The Value of Energy Tax Incentives for Different Types of Energy Resources

The U.S. tax code supports the energy sector by providing a number of targeted tax incentives, or tax incentives available only for the energy industry. Some policymakers have expressed interest in understanding how energy tax benefits are distributed across different domestic energy resources. For example, what percentage of energy-related tax benefits support fossil fuels (or support renewables)? How much domestic energy is produced using fossil fuels (or produced using renewables)? And how do these figures compare?

In 2017, the value of federal tax-related support for the energy sector was estimated to be $17.8 billion. Of this, $4.6 billion (25.8%) can be attributed to tax incentives supporting fossil fuels. Tax-related support for renewables was an estimated $11.6 billion in 2017 (or 65.2% of total tax-related support for energy). The remaining tax-related support went toward nuclear energy, efficiency measures, and alternative technology vehicles.

While the cost of tax incentives for renewables has exceeded the cost of incentives for fossil fuels in recent years, the majority of energy produced in the United States continues to be derived from fossil fuels. In 2017, fossil fuels accounted for 77.7% of U.S. primary energy production. The remaining primary energy production is attributable to renewable energy and nuclear electric resources, with shares of 12.8% and 9.5%, respectively.

The balance of energy-related tax incentives has changed over time, and it is projected to continue to change, under current law, in coming years. Factors that have contributed to recent changes in the balance of energy-related tax incentives include the following:

Increased tax expenditures for solar and wind. Tax expenditures associated with the energy credit for solar and the production tax credit for wind have increased substantially in recent years. Following the long-term extensions of these temporary tax benefits provided in the Consolidated Appropriations Act, 2016 (P.L. 114-113), tax expenditures for the solar energy credit are projected to remain stable for several years, before decreasing in the longer term.

The expiration of tax-related support for renewable fuels. Tax-related support for renewable fuels declined substantially after the tax credits for alcohol fuels were allowed to expire at the end of 2011. Other fuels-related incentives also expired at the end of 2017 (although these may be extended as part of the “tax extenders”).

Decline then increase in tax expenditures for fossil fuels. Tax expenditures for fossil fuels declined between 2017 and 2018, an indirect effect of the 2017 tax act (P.L. 115-97). Over time, however, the tax expenditures associated with permanent fossil fuels tax incentives are estimated to increase.

One starting point for evaluating energy tax policy may be a calculation of subsidy relative to production level. However, a complete policy analysis might consider why the level of federal financial support differs across various energy technologies. Tax incentives for energy may support various environmental or economic objectives. For example, tax incentives designed to reduce reliance on imported petroleum may be consistent with energy security goals. Tax incentives that promote renewable energy resources may be consistent with certain environmental objectives.

The Value of Energy Tax Incentives for Different Types of Energy Resources

Jump to Main Text of Report

Contents

- Tax Incentives Relative to Energy Production

- Limitations of the Analysis

- Energy Production

- Energy Tax Incentives

- Fossil Fuels Versus Renewables: Relative Production and Tax Incentive Levels

- Energy Tax Incentive Trends

- Concluding Remarks

Figures

Summary

The U.S. tax code supports the energy sector by providing a number of targeted tax incentives, or tax incentives available only for the energy industry. Some policymakers have expressed interest in understanding how energy tax benefits are distributed across different domestic energy resources. For example, what percentage of energy-related tax benefits support fossil fuels (or support renewables)? How much domestic energy is produced using fossil fuels (or produced using renewables)? And how do these figures compare?

In 2017, the value of federal tax-related support for the energy sector was estimated to be $17.8 billion. Of this, $4.6 billion (25.8%) can be attributed to tax incentives supporting fossil fuels. Tax-related support for renewables was an estimated $11.6 billion in 2017 (or 65.2% of total tax-related support for energy). The remaining tax-related support went toward nuclear energy, efficiency measures, and alternative technology vehicles.

While the cost of tax incentives for renewables has exceeded the cost of incentives for fossil fuels in recent years, the majority of energy produced in the United States continues to be derived from fossil fuels. In 2017, fossil fuels accounted for 77.7% of U.S. primary energy production. The remaining primary energy production is attributable to renewable energy and nuclear electric resources, with shares of 12.8% and 9.5%, respectively.

The balance of energy-related tax incentives has changed over time, and it is projected to continue to change, under current law, in coming years. Factors that have contributed to recent changes in the balance of energy-related tax incentives include the following:

- Increased tax expenditures for solar and wind. Tax expenditures associated with the energy credit for solar and the production tax credit for wind have increased substantially in recent years. Following the long-term extensions of these temporary tax benefits provided in the Consolidated Appropriations Act, 2016 (P.L. 114-113), tax expenditures for the solar energy credit are projected to remain stable for several years, before decreasing in the longer term.

- The expiration of tax-related support for renewable fuels. Tax-related support for renewable fuels declined substantially after the tax credits for alcohol fuels were allowed to expire at the end of 2011. Other fuels-related incentives also expired at the end of 2017 (although these may be extended as part of the "tax extenders").

- Decline then increase in tax expenditures for fossil fuels. Tax expenditures for fossil fuels declined between 2017 and 2018, an indirect effect of the 2017 tax act (P.L. 115-97). Over time, however, the tax expenditures associated with permanent fossil fuels tax incentives are estimated to increase.

One starting point for evaluating energy tax policy may be a calculation of subsidy relative to production level. However, a complete policy analysis might consider why the level of federal financial support differs across various energy technologies. Tax incentives for energy may support various environmental or economic objectives. For example, tax incentives designed to reduce reliance on imported petroleum may be consistent with energy security goals. Tax incentives that promote renewable energy resources may be consistent with certain environmental objectives.

Since the 1970s, policymakers have increasingly used the tax code to promote energy policy goals. Long-term energy policy goals include providing a secure supply of energy, providing energy at a low cost, and ensuring that energy production and consumption is consistent with environmental objectives.1 A range of federal policies, including various research and development programs, mandates, and direct financial support such as tax incentives or loan guarantees, promotes various energy policy objectives. This report focuses on tax incentives that support the production of or investment in various energy resources.2

Through the mid-2000s, the majority of revenue losses associated with energy tax incentives were from provisions benefiting fossil fuels. At present, the balance has shifted, such that the bulk of federal revenue losses associated with energy tax provisions are from incentives for renewable energy production and investment.3 While there has been growth in the amount of energy from renewable resources, the majority of domestic energy produced continues to be from fossil energy resources. This has raised questions regarding the value of energy tax incentives relative to production and the relative subsidization of various energy resources.

Although the numbers in this report may be useful for policymakers evaluating the current status of energy tax policy, it is important to understand the limitations of this analysis. This report evaluates energy production relative to the value of current energy tax expenditures. It does not, however, seek to analyze whether the current system of energy tax incentives is economically efficient, effective, or otherwise consistent with broader energy policy objectives.4 Further, analysis in this report does not include information on federal spending on energy that is not linked to the tax code.5

Tax Incentives Relative to Energy Production

The following sections estimate the value of tax incentives relative to the level of energy produced using fossil and renewable energy resources. Before proceeding with the analysis, some limitations are outlined. The analysis itself requires quantification of energy production and energy tax incentives. Once data on energy production and energy tax incentives have been presented, the value of energy tax incentives can be evaluated relative to current levels of energy production.

Limitations of the Analysis

The analysis below provides a broad comparison of the relative tax support for fossil fuels as compared with the relative support for renewables. Various data limitations prevent a precise analysis of the amount of subsidy per unit of production across different energy resources. Limitations associated with this type of analysis include the following:

- Current-year tax incentives may not directly support current-year production.

Many of the tax incentives available for energy resources are designed to encourage investment, rather than production. For example, the expensing of intangible drilling costs (IDCs) for oil and gas provides an incentive to invest in capital equipment and exploration. Although the ability to expense IDCs does not directly support current production of crude oil and natural gas, such subsidies are expected to increase long-run supply.

- Differing levels of federal financial support may or may not reflect underlying policy rationales.

Various policy rationales may exist for federal interventions in energy markets. Interventions may be designed to achieve various economic, social, or other policy objectives. Although analysis of federal financial support per unit of energy production may help inform the policy debate, it does not directly consider why various energy sources may receive different levels of federal financial support.

- Tax expenditures are estimates.

The tax expenditure data provided by the Joint Committee on Taxation (JCT) are estimates of federal revenue losses associated with specific provisions.6 These estimates do not provide information on actual federal revenue losses, nor do these estimates reflect the amount of revenue that would be raised should the provision be eliminated.7 Additionally, the JCT advises that tax expenditures across provisions not be summed, due to interaction effects.

- Tax expenditure data are not specific to energy source.

Many tax incentives are available to a variety of energy resources. For example, the tax expenditure associated with the expensing of IDCs does not distinguish between revenue losses associated with natural gas versus those associated with oil. The tax expenditure for five-year accelerated depreciation also does not specify how much of the benefit accrues to various eligible technologies, such as wind and solar.

- A number of tax provisions that support energy are not energy specific.

The U.S. energy sector benefits from a number of tax provisions that are not targeted at energy. For example, the production activities deduction (Section 199), before being repealed in the 2017 tax act (P.L. 115-97), benefited all domestic manufacturers.8 For the purposes of the Section 199 deduction, oil and gas extraction was considered a domestic manufacturing activity.9 Certain energy-related activities may also benefit from other tax incentives that are available to non-energy industries, such as the ability to issue tax-exempt debt,10 the ability to structure as a master limited partnership,11 or tax incentives designed to promote other activities, such as research and development.

Energy Production

The Energy Information Administration (EIA) provides annual data on U.S. primary energy production. EIA defines primary energy as energy that exists in a naturally occurring form, before being converted into an end-use product. For example, coal is considered primary energy, which is typically combusted to create steam and then electricity.12

This report relies on 2017 data on U.S. primary energy production (see Table 1).13 In 2017, most primary energy was produced using fossil fuels. Natural gas was the largest source of primary energy production, accounting for 32.0% of primary energy produced. Crude oil accounted for 22.1% of U.S. primary energy production in 2017, and coal accounted for 17.7%. Taken together, fossil energy sources were used for 77.7% of 2017 primary energy production.

The remaining U.S. primary energy production is attributable to nuclear electric and renewable energy resources. Overall, 9.5% of 2017 U.S. primary energy was produced as nuclear electric energy. Renewables (including hydroelectric power) constituted 12.8% of 2017 U.S. primary energy production.

Biomass was the largest source of primary production among the renewables in 2017, accounting for 5.9% of overall primary energy production and 46.1% of renewable energy production. This was followed by hydroelectric power at 3.1% and wind energy at 2.7% of primary energy production. Solar energy and geothermal energy were responsible for 0.9% and 0.2%, respectively, of 2017 primary energy production (see Table 1).

Primary energy produced using biomass can be further categorized as biomass being used to produce biofuels (e.g., ethanol) and biomass being used to generate biopower.14 Of the 5.2 quadrillion Btu of energy produced using biomass, about 2.3 quadrillion Btu was used in the production of biofuels.15

|

Source |

Quadrillion Btua |

Percent of Total |

|||||

|

Fossil Fuels |

|||||||

|

Coal |

|

|

|||||

|

Natural Gas |

|

|

|||||

|

Crude Oil |

|

|

|||||

|

Natural Gas Plant Liquids |

|

|

|||||

|

Nuclear |

|

||||||

|

Nuclear Electric |

|

|

|||||

|

Renewable Energy |

|

||||||

|

Biomassb |

|

|

|||||

|

Hydroelectric Power |

|

|

|||||

|

Wind |

|

|

|||||

|

Solar/PV |

|

|

|||||

|

Geothermal |

|

|

|||||

|

Total |

|

|

|||||

Source: CRS analysis of data from Energy Information Administration, Table 1.2 Primary Energy Production by Source, January 2019, at https://www.eia.gov/totalenergy/data/annual/index.php.

Note: Columns may not sum due to rounding.

a. A British thermal unit (Btu) is the amount of heat required to raise the temperature of one pound of water 1 degree Fahrenheit.

b. Within the biomass category, 2.3 quadrillion Btu can be attributed to biofuels. Biofuels constituted 2.7% of total primary energy production in 2017.

Energy Tax Incentives

The tax code supports the energy sector by providing a number of targeted tax incentives, or tax incentives only available for the energy industry. In addition to targeted tax incentives, the energy sector may also benefit from a number of broader tax provisions that are available for energy- and non-energy-related taxpayers.16 These broader tax incentives are not included in the analysis, since tax expenditure estimates do not indicate how much of the revenue loss associated with these generally available provisions is associated with energy-related activities.

Joint Committee on Taxation (JCT) tax expenditure estimates are used to tabulate federal revenue losses associated with energy tax provisions.17 The tax expenditure estimates provided by the JCT are forecasted revenue losses. These revenue losses are not reestimated on the basis of actual economic conditions. Thus, revenue losses presented below are projected, as opposed to actual revenue losses.

The JCT advises that individual tax expenditures cannot be simply summed to estimate the aggregate revenue loss from multiple tax provisions. This is because of interaction effects. When the revenue loss associated with a specific tax provision is estimated, the estimate is made assuming that there are no changes in other provisions or in taxpayer behavior. When individual tax expenditures are summed, the interaction effects may lead to different revenue loss estimates. Consequently, aggregate tax expenditure estimates, derived from summing the estimated revenue effects of individual tax expenditure provisions, are unlikely to reflect the actual change in federal receipts associated with removing various tax provisions.18 Thus, total tax expenditure figures presented below are an estimate of federal revenue losses associated with energy tax provisions, and should not be interpreted as actual federal revenue losses.

Table 2 provides information on revenue losses and outlays associated with energy-related tax provisions in FY2017 and FY2018.19 The FY2017 figures are included to facilitate comparison with the primary energy production using different energy resources. Since the tax code was substantially changed beginning in 2018, FY2018 tax expenditures are also included.

In 2017, the tax code provided an estimated $17.8 billion in support for the energy sector. More than one-third of the 2017 total, $6.4 billion, was due to the renewable energy production tax credit (PTC) and investment tax credit (ITC).20

Nine different provisions supporting fossil fuels had an estimated cost of $4.6 billion, collectively, in 2017. This declined to $3.2 billion for 2018. While the tax legislation enacted late in 2017 (P.L. 115-97) did not directly change fossil-fuel-related tax provisions, other changes, including the reduced corporate tax rate, lowered the tax savings associated with various tax incentives for fossil fuels.

While the majority of federal tax-related support for energy in 2017 can be attributed to either fossil fuels or renewables, provisions supporting energy efficiency, alternative technology vehicles, and nuclear energy also resulted in forgone revenue in 2017 and 2018.

|

Provision |

2017 Cost |

2018 Cost |

|||||

|

Fossil Fuels |

|||||||

|

Credits for investments in Clean Coal Facilities |

|

|

|||||

|

Expensing of Exploration and Development Costs: Oil and Gas |

|

|

|||||

|

Excess of Percentage over Cost Depletion: Oil and Gas |

|

|

|||||

|

Excess of Percentage over Cost Depletion: Other Fuels |

|

|

|||||

|

Amortization of Geological and Geophysical Expenditures Associated with Oil and Gas Exploration |

|

|

|||||

|

Amortization of Air Pollution Control Facilities |

|

|

|||||

|

15-year Depreciation Recovery Period for Natural Gas Distribution Lines |

|

|

|||||

|

Exceptions for Publicly Traded Partnerships with Qualified Income Derived from Certain Energy-Related Activities |

|

|

|||||

|

Alternative Fuel Mixture Credit |

|

|

|||||

|

Subtotal, Fossil Fuels |

|

|

|||||

|

Renewables |

|

||||||

|

Energy Credit, Investment Tax Credit (ITC) |

|

|

|||||

|

Production Tax Credit (PTC) |

|

|

|||||

|

Residential Energy-Efficient Property Credit |

|

|

|||||

|

Credit for Investment in Advanced Energy Property |

|

|

|||||

|

Treasury Grant in Lieu of Tax Credit |

|

|

|||||

|

Subtotal, Renewables |

|

|

|||||

|

Efficiency |

|

||||||

|

Credit for New Energy-Efficient Homes |

|

|

|||||

|

Deduction for Energy-Efficient Commercial Buildings |

|

|

|||||

|

Credit for Energy-Efficient Improvements to Existing Homes |

|

|

|||||

|

Subtotal, Efficiency |

|

|

|||||

|

Renewable Fuels |

|

||||||

|

Biodiesel Tax Credits |

|

|

|||||

|

Subtotal, Renewable Fuels |

|

|

|||||

|

Alternative Technology Vehicles |

|

||||||

|

Credit for Plug-In Electric Vehicles |

|

|

|||||

|

Subtotal, Alternative Technology Vehicles |

|

|

|||||

|

Nucleara |

|

||||||

|

Special Tax Rate for Nuclear Decommissioning Reserve Fund |

|

|

|||||

|

Subtotal, Nuclear |

|

|

|||||

|

Other |

|

||||||

|

Special Rule to Implement Electric Transmission Restructuring |

|

|

|||||

|

Subtotal, Other |

|

|

|||||

|

Total |

|

|

|||||

Source: Joint Committee on Taxation, Estimates of Federal Tax Expenditures for Fiscal Years 2017-2021, JCX-24-18, May 25, 2018; Joint Committee on Taxation, Estimates of Federal Tax Expenditures for Fiscal Years 2018-2022, JCX-81-18, October 4, 2018; Joint Committee on Taxation, Estimated Revenue Budget Effects Of Division Q Of Amendment #2 To The Senate Amendment To H.R. 2029 (Rules Committee Print 114-40), The 'Protecting Americans From Tax Hikes Act of 2015,' JCX-143-15, December 16, 2015; Joint Committee on Taxation, Estimated Budget Effects Of The Revenue Provisions Contained In The 'Bipartisan Budget Act Of 2018', JCX-4-18, February 8, 2018; and Treasury "Tax Expenditures" estimates, available at https://home.treasury.gov/policy-issues/tax-policy/tax-expenditures.

Notes: Provisions with a revenue score of less than $50 million during all years are omitted from the table. An -i- indicates an estimate of less than $50 million for the specified year.

a. The JCT tax expenditure list includes the special tax rate for nuclear decommissioning reserve funds in the "National Resources and Environment" budget function. Other tax expenditures for nuclear were either classified as de minimis (the advanced nuclear power production tax credit) or nonquantifiable (accelerated deductions for nuclear decommissioning costs) in recent tax expenditure publications.

Fossil Fuels Versus Renewables: Relative Production and Tax Incentive Levels

Table 3 provides a side-by-side comparison of fossil fuel and renewable production, along with the cost of tax incentives supporting fossil fuel and renewable energy resources.21 During 2017, 77.7% of U.S. primary energy production could be attributed to fossil fuel sources. Of the federal tax support targeted to energy in 2017, an estimated 25.8% of the value went toward supporting fossil fuels. During 2017, an estimated 12.8% of U.S. primary source energy was produced using renewable resources. Of the federal tax support targeted to energy in 2017, an estimated 65.2% went toward supporting renewables.

Table 3 also contains information on subcategories of renewables, specifically (1) renewables excluding hydro and (2) renewables excluding biofuels. Excluding hydro might be instructive since current energy production is the result of past investment decisions, some of which may not have benefited from targeted tax incentives. Thus, it may not always be appropriate to compare the current value of tax incentives to current levels of energy production.22 For example, energy generated using hydroelectric power technologies might be excluded from the renewables category, as most existing hydro-generating capacity was installed before the early 1990s.23 Thus, there is no current federal tax benefit for most electricity currently generated using hydropower.24 Further, with many of the best hydro sites already developed, there is limited potential for growth in conventional hydropower capacity. There is, however, potential for development of additional electricity-generating capacity through smaller hydro projects that could substantially increase U.S. hydroelectric generation capacity.25 Excluding hydro from the renewables category, or removing an energy resource where the development was not likely supported by current renewables-related tax incentives, nonhydro renewables accounted for 9.7% of 2017 primary energy production (see Table 3).

During 2017, certain tax expenditures for renewable energy did, however, benefit taxpayers developing and operating hydroelectric power facilities. Certain hydroelectric installations, including efficiency improvements or capacity additions at existing facilities, may be eligible for the renewable energy production tax credit (PTC). Given that hydro is supported by 2017 tax expenditures, one could also argue that for the purposes of the comparison being made in this report, hydro should be included in the renewables category.

It may also be instructive to consider incentives that generally support renewable electricity separately from those that support biofuels.26 Of the estimated $17.8 billion in energy tax provisions in 2017, an estimated $2.1 billion, or 11.8%, went toward supporting biofuels.27 Excluding tax incentives for biofuels, 53.4% of energy-related tax incentives in 2017 were attributable to renewables. In other words, excluding biofuels from the analysis reduces the share of tax incentives attributable to renewables from 65.2% to 53.4% (see Table 3). Excluding biofuels from the analysis also reduces renewables' share of primary energy production. When biofuels are excluded, the share of primary energy produced in 2017 attributable to renewables falls by 2.7 percentage points, from 12.8% to 10.1% (Table 3).

In 2017, 9.5% of primary energy produced was from nuclear resources.28 The one tax benefit for nuclear with a positive tax expenditure in 2017 was the special tax rate for nuclear decommissioning reserve funds. At $0.2 billion in 2017, this was 1.7% of the value of all tax expenditures for energy included in the analysis. Like many other energy-related tax expenditures, the special tax rate for nuclear decommissioning reserve funds is not directly related to current energy production. Instead, this provision reduces the cost of investing in nuclear energy by taxing income from nuclear decommissioning reserve funds at a preferred rate (a flat rate of 20%).

|

Production |

Tax Incentives |

||||||||||||||||

|

Quadrillion Btu |

% of Total |

Billions of Dollars |

% of Total |

||||||||||||||

|

Fossil Fuels |

|

|

|

|

|||||||||||||

|

Renewablesa |

|

|

|

|

|||||||||||||

|

Renewables: Alternative Subcategories |

|

|

|

|

|||||||||||||

|

Renewables, Excluding Hydroelectricb |

|

|

|

|

|||||||||||||

|

Renewables, Excluding Biofuels |

|

|

|

|

|||||||||||||

|

Renewables, Excluding Hydroelectric and Biofuels |

|

|

|

|

|||||||||||||

|

Nuclear |

|

|

|

|

|||||||||||||

Source: Calculated using data presented in Table 1 and Table 2 above.

Note: Tax incentive shares do not sum to 100% as some incentives are for efficiency or alternative technology vehicles.

a. Renewables tax incentives include targeted tax incentives designed to support renewable electricity and renewable fuels.

b. The value of total tax incentives for renewables excluding hydroelectric power is less than the total value of tax incentives when those available for hydropower are included. However, the difference is small. JCT estimates that in 2017, the tax expenditures for qualified hydropower under the PTC are less than $50 million.

Energy Tax Incentive Trends

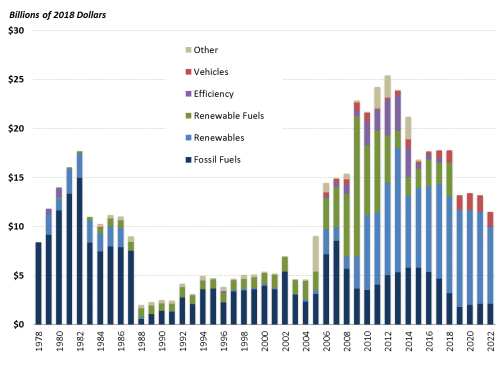

Over time, there have been substantial shifts in the proportion of energy-related tax expenditures benefiting different types of energy resources. Figure 1 illustrates the projected value of energy-related tax incentives since 1978.29 Energy tax provisions are categorized as primarily benefiting fossil fuels, renewables, renewable fuels, efficiency, vehicles, or some other energy purpose.

Until the mid-2000s, most of the value of energy-related tax incentives supported fossil fuels. Starting in the mid-2000s, the cost of energy-related tax preferences supporting renewables increased.30 Some of this increase was attributable to provisions supporting renewable fuels, which have since expired.

From the 1980s through 2011, most of the tax-related federal financial support for renewable energy was for renewable fuels, mainly alcohol fuels (i.e., ethanol).31 The tax credits for alcohol fuels (including ethanol) expired at the end of 2011. Starting in 2008, the federal government incurred outlays associated with excise tax credits for biodiesel and renewable diesel. Under current law, the tax credits for biodiesel and renewable diesel expired at the end of 2017. Thus, after FY2018 (which includes the end of calendar year 2017), there are no projected costs associated with tax incentives for renewable fuels. Expired tax incentives may be extended, however, as part of the "tax extenders."32

Beginning in the mid-2000s, the cost of energy tax incentives for renewables began to increase. Beginning in 2009, the Section 1603 grants in lieu of tax credits contributed to increased costs associated with tax-related benefits for renewable energy.33 Through 2014, Section 1603 grants in lieu of tax credits exceeded tax expenditures associated with the production tax credit (PTC) and investment tax credit (ITC) combined.34 The Section 1603 grant option is not available for projects that began construction after December 31, 2011. However, since grants are paid out when construction is completed and eligible property is placed in service, outlays under the Section 1603 program continued through 2017.

Tax expenditures for the ITC and PTC have increased substantially in recent years. As a result of the extensions for wind and solar enacted in the Consolidated Appropriations Act, 2016 (P.L. 114-113), ITC and PTC tax expenditures are projected to remain stable for several years. Under current law, the PTC will not be available to projects that begin construction after December 31, 2019. However, since the PTC is available for the first 10 years of renewable electricity production, and the expiration date is a start-of-construction deadline as opposed to a placed-in-service deadline, PTC tax expenditures will continue after the provision expires. The ITC for solar, currently 30%, is scheduled to decline to 26% for property beginning construction in 2020, and 22% for property beginning construction in 2021, before returning to the permanent rate of 10% after 2021. Thus, absent additional policy changes, the higher tax expenditures associated with the PTC and ITC are expected to be temporary.

Tax expenditures for tax incentives supporting energy efficiency increased in the late 2000s, but subsequently declined. Most of the increase in revenue losses for efficiency-related provisions was associated with tax incentives for homeowners investing in certain energy-efficient property.35 The primary tax incentive for energy efficiency improvements to existing homes expired at the end of 2017.36 Extension of expired tax incentives for energy efficiency would increase the cost of energy efficiency-related tax incentives.

As was noted above, many energy-related tax provisions, particularly those that support renewables, are temporary. Over time as these incentives phase out, tax expenditures associated with these provisions will decline. This process may take some time. For the PTC, for example, the credit is claimed during the first 10 years of qualifying production. It is possible that qualifying production begins after the December 31, 2019, start-of-construction expiration date, meaning that tax expenditures for the PTC are expected to continue for at least the next decade.

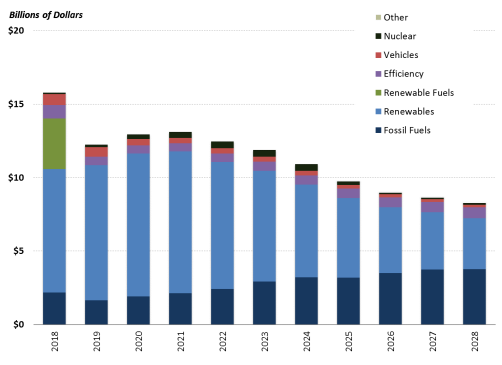

U.S. Department of the Treasury tax expenditure estimates can be used to illustrate how expiring provisions affect the distribution of energy-related tax expenditures over time (see Figure 2). Treasury and JCT tax expenditure estimates differ in a number of ways. The Treasury provides tax expenditures over an 11-year budget window. The JCT uses a shorter 5-year window. The JCT and Treasury also use different methodologies when preparing tax expenditure estimates, and have different classifications as to what provisions constitute tax expenditures.37 Thus, the tax expenditure estimates prepared by each entity are not directly comparable. However, looking at Treasury tax expenditure estimates over time can illustrate broader trends regarding which types of energy are receiving tax-related benefits.

In 2018, according to Treasury's tax expenditure estimates, tax expenditures supporting renewables totaled an estimated $8.4 billion. By 2028, that number is expected to decline to $3.5 billion. The decline can be explained by the reduced tax expenditures for the PTC and ITC as these provisions phase down or expire. Treasury estimates that tax expenditures supporting fossil fuels will total $2.2 billion in 2018. The Treasury anticipates this number increasing over time, reaching an estimated $3.8 billion by 2028. The Treasury estimates that the revenue losses associated with most permanent oil-and-gas tax incentives will increase over the next decade.

|

Figure 2. Projected Cost of Energy Tax Provisions: FY2018-FY2028 |

|

|

Source: CRS, using data from U.S. Department of the Treasury, https://home.treasury.gov/policy-issues/tax-policy/tax-expenditures. Notes: Treasury tax expenditure estimates are not directly comparable to JCT tax expenditure estimates. See the text for additional information. |

Concluding Remarks

The energy sector is supported by an array of tax incentives reflecting diverse policy objectives. As a result, the amount of tax-related federal financial support for energy differs across energy sectors, and is not necessarily proportional to the amount of energy production from various energy sectors. The total amount of energy-related tax incentives is projected to decline under current law, although extensions of expired energy tax provisions, or other modifications to energy tax provisions, could change these figures. Over the longer term, the amount of tax-related support for the energy sector could decline if provisions are allowed to expire as scheduled under current law.

Author Contact Information

Acknowledgments

Timothy Planert, intern in the Government and Finance Division, assisted in updating this report.

Footnotes

| 1. |

For background on the U.S. energy sector, see CRS Report R44854, 21st Century U.S. Energy Sources: A Primer, coordinated by Michael Ratner. |

| 2. |

Tax incentives related to efficiency and conservation are noted to provide a complete picture of the portfolio of energy-related tax incentives, but are not included in the discussion tying tax incentives to the various forms of energy they support. |

| 3. |

For historical revenue losses associated with energy tax incentives, see CRS Report R41227, Energy Tax Policy: Historical Perspectives on and Current Status of Energy Tax Expenditures, by Molly F. Sherlock. |

| 4. |

For a discussion of an economic framework for evaluating energy tax incentives, see CRS Report R43206, Energy Tax Policy: Issues in the 114th Congress, by Molly F. Sherlock and Jeffrey M. Stupak, and U.S. Congress, Joint Committee on Taxation, "Present Law And Analysis of Energy-Related Tax Expenditures," June 9, 2016, JCX-46-16. |

| 5. |

For an analysis of both tax and nontax subsidies for energy, see Energy Information Administration, Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2016, Washington, DC, April 24, 2018, https://www.eia.gov/analysis/requests/subsidy/. Previous versions of this report summarize past EIA analysis. See CRS Report R41953, Energy Tax Incentives: Measuring Value Across Different Types of Energy Resources, by Molly F. Sherlock and Jeffrey M. Stupak. |

| 6. |

These caveats also apply to the annual tax expenditure estimates provided by the U.S. Department of the Treasury. |

| 7. |

Data on the actual revenue losses associated with various provisions are generally not publicly available. |

| 8. |

For more information, see CRS Report R41988, The Section 199 Production Activities Deduction: Background and Analysis, by Molly F. Sherlock. |

| 9. |

The Emergency Economic Stabilization Act of 2008 (EESA; P.L. 110-343) permanently limited oil and gas extraction to a 6% deduction. Other qualified activities could claim a 9% deduction. |

| 10. |

For more information on subsidized debt financing for energy, see CRS Report R41573, Tax-Favored Financing for Renewable Energy Resources and Energy Efficiency, by Molly F. Sherlock and Steven Maguire. |

| 11. |

For additional background, see CRS Report R41893, Master Limited Partnerships: A Policy Option for the Renewable Energy Industry, by Molly F. Sherlock and Mark P. Keightley. |

| 12. |

Definitions and data can be found in Energy Information Administration, Monthly Energy Review, April, 2017, Washington, DC, April 25, 2017, https://www.eia.gov/totalenergy/data/monthly/#Glossary. |

| 13. |

The data on primary energy production are calendar year. Below, calendar year data for 2017 are compared to financial data from FY2017. While it may be possible to construct fiscal year primary energy production data, doing so would not materially change the analysis, as the share of primary energy produced using different energy resources tends to be stable in the near term. |

| 14. |

It is unclear whether biopower is carbon neutral. For background on this debate, see CRS Report R41603, Is Biopower Carbon Neutral?, by Kelsi Bracmort. |

| 15. |

Biofuels includes wood and wood-derived fuels, biomass waste, and total biomass inputs to the production of fuel |

| 16. |

For example, through 2017, oil and gas producers currently benefit from the Section 199 domestic production deduction. This incentive was available to all domestic manufacturers and is not specifically targeted toward the oil and gas sector. |

| 17. |

The Congressional Budget and Impoundment Act of 1974 (the Budget Act; P.L. 93-344) defines tax expenditures as "revenue losses attributable to provisions of the federal tax laws which allow a special exclusion, exemption, or deduction from gross income or which provide a special credit, a preferential rate of tax, or a deferral of tax liability." JCT is the official scorekeeper for congressional budget purposes. The Treasury also provides a list of tax expenditures annually. |

| 18. |

U.S. Congress, Senate Committee on the Budget, Tax Expenditures: Compendium of Background Material on Individual Provisions, committee print, prepared by Congressional Research Service, S. Prt. 115-28, December 2018. |

| 19. |

Energy-related tax provisions are those listed under the "Energy" budget function in the Joint Committee on Taxation's annual tax expenditure list. The special tax rate for nuclear decommissioning reserve funds is also included, although this tax expenditure is listed under the "Natural Resources and Environment" budget function. Although technically not tax expenditures, the cost associated with excise tax credits and outlays under the Section 1603 grants in lieu of tax credits program are included. Credits that offset excise tax liability that are claimed for alternative fuel mixtures and biodiesel are also included. There are 10 de minimis energy tax expenditures that are not included in the table: (1) the credit for second-generation biofuel production; (2) the credit for biodiesel and renewable diesel fuel (income tax component); (3) the credit for enhanced oil recovery costs; (4) the credit for producing oil and gas from marginal wells; (5) the credit for production of electricity from qualifying advanced nuclear power facilities; (6) the credit for producing fuels from a nonconventional source; (7) seven-year MACRS Alaska natural gas pipeline; (8) 50-percent expensing of cellulosic biofuel plant property; (9) partial expensing of investments in advanced mine safety equipment; and (10) expensing of tertiary injectants. Energy tax expenditures for which quantification is not available are the accelerated deductions for nuclear decommissioning costs and fossil fuel capital gains treatment. Recent tax expenditure publications do not include estimates for the credit for alternative fuel vehicle refueling property, the credit for energy-efficient new homes, or the deduction for energy-efficient commercial buildings. Since these three provisions have recently been extended as part of "tax extenders" legislation, estimates from recent extensions are included in Table 2 when the amount exceeds the de minimis threshold. |

| 20. |

For background information on these provisions, see CRS In Focus IF10479, The Energy Credit: An Investment Tax Credit for Renewable Energy, by Molly F. Sherlock; and CRS Report R43453, The Renewable Electricity Production Tax Credit: In Brief, by Molly F. Sherlock. |

| 21. |

The data in Table 3 can be used to provide an estimate of federal tax support per million Btu produced using fossil fuel and renewable energy resources. Such analysis, however, does not directly link the amount of federal financial support given directly to energy produced, as many federal tax incentives for energy reward investments rather than production. In other words, current federal financial incentives do not directly support current energy production. From this perspective, evaluating the current value of federal financial support per Btu of energy production is methodologically flawed. Nonetheless, this type of analysis has been used in the past. For example, see Energy Information Administration, Federal Financial Interventions and Subsidies in Energy Markets 2007, Report #:SR/CNEAF/2008-01, Washington, DC, April 2008, http://www.eia.gov/analysis/requests/2008/subsidy2/pdf/subsidy08.pdf. The EIA did not calculate estimates of federal financial support per million Btu produced in more recent reports on federal financial interventions in the energy sector. |

| 22. |

As discussed above, this observation holds for a range of energy resources, and is not unique to hydro. |

| 23. |

Energy Information Administration, Hydroelectric Generators are Among the United States' Oldest Power Plants, March 13, 2017, https://www.eia.gov/todayinenergy/detail.php?id=30312#. |

| 24. |

Most coal electric generating capacity was also installed before 1990. See Energy Information Administration, Most Coal Plants in the United States were Built Before 1990, April 17, 2017, https://www.eia.gov/todayinenergy/detail.php?id=30812. Current tax incentives that reduce the cost of extracting coal reduce the cost of producing electricity using coal. |

| 25. |

See CRS Report R42579, Hydropower: Federal and Nonfederal Investment, by Kelsi Bracmort, Adam Vann, and Charles V. Stern. |

| 26. |

In the past, particularly before tax incentives for ethanol expired, a large proportion of renewables-related tax support was for biofuels as opposed to other forms of renewables. |

| 27. |

The tax credit for biodiesel and renewable diesel expired at the end of calendar year 2017. As of late February 2019, the provision had not been extended. Since the cost estimates in Table 2 are fiscal year estimates, much of the cost attributable to 2018 is associated with activity that took place in calendar year 2017. |

| 28. |

Similar to hydropower and coal, most of the nuclear electricity generating capacity was installed before 1990. See Energy Information Administration, Most U.S. Nuclear Power Plants were Built Between 1970 and 1990, April 27, 2017, https://www.eia.gov/todayinenergy/detail.php?id=30972. |

| 29. |

For more information on historical trends, see CRS Report R41227, Energy Tax Policy: Historical Perspectives on and Current Status of Energy Tax Expenditures, by Molly F. Sherlock. |

| 30. |

The increase in tax expenditures for fossil fuels in the mid-2000s is due to the unconventional fuels tax credit. For more, see CRS Report R41227, Energy Tax Policy: Historical Perspectives on and Current Status of Energy Tax Expenditures, by Molly F. Sherlock. |

| 31. |

The dramatic increase in JCT's estimated revenue losses in 2009 for renewable fuels was due to "black liquor." |

| 32. |

For more information, see CRS Report R45347, Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock. |

| 33. |

For additional background, see CRS Report R41635, ARRA Section 1603 Grants in Lieu of Tax Credits for Renewable Energy: Overview, Analysis, and Policy Options, by Phillip Brown and Molly F. Sherlock. |

| 34. |

As of March 1, 2018, $26.2 billion had been awarded in §1603 grants in lieu of tax credits. A list of awards is available from the U.S. Department of the Treasury, at https://www.treasury.gov/initiatives/recovery/Pages/1603.aspx. |

| 35. |

For more information, see CRS Report R42089, Residential Energy Tax Credits: Overview and Analysis, by Margot L. Crandall-Hollick and Molly F. Sherlock. |

| 36. |

The nonbusiness energy property credit (Internal Revenue Code (IRC) §25C) expired at the end of 2016. |

| 37. |

For more information on the differences between JCT and Treasury tax expenditure estimates, see Joint Committee on Taxation, Estimates of Federal Tax Expenditures for Fiscal Years 2018-2022, JCX-81-18, October 4, 2018, pp. 10-12. |