Agriculture and Related Agencies: FY2018 Appropriations

The Agriculture appropriations bill funds the U.S. Department of Agriculture (USDA) except for the Forest Service. It also funds the Food and Drug Administration (FDA) and—in even-numbered fiscal years—the Commodity Futures Trading Commission (CFTC).

Agriculture appropriations include both mandatory and discretionary spending. Discretionary amounts, though, are the primary focus during the bill’s development, since mandatory amounts are generally set by authorizing laws such as the farm bill.

The largest discretionary spending items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); agricultural research; FDA; rural development; foreign food aid and trade; farm assistance programs; food safety inspection; conservation; and animal and plant health programs. The main mandatory spending items are the Supplemental Nutrition Assistance Program (SNAP), child nutrition, crop insurance, and the farm commodity and conservation programs paid by the Commodity Credit Corporation.

Congress passed the FY2018 Consolidated Appropriations Act on March 23, 2018 (H.R. 1625). The discretionary total of the FY2018 Agriculture appropriation (Division A) is $23.3 billion. This is an increase of $2.1 billion above the amount enacted in FY2017 (+10%). The appropriations also carry nearly $123 billion of mandatory spending, though that amount is largely determined in separate authorizing laws. Thus, the overall total of the enacted FY2018 Agriculture appropriation is about $146 billion.

Compared to FY2017, the enacted appropriation increases spending primarily through an extra $1.38 billion in General Provisions, including an additional $500 million for rural water programs, $600 million for rural broadband, $116 million for Food for Peace foreign food aid, and $94 million for opioid enforcement and surveillance.

The Consolidated Appropriations Act also increases regular funding for agricultural research by $138 million, and Food for Peace by $134 million. Unlike the past decade, the FY2018 Agriculture appropriation does not include as many changes to mandatory program spending (CHIMPS), such as to the Environmental Quality Incentives Program (EQIP).

Both the House and Senate Appropriations Committees reported Agriculture appropriations bills in July 2017 (H.R. 3268, S. 1603). As the beginning of the fiscal year approached, the House passed a consolidated bill in September 2017 that included an agriculture appropriation (Division B of H.R. 3354). The full Senate did not consider an agriculture appropriations bill on the floor.

The government continued to operate for the first six months of the fiscal year under continuing resolutions (CRs). The last CR, the Bipartisan Budget Act of 2018 (P.L. 115-123), also enacted supplemental appropriations that included agricultural assistance, amended certain farm bill statutes, and passed new, higher budget caps that facilitated the final appropriation.

Agriculture and Related Agencies: FY2018 Appropriations

Jump to Main Text of Report

Contents

- Status of FY2018 Agriculture Appropriations

- Scope of Agriculture Appropriations

- Recent Trends in Agriculture Appropriations

- Action on FY2018 Appropriations

- Administration's Budget Request

- House Action

- Senate Action

- Continuing Resolutions

- Supplemental Appropriations and the Bipartisan Budget Act

- Supplemental Appropriation

- Changes to the Farm Bill

- Discretionary Budget Caps

- Consolidated Appropriations Act

Figures

Tables

- Table 1. Legislative Status of FY2018 Agriculture Appropriations

- Table 2. Agriculture and Related Agencies Appropriations, by Title, FY2017-FY2018

- Table 3. Agriculture and Related Agencies Appropriations, by Agency, FY2015-FY2018

- Table A-1. Sequestration from Discretionary and Mandatory Agriculture Appropriations

- Table A-2. Sequestration of Mandatory Accounts in Agriculture Appropriations

- Table B-1. Congressional Action on Agriculture Appropriations Since FY1997

Summary

The Agriculture appropriations bill funds the U.S. Department of Agriculture (USDA) except for the Forest Service. It also funds the Food and Drug Administration (FDA) and—in even-numbered fiscal years—the Commodity Futures Trading Commission (CFTC).

Agriculture appropriations include both mandatory and discretionary spending. Discretionary amounts, though, are the primary focus during the bill's development, since mandatory amounts are generally set by authorizing laws such as the farm bill.

The largest discretionary spending items are the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); agricultural research; FDA; rural development; foreign food aid and trade; farm assistance programs; food safety inspection; conservation; and animal and plant health programs. The main mandatory spending items are the Supplemental Nutrition Assistance Program (SNAP), child nutrition, crop insurance, and the farm commodity and conservation programs paid by the Commodity Credit Corporation.

Congress passed the FY2018 Consolidated Appropriations Act on March 23, 2018 (H.R. 1625). The discretionary total of the FY2018 Agriculture appropriation (Division A) is $23.3 billion. This is an increase of $2.1 billion above the amount enacted in FY2017 (+10%). The appropriations also carry nearly $123 billion of mandatory spending, though that amount is largely determined in separate authorizing laws. Thus, the overall total of the enacted FY2018 Agriculture appropriation is about $146 billion.

Compared to FY2017, the enacted appropriation increases spending primarily through an extra $1.38 billion in General Provisions, including an additional $500 million for rural water programs, $600 million for rural broadband, $116 million for Food for Peace foreign food aid, and $94 million for opioid enforcement and surveillance.

The Consolidated Appropriations Act also increases regular funding for agricultural research by $138 million, and Food for Peace by $134 million. Unlike the past decade, the FY2018 Agriculture appropriation does not include as many changes to mandatory program spending (CHIMPS), such as to the Environmental Quality Incentives Program (EQIP).

Both the House and Senate Appropriations Committees reported Agriculture appropriations bills in July 2017 (H.R. 3268, S. 1603). As the beginning of the fiscal year approached, the House passed a consolidated bill in September 2017 that included an agriculture appropriation (Division B of H.R. 3354). The full Senate did not consider an agriculture appropriations bill on the floor.

The government continued to operate for the first six months of the fiscal year under continuing resolutions (CRs). The last CR, the Bipartisan Budget Act of 2018 (P.L. 115-123), also enacted supplemental appropriations that included agricultural assistance, amended certain farm bill statutes, and passed new, higher budget caps that facilitated the final appropriation.

Status of FY2018 Agriculture Appropriations

Congress passed the FY2018 Consolidated Appropriations Act on March 23, 2018 (H.R. 1625). Both the House and Senate Appropriations Committees had reported Agriculture appropriations bills for FY2018 (H.R. 3268, S. 1603). The House also had passed a consolidated bill that included agriculture (H.R. 3354). The full Senate did not consider the Agriculture appropriations bill on the floor. New, higher budget caps in the Bipartisan Budget Act of 2018 (P.L. 115-123) facilitated the final appropriation.

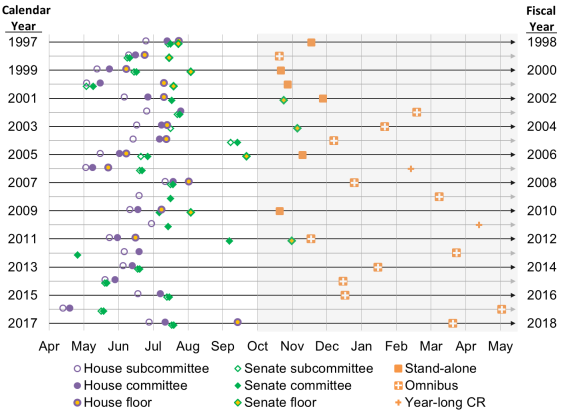

Specifically, the House Appropriations Committee passed H.R. 3268 on July 12, 2017, and the Senate Appropriations Committee passed S. 1603 on July 20, 2017. On September 14, the House passed an eight-bill consolidated appropriation, H.R. 3354, with the Agriculture bill as Division B that included amendments to the House-reported version (Table 1, Figure 1, Appendix B).

The discretionary total of the enacted Agriculture appropriation is $23.3 billion, which is $2.1 billion more than enacted in FY2017 (+10%), on a comparable basis that includes the Commodity Futures Trading Commission (CFTC; Table 2).1 The Administration had proposed a $15.8 billion discretionary total (a reduction of 25%), the House-passed bill $20 billion, and the Senate-reported bill $20.53 billion.

The appropriations also carry mandatory spending—though that is largely determined in separate authorizing laws—that total nearly $123 billion. Thus, the overall total of the enacted FY2018 Agriculture appropriation is $146 billion.

The Trump Administration released its full FY2018 budget request on May 23, 2017,2 along with the detailed justification from the U.S. Department of Agriculture (USDA).3

|

House Action |

Senate Action |

Final Appropriation |

|||||||

|

Subcmte. |

Cmte. |

Floor |

Subcmte. |

Cmte. |

Floor |

Enacted |

Public Law |

||

|

6/28/2017 Draft Voice vote |

7/12/2017 Voice vote |

9/14/2017 H.R. 3354 (Division B) Vote of 211-198 |

7/18/2017 Voice vote |

7/20/2017 Vote of 31-0 |

— |

3/23/2018 Votes H: 256-167 S: 65-32 |

|||

Table 2. Agriculture and Related Agencies Appropriations, by Title, FY2017-FY2018

(budget authority in millions of dollars)

|

FY2017 |

FY2018 |

||||||

|

Title of Agriculture Appropriations Act |

Admin. Request |

House H.R. 3354 |

S. Cmte. S. 1603 |

Enacted H.R. 1625 |

Change FY2017 to FY2018 Enacted |

||

|

I. Agricultural Programs: Discretionarya |

7,107.7a |

4,861.2 |

5,141.2 |

5,363.1 |

5,626.8 |

+219.0b |

+4.0%b |

|

Mandatory (Section 32 in FY2018)a |

31,280.2a |

1,344.0 |

1,344.0 |

1,344.0 |

1,344.0 |

+22.0b |

+1.7%b |

|

Subtotala |

38,387.9a |

6,205.2 |

6,485.2 |

6,707.1 |

6,970.8 |

+240.5b |

+3.6%b |

|

II. Farm Production and Conservation Programsa |

1,027.4a |

2,330.2 |

2,527.8 |

2,726.4 |

2,735.6 |

+9.8b |

+0.4%b |

|

Mandatory (CCC, crop insurance in FY2018)a |

—a |

25,728.5 |

25,728.5 |

25,728.5 |

23,198.3 |

-6,759.9b |

-22.6%b |

|

Subtotala |

—a |

28,058.7 |

28,256.3 |

28,454.9 |

25,933.9 |

-6,750.0b |

-20.7%b |

|

III. Rural Development |

3,069.2 |

2,157.5 |

2,807.1 |

2,949.8 |

3,000.9c |

-68.3 |

-2.2% |

|

IV. Domestic Food Programs: Discretionary |

6,884.7 |

6,615.9 |

6,664.5 |

6,887.9 |

6,709.8 |

-174.9 |

-2.5% |

|

Mandatory (SNAP and child nutrition) |

101,226.7 |

97,845.8 |

97,842.9 |

97,842.9 |

98,209.6 |

-3,017.0 |

-3.0% |

|

Subtotal |

108,111.3 |

104,461.7 |

104,507.4 |

104,730.8 |

104,919.4 |

-3,191.9 |

-3.0% |

|

V. Foreign Assistance |

1,872.9c |

195.1 |

1,804.7 |

2,013.7 |

2,021.0c |

+148.1 |

+7.9% |

|

VI. Related Agencies: Food and Drug Admin. |

2,771.2 |

1,828.5 |

2,768.1 |

2,772.2 |

2,811.9c |

+40.7 |

+1.5% |

|

Commodity Futures Trading Commission |

[250.0] |

250.0 |

248.0 |

[250.0]d |

249.0 |

-1.0 |

-0.4% |

|

VII. General Provisions: CHIMPSe & rescissions |

-1,598.0 |

-1,931.7 |

-1,490.0 |

-1,741.0 |

-801.0 |

+797.0 |

-49.9% |

|

Disaster/emergency programs |

234.8 |

— |

— |

— |

— |

-234.8 |

-100.0% |

|

Other appropriations |

237.4 |

— |

6.5 |

35.1 |

1,378.1 |

+1,140.7 |

+480.5% |

|

Scorekeeping adjustmentsf |

-524.0 |

-485.0 |

-481.0 |

-482.0 |

-481.0 |

+43.0 |

-8.2% |

|

Subtract disaster declaration in this bill |

-206.1 |

— |

— |

— |

— |

+206.1 |

-100.0% |

|

Discretionary: Senate basis w/o CFTC |

20,877.0 |

15,571.6 |

[19,748.9] |

20,525.1 |

[23,002.0] |

+2,125.0 |

+10.2% |

|

Discretionary: House basis w/ CFTC |

[21,127.0] |

15,821.6 |

19,996.9 |

[20,775.1] |

23,251.0 |

+2,124.0 |

+10.1% |

|

Mandatory |

132,506.9 |

124,918.3 |

124,915.4 |

124,915.4 |

122,752.0 |

-9,754.9 |

-7.4% |

|

Total: Senate basis w/o CFTC |

153,383.9 |

140,489.9 |

144,664.3 |

145,440.5 |

145,754.0 |

-7,629.9 |

-5.0% |

|

Total: House basis w/ CFTC |

153,633.9 |

140,739.9 |

144,912.3 |

145,690.5 |

146,003.0 |

-7,630.9 |

-5.0% |

Source: CRS, using appropriations text and reports, and unpublished CBO tables. House column reflects H.R. 3354 as amended from H.R. 3268

Notes: Amounts are nominal discretionary budget authority in millions of dollars unless labeled otherwise. Excludes amounts in supplemental appropriations acts. Bracketed amounts are not in the official totals due to differing House-Senate jurisdiction for CFTC.

a. Row headings reflect recent USDA reorganization. For FY2018, the Farm Service Agency and Risk Management Agency were moved from Title I to Title II, as was Commodity Credit Corporation (CCC) and Federal Crop Insurance Corporation within mandatory spending.

b. Differences were computed using amounts for FY2017 that were adjusted to reflect the reorganization.

c. Excludes a portion of the other appropriations that are provided separately in General Provisions.

d. Senate Financial Services Appropriations Subcommittee, chairman's draft, in lieu of subcommittee markup.

e. Changes in Mandatory Program Spending (CHIMPS) are reductions made to mandatory programs.

f. "Scorekeeping adjustments" are not necessarily appropriated but are part of the official CBO accounting.

|

Figure 1. Timeline of Action on Agriculture Appropriations, FY1998-FY2018 |

|

|

Source: CRS. |

Scope of Agriculture Appropriations

The Agriculture appropriations bill—formally known as the Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Appropriations Act—funds all of USDA, excluding the U.S. Forest Service. It also funds the Food and Drug Administration (FDA) in the Department of Health and Human Services. In even-numbered fiscal years, the act carries CFTC funding under a practice started in FY2008 for handling House-Senate jurisdictional differences.

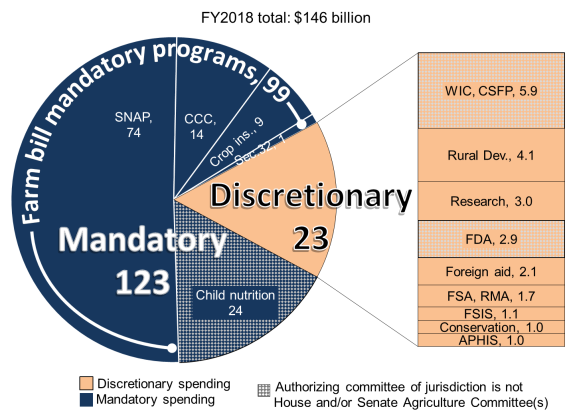

Jurisdiction is with the House and Senate Committees on Appropriations and their respective Subcommittees on Agriculture, Rural Development, Food and Drug Administration, and Related Agencies. The bill includes mandatory and discretionary spending, but the discretionary amounts are the primary focus during the bill's development. The scope of the bill is shown in Figure 2.

The federal budget process treats discretionary and mandatory spending differently.4

- Discretionary spending is controlled by annual appropriations acts and receives most of the attention during the appropriations process. The annual budget resolution5 process sets spending limits for discretionary appropriations. Agency operations (salaries and expenses) and many grant programs are discretionary.

- Mandatory spending6—though carried in the appropriation and usually advanced unchanged—is controlled by budget rules (e.g., PAYGO) during the authorization process.7 Spending for so-called entitlement programs is set in laws such as the 2014 farm bill8 and 2010 child nutrition reauthorizations.9

In FY2018 Agriculture appropriations, discretionary appropriations were 16% ($23.3 billion) of the total. Mandatory spending carried in the act comprised $123 billion, about 84% of the $146 billion total. About $99 billion of the $123 billion mandatory amount could be attributed to programs in the 2014 farm bill (Figure 2). Other programs are not in the authorizing jurisdiction of the Agriculture Committees.

Within the discretionary total, the largest discretionary spending items are for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); rural development; agricultural research; FDA; foreign food aid and trade; farm assistance program salaries and loans; food safety inspection; conservation; and animal and plant health programs (Figure 2).

The main mandatory spending items are the Supplemental Nutrition Assistance Program (SNAP, and other food and nutrition act programs), child nutrition (school lunch and related programs), crop insurance, and farm commodity and conservation programs paid through USDA's Commodity Credit Corporation (CCC). SNAP is referred to as an "appropriated entitlement" and requires an annual appropriation.10 Amounts for the nutrition program are based on projected spending needs. In contrast, the CCC operates on a line of credit. The annual appropriation provides funding to reimburse the Treasury for using this line of credit.

|

Key Budget Terms Budget authority is the main purpose of an appropriations act or a law authorizing mandatory spending. It provides the legal basis from which to obligate funds. It expires at the end of a period and is usually available for one year unless specified otherwise (e.g., two years or indefinite). Most amounts in this report are budget authority. Obligations are contractual agreements between an agency and its clients or employees. They occur when an agency proceeds to spend money from its budget authority. The Antideficiency Act prohibits agencies from obligating more budget authority than is provided in law, such as during a government shutdown. Outlays are the payments (cash disbursements) that satisfy a valid obligation. Outlays may differ from budget authority or obligations because payments from an agency may not occur until services are fulfilled, goods are delivered, or construction is completed, even though an obligation occurred. Program level represents the sum of the activities supported or undertaken by an agency. A program level may be higher than a budget authority if the program (1) receives user fees that can be used to pay for activities, (2) makes or guarantees loans that are leveraged on the expectation of repayment (more than $1 of loan authority for $1 of budget authority), or (3) receives transfers from other agencies. Rescissions are adjustments that cancel or reduce budget authority after it has been enacted. They score budgetary savings. CHIMPS (Changes in Mandatory Program Spending) are adjustments in an appropriations act to mandatory budget authority. CHIMPS in appropriations usually reduce or limit spending by mandatory programs for one year and score budgetary savings. They do not change the underlying authority of the program in statute. For more background, see CRS Report 98-405, The Spending Pipeline: Stages of Federal Spending. |

Recent Trends in Agriculture Appropriations

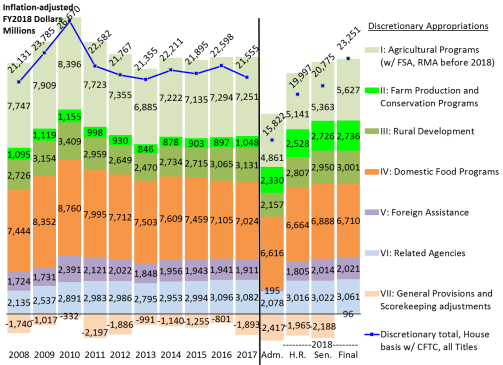

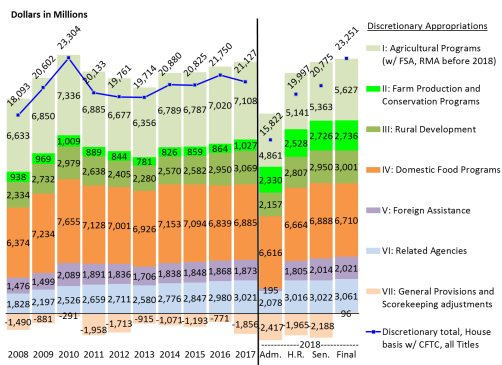

Over time, changes by title of the Agriculture appropriations bill have generally been proportionate to changes in the bill's total discretionary limit, though some activities have sustained relative increases and decreases. Agriculture appropriations peaked in FY2010, declined through FY2013, and since then have increased (Figure 3). Comparisons to historical benchmarks, though, may depend on adjustments for inflation and other factors (Figure 4).

The stacked bars in Figure 3 represent the discretionary spending that was authorized for each appropriations title since FY2008. Prior to FY2018 enactment, the total of the positive stacked bars is the budget authority contained in Titles I-VI. It was higher than the official discretionary spending allocation for the subcommittee (the line) because of the budgetary offset from negative amounts in Title VII general provisions and other scorekeeping adjustments. General provisions were net negative mostly because of rescissions and limits placed on mandatory programs.

|

Figure 3. Discretionary Agriculture Appropriations, by Title, Since FY2008 |

|

|

Source: CRS. Includes CFTC in Related Agencies in all years for comparison, regardless of jurisdiction. |

Action on FY2018 Appropriations

Administration's Budget Request

Like most new Administrations, the Trump Administration released its FY2018 budget request in 2017 later than the usually expected first week of February.11 It released an outline (sometimes called a "skinny budget")12 on March 16, 2017, that expressed intentions primarily at the Cabinet level. For USDA, it proposed a 21% reduction, including eliminating funding for some programs.

The Administration's budget outline overlapped with Congress finishing FY2017 appropriations. On May 5, 2017, the explanatory statement for the FY2017 appropriation (P.L. 115-31) addressed the direction of the new request for FY2018 by reminding the Administration of Congress's role:

USDA and FDA should be mindful of Congressional authority to determine and set final funding levels for fiscal year 2018. Therefore, the agencies should not presuppose program funding outcomes and prematurely initiate action to redirect staffing prior to knowing final outcomes on fiscal year 2018 program funding.13

On May 23, 2017, the Administration released its full FY2018 budget request.14 USDA concurrently released its full budget summary and justification,15 as did the FDA.16 Some OMB proposals17 were not consistent with the USDA request. As an independent agency, CFTC requested a different amount in its budget justification18 than the Administration requested.

For Agriculture appropriations (including CFTC), the Trump Administration requested $15.82 billion of discretionary spending, $5.3 billion less than in FY2017 (-25%; Table 2, Figure 3).

From these documents, the congressional appropriations committees evaluated the request and began to consider their own bills in the summer of 2017.

|

CRS Products on the FY2018 Agriculture Request

|

House Action

At the time the House appropriations subcommittees began marking up their FY2018 bills, an FY2018 budget resolution had not yet been adopted. Therefore, the House Appropriations Committee incrementally made "302(b)" allocations19 to its subcommittees to facilitate markups beginning in June 2017.20 The Agriculture Subcommittee was allowed nearly $20 billion of discretionary budget authority for FY2018.

The House Agriculture Appropriations Subcommittee marked up its FY2018 bill on June 28, 2017, by voice vote.21 On July 12, 2017, the full Appropriations Committee passed and reported an amended bill (H.R. 3268, H.Rept. 115-232) by voice vote (Table 1, Figure 1).

As the beginning of the fiscal year neared without many floor-passed appropriations bills, the House passed on September 14, 2017, an eight-bill consolidated appropriation (H.R. 3354) with Agriculture as Division B. It included several budget-neutral amendments to the reported version.

The $20 billion discretionary total in the House-passed FY2018 Agriculture appropriation (Table 2, Figure 3) was officially $1.13 billion less than enacted in FY2017 (-5.3%, on a comparable basis that adds CFTC back to the FY2017 Agriculture appropriation's total).

Compared to FY2017, the House-passed bill would have achieved this reduction primarily by reducing rural development by $262 million, nutrition assistance by $220 million, farm and conservation programs by $199 million, department administration by $123 million, and research by $98 million, among other changes. Table 3 provides details at the agency level.

Senate Action

In the absence of an adopted FY2018 budget resolution, the Senate Appropriations Committee made 302(b) allocations to its subcommittees in July 2017, similar to the House approach.22 The Agriculture Subcommittee was allowed $20.53 billion of discretionary authority for FY2018.

The Senate Agriculture Appropriations Subcommittee marked up its FY2018 bill on July 18, 2017, by voice vote. Two days later, the full Appropriations Committee passed and reported its amended bill (S. 1603, S.Rept. 115-131) on July 20, 2017, by a vote of 31-0 (Table 1, Figure 1).

The discretionary total of the Senate-reported bill was $20.53 billion (Table 2, Figure 3), which was $352 million less than enacted in FY2017 without CFTC (-1.7%). The Senate-reported bill would have provided $776 million more than the House-passed bill on a comparable basis without the CFTC.

The Senate-reported bill would have made fewer and smaller reductions compared to FY2017 than the House-passed bill. Compared to FY2017, it would have reduced rural development by $119 million and agricultural research by $57 million and increased foreign food aid by $140 million, providing more for each of these program areas than the House-passed bill (Table 3). It would also have made $220 million more in reductions—through rescissions and changing mandatory programs—than the House-passed bill.

Continuing Resolutions

FY2018 began on October 1, 2017, without an enacted appropriation. As a result, Congress has passed CRs to continue to fund the government.23 In general, a CR continues the funding rate and other provisions of the previous year's appropriation.24 However, the Office of Management and Budget (OMB) prorates funding to the agencies on an annualized basis for the duration of the CR through a process known as apportionment.25 CRs may also provide a different amount through anomalies or make specific administrative changes.26

- 1. The first CR for FY2018 (Division D of P.L. 115-56) lasted until December 8, 2017. It continued FY2017 funding levels and provisions with two general exceptions and two anomalies for the agriculture appropriation:

- A 0.6791% across-the-board reduction (Section 101(b)).

- Sufficient funding to maintain mandatory program levels, including for nutrition programs (Section 111).

- An increase of about $2 million for the Commodity Supplemental Food Program, a domestic food assistance program that predominantly serves the low-income elderly. Rather than the FY2017 funding level of $236 million, the CR provides about $238 million for this program. This anomaly is typically included to maintain caseload and participation based on food costs (Section 116).

- A technical correction for the computation of a rescission to Section 32 funds in light of the availability that is allowed for carryover funds, especially for disaster payments that are at the discretion of the USDA (Section 117).

- 2. A second CR (P.L. 115-90) extended the provisions and anomalies of the first CR to December 22, 2017.

- 3. A third CR (P.L. 115-96) extended the CR to January 19, 2018. It also waived PAYGO rules (Section 5002) for the Tax Cuts and Jobs Act (P.L. 115-97) that could have caused a sequestration of mandatory spending as an automatic budgetary offset, which could have affected the farm bill budget.27

- 4. In the absence of a further CR or appropriation by January 19, a three-day government shutdown occurred through January 22, when a fourth CR (P.L. 115-120) extended the CR to February 8, 2018.

- 5. In the absence of a further CR or appropriation by February 8, an overnight government shutdown occurred during the early morning of February 9, when a fifth CR (P.L. 115-123) extended the CR to March 23, 2018. This CR was part of the Bipartisan Budget Act of 2018 that raised the budget caps for discretionary spending in FY2018 and FY2019, provided disaster assistance for agriculture, amended several farm bill provisions, and extended sequestration effects.

Supplemental Appropriations and the Bipartisan Budget Act

On February 9, 2018, Congress passed the Bipartisan Budget Act of 2018 (BBA; P.L. 115-123), which broadly authorized supplemental appropriations, including for crop and livestock losses from 2017 hurricanes and wildfires (Division B, Subdivision 1, Title I). The act also included a six-week CR through March 23, 2018 (Division B, Subdivision 3). Importantly for the anticipated farm bill reauthorization, the BBA revised several agriculture programs, which had long-term policy implications because it changed farm bill statutes (Division B, Section 20101; and Division F) and added mandatory spending authority. Perhaps most importantly for completing the FY2018 appropriation, it raised the discretionary spending caps (Division C, Title I) that are in statute from the Budget Control Act of 2011 (BCA; P.L. 112-25).

|

CRS Products on Agriculture in the Supplemental

|

Supplemental Appropriation

In supplemental appropriations, the BBA added $3.6 billion of disaster assistance in FY2018. Specifically, it provided $2.36 billion of block grants to the states for losses from 2017 hurricanes and wildfires. It added $941 million for conservation and watershed recovery, $165 million for rural water and wastewater recovery, and $89 million for disasters in six other USDA accounts.

Changes to the Farm Bill

For the expected successor to the current farm bill, the BBA added $1.4 billion of mandatory funding to the 10-year baseline. Specifically, it added $1.1 billion for dairy programs, $240 million for permanent disaster assistance programs, and a $62 million net addition for cotton. The cotton addition is nearly $3 billion from adding seed cotton to the farm commodity programs, offset by about $2.9 billion in reductions from reallocating base acres and crop insurance. A version of these changes was in the Senate appropriations markup, Section 728 of S. 1603.

The BBA offsets some of these additions by extending sequestration on mandatory accounts under the BCA (Appendix A) for two more years, for FY2026 and FY2027, at an estimated future effect on agriculture accounts of $2.6 billion.

Discretionary Budget Caps

Raising the budget caps for overall discretionary spending—that were set by the BCA—facilitated the development of a final full-year appropriation for FY2018. A majority in Congress desired greater spending for at least some of the appropriations subcommittees. For FY2018, the BBA raised the nondefense discretionary cap by $63 billion from $516 billion to $579 billion and for defense by $80 billion from $549 billion to $629 billion. For FY2019, it raised the nondefense discretionary cap by $68 billion and the defense cap by $85 billion.28

Consolidated Appropriations Act

On March 23, 2018, Congress passed the FY2018 Consolidated Appropriations Act (H.R. 1625). The discretionary total of the Agriculture portion (Division A) is $23.3 billion, an increase of $2.1 billion above the enacted amount in FY2017 (+10%, on a comparable basis that includes CFTC; Table 2). The discretionary total is higher than in either the House-passed or Senate-reported bills, as became possible under the BBA, and is nearly as high as the peak in Agriculture appropriations in FY2010 (Figure 3).

The appropriations also carry nearly $123 billion of mandatory spending, though that total is largely determined in separate authorizing laws. Thus, the overall total of the enacted FY2018 Agriculture appropriation is about $146 billion (Figure 2).

Compared to FY2017, the enacted appropriation increases spending primarily through an extra $1.38 billion in General Provisions, for programs that receive funding elsewhere in the appropriation. Amounts in General Provisions may not be as likely to become part of the annual base for those programs. For example, in addition to amounts for the Rural Utilities Service elsewhere in the Act, the General Provisions provide an additional $500 million for rural water programs, and $600 million for expanding rural broadband. The General Provisions also provide an extra $116 million for Food for Peace foreign food aid, and $94 million for opioid enforcement and surveillance at FDA (Table 3).

In the regular portion of the appropriations for agencies, the Consolidated Appropriations Act increases agricultural research spending by $138 million over four agencies (including increasing the Agriculture and Food Research Initiative by $25 million to $400 million, and increasing buildings and facilities funding by $41 million for the Agricultural Research Service). It also increases the base amount for Food for Peace by $134 million to $1.6 billion.

Unlike the practice from more than the past decade, the FY2018 Agriculture appropriation does not impose as many changes to mandatory program spending (CHIMPS), such as to the Environmental Quality Incentives Program (EQIP), Fresh Fruit and Vegetable program, or rescissions to the Rural Development cushion of credit account or to Section 32. The absence of these usual CHIMPS in the FY2018 Agriculture appropriation costs about $740 million against the discretionary limit of the bill compared to FY2017.

Table 3 presents the amounts in the FY2018 Consolidated Appropriations Act by agency and many programs, compared to the House-passed, Senate-reported, and Administration proposals. It also compares the FY2018 appropriation to three prior years, FY2015-FY2017.

Table 3. Agriculture and Related Agencies Appropriations, by Agency, FY2015-FY2018

(budget authority in millions of dollars)

|

FY2015 |

FY2016 |

FY2017 |

FY2018 |

||||||

|

Agency or Major Program |

Admin. Request |

House H.R. 3354 |

S. Cmte. S. 1603 |

Enacted H.R. 1625 |

Change FY2017 to FY2018 Enacted |

||||

|

Title I. Agricultural Programs |

|||||||||

|

Departmental Administration |

364.5 |

373.2 |

403.9 |

376.9 |

280.5 |

398.2 |

396.0 |

-8.0 |

-2.0% |

|

Research, Education and Economics |

|||||||||

|

Agricultural Research Service |

1,177.6 |

1,355.9 |

1,269.8 |

993.1 |

1,194.1 |

1,182.4 |

1,343.4 |

+73.5 |

+5.8% |

|

National Institute of Food and Agriculture |

1,289.5 |

1,326.5 |

1,362.9 |

1,252.8 |

1,343.8 |

1,373.2 |

1,407.8 |

+44.9 |

+3.3% |

|

National Agricultural Statistics Service |

172.4 |

168.4 |

171.2 |

185.7 |

178.2 |

191.7 |

191.7 |

+20.5 |

+12.0% |

|

Economic Research Service |

85.4 |

85.4 |

86.8 |

76.7 |

76.8 |

86.8 |

86.8 |

+0.0 |

+0.0% |

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.9 |

0.8 |

0.9 |

0.8 |

-0.1 |

-10.4% |

|

Marketing and Regulatory Programs |

|||||||||

|

Animal and Plant Health Inspection Service |

874.5 |

897.6 |

949.4 |

812.9 |

907.8 |

956.4 |

985.1 |

+35.7 |

+3.8% |

|

Agricultural Marketing Servicea |

82.4 |

82.5 |

86.2 |

78.6 |

76.7 |

90.2 |

156.8 |

+27.2d |

+21.0%d |

|

Section 32 (M) |

1,284.0 |

1,303.0 |

1,322.0 |

1,344.0 |

1,344.0 |

1,344.0 |

1,344.0 |

+22.0 |

+1.7% |

|

Grain Inspection, Packers, Stockyards Admin.a |

43.0 |

43.1 |

43.5 |

43.0 |

42.9 |

43.5 |

moved to Agricultural Marketing Servicea |

||

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.9 |

0.8 |

0.9 |

0.9 |

+0.0 |

+0.0% |

|

Food Safety |

|||||||||

|

Food Safety and Inspection Service |

1,016.5 |

1,014.9 |

1,032.1 |

1,038.1 |

1,038.1 |

1,038.1 |

1,056.8 |

+24.8 |

+2.4% |

|

Under Secretary |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

-0.0 |

-2.3% |

|

Farm and Commodity Programsa |

|||||||||

|

Farm Service Agencyb |

1,603.3 |

1,595.1 |

1,624.0 |

moved to Title II: Farm Production and Conservationa |

|||||

|

FSA Farm Loans: Loan Authorityc |

6,402.1 |

6,402.1 |

8,002.6 |

moved to Title II: Farm Production and Conservationa |

|||||

|

Risk Management Agency Salaries and Exp. |

74.8 |

74.8 |

74.8 |

moved to Title II: Farm Production and Conservationa |

|||||

|

Federal Crop Insurance Corporation (M) |

8,930.5 |

7,858.0 |

8,667.0 |

moved to Title II: Farm Production and Conservationa |

|||||

|

Commodity Credit Corporation (M) |

13,444.7 |

6,871.1 |

21,290.7 |

moved to Title II: Farm Production and Conservationa |

|||||

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.9 |

— |

— |

— |

-0.9 |

-100.0% |

|

Subtotal |

|||||||||

|

Discretionary |

6,786.9 |

7,020.3 |

7,107.7 |

4,861.2 |

5,141.2 |

5,363.1 |

5,626.8 |

+219.0d |

+4.0%d |

|

Mandatory (M; Section 32 in FY2018) |

23,659.7 |

16,032.6 |

31,280.2 |

1,344.0 |

1,344.0 |

1,344.0 |

1,344.0 |

+22.0d |

+1.7%d |

|

Subtotal |

30,446.6 |

23,052.9 |

38,387.9 |

6,205.2 |

6,485.2 |

6,707.1 |

6,970.8 |

+240.5d |

+3.6%d |

|

Title II. Farm Production and Conservationa |

|

|

|

|

|

|

|

|

|

|

Business Center |

— |

— |

— |

— |

— |

— |

1.0 |

+1.0 |

— |

|

Farm Service Agencyb |

moved from Title Ia |

1,508.8 |

1,555.4 |

1,627.0 |

1,625.2 |

+1.2 |

+0.1% |

||

|

FSA Farm Loans: Loan Authorityc |

moved from Title Ia |

6,953.9 |

7,163.9 |

8,002.6 |

8,005.6 |

+3.0 |

+0.0% |

||

|

Risk Management Agency Salaries and Exp. |

moved from Title Ia |

55.0 |

55.0 |

74.8 |

74.8 |

+0.0 |

+0.0% |

||

|

Federal Crop Insurance Corporation (M) |

moved from Title Ia |

8,245.0 |

8,245.0 |

8,245.0 |

8,913.0 |

+246.0 |

+2.8% |

||

|

Commodity Credit Corporation (M) |

moved from Title Ia |

17,483.0 |

17,483.0 |

17,483.0 |

14,284.8 |

-7,005.9 |

-32.9% |

||

|

Conservation Operations |

846.4 |

850.9 |

864.5 |

766.0 |

864.5 |

874.1 |

874.1 |

+9.6 |

+1.1% |

|

Watershed and Flood Prevention |

— |

— |

150.0 |

— |

42.0 |

150.0 |

150.0 |

+0.0 |

+0.0% |

|

Watershed Rehabilitation Program |

12.0 |

12.0 |

12.0 |

— |

10.0 |

0.0 |

10.0 |

-2.0 |

-16.7% |

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

0.9 |

+0.0 |

+0.0% |

|

Subtotal |

|||||||||

|

Discretionary |

859.3 |

863.8 |

1,027.4 |

2,330.2 |

2,527.8 |

2,726.4 |

2,735.6 |

+9.8d |

+0.4%d |

|

Mandatory (M; CCC, crop insurance in FY2018) |

moved from Title I Ia |

25,728.5 |

25,728.5 |

25,728.5 |

23,198.3 |

-6,759.9d |

-22.6%d |

||

|

Subtotal |

moved from Title I Ia |

28,058.7 |

28,256.3 |

28,454.9 |

25,933.9 |

-6,750.0d |

-20.7%d |

||

|

Title III. Rural Development |

|

|

|

|

|

|

|

|

|

|

Salaries and Expenses (including transfers)e |

678.2 |

682.9 |

675.8 |

624.0 |

656.6 |

675.8 |

680.8 |

+5.0 |

+0.7% |

|

Rural Housing Service |

1,298.4 |

1,616.4 |

1,654.9 |

1,365.3 |

1,465.7 |

1,565.1 |

1,582.4 |

-72.5 |

-4.4% |

|

RHS Loan Authorityc |

27,421.5 |

27,496.8 |

28,083.4 |

27,260.0 |

27,965.7 |

28,483.4 |

28,390.1 |

+306.7 |

+1.1% |

|

Rural Business-Cooperative Servicef |

103.2 |

90.5 |

97.7 |

— |

83.6 |

95.5 |

109.5 |

+11.8 |

+12.1% |

|

RBCS Loan Authorityc |

984.5 |

979.3 |

988.4 |

— |

877.1 |

988.4 |

991.2 |

+2.8 |

+0.3% |

|

Rural Utilities Service |

501.7 |

559.3 |

639.9 |

5.4 |

478.6 |

612.4 |

628.1g |

-11.7 |

-1.8% |

|

RUS Loan Authorityc |

7,464.1 |

8,210.6 |

8,217.0 |

6,217.0 |

8,217.0 |

8,217.0 |

8,219.9 |

+2.8 |

+0.0% |

|

Rural Economic Infrastructure Grants |

— |

— |

— |

161.9 |

122.7 |

— |

— |

— |

— |

|

Under Secretary |

0.9 |

0.9 |

0.9 |

0.9 |

— |

0.9 |

— |

-0.9 |

-100.0% |

|

Subtotal, Discretionary |

2,582.4 |

2,950.0 |

3,069.2 |

2,157.5 |

2,807.1 |

2,949.8 |

3,000.9g |

-68.3 |

-2.2% |

|

Subtotal, RD Loan Authorityc |

35,870.1 |

36,686.7 |

37,288.9 |

33,477.0 |

37,059.8 |

37,688.9 |

37,601.2 |

+312.3 |

+0.8% |

|

Title IV. Domestic Food Programs |

|

|

|

|

|

|

|

|

|

|

Child Nutrition Programs (M) |

21,300.2 |

22,149.7 |

22,794.0 |

24,256.3 |

24,280.9 |

24,296.5 |

24,254.1 |

+1,460.2 |

+6.4% |

|

WIC Program |

6,623.0 |

6,350.0 |

6,350.0 |

6,150.0 |

6,150.0 |

6,350.0 |

6,175.0 |

-175.0 |

-2.8% |

|

SNAP, Food and Nutrition Act Programs (M) |

81,837.6 |

80,849.4 |

78,480.7 |

73,612.5 |

73,610.0 |

73,612.5 |

74,013.5 |

-4,467.2 |

-5.7% |

|

Commodity Assistance Programs |

278.5 |

296.2 |

315.1 |

293.6 |

317.1 |

317.1 |

322.1 |

+7.0 |

+2.2% |

|

Nutrition Programs Administration |

150.8 |

150.8 |

170.7 |

148.5 |

148.5 |

153.8 |

153.8 |

-16.9 |

-9.9% |

|

Under Secretary |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

-0.0 |

-1.7% |

|

Subtotal |

|||||||||

|

Discretionary |

7,094.1 |

6,838.9 |

6,884.7 |

6,615.9 |

6,664.5 |

6,887.9 |

6,709.8 |

-174.9 |

-2.5% |

|

Mandatory (M) |

103,096.7 |

102,958.1 |

101,226.7 |

97,845.8 |

97,842.9 |

97,842.9 |

98,209.6 |

-3,017.0 |

-3.0% |

|

Subtotal |

110,190.9 |

109,797.0 |

108,111.3 |

104,461.7 |

104,507.4 |

104,730.8 |

104,919.4 |

-3,191.9 |

-3.0% |

|

Title V. Foreign Assistance |

|

|

|

|

|

|

|

|

|

|

Foreign Agricultural Service |

181.4 |

191.6 |

196.6 |

188.2 |

195.3 |

197.5 |

199.7 |

+3.1 |

+1.6% |

|

Food for Peace Title II, and admin. expenses |

1,468.5 |

1,468.5g |

1,466.1g |

0.1 |

1,400.1 |

1,600.1 |

1,600.1g |

+134.0 |

+9.1% |

|

McGovern-Dole Food for Education |

191.6 |

201.6 |

201.6 |

0.0 |

201.6 |

206.6 |

207.6 |

+6.0 |

+3.0% |

|

CCC Export Loan Salaries |

6.7 |

6.7 |

8.5 |

6.7 |

6.7 |

8.5 |

8.8 |

+0.3 |

+3.6% |

|

Office of Codex Alimentarius |

— |

— |

— |

— |

— |

— |

3.8 |

+3.8 |

— |

|

Under Secretary |

— |

— |

— |

— |

0.9 |

0.9 |

0.9 |

+0.9 |

— |

|

Subtotal |

1,848.3 |

1,868.5 |

1,872.9 |

195.1 |

1,804.7 |

2,013.7 |

2,021.0 |

+148.1 |

+7.9% |

|

Title VI. Related Agencies |

|

|

|

|

|

|

|

|

|

|

Food and Drug Administration |

2,597.3 |

2,729.6 |

2,771.2 |

1,828.5 |

2,768.1 |

2,772.2 |

2,811.9 |

+40.7 |

+1.5% |

|

Commodity Futures Trading Commissionh |

[250.0] |

250.0 |

[250.0] |

250.0 |

248.0 |

[250.0]i |

249.0 |

-1.0 |

-0.4% |

|

Subtotal |

2,597.3 |

2,979.6 |

[3,021.2] |

2,078.5 |

3,016.1 |

[3,022.2] |

3,060.9 |

+39.7 |

+1.3% |

|

Title VII. General Provisions |

|

|

|

|

|

|

|

|

|

|

Reductions in Mandatory Programsj |

|||||||||

|

a. Environmental Quality Incentives Program |

-136.0 |

-209.0 |

-179.0 |

-209.0 |

— |

-179.0 |

— |

+179.0 |

-100.0% |

|

b. Watershed Rehabilitation Program |

-69.0 |

-68.0 |

-54.0 |

-55.0 |

-55.0 |

-55.0 |

— |

+54.0 |

-100.0% |

|

c. Fresh Fruit and Vegetable Program |

-122.0 |

-125.0 |

-125.0 |

-125.0 |

-125.0 |

-125.0 |

— |

+125.0 |

-100.0% |

|

d. Biorefinery Assistance Program |

-16.0 |

-19.0 |

-20.0 |

-175.0 |

-175.0 |

-36.0 |

— |

+20.0 |

-100.0% |

|

e. Biomass Crop Assistance Program |

-2.0 |

-20.0 |

-20.0 |

-20.0 |

-21.0 |

-21.0 |

-21.0 |

-1.0 |

+5.0% |

|

f. Cushion of Credit (Rural Development) |

-179.0 |

-179.0 |

-132.0 |

-176.0 |

-196.0 |

-196.0 |

— |

+132.0 |

-100.0% |

|

g. Section 32 |

-121.0 |

-216.0 |

-231.0 |

-263.0 |

-263.0 |

-263.0 |

— |

+231.0 |

-100.0% |

|

h. Other CHIMPS and mandatory rescissions |

-140.0 |

+5.0 |

+17.0 |

-9.0 |

-55.0 |

-66.0 |

+20.0 |

+3.0 |

+17.6% |

|

Subtotal, CHIMPS |

-785.0 |

-831.0 |

-744.0 |

-1,032.0 |

-890.0 |

-941.0 |

-1.0 |

+743.0 |

-99.9% |

|

Rescissions (discretionary) |

-17.0 |

-34.0 |

-854.0 |

-899.7 |

-600.0 |

-800.0 |

-800.0 |

+54.0 |

-6.3% |

|

Other appropriations |

|||||||||

|

a. Disaster/emergency programs |

116.0 |

273.0 |

234.8k |

— |

— |

— |

— |

-234.8 |

-100.0% |

|

b. Water and Waste Water |

— |

— |

— |

— |

— |

— |

+500.0 |

+500.0 |

— |

|

c. Broadband pilot |

— |

— |

— |

— |

— |

— |

+600.0 |

+600.0 |

— |

|

d. Opioid Enforcement and Surveillance |

— |

— |

— |

— |

— |

— |

+94.0 |

+94.0 |

— |

|

e. Food for Peace |

— |

250.0 |

134.0 |

— |

— |

— |

+116.0 |

-18.0 |

-13.4% |

|

f. Other appropriations |

6.6 |

33.1 |

103.4 |

— |

6.5 |

35.1 |

68.1 |

-35.3 |

-34.1% |

|

Subtotal, Other appropriations |

122.6 |

556.1 |

472.2 |

— |

6.5 |

35.1 |

1,378.1 |

+905.9 |

+191.9% |

|

Total, General Provisions |

-679.4 |

-308.9 |

-1,125.8 |

-1,931.7 |

-1,483.5 |

-1,705.9 |

577.1 |

+1,702.9 |

-151.3% |

|

Scorekeeping Adjustmentsl |

|

|

|

|

|

|

|

|

|

|

Disaster declaration in this bill |

-116.0 |

-130.0 |

-206.1k |

— |

— |

— |

0.0 |

+206.1 |

-100.0% |

|

Other scorekeeping adjustments |

-398.0 |

-332.0 |

-524.0 |

-485.0 |

-481.0 |

-482.0 |

-481.0 |

+43.0 |

-8.2% |

|

Subtotal, Scorekeeping adjustments |

-514.0 |

-462.0 |

-730.1 |

-485.0 |

-481.0 |

-482.0 |

-481.0 |

+249.1 |

-34.1% |

|

Totals |

|

|

|

|

|

|

|

|

|

|

Discretionary: Senate basis w/o CFTC |

20,575.0 |

[21,500.0] |

20,877.0 |

15,571.6 |

[19,748.9] |

20,525.1 |

[23,002.0] |

+2,125.0 |

+10.2% |

|

Discretionary: House basis w/ CFTC |

[20,825.0] |

21,750.0 |

[21,127.0] |

15,821.6 |

19,996.9 |

[20,775.1] |

23,251.0 |

+2,124.0 |

+10.1% |

|

Mandatory (M) |

126,756.5 |

118,990.7 |

132,506.9 |

124,918.3 |

124,915.4 |

124,915.4 |

122,752.0 |

-9,754.9 |

-7.4% |

|

Total: Senate basis w/o CFTC |

147,331.5 |

140,490.7 |

153,383.9 |

140,489.9 |

144,664.3 |

145,440.5 |

145,754.0 |

-7,629.9 |

-5.0% |

|

Total: House basis w/ CFTC |

147,581.5 |

140,740.7 |

153,633.9 |

140,739.9 |

144,912.3 |

145,690.5 |

146,003.0 |

-7,630.9 |

-5.0% |

Source: CRS, using appropriations text and report tables, and unpublished Congressional Budget Office (CBO) tables. Reflects H.R. 3354 as amended from H.R. 3268.

Notes: Amounts are nominal discretionary budget authority in millions of dollars unless labeled otherwise; (M) indicates that the account is mandatory authority (or primarily mandatory authority). Excludes amounts in supplemental appropriations acts. Bracketed amounts are not in the official totals due to differing House-Senate jurisdiction for CFTC but are shown for comparison.

a. Row headings reflect recent USDA reorganization. The Farm Service Agency and Risk Management Agency were moved from Title I to Title II, as was the Commodity Credit Corporation and Federal Crop Insurance Corporation in mandatory spending. Grain Inspection, Packers, and Stockyards Administration was moved into the Agricultural Marketing Service.

b. Includes regular FSA salaries and expenses, plus transfers for farm loan program salaries and administrative expenses. Also includes farm loan program loan subsidy, State Mediation Grants, Dairy Indemnity Program (mandatory funding), and Grassroots Source Water Protection Program. Does not include appropriations to the Foreign Agricultural Service for export loans and P.L. 480 administration that are transferred to FSA.

c. Loan authority is the amount of loans that can be made or guaranteed with a loan subsidy. This amount is not added in the budget authority subtotals or totals.

d. Differences were computed using amounts for FY2017 that were adjusted to reflect the placement of agencies under the reorganization.

e. Includes Rural Development salaries and expenses and transfers from the three rural development agencies for salaries and expenses. Amounts for the agencies thus reflect program funds for loans and grants.

f. Amounts for the Rural Business-Cooperative Service (RBCS) are before the rescission in the Cushion of Credit account, unlike in Appropriations Committee tables. The rescission is included with the CHIMPS as classified by CBO, which allows the RBCS subtotal to remain positive.

g. Excludes a portion of the other appropriations that are provided separately in General Provisions.

h. Jurisdiction for CFTC is in the House Agriculture Appropriations Subcommittee and the Senate Financial Services Appropriations Subcommittee. After FY2008, CFTC is carried in enacted Agriculture appropriations in even-numbered fiscal years in House Agriculture markup but not in Senate Agriculture markup. Bracketed amounts are not in the official totals due to differing House-Senate jurisdiction for CFTC but are shown for comparison.

i. Senate Financial Services and General Government Appropriations Subcommittee, chairman's draft, in lieu of subcommittee markup, November 20, 2017.

j. Includes reductions (limitations and rescissions) to mandatory programs that may also be known as CHIMPS.

k. Includes $206 million appropriated for the Emergency Conservation Program (ECP) and Emergency Watershed Program (EWP) in the FY2017 second CR (P.L. 114-254, Section 185) that were offset as emergency spending. Another $29 million for ECP was included in the final appropriation (Section 753).

l. "Scorekeeping adjustments" are not necessarily appropriated items and may not be shown in appropriations committee tables but are part of the official CBO score (accounting) of the bill. They predominantly include "negative subsidies" in loan program accounts and adjustments for disaster designations in the bill.

Appendix A. Budget Sequestration

Sequestration is a process of automatic, largely across-the-board reductions that permanently cancel mandatory and/or discretionary budget authority.29 Sequestration is triggered as a budget enforcement mechanism when federal spending would exceed statutory budget goals.30 Sequestration is currently authorized in the BCA (P.L. 112-25) for discretionary spending through FY2021 and for mandatory spending through FY2027, as amended by subsequent acts and explained below.

Besides FY2013—when the timing of appropriations and the first year of sequestration resulted in triggering sequestration on discretionary spending—Bipartisan Budget Acts in 2013, 2015, and 2018 (P.L. 113-67, P.L. 114-74, and P.L. 115-123, respectively) have avoided sequestration on discretionary spending. These acts raised the discretionary budget caps that were placed in statute by the BCA and allowed Congress to enact larger appropriations than were allowed under the BCA. Sequestration, however, continues to apply to certain accounts of mandatory spending and is not avoided by the Bipartisan Budget Acts (Table A-1).

The original FY2021 sunset on the sequestration of mandatory accounts has been extended four times to pay for avoiding sequestration of discretionary spending in the near term or as a general budgetary offset for other bills:

- 1. Congress extended the duration of mandatory sequestration by two years (until FY2023) as an offset in the Bipartisan Budget Act of 2013.31

- 2. Congress extended it by another year (until FY2024) to maintain retirement benefits for certain military personnel (P.L. 113-82).

- 3. Congress extended sequestration on nonexempt mandatory accounts another year (until FY2025) as an offset in the Bipartisan Budget Act of 2015.32

- 4. Congress extended sequestration on nonexempt mandatory accounts by another two years (until FY2027) as an offset in the Bipartisan Budget Act of 2018 (P.L. 115-123 Division C, Section 30101(c)).33

Some farm bill mandatory programs are exempt from sequestration. The nutrition programs and the Conservation Reserve Program are statutorily exempt,34 and some prior legal obligations in crop insurance and the farm commodity programs may be exempt35 as determined by OMB.36 Generally speaking, the experience since FY2013 is that OMB has ruled that most of crop insurance is exempt from sequestration, while the farm commodity programs, disaster assistance, and most conservation programs have been subject to it.37

For example, under the 2014 farm bill, the first farm commodity program payments began to be paid in October 2015, and USDA indicated that they would be subject to the 6.8% reduction that was applicable to FY2016.38

Thus, sequestration on nonexempt mandatory accounts continues in FY2018. Nonexempt mandatory spending in agriculture accounts are reduced by a 6.6% sequestration rate and thus are paid at 93.4% of what they would have otherwise provided. This results in a reduction of about $1.3 billion less than what would have been authorized from mandatory agriculture accounts in FY2018.

Table A-1 shows the rates of sequestration that have been announced so far and the total amounts of budget authority that have been cancelled from accounts in the Agriculture appropriations bill. Table A-2 provides additional detail at the account level for sequestration on mandatory accounts within the jurisdiction of Agriculture appropriations.

Table A-1. Sequestration from Discretionary and Mandatory Agriculture Appropriations

(sequestered budget authority in millions of dollars)

|

Discretionary Accounts |

Mandatory Accounts |

|||

|

Fiscal year |

Rate |

Amount |

Rate |

Amount |

|

2013 |

5.0% |

1,153 |

5.1% |

713 |

|

2014 |

— |

— |

7.2% |

1,052 |

|

2015 |

— |

— |

7.3% |

1,153 |

|

2016 |

— |

— |

6.8% |

1,819 |

|

2017 |

— |

— |

6.9% |

1,686 |

|

2018 |

— |

— |

6.6% |

1,316 |

Source: CRS, compiled from OMB, Reports to the Congress on the Joint Committee Reductions, various fiscal years. Available for FY2018 at https://www.whitehouse.gov/omb/legislative/omb-reports and FY2013-FY2017 at https://obamawhitehouse.archives.gov/omb/legislative_reports/sequestration.

Notes: Sequestration rates listed here are for nonexempt, nondefense accounts. Amount totals were computed by CRS, as compiled in Table A-2.

Table A-2. Sequestration of Mandatory Accounts in Agriculture Appropriations

(sequestered budget authority in millions of dollars)

|

FY2013 |

FY2014 |

FY2015 |

FY2016 |

FY2017 |

FY2018 |

|

|

Sequestration rate on nonexempt, nondefense mandatory accounts |

5.1% |

7.2% |

7.3% |

6.8% |

6.9% |

6.6% |

|

U.S. Department of Agriculture |

||||||

|

Office of the Secretary |

— |

— |

0.9 |

0.9 |

0.9 |

0.9 |

|

Office of Chief Economist |

— |

— |

0.1 |

0.1 |

0.1 |

0.1 |

|

Agricultural Research Service |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

National Institute of Food and Agriculture |

— |

— |

— |

9.9 |

10.0 |

— |

|

Extension |

0.3 |

0.4 |

1.8 |

— |

— |

3.3 |

|

Biomass Research and Development |

— |

— |

0.2 |

0.2 |

0.2 |

— |

|

Integrated Activities |

— |

— |

7.3 |

— |

— |

6.6 |

|

Animal and Plant Health Inspection Service |

||||||

|

Salaries appropriation |

13.6 |

18.8 |

21.5 |

20.1 |

19.5 |

18.8 |

|

Miscellaneous Trust Funds |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Food Safety Inspection Service |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Grain Inspection Packers and Stockyards Administration |

2.1 |

3.0 |

3.0 |

3.1 |

3.1 |

2.9 |

|

Agricultural Marketing Service |

||||||

|

Section 32 |

40.4 |

79.7 |

81.9 |

77.3 |

79.6 |

78.1 |

|

Milk Market Orders Assessment Fund |

2.9 |

4.2 |

4.2 |

4.0 |

4.1 |

4.0 |

|

Perishable Ag Commodities Act |

0.6 |

0.8 |

0.8 |

0.8 |

0.8 |

0.7 |

|

Expenses and refunds |

0.4 |

0.9 |

0.9 |

1.3 |

1.3 |

0.4 |

|

Payments to States and Possessions |

— |

— |

5.3 |

5.0 |

5.0 |

5.6 |

|

Marketing Services |

— |

— |

2.2 |

2.0 |

2.1 |

2.0 |

|

Risk Management Agency |

— |

— |

— |

— |

0.6 |

— |

|

Federal Crop Insurance Corporation |

3.0 |

4.2 |

5.9 |

3.5 |

3.9 |

3.7 |

|

Farm Service Agency |

||||||

|

Commodity Credit Corporation Fund |

329.5 |

573.7 |

710.8 |

1,388.6 |

1,238.6 |

904.1 |

|

Agricultural Credit Insurance Corporation |

— |

— |

0.1 |

0.1 |

0.1 |

0.1 |

|

Commodity Credit Corporation Export Loans |

— |

— |

— |

0.4 |

0.4 |

0.3 |

|

Pima Cotton Trust Fund |

— |

— |

— |

1.1 |

1.1 |

1.1 |

|

Wool Apparel Manufacturers Trust Fund |

— |

— |

— |

2.0 |

2.1 |

2.0 |

|

Agricultural Disaster Relief Fund |

70.0 |

— |

— |

— |

— |

— |

|

Tobacco Trust Fund |

49.0 |

69.1 |

— |

— |

— |

— |

|

Natural Resources Conservation Service |

||||||

|

Farm Security and Rural Investment Programs |

171.2 |

263.1 |

269.9 |

265.7 |

281.5 |

254.9 |

|

Watershed Rehabilitation Program |

— |

11.9 |

11.2 |

4.7 |

4.7 |

4.4 |

|

Rural Development, Rural Business Cooperative Service |

||||||

|

Rural Energy for America Program |

1.1 |

3.0 |

3.7 |

3.4 |

3.5 |

3.3 |

|

Rural Microenterprise Investment Program |

— |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

Energy Assistance Payments |

3.3 |

3.2 |

1.1 |

1.0 |

1.0 |

1.0 |

|

Biorefinery Assistance Program |

— |

— |

3.7 |

3.4 |

1.4 |

1.3 |

|

Rural Economic Development Grants |

— |

— |

— |

1.6 |

— |

— |

|

Foreign Agricultural Service |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Food and Nutrition Servicea |

||||||

|

SNAP |

4.7 |

8.0 |

8.4 |

9.8 |

10.6 |

9.6 |

|

Child Nutrition Programs |

2.5 |

4.2 |

4.2 |

3.9 |

4.3 |

4.0 |

|

Commodity Assistance Program |

1.1 |

1.5 |

1.5 |

1.4 |

1.4 |

1.4 |

|

WIC |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Related Agencies |

||||||

|

Food and Drug Administration |

||||||

|

Revolving Fund for Certification |

0.4 |

0.6 |

0.6 |

0.6 |

0.6 |

0.6 |

|

User Fees |

16.3 |

— |

— |

— |

— |

— |

|

Farm Credit System Insurance Corporation |

0.2 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

|

Commodity Futures Trading Commission |

0.7 |

0.9 |

1.0 |

2.2 |

2.2 |

0.1 |

|

Total |

713.3 |

1,051.9 |

1,153.0 |

1,818.9 |

1,685.6 |

1,315.9 |

Source: CRS, compiled from OMB, Reports to the Congress on the Joint Committee Reductions, various fiscal years. Available for FY2018 at https://www.whitehouse.gov/omb/legislative/omb-reports and FY2013-FY2017 at https://obamawhitehouse.archives.gov/omb/legislative_reports/sequestration.

Notes: Sequestration rates are for nonexempt, nondefense accounts. The sequesterable budget authority for each row may be computed by dividing the amount of sequestration by the sequestration rate. Column totals were computed by CRS.

a. Benefits from the nutrition programs are generally exempt from sequestration by statute, but some administrative expenses in these programs may be subject to sequestration, and therefore a relatively small portion of the total budget authority may be sequesterable.

Appendix B. Action on Agriculture Appropriations

|

House Action |

Senate Action |

Final Appropriation |

|||||||||

|

Fiscal Year |

Subcmte. |

Cmte. |

Floor |

Subcmte. |

Cmte. |

Floor |

Enacteda |

Public Law |

CRS Report |

||

|

1997 |

5/30/1996 |

6/6/1996 |

6/12/1996 |

7/10/1996 |

7/11/1996 |

7/24/1996 |

8/6/1996 |

E |

IB96015 |

||

|

1998 |

6/25/1997 |

7/14/1997 |

7/24/1997 |

7/15/1997 |

7/17/1997 |

7/24/1997 |

11/18/1997 |

E |

|||

|

1999 |

6/10/1998 |

6/16/1998 |

6/24/1998 |

6/9/1998 |

6/11/1998 |

7/16/1998 |

10/21/1998 |

O |

|||

|

2000 |

5/13/1999 |

5/24/1999 |

6/8/1999 |

6/15/1999 |

6/17/1999 |

8/4/1999 |

10/22/1999 |

E |

|||

|

2001 |

5/4/2000 |

5/16/2000 |

7/11/2000 |

5/4/2000 |

5/10/2000 |

7/20/2000 |

10/28/2000 |

E |

|||

|

2002 |

6/6/2001 |

6/27/2001 |

7/11/2001 |

Polled outb |

7/18/2001 |

10/25/2001 |

11/28/2001 |

E |

|||

|

2003 |

6/26/2002 |

7/26/2002 |

— |

7/23/2002 |

7/25/2002 |

— |

2/20/2003 |

O |

|||

|

2004 |

6/17/2003 |

7/9/2003 |

7/14/2003 |

7/17/2003 |

11/6/2003 |

11/6/2003 |

1/23/2004 |

O |

|||

|

2005 |

6/14/2004 |

7/7/2004 |

7/13/2004 |

9/8/2004 |

9/14/2004 |

— |

12/8/2004 |

O |

|||

|

2006 |

5/16/2005 |

6/2/2005 |

6/8/2005 |

6/21/2005 |

6/27/2005 |

9/22/2005 |

11/10/2005 |

E |

|||

|

2007 |

5/3/2006 |

5/9/2006 |

5/23/2006 |

6/20/2006 |

6/22/2006 |

— |

2/15/2007 |

Y |

|||

|

2008 |

7/12/2007 |

7/19/2007 |

8/2/2007 |

7/17/2007 |

7/19/2007 |

— |

12/26/2007 |

O |

|||

|

2009 |

6/19/2008 |

— |

— |

Polled outb |

7/17/2008 |

— |

3/11/2009 |

O |

|||

|

2010 |

6/11/2009 |

6/18/2009 |

7/9/2009 |

Polled outb |

7/7/2009 |

8/4/2009 |

10/21/2009 |

E |

|||

|

2011 |

6/30/2010 |

— |

— |

Polled outb |

7/15/2010 |

— |

4/15/2011 |

Y |

|||

|

2012 |

5/24/2011 |

5/31/2011 |

6/16/2011 |

Polled outb |

9/7/2011 |

11/1/2011 |

11/18/2011 |

O |

|||

|

2013 |

6/6/2012 |

6/19/2012 |

— |

Polled outb |

4/26/2012 |

— |

3/26/2013 |

O |

|||

|

2014 |

6/5/2013 |

6/13/2013 |

— |

6/18/2013 |

6/20/2013 |

— |

1/17/2014 |

O |

|||

|

2015 |

5/20/2014 |

5/29/2014 |

— |

5/20/2014 |

5/22/2014 |

— |

12/16/2014 |

O |

|||

|

2016 |

6/18/2015 |

7/8/2015 |

— |

7/14/2015 |

7/16/2015 |

— |

12/18/2015 |

O |

|||

|

2017 |

4/13/2016 |

4/19/2016 |

— |

5/17/2016 |

5/19/2016 |

— |

5/5/2017 |

O |

|||

|

2018 |

6/28/2017 |

7/12/2017 |

9/14/2017 |

7/18/2017 |

7/20/2017 |

— |

3/23/2018 |

O |

|||

Source: CRS.

a. E = Enacted as standalone appropriation (seven times over 22 years); O = Omnibus appropriation (13 times); Y = Year-long CR (two times).

b. A procedure that permits a Senate subcommittee to transmit a bill to its full committee without a formal markup session. See CRS Report RS22952, Proxy Voting and Polling in Senate Committee.

Author Contact Information

Key Policy Staff

|

Area of Expertise |

Name |

Phone |

|

|

Agricultural appropriations, USDA budget |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Agricultural Marketing Service |

Joel Greene |

[phone number scrubbed] |

[email address scrubbed] |

|

Animal and Plant Health Inspection Service |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Commodity Futures Trading Commission |

Rena Miller |

[phone number scrubbed] |

[email address scrubbed] |

|

Conservation |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Crop insurance |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Dietary guidelines |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Disaster assistance |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Farm Service Agency |

[author name scrubbed] [author name scrubbed] |

[phone number scrubbed] [phone number scrubbed] |

[email address scrubbed] [email address scrubbed] |

|

Food and Drug Administration |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Food safety, generally |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Food safety, meat and poultry inspection |

Joel Greene |

[phone number scrubbed] |

[email address scrubbed] |

|

Foreign food aid |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Nutrition and domestic food assistance |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Research and extension |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Rural development |

[author name scrubbed] |

[phone number scrubbed] |

[email address scrubbed] |

|

Trade |

[author name scrubbed] [author name scrubbed] |

[phone number scrubbed] [phone number scrubbed] |

[email address scrubbed] [email address scrubbed] |

Footnotes

| 1. |

Jurisdiction for CFTC appropriations differs between the chambers. Since FY2008, CFTC is marked up in the Agriculture Subcommittee of the House Appropriations Committee and in the Financial Services and General Government Subcommittee of the Senate Appropriations Committee. The enacted CFTC appropriation is carried in the Agriculture bill in even-numbered fiscal years and in the Financial Services bill in odd-numbered fiscal years. |

| 2. |

Office of Management and Budget (OMB), FY2018 Budget of the U.S. Government, especially in the Appendix, http://www.whitehouse.gov/omb/budget/Appendix. |

| 3. |

USDA, FY2018 USDA Budget Summary; and USDA, 2018 Explanatory Notes, http://www.obpa.usda.gov. |

| 4. |

See CRS Report R44582, Overview of Funding Mechanisms in the Federal Budget Process, and Selected Examples. |

| 5. |

See CRS Report R42388, The Congressional Appropriations Process: An Introduction. |

| 6. |

Mandatory spending creates funding stability and consistency compared to annual discretionary appropriations. In agriculture, it originated with farm commodity programs that had uncertain outlays due to weather and the market. |

| 7. |

See CRS Report 98-560, Baselines and Scorekeeping in the Federal Budget Process. |

| 8. |

P.L. 113-79. See CRS In Focus IF10783, Farm Bill Primer: Budget Issues. |

| 9. |

P.L. 111-296. See CRS Report R44373, Tracking the Next Child Nutrition Reauthorization: An Overview. |

| 10. |

See CRS Report RS20129, Entitlements and Appropriated Entitlements in the Federal Budget Process. |

| 11. |

See CRS Report R42388, The Congressional Appropriations Process: An Introduction. |

| 12. |

The White House, America First: A Budget Blueprint to Make America Great Again, March 16, 2017. |

| 13. |

Congressional Record, May 3, 2017, p. H3328. |

| 14. |

OMB, FY2018 Budget of the U.S. Government, Appendix. |

| 15. |

USDA, FY2018 USDA Budget Summary; and USDA, 2018 Budget Explanatory Notes, http://www.obpa.usda.gov. |

| 16. |

FDA, FY2018 FDA Justification of Estimates for Appropriations, https://www.hhs.gov/about/budget/index.html. |

| 17. |

OMB, FY2018 Budget of the U.S. Government, Major Savings and Reforms. |

| 18. |

CFTC, FY2018 CFTC Budget Request, http://www.cftc.gov/About/CFTCReports/ssLINK/cftcbudget2018. |

| 19. |

Budget enforcement for appropriations has both procedural and statutory elements. The procedural elements are associated with the budget resolution and are enforced through points of order. The appropriations committees and subcommittees receive procedural limits on budget authority, referred to as 302(a) and 302(b) allocations, respectively (see CRS Report R42388, The Congressional Appropriations Process: An Introduction). The statutory elements impose limits on discretionary spending in FY2012-FY2021 and are enforced through discretionary budget caps and sequestration (see CRS Report R42972, Sequestration as a Budget Enforcement Process: Frequently Asked Questions). |

| 20. |

For example, for the limit for Agriculture appropriations, see House Appropriations Committee, "Revised Interim Suballocation of Budget Allocations for FY2018," https://appropriations.house.gov/uploadedfiles/sbdv-3.pdf. |

| 21. |

The House subcommittee draft is available at https://appropriations.house.gov/uploadedfiles/bills-115hr-sc-ap-fy2018-agriculture-agriculture.pdf. |

| 22. |

For example, see "FY2018 Funding Guidance" at https://www.appropriations.senate.gov/imo/media/doc/072017%20FY2018%20Funding%20Guidance%20-%20Background.pdf. |

| 23. |

CRS Report R42647, Continuing Resolutions: Overview of Components and Recent Practices. |

| 24. |

CRS Report RL34700, Interim Continuing Resolutions (CRs): Potential Impacts on Agency Operations. |

| 25. |

For example, if a CR lasts for three months, OMB may apportion 3/12 of the previous fiscal year amount during the CR to limit agency spending. |

| 26. |

CRS Report R44978, Overview of Continuing Appropriations for FY2018 (P.L. 115-56). |

| 27. |

CBO, "Effects of Legislation That Would Raise Deficits by an Estimated $1.5 Trillion over the 2018-2027 Period," letter to Steny Hoyer, November 14, 2017. |

| 28. |

CRS Insight IN10861, Discretionary Spending Levels Under the Bipartisan Budget Act of 2018. |

| 29. |

CRS Report R43411, The Budget Control Act of 2011: Legislative Changes to the Law and Their Budgetary Effects. |

| 30. |

CRS Report R42972, Sequestration as a Budget Enforcement Process: Frequently Asked Questions. |

| 31. |

CBO, Bipartisan Budget Act of 2013, December 11, 2013, https://www.cbo.gov/publication/44964. |

| 32. |