Market-Based Greenhouse Gas Emission Reduction Legislation: 108th Through 118th Congresses

Changes from January 29, 2020 to September 29, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Market-Based Greenhouse Gas Emission Reduction Legislation: 108th through 116th Congresses

Contents

- Introduction

- Background

- What Is a GHG Emissions Cap-and-Trade System?

- What Is a Carbon Tax or Emissions Fee?

- GHG Emission Reduction Legislation by Congress

Figures

Tables

- Table 1. GHG Emission Reduction Proposals: 108th Congress

- Table 2. GHG Emission Reduction Proposals: 109th Congress

- Table 3. GHG Emission Reduction Proposals: 110th Congress

- Table 4. GHG Emission Reduction Proposals: 111th Congress

- Table 5. GHG Emission Reduction Proposals: 112th Congress

- Table 6. GHG Emission Reduction Proposals: 113th Congress

- Table 7. GHG Emission Reduction Proposals: 114th Congress

- Table 8. GHG Emission Reduction Proposals: 115th Congress

- Table 9. GHG Emission Reduction Proposals: 116th Congress

Summary

Market-Based Greenhouse Gas Emission

September 29, 2020

Reduction Legislation: 108th through 116th

Jonathan L. Ramseur

Congresses

Specialist in Environmental Policy

Congressional interest in market-based greenhouse gas (GHG) emission control legislation has

fluctuated over the past 15 years. During that time, legislation has often involved market-based approaches, such as a cap-and-trade system or a carbon tax or emissions fee program. Both

approaches would place a price—directly or indirectly—on GHG emissions or their inputs, namely fossil fuels. Both would increase the price of fossil fuels , and both would reduce GHG emissions to some degree. Both would allow emission sources to choose the best way to meet their emission requirements or reduce costs, potentiallypotentialy by using market forces to minimize national costs of emission reductions. Preference between the two approaches ultimately depends on which variable policymakers prefer to precisely control—emission levels or emission prices.

A primary policy concern with either approach is the economic impacts that may result. Expected energy price increases could have both economy-wide impacts (e.g., on the U.S. gross domestic product) and disproportionate effects on specific industries and particular demographic groups. The degree of these potential effects would depend on a number of factors, including the magnitude, design, and scope of the program and the use of tax or fee revenues or emission allowance values.

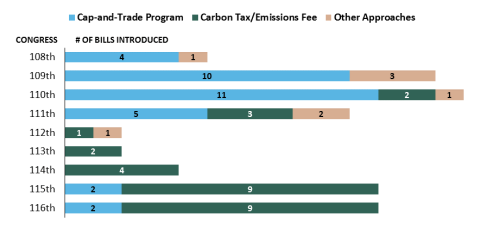

As the figurefigure below illustrates, between the 108th and 111th108th and 111th Congresses, most of the introduced bills would have established cap-and-trade systems. Between the 112th and 115th112th and 115th Congresses, most of the introduced bills would have established carbon tax or emissions fee programs. Most of the proposals from the 116th116th Congress would establish a carbon tax or emissions fee program. The proposals range in the scope of emissions covered from CO2CO2 emissions from fossil fuel combustion to multiple GHG GHG emissions from a broader array of sources. In addition, the proposals differ by how, to whom, and for what purpose the fee revenues or allowance value would be applied. Some economic analyses indicate that policy choices to distribute the tax, fee, or emission allowance revenue would yield greater economic impacts than the direct impacts of the carbon price.

Congressional Research Service Market-Based Greenhouse Gas Emission Reduction Legislation This report includes a separate table for each Congress, comparing GHG emission reduction legislation by the following characteristics:

-

General framework: the proposed program structure and scope in terms of emissions covered, multiple

GHGGHG emissions, or just carbon dioxide (CO2) emissions. - CO2) emissions.

Covered entities/materials: a list of the industries, sectors, or materials that would be subject to the

program. -

program.

Emissions limit or target: the GHG or

CO2CO2 emissions target or cap for a specified year. - Distribution of allowance value or tax revenue: how emission allowance value or carbon tax or fee revenue would be distributed.

- Offset and international allowance treatment: the degree to which offsets and international allowances could be used for compliance purposes and the types of offset activities that would qualify.

-

Mechanism to address carbon-intensive imports: a U.S. GHG

-

Additional GHG

Introduction

Congressional Research Service

link to page 5 link to page 7 link to page 7 link to page 8 link to page 10 link to page 2 link to page 7 link to page 7 link to page 11 link to page 14 link to page 21 link to page 31 link to page 39 link to page 41 link to page 44 link to page 50 link to page 62 link to page 75 Market-Based Greenhouse Gas Emission Reduction Legislation

Contents

Introduction ................................................................................................................... 1 Background.................................................................................................................... 3

What Is a GHG Emissions Cap-and-Trade System? ........................................................ 3 What Is a Carbon Tax or Emissions Fee? ....................................................................... 4

GHG Emission Reduction Legislation by Congress .............................................................. 6

Figures Figure 1.Number and Type of Introduced GHG Emission Reduction Bills ............................... 2 Figure 2. Number and Type of Market-Based GHG Emission Reduction Bil s Introduced

in 108th Congress through 116th Congress ......................................................................... 3

Tables Table 1. GHG Emission Reduction Proposals: 108th Congress ................................................ 7 Table 2. GHG Emission Reduction Proposals: 109th Congress .............................................. 10 Table 3. GHG Emission Reduction Proposals: 110th Congress .............................................. 17 Table 4. GHG Emission Reduction Proposals: 111th Congress .............................................. 27 Table 5. GHG Emission Reduction Proposals: 112th Congress .............................................. 35 Table 6. GHG Emission Reduction Proposals: 113th Congress .............................................. 37 Table 7. GHG Emission Reduction Proposals: 114th Congress .............................................. 40 Table 8. GHG Emission Reduction Proposals: 115th Congress .............................................. 46 Table 9. GHG Emission Reduction Proposals: 116th Congress .............................................. 58

Contacts

Author Information ....................................................................................................... 71

Congressional Research Service

Market-Based Greenhouse Gas Emission Reduction Legislation

Introduction Human activities, particularly fossil fuel combustion and industrial operations, have raised the atmospheric concentration of carbon dioxide (CO2CO2) and other greenhouse gases (GHGs)11 by about 40% over the past 150 years. Almost all al climate scientists agree that these GHG increases have contributed to a warmer climate today and that, if they continue, they will wil contribute to future climate change.22 Although a range of actions that seek to reduce GHG emissions are currently

underway or being developed on the international3international3 and subnational level (e.g., individual state actions or regional partnerships),4,4 federal policymakers and stakeholders have different

viewpoints over what to do, if anything, about future climate change and related impacts.

Congressional interest in GHG emission control legislation has fluctuated over the last 15 years. Proposals to limit GHG emissions have often focused on market-based approaches, such as a GHG emission cap-and-trade program or a GHG emissions tax (often referred to as a carbon tax) or fee.55 In general, a market-based approach would place a price on GHG emissions (e.g., through an emissions cap or emission tax or fee), allowingal owing covered entities to determine their pathway of compliance.6

compliance.6

This report provides a comparison of the legislative proposals from the 108th108th through the 116th 116th Congresses that were and are designed primarily to reduce GHG emissions using market-based

approaches such as cap-and-trade or carbon tax/fee programs. During this time frame, Members introduced multiple energy-related proposals that would have likely resulted in reductions in GHG emissions—legislation that promotes renewable energy7 or encourages carbon capture and sequestration8—but these bills are not discussed in this report.

In addition, starting in the 112th

1 GHGs in the atmosphere trap radiation as heat, warming the Earth’s surface and oceans. T he primary GHGs emitted by human activities (and estimated by EPA in its annual inventories) include CO2, methane, nitrous oxide (N2O), sulfur hexafluoride (SF6), chlorofluorocarbons, hydrofluorocarbons (HFCs), and perfluorocarbons (PFCs). Other GHGs include carbonaceous and sulfuric aerosols, hydrochlorofluorocarbons, and elevated tropospheric ozone pollution generated by emissions of nitrogen oxides and volatile organic compounds, such as solvents.

2 For the latest U.S. assessment of the human contribution to climate change, see Intergovernmental Panel on Climate Change, Global Warm ing of 1.5°C, Special Report, 2018; and U.S. Global Change Research Program, Fourth National Clim ate Assessm ent, vol. II: Im pacts, Risks, and Adaptation in the United States, 2018. See also CRS Report R45086, Evolving Assessm ents of Hum an and Natural Contributions to Clim ate Change , by Jane A. Leggett .

3 Some countries have levied carbon taxes (or something similar) for over 20 years. For a review of carbon prices in other countries, see OECD, Effective Carbon Rates: Pricing CO2 through Taxes and Em issions Trading System s, 2016, http://www.oecd-ilibrary.org/taxation/effective-carbon-rates_9789264260115-en; and the Carbon T ax Center website at http://www.carbontax.org/where-carbon-is-taxed.

4 A number of U.S. states have taken action requiring GHG emission reductions. T he most aggressive actions have come from California and from the Regional Greenhouse Gas Initiative (RGGI)—a coalition of nine states from the Northeast and Mid-Atlantic regions. T he RGGI is a cap-and-trade system that t ook effect in 2009 that applies to CO2 emissions from electric power plants. (See CRS Report R41836, The Regional Greenhouse Gas Initiative: Background, Im pacts, and Selected Issues, by Jonathan L. Ramseur.) California established a cap-and-trade program that took effect in 2013. California’s cap covers multiple GHGs, which account for approximately 85% of California’s GHG emissions. For more details, see the California Air Resources Board website, https://www.arb.ca.gov/cc/capandtrade/capandtrade.htm. In addition to its emissions cap, California has adopted a range of other climate change mitigation policies (e.g., renewable energy portfolio stan dards). 5 Other approaches may include performance-based or technology-based standards (e.g., best available control technology). See CRS Report R41973, Clim ate Change: Conceptual Approaches and Policy Tools, by Jane A. Leggett .

6 T he 1990 Clean Air Act Amendments established a market -based cap-and-trade program to control the air emissions (sulfur dioxide and nitrogen oxides) that lead to acid rain. Although controversial at its inception, the progra m is widely considered a success. See, for example, Gabriel Chan et al., The SO2 Allowance Trading System and the Clean Air Act Am endm ents of 1990: Reflections on Twenty Years of Policy Innovation , Harvard Environmental Economics Program, 2012, https://www.belfercenter.org/sites/default/files/legacy/files/so2-brief_digital4_final.pdf.

Congressional Research Service

1

link to page 7 Market-Based Greenhouse Gas Emission Reduction Legislation

GHG emissions—legislation that promotes renewable energy7 or encourages carbon capture and

sequestration8—but these bil s are not discussed in this report.

In addition, starting in the 112th Congress, some Members have introduced resolutions in the

Congress, some Members have introduced resolutions in the House and Senate expressing the view that a carbon tax is not in the economic interests of the United States. In September 2018, the House passed a resolution "“expressing the sense of Congress that a carbon tax would be detrimental to the United States economy" (” (H.Con.Res. 119).9

119).9 An analogous resolution was not introduced in the Senate in the 115th Congress.

As Figure 1 illustrates, between the 108th and 111th115th Congress.

As Figure 2 il ustrates, between the 108th and 111th Congresses, most of the introduced bills bil s would have established cap-and-trade systems. Between the 112th and 115th112th and 115th Congresses, most of

the introduced billsbil s would have established carbon tax or emissions fee programs.

In the 111th111th Congress, Members offered multiple and varied proposals,1010 ultimately resulting in the House passage of H.R. 2454, an economy-wide cap-and-trade bill.11bil .11 A companion bill bil in the Senate (S. 1733) was ordered reported from the Committee on Environment and Public Works,

but the bill bil was never brought to the Senate floor for consideration.

In subsequent Congresses, some Members continued to offer GHG emission control legislation, but these proposals saw minimal legislative activity. During that time frame, the U.S.

Environmental Protection Agency (EPA) used existing Clean Air Act authorities to promulgate GHG emission standards for key sectors, including the electric power and transportation sectors.12 12 EPA rulemakings in this area—particularly the 2015 Clean Power Plan final rule13rule13 and the 2019

Affordable Clean Energy final rule14rule14—continue to generate interest and debate in Congress.

The proposals from the 116th116th Congress range in their scope of emissions covered from CO2 CO2 emissions from fossil fuel combustion to multiple GHG emissions from a broader array of sources. In addition, the proposals differ by how, to whom, and for what purpose the fee revenues or al owanceor allowance value would be applied. Some economic analyses indicate that policy choices to

distribute the tax, fee, or emission allowanceal owance revenue would yield greater economic impacts than

the direct impacts of the carbon price.

The first section of this report provides background information on cap-and-trade and carbon tax or emission fee programs. The second section compares the GHG emission reduction legislation in each Congress (108th-116th).

Background

Over the last 15 years, broad GHG emission reduction legislation has generallygeneral y involved market-based approaches—such as cap-and-trade systems or carbon tax programs—that rely on private sector choices and market forces to minimize the costs of emission reductions and spur innovation.1516 Both carbon tax and emissions cap-and-trade programs would place a price—directly or indirectly—on GHG emissions or their inputs (e.g., fossil fuels), both wouldw ould increase the price of fossil fuels for the consumer, and both would reduce GHG emissions to some degree.

Preference between the two approaches ultimately depends on which variable policymakers prefer to precisely control: emission levels or emission prices. As a practical matter, these market-based policies may include complementary or hybrid designs, incorporating elements to increase certainty in price or emissions quantity. For example, legislation could provide mechanisms for adjusting a carbon tax/fee if a targeted range of emissions reductions were not achieved in a given

period. Alternatively, legislation could include mechanisms that would bound the range of market

prices for a cap-and-trade system'’s emissions allowancesal owances to improve price certainty.

What Is a GHG Emissions Cap-and-Trade System?

A GHG cap-and-trade system creates an overall overal limit, or cap, on GHG emissions from certain sources. Cap-and-trade programs can vary by the sources covered, which often include major

16 In some instances, legislation would have directed EPA to establish a GHG emissions reduction program with a market -based approach as one option. An alternative approach to a market -based system might involve regulatory directives that require emission performance standards for specific sources or the application of best available control technology.

Congressional Research Service

3

link to page 5 Market-Based Greenhouse Gas Emission Reduction Legislation

emitting sectors (e.g., power plants and carbon-intensive industries), fuel producers and/or

processors (e.g., coal mines or petroleum refineries), or some combination of both.

The emissions cap is partitioned into emission allowances. TypicallyTypical y, in a GHG cap-and-trade

system, one emission allowanceal owance represents the authority to emit one metric ton16ton17 of carbon dioxide-equivalent (mtCO2e).17 (mtCO2e).18 The emissions cap creates a new commodity—the emission allowanceal owance. Policymakers may decide to distribute the emission allowancesal owances to covered entities at no cost (based on, for example, previous years'’ emissions), sell the allowancessel the al owances (e.g., through an auction), or use some combination of these strategies. The distribution of emission allowances is typicallyal owances is

typical y a source of significant debate during a cap-and-trade program'’s development, because the allowances

the al owances have monetary value.

At the end of each established compliance period (e.g., a calendar year or multiple years),

covered sources submit emission allowancesal owances to an implementing agency to cover the number of tons emitted. If a source did not provide enough allowancesal owances to cover its emissions, the source would be subject to penalties. Covered sources would have a financial incentive to make reductions beyond what is required, because they could (1) sell sel or trade unused emission allowancesal owances to entities that face higher costs to reduce their facility emissions, (2) reduce the

number of emission allowanceal owance they need to purchase, or (3) bank them, if allowedal owed, to use in a

future year.

The use of emission offsets as a compliance option received attention during debate over cap-and-

trade programs. An offset is a measurable reduction, avoidance, or sequestration of GHG emissions from a source not covered by an emission reduction program. Economic analyses of cap-and-trade proposals concluded that offset treatment (i.e., whether or not to allowal ow their use and, if so, to what degree) would have a substantial impact on overall overal program cost. This is because some emissions and sources often not covered in cap-and-trade programs can reduce

emissions at a lower cost per ton than many typicallytypical y covered sources. However, the use of offsets generates considerable controversy, primarily over the concern that difficult-to-assess or

fraudulent offsets could create uncertainty about the quantity of emission reductions.18

19

In addition, other mechanisms—such as allowanceal owance banking or borrowing—may be included to

increase the flexibility of the program and, generallygeneral y, reduce the costs.

What Is a Carbon Tax or Emissions Fee?

In a carbon tax or emissions fee program, policymakers attach a price to GHG emissions or the inputs that create them. A carbon tax/fee on emissions or emissions inputs—namely fossil fuels—would increase the relative price of the more carbon-intensive energy sources. This result is

17 A metric ton is approximately 2,205 pounds. A short ton equals 2,000 pounds. 18 T his term of measure (CO2e) is used because GHGs vary by global warming potential (GWP). GWP is an index developed by the Intergovernmental Panel on Climate Change (IPCC) that allows comparisons of the heat -trapping ability of different gases over a period of time, typically 100 years. Consistent with international GHG reporting requirements, EPA’s most recent GHG inventory (2018) uses the GWP values presented in the IPCC’s 2007 Fourth Assessment Report. For example, based on these GWP values, a ton of methane is 25 times more potent than a ton of CO2 when averaged over a 100-year time frame. T he IPCC has since updated the 100-year GWP estimates, with some increasing and some decreasing. For example, the IPCC 2013 Fifth Assessment Report reported the 100 -year GWP for methane as ranging from 28 to 36. EPA compares the 100-year GWP values in T able 1-3 of its 2018 GHG Inventory.

19 Both the RGGI and California cap-and-trade systems allow offsets as a compliance option (see footnote 4).

Congressional Research Service

4

Market-Based Greenhouse Gas Emission Reduction Legislation

would increase the relative price of the more carbon-intensive energy sources. This result is expected to spur innovation in less carbon-intensive technologies and stimulate other behavior

that may decrease emissions.19

20

Economic modeling indicates that a carbon tax/fee approach could achieve emission reductions,

the level of which would depend on the scope and stringency (i.e., tax or fee level) of the program.2021 For example, to address emissions from fossil fuel combustion—76% of total U.S. GHG emissions22GHG emissions21—policymakers could apply a tax/fee to fossil fuels at approximately 3,000 entities, including coal mines, petroleum refineries, and entities required to report natural gas deliveries.22

deliveries.23

A carbon tax/fee would generate a new revenue stream. The magnitude of the revenues would depend on the scope and rate of the tax or fee, the responsiveness of covered entities in reducing their potential emissions, and multiple other market factors. A 2016 Congressional Budget Office

study estimated that a $25/ton carbon tax would yield approximately $100 billion bil ion in the first year

of the program.23

24

When designing a carbon tax/fee system, one of the more controversial and challengingchal enging questions

for policymakers is how, to whom, and for what purpose the new tax or fee revenues could be applied. Congress would face the same issues that would be encountered during a debate over emission allowance

emission al owance value distribution in a cap-and-trade system.

When deciding how to allocateal ocate the revenues, policymakers would encounter trade-offs among objectives. The central trade-offs involve minimizing economy-wide costs, lessening the costs borne by specific groups—particularly low-income households and displaced workers or

communities—and supporting a range of specific policy objectives.

A primary argument against a carbon tax/fee system (and a cap-and-trade program) is the concern about the economy-wide costs that a carbon price could impose. The potential costs would depend on a number of factors, including the magnitude, design, and use of revenues of the carbon tax or fee.

Others who may oppose a carbon tax system express opposition to federal taxes in general or the possibility that the revenues would enable greater federal spending. Owners of coal resources, in

particular, would likely lose asset values under a carbon tax system—as under a cap-and-trade

system—to the degree that coal becomes less competitive under the costs of emission reductions.

20 T his differs from a price system that applies to energy content, such as a tax based on British thermal units (Btu). In 1993, President Clinton proposed a deficit reduction package that included a t ax based on energy content, measured in Btu. T he goals of the 1993 Btu tax proposal were to promote energy conservation and raise revenue. At the time, the proposed tax would have generated a new revenue stream of about $30 billion per year. T he proposal was met with strong opposition and was not enacted; Congress ultimately enacted an approximately five-cent-per-gallon increase in the motor fuels taxes.

21 See, for example, Alexander R. Barron et al., “Policy Insights from the EMF 32 Study on U.S. Carbon T a x Scenarios,” Climate Change Economics, vol. 9, no. 1 (2018). 22 EPA, Inventory of U.S. Greenhouse Gas Emissions and Sinks, 1990-2017, April 2019. 23 See T able A-1 in CRS Report R45625, Attaching a Price to Greenhouse Gas Emissions with a Carbon Tax or Em issions Fee: Considerations and Potential Im pacts, by Jonathan L. Ramseur and Jane A. Leggett .

24 Congressional Budget Office, Options for Reducing the Deficit: 2017-2026, 2016.

Congressional Research Service

5

Market-Based Greenhouse Gas Emission Reduction Legislation

GHG Emission Reduction Legislation by Congress GHG Emission Reduction Legislation by Congress

This section compares GHG emission reduction legislation from the 108th108th Congress to the 116th 116th Congress by including a separate legislative table for each Congress.2425 The tables compare the billsbil s by their overall overal framework, scope, stringency, and selected design elements. Categories of

comparison include

-

General framework: the proposed program structure—emissions cap, emissions

tax or fee, or some combination of both—and scope in terms of emissions covered (multiple GHG emissions or just

CO2 emissions). - CO2 emissions). Covered entities/materials: the industries, sectors, or materials that would be subject to the program.

-

Emissions limit or target: the GHG or

CO2CO2 emissions target or cap for a particular year. Some targets/caps would apply only to covered sources; others apply to total U.S. GHG emissions. -

Distribution of allowance value or tax revenue: how emission

allowanceal owance value or carbon tax or fee revenue would be distributed (if applicable). -

Offset and international allowance treatment: the degree to which offsets and

international allowancesinternational al owances could be used for compliance purposes and the types of offset activities that would qualify. Some proposals limit offsets by percentage of required reductions; others limit offsets as a percentage ofallowanceal owance submissions. -

Mechanism to address carbon-intensive imports: a central concern with a U.S.

GHG reduction program is that it could raise U.S. prices more than goods manufactured abroad, potentially creating a competitive disadvantage for some

domestic businesses, particularly carbon-intensive, trade-exposed industries. Policymakers could address these potential impacts in several ways—for example, through border adjustments, tax rebates, or emission

allowancesal owances provided at no cost to selected industrial sectors. -

Additional GHG

further reduce GHG emissions that are not covered in the central program.

Table 1. GHG Emission Reduction Proposals: 108th Congress

Ordered Chronologically by Introduced Date

|

Bill Number, Sponsor, Introduced Date, and Committee or Floor Action |

General Framework |

Covered Entities/Materials |

Emissions Limit or Target |

Distribution of Allowance Value or Tax/Fee Revenue |

Offset and International Allowance Treatment |

Mechanism to Address Carbon-Intensive Imports |

Additional GHG Reduction Measures |

Discharged by unanimous consent by the Senate Committee on Environment and Public Works on Oct. 29, 2003 S.Amdt. 2028, which contained similar provisions, was not agreed to on Oct. 30, 2003 |

Cap-and-trade system for GHG emissions from multiple sectors |

Electric power, industrial, or commercial entities that emit over 10,000 mtCO2e annually; any refiner or importer of petroleum products for transportation use that, when combusted, will emit over 10,000 mtCO2e annually; and any importer or producer of HFC, PFC, and SF6 that, when used, will emit over 10,000 mtCO2e |

Cap of 5,896 mtCO2e for covered sources by 2010 (equivalent to 2000 levels), reduced by the level of emissions from non-covered sources; cap of 5,123 mtCO2e for covered sources by 2016 (equivalent to 1990 levels), reduced by the level of emissions from non-covered sources |

|

From 2010 through 2015, up to 15% of submitted allowances can come from domestic or international offsets; after 2015, 10% of submitted allowance can come from offsets |

No specific provision |

No specific provision |

|

Cap-and-trade system for CO2 emissions from power plants; also addresses other air pollutants (mercury, sulfur dioxide, nitrogen oxide) |

Fossil-fuel-fired electric generating facilities with a capacity of greater than 15 megawatts |

Cap on electric power emissions of 2.05 billion metric tons in 2009 (equivalent to 1995 emissions) |

EPA allocates free allowances to the following: 60% to households to alleviate increased electricity prices 6% for worker transition assistance 20% for renewable energy and energy efficiency 10% to electricity generation facilities 1% for forest sequestration 2% for geologic sequestration

S. 843

Cap-and-trade

Fossil-fuel-fired electric

Cap on electric power

Al otted to

Determined by

No specific

No specific

Carper

system for CO2 generating facility that has a emissions of 2006 levels

covered sources

EPA

provision

provision

Apr. 9, 2003

emissions from

capacity of greater than 25

in 2009; lowered to

at no cost based

electricity

megawatts and generates

2001 levels in 2013

on previous year’s

sector; also

electricity for sale

emission levels

addresses

(minus a reserve

other air

set aside for new

pol utants

units)

(mercury, sulfur dioxide, nitrogen oxide)

H.R. 2042

Directs EPA to

Fossil-fuel-fired electric

1990 CO2 levels for

No specific

No specific

No specific

No specific

Waxman

issue

generating facility that has a power plants by 2009

provision

provision

provision

provision

May 8, 2003

regulations to

capacity of greater than 25

meet CO2

megawatts and generates

emissions goals; electricity for sale |

No specific provision |

No specific provision |

No specific provision |

|

Cap-and-trade system for CO2 emissions from electricity sector; also addresses other air pollutants (mercury, sulfur dioxide, nitrogen oxide) |

Fossil-fuel-fired electric generating facility that has a capacity of greater than 25 megawatts and generates electricity for sale |

Cap on electric power emissions of 2006 levels in 2009; lowered to 2001 levels in 2013 |

Allotted to covered sources at no cost based on previous year's emission levels (minus a reserve set aside for new units) |

Determined by EPA |

No specific provision |

No specific provision |

|

|

Fossil-fuel-fired electric generating facility that has a capacity of greater than 25 megawatts and generates electricity for sale |

1990 CO2 levels for power plants by 2009 |

No specific provision |

No specific provision |

No specific provision |

No specific provision |

|

Cap-and-trade system for GHG emissions from multiple sectors |

Electric power, industrial, or commercial entities that emit over 10,000 mtCO2e annually; any refiner or importer of petroleum products for transportation use that, when combusted, will emit over 10,000 mtCO2e annually; and any importer or producer of HFC, PFC, and SF6 that, when used, will emit over 10,000 mtCO2e |

1990 GHG levels for covered sources, reduced by the level of emissions from non-covered sources by 2020 |

Determined by the Secretary of Commerce; allowances provided to covered entities at no cost and to the newly established, nonprofit Climate Change Credit Corporation, which may use allowance to help energy consumers with increased prices and provide transition assistance to dislocated workers and communities, among other objectives |

Up to 15% of submitted allowances can come from domestic or international offsets; if offsets account for 15% of allowances, at least 1.5% must come from agricultural sequestration |

No specific provision |

No specific provision |

Source: Prepared by CRS.

Table 2. GHG Emission Reduction Proposals: 109th Congress

Ordered Chronologically by Introduced Date

|

Bill Number, Sponsor, Introduced Date, and Committee or Floor Action |

General Framework |

Covered Entities/Materials |

Emissions Limit or Target |

Distribution of Allowance Value or Tax/Fee Revenue |

Offset and International Allowance Treatment |

Mechanism to Address Carbon-Intensive Imports |

Additional GHG Reduction Measures |

|

Cap-and-trade system for CO2 emissions from power plants; also addresses other air pollutants (mercury, sulfur dioxide, nitrogen oxide) |

Fossil-fuel-fired electric generating facilities with a capacity of greater than 15 megawatts |

Cap on electric power emissions of 2.05 billion metric tons in 2010 |

In 2010, EPA allocates free allowance to the following: 60% to households to alleviate increased electricity prices 6% for worker transition assistance transition assistance 20% for renewable energy and energy efficiency 10% to electricity generation facilities 1% for forest sequestration 2% for geologic sequestration

S. 342

Cap-and-trade system for

Electric power,

Cap of

Determined by the

Up to 15% of

No specific

No specific

McCain

GHG emissions from

industrial, or

5,896

Secretary of

submitted

provision

provision

Feb. 10, 2005

multiple sectors

commercial entities

mtCO2e for

Commerce; al owances

al owances can

that emit over 10,000

covered

provided to covered

come from

mtCO2e annual y; any

sources by

entities at no cost and

domestic or

refiner or importer of

2010

to the newly

international

petroleum products

(equivalent

established, nonprofit

offsets; if offsets

for transportation use

to 2000

Climate Change Credit

account for 15%

that, when

levels),

Corporation, which

of al owances, at

CRS-10

Bill

Number, Sponsor,

Introduced

Mechanism to

Date, and

Offset and

Address

Additional

Committee

Emissions

Distribution of

International

Carbon-

GHG

or Floor

Covered

Limit or

Allowance Value or

Allowance

Intensive

Reduction

Action

General Framework

Entities/Materials

Target

Tax/Fee Revenue

Treatment

Imports

Measures

combusted, wil emit

reduced by

may use al owance to

least 1.5% must

over 10,000 mtCO2e

the level of

help energy consumers

come from

annual y; and any

emissions

with increased prices

agricultural

importer or producer

from non-

and provide transition

sequestration

of HFC, PFC, and SF6

covered

assistance to dislocated

that, when used, wil

sources

workers and

emit over 10,000

communities, among

mtCO2e

other objectives

H.R. 759

Cap-and-trade system for

Electric power,

Cap of

Determined by the

Up to 15% of

No specific

No specific

Gilchrest

GHG emissions from

industrial, or

5,896

Secretary of

submitted

provision

provision

Feb. 10, 2005

multiple sectors

commercial entities

mtCO2e for

Commerce; al owances

al owances can

that emit over 10,000

covered

provided to covered

come from

mtCO2e annual y; any

sources by

entities at no cost and

domestic or

refiner or importer of

2010

to the newly

international

petroleum products

(equivalent

established, nonprofit

offsets; if offsets

for transportation use

to 2000

Climate Change Credit

account for 15%

that, when

levels),

Corporation, which

of al owances, at

combusted, wil emit

reduced by

may use al owance to

least 1.5% must

over 10,000 mtCO2e

the level of

help energy consumers

come from

annual y; and any

emissions

with increased prices

agricultural

importer or producer

from non-

and provide transition

sequestration

of HFC, PFC, and SF6

covered

assistance to dislocated

that, when used, wil

sources

workers and

emit over 10,000

communities, among

mtCO2e

other objectives

H.R. 1451

Directs EPA to issue

Fossil-fuel-fired

1990 CO2

No specific provision

No specific

No specific

No specific

Waxman

regulations to meet CO2

electric generating

levels for

provision

provision

provision

Mar. 17, 2005

emissions goals; may include facilities that have a

power

a market-based approach;

capacity of greater

plants by

also addresses other air

than 25 megawatts

2010

CRS-11

Bill

Number, Sponsor,

Introduced

Mechanism to

Date, and

Offset and

Address

Additional

Committee

Emissions

Distribution of

International

Carbon-

GHG

or Floor

Covered

Limit or

Allowance Value or

Allowance

Intensive

Reduction

Action

General Framework

Entities/Materials

Target

Tax/Fee Revenue

Treatment

Imports

Measures

pol utants (mercury, sulfur

and generate

dioxide, nitrogen oxide)

electricity for sale

S. 730

EPA determines the

Fossil-fuel-fired

Cap on

No specific provision

No specific

No specific

No specific

Leahy

framework of the program;

electric generating

electric

provision

provision

provision

Apr. 6, 2005

also addresses other air

facilities (no minimum

power

pol utants (mercury, sulfur

threshold)

emissions of

dioxide, nitrogen oxide)

2.05 bil ion metric tons in 2010

H.R. 1873

Cap-and-trade system for

Fossil-fuel-fired

Cap on

Al otted to covered

Determined by

No specific

No specific

Bass

CO2 emissions from

electric generating

electric

sources at no cost

EPA

provision

provision

Apr. 27, 2005

electricity sector; also

facilities that have a

power

based on previous

addresses other air

capacity of greater

emissions of

years emission levels

pol utants (mercury, sulfur

than 25 megawatts

2006 levels

(minus a reserve set

dioxide, nitrogen oxide)

and generate

in 2010;

aside for new units)

electricity for sale

lowered to 2001 levels in 2015

S. 1151

Cap-and-trade system for

Electric power,

Cap of

Determined by the

Up to 15% of

No specific

No specific

McCain

GHG emissions from

industrial, or

5,896

Secretary of

submitted

provision

provision

May 26, 2005

multiple sectors

commercial entities

mtCO2e for

Commerce; al owances

al owances can

that emit over 10,000

covered

provided to covered

come from

mtCO2e annual y; any

sources by

entities at no cost and

domestic or

refiner or importer of

2010

to the newly

international

petroleum products

(equivalent

established, nonprofit

offsets; if offsets

for transportation use

to 2000

Climate Change Credit

account for 15%

that, when

levels),

Corporation, which

of al owances, at

combusted, wil emit

reduced by

may use al owance to

least 1.5% must

over 10,000 mtCO2e

the level of

help energy consumers

come from

annual y; and any

emissions

with increased prices

CRS-12

Bill

Number, Sponsor,

Introduced

Mechanism to

Date, and

Offset and

Address

Additional

Committee

Emissions

Distribution of

International

Carbon-

GHG

or Floor

Covered

Limit or

Allowance Value or

Allowance

Intensive

Reduction

Action

General Framework

Entities/Materials

Target

Tax/Fee Revenue

Treatment

Imports

Measures

importer or producer

from non-

and provide transition

agricultural

of HFC, PFC, and SF6

covered

assistance to dislocated

sequestration

that, when used, wil

sources

workers and

emit over 10,000

communities, among

mtCO2e

other objectives

H.R. 2828

Cap-and-trade system for

Electric power,

Cap of

Determined by the

Up to 15% of

No specific

No specific

Inslee

GHG emissions from

industrial, or

5,896

Secretary of

submitted

provision

provision

June 9, 2005

multiple sectors

commercial entities

mtCO2e for

Commerce; al owances

al owances can

that emit over 10,000

covered

provided to covered

come from

mtCO2e annual y; any

sources by

entities at no cost and

domestic or

refiner or importer of

2010

to the newly

international

petroleum products

(equivalent

established, nonprofit

offsets; if offsets

for transportation use

to 2000

Climate Change Credit

account for 15%

that, when

levels),

Corporation, which

of al owances, at

combusted, wil emit

reduced by

may use al owance to

least 1.5% must

over 10,000 mtCO2e

the level of

help energy consumers

come from

annual y; and any

emissions

with increased prices

agricultural

importer or producer

from non-

and provide transition

sequestration

of HFC, PFC, and SF6

covered

assistance to dislocated

that, when used, wil

sources

workers and

emit over 10,000

communities, among

mtCO2e

other objectives

H.R. 5049

Cap-and-trade system for

Emissions from

Maintains

20% to electric power,

Provides

No specific

No specific

Udal

GHG emissions from

domestic and

existing

fossil fuel production,

additional

provision

provision

Mar. 29, 2006

multiple sectors, with a

imported fossil fuels;

emission

and energy intensive

al owances for

price ceiling of $25 per ton

emissions from

levels; the

industries

sequestration

of carbon, indexed to

agricultural, industrial,

number of

15% to states for

projects

inflation

and manufacturing

al owances

worker transition

processes, excluding

distributed

assistance

methane from animals

based on emissions

CRS-13

Bill

Number, Sponsor,

Introduced

Mechanism to

Date, and

Offset and

Address

Additional

Committee

Emissions

Distribution of

International

Carbon-

GHG

or Floor

Covered

Limit or

Allowance Value or

Allowance

Intensive

Reduction

Action

General Framework

Entities/Materials

Target

Tax/Fee Revenue

Treatment

Imports

Measures

from years

5% to states for energy

prior to

assistance to low-

enactment,

income households

without

25% to the Department

reductions

of Energy to support

in

energy research and

subsequent

development

years

10% to the Department of State to invest in low-emission and emission-free policies |

No specific provision |

No specific provision |

No specific provision |

|

Cap-and-trade system for GHG emissions from multiple sectors |

Electric power, industrial, or commercial entities that emit over 10,000 mtCO2e annually; any refiner or importer of petroleum products for transportation use that, when combusted, will emit over 10,000 mtCO2e annually; and any importer or producer of HFC, PFC, and SF6 that, when used, will emit over 10,000 mtCO2e |

Cap of 5,896 mtCO2e for covered sources by 2010 (equivalent to 2000 levels), reduced by the level of emissions from non-covered sources |

Determined by the Secretary of Commerce; allowances provided to covered entities at no cost and to the newly established, nonprofit Climate Change Credit Corporation, which may use allowance to help energy consumers with increased prices and provide transition assistance to dislocated workers and communities, among other objectives |

Up to 15% of submitted allowances can come from domestic or international offsets; if offsets account for 15% of allowances, at least 1.5% must come from agricultural sequestration |

No specific provision |

No specific provision |

|

Cap-and-trade system for GHG emissions from multiple sectors |

Electric power, industrial, or commercial entities that emit over 10,000 mtCO2e annually; any refiner or importer of petroleum products for transportation use that, when combusted, will emit over 10,000 mtCO2e annually; and any importer or producer of HFC, PFC, and SF6 that, when used, will emit over 10,000 mtCO2e |

Cap of 5,896 mtCO2e for covered sources by 2010 (equivalent to 2000 levels), reduced by the level of emissions from non-covered sources |

Determined by the Secretary of Commerce; allowances provided to covered entities at no cost and to the newly established, nonprofit Climate Change Credit Corporation, which may use allowance to help energy consumers with increased prices and provide transition assistance to dislocated workers and communities, among other objectives |

Up to 15% of submitted allowances can come from domestic or international offsets; if offsets account for 15% of allowances, at least 1.5% must come from agricultural sequestration |

No specific provision |

No specific provision |

|

Directs EPA to issue regulations to meet CO2 emissions goals; may include a market-based approach; also addresses other air pollutants (mercury, sulfur dioxide, nitrogen oxide) |

Fossil-fuel-fired electric generating facilities that have a capacity of greater than 25 megawatts and generate electricity for sale |

1990 CO2 levels for power plants by 2010 |

No specific provision |

No specific provision |

No specific provision |

No specific provision |

|

EPA determines the framework of the program; also addresses other air pollutants (mercury, sulfur dioxide, nitrogen oxide) |

Fossil-fuel-fired electric generating facilities (no minimum threshold) |

Cap on electric power emissions of 2.05 billion metric tons in 2010 |

No specific provision |

No specific provision |

No specific provision |

No specific provision |

|

Cap-and-trade system for CO2 emissions from electricity sector; also addresses other air pollutants (mercury, sulfur dioxide, nitrogen oxide) |

Fossil-fuel-fired electric generating facilities that have a capacity of greater than 25 megawatts and generate electricity for sale |

Cap on electric power emissions of 2006 levels in 2010; lowered to 2001 levels in 2015 |

Allotted to covered sources at no cost based on previous years emission levels (minus a reserve set aside for new units) |

Determined by EPA |

No specific provision |

No specific provision |

|

Cap-and-trade system for GHG emissions from multiple sectors |

Electric power, industrial, or commercial entities that emit over 10,000 mtCO2e annually; any refiner or importer of petroleum products for transportation use that, when combusted, will emit over 10,000 mtCO2e annually; and any importer or producer of HFC, PFC, and SF6 that, when used, will emit over 10,000 mtCO2e |

Cap of 5,896 mtCO2e for covered sources by 2010 (equivalent to 2000 levels), reduced by the level of emissions from non-covered sources |

Determined by the Secretary of Commerce; allowances provided to covered entities at no cost and to the newly established, nonprofit Climate Change Credit Corporation, which may use allowance to help energy consumers with increased prices and provide transition assistance to dislocated workers and communities, among other objectives |

Up to 15% of submitted allowances can come from domestic or international offsets; if offsets account for 15% of allowances, at least 1.5% must come from agricultural sequestration |

No specific provision |

No specific provision |

|

Cap-and-trade system for GHG emissions from multiple sectors |

Electric power, industrial, or commercial entities that emit over 10,000 mtCO2e annually; any refiner or importer of petroleum products for transportation use that, when combusted, will emit over 10,000 mtCO2e annually; and any importer or producer of HFC, PFC, and SF6 that, when used, will emit over 10,000 mtCO2e |

Cap of 5,896 mtCO2e for covered sources by 2010 (equivalent to 2000 levels), reduced by the level of emissions from non-covered sources |

Determined by the Secretary of Commerce; allowances provided to covered entities at no cost and to the newly established, nonprofit Climate Change Credit Corporation, which may use allowance to help energy consumers with increased prices and provide transition assistance to dislocated workers and communities, among other objectives |

Up to 15% of submitted allowances can come from domestic or international offsets; if offsets account for 15% of allowances, at least 1.5% must come from agricultural sequestration |

No specific provision |

No specific provision |

|

Cap-and-trade system for GHG emissions from multiple sectors, with a price ceiling of $25 per ton of carbon, indexed to inflation |

Emissions from domestic and imported fossil fuels; emissions from agricultural, industrial, and manufacturing processes, excluding methane from animals |

Maintains existing emission levels; the number of allowances distributed based on emissions from years prior to enactment, without reductions in subsequent years |

20% to electric power, fossil fuel production, and energy intensive industries 15% to states for worker transition assistance 5% to states for energy assistance to low-income households 25% to the Department of Energy to support energy research and development 10% to the Department of State to invest in low-emission and emission-free policies in developing countries in developing countries 25% to the Department of the Treasury to be sold at auction with the proceeds deposited in the Treasury

S. 2724

Cap-and-trade system for

Fossil-fuel-fired

2001 CO2

Al otted to covered

Determined by

No specific

No specific

Carper

CO2 emissions from

electric generating

emission

sources based on

EPA

provision

provision

May 4, 2006

electricity sector; also

facilities that have a

levels by

previous years emission

addresses other air

capacity of greater

2015

levels

pol utants (mercury, sulfur

than 25 megawatts

dioxide, nitrogen oxide)

and generate electricity for sale

H.R. 5642

Cap-and-trade system for

Determined by EPA

1990 GHG

Determined by the

No specific

No specific

EPA to

Waxman

GHG

levels for

President based on plan provision

provision

promulgate

June 20, 2006

covered

submitted to Congress;

additional

sources by

sel via auction and

regulations to

2020; 80%

distribute to non-

reduce GHG

below 1990

covered sources to

emissions,

CRS-14

Bill

Number, Sponsor,

Introduced

Mechanism to

Date, and

Offset and

Address

Additional

Committee

Emissions

Distribution of

International

Carbon-

GHG

or Floor

Covered

Limit or

Allowance Value or

Allowance

Intensive

Reduction

Action

General Framework

Entities/Materials

Target

Tax/Fee Revenue

Treatment

Imports

Measures

levels by

achieve specified goals:

including

2050

maximize public

performance

benefit, mitigate energy

standards,

costs to consumers,

efficiency

provide worker

standards,

transition assistance,

technology

among others

requirements, among others; directs Department of Energy to promulgate renewable portfolio standards

S. 3698

Directs EPA to issue

Determined by EPA

1990 GHG

Determined by EPA;

No specific

No specific

Directs EPA to

Jeffords

regulations to meet GHG

levels by

al owances to covered

provision

provision;

issue CO2

July 20, 2006

emissions goals; may include

2020; 80%

entities; remaining

al owances may

emissions

a market-based approach

below1990

al owances to

be al otted to

standards for

levels by

households,

companies that

vehicles and

2050

communities, and other

experience

CO2 emissions

groups for various

disproportionate

standards for

objectives

impacts from

new power

lower-carbon

plants, create

economy

low-carbon electricity generation standards and trading program, promulgate

CRS-15

Bill

Number, Sponsor,

Introduced

Mechanism to

Date, and

Offset and

Address

Additional

Committee

Emissions

Distribution of

International

Carbon-

GHG

or Floor

Covered

Limit or

Allowance Value or

Allowance

Intensive

Reduction

Action

General Framework

Entities/Materials

Target

Tax/Fee Revenue

Treatment

Imports

Measures

electricity efficiency standards, and establish renewable energy portfolio standards

S. 4039

Cap-and-trade system for

Determined by EPA

1990 GHG

Determined by the

No specific

No specific

No specific

Kerry

GHG emissions

through a rulemaking

levels for

President; Congress

provision

provision

provision

Sept. 29, 2006

process

covered

may enact alternative

sources by

plan within one year

2020

Source: Prepared by CRS.

CRS-16

Table 3. GHG Emission Reduction Proposals: 110th Congress

Ordered Chronological y by Introduced Date

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

S. 280

Cap-and-trade

Electric power,

1990 GHG

Determined by EPA

Up to 15% of

No specific

No specific provision

Lieberman

system for GHG

industrial, or

levels for

submitted

provision

Jan. 12, 2007

emissions from

commercial entities that covered

al owances can

multiple sectors

emit over 10,000

sources by

come from

mtCO2e annual y; any

2020,

domestic or

refiner or importer of

reduced by

international

petroleum products for

the level of

offsets; if offsets

transportation use that,

emissions

account for 15%

when combusted, wil

from non-

of al owances, at

emit over 10,000

covered

least 1.5% must

mtCO2e annual y; and

sources

come from

any importer or

agricultural

producer of HFC, PFC,

sequestration

and SF6 that, when used, wil emit over 10,000 mtCO2e

S. 309

Determined by

Determined by EPA

1990 GHG

Determined by EPA

No specific

No specific

GHG emission

Sanders

EPA, but must be through a rulemaking

levels for al

provision

provision

standards for

Jan. 16, 2007

a market-based

process

sources by

vehicles, new electric

program for

2020

power plants, and an

GHG emissions

energy efficiency performance standard

S. 317

Cap-and-trade

Fossil-fuel-fired electric

5% below

Initial y provided to

Up to 25% of

No specific

No specific provision

Feinstein

system for GHG

generating facilities with

2001 GHG

covered entities at

required

provision

Jan. 17, 2007

emissions from

a capacity of greater

levels for

no cost; percentage

reductions may

electricity sector

than 25 megawatts

electric

of al owances sold

be achieved with

via auction gradual y

EPA-approved

CRS-17

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

generators by increases: by 2036,

international

2020

100% sold via

credits

auction; activities funded by auction revenues include technology development and energy efficiency

H.R. 620

Cap-and-trade

Electric power,

1990 GHG

Determined by EPA

Up to 15% of

No specific

No specific provision

Olver

system for GHG

industrial, or

levels for

al owance

provision

Jan. 22, 2007

emissions from

commercial entities that covered

submission can

multiple sectors

emit over 10,000

sources by

come from

mtCO2e annual y; any

2020,

domestic and/or

refiner or importer of

reduced by

international

petroleum products for

the level of

offsets

transportation use that,

emissions

when combusted, wil

from non-

emit over 10,000

covered

mtCO2e annual y; and

sources

any importer or producer of HFCs, PFCs, or SF6 that, when used, wil emit over 10,000 mtCO2e

S. 485

Cap-and-trade

Determined by EPA

1990 GHG

Determined by the

No specific

No specific

No specific provision

Kerry

system for GHG

through a rulemaking

levels for

President; Congress

provision

provision

Feb. 1, 2007

emissions

process

covered

may enact

sources by

alternative plan

2020

within one year

CRS-18

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

H.R. 1590

Cap-and-trade

Determined by EPA

1990 GHG

Determined by the

No specific

No specific

GHG emission

Waxman

system for GHG

through a rulemaking

levels for al

President; Congress

provision

provision

standards for

Mar. 20, 2007

emissions

process

sources by

may enact

vehicles, energy

2020

alternative plan

efficiency standards,

within one year

renewable portfolio standards

H.R. 2069

Tax starting at

Manufacturers,

Tax rate

No specific

NA

No specific

No specific provision

Stark

$10/short ton of

producers, or

freeze if CO2

provision

provision

Apr. 26, 2007

carbon content

importers who sel a

emissions do

in taxable fuels,

taxable fuel, which

not exceed

which equates to includes coal,

20% of U.S.

approximately

petroleum and

1990 CO2

$2.70/tCO2

petroleum products,

emissions by

emissions

and natural gas

2020

The rate increases $10 per year (in nominal dol ars)

S. 1766

Cap-and-trade

Petroleum refineries,

1990 GHG

In 2012, 53% of

Unlimited use of

International

No specific provision

Bingaman

system for GHG

natural gas processing

levels for

al owances al ocated

domestic offsets;

reserve

July 11, 2007

emissions from

plants, and imports of

covered

to covered and

international

al owances must

multiple sectors

petroleum products,

sources by

certain industrial

offsets limited to

accompany

with al owance

coke, or natural gas;

2020

entities

10% of a

imports of any

price ceiling: in

entities that consume

23% al ocated to

regulated entity’s

covered GHG

2012, $12/ton,

more than 5,000 tons of

states and for

emissions target

intensive goods

increasing by 5%

coal a year; importers

sequestration and

and primary

annual y plus

of HFCs, PFC, SF6,

early reduction

products to the

inflation

N2O, or products

activities

United States

containing such

Least developed

compounds, and adipic

24% are auctioned

nations or those

acid and nitric acid

to fund low-income

that contribute

CRS-19

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

plants, aluminum

assistance, carbon

no more than

smelters, and facilities

capture and storage,

0.5% of global

that emit HFCs as a

and adaptation

emissions are

byproduct of HCFC

activities

excluded

production

The percentage auctioned increases steadily, reaching 53% by 2030

H.R. 3416

Tax on CO2

Manufacturers,

No specific

In first year (2008),

Al ows for

No specific

No specific provision

Larson

content on fossil

producers, or

provision

approximately 76%

domestic offset

provision other

Aug. 3, 2007

fuels, starting at

importers of coal,

would support a

projects (as

than direct

$15/short ton

petroleum, and natural

payrol tax rebate

prescribed by the

assistance to

CO2 emissions,

gas

16% would fund

Secretary of the

affected

increasing by

clean energy

Treasury) to be

industries

10% annual y

technology

submitted as tax

(determined by

plus inflation

credits or tax

the Secretaries

8% would support

refunds

of the Treasury

affected industry

and Labor)

transition assistance (declining to zero by 2017)

H.R. 4226

Cap-and-trade

Electric power,

85% of 2006

Determined by EPA

Up to 15% of

The President

No specific provision

Gilchrest

system for GHG

industrial, or

GHG levels

al owance

may establish a

Nov. 15, 2007

emissions from

commercial entities that from covered

submission can

program to

multiple sectors

emit over 10,000

sources,

come from

require

A Carbon

mtCO2e annual y;

reduced by

domestic and/or

importers to pay

Market Efficiency refiners or importers of

the level of

international

the value of

Board may

petroleum products for

emissions

offsets

GHGs emitted

implement cost-

transportation use that,

from non-

during the

relief measures

when combusted, wil

covered

production of

emit over 10,000

goods or

mtCO2e annual y; and

services

CRS-20

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

importers or producers

sources by

imported into

of HFCs, PFCs, or SF6

2020

the United

that, when used, wil

States from

emit over 10,000

countries that

mtCO2e

have no comparable emission restrictions to those of the United States

S. 2191

Cap-and-trade

Producers or importers

Emission cap

In 2012: 40% of

Up to 15% of

International

Low carbon fuel

Lieberman

system for GHG

of petroleum or coal-

for covered

al owances al ocated

al owance

reserve

standard for

Oct. 18, 2007

emissions from

based liquid or gaseous

sources in

to covered electric

requirement may

al owances must

transportation fuels

Ordered

multiple sectors

fuel that emits GHGs,

2020 is 4.924

utilities, industrial

be achieved

accompany

reported by the

or facilities that

bil ion tCO2e

facilities, and coops

through domestic

imports of any

Senate

produce or import

(19% below

9% al ocated to

offsets;

covered GHG-

Committee on

more than 10,000

2005 levels

states for

international

intensive goods

Environment

mtCO2e of GHG

for covered

conservation, extra

offsets can satisfy

and primary

and Public

chemicals annual y;

sources)

reductions, and

an additional 15%

products to the

Works on Dec.

facilities that use more

other activities

United States

5, 2007

than 5,000 tons of coal

Least developed

annual y; natural gas

11.5% for various

nations or those

processing plants or

sequestration

that contribute

importers (including

activities

no more than

liquid natural gas

10% al ocated for

0.5% of global

[LNG]); or facilities that

electricity consumer

emissions are

emit more than 10,000

assistance

excluded

mtCO2e of HFCs

5% for early

annual y as a byproduct

reductions

of HFC production

0.5% for tribal governments

CRS-21

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

18% (plus an early auction of 6%) auctioned to fund technology deployment, carbon capture and storage, low-income and rural assistance, and adaptation activities

S. 3036

Cap-and-trade

Producers or importers

Emission cap

A share of

Up to 15% of

International

Low carbon fuel

Boxer

system for GHG

of petroleum- or coal-

for covered

al owances are

al owance

reserve

standard for

May 20, 2008

emissions from

based liquid or gaseous

sources in

auctioned for deficit

requirement may

al owances must

transportation fuels

S.Amdt. 4825

multiple sectors

fuel that emits GHGs,

2020 is 4.924

reduction increasing

be achieved

accompany

(in the nature of

A Carbon

or facilities that

bil ion tCO2e

from 6.1% in 2012

through domestic

imports of any

substitute) failed

Market Efficiency produce or import

(19% below

to 15.99% in 2031

offsets;

covered GHG-

a cloture motion

Board may

more than 10,000

2005 levels

and thereafter

international

intensive goods

on June 6, 2008

implement cost-

mtCO2e of GHG

for covered

The “remainder

al owances can

and primary

relief measures if

chemicals annual y;

sources)

al owances” are

satisfy an

products to the

necessary

facilities that use more

distributed in 2012

additional 15%

United States

than 5,000 tons of coal

(adjusted in future

Least developed

annual y; natural gas

years) as fol ows:

nations or those

processing plants or

that contribute

importers (including

38% of al owances

no more than

LNG); or facilities that

to covered electric

0.5% of global

emit more than 10,000

utilities, industrial

emissions are

mtCO

facilities, and co-ops

2e of HFCs

excluded

annual y as a byproduct

10.5% to states for

of HFC production

conservation, extra reductions, and other activities

CRS-22

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

7.5% for various sequestration activities 11% al ocated for electricity and natural gas consumer assistance 5% for early reductions 0.5% for tribal governments 1% for methane reduction projects 21.5% (plus an early auction of 5%) auctioned to fund technology deployment, carbon capture and storage, low income and rural assistance, and adaptation activities, as wel as program management

H.R. 6186

Cap-and-trade

Electric power or

Emission cap

Between 2012 and

Up to 15% of

International

EPA to develop

Markey

system for GHG

industrial facilities that

for covered

2019, 6% of

al owance

reserve

emission

June 4, 2008

emissions from

emit over 10,000

sources in

al owances would

requirement may

al owances must

performance

multiple sectors

mtCO2e; producers or

2020 is 4.983

be distributed to

be achieved

accompany

standards for certain

importers of petroleum

bil ion tCO2e

manufacturers of

through domestic

imports of any

non-covered entities

or coal-based liquid

offsets;

covered GHG

products that, when

international

intensive goods

CRS-23

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

combusted, wil emit

“trade-exposed

offsets or

and primary

that exceed 10,000

over 10,000 mtCO2e

primary goods”

al owances can

products to the

tCO2e per year

annual y; local

Remaining 94%

satisfy an

United States

Low-carbon fuel

distribution companies

auctioned (100% by

additional 15%

Least developed

standard for

that deliver natural gas

2020), with

nations or those

transportation fuels

that, when combusted,

revenues distributed

that contribute

wil emit over 10,000

Performance

(in FY2010-FY2019)

no more than

tCO

standard for certain

2e annual y;

as fol ows:

0.5% of global

producers or importers

coal-fired power

emissions are

of HFCs, PFCs, SF

58.5% to middle-

plants to capture and

6, or

excluded

NF

and low-income

geological y sequester

3 that, when used,

wil emit over 10,000

households as tax

not less than 85% of

mtCO

credits and/or

their CO2 emissions

2e; sites at which

CO

rebates

2 is geological y

sequestered on a

12.5% for

commercial scale

development and promotion of low-carbon technology 12.5% for energy efficiency programs 4.5% for biological sequestration 1.5% for worker transition assistance 2% for domestic adaptation efforts 1.5% for protection of natural resources 1.5% for international forest protection

CRS-24

Bill Number,

Sponsor,

Introduced

Mechanism to

Date, and

Distribution of

Offset and

Address

Committee

Emissions

Allowance Value

International

Carbon-

Additional GHG

or Floor

General

Covered

Limit or

or Tax/Fee

Allowance

Intensive

Reduction

Action

Framework

Entities/Materials

Target

Revenue

Treatment

Imports

Measures

3.5% for international clean technology 2% for international adaptation efforts

H.R. 6316

Cap-and-trade

Producers or importers

Emission cap

In 2012, 5% of the

Up to 10% of

International

EPA to promulgate

Doggett

system for GHG

of petroleum- or coal-

for covered

al owances are

al owance

reserve

regulations that

June 19, 2008

emissions from

based liquid or gaseous

sources in