The Smart Grid: Status and Outlook

The electrical grid in the United States comprises all of the power plants generating electricity, together with the transmission and distribution lines and systems that bring power to end-use customers. The “grid” also connects the many publicly and privately owned electric utility and power companies in different states and regions of the United States. However, with changes in federal law, regulatory changes, and the aging of the electric power infrastructure as drivers, the grid is changing from a largely patchwork system built to serve the needs of individual electric utility companies to essentially a national interconnected system, accommodating massive transfers of electrical energy among regions of the United States.

The modernization of the grid to accommodate today’s more complex power flows, serve reliability needs, and meet future projected uses is leading to the incorporation of electronic intelligence capabilities for power control purposes and operations monitoring. The “Smart Grid” is the name given to this evolving intelligent electric power network. The U.S. Department of Energy (DOE) describes the Smart Grid as “an intelligent electricity grid—one that uses digital communications technology, information systems, and automation to detect and react to local changes in usage, improve system operating efficiency, and, in turn, reduce operating costs while maintaining high system reliability.”

In 2007, Congress passed the Energy Independence and Security Act (P.L. 110-140). Title XIII of the act described characteristics of the Smart Grid and directed DOE to establish a Smart Grid Investment Matching Grant (SGIG) program to help support the modernization of the nation’s electricity system.

In 2014, DOE concluded that the adoption of Smart Grid technologies was accelerating but at varying rates “depending largely on decision-making at utility, state, and local levels.” DOE noted that the nation’s electricity system is in the midst of “potentially transformative change,” with challenges for Smart Grid deployment remaining with respect to grid-connected renewable and distributed energy sources and adaptability to current and future consumer-oriented applications.

Costs of deploying the Smart Grid remains an issue, and study estimates vary. While some DOE programs have supported grid modernization, Congress has not explicitly appropriated funding for deployment of the Smart Grid since the American Recovery and Reinvestment Act of 2009 (P.L. 111-5). In its 2014 study, DOE estimated historical and forecast investment in the Smart Grid as approximately $32.5 billion between 2008 and 2017, averaging $3.61 billion annually in the period. If this level of investment remains constant, it would put spending well below levels the Electric Power Research Institute (in 2011) and the Brattle Group (in 2008) estimated were needed to fully build the Smart Grid by approximately 2030. From 2010 to 2015, $3.4 billion in SGIG grants supported 99 projects resulting in $8 billion in grid modernization.

Congress could provide funding to help bridge the funding gap if it chooses to accelerate adoption of the Smart Grid. A number of near-term trends—including electric vehicles, environmental concerns, and the ability of customers to take advantage of real-time pricing programs to reduce consumer cost and energy demand—would benefit from investments in Smart Grid enabled technologies.

While concerns such as cybersecurity and privacy exist, most electric utilities appear to view Smart Grid systems positively. Costs could be reduced and system resiliency improved by further integration of automated switches and sensors, even considering the cost of a more cybersecure environment. But with the potentially high costs of a formal transition, some see the deployment of the Smart Grid continuing much the same as it has, with a gradual modernization of the system as older components are replaced.

The Smart Grid: Status and Outlook

Jump to Main Text of Report

Contents

- Introduction

- Smart Grid Technologies

- Status of Smart Grid Deployment

- Technology Compatibility as a Barrier to Adoption

- Estimates of Smart Grid Cost

- Potential Smart Grid Benefits

- Smart Grid Investment Matching Grants

- Estimating the Cost of Smart Grid Deployment to 2030

- Electricity Infrastructure

- Electricity Providers and Sources of Infrastructure Funding

- The Smart Grid as Enabler or a Result of Change?

- Potential Drivers of New Infrastructure Spending

- Electric Vehicles and Climate Change

- Customer-Focused Programs

- Major Smart Grid Concerns

- Cybersecurity

- Privacy and Customer Data

- Recent Legislation

Figures

Summary

The electrical grid in the United States comprises all of the power plants generating electricity, together with the transmission and distribution lines and systems that bring power to end-use customers. The "grid" also connects the many publicly and privately owned electric utility and power companies in different states and regions of the United States. However, with changes in federal law, regulatory changes, and the aging of the electric power infrastructure as drivers, the grid is changing from a largely patchwork system built to serve the needs of individual electric utility companies to essentially a national interconnected system, accommodating massive transfers of electrical energy among regions of the United States.

The modernization of the grid to accommodate today's more complex power flows, serve reliability needs, and meet future projected uses is leading to the incorporation of electronic intelligence capabilities for power control purposes and operations monitoring. The "Smart Grid" is the name given to this evolving intelligent electric power network. The U.S. Department of Energy (DOE) describes the Smart Grid as "an intelligent electricity grid—one that uses digital communications technology, information systems, and automation to detect and react to local changes in usage, improve system operating efficiency, and, in turn, reduce operating costs while maintaining high system reliability."

In 2007, Congress passed the Energy Independence and Security Act (P.L. 110-140). Title XIII of the act described characteristics of the Smart Grid and directed DOE to establish a Smart Grid Investment Matching Grant (SGIG) program to help support the modernization of the nation's electricity system.

In 2014, DOE concluded that the adoption of Smart Grid technologies was accelerating but at varying rates "depending largely on decision-making at utility, state, and local levels." DOE noted that the nation's electricity system is in the midst of "potentially transformative change," with challenges for Smart Grid deployment remaining with respect to grid-connected renewable and distributed energy sources and adaptability to current and future consumer-oriented applications.

Costs of deploying the Smart Grid remains an issue, and study estimates vary. While some DOE programs have supported grid modernization, Congress has not explicitly appropriated funding for deployment of the Smart Grid since the American Recovery and Reinvestment Act of 2009 (P.L. 111-5). In its 2014 study, DOE estimated historical and forecast investment in the Smart Grid as approximately $32.5 billion between 2008 and 2017, averaging $3.61 billion annually in the period. If this level of investment remains constant, it would put spending well below levels the Electric Power Research Institute (in 2011) and the Brattle Group (in 2008) estimated were needed to fully build the Smart Grid by approximately 2030. From 2010 to 2015, $3.4 billion in SGIG grants supported 99 projects resulting in $8 billion in grid modernization.

Congress could provide funding to help bridge the funding gap if it chooses to accelerate adoption of the Smart Grid. A number of near-term trends—including electric vehicles, environmental concerns, and the ability of customers to take advantage of real-time pricing programs to reduce consumer cost and energy demand—would benefit from investments in Smart Grid enabled technologies.

While concerns such as cybersecurity and privacy exist, most electric utilities appear to view Smart Grid systems positively. Costs could be reduced and system resiliency improved by further integration of automated switches and sensors, even considering the cost of a more cybersecure environment. But with the potentially high costs of a formal transition, some see the deployment of the Smart Grid continuing much the same as it has, with a gradual modernization of the system as older components are replaced.

Introduction

The electrical grid in the United States comprises all of the power plants generating electricity, together with the transmission and distribution lines and systems that bring power to end-use customers. The "grid" also connects the many publicly and privately owned electric utility and power companies in different states and regions of the United States. However, with changes in federal law, regulatory changes, and the aging of the electric power infrastructure as drivers, the grid is changing from a largely patchwork system built to serve the needs of individual electric utility companies to essentially a national interconnected system, accommodating massive transfers of electrical energy among regions of the United States.

The modernization of the grid to accommodate today's power flows, serve reliability needs, and meet future projected uses is leading to the incorporation of electronic intelligence capabilities for power control purposes and operations monitoring. The "Smart Grid" is the name given to this evolving intelligent electric power network, with digital technologies increasingly replacing analog devices, thus enabling Smart Grid hardware and software functions.

The U.S. Department of Energy (DOE) describes the Smart Grid as "an intelligent electricity grid—one that uses digital communications technology, information systems, and automation to detect and react to local changes in usage, improve system operating efficiency, and, in turn, reduce operating costs while maintaining high system reliability."1

The Smart Grid is viewed as a modernization of the nation's power grid by the Edison Electric Institute (EEI), the trade association of the U.S. investor-owned utilities, which serve approximately 68% of U.S. electricity customers. EEI states that "[t]he modern grid will utilize telecommunications and information technology infrastructure to enhance the reliability and efficiency of the electric delivery system. The smart grid will meet the growing electricity needs of our digital economy more effectively."2

|

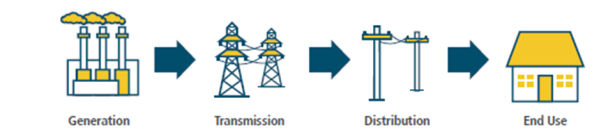

|

Source: DOE, Quadrennial Energy Review Report: An Integrated Study of the U.S. Electricity System, January 2017. |

Smart Grid technologies are seen as necessary to handle the more complex power flows on the modern grid. The grid was originally designed by electric utilities to serve customers within the same state, and as shown in Figure 1, electricity flowed in one direction from power plants to customers. Over time, the grid expanded as utilities formed power pools to interconnect their transmission systems to share power generation resources. In the closing decades of the last century, with the advent of competition in the electricity industry and power marketing and the development of regional transmission organizations serving multi-state areas, large regional power flows began to dominate transmission systems.

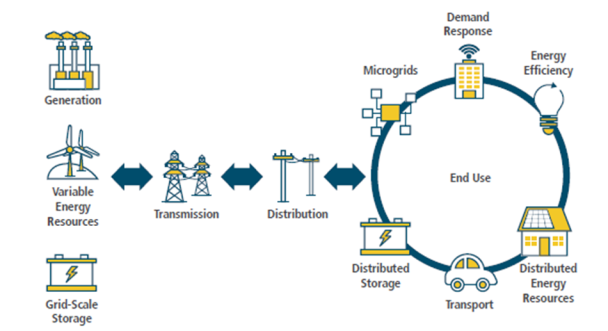

|

|

Source: DOE, Quadrennial Energy Review Report: An Integrated Study of the U.S. Electricity System, January 2017. Note: Distributed energy resources are small, modular, energy generation and storage technologies that provide electric capacity or energy near the consumer of electricity. |

Now, with increasing two-directional power flows (as illustrated in Figure 2), the grid is being augmented with new technologies to manage an evolving system with many potential points for electricity generation, demand response,3 and energy storage.

Smart Grid Technologies

DOE summarizes Smart Grid technologies as being able to "monitor, protect, and automatically optimize the operation of its interconnected elements, including central and distributed generation; transmission and distribution systems; commercial and industrial users; buildings; energy storage; electric vehicles; and thermostats, appliances, and consumer devices."4 These technologies will include both new and redesigned technologies, such as phasor measurement units and advanced meters, which are expected to increase electric system reliability, flexibility, and grid resiliency.

Within the delivery portion of the electric grid, smart grid technology is enabling sizable improvements in distribution and transmission automation. Emerging technologies on the distribution grid (whether digital communications, sensors, control systems, digital "smart" meters, distributed energy resources, greater customer engagement, etc.) present both technical and policy challenges and opportunities for the delivery of energy services.5

According to DOE, there are likely to be many other opportunities to infuse advanced technology into key operating elements of the grid, and some of these technologies are described in Table 1.

|

Grid Component/Opportunity |

Description |

|

AC/DC power flow controllers/converters |

Technologies that adjust power flow at a more detailed and granular level than simple switching. |

|

Advanced multi-mode optimizing controls |

Controls capable of integrating multiple objectives and operating over longer time horizons, to replace simple manual and tuning controls, or controls that operate based only on conditions at single points in time. |

|

Bilaterally fast storage |

Energy storage in which charge and discharge rates are equally fast and thus more flexible. |

|

Control frameworks |

New hybrid centralized/distributed control elements and approaches. |

|

Management of meta-data, including network models |

New tools for obtaining, managing, and distributing grid meta-data, including electric network models. |

|

Synchronized distribution sensing |

Synchronization of measurements in order to provide more accurate snapshots of what is happening on the grid. |

|

Transactive buildings |

Buildings with controls and interfaces that connect and coordinate with grid operations in whole-grid coordination frameworks. |

|

"X"-to-grid interface and integration |

Interface technologies, tools, and standards for the general connection of energy devices to power grids; includes integrated mechanisms for coordinating those devices with grid operations in whole-grid coordination frameworks. |

|

Distribution System Operation |

Structure for clear responsibility for distributed reliability. |

Source: DOE, QER Report: Energy Transmission, Storage, and Distribution Infrastructure, Table 3-1, Examples of Key Technologies for the Grid of the Future, https://energy.gov/sites/prod/files/2015/04/f22/QER%20ch3%20final_0.pdf.

Status of Smart Grid Deployment

In 2014, DOE issued a report assessing the status of Smart Grid deployment, concluding that the adoption of Smart Grid technologies (i.e., digital sensing, communications, and control technologies) was accelerating but at varying rates "depending largely on decision-making at utility, state, and local levels."6 DOE noted that the nation's electricity system is in the midst of "potentially transformative change," with challenges for Smart Grid deployment remaining with respect to the incorporation of grid-connected renewable and distributed energy sources and adaptability to current and future consumer-oriented applications.7

A study by the RAND Corporation discussed hurdles to Smart Grid adoption, noting that cost was among the primary barriers:

Our findings suggest that, although the benefits of the smart grid are likely positive on net when viewed from a societal standpoint, several barriers to adoption (i.e., costs) can reduce the size of the overall benefits and create both winners and losers across households and other consumers. Technical solutions at the transmission and distribution levels (such as the increased ability to monitor the system for problems and incorporate intermittent renewable energy sources) can provide some benefits to both utilities and customers (through passed through savings), and the efficiency benefits associated with real-time pricing and demand response enabled by smart-grid technologies can be significant.8

Technology Compatibility as a Barrier to Adoption

In 2007, Congress passed the Energy Independence and Security Act (EISA; P.L. 110-140). EISA directed the National Institute of Standards and Technology (NIST) to develop a set of standards to help ensure the compatibility of Smart Grid technologies.9 The Federal Energy Regulatory Commission (FERC) was authorized to adopt a set of interoperability standards that NIST would develop based on recommendations of the Smart Grid Federal Advisory Committee (SGAC). In 2010, NIST developed a set of recommended interoperability standards and presented these to FERC.10 FERC did not adopt the recommended standards largely due to cybersecurity and other concerns expressed by industry and state stakeholders.11 The SGAC continues to work on developing and recommending standards that might meet interoperability and cybersecurity goals.12

Estimates of Smart Grid Cost

Estimating costs for Smart Grid systems can be difficult given that digital technologies are constantly evolving and must be designed or augmented for cybersecurity. That said, two recent estimates illustrate a range of costs for building the Smart Grid.

In 2011, the Electric Power Research Institute (EPRI) estimated that $338 billion to $476 billion over a 20-year period would be required for a "fully functioning Smart Grid."13 The estimate includes preliminary amounts of $82 billion to $90 billion for transmission systems and substations, $232 billion to $339 billion for distribution systems, and $24 billion to $46 billion for consumer systems.14

Previously, the Brattle Group had estimated in 2008 that the electric utility industry "will need to make a total infrastructure investment of $1.5 trillion to $2.0 trillion by 2030" in its "realistically achievable potential" (RAP) efficiency base case scenario.15 As part of that investment, Brattle identified $880 billion in transmission and distribution system modernization to integrate renewable energy and continue the installation of the Smart Grid.16

Potential Smart Grid Benefits

EPRI estimated that investments between $338 billion and $476 billion could result in net benefits between $1,294 billion and $2,028 billion for a benefit-to-cost ratio between 2.8 and 6.0. EPRI's study described the potential benefits of the Smart Grid as follows:

Allows Direct Participation by Consumers. The Smart Grid consumer is informed, modifying the way they use and purchase electricity. They have choices, incentives, and disincentives.

Accommodates all Generation and Storage Options. The Smart Grid accommodates all generation and storage options.

Enables New Products, Services, and Markets. The Smart Grid enables a market system that provides cost-benefit tradeoffs to consumers by creating opportunities to bid for competing services.

Provides Power Quality for the Digital Economy. The Smart Grid provides reliable power that is relatively interruption-free.

Optimizes Asset Utilization and Operational Efficiently. The Smart Grid optimizes assets and operates efficiently.

Anticipates and Responds to System Disturbances (Self-heal). The Smart Grid independently identifies and reacts to system disturbances and performs mitigation efforts to correct them.

Operates Resiliently against Attack and Natural Disaster. The Smart Grid resists attacks on both the physical infrastructure (substations, poles, transformers, etc.) and the cyber-structure (markets, systems, software, communications).17

DOE stated in its 2014 Smart Grid status report that "[t]echnology costs and benefits are still being determined and will continue to constrain decisions for deployment."18

Another study in 2009 by KEMA, Inc., stated its view of the potential benefits of the Smart Grid as follows:

[The] Smart Grid is universally understood to be the key enabling technology for the nation's ambitions for renewable energy development, electric vehicle adoption, and energy efficiency improvements.... [The] Smart Grid is to the electric energy sector what the Internet was to the communications sector and should be viewed and supported on that basis.19

Smart Grid Investment Matching Grants

Title XIII of EISA describes characteristics of the Smart Grid to help support the modernization of the nation's electricity system. EISA Section 1306 directed DOE to establish a Smart Grid Investment Grant (SGIG) program to "provide reimbursement of one-fifth (20 percent) of qualifying Smart Grid investments."

The American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5) increased potential federal matching for grants to ''up to one-half (50 percent)."20 From 2010 to 2015, ARRA provided $3.4 billion to fund 99 projects under the SGIG program resulting in $8 billion in grid modernization.21

Estimating the Cost of Smart Grid Deployment to 2030

The high cost of the Smart Grid is considered a primary barrier to its adoption. Smart Grid technologies and capabilities continue to be developed. The eventual costs of a Smart Grid build-out may therefore be influenced by new technologies that have yet to be deployed or current technologies that may be modified.

In its 2014 study, DOE estimated historical and forecast investment in the Smart Grid as approximately $32.5 billion between 2008 and 2017, averaging $3.61 billion annually in the period.22 If this level of investment continues, this would put spending well below estimates made by EPRI and Brattle to fully build the Smart Grid by approximately 2030. If Congress chooses to, it could provide funding to help bridge the funding gap to accelerate adoption of the Smart Grid.

The original EPRI and Brattle estimates consider Smart Grid investments to 2030 (over approximately 20 years). Using 20 years as the time frame for both estimates results in a range for annual expenditures ranging from $23.8 billion (using the higher estimate of $476 billion from EPRI) to $44 billion annually (using the Brattle estimate of $880 billion) in nominal dollars.

Using DOE's estimate as a basis, a reasonable assumption may be that Smart Grid spending by the electricity industry of approximately $3.5 billion annually could continue through 2030 as part of modernization efforts. Under this scenario, total U.S. Smart Grid spending by the electricity industry could reach $46 billion for the 2018-2030 period (in nominal dollars).

Estimating a range of investment for 2018 to 2030 to fully implement the Smart Grid could be accomplished in a number of ways. For example, deducting the $32.5 billion in DOE's historical and forecast spending in the period from 2008 to 2017 from the original EPRI and Brattle estimates results in remaining investment needs of $444 billion (EPRI) to $847 billion (Brattle). These amounts could be further reduced by deducting the $46 billion in assumed industry spending from 2018 to 2030 resulting in a range roughly between $400 billion (EPRI) and $800 billion (Brattle) (in nominal dollars).

Alternatively, if the original EPRI and Brattle estimates are annualized over 20 years, then the remaining period from 2018 to 2030 could result in investment amounts ranging from $309 billion (EPRI) to $572 billion (Brattle). Deducting the $46 billion in assumed industry spending from 2018 to 2030 to arrive at a range roughly between $260 billion (EPRI) and $526 billion (Brattle) (in nominal dollars).

Additionally, other estimates of costs to modernize electricity infrastructure range from $350 billion to $500 billion.23

Electricity Infrastructure

Electric utility infrastructure mostly consists of the power plants generating electricity and the transmission and distribution lines and other equipment delivering electricity to customers. Electricity infrastructure equipment generally has a long lifespan, and modernization is an ongoing process.24

As of 2014, there were more than 3,300 electricity providers—comprised of 2,012 publicly-owned utilities (POUs), 187 investor-owned utilities (IOUs), 876 co-operative electric utilities (co-ops), 218 power marketers, and nine federal power agencies (FPAs)—serving almost 148 million customers.25 IOUs had about 52% of electric industry electricity sales in 2014, followed by power marketers with 20%, POUs with 15%, co-ops with 11%, and FPAs with 1%.26 Most electricity infrastructure is financed by private sector investment and is built by IOUs, POUs, and co-ops. The cost of capital can vary according to several factors, including by type of electricity provider.

Electricity Providers and Sources of Infrastructure Funding

Different electricity providers have different sources of financing to fund electric infrastructure development and are subject to different oversight and regulatory requirements.

POUs are nonprofit government entities that are member-owned and include local or municipal utilities, public utility districts and public power districts, state authorities, irrigation districts, and joint municipal action agencies.27 They obtain their financing for infrastructure from the sale of tax-free general obligation bonds and from revenue bonds secured by proceeds from the sale of electricity. New bond issues for public power in 2016 were expected to be $7 billion and are estimated to have averaged between $10 billion and $13 billion over the last 10 years.28 This would include all public power infrastructure investments, not just Smart Grid modernization.

Electric power IOUs are privately owned, for-profit entities that operate in almost all U.S. states. Many IOUs provide services for the generation, transmission, and distribution of electricity.29 Capital expenditures by IOUs were estimated at $120.8 billion in 2016.30 DOE reports that Smart Grid investments by IOUs in electric delivery systems averaged $8.5 billion annually for transmission system upgrades and $17 billion annually for distribution system upgrades from 2003 to 2012 (in 2012 dollars).31

IOUs raise funds from stock and corporate bond issues and bank loans. Some IOUs operate in states with competitive regional markets for power generation, administered by a Regional Transmission Organization, subject to oversight from FERC over wholesale rates.32 Interstate transmission projects generally require rates for cost recovery from customers to be approved by FERC.33 Other IOUs are regulated by state commissions and must gain approval for infrastructure projects, as cost recovery is from customers through utility rates. IOU credit ratings have "steadily declined" over the past 30 years,34 and the cost of capital for IOU infrastructure projects can be higher than for POUs.35

Co-ops generally operate in rural areas with relatively low numbers of customers per transmission mile.36 They are incorporated under state laws and are governed by the organization's board of directors elected by the members. Co-ops are owned by the consumers they serve, and as nonprofit entities, they are required to provide electric service to their members at cost. The Rural Utilities Service (RUS) of the U.S. Department of Agriculture and the National Rural Utilities Cooperative Finance Corporation are important sources of debt financing for co-op infrastructure projects.37 The RUS electric program38 has a $5.5 billion annual loan budget authority for financing all electric infrastructure in rural areas, which would likely include Smart Grid technologies.39

FPAs are part of several U.S. government agencies: the Army Corps of Engineers, the Bureau of Indian Affairs and the Bureau of Reclamation under the Department of the Interior, the Power Marketing Administrations under the DOE (Bonneville, Southeastern, Southwestern, and Western),40 and the Tennessee Valley Authority (TVA).41 TVA is a self-financing government corporation, funding operations through electricity sales and bond financing. In order to meet its future capacity needs, fulfill its environmental responsibilities, and modernize its aging generation system, TVA uses integrated resource plans to map out infrastructure needs and costs.42 TVA's financial statement lists $2.1 billion in construction expenses for FY2017,43 which likely includes Smart Grid innovations as part of TVA's Grid Modernization program.44

The Smart Grid as Enabler or a Result of Change?

Most electric utilities appear to view Smart Grid systems positively, even with the added concerns for cybersecurity. Cost of operations could be reduced and system resiliency improved by further integration of automated switches and sensors, even considering the cost of a more cybersecure environment. But with the potentially high costs of a formal transition, some see Smart Grid deployment continuing much the same as it has, with a gradual modernization of the system as older components are replaced.

The potential for the Smart Grid to enable change may be most visibly exemplified in the potential to further integrate variable renewable resources at a lower cost. A wider deployment of a "fully functional" Smart Grid could see the renewable generation in one state or region supporting energy needs in another state or region. It is likely that all of the drivers and technologies—from microgrids, energy efficiency, smart appliances, and zero-net energy homes to electric vehicles (EVs) and energy storage—could see more effective deployment at lower cost from an integrated Smart Grid approach.45

Modernization of the grid has been accomplished to various degrees as new digital systems replace old analog components. Attempts to introduce some components of the Smart Grid have been deemed successful (e.g., the deployment of synchrophasors providing real-time information on system power conditions and the replacement of old inverters on solar photovoltaic systems with smart inverters capable of disconnecting from the grid during times of power interruption).46 But introduction of other components have been problematic. Smart meters have run into cost and performance issues and resistance to the technology (generally from concerns of some customers over potential health impacts of radio wave emissions).47

Potential Drivers of New Infrastructure Spending

A number of near-term trends—including technology, environmental concerns, and consumer interest regulation—are leading to more industry investments in the Smart Grid.

Electric Vehicles and Climate Change

One area with the potential for increased electricity consumption is transportation. A growing number of automobile manufacturers are introducing plug-in EVs. Some utilities are considering whether EVs will be a longer term means for addressing increasing electricity demand and provide opportunities for vehicle-to-grid energy storage and related services.48

However, obstacles exist to the wider adoption of EVs, such as high cost and the limited range for EV travel. Building out a national infrastructure for EV charging—whether built by electric utilities or some other entity—might address some of this concern. Regulatory issues have also been raised as regards the sale of electricity from private owners of EV charging stations (including the question of whether a sale of electricity from an EV charging station is a "sale for resale" and, as such, subject to laws governing electric utilities). Some state jurisdictions have moved to prevent classification of EV charging stations as electric utilities.

A recent United Nations study predicted an almost complete transition of U.S. automobiles from internal combustion engines to EVs by 2050, should that be a policy goal for carbon dioxide reduction.49 Recent events add credence to that study as several nations have looked at greenhouse gas emissions reduction and climate change goals. In 2017, Swedish car maker Volvo announced plans to phase out cars solely powered by internal combustion engines beginning around 2019, after which all vehicles Volvo produces will be electric-gas hybrids or EVs.50 General Motors made a similar announcement in October 2017, revealing its plans for 20 all-electric vehicle models to be sold globally by 2023. These moves come as China, Britain, and France have indicated or announced plans to ban gasoline-fueled vehicles in the next 20 years.51

The readiness of the grid to accept EVs is another issue.52 Some state and utility jurisdictions may be better able to accommodate the needs, and potentially benefit from energy storage attributes of EVs, than others. Charging and discharging of EV batteries will primarily affect electricity distribution systems where EVs will be parked or garaged, and this is where major infrastructure modifications may be needed. If EV charging takes place mostly at night, then electric utilities may potentially benefit if demand for power is increased.53

Customer-Focused Programs

The ability of customers to take advantage of real-time pricing programs to reduce consumer cost and energy demand depends on the deployment of smart technologies and program approval by regulatory jurisdictions. Such programs have been shown to result in significant customer savings and are dependent on Smart Grid sensors, controls, and metering technologies.54

Grid modernization programs are likely to extend beyond the grid's operational needs and better enable customers to manage their energy choices.

Grid modernization investments in reliability and adaptability, and price responsive demand, are the building blocks to a grid that best serves the customer needs for power. Power system investments, especially in the delivery system, consider financial and physical factors to reflect planning and operating considerations. Selecting from among alternatives should be based on the expected net benefits to the customer, which includes, but is not restricted to, current supply costs. Customers responding to prices based on marginal supply costs provide signals to what aspects of grid modernization are most essential, and many elements of grid modernization are needed to achieve the desired level of price response.55

Major Smart Grid Concerns

This section discusses some of the major concerns expressed about Smart Grid adoption. While other potential issues exist, most electric utilities appear to view the intelligence and communications capabilities of Smart Grid systems positively with regard to the potential benefits of Smart Grid adoption discussed earlier in this report.

Cybersecurity

Smart Grid modernization ensues as upgrades to electric power infrastructure are added. Substations are being automated with superior switching capabilities to enhance current flows and control of the grid. Devices called "phasor measurement units" are also being added to substations to make time- and location-specific measurements of transmission line voltage, current, and frequency (i.e., synchrophasor measurements made on the order of 30 times per second instead of data measured once every two to four seconds by current industrial control systems), providing better tools to improve power system reliability.

While these new components may add to the ability to control power flows and enhance the efficiency of grid operations, they also potentially increase the susceptibility of the grid to cyberattack. Other aspects of Smart Grid systems, such as wireless and two-way communications through internet-connected devices, can also increase cybersecurity vulnerabilities. The potential for a major disruption or widespread damage to the nation's power system from a large-scale cyberattack has increased focus on the cybersecurity of the Smart Grid.56

The speed inherent in the Smart Grid's enabling digital technologies may also increase the chances of a successful cyberattack, potentially exceeding the ability of the defensive system and defenders to respond. Such scenarios may become more common as machine-to-machine interfaces enabled by artificial intelligence (AI) are being integrated into cyber defenses. However, AI systems learn from experience and may be of limited use in cybersecurity defenses.

Unfortunately, machine learning will never be a silver bullet for cybersecurity compared to image recognition or natural language processing, two areas where machine learning is thriving. There will always be a person who tries to find issues in our systems and bypass them. Therefore, if we detect 90% attacks today, new methods will be invented tomorrow. To make things worse, hackers could also use machine learning to carry out their nefarious endeavors.57

Thus, one could envision a scenario where AI may be susceptible to intrusion feints, which may cause systems to protect against false or disguised cyberattacks, potentially allowing an attack focused along another path to continue.

DOE and the electric utility industry continue to work cooperatively to address these and other cybersecurity concerns.

As the Sector-Specific Agency ... for electrical infrastructure, DOE ensures unity of effort and serves as the day-to-day federal interface for the prioritization and coordination of activities to strengthen the security and resilience of critical infrastructure in the electricity subsector. Our ongoing collaboration with vendors, utility owners, and operators of the electricity and oil and natural gas sectors strengthens the cybersecurity of critical energy infrastructure against current and future threats.58

Privacy and Customer Data

The sharing of information in applications used by the Smart Grid has raised questions on the safety of that information. Security of customer information in wireless applications and how personal data characteristics (such as customer usage information) can be protected are issues often mentioned in discussions of the Smart Grid and cybersecurity. Proposed solutions include encryption of data (with limited decryption for data checking), aggregation of data at high levels to mask individual usership, limiting the amount of data to just information needed for billing purposes, and real-time monitoring of these networks. But even these methods might not be enough to guard against a sophisticated intruder. The development of Smart Grid standards governing the collection and use of customer data may be a possible next step.59

If customers participate in demand-side management programs, then customer usage data can provide a wealth of information for a variety of programs for interruptible loads or time-of-use rates. But customer-specific data stored in home area networks (HANs)—or customer-specific data communicated between the HAN and distribution utility (or load aggregator)—must be secure to protect the privacy of information. EVs may offer another potential payload of data on customer movement and habits if data collected or stored is not restricted to electricity consumption for billing purposes.

Recent Legislation

In the 115th Congress, the "Distributed Energy Demonstration Act of 2017" (S. 1874), introduced in September 2017, would direct the Secretary of Energy to establish demonstration grant programs related to the Smart Grid and distributed energy resource technologies that are likely dependent on its deployment. These technologies include energy generation technologies, demand response and energy efficiency resources, EVs and associated supply equipment and systems, and aggregations and integrated control systems, including virtual power plants, microgrids, and networks of microgrid cells. Federal matching funds would be provided for qualifying Smart Grid investments. S. 1874 would support the continued deployment of Smart Grid technologies but modify certain conditions of SGIG grants to ensure various consumer benefits.

In the 114th Congress, the "North American Energy Security and Infrastructure Act of 2015" (H.R. 8) was passed by the House in December 2015. The legislation included provisions to capitalize on the enabling nature of the Smart Grid for new energy efficient technologies. The bill would have required DOE to develop an energy security plan and to report on smart meter security concerns. Further, the bill would have directed the Federal Trade Commission to consider Energy Guide labels on new products to state that the product features Smart Grid capability. The use and value of that feature would depend upon the Smart Grid capability of the utility system in which the product is installed and the active utilization of that feature by the customer. Using the product's Smart Grid capability on such a system could reduce the product's annual operation costs.

Author Contact Information

Footnotes

| 1. |

DOE, Transforming the Nation's Electricity System: The Second Installment of the Quadrennial Energy Review, January 2017, p. S-4, https://energy.gov/sites/prod/files/2017/01/f34/Transforming%20the%20Nation%27s%20Electricity%20System-The%20Second%20Installment%20of%20the%20Quadrennial%20Energy%20Review—%20Full%20Report.pdf. |

| 2. |

EEI, What Is the Smart Grid?, 2017, http://smartgrid.eei.org/Pages/FAQs.aspx#grid. |

| 3. |

"Demand response programs are incentive-based programs that encourage electric power customers to temporarily reduce their demand for power at certain times in exchange for a reduction in their electricity bills. Some demand response programs allow electric power system operators to directly reduce load, while in others, customers retain control. Customer-controlled reductions in demand may involve actions such as curtailing load, operating onsite generation, or shifting electricity use to another time period. Demand response programs are one type of demand-side management, which also covers broad, less immediate programs such as the promotion of energy-efficient equipment in residential and commercial sectors." See Energy Information Administration, Glossary, 2017, https://www.eia.gov/tools/glossary/index.php. |

| 4. |

DOE, QER Report: Energy Transmission, Storage, and Distribution Infrastructure, April 2015, https://energy.gov/sites/prod/files/2015/04/f22/QER%20ch3%20final_0.pdf. |

| 5. |

DOE, QER Report, pp. 3-13. |

| 6. |

DOE, 2014 Smart Grid System Report, August 2014, https://www.smartgrid.gov/files/2014-Smart-Grid-System-Report.pdf. |

| 7. |

DOE, 2014 Smart Grid System Report, p. 17. |

| 8. |

Christopher Guo, Craig A. Bond, and Anu Narayanan, The Adoption of New Smart-Grid Technologies: Incentives, Outcomes, and Opportunities, RAND Corporation, 2015, p. xii, https://www.rand.org/pubs/research_reports/RR717.html. |

| 9. |

"Such protocols and standards shall further align policy, business, and technology approaches in a manner that would enable all electric resources, including demand-side resources, to contribute to an efficient, reliable electricity network." See EISA, §1305. |

| 10. |

The proposed standards focused on protocols for data exchange between devices, networks and control centers, and common data formats to facilitate substation automation, communication, and addressing the cybersecurity implications of all proposed standards. |

| 11. |

U.S. Government Accountability Office, Electricity Grid Modernization, GAO-11-117, January 2011, p. 17, https://www.ferc.gov/industries/electric/indus-act/smart-grid/gao-report.pdf. |

| 12. |

NIST, Smart Grid Federal Advisory Committee, 2018, https://www.nist.gov/engineering-laboratory/smart-grid/smart-grid-federal-advisory-committee. |

| 13. |

EPRI states that since the present grid "was not designed to meet the needs of a restructured electricity marketplace, the increasing demands of a digital society, or the increased use of renewable power production," the Smart Grid will require the modernization of the "electricity delivery system so that it monitors, protects, and automatically optimizes the operation of its interconnected elements—from the central and distributed generator through the high-voltage transmission network and the distribution system, to industrial users and building automation systems, to energy storage installations, and to end-use consumers and their thermostats, electric vehicles, appliances, and other household devices." EPRI, Estimating the Costs and Benefits of the Smart Grid, 2011, p. 1-1, https://www.smartgrid.gov/files/Estimating_Costs_Benefits_Smart_Grid_Preliminary_Estimate_In_201103.pdf. |

| 14. |

EPRI, Estimating the Costs and Benefits of the Smart Grid, p. 1-4. |

| 15. |

Brattle defined its RAP base case scenario as "realistically achievable potential for [energy efficiency/distributed resources (EE/DR)] programs, but does not include any new federal carbon policy. This scenario includes a forecast of likely customer behavior and takes into account existing market, financial, political, and regulatory barriers that are likely to limit the amount of savings that might be achievable through EE/DR programs. It is important to note that the RAP Efficiency Base Case Scenario is our most likely case in the absence of a new federal carbon policy." Marc W. Chupka et al., Transforming America's Power Industry: The Investment Challenge 2010-2030, Brattle Group (for the Edison Foundation), November 2008, p. vi, http://www.edisonfoundation.net/iei/publications/Documents/Transforming_Americas_Power_Industry.pdf. |

| 16. |

Chupka et al., Transforming America's Power Industry, p. xi. |

| 17. |

EPRI, Estimating the Costs and Benefits of the Smart Grid, pp. 1-8. |

| 18. |

DOE, 2014 Smart Grid System Report, p. 17. |

| 19. |

KEMA, Inc., The U.S. Smart Grid Revolution: KEMA's Perspectives for Job Creation, January 13, 2009, https://www.smartgrid.gov/files/The_US_Smart_Grid_Revolution_KEMA_Perspectives_for_Job_Cre_200907.pdf. |

| 20. |

See ARRA Sec. 405. Amendments to Title XIII of EISA. |

| 21. |

ARRA provided $4.5 billion to DOE's Office of Electricity Reliability and Energy Delivery for Grid Modernization/Smart Grid/Electricity Storage, with $3.4 billion going to the SGIG program. DOE, Smart Grid Investment Grant (SGIG) Program Final Report, December 2016, https://www.smartgrid.gov/document/us_doe_office_electricity_delivery_and_energy_reliability_sgig_final_report.html. |

| 22. |

This includes both industry and federal cost-matched funding. See DOE, 2014 Smart Grid System Report, Figure 2, Baseline U.S. Smart Grid Spending 2008-2017. Spending represents advanced Smart Grid projects, distribution automation, and smart metering. |

| 23. |

DOE, Transforming the Nation's Electricity System, p. 7-9. |

| 24. |

"The electricity sector is ... confronting a complex set of changes and challenges, including: aging infrastructure; a changing generation mix; [and] growing penetration of variable generation." DOE, Transforming the Nation's Electricity System, p. S-1. |

| 25. |

American Public Power Association, U.S. Electric Utility Industry Statistics, 2014, 2016, http://appanet.files.cms-plus.com/PDFs/Directory%20-%20Statistical%20Report.pdf. |

| 26. |

American Public Power Association, U.S. Electric Utility Industry Statistics. |

| 27. |

DOE, A Primer on Electric Utilities, Deregulation, and Restructuring of U.S. Electricity Markets, May 2002, http://www.pnl.gov/main/publications/external/technical_reports/PNNL-13906.pdf. "Local, or municipal, utilities were established to provide service to their communities and nearby consumers at cost.... State authorities ... are agencies of their respective State governments. Irrigation districts are primarily located in the western United States.... They were organized by local citizens initially to manage water resources for agricultural purposes. Because electricity is integral to this function, many also provide retail electric service.... Some States have created joint municipal action agencies for the purpose of constructing power plants and purchasing wholesale power for resale to municipal distribution utilities participating in the organization." U.S. Energy Information Administration, Electric Power Industry Overview 2007, 2007, http://www.eia.gov/electricity/archive/primer/. |

| 28. |

Email from Desmarie Waterhouse, Vice President of Government Relations and Counsel, American Public Power Association, February 24, 2017. |

| 29. |

DOE, A Primer on Electric Utilities. |

| 30. |

EEI, Delivering America's Energy Future, February 8, 2017, http://www.eei.org/resourcesandmedia/industrydataanalysis/industryfinancialanalysis/Documents/Wall_Street_Briefing.pdf. |

| 31. |

DOE, 2014 Smart Grid System Report, p. 3. |

| 32. |

Regional Transmission Organizations "coordinate, control, and monitor the operation of the electric power system within their territory [and] engage in regional planning to make sure the needs of the system are met with the appropriate infrastructure." DOE, United States Electricity Industry Primer, July 2015, pp. 25-26, https://energy.gov/sites/prod/files/2015/12/f28/united-states-electricity-industry-primer.pdf. |

| 33. |

For further details see CRS Report R42068, Regulatory Incentives for Electricity Transmission—Issues and Cost Concerns, by [author name scrubbed]. |

| 34. |

"Although most utilities still maintain investment grade status (BBB and above) there are currently utilities with 'junk' ratings (BB and below), few utilities rated AA, and no AAA rated utilities." DOE, "QER Public Stakeholder Meeting: Financing Energy Infrastructure (Transmission, Storage, and Distribution)," October 6, 2014, https://www.energy.gov/sites/prod/files/2014/09/f18/Finance%20meeting%20memo%20v18.pdf. |

| 35. |

"Electric utility costs of capital vary over a fairly wide range depending on the state of the economy, but regardless of absolute values there is typically a 5 percent point spread by which IOU capital charge rates exceed POU capital charge rates." Gerry Braun and Stan Hazelroth, "Energy Infrastructure Finance: Local Dollars for Local Energy," Electricity Journal, June 2015, http://www.sciencedirect.com/science/article/pii/S1040619015001104. |

| 36. |

DOE, A Primer on Electric Utilities. |

| 37. |

For further information on farm bill funding for the RUS programs, see CRS Report RL31837, An Overview of USDA Rural Development Programs, by [author name scrubbed]. |

| 38. |

The electric programs offer direct loans, guaranteed loans, and bond and note guarantees. Direct loans under Section 4 of the Rural Electrification Act of 1936, as amended (7 U.S.C. 904), may be used to finance electric distribution, transmission, and generation systems and for demand-side management, energy efficiency and conservation programs, and renewable energy systems to serve rural areas. |

| 39. |

See Rural Electrification and Telecommunications Loans Program Account, Consolidated Appropriations Act of 2016 (P.L. 114-113). |

| 40. |

FPA infrastructure budgets (other than TVA) are largely covered under the Water and Dams section of this report. |

| 41. |

Most federal power plants are hydroelectric projects designed for flood control, irrigation purposes, and (pursuant to statutory obligations) supplying wholesale power to publicly owned utilities and electric cooperatives. |

| 42. |

For more details, see CRS Report R43172, Privatizing the Tennessee Valley Authority: Options and Issues, by [author name scrubbed]. |

| 43. |

TVA, Financial Statements, 2017, http://www.snl.com/IRW/AsReported/4063363/Index. |

| 44. |

Tennessee Valley Authority, Grid Modernization, 2018, http://152.87.4.98/environment/technology/smart_grid.htm. |

| 45. |

These technologies are discussed further in CRS Report R43742, Customer Choice and the Power Industry of the Future, by [author name scrubbed]. |

| 46. |

Smart inverters can also smooth the swings in power flow due to intermittent power generation from solar photovoltaic operation. Herman K. Trabish, "Smart Inverters: The Secret to Integrating Distributed Energy onto the Grid?," Utility Dive, June 4, 2014, https://www.utilitydive.com/news/smart-inverters-the-secret-to-integrating-distributed-energy-onto-the-grid/269167/. |

| 47. |

American Cancer Society, "Smart Meters," 2018, https://www.cancer.org/cancer/cancer-causes/radiation-exposure/smart-meters.html. Smart meters emit the same type of radiofrequency (RF) waves as cell phones and wi-fi devices. The American Cancer Society notes that, "because the amount of RF radiation you could be exposed to from a smart meter is much less than what you could be exposed to from a cell phone, it is very unlikely that living in a house with a smart meter increases risk of cancer." |

| 48. |

Under this concept, EV batteries could eventually be used as storage of off-peak energy for the grid and help provide demand response when the vehicles are not in use. |

| 49. |

United Nations, Sustainable Development Solutions Network and Institute for Sustainable Development and International Relations, Pathways to Deep Decarbonization, July 8, 2014, http://unsdsn.org/wp-content/uploads/2014/09/DDPP_Digit.pdf. |

| 50. |

Volvo Car Group, "Volvo Cars to Go All Electric," press release, July 5, 2017, https://www.media.volvocars.com/global/en-gb/media/pressreleases/210058/volvo-cars-to-go-all-electric. |

| 51. |

Nathan Bomey, "General Motors to Switch to Electric Vehicles as Gas Vehicles Die a Slow Death," USA Today, October 2, 2017, https://www.usatoday.com/story/money/cars/2017/10/02/gm-electric-vehicles/722896001/. |

| 52. |

Robert Walton, "Time Not on Their Side: Utilities Ill-Prepared for EV Demand, SEPA Finds," Utility Dive, March 21, 2018, https://www.utilitydive.com/news/time-not-on-their-side-utilities-ill-prepared-for-ev-demand-sepa-finds/519530/. |

| 53. |

Nick Stockton, "Electric Cars Could Destroy the Electric Grid—or Fix It Forever," Wired, February 3, 2018, https://www.wired.com/story/electric-cars-impact-electric-grid/. |

| 54. |

Environmental Defense Fund, "New Smart Meter Data Shows Potential of Real-Time Pricing to Lower Electric Bills," press release, November 14, 2017, https://www.edf.org/media/new-smart-meter-data-shows-potential-real-time-pricing-lower-electric-bills. |

| 55. |

U.S. Congress, House Committee on Energy and Commerce, Subcommittee on Energy, Modernizing Energy and Electricity Delivery Systems: Challenges and Opportunities to Promote Infrastructure Improvement and Expansion, statement from Michael Howard, Electric Power Research Institute, 115th Cong., 2nd sess., February 15, 2017, H.Hrg 115-IF03. |

| 56. |

For more details, see CRS Report R43989, Cybersecurity Issues for the Bulk Power System, by [author name scrubbed]. |

| 57. |

Alexander Polyakov, "The Truth About Machine Learning In Cybersecurity: Defense," Forbes, November 30, 2017, https://www.forbes.com/sites/forbestechcouncil/2017/11/30/the-truth-about-machine-learning-in-cybersecurity-defense/2/#68f33298416c. |

| 58. |

DOE, "Cybersecurity for Critical Energy Infrastructure," 2018, https://www.energy.gov/oe/activities/cybersecurity-critical-energy-infrastructure. |

| 59. |

"The Office of Electricity Delivery and Energy Reliability and the Federal Smart Grid Task Force have facilitated a multi-stakeholder process to develop a Voluntary Code of Conduct (VCC) for utilities and third parties providing consumer energy use services that addresses privacy related to data enabled by smart grid technologies. Industry stakeholders attended open meetings and participated in work group activities to draft the VCC principles." DOE, "Data Privacy and the Smart Grid: A Voluntary Code of Conduct," https://www.energy.gov/oe/downloads/data-privacy-and-smart-grid-voluntary-code-conduct. |