Bitcoin, Blockchain, and the Energy Sector

The popularity of cryptocurrencies such as Bitcoin and the underlying blockchain technology presents both challenges and opportunities to the energy sector. As interest in Bitcoin and other cryptocurrencies has increased, the energy demand to support cryptocurrency “mining” activities has also increased. The increased energy demand—when localized—can exceed the available power capacity and increase customers’ electricity rates. On the other hand, not all cryptocurrencies require energy-intensive mining operations. Some cryptocurrencies can operate under algorithms that require less energy. In addition, blockchain technologies could present opportunities for the energy sector by facilitating energy and financial transactions on a smart grid.

Bitcoin and other cryptocurrencies can be used to make payments without banks or other third-party intermediaries, and are sometimes considered virtual currency. The technology underlying these cryptocurrencies is blockchain. A blockchain is a digital distributed ledger that enables parties who may not otherwise trust one another to agree on the current ownership and distribution of assets in order to conduct new business. New blocks may be added to a blockchain through a variety of methods. In mining blocks, users seek to add the next block to the chain. For Bitcoin, new blocks are added to the blockchain through a proof-of-work (PoW) algorithm. Under PoW, miners—those seeking to add a block to a blockchain—are presented a difficult computational problem. Once the problem is solved, other users can validate the solution and confirm the block, adding the next block to the chain. In the case of Bitcoin, miners who create and publish new blocks are rewarded with Bitcoin. Less energy intensive, alternative algorithms exist, such as proof of stake and proof of authority.

Cryptocurrency mining through PoW requires substantial energy to (1) operate the devices computing the calculations required to maintain the integrity of the blockchain and (2) thermally regulate the devices for optimal operation. Devices have different performance capabilities and have different power requirements. Generally, the device, or a cluster of devices, that can perform more calculations per second will require more energy for powering and cooling the device or devices.

Global power requirement estimates for Bitcoin have increased within the last five years. Network power estimates for 2018 range between 2,500 megawatts (MW) and 7,670 MW, which, for comparison, is nearly 1% of U.S. electricity generating capacity. Opinions differ on whether future growth in Bitcoin will significantly impact energy consumption and subsequent carbon dioxide (CO2) emissions.

Cryptocurrency mining includes costs associated with equipment, facilities, labor, and electricity. Some users pool computational resources to solve PoW problems faster, and are on a worldwide hunt for cheap, reliable electricity in abundance. While many mining pools are in China, some have been able to utilize closed industrial facilities in the United States that can provide abundant electricity at affordable rates. According to a study in 2017, nearly three-quarters of all major mining pools are based in either China (58%) or in the United States (16%). By some estimates, the state of Washington hosted 15%-30% of all Bitcoin mining operations globally in 2018.

Governments are developing various policies in response to growth in energy demand by cryptocurrency mining activities. In some areas, applications from potential mining companies have exceeded the available capacity. Other areas have offered reduced electricity rates to attract miners. In the United States, in addition to efforts at the state and local level, there are potential options that could be adopted by the federal government to improve the energy efficiency of mining operations. Potential federal policy options include minimum energy conservation standards, voluntary energy efficiency standards, and data center energy efficiency standards.

In addition to the challenges that cryptocurrency mining presents to the energy sector, there are also opportunities, particularly for blockchain. These may include electric vehicle charging infrastructure and distributed energy resources, among others. The U.S. electricity grid is critical infrastructure and subject to certain regulations to maintain safe and reliable operations. Opinions differ as to a potential role for blockchain technology in the energy sector.

Bitcoin, Blockchain, and the Energy Sector

Jump to Main Text of Report

Contents

- Introduction

- Blockchain and Cryptocurrencies

- Cryptocurrency Mining

- Mining Technology

- How Much Energy Is Consumed from Bitcoin and Other Cryptocurrency Mining?

- What Is the Cryptocurrency Industry Doing to Reduce Energy Consumption?

- Where Is Bitcoin Mined?

- Cryptocurrency Mining and Utilities: Domestic and International Examples

- New York State

- Plattsburgh, NY

- Massena, NY

- Washington State

- International Case Studies

- Canada

- Georgia

- Iran

- Blockchain Technology Potential for the Energy Sector

- Options for Congress to Address Cryptocurrency's Energy Consumption

- Minimum Energy Conservation Standards

- Voluntary Energy Efficiency Standards

- Data Center Energy Efficiency Standards

- Options for Federal Regulation of Blockchain Technology for Distributed Energy

Summary

The popularity of cryptocurrencies such as Bitcoin and the underlying blockchain technology presents both challenges and opportunities to the energy sector. As interest in Bitcoin and other cryptocurrencies has increased, the energy demand to support cryptocurrency "mining" activities has also increased. The increased energy demand—when localized—can exceed the available power capacity and increase customers' electricity rates. On the other hand, not all cryptocurrencies require energy-intensive mining operations. Some cryptocurrencies can operate under algorithms that require less energy. In addition, blockchain technologies could present opportunities for the energy sector by facilitating energy and financial transactions on a smart grid.

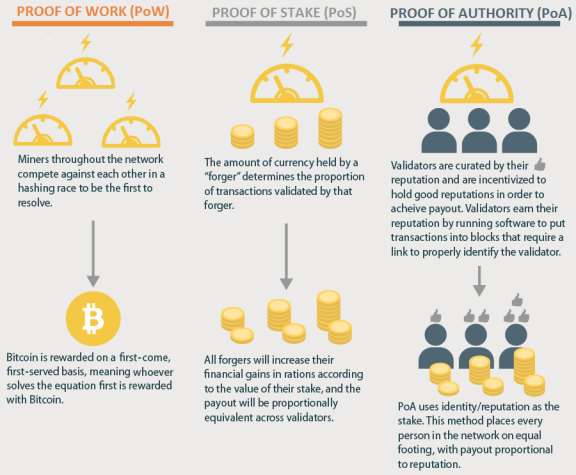

Bitcoin and other cryptocurrencies can be used to make payments without banks or other third-party intermediaries, and are sometimes considered virtual currency. The technology underlying these cryptocurrencies is blockchain. A blockchain is a digital distributed ledger that enables parties who may not otherwise trust one another to agree on the current ownership and distribution of assets in order to conduct new business. New blocks may be added to a blockchain through a variety of methods. In mining blocks, users seek to add the next block to the chain. For Bitcoin, new blocks are added to the blockchain through a proof-of-work (PoW) algorithm. Under PoW, miners—those seeking to add a block to a blockchain—are presented a difficult computational problem. Once the problem is solved, other users can validate the solution and confirm the block, adding the next block to the chain. In the case of Bitcoin, miners who create and publish new blocks are rewarded with Bitcoin. Less energy intensive, alternative algorithms exist, such as proof of stake and proof of authority.

Cryptocurrency mining through PoW requires substantial energy to (1) operate the devices computing the calculations required to maintain the integrity of the blockchain and (2) thermally regulate the devices for optimal operation. Devices have different performance capabilities and have different power requirements. Generally, the device, or a cluster of devices, that can perform more calculations per second will require more energy for powering and cooling the device or devices.

Global power requirement estimates for Bitcoin have increased within the last five years. Network power estimates for 2018 range between 2,500 megawatts (MW) and 7,670 MW, which, for comparison, is nearly 1% of U.S. electricity generating capacity. Opinions differ on whether future growth in Bitcoin will significantly impact energy consumption and subsequent carbon dioxide (CO2) emissions.

Cryptocurrency mining includes costs associated with equipment, facilities, labor, and electricity. Some users pool computational resources to solve PoW problems faster, and are on a worldwide hunt for cheap, reliable electricity in abundance. While many mining pools are in China, some have been able to utilize closed industrial facilities in the United States that can provide abundant electricity at affordable rates. According to a study in 2017, nearly three-quarters of all major mining pools are based in either China (58%) or in the United States (16%). By some estimates, the state of Washington hosted 15%-30% of all Bitcoin mining operations globally in 2018.

Governments are developing various policies in response to growth in energy demand by cryptocurrency mining activities. In some areas, applications from potential mining companies have exceeded the available capacity. Other areas have offered reduced electricity rates to attract miners. In the United States, in addition to efforts at the state and local level, there are potential options that could be adopted by the federal government to improve the energy efficiency of mining operations. Potential federal policy options include minimum energy conservation standards, voluntary energy efficiency standards, and data center energy efficiency standards.

In addition to the challenges that cryptocurrency mining presents to the energy sector, there are also opportunities, particularly for blockchain. These may include electric vehicle charging infrastructure and distributed energy resources, among others. The U.S. electricity grid is critical infrastructure and subject to certain regulations to maintain safe and reliable operations. Opinions differ as to a potential role for blockchain technology in the energy sector.

The popularity of cryptocurrencies such as Bitcoin and the underlying blockchain technology presents both challenges and opportunities to the energy sector. As interest in Bitcoin and other cryptocurrencies has increased, the energy demand to support cryptocurrency "mining" activities has also increased. The increased energy demand—when localized—can exceed the available power capacity and increase customers' electricity rates. On the other hand, not all cryptocurrencies require energy-intensive mining operations. Some cryptocurrencies can operate under algorithms that require less energy. In addition, blockchain technologies could present opportunities for the energy sector by facilitating energy and financial transactions on a smart grid.

Bitcoin and other cryptocurrencies can be used to make payments without banks or other third-party intermediaries, and are sometimes considered virtual currency. The technology underlying these cryptocurrencies is blockchain. A blockchain is a digital distributed ledger that enables parties who may not otherwise trust one another to agree on the current ownership and distribution of assets in order to conduct new business. New blocks may be added to a blockchain through a variety of methods. In mining blocks, users seek to add the next block to the chain. For Bitcoin, new blocks are added to the blockchain through a proof-of-work (PoW) algorithm. Under PoW, miners—those seeking to add a block to a blockchain—are presented a difficult computational problem. Once the problem is solved, other users can validate the solution and confirm the block, adding the next block to the chain. In the case of Bitcoin, miners who create and publish new blocks are rewarded with Bitcoin. Less energy intensive, alternative algorithms exist, such as proof of stake and proof of authority.

Cryptocurrency mining through PoW requires substantial energy to (1) operate the devices computing the calculations required to maintain the integrity of the blockchain and (2) thermally regulate the devices for optimal operation. Devices have different performance capabilities and have different power requirements. Generally, the device, or a cluster of devices, that can perform more calculations per second will require more energy for powering and cooling the device or devices.

Global power requirement estimates for Bitcoin have increased within the last five years. Network power estimates for 2018 range between 2,500 megawatts (MW) and 7,670 MW, which, for comparison, is nearly 1% of U.S. electricity generating capacity. Opinions differ on whether future growth in Bitcoin will significantly impact energy consumption and subsequent carbon dioxide (CO2) emissions.

Cryptocurrency mining includes costs associated with equipment, facilities, labor, and electricity. Some users pool computational resources to solve PoW problems faster, and are on a worldwide hunt for cheap, reliable electricity in abundance. While many mining pools are in China, some have been able to utilize closed industrial facilities in the United States that can provide abundant electricity at affordable rates. According to a study in 2017, nearly three-quarters of all major mining pools are based in either China (58%) or in the United States (16%). By some estimates, the state of Washington hosted 15%-30% of all Bitcoin mining operations globally in 2018.

Governments are developing various policies in response to growth in energy demand by cryptocurrency mining activities. In some areas, applications from potential mining companies have exceeded the available capacity. Other areas have offered reduced electricity rates to attract miners. In the United States, in addition to efforts at the state and local level, there are potential options that could be adopted by the federal government to improve the energy efficiency of mining operations. Potential federal policy options include minimum energy conservation standards, voluntary energy efficiency standards, and data center energy efficiency standards.

In addition to the challenges that cryptocurrency mining presents to the energy sector, there are also opportunities, particularly for blockchain. These may include electric vehicle charging infrastructure and distributed energy resources, among others. The U.S. electricity grid is critical infrastructure and subject to certain regulations to maintain safe and reliable operations. Opinions differ as to a potential role for blockchain technology in the energy sector.

Introduction

The rise in popularity of cryptocurrencies and the underlying blockchain technology presents both challenges and opportunities to the energy sector. Cryptocurrencies, such as Bitcoin, are sometimes referred to as virtual currency, a term that can also refer to a broader class of electronic money.1 A blockchain is a digital ledger that enables parties to agree on the current ownership and distribution of assets in order to conduct new business. When applied to cryptocurrencies, the blockchain allows the validation of transactions to occur by a decentralized network of computers. As cryptocurrencies (such as Bitcoin, the cryptocurrency with the largest market capitalization) have increased in popularity, the energy demand to support cryptocurrency mining activities has also increased. The state of Washington, by some estimates, hosted 15%-30% of all Bitcoin mining operations globally in 2018. When such increases in energy demand for cryptocurrency mining occur at a local level, the resulting peak loads may increase customers' electricity rates depending on pricing structure. However, not all cryptocurrencies require energy-intensive operations. Outside of cryptocurrencies, opportunities arising from blockchain technologies could include facilitating energy and financial transactions on a smart grid.2

This report explains how cryptocurrency is "mined," where mining activity is concentrated, how some states and utilities are responding to localized increases in energy demand from Bitcoin mining facilities, and potential considerations for Congress. Considerations for Congress include potential policy options to address energy conservation and energy efficiency standards as well as options for blockchain technology in the energy sector. This report is part of a suite of CRS products on cryptocurrencies and the underlying technology, distributed ledger technology, and blockchain (see textbox below).

Blockchain and Cryptocurrencies

Blockchain provides a means of transacting among parties who may not otherwise trust one another. Blockchain networks allow for individuals engaging in transactions to also be the ones to validate them. Cryptocurrencies such as Bitcoin, Ether, Alpha Coin, and Papyrus provide a means of validating transactions in a decentralized network that is outside of an intermediary, such as a bank for financial transactions or a title company for a real estate transaction. This validation can be done in bulk and at relatively high speeds, making cryptocurrency an attractive avenue for certain financial transactions. Cryptocurrencies are built to allow the exchange of some digital asset of value (the cryptocurrency) for a good or service. Bitcoin is the most popular cryptocurrency, garnering the largest market share, and Bitcoin arguably initiated the interest in blockchain technology.

Blockchain uses a combination of technologies to work. These technologies include encryption and peer-to-peer (P2P) networks.3 Transactions are added to a blockchain in an addition-only manner. Once added, a transaction cannot be altered, providing a layer of security and transparency. Transactions are grouped together to form a tranche, or "block." Blocks are added to a blockchain in a manner that links it to the previous block, so any change data in a previous block makes that change known to users immediately as they try to add a new block. Encryption is used to ensure that parties trading assets on a blockchain have rights to that asset, and that data held in the blockchain is tamper resistant. P2P networks are used to distribute information across participating users without a central authority acting as an arbiter of that information.4

Cryptocurrency Mining

There are three primary approaches to gaining ownership of Bitcoin: purchase Bitcoin directly by exchanging conventional money and a paying an exchange fee; earn Bitcoin in return for a product or service; or create Bitcoin through mining.5 Bitcoin and other cryptocurrencies each implement their own blockchain: mining is the creation and publication of a new block in a blockchain.6 Early cryptocurrency platforms, like Bitcoin, required the use of mining to validate transactions. In blockchain platforms generally, miners—those seeking to add a block to a blockchain—are incentivized to improve their value in that blockchain through either a monetary, reputational, or stake award, for example. New blocks may be added to a blockchain through a variety of methods.

For Bitcoin, new blocks are added to the blockchain through proof-of-work (PoW). Under PoW, miners are presented a difficult computational problem, or puzzle. PoW identifies a numeric value (called a nonce), which is used to generate an authenticator (hash value). Hash values are used to ensure the integrity of data, in this case, that a block of data in the blockchain has not been modified. Hashes are determined by submitting the data through an algorithm that will output a string of characters. By inserting the nonce into the algorithm, miners seek to change the hash value. The problem Bitcoin miners are trying to solve is the creation of a hash value for a given block which begins with a certain number of zeros. They add data to the block through changing the nonce in order to change the hash value and discover the solution. Identifying these valid nonces and hashes is computationally intensive, and the essence of mining.7 The security properties of hash algorithms are such that a miner tests nonces until a valid hash is found for a block.8

Generally, by solving the problem or puzzle, miners win the opportunity to post the next block and possibly gain a reward for doing so. In the case of Bitcoin, miners who create and publish new blocks in the blockchain are rewarded with Bitcoin. Once the problem is solved and a valid hash is identified, the miner announces it to the community using P2P networking. Other users can validate the solution immediately—without going through the resource-intensive computation process.9 Once the majority of the community of users validates and confirms the block, it is added to the chain.

Miners are held to a strict set of rules that maintain the overall market structure. There are a limited number of Bitcoin to be mined, which creates a value attributed to scarcity. For Bitcoin, new blocks are published every 10 minutes. As the rewards for published blocks halve every 210,000 blocks, the reward of new Bitcoin diminishes roughly every four years (e.g., the reward of 50 Bitcoins per block in 2008 was reduced to 25 in 2012).10 On October 31, 2018, block 548173 rewarded the miner with 12.5 Bitcoins plus approximately 0.2 Bitcoins in transaction fees.11 On the date that block was generated, trading for 1 Bitcoin closed at approximately $6,343; as of July 29, 2019, trading for 1 Bitcoin closed at approximately $9,507.12

Bitcoin is rewarded on a first-come, first-served basis, meaning whoever solves and publishes the solution first is rewarded with Bitcoin. Miners throughout the network compete against each other in a race to be the first to resolve the PoW and earn the reward. The competition often is a criticism of the PoW system, as there are many more miners expending energy for these "useless" calculations than the one miner that wins the race and correctly resolves the PoW.

Mining Technology

The technology used by miners has advanced over time. Early miners were able to earn Bitcoin relatively easily with affordable equipment. Bitcoin could initially be mined on a central processing unit (CPU) such as a personal laptop or desktop computer. As interest in Bitcoin mining increased, miners discovered that graphic cards could more efficiently run hashing algorithms and aid in mining. Field Programmable Gate Arrays (FPGAs) then replaced graphic cards, as the circuits in an FPGA could be configured and programmed by users after manufacturing.13 Application-specific integrated circuits (ASICs) have replaced these and graphic cards. ASICs are designed for a particular use—such as Bitcoin mining.

As more sophisticated equipment has been adopted, miners have also moved away from working individually to working in larger groups. Many miners have determined it is more cost efficient to join "mining pools" that help disperse the energy and equipment costs (and the profits) and increase the speed or likelihood of a successful transaction. ASICs used for Bitcoin mining are usually housed in thermally-regulated data centers with access to low-cost electricity.14 While these developments have transformed Bitcoin mining into a more consolidated industry, they have not resolved the energy consumption issue or the computational "waste," as different Bitcoin mining pools still must compete against one another using the PoW method.

How Much Energy Is Consumed from Bitcoin and Other Cryptocurrency Mining?

Cryptocurrency mining requires energy to (1) operate the devices computing the calculations required to maintain the integrity of the blockchain and (2) thermally regulate the devices for optimal operation. A node, or computing system, on the blockchain may be composed of an individual user or a group of users that have pooled resources; as such, the exact number of connected devices on the network is unknown. Devices have different hashrates—the number of calculations (or hash functions) performed on the network per second—and have different power requirements. Devices with greater hashrates can perform more calculations in the same amount of time than devices with lesser hashrates. For example, "a hashrate of 14 terahashes [14 trillion attempted mining solutions] per second can either come from a single Antminer S9 running on just 1,372 W [Watts], or more than half a million Sony Playstation-3 devices running on 40 MW [megawatts—million Watts]."15

There are four main factors that contribute to energy consumption of cryptocurrency mining:

- 1. hardware computing power;

- 2. network hashrate;

- 3. the difficulty; and

- 4. the thermal regulation for the hardware.16

These factors, some of which also interact with the price of Bitcoin, can alter the energy intensity of mining. For instance, in December 2017, the price of Bitcoin rose creating an influx of mining. As the mining network grew, the difficulty and hashrate increased. Miners sought out more powerful equipment as the competition increased, which consumed more energy. 17

Several studies have examined the energy consumption of cryptocurrencies. While technology advancements in devices used for Bitcoin mining have led to increases in the hashrates of mining devices (i.e., improved device efficiency), the network hashrate has also increased as the popularity of Bitcoin increased. According to one recent estimate, as of "mid-March 2018, about 26 quintillion hashing operations are performed every second and non-stop by the Bitcoin network."18 Estimating the power consumption of the global Bitcoin network depends upon the efficiency of different hardware, the number of machines in use, and the cooling requirements for large-scale mining facilities. Table 1 presents various estimates for the power required by the Bitcoin network. Generally, these estimates use hashrates and miner hashing efficiencies to determine energy consumption. One study relied upon hardware data derived from initial public offering (IPO) filings to estimate power consumption.19 Fewer studies have examined power requirements for other cryptocurrencies (Bitcoin is the largest cryptocurrency platform in both currency in circulation and transactions processed), although those studies have found comparatively lower power requirements than for Bitcoin.20

|

Year of Estimate |

Power Estimate (MW) |

Study |

|

2014 |

115 |

McCook |

|

2016 |

283 |

Krause and Tolaymat |

|

2016 |

345 |

Stoll, Klaaßen, and Gallersdörfer |

|

2017 |

470-540 |

Bevand |

|

2017 |

948 |

Krause and Tolaymat |

|

2017 |

100-500 |

Vranken |

|

2017 |

1,637 |

Stoll, Klaaßen, and Gallersdörfer |

|

2018 |

2,500-7,670a |

de Vries |

|

2018 |

3,441 |

Krause and Tolaymat |

|

2018 |

3,441 |

Stoll, Klaaßen, and Gallersdörfer |

Source: Hass McCook, An Order-of-Magnitude Estimate of the Relative Sustainability of the Bitcoin Network, 2nd Edition, July 15, 2014, p. 37, https://Bitcoin.fr/public/divers/docs/Estimation_de_la_durabilite_et_du_cout_du_reseau_Bitcoin.pdf; M. Bevand, "Op Ed: Bitcoin Miners Consume a Reasonable Amount Energy—And It's All Worth It," Bitcoin Magazine, 2017, https://Bitcoinmagazine.com/articles/op-ed-Bitcoin-miners-consume-reasonable-amount-energy-andits-all-worth-it/; Vranken, 2017; de Vries, 2018; Krause and Tolaymat, 2018; Stoll, Klaaßen, and Gallersdörfer, 2019.

a. In addition to using hashrates and miner hashing efficiencies, the upper estimate (7,670 MW) also incorporates cooling requirements.

Global power requirement estimates for Bitcoin have increased within the last five years. For comparison, the largest estimate of 7,670 MW in Table 1 is nearly 1% of U.S. electricity generating capacity (or approximately 0.1% of global electricity generating capacity).21 Opinions differ on whether future growth in Bitcoin will significantly impact energy consumption and subsequent carbon dioxide (CO2) emissions. Some argue that sustainability concerns due to energy consumption are misplaced, and that the competitiveness of Bitcoin mining means that only miners with the most competitive mining hardware and the lowest electricity costs will persist over time.22 Further, this could lead to fewer miners using energy inefficient hardware, as they may no longer be able to compete effectively. Some anticipate that energy demands will diminish as the reward incentive shifts from discovering new Bitcoin to earning revenue through transaction fees. As a result, some would argue that the energy consumption from mining Bitcoin is a temporary issue.23 Others recognize the volatility of cryptocurrency markets but observe that network hashrates of several cryptocurrencies have trended upward suggesting that energy consumption (and subsequent CO2 emissions) will increase. However, these estimates do not include energy required for cooling systems and other operations and maintenance activities associated with cryptocurrency mining.24

One study on projections of Bitcoin growth considered the potential effects on global CO2 emissions should Bitcoin eventually replace other cashless transactions.25 The study found that the associated energy consumption of Bitcoin usage could potentially produce enough CO2 emissions to lead to a 2oC increase in global mean average within 30 years.26 These projections assume that the global portfolio of fuel types (and subsequent CO2 emissions) used to generate electricity remains fixed according to portfolio profiles from 2014 and does not consider that, in many cases, Bitcoin is often mined in areas with plentiful and affordable renewable energy.27 Further, the projections do not consider any potential effects of a collapse of Bitcoin prices on hashrates or energy consumption, and whether the capital invested in Bitcoin mining could be used for other cryptocurrencies or for other purposes.28 Projections of continued growth in energy consumption led some to call for reform in the cryptocurrency industry.29 Others argue that continued reliance on fossil-fuel-based electricity is the important issue and not the energy intensity of Bitcoin.30

What Is the Cryptocurrency Industry Doing to Reduce Energy Consumption?

As the Bitcoin network's energy consumption grows, some have questioned whether the PoW algorithm is sustainable. One option to reduce cryptocurrency energy consumption is to shift to alternative protocols for validating transfers. Currently, PoW is the most widely used. However, other protocols, such as Proof-of-Stake (PoS) and Proof-of-Authority (PoA) could potentially accomplish validations more energy efficiently. Many other alternative algorithms exist.31 Each algorithm presents trade-offs; for example, some algorithmic attributes facilitate scalability and others facilitate speed of transactions. The potential application of blockchain technology to the energy sector (and other sectors) will depend upon the ability for these technologies to provide transparent, secure, scalable, and timely transaction validation. The technical differences and their applicability are discussed in the Appendix.

Where Is Bitcoin Mined?

Several factors contribute to ideal mining locations and include energy costs, regulations, and technology.32 Often the energy costs are affected by geographical characteristics like proximity to hydroelectric power or lower ambient temperature that reduces the need for cooling. Local and national governments around the world have responded differently to the growth of Bitcoin: some are actively developing cryptocurrency industries, some are restricting cryptocurrencies, and some are regulating cryptocurrencies in an effort to balance financial innovation and risk management.33

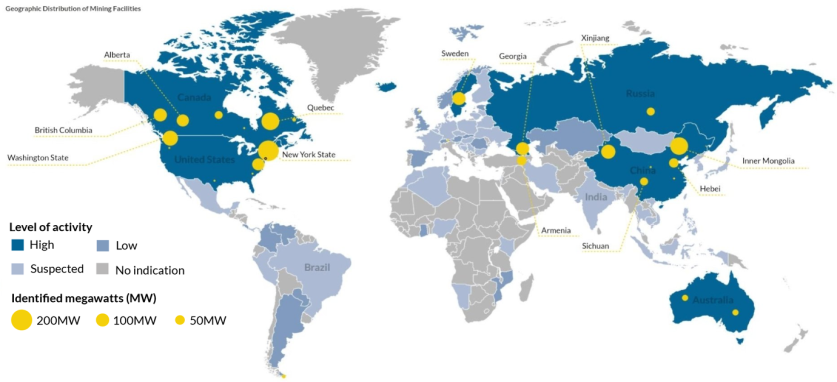

According to a study in 2017, nearly three-quarters of all major mining pools are based in either China (58%) or in the United States (16%).34 Some countries and regions where significant cryptocurrency mining activities have been identified include Australia, Canada, Georgia, Russia, and Sweden, as shown in Figure 1.35

China has taken steps to regulate and tax the trading of Bitcoin, and has even proposed implementing a ban on mining. As of April 2019, it was reported that the National Development and Reform Commission, deemed mining as a "wasteful and hazardous" activity.36 China's share of major mining pools may change substantially in response to regulations and policy actions. In 2013, the Chinese government reportedly restricted Chinese banks from using cryptocurrencies as currency, citing concerns about money laundering and a threat to financial stability.37 In September 2017, Beijing declared that initial coin offerings (ICO)38 were illegal and that all mainland cryptocurrency exchanges be shut down. In January 2018, China's Leading Group of Internet Financial Risks Remediation submitted a request to local governments to regulate electricity, taxes, and land use for mining companies, and "guide the orderly exit of such companies from the Bitcoin mining business."39 Since the implementation of these regulatory measures, Bitcoin trading with the Chinese yuan has reportedly dropped from 90% of global Bitcoin trading to under 1%.40 However, as illustrated in Figure 1, China, despite changes in regulation, remained a popular location for mining in 2018, partly due to the comparatively low cost of energy.41 The generation sources that provide low cost electricity to cryptocurrency miners in China vary regionally. In some regions, the electricity likely is provided from fossil fuel sources; for example, in Inner Mongolia where cryptocurrency miners have been active, thermal power represents 63% of the electric capacity.42

|

Figure 1. Global Cryptoasset Mining Map Geographic Distribution of Mining Facilities |

|

|

Source: Used with permission. Michel Rauchs, et al. "2nd Global Cryptoasset Benchmarking Study," University of Cambridge, December 2018, https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2019-01-ccaf-2nd-global-cryptoasset-benchmarking.pdf. Notes: Levels of activity are defined by Rauchs et al. 2018. Countries with a "high" level of activity are those that host more than 40 MW of cryptoasset mining. Countries with a "low" level of activity are those that are known to host mining facilities. Countries with "suspected" activity are those where cryptoasset mining could not be confirmed by multiple sources. Size of identified megawatts does not correlate to actual geographic location. There are likely hundreds of hashing facilities all over the world; however due to a lack of credible and reliable data, the Cambridge authors were not able to identify every facility. See above source for additional information. |

Cryptocurrency Mining and Utilities: Domestic and International Examples

Cryptocurrency mining includes costs associated with equipment, facilities, labor, and electricity. Mining pool companies around the world therefore seek cheap, reliable electricity. While many mining pools are still in China, some have been able to utilize closed industrial facilities in the United States that can provide abundant electricity at affordable rates. As miners are not typically bound by geographic location, locations with favorable electricity rates and policies may encourage operations. Conversely, locations with restrictive regulations or high electricity prices may discourage mining operations.

In the United States, the sale of electricity is governed by a patchwork of federal, state, and local regulations. For the sale of electricity, the states generally have regulatory jurisdiction over retail electricity transactions, though federal and municipal authorities may also play a role.43 State approaches to regulation vary considerably. States and cities that are dealing with an influx of cryptocurrency mining because of affordable electricity rates are instituting local laws as issues arise. Examples of such approaches—both domestic and international—along with the more general benefits and challenges associated with developing a cryptocurrency mining industry are delineated through the selected examples below.

New York State

The state of New York and the city of Plattsburgh (NY) have developed various policies in response to growth in energy demand by cryptocurrency mining activities. In December 2018, New York State approved Assembly Bill A8783B, creating a new digital currency task force. This task force will include a team of technology experts, investors, and academics all appointed by the Governor, the state Senate, and the Assembly.44 The task force intends to produce a report in 2020 that includes a discussion of "the energy consumption necessary for cryptocurrency mining operations and other policy considerations related thereto."45 The task force law does not include any specific measures regarding licensing, but New York State already requires a license for cryptocurrency businesses, known as a "Bitlicense." Introduced in 2014, fewer than 20 licenses have been granted as of January 2019. The Bitlicense is intended to subject crypto mining companies to anti-money laundering and counterterrorism standards, as well as require background checks on all employees.46

Plattsburgh, NY

Plattsburgh's 20,000 residents reportedly have electricity rates below $0.05 per kilowatt-hour (kWh) year-round (as compared to the U.S. average retail price of about $0.10/kWh).47 Inexpensive electricity for Plattsburgh is generated from the New York Power Authority's (NYPA's) hydroelectric facility on the St. Lawrence River. Plattsburgh has an agreement with the NYPA to buy 104 MW of power at any time to serve its customers.48 This has exceeded electricity demand requirements for Plattsburgh, even with several industrial facilities in operation. Plattsburgh has faced a number of challenges balancing the promise and pitfalls of cryptocurrency mining.

Bitcoin mining companies were attracted to the abundant and cheap electricity, with two cryptocurrency mining businesses reportedly operating in Plattsburgh in 2017.49 As Plattsburgh residents primarily rely on electricity for home heating, during a particularly cold winter in early 2018, electricity rates increased as the 104 MW of power from the hydropower facility was reportedly exceeded, and electric power had to be purchased from other sources at higher rates.50 During January and February of 2018, cryptocurrency mining operations were recorded as responsible for approximately 10% of the local power demand.51 The cost of purchasing additional power to meet the increased demand were proportionally distributed among all customer classes.52 The costs of purchasing additional power combined with increased energy use in response to cold weather resulted in residential electricity bills that were reportedly up to $300 higher than usual.53 According to the New York Public Service Commission, the two cryptocurrency companies operating in Plattsburgh at the time contributed to an increase of nearly $10 to monthly electricity bills in January 2018 for residential customers.54

In March 2018, the city of Plattsburgh also instituted an 18-month moratorium on any new cryptocurrency mining operations—a first in the United States.55 Also in March 2018, the New York Public Service Commission ruled that municipal power authorities could issue a tariff on high-density-load customers—including cryptocurrency companies—"that do not qualify for economic development assistance and have a maximum demand exceeding 300 kW and a load density that exceeds 250 kWh per square foot per year."56 Additionally, Plattsburgh began addressing fire safety concerns, heat management, and overall nuisance associated with cryptocurrency mining by passing local laws.57 None of the new laws specifically address energy consumption, or noise, which is a concern for some local residents.58

Massena, NY

In December 2017, Coinmint, a crypto mining company, looking to expand operations, went to Massena, NY (90 miles west of Plattsburgh) and signed a lease to convert a retired Alcoa aluminum plant into a cryptocurrency mining facility. Coinmint reportedly requested from NYPA 15 MW of subsidized power that would in turn lead to 150 jobs and $700 million in local investment.59 The proposal required the approval of NYPA's board of trustees and was added to their January 2018 agenda for consideration.60 However, in March 2018, following consideration of the Coinmint proposal, the NYPA board of trustees approved a moratorium on allocating economic development assistance in the form of subsidized power to high-density-load operations until NYPA could analyze all possible impacts.61 The New York State Public Service Commission approved, in July 2018, new electricity rates for the Massena Electric Department to allow high-density load customers—such as cryptocurrency companies—to be eligible for service under an individual service agreement.62 This is the second ruling by the commission on cryptocurrency rates.

Washington State

By some estimates, the state of Washington hosted 15%-30% of all Bitcoin mining operations globally in 2018.63 Like New York, Washington has affordable, reliable hydropower. Along the Columbia River in a region known as the Mid-Columbia Basin, five hydroelectric dams reportedly generate nearly six times as much power as the residents and local businesses can utilize.64 These hydroelectric facilities typically export the surplus electricity to larger electricity demand markets, such as Seattle or Los Angeles, which helps to keep the costs of electricity relatively low for local consumers at about $0.025/kWh (as compared to the U.S. average retail price of about $0.10/kWh).65

Since 2012, the Mid-Columbia Basin has reportedly attracted Bitcoin mining companies because of low-priced electricity, and the resulting growth in energy demand has challenged the cost structure of several of the region's public utility districts (PUDs).66 Several PUDs imposed a moratorium on new applications for mining operations. The moratorium was issued as public utilities are required to hear and rule on applications for future power contracts. If the applications for mining operations continued to be approved, the contracts could have outpaced the public utilities' original projections and planning for demand increases. For example, in Douglas County—where the bulk of the new mining projects are occurring—a new 84-MW substation that was previously expected to provide enough capacity to serve the area for the next 30 to 50 years under a normal population growth scenario was fully subscribed in less than a year.67 In response, the PUDs will have to find alternatives for meeting the growing demand, such as purchasing power on the open market. In addition, there are concerns over the cost of upgrading new infrastructure, including substations and transmission lines, and who would bare those costs.

PUDs in the region are also challenged by "rogue" miners, those that set up server equipment in homes without any proper licensing, permits, or infrastructure upgrades. These servers have a larger demand for energy than the infrastructure in a residential community is designed to provide. It is relatively easy for the PUDs to locate rogue miners given the abnormal increase in power demand; once identified, the miners are required to obtain the proper equipment and permits but may simply move operations to another unpermitted location.68

Other PUDs in the region are adapting to increased interest in mining operations. In December 2018, Chelan County PUD approved a new rate for blockchain operations starting April 2019 and lifted a moratorium.69 While some are concerned that Bitcoin mining operations and related infrastructure could eventually lead to utility stranded assets, others see Bitcoin as a stepping block to a larger possibly more prosperous endeavor—researching alternative uses for blockchain technology. The Department of Commerce for Douglas County intends to build a "blockchain innovation campus," which the county states could both assuage concerns over the volatility of the Bitcoin market and be an investment in the future diversification of the local economy.70 This approach, however, is not entirely without risk. For example, Giga Watt, a Bitcoin mining firm, declared bankruptcy in 2018, owing creditors nearly $7 million, $310,000 of which is owed to Douglas County Public Utility District.71

International Case Studies

Due to the decentralized nature of cryptocurrency mining, miners are not typically bound by geographic location. These characteristics typically impact mining profits and contribute to selecting the ideal location for operations. While some countries may have favorable energy costs, they may have restrictive regulations (e.g., China). Below are a few international locations that have garnered the attention of cryptocurrency miners.

Canada

Canada generates affordable (albeit not the cheapest) hydroelectric power. Further, Canada has the added benefit of being in a cold weather climate, which can reduce overall cooling costs. In 2016, approximately 58% of total electricity generation in Canada was from hydropower resources.72 Canadian electricity providers generate 13 terawatt hours (TWh) more electricity than their domestic consumers need. Due to this excess in electricity some providers have offered incentives for miners. In January 2018, the public utility Hydro-Quebec offered electricity at a rate of $0.0394/kWh to cryptocurrency miners.73

Miners responded, and by February 2018, Hydro-Quebec has received around 100 inquiries.74 Based on these inquiries, 10 TWh of the surplus would have been obligated to mining. Hydro-Quebec did not expect the high degree of new demand (reportedly several thousand megawatts worth of project proposals) for electricity and in March 2018 ceased processing requests until guidelines are developed.75

In response to concerns with the sharp increase in electricity demand, Hydro-Quebec commissioned a study on the economic benefits of cryptocurrency mining. In May 2018, the study estimated that direct job creation for cryptocurrency mining ranges from 1.2 jobs per MW of a 20 MW operation to 0.4 jobs per MW for a 250 MW operation.76 Data centers, by comparison, can create between 5 and 25 jobs per MW.77

By June 2018, Hydro-Quebec announced it would triple the price it originally offered to new applicants for cryptocurrency mining operations (although the utility indicated this is a temporary adjustment until a final determination is made).78 Meanwhile towns across the Quebec Province have placed moratoriums on new mining operations citing energy demand, size, and noise concerns.79

Georgia

Georgia has positioned itself as an attractive location for Bitcoin mining operations. In Georgia, mining company Bitfury's electricity rates reportedly range from around $0.05/kWh to $0.06/kWh.80 Georgia's low price of electricity can be attributed to large hydropower resources.81 In 2016, hydropower accounted for 81% of the total electricity generated.82 The low cost of electricity, plus a favorable regulatory environment, makes Georgia a favorable location for Bitcoin mining operations.83

In 2015, the government of Georgia offered Bitfury a $10 million dollar loan to mine in Georgia. The government expanded a power plant to provide electricity to Bitfury's cryptocurrency mining facility at no additional cost. Local Bitcoin miners, however, are having a difficult time competing with Bitfury. Smaller local mining pools were not offered similar incentives and have been struggling to mine in a low-price environment.

Furthermore, some locals criticize the government for providing Bitfury incentives. The Georgian government has created tax-free zones for mining activities and electricity.84 Without a tax regime in place for mining, some Georgian lawmakers claim that Georgians are losing possible tax revenue.

Iran

Iran also has relatively cheap electricity making it attractive to mining operations. Iran's electricity mix is dominated by natural gas. According to the U.S. Energy Information Administration, Iran is the third largest producer of dry natural gas in the world at nearly 9.5 trillion cubic feet (Tcf) in 2017 and most of it (6.9 Tcf) was consumed domestically.85 In addition, Iran subsidizes electricity produced from fossil fuels. According to International Energy Agency data from July 23, 2019, subsidies for electricity were valued at $16.6 billion in 2018.86 With energy subsidies, average electricity prices in Iran are reportedly around $0.006/kWh, far cheaper than even in China.87

Despite the low price of electricity in Iran, miners face other challenges, such as U.S. sanctions. The decentralized and pseudonymous nature of Bitcoin transactions may make financial sanctions imposed on governments and individuals difficult to enforce. However, Bitcoin transactions are publicly recorded on its digital ledger. According to the U.S. Department of the Treasury Under Secretary for Terrorism and Financial Intelligence,

We are publishing digital currency addresses to identify illicit actors operating in the digital currency space. Treasury will aggressively pursue Iran and other rogue regimes attempting to exploit digital currencies and weaknesses in cyber and [Anti-Money Laundering and Countering the Financing of Terrorism] AML/CFT safeguards to further their nefarious objectives.88

Since the reintroduction of U.S. sanctions, the Iranian government has recognized a potential role for cryptocurrencies.89 In January 2019, the Central Bank of Iran presented a draft of new cryptocurrency regulation. Digital currencies, not backed by the Central Bank, will be restricted as a form of payment inside Iran. The draft framework, however, would authorize rial-backed cryptocurrency use, ICOs, mining, and other crypto-related activities.90 These draft regulations and the possible negative consequences from the United States may keep some miners from relocating to Iran, despite the low cost of electricity.91

Iranian state media reported that Tadvin Electricity Company saw an increase in energy demand of 7% due to cryptocurrency mining activities in June 2018. In response, Iran's Power Ministry is reportedly considering enforcing special tariffs on cryptocurrency miners.92 The Iranian Cabinet reportedly ratified a bill in August 2019 that introduces new rules for the cryptocurrency market in Iran. The regulations reportedly stipulate that mining cryptocurrencies would be allowed in Iran if certain conditions are met. Conditions reportedly include receiving approval from Iran's Ministry of Industry and conducting mining activities outside of provincial centers (with exceptions for Tehran and Esfahan where additional restrictions may apply).93

Blockchain Technology Potential for the Energy Sector

Blockchain is a method of quickly validating transactions and of record keeping for large quantities of data. Some blockchains and cryptocurrencies do not operate through a decentralized, permission-less network like Bitcoin.94 Within the energy sector, a number of opportunities for blockchain technology have been proposed.95 These opportunities include smart contracts,96 distributed energy resource record keeping, and ownership records.

One of the more easily transferrable options for blockchain is trading Renewable Energy Credits (RECs). Using blockchain to trade RECs could provide customers the ability to purchase RECs without the need for a centralized entity to verify transactions. In October 2018, a subsidiary of the PJM Interconnection LLC—a regional transmission organization that operates an electric transmission system serving part of the Eastern Interconnection electricity grid97—announced plans for testing blockchain technology to trade RECs.98

Other more advanced utilizations for blockchain in the energy sector could be highly disruptive. For example, there is increasing interest in net metering and a transactional grid (i.e., where producers of distributed energy resources, such as rooftop solar, can sell the electricity to nearby consumers). Prototype projects have relied upon blockchain technology among other peer-to-peer approaches to facilitate renewable energy transactions at the local level.99 Other peer-to-peer efforts include managing virtual power plant operations and enabling those who do not own renewable energy systems to pay for a portion of the energy generation of a host's system in exchange for a reduction on their utility bills (e.g., renters paying for a portion of an apartment building's rooftop solar system).100

If such applications are found to be practical and economical, blockchain technology could alter the manner in which electricity customers and producers interact. Traditionally electric utilities are vertically integrated. Blockchain could disrupt this convention by unbundling energy services along a distributed energy system. For instance, a customer could directly purchase excess electricity produced from their neighbor's solar panels instead of purchasing electricity from the utility. On the one hand, this could result in a more transparent and efficient system. Blockchain could encourage more competition among generators and more flexibility and choice for consumers. On the other hand, unbundling energy services could lead to concerns over distribution control to accommodate the decentralization.101 Furthermore, storing vast quantities of data about critical infrastructure on distributed ledgers may introduce additional cybersecurity concerns.102

The sale of electricity via blockchains that are independent of a conventional utility framework may be subject to significant legal interpretation, and potentially represents the intersection of various federal and state statutes and regulations. Jurisdiction over the sale of electricity from a distributed energy resource or electric vehicle charging station hinges upon its definition as either a retail transaction or a sale for resale. Retail transactions are generally defined by the Federal Energy Regulatory Commission (FERC) as "sales made directly to the customer that consumes the energy product," whereas sales for resale are defined as "a type of wholesale sales covering energy supplied to other electric utilities, cooperatives, municipalities, and Federal and state electric agencies for resale to ultimate consumers."103 States typically regulate retail electricity transactions, while FERC has jurisdiction over the transmission and wholesale sales of electricity in interstate commerce.

One survey by the Electric Power Research Institute, collected data on the potential barriers and advantages of blockchain in utilities. Of those surveyed, utilities in the United States were in early pilot stages or in the research phase, while some utilities in Europe had been using blockchain for over a year.104 Respondents identified opportunities and challenges to investment in blockchain technology with 77% of respondents identifying concerns that the energy industry "lacks appropriate standards."105

Options for Congress to Address Cryptocurrency's Energy Consumption

In addition to state and local policy efforts that seek to mitigate the regional effects of growth in cryptocurrency mining, there are options that could be adopted by the federal government to improve the energy efficiency of mining operations. Further, as the financial and energy sectors, among others, explore adopting blockchain, Congress may consider options to curb the energy intensity of the technology.

Minimum Energy Conservation Standards

An approach to reducing the energy consumption of cryptocurrencies could include the establishment of minimum energy conservation standards for the equipment engaged in mining activities or the cooling equipment that maintains efficient mining operations.

The Department of Energy (DOE) administers national energy efficiency standards for appliances and other equipment. DOE maintains federal energy efficiency standards as authorized under the Energy Policy and Conservation Act (P.L. 94-163, 42 U.S.C. §§6201-6422) as amended. DOE's Appliance and Equipment Standards program sets minimum energy efficiency standards for approximately 60 commercial product categories.

There are no national standards for computer products. In 2012, DOE issued a request for information regarding miscellaneous residential and commercial electrical equipment, and in 2014 issued a proposed determination of coverage for computers and battery backup systems.106 Some view voluntary and market-driven approaches as more appropriate for computer technology than minimum energy conservation standards.107 Others state the importance of public and private sector collaboration in developing energy efficiency standards that are "ambitious and achievable."108 Congress may consider whether minimum national energy efficiency standards that address cryptocurrency mining should be established. Such standards could focus on the specific technology used by cryptocurrency miners—ASICs—or could focus on computer and battery backup systems as defined within DOE's proposed determination.109

DOE published energy conservation standards and test procedures for computer room air conditioners (CRACs) on May 16, 2012.110 According to the final rule, a CRAC is defined as:

A basic model of commercial package air conditioning and heating equipment (packaged or split) that is: (1) Used in computer rooms, data processing rooms, or other information technology cooling applications; (2) rated for sensible coefficient of performance (SCOP) and tested in accordance with 10 CFR 431.96, and (3) not a covered consumer product under 42 U.S.C. 6291(1)–(2) and 6292. A computer room air conditioner may be provided with, or have as available options, an integrated humidifier, temperature, and/or humidity control of the supplied air, and reheating function.111

DOE established 30 different equipment classes for CRAC and set minimum requirements for each class. Initial compliance dates of October 29, 2012, or October 29, 2013, were established, depending upon the equipment class.112 DOE is required to review test procedures for covered products at least once every seven years.113 The frequency requirement for reviewing energy efficiency standards of covered products is no later than six years after issuance of a final rule.114 DOE issued a request for information regarding test procedures for CRACs on July 25, 2017.115

Voluntary Energy Efficiency Standards

In addition to minimum national energy efficiency standards issued by DOE, the U.S. Environmental Protection Agency (EPA) and DOE jointly administer the voluntary ENERGY STAR labeling program for energy-efficient products, homes, buildings, and manufacturing plants.116 ENERGY STAR has standards for miscellaneous residential and commercial electrical equipment—including computers and displays. ENERGY STAR also has specifications for enterprise servers, data storage equipment, small network equipment, large network equipment, and uninterruptible power supplies.117 Congress may consider whether ENERGY STAR specifications for cryptocurrency mining technology are needed, or whether existing specifications for equipment used in data centers are appropriate.

|

California Minimum Energy Efficiency Standards for Computer Products In the absence of national standards for computer products, the California Energy Commission (CEC) established energy efficiency standards for computers and monitors in 2016. California anticipates saving 2,332 GWh per year through these combined standards.118 The energy efficiency standards for computers set a baseline energy use target according to computer type—desktops, thin clients, and mobile gaming systems; notebook computers and portable all-in-ones; and high expandability computers, small-scale servers, workstations, and mobile workstations.119 The computer standards provide additional energy use allowances for features and technologies that may be added to a unit. The energy efficiency standard focuses on the performance of the computer during idle, sleep, and off modes. The energy efficiency standards for monitors set a limit on the amount of power that can be consumed when the monitor or display is on, in sleep mode, or off. The standard for on mode is based upon a calculation of the screen area and resolution, and is intended to encourage the use of higher efficiency LED backlights and screen technologies. Specialty monitors are allowed to consume additional power above the base standard. The California energy efficiency standards for computers and monitors will be implemented in stages. The first standard for workstations and small-scale servers went into effect on January 1, 2018. Energy efficiency requirements for desktop computers and computer monitors are set according to tiers. Initial energy efficiency standards went into effect in January and July of 2019. More efficient requirements go into effect in 2021. |

Data Center Energy Efficiency Standards

Congress may also choose to consider the creation or adoption of energy efficiency standards for data centers used by mining companies. Verifiable information on cryptocurrency mining power usage is limited and based on what is voluntarily reported. Under these circumstances, it is reported that as cryptocurrency mining centralizes and professionalizes, mining facilities are taking on characteristics (e.g., power and cooling needs) that are similar to other large computing facilities, such as data centers. One option for improving the energy efficiency of Bitcoin mining could be to establish energy efficiency standards for data centers or large computing facilities.

According to DOE, data centers are energy-intensive compared to other building types.120 DOE estimates that data centers account for approximately 2% of total U.S. electricity use. In 2014, data centers in the United States consumed an estimated 70 billion kWh, and are projected to consume approximately 73 billion kWh in 2020.121 The growth in cloud computing services has led to commitments by some data-centric companies to power data centers with renewable energy.122

Although there are no national efficiency requirements for data centers, the federal government has taken steps to improve the efficiency of its own data centers. In 2010, the Federal Data Center Consolidation Initiative (DCCI) was established. The Federal Information Technology Acquisition Reform Act (FITARA, P.L. 113-291) was enacted on December 19, 2014, to establish a long-term framework through which federal IT investments could be tracked, assessed, and managed, to significantly reduce wasteful spending and improve project outcomes.123 The DCCI was superseded by the Data Center Optimization Initiative (DCOI) in 2016.124 The DCCI established and the DCOI maintains requirements for agencies to develop and report on strategies "to consolidate inefficient infrastructure, optimize existing facilities, improve security posture, achieve cost savings, and transition to more efficient infrastructure."125 The DCOI also included energy efficiency goals for data centers:

- 1. Existing tiered data centers to achieve and maintain a power usage effectiveness (PUE) of less than 1.5 by September 30, 2018, and

- 2. New data centers must be designed and maintain a PUE no greater than 1.4, and are encouraged to achieve a PUE no greater than 1.2.126

For the PUE metric, the DCOI references Executive Order (E.O.) 13693 and the implementation instructions.127 E.O. 13693 was revoked by and replaced with E.O. 13834, which does not discuss data centers.128 The implementation instructions for E.O. 13834 state that "data centers are energy intensive operations that contribute to agency energy and water use and costs," and encourage agencies "to implement practices that promote energy efficient management of servers and Federal data centers," and "to install sub-meters, including advanced energy meters, in data centers where cost effective and beneficial for tracking energy performance and improving energy management."129 The authorization of the DCOI was extended until October 1, 2020, by the FITARA Enhancement Act of 2017 (P.L. 115-88). Congress may choose to consider whether federal data center PUE requirements should be extended to certain types of data centers outside the federal government. For Bitcoin mining facilities, reportedly little is known about their operations, including power usage effectiveness.130

Options for Federal Regulation of Blockchain Technology for Distributed Energy

Rules and regulations governing the retail sale of electricity generally originate with a state public utility commission. An electric utility is defined in federal law as any person, state, or federal agency "which sells electric energy." Definitions may be found in Public Utility Regulatory Policies, 16 U.S.C. Section 2602. This definition could potentially be interpreted that generators of electricity that make energy trades using blockchain technology are electric utilities by virtue of the fact that they sell electricity, and are therefore subject to all laws, requirements, and regulations pertaining to electric utilities.

Congress may choose to consider extending or clarifying FERC's role regulating blockchain technology use in the energy sector. While blockchain could be implemented as a means to validate peer-to-peer distributed electricity trading, these transactions could potentially still be subject to FERC oversight as engaging in a sale for resale. Applications of blockchain technology in the energy sector have been limited in scope to date; wide-scale adoption of blockchain technologies could pose additional vulnerabilities to grid operations. FERC may also have a role in considering whether the existing grid infrastructure is capable of handling more power movement at high speeds in response to blockchain users' transactions.131 Other potential issues could include data privacy, interoperability of technology solutions, and market structure.132 FERC has not issued guidance or announced standards associated with blockchain technologies. Within this context, utilities and industry groups may interpret the lack of guidance as a signal to continue business as usual.133

Appendix. Select Algorithmic Approaches to Crypto-Mining

As the Bitcoin network's energy consumption grows, some have questioned whether the proof-of-work (PoW) algorithm that is used by Bitcoin is sustainable. Many alternative algorithms exist.134 PoW and two approaches that are conceptually less energy intensive—proof-of-stake and proof-of-authority—are discussed below and illustrated in Figure A-1.

Proof-of-Work

Under proof-of-work (PoW), miners are presented a difficult computational problem, or puzzle. PoW identifies a numeric value (called a nonce), which is used to generate an authenticator (hash value). The hash value ensures a user that the block of data sent has not changed. Hashes are determined by submitting the data through an algorithm that will output a string of characters. By inserting the nonce into the algorithm, miners seek to change the hash value. Identifying these valid nonces and hashes is computationally intensive, and the essence of mining.135 The security properties of hash algorithms are such that a miner tests nonces until a valid hash is found for a block.136

Generally, by solving the problem or puzzle, miners win the opportunity to post the next block and possibly receive a reward for doing so. In the case of Bitcoin, miners who create and publish new blocks in the blockchain are rewarded with Bitcoin. Once the problem is solved and a valid hash is identified, the miner announces it to the community. Other users can validate the solution immediately—without going through the resource-intensive computation process—by having transparent access to the entire history of the blockchain's transaction ledger.137 Once the majority of the community validates and confirms the block, the next block can be added to the chain.

Proof-of-Stake

Proof-of-stake (PoS) depends on the community's actual stake in the currency instead of consuming energy in a race to be the first to solve computations. The more currency a "forger" (i.e., the PoS term in lieu of the PoW term "miner") holds, the more transactions can be validated. This method skips the energy-intense hashing race. All of the currency is already created, and the amount is stagnant. Forgers earn currency through transaction fees for building a new block (and thereby validating a transaction). A new block is determined by the level of stake (e.g., wealth) a forger has invested in the cryptocurrency. Thus, forgers put their own cryptocurrency investment at risk and therefore would likely only build a block for valid transactions. If a forger added a block to the blockchain based on an invalid transaction, it would risk losing its stake.

Potential energy reductions from use of PoS are leading to changes in some major cryptocurrencies. Ethereum—a platform that uses a cryptocurrency called Ether—plans to move to a PoS system and is currently working on the remaining challenges, such as scaling a PoS system and maintaining a decentralized system. The Ethereum network expects to go through several upgrade phases in order to fully transition to PoS. The timeline for this transition has not yet been revealed, but this new solution upgrade, known as Serenity, was announced at DevCon 4.138 The Serenity upgrade would utilize a new PoS algorithm called "Casper" that is intended to overcome some of the drawbacks (e.g., centralizing a traditionally decentralized currency) of a PoS community.

Proof-of-Authority

Proof-of-authority (PoA) is another method of validating transactions in a blockchain. Like much of the terminology associated with blockchain, there is not a formal definition of PoA, and the definition may differ from one group to another, depending on the purpose of the blockchain platform.139 One understanding of PoA—as it relates to cryptocurrency—has validators curating their own reputation in order to achieve payout. Validators earn their reputation by running software to put transactions into blocks that require a link to properly identify that validator. This method places every person in the network on equal footing—everyone only has one identity.140 An alternative understanding of PoA, among the supply chain industry, uses a blockchain network to track logistics transparently. PoA provides a level of scalability and security within private networks that PoS or PoW cannot.

Limitations of PoS, PoA, and PoW

PoS, PoA, and PoW algorithms have limitations. While PoS and PoA both reduce energy consumption levels and require far less sophisticated equipment, they both create a more controlling and limited environment. PoW requires community decisionmaking. PoS and PoA are more individualistic. This could undermine the concept of the decentralized nature of the distributed ledger system design, which is one of the fundamental principles in cryptocurrency.141 Cryptocurrency was developed to move away from the centralized power of the banking system and move toward a decentralized network. The Ethereum upgrade is intended to integrate several new aspects and is expected to achieve a more decentralized system even when compared with PoS. Ethereum's "Phase Zero" of the PoS specification was frozen on June 30, 2019, with the formal launch targeted for January 3, 2020.142

PoW is also vulnerable to attacks. PoW blockchains publish new blocks to the longest available chain. Although difficult to accomplish, a malicious actor could devote overwhelming computational resources to rewriting a blockchain—developing different transactions with different nonce and hash values. This is known as the "51% attack." At a point where their chain is the longest, the malicious actor could publish the blockchain, and the system would accept it as the valid one. By rewriting the chain, the malicious actor would reestablish the distribution of resources (i.e., which accounts have Bitcoin and how much the account holds). This would require substantial energy consumption, space, equipment, and money, and would all have to be done covertly to avoid being caught. While this may appear to be difficult to execute, PoW algorithms are not invulnerable.143

Author Contact Information

Footnotes

| 1. |

The Internal Revenue Service (IRS) considers virtual currency as property, and as such, the tax principles applicable to property transactions apply to transactions using virtual property; see IRS, IRS Notice 2014-21, 2014, https://www.irs.gov/pub/irs-drop/n-14-21.pdf. |

| 2. |

For more information on the smart grid, see CRS Report R45156, The Smart Grid: Status and Outlook, by Richard J. Campbell. |

| 3. |

A peer-to-peer (P2P) network allows a disparate system of computers to connect directly with each other without the reference, instruction, or routing of a central authority. P2P networks allow for the sharing of files, computational resources, and network bandwidth among those in the network. For more on blockchain and P2P, see CRS Report R45116, Blockchain: Background and Policy Issues, by Chris Jaikaran. |

| 4. |

Christian Catalini, "How Blockchain Applications Will Move Beyond Finance," Harvard Business Review, March 2, 2017, https://hbr.org/2017/03/how-blockchain-applications-will-move-beyond-finance. |

| 5. |

For more information on Bitcoin, see CRS Report R43339, Bitcoin: Questions, Answers, and Analysis of Legal Issues. |

| 6. |

CRS Report R45116, Blockchain: Background and Policy Issues, by Chris Jaikaran. |

| 7. |

For an example of how this works see http://blockchain.mit.edu/how-blockchain-works. |

| 8. |

Fan Zhang, Ittay Eyal, and Robert Escriva, et al., "REM: Resource-Efficient Mining for Blockchains," Proceedings of the 26th USENIX Security Symposium, August 16-18, 2017, p. 1429. |

| 9. |

Ibid., p. 1429. |

| 10. |

According to Satoshi Nakamoto, the creator of Bitcoin, "To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they're generated too fast, the difficulty increases." See Satoshi Nakamoto, "Bitcoin: A Peer-to-Peer Electronic Cash System," paper, October 2008, at https://bitcoin.org/bitcoin.pdf. |

| 11. |

"Block Height 548173," Blockchain, http://www.blockchain.com/btc/blockheight/548173. |

| 12. |

Price data provided by CryptoCompare to Yahoo!Finance; see https://finance.yahoo.com/quote/BTC-USD. |

| 13. |

Harold Vranken, "Sustainability of bitcoin and blockchains," Current Opinion in Environmental Sustainability, vol. 28 (2017), p. 3; hereinafter Vranken, 2017. |

| 14. |

Data centers are facilities—buildings or parts of buildings—used to store, manage, and disseminate electronic information for a computer network. They house servers, which are computers used to perform network-management functions such as data storage and processing, and communications equipment and devices to connect the servers with the network. These facilities may range in size from small rooms called server closets, or even parts of rooms, within a conventional building, to large dedicated buildings called enterprise-class data centers. Larger centers may be purpose-built or retrofitted. |

| 15. |

Antminer S9 is an ASIC designed for mining Bitcoin and is one of the more efficient miners commercially available. A single Playstation-3 device—a home video game console with software capable of supercomputing—has a hashrate of 21 megahashes per second and a power use of 60 W, see Alex de Vries, "Bitcoin's Growing Energy Problem," Joule, vol. 2 (May 16, 2018), p. 801; hereinafter de Vries, 2018. |

| 16. |

George Kamiya, "Commentary: Bitcoin Energy Use-Mined the Gap," International Energy Agency, July 5, 2019. |

| 17. |

Ibid. |

| 18. |

de Vries, 2018. |

| 19. |

Christian Stoll, Lena Klaaßen, and Ulrich Gallersdörfer, "The Carbon Footprint of Bitcoin," Joule, vol. 3, p. 1648; hereinafter Stoll, Klaaßen, and Gallersdörfer, 2019. |

| 20. |

Power network requirements were compared for Bitcoin, Ethereum, Litecoin, and Monero; see Max J. Krause and Thabet Tolaymat, "Quantification of Energy and Carbon Costs for Mining Cryptocurrencies," Nature Sustainability, vol. 1 (November 2018), pp. 711-718; hereinafter Krause and Tolaymat, 2018. |

| 21. |

According to the Energy Information Administration (EIA), in 2016 the total U.S. electric power sector capacity was approximately 1,042 GW; see A9 Table 9. Electricity Generating Capacity in EIA, Annual Energy Outlook 2018, February 6, 2018, https://www.eia.gov/outlooks/aeo/. The total installed global electricity generating capacity is estimated to be 7,365 GW; see Central Intelligence Agency, "Country Comparison: Electricity—Installed Generating Capacity," The World Factbook, https://www.cia.gov/library/publications/the-world-factbook/rankorder/2236rank.html. |

| 22. |

Harold Vranken, "Sustainability of Bitcoin and Blockchains," Current Opinion in Environmental Sustainability, vol. 28 (2017), p. 8. |

| 23. |

According to Christian Catalini, current energy trends of Bitcoin are not permanent, and "once we're at scale and so few bitcoins are being mined that it is essentially irrelevant for the system, the revenue for the miners will have to come from transaction fees. So in equilibrium, the energy and security provided by the network from this wasteful computation will have to be equivalent to the transaction fee." See Chris Mooney and Steven Mufson, "Why the Bitcoin Craze Is Using Up So Much Energy," The Washington Post, December 19, 2017, https://www.washingtonpost.com/news/energy-environment/wp/2017/12/19/why-the-bitcoin-craze-is-using-up-so-much-energy. |

| 24. |

Max J. Krause and Thabet Tolaymat, "Quantification of Energy and Carbon Costs for Mining Cryptocurrencies," Nature Sustainability, vol. 1 (November 2018), p. 712. |

| 25. |

Camilo Mora, Randi L. Rollins, and Katie Taladay, et al., "Bitcoin Emissions Alone Could Push Global Warming Above 2oC," Nature Climate Change, vol. 8 (November 2018), pp. 931-933. |

| 26. |

Ibid. |

| 27. |

George Kamiya, "Commentary: Bitcoin Energy Use-Mined the Gap," International Energy Agency, July 5, 2019. |

| 28. |

Max J. Krause and Thabet Tolaymat, "Quantification of Energy and Carbon Costs for Mining Cryptocurrencies," Nature Sustainability, vol. 1 (November 2018), p. 712. |

| 29. |