The Commodity Credit Corporation (CCC)

Changes from April 19, 2018 to September 4, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

The Commodity Credit Corporation: In Brief

Contents

- Origin of the CCC

- CCC Charter Act

- Management of CCC

- Financing CCC

- Borrowing Authority

- Net Expenditures

- Net Realized Losses

Non-Borrowing Authority Appropriations- Issues for Congress

- Expansion of CCC Activities

- Restrictions on Use

- Conclusion

- Conclusion

Summary

The Commodity Credit Corporation (CCC) has served as a mandatory funding mechanism for agricultural programs since 1933. The CCC Charter Act enables the CCC to broadly support the U.S. agriculture industry through authorized programs including commodity and income support, natural resources conservation, export promotion, international food aid, disaster assistance, agricultural research, and bioenergy development.

While CCC is authorized to carry out a number of activities, it has no staff of its own. Rather, U.S. Department of Agriculture (USDA) employees and facilities carry out all of its activities. CCC is overseen by the Secretary of Agriculture and a board of directors, which are also USDA officials. CCC has $100 million in capital stock; buys, owns, sells, and donates commodity stocks; and provides loans to farmers and ranchers. It has a permanent indefinite borrowing authority of $30 billion from the U.S. Treasury. By law, it receives an annual appropriation equal to the amount of the previous year's net realized loss. This replenishes its borrowing authority from the Treasury and allows it to cover authorized expenditures that will not be recovered.

The majority of CCC activities are authorized through omnibus farm bills—most recently the Agriculture Improvement Act of 2018 (P.L. 115-334). Farm bill authorization allows programs to utilize CCC's borrowing authority, thereby dispensing with the need for an annual appropriation for individual programs. The use of this mandatory authority has expanded over time and has led to tension between authorizing committees and appropriation committees in previous fiscal years.

The Charter Act also grants the Secretary of Agriculture broad powers and discretion in the use of the CCC. This discretionary use was restricted in annual appropriations legislation from FY2012 through FY2017, effectively reducing the Secretary's discretionary use of CCC. The FY2018 Consolidated Appropriations Act (P.L. 115-124) did not include these restrictions, which has allowed the Trump Administration to use CCC's authority to address market impacts from China's retaliatory tariffs on certain U.S. agricultural commodities in 2018 and 2019.

The Commodity Credit Corporation (CCC) has served as the financial institution for carrying out federal farm commodity price support and production programs since 1933. It is a wholly government-owned entity that exists solely to finance authorized programs that support U.S. agriculture. It is subject to the supervision and direction of the Secretary of Agriculture at the U.S. Department of Agriculture (USDA). The CCC mission was conceived mostly as one of commodity support, but over time it has expanded to include an increasingly broad array of programs, including export and commodity programs, resource conservation, disaster assistance, agricultural research, and bioenergy development.

While CCC operates according to a large number of statutory authorities, its broad powers allow it to carry out almost any operation required to meet the objectives of supporting U.S. agriculture. This broad mandate, and its significant borrowing authority, has traditionally drawn little attention. For most of its history, CCC's responsibilities have been expanded through legislative directives such as the farm bill. RecentlyIn past years, Congress took actions to limit the discretional uses of CCC funds through restrictions in appropriations language. These restrictions highlight a tension between authorizers and appropriators when it comes to the use of the CCC (see "Tension Between Authorizers and Appropriators" box). While these restrictions have since been removedare no longer included, questions remain about what the CCC is, how it operates, what its current uses are, and what it may be used for in the future. This report provides a brief review of CCC's unique history, funding structure, general operation, and recent issues associated with its use. Other CRS reports cover in detail programs and activities authorized through CCC.1

Origin of the CCC

For over a decade prior to the creation of CCC in 1933, the farm economy struggled with low levels of income from depressed commodity prices and increasing costs for needed supplies and services. The first major federal effort to boost commodity prices was through the Federal Farm Board, established by the Agricultural Marketing Act of 1929.2 An inadequate and ultimately failed effort to eliminate surpluses was attempted by making loans to cooperative associations for the purpose of carrying out surplus purchase operations. Without the ability to control production, it was impossible to eliminate surplus stocks. This led to proposals to regulate the harvested acreage of farm commodities and quantities sold. The concept of acreage and marketing controls was incorporated in to the Agricultural Adjustment Act of 1933 (AAA).3

The AAA sought to reduce production by paying producers to participate in acreage control programs. Funding came from a tax on companies that processed farm products. Additional provisions of the law dealt with fair marketing practices and voluntary agreements between producers and handlers of commodities to regulate marketing. A financial institution was needed to carry out the newly authorized farm legislation, and this was accomplished with the creation of the Commodity Credit Corporation. Executive Order 6340 of October 17, 1933, directed the incorporation of CCC in the state of Delaware.4

The Delaware charter authorized CCC, among other things, to buy and sell farm commodities; lend; undertake activities for the purpose of increasing production, stabilizing prices, and insuring adequate supplies; and facilitate the efficient distribution of agricultural commodities. It was originally capitalized with $3 million appropriated by Congress. In 1936, sufficient stock was acquired to raise the capitalization to $100 million. Its capital stock remains at this level today.5 In 1939, Executive Order 8219 ordered that all rights of the United States arising out of the ownership of CCC be transferred to the Secretary of Agriculture.6

At that time, low prices became so critical for cotton and corn producers that waiting for another season for supply controls to impact the market was judged to be untenable. With the establishment of CCC, it became possible to make nonrecourse loans so that farmers would have funds to hold their products off the market until prices improve. The first loans were made to cotton farmers at the rate of 10 cents per pound, while the average market price was between eight and nine cents per pound. Since loans were higher than the market price and were nonrecourse, they could be satisfied by forfeiting the cotton pledged as collateral against the loan, they served as a form of price support and set the floor for the domestic market.7 Funding for these first loan operations came from a tax on commodity processing and from CCC's $3 million capital account, which was appropriated under authority of the National Industrial Recovery Act and the Fourth Deficiency Act.8

Constitutional difficulties with some provisions of the AAA, and practical shortcomings with elements of the law, led to additional legislation in the 1930s that continues today as permanent authority for many USDA activities. Subsequent omnibus "farm bills" now set most of the policy goals and program constraints for farm price and income support operations that are funded through CCC.

CCC Charter Act

The Government Corporation Control Act of 19459 (GCCA) required all wholly owned government corporations to be reincorporated as agencies or instrumentalities of the United States. Accordingly, Congress passed the Commodity Credit Corporation Charter Act of 1948 (Charter Act).10 All CCC rights, duties, assets, and liabilities were assumed by the federal corporation, and the Delaware corporation was dissolved.

|

Government Corporations in General Government corporations have existed for over a century. The exact number of government corporations depends on how they are defined (ranging from around a dozen to over 40). While no single definition exists, they are generally defined as agencies of the federal government established by Congress to perform a public purpose. Commonly, they provide a market-oriented product or service and are intended to produce revenue that meets or approximates its expenditures. Generally, government corporations must submit annual management reports to Congress and are assigned to committees of subject matter jurisdiction. |

According to the Charter Act, the purpose of CCC is to stabilize, support, and protect farm income and prices; assist in maintaining balanced and adequate supplies of agricultural commodities; and facilitate the orderly distribution of commodities. A list of some of CCC's authorities (paraphrased from Section 5 of the Charter Act, 15 U.S.C. Section §714(c)) conveys a sense of its broadly stated powers:

- Support agricultural commodity prices

1112 through loans, purchases, payments, and other operations. - Make available materials and facilities in connection with the production and marketing of agricultural products.

- Procure commodities for sale to other government agencies; foreign governments; and domestic, foreign, or international relief or rehabilitation agencies and for domestic requirements.

- Remove and dispose of surplus agricultural commodities.

- Increase the domestic consumption of commodities by expanding markets or developing new and additional markets, marketing facilities, and uses for commodities.

- Export, or cause to be exported, or aid in the development of foreign markets for commodities.

- Carry out authorized conservation or environmental programs.

Over time, Congress has authorized CCC to fund an increasing number of diverse programs and activities related to its charter (see text box below). In carrying out operations, CCC is directed, to the maximum extent practicable, to use the usual and customary channels, facilities, and arrangements of trade and commerce.

|

CCC is authorized to fund a broad array of programs supporting U.S. agriculture. These programs are typically authorized through omnibus farm bills. A general description of the assistance offered and examples of associated programs are listed below. This is not an exhaustive list. For additional information on these and other CCC-funded programs, see CRS farm bill reports at http://www.crs.gov/iap/agriculture-and-food. Commodity and Income Support provides farm payments and loans when crop prices or revenues decline for major commodity crops—including wheat, corn, soybeans, peanuts, and rice—as well as other support mechanisms for dairy, cotton, and sugar (e.g., Agriculture Risk Coverage, Price Loss Coverage, and Dairy Margin Conservation provides financial and technical assistance for voluntary participation in resource conservation programs to protect soil, water, wildlife, and other natural resources on private lands (e.g., Environmental Quality Incentives Program, Conservation Reserve Program, and Agricultural Conservation Easement Program). Disaster provides payments for livestock and crop production losses resulting from weather events and disease outbreaks (e.g., Livestock Forage Program, Noninsured Crop Disaster Assistance Program, and Tree Assistance Program). Export and Foreign Food Assistance promotes U.S. agricultural products abroad, develops export markets, and supports international food assistance programs (e.g., Bioenergy provides assistance for the research, development, and adoption of renewable energy—primarily biofuels (e.g., Biorefinery Assistance Specialty Crops supports research, market promotion (including organic certification), and pest and disease prevention for fruits, vegetables, tree nuts, floriculture, and other ornamental products (e.g., Specialty Crop Block Grant Program |

Management of CCC

The Charter Act makes CCC an agency and instrumentality of the United States within USDA, subject to the supervision and direction of the Secretary of Agriculture. A board of directors appointed by the President, consisting of the Secretary and seven other USDA officials, is responsible for the management of CCC. CCC officers and advisors—also USDA officials—are charged with maintaining liaisons with other governmental and private trade operations on the CCC's behalf.

The CCC has no personnel of its own. Rather, USDA employees and facilities carry out all of its activities. Administrative functions generally fall to the USDA agencies directed to administer the various CCC programs. The majority of its functions are administered by the Farm Service Agency (FSA), which operates most of the commodity and income support programs. Other agencies that administer CCC programs include the Natural Resources Conservation Service, the Agricultural Marketing Service, the Foreign Agricultural Service, and the United States Agency for International Development (USAID). CCC directly pays salaries and expenses incurred by FSA for CCC activities and also reimburses other agencies for their administrative costs.

CCC cannot acquire property or interest in property unless it is related to providing storage for program implementation or protecting CCC's financial interests.1213 CCC is allowed to rent or lease space necessary to conduct business (e.g., warehousing of commodities).

Financing CCC

CCC is responsible for the direct spending and credit guarantees used to finance the federal government's agricultural commodity price support and related activities that are undertaken by authority of agricultural legislation (such as farm bills) or the Charter Act itself. It is, in brief, a broadly empowered financial institution. The money CCC needs comes from its own funds (including its $100 million capital stock, appropriations from Congress, and its earnings) and from borrowings. In accordance with government accounting statutes and regulations, CCC is required to submit an annual business-type budget statement to Congress. This is typically released annually with the President's budget request.13

The Office of Management and Budget (OMB) also plays a role in how CCC funds are administered through an apportionment process, which allows OMB to set a limit on the funds available for obligation and subsequent outlay.1415 OMB apportions funds for select CCC programs and operating expenditures.1516 OMB is precluded, however, from apportioning funds "for price support and surplus removal of agricultural commodities."16

Borrowing Authority

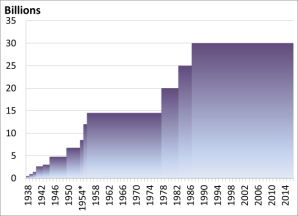

Most CCC-funded programs are classified as mandatory spending programs and therefore do not require annual appropriations in order to operate. CCC instead borrows from the U.S. Treasury to finance its programs. CCC has permanent indefinite authority to borrow from the Treasury (and also private lending institutions) within limits set by Congress. As the amount of money needed to carry out its activities has grown over time, the borrowing limit has been steadily increased (Figure 1). At present, CCC's borrowing authority is limited to $30 billion,1718 an amount that has not been increased since 1987.

CCC activity is often described using two similar but different measures. The first is net expenditures, which is a combination of outlays and receipts. The second is net realized losses, which are expenditures that will never be recovered.

Net Expenditures

CCC recoups some money from authorized activities (e.g., sale of commodity stocks, loan repayments, and fees), though not nearly as much money as it spends, resulting in net expenditures. Net expenditures include all cash outlays minus all cash receipts, commonly referred to as "cash flow." CCC outlays or expenditures represent the total cash outlays of the CCC-funded programs (e.g., loans made, conservation program payments, commodity purchases, and disaster payments). Outlays are offset by receipts (e.g., loan repayment, sale of commodities, and fees). In FY2015, CCC gross outlays were $12.4 billion. Gross cash receipts were $6.0 billion, resulting in net expenditures in FY2015 of approximately $6.4 billion.18 In practice a portion of these net expenditures may be recovered in future years (e.g., through loan repayments).

Net Realized Losses

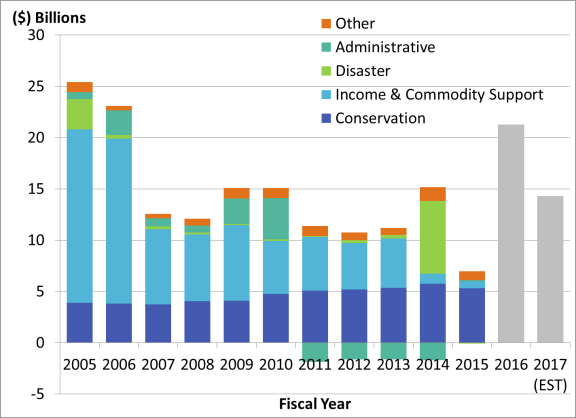

CCC also has "net realized losses," also referred to as nonrecoverable losses. These refer to the outlays that CCC will never recover, such as the cost of commodities sold or donated, uncollectible loans, storage and transportation costs, interest paid to the Treasury, program payments, and operating expenses. The net realized loss is the amount that CCC, by law, is authorized to receive through appropriations to replenish the CCC's borrowing authority (see Figure 2).19

|

Figure 2. CCC FY2005- |

|

|

Source: Compiled by CRS from USDA, FSA, Commodity Estimates Book, FY2008

|

The annual appropriation for CCC varies each year based on the net realized loss of the previous year.20 For example, the FY2018FY2019 appropriation (P.L. 115-124116-6) continues to provide an indefinite appropriation, covering the net realized loss for FY2017FY2018, which was $14.2815.41 billion, 33% lower8% more than the net realized loss in FY2016 of $21.29FY2017 of $14.28 billion. The reductionincrease does not indicate any action by Congress to change program support but rather changes in farm program payments and other CCC activities that fluctuate based on economic circumstances and weather conditions. Also, CCC's assets, which include loans and commodity inventories, are not considered to be "losses" until CCC ultimately disposes of the asset (e.g., by sales, exports, or donations). At that time, the total cost is realized and added to other program expenses less any other program income.

Non-Borrowing Authority Appropriations

Some CCC operations are financed through appropriated funds and are unrelated to the permanent indefinite borrowing authority described above.21 These activities include a specific statutory authority for separate reimbursement—for example, export credit guarantee programs, foreign donations, concessional sales under the Food for Peace Program (P.L. 83-480, also known as P.L. 480), and disaster aid.

CCC has what it refers to as a "parent/child" account relationship with USAID. CCC allocates funds (as the parent) to USAID (as the child) to fund P.L. 480 Title II and Bill Emerson Humanitarian Trust transportation costs and other administrative costs in connection with foreign commodity donations. CCC then reports USAID's budgetary and proprietary activities in its financial statements.22

Issues for Congress

Expansion

of CCC ActivitiesOver time, a number of new activities have been added to CCC's original mission, including conservation, specialty crop support, and bioenergy development. Some have suggested adding other agriculture-related activities to CCC. The idea of expanding CCC's activities generates both concern and support. Some consider this expansion to be beyond CCC's chartered purpose. Others, however, prefer the stability and consistency of mandatory funding to that of the annual appropriations process. Any expansion of mandatory funding authority, however, would require a spending or revenue offset under current budgetary rules.

Although Congress as a whole makes final funding decisions, the rise in the number of agricultural programs with mandatory budget authority from the authorizing committees has not gone unnoticed or untouched by appropriators. In recentprevious years, appropriations bills have reduced mandatory program spending below authorized levels. These reductions, as estimated by the Congressional Budget Office, are commonly referred to as changes in mandatory program spending (CHIMPS). CHIMPS can be used to offset increases in discretionary spending that are above discretionary budget caps.23

|

Tension Between Authorizers and Appropriators The U.S. Constitution grants the power over appropriations (the "power of the purse") to Congress. House and Senate rules create a division of labor through the procedural separation between authorizations and appropriations. Legislative committees (such as, for agriculture, the House Committee on Agriculture and the Senate Committee on Agriculture, Nutrition, and Forestry) are responsible for authorizing legislation. Appropriations committees (such as the House and Senate Appropriations Subcommittees on Agriculture, Rural Development, Food and Drug Administration, and Related Agencies) are responsible for establishing annual appropriations. Procedural rules generally prohibit encroachment on these distinct committee responsibilities. However, multiyear funding for mandatory spending programs is provided in one step by authorizing legislation, which bypasses the two-step authorization-appropriation process.24 The current tension over which committee is responsible for bringing final budget recommendations to the floor for certain agricultural programs—appropriators or authorizers—dates from when CCC was originally chartered and the creation of farm commodity programs. Some farm commodity subsidies are volatile and therefore difficult to budget, because they depend upon both market prices and yields. These payments resemble entitlements,25 and any appropriation set in advance would likely be too little or too much. Thus, CCC was created, in part, as a funding mechanism to deal with the variable nature of farm program payments. This separation operated for many decades with little tension. But the dynamic changed, particularly with the 1996 and 2002 farm bills,26 when authorizers began writing laws using CCC to fund programs that were typically Ultimately, Congress as a whole—not individual committees—makes the final funding decisions when it passes authorizing and appropriations legislation. Congress may fund programs both in multi-year authorizing laws and in annual appropriations acts. Some contend that tension among committees, interest groups, and political parties is part of the process by which Congress passes legislation

|

Restrictions on Use

Beginning in FY2012From FY2012 to FY2017, annual appropriation acts limited USDA's discretionary use ofdiscretion to use CCC's authority to remove surplus commodities and support prices (see text box below). The FY2018 omnibus appropriation removeddid not include this limitation, effectively allowing USDA to use CCC's full authority, including its discretion for surplus removal and price support activities, along with other authorized uses.

|

How Was CCC Restricted and Why? Each annual appropriation between FY2012 and FY2017 prohibited the use of select discretionary authority under the CCC. This restriction was specific to any surplus removal activities or price support activities under Section 5 of the Commodity Credit Corporation Charter Act (15 U.S.C. §714c). This recurring provision was a reaction to administrative activities following 2009 crop losses, in which the Obama Administration announced that it would implement a disaster program under "Section 32" authority. Critics of the 2009 disaster assistance, in Congress and elsewhere, questioned whether USDA had authority to make such payments without a legislative mandate. Concerns at that time about the limits on CCC's mandate |

USDA's ability to use its administrative powers in the Charter Act, however, may be restricted by executive budgetary rules such as "administrative PAYGO"––that is, the need to offset additional spending created by administrative action.3432 Administrative PAYGO has been cited as a potential roadblock to undertaking certain CCC actions but has also been waived or not raised as an issue in other cases involving CCC.

The majority of CCC operations are directed by statutory authorities that specifically direct USDA on how to administer CCC activities and in what amounts to fund them. The broad CCC authorities, however, also allow USDA a level of discretion to carry out effectively any operation that supports U.S. agriculture. This discretion has been used throughout CCC's history for a number of different purposes, including responses to natural disasters, economic conditions, and administrative priorities. The scope and scale of this discretion has traditionally been targeted to specific events, crops, or domestic needs. In the decade before FY2018, administrative discretion was partially restricted (see "Restrictions on Use"). USDA's use of the unrestricted portion of CCC's authority during this period totaled in the hundreds of millions of dollars (see examples below).

|

Examples of Administrative Discretion: Biofuels and Cotton USDA has at times been both assertive and reluctant to use the general powers of CCC based on its interpretation of congressional intent. This has created policy debates between Congress and Administrations. In June 2015, USDA announced the availability of $100 million in matching grants under a Biofuel Infrastructure Partnership (BIP) initiative. Critics of the initiative questioned the use of CCC authority, citing amendments made in the 2014 farm bill (Section 9001 of P.L. 113-79) that prohibit USDA from using farm bill energy programs to fund blender pumps under the Rural Energy for America program. In a reversal of roles, the issue of CCC authority and congressional intent was raised again in early 2016 when USDA announced that it was denying the cotton industry's request to provide subsidies for cottonseed. Ultimately, USDA used CCC authority to create the Cotton Ginning Cost Share program, which provides payments based on cotton acres and average ginning costs. The program was initiated again in 2018 using CCC authorities similar to those of the BIP initiative (i.e., market expansion). 42 |

Congressional support for discretionary use of CCC typically varies depending on purpose. Some in Congress have questioned how USDA has used CCC, but few have advocated for a restriction or repeal of the discretionary authority in the last two years. Some Members have called on USDA to use CCC for similar assistance to industries within their states and districts.44 Congress did require USDA to expand payments under the trade aid program in the FY2019 supplemental appropriations. This expansion could be viewed as congressional support for the trade aid package.45

Conclusion

CCC is a government-owned and broadly empowered financial institution that has a mandate to support U.S. agriculture. Its activities are derived from authorities granted by Congress. While it is the primary funding mechanism used in omnibus farm bills, its existence, use, and operations are frequently misunderstood and often confused with USDA itself. One reason for this confusion may be because much of CCC's functional operations support USDA's program activities––CCC has no staff of its own; rather, it operates through USDA agencies.

These broad authorities that Congress has granted to CCC allow it to carry out almost any operation that is consistent with the objective of supporting U.S. agriculture. It is these same broad powers that make CCC the object of attention from various interest groups and from Congress.

The mandatory funding nature of CCC activities makes it an attractive funding mechanism. Any expansion of mandatory funding authority by Congress, however, may require a spending/revenue offset or an amendment to current budgetary rules. As Congress considers successor legislation to the 2014 farm law, CCC's general authorities may be a topic of interest.

Additionally, recent congressional action to remove limitations on CCC's authority have led some to wonder whether the Trump Administration may seek to use CCC to mitigate commodity price declines that could result from recently imposed Chinese tariffs on a variety of U.S. agricultural products. USDA officials have indicated that they agency is reviewing all options.43

Author Contact Information

The use of CCC's discretionary authority for the FY2018 and FY2019 trade aid packages is perhaps less controversial than the total amount authorized. Each package is close to the total amount expended by CCC annually in recent fiscal years, effectively doubling the annual net realized loss.46 This increase in spending brings CCC close to its borrowing authority limit of $30 billion. If the borrowing authority limit were reached before Congress appropriates the net realized loss reimbursement, all functions and operations of CCC would be suspended, including those authorized in the recently enacted 2018 farm bill.47 Additionally, since the two trade aid packages were undertaken using CCC's discretionary authority, no congressional budget offset was required, and administrative PAYGO was not raised. The corporation's permanent, indefinite funding authority means that trade aid expenditures are reimbursed annually as a net realized loss, thus increasing total federal spending.

Author Contact Information

Megan Stubbs, Specialist in Agricultural Conservation and Natural Resources Policy ([email address scrubbed], [phone number scrubbed])Footnotes

| 1. |

For additional information regarding programs and activities authorized through CCC, see CRS farm bill reports at http://www.crs.gov/iap/agriculture-and-food. |

|||||||||||

| 2. |

P.L. 71-10; 46 Stat. 11. |

|||||||||||

| 3. |

P.L. 73-10; 48 Stat. 31. |

|||||||||||

| 4. |

Executive Order 6340, "Creating the Commodity Credit Corporation," Public Papers of the Presidents of the United States: Franklin D. Roosevelt (Washington: GPO, October 16, 1933). |

|||||||||||

| 5. |

The Reconstruction Finance Corporation originally acquired the $100 million capitalization stock. The Reconstruction Finance Corporation was a New Deal–era government corporation that provided financial support and loans, including the recapitalization of banks. |

|||||||||||

| 6. |

Executive Order 8219, 4 Federal Register 3565, August 10, 1939. |

|||||||||||

| 7. |

David Godfrey, "The Commodity Credit Corporation," Texas Tech University, 1974, http://hdl.handle.net/10601/1696. |

|||||||||||

| 8. |

48 Stat. 195, and 48 Stat. 274, respectively. |

|||||||||||

| 9. |

The GCCA (31 U.S.C. §§9101-9110) standardized budget, auditing, debt management, and depository practices for government corporations. The GCCA is not a general incorporation act such as those in effect in the states. The charter for each federal government corporation is the separate enabling legislation passed by Congress. The GCCA also does not offer a general definition of what constitutes a government corporation. It simply enumerates the organizations covered by the act. For additional information, see |

|||||||||||

| 10. |

P.L. 80-89; 62 Stat. 1070; 15 U.S.C. §714. |

|||||||||||

11.

|

|

12.

GAO, Federally Created Entities: An Overview of Key Attributes, GAO-10-97, October 2009, pp. 13-16, https://www.gao.gov/products/GAO-10-97. |

Amendments to the Charter Act in 2004 preclude tobacco from being considered within the definition of "agricultural commodities" (P.L. 108-357). |

||||||||||

|

16 U.S.C. §714b(h). |

||||||||||||

|

CCC budget documents may be found at http://www.fsa.usda.gov/about-fsa/budget-and-performance-management/budget/ccc-budget-essentials/index. |

||||||||||||

|

|

||||||||||||

|

In accordance with the Antideficiency Act, as amended (31 U.S.C. §1512), among others. |

||||||||||||

|

31 U.S.C. §1511(b)(1)(A). |

||||||||||||

|

15 U.S.C. §714b(i). |

||||||||||||

|

CCC estimates also include the change in working capital, which increases the total CCC net expenditure in FY2015 to $6.65 billion. See USDA, FSA, Commodity Estimates Book FY2017 President's Budget Commodity Credit Corporation, Presentation Number: 2017-01, February 9, 2016, Output 2, http://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/AboutFSA/Budget/pdf/ebooks/FY%202017%20Commodity%20Estimates%20Book%20-%20Web%20Version.pdf. FY2015 is the most recent year for which information is available, as CCC did not publish a Commodity Estimates Book with the FY2018 or FY2019 President's Budget. |

||||||||||||

| 19. |

|

|||||||||||

| 20. |

According to a GAO report, CCC changed the manner in which it calculates its request for an appropriation to cover its net realized losses in 1998 in response to recommendations from USDA's Office of Inspector General. Prior to 1998, the annual appropriation request included estimates for prior and future losses. This resulted in an over-appropriation of about $5 billion in FY1996 due to overestimates of CCC's prior and future losses. GAO, Commodity Credit Corporation: Information on the Availability, Use, and Management of Funds, GAO/RCED-98-114, April 1998. |

|||||||||||

| 21. |

USDA, Office of Inspector General, Commodity Credit Corporation's Financial Statements for Fiscal |

|||||||||||

| 22. |

OMB, Financial Reporting Requirements, Circular No. A-136 (Revised), |

|||||||||||

| 23. |

For additional information about CHIMPS in the |

|||||||||||

| 24. |

For additional information on mandatory and discretionary funding, see CRS Report R44582, Overview of Funding Mechanisms in the Federal Budget Process, and Selected Examples. For additional information on the appropriations process, see CRS Report R42388, The Congressional Appropriations Process: An Introduction. |

|||||||||||

| 25. |

Entitlements are programs that require payments if specific eligibility criteria in an authorizing law are met. This form of mandatory spending is not controlled through the annual appropriations process. The total amount of entitlement spending is determined by the aggregate total of all individual benefits and, in most cases, is not capped. See CRS Report RS20129, Entitlements and Appropriated Entitlements in the Federal Budget Process. |

|||||||||||

| 26. |

Federal Agricultural Improvement and Reform Act of 1996 (P.L. 104-127, 1996 farm bill) and Farm Security and Rural Investment Act of 2002 (P.L. 107-171, 2002 farm bill). |

|||||||||||

| 27. |

For | |||||||||||

| 28. |

Letter from Agriculture Land-Based Training Association, ALA-TOM Resource Conservation and Development Council, Alabama Association of Conservation Districts, et al. to the Honorable Robert Aderholt, chairman, House Agriculture Appropriations Subcommittee et al., April 5, 2017, http://www.nacdnet.org/wp-content/uploads/2017/04/FY18-conservation-appropriations-letter-4-5-2017-2.pdf. |

|||||||||||

| 29. |

|

|||||||||||

|

Appropriations acts also limited clause 3 of Section 32, which provides that funds may be used to reestablish farmers' purchasing power by making payments in connection with the normal production of any agricultural commodity for domestic consumption (7 U.S.C. §612c). |

||||||||||||

|

USDA's Section 32 program is funded by a permanent appropriation of 30% of the previous year's customs receipts, less certain mandatory transfers. Section 32 funds are used for a variety of activities, including child nutrition programs, the purchase of commodities for domestic food programs, and farm disaster relief. For more information, see CRS Report RL34081, Farm and Food Support Under USDA's Section 32 Program. |

||||||||||||

|

On October 22, 2010, USDA announced it would begin making payments to producers in eligible counties under the Crop Assistance Program using payment rates established for each crop. A fact sheet is available at http://www.fsa.usda.gov/Internet/FSA_File/cap10pfs.pdf. |

||||||||||||

|

USDA, Background on 2009 Disaster Assistance, http://www.agri-pulse.com/uploaded/Disaster_Backgrounder.pdf. |

||||||||||||

|

"Administrative PAYGO" is different from the statutory budget enforcement process often referred to as statutory "pay-as-you-go" (PAYGO) in several significant respects. These include the stages of the budget process in which activities occur, the actors who are involved, and transparency to Congress and the public. For additional background on administrative PAYGO, see CRS Report R41375, OMB Controls on Agency Mandatory Spending Programs: "Administrative PAYGO" and Related Issues for Congress. |

||||||||||||

|

For additional analysis of BIP, see CRS In Focus IF10377, USDA Initiative Is Funding New Ethanol Infrastructure. |

||||||||||||

|

USDA, "Biofuels Infrastructure Partnership (BIP): Frequently Asked Questions," http://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/Energy/FAQs_Biofuel_Infrastruct_Prtnrship.pdf. |

||||||||||||

|

Daniel Enoch, "USDA Seeks to Boost Availability of E15, E85 at the Pump," Agri-Pulse, May 29, 2015. |

||||||||||||

|

For additional analysis of the cottonseed issue, see CRS Report R45143, Seed Cotton as a Farm Program Crop: In Brief. |

||||||||||||

|

|

38.

See CRS Report R45143, Seed Cotton as a Farm Program Crop: In Brief. |

Letter from Thomas J. Vilsack, Secretary of Agriculture, to Mike Conaway, chairman of the House Committee on Agriculture, February 3, 2016, http://www.agri-pulse.com/Uploaded/Conaway-Feb-3-2016%20.pdf. |

||||||||||

|

U.S. House, Committee on Agriculture, "House Agriculture Committee Review State of the Rural Economy," February 24, 2016, http://agriculture.house.gov/calendar/eventsingle.aspx?EventID=3159. |

||||||||||||

| 41. |

See CRS Report R45143, Seed Cotton as a Farm Program Crop: In Brief. |

|||||||||||

|

USDA, "USDA Provides Targeted Assistance to Cotton Producers to Share in the Cost of Ginning," press release, June 6, 2016, http://www.fsa.usda.gov/news-room/news-releases/2016/nr_20160606_rel_0140; and USDA, "USDA Helps Cotton Producers Maintain, Expand Domestic Market," press release, March 3, 2018, https://www.fsa.usda.gov/news-room/news-releases/2018/nr_20180303_rel_0000. |

||||||||||||

|

|

For more information, see CRS Insight IN10880, China's Retaliatory Tariffs on Selected U.S. Agricultural Products. 42.

|

|

For more information, see CRS Report R45310, Farm Policy: USDA's 2018 Trade Aid Package. 43.

|

|

For more information, see CRS Report R45865, Farm Policy: USDA's 2019 Trade Aid Package. 44.

|

|

For example, see Senator Angus King, "King Statement on Exclusion of Lobster Industry from Administration Plan to Mitigate Tariff Impacts," press release, July 25, 2018, https://www.king.senate.gov/newsroom/press-releases/king-statement-on-exclusion-of-lobster-industry-from-administration-plan-to-mitigate-tariff-impacts; and Representative Joe Courtney, "Bipartisan, Bicameral Congressional Coalition Sends Letter to USDA Urging Market Balancing Help for Struggling Milk Producers," press release, July 28, 2016, https://courtney.house.gov/media-center/press-releases/bipartisan-bicameral-congressional-coalition-sends-letter-usda-urging. 45.

|

|

Section 103 of the FY2019 supplemental appropriation (P.L. 116-20) amends the Market Facilitation Program's (MFP) adjusted gross income (AGI) requirement to (1) change the tax years used to calculated AGI to 2013, 2014, and 2015 and (2) allow MFP payments for those with AGI more than $900,000 if at least 75% of their AGI came from farming, ranching, or forestry-related activities. For additional information on MFP, see CRS In Focus IF11289, Farm Policy: Comparison of 2018 and 2019 MFP Programs and CRS In Focus IF11245, FY2019 Supplemental Appropriations for Agriculture. 46.

|

If fully expended, USDA's trade aid packages are authorized up to $12 billion and $16 billion each. As shown in Figure 2, recent annual CCC losses have been of a similar size.

47.

|

Agricultural Improvement Act of 2018, P.L. 115-334 |

|