U.S. Farm Income Outlook: November 2019 Forecast

This report uses the U.S. Department of Agriculture’s (USDA’s) farm income projections (as of November 27, 2019) and agricultural trade outlook update (as of November 25, 2019) to describe the U.S. farm economic outlook for 2019. According to USDA’s Economic Research Service (ERS), national net farm income—a key indicator of U.S. farm well-being—is forecast at $92.5 billion in 2019, up $8.5 billion (+10.2%) from last year. The forecast rise in 2019 net farm income is largely the result of a 64.0% increase in government payments to the agricultural sector, with a projected total value of $22.4 billion (highest since 2005).

USDA’s forecast of outlays for farm support for 2019 includes $14.3 billion in direct payments made under trade assistance programs intended to help offset foreign trade retaliation against U.S. agricultural products, as well as over $8 billion in payments from other farm programs, including the Wildfire and Hurricane Indemnity Program (WHIP). Without this federal support, net farm income would be lower, primarily due to continued weak prices for most major crops. Commodity prices are under pressure from large carry-in stocks from a record soybean and near-record corn harvest in 2018, and diminished export prospects due to the ongoing trade dispute with China. Should these conditions persist into 2020, they would signal the potential for continued dependence on federal programs to sustain farm incomes in 2020.

Since 2008, U.S. agricultural exports have accounted for a 20% share of U.S. farm and manufactured or processed agricultural sales. In 2018, total agricultural exports were estimated at $143.4 billion (the second-highest export value on record). However, strong competition from major foreign competitors and the ongoing U.S.-China trade dispute are expected to shift trade patterns and lower U.S. agricultural export prospects significantly (-5.5%) to a projected $135.5 billion in 2019.

Farm asset value in 2019 is projected up from 2018 at $3.1 trillion (+2.3%). Farm asset values reflect farm investors’ and lenders’ expectations about long-term profitability of farm sector investments. U.S. farmland values are projected to rise 2.1% in 2019, slightly higher than the 1.6% in 2018 but below the 3.0% of 2017. Because they comprise 83% of the U.S. farm sector’s asset base, change in farmland values is a critical barometer of the farm sector’s financial performance. However, another critical measure of the farm sector’s well-being is aggregate farm debt, which is projected to be at a record $415.5 billion in 2019—up 3.5% from 2018. Both the debt-to-asset and the debt-to-equity ratios have risen for seven consecutive years, suggesting a weakening of the U.S. farm sector’s financial situation.

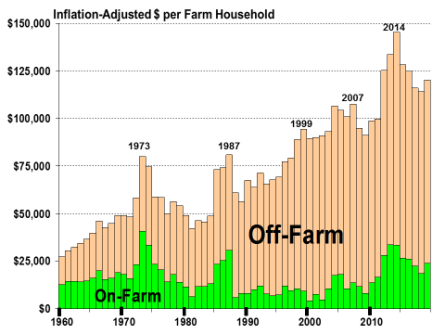

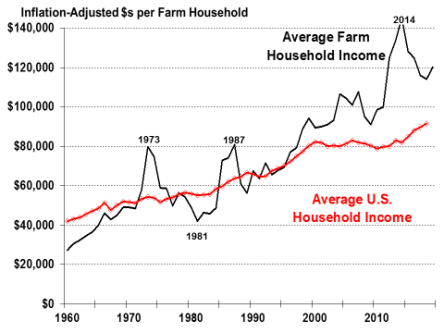

At the farm household level, average farm household incomes have been well above average U.S. household incomes since the late 1990s. However, this advantage derives primarily from off-farm income as a share of farm household total income. Since 2014, over half of U.S. farm operations have had negative income from their agricultural operations. Furthermore, the farm household income advantage over the average U.S. household has narrowed in recent years. In 2014, the average farm household income (including off-farm income sources) was about 77% higher than the average U.S. household income. In 2018 (the last year with comparable data), that advantage was expected to decline to 25%.

USDA Farm Income Projections as of November 27, 2019

This report discusses aggregate national net farm income projections for calendar year 2019 as forecast by USDA’s ERS on November 27, 2019. It is the third ERS forecast for 2019 and follows an initial forecast made on March 6, 2019, when USDA forecast 2019 net farm income at $69.4 billion, and a second forecast made on August 30, 2019, when net farm income was forecast at a much higher $88 billion, largely the result of an increase in government payments to the agricultural sector.

The initial March forecast is discussed in CRS Report R45697, U.S. Farm Income Outlook: March 2019 Forecast, by Randy Schnepf. The second forecast made in August is discussed in CRS Report R45924, U.S. Farm Income Outlook: August 2019 Forecast, by Randy Schnepf.

U.S. Farm Income Outlook: November 2019 Forecast

Jump to Main Text of Report

Contents

- Introduction

- USDA's November 2019 Farm Income Forecast

- Highlights

- Three Major Factors Dominate the 2019 Farm Income Outlook

- Large Corn and Soybean Stocks Continue to Dominate Commodity Markets

- Poor Weather for Planting, Harvesting U.S. Corn and Soybean Crops

- Diminished Trade Prospects Contribute to Market Uncertainty

- Livestock Outlook for 2019 and 2020

- Background on the U.S. Cattle-Beef Sector

- Robust Production Growth Projected Across the Livestock Sector

- Livestock-Price-to-Feed-Cost Ratios Signal Profitability Outlook

- Gross Cash Income Highlights

- Crop Receipts

- Livestock Receipts

- Government Payments

- Dairy Margin Coverage Program Outlook

- Production Expenses

- Cash Rental Rates

- Agricultural Trade Outlook

- Key U.S. Agricultural Trade Highlights

- Farm Asset Values and Debt

- Average Farm Household Income

- Total vs. Farm Household Average Income

Figures

- Figure 1. Annual U.S. Farm Sector Nominal Income, 1940-2019F

- Figure 2. U.S. Farm Sector Inflation-Adjusted Income, 1940-2019F

- Figure 3. Stocks-to-Use Ratios and Farm Prices: Corn, Soybeans, Wheat, and Cotton

- Figure 4. U.S. Beef Cattle Inventory (Including Calves) Since 1973

- Figure 5. Livestock Farm-Price-to-Feed Ratios, Indexed

- Figure 6. Farm Cash Receipts by Source, 2008-2019F

- Figure 7. Crop Cash Receipts by Source, 2008-2019

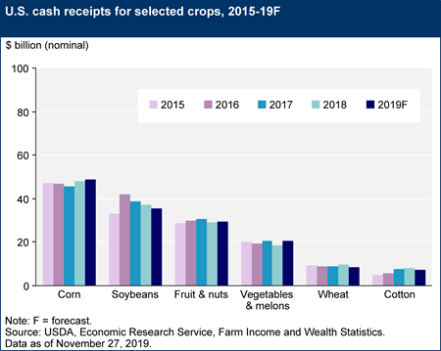

- Figure 8. Cash Receipts for Selected Crops, 2015-2019F

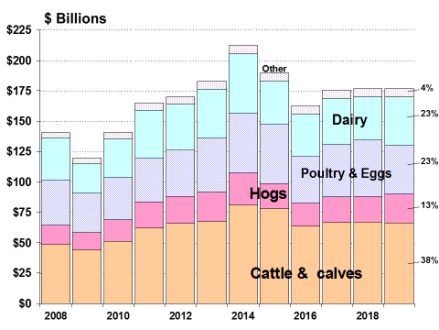

- Figure 9. U.S. Livestock Product Cash Receipts by Source, 2008-2019F

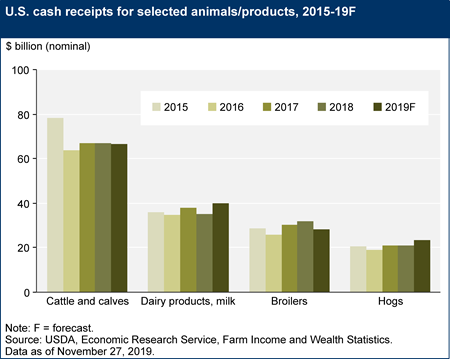

- Figure 10. Cash Receipts for Selected Animal Products, 2015-2019F

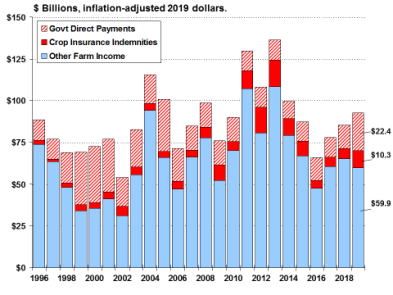

- Figure 11. U.S. Government Farm Support, Direct Outlays, 1996-2019F

- Figure 12. Net Farm Income by Source, 1996-2019F

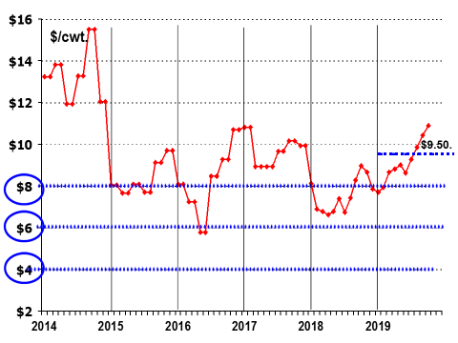

- Figure 13. The Dairy Output-to-Input Margin Has Risen Above $9.50/cwt. in 2019

- Figure 14. Total Annual Farm Production Expenses, 1970-2019F

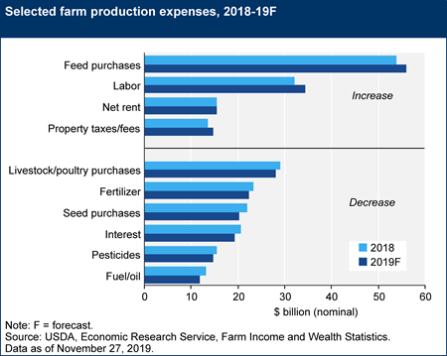

- Figure 15. Farm Production Expenses for Selected Items, 2018 and 2019F

- Figure 16. Index of Monthly Prices Received vs. Prices Paid, 2006-2019

- Figure 17. U.S. Average Farmland Cash Rental Rates Since 1998

- Figure 18. U.S. Agricultural Trade Since 2005 in 2019 Dollars

- Figure 19. U.S. Agricultural Export Value (Total and to China) Peaked in FY2014

- Figure 20. U.S. Agricultural Trade: Bulk vs. High-Value Shares

- Figure 21. Real Estate Share Estimated at 83% of Total Farm Sector Assets in 2019

- Figure 22. U.S. Average Farm Land Values, 1985-2019

- Figure 23. U.S. Farm Debt-to-Asset Ratio, 1960-2019F

- Figure 24. U.S. Average Farm Household Income, by Source, 1960-2019F

- Figure 25. Farm Household Income Has Been Above U.S. Average Since 1996

- Figure A-1. Monthly Farm Prices for Corn, Soybeans, and Wheat, Indexed Dollars

- Figure A-2. Monthly Farm Prices for Cotton and Rice, Indexed Dollars

- Figure A-3. Monthly Farm Prices for All-Milk and Cattle (500+ lbs.), Indexed Dollars

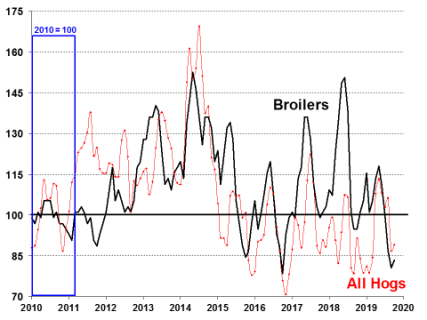

- Figure A-4. Monthly Farm Prices for All Hogs and Broilers, Indexed Dollars

Tables

- Table A-1. Annual U.S. Farm Income ($ Billions) Since 2014 including 2019 Forecasts

- Table A-2. Average Annual Income per U.S. Household, Farm vs. All, 2012-2019

- Table A-3. Average Annual Farm Sector Debt-to-Asset Ratio, 2012-2019

- Table A-4. U.S. Farm Prices and Support Rates for Selected Commodities Since 2014/15 Marketing Year

Appendixes

Summary

This report uses the U.S. Department of Agriculture's (USDA's) farm income projections (as of November 27, 2019) and agricultural trade outlook update (as of November 25, 2019) to describe the U.S. farm economic outlook for 2019. According to USDA's Economic Research Service (ERS), national net farm income—a key indicator of U.S. farm well-being—is forecast at $92.5 billion in 2019, up $8.5 billion (+10.2%) from last year. The forecast rise in 2019 net farm income is largely the result of a 64.0% increase in government payments to the agricultural sector, with a projected total value of $22.4 billion (highest since 2005).

USDA's forecast of outlays for farm support for 2019 includes $14.3 billion in direct payments made under trade assistance programs intended to help offset foreign trade retaliation against U.S. agricultural products, as well as over $8 billion in payments from other farm programs, including the Wildfire and Hurricane Indemnity Program (WHIP). Without this federal support, net farm income would be lower, primarily due to continued weak prices for most major crops. Commodity prices are under pressure from large carry-in stocks from a record soybean and near-record corn harvest in 2018, and diminished export prospects due to the ongoing trade dispute with China. Should these conditions persist into 2020, they would signal the potential for continued dependence on federal programs to sustain farm incomes in 2020.

Since 2008, U.S. agricultural exports have accounted for a 20% share of U.S. farm and manufactured or processed agricultural sales. In 2018, total agricultural exports were estimated at $143.4 billion (the second-highest export value on record). However, strong competition from major foreign competitors and the ongoing U.S.-China trade dispute are expected to shift trade patterns and lower U.S. agricultural export prospects significantly (-5.5%) to a projected $135.5 billion in 2019.

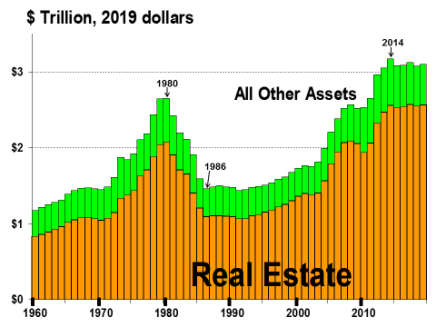

Farm asset value in 2019 is projected up from 2018 at $3.1 trillion (+2.3%). Farm asset values reflect farm investors' and lenders' expectations about long-term profitability of farm sector investments. U.S. farmland values are projected to rise 2.1% in 2019, slightly higher than the 1.6% in 2018 but below the 3.0% of 2017. Because they comprise 83% of the U.S. farm sector's asset base, change in farmland values is a critical barometer of the farm sector's financial performance. However, another critical measure of the farm sector's well-being is aggregate farm debt, which is projected to be at a record $415.5 billion in 2019—up 3.5% from 2018. Both the debt-to-asset and the debt-to-equity ratios have risen for seven consecutive years, suggesting a weakening of the U.S. farm sector's financial situation.

At the farm household level, average farm household incomes have been well above average U.S. household incomes since the late 1990s. However, this advantage derives primarily from off-farm income as a share of farm household total income. Since 2014, over half of U.S. farm operations have had negative income from their agricultural operations. Furthermore, the farm household income advantage over the average U.S. household has narrowed in recent years. In 2014, the average farm household income (including off-farm income sources) was about 77% higher than the average U.S. household income. In 2018 (the last year with comparable data), that advantage was expected to decline to 25%.

|

USDA Farm Income Projections as of November 27, 2019 This report discusses aggregate national net farm income projections for calendar year 2019 as forecast by USDA's ERS on November 27, 2019. It is the third ERS forecast for 2019 and follows an initial forecast made on March 6, 2019, when USDA forecast 2019 net farm income at $69.4 billion, and a second forecast made on August 30, 2019, when net farm income was forecast at a much higher $88 billion, largely the result of an increase in government payments to the agricultural sector. The initial March forecast is discussed in CRS Report R45697, U.S. Farm Income Outlook: March 2019 Forecast, by Randy Schnepf. The second forecast made in August is discussed in CRS Report R45924, U.S. Farm Income Outlook: August 2019 Forecast, by Randy Schnepf. |

Introduction

The U.S. farm sector is vast and varied. It encompasses production activities related to traditional field crops (such as corn, soybeans, wheat, and cotton) and livestock and poultry products (including meat, dairy, and eggs), as well as fruits, tree nuts, and vegetables. In addition, U.S. agricultural output includes greenhouse and nursery products, forest products, custom work, machine hire, and other farm-related activities. The intensity and economic importance of each of these activities, as well as their underlying market structure and production processes, vary regionally based on the agro-climatic setting, market conditions, and other factors. As a result, farm income and rural economic conditions may vary substantially across the United States.

Annual U.S. net farm income is the single most watched indicator of farm sector well-being, as it captures and reflects the entirety of economic activity across the range of production processes, input expenses, and marketing conditions that have prevailed during a specific time period. When national net farm income is reported together with a measure of the national farm debt-to-asset ratio, the two summary statistics provide a quick and widely referenced indicator of the economic well-being of the national farm economy.

|

Measuring Farm Profitability Two different indicators measure farm profitability: net cash income and net farm income. Net cash income compares cash receipts to cash expenses. As such, it is a cash flow measure representing the funds that are available to farm operators to meet family living expenses and make debt payments. For example, crops that are produced and harvested but kept in on-farm storage are not counted in net cash income. Farm output must be sold before it is counted as part of the household's cash flow. Net farm income is a more comprehensive measure of farm profitability. It measures value of production, indicating the farm operator's share of the net value added to the national economy within a calendar year independent of whether it is received in cash or noncash form. As a result, net farm income includes the value of home consumption, changes in inventories, capital replacement, and implicit rent and expenses related to the farm operator's dwelling that are not reflected in cash transactions. Thus, once a crop is grown and harvested, it is included in the farm's net income calculation, even if it remains in on-farm storage. Key Concepts Behind Farm Income

National vs. State-Level Farm Household Data Aggregate data often obscure or understate the diversity and regional variation that occurs across America's agricultural landscape. For insights into the differences in American agriculture, visit the ERS websites on "Farm Structure and Organization" and "Farm Household Well-being."1 |

USDA's November 2019 Farm Income Forecast

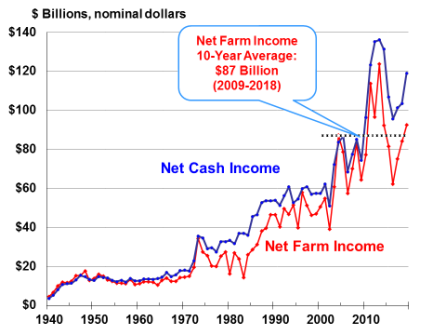

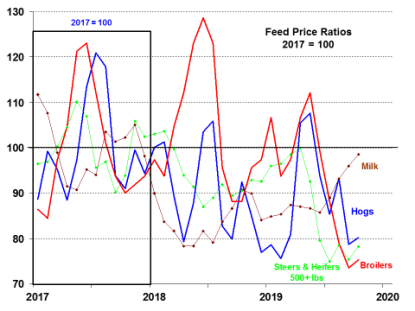

In the third of three official U.S. farm income outlook releases scheduled for 2019 (see shaded box below), ERS projects that U.S. net farm income will rise 10.2% in 2019 to $92.5 billion, up $8.5 billion from last year.2 Net cash income (calculated on a cash-flow basis) is also projected higher in 2019 (+15.0%) at $119.0 billion. The November forecast of $92.5 billion is 6.3% above the 10-year average of $87.0 billion but is well below 2013's record high of $123.7 billion.

|

ERS's Annual Farm Income Forecasts ERS releases three farm income forecasts each calendar year. The first forecast is generally released in February as part of the President's budget process and coincides with USDA's annual outlook forum, which convenes toward the end of every February. This year (2019), the initial forecast was delayed until March 6, 2019, due to the federal government shutdown, which began on midnight EST, December 22, 2018, and lasted until January 25, 2019. The initial forecast consists primarily of trend projections for the year, since it precedes most agricultural activity, which occurs later in the spring and summer. The initial projections rely heavily on assumptions of trend yields and USDA's baseline forecasts for market conditions. ERS's second farm income forecast is generally released in late August as part of what USDA refers to as the mid-session budget review. By late August, most planting of major program crops is finished and crop growing conditions are better known, thus contributing to improved yield estimates. Domestic and international market conditions and trade patterns have also been established, thus improving forecasts for most commodity prices. It is not unusual for large variations in farm income projections to occur between the first and second farm income forecasts. ERS's third farm income forecast is generally released in late November and represents a tightening up of the data—preliminary forecasts of planted acres and yields are gradually replaced with estimates based on actual field surveys and crop reporting by farmers to USDA. In most years, only small variations in farm income estimates occur between the second and third forecasts. The farm income forecast cycle then begins anew in the succeeding year. However, changes to estimates from previous years continue to occur for several years as more complete data become available. This report discusses aggregate national net farm income projections for calendar year 2019 as reported by USDA's ERS on November 27, 2019.3 It is an update of both an initial forecast made on March 6, 2019, and an update made on August 30, 2019. These two previous USDA farm income forecasts for 2019 are discussed in CRS Report R45697, U.S. Farm Income Outlook: March 2019 Forecast, and CRS Report R45924, U.S. Farm Income Outlook: August 2019 Forecast. |

The November 2019 net farm income forecast represents an increase from both USDA's preliminary March 2019 forecast of $69.4 billion, and the August 2019 forecast of $88.0 billion (Table A-1). The initial March forecast did not anticipate the second round of MFP payments (valued at up to $14.5 billion). The increase in government support in 2019, projected at $22.4 billion and up 64.0% from 2018, is the principal driver behind the rise in net farm income—both year-to-year and from the previous two forecasts. Support from traditional farm programs is expected to be bolstered by large direct government payments in response to trade retaliation under the trade war with China.4 Direct government payments of $22.4 billion in 2019, if realized, would represent 24.2% of net farm income—the largest share since a 27.6% share in 2006.5

Highlights

- For historical perspective, both net cash income and net farm income achieved record highs in 2013 but fell to recent lows in 2016 (Figure 1) before trending higher in each of the past three years (2017, 2018, and 2019).

- When adjusted for inflation and represented in 2019 dollars (Figure 2), the net farm income for 2019 is projected to be on par with the average of $86.8 billion for net farm income since 1940.

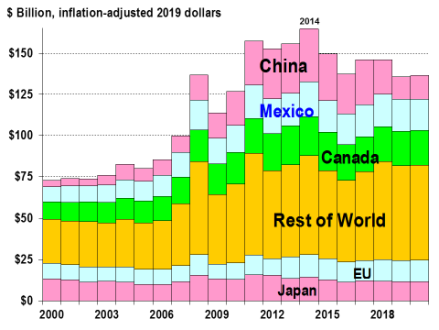

- Global demand for U.S. agricultural exports (Figure 18) is projected at $134.5 billion in 2019, down from 2018 (-6.2%), due largely to a decline in sales to China.6

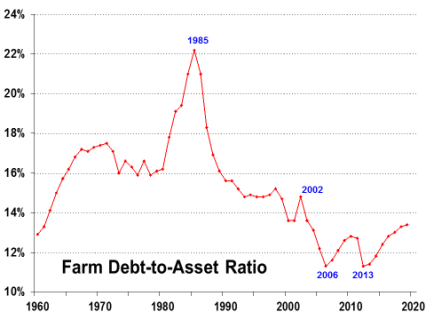

- Farm asset values and debt levels are projected to reach record levels in 2019—asset values at $3.1 trillion (+2.1%) and farm debt at $415.5 billion (+3.4%)—pushing the projected debt-to-asset ratio up to 13.5%, the highest level since 2003 (Figure 23).

- For 2019, USDA forecasts that prices for most major commodities—barley, soybeans, sorghum, oats, rice, hogs, and milk—will be up slightly from 2018, while cotton, wheat, choice steers, broilers, and eggs are expected to be lower (Table A-4). However, these projections are subject to substantial uncertainty associated with international commodity markets.

Three Major Factors Dominate the 2019 Farm Income Outlook

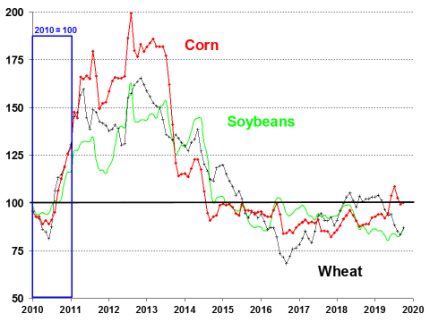

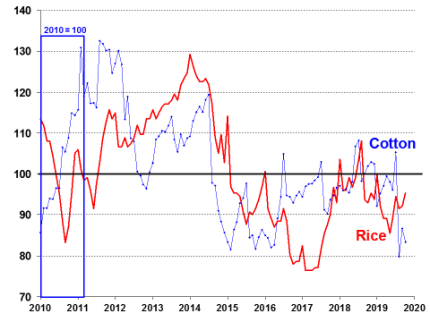

Abundant domestic and international supplies of grains and oilseeds contributed to a fifth straight year of relatively weak commodity prices in 2019 (Figure A-1 through Figure A-4, and Table A-4). Furthermore, prospects for market conditions heading into 2020 remain uncertain. Three major factors have dominated U.S. agricultural markets during 2019, and have contributed to uncertainty over both supply and demand prospects, as well as market prices, heading into 2020.

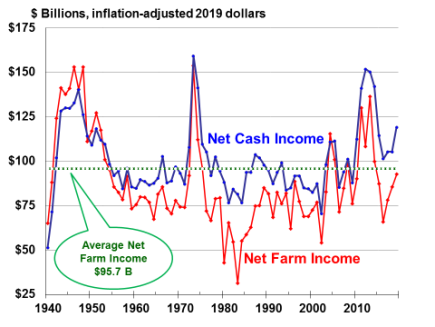

First, large domestic supplies of corn, soybeans, wheat, and cotton were carried over into 2019 (Figure 3). Large corn and soybean stocks have kept pressure on commodity prices throughout the grain and feed complex in 2019.

Second, adverse weather conditions during the spring planting and fall harvesting periods have contributed to market uncertainty regarding the size of the 2019 corn and soybean crops.

Third, the U.S.-China trade dispute has led to declines in U.S. exports to China—a major market for U.S. agricultural products—and added to market uncertainty.7 In particular, the United States lost its dominant role in the world's preeminent market for soybeans—China. It is unclear how soon, if at all, the United States may resolve its trade dispute with China or how international demand may evolve heading into 2020.

Large Corn and Soybean Stocks Continue to Dominate Commodity Markets

Corn and soybeans are the two largest U.S. commercial crops in terms of both value and acreage. For the past several years, U.S. corn and soybean crops have experienced strong growth in both productivity and output, thus helping to build stockpiles at the end of the marketing year.

In 2018, U.S. farmers produced a record U.S. soybean harvest of 4.5 billion bushels and record ending stocks (913 million bushels or a 23.0% stocks-to-use ratio) that year (Figure 3).8 The record soybean harvest in 2018, combined with the sudden loss of the Chinese soybean market (as discussed in the "Agricultural Trade Outlook" section of this report), kept downward pressure on U.S. soybean prices. A smaller crop and lower stocks are projected for 2019; however, the reduction in volume of U.S. soybean exports to China has prevented a major price recovery.

Similarly, several consecutive years of bumper U.S. corn crops have built domestic corn supplies. U.S. corn ending stocks in 2019 are projected to approach or surpass 2 billion bushels for the fourth consecutive year. U.S. wheat and cotton supplies are also projected to remain high relative to use, thus keeping downward pressure on farm prices.

Poor Weather for Planting, Harvesting U.S. Corn and Soybean Crops

U.S. agricultural production activity got off to a late start in 2019 due to prolonged cool, wet conditions throughout the major growing regions, particularly in states across the eastern Corn Belt and the Dakotas. This resulted in record large "prevented plant" acres (reported at 19.6 million acres by the Farm Service Agency)9 and delays in the planting of the corn and soybean crops, especially in Illinois, Michigan, Ohio, Wisconsin, and North and South Dakota.

Traditionally, 96% of the U.S. corn crop is planted by June 2, but in 2019 67% of the crop had been planted by that date. Similarly, the U.S. soybean crop was planted with substantial delays. By June 16, 77% of the U.S. soybean crop was planted, whereas an average of 93% of the crop has been planted by that date during the past five years. These planting delays have significant implications for crop development because they push both crops' growing cycle into hotter, drier periods of the summer than usual and increase the risk of plant growth being shut off by an early freeze, thus preventing the plants from achieving their maximum yield potential.

Then, in the fall, early bouts of cold, wet conditions delayed corn and soybean harvests in the Western Corn Belt and produced high-moisture crops, requiring costly drying prior to storage. Many farmers left crops in the field unharvested due to wet fields or the lack of access to sufficient propane to dry wet crops. As of December 2, 2019, nearly 11% of the corn crop remained unharvested.10

Diminished Trade Prospects Contribute to Market Uncertainty

The United States is traditionally one of the world's leading exporters of corn, soybeans, and soybean products—vegetable oil and meal. During the recent five-year period from marketing year 2013/2014 to 2017/2018, the United States exported 49% of its soybean production and 15% of its corn crop.11 Thus, the export outlook for both of these crops is critical to farm sector profitability and regional economic activity across large swaths of the United States as well as in international markets. However, the tariff-related trade dispute between the United States and China (as well as several other major trading partners) has resulted in lower purchases of U.S. agricultural products by China in calendar years 2018 and 2019, and has cast uncertainty over the outlook for the U.S. agricultural sector, including the corn and soybean markets.12

Livestock Outlook for 2019 and 2020

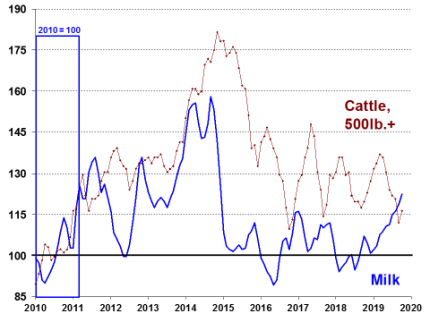

Because the livestock sectors (particularly dairy and cattle, but hogs and poultry to a lesser degree) have longer biological lags and often require large capital investments up front, they are slower to adjust to changing market conditions than is the crop sector. As a result, USDA projects livestock and dairy production and prices an extra year into the future (compared with the crop sector) through 2020, and market participants consider this expanded outlook when deciding their market interactions—buy, sell, invest, etc.

Background on the U.S. Cattle-Beef Sector

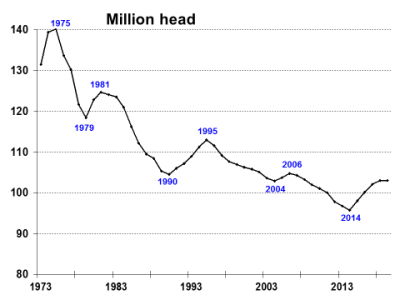

During the 2007-2014 period, high feed and forage prices plus widespread drought in the Southern Plains—the largest U.S. cattle production region—resulted in an 8% contraction of the U.S. cattle inventory. Reduced beef supplies led to higher producer and consumer prices and record profitability among cow-calf producers in 2014. This was coupled with then-improved forage conditions, all of which helped to trigger the slow rebuilding phase in the cattle cycle that started in 2014 (Figure 4).

|

Figure 4. U.S. Beef Cattle Inventory (Including Calves) Since 1973 |

|

|

Source: NASS, Cattle, July 19, 2019. Notes: Inventory data are for July 1 of each year. |

The expansion continued through 2018, despite weakening profitability, primarily due to the lag in the biological response to the strong market price signals of late 2014.13 The cattle expansion appears to have levelled off in 2019, with the estimated cattle and calf population unchanged from a year earlier at 103 million.14 Another factor working against continued expansion in cattle numbers is that producers are now producing more beef with fewer cattle as a result of heavier weights for marketed cattle.

Robust Production Growth Projected Across the Livestock Sector

Similar to the cattle sector, U.S. hog and poultry flocks have been growing in recent years and are expected to continue to expand in 2019.15 For 2019, USDA projects production of beef (+0.6%), pork (+5.0%), broilers (+2.7%), and eggs (+2.5%) to expand robustly heading into 2020. This growth in protein production is expected to be followed by continued positive growth rates in 2020: beef (+1.9%), pork (+3.8%), broilers (+1.8%), and eggs (+0.8%). A key uncertainty for the meat-producing sector is whether demand will expand rapidly enough to absorb the continued growth in output or whether surplus production will begin to pressure prices lower. USDA projects that combined domestic and export demand for 2019 will continue to grow for red meat (+6.2%)—driven primarily by demand for pork products—but flatten for poultry (+0.0%).

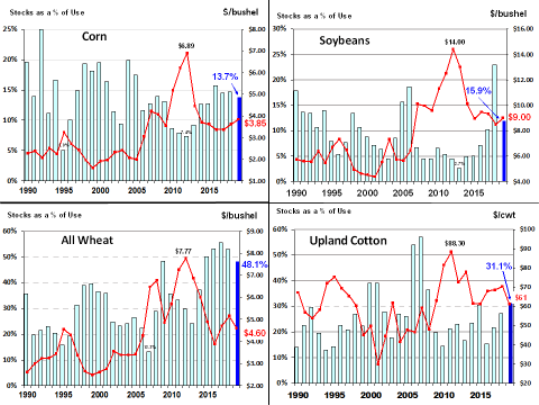

Livestock-Price-to-Feed-Cost Ratios Signal Profitability Outlook

The changing conditions for the U.S. livestock sector may be tracked by the evolution of the ratios of livestock output prices to feed costs (Figure 5). A higher ratio suggests greater profitability for producers.16 The cattle-, hog-, and broiler-to-feed margins have all exhibited significant volatility during the 2017-2019 period.17 The hog, broiler, and cattle feed ratios have trended downward during 2018 and 2019, suggesting eroding profitability. The milk-to-feed price ratio has trended upward from mid-2018 into 2019. While this result varies widely across the United States, many small or marginally profitable cattle, hog, broiler, and milk producers face continued financial difficulties.

Continued production growth of between 1% and 4% for red meat and poultry suggests that prices are vulnerable to weakness in demand. However, USDA projects that the price outlook for cattle, hogs, and poultry is expected to turn upward in 2020 (Table A-4). Similarly, U.S. milk production is projected to continue growing in 2019 (+0.5%) and 2020 (+1.7%). Despite this growth, USDA projects U.S. milk prices up in both 2019 (+14.4%) and 2020 (1.3%).18

Gross Cash Income Highlights

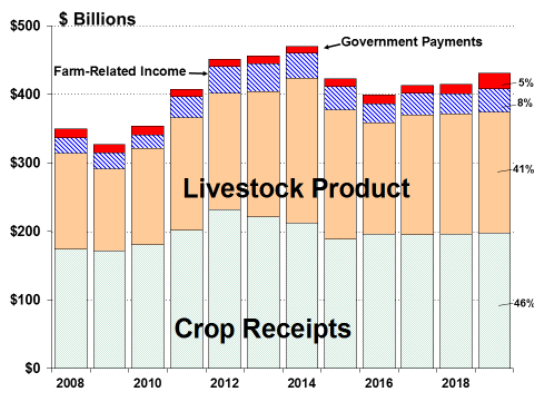

Projected farm-sector revenue sources in 2019 include crop revenues (46% of sector revenues), livestock receipts (41%), government payments (5%), and other farm-related income (8%), including crop insurance indemnities, machine hire, and custom work. Total farm sector gross cash income for 2019 is projected to be up (+3.9%) to $431.0 billion, driven by increases in both direct government payments (+64.0%) and other farm-related income (+18.1%). Cash receipts from crop receipts (+1.0%) and livestock product (+0.1%) are up (+0.6%) in the aggregate (Figure 6).

|

|

Source: ERS, "2019 Farm Income Forecast," November 27, 2019. All values are nominal—that is, not adjusted for inflation. Values for 2019 are forecasts. Gross farm income percentage shares (right-hand side) are for 2019. Notes: Farm-related income includes income from custom work, machine hire, agro-tourism, forest product sales, crop insurance indemnities, and cooperative patronage dividend fees. |

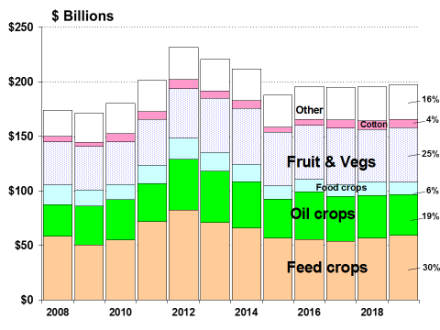

Crop Receipts

Total crop sales peaked in 2012 at $231.6 billion when a nationwide drought pushed commodity prices to record or near-record levels. In 2019, crop sales are projected at $197.4 billion, up 1.0% from 2018 (Figure 7). Projections for 2019 and percentage changes from 2018 include

- Feed crops—corn, barley, oats, sorghum, and hay: $59.6 billion (+4.5%);

- Oil crops—soybeans, peanuts, and other oilseeds: $37.6 billion (-5.2%);

- Fruits and nuts: $29.4 billion (+1.3%);

- Vegetables and melons: $20.4 billion (+10.0%);

- Food grains—wheat and rice: $11.3 billion (-7.2%);

- Cotton: $7.4 billion (-8.5%); and

- Other crops including tobacco, sugar, greenhouse, and nursery: $31.3 billion (+3.4%).

Livestock Receipts

The livestock sector includes cattle, hogs, sheep, poultry and eggs, dairy, and other minor activities. Cash receipts for the livestock sector grew steadily from 2009 to 2014, when it peaked at a record $212.3 billion. However, the sector turned downward in 2015 (-10.7%) and again in 2016 (-14.1%), driven largely by projected year-over-year price declines across major livestock categories (Table A-4 and Figure 9).

In 2017, livestock sector cash receipts recovered with year-to-year growth of 8.1% to $175.6 billion. In 2018, cash receipts increased slightly (+0.6%). In 2019, cash receipts are projected up slightly (+0.1%) for the sector at $176.8 billion as increased hog and dairy sales offset declines in poultry and cattle. Projections for 2019 (and percentage changes from 2018) include

- Cattle and calf sales: $66.5 billion (-0.9%);

- Poultry and egg sales: $40.0 billion (-13.6%);

- Dairy sales: valued at $39.9 billion (+13.2%);

- Hog sales: $23.5 billion (+11.2%); and

- Miscellaneous livestock:19 valued at $7.0 billion (+2.1%).

|

|

Source: ERS, "2019 Farm Income Forecast," November 27, 2019. All values are nominal—not adjusted for inflation. Values for 2019 are forecasts. Percentage shares of crop receipts (right-hand side) are for 2019. |

|

|

Source: ERS, "2019 Farm Income Forecast," November 27, 2019. All values are nominal—that is, not adjusted for inflation. Values for 2019 are forecasts. |

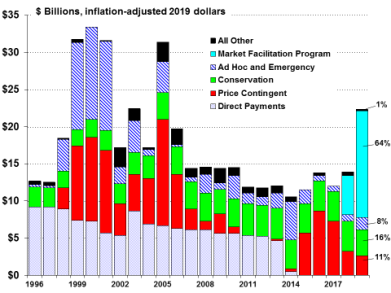

Government Payments

Historically, government payments have included

- Direct payments (decoupled payments based on historical planted acres),

- Price-contingent payments (program outlays linked to market conditions),

- Conservation payments (including the Conservation Reserve Program and other environmental-based outlays),

- Ad hoc and emergency disaster assistance payments (including emergency supplemental crop and livestock disaster payments and market loss assistance payments for relief of low commodity prices), and

- Other miscellaneous outlays (including market facilitation payments, cotton ginning cost-share, biomass crop assistance program, peanut quota buyout, milk income loss, tobacco transition, and other miscellaneous payments).

Projected government payments of $22.4 billion in 2019 would be up 64.0% from 2018 and would be the largest taxpayer transfer to the agriculture sector (in absolute dollars) since 2005 (Figure 11 and Table A-1). The projected surge in federal subsidies is driven by large "trade-damage" payments made under the MFP initiated by USDA in response to the U.S.-China trade dispute.20 MFP payments (reported to be $14.3 billion) in 2019 include outlays from the 2018 MFP program that were not received by producers until 2019, as well as expected payments under the first and second tranches of the 2019 MFP program.

USDA ad hoc disaster assistance21 is projected higher year-over-year at $1.7 billion (+90.7%). Most of the $1.7 billion comes from a new, temporary program, the Wildfire and Hurricane Indemnity Program Plus (WHIP+) enacted through the Disaster Relief Act of 2019 (P.L. 116-20). Payments under the Agricultural Risk Coverage and Price Loss Coverage programs are projected lower (-19.0%) in 2019 at a combined $2.6 billion compared with an estimated $3.2 billion in 2018 (see "Price Contingent" in Figure 11).22

Conservation programs include all conservation programs operated by USDA's Farm Service Agency and the Natural Resources Conservation Service that provide direct payments to producers. Estimated conservation payments of $3.5 billion are forecast for 2019, down (-11.3%) from $4.0 billion in 2018.

Total government payments of $22.4 billion represents a 5% share of projected gross cash income of $425.3 billion in 2019 (Figure 6). In contrast, government payments are expected to represent 24% of the projected net farm income of $92.5 billion. If realized, this would be the largest share since 2006 (Figure 12). The government share of net farm income reached a peak of 65.2% in 1984 during the height of the farm crisis of the 1980s. The importance of government payments as a percentage of net farm income varies nationally by crop and livestock sector and by region.

|

|

Source: Compiled by CRS from ERS, "2019 Farm Income Forecast," November 27, 2019. |

Dairy Margin Coverage Program Outlook

The 2018 farm bill (P.L. 115-334) made several changes to the previous Margin Protection Program (MPP), including a new name—the Dairy Margin Coverage (DMC) program—and expanded margin coverage choices from the original range of $4.00-$8.00 per hundredweight (cwt.).23 Under the 2018 farm bill, milk producers have the option of covering the milk-to-feed margin up to a threshold of $9.50/cwt. on the first 5 million pounds of milk coverage.

The DMC margin differs from the USDA-reported milk-to-feed ratio (shown in Figure 5), but reflects the same market forces. As of October 2019, the formula-based milk-to-feed margin used to determine government payments had risen to $10.88/cwt., above the newly instituted $9.50/cwt. payment threshold (Figure 13), thus decreasing the likelihood that DMC payments might be available in the second half of 2019. In total, the DMC program is expected to make $214 million in payments in 2019, down from $250 million under the previous MPP in 2018.

|

Figure 13. The Dairy Output-to-Input Margin Has Risen Above $9.50/cwt. in 2019 (The dairy margin equals the national average farm price of milk less average feed costs per 100 pounds.) |

|

|

Source: NASS, Agricultural Prices, November 27, 2019; calculations by CRS. All values are nominal. Note: The margin equals the All Milk price minus a composite feed price based on the formula used by the DMC of the 2018 farm bill starting January 2019 and, for all prior months, the MPP of the 2014 farm bill (P.L. 113-79). See CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison. |

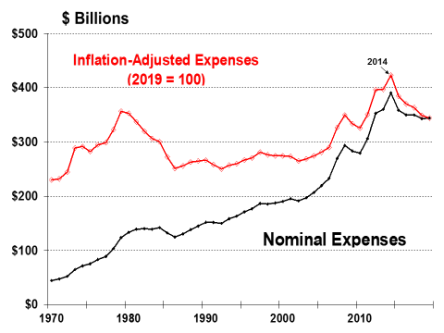

Production Expenses

Total production expenses for 2019 for the U.S. agricultural sector are projected to be up slightly (+0.2%) from 2018 in nominal dollars at $344.6 billion (Figure 14). Production expenses peaked in both nominal and inflation-adjusted dollars in 2014, then declined for five consecutive years in inflation-adjusted dollars. However, in nominal dollars production expenses are projected to turn upward in 2019.

Production expenses affect crop and livestock farms differently. The principal expenses for livestock farms are feed costs, purchases of feeder animals and poultry, and hired labor. Feed costs, labor expenses, and property taxes are all projected up in 2019 (Figure 15). In contrast, fuel, seed, pesticides, interest, and fertilizer costs—all major crop production expenses—are projected lower.

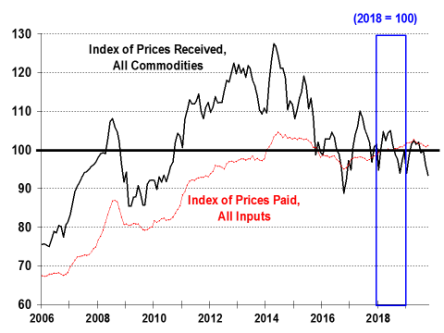

But how have production expenses moved relative to revenues? A comparison of the indexes of prices paid (an indicator of expenses) versus prices received (an indicator of revenues) reveals that the prices received index generally declined from 2014 through 2016, rebounded in 2017, then declined again in 2019 (Figure 16). Farm input prices (as reflected by the prices paid index) showed a similar pattern but with a smaller decline from their 2014 peak and have climbed steadily since mid-2016, suggesting that farm sector profit margins have been squeezed since 2016.

|

Figure 15. Farm Production Expenses for Selected Items, 2018 and 2019F |

|

|

Source: ERS, "2019 Farm Income Forecast," November 27, 2019. All values are nominal. Values for 2019 are forecasts. |

Cash Rental Rates

Renting or leasing land is a way for young or beginning farmers to enter agriculture without incurring debt associated with land purchases. It is also a means for existing farm operations to adjust production more quickly in response to changing market and production conditions while avoiding risks associated with land ownership. The share of rented farmland varies widely by region and production activity. However, for some farms it constitutes an important component of farm operating expenses. Since 2002, about 39% of agricultural land used in U.S. farming operations has been rented.24

The majority of rented land in farms is rented from nonoperating landlords.25 Nationally in 2017, 29% of all land in farms was rented from someone other than a farm operator. Some farmland is rented from other farm operations—nationally about 8% of all land in farms in 2017 (the most recent year for which data are available)—and thus constitutes a source of income for some operator landlords. Total net rent to nonoperator landlords is projected to be down (-1.2%) to $12.7 billion in 2019.

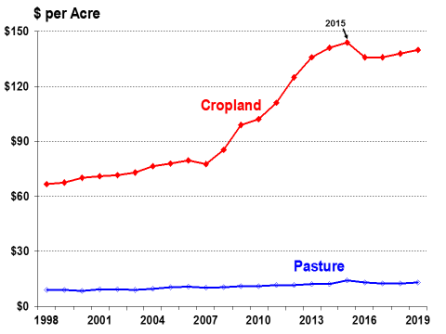

Average cash rental rates for 2019 were up (+1.4%) year-over-year ($140 per acre versus $138 in 2018). Farm rental rates are generally set during the preceding fall or in early spring prior to field work. National average rental rates dipped in 2016, but continue to reflect the high crop prices and large net returns of the preceding several years, especially the 2011-2014 period (Figure 17). The national rental rate for cropland peaked at $144 per acre in 2015.26

|

Figure 17. U.S. Average Farmland Cash Rental Rates Since 1998 |

|

|

Source: NASS, Agricultural Land Values, August 2019. All values are nominal. |

Agricultural Trade Outlook

U.S. agricultural exports have been a major contributor to farm income, especially since 2005. As a result, the financial success of the U.S. agricultural sector is strongly linked to international demand for U.S. products. Because of this strong linkage, the downturn in U.S. agricultural exports that started in 2015 (Figure 18) deepened the downturn in farm income that ran from 2013 through 2016 (Figure 1). Since 2018, the U.S. agricultural sector's trade outlook has been vulnerable to several international trade disputes, particularly the ongoing dispute between the United States and China.27 A return to market-based farm income growth for the U.S. agricultural sector would likely need improved international trade prospects.

Key U.S. Agricultural Trade Highlights

- USDA projects U.S. agricultural exports at $135.5 billion in FY2019, down (-5.5%) from $143.4 billion in FY2018.28 Export data include processed and unprocessed agricultural products. This aggregate downturn masks larger country-level changes that have occurred as a result of ongoing trade disputes (discussed below).

- In FY2019, U.S. agricultural imports are projected up at $113.0 billion (+2.7%), and the resultant agricultural trade surplus of $7.0 billion would be the lowest since 2006.

|

Figure 18. U.S. Agricultural Trade Since 2005 in 2019 Dollars |

|

|

Source: ERS, Outlook for U.S. Agricultural Trade, AES-110, November 25, 2019. Amounts for 2019 and 2020 are projected. |

- A substantial portion of the surge in U.S. agricultural exports that occurred between 2010 and 2014 was due to higher-priced grain and feed shipments, including record oilseed exports to China and growing animal product exports to East Asia. As commodity prices have leveled off, so too have export values (see the commodity price indexes in Figure A-1 and Figure A-2).

- In FY2017, the top three markets for U.S. agricultural exports were China,29 Canada, and Mexico, in that order. Together, these three countries accounted for 47% of total U.S. agricultural exports during the five-year period FY2013-FY2017 (Figure 19).

- However, in FY2019 the combined share of U.S. exports taken by China, Canada, and Mexico is projected down to 40% largely due to lower exports to China. The ordering of the top markets in 2019 is projected to be Canada, Mexico, the European Union (EU), Japan, and China, as China is projected to decline as a destination for U.S. agricultural exports.

- From FY2013 through FY2017, China imported an average of $26.4 billion of U.S. agricultural products. However, USDA reported that China's imports of U.S. agricultural products declined to $20.5 billion in FY2018, and are projected to decline further to $13.6 billion in FY2019 as a result of the U.S.-China trade dispute.

- The fourth- and fifth-largest U.S. export markets have traditionally been the EU and Japan, which accounted for a combined 17% of U.S. agricultural exports during the FY2014 to FY2018 period. These two markets have shown limited growth in recent years when compared with the rest of the world. However, their combined share is projected to grow slightly to 18% in FY2019 (Figure 19).

- The "Rest of World" (ROW) component of U.S. agricultural trade—South and Central America, the Middle East, Africa, and Southeast Asia—has shown strong import growth in recent years. ROW is expected to account for 42% of U.S. agricultural exports in FY2019. ROW import growth is being driven in part by both population and GDP growth but also from shifting trade patterns as some U.S. products previously targeting China have been diverted to new ROW markets.

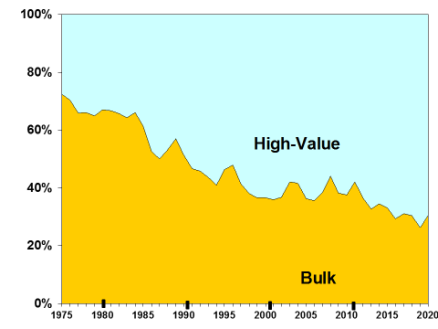

- Over the past four decades, U.S. agricultural exports have experienced fairly steady growth in shipments of high-value products—including horticultural products, livestock, poultry, and dairy. High-valued exports are forecast at $100.1 billion for a 73.8% share of U.S. agricultural exports in FY2019 (Figure 20).

- In contrast, bulk commodity shipments (primarily wheat, rice, feed grains, soybeans, cotton, and unmanufactured tobacco) are forecast at a record low 26.2% share of total U.S. agricultural exports in FY2019 at $35.5 billion. This compares with an average share of over 60% during the 1970s and into the 1980s. As grain and oilseed prices decline, so will the bulk value share of U.S. exports.

|

Figure 20. U.S. Agricultural Trade: Bulk vs. High-Value Shares |

|

|

Source: ERS, Outlook for U.S. Agricultural Trade, AES-110, November 25, 2019. Amounts for 2019 are projected. |

Farm Asset Values and Debt

The U.S. farm income and asset-value situation and outlook suggest a slowly eroding financial situation heading into 2019 for the agriculture sector as a whole. Considerable uncertainty clouds the economic outlook for the sector, reflecting the downward outlook for prices and market conditions, an increasing dependency on international markets to absorb domestic surpluses, and an increasing dependency on federal support to offset lost trade opportunities due to ongoing trade disputes.

- Farm asset values—which reflect farm investors' and lenders' expectations about long-term profitability of farm sector investments—are projected to be up 2.3% in 2019 to a nominal $3.1 trillion (Table A-3). In inflation-adjusted terms (using 2018 dollars), farm asset values peaked in 2014 (Figure 21).

- Nominally higher farm asset values are expected in 2019 due to increases in both real estate values (+2.1%) and nonreal-estate values (+3.4%). Real estate is projected to account for 83% of total farm sector asset value.

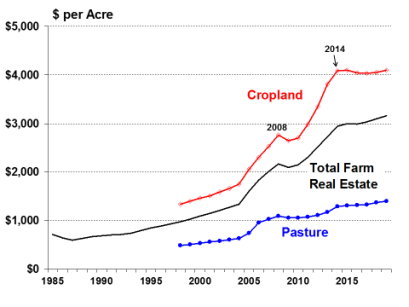

- Crop land values are closely linked to commodity prices. The leveling off of crop land values since 2015 reflects stagnant commodity prices (Figure 22).

|

|

Source: NASS, Land Values 2019 Summary, August 2019. Notes: Farm real estate value measures the value of all land and buildings on farms. Separate cropland and pasture values are available only since 1998. All values are nominal. |

|

Measuring Farm Wealth: The Debt-to-Asset Ratio A useful measure of the farm sector's financial well-being is net worth as measured by farm assets minus farm debt. A summary statistic that captures this relationship is the debt-to-asset ratio. Farm assets include both physical and financial farm assets. Physical assets include land, buildings, farm equipment, on-farm inventories of crops and livestock, and other miscellaneous farm assets. Financial assets include cash, bank accounts, and investments such as stocks and bonds. Farm debt includes both business and consumer debt linked to real estate and nonreal-estate assets (e.g., financial assets, inventories of agricultural products, and the value of machinery and motor vehicles) of the farm sector. The debt-to-asset ratio compares the farm sector's outstanding debt related to farm operations relative to the value of the sector's aggregate assets. Change in the debt-to-asset ratio is a critical barometer of the farm sector's financial performance, with lower ratios indicating greater financial resiliency. A lower debt-to-asset ratio suggests that the sector is better able to withstand short-term increases in debt related to interest rate fluctuations or changes in the revenue stream related to lower output prices, higher input prices, or production shortfalls. The largest single component in a typical farmer's investment portfolio is farmland. As a result, real estate values affect the financial well-being of agricultural producers and serve as the principal source of collateral for farm loans. |

- Total farm debt is forecast to rise to a record $415.5 billion in 2019 (+3.4%) (Table A-3). Farm equity—or net worth, defined as asset value minus debt—is projected to be up slightly (+2.2%) at $2.7 trillion in 2019 (Table A-3).

- The farm debt-to-asset ratio is forecast up in 2019 at 13.4%, the highest level since 2003 but still relatively low by historical standards (Figure 23). If realized, this would be the seventh consecutive year of increase in the debt-to-asset ratio.

|

|

Source: ERS, "2019 Farm Income Forecast," November 27, 2019. Values for 2019 are forecasts. |

Average Farm Household Income

A farm can have both an on-farm and an off-farm component to its income statement and balance sheet of assets and debt.30 Thus, the well-being of farm operator households is not equivalent to the financial performance of the farm sector or of farm businesses because of the inclusion of nonfarm investments, jobs, and other links to the nonfarm economy.

- Average farm household income (sum of on- and off-farm income) is projected at $120,082 in 2019 (Table A-2), up 7.0% from 2018 but 10.5% below the record of $134,165 in 2014.

- About 20% ($24,106) of total farm household income in 2019 is projected to be from farm production activities, and the remaining 80% ($95,976) is earned off the farm (including financial investments).

- The share of farm income derived from off-farm sources had increased steadily for decades but peaked at about 95% in 2000 (Figure 24). Since 2014, over half of U.S. farm operations have had negative income from their agricultural operations.

Total vs. Farm Household Average Income

- Since the late 1990s, farm household incomes have surged ahead of average U.S. household incomes (Figure 25). In 2018 (the last year for which comparable data were available), the average farm household income of $112,211 was about 25% higher than the average U.S. household income of $90,021 (Table A-2).

Appendix. Supporting Charts and Tables

Figure A-1 to Figure A-4 present USDA data on monthly farm prices received for several major farm commodities—corn, soybeans, wheat, upland cotton, rice, milk, cattle, hogs, and chickens. The data are presented in an indexed format where monthly price data for year 2010 = 100 to facilitate comparisons.

Table A-1 to Table A-3 present aggregate farm income variables that summarize the financial situation of U.S. agriculture. In addition, Table A-4 presents the annual average farm price received for several major commodities, including the USDA forecast for the 2019-2020 marketing year.

|

2019 Forecasts |

2018 to 2019 |

||||||||||||||||||||||||||

|

Item |

2014 |

2015 |

2016 |

2017 |

2018 |

3-6-19 |

8-30-19 |

11-27-19 |

Change (%)a |

||||||||||||||||||

|

1. Cash receipts |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Cropsb |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Livestock |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

2. Government paymentsc |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

CCP-PLC-ARCd |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Marketing loan benefitse |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Conservation |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Ad hoc and emergencyf |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

All otherg |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

3. Farm-related incomeh |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

4. Gross cash income (1+2+3) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

5. Cash expensesi |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

6. NET CASH INCOME |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

7. Total gross revenuesj |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

8. Total production expensesk |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

9. NET FARM INCOME |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Source: ERS, Farm Income and Wealth Statistics; U.S. and State Farm Income and Wealth Statistics, updated as of November 27, 2019. NA = not applicable.

a. Change represents year-to-year projected change between 2018 and the November 27, 2019, forecast for 2019.

b. Includes Commodity Credit Corporation loans under the farm commodity support program.

c. Government payments reflect payments made directly to all recipients in the farm sector, including landlords. The nonoperator landlords' share is offset by its inclusion in rental expenses paid to these landlords and thus is not reflected in net farm income or net cash income.

d. CCP = counter-cyclical payments. PLC = Price Loss Coverage. ARC = Agricultural Risk Coverage.

e. Includes loan deficiency payments, marketing loan gains, and commodity certificate exchange gains.

f. Includes payments made under the Average Crop Revenue Election program, which was eliminated by the 2014 farm bill (P.L. 113-79).

g. Market facilitation payments, cotton ginning cost-share, biomass crop assistance program, milk income loss, tobacco transition, and other miscellaneous payments.

h. Income from crop insurance indemnities, custom work, machine hire, agri-tourism, forest product sales, and other farm sources.

i. Excludes depreciation and perquisites to hired labor.

j. Gross cash income plus inventory adjustments, the value of home consumption, and the imputed rental value of operator dwellings.

k. Cash expense plus depreciation and perquisites to hired labor.

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|||||||||

|

Average U.S. farm income by source |

|

|

|

|

|

|

|

|

||||||||

|

On-farm income |

|

|

|

|

|

|

|

|

||||||||

|

Off-farm income |

|

|

|

|

|

|

|

|

||||||||

|

Total farm income |

|

|

|

|

|

|

|

|

||||||||

|

Average U.S. household income |

|

|

|

|

|

|

|

NA |

||||||||

|

Farm household income as share of U.S. avg. household income (%) |

156% |

161% |

177% |

151% |

142% |

129% |

125% |

NA |

Source: ERS, Farm Household Income and Characteristics, principal farm operator household finances, data set updated as of November 27, 2019, http://www.ers.usda.gov/data-products/farm-household-income-and-characteristics.aspx.

Note: NA = not available. Data for 2019 are USDA forecasts.

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|||||||||||||||||

|

Farm assets |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Farm debt |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Farm equity |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Debt-to-asset ratio (%) |

|

|

|

|

|

|

|

|

Source: ERS, Farm Income and Wealth Statistics; U.S. and State Farm Income and Wealth Statistics, updated as of November 27, 2019, http://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics.aspx.

Note: Data for 2019 are USDA forecasts.

|

Commoditya |

Unit |

Year |

2014-2015 |

2015-2016 |

2016-2017 |

2017-2018 |

2018-2019 |

2019-2020b |

% Change 2018/19 to 2019/20 |

2020-2021b |

% Change 2019/20 to 2020/21 |

Loan Ratec |

Refer-ence Price |

|||||||||||||||||||

|

Wheat |

$/bu |

Jun-May |

|

|

|

|

|

|

|

— |

— |

|

|

|||||||||||||||||||

|

Corn |

$/bu |

Sep-Aug |

|

|

|

|

|

|

|

— |

— |

|

|

|||||||||||||||||||

|

Sorghum |

$/bu |

Sep-Aug |

|

|

|

|

|

|

|

— |

— |

|

|

|||||||||||||||||||

|

Barley |

$/bu |

Jun-May |

|

|

|

|

|

|

|

— |

— |

|

|

|||||||||||||||||||

|

Oats |

$/bu |

Jun-May |

|

|

|

|

|

|

|

— |

— |

|

|

|||||||||||||||||||

|

Rice |

$/cwt |

Aug-Jul |

|

|

|

|

|

|

|

— |

— |

|

|

|||||||||||||||||||

|

Soybeans |

$/bu |

Sep-Aug |

|

|

|

|

|

|

|

— |

— |

|

|

|||||||||||||||||||

|

Soybean Oil |

¢/lb |

Oct-Sep |

|

|

|

|

|

|

|

— |

— |

— |

— |

|||||||||||||||||||

|

Soybean Meal |

$/st |

Oct-Sep |

|

|

|

|

|

|

|

— |

— |

— |

— |

|||||||||||||||||||

|

Cotton, Upland |

¢/lb |

Aug-Jul |

|

|

|

|

|

|

|

— |

— |

45-52 |

none |

|||||||||||||||||||

|

Choice Steers |

$/cwt |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

|||||||||||||||||||

|

Barrows/Gilts |

$/cwt |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

|||||||||||||||||||

|

Broilers |

¢/lb |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

|||||||||||||||||||

|

Eggs |

¢/doz |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

|||||||||||||||||||

|

Milk |

$/cwt |

Jan-Dec |

|

|

|

|

|

|

|

|

|

— |

— |

|||||||||||||||||||

Source: Various USDA agency sources as described in the notes below.

Notes: bu = bushels, cwt = 100 pounds, lb = pound, st = short ton (2,000 pounds), doz = dozen.

a. Price for grains and oilseeds are from USDA, World Agricultural Supply and Demand Estimates (WASDE), November 8, 2019. Calendar year data are for the first year. For example, 2019-2020 = 2019. "—" = no value, and USDA's out-year 2020/21 crop price forecasts will first appear in the May 2020 WASDE. Soybean and livestock product prices are from USDA, Agricultural Marketing Service: soybean oil—Decatur, IL, cash price, simple average crude; soybean meal—Decatur, IL, cash price, simple average 48% protein; choice steers—Nebraska, direct 1,100-1,300 lbs.; barrows/gilts—national base, live equivalent 51%-52% lean; broilers—wholesale, 12-city average; eggs—Grade A, New York, volume buyers; and milk—simple average of prices received by farmers for all milk.

b. Data for 2019-2020 are USDA forecasts. Data for 2020-2021 are USDA projections.

c. Loan rate and reference prices are for the 2019-2020 market year as defined under the 2018 farm bill (P.L. 115-334). The loan rate for upland cotton equals the average market-year-average price for the two preceding crop years but within the range of 45 cents/lb. and 52 cents/lb. See CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison

Author Contact Information

Footnotes

| 1. |

ERS, "Farm Structure and Organization," http://www.ers.usda.gov/topics/farm-economy/farm-structure-and-organization.aspx; and "Farm Household Well-Being," http://www.ers.usda.gov/topics/farm-economy/farm-household-well-being.aspx. |

| 2. |

See the shadow box "ERS's Annual Farm Income Forecast," for a description of ERS's farm income forecast schedule. ERS's 2019 Farm Sector Income Forecasts are available at https://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances/farm-sector-income-forecast/. |

| 3. |

For both national and state-level farm income, see ERS, "U.S. and State Farm Income and Wealth Statistics," http://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics.aspx. |

| 4. |

See CRS Report R45865, Farm Policy: USDA's 2019 Trade Aid Package, by Randy Schnepf. |

| 5. |

Indirect federal subsidies such as crop insurance premium subsidies—valued at a projected $10.2 billion in 2019—are not included in the $22.4 billion federal subsidy amount. |

| 6. |

ERS, Outlook for U.S. Agricultural Trade, August 29, 2019. |

| 7. |

See CRS Report R45903, Retaliatory Tariffs and U.S. Agriculture, by Anita Regmi. |

| 8. |

USDA, World Agricultural Outlook Board (WAOB), World Agricultural Supply and Demand Estimates (WASDE), November 8, 2019. |

| 9. |

USDA, Farm Service Agency (FSA), FSA Crop Acreage Data Reported to FSA, 2019 Crop Year, as of November 24, 2019. |

| 10. |

During the previous five-year period, 2014-2018, on average, 98% of the U.S. corn crop has been harvested by December 2. USDA, National Agricultural Statistics Service (NASS), Crop Progress, December 2, 2019. |

| 11. |

A marketing year is the 12-month period that starts with the harvest of a program crop. For corn and soybeans, the marketing year starts on September 1 and runs through August 31 of the following year. |

| 12. |

CRS Report R45903, Retaliatory Tariffs and U.S. Agriculture, by Anita Regmi. |

| 13. |

J. Mintert, "Cattle Inventory Growth Slowing Down, but Beef Production Still Increasing," farmdoc daily, vol. 8, no. 18 (February 5, 2018). |

| 14. |

NASS, Cattle, July 19, 2019. |

| 15. |

WAOB, WASDE, Table—U.S. Quarterly Animal Product Production, November 8, 2019, pp. 31 and 32. |

| 16. |

The ratio is calculated as the farm price for milk, cattle (steers and heifers), hogs, and broilers compared to their major feed source: Cattle and hog feed cost is 100% corn; broilers feed cost is 58% corn and 42% soybeans; dairy feed cost is a mix of corn, soybean meal, and alfalfa hay. Feed costs—at 30%-80% of variable costs—are generally the largest cost component in livestock operations. |

| 17. |

Broilers are chickens raised for meat. Layers are chickens retained for egg production. |

| 18. |

WAOB, WASDE, Table—U.S. Quarterly Prices for Animal Products, November 8, 2019, p. 31. |

| 19. |

Miscellaneous livestock includes aquaculture, sheep and lambs, honey, mohair, wool, pelts, and other animal products. |

| 20. |

USDA has initiated two trade aid packages with up to $28 billion of financial support designed to partially offset the negative price and income effects of lost commodity sales to major markets. The 2018 trade aid package was valued at up to $12 billion (see CRS Report R45310, Farm Policy: USDA's 2018 Trade Aid Package), while the 2019 trade aid package was valued at up to $16 billion (see CRS Report R45865, Farm Policy: USDA's 2019 Trade Aid Package). |

| 21. |

Fiscal year payments generally involve outlay commitments incurred during the previous crop year. For example, FY2019 disaster assistance payments are primarily related to disasters for crops that were grown and harvested in 2018. See CRS Report RS21212, Agricultural Disaster Assistance, for information on available farm disaster programs. |

| 22. |

For details see CRS Report R43448, Farm Commodity Provisions in the 2014 Farm Bill (P.L. 113-79). |

| 23. |

The margin equals the All Milk price minus a composite feed price based on the formula used by the DMC of the 2018 farm bill starting January 2019 and, for all prior months, the MPP of the 2014 farm bill (P.L. 113-79). See CRS Report R45525, The 2018 Farm Bill (P.L. 115-334): Summary and Side-by-Side Comparison, and CRS In Focus IF10195, U.S. Dairy Programs After the 2014 Farm Bill (P.L. 113-79). |

| 24. |

ERS, "Land Use, Land Values and Tenure: Farmland Ownership and Tenure," https://www.ers.usda.gov/topics/farm-economy/land-use-land-value-tenure/farmland-ownership-and-tenure/. |

| 25. |

A landlord maybe either an operator (that is, an active farmer) or nonoperator (that is, not engaged in farming). |

| 26. |

Local and regional land rental rates may vary substantially from the national average. |

| 27. |

For details, see CRS Report R45903, Retaliatory Tariffs and U.S. Agriculture, by Anita Regmi. |

| 28. |

ERS, Outlook for U.S. Agricultural Trade, AES-110, November 25, 2019. |

| 29. |

All China trade statistics include Hong Kong trade. |

| 30. |

ERS, "Farm Household Well-Being," http://www.ers.usda.gov/topics/farm-economy/farm-household-well-being.aspx. |