced by $54.667 billion.

Base for Allocating Reductions and Method of Reduction

The annual reduction is further allocated between discretionary and direct spending within each of the function groups. Once the reductions are allocated, separate methods are used to implement the reductions for discretionary appropriations and direct spending.

|

Joint Committee required savings |

1,200.000 |

|

Deduct debt service savings (18%) |

-216.000 |

|

Net programmatic reductions |

984.000 |

|

Divide by 9 to calculate annual reduction |

109.333 |

|

Split 50/50 between defense and nondefense functions |

54.667 |

Discretionary Reductions. The base for allocating reductions to discretionary appropriations is the discretionary spending limit for FY 2020 set forth in section 251(c). The reductions are implemented by lowering the discretionary spending limits for the revised security (defense) category and the revised nonsecurity (nondefense) category.

Direct Spending Reductions. Pursuant to paragraphs (3) and (4) of section 251A, and consistent with section 6 of the Statutory Pay-As-You-Go Act of 2010, the base for allocating reductions to budget accounts with direct spending is the sum of the direct spending outlays in the budget year and the subsequent year that would result from sequestrable budgetary resources in FY 2020.

Estimates of sequestrable budgetary resources and outlays for budget accounts with direct spending are equal to the current law baseline amounts contained in the President's FY 2020 Budget, and include direct spending unobligated balances in the defense function40 and Federal administrative expenses that would otherwise be exempt.41

The majority of estimated direct spending unobligated balances in the defense function are in Department of Defense accounts. The Department of Defense estimates of unobligated balances as of October 1, 2019, are consistent with the estimates in the FY 2020 Budget.

For purposes of applying the Joint Committee sequestration to direct spending under BBEDCA, "administrative expenses" for typical Government programs are defined as the object classes for personnel compensation, travel, transportation, communication, equipment, supplies, materials, and other services. For Government programs engaging in commercial, business-like activities, administrative expenses constitute overhead costs that are necessary to run a business, and not expenses that are directly tied to the production and delivery of goods or services.

The reductions to direct spending are implemented through sequestration of nonexempt budgetary resources. Pursuant to sections 251A(6), 255, and 256, most direct spending is exempt from sequestration or, in the case of the Medicare program and certain other health programs, is subject to a 2 percent limit on sequestration.

Defense Function Reduction

Steps 1 and 2 on Table D-2 show the calculation of the reduction required for discretionary appropriations and direct spending within the defense function. Steps 3 and 4 on Table D-2 reflect the implementation of the reductions calculated in steps 1 and 2 through an adjustment to the discretionary spending limit for the defense category and a sequestration of direct spending in the defense function.

The calculation of the reduction involves the following steps:

Step 1. Pursuant to section 251A(3), the total reduction of $54.667 billion is allocated proportionately between discretionary appropriations and direct spending. The total base is the sum of the FY 2020 discretionary spending limit for the defense category ($630 billion) and OMB's baseline estimates of sequestrable direct spending outlays ($9.844 billion) in the defense function in FY 2020 and FY 2021 from direct spending sequestrable resources in FY 2020. Discretionary appropriations comprise approximately 98 percent of the total base in the defense function.

|

Calculation of Reduction: |

Discretionary |

Direct |

Total |

|

Step 1. Base for allocating reduction |

630.000 |

9.844 |

639.844 |

|

Percentage allocation of reductions |

98.46% |

1.54% |

|

|

Step 2. Allocation of total reduction |

53.825 |

0.842 |

54.667 |

|

Implementation of Reduction: |

|||

|

Step 3. Reduction in defense cap: |

|||

|

Appropriations reduction required |

-53.825 |

||

|

Adjusted defense cap |

576.175 |

||

|

Step 4. Sequestration percentages calculation: |

|||

|

Reduction amount |

0.842 |

||

|

Sequestrable base |

9.844 |

||

|

Sequestration percentage |

8.6% |

Step 2. Total defense function spending must be reduced by $54.667 billion. As required by section 251A(3)(A), allocating the reduction based on the ratio of the discretionary spending limit to the total base (the sum of the defense discretionary spending limit and sequestrable direct spending) yields a $53.825 billion reduction required to be made to discretionary appropriations. Under section 251A(3)(B), the remaining $0.842 billion is the reduction required for budget accounts with direct spending.

The implementation of the reductions involves the following steps:

Step 3. As required by section 251A(5)(B), the discretionary spending limit for the defense category is lowered by the amount calculated in step 2, which results in a discretionary defense cap for FY 2020 of $576.175 billion.

Step 4. As required by section 251A(6), the percentage reduction for nonexempt direct spending is calculated by dividing the direct spending reduction amount ($0.842 billion) by the sequestrable budgetary resources ($9.844 billion) for budget accounts with direct spending, which yields a 8.6 percent sequestration for budget accounts with nonexempt direct spending.

Nondefense Function Reduction

Steps 1 and 2 on Table D-3 show the calculation of the reduction required for discretionary appropriations and direct spending within all other functions besides 050 (nondefense function). The calculation is more complicated than the calculation for the defense function due to a two percent limit in the reduction of Medicare non-administrative spending and a special rule for applying the reduction to student loans. Steps 3 and 4 on Table D-3 reflect the implementation of the reductions calculated in steps 1 and 2 through an adjustment to the discretionary spending limit for the nondefense category and a sequestration of direct spending in the nondefense function.

The calculation of the reduction involves the following steps:

Step 1. Total spending in the nondefense function must be reduced by $54.667 billion. The portion of Medicare subject to the two percent limit is estimated to have combined FY 2020 and FY 2021 outlays of $765.495 billion from FY 2020 budgetary resources, so a two percentage point reduction would reduce outlays by $15.310 billion, leaving a reduction of $39.357 billion to be taken from discretionary appropriations and other direct spending in the nondefense function.

Step 2. Pursuant to section 251A(4), the remaining reduction of $39.357 billion is allocated proportionately between discretionary appropriations and other direct spending in the nondefense function. The base ($653.518 billion) is the sum of the FY 2020 discretionary spending limit for the nondefense category ($578.000 billion) and the remaining sequestrable direct spending base ($75.518 billion). The latter amount equals OMB's 2020 Budget baseline estimates of total sequestrable direct spending outlays in the nondefense function in FY 2020 and FY 2021 from direct spending sequestrable resources in FY 2020 ($841.013 billion) minus the portion of Medicare subject to the two percent limit ($765.495 billion). Discretionary appropriations account for 88.44 percent of the remaining base in the nondefense function, and direct spending accounts for 11.56 percent.

As required by section 251A(4), applying these percentage allocations to the remaining required reduction for programs in the nondefense function yields the reduction for discretionary appropriations ($34.807 billion) and for remaining direct spending ($4.550 billion).42

The implementation of the reductions involves the following steps:

Step 3. As required by section 251A(5)(B), the discretionary spending limit for the nondefense category is lowered by the amount calculated in step 2, which results in a discretionary nondefense cap for FY2020 of $543.193 billion.

|

Calculation of Reduction: |

Discretionary |

Direct |

Total |

|

Step 1. Total reduction, excluding savings from Medicare 2% limit: |

|||

|

Medicare base subject to 2% limit |

765.495 |

||

|

Total nondefense function reduction |

54.667 |

||

|

Reduce Medicare by 2% |

-15.310 |

||

|

Non-Medicare reduction amounts |

39.357 |

||

|

Step 2. Allocate non-Medicare reduction: |

|||

|

Total base for allocating reduction |

578.000 |

841.013 |

1,419.013 |

|

Exclude Medicare (portion subject to 2% limit) |

-765.495 |

-765.495 |

|

|

Non-Medicare base |

578.000 |

75.518 |

653.518 |

|

Percentage allocation of non-Medicare base |

88.44% |

11.56% |

|

|

Non-Medicare reduction amounts |

34.807 |

4.550 |

39.357 |

|

Percentage allocation of non-Medicare reduction |

88.44% |

11.56% |

|

|

Implementation of Reduction: |

|||

|

Step 3: Reduction in nondefense cap: |

|||

|

Appropriations reduction required |

-34.807 |

||

|

Adjusted nondefense cap |

543.193 |

||

|

Step 4: Sequestration percentages calculation: |

|||

|

Remaining reduction amounts |

4.550 |

||

|

Savings from uniform percentage reduction: |

|||

|

From 5.9% increase in student loan fee |

0.059 |

||

|

From remaining sequestrable budget accounts |

4.491 |

||

|

Sequestrable base for uniform percentage reduction |

75.518 |

||

|

Sequestration percentage |

5.90% |

||

|

Summary of Reductions: |

|||

|

2% sequestration of Medicare |

15.310 |

||

|

Student loan fee increase |

0.059 |

||

|

Uniform percentage reduction |

4.491 |

||

|

Total reduction |

34.807 |

19.860 |

54.667 |

Step 4. The remaining reduction ($4.550 billion) to direct spending is applied as a uniform percentage reduction to the remaining budget accounts with sequestrable direct spending and by increasing student loan fees by the same uniform percentage, as specified in sections 251A(6) and 256(b). Each percentage point increase in the sequestration rate is estimated to result in $0.010 billion of savings in the direct student loan program. Solving simultaneously for the percentage that would achieve the remaining reduction when applied to both the remaining sequestrable direct spending ($75.518 billion) and to student loan fees yields a 5.9 percent reduction. This percentage reduction yields outlay savings of $0.059 billion in the direct student loan program and $4.491 billion from the remaining budget accounts with nonexempt direct spending.

Appendix E. List of Federal Programs Exempt from the Mandatory Sequester

Many programs and activities are exempt from the mandatory sequester under Sections 255 and 256(d)(7) of BBEDCA (2 U.S.C. §905).43 In dollar terms, three-quarters of all mandatory spending is exempt from the mandatory sequester (see Figure 2).44

Exempt mandatory spending programs include

Social Security benefits and Tier I railroad retirement benefits

Veterans' compensation, pensions, life insurance45

Net interest (payments on accumulated federal debt)

Refundable income tax credits46

Nondefense unobligated balances of budget authority carried over from prior fiscal years

Claims, judgments, and relief acts

Exchange Stabilization Fund

Federal Deposit Insurance Corporation, Deposit Insurance Fund

Federal Home Loan Mortgage Corporation (Freddie Mac)

Federal Housing Finance Agency, administrative expenses

Federal National Mortgage Corporation (Fannie Mae)

Federal Reserve Bank Reimbursement Fund

National Credit Union Administration funds

Federal retirement and disability including civil service, military, foreign service, and judicial

- Child Care Entitlement to States

- Child Nutrition Programs (with the exception of Special Milk)

- Children's Health Insurance Program

- Family support programs (including Child Support Enforcement)

- Federal Pell Grants (under Section 1070a of Title 20)47

- Grants to states for Medicaid

- Medicare Part D low-income subsidies, catastrophic subsidies, and Qualified Individual premiums

- Payments for foster care and permanency48

- Supplemental Nutrition Assistance Program (formerly "food stamps")

- Supplemental Security Income

- Temporary Assistance for Needy Families

Economic recovery programs including GSE preferred stock purchase agreements, Office of Financial Stability

Federal-Aid Highways and Safety Programs49

Unemployment compensation (but federal share of extended benefits is not exempt)50

Postal Service Fund

Salaries of Article III judges

Certain tribal and Indian trust accounts

Universal Service Fund

Various prior legal obligations of the government including

- Credit liquidating accounts

- Federal Crop Insurance Corporation Fund (however, farm price and income supports are not exempt from the Joint Committee sequester)

- Federal Emergency Management Agency, National Flood Insurance Fund

- Pension Benefit Guaranty Corporation Fund

- Terrorism Insurance Program.

Appendix F. Additional CRS Resources on Sequestration

CRS Insight IN11148, The Bipartisan Budget Act of 2019: Changes to the BCA and Debt Limit, by Grant A. Driessen and Megan S. Lynch.

CRS Report R44874, The Budget Control Act: Frequently Asked Questions, by Grant A. Driessen and Megan S. Lynch.

CRS Report R45106, Medicare and Budget Sequestration, by Patricia A. Davis.

CRS Report R42050, Budget "Sequestration" and Selected Program Exemptions and Special Rules, coordinated by Karen Spar.

CRS Report R42972, Sequestration as a Budget Enforcement Process: Frequently Asked Questions, by Megan S. Lynch.

CRS Report R43133, The Impact of Sequestration on Unemployment Insurance Benefits: Frequently Asked Questions, by Katelin P. Isaacs and Julie M. Whittaker.

Author Contact Information

Acknowledgments

The author gratefully acknowledges the work of current and former CRS colleagues whose research, analysis, and publication support contributed to this report: Richard Campbell, Benjamin Collins, Cheryl Cooper, Eliot Crafton, Patricia A. Davis, Grant Driessen, Sandra Edwards, Adrienne Fernandes-Alcantara, Bernadette Fernandez, Jill Gallagher, Raj Gnanarajah, Elayne J. Heisler, Jamie Hutchinson, Bill Heniff, Kristy Kamarck, Robert Kirk, Karen Lynch, Megan Lynch, Brendan McGarry, Jim Monke, Sidath V. Panangala, Elizabeth Rybicki, Lisa Sacco, Pervaze Sheikh, David Smole, James Saturno, Kyle Shohfi, Karen Spar, and Eric Weiss.

Footnotes

| 1. |

Title II of P.L. 99-177, August 2, 2011, 125 Stat. 240, 2 U.S.C. §900 et seq.; also known as the "Deficit Control Act" and originally known as "Gramm-Rudman-Hollings" for the law's three Senate cosponsors—Senators Phil Gramm, Warren Rudman, and Ernest "Fritz" Hollings. |

| 2. |

The spending caps were increased by the Bipartisan Budget Act (BBA) of 2013 (P.L. 113-67), the BBA of 2015 (P.L. 114-74), the BBA of 2018 (P.L. 115-123), and the BBA of 2019 (P.L. 116-37). See, The Bipartisan Budget Act of 2019: Changes to the BCA and Debt Limit, by Grant A. Driessen and Megan S. Lynch. |

| 3. |

2 U.S.C. §901(c). |

| 4. |

Pursuant to paragraphs (3) and (4) of Section 251A of BBEDCA—and consistent with Section 6 of the Statutory Pay-As-You-Go Act of 2010—the base for allocating reductions to budget accounts with direct spending is the sum of the direct spending outlays in the budget year and the subsequent year that would result from sequestrable budgetary resources in the budget year. For FY2020, estimates of sequestrable budgetary resources and outlays for budget accounts with direct spending are equal to the current law baseline amounts contained in the President's FY2020 budget and include direct spending unobligated balances in the defense function and administrative expenses. |

| 5. |

Pursuant to Section 256(k)(2) of BBEDCA, the sequestration must be applied equally at the PPA level. For annually appropriated accounts, OMB and agencies identify PPAs by reference to committee reports and budget justifications. For permanent appropriations, OMB and agencies identify PPAs by the program and financing schedules that the President provides in the "Detailed Budget Estimates" in the Budget Appendix for the relevant fiscal year. |

| 6. |

This calculation includes Medicare outlays that flow from FY2020 budgetary resources and are booked in FY2020 or in FY2021. See footnote 7. |

| 7. |

This percentage reduction yields outlay savings of $59 million in the direct student loan program and $4.491 billion from the remaining budget accounts with nonexempt mandatory spending. OMB describes this calculation as "solving simultaneously for the percentage that would achieve the remaining reduction when applied to both the remaining sequestrable direct spending ($75.518 billion) and to student loan fees yields a 5.9 percent reduction." The BCA requires that each percentage point increase in the sequestration rate is estimated to result in $0.010 billion of savings in the direct student loan program. |

| 8. |

See footnote 5. |

| 9. |

The Congressional Budget Office (CBO) has scored the following budgetary savings associated with extension of the mandatory sequester: BBA of 2019: CBO, CBO Estimate for the Bipartisan Budget Act of 2019, July 23, 2019, p. 1, https://www.cbo.gov/system/files/2019-07/BipartisanBudgetActof2019.pdf. BBA of 18: CBO, CBO Estimate for Senate Amendment 1930, the Bipartisan Budget Act of 2018, Direct Spending and Revenue Provisions, Division C, February 8, 2018, pp. 1-2, https://www.cbo.gov/system/files/115th-congress-2017-2018/costestimate/bipartisanbudgetactof2018.pdf. BBA of 15: CBO, Estimate of the Budgetary Effects of H.R. 1314, the Bipartisan Budget Act of 2015, as reported by the House Committee on Rules, October 28, 2015, p. 1, https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/costestimate/hr1314.pdf. BBA of 13: CBO, Bipartisan Budget Act of 2013, December 11, 2013, Table 2, https://www.cbo.gov/sites/default/files/113th-congress-2013-2014/costestimate/bipartisan-budget-act-20130.pdf. |

| 10. |

See 2 U.S.C. §901a(6)(B): "On the dates OMB issues its sequestration preview reports for each of fiscal years 2022 through 2027, pursuant to section 904(c) of this title, the President shall order a sequestration, effective upon issuance such that-(i) the percentage reduction for nonexempt direct spending for the defense function is the same percent as the percentage reduction for nonexempt direct spending for the defense function for fiscal year 2021 calculated under paragraph (3)(B); and (ii) the percentage reduction for nonexempt direct spending for nondefense functions is the same percent as the percentage reduction for nonexempt direct spending for nondefense functions for fiscal year 2021 calculated under paragraph (4)(B)." Note that this provision applies through FY2029 with enactment of the BBA of 19 (P.L. 116-37). |

| 11. |

All of the account reductions are listed in OMB, Report to the Congress on the Joint Committee Reductions for Fiscal Year 2020, pp. 6-17. |

| 12. |

The BCA is an amendment to BBEDCA and repeals BBEDCA's expiration date. Exemptions are set forth in Sections 255 and 256(d)(7) of the BBEDCA, as amended (2 U.S.C. §905). For additional background on exemptions and special rules, see CRS Report R42050, Budget "Sequestration" and Selected Program Exemptions and Special Rules, coordinated by Karen Spar. |

| 13. |

Calculated as follows: total baseline mandatory spending in FY2020 is $3,368 billion (Budget of the United States Fiscal Year 2020, Analytical Perspectives, Table 26-12); mandatory spending subject to sequester in FY2020 is $841 billion for nondefense (including Medicare) plus $9.8 billion for defense (FY2020 Report on the Joint Committee Reductions for FY2020), which together comprise 25.2% of total mandatory spending. |

| 14. |

End-stage renal disease is permanent kidney failure requiring dialysis or transplant. For additional information on the Medicare programs, see CRS Report R40425, Medicare Primer, coordinated by Patricia A. Davis. |

| 15. |

Medicare benefit payments are defined by Section 256(d) of BBEDCA (2 U.S.C. §906) as "individual payments for services" under Parts A and B and "monthly payments under contracts" for Parts C and D. The 2 percent limit for the Medicare sequester is set forth in Section 251A(8) of BBEDCA (2 U.S.C. §901a(6)(A)): "When implementing the sequestration of direct spending pursuant to this paragraph, OMB shall follow the procedures specified in section 935 of this title, the exemptions specified in section 905 of this title, and the special rules specified in section 906 of this title, except that the percentage reduction for the Medicare programs specified in section 906(d) of this title shall not be more than 2 percent for a fiscal year." In contrast, in the event that sequestration is triggered by the Statutory Pay-As-You-Go Act of 2010, the Medicare sequester is limited to 4 percent. |

| 16. |

CRS Report R45106, Medicare and Budget Sequestration, by Patricia A. Davis. According to guidance issued by CMS, any sequestration reductions are to be made to claims after determining coinsurance, deductibles, and any applicable Medicare Secondary Payment adjustments. CMS, "Monthly Payment Reductions in the Medicare Fee-for-Service (FFS) Program—'Sequestration,'" March 8, 2013, https://www.cms.gov/outreach-and-education/outreach/ffsprovpartprog/downloads/ 2013-03-08-standalone.pdf. |

| 17. |

Medicare Part A (Hospital Insurance) covers inpatient hospital services, skilled nursing care, hospice care, and home health services, funded by a 2.9% payroll tax on earnings of current workers, shared equally between employers and workers. Part B covers physician services, laboratory services, durable medical equipment, and outpatient hospital services. Enrollment in Part B is optional, and benefits are paid for out of premiums and federal general revenues. Part C (Medicare Advantage) is a private plan option that covers Part A and B services, except hospice. About one-third of Medicare beneficiaries are enrolled in Medicare Advantage. Part D is a private plan option for outpatient prescription drug benefits. Part D benefits are funded through beneficiary premiums and federal general revenues. |

| 18. |

CMS has stated, "Whether and how sequestration might affect an MAO's payments to its contracted providers are governed by the terms of the contract between the MAO and the provider." Cheri Rice and Danielle Moon, "Additional Information Regarding the Mandatory Payment Reductions in the Medicare Advantage, Part D, and Other Programs," CMS, May 1, 2013. |

| 19. |