Monetary Policy and the Federal Reserve: Current Policy and Conditions

Changes from January 9, 2018 to January 18, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Monetary Policy and the Federal Reserve:

Current Policy and Conditions

Contents

- Introduction

- The Current Monetary Policy Stance

- How Does the Federal Reserve Execute Monetary Policy?

- Policy Tools

- Economic Effects of Monetary Policy in the Short Run and Long Run

- Monetary Versus Fiscal Policy

- Unconventional Monetary Policy During and After the Financial Crisis

- Before the Financial Crisis

- The Early Stages of the Crisis and the Zero Lower Bound

- Direct Assistance During and After the Financial Crisis

- Quantitative Easing and the Growth in the Fed's Balance Sheet and Bank Reserves

- Forward Guidance

- The "Exit Strategy": Normalization of Monetary Policy After QE

- Regulatory Responsibilities

Summary

Congress has delegated responsibility for monetary policy to the nation's central bank, the Federal Reserve (the Fed)18, 2019

Congressional Research Service

https://crsreports.congress.gov

RL30354

SUMMARY

Monetary Policy and the Federal Reserve:

Current Policy and Conditions

Congress has delegated responsibility for monetary policy to the Federal Reserve (the Fed), the

nation’s central bank, but retains oversight responsibilities for ensuring that the Fed is adhering to

its statutory mandate of "“maximum employment, stable prices, and moderate long-term interest

rates."” To meet its price stability mandate, the Fed has set a longer-run goal of 2% inflation.

The Fed'

RL30354

January 18, 2019

Marc Labonte

Specialist in

Macroeconomic Policy

The Fed’s control over monetary policy stems from its exclusive ability to alter the money supply

and credit conditions more broadly. Normally, the Fed conducts monetary policy by setting a target for the federal funds rate, ,

the rate at which banks borrow and lend reserves on an overnight basis. It meets its target through open market operations,

financial transactions traditionally involving U.S. Treasury securities. Beginning in September 2007, the federal funds target was

reduced from 5.25% to a range of 0% to 0.25% in December 2008, which economists call the zero lower bound. By historical

standards, rates were kept unusually low for an unusually long time to mitigate the effects of the financial crisis and its

aftermath. Starting in December 2015, the Fed has been raising interest rates and expects to gradually raise rates further.

The

Fed raised rates once in 2016, three times in 2017, and four times in 2018, by 0.25 percentage points each time.

The Fed influences interest rates to affect interest-sensitive spending, such as business capital spending on plant and

equipment, household spending on consumer durables, and residential investment. In addition, when interest rates diverge

between countries, it causes capital flows that affect the exchange rate between foreign currencies and the dollar, which in

turn affects spending on exports and imports. Through these channels, monetary policy can be used to stimulate or slow

aggregate spending in the short run. In the long run, monetary policy mainly affects inflation. A low and stable rate of

inflation promotes price transparency and, thereby, sounder economic decisions.

The Fed’s relative independence from Congress and the Administration has been justified by many economists on the

grounds that it reduces political pressure to make monetary policy decisions that are inconsistent with a long-term focus on

stable inflation. But independence reduces accountability to Congress and the Administration, and recent legislation and

criticism of the Fed by the President has raised the question about the proper balance between the two.

While the federal funds target was at the zero lower bound, the Fed attempted to provide additional stimulus through

unsterilized purchases of Treasury and mortgage-backed securities (MBS), a practice popularly referred to as quantitative easingquantitative

easing (QE). Between 2009 and 2014, the Fed undertook three rounds of QE. The third round was completed in October

2014, at which point the Fed'’s balance sheet was $4.5 trillion—five times its precrisis size. After QE ended, the Fed

maintained the balance sheet at the same level until September 2017, when it began to very gradually reduce it to a more

normal size—a process that is expected to last fortake several years. The Fed has raised interest rates in the presence of a large

balance sheet through the use of two new tools—by raising the rate of interest paid to banks on reservespaying banks interest on reserves held at the Fed and by engaging in

reverse repurchase agreements (reverse repos) through a new overnight facility.

The Fed "expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run." Thus, although rates are being raised, the Fed plans to maintain an unusually stimulative monetary policy for the time being. In terms of its mandate, the Fed believes that unemployment has reached the rate that it considers consistent with maximum employment, but inflation has generally remained below the Fed's 2% goal since 2013 by the Fed's preferred measure) through a new overnight facility.

With regard to its mandate, the Fed believes that unemployment is currently lower than the rate that it considers consistent

with maximum employment, and inflation is close to the Fed’s 2% goal by the Fed’s preferred measure. Even after recent

rate increases, monetary policy is still considered expansionary. This monetary policy stance is unusually stimulative

compared with policy in this stage of previous expansions, and is being coupled with a stimulative fiscal policy (larger

structural budget deficit). Debate is currently focused on how quickly the Fed should raise rates. Some contend the greater

risk is that raising rates too slowly at full employment will cause inflation to become too high or cause financial instability,

whereas others contend that raising rates too quickly will cause inflation to remain too low and choke off the expansion.

Introduction

The Federal Reserve's (the Fed's) responsibilities as the nation'’s central bank fall into four main

categories: monetary policy, provision of emergency liquidity through the lender of last resort

function, supervision of certain types of banks and other financial firms for safety and soundness,

and provision of payment system services to financial firms and the government.1

1

Congress has delegated responsibility for monetary policy to the Fed, but retains oversight

responsibilities to ensure that the Fed is adhering to its statutory mandate of "maximum “maximum

employment, stable prices, and moderate long-term interest rates."2”2 The Fed has defined stable

prices as a longer-run goal of 2% inflation—the change in overall prices, (as measured by the

Personal Consumption Expenditures (PCE) price index. By contrast, the Fed states that “it would

not be appropriate to specify a fixed goal for employment; rather, the Committee’s policy

decisions must be informed by assessments of the maximum level of employment, recognizing

that such assessments are necessarily uncertain and subject to revision.”3 Monetary policy can be

used to stabilize business cycle fluctuations (alternating periods of economic expansions and

recessions) in the short run, while it mainly affects inflation in the long run. The Fed’s

Personal Consumption Expenditures price index).3

The Fed's monetary policy function is one of aggregate demand management—stabilizing business cycle fluctuations. The Federal Open Market Committee (FOMC), consisting of 12 Fed officials, meets periodically to consider whether to maintain or change the current stance of monetary policy.4 The Fed's conventional tool for monetary policy is to target the federal funds rate—the overnight, interbank lending rate. It influences the federal funds rate through open market operations, transactions that have traditionally involved Treasury securities.

lending rate.4

This report provides an overview of how monetary policy works and recent developments, a

summary of the Fed'’s actions following the financial crisis, and ends with a brief overview of the Fed'

Fed’s regulatory responsibilities.

Recent Monetary Policy Developments

s regulatory responsibilities. For an overview of legislative activity, see CRS Report R44848, Federal Reserve: Legislation in the 115th Congress, by [author name scrubbed].

The Current Monetary Policy Stance

In December 2008, in the midst of the financial crisis and the "“Great Recession,"” the Fed lowered

the federal funds rate to a range of 0% to 0.25%. This was the first time rates were ever lowered

to what is referred to as the zero lower bound. As. The recession ended in 2009, but as the economic

recovery consistently proved weaker than expected in the years that followed, the Fed repeatedly

pushed back its time frame for raising interest rates. As a result, the economic expansion was in

its seventh year and the unemployment rate was already near the Fed'’s estimate of full

employment when it began raising rates on December 16, 2015. This was a departure from past

practice—in the previous two economic expansions, the Fed began raising rates within three

years of the preceding recession ending. Since then, the Fed has continued to raise rates more slowly than it initially intended in a in a

series of steps to incrementally tighten monetary policy. The Fed raised rates once in 2016, three

times in 2017, and four and three times in 20172018, by 0.25 percentage points each time. The Fed has stated

that “some further gradual increases in…the federal funds rate” are necessary to fulfill its

mandate. The Fed describes its plans as “data dependent,” meaning it would be altered if actual

employment or inflation deviate from its forecast.

1

For background on the makeup of the Federal Reserve, see CRS In Focus IF10054, Introduction to Financial

Services: The Federal Reserve, by Marc Labonte.

2 Section 2A of the Federal Reserve Act, 12 U.S.C. §225a.

3 Federal Reserve, Statement on Longer-Run Goals and Monetary Policy Strategy, January 24, 2012,

http://www.federalreserve.gov/monetarypolicy/files/FOMC_LongerRunGoals.pdf.

4 Current and past monetary policy announcements can be accessed at http://www.federalreserve.gov/monetarypolicy/

fomccalendars.htm. For more information on the business cycle, see CRS In Focus IF10411, Introduction to U.S.

Economy: The Business Cycle and Growth, by Jeffrey M. Stupak.

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

1

Monetary Policy and the Federal Reserve: Current Policy and Conditions

Although monetary policy is now less stimulative than it had been at the zero lower bound, the

Fed is still adding stimulus to the economy as long as the federal funds rate is below what

economists call the “neutral rate” (or the long-run equilibrium rate). To illustrate, the federal

funds rate is currently similar to the inflation rate, meaning that the real (i.e., inflation-adjusted)

federal funds rate is around zero. However, there is uncertainty as to what constitutes a neutral

rate today. By historical standards, a zero real interest rate would be well below the neutral rate,

but the neutral rate appears to have fallen following the financial crisis, so that current rates may

be close to the neutral rate today.5

Typically, the Fed keeps interest rates below the neutral rate when the economy is operating

below full employment, at neutral levels when the economy is near full employment, and above

the neutral rate when the economy is at risk of overheating. Indeed, the Fed identifies this as one

of its “three key principles of good monetary policy.”6 Because of lags between changes in

interest rates and their economic effects, in the past, the Fed has often preemptively changed its

monetary policy stance before the economy reaches the state that the Fed is anticipating.

In this business cycle, the Fed has maintained a (progressively less) stimulative monetary policy

throughout the expansion, boosting economic activity. In one sense, this policy could be viewed

as having successfully delivered on the Fed’s mandated goals of full employment and stable

prices. The unemployment rate has been below 5% since 2015 and is now lower than the rate

believed to be consistent with full employment. Other labor market measures are also consistent

with full employment, with the possible exception of the still-low labor force participation rate.

Economic theory posits that lower unemployment will lead to higher inflation in the short run, but

, by 0.25 percentage points each time.

Although monetary policy is now less stimulative than it had been at the zero lower bound, the Fed is still adding stimulus to the economy as long as the federal funds rate is below what economists call the "neutral rate" (or the long-run equilibrium rate).5 For example, the federal funds rate has remained lower than the inflation rate, to date, meaning that the real (i.e., inflation-adjusted) federal funds rate is negative. Typically, the Fed keeps interest rates below the neutral rate when the economy is operating below full employment, at neutral levels when the economy is near full employment, and above the neutral rate when the economy is at risk of overheating. Because of lags between changes in interest rates and their economic effects, the Fed often will preemptively change its monetary policy stance before the economy reaches the state that the Fed is anticipating. By contrast, the Fed's forward guidance on its expectations for future policy states that it intends to keep "accommodative" policy in place for some time—it currently "expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run."6 The Fed describes this path as "data dependent," meaning it would be altered if actual employment or inflation deviate from its forecast.

The Fed's unprecedentedly stimulative policy stance has been controversial. Normally, such a stance would risk resulting in higher inflation. In this case, inflation has remained persistently below its 2% target. Choosing a policy path that is consistent with the Fed's dual mandate depends on an accurate assessment of how close the economy is to full employment and how quickly inflation will return to the Fed's goal of 2%. Because the last recession was unusually severe, economists disagree about both how much slack remains in the economy today and how quickly the Fed should remove monetary stimulus.

The economy has made more progress toward achieving the maximum employment part of the mandate than the price stability part. The unemployment rate—which has been between 4% and 5% since 2015—is now below the Fed's estimated range of the long-term sustainable unemployment rate. Other labor market measures are also consistent with full employment, with the notable exception of the still-low labor force participation rate. Economic theory posits that lower unemployment will lead to higher inflation in the short run, but inflation has not proven responsive to lower unemployment in recent years.7 The Fed's preferred measure of inflation has generally been slightly below its 2% goal since 2013 (or 2012, with no upward trend, if food and energy prices are omitted).

Economic growth has been persistently low by historical standards during the economic expansion—growth has not exceeded 3% for more than two consecutive quarters at any point. If this weakness is cyclical (i.e., held back by weak spending), then continued monetary stimulus could help boost growth. Alternatively, if the weakness is structural (i.e., the economy is not capable of growing faster), monetary stimulus would be more likely to result in economic overheating.8

The Fed's intended policy path poses upside and downside risks. If the Fed raises rates too slowly, the economy could overheat, resulting in high inflation and posing risk to financial stability. As an example of how overly stimulative monetary policy can lead to the latter, critics contend that low interest rates during the economic recovery starting in 2001 contributed to the housing bubble. Critics see these risks as outweighing any marginal benefit associated inflation has not proven responsive to lower unemployment in recent years.7 After remaining

persistently below the Fed’s 2% target from mid-2012 to early 2018 as measured by core PCE,

inflation has remained around 2% in 2018 as measured by headline or core PCE. Economic

growth has also picked up beginning in the second quarter of 2017, after being persistently low

by historical standards throughout the expansion.

Contributing to the 2018 growth acceleration, a more expansionary fiscal policy (larger structural

budget deficit) added more stimulus to the economy in the short run. Two notable policy changes

contributing to fiscal stimulus in 2018 were the 2017 tax cuts (P.L. 115-97) and the boost to

discretionary spending in FY2018 and FY2019 agreed to in P.L. 115-123. The Fed did little to

offset this fiscal stimulus, as the pace of monetary tightening in 2018 was only slightly faster than

in 2017.

The Fed’s intended policy path poses risks. If the Fed raises rates too slowly, the economy could

overheat, resulting in high inflation and posing risk to financial stability. As an example of how

overly stimulative monetary policy can lead to the latter, critics contend that the Fed contributed

to the precrisis housing bubble by keeping interest rates too low for too long during the economic

recovery starting in 2001. Critics see these risks as outweighing any marginal benefit associated

For more information, see Kevin Lansing, R Star, “Uncertainty, and Monetary Policy,” Federal Reserve Bank of San

Francisco Economic Letter, 2017-16, May 30, 2017, https://www.frbsf.org/economic-research/publications/economicletter/2017/may/r-star-macroeconomic-uncertainty-and-monetary-policy/.

6 Federal Reserve, Principles for the Conduct of Monetary Policy, webpage, March 2018,

https://www.federalreserve.gov/monetarypolicy/principles-for-the-conduct-of-monetary-policy.htm. The other two

principles are that monetary policy should be well understood and systematic and that interest rates should respond

with a more than one-for-one change to a change in inflation.

7 For more information, see CRS Report R44663, Unemployment and Inflation: Implications for Policymaking, by

Jeffrey M. Stupak.

5

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

2

Monetary Policy and the Federal Reserve: Current Policy and Conditions

with monetary stimulus when the economy is already so close to full employment.8 Raising rates

with monetary stimulus when the economy is already so close to full employment.9 Raising rates more quickly would also provide more "headroom"“headroom” for the Fed to lower rates more aggressively

during the next economic downturn. The potential percentage point reduction in rates before

hitting the zero bound is currently smaller than the rate cuts that the Fed has undertaken in past

recessions.10 Alternatively, with inflation persistently below the Fed's target, some economists argue there is no reason to raise rates until we see the "whites of inflation's eyes." Pointing to the experiences of the Eurozone in 2011 and of Japan since the 1990s, opponents of raising rates believe that removing monetary stimulus too soon after a financial crisis could lead to deflation (falling prices) and prematurely choke off the expansion.11

A more expansionary fiscal policy, notably via the 2017 tax cuts (P.L. 115-97), adds more stimulus to the economy in the short run. It remains to be seen whether the Fed will decide to raise rates more quickly to offset fiscal stimulus in an effort to prevent higher inflation with the economy close to full employment.

Another legacy of the Fed's actions during the financial crisis is its large balance sheet. Because the Fed could not provide any further stimulus through conventional policy at the zero lower bound, it turned to unconventional policy to provide further stimulus to the economy.12 The Fed attempted to stimulate the economy through three rounds of large-scale asset purchases of U.S. Treasury securities, agency debt, and agency mortgage-backed securities (MBS) beginning in 2009, popularly referred to as quantitative easing (QE).13 The third round was completed in October 2014, at which point the Fed's balance sheet was $4.5 trillion—five times its precrisis size. The end of QE was the first step to normalizing monetary policy. Instead of normalizing monetary policy by selling its assets to reduce its balance sheet, the Fed has raised rates while maintaining the balance sheet at its current size for the time being. This has been made possible through two new tools: (1) increases in the interest rate the Fed pays banks on the reserves deposited at the Fed, and (2) an overnight reverse repurchase agreement facility.14 In September 2017, the Fed began to slowly shrink its balance sheet by allowing a limited amount of securities to "run off" as they mature—a process that is likely to last for several years.15 Some critics have expressed concerns regarding how the Fed's normalization policy might affect inflation, asset prices, and the functioning of certain financial markets, such as the repo market.

How Does the Federal Reserve Execute Monetary Policy?

The Fed's control over monetary policy stems from its exclusive ability to alter the money supply and credit conditions more broadly. The Fed directly controls a portion of the money supply called the monetary base, which is made up of currency (Federal Reserve notes) and bank reserves. The Fed defines monetary policy as the actions it undertakes to influence the availability and cost of money and credit to promote the goals mandated by Congress, a stable price level and maximum sustainable employment. Because the expectations of households as consumers and businesses as purchasers of capital goods exert an important influence on the major portion of spending in the United States, and because these expectations are influenced in important ways by the Fed's actions, a broader definition of monetary policy would include the directives, policies, statements, economic forecasts, and other Fed actions, especially those made by or associated with the chairman of its Board of Governors, who is the nation's central banker.

Policy Tools

The Federal Reserve has traditionally relied on three instruments to conduct monetary policy:

1. The primary method is called9 Alternatively, there is uncertainty about whether strong growth, low unemployment, inflation around 2%, and the generally benign economic environment will continue. Economic expansions do not “die of old age;” nevertheless, the current expansion is already the second longest on record and cannot last forever. The flattening of the yield curve (i.e., long-term Treasury yields are similar to short-term Treasury yields) is seen by some as a warning signal that rates are too high. Although there is a risk of stimulative monetary policy causing the economy to overheat, there is also a risk that tightening too quickly could be harmful if the economy slows. Some critics would prefer clear evidence that inflation be above the Fed’s target or financial conditions be imbalanced before additional rate increases. How Does the Federal Reserve Execute Monetary Policy? Monetary policy refers to the actions the Fed undertakes to influence the availability and cost of money and credit to promote the goals mandated by Congress, a stable price level and maximum sustainable employment. Because the expectations of households as consumers and businesses as purchasers of capital goods exert an important influence on the major portion of spending in the United States, and because these expectations are influenced in important ways by the Fed’s actions, a broader definition of monetary policy would include the directives, policies, statements, economic forecasts, and other Fed actions, especially those made by or associated with the chairman of its Board of Governors, who is the nation’s central banker. The Fed’s Federal Open Market Committee (FOMC) meets every six weeks to choose a federal funds target and sometimes meets on an ad hoc basis if it wants to change the target between regularly scheduled meetings. The FOMC is composed of the 7 Fed governors, the President of the Federal Reserve Bank of New York, and 4 of the other 11 regional Federal Reserve Bank presidents serving on a rotating basis.10 Policy Tools The Fed targets the federal funds rate to carry out monetary policy. The federal funds rate is determined in the private market for overnight reserves of depository institutions (called the federal funds market). At the end of a given period, usually a day, depository institutions must calculate how many dollars of reserves they want or need to hold against their reservable See, for example, John Taylor, “A Monetary Policy for the Future,” speech at the International Monetary Fund, April 15, 2015, http://web.stanford.edu/~johntayl/2015_pdfs/A_Monetary_Policy_For_the_Future-4-15-15.pdf. 9 Janet Yellen, “The Federal Reserve’s Monetary Policy Toolkit,” speech at Jackson Hole, Wyoming, August 26, 2016, at https://www.federalreserve.gov/newsevents/speech/yellen20160826a.htm. 10 Of the monetary policy tools described below, the board is generally responsible for setting reserve requirements and interest rates paid by the Fed, whereas the federal funds target is set by the FOMC. The discount rate is set by the 12 Federal Reserve banks, subject to the board’s approval. In practice, the board and FOMC coordinate the use of these tools to implement a consistent monetary policy stance. The New York Fed determines what open market operations are necessary on an ongoing basis to maintain the federal funds target. 8 Congressional Research Service RL30354 · VERSION 105 · UPDATED 3 Monetary Policy and the Federal Reserve: Current Policy and Conditions liabilities (deposits).11 Some institutions may discover a reserve shortage (too few reservable assets relative to those they want to hold), whereas others may have reservable assets in excess of their wants. These reserves can be borrowed and lent on an overnight basis in a private market called the federal funds market. The interest rate in this market is called the federal funds rate. If it wishes to expand money and credit, the Fed will lower the target, which encourages more lending activity and, thus, greater demand in the economy. Conversely, if it wishes to tighten money and credit, the Fed will raise the target. The federal funds rate is linked to the interest rates that banks and other financial institutions charge for loans. Thus, whereas the Fed may directly influence only a very short-term interest rate, this rate influences other longer-term rates. However, this relationship is far from being on a one-to-one basis because longer-term market rates are influenced not only by what the Fed is doing today, but also by what it is expected to do in the future and by what inflation is expected to be in the future. This fact highlights the importance of expectations in explaining market interest rates. For that reason, a growing body of literature urges the Fed to be very transparent in explaining what its policy is, will be, and in making a commitment to adhere to that policy.12 The Fed has responded to this literature and is increasingly transparent in explaining its policy measures and what these measures are expected to accomplish. The Federal Reserve uses two methods to maintain its target for the federal funds rate: Traditionally, the Fed primarily relied on open market operations, and it, which involves1613 Should thereposrepos instead, described in the text box. When the Fed wishes to add liquidity tothe banking system, it enters into repos. When it wishes to remove liquidity, as it is planning to do during the normalization period, the Fed enters into reverse repos.17- 2. The Fed can also change reserve requirements, which specify what portion of customer deposits (primarily checking accounts) banks must hold as vault cash or on deposit at the Fed. Thus, reserve requirements affect the liquidity available within the federal funds market. Statute sets the numerical levels of reserve requirements, although the Fed has some discretion to adjust them. Currently, banks are required to hold 0% to 10% of their deposits that qualify as net transaction accounts in reserves, depending on the size of the bank's deposits.18 This tool is used rarely—the percentage was last changed in 1992.19

3. Finally, the Fed can change the two interest rates it administers directly by fiat, and these interest rates influence market rates—the rate it charges to borrowers and the rate it pays to depositors. The Fed permits depository institutions to borrow from it directly on a temporary basis at the discount window.20temporary basis at the discount window.15 That is, these institutions can2116 The Fed is"“lender of last resort"” because direct lending, from therequired and excess reserves deposited at the Fedreserves that banks deposit at the Fed. (It pays interest on both required and excess reserves.) Since 2008, this has been the primary tool for maintaining the federal funds target. Reducing the opportunity cost for banks of holding thatmoney asmoney as reserves at the Fed as opposed to lending it outshould also influenceinfluences the ratesfunds rate.

What Are Repos? Repurchase agreements (repos) are agreements between two parties to purchase and then repurchase securities at a fixed price and future date, often overnight. Although legally structured as a pair of security sales, they are economically equivalent to a collateralized loan. The difference in price between the first and second transaction determines the interest rate on the loan. The repo market is one of the largest short-term lending markets, where banks and other financial institutions are active borrowers and lenders. For the seller of the security, who receives the cash, the transaction is called a repo. For the purchaser of the security, who lends the cash, it is called a reverse repo. Collateral protects the lender against potential default. In principle, any type of security can be used as collateral, but the most common collateral—and the types used by the Fed—are Treasury securities, agency MBS, and agency debt.

|

|

Arguments For and Against Reserve Requirements Reserve requirements impose an opportunity cost on banks and the broader economy—funds that banks must hold as reserves cannot be used for loans or other bank activities. Other types of financial institutions do not face reserve requirements. Given the opportunity cost, reserve requirements can only be justified if they provide sufficient benefits. The intended benefit is to ensure banks hold enough liquidity to avoid destabilizing runs. Some economists have questioned whether reserve requirements should be reformed or abolished for a number of reasons. First, changing reserve requirements is a blunt monetary policy tool that has not been used in recent decades. Second, banks can avoid reserve requirements through practices such as sweeps, a practice in which banks automatically shift funds in and out of accounts subject to reserve requirements. Third, reserve requirements could be better targeted to a bank's liquidity needs. By comparison, the new liquidity coverage ratio, which only applies to large banks, tries to measure the amount of liquid assets that would be needed to meet net outflows in a stressed environment and takes into account that reserves are not the only liquid asset a bank holds. However, because the federal funds market arose to meet reserve requirements, abolishing reserve requirements could complicate the Fed's use of the federal funds rate as its primary target for policy. Currently and atypically, reserves far exceed reserve requirements as a result of QE. As a result, reserve requirements are currently not influencing most banks' behavior. |

Each of these tools works by altering the overall liquidity available for use by the banking system, which influences the amount of assets these institutions can acquire. These assets are often called credit because they represent loans the institutions have made to businesses and households, among others.

The Fed's definition of monetary policy as the actions it undertakes to influence the availability and cost of money and credit suggests two ways to measure the stance of monetary policy. One is to look at the cost of money and credit as measured by the rate of interest relative to inflation (or inflation projections), and the other is to look at the growth of money and credit itself. Thus, it is possible to look at either interest rates or the growth in the supply of money and credit in coming to a conclusion about the current stance of monetary policy—that is, whether it is expansionary (adding stimulus to the economy), contractionary (slowing economic activity), or neutral.

Since the great inflation of the 1970s, most central banks have preferred to formulate monetary policy in terms of the cost of money and credit rather than in terms of their supply. The Fed thus conducts monetary policy by focusing on the cost of money and credit as proxied by an interest rate. In particular, it targets a very short-term interest rate known as the federal funds rate. The FOMC meets every six weeks to choose a federal funds target and sometimes meets on an ad hoc basis if it wants to change the target between regularly scheduled meetings.22 The FOMC is composed of the 7 Fed governors, the President of the Federal Reserve Bank of New York, and 4 of the other 11 regional Federal Reserve Bank presidents selected on a rotating basis.

The federal funds rate is determined in the private market for overnight reserves of depository institutions. At the end of a given period, usually a day, depository institutions must calculate how many dollars of reserves they want or need to hold against their reservable liabilities (deposits).23 Some institutions may discover a reserve shortage (too few reservable assets relative to those they want to hold), whereas others may have reservable assets in excess of their wants. These reserves can be bought and sold on an overnight basis in a private market called the federal funds market. The interest rate in this market is called the federal funds rate. It is this rate that the Fed uses as a target for conducting monetary policy. If it wishes to expand money and credit, the Fed will lower the target, which encourages more lending activity and, thus, greater demand in the economy. To support this lower target, the Fed must stand ready to buy more U.S. Treasury securities. Conversely, if it wishes to tighten money and credit, the Fed will raise the target and remove as many reserves from depository institutions as necessary to accomplish its ends. This could require the sale of treasuries from its portfolio of assets.

The federal funds rate is linked to the interest rates that banks and other financial institutions charge for loans—or the provision of credit. Thus, whereas the Fed may directly influence only a very short-term interest rate, this rate influences other, longer-term rates. However, this relationship is far from being on a one-to-one basis because the longer-term market rates are influenced not only by what the Fed is doing today but also by what it is expected to do in the future and by what inflation is expected to be in the future. This fact highlights the importance of expectations in explaining market interest rates. For that reason, a growing body of literature urges the Fed to be very transparent in explaining what its policy is and will be and in making a commitment to adhere to that policy.24 The Fed has responded to this literature and is increasingly transparent in explaining its policy measures and what these measures are expected to accomplish.

Using market interest rates as an indicator of monetary policy is potentially misleading, however. Economists call the interest rate that is essential to decisions made by households and businesses to buy capital goods the real interest essential to decisions made by households and businesses to buy capital goods the real interest

rate. It is often proxied by subtracting from the market interest rate the actual or expected rate of inflation.

inflation. If inflation rises and market interest rates remain the same, then real interest rates have

fallen, with a similar economic effect as if market rates (called nominal rates) had fallen by the

same amount with a constant inflation rate.

The federal funds rate is only one of the many interest rates in the financial system that

determines economic activity. For these other rates, the real rate is largely independent of the

amount of money and credit over the longer run because it is determined by the interaction of

saving and investment (or the demand for capital goods). The internationalization of capital

markets means that for most developed countries the relevant interaction between saving and

investment that determines the real interest rate is on a global basis. Thus, real rates in the United

States depend not only on U.S. national saving and investment but also on the saving and

17

Checking accounts are subject to reserve requirements, but savings accounts are not. As a result, the Fed defines by

regulation the different characteristics that checking and savings accounts may have. For example, savings accounts are

subject to a limit on monthly withdrawals.

18 The deposit threshold is regularly adjusted for inflation. For current reserve requirements, see

http://www.federalreserve.gov/monetarypolicy/reservereq.htm.

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

6

Monetary Policy and the Federal Reserve: Current Policy and Conditions

investment of other countries. For that reason, national interest rates are influenced by

international credit conditions and business cycles.

Economic Effects of Monetary Policy in the Short Run and Long Run

Long Run

How do changes in short-term interest rates affect the overall economy? In the short run, an

expansionary monetary policy that reduces interest rates increases interest-sensitive spending, all

else equal. Interest-sensitive spending includes physical investment (i.e., plant and equipment) by

firms, residential investment (housing construction), and consumer-durable spending (e.g.,

automobiles and appliances) by households. As discussed in the next section, it also encourages

exchange rate depreciation that causes exports to rise and imports to fall, all else equal. To reduce

spending in the economy, the Fed raises interest rates and the process works in reverse.

An examination of U.S. economic history will show that money- and credit-induced demand

expansions can have a positive effect on U.S. GDP growth and total employment. The extent to

which greater interest-sensitive spending results in an increase in overall spending in the

economy in the short run will depend in part on how close the economy is to full employment.

When the economy is near full employment, the increase in spending is likely to be dissipated

through higher inflation more quickly. When the economy is far below full employment,

inflationary pressures are more likely to be muted. This same history, however, also suggests that

over the longer run, a more rapid rate of growth of money and credit is largely dissipated in a

more rapid rate of inflation with little, if any, lasting effect on real GDP and employment. (Since the crisis, the historical relationship between money growth and inflation has not held so far, as will be discussed below.)

19

Economists have two explanations for this paradoxical behavior. First, they note that, in the short

run, many economies have an elaborate system of contracts (both implicit and explicit) that

makes it difficult in a short period for significant adjustments to take place in wages and prices in

response to a more rapid growth of money and credit. Second, they note that expectations for one

reason or another are slow to adjust to the longer-run consequences of major changes in monetary

policy. This slow adjustment also adds rigidities to wages and prices. Because of these rigidities,

changes in the growth of money and credit that change aggregate demand can have a large initial

effect on output and employment, albeit with a policy lag of six to eight quarters before the

broader economy fully responds to monetary policy measures. Over the longer run, as contracts

are renegotiated and expectations adjust, wages and prices rise in response to the change in

demand and much of the change in output and employment is undone. Thus, monetary policy can

matter in the short run but be fairly neutral for GDP growth and employment in the longer run.25

20

In societies in which high rates of inflation are endemic, price adjustments are very rapid. During

the final stages of very rapid inflations, called hyperinflation, the ability of more rapid rates of

growth of money and credit to alter GDP growth and employment is virtually nonexistent, if not negative.

negative.

19

During the financial crisis, the historical relationship between money growth and inflation did not hold, as will be

discussed below in the section entitled “Quantitative Easing and the Growth in the Fed’s Balance Sheet and Bank

Reserves.”

20

Two interesting papers bearing on what monetary policy can accomplish by two former officials of the Federal

Reserve are Anthony M. Santomero, “What Monetary Policy Can and Cannot Do,” Business Review, Federal Reserve

Bank of Philadelphia, First Quarter 2002, pp. 1-4, and Frederic S. Mishkin, “What Should Central Banks Do?,” Review,

Federal Reserve Bank of St. Louis, November/December 2000, pp. 1-14.

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

7

Monetary Policy and the Federal Reserve: Current Policy and Conditions

Federal Reserve Independence

The Fed is more independent from Congress and the Administration than most other agencies. Its independence

is attributable to structural reasons, such as 14-year terms of office for its board, “for cause” removal, and

budgetary independence21, and as a result of unofficial norms, such as the President refraining from opining on

monetary policy decisions in recent decades.22 In 2018, President Trump upended these norms with a series of

statements criticizing the Fed for raising interest rates.23

Economists have justified this independence on the grounds that the mismatch between short-term and long-term

benefits of monetary policy decisions (discussed above) creates political pressure to pursue interest rate targets

that are too low to be inconsistent with stable inflation.24 Independence, it is argued, insulates the Fed’s decisionmaking from this political pressure, and may help explain why the Fed has successfully kept inflation consistently

low since the early 1990s.25 Furthermore, independence enhances the Fed’s credibility that it will maintain stable

inflation, it is argued, and this makes interest rate changes more potent than if inflation expectations increased

whenever the Fed pursued expansionary monetary policy. For better or worse, the tradeoff of more

independence is less accountability to Congress and the President, however.

Monetary Versus Fiscal Policy

Monetary Versus Fiscal Policy

Either fiscal policy (defined here as changes in the structural budget deficit, caused by policy

changes to government spending or taxes) or monetary policy can be used to alter overall

spending in the economy. However, there are several important differences to consider between

the two.

First, economic conditions change rapidly, and in practice monetary policy can be more nimble

than fiscal policy. The Fed meets every six weeks to consider changes in interest rates and can

call an unscheduled meeting any time. Large changes to fiscal policy typically occur once a year

at most. Once a decision to alter fiscal policy has been made, the proposal must travel through a

long and arduous legislative process that can last months before it can become law, whereas

monetary policy changes are made instantly.26

26

Both monetary and fiscal policy measures are thought to take more than a year to achieve their

full impact on the economy due to pipeline effects. In the case of monetary policy, interest rates

throughout the economy may change rapidly, but it takes longer for economic actors to change

their spending patterns in response. For example, in response to a lower interest rate, a business

must put together a loan proposal, apply for a loan, receive approval for the loan, and then put the

funds to use. In the case of fiscal policy, once legislation has been enacted, it may take some time

for authorized spending to be outlayed. An agency must approve projects and select and negotiate

with contractors before funds can be released. In the case of transfers or tax cuts, recipients must

receive the funds and then alter their private spending patterns before the economy-wide effects

are felt. For both monetary and fiscal policy, further rounds of private and public decision making

must occur before multiplier or ripple effects are fully felt.

Second, political constraints have prevented increases in budget deficits from being fully reversed during expansions. Over the course of the business cycle, aggregate spending in the economy can be expected to be too high as often as it is too low. This means that stabilization policy should be tightened as often as it is loosened, yet increasing the budget deficit has proven to be much more popular than implementing the spending cuts or tax increases necessary to reduce it. As a result, the budget has been in deficit in all but five years since 1961, which has led to an accumulation of federal debt that gives policymakers less leeway to potentially undertake a robust expansionary fiscal policy,

21

The Fed earns interest on its securities holdings, and it uses this interest to fund its operations. It sets its own budget

and is not subject to the appropriations process.

22 For more information, see CRS Report R43391, Independence of Federal Financial Regulators: Structure, Funding,

and Other Issues, by Henry B. Hogue, Marc Labonte, and Baird Webel.

23 Christopher Condon, “A Timeline of Trump’s Quotes on Powell and the Fed,” Bloomberg, December 17, 2018.

24 Note that this prediction has not always held over time—at times, some members of Congress have criticized the Fed

for keeping interest rates too low.

25 See CRS Report RL31056, Economics of Federal Reserve Independence, by Marc Labonte.

26 To some extent, fiscal policy automatically mitigates changes in the business cycle without any policy changes

because tax revenue falls relative to GDP and certain mandatory spending (such as unemployment insurance) rises

when economic growth slows and vice versa.

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

8

Monetary Policy and the Federal Reserve: Current Policy and Conditions

Second, monetary policy is determined based only on the Fed’s mandate, whereas fiscal policy is

determined based on competing political goals. Fiscal policy changes have macroeconomic

implications regardless of whether that was policymakers’ primary intent. Political constraints

have prevented increases in budget deficits from being fully reversed during expansions. Over the

course of the business cycle, aggregate spending in the economy can be expected to be too high

as often as it is too low. This means that stabilization policy should be tightened as often as it is

loosened, yet increasing the budget deficit has proven to be much more popular than

implementing the spending cuts or tax increases necessary to reduce it. As a result, the budget has

been in deficit in all but five years since 1961, which has led to an accumulation of federal debt

that gives policymakers less leeway to potentially undertake a robust expansionary fiscal policy,

if needed, in the future. By contrast, the Fed is more insulated from political pressures, as

discussed in the previous section,if needed, in the future. By contrast, the Fed is more insulated from political pressures,27 and experience shows that it is as willing to raise interest rates as it is to lower them.

or lower interest

rates.

Third, the long-run consequences of fiscal and monetary policy differ. Expansionary fiscal policy

creates federal debt that must be serviced by future generations. Some of this debt will be "owed “owed

to ourselves,"” but some (presently, about half) will be owed to foreigners. To the extent that

expansionary fiscal policy crowds out private investment, it leaves future national income lower

than it otherwise would have been.2827 Monetary policy does not have this effect on generational

equity, although different levels of interest rates will affect borrowers and lenders differently.

Furthermore, the government faces a budget constraint that limits the scope of expansionary fiscal

policy—it can only issue debt as long as investors believe the debt will be honored, even if

economic conditions require larger deficits to restore equilibrium.

Fourth, openness of an economy to highly mobile capital flows changes the relative effectiveness

of fiscal and monetary policy. Expansionary fiscal policy would be expected to lead to higher

interest rates, all else equal, which would attract foreign capital looking for a higher rate of return,

causing the value of the dollar to rise.2928 Foreign capital can only enter the United States on net

through a trade deficit. Thus, higher foreign capital inflows lead to higher imports, which reduce

spending on domestically produced substitutes and lower spending on exports. The increase in the

trade deficit would cancel out the expansionary effects of the increase in the budget deficit to

some extent (in theory, entirely if capital is perfectly mobile). Expansionary monetary policy

would have the opposite effect—lower interest rates would cause capital to flow abroad in search

of higher rates of return elsewhere, causing the value of the dollar to fall. Foreign capital outflows

would reduce the trade deficit through an increase in spending on exports and domestically

produced import substitutes. Thus, foreign capital flows would (tend to) magnify the

expansionary effects of monetary policy.30

29

Fifth, fiscal policy can be targeted to specific recipients. In the case of normal open market

operations, monetary policy cannot. This difference could be considered an advantage or a

disadvantage. On the one hand, policymakers could target stimulus to aid the sectors of the

economy most in need or most likely to respond positively to stimulus. On the other hand,

27

An exception to the rule would be a situation in which the economy is far enough below full employment that

virtually no crowding out takes place because the stimulus to spending generates enough resources to finance new

capital spending.

28 For more information, see CRS Report RL31235, The Economics of the Federal Budget Deficit, by Brian W.

Cashell.

29 These exchange rate effects require a change in domestic interest rates relative to foreign interest rates. If fiscal or

monetary policy moves synchronously among trading partners (e.g., all countries expand monetary policy

simultaneously), then there would be no change in relative interest rates and therefore no change in exchange rates or

the trade balance.

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

9

Monetary Policy and the Federal Reserve: Current Policy and Conditions

stimulus could be allocated on the basis of political or other noneconomic factors that reduce the

macroeconomic effectiveness of the stimulus. As a result, both fiscal and monetary policy have

distributional implications, but the latter'’s are largely incidental whereas the former'’s can be

explicitly chosen.

In cases in which economic activity is extremely depressed, monetary policy may lose some of its

effectiveness. When interest rates become extremely low, interest-sensitive spending may no

longer be very responsive to further rate cuts. Furthermore, interest rates cannot be lowered below

zero so traditional monetary policy is limited by this "“zero lower bound."” In this scenario, fiscal

policy may be more effective. As is discussed in the next section, some argue that the U.S.

economy experienced this scenario following the recent financial crisis.

Of course, using monetary and fiscal policy to stabilize the economy are not mutually exclusive

policy options. But because of the Fed'’s independence from Congress and the Administration, the

two policy options are not always coordinated. If Congress and the Fed were to choose

compatible fiscal and monetary policies, respectively, then the economic effects would be more

powerful than if either policy were implemented in isolation. For example, if stimulative

monetary and fiscal policies were implemented, the resulting economic stimulus would be larger

than if one policy were stimulative and the other were neutral. ButAlternatively, if Congress and the

Fed were to select incompatible policies, these policies could partially negate each other. For

example, a stimulative fiscal policy and contractionary monetary policy may end up having little

net effect on aggregate demand (although there may be considerable distributional effects). Thus,

when fiscal and monetary policymakers disagree in the current system, they can potentially

choose policies with the intent of offsetting each other'’s actions.3130 Whether this arrangement is

better or worse for the economy depends on what policies are chosen. If one actor chooses

inappropriate policies, then the lack of coordination allows the other actor to try to negate its

effects.

Unconventional Monetary Policy During and After

the Financial Crisis

When the United States experienced the worst financial crisis since the Great Depression, the Fed

undertook increasingly unprecedented steps in an attempt to restore financial stability. These steps

included reducing the federal funds rate to the zero lower bound, providing direct financial

assistance to financial firms, and “quantitative easing.” These unconventional policy decisions

continue to have consequences for monetary policy today, as the Fed embarks on monetary policy

“normalization.”

The Early Stages of the Crisis and the Zero Lower Bound

The bursting of the housing bubble led to the onset of a financial crisis that affected both

depository institutions and other segments of the financial sector involved with housing finance.

As the delinquency rates on home mortgages rose to record numbers, financial firms exposed to

the mortgage market suffered capital losses and lost access to liquidity. The contagious nature of

30

It is important to take this possibility into consideration when evaluating the potential effects of fiscal policy on the

business cycle. Because the Fed presumably chooses (and continually updates) a monetary policy that aims to keep the

economy at full employment, the Fed would need to alter its policy to offset the effects of any stimulative fiscal policy

changes that moved the economy above full employment. Thus, the actual net stimulative effect of a fiscal policy

change (after taking into account monetary policy adjustments) could be less than the effects in isolation.

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

10

Monetary Policy and the Federal Reserve: Current Policy and Conditions

this development was soon obvious as other types of loans and credit became adversely affected.

This, in turn, spilled over into the broader economy, as the lack of credit soon had a negative

effect on both production and aggregate demand. In December 2007, the economy entered a

recession.

As the housing slump’s spillover effects to the financial system, as well as its international scope,

the Financial Crisis

Until financial turmoil began in 2007, a consensus had emerged among economists that a relatively stable business cycle could be maintained through prudent and nimble changes to interest rates via transparently communicated and signaled open market operations. That proved not to be the case in periods of extreme financial instability, and the Fed took increasingly unconventional and unprecedented steps to restore financial stability. Whereas traditional open market operations managed to contain systemic risk following the bursting of the "dot-com" stock bubble in 2000, the Fed was unable to contain systemic risk following the bursting of the housing bubble. This had led to a debate about whether the Fed should be aggressive in using monetary policy against asset bubbles, even at the expense of meeting its mandate in the short term. In the past, the Fed has expressed doubt that it could correctly identify or safely neutralize bubbles using monetary policy.

Before the Financial Crisis

As the U.S. economy was coming out of the short and shallow 2001 recession, unemployment continued rising until mid-2003. Fearful that the economy would slip back into recession, the Fed kept the federal funds rate extremely low.32 The federal funds target reached a low of 1% by mid-2003. As the expansion gathered momentum and prices began to rise, the federal funds target was slowly increased in a series of moves to 5.25% in mid-2006.

Some economists now argue that the financial crisis was, at least in part, caused by the Fed keeping short-term rates too low for too long after the 2001 recession had ended. Low rates, they claim, caused an increased demand for housing that resulted in a price bubble (a bubble that was also due, in part, to lax lending standards that were subject to regulation by the Fed and others).33 The shift in preference from fixed to variable rate mortgages made this sector of the economy increasingly vulnerable to movements in short-term interest rates. An alternative perspective, championed by Ben Bernanke and others, was that the low mortgage rates that helped fuel the housing bubble were mainly caused by a "global savings glut" over which the Fed had little control.34 One consequence of the tightening of monetary policy later in the decade, critics now claim, was to burst this price bubble.

The Early Stages of the Crisis and the Zero Lower Bound

The bursting of the housing bubble led to the onset of a financial crisis that affected both depository institutions and other segments of the financial sector involved with housing finance. As the delinquency rates on home mortgages rose to record numbers, financial firms exposed to the mortgage market suffered capital losses and lost access to liquidity. The contagious nature of this development was soon obvious as other types of loans and credit became adversely affected. This, in turn, spilled over into the broader economy, as the lack of credit soon had a negative effect on both production and aggregate demand. In December 2007, the economy entered a recession.

As the housing slump's spillover effects to the financial system, as well as its international scope, became apparent, the Fed responded by reducing the federal funds target and the discount rate.35 became apparent, the Fed responded by reducing the federal funds target and the discount rate.31

Beginning on September 18, 2007, and ending on December 16, 2008, the federal funds target

was reduced from 5.25% to a range between 0% and 0.25%, where it remained until December

2015. Economists call this the zero lower bound to signify that once the federal funds rate is

lowered to zero, conventional open market operations cannot be used to provide further stimulus.

The Fed attempted to achieve additional monetary stimulus at the zero bound through a pledge to

keep the federal funds rate low for an extended period of time, which has been called forward

guidance or forward commitment.

The decision to maintain a target interest rate near zero was unprecedented. First, short-term

interest rates have never before been reduced to zero in the history of the Federal Reserve.36 32

Second, the Fed waited much longer than usual to begin tightening monetary policy in the current

recovery. For example, in the previous two expansions, the Fed began raising rates less than three

years after the preceding recession ended.

Direct Assistance During and After the Financial Crisis

With liquidity problems persisting as the federal funds rate was reduced, it appeared that the

traditional transmission mechanism linking monetary policy to activity in the broader economy

was not working. Monetary authorities became concerned that the liquidity provided to the

banking system was not reaching other parts of the financial system. Using only As noted above, using only

traditional monetary policy tools, additional monetary stimulus cannot be provided once the

federal funds rate has reached its zero bound. To circumvent this problem, the Fed decided to use

nontraditional methods to provide additional monetary policy stimulus.

First, the Federal Reserve introduced a number of emergency credit facilities to provide increased

liquidity directly to financial firms and markets. The first facility was introduced in December

2007, and several were added after the worsening of the crisis in September 2008. These facilities

were designed to fill perceived gaps between open market operations and the discount window,

and most of them were designed to provide short-term loans backed by collateral that exceeded

the value of the loan.3733 A number of the recipients were nonbanks that are outside the regulatory

umbrella of the Federal Reserve; this marked the first time that the Fed had lent to nonbanks since

the Great Depression. The Fed authorized these actions under Section 13(3) of the Federal

Reserve Act,3834 a seldom-used emergency provision that allowsallowed it to extend credit to nonbank

financial institutions and to nonfinancial firms as well.

The Fed provided assistance through liquidity facilities, which included both the traditional discount window and the newly created emergency facilities mentioned above, and through direct support to prevent the failure of two specific institutions, American International Group (AIG) and Bear Stearns. The amount of assistance provided was an order of magnitude larger than

For a detailed account of the Fed’s role in the financial crisis, see CRS Report RL34427, Financial Turmoil: Federal

Reserve Policy Responses, by Marc Labonte.

32 The Fed did not target the federal funds rate as its monetary policy instrument until the late 1980s or early 1990s.

(See Daniel Thornton, “When Did the FOMC Begin Targeting the Federal Funds Rate?,” Federal Reserve Bank of St.

Louis, Working Paper no. 2004-015B, May 2005, http://research.stlouisfed.org/wp/2004/2004-015.pdf.) Data on the

federal funds rate back to 1914 is not available. Before 2008, the Fed had not set its discount rate (the rate charged at

the Fed’s discount window) as low as 0.5% since 1914.

33 See CRS Report R44185, Federal Reserve: Emergency Lending, by Marc Labonte.

34 12 U.S.C. §343.

31

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

11

Monetary Policy and the Federal Reserve: Current Policy and Conditions

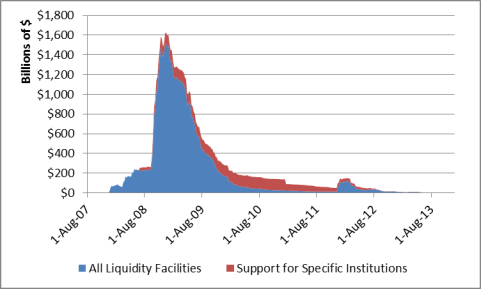

The Fed provided assistance through liquidity facilities, which included both the traditional

discount window and the newly created emergency facilities mentioned above, and through direct

support to prevent the failure of two specific institutions, American International Group (AIG)

and Bear Stearns. The amount of assistance provided was an order of magnitude larger than

normal Fed lending, as shown in Figure 1. Total assistance from the Federal Reserve at the

beginning of August 2007 was approximately $234 million provided through liquidity facilities,

with no direct support given. In mid-December 2008, this number reached a high of $1.6 trillion,

with a near-high of $108 billion given in direct support. From that point on, it fell steadily.

Assistance provided through liquidity facilities fell below $100 billion in February 2010, when

many facilities were allowed to expire, and support to specific institutions fell below $100 billion

in January 2011.3935 The last loan from the crisis was repaid on October 29, 2014.4036 Central bank

liquidity swaps (temporary currency exchanges between the Fed and central foreign banks) are

the only facility created during the crisis still active, but they have not been used on a large scale

since 2012. All assistance through expired facilities has been fully repaid with interest. In 2010,

the Dodd-Frank Act41Act37 changed Section 13(3) to rule out direct support to specific institutions in

the future.

Figure 1. Direct Fed Assistance to the the future.

Financial Sector (August 1, 2007-December 31, 2013) |

|

Source: Fed, Recent Balance Sheet Trends |

.

From the introduction of its first emergency lending facility in December 2007 to the worsening

of the crisis in September 2008, the Fed sterilized the effects of lending on its balance sheet (i.e.,

prevented the balance sheet from growing) by selling an offsetting amount of Treasury securities.

After September 2008, assistance exceeded remaining Treasury holdings, and the Fed allowed its

balance sheet to grow. Between September 2008 and November 2008, the Fed'’s balance sheet

Data from “Recent Balance Sheet Trends,” Credit and Liquidity Programs and the Balance Sheet,

http://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm. Values include totals from credit extended

through Federal Reserve liquidity facilities and support for specific institutions.

36 Federal Reserve, Quarterly Report on Federal Reserve Balance Sheet Developments, November 2014,

http://www.federalreserve.gov/monetarypolicy/bsd-content-201411.htm.

37 P.L. 111-203.

35

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

12

Monetary Policy and the Federal Reserve: Current Policy and Conditions

more than doubled in size, increasing from less than $1 trillion to more than $2 trillion. The loans

and other assistance provided by the Federal Reserve to banks and nonbank institutions are

considered assets on this balance sheet because they represent money owed to the Fed.

With the federal funds rate at its zero bound and direct lending falling as financial conditions

began to normalize in 2009, the Fed faced the decision of whether to try to provide additional

monetary stimulus through unconventional measures. It did so through two unconventional

tools—large-scale asset purchases (quantitative easing) and forward guidance.

Quantitative Easing and the Growth in the Fed'’s Balance Sheet and

Bank Reserves

With short-term rates constrained by the zero bound, the Fed hoped to reduce long-term rates

through large-scale asset purchases, which were popularly referred to as quantitative easing (QE).

Between 2009 and 2014, the Fed undertook three rounds of QE, buying U.S. Treasury securities,

agency debt, and agency mortgage-backed securities (MBS). These securities now comprise most

of the assets on the Fed'’s balance sheet.

To understand the effect of quantitative easing on the economy, it is first necessary to describe its

effect on the Fed'’s balance sheet. In 2009, the Fed'’s emergency lending declined rapidly as

market conditions stabilized, which would have caused the balance sheet to decline if the Fed

took no other action. Instead, asset purchases under the first round of QE (QE1) offset the decline

in lending, and from November 2008 to November 2010, the overall size of the Fed'’s balance

sheet did not vary by much. Its composition changed because of QE1, however—the amount of

Fed loans outstanding fell to less than $50 billion at the end of 2010, whereas holdings of

securities rose from less than $500 billion in November 2008 to more than $2 trillion in

November 2010. The second round of QE, QE2, increased the Fed'’s balance sheet from $2.3

trillion in November 2010 to $2.9 trillion in mid-2011. It remained around that level until

September 2012,4238 when it began rising for the duration of the third round, QE3. It was about $4.5

trillion (comprised of $2.5 trillion of Treasury securities, $1.7 trillion MBS, and $0.4 trillion of

agency debt) when QE3 ended in October 2014, and has remained at that level since.

Table 1 summarizes the Fed'’s QE purchases. In total, the Fed'’s balance sheet increased by more

than $2.5 trillion over the course of the three rounds of QE, making it about five times larger than

it was before the crisis.

Table 1. Quantitative Easing (QE):

Changes in Asset Holdings on the Fed'’s Balance Sheet

(billions of dollars)

Treasury Security

Holdings

Agency MBS

Holdings

Agency Debt

Holdings

Total

Assets

QE1

(Mar. 2009-May 2010)

+$302

+$1,129

+$168

+$451

QE2

(Nov. 2010-July 2011)

+$788

-$142

-$35

+$578

38

Between QE2 and QE3, the Fed created the Maturity Extension Program, popularly referred to as Operation Twist.

Under this program, the Fed sold short-term Treasury securities and purchased long-term Treasury securities, resulting

in no net increase in the size of its balance sheet.

Congressional Research Service

RL30354 · VERSION 105 · UPDATED

13

Monetary Policy and the Federal Reserve: Current Policy and Conditions

Treasury Security

Holdings

Agency MBS

Holdings

Agency Debt

Holdings

Total

Assets

QE3

(Oct. 2012-Oct. 2014)

+$810

+874

-$48

+$1,663

Total

(Mar. 2009-Oct. 2014)

+$1,987

+$1,718

+$40

+$2,587

Source: (billions of dollars)

|

Treasury Security Holdings |

Agency MBS Holdings |

Agency Debt Holdings |

Total Assets |

|

|

+$302 |

+$1,129 |

+$168 |

+$451 |

|

+$788 |

-$142 |

-$35 |

+$578 |

|

+$810 |

+874 |

-$48 |

+$1,663 |

|

+$1,987 |

+$1,718 |

+$40 |

+$2,587 |

Source: Congressional Research Service (CRS) calculations based on Fed data.

Congressional Research Service (CRS) calculations based on Fed data.

Notes: The first round of QE, QE1, was announced in March 2009. The "QE1" and "total"“QE1” and “total” rows include agency

securities and mortgage-backed securities (MBS) that the Fed began purchasing in September 2008 and January

2009, respectively. The final column does not equal the sum of the first three columns because of changes in

other items (not shown) on the Fed'’s balance sheet. The final row does not equal the sum of the first three rows

because it includes changes in holdings between the three rounds of QE. Data on the table is based on actual

data, not announced amounts at the onset of the program. The two can differ because of timing and the maturity

of prior holdings, which decrease the amounts shown in the table.

This increase in the Fed'’s assets must be matched by a corresponding increase in the liabilities on

its balance sheet.39 The Fed'’s liabilities mostly take the form of currency, bank reserves, and cash

deposited by the U.S. Treasury at the Fed. QE has mainly resulted in an increase in bank reserves,

from about $46 billion in August 2008 to $820 billion at the end of 2008. Since October 2009,

bank reserves have exceeded $1 trillion, and they have been between $2.5 trillion and $2.8 trillion

since 2014.4340 The increase in bank reserves can be seen as the inevitable outcome of the increase

in assets held by the Fed because the bank reserves, in effect, financed the Fed'’s asset purchases

and loan programs. Reserves increase because when the Fed makes loans or purchases assets, it

credits the proceeds to the recipients'’ reserve accounts at the Fed.

The intended purpose of QE was to put downward pressure on long-term interest rates.

Purchasing long-term Treasury securities and MBS should directly reduce the rates on those

securities, all else equal. The hope is that a reduction in those rates feeds through to private

borrowing rates throughout the economy, stimulating spending on interest-sensitive consumer

durables, housing, and business investment in plant and equipment. Indeed, Treasury and

mortgage rates have been unusually low since the crisis compared with the past few decades,

although the timing of declines in those rates do not match up closely to the timing of asset

purchases. Determining whether QE has reduced rates more broadly and stimulated interest-sensitive

spending requires controlling for other factors, such as the weak economy, which tends to reduce

both rates and interest-sensitive spending.44

41

The increase in the Fed'’s balance sheet has the potential to be inflationary because bank reserves

are a component of the portion of the money supply controlled by the Fed (called the monetary basemonetary

base), which has growngrew at an unprecedented pace during QE. In practice, overall measures of the

money supply have not grown as quickly as the monetary base, and inflation has remained below

the Fed'’s goal of 2% for most of the period since 2008. The growth in the monetary base has not

translated into higher inflation because bank reserves have mostly remained deposited at the Fed

and have not led to increased lending or asset purchases by banks.

Another concern is that by holding large amounts of MBS, the Fed is allocating credit to the housing sector, putting the rest of the economy at a disadvantage compared with that sector. Advocates of MBS purchases note that housing was the sector of the economy most in need of stabilization, given the nature of the crisis (this argument becomes less persuasive as the housing market continues to rebound); that MBS markets are more liquid than most alternatives, limiting the potential for the Fed's purchases to be disruptive; and that the Fed is legally permitted to purchase few other assets, besides Treasury securities.

Forward Guidance

Another tool the Fed introduced to achieve additional monetary stimulus at the zero bound was a pledge to keep the federal funds rate low for an extended period of time, which has been called forward guidance or forward commitment. The Fed believes this would stimulate economic activity because businesses, for example, will be more likely to take on long-term investment commitments if they are confident rates will be low over the life of a loan. Over time, this forward guidance became more detailed and explicit. In August 2011, the Fed set a date for how long it expected to maintain "exceptionally low levels for the federal funds rate." In December 2012, the Fed replaced the date threshold with an economic threshold: it pledged to maintain an "exceptionally low" federal funds target at least as long as unemployment is above 6.5% and inflation is low.