U.S. Trade in Services: Trends and Policy Issues

Changes from January 26, 2018 to January 22, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

U.S. Trade in Services: Trends and Policy Issues

Contents

- Introduction

- U.S. Trade in Services

- Modes of Delivery

- Overall Trends

- Cross-Border Trade (Modes 1, 2, and 4)

- Commercial Presence (Mode 3)

Geographical Distribution- Trade by Type of Service

- World Trade in Services

- Global Value Chains and Services

- Barriers to Trade in Services

- The Economic Effects of Barriers to Services Trade

- U.S. Trade Agreements

- WTO

- GATS

- WTO

Doha Development Agenda (Doha Round)Ongoing Negotiations

- Key Concepts for Services in FTAs

- Market Access and the Negative List Approach

- Rules of Origin

- Multiple Disciplines on Services

- Regulatory Transparency

- Regulatory Heterogeneity

- Current U.S. Trade Agreement Negotiations

- U.S. Trade Negotiating Objectives

- Trans-Pacific Partnership (TPP)

- Trade in Services Agreement (TiSA)

- North American Free Trade Agreement (NAFTA)

U.S.-South Korea Free TradeU.S.-Mexico-Canada Agreement (KORUS FTA)- Potential Transatlantic Trade and Investment Partnership (T-TIP)

- China

- Potential Trade Agreements with EU and/or UK

- Potential Issues for Congress

Figures

- Figure 1. Four Modes of Service Delivery

- Figure 2. U.S. Net Trade in Goods & Services,

1992-1999-2018 Figure 3. U.S. Exports by Mode, 2016 - Figure

34. U.S. Trade in Services by Geographic Region,20162018

- Figure

45. U.S. Services Supplied Through Majority-Owned Foreign Affiliates,20152017

- Figure

5. U.S. Services Exports by Type of Service - Figure 6. Trade Restrictiveness of the United States Compared with Brazil

Tables

- Table 1. Services Supplied to Foreign and U.S. Markets through Cross-Border Trade and Affiliates, 2012-2016

Table 26. Services Supplied to U.S. Persons by Foreign MNEs Through Their MOUSAs, 2017- Figure 7. U.S. Cross-Border Services Exports by Type of Service

- Figure 8. U.S. Services Exports by Type of Service Through U.S. Majority-Owned Foreign Affiliates

Figure 9. Commercial Services Trade: Leading Exportersand Importers, 2016- Table 3. Commercial Services Trade: Leading Exporters and Importers, 2016

- Figure 10. Relative Trade Restrictiveness of the United States

Summary

Trade in "services" refers to a wide and growing range of economic activities. These activities include transport, tourism, financial services, use of intellectual property, telecommunications and information services, government services, maintenance, and other professional services from accounting to legal services. Compared to goods, the types and volume of services that can be traded are limited by factors such as the requirement for direct buyer-provider contact, and other unique characteristics such as the reusability of services (e.g., professional consulting) for which traditional value measures do not account. In addition to services as independent exports, manufactured and agricultural products incorporate and depend on services, such as research and development or shipping of intermediate or final goods. As services account for 8271% of U.S. private sector jobsemployment, U.S. trade in services, both services as exports and as inputs to other exported products, can have a broad impact across the U.S. economy.

Rapid advances in information technology and the related growth of global value chains have expanded both the level and the range of services tradable across national borders. As a result, services have become a priority in U.S. trade policy, and a significant part of U.S. trade flows and of global trade in general, accounting for $752.4827 billion in U.S. exports in 2018. As the United States is the world's largest exporter and importer of services (1514% and 10% of the global total in 20162018), the Administration's discussions on potential and existing trade agreements that include services are significant.

A number of economists argue that "behind the border" barriers imposed by foreign governments prevent U.S. trade in services from expanding to its full potential. The United States continues to negotiate trade agreements to lower these barriers. It was a leading force in concluding the General Agreement on Trade in Services (GATS) in the World Trade Organization (WTO) in 1994, and in past U.S. free trade agreements, all of which contain significant provisions on market access and rules for liberalizing trade in services. Trade agreementsnegotiations involving trade in services currently under discussion include the following.

- Renegotiation of the North American Free Trade Agreement (NAFTA) with Canada and Mexico.

- Review of the U.S.-South Korea Free Trade Agreement (KORUS).

- Potential continued negotiation of the Trade in Services Agreement (TiSA), a plurilateral agreement outside of the WTO with 22 other countries, or of the Transatlantic Trade and Investment Partnership (T-TIP) free trade agreement with the European Union (EU).

Potential new and updated bilateral free trade agreements with other partners:- Expansion of services liberalization under WTO;

- Recently approved U.S.-Mexico-Canada Agreement (USMCA);

- Phase One agreement with China and future Phase Two discussions; and

Potential bilateral trade agreement negotiations with the European Union (EU) and/or the United Kingdom (UK).

In each case, participants have difficult issues to address and the outlook for progress is uncertain. For each agreementmost agreements, Congress may consider legislation to implement agreements potentially concluded in the future.

Congress and U.S. trade negotiators face additional issues, including how to balance the need for effective regulations of services with the objective of opening markets for U.S. exports and trade in services; ensuring adequate and accurate data to measure trade in services to inform trade policy; and determining whether further international cooperation efforts are needed to improve the regulatory environment for services trade beyond initial market access. This report provides background information and analysis on these and other emerging issues related to U.S. international trade in services. In addition, it examines existing and potential trade agreements as they relate to services trade.

Introduction

Services are a significant element across the U.S. economy, at the national, state, and local levels. The term "services" refers to an expanding range of economic activities, such as audiovisual, construction, computer and related services, express delivery, telecommunications, e-commerce, financial, professional (such as accounting and legal services), retail and wholesaling, transportation, and tourism. Services not only function as end-use products but also facilitate the rest of the economy. For example, transportation services move intermediate products along global supply chains and final products to consumers; telecommunications services open e-commerce channels; and financial services provide credit for the manufacture and consumption of goods or the production of crops.

Services account for a majority of the U.S. economy—7869% of U.S. gross domestic product (GDP) and 8271% of total U.S. U.S. private sector full-time employment.1 Services have also become a significant component of U.S. international trade, accounting for $752.4827.0 billion of U.S. exports in 20162018. As such, it is an increasingly important component of U.S. trade policy and of global trade in general.2

Rapid advances in information technology and the related growth of global value chains are making an expanding range of services tradable across national borders. However, certain characteristics have limited the types and volume of services that can be traded; for example, a hair stylist must be physically near a client. Other service providers are no longer required to be in the same location as the customer, such as a graphic designer who can send a product (e.g., an electronic file of a design) to a client across the globe.3 A number of economists have argued that foreign government barriers prevent U.S. trade in services from expanding to its full potential.34 Under the Trump Administration, the United States may continuecontinues to engage in trade negotiations on multilateral, plurilateral, bilateral, and regional agreements with one goal being to lower these barriers.

Congress has a significant role to play in negotiating and implementing trade-liberalizing agreements, including those on services. In fulfilling its responsibilities for regulation of commerce and oversight of U.S. trade policymaking and implementation, Congress monitors trade negotiations and the implementation of trade agreements. Congress establishes trade negotiating objectives and priorities, including through trade promotion authority (TPA) legislation and consultations with the Administration. More directly, Congress must pass legislation to implementbefore a trade agreement requiring changes to U.S. law before it can enter into force in the United States, Congress would need to pass legislation to implement the agreement.

This report provides background information and analysis on U.S. international trade in services, including the types and volumes of traded services. It analyzes policy issues before the United States, especially relating to negotiating international disciplines on trade in services and the complexities in measuring trade in services. The report also examines emerging issues and current and potential trade agreements, including renegotiation of the North American Free Trade Agreement (NAFTA), the Trade in Services Agreement (TiSA), and the Transatlantic Trade and Investment Partnership (T-TIP)the recently approved U.S.-Mexico-Canada Agreement (USMCA) to replace the North American Free Trade Agreement (NAFTA), ongoing negotiations with China, ongoing multilateral and plurilateral negotiations at the World Trade Organization (WTO), and potential trade negotiations with the European Union and the United Kingdom.

U.S. Trade in Services

Modes of Delivery

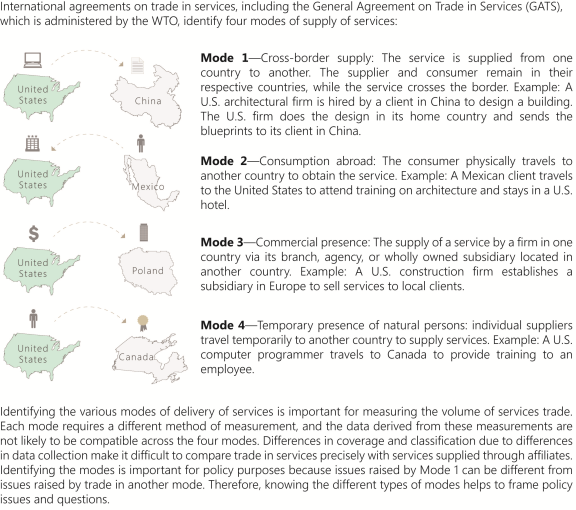

The basic characteristics of services are complex (especially compared to goods) due to their intangibility and their ability to be delivered via various formats, including electronically and direct provider-to-consumer contact. To address this complexity, members of the World Trade Organization (WTO) have adopted a system of classifying four modes of delivery for services to measure trade in services and to classify government measures that affect trade in services in international agreements. The General Agreement on Trade in Services (GATS) modes of supply are defined based on the location of the service supplier and the consumer, taking into account their respective nationalities (see Figure 1).

|

|

Source: CRS based on WTO.

|

Overall Trends

U.S. international trade in services plays an important role in the overall U.S. economy and global trade. The wide range of existing and potential services, from e-commerce to engineering, is delivered through multiple modes that often complement, or integrate with, one another.4

Measurements of trade in services are captured in two types of data: cross-border trade includes services sold via Modes 1, 2, and 4, described above.56 The second set of data measures services sold by an affiliate, that is, the services a local affiliate of a foreign company sells to a consumer of the local economy (Mode 3).6

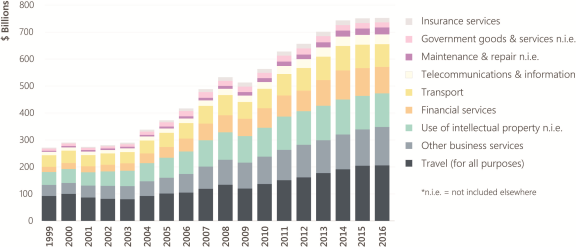

For cross-border trade, in 20167

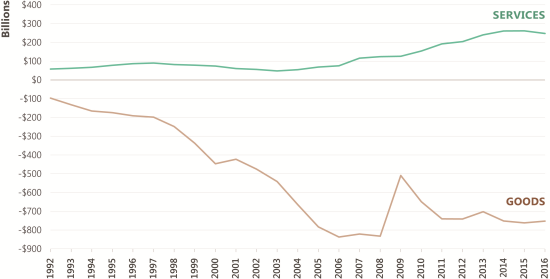

In 2018, total cross-border trade (Modes 1, 2, and 4), services accounted for 3433.1% of the $2,208501 billion total in U.S. exports (of goods and services) and 18.61% of the $2,7133,129 billion in total U.S. imports.78 Figure 2 shows that the United States has continually realized surpluses in cross-border services trade, which have partially offset large trade deficits in goods trade in the U.S. current account.8

| 1999-2018 |

|

|

Source: CRS, based on data from U.S. Department of Commerce, Bureau of Economic Analysis. |

Cross-Border Trade (Modes 1, 2, and 4)

Information and communications technology (ICT)-enabled services fall under Mode 1 of cross-border services. These include services such as online banking, web-hosting, and services provided via telephone when providers and customers are from different countries. Given the increasing role of digital technologies in facilitating cross-border trade, in October 2016, the U.S. Bureau of Economic Analysis (BEA) began to identify trade in ICT services and potentially ICT-enabled (PICTE) services, reflecting the growth and economic impact of digital trade and digitally-enabled services.10 PICTE services include a wide array of services: insurance and financial services, as well as many business services like research, consulting, and engineering services which could be delivered electronically. In 2018, exports of ICT services accounted for $71.4 billion of U.S. exports while potentially ICT-enabled services exports were another $451.9 billion, demonstrating the impact of the internet and digital revolution. Together, ICT and potentially ICT-enabled services were 63% of total U.S. service exports in (and 57% of U.S. service imports). To measure the actual mode of cross-border delivery, as opposed to potential (e.g., a financial services consumer could travel abroad to a bank to conduct a transaction or do so online), BEA conducted a survey. BEA found that, for some sectors, such as computer and legal services, the vast majority is conducted via Mode 1 (e.g., by phone, online, etc.), while other services, such as education, are predominantly delivered in person with either the customer or provider traveling abroad (via Mode 2 or 4).11 (Mode 3) through a foreign affiliate. It is unclear how advances in information and communications technology will affect trade in services via Mode 3 as virtual delivery via the Internetinternet expands the range of services offered and also drives increased demand.

In

Source: CRS using data from Michael A. Mann, Measuring Trade in Services by Mode of Supply, U.S. Department of Commerce, Bureau of Economic Analysis, August 2019. Notes: * = n.i.e. (not included elsewhere.). Expend. = expenditures.

20152017 (the latest year for which published data are available), U.S. firms sold $1,463.5558 billion in services to foreigners through their majority-owned foreign affiliates, and foreign firms sold $952.51,083 billion in services to U.S. residents through their majority-owned foreign affiliates located in the United States.9 The12 Although the data for cross-border trade and for sales by majority-owned affiliates are not directly compatiblecomparable due to differences in coverage and classification, BEA created a mapping to measure services supplied by mode.13

The.10 Nevertheless, the data presented in Table 1Figure 3 indicate that, in terms of magnitude, a large proportion of sales of services occurs through the commercial presence of companies in foreign markets rather than cross-border trade. Financial, computer, and distribution services are the largest sources of U.S. Mode 3 exports.

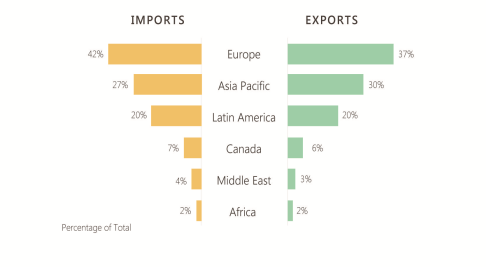

Geographical Distribution

The United States supplies services (both via cross-border trade and FDI) to many different regions of the world (see Figure 4). Europe accounted for the majority of U.S. total trade in services. The United Kingdom (UK) alone accounted for 9% of U.S. services exports and 11% of services imports in 2018. Apart from the UK, 29% of U.S. exports of services went elsewhere in Europe, while 31% of U.S. imports of services came from those countries. Canada accounted for 8% of U.S. services exports and 6% of U.S. services imports; China was 7% and 3%, respectively, while other Asian and Pacific countries accounted for 23% of U.S. exports and 24% of imports of services in 2018. Japan's consumption of U.S. services was less than that of China, but Japan accounted for approximately double the amount of U.S. services imports, largely driven by U.S. affiliates of Japanese MNC's use of intellectual property.14

indicate that, in terms of magnitude, a large proportion of sales of services occurs through the commercial presence of companies in foreign markets rather than cross-border trade.

Table 1. Services Supplied to Foreign and U.S. Markets throughCross-Border Trade and Affiliates, 2012-2016

(billions of dollars)

|

To Foreign Markets |

To U.S. Markets |

|||

|

Cross-Border Trade |

Through U.S.-owned Affiliates |

Cross-Border Trade |

Through Foreign-owned Affiliates |

|

|

2012 |

$656.4 |

$1,285.9 |

$452.0 |

$813.3 |

|

2013 |

$701.5 |

$1,321.5 |

$461.1 |

$891.9 |

|

2014 |

$741.9 |

$1,534.8 |

$480.8 |

$940.4 |

|

2015 |

$753.1 |

$1,463.5 |

$491.7 |

$952.5 |

|

2016 |

$752.4 |

NA |

$504.7 |

NA |

Source: Department of Commerce, Bureau of Economic Analysis, available at http://www.bea.gov. Foreign-owned affiliate data lag by one year.

Conventional trade data are not measured on a value-added basis and do not attribute any portion of the traded value of manufactured and agricultural products to services inputs, such as research and development, design, transportation costs, and finance. Instead, traditional data measure exports and imports of goods based on the value of the final product (e.g., medical device or t-shirt).

Measuring trade flows based on value-added11 rather than final cost, the Organization for Economic Co-operation and Development (OECD) and the WTO estimated that in 2009, close to 50% of the value of U.S. exports of manufactured goods was attributable to services inputs.12 This finding suggests a larger role for services in international trade than is reflected in conventional trade data; it also suggests trade in services is likely to grow in importance with the growth of global value chains. An economist at Standard Chartered also argues that there are discrepancies in trade statistics, showing that by traditional measures services are 20% of global exports but, by his estimates of value-added, services account for 45%.13

Geographical Distribution

The United States supplies services (both via cross-border trade and FDI) to many different regions of the world (see Figure 3). Europe accounted for the majority of U.S. total trade in services. The United Kingdom (UK) alone accounted for 9% of U.S. services exports and 10% of services imports in 2016. Apart from the UK, 28% of U.S. exports of services went elsewhere in Europe, while 32% of U.S. imports of services came from those countries. Canada accounted for 7% of U.S. services exports and 6% of U.S. services imports; China was 7% and 3%, respectively, while other Asian and Pacific countries accounted for 23% of U.S. exports and 24% of imports of services in 2016. Japan's consumption of U.S. services was similar to that of China, but Japan accounted for approximately double the amount of U.S. services imports.14

|

|

Source: |

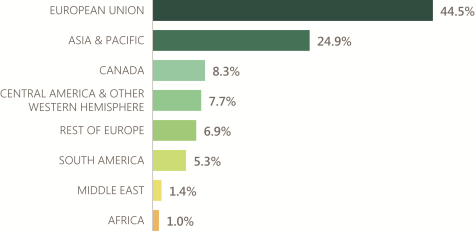

Europe's dominance in U.S. services trade is more apparent when taking into account services that are provided through multinational corporations (MNCs)MNCs and their affiliates. In 20152017 (latest data available), 4447% of services supplied by U.S. MNCs were to foreign persons located in European Union countries, 25% to foreign persons located in Asian countries (including China), and 8% to foreign persons located in Canada (see Figure 45).

In 2017). In 2015, 56% of sales of services to U.S. persons by U.S. affiliates of foreign-owned MNCs were by MNCs based in European countries; 2625% by MNCs based in Asia (including China), Middle East, and Africa; and 1012% by MNCs based in Canada.15

|

Figure |

|

|

Source: CRS, based on data from the Department of Commerce, Bureau of Economic Analysis. |

Trade by Type of Service

Source: CRS, based on data from the Department of Commerce, Bureau of Economic Analysis. Note: MOUSA = majority-owned U.S. affiliates of foreign enterprisesThe U.S. Bureau of Economic Analysis divides

Figure 6. Services Supplied to U.S. Persons by Foreign MNEs Through Their MOUSAs, 2017

Trade by Type of Service

BEA divides cross-border services into nine categories:16

- Maintenance and repair;

- Transport;

- Travel (for all purposes including tourism, education);

- Insurance;

- Financial;

- Charges for the use of intellectual property (IP) (e.g., patents, trademarks, franchise fees);

- Telecommunications, computer, and information;

- Other business services (e.g., research and development, accounting, engineering); and

- Government goods and services.

In 20162018, U.S. exports covered a diverse range of services (see Figure 57). Travel accounted for the largest percent of U.S. services exports at 27%. Royalties and fees generated from intellectual property as well as other business services contributed another 17% and 1926%. Other business services, as well as royalties and fees generated from intellectual property, contributed another 20% and 16%, respectively. Transportation and financial services were 11% and 1314%, respectively, of U.S. services exports.17

|

Figure |

|

|

Source: CRS, based on data from the Department of Commerce, Bureau of Economic Analysis. |

Sales of services by MNCs via commercial presence (Mode 3) include a broader range of industries. In

Source: CRS, based on data from the Department of Commerce, Bureau of Economic Analysis. In the other direction, the total value of services supplied by foreign MNCs through their U.S. affiliates was smaller, but the composition of the services supplied was similar. 20152017 (latest data available), the value of services sold by U.S.-owned MNCs through their foreign affiliates ranged from 17% for professional, scientific, and technical services and information services to 2% for manufacturing (see Figure 8).18

(latest data available), the value of services sold by U.S.-owned MNCs through their foreign affiliates was 16% and 7% from wholesale and retail trade services, respectively. Additionally, financial services accounted for 16%; sales of professional services, including computer systems management and design, architectural, engineering, and other professional services were 16%; information-related services were 17%; and "other industries" (a category that includes utilities, transportation, and other services) were 19%. Manufacturing services accounted for 2%, followed by mining at 3% and real estate at 4%.18

In the other direction, the total value of services supplied by foreign MNCs through their U.S. affiliates was smaller, but the composition of the services supplied was similar.

In October 2016, the U.S. Bureau of Economic Analysis began to identify trade in Information and Communications Technology (ICT) services and potentially ICT-enabled services, reflecting the growth and economic impact of digital trade and digitally enabled services. ICT services include telecommunications and computer services, as well as related charges for the use of computer software. In addition, ICT-enabled services are those services with outputs delivered remotely over ICT networks such as online banking or education. For many types of services, however, the actual mode of delivery is not known (e.g., a consumer could go to a bank to conduct a transaction or do so online). As such, BEA tracks potentially ICT-enabled services which include a variety of services, including insurance and financial services, as well as many business services like research, architectural, and engineering services which could be delivered electronically. In 2016, exports of ICT services accounted for $66 billion of U.S. exports while potentially ICT-enabled services exports were another $403 billion, demonstrating the impact of the Internet and digital revolution. Together, ICT and potentially ICT-enabled services were 62% of total U.S. service exports in 2016 (and 57% of U.S. service imports). (For more information, see Grimm, Alexis N., BEA, Trends in U.S. Trade in Information and Communications Technology (ICT) Services and in ICT-Enabled Services, May 2016, http://www.bea.gov/scb/pdf/2016/05%20May/0516_trends_%20in_us_trade_in_ict_serivces2.pdf). |

World Trade in Services

Globally, the OECD finds that services account for over two-thirds of global GDP and three-quarters of global FDI in advanced economies.19 According to the WTO, world exports of commercial services, excluding government procurement, increased to $4.735.63 trillion in 20162018.20

The United States is a major exporter and importerthe leading trader of services in global markets. If the European Union (EU)21 countries are treated separately, the United States was the largest single-country exporter (15.214.0%) and importer (10.39.8%) of global commercial services (see Table 2).. 21 The United States was the second-largest exporter (19.918.7%) and importer (13.212.8%) in 20162018, if the EU is treated as a single entity (see Table 3 Figure 9).

Source: World Trade Organization, World Trade Statistical Review 2017. Conventional trade data are not measured on a value-added basis and do not attribute any portion of the traded value of manufactured and agricultural products to services inputs, such as research and development, design, transportation costs, and finance. Instead, traditional data measure exports and imports of goods based on the value of the final product (e.g., medical device or t-shirt). Measuring trade flows based on value-added22 rather than final cost, the OECD estimated that in 2015, close to 30% of the value of U.S. exports of manufactured goods was attributable to services inputs.23 Globally, approximately 75% of trade in services consists of intermediate inputs for the production of goods and services24 and services represent more than 50% of the value added in gross exports.25 This finding suggests a larger role for services in international trade than is reflected in conventional trade data. The growth of global value chains (GVCs) in which economic activities are fragmented across multiple countries and regions has heightened the interdependence and interconnectedness of the global economy. GVCs provide industries access to wider markets and have the potential to increase productivity and efficiency, lower costs, and create new offerings for companies and consumers. U.S. firms have expanded global value chains using advances in information technology to bring goods and services to market. According to the WTO, GVCs covered 57% of world trade in 2015.26 China, the European Union, and United States were the top traders of intermediate goods in 2017.27 Computers, electronics, and optical products; motor vehicles; and textiles and apparel are the most "globally integrated" sectors, according to the OECD.28 GVCs may also serve as a motivator for countries involved at any point along a global value chain to seek more open markets for moving intermediate goods and service imports and exports. Global value chains have expanded and redefined the role that services play in international trade and are one reason for growth in services trade. Despite a recent slowdown in globalization, the role of trade in services is likely to grow as global value chains expand in certain sectors and countries. Intermediate services embedded within a value chain include not only transportation and distribution to move goods along, but also research and development, design and engineering, as well as business services, such as legal, accounting, or financial services. The independent value of these services (as opposed to the value of the final product) can be captured in trade in value added statistics (see earlier discussion).29 As manufacturing and agriculture grow more complex and technologically advanced, their consumption of value-added services also grows.Table 2

Figure 9. Commercial Services Trade: Leading Exporters, 2018

Global Value Chains and Services

. Commercial Services Trade: Leading Exporters and Importers, 2016

|

Rank |

Exporter |

Value ($ bn) |

Share (%) |

Annual % Change |

Rank |

Importer |

Value ($ bn) |

Share (%) |

Annual % Change |

|

|

1 |

United States |

733 |

15.2 |

0 |

1 |

United States |

482 |

10.3 |

3 |

|

|

2 |

United Kingdom |

324 |

6.7 |

-5 |

2 |

China |

450 |

9.6 |

4 |

|

|

3 |

Germany |

268 |

5.6 |

3 |

3 |

Germany |

311 |

6.6 |

4 |

|

|

4 |

France |

236 |

4.9 |

-2 |

4 |

France |

236 |

5.0 |

2 |

|

|

5 |

China |

207 |

4.3 |

-4 |

5 |

United Kingdom |

195 |

4.1 |

-6 |

|

|

6 |

Netherlands |

177 |

3.7 |

1 |

6 |

Ireland |

192 |

4.1 |

15 |

|

|

7 |

Japan |

169 |

3.5 |

7 |

7 |

Japan |

183 |

3.9 |

3 |

|

|

8 |

India |

161 |

3.4 |

4 |

8 |

Netherlands |

169 |

3.6 |

1 |

|

|

9 |

Singapore |

149 |

3.1 |

1 |

9 |

Singapore |

155 |

3.3 |

1 |

|

|

10 |

Ireland |

146 |

3.0 |

9 |

10 |

India |

133 |

2.8 |

8 |

Source: World Trade Organization, World Trade Statistical Review 2017, p. 104.

Note: Based on Balance of Payments data that may underestimate some items.

|

Rank |

Exporter |

|

Share (%) |

Annual % Change |

Rank |

Importer |

Value ($ bn) |

Share (%) |

Annual % Change |

|

|

1 |

Extra-EU(28) exports |

917 |

24.9 |

0 |

1 |

Extra-EU(28) exports |

772 |

21.1 |

2 |

|

|

2 |

United States |

733 |

19.9 |

0 |

2 |

United States |

482 |

13.2 |

3 |

|

|

3 |

China |

207 |

5.6 |

-4 |

3 |

China |

450 |

12.3 |

4 |

|

|

4 |

Japan |

169 |

4.6 |

7 |

4 |

Japan |

183 |

5.0 |

3 |

|

|

5 |

India |

161 |

4.4 |

4 |

5 |

Singapore |

155 |

4.2 |

1 |

|

|

6 |

Singapore |

149 |

4.1 |

1 |

6 |

India |

133 |

3.6 |

8 |

|

|

7 |

Switzerland |

112 |

3.1 |

1 |

7 |

Korea, Republic of |

109 |

3.0 |

-2 |

|

|

8 |

Hong Kong, China |

98 |

2.7 |

-6 |

8 |

Canada |

96 |

2.6 |

-2 |

|

|

9 |

Korea, Republic of |

92 |

2.5 |

-5 |

9 |

Switzerland |

95 |

2.6 |

1 |

|

|

10 |

Canada |

80 |

2.2 |

1 |

10 |

United Arab Emirates |

82 |

2.2 |

3 |

Source: World Trade Organization, World Trade Statistical Review 2017, p. 105.

Note: Excludes Intra-EU trade.

Global Value Chains and Services

The growth of global value chains (GVCs) in which economic activities are fragmented across multiple countries and regions has heightened the interdependence and interconnectedness of the global economy. GVCs provide industries access to wider markets and have the potential to increase productivity and efficiency, lower costs, and create new offerings for companies and consumers. U.S. firms are expanding global value chains using advances in information technology to bring goods and services to market. Today, more than half of global manufacturing imports are intermediate goods traveling within supply chains, while over 75% of the world's services imports are intermediate services.22 Intermediate services embedded within a value chain include not only transportation and distribution to move goods along, but also research and development, design and engineering, as well as business services such as legal, accounting, or financial services. The independent value of these services (as opposed to the value of the final product) can be captured in trade in value added statistics (see earlier discussion).23 As manufacturing and agriculture grow more complex and technologically advanced, their consumption of value-added services also grows.

Global value chains have expanded and redefined the role that services play in international trade and are one reason for growth in services trade. Furthermore, GVCs may also serve as a motivator for countries involved at any point along a global value chain to seek more open markets for moving intermediate goods and service imports and exports. According to one study, a domestically manufactured good in many countries contains over 20% of foreign value added, and over 50% in some countries and industries.24 Similarly, imported goods often contain a significant amount of domestic content. For example, a French wine imported into the United States may be transported by a U.S. express delivery service and use a label designed and printed by a U.S. marketing firm, while a gadget assembled domestically and exported by a U.S. firm may not only have components from abroad but also may rely on foreign research and engineering skills. With U.S. firms supplying many of the world's services, these findings imply that more U.S. services are traded internationally and many more service industry jobs in the United States are linked to international trade than traditional trade statistics indicate.

The WTO's "Made in the World" initiative finds that the increased use of GVCs has led industries to demand greater trade liberalization and lower protectionism as these firms depend on other links in the value chain, both domestic and foreign. The disaggregation of value chains into smaller pieces, or modules, opens up domestic and international business opportunities to specialized firms or small or mid-sized enterprises (SMEs) who can focus on one piece. As such, the strategic and potential economic impact of both trade barriers and efforts to liberalize trade in services may be greater than many people realize. By expanding through GVCs, U.S. industries could obtain greater and efficient access to markets, less expensive labor, and lower production costs, as well as talents and specializations from across the world.

However, using global supply chains entails potential costs and risks. Managing a complex supply chain across countries and/or time zones can be difficult and create additional costs. Some analysts point out that the benefits of increasingly interconnected supply chains may be offset by potential costs associated with overreliance on foreign or dispersed suppliers, or increased exposure or vulnerability to intellectual property rights theft or external shocks from abroad, such as an environmental disaster (e.g., earthquake) or market disturbances (e.g., financial crash or truck -driver strike).25

30

Unexpected changes in tariff rates is another risk that companies accept when sourcing from overseas. For example, the Trump Administration has imposed tariffs on multiple tranches of imports from China. China, in turn, has imposed retaliatory tariffs on certain U.S. imports.31 As a result of the ongoing trade dispute, some analysts and businesses have begun to question the merit of maintaining GVCs that rely on imports from other countries and some U.S. firms have shifted, or are considering shifting, supply chains to other countries or back to the United States.32

Barriers to Trade in Services

Liberalizing trade in services can be more complex than for goods, as the impediments are often "behind the border" barriers (occurring within the importing country) whereas those faced by goods suppliers, including tariffs and quotas, are frequently at the border.

The GATS identifies specific "market access" barriers and limits restrictions on the following: the number of foreign service suppliers, the total value of service transactions or assets, the number of transactions or value of output, the type of legal entity or joint venture through which services may be supplied, and the share of foreign capital in terms of maximum percentage limit on foreign shareholding or total value of foreign direct investment.

In many cases the impediments are government regulations or rules that appear legitimate but may intentionally or unintentionally discriminate against foreign providers and impede trade.

The right of governments to regulate service industries is widely recognized as prudent and necessary to protect consumers from harmful or unqualified providers. For example, doctors and other medical personnel must be licensed by government-appointed boards; lawyers, financial services providers, and many other professional service providers must be also certified in some manner. In addition, governments apply minimum capital requirements on banks to ensure their solvency. Each government can determine what it deems to be a prudent level of regulation. However, one concern in international trade is whether these regulations are applied to foreign service providers in a discriminatory and unnecessarily trade restrictive manner that limits market access. Because services transactions more often require direct contact between the consumer and provider than is the case with goods trade, many of the "trade barriers" that foreign companies face pertain to the establishment of a commercial presence in the consumers' country in the form of direct investment (Mode 3) or to the temporary movement of providers and consumers across borders (Modes 2 and 4).

|

Examples of Common Service Trade Barriers

| 33

The Economic Effects of Barriers to Services Trade

The most significant barriers to trade in services are not readily quantifiable, and measuring their effects has challenges and limitations. To help inform trade policy, economists have constructed methods to estimate the effects, but these studies are sensitive to the assumptions made and may not necessarily reflect the entire range of factors influencing trade flows. Another considerationMost economists argue that by reducing barriers to trade in services, economies can more efficiently allocate resources, increasing general economic welfare. Opponents of liberalization in trade in services argue that a country would be forced to relinquish some regulatory control. Another factor to consider is that, as restrictions to trade are eliminated, cross-border trade via modes 1, 2, and 4 could grow at the expense of mode 3 if local presence is no longer a requirement to provide services in a particular country. However, removal of restrictions on foreign investment could offset any potential decline over the long term.27

Most economists argue that by reducing barriers to trade in services, economies can more efficiently allocate resources, increasing general economic welfare. Opponents of liberalization in trade in services argue that a country would be forced to relinquish some regulatory control.

Economists at the Peterson Institute for International Economics (PIIE) published the results of one analysis of the impact of barriers on services trade. They first determined that U.S. trade in "business services"—a category that includes such activities as information, financial, scientific, and management services—is lower than one might expect given U.S. comparative advantage in those services. To come to this conclusion, the PIIE economists first determined that many business services are tradable, that is, capable of being sold from one region to another because many of them are "traded" between regions within the United States. Based on these assumptions, they compared the trade profiles of manufacturing firms and those of service firms and concluded that while about 27% of U.S. manufacturing firms export, only 5% of U.S. firms providing business services engage in exporting, even though the United States has a comparative advantage in business services. The PIIE study concludes that foreign government trade barriers are a major factor in the relatively low participation of U.S. service providers in trade. It also calculated the export/total sales ratios of manufacturing firms compared to business services firms, with the former being 0.20 and the latter 0.04. The study argues that if the ratio of business services could be raised to 0.1 or half of the manufacturers' ratio, it would increase total U.S. goods and services exports by 15%.28 Given that four-fifths of the U.S. private sector workforce is in services, a change in the ratio of exporting service businesses could have a significant impact.29 If more businesses engaged in exporting services, U.S. imports of services may also increase.

34

The most significant barriers to trade in services are not readily quantifiable, and measuring their effects has challenges and limitations. Nontariff barriers for services specifically related to digital trade and data flows establish restrictions that may impact what a firm offers in a market or how it operates. For example, data transfer regulations that restrict cross-border data flows ("forced" localization barriers to trade), such as requiring locally -based servers, may limit the type of financial transactions and services that a firm can sell in a given country (see text box below). Similarly, country-specific data regulations may create a disincentive for U.S. firms to invest in certain markets if a firm is hindered in its ability to export its own data from a foreign affiliate to a U.S.-based headquarters in order to aggregate and analyze information from across its global operations. The proponents of data localization seek to ensure privacy of citizens, security, and domestic control. Others point out that maintaining data within a country does not necessarily guarantee security or protect a country from exposure to foreign attacks.3035 Opponents of localization restrictions on digital trade also point to lost efficiencies and increased costs of not allowing a free flow of information across borders. According to the U.S. International Trade Commission, based on 2014 estimates, decreasing barriers to cross-border data flows would increase GDP in the United States by 0.1% to 0.3%.3136

|

Localization Requirements as Trade Barriers Localization requirements by other countries can create trade barriers to U.S. businesses, whether in developed or developing economies. For example, |

37

The vast majority of U.S. small businesses that export rely on digital services such as online payment and e-commerce websites to facilitate export sales, but trade barriers (e.g., on the use of U.S. financial services) may limit the ability of U.S. firms to take advantage of online tools. A study by the U.S. Chamber of Commerce and Google found that 9% of U.S. small businesses export but that more would do so given greater market access.38 The study estimates that with better access to export markets, small business exports would increase 14% over three years, generating $81 billion and adding over 900,000 U.S. jobs. 3339 The study finds that more restrictive countries not only import less in services but also export less, suggesting that restrictions also hurt the competitiveness of domestic industry. The negative effect of trade restrictions holds true across the various service sectors the researchers investigated. Financial services saw the greatest impact when restrictions changed; limitations on financial services were mostly in the form of market entry restrictions such as equity limits. Another OECD study finds that SMEs benefit relatively more compared to larger multinational firms from the reduction in market access barriers.34

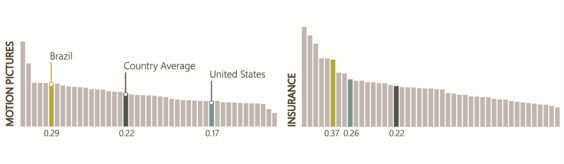

According to the OECD ServiceServices Trade Restrictiveness Index (STRI),35 for 2018, the United States has a relatively open and competitive business environment in comparison to the 4045 countries included in the study, as foreign providers have access and are allowed to compete equally in most sectors in the United States.42 The United States scored as the most open country for sound recordingfor rail freight transport, motion pictures, and distribution services, reflecting the highly competitive U.S. industry in these sectors. On the other hand, the study identifies air transport, maritime transport, and courier services as the U.S. business sectorssector with the most restrictions impacting foreign firms seeking to do business in the country. As an example, the STRI shows that the United States is much more open than Brazil for trade in motion picturesbroadcasting and commercial banking, but that both are relatively restrictive for international insurance trade (see. Figure 6)10 shows how the United States compares to other countries and the overall average score by sector. The STRI can also show the impact of a country's reform efforts. For example, reforms by Indonesia in 2016 reduced its trade restrictiveness in particular sectors, including sound recording and air transport, compared to 2014.36

|

Figure |

|

|

Source: |

U.S. Trade Agreements

The United States has worked with trading partners to develop and implement rules on several fronts to reduce barriers and facilitate trade in services without infringing on the sovereign rights of governments to regulate services for prudential, sound regulatory, and national security reasons. The broadest and most challenging in terms of the number of countries involved are the multilateral rules contained in the General Agreement on Trade in Services (GATS) that entered into force in 1995 and are administered by the 164-member World Trade Organization (WTO). The United States has also sought to go beyond the GATS (WTO-plus) under more comprehensive rules in the free trade agreements (FTAs) it has in force and, according to press reports, in current renegotiation of the North American Free Trade Agreement (NAFTA). The Administration may also decide to continue services discussions in Trade in Services Agreement (TiSA) and Transatlantic Trade and Investment Partnership (T-TIP) in the U.S.-Mexico-Canada Agreement (USMCA) to replace the North American Free Trade Agreement (NAFTA), as well as potential new trade agreements with China and the EU. Overall U.S. negotiating objectives, as defined in legislation (see "U.S. Trade Negotiating Objectives"), in each of these fora are to establish a more open, rules-based trade regime that is flexible enough to increase the flow of services and to take into account the expansion of types of services, but clear enough not to impede the ability of governments to regulate the sectors.3744

|

Select Highlights of Services in Some U.S. Trade Agreements

|

One complication for the United StatesOngoing negotiations at the WTO on trade in services and on e-commerce, as well as bilateral negotiations with the EU and China, provide opportunities to further open services markets to U.S. firms.

One aspect of U.S. practice is that while trade negotiations are handled by the federal government, states often regulate services, including licensing and certification requirements. While regulations may vary across states, they all must comply with the commitments made by the federal government in international trade agreements.

WTO

The seeds for multilateral negotiations in services trade were planted more than 40 years ago. In the Trade Act of 1974, Congress instructed the Administration to push for an agreement on trade in services under the General Agreement on Tariffs and Trade (GATT) during the Tokyo Round negotiations.45 While the Tokyo Round concluded in 1979 without a services agreement, the industrialized countries, led by the United States, continued to press for its inclusion in later negotiations. Developing countries, whose service sectors are less advanced than those of the industrialized countries, were reluctant to have services included. Eventually, services were included as part of the Uruguay Round negotiations launched in 1986.3846 At the end of the round in 1994, countries agreed to a new set of rules for services, the GATS, and a new multilateral body, the WTO, to administer the GATS, the GATT, and the other agreements reached on financial services and telecommunications. Specific market access commitments were relatively limited.

GATS

The GATS provides the first and only multilateral framework of principles and rules for government policies and regulations affecting trade in services among the 164 WTO countries representing many levels of economic development. In so doing, it provides the foundation or floor on which rules in other agreements on services are based. As with the rest of the WTO, the GATS has remained a work in progress. The agreement is divided into six parts:3947

Part I (Article I) defines the scope of the GATS. It provides that the GATS applies to the following:

- all services, except those supplied in the routine exercise of government authority;

- all government barriers to trade in services at all levels of government—national, regional, and local; and

- all four modes of delivery of services.

Part II (Articles II-XV) presents the "principles and obligations," some of which mirror those contained in the GATT for trade in goods, while others are specific to services. They include the following:

- unconditional most-favored-nation (MFN), nondiscriminatory treatment—services imported from one member country cannot be treated any less favorably than the services imported from another member country;

4048

- transparency—governments must publish rules and regulations;

- reasonable, impartial, and objective administration of government rules and regulations that apply to covered services;

- monopoly suppliers must act consistently with obligations under the GATS in covered services;

- a member incurring balance of payments difficulties may temporarily restrict trade in services covered by the agreement; and

- a member may circumvent GATS obligations for national security purposes.

Part III (Articles XVI-XVIII) of the GATS establishes market access and national treatment obligations for members. The GATS

- binds each member to its commitments once it has made them, that is, a member country may not impose less favorable treatment than that to which it has committed;

- provides market access by prohibiting member-country governments from placing limits on suppliers of services from other member countries regarding the number of foreign service suppliers, the total value of service transactions or assets, the number of transactions or value of output, the type of legal entity or joint venture through which services may be supplied, and the share of foreign capital or total value of foreign direct investment;

- requires that member governments accord service suppliers from other member countries national treatment, that is, a foreign service or service provider may not be treated any less favorably than a domestic provider of the service; and

- allows members to negotiate further reductions in barriers to trade in services.

Importantly, unlike MFN treatment and the other principles listed in Part II, which apply to all service providers more or less unconditionally, the obligations under Part III are restricted. They apply only to those services and modes of delivery listed in each member's schedule of commitments. Thus, unless a member country has specifically committed to open its market to service suppliers in a particular service that is provided via one or more of the four modes of delivery, the national treatment and market access obligations do not apply. This is often referred to as the positive list approach to trade commitments. Each member country's schedule of commitments is contained in an annex to the GATS.4149 The schedules of market access commitments are, in essence, the core of the GATS.

|

Positive and Negative Lists Trade agreements may take a positive or negative list approach to identify each party's market access commitments and national treatment coverage. Positive list—Each member explicitly identifies which sectors and subsectors will be included and subject to the commitments of the agreement. Unless a member undertakes a specific commitment for a given category, it is not obliged to provide market access or national treatment to the service providers of other members. Parties may include different sectors and subsectors for market access and national treatment commitments. Each party may set conditions or exceptions to its commitments known as "limitations" or "reservations." The lists of sectors included by each member, and any exceptions, are usually included as an annex to the agreement, known as the schedules. Negative list—All sectors and subsectors are subject to the agreement's market access and national treatment commitments unless a member identifies specific exclusions through limitations or reservations. All newly created or domestically provided services are by default covered under this approach, unless explicitly excluded. The negative list is considered more comprehensive and clearly identifies sectors not opened. Nonconforming Measures (NCM)—Included in its list of exceptions, a party may list its nonconforming measures, any law, regulation, procedure, requirement, or practice that violates certain articles of the agreement but that the party will continue to enforce. |

Parts IV-VI (Articles XIX-XXIX) are technical elements of the agreement. Among other things, they require that, no later than 2000, the GATS members start new negotiations (which they did) to expand coverage of the agreement and that conflicts between members involving implementation of the GATS are to be handled in the WTO's dispute settlement mechanism. The GATS also includes eight annexes, including one on MFN exemptions. Another annex provides a "prudential carve out," that is, a recognition that governments take "prudent" actions to protect investors or otherwise maintain the integrity of the national financial system. These prudent actions are allowed, even if they conflict with obligations under the GATS.

Not all of the issues in services were resolved when the Uruguay Round negotiations ended in 1994. Fifty-six WTO members, mostly developed economies, negotiated and concluded an agreement in 1997 in which they made commitments on financial services. The schedules of commitments largely reflected national regimes already in place.4250 Furthermore, 69 WTO members negotiated and concluded an agreement in 1997 on telecommunications services. That agreement laid out principles on competition safeguards, interconnection policies, regulatory transparency, and the independence of regulatory agencies. Both agreements were added to the GATS as protocols.4351 Today, a total of 108 WTO members have made some level of commitment to facilitate trade in telecommunications services.44

WTO Doha Development Agenda (Doha Round)

52

WTO Ongoing Negotiations

Article XIX of the GATS required WTO members to begin a new set of negotiations on services in 2000 as part of the so-called WTO "built-in agenda" to complete what was unfinished during the Uruguay Round and to expand the coverage of the GATS to further liberalize trade in services. However, because no agreement was reached, the services negotiations were folded—along with agriculture and nonagriculture negotiations—into the agenda of the Doha Development Agenda (Doha Round) round thatThe Doha Round launched in December 2001.45

U.S. priorities in the services negotiations included the following:

- removing unnecessary restrictions on foreign providers establishing a commercial presence;

- improving the quality of commitments from what was established originally in the GATS;

- regulatory transparency so that foreign services providers are better informed about host country regulations that may affect them; and

- expanding market access in financial services, telecommunication services, express delivery, energy services, environmental services, distribution services, education and training services, professional services, computer and related services, and audiovisual and advertising services.

In general, the Doha Round negotiations were characterized by persistent differences among developed and developing countries on major issues in tariffs and nontariff barriers for goods, services, and agriculture. For example, developing countries (including emerging economic powerhouses such as China, Brazil, and India) sought the reduction of agriculture tariffs and subsidies among developed countries, nonreciprocal market access for manufacturing sectors, and protection for their services industries. In contrast, the United States, the EU, and other developed countries sought reciprocal trade liberalization, especially commercially meaningful access to advanced developing countries' industrial and services sectors, and some measure of protection for their agricultural sectors. The developed countries also sought to incorporate new issues that impact services, such as digital trade (data flows, cybertheft, and trade secrets) and global value chains.

The complexity of the services agenda and the number of players involved may have contributed to the lack of progress in the Doha Round negotiations. The term "services" includes a broad range of economic activities, many with few characteristics in common except that they are not goods. Exporters face different trade barriers across service sectors, making the formulation of trade rules a significant challenge. For example, licensing regulations are especially important to professional service providers, such as lawyers and medical professionals, while data transfer regulations are important to financial services providers. Furthermore, services negotiations include many participants from trade ministers to representatives of finance ministries and regulatory agencies, many of whom do not consider trade liberalization a primary part of their mission. Negotiators often found it difficult to formulate mechanisms that distinguish between government regulations that are purely protectionist and those that have legitimate purposes.46

After 14 years, the divisions in the Doha Round called into question the viability of the "single undertaking" (one package to address all trade issues together) type of negotiation and some parties voiced a need for institutional reform. After the WTO's 2015 Ministerial was held in Nairobi, Kenya, the Ministerial Declaration acknowledged the division over the future of the Doha Round and failed to reaffirm its continuation. Despite the disagreements, there was some progress in certain issues, such as the LDC Services Waiver to provide preferential treatment to least-developed countries (LDCs) for specific service sectors and modes.47 Members did not conclude any multilateral agreements at the December 2017 Ministerial, but there was a joint statement by at least 60 countries seeking to address domestic regulation. The group did not include the United States. According to press reports, the proposed text is similar to that being discussed in the TiSA negotiations.48

The U.S. delegation remains active in the broader Working Party on Domestic Regulation.53 The Committee on Specific Commitments continues discussing how members can classify digital services, whether they are new services or a new means for delivering existing services. The WTO continues to hold educational and outreach workshops on domestic regulations to facilitate services trade.54Frustration with the Doha RoundNovember 2001 included services negotiations, but after nearly two decades of negotiations, members did not achieve its agenda. Put simply, the large and diverse membership of the WTO made consensus on the broad Doha mandate difficult. The latest WTO Ministerial Conference in December 2017 served as an opportunity for members to take stock of ongoing talks and further define priority work areas. Members did not conclude any multilateral agreements at the Ministerial, but there was a joint statement by at least 60 countries seeking to address domestic regulation. The group did not include the United States, although it may decide to join any agreement at a later date.

It also was a key factor in a group of like-minded WTO members deciding to pursue further trade liberalization in the Trade in Services Agreement (TiSA) launched in 2013 (see below).

Key Concepts for Services

Key Concepts for Services in FTAs

The United States has made services a priority in each of the FTAs it has negotiated that cover trade with 20 countries (including the U.S.-Canada FTA, which was superseded by the entry into force of NAFTA on January 1, 1994)its FTAs. While the specific treatment of services differs among the FTAs because of the status of U.S. trade relations with the partner(s) involved and the evolution of issues, the FTAs share some characteristics that define a framework of U.S. policy priorities. Some of these aspects reaffirm adherence to principles embedded in the GATS, while others go significantly beyond the GATS.

Market Access and the Negative List Approach

Each U.S. FTA uses a negative list in determining market access commitments and national treatment coverage and commitments from each partner. A negative list means that the FTA provisions for market access and national treatment apply to all categories and subcategories of services in all modes of delivery, unless a party to the agreement has listed a service or mode of delivery as an exception. The negative list implies that a newly created or domestically provided service is automatically covered under the FTA, unless it is specifically listed as an exception in an annex to the agreement. The negative list approach is widely considered to be more comprehensive and flexible than the positive list, which is used in the GATS and which some other countries use in their bilateral and regional FTAs.

Rules of Origin

Under FTAs in which the United States is a party, any service provider is eligible for the FTA benefits irrespective of ownership nationality as long as that provider is an enterprise organized under the laws of either the United States or the other party(ies) or is a branch conducting business in the territory of a party. Such criteria potentially expand the benefits of the FTA to service providers from other countries that are not direct parties to the FTA. For example, a U.S. subsidiary of a Canadian-owned insurance company would be covered by the U.S.-South Korea FTA. The FTAs do allow one party to deny benefits to a provider located in the territory of another party, if that provider is owned or controlled by a person from a nonparty country and does not conduct substantial business in the territory of the other party, or if the party denying the benefits does not otherwise conduct normal economic relations with the nonparty country.4955

Multiple Disciplines on Services

In many U.S. FTAs, trade in services spans several chapters, indicating its prominence in U.S. trade policy, the complexity in addressing services trade barriers, and the specificity of U.S. trade policy negotiating objectives. Each FTA has a specific chapter on cross-border trade in services—trade by all modes except commercial presence (Mode 3). This chapter requires the United States and the FTA partner(s) to accord nondiscriminatory treatment—both MFN treatment and national treatment—to services originating in each other's territory. The agreement prohibits the FTA partner-governments from imposing restrictions on the number of service providers, the total value of service transactions that can be provided, the total number of service operations or the total quantity of services output, or the total number of natural persons that can be employed in a services operation. In addition, the governments cannot require a service provider from the other FTA partner to have a presence in its territory in order to provide services. The FTA partners may exclude categories or subcategories of services from the agreement, which they designate in annexes.

Each U.S. FTA also contains a chapter on foreign direct investment, including service providers that have a commercial presence (Mode 3) in the territory of an FTA partner and a chapter on intellectual property rights (IPR), which is also relevant to services trade.5056 In addition, many U.S. FTAs contain separate provisions or chapters on specific service categories which have been priority areas in U.S. trade policy. They include the following:

- Financial Services: The FTAs define financial services to "include all insurance and insurance-related services, and all banking and other financial services, as well as services incidental or auxiliary to a service of a financial nature." Among other things, the financial services chapter allows governments to apply restrictions for prudential reasons and allows financial service providers from an FTA partner to sell a new financial service without additional legislative authority, if local service providers are allowed to provide the same service.

- Telecommunication Services: The United States and trading partners agree that enterprises from each other's territory are to have nondiscriminatory access to public telecommunications services. For example, both countries will ensure that domestic suppliers of telecommunications services who dominate the market do not engage in anticompetitive practices. They also ensure that public telecommunications suppliers provide enterprises based in the territory of the FTA partner with interconnection, number portability, dialing parity, and access to underwater cable systems.

- E-commerce/Digital Trade: The FTAs include provisions to ensure that electronically supplied services are treated no less favorably than services supplied by other modes of delivery and that customs duties are not applied to digital products whether they are conveyed electronically or via a tangible medium such as a disk. Recent and ongoing trade negotiations seek to ensure open digital trade by prohibiting "forced" localization or other requirements that limit cross-border flows.

51

57Regulatory Transparency

Many U.S. FTAs require FTA partners to practice transparency when implementing and developing domestic regulations that affect services. In particular, the FTAs require the partner countries to provide notice of impending investigations that might affect service providers from the other partner(s). The FTAs go beyond the transparency provisions in the GATS by providing mechanisms for interested parties to comment on proposed regulations and appeal adverse decisions.

Regulatory Heterogeneity

In addition to market access restrictions, firms operating in multiple countries or having a global supply chain may be subject to an array of local regulations that vary in each market, and impact the services that firms can access or sell. This regulatory heterogeneity, while neither discriminatory nor anticompetitive, may increase operational costs and thereby limit a firm's ability to do business in a foreign market. For example, regulatory heterogeneity can limit the access of professional service providers (e.g., architects, doctors, etc.) whose licenses or certifications may not be recognized in foreign markets. Because regulatory cooperation, such as when countries or regions harmonize to common standards or establish mutual recognition, can help minimize the impact of the differing regulatory regimes, some stakeholders seek to mandate such efforts under trade agreements.5258 The U.S.-South Korea FTA is one example of using FTA negotiations to address differing regulatory regimes for services (see below). Regulatory cooperation to ease trade in services may also occur outside of FTA negotiations.

Current U.S. Trade Agreement Negotiations

U.S. Trade Negotiating Objectives

The Trade Promotion Authority (TPA) legislation signed into law on June 29, 2015,5359 contained specific provisions establishing U.S. trade negotiating objectives on services trade (P.L. 114-26). The text states that "[t]he principal negotiating objective of the United States regarding trade in services is to expand competitive market opportunities for the United States." Congress also specifically pointed to the utilization of global value chains and supported pursuing the objectives of reducing or eliminating trade barriers through "all means, including through a plurilateral agreement" with partners able to meet high standards.

Congress provided objectives specific to "digital trade in goods and services and cross-border data flows," instructing the President to ensure that cross-border data flows and electronically delivered goods and services have the same level of coverage and protection as those in physical form, and are not impeded by regulation, excepting for legitimate objectives. Congress recognized the challenges presented by localization regulations, and sought to ensure that trade agreements eliminate and prevent measures requiring the locating of "facilities, intellectual property, or other assets in a country."

Trans-Pacific Partnership (TPP)

The TPP was a proposed FTA among 12 Asia-Pacific countries, including the United States, to reduce and eliminate tariff and nontariff barriers on goods, services, and agriculture, and establish trade rules and disciplines that expand on existing WTO commitments and address new issues.54 Similar to other U.S. FTAs, due to the complexity of services trade barriers, negotiations addressed services in multiple chapters, including Cross Border Trade in Services, Financial Services, Temporary Entry, Telecommunications, and Electronic Commerce. On January 30, 2017, the United States gave notice to the other TPP signatories that it did not intend to ratify the agreement, effectively ending the U.S. ratification process and TPP's potential entry into force. The 11 remaining TPP countries—Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam—are concluding a revised Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) that is planned to come into force without the United States.55 The revised agreement is to suspend some of the TPP provisions advanced by the United States. President Trump stated he may reconsider joining a "substantially better" agreement in the future.56

Trade in Services Agreement (TiSA) 57Trade in Services Agreement (TiSA)60

Largely because of the lack of progress in the WTO, negotiations on a proposed Trade in Services Agreement (TiSA) were launched in April 2013 to achieve a sector-specific, plurilateral agreement to liberalize trade in services.5861 The group of 23 WTO members—including the United States—account for around 70% of world trade in services.59 The United States and Australia have been at the forefront of the TiSA negotiations, with other WTO members, including some developing countries, becoming increasingly active as the discussions have progressed. The Trump Administration has not stated an official position on the continuation of TiSA negotiations, but USTR Robert Lighthizer indicated that the Trump Administration may support its continuation.60

While not directly linked currently to the WTO, TiSA participants are taking as their guide the "Elements of Political Guidance" issued at the end of the 8th WTO ministerial in December 2011. It stipulated that members could pursue negotiations outside of the single undertaking in order to accomplish the objectives of the Doha Round.61

For proponents of services trade liberalization, the plurilateral approach offers some advantages, such as holding negotiations among countries willing to negotiate further liberalization and thus potentially enhancing prospects for a successful conclusion; providing flexibility in the scope of the agreement that can be expanded as countries accede to its provisions; and aiming to reduce barriers to trade and services beyond the limited commitments under the GATS and the offers made during the Doha Roundin multilateral settings.

However, critics highlight possible drawbacks to the approach, including the lack of participation of some of the economically significant emerging economies, such as Brazil, India, and China, which present larger potential market opportunities for services but also impose significant impediments to trade and investment in services. In addition, a plurilateral services pact might further diminish the credibility of, and likelihood of concluding new agreements through, the multilateral trade negotiation framework.

The participants agreed to a framework of five basic objectives on which the negotiations are to be conducted.62 According to the framework, the agreement should:

(1) be compatible with the GATS to attract broad participation and possibly be brought within the WTO framework in the future;

(2) be comprehensive in scope, with no exclusions of any sector or mode of supply;

(3) include commitments that correspond as closely as possible to applied practices and provide opportunities for improved market access;

(4) include new and enhanced disciplines to be developed on the basis of proposals brought forward by participants during the negotiations; and

(5) be open to new participants who share the objectives but also should take into account the development objectives of least developed countries (LDCs).

TiSA participants schedule trade liberalization based on a "hybrid" approach combining both a negative and positive list of commitments. Market access obligations are being negotiated under a positive list, while national treatment obligations are being negotiated under a negative list.63

Another issue was the application of the TiSA commitments to nonparticipants. The participants agreed to conduct the negotiations on a non-MFN basis, that is, the benefits of the commitments made by the participants in the TiSA would apply to only those countries that have signed on to the agreement, thereby avoiding "free-riders." This exception to the general WTO MFN principle is consistent with Article V of the GATS, which allows WTO members to form preferential agreements to liberalize trade in services as long as the agreement has substantial service sectoral coverage and provides for the absence or elimination of substantially all discrimination between or among the parties.

Many members of the U.S. business community, especially service providers and related industries, strongly support the conclusion of TiSA.64 They view the agreement as an opportunity to strengthen rules and achieve greater market access on trade in services beyond what are contained in the GATS—which are largely considered to be weak. Opponents, such as labor unions and some civil society groups, argue that, rather than employing TiSA as a means to expand on the GATS, it should be used to reverse what they consider to be infringements of GATS provisions on the authority of national, state, and local governments to regulate services.

Since negotiations launched in April 2013, 21 rounds of TiSA negotiations, and meetings in between, occurred in an effort to make further progress. The agreement, whose status is currently unknown, would likely include a core text, as well as sections on transparency, movement of persons for business purposes, domestic regulation, and government procurement. The current text is said to contain sectoral annexes for air transport, e-commerce, maritime transport, telecommunications, and financial services. As many of these topics and sectors may be sensitive or controversial among and within some of the negotiating parties, the final structure of TiSA is not yet decided.

One area of contention is whether "new services" would be included under the nondiscrimination obligations. While the United States supports the inclusion of all yet-to-be-defined services, the EU has stated that it wants to preserve so-called policy space in that area and exempt all new services.65 The e-commerce annex reportedly covers cross-border data flows, consumer online protection, interoperability, and international regulatory cooperation, among other provisions.66 To date, however, the EU has not engaged in discussions on data flows, creating an obstacle in the negotiations. As financial services may not be covered by the e-commerce provisions, the United States separately proposed a ban on data localization for financial services that the parties continue to discuss.67

For professional services, the negotiations have not included explicit mutual recognition agreements, but rather discussion aims to recognize foreign professionals and expedite licensing procedures.