The President’s FY2018 Budget Request for Agriculture Appropriations and the Farm Bill

Background

The Trump Administration released its first full budget request on May 23, 2017. It proposes specific amounts for the FY2018 Agriculture appropriation as well as legislative changes to various mandatory spending programs, including those in the farm bill.

The Administration's budget outline, released on March 16, 2017, proposed an overall 21% reduction for the U.S. Department of Agriculture, and it mentioned seven specific discretionary programs for elimination or reduction. It did not address any mandatory spending proposals. (See CRS Insight IN10675, The President's FY2018 Budget Outline for the U.S. Department of Agriculture.)

This report separates the President's budget request into proposed changes for agriculture based on congressional jurisdiction. The proposals are likely to be treated differently in Congress because of separate appropriations and authorizing committee jurisdictions. The Appropriations committees will determine funding levels for FY2018 through the budget and appropriations process and may incorporate elements of the request. The Agriculture committees may respond to the mandatory spending proposals, which would need separate legislative action to be enacted, and the committees may wait until 2018, when the current farm bill is due for reauthorization.

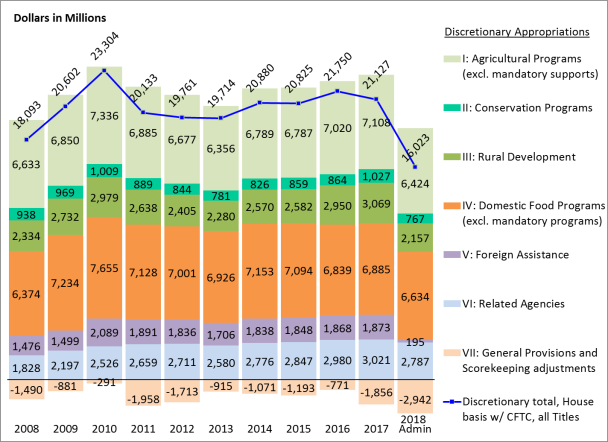

Agriculture Appropriations Request

The President's budget request for FY2018 proposes an estimated $5.1 billion reduction (-24%) in discretionary spending for accounts that are in the Agriculture and Related Agencies Appropriations bill (Figure 1, Table 1). This CRS estimate is preliminary and subject to rescoring by the Congressional Budget Office (CBO). The estimate is based on Agriculture appropriations jurisdiction, which does not cover all of USDA. It excludes the Forest Service, includes the Food and Drug Administration and, in the House, includes the Commodity Futures Trading Commission. It is also relative to the enacted FY2017 appropriation (P.L. 115-31; see CRS Report R44441, FY2017 Agriculture and Related Agencies Appropriations: In Brief) rather than the FY2017 continuing resolution that existed when the budget request was assembled.

The $5.1 billion reduction to Agriculture appropriations is comprised largely of the following proposals:

- $1.7 billion reduction in foreign food aid (-90%, by eliminating Food for Peace and McGovern-Dole Food for Education),

- $912 million reduction to rural development (-30%, including eliminating rural water and waste disposal grants, and the Rural Business Cooperative Service),

- $382 million reduction to agricultural research agencies (-13%),

- $260 million reduction to conservation programs (-25%),

- $250 million reduction to discretionary domestic nutrition assistance programs, primarily the Supplemental Nutrition Program for Women, Infants and Children (WIC, -3%),

- $234 million reduction to the Food and Drug Administration (-8.5%),

- $136 million reduction to animal and plant health inspection (-14%),

- $115 million reduction to Farm Service Agency operations (-7%), including a 13% reduction in the amount of ownership and operating loans that can be made to farmers,

- $1.1 billion of rescissions and limitations beyond the FY2017 level of $1.8 billion (including a $212 million rescission of prior-year funds for research facilities, and $410 million of limitations to mandatory programs beyond the FY2017 level of $744 million).

The request also proposes reducing USDA staffing by over 5,000 employees (-5%), including an 8% reduction at the Farm Service Agency (headquarters and county offices), 19% at Rural Development, and 10% at the Agricultural Research Service.

Farm Bill and Other Legislative Requests

The President's budget request proposes nearly $240 billion of reductions over 10 years to mandatory spending programs that are in the jurisdiction of the House and Senate Agriculture Committees. The reduction includes $229 billion affecting farm bill programs, nearly $2 billion in rural development programs, and $9 billion of proposed user fees (Table 2). This Office of Management and Budget estimate is subject to rescoring by CBO.

This request may be an indicator of the Administration's priorities for the next farm bill, which is expected to receive legislative attention by 2018, when the current farm bill expires. The request proposes reducing the Supplemental Nutrition Assistance Program (SNAP), capping crop insurance premiums, eliminating a crop insurance option, tightening income eligibility requirements for farm subsidies, reducing conservation programs, and eliminating various smaller farm bill programs such as trade promotion and specialty crop support.

These reductions are relative to a farm bill baseline of about $870 billion for the same period based on the January 2017 CBO baseline projection. (See CRS Report R44784, Previewing a 2018 Farm Bill.) If enacted, the $229 billion subtotal of farm bill reductions would imply a 26% reduction to the farm bill baseline over FY2018-FY2027. The SNAP proposals would be a 28% reduction to its $672 billion 10-year baseline, and the crop insurance proposals would be a 35% reduction to its $79 billion baseline.

Table 1. President's FY2018 Request for Agriculture and Related Agencies Appropriations

(discretionary budget authority in millions of dollars)

|

FY2017 |

FY2018 |

Change from FY2017 to FY2018 Request |

||

|

Agency or Major Program |

P.L. 115-31 |

Admin. Request |

||

|

Title I. Agricultural Programs |

|

|

|

|

|

Departmental Administration |

410.1 |

383.0 |

-27.1 |

-6.6% |

|

Agricultural Research Service |

1,269.8 |

993.1 |

-276.7 |

-21.8% |

|

National Institute of Food and Agriculture |

1,362.9 |

1,252.8 |

-110.1 |

-8.1% |

|

National Agricultural Statistics Service |

171.2 |

185.7 |

+14.4 |

+8.4% |

|

Economic Research Service |

86.8 |

76.7 |

-10.1 |

-11.6% |

|

Animal and Plant Health Inspection Service |

949.4 |

812.9 |

-136.5 |

-14.4% |

|

Agricultural Marketing Service |

86.2 |

78.6 |

-7.6 |

-8.8% |

|

Grain Inspection, Packers and Stockyards Administration |

43.5 |

43.0 |

-0.5 |

-1.2% |

|

Food Safety and Inspection Service |

1,032.1 |

1,038.1 |

+6.0 |

+0.6% |

|

Farm Service Agency |

1,623.5 |

1,508.3 |

-115.2 |

-7.1% |

|

Risk Management Agency |

74.8 |

55.0 |

-19.8 |

-26.5% |

|

Subtotal |

7,110.3 |

6,427.1 |

-683.2 |

-9.6% |

|

FSA Farm Loan Authority |

8,002.6 |

6,953.9 |

-1,048.7 |

-13.1% |

|

Title II. Conservation Programs |

|

|

|

|

|

Conservation Operations |

864.5 |

766.0 |

-98.5 |

-11.4% |

|

Watershed and Flood Prevention |

150.0 |

0.0 |

-150.0 |

-100.0% |

|

Watershed Rehabilitation Program |

12.0 |

0.0 |

-12.0 |

-100.0% |

|

Subtotal |

1,026.5 |

766.0 |

-260.5 |

-25.4% |

|

Title III. Rural Development |

|

|

|

|

|

Salaries and Expenses (including transfers) |

675.8 |

624.0 |

-51.8 |

-7.7% |

|

Rural Economic Infrastructure Grants |

— |

161.9 |

+161.9 |

— |

|

Rural Housing Service |

1,654.9 |

1,365.3 |

-289.6 |

-17.5% |

|

Rural Business-Cooperative Service |

97.7 |

0.0 |

-97.7 |

-100.0% |

|

Rural Utilities Service |

639.9 |

5.4 |

-634.5 |

-99.2% |

|

Subtotal |

3,068.3 |

2,156.6 |

-911.7 |

-29.7% |

|

Rural Development Loan Authority |

37,288.9 |

33,477.0 |

-3,811.9 |

-10.2% |

|

Title IV. Domestic Food Programs |

|

|

|

|

|

Women, Infants, and Children (WIC) Program |

6,350.0 |

6,150.0 |

-200.0 |

-3.1% |

|

Commodity Assistance Programs |

315.1 |

293.6 |

-21.5 |

-6.8% |

|

Nutrition Programs Administration |

170.7 |

148.5 |

-22.2 |

-13.0% |

|

Discretionary amounts in child nutrition, SNAP |

48.0 |

40.9 |

-7.1 |

-14.7% |

|

Subtotal |

6,883.9 |

6,633.1 |

-250.8 |

-3.6% |

|

Title V. Foreign Assistance |

|

|

|

|

|

Foreign Agricultural Service and other admin. |

205.3 |

195.1 |

-10.2 |

-5.0% |

|

Food for Peace Title II |

1,466.0 |

0.0 |

-1,466.0 |

-100.0% |

|

McGovern-Dole Food for Education |

201.6 |

0.0 |

-201.6 |

-100.0% |

|

Subtotal |

1,872.9 |

195.1 |

-1,677.8 |

-89.6% |

|

Title VI. Related Agencies |

|

|

|

|

|

Food and Drug Administration |

2,771.2 |

2,536.7 |

-234.4 |

-8.5% |

|

Commodity Futures Trading Commission |

[250.0] |

250.0a |

+0.0 |

+0.0% |

|

Subtotal |

[3,021.2] |

2,786.7 |

-234.4 |

-7.8% |

|

Title VII. General Provisions |

|

|

|

|

|

Changes in Mandatory Program Spending |

-744.0 |

-1,154.2 |

-410.2 |

+55.1% |

|

Rescissions |

-854.0 |

-1,424.7 |

-570.7 |

+66.8% |

|

Other appropriations |

266.0 |

0.0 |

-266.0 |

-100.0% |

|

Scorekeeping adjustments |

-524.0 |

-363.0 |

+161.0 |

-30.7% |

|

Subtotal |

-1,855.9 |

-2,941.9 |

-1,086.0 |

+58.5% |

|

Totals |

|

|

|

|

|

Discretionary: Senate basis w/o CFTC |

20,877.0 |

15,772.5 |

-5,104.5 |

-24.5% |

|

Discretionary: House basis w/ CFTC |

[21,127.0] |

16,022.5 |

-5,104.5 |

-24.2% |

Source: CRS, using P.L. 115-31, and Office of Management and Budget, President's Budget for FY2018: Appendix, May 2017.

Notes: FY0218 data are a preliminary compilation by CRS of congressional appropriations jurisdiction, based on the President's budget. Bracketed amounts are not in the official totals due to differing House-Senate appropriations jurisdiction for the Commodity Futures Trading Commission.

a. As an independent agency, CFTC submits its budget concurrently to Congress and the Administration. CFTC is requesting a different amount in its budget justification: $281.5 million, an increase of $31.5 million (+12.6%). See CRS Insight IN10715, When an Agency's Budget Request Does Not Match the President's Request: The FY2018 CFTC Request and "Budget Bypass", by [author name scrubbed], [author name scrubbed], and [author name scrubbed].

|

10-year reduction FY2018-FY2027 ($ billion) |

|

|

Farm Bill Savings |

|

|

SNAP reform (including categorical eligibility, able-bodied waivers, state matching) |

-190.9 |

|

Crop Insurance Premium Subsidy Limit (create new $40,000 limit) |

-16.2 |

|

Eliminate Harvest Price Option (reduce crop insurance) |

-11.9 |

|

AGI Eligibility Limit (tighten the limit from $900,000 to $500,000) |

-1.1 |

|

Conservation programs (including reductions to Agricultural Management Assistance, Regional Conservation Partnership Program, Conservation Stewardship Program) |

-5.8 |

|

Eliminate other programs (including Specialty Crop Block Grants, Farmers Markets Promotion, Market Access Program, Foreign Market Development, Pima Cotton and Wool trust funds) |

-3.1 |

|

Subtotal of farm bill programs |

-229.0 |

|

Other reductions |

|

|

Eliminate Interest Payments to Rural Utilities (cushion of credit account) |

-1.4 |

|

Eliminate Rural Economic Development Program (cushion of credit account) |

-0.5 |

|

Create user fees |

|

|

Food Safety and Inspection Service (fee for inspections) |

-5.9 |

|

SNAP Retailer Application Fee (fee to become a retailer) |

-2.4 |

|

Grain Inspection, Packers, and Stockyards Admin. (licensing and standards development) |

-0.3 |

|

Agricultural Marketing Service (to pay for marketing orders) |

-0.2 |

|

Animal and Plant Health Inspection Service (animal welfare, biotechnology, veterinary biologics) |

-0.2 |

|

Total |

-239.8 |

Source: CRS, compiled from Office of Management and Budget, President's Budget for FY2018: Major Savings and Reforms, and Appendix, May 2017. Other parts of the budget may propose changes to programs that were not included in the Major Savings list.