International Approaches to Digital Currencies

Since Bitcoin was introduced a decade ago, about 2,100 cryptocurrencies have been developed. Cryptocurrencies are digital representations of value that have no status as legal tender and are administered using distributed ledger technology, running on a network of independent, peer-to-peer computers. Cryptocurrencies are controversial. Some think they will revolutionize the international payments system for the better; others are skeptical of the business model, calling it a scam. The interest and debate surrounding cryptocurrencies has led some central banks to examine whether the technology underpinning cryptocurrencies could be used to create digital versions of fiat currencies, which would have legal status in their jurisdiction of issue.

Governments around the world are taking different approaches to cryptocurrencies and digital fiat currencies, an area of increasing focus for international organizations and forums underpinning the global economy. As Congress considers issues related to digital currencies, including whether to regulate further the cryptocurrency industry, the approaches taken by other governments and international bodies may be of interest.

National Approaches to Cryptocurrencies

Cryptocurrencies span borders and are international in nature, but governments around the world have responded differently to the proliferation of cryptocurrencies. Three types of responses have generally taken shape. First, some governments, such as Malta, Singapore, and Switzerland, are active cryptocurrency hubs; they have been attracting and developing cryptocurrency industries in their countries. Second, some governments, such as China, India, and South Korea, have banned the use of cryptocurrencies or specific activities associated with cryptocurrencies. Third, some governments, including many European countries and the United States, are seeking balance between financial innovation and risk-management through regulation of cryptocurrencies.

National Approaches to Digital Fiat Currencies

To date, one country, Venezuela, which is mired in a serious economic crisis, has issued a digital fiat currency, and there are serious questions about the new currency’s success and operational viability. A few small countries are in the process of launching digital fiat currencies. Some countries, including China and Sweden, are researching the costs and benefits of these currencies, and Iran and Russia are considering them as a way to evade U.S. sanctions. Many central banks in major economies, including in the United States and the Eurozone, have argued against issuing a digital fiat currency at this time.

International Bodies’ Engagement on Digital Currencies

Many international organizations and forums are examining the implications of cryptocurrencies and, in some cases, are starting to make policy recommendations. They have examined a range of issues, including the utility of digital currencies for improving the international payments systems, the possible threats digital currencies may or may not pose to international financial stability, the divergence of national-level cryptocurrency regulations and whether international regulatory coordination is desirable, how cryptocurrencies should be treated in bank prudential regulation, and how to adapt international recommendations to combat money laundering and terrorist financing in light of cryptocurrencies.

Possible Questions for Congress

In November 2018, the Department of the Treasury announced it is developing a report on cryptocurrency regulation, including a legislative framework for Congress to consider in 2019. How do U.S. current regulations, and the proposed regulations when they are released, compare to other countries’ regulations? Some governments are actively developing cryptocurrency industries. Should the United States follow suit, or risk losing market share in the industry? Alternatively, some governments are tightly restricting, or even banning, cryptocurrency activities to protect consumers. In the United States, do consumers have adequate protections in terms of cryptocurrencies?

Has the Federal Reserve adequately assessed the potential benefits and costs of developing a digital U.S. dollar relying on distributed ledger technology? How does the U.S. position on digital fiat currencies compare to other countries’ calculations? What are the potential future impacts on the role of the dollar as a reserve currency?

What types of digital currency policies is the Trump Administration advocating at various international organizations? How do international recommendations and standards fit with U.S. regulations?

International Approaches to Digital Currencies

Jump to Main Text of Report

Contents

- Introduction

- Digital Currencies: Terminology

- Cryptocurrencies in the International Economy

- Market Development and Size

- Government Approaches to Cryptocurrencies

- Approach 1: Develop a Crytpocurrency Hub

- Approach 2: Restrict Cryptocurrencies

- Approach 3: Regulate Cryptocurrencies

- Digital Fiat Currencies

- "Central Bank Digital Currencies:" Potential and Risks

- Government Approaches to Digital Fiat Currencies

- Approach 1: Launch a Digital Fiat Currency

- Approach 2: Research the Pros and Cons of a Digital Fiat Currency

- Approach 3: Refrain from Creating a Digital Fiat Currency

- International Organization Approaches to Digital Currencies

- Questions for Congress

Appendixes

Summary

Since Bitcoin was introduced a decade ago, about 2,100 cryptocurrencies have been developed. Cryptocurrencies are digital representations of value that have no status as legal tender and are administered using distributed ledger technology, running on a network of independent, peer-to-peer computers. Cryptocurrencies are controversial. Some think they will revolutionize the international payments system for the better; others are skeptical of the business model, calling it a scam. The interest and debate surrounding cryptocurrencies has led some central banks to examine whether the technology underpinning cryptocurrencies could be used to create digital versions of fiat currencies, which would have legal status in their jurisdiction of issue.

Governments around the world are taking different approaches to cryptocurrencies and digital fiat currencies, an area of increasing focus for international organizations and forums underpinning the global economy. As Congress considers issues related to digital currencies, including whether to regulate further the cryptocurrency industry, the approaches taken by other governments and international bodies may be of interest.

National Approaches to Cryptocurrencies

Cryptocurrencies span borders and are international in nature, but governments around the world have responded differently to the proliferation of cryptocurrencies. Three types of responses have generally taken shape. First, some governments, such as Malta, Singapore, and Switzerland, are active cryptocurrency hubs; they have been attracting and developing cryptocurrency industries in their countries. Second, some governments, such as China, India, and South Korea, have banned the use of cryptocurrencies or specific activities associated with cryptocurrencies. Third, some governments, including many European countries and the United States, are seeking balance between financial innovation and risk-management through regulation of cryptocurrencies.

National Approaches to Digital Fiat Currencies

To date, one country, Venezuela, which is mired in a serious economic crisis, has issued a digital fiat currency, and there are serious questions about the new currency's success and operational viability. A few small countries are in the process of launching digital fiat currencies. Some countries, including China and Sweden, are researching the costs and benefits of these currencies, and Iran and Russia are considering them as a way to evade U.S. sanctions. Many central banks in major economies, including in the United States and the Eurozone, have argued against issuing a digital fiat currency at this time.

International Bodies' Engagement on Digital Currencies

Many international organizations and forums are examining the implications of cryptocurrencies and, in some cases, are starting to make policy recommendations. They have examined a range of issues, including the utility of digital currencies for improving the international payments systems, the possible threats digital currencies may or may not pose to international financial stability, the divergence of national-level cryptocurrency regulations and whether international regulatory coordination is desirable, how cryptocurrencies should be treated in bank prudential regulation, and how to adapt international recommendations to combat money laundering and terrorist financing in light of cryptocurrencies.

Possible Questions for Congress

- In November 2018, the Department of the Treasury announced it is developing a report on cryptocurrency regulation, including a legislative framework for Congress to consider in 2019. How do U.S. current regulations, and the proposed regulations when they are released, compare to other countries' regulations? Some governments are actively developing cryptocurrency industries. Should the United States follow suit, or risk losing market share in the industry? Alternatively, some governments are tightly restricting, or even banning, cryptocurrency activities to protect consumers. In the United States, do consumers have adequate protections in terms of cryptocurrencies?

- Has the Federal Reserve adequately assessed the potential benefits and costs of developing a digital U.S. dollar relying on distributed ledger technology? How does the U.S. position on digital fiat currencies compare to other countries' calculations? What are the potential future impacts on the role of the dollar as a reserve currency?

- What types of digital currency policies is the Trump Administration advocating at various international organizations? How do international recommendations and standards fit with U.S. regulations?

Introduction

Since their creation a decade ago, cryptocurrencies have become more prominent in the global economy. Cryptocurrencies are digital representations of value that have no status as legal tender and are administered using distributed ledger technology, running on a network of independent, peer-to-peer computers. Bitcoin is the most common and well-known cryptocurrency, but according to one estimate, about 2,100 cryptocurrencies are currently in circulation.1

Some analysts believe that cryptocurrencies could revolutionize the financial and banking industries, increasing the speed and reducing the cost of transactions. Others believe that cryptocurrencies, which do not have status as legal tender, are a scam and a financial bubble that has burst, as evidenced by the approximately 85% drop in value of cryptocurrencies over the course of 2018.2

Governments around the world are taking different approaches to cryptocurrencies. Some governments are actively promoting digital currencies in their jurisdictions, while others are banning them outright. Others still are seeking a middle path, allowing cryptocurrency transactions, but regulating the industry to minimize the risks.

The interest and debate surrounding cryptocurrencies has led some central banks to examine whether the technology underpinning cryptocurrencies could be leveraged to create digital versions of state-created currencies, which would have legal status in their jurisdiction of issue. A major policy question is whether state-issued digital currencies could draw on the benefits of cryptocurrencies while minimizing the risks, but there are varying views on the need for or desirability of digital fiat currencies.

The policy questions posed by digital currencies, as well as variation in government responses, have also become a focus for several international organizations and forums.

In November 2018, the U.S. Department of the Treasury announced it is developing a report on cryptocurrency regulation, including a legislative framework for the 116th Congress to consider in 2019.3 As Congress considers issues related to digital currencies, including whether to regulate further the cryptocurrency industry, the approaches taken by other governments and international bodies may be of interest. This report is part of a suite of CRS products on digital currencies and the underlying technology, distributed ledger technology and blockchain (see textbox below).

|

CRS Products on Digital Currencies and Related Technology

|

Digital Currencies: Terminology

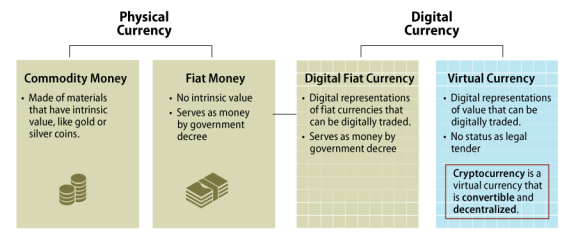

Money is the set of assets in an economy that consumers, businesses, and governments regularly use to buy goods and services from others.4 It has three functions in the economy: 1) a medium of exchange (an item that buyers give to sellers when they want to purchase goods and services); 2) a unit of account (the yardstick people use to post prices and record debts); and 3) a store of value (an item that people can use to transfer purchasing power from the present to the future).

Traditionally, money has taken two major forms (Figure 1). Commodity money is made of materials that have intrinsic value, like gold and silver coins. Fiat money has no intrinsic value, but serves as money by government decree. Before World War I, most countries were on the gold standard, using gold coins or paper money convertible to gold on demand. Today, most countries, including the United States and other major economies, use fiat money as national currencies.

More recently, technological developments have led to the creation of virtual currencies, digital representations of value that can be digitally traded (without any physical banknotes or coins) and strive to function as a medium of exchange, unit of account, and store of value. However, unlike a fiat currency, virtual currencies generally do not have legal tender status in any jurisdiction; they have value only by agreement within the community of users of the virtual currency.

There are different types of virtual currencies. Convertible virtual currencies can be exchanged back-and-forth with fiat (real) currencies, while nonconvertible virtual currencies are used in restricted online domains (such as multiplayer online gaming) and are not converted into fiat currencies. There are a number of exchanges that have been established to facilitate the conversion of virtual currencies to other assets, such as conventional fiat money or different virtual currencies.

Additionally, some virtual currencies are run by a centralized administrator that issues currency and maintains a central payment ledger. Other virtual currencies are decentralized, for which transactions are recorded on a distributed ledger, which is maintained by many independent, peer-to-peer computers.5 They rely on encryption techniques to control the creation of monetary units and to verify the transfer of funds.6 Users are given some level of anonymity or pseudonymity, and the system does not rely on government agencies (central banks) or financial institutions, which are generally embedded in the creation and transfer of fiat money.

Convertible, decentralized virtual currencies are often referred to as cryptocurrencies. Bitcoin was the first and continues to be the most widely used cryptocurrency, but a number of competitors have emerged. According to one estimate, there are about 2,100 cryptocurrencies currently in circulation, with a total market capitalization of $121.1 billion as of November 25, 2018.7 As cryptocurrencies have proliferated, they have taken on more forms. Some virtual currencies, such as Ripple, are arguably centralized currencies, but nonetheless are frequently referred to under the general umbrella term of cryptocurrencies.8 "Cryptocurrency" is sometimes used broadly for any digital currency not issued by a sovereign government.

One process by which new cryptocurrency coins or tokens are issued is called initial coin offerings (ICOs). Cryptocurrency currency transactions are validated by a process known as mining; successful miners are rewarded for their efforts through new cryptocurrency tokens. A number of companies have also developed to facilitate the use of cryptocurrencies. For example, exchanges are platforms that allow customers to trade cryptocurrencies for other cryptocurrencies and/or fiat currencies. Wallets are applications or interfaces that can be downloaded onto a device to make transacting in cryptocurrencies more user friendly.

Some central banks are considering or are actively exploring using distributed ledger technology to create digital representations of fiat currencies, or digital fiat currencies. Thus far, Venezuela is the only country that has launched a digital fiat currency, but several other central banks are in the process of doing so or undertaking research efforts to consider the option.

Digital currency is a broad term that refers to virtual (nonfiat) currency and digital fiat currency.

|

|

Source: Created by CRS based on definitions in provided in the Financial Action Task Force, "Virtual Currencies: Key Definitions and Potential AML/CFT Risks," 2014. |

Cryptocurrencies in the International Economy

Market Development and Size

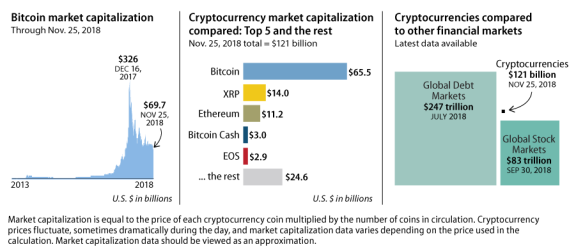

In the 10 years since Bitcoin was first issued, the size and scope of the global cryptocurrency market initially increased dramatically. After peaking at over $800 billion in January 2018, the cryptocurrency market fell by about 85% in 2018 to $121.1 billion on November 25, 2018 (Figure 2).9 Bitcoin was the first and continues to be the most widely used cryptocurrency, but about 2,100 competitors have emerged.10 Bitcoin has the largest market share, accounting for about half of the total market capitalization. The five largest cryptocurrencies account for almost 80% of the total virtual currency market capitalization, and include Bitcoin ($65.5 billion), Ripple ($14.0 billion), Ethereum ($11.2 billion), Bitcoin Cash ($3.0 billion, a 2017 offshoot of Bitcoin); and EOS ($2.9 billion) (Figure 2).11

Cryptocurrencies generate a lot of debate. Some argue that the development and spread of virtual currencies have the potential to revolutionize the financial and banking industries. Virtual currencies could increase payment efficiency, reduce transaction costs of payments and fund transfers, increase participation in the financial system, and facilitate transactions. Others are far more skeptical. The value of virtual currencies is highly volatile, virtual currencies and the exchanges on which they are traded face an uneven regulatory framework compared to banks, creating concerns for consumer protections and anti-money laundering efforts, and virtual currencies require sizeable energy resources for the associated computations.12

|

|

Source: CRS analysis of data from CoinMarketCap (www.coinmarketcap.com), Global Financial Data, Inc., and Institute of International Finance, "Global Debt Monitor – July 2018." |

Cryptocurrencies are still a relatively new phenomenon, and the market size is relatively small compared to other global financial markets. Whereas the cryptocurrency market was valued at $121.1 billion on November 25, 2018, the global stock market is valued around $80 trillion and the global bond market is valued around $250 trillion (Figure 2).13 A 2016 survey estimated that trading in foreign exchange markets (with traditional fiat currencies) averages $5.1 trillion per day.14 Global net inflows of foreign direct investment are around $2.0 trillion annually.15

Government Approaches to Cryptocurrencies

Cryptocurrencies span borders and are international in nature, but governments around the world have responded differently to the proliferation of cryptocurrencies. Governments have applied different nomenclatures and definitions, and tackled different legal and policy questions, including their tax treatment, their anti-money laundering/countering the financing of terrorism (AML/CFT) implications, their reporting requirements, and the conduct rules for financial institutions dealing with them.16

Three government responses to cryptocurrencies are seen: 1) encouraging the use and development of cryptocurrencies within the jurisdiction; 2) banning or restricting the use of cryptocurrencies within the jurisdiction; and 3) regulating the use of cryptocurrencies to minimize potential risks while encouraging financial innovation. Since cryptocurrencies are still relatively new, government approaches in some cases are still evolving.

Approach 1: Develop a Crytpocurrency Hub

Some governments are actively seeking to become cryptocurrency hubs by attracting and developing cryptocurrency industries in their countries. These governments generally view cryptocurrency as an important financial innovation that can create jobs and generate economic activity. They have created frameworks tailored to, and designed to attract, a range of businesses and activities in the cryptocurrency industry, including cryptocurrency exchanges and ICOs.

For example, Malta is creating a "crypto-friendly" framework that covers cryptocurrency brokerages, exchanges, asset managers, and traders, which aims to provide the "necessary legal certainty to allow this industry to flourish."17 The framework entails a range of discussion papers and legislation, passed in July 2018, and the creation of a "National Blockchain Strategy Taskforce" to advise the government on a framework for cryptocurrencies and other distributed ledger technology applications. Malta's favorable tax rate for international companies is also attracting businesses associated with the cryptocurrency industry. Nicknamed "Blockchain Island," Malta has attracted two prominent crypto exchanges (Binance and OKEx), among other companies working in the cryptocurrency industry.18

Similarly, Singapore is striving to become a cryptocurrency hub in Asia, with analysts describing its regulators as well-informed and transparent about blockchain and cryptocurrency, compared to regulatory uncertainties in other jurisdictions.19 The government has used various policies to promote the use of cryptocurrencies, including a "token day," when some retailers accept various cryptocurrencies as payment in an effort to normalize their use.20 Singapore has attracted 56 initial coin offerings in the first five months of 2018 raising over $1 billion, compared to 35 ICOs raising $641 million during all of 2017.21

Switzerland is also seeking to create a cryptocurrency industry, or "Crypto Valley," a cluster of companies associated with the cryptocurrency akin to the cluster of technology companies in Silicon Valley. "Crypto Valley" is located in Zug, a small town outside of Zurich. The jurisdiction has tried to attract cryptocurrency companies and exchanges through the early adoption of regulations designed to provide regulatory certainty; these regulations are also generally viewed as favorable to attracting cryptocurrency activities. As with Malta, multinationals are attracted to Zug's low tax rates. Companies that created and promote Ethereum, the second largest cryptocurrency by value, are located in Zug, and as many as 200-300 cryptocurrency entities have opened there in recent years.22 Government agencies in Zug also accept cryptocurrencies as a means of payment.23 However, following the publishing of ICO guidelines in February 2018, many cryptocurrency businesses presumably feeling the regulations too restrictive left Switzerland for rivals such as Liechtenstein, Gibraltar, and the British Virgin Islands.24 Companies in the cryptocurrency industry have approached the Swiss central bank and regulators in efforts to make Swiss banks more accessible to cryptocurrency ventures.25

Approach 2: Restrict Cryptocurrencies

Some governments have banned the use of cryptocurrencies or specific activities associated with cryptocurrencies. These governments generally view the risks of cryptocurrencies, including undermining financial stability, lack of investor and consumer protections, and the potential for illicit transactions, as more significant than the possible benefits.

For example, the Chinese government has put broad restrictions on the use of cryptocurrencies and related activities. In 2013, it restricted Chinese banks from using cryptocurrencies as currency, citing concerns about money laundering and a threat to financial stability.26 In 2017, the Chinese government banned ICOs and restricted cryptocurrency exchanges operating in China, as part of broader efforts against financial risks following a rapid run-up in corporate debt and a proliferation of new, risky investment products.27 In 2018, Chinese authorities in an eastern district of Beijing directed stores, hotels, and offices not to host any cryptocurrency-related speeches, events, or activities, and blocked a number of public accounts involving ICOs on the popular messaging app WeChat.28

South Korea has also banned some cryptocurrency activities. A week following China's ban on ICOs, South Korean financial regulators banned ICOs as well, citing concerns about the increasing risk of financial scams.29 South Korea has not, however, gone as far as China in restricting cryptocurrency activities, however; in January 2018, South Korea's finance minister said the government has no plans to shut down cryptocurrency trading on exchanges.30

India has also imposed tight restrictions on cryptocurrencies, and the Secretary of Economic Affairs recommended a formal ban on cryptocurrencies. In April 2018, India's central bank, the Reserve Bank of India, banned banks, financial institutions, and other regulated institutions from providing any services related to virtual currencies, giving the institutions three months to exit operations.31 The directive was upheld by India's Supreme Court in July 2018, during which the central bank argued that cryptocurrencies cannot be treated as currency under India's existing law that mandates coins be made of metal or exist in physical form and be stamped by the government.32 In October 2018, a committee chaired by the Secretary of Economic Affairs recommended devising a legal framework to ban the use of cryptocurrencies in India.33

In addition, Bangladesh and Kyrgyzstan have banned cryptocurrencies; Bolivia has banned any currency not issued by a government, including cryptocurrencies; Egypt has prohibited trading in cryptocurrencies; Indonesia has banned cryptocurrency transactions; Lebanon has banned financial institutions from dealing with virtual currencies; Taiwan has banned banks from transacting in cryptocurrencies; and Vietnam has banned the use of virtual currencies for payment.34

Approach 3: Regulate Cryptocurrencies

Some governments are seeking to regulate cryptocurrencies. These governments stop short of banning cryptocurrencies but are not actively seeking to become cryptocurrency hubs. In general, they appear to seek balance between encouraging financial innovation and managing the risks posed by cryptocurrencies, while providing greater clarity surrounding the emergence of cryptocurrencies. Regulations are a mix of applying existing regulations to cryptocurrencies and developing new regulations specifically targeting cryptocurrencies.

Although governments vary in the types of cryptocurrency activities they have sought to regulate, regulations have commonly focused on, for example, cryptocurrency exchanges, the taxation of cryptocurrencies, and the application of security laws to ICOs. There is wide variation among countries in how these regulations are applied. For example, in terms of the exchanges, countries vary in whether they require the exchanges to register with the government, apply anti-money laundering and counter terrorist financing regulations, and meet minimum capital and cybersecurity requirements, among other factors. In terms of the tax treatment of cryptocurrencies, governments vary in whether they are taxing cryptocurrencies, and if so, whether they are applying, for example, value-added-tax, capital gains tax, or property tax to cryptocurrencies. Governments also vary in whether they apply securities laws to ICOs, and if so, which characteristics make an ICO subject to securities laws. More detailed examples are in the text box below ("Regulations Applied to Cryptocurrency Transactions: Examples").

Despite the differences in regulatory approaches, one survey of cryptocurrency regulations around the world finds one of the most common activities across countries is government-issued warnings about the pitfalls of investing in cryptocurrency markets.35 The warnings are mostly issued by central banks, and are largely designed to educate citizens about the difference between fiat currencies and cryptocurrencies. The warnings caution that citizens invest in cryptocurrencies do so at their own personal risk and there is no legal recourse available in the event of loss.

|

Examples of Regulations Applied to Cryptocurrency Exchanges

|

Digital Fiat Currencies

"Central Bank Digital Currencies:" Potential and Risks

Some central banks are experimenting with or exploring the creation of digital fiat currencies, or digital representations of fiat currency that also rely on distributed ledger technology. Digital fiat currencies have also been called "central bank cryptocurrencies" and "central bank digital currencies."

The administration of digital fiat currencies would set them apart from existing electronic central bank payments.37 Distributed ledger technology would allow digital fiat currencies to be exchanged directly between the payer and payee without the need for a central intermediary. In contrast, other existing forms of electronic central bank money, such as reserves, are exchanged across accounts at the central bank.

Digital fiat currencies could take different forms. For example, a digital fiat currency could be widely available for retail transactions (involving individuals or small businesses) or restricted to wholesale transactions (involving just banks and other financial institutions). Additionally, design choices could entail the degree of anonymity, security, transaction limits, operational availability, and interest earned.38

Digital fiat currencies could improve efficiency and reduce settlement costs, some say, and if focused on retail transactions, grant greater public access to accounts at the central bank.39 In addition, some observers have argued that digital fiat currencies could allow central banks to more directly transmit monetary policy to their economies, and perhaps allow them to escape the zero lower bound constraints and transmit negative rates.40 However, some analysts are concerned that digital currencies would increase the size, role, and power of central banks in the economy in an undesirable way.41 It could give the central bank a significant role in the allocation of credit in the economy, and put a central bank in competition with private banks, which are generally regulated by the central bank. The availability of digital currencies backed by the central bank could also increase the likelihood and severity of runs on private banks during financial crises. There are also concerns about operational risks arising from disruptions and cyberattacks.42

Government Approaches to Digital Fiat Currencies

Governments have varying views on digital fiat currencies. As yet, one country, Venezuela, which is mired in a serious economic crisis, has issued a digital fiat currency, and there are serious questions about the new currency's success. A few small countries are in the process of launching digital fiat currencies. Some countries, including China and Sweden, are researching the costs and benefits of these currencies, and Iran and Russia are considering them as a way to evade U.S. sanctions. Over time, they may decide to ultimately adopt or rule out digital currencies. Many central banks in major economies, including in the United States and the Eurozone, have ruled out issuing a digital fiat currency at this time.

Approach 1: Launch a Digital Fiat Currency

Venezuela

Venezuela is the only government to date that has launched a digital fiat currency. Venezuela is in the throes of a deep economic and humanitarian crisis under the authoritarian rule of President Nicolás Maduro.43 The economy has contracted by more than a third since 2014, is grappling with hyperinflation and is facing critical shortages in food and medicine; millions of Venezuelans have fled to neighboring countries. In December 2017, Maduro announced plans to launch a new digital fiat currency, the "petro," backed by oil reserves and administered using blockchain technology.44 Maduro hoped that creating and selling a new digital currency, if successful, could provide the cash-strapped government with a fresh infusion of funds. Maduro also stressed that the petro would help Venezuela "advance in issues of monetary sovereignty, to make financial transactions and overcome the financial blockade," an apparent reference to U.S. sanctions that restrict Venezuela's access to U.S. financial markets.45 There were a number of questions about how such a currency would operate, including how it would be administered and how the oil guarantee would work.

The government launched the petro in February 2018 through a private presale that went through mid-March. The government claims it raised $3.3 billion,46 but the amount raised has never been confirmed by an independent audit.47 Venezuelans are prohibited from buying petros with the local currency, at the time the bolívar, but the government claimed to draw investors from Turkey, Qatar, and Europe.48 Many analysts are skeptical about the viability of the petro, which sold at a deep discount from the face value. In March 2018, the Trump Administration through executive order banned U.S. individuals and entities from purchasing or transacting in any digital currency issued by the Venezuelan government.49 Some analysts have called the petro a "scam," saying there is a lack of key technical information about how the currency is actually backed by oil, as well as concerns that the government, with a long history of economic mismanagement, will be unable to manage complex blockchain technology.50 In August 2018, the Venezuelan government devalued the bolívar by about 95%, renamed the currency the "sovereign bolívar," and pegged it to the petro.51 However, there are few signs of the petro being circulated within Venezuela or sold on any major cryptocurrency exchange.52

Other Countries

A few other countries are in the process of developing or launching their own digital fiat currencies

- The Eastern Caribbean Central Bank (ECCB), the monetary authority for eight island economies (Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines), has signed a memorandum of understanding in March 2018 with a Barbados-based financial technology company to launch a pilot program that will enable it to issue a digital currency.53

- The Marshall Islands plans to issue a decentralized digital currency as a second legal tender in addition to the U.S. dollar, enacting the necessary legislation in February 2018.54 A foreign private company—an Israel-based start-up which, according to the IMF, "limited financial sector experience"—would be in charge of the issuance.55

- In Lithuania, the central bank announced plans in March 2018 to issue a digital collector coin using blockchain or similar technology.56

Approach 2: Research the Pros and Cons of a Digital Fiat Currency

Some central banks are in the process of researching the possible adoption of a digital currency. The Swedish central bank, Riksbank, is investigating whether its currency, the Swedish kronor, should be made available in electronic form, the so-called "e-krona."57 In China, the central bank (the People's Bank of China) is researching the creation of a state-backed digital currency. It has opened an Institute of Digital Money and designed a prototype.58 Iran and Russia are considering issuing digital fiat currencies as a way to avoid U.S. sanctions.59 Iran is developing plans for a digital fiat currency, but it is unclear when it would launch or how the currency would operate in practice.60 There is some speculation that Russia could launch a digital fiat currency, the "CryptoRuble," in the middle of 2019, but no formal announcement to date has been made.61

Approach 3: Refrain from Creating a Digital Fiat Currency

Several central banks in advanced economies, including the U.S. Federal Reserve,62 the European Central Bank (ECB),63 the Bank of England,64 the Reserve Bank of Australia,65 the Bank of Israel,66 and the Reserve Bank of New Zealand,67 have argued against the benefits of digital fiat currencies and/or announced that they do not intend to adopt a digital fiat currency at this time. To varying degrees, they have questioned the need for digital fiat currencies and cautioned that digital fiat currencies could undermine financial stability.

International Organization Approaches to Digital Currencies

The emergence of digital currencies has captured attention outside of national-level governments. Many international organizations and forums are examining the potential implications of digital currencies and, in some cases, are starting to make policy recommendations. They have examined a range of issues, including

- the utility of digital currencies for improving the international payments systems;

- the possible threats digital currencies may or may not pose to international financial stability;

- the divergence of national-level cryptocurrency regulations and whether international regulatory coordination is desirable;

- how cryptocurrencies should be treated in bank prudential regulation; and

- how to adapt international recommendations to combat money laundering and terrorist financing to cryptocurrencies.

Below is an overview of major assessments and recommendations from different intergovernmental forums and organizations on digital currencies; a more thorough discussion is provided in the Appendix (Table A-1).

- The G-7 and G-20 finance ministers and central bank governors have discussed cryptocurrency and its implications for global financial stability; they have expressed a desire to coordinate national-level regulations of cryptocurrencies, similar to their work coordinating financial regulatory policies following the global financial crisis of 2008-2009.68

- The Financial Stability Board (FSB), which promotes international financial stability by coordinating national financial authorities and international standard-setting bodies, created a framework to monitor the financial stability implications of developments in cryptocurrency markets.69 The FSB found that cryptocurrencies do not currently pose a risk to global financial stability. The FSB cautions that cryptocurrencies could pose risks in the future but the risks are difficult to assess and monitor due to information gaps about the market.70

- The International Monetary Fund (IMF), an international organization tasked with promoting international monetary stability, has weighed the pros and cons of cryptocurrencies.71 IMF Managing Director Christine Lagarde has said that international regulation and supervision of cryptocurrencies is "inevitable."72 The IMF has also discouraged at least one country (the Marshall Islands) from adopting a digital fiat currency,73 and released a staff discussion paper conceptually evaluating the creation of digital fiat currencies.74

- The Basel Committee on Banking Supervision (BCBS), the primary global standard setter for the prudential regulation of banks and a forum for regular cooperation on banking supervisory matters, is assessing banks' direct and indirect exposure to cryptocurrencies.75 It is also considering whether to formally clarify the prudential treatment of cryptocurrencies across the set of risk categories.

- The Financial Action Task Force (FATF), which sets standards and promotes effective implementation of legal, regulatory, and operational measures for combating money laundering and terrorist financing, has adapted its recommendations to combat money laundering and terrorist financing to clarify how they apply in the case of financial activities involving virtual currencies.76

- The International Organization of Securities Commissions (IOSCO), an association of organizations that regulate the world's securities and futures markets, has discussed the investor protection concerns posed by ICOs.77

- The Bank for International Settlements (BIS), which fosters monetary and financial stability through discussion and collaboration among central banks, has assessed the utility and risks of digital fiat currencies.78

- The World Bank, a multilateral development bank that promotes economic development around the world, has been critical of cryptocurrencies but used the underlying technology to issue the world's first bond created and managed using blockchain technology.79

Questions for Congress

After 10 years, the relevance, utility, and implications of digital currencies powered by distributed ledger technology are still evolving. For cryptocurrencies, the market is worth roughly 15% of its peak at the start of 2018, but the number of cryptocurrencies continues to grow. Meanwhile, governments are taking different approaches to cryptocurrencies. The resulting patchwork of national-level cryptocurrency regulation is being assessed by international organizations and forums; these groups are considering whether greater coordination is needed. They are also considering many policy issues raised by cryptocurrencies, ranging from efforts to combat money laundering to updating bank prudential standards to financing World Bank development projects. Some central banks are also considering, or are in the process of, launching digital fiat currencies, while others have determined that at present digital fiat currencies are either unnecessary or undesirable.

The changing and developing international landscape for digital currencies raises a number of potential oversight issues and questions for Congress. These include the following:

- The Department of the Treasury announced it is developing a report on cryptocurrency regulation, including a legislative framework for Congress to consider in 2019. How do U.S. current regulations and the Treasury's proposed framework, when released, compare to other countries' regulations? What lessons might be gleaned from other countries that could inform U.S. regulations of the cryptocurrency market?

- Some governments are actively recruiting cryptocurrency companies and developing cryptocurrency industries. Should the United States follow suit, or risk losing market share in the industry? Alternatively, some governments are tightly restricting, or even banning, cryptocurrency activities to protect consumers. In the United States, do consumers have adequate protections in terms of cryptocurrencies?

- In April 2009, the G-20 leaders agreed that "major failures in the financial sector and in financial regulation and supervision were fundamental causes of the [global financial] crisis."80 The G-20 leaders then launched a major multi-year effort to undertake and coordinate financial sector reforms. Ten years after the crisis, cryptocurrency has emerged as a new financial market, and national governments are taking dramatically different regulatory approaches. Does the experience of the global financial crisis suggest that there should there be more international coordination on digital currency regulations? Or does variation in regulatory approaches allow for desirable financial innovation and competition in a growing industry?

- Has the Federal Reserve adequately assessed the potential benefits and costs of developing a digital U.S. dollar relying on distributed ledger technology? How does the U.S. position on this issue compare to other countries' calculations? If other countries proceed with digital fiat currencies and the United States does not, would this affect the status of the U.S. dollar as a reserve currency? Or does the continuing importance of the U.S. dollar give the United States a leadership role in shaping the international payment systems, including the extent to which distributed ledger technology is adopted?

- Many international organizations and forums are working on various aspects of digital currencies. Is there, or should there be, a leading international body on digital currency, and if so, which one? How are international bodies dividing up analysis of digital currencies, and how are they coordinating their work? Is there duplication of efforts, or gaps, in international bodies' analysis of digital currencies?

- What digital currency policies are being advocated by the Trump Administration at various international organizations? How much sway does the United States have in shaping these discussions? How do international recommendations and standards fit with U.S. regulations?

Appendix.

Table A-1. International Organizations and Forums: Recent Engagement with and Analysis of Digital Currencies

|

International Organization or Forum |

Engagement with and Analysis of Digital Currencies |

|

Bank for International Settlements (BIS) The BIS is owned by 60 central banks (including the U.S. Federal Reserve). Established in 1930 and currently representing about 95% of world GDP,a its mission is to foster monetary and financial stability, focusing on fostering discussion and facilitating collaboration among central banks. |

In March 2018, the BIS released a report examining digital fiat currencies.b The report highlights the various ways digital fiat currencies could be designed, including the extent of access, degree of anonymity, and operational availability, among other features, It also discusses the potential implications for payment systems, monetary policy implementation and transmission, and the structure and stability of the financial system.c One risk highlighted is the report is the potential for "digital runs" on the central bank with "unprecedented speed and scale."d In terms of cryptocurrencies, the BIS published a critical analysis in June 2018.e It stresses the difficulty in identifying a specific economic problem that cryptocurrencies solve, as well as the slow, costly, and energy-intensive transactions associated with cryptocurrencies. It argues that distributed ledger technology, which is used to administer cryptocurrencies, could have promise in other applications, particularly simplifying administrative processes in the settlement of financial transactions. |

|

Basel Committee on Banking Supervision (BCBS) |

|

|

The BCBS is the primary global standard setter for the prudential regulation of banks and provides a forum for regular cooperation on banking supervisory matters. Created in 1974, its membership has grown to central banks and bank supervisors from 28 jurisdictions. |

Current Basel rules on bank capital do not explicitly refer to cryptocurrencies.f However, there are minimum capital requirements and liquidity rules for so-called "other assets." In July 2018, it was announced that Basel is conducting an initial assessment on the materiality of banks' direct and indirect exposure to cryptocurrencies.g Once it has collected the data and assessed national rules on cryptocurrencies, it will consider whether to "formally clarify" the prudential treatment of cryptocurrencies across the set of risk categories. |

|

Financial Action Task Force (FATF) The FATF sets standards and promotes effective implementation of legal, regulatory, and operational measures for combating money laundering, terrorist financing, or other related threats to the integrity of the international financial system. It was founded in 1989 and has 37 members. |

FATF argues that, although digital currencies and related financial services have the potential to spur financial innovation and efficiency and improve financial inclusion, they also create new opportunities for criminals and terrorists to launder their proceeds or finance their illicit activities.h FATF Recommendations set out comprehensive requirements for combating money laundering and terrorist financing that apply to all forms of financial activity—including those that make use of virtual currencies. However, governments and the private sector have asked for greater clarity about exactly which activities the FATF standards apply to in this context. In October 2018, the FATF adopted changes to the FATF Recommendations that clarify how they apply in the case of financial activities involving virtual currencies. These changes build on earlier FATF guidance pertaining to virtual currencies issued in 2015. |

|

Financial Stability Board (FSB) Created in 2009 as a successor the Financial Stability Forum, the FSB promotes international financial stability by coordinating national financial authorities and international standard-setting bodies as they work toward developing strong regulatory, supervisory, and other financial sector policies. Membership includes the G-20 countries, plus Hong Kong, the Netherlands, Singapore, Spain, and Switzerland. The FSB was heavily involved in coordinating financial regulatory reform across countries following the global financial crisis of 2008-2009. |

In July 2018, the FSB published a report outlining a framework, developed in collaboration with the Bank for International Settlements, for monitoring the financial stability implications of developments in cryptocurrency markets, including metrics that the FSB will use to monitor cryptocurrency markets.i The metrics focus on the size and growth of cryptocurrency markets, financial institution exposures to cryptocurrency markets, and metrics on trading volumes, pricing, and clearing, among others. The FSB argued that cryptocurrencies do not pose a material risk to global financial stability at this time, but recognizes the need for vigilant monitoring, focusing on the transmission channels from crypto-asset markets that many give rise to financial stability risks. In a report released in October 2018, the FSB argued that cryptocurrencies do not serve the key functions of traditional money (a medium of exchange, a unit of account, or a store of value).j It also argued that cryptocurrencies could have implications for financial stability in the future if the market grows, but risks are difficult to assess and monitor due to gaps in information on the extent of leverage in cryptocurrency markets and on the direct and indirect exposures of financial institutions to cryptocurrencies. |

|

Group of 7 (G-7) The G-7 is an informal group of seven of the world's largest advanced economies: Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. With roots back to the 1970s, it was considered the premier forum for international economic coordination, until the G-20 supplanted its role as such following the global financial crisis of 2008-2009. G-7 leader meetings (summits) are held annually; meetings among lower level officials are held more regularly throughout the year. |

In their June 2018 meeting, the G-7 finance ministers and central bank governors' concluded that cryptocurrencies have the potential to make the financial sector more efficient, but carry risks pertaining to illicit transactions, investor protections, and market integrity. They agree that international coordination is needed to ensure that regulatory actions are effective in a globally interconnected financial system.k |

|

Group of 20 (G-20)l The G-20 is a forum for advancing international cooperation and coordination among 20 major advanced and emerging-market economies, including the United States. Originally established in 1999, the G-20 rose to prominence during the global financial crisis of 2008-2009 and is now the premier forum for international economic cooperation. G-20 leaders typically meet annually; lower-level officials, including finance ministers and central bank governors, meet more frequently. |

G-20 finance ministers and central bank governors discussed cryptocurrencies at their meetings in March and July 2018. In the joint statement released at the conclusion of the meetings, they acknowledged that technological innovation, including cryptocurrencies, has the potential to improve the efficiency and inclusiveness of the financial system and the economy more broadly. However, they also cautioned that cryptocurrencies raise issues with respect to consumer and investor protection, market integrity, tax evasion, money laundering, and terrorist financing, and could have implications for financial stability at some point. They also committed to working with other international organizations to continuing monitoring the risks of cryptocurrencies. |

|

International Monetary Fund (IMF) Created after World War II, the International Monetary Fund (IMF) is an international organization focused on promoting international monetary stability. The functions it performs have changed as the global economy has changed. Today, the IMF performs three major functions: surveillance of member economies and the global economy; lending to countries facing economic crises; and technical assistance to strengthen member countries' capacity to design and implement effective policies. The IMF has 189 members, and the United States is the Fund's largest shareholder. |

The IMF is increasingly focused on the implications of digital currencies. The IMF has examined the potential risks and benefits of cryptocurrencies. It stressed that cryptocurrencies enable fast and inexpensive financial transactions and the technology underlying cryptocurrencies (blockchain) has broader potential uses in the global economy, particularly in developing countries that have trouble securing property rights and attracting investment.m However, the IMF also cautions about the "dark side of the crypto world," including as a new vehicle for money laundering and the financing of terrorism, the extreme volatility in their traded prices, and their ill-defined connections to the traditional financial world which could create vulnerabilities in the global economy.n The IMF argued that a global framework will be needed to address the risks posed by cryptocurrencies and that international cooperation on such efforts will be "indispensable." In February 2018, IMF Managing Director Christine Lagarde said that international regulation and supervision of cryptocurrencies is "inevitable."o Through its surveillance of countries' economies and policies, the IMF is also starting to weigh in on countries' plans to adopt digital currencies. In September 2018, the IMF evaluated the Marshall Islands' plans to adopt a decentralized digital currency issued by a third party as a second legal tender in their jurisdiction, in addition to the U.S. dollar. The IMF cautioned strongly against the policy, highlighting economic, reputation, anti-money laundering, and governance risks.p In November 2018, the IMF released a staff discussion paper proposing a conceptual framework to assess the case for central bank digital currencies from the perspective of users and central banks.q |

|

International Organization of Securities Commissions (IOSCO) |

|

|

Established in 1983, IOSCO is an international association of organizations that regulate the world's securities and futures markets. IOSCO develops, implements, and promotes adherence to internationally recognized standards for securities regulation. Its membership regulates more than 95% of the world's securities markets in more than 115 jurisdictions, including the United States. |

In October 2017, the Board of IOSCO discussed the growing usage of ICOs to raise capital as an area of concern, finding that ICOs are "highly speculative" investments and raise a host of investor protection concerns.r Following this meeting, IOSCO issued a statement to its members regarding the risks of ICOs and referenced various approaches to ICOs taken by members and other regulatory bodies. In January 2018, the IOSCO Board established an ICO Consultation Network, through which members can discuss their experiences and bring their concerns, including any cross-border issues, to the attention of fellow regulators. |

|

World Bank With a membership of 189 countries, the World Bank is a multilateral development bank focused on promoting economic development. Created after World War II, a major source of funding for developing countries. |

In February 2018, the President of the World Bank, Jim Yong Kim, expressed doubts about the legitimacy of cryptocurrencies, comparing them to "Ponzi schemes."s A Ponzi scheme is a form of fraud in which money invested by later investors is used to pay earlier investors. However, the World Bank is exploring ways to adapt distributed ledger technology to improve its financial operations. In August 2018, the World Bank issued the world's first bond created and managed using blockchain technology.t The deal was managed by the Commonwealth Bank of Australia and raised 110 million Australian dollars (about US$78 million). |

Source: Compiled by CRS. See footnotes below for sources.

a. "About BIS – Overview," BIS website, https://www.bis.org/about/index.htm?m=1%7C1.

b. "Central Bank Digital Currencies," Bank for International Settlements, Committee on Payments and Market Infrastructures, March 2018, https://www.bis.org/cpmi/publ/d174.pdf.

c. "Central Bank Digital Currencies," Bank for International Settlements, Committee on Payments and Market Infrastructures, March 2018, https://www.bis.org/cpmi/publ/d174.pdf.

d. Claire Jones and Hannah Murphy, "Central Bank Cryptocurrencies Pose Stability Risk, Says BIS," Financial Times, March 12, 2018.

e. Bank for International Settlements, "Cryptocurrencies: Looking Beyond the Hype," in Annual Economic Report (June 17, 2018), https://www.bis.org/publ/arpdf/ar2018e5.htm.

f. Hannah Murphy, "Banks Under Watch Over Exposure to Cryptocurrencies," Financial Times, July 16, 2018.

g. Financial Stability Board, "Crypto-asset Markets: Potential Channels for Future Financial Stability Implications," October 10, 2018, http://www.fsb.org/wp-content/uploads/P101018.pdf.

h. Financial Action Task Force, "Regulation of Virtual Assets," October 19, 2018, http://www.fatf-gafi.org/publications/fatfrecommendations/documents/regulation-virtual-assets.html.

i. "FSB Report Sets Out Framework to Monitor Crypto-Asset Markets," Financial Stability Board, July 16, 2018, http://www.fsb.org/2018/07/fsb-report-sets-out-framework-to-monitor-crypto-asset-markets/.

j. "FSB Sets Out Potential Financial Stability Implications from Crypto-Assets," Financial Stability Board, October 10, 2018, http://www.fsb.org/2018/10/fsb-sets-out-potential-financial-stability-implications-from-crypto-assets/.

k. "Chair's Summary: G-7 Finance Ministers and Central Bank Governors' Meeting," Whistler, British Columbia, Canada, June 2, 2018, http://www.g7.utoronto.ca/finance/180602-summary.html.

l. For more on the G-20, see CRS Report R40977, The G-20 and International Economic Cooperation: Background and Implications for Congress, by Rebecca M. Nelson, by Rebecca M. Nelson.

m. Christine Lagarde, "An Even-handed Approach to Crytpo-Assets," IMF, April 16, 2018, https://blogs.imf.org/2018/04/16/an-even-handed-approach-to-crypto-assets/#more-23262.

n. Christine Lagarde, "Addressing the Dark Side of the Crypto World," IMF, March 13, 2018, https://blogs.imf.org/2018/03/13/addressing-the-dark-side-of-the-crypto-world/.

o. Zahraa Alkhalisi, "IMF Chief: Cryptocurrency Regulation is 'Inevitable'," CNN, February 11, 2018.

p. IMF, "Republic of the Marshall Islands: 2018 Article IV Consultation—Press Release; Staff Report; and Statement by the Executive Director for Republic of the Marshall Islands," September 2018.

q. Tommaso Mancini-Griffoli, Maria Soledad Martinez Peria, Itai Agur, et al., "Casting Light on Central Bank Digital Currency," IMF Staff Discussion Note, November 2018.

r. IOSCO Board Communication on Concerns Related to Initial Coin Offerings (ICOs)," International Organization of Securities Commissions (IOSCO), January 18, 2018, https://www.iosco.org/news/pdf/IOSCONEWS485.pdf.

s. Shelly Hagan, "Cryptocurrencies are Like Ponzi Schemes, World Bank Chief Says," Bloomberg, February 7, 2018.

t. World Bank, "World Bank Prices First Global Blockchain Bond, Raising A$110 Million," press release, August 23, 2018, https://www.worldbank.org/en/news/press-release/2018/08/23/world-bank-prices-first-global-blockchain-bond-raising-a110-million.

Author Contact Information

Footnotes

| 1. |

"Cryptocurrency Market Capitalizations," https://coinmarketcap.com/all/views/all/, with values as accessed on October 22, 2018. Market capitalization data is not available for about 360 cryptocurrencies. |

| 2. |

For example, see Nouriel Roubini, "Crypto is the Mother of All Scams and (Now Busted) Bubbles While Blockchain is the Most Over-Hyped Technology Ever, No Better than a Spreadsheet/Database," October 2018, testimony before the Hearing of the U.S. Senate Committee on Banking Housing, and Community Affairs on "Exploring the Cryptocurrency and Blockchain Ecosystem," https://www.banking.senate.gov/imo/media/doc/Roubini%20Testimony%2010-11-18.pdf. |

| 3. |

Patrick Temple-West, "Treasury Developing Cryptocurrency Regulatory Report," Politico Pro, November 5, 2018. |

| 4. |

Information about traditional functions of money and commodity and fiat currencies from N. Gregory Mankiw, Principles of Macroeconomics, N. Gregory Mankiw, Principles of Macroeconomics, 2nd ed. (Harcourt College Publishers, 2001). Definitions of virtual and digital currencies used in this report draws from the Financial Action Task Force, "Virtual Currencies: Key Definitions and Potential AML/CFT Risks," 2014. Virtual currencies are relatively new, however, and nomenclatures appear to vary across sources and may continue to evolve. For example, some governments refer to "cryptocurrencies" as digital currencies, virtual commodities, crypto-tokens, payment tokens, cyber currencies, electronic currencies, and virtual assets. See "Regulation of Cryptocurrency Around the World," Global Legal Research Center, Law Library of Congress, June 2018. |

| 5. |

For more on distributed ledger technology and blockchain, see CRS Report R45116, Blockchain: Background and Policy Issues, by Chris Jaikaran. |

| 6. |

PriceWaterhouseCoopers, "Money is No Object: Understanding the Evolving Cryptocurrency Market," September 2015. |

| 7. |

CoinMarketCap (www.coinmarketcap.com), accessed November 25, 2018. |

| 8. |

For example, see Michael del Castillo, "Ripple Not Included: New Morgan Creek Fund Excludes Pre-Mind Cryptocurrencies," Forbes, August 28, 2018. |

| 9. |

CoinMarketCap (www.coinmarketcap.com), accessed November 25, 2018. |

| 10. |

Ibid. |

| 11. |

Ibid. |

| 12. |

Casey Ega, "National Security Risks Seen in Emerging Blockchain Technology," Roll Call, January 25, 2018. |

| 13. |

Global Financial Data, Inc. and Institute of International Finance, "Global Debt Monitor – July 2018," July 9, 2018. |

| 14. |

Bank for International Settlements, Triennial Central Bank Survey: Foreign Exchange Turnover in April 2016, September 2016. |

| 15. |

World Bank Development Indicators, accessed November 7, 2018. |

| 16. |

Claire Groden, Edorado Saravalle, and Julia Solomon-Strauss, "Uncharted Waters: A Primer on Virtual Currency Regulation Around the World," Center for a New American Security and The Center on Law and Security at the NYU School of Law, September 2018. |

| 17. |

Viren Vaghela and Andrea Tan, "How Malta Became a Hub of the Cryptocurrency World," Bloomberg Businessweek, April 23, 2018; "Regulation of Cryptocurrency Around the World," Global Legal Research Center, Law Library of Congress, June 2018. |

| 18. |

Roger Aitken, "Crypto Investors Flocking to 'Blockchain Island' Malta in Droves," Forbes, October 29, 2018. |

| 19. |

Joyce Yang, "Singapore is the Crypto Sandbox that Asia Needs," TechCrunch, September 22, 2018. |

| 20. |

"Launch of 'Token Day' in Singapore to Bring Cryptocurrency to the Masses," Business Insider, October 31, 2018. |

| 21. |

Ibid. |

| 22. |

Anna Irrera and Brenna Hughes Neghaisi, "Switzerland Seeks to Regain Cryptocurrency Crown," Reuters, July 19, 2018. |

| 23. |

"Regulation of Cryptocurrency Around the World," Global Legal Research Center, Law Library of Congress, June 2018. |

| 24. |

Anna Irrera and Brenna Hughes Neghaisi, "Switzerland Seeks to Regain Cryptocurrency Crown," Reuters, July 19, 2018. |

| 25. |

Ibid. |

| 26. |

Gerry Mullany, "China Restricts Banks' Use of Bitcoin," New York Times, December 5, 2013. |

| 27. |

Chao Deng, "China Bans Fundraising Via Cryptocurrencies, Known as ICOs," Wall Street Journal, September 4, 2017; Kenneth Rapoza, "Cryptocurrency Exchanges Officially Dead in China," Forbes, November 2, 2017. |

| 28. |

Steven Russolillo and Chao Deng, "China is Getting Even Tougher on Cryptocurrencies a Year After Its Crackdown," Wall Street Journal, August 25, 2018. |

| 29. |

Oscar Williams-Grut, "South Korea Banks ICOs," Business Insider, September 29, 2017. |

| 30. |

Dahee Kim and Cynthia Kim, "South Korea Says No Plans to Bank Cryptocurrency Exchanges, Uncovers $600 Million in Illegal Trades," Reuters, January 30, 2018. |

| 31. |

Upmanyu Trivedi and Rahul Satija, "Cryptocurrency Virtually Outlawed in India as Top Court Backs Ban," Bloomberg, July 3, 2018. |

| 32. |

Ibid. |

| 33. |

Press Information Bureau, Government of India, Ministry of Finance, "19th Meeting of the Financial Stability and Development Council held under the Chairmanship of the Union Finance Minister, Shri Arun Jaitley," October 30, 2018, http://pib.nic.in/newsite/PrintRelease.aspx?relid=184478. |

| 34. |

Claire Groden, Edorado Saravalle, and Julia Solomon-Strauss, "Uncharted Waters: A Primer on Virtual Currency Regulation Around the World," Center for a New American Security and The Center on Law and Security at the NYU School of Law, September 2018. |

| 35. |

"Regulation of Cryptocurrency Around the World," Global Legal Research Center, Law Library of Congress, June 2018. |

| 36. |

Claire Groden, Edorado Saravalle, and Julia Solomon-Strauss, "Uncharted Waters: A Primer on Virtual Currency Regulation Around the World," Center for a New American Security and The Center on Law and Security at the NYU School of Law, September 2018. |

| 37. |

Morten Linnemann Bech and Rodney Garratt, "Central Bank Cryptocurrencies," BIS [Bank for International Settlements] Quarterly Review, September 17, 2017, https://www.bis.org/publ/qtrpdf/r_qt1709f.htm. |

| 38. |

"Central Bank Digital Currencies," Committee on Payments and Market Infrastructures, Bank for International Settlements, March 2018, https://www.bis.org/cpmi/publ/d174.htm; Tommaso Mancini-Griffoli, Maria Soledad Martinez Peria, Itai Agur, et al., "Casting Light on Central Bank Digital Currency," IMF Staff Discussion Note, November 2018. |

| 39. |

For example, see Michael D. Bordo and Andrew T. Levin, "Central Bank Digital Currency and the Future of Monetary Policy," NBER Working Paper 23711, August 2017, http://www.nber.org/papers/w23711. |

| 40. |

For example, see "Central Bank Digital Currencies," Committee on Payments and Market Infrastructures, Bank for International Settlements, March 2018, https://www.bis.org/cpmi/publ/d174.htm |

| 41. |

For example, see discussion during U.S. Congress, House Committee on Financial Services, Subcommittee on Monetary Policy and Trade, The Future of Money: Digital Currency, 115th Cong., 2nd sess., July 18, 2018. |

| 42. |

Tommaso Mancini-Griffoli, Maria Soledad Martinez Peria, Itai Agur, et al., "Casting Light on Central Bank Digital Currency," IMF Staff Discussion Note, November 2018. |

| 43. |

For more information on Venezuela, see CRS Report R44841, Venezuela: Background and U.S. Relations, coordinated by Clare Ribando Seelke and CRS Report R45072, Venezuela's Economic Crisis: Issues for Congress, by Rebecca M. Nelson. |

| 44. |

Alexandra Ulmer and Deisy Buirago, "Enter to 'Petro': Venezuela to Launch Oil-Backed Cryptocurrency," Reuters, December 3, 2017. |

| 45. |

Ibid. |

| 46. |

Eric Lam, "Here's What Maduro Has Said of Venezuela's Petro Cryptocurrency," Bloomberg, August 20, 2018. |

| 47. |

Aaron Mak, "What Does it Mean for Venezuela to Peg Its New Currency to a Cryptocurrency?," Slate, August 22, 2018. |

| 48. |

Camila Russo, "Venezuelans Can't Buy Maduro's Cryptocurrency with Bolivars," Bloomberg, February 22, 2018. |

| 49. |

Executive Order 13827, "Taking Additional Steps to Address the Situation in Venezuela," 83 Federal Register 12469-12470, March 19, 2018. |

| 50. |

Eric Lam, "Here's What Maduro Has Said of Venezuela's Petro Cryptocurrency," Bloomberg, August 20, 2018. |

| 51. |

Sam Jacobs, "Venezuela Just Devalued the Bolivar by 95% and Pegged it to a Cryptocurrency," Business Insider, August 20, 2018. |

| 52. |

Brian Ellsworth, "Special Report: In Venezuela, New Cryptocurrency is Nowhere to Be Found," Reuters, August 30, 2018. |

| 53. |

"Regulation of Cryptocurrency Around the World," Global Legal Research Center, Law Library of Congress, June 2018. |

| 54. |

IMF, "Republic of the Marshall Islands: 2018 Article IV Consultation—Press Release; Staff Report; and Statement by the Executive Director for Republic of the Marshall Islands," September 2018. |

| 55. |

Ibid. |

| 56. |

"Regulation of Cryptocurrency Around the World," Global Legal Research Center, Law Library of Congress, June 2018. |

| 57. |

"E-krona," Riksbank, October 18, 2018, https://www.riksbank.se/en-gb/payments--cash/e-krona/. |

| 58. |

Sara Hsu, "After Cracking Down on Bitcoin, China Contemplates Its Own Digital Currency," Forbes, October 19, 2017; Wang Yanfei, "PBOC Inches Closer to Digital Currency," China Daily, October 14, 2017. |

| 59. |

Yaya Fanusie, "Blockchain Authoritarianism: The Regime in Iran Goes Crypto," Forbes, August 15, 2018; Max Seddon and Martin Arnold, "Putin Considers 'Cryptorouble' as Moscow Seeks to Evade Sanctions," Financial Times, January 1, 2018. For more on the use of digital currencies to evade sanctions, see CRS In Focus IF10825, Digital Currencies: Sanctions Evasion Risks, by Rebecca M. Nelson and Liana W. Rosen. |

| 60. |

Anthony Cuthbertson, "Iran Plans National Cryptocurrency to Evade US Sanctions," Independent, August 29, 2018. |

| 61. |

Helen Partz, "Is CryptoRuble Back/ Launch Set for Mid-2019, Says Russian Blockchain Association," Cointelegraph, January 18, 2018. |

| 62. |

Lael Brainard (U.S. Federal Reserve Board of Governors), "Cryptocurrencies, Digital Currencies, and Distributed Ledger Technologies: What are We Learning?," Speech, San Francisco, May 15, 2018, https://www.federalreserve.gov/newsevents/speech/brainard20180515a.htm. |

| 63. |

Francesco Canepa, "ECB Has No Plan to Issue Digital Currency: Draghi," Reuters, September 14, 2018. |

| 64. |

"Digital Currencies," Bank of England, August 22, 2018, https://www.bankofengland.co.uk/research/digital-currencies. |

| 65. |

Tony Richards (Head of Payments Policy Department at the Reserve Bank of Australia), "Cryptocurrencies and Distributed Ledger Technology," Speech at Austrian Business Economists Briefing, Sydney, June 26, 2018, https://www.rba.gov.au/speeches/2018/sp-so-2018-06-26.html. |

| 66. |

"The Bank of Israel Published a Summary of the Work of the Team to Examine Central Bank Digital Currency," June 11, 2018, https://www.boi.org.il/en/NewsAndPublications/PressReleases/Pages/6-11-18.aspx. |

| 67. |

Geoff Bascand (Governor of the Reserve Bank of New Zealand), "In Search of Gold: Exploring Central Bank Digital Currency," Speech, June 26, 2018, Auckland, https://www.rbnz.govt.nz/research-and-publications/speeches/2018/speech2018-06-25. |

| 68. |

"Chair's Summary: G-7 Finance Ministers and Central Bank Governors' Meeting," Whistler, British Columbia, Canada, June 2, 2018, http://www.g7.utoronto.ca/finance/180602-summary.html; G-20 Finance Ministers and Central Bank Governors Communiqué, March 20, 2018, http://www.g20.utoronto.ca/2018/2018-03-30-g20_finance_communique-en.html; G-20 Finance Ministers and Central Bank Governors Communiqué, July 23, 2018, http://www.g20.utoronto.ca/2018/2018-07-22-finance.html. |

| 69. |

"FSB Report Sets Out Framework to Monitor Crypto-Asset Markets," Financial Stability Board, July 16, 2018, http://www.fsb.org/2018/07/fsb-report-sets-out-framework-to-monitor-crypto-asset-markets/. |

| 70. |

"FSB Sets Out Potential Financial Stability Implications from Crypto-Assets," Financial Stability Board, October 10, 2018, http://www.fsb.org/2018/10/fsb-sets-out-potential-financial-stability-implications-from-crypto-assets/. |

| 71. |

Christine Lagarde, "An Even-handed Approach to Crytpo-Assets," IMF, April 16, 2018, https://blogs.imf.org/2018/04/16/an-even-handed-approach-to-crypto-assets/#more-23262; Christine Lagarde, "Addressing the Dark Side of the Crypto World," IMF, March 13, 2018, https://blogs.imf.org/2018/03/13/addressing-the-dark-side-of-the-crypto-world/. |

| 72. |

Zahraa Alkhalisi, "IMF Chief: Cryptocurrency Regulation is 'Inevitable'," CNN, February 11, 2018. |

| 73. |

IMF, "Republic of the Marshall Islands: 2018 Article IV Consultation—Press Release; Staff Report; and Statement by the Executive Director for Republic of the Marshall Islands," September 2018. |

| 74. |

Tommaso Mancini-Griffoli, Maria Soledad Martinez Peria, Itai Agur, et al., "Casting Light on Central Bank Digital Currency," IMF Staff Discussion Note, November 2018. |

| 75. |

Hannah Murphy, "Banks Under Watch Over Exposure to Cryptocurrencies," Financial Times, July 16, 2018. |

| 76. |

"Regulation of Virtual Assets," Financial Action Task Force, October 19, 2018, http://www.fatf-gafi.org/publications/fatfrecommendations/documents/regulation-virtual-assets.html |

| 77. |

"IOSCO Board Communication on Concerns Related to Initial Coin Offerings (ICOs)," International Organization of Securities Commissions (IOSCO), January 18, 2018, https://www.iosco.org/news/pdf/IOSCONEWS485.pdf. |

| 78. |

"Central Bank Digital Currencies," Bank for International Settlements, Committee on Payments and Market Infrastructures, March 2018, https://www.bis.org/cpmi/publ/d174.pdf. |

| 79. |

World Bank, "World Bank Prices First Global Blockchain Bond, Raising A$110 Million," press release, August 23, 2018, https://www.worldbank.org/en/news/press-release/2018/08/23/world-bank-prices-first-global-blockchain-bond-raising-a110-million. |

| 80. |

G-20, London Summit—Leader' Statement, April 2, 2009. |