The Emergency Food Assistance Program (TEFAP): Background and Funding

Changes from January 8, 2020 to July 21, 2021

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction

- The Demand for Emergency Food Assistance

- Characteristics of Emergency Food Recipients

- Program Administration

- Federal Role

- State Role

- Local Role

- Eligibility Rules for Individuals and Households

- Funding and Appropriations

- Commodity Food Support

- Entitlement Commodities

- Bonus Commodities

- Types of Foods

- Administrative Cash Support

- Funding Trends

- State Allocation Formula

- State Funding

- Role of TEFAP During Disaster Response

- The 2018 Farm Bill

Figures

Tables

Summary

The Emergency Food Assistance Program

July 21, 2021

(TEFAP): Background and Funding

Kara Clifford Billings

The Emergency Food Assistance Program (TEFAP) is a federal food distribution

Analyst in Social Policy

program that supports food banks, food pantries, soup kitchens, and other emergency

feeding organizations serving low-income Americans. Federal assistance takes the form of federal yof federally purchased commodities—including fruits, vegetables, meats, and grains—

and funding for administrative costs. Food aid and funds are distributed to states using a statutory formula that takes into account poverty and unemployment rates. TEFAP is administered by the U.S.

Department of Agriculture's ’s (USDA’s) Food and Nutrition Service (USDA-FNS).

FNS).

TEFAP was established as the Temporary Emergency Food Assistance Program by the Emergency Food Assistance Act of 1983. The Emergency Food Assistance Act continues to govern program operations, while the

Food and Nutrition Act authorizes funding for TEFAP’s entitlement commoditiesFood and Nutrition Act provides mandatory funding authority for TEFAP commodities. Based on levels set in statute, appropriations provided $322.3 million in mandatory funding for TEFAP's entitlement commodities in FY2020. TEFAP also incorporates bonus commodities, which are distributed at USDA'’s discretion throughout the year to support different crops using separate budget authority. A smal er amount of discretionary funding is appropriated annual y to cover administrative and distribution costs under Emergency Food Assistance Act authority. In addition to normal aid, additional commodities and administrative funds have been distributed through TEFAP in recent years as a result

of USDA’s Trade Mitigation Food Purchase and Distribution Program and supplemental appropriations from

COVID-19 pandemic response laws. In FY2020, federal spending on TEFAP was nearly $2.8 bil ion.

FNS coordinates the purchasing of commodities and the al ocationseparate budget authority. USDA purchased $308.9 million worth of bonus commodities for TEFAP in FY2018 (the latest year for which data are available). A smaller amount of cash assistance ($79.6 million in FY2020) is appropriated to cover administrative and distribution costs under Emergency Food Assistance Act authority. These administrative funds are discretionary.

USDA-FNS coordinates the purchasing of commodities and the allocation of commodities and administrative funds to of commodities and administrative funds to

states, and provides general program oversight. State agencies—often state departments of health and human services, agriculture, or education—determine program eligibility rules and allocationsal ocations of aid to feeding organizations (calledcal ed recipient agencies). States often task food banks, which operate regional warehouses, with distributing foods to other recipient agencies. TEFAP aid makes up a modest proportion of the food and funds available

available to emergency feeding organizations, which are reliant on private donations as well.

TEFAP is the largest source of federal support forwel .

TEFAP is the primary federal program supporting emergency feeding organizations. Other related food distribution programs focus on specific subpopulations; for example, the Federal Emergency Management Agency'Agency’s (FEMA'’s) Emergency Food and Shelter Program distributes food to homeless individuals and USDA's ’s

Commodity Supplemental Food Program distributes food to low-income elderly individuals.

TEFAP is typicallyolder individuals with lower incomes.

TEFAP is typical y amended and reauthorized through farm billsbil s. Most recently, the 2018 farm bill (bil (P.L. 115-334) )

extended funding for TEFAP'’s entitlement commodities through FY2023. The law also funded new projects aimed at incorporating non-federallyfederal y donated foods into the program and reducing food waste. Recent program developments include TEFAP's use in disaster response and receipt of commodities from the Administration's 2018 and 2019 trade aid packages.

Introduction

’s use in response to the COVID-19 pandemic and receipt of trade mitigation

commodities.

Congressional Research Service

link to page 5 link to page 7 link to page 8 link to page 9 link to page 9 link to page 10 link to page 11 link to page 12 link to page 13 link to page 14 link to page 14 link to page 15 link to page 16 link to page 17 link to page 18 link to page 19 link to page 20 link to page 20 link to page 21 link to page 22 link to page 6 link to page 8 link to page 19 link to page 13 link to page 23 link to page 25 link to page 23 link to page 25 link to page 27 The Emergency Food Assistance Program (TEFAP): Background and Funding

Contents

Introduction ................................................................................................................... 1 The Demand for Emergency Food Assistance ...................................................................... 3

Characteristics of Emergency Food Recipients ............................................................... 4

Program Administration ................................................................................................... 5

Federal Role ............................................................................................................. 5

State Role................................................................................................................. 6 Local Role................................................................................................................ 7

Eligibility Rules for Individuals and Households.................................................................. 8 Funding and Appropriations.............................................................................................. 9

Commodity Food Support ......................................................................................... 10

Entitlement Commodities .................................................................................... 10 Bonus Commodities ........................................................................................... 11

Types of Foods .................................................................................................. 12

Administrative Cash Support ..................................................................................... 13 Funding Trends ....................................................................................................... 14 State Allocation Formula .......................................................................................... 15 State Funding.......................................................................................................... 16

Role of TEFAP During Disasters and Emergencies ............................................................. 16

COVID-19 Pandemic Response ................................................................................. 17

The 2018 Farm Bill ....................................................................................................... 18

Figures Figure 1. Flow of Foods and Funds through TEFAP ............................................................. 2 Figure 2. Number of Households Using Food Pantries, 2005-2019 ......................................... 4 Figure 3. TEFAP Expenditures, FY1983-FY2020............................................................... 15

Tables Table 1. TEFAP Funding, FY2021 ..................................................................................... 9

Table A-1. Total TEFAP Expenditures, FY1983-FY2020 ..................................................... 19 Table B-1. TEFAP Expenditures by State, FY2020 ............................................................. 21

Appendixes Appendix A. TEFAP Spending, FY1983-FY2020............................................................... 19 Appendix B. TEFAP Spending by State, FY2020 ............................................................... 21 Appendix C. Legislative History of TEFAP....................................................................... 23

Congressional Research Service

link to page 29 The Emergency Food Assistance Program (TEFAP): Background and Funding

Contacts Author Information ....................................................................................................... 25

Congressional Research Service

link to page 6 link to page 6 link to page 27 link to page 9 The Emergency Food Assistance Program (TEFAP): Background and Funding

Introduction The Emergency Food Assistance Program (TEFAP; previously the Temporary Emergency Food Assistance Program) provides federallyfederal y purchased commodities and a smallersmal er amount of cash

support to food banks, food pantries, soup kitchens, shelters, and other types of emergency feeding organizations serving low-income households and individuals.11 Commodities include fruits, vegetables, meats, and grains, among other foods.2 In addition to serving needy individuals, TEFAP'TEFAP’s domestic commodity purchases support the agricultural economy by reducing supply on the market, thereby increasing food prices. TEFAP is administered by the U.S. Department of Agriculture's

Agriculture’s (USDA’s) Food and Nutrition Service (USDA-FNS).

FNS).

TEFAP was established under the Emergency Food Assistance Act of 1983 in an effort to dispose of government-held agricultural surpluses and alleviateal eviate hunger in the wake of a recession and

declining food stamp benefits.23 Since then, TEFAP has evolved into a permanent program withthat includes mandatory, annuallyannual y appropriated funding that operates in all al 50 states, the District of Columbia, and four U.S. territories.34 The program was most recently reauthorized by the 2018 farm bill (

farm bil (P.L. 115-334).

).

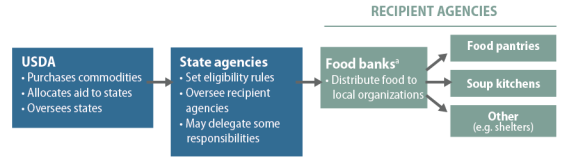

At the federal level, TEFAP is administered by USDA-FNS in collaboration with USDA'’s purchasing agencies:agency, the Agricultural Marketing Service (AMS) and Commodity Credit Corporation (CCC). At the state level, TEFAP is administered by a state distributing agency designated by the governor or state legislature; generallygeneral y, they are state departments of health and human services, agriculture, or education. Federal commodities and

funds may flow through the state or directly to feeding organizations (calledcal ed recipient agencies) based on how the state structures the program.45 States will wil often task food banks with processing and distributing food to local feeding organizations. Food banks typicallytypical y operate regional warehouses and distribute food to other organizations rather than to households directly.56 Figure

1 depicts the flow of commodities and funds through TEFAP.

1 T he 1990 farm bill (P.L. 101-624) removed “T emporary” from the program title. 2 USDA, FNS, USDA Foods Available List for The Emergency Food Assistance Program (TEFAP) 2021 , March 15, 2021, https://www.fns.usda.gov/tefap/usda-foods-available-list-tefap.

3 See Appendix C for further legislative history. 4 Puerto Rico, the U.S. Virgin Islands, the Commonwealth of the Northern Mariana Islands, and Guam. T hroughout this report, the term states includes these other jurisdictions. For an explanation of appropriated mandatory funding, see CRS Report RS20129, Entitlem ents and Appropriated Entitlem ents in the Federal Budget Process. 5 Consistent with statute and regulations, this report uses the term recipient agency to describe organizations receiving T EFAP support , with the understanding that emergency feeding organizations are the most common type of recipient agency.

6 See “Program Administration” for further discussion of federal, state, and local roles. C. Cabili, E. Eslami, and R. Briefel, White Paper on the Em ergency Food Assistance Program (TEFAP) , prepared by Mathematica for the Office of Policy Support, Food and Nutrition Service, U.S. Department of Agriculture, August 2013, https://fns-prod.azureedge.net/sites/default/files/T EFAPWhitePaper.pdf.

Congressional Research Service

1

link to page 23 link to page 25 link to page 27

The Emergency Food Assistance Program (TEFAP): Background and Funding

Figure 1. Flow of Foods and Funds through TEFAP

|

|

Source: Adapted from USDA a. States may distribute food to recipient agencies directly or task recipient agencies with food distribution to other recipient agencies. States often delegate this responsibility |

TEFAP is part of a larger web of food assistance programs.67 Some of these programs provide cash assistance while others primarily distribute food. TEFAP foods may reach individuals who do not qualify for other food assistance programs or supplement the assistance that individuals receive

through other programs. Relatedthrough other programs. With more than $400 million in appropriated funding in FY2020, TEFAP is the largest source of federal support for emergency feeding organizations. Other related federal programs include the Federal Emergency Management Agency'Agency’s (FEMA'’s) Emergency Food and Shelter Program, funded at $125 million in FY2020, which, among its other services for homeless individuals, provides food through shelters, food banks, and food pantries.78 In addition, USDA'USDA’s Commodity Supplemental Food Program, funded at $245 million in FY2020, distributes monthly food packages to low-income elderly individuals through local organizations, which can include food banks and pantries.8

pantries.9 The Farmers to Families Food Box Program, which USDA operated from May 2020 to June 2021, provided food boxes to food banks and other nonprofit organizations for distribution

to households in need during the COVID-19 pandemic.10

This report begins by describing the population using emergency food assistance. It goes on to discuss the TEFAP program, including its administration at the federal, state, and local levels, eligibility eligibility rules, and funding structure. The report concludes by summarizing TEFAP'’s role in disaster response and recent reauthorization efforts. Appendix A lists TEFAP expenditures from the program'’s inception in 1983 to present; Appendix B provides a brief legislative history of TEFAP; and Appendix C lists TEFAP funding by state.

Definitions

” Common types of EFOs:

”

Source: Section 201A of the Emergency Food Assistance Act (codified at 7 U.S.C. §7501)

|

The Demand for Emergency Food Assistance

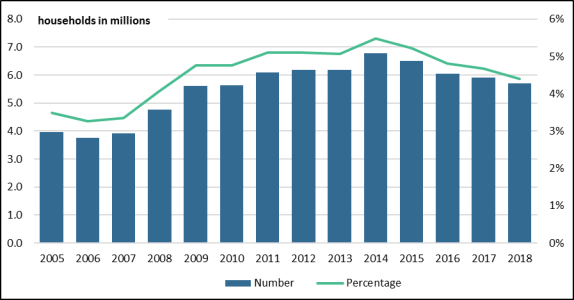

According to an analysis of Current Population Survey (CPS) data by USDA'’s Economic Research Service (ERS), an estimated 5.7 millionmil ion households (4.4%) utilized food pantries (see Figure 2) and at least 657,000129,200 households (0.5%) utilized soup kitchens in 2018.9 at least once in 2019.11 However, this is likely an underestimate of the population using emergency food assistance because the sample did not include certainexcluded households with incomes over 185% of the poverty guidelines that

did not report any indications of food insecurity on screener questions, and the CPS does not fully capture households who are homeless or in tenuous housing arrangements. For comparison, a survey by Feeding America, a nonprofit membership and advocacy organization, estimated that approximately 15.5 million mil ion households accessed its network of feeding organizations in 2013 (the same year, ERS estimated that 6.9 millionmil ion households used food pantries and soup kitchens). The

Feeding America network represents a large segment of emergency feeding organizations nationwide.10

Data on the number of TEFAP recipients specifically

nationwide.12

More recent analyses indicate that use of emergency feeding organizations rose during the

COVID-19 pandemic. An analysis by the Urban Institute (a nonprofit research organization) found that 19.7% of nonelderly adults utilized food banks, food pantries, soup kitchens, and

similar organizations in December 2020, up from 13.2% in December 2019.13

Data on the number of TEFAP food recipients are not available, in part because TEFAP commodities are mixed in with other commodities provided by emergency feeding organizations

and because of "“the transient nature of participation."11

And as a percentage of households nationwide |

|

2019. Notes: This represents |

Characteristics of Emergency Food Recipients

Food insecurity is common among households using emergency feeding organizations.12 15 According to the ERS analysis, 65.7% of households using food pantries and soup kitchens were

food insecure in 20182019, meaning that they had difficulty providing enough food for all al of their members at times during the year due to a lack of resources.1316 Roughly half of these households experienced very low food security, meaning that the food intake of some household members

was reduced and normal eating patterns were disrupted due to limited resources. Nationally, the percentage of households experiencing food insecurity was 11.1% in 2018, down from a recent high of 14.9% in 2011.14

According to the ERS analysis, in 20182019 households using food pantries were more likely to have incomes below 185% of poverty compared to the general population (67% vs. 21other respondents (66% vs. 20%) and to include children (3634% vs. 29%).1517 Meanwhile, according to the 2014 Feeding America survey, individuals

15 A. Coleman-Jensen, M.P. Rabbitt, C.A. Gregory, and A. Singh, Statistical Supplement to Household Food Security in the United States in 2019, AP-084, U.S. Department of Agriculture, Economic Research Service, September 20 20, pp. 21-23, https://www.ers.usda.gov/webdocs/publications/99289/ap-084.pdf?v=

6449https://www.ers.usda.gov/publications/pub-deta ils/?pubid=94869. 16 Ibid. “Food security” focuses on economic and access-related factors associat ed with an individual’s ability to purchase food or otherwise obtain enough to eat, as opposed to hunger, which is considered a physiological condit ion. For more information on the differences between food insecurity and hunger, see CRS Report R42353, Dom estic Food Assistance: Sum m ary of Program s. 17 A. Coleman-Jensen, M.P. Rabbitt, C.A. Gregory, and A. Singh, Statistical Supplement to Household Food Security in the United States in 2019, AP-084, U.S. Department of Agriculture, Economic Research Service, September 20 20,

Congressional Research Service

4

link to page 19 The Emergency Food Assistance Program (TEFAP): Background and Funding

Meanwhile, according to the 2014 Feeding America survey, individuals using meal programs (e.g., soup kitchens and shelters) were generallygeneral y single-person households and were more likely to be homeless. In 2013, just over 70% of households using the Feeding America network of meal programs had a single member and nearly 34% were homeless or living

in temporary housing.16

18

In addition, emergency feeding organizations may act as a safety net for food insecure households who are ineligible for or do not participate in other federal food assistance programs. For example, in the case of the Supplemental Nutrition Assistance Program (SNAP), households may have an income too high to qualify for assistance but still stil experience difficulty purchasing food,

or they may fail to meet other program eligibility rules.1719 Among households using feeding organizations affiliated with Feeding America'’s network, a little more than half (55%) reported

receiving SNAP benefits in 2013.18

20 Program Administration

Federal Role FNS is responsible for al ocating aid to states (see “State Al ocation Formula”)Federal Role

TEFAP is administered by USDA's Food and Nutrition Service (FNS), which is responsible for allocating aid to states (see "State Allocation Formula") and coordinating the ordering, processing, and distribution of commodities. Specifically, FNS receives requests for certain quantities and types of commodities from state agencies, which place orders based on their entitlement allocation and in consultation with recipient agencies.19 FNS then collaborates closely with USDA's purchasing agenciesSpecifical y, FNS al ocates entitlement aid and administrative funds to states and decides which foods wil be available in the USDA Foods catalog. States and recipient agencies then place orders for certain quantities and types of commodities based on their entitlement al ocation (discussed further in the next section).21 FNS

collaborates closely with USDA’s purchasing agency—the Agricultural Marketing Service (AMS)—to process and fulfil the orders.22 AMS and FNS also collaborate to purchase and distribute(AMS) and Commodity Credit Corporation (CCC)—to fulfill the orders.20 FNS also collaborates with AMS and CCC to purchase bonus commodities throughout the year that are not based on state requests but rather USDA'USDA’s discretion to support different crops. Commodities are delivered to state distribution points, which may be operated by a state agency, private contractor, or recipient agency.21 According to a 50-state survey conducted by the Washington State Department of Agriculture in 2015, most states reported that commodities were sent to nonprofit-run warehouses (i.e., food banks).22

FNS also issues regulations and guidance and provides general oversight of states' TEFAP operations. FNS provides oversight by reviewing and approving state TEFAP plans, which are documents that outline each state's operation of TEFAP. States are required to submit amendments to the plan for approval "when necessary to reflect any changes in program Selected vendors deliver both entitlement and

bonus commodities to state-selected distribution points.23

FNS also issues regulations and guidance and provides general oversight of states’ TEFAP operations. FNS provides oversight by reviewing and approving state TEFAP plans, which are documents that outline each state’s operation of TEFAP. States are required to submit

amendments to the plan for approval “when necessary to reflect any changes in program

pp. 22-23, https://www.ers.usda.gov/webdocs/publications/99289/ap-084.pdf?v=6449.

18 Weinfield et al., Hunger in America 2014, Feeding America, prepared by Westat and the Urban Institute, August 2014, pp. 91, 100-102, http://help.feedingamerica.org/HungerInAmerica/hunger-in-america-2014-full-report.pdf. 19 For more information on SNAP eligibility, see CRS Report R42505, Supplemental Nutrition Assistance Program (SNAP): A Prim er on Eligibility and Benefits.

20 Weinfield et al., Hunger in America 2014, Feeding America, prepared by Westat and the Urban Institute, August 2014, http://help.feedingamerica.org/HungerInAmerica/hunger-in-america-2014-full-report.pdf. 21 For the 2021 list of T EFAP food selections, see USDA, FNS, “T he Emergency Food Assistance Program; Availability of Foods for Fiscal Year 2021,” 86 Federal Register 3988, January 15, 2021, https://fns-prod.azureedge.net/sites/default/files/tefap/tefap-foods-available.pdf.

22 C. Cabili, E. Eslami, and R. Briefel, White Paper on the Emergency Food Assistance Program (TEFAP) , prepared by Mathematica for the Office of Policy Support, Food and Nutrition Service, U.S. Department of Agricult ure, August 2013, https://fns-prod.azureedge.net/sites/default/files/T EFAPWhitePaper.pdf.

23 Section 203B of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7505); 7 C.F.R. §251.4.

Congressional Research Service

5

link to page 12 The Emergency Food Assistance Program (TEFAP): Background and Funding

operations or administration as described in the plan, or at the request of FNS, to the appropriate

FNS Regional Office.”24

operations or administration as described in the plan, or at the request of FNS, to the appropriate FNS Regional Office."23

State Role

State Role TEFAP is administered at the state level by an agency designated by the governor "“or other appropriate State executive authority"” that enters into an agreement with FNS.2425 As of 2015, 2021, states most commonly housed TEFAP in a health and human, human, or social services department (19 21 states), agriculture department (14 states), or education department (810 states).2526 State agencies

administering TEFAP are responsible for creating eligibility criteria (see "Eligibility Rules for Individuals and Households"), selecting recipient agencies, distributing commodities and funds to recipient agencies, and overseeing recipient agencies. States also maintain state TEFAP plans, which contain program and eligibility rules.26

Federal regulations allow and other program rules (see “Eligibility Rules for Individuals and Households”), which are outlined in state plans approved by

FNS.27 They are also responsible for selecting and overseeing recipient agencies.

Federal regulations al ow states to delegate a number of responsibilities to recipient agencies (e.g., regional food banks), including selecting and subcontracting with other recipient agencies.28 States often delegate the ordering and distribution of USDA Foods to food banks, which receive foods and make deliveries to other recipient organizations, such as food pantries.29 According to a 50-state analysis conducted by Feeding America in 2020, nearly al states reported that

commodities were delivered directly to recipient agencies (often to food banks for distribution to other organizations).30 states to delegate a number of responsibilities to recipient agencies, if desired. States can (and often do) delegate the responsibility of warehousing and transporting commodities to one or more eligible recipient agencies, most often to food banks.27 They also frequently delegate the role of selecting and contracting with other recipient agencies; for example, enabling a food bank to contract with multiple food pantries.28 States cannot delegate their responsibility to set eligibility rules or oversee

recipient agencies.29

31

States must review at least 25% of recipient agencies contracting directly with the state (e.g., food banks) at least once every four years, and at least one-tenth or 20 (whichever is fewer) of other recipient agencies each year.3032 If the state finds deficiencies in the course of review, the state agency must submit a report with the findings to the recipient agency and ensure that corrective

action is taken.

Local Role

Organizations that are eligible

24 Section 202A of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7503). 25 7 C.F.R. §251.2. 26 USDA, FNS, TEFAP State Contacts, https://www.fns.usda.gov/contacts, accessed on June 15, 2021. T he remaining 9 states/territories housed T EFAP in another department, such as a family services or economic security agency. T he state agency was not listed for the U.S. Virgin Islands and the Commonwealth of the Northern Mariana Islands.

27 Individual state plans can usually be found on the state agency’s website that administers T EFAP. A list of state agencies that administer T EFAP is available at https://www.fns.usda.gov/contacts. According to Section 202A of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7503), state plans must include eligibility rules. 28 7 C.F.R. §251.2, 7 C.F.R. §251.5; C. Cabili, E. Eslami, and R. Briefel, White Paper on the Emergency Food Assistance Program (TEFAP), prepared by Mathematica for the U.S. Department of Agriculture, Food and Nutrition Service, Office of Policy Support , August 2013, https://fns-prod.azureedge.net/sites/default/files/T EFAPWhitePaper.pdf.

29 Feeding America, The Emergency Food Assistance Program: State Guide, February 2020, https://feedingamericaaction.org/wp-content/uploads/2021/04/Resource_Feeding-America-T EFAP-State-by-State-Guide.pdf; Washington State Department of Agriculture, The Em ergency Food Assistance Program (TEFAP): Distribution National Survey 2015, AGR 609-574. Per Section 202A of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7503), state plans must describe how the st ate will give recipient agencies an opportunity to provide input on the commodities selected. 30 Washington State Department of Agriculture, The Emergency Food Assistance Program (TEFAP): Distribution National Survey 2015, AGR 609-574. Larger states often reported multiple, regional warehouses while smaller states sometimes had one central warehouse.

31 7 C.F.R. §251.5. 32 7 C.F.R. §251.10.

Congressional Research Service

6

The Emergency Food Assistance Program (TEFAP): Background and Funding

Local Role Organizations that are eligible for TEFAP aid are referred to as recipient agencies in the

Emergency Food Assistance Act. According to the statute, recipient agencies are public or

nonprofit organizations that administer

- emergency feeding organizations;

- charitable institutions;

- charitable institutions; summer camps or child nutrition programs;

- nutrition projects operating under the Older Americans Act of 1965; or

- disaster relief programs.

31

33

The first category of organizations—emergency feeding organizations—receive priority under TEFAP statute and regulations and also receive the majority of TEFAP aid.3234 Emergency feeding organizations are defined as public or nonprofit organizations "“providing nutrition assistance to

relieve situations of emergency and distress through the provision of food to needy persons, including low-income and unemployed persons."33”35 They include food banks, food pantries, soup

kitchens, and other organizations serving similar functions.

Recipient agencies are responsible for serving and distributing TEFAP foods to individuals and households. As discussed above, they may also have additional responsibilities as delegated by the state agency; for example, food banks, which operate food warehouses, may be tasked with distributing food to subcontracting subcontracted recipient agencies like food pantries and soup kitchens, which in turn distribute foods or serve

prepared meals to low-income individuals and families.

In addition, recipient agencies must adhere to program rules. For example, they must safely store food and comply with state and/or local food safety and health inspection requirements.34 36 Recipient agencies must also maintain records of the commodities they receive and a list of

households receiving TEFAP foods for home consumption.3537 There are also restrictions on the types of activities that can occur at distribution sites. Recipient agencies must ensure that any unrelated activities are conducted in a way that makes clear that the activity is not part of TEFAP and that receipt of TEFAP foods is not contingent on participation in the activity.3638 Activities may not disrupt food distribution or meal service and may not be explicitly religious.3739 In addition,

recipient agencies may not engage in recruitment activities designed to persuade an individual to

to apply for SNAP benefits.38

40

33 Section 201A of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7501). 34 Section 203B of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7505) gives states the option to give emergency feeding organizations priority. When they cannot meet the full demand of all eligible recipient organizations, states m ust give priority to emergency feeding organizations according to T EFAP regulations (7 C.F.R. §251.4). T he statement that emergency feeding organizations receive the majority of T EFAP aid is based on CRS communication with the Food and Nutrition Service in September 2018.

35 Section 201A of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7501). 36 7 C.F.R. §250.14. 37 7 C.F.R. §251.10. 38 Ibid. 39 Ibid; USDA, FNS, Further Clarification on the Prohibition Against Explicitly Religious Activities As Part of TEFAP and CSFP Activities, FD-142, November 28, 2016, https://fns-prod.azureedge.net/sites/default/files/fdd/FD-142-Prohibition-Religious-Activities.pdf. 40 USDA, FNS, Prohibition of SNAP Recruitment and Promotion Activities by FDPIR and TEFAP Administering

Congressional Research Service

7

The Emergency Food Assistance Program (TEFAP): Background and Funding

Characteristics of Emergency Feeding Organizations

The most recent national y representative

year to year. Most food banks in the ERS survey were secular, |

46 Eligibility Rules for Individuals and Households

Under broad federal guidelines, states set eligibility rules for individuals and households participating in TEFAP. Eligibility rules differ for organizations distributing commodities directly to households (e.g., food pantries) and organizations providing prepared meals (e.g., soup

kitchens). States must develop income-based standards for households receiving foods directly, but cannot set such standards for individuals receiving prepared meals. However, organizations serving prepared meals must serve predominantly needy persons, and states "“may establish a higher standard than 'predominantly'‘predominantly’ and may determine whether organizations meet the applicable standard by considering socioeconomic data of the area in which the organization is

located, or from which it draws its clientele."46

”47

Income eligibility rules for households receiving TEFAP foods directly vary by state. Many states limit limit income eligibility to household incomes at or below 185% of the poverty guidelines.4748 Some

states also confer household eligibility based on participation in other federal and state programs

(known as categorical eligibility).48

States may also create other eligibility rules for households'49

Agencies, Policy Memorandum No. FD-143, May 2017, https://fns-prod.azureedge.net/sites/default/files/fdd/FD-143-prohibition-snap-recruitment.pdf. 41 Feeding America published a study in 2014 of its network of feeding organizations (discussed in this report). However, while the Feeding America network comprises a large portion of the emergency feeding network, it is not a nationally representative sample of organizations.

42 J.C. Ohls et al., The Emergency Food Assistance System —Findings From the Provider Survey, 16-2, prepared by Mathematica Policy Research, Inc. for the Food and Rural Economics Division, Economic Research Service, USDA, October 2002, https://www.ers.usda.gov/publications/pub-details/?pubid=46507.

43 Ibid; see pp. 133-134 for T EFAP’s proportion of foods and pp. 45, 77, 110 for its proportion of operating costs. 44 J.C. Ohls et al., The Emergency Food Assistance System —Findings From the Provider Survey, 16-2, prepared by Mathematica Policy Research, Inc. for the Food and Rural Economics Division, Economic Resea rch Service, USDA, October 2002, pp. 16 and 50, https://www.ers.usda.gov/publications/pub-details/?pubid=46507.

45 Ibid, p. 81. 46 Ibid, pp. 39, 72, 108. 47 7 C.F.R. §251.5. 48 Examples include Arizona, Hawaii, Indiana, Iowa, Massachusetts, Nevada, New Mexico, and Wisconsin. Individual state plans can usually be found on the state agency’s website that administers T EFAP. A list of state agencies that administer T EFAP is available at https://www.fns.usda.gov/contacts. 49 See page 10 of Feeding America, The Emergency Food Assistance Program: State Guide, February 2020, https://feedingamericaaction.org/wp-content/uploads/2021/04/Resource_Feeding-America-T EFAP-State-by-State-

Congressional Research Service

8

link to page 13 link to page 21 link to page 14 The Emergency Food Assistance Program (TEFAP): Background and Funding

States may also create other eligibility rules for households’ receipt of TEFAP foods, such as requiring identification or proof of residency within the state.49 or a specific locality.50 However,

However, according to federal regulations, length of residency cannot be a criterion.50

51 Funding and Appropriations

Federal assistance through TEFAP is primarily provided in the form of USDA-purchased domestic agricultural commodities (USDA Foods). A smallersmal er amount of assistance is provided in

the form of cash support for administrative and distribution costs.

There are two types of TEFAP commodities: entitlement commodities and bonus commodities. Entitlement commodities are appropriated entitlementsFunding for entitlement commodities is considered appropriated mandatory spending, meaning

, meaning that the authorizing law sets the level of spending but an annual appropriation is needed to provide funding.5152 Funding for bonus commodities is not included in the TEFAP appropriation and is instead provided by separate USDA budget authority. These funds are used by USDA for bonus commodity purchases for the program throughout the year. TEFAP's administrative funds

are discretionary spending, requiring an annual appropriation.

In FY2020, the enacted appropriation provided $322.3 million for entitlement commodities and $79.6 million for administrative costs.52 Appropriations for TEFAP's entitlement commodities were contained in the SNAP account and appropriations for administrative costs were contained in the Commodity Assistance Program (CAP) account. In FY201853

In FY2021, there is nearly $2.3 bil ion available for entitlement purchases and administrative funds, including funds from COVID-19 pandemic response acts (shown in Table 1, and discussed further in the “COVID-19 Pandemic Response” section). USDA may also distribute bonus

commodities in FY2021 (not reflected in the table). In FY2020 (the most recent year with complete data), USDA purchased and distributed $308.9 million distributed $701 mil ion in bonus commodities forthrough TEFAP.5354 Bonus commodities are projected to increase in FY2019increased in FY2019 and FY2020 as a result of the Administration'’s trade aid

package (discussed below).

Table 1. TEFAP Funding, FY2021

Budget Authority for TEFAP Entitlement Foods, Administrative Funds, and Other Activities (Excluding

Bonus Foods) in FY2021

Budget

Authority

(millions

Authority

Description

of dollars)

The Agriculture Improvement Act of 2018

Mandatory funding for TEFAP’s Farm to Food Bank

3.7a

(Section 4018 of P.L. 115-334)

Projects (available through FY2022)

Guide.pdf. 50 See individual state plans for state-specific eligibility rules, which can usually be found on the state agency’s website that administers T EFAP. A list of state agencies that administer T EFAP is available at https://www.fns.usda.gov/contacts. For a summary of state policies as of February 2020, see Feeding America, The Em ergency Food Assistance Program : State Guide, February 2020, https://feedingamericaaction.org/wp-content/uploads/2021/04/Resource_Feeding-America-T EFAP -State-by-State-Guide.pdf.

51 7 C.F.R. §251.5(b); Feeding America, The Emergency Food Assistance Program: State Guide, February 2020, https://feedingamericaaction.org/wp-content/uploads/2021/04/Resource_Feeding-America-T EFAP-State-by-State-Guide.pdf. 52 For an explanation of appropriated mandatory spending, see CRS Report R44582, Overview of Funding Mechanisms in the Federal Budget Process, and Selected Exam ples.

53 Funding for T EFAP’s entitlement commodities is typically contained in the Supplemental Nutrition Assistance Program (SNAP) account and appropriations for administrative costs is typically contained in the Commodity Assistance Program (CAP) account of annual appropriations acts. 54 USDA, FNS, “FY2022 USDA Explanatory Notes – Food and Nutrition Service,” p. 34-129, https://www.usda.gov/sites/default/files/documents/34FNS2022Notes.pdf.

Congressional Research Service

9

link to page 14 link to page 14 The Emergency Food Assistance Program (TEFAP): Background and Funding

Budget

Authority

(millions

Authority

Description

of dollars)

The Further Consolidated Appropriations

Carryover funds from FY2020 for TEFAP

190.6

Act, 2020 (P.L. 116-94)

entitlement foods and administrative costs (available through FY2021)

Families First Coronavirus Response Act

Supplemental funding for TEFAP entitlement foods

197.1

(FFCRA; P.L. 116-127)

and administrative costs (available through FY2021)

CARES Act (P.L. 116-136)

Supplemental funding for TEFAP entitlement foods

81.2

and administrative costs (available through FY2021)

Consolidated Appropriations Act, 2021

Annual appropriation for TEFAP entitlement foods

421.6

(Title IV, Division A, P.L. 116-260)

and administrative costs (available through FY2022)

Consolidated Appropriations Act, 2021

Supplemental funding for TEFAP entitlement foods

400.0

(Section 711 of Title VII, Division N, P.L.

and administrative costs (available through FY2021)

116-260)

Consolidated Appropriations Act, 2021

Supplemental funding for the Office of the

500.0b

(Section 751 of Title VII, Division N, P.L.

Agricultural Secretary (“available until expended, to

116-260)

prevent, prepare for, and respond to coronavirus”)

American Rescue Plan Act of 2021 (ARPA;

Supplemental funding for the Office of the

500.0b

Section 1001 of P.L. 117-2)

Agricultural Secretary (available through FY2021)

Total

2,294.2

Source: CRS, based on current law; correspondence with USDA, FNS, in June 2021; USDA, FNS, “FY 2021 Food and Administrative Funding for The Emergency Food Assistance Program,” February 16, 2021, https://www.fns.usda.gov/tefap/fy-2021-funding; and USDA, FNS, “FY2022 USDA Explanatory Notes – Food and Nutrition Service,” p. 34-129, https://www.usda.gov/sites/default/files/documents/34FNS2022Notes.pdf. Notes: Excludes budget authority for bonus commodities that may be distributed through TEFAP in FY2021. a. FY2021 funding after sequestration (Section 4018 of P.L. 115-334 provides $4 mil ion for TEFAP’s Farm to

Food Bank Projects in each of FY2019-FY2023).

b. On June 4, 2021, USDA announced that it would use $500 mil ion in Consolidated Appropriations Act,

2021 funds and $500 mil ion in ARPA funds for TEFAP to support the Build Back Better initiative (USDA, “USDA to Invest $1 Bil ion to Purchase Healthy Food for Food Insecure Americans and Build Food Bank Capacity,” June 4, 2021, https://www.usda.gov/media/press-releases/2021/06/04/usda-invest-1-bil ion-purchase-healthy-food-food-insecure-americans). According to CRS communication with FNS on June 28, 2021, these funds were from Section 751 of the Consolidated Appropriations Act, 2021 and Section 1001 of ARPA, both of which included funding for the Secretary of Agriculture to purchase and distribute agricultural commodities to individuals in need.

package (discussed below).

|

TEFAP's Authorizing Laws The Emergency Food Assistance Act of 1983: governs TEFAP operations and authorizes mandatory funding for administrative costs (7 U.S.C. 7501-7516) The Food and Nutrition Act of 2008 (previously the Food Stamp Act): Section 27 authorizes mandatory funding for TEFAP commodities (7 U.S.C. 2036) |

Commodity Food Support

Commodity Food Support Entitlement Commodities

Mandatory funding for TEFAP commodities is authorized by Section 27 of the Food and

Nutrition Act (codified at 7 U.S.C. §2036). The act authorizes $250 million annuallymil ion annual y plus additional amounts each year in FY2019 through FY2023 as a result of amendments made by the 2018 farm bill (bil (P.L. 115-334). In FY2019, the additional amount was $23 millionmil ion; for each of FY2020-FY2023, the additional amount is $35 millionmil ion. Both the base funding of $250 mil ion

Congressional Research Service

10

The Emergency Food Assistance Program (TEFAP): Background and Funding

and the additional amounts are adjusted for food price inflation.55 Appropriations may also provide additional . Both the base funding of $250 million and the additional amounts are adjusted for food price inflation.54 Based on this statutory criteria, the FY2020 appropriation provided $322.3 million for TEFAP's entitlement commodities (contained in the SNAP account) (see Table 1).55

Appropriations occasionally provide additional discretionary funding for commodities beyond the levels set in the Food and

Nutrition Act.

Historical yNutrition Act. Most recently, $19 million was appropriated through a general provision in FY2017.

Historically, appropriations laws have allowedal owed states to convert a portion of their funds for entitlement commodities into administrative funds. In past years, states were allowedal owed to convert 10% of funds; FY2018 and FY2019 appropriations acts increased the proportion to 15%;, and the FY2020 appropriationand FY2021 appropriations acts increased the proportion to 20%.56 States generally general y exercise this option; for example, in FY2018FY2020, states converted $25.9 million52.8 mil ion out of a possible $43.1 million

$63.5 mil ion in eligible funds.5657 States are also allowedal owed to carry over entitlement commodity

funds into the next fiscal year.57

58

Within USDA, FNS works closely with AMS to determine what purchases are made for TEFAP.

FNS also solicits input from state and local agencies. According to TEFAP’s authorization of appropriations in the Food and Nutrition Act, USDA must, “to the extent practicable and appropriate, make purchases based on (1) agricultural market conditions; (2) preferences and

needs of States and distributing agencies; and (3) preferences of recipients.”59

TEFAP’s Authorizing Laws

The Emergency Food Assistance Act of 1983: governs TEFAP operations and authorizes discretionary funding for administrative costs (codified at 7 U.S.C. §7501-7516) The Food and Nutrition Act of 2008 (previously the Food Stamp Act): Section 27 authorizes mandatory funding for TEFAP commodities (codified at 7 U.S.C. §2036)

Bonus Commodities

Bonus Commodities

Bonus commodities are purchased at USDA'’s discretion throughout the year using separate (non-TEFAP) USDA budget authority for that purpose. USDA'’s purchases of bonus commodities are based on agricultural surpluses or other economic problems, as raised by farm and industry organizations or USDA'’s own commodity experts. The amount and type of bonus commodities

that USDA purchases for TEFAP fluctuates from year to year, and depends largely on agricultural

market conditions. States and recipient agencies are not required to accept bonus foods.

USDA’s purchases of bonus commodities stem from two authorities: Section 32 of the Act of

August 24, 1935 and the Commodity Credit Corporation (CCC).60 Section 32 is a permanent 55 Amounts are adjusted using the T hrifty Food Plan (T FP), a USDA-calculation that estimates the cost of purchasing a nutritionally adequate low-cost diet . T he T FP is the cheapest of four diet plans meeting minimal nutrition requirements devised by USDA. USDA calculates the cost of the T FP each year to account for food price inflation ; however, the contents of the T FP—often thought of as its own market basket of goods—were last revised in 2006. 56 T he Consolidated Appropriations Act, 2021 (P.L. 116-260). For FY2002-FY2008, states were allowed to convert $10 million of entitlement commodity funds into administrative funds. For FY2009-FY2017, states were allowed to convert 10% of entitlement commodity funds into administrative funds. For FY2018 and FY2019, they were allowed to convert 15%. For FY2020 and FY2021, they were allowed to convert 20%. St ates may convert any amount of administrative funds into food funds, but this happens to a lesser extent.

57 USDA, FNS, “FY2022 USDA Explanatory Notes – Food and Nutrition Service,” p. 34-129, https://www.usda.gov/sites/default/files/documents/34FNS2022Notes.pdf. 58 T his has occurred since FY2015 as a result of a provision in the 2014 farm bill (P.L. 113-79). 59 Section 27 of the Food and Nutrition Act of 2008 (codified at 7 U.S.C. §2036(b)). 60 For Section 32 purchasing authorities, see Section 32 of the act of August 24, 1935 (P .L. 74-320). For CCC purchasing authorities, see Section 5 of the CCC Charter Act. T he Secretary’s authority to donate such commodities to T EFAP is established by Section 17 of the Commodity Distribution Reform And WIC Amendments Act Of 1987.

Congressional Research Service

11

link to page 19 The Emergency Food Assistance Program (TEFAP): Background and Funding

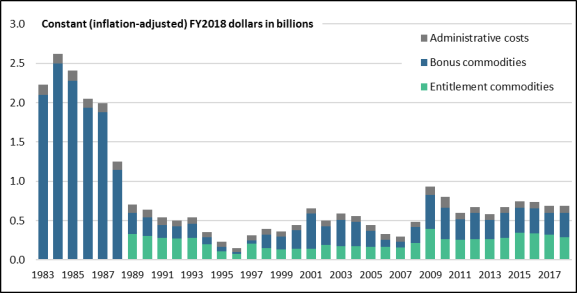

appropriation that sets aside the equivalent of 30% of annual customs receipts to support the farm sector through the purchase of surplus commodities and a variety of other activities.61 The CCC is market conditions. In FY2018, USDA purchased $308.9 million in bonus commodities for TEFAP. The level of bonus commodities has fluctuated substantially over time (see Figure 3).

USDA's 2018 and 2019 Trade Aid Packages

In 2018 and 2019, the Trump Administration announced two trade aid packages aimed at assisting farmers impacted by retaliatory tariffs.58 USDA's 2018 trade aid package, announced in August 2018, included $1.2 billion in purchases of bonus commodities for distribution to TEFAP and other domestic food assistance programs.59 USDA's 2019 trade aid package, announced in May 2019, provided another $1.4 billion for such purposes.60 Trade aid purchases resulted in an influx of bonus commodities in TEFAP in FY2019 that will likely continue into FY2020.

USDA's Purchasing Authorities: Section 32 and the Commodity Credit Corporation

USDA's purchases of bonus commodities stem from two accounts: Section 32 and the Commodity Credit Corporation (CCC).61

Section 32 of the Act of August 24, 1935, is a permanent appropriation that sets aside the equivalent of 30% of annual customs receipts to support the farm sector through the purchase of surplus commodities and a variety of other activities.62 The Section 32 appropriation has totaled nearly $10 billion annually in recent years, a small portion of which goes toward TEFAP commodities.63 USDA's Agricultural Marketing Service (AMS) makes Section 32 purchases.

The CCC is a government-owned entity that finances authorized programs that support U.S. agriculture. Its operations are supported by USDA'’s Farm Service Agency. The CCC has permanent, indefinite

authority to borrow up to $30 billionbil ion from the U.S. Treasury to finance its programs.64

Prior to the trade aid purchases, 62

Section 32 has historicallyhistorical y financed TEFAP commodities to a greater extent than the Commodity Credit Corporation.6563 Unlike CCC support, which is normallynormal y limited to price-supported commodities (such as milk, grains, and sugar), Section 32 is less constrained in the types of

commodities that may be provided, and can include meats, poultry, fruits, vegetables, and seafood.

Within USDA, the Food and Nutrition Service (FNS) works closely with AMS and the CCC to determine what purchases are made for TEFAP. FNS also solicits input from state and local agencies. According to TEFAP's authorization of appropriations in the Food and Nutrition Act, USDA must, "to the extent practicable and appropriate, make purchases based on (1) agricultural market conditions; (2) preferences and needs of States and distributing agencies; and (3) preferences of recipients."66

seafood.

In FY2020, USDA distributed $701 mil ion in bonus commodities purchased under Section 32

through TEFAP.64 Other bonus commodities were funded under CCC authority (discussed below).

The level of bonus commodities has fluctuated substantial y over time (see Figure 3).

Trade Mitigation Purchases

In 2018 and 2019, the Trump Administration announced two trade aid packages aimed at assisting farmers impacted by retaliatory tariffs, using CCC authority.65 The first trade aid package,

announced in August 2018, included $1.2 bil ion in purchases of bonus commodities for distribution to TEFAP and other domestic food assistance programs.66 The second trade aid package, announced in May 2019, provided another $1.4 bil ion for such purposes.67 In total, USDA distributed $1.1 bil ion worth of trade mitigation foods through TEFAP in FY2019 and $1.2 bil ion in FY2020.68 The Biden Administration has not announced any plans to purchase

trade mitigation commodities.

Types of Foods

Types of Foods

USDA-purchased agricultural products (USDA Foods) in TEFAP include a variety of products, such as meats, eggs, vegetables, soup, beans, nuts, peanut butter, cereal, pasta, milk, and juice.67 69 Most foods are nonperishable and ready for distribution when delivered to states, although some 61 For more information, see CRS Report RL34081, Farm and Food Support Under USDA’s Section 32 Program . 62 For more information, see CRS Report R44606, The Commodity Credit Corporation (CCC). 63 CRS communication with the Food and Nutrition Service in September 2018. 64 USDA, FNS, “FY2022 USDA Explanatory Notes – Food and Nutrition Service,” p. 34-129, https://www.usda.gov/sites/default/files/documents/34FNS2022Notes.pdf. 65 For more information, see CRS Report R45310, Farm Policy: USDA’s 2018 Trade Aid Package; and CRS Report R45865, Farm Policy: USDA’s 2019 Trade Aid Package.

66 For more information, see CRS Report R45310, Farm Policy: USDA’s 2018 Trade Aid Package; and CRS Report R45865, Farm Policy: USDA’s 2019 Trade Aid Package. USDA, “ USDA Announces Details of Assistance for Farmers Impacted by Unjustified Retaliation,” press release, August 27, 2018, https://www.usda.gov/media/press-releases/2018/08/27/usda-announces-details-assistance-farmers-impacted-unjustified. T he largest purchases announced include pork, sweet cherries, apples, pistachios, dairy, and almonds. 67 USDA, “USDA Announces Support for Farmers Impacted by Unjustified Retaliation and T rade Disruption,” press release, May 23, 2019, https://www.usda.gov/media/press-releases/2019/05/23/usda-announces-support -farmers-impacted-unjustified-retaliation-and.

68 USDA, FNS, “FY2022 USDA Explanatory Notes – Food and Nutrition Service,” p. 34-129, https://www.usda.gov/sites/default/files/documents/34FNS2022Notes.pdf.

69 USDA, FNS, USDA Foods Available List for The Emergency Food Assistance Program (TEFAP) 2021 , March 15, 2021, https://www.fns.usda.gov/tefap/usda-foods-available-list-tefap.

Congressional Research Service

12

The Emergency Food Assistance Program (TEFAP): Background and Funding

Most foods are nonperishable and ready for distribution when delivered to states, although some foods, such as some meat and dairy products, require refrigeration.6870 States and recipient agencies can request entitlement commodities from a list of USDA Foods. USDA selects bonus foods based on market conditions.69 In FY2018 In FY2020, bonus food purchases included "beans, blueberries, catfish“apples, beans, cheese, dried cherries, chicken, ground beef, lentils, milk, mixed fruit, peaches, plums, pork chops, raspberries, strawberries, tomato sauce, and turkey."70

eggs, fig pieces, milk, orange juice, plums, pollock, potatoes, spaghetti

sauce, lentils, shrimp, deli turkey breast, and almonds.”71

According to a 2012 USDA study, TEFAP foods are relatively nutritious compared to foods in the average American diet.7172 The study found that TEFAP entitlement and bonus foods delivered to states in FY2009 scored 88.9 points out of a possible 100 points on the Healthy Eating Index—a

measure of compliance with federal dietary guidelines—compared to 57.5 points scored by the average American diet.7273 Keeping in mind that TEFAP foods are generallygeneral y meant to supplement diets, the study also found that these foods would supply 81% of fruits, 69% of vegetables, 98% of grains, 171% of protein, 36% of dairy, 84% of oils, and 39% of the maximum solid fats and

added sugars recommended for a 2,000-calorie diet.73

74 Administrative Cash Support

TEFAP provides funds to cover state and recipient agency costs related to processing, storing,

transporting, and distributing USDA-purchased commodities, as well wel as administrative costs related to determining eligibility, training staff, recordkeeping, and publishing announcements.74 75

Administrative funds can also be used to support states'’ food recovery efforts.75

76

The Emergency Food Assistance Act of 1983 authorizes $100 millionmil ion to be appropriated annually annual y for administrative costs.77 In recent years, annual appropriations acts have provided nearly $80

mil ion in discretionary funding for TEFAP administrative funds.78

for administrative costs.76 In FY2020, appropriations provided $79.6 million in discretionary funding for TEFAP administrative funds. The administrative fund appropriation was higher in FY2019 and FY2020 compared to prior years (see Table 1).77 The Emergency Food Assistance Act of 1983 also authorizes up to $15 million mil ion to be appropriated for TEFAP infrastructure grants (and this authority was extended by the 2018 farm bill); however, funds have not beenbil ). Funds were last appropriated for these grants sincein FY2010.79 In FY2021, USDA made $100 mil ion 70 C. Cabili, E. Eslami, and R. Briefel, White Paper on the Emergency Food Assistance Program (TEFAP) , prepared by Mathematica for the Office of Policy Support, Food and Nutrition Service, U.S. Department of Agricult ure, August 2013, https://fns-prod.azureedge.net/sites/default/files/T EFAPWhitePaper.pdf.

71 USDA, FNS, “FY2022 USDA Explanatory Notes – Food and Nutrition Service,” p. 34-128, https://www.usda.gov/sites/default/files/documents/34FNS2022Notes.pdf. 72 See USDA, FNS, Nutrient and MyPyramid Analysis of USDA Foods in Five of Its Food and Nutrition Programs, prepared by Westat for the Office of Research an d Analysis, January 2012, p. 3-76 to 3-84, https://fns-prod.azureedge.net/sites/default/files/ops/NutrientMyPyramid.pdf.

73 Federal dietary guidelines refer to the 2010 USDA Food Patterns, which are based on the Dietary Guidelines for Americans. 74 USDA, FNS, Nutrient and MyPyramid Analysis of USDA Foods in Five of Its Food and Nutrition Programs, prepared by Westat for the Office of Research and Analy sis, January 2012, https://fns-prod.azureedge.net/sites/default/files/ops/NutrientMyPyramid.pdf.

75 Section 204 of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7508). 76 Section 203D and Section 204 of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. 7§507). Also see C. Cabili, E. Eslami, and R. Briefel, White Paper on the Em ergency Food Assistance Program (TEFAP) , prepared by Mathematica for the Office of Policy Support, Food and Nutrition Service, U.S. Department of Agricult ure, August 2013, https://fns-prod.azureedge.net/sites/default/files/T EFAPWhitePaper.pdf.

77 Section 204 of the Emergency Food Assistance Act Of 1983 (codified at 7 U.S.C. §7508). 78 T he Further Consolidated Appropriations Act , 2020 (P.L. 116-94) and the Consolidated Appropriations Act, 2021 (P.L. 116-260) provided an annual appropriation of $79.6 million for T EFAP administrative funds in each of FY2020 and FY2021. 79 USDA, FNS, The Emergency Food Assistance Program (TEFAP) General Infrastructure Grant,

Congressional Research Service

13

link to page 21 link to page 19 link to page 23 link to page 27 The Emergency Food Assistance Program (TEFAP): Background and Funding

available for a new program that wil include infrastructure improvements (discussed further in

the “COVID-19 Pandemic Response” section).80

The statute specifies that administrative funds must be made available to states, which must in

turn distribute at least 40% of the funds to emergency feeding organizations.81 However, states are required to match whatever administrative funds they keep. As a result, states typical y send

nearly al of these funds to emergency feeding organizations.82

States can convert any amount of their administrative funds to food funds, but this happens to a

lesser extent than the conversion of food funds to administrative funds.83

Funding Trends Figure 3 displays TEFAP’ FY2010.78

The statute specifies that administrative funds must be made available to states, which must in turn distribute at least 40% of the funds to emergency feeding organizations.79 However, states are required to match whatever administrative funds they keep. As a result, states typically send nearly all of these funds to emergency feeding organizations.80

States can convert any amount of their administrative funds to food funds, but this happens to a lesser extent than the conversion of food funds to administrative funds. In FY2018, states converted only $64,214 of administrative funds to food funds.81

|

Appropriations |

Purchases |

||

|

Fiscal Year |

Administrative Funds |

Entitlement Commodities |

Bonus Commodities |

|

2008 |

49.7 |

190.0 |

178.1 |

|

49.5 |

250.0 |

373.7 |

|

49.5 |

308.0 |

346.6 |

|

2011 |

49.4 |

247.5 |

235.3 |

|

2012 |

48.0 |

260.3 |

304.2 |

|

49.4 |

265.8 |

228.5 |

|

2014 |

49.4 |

268.8 |

298.8 |

|

2015 |

49.4 |

327.0 |

302.9 |

|

2016 |

54.4 |

318.0 |

305.5 |

|

2017 |

59.4 |

316.0 |

268.6 |

|

2018 |

64.4 |

289.5 |

308.9 |

|

109.6 |

294.5 |

Not avail. |

|

2020 |

79.6 |

322.3 |

Not avail. |

Source: FY008-FY2019 data from congressional budget justifications for FY2010-FY2020; FY2020 appropriations from the Further Consolidated Appropriations Act, 2020 (P.L. 116-94) and accompanying explanatory statement.

Notes: Appropriations displayed are prior to any conversions of entitlement commodity funds into administrative funds. Table does not include TEFAP infrastructure grant appropriations (most recently, $6 million was appropriated in FY2010).

a. Note that the American Recovery and Reinvestment Act (ARRA) provided an additional $150 million in funding for TEFAP entitlement commodities and administrative costs in FY2009 and FY2010 (not reflected in table).

b. Table does not include a supplemental appropriation of $5.7 million for TEFAP disaster assistance in FY2013.

c. The FY2019 administrative fund appropriation includes $30.0 million in a transfer of Commodity Supplemental Food program prior-year funds.

Funding Trends

Figure 3 displays TEFAP's expenditures on administrative costs, entitlement commodities, and bonus commodities from the program'’s inception (FY1983) to FY2018 (seeFY2020 in constant (inflation-adjusted) dollars (see Appendix A for specific dollar amounts). Originally, bonus foods were the only type of commodities in TEFAP; the programTEFAP expenditures reached a recent high in FY2019 and FY2020 as a result of additional funding for entitlement commodities

and administrative costs provided by COVID-19 pandemic response acts and the Trump Administration’s trade mitigation program. Previously, spending was highest around the time of the program’s inception, when TEFAP served as a means for disposing of large stockpiles of

government-held commodities (for further legislative history, see Appendix C).

https://www.fns.usda.gov/emergency-food-assistance-program-tefap-general-infrastructure-grant; Section 209 of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7511a).

80 USDA, “USDA to Invest $1 Billion to Purchase Healthy Food for Food In secure Americans and Build Food Bank Capacity,” June 4, 2021, https://www.usda.gov/media/press-releases/2021/06/04/usda-invest-1-billion-purchase-healthy-food-food-insecure-americans. 81 Section 204 of the Emergency Food Assistance Act Of 1983 (codified at 7 U.S.C. §7508). 82 For the percentage of administrative funds distributed to recipient organizations by state, see USDA, FNS, “Percentage of T EFAP Administrative Funds Passed T hrough from State Agencies to Emergency Feeding Organizations: FY2019,” https://www.fns.usda.gov/tefap/percentage-tefap-administrative-funds-passed-through-state-agencies-emergency-feeding. 83 USDA, AMS, “FY2022 USDA Explanatory Notes – Agricultural Marketing Service,” p. 23-116, https://www.usda.gov/sites/default/files/documents/23AMS2022Notes.pdf.

Congressional Research Service

14

The Emergency Food Assistance Program (TEFAP): Background and Funding

Figure 3. TEFAP Expenditures, FY1983-FY2020

Source: CRS calculations using USDA, FNS Congressional Budget Justifications for FY1983-FY2022. Amounts are in FY2020 dol ars, adjusted for GDP inflation by CRS using Office of Management and Budget (OMB), “Historical Tables: Table 10.1—Gross Domestic Product and Deflators Used in the Historical Tables: 1940–2026,” April 2021.

Notes: Expenditures are after conversion of any entitlement commodity funds to administrative funds, and administrative funds to commodity funds, and include any entitlement food and administrative funds that states carried over from the prior fiscal year. In FY2009 and FY2010, entitlement food and administrative fund amounts include supplemental American Recovery and Reinvestment Act (ARRA) funding. ARRA included $100 mil ion in TEFAP commodity funding and $50 mil ion in TEFAP administrative funding that was distributed in FY2009 and FY2010. An additional $28 mil ion in ARRA funds were reprogrammed as TEFAP administrative funds in FY2010.

government-held commodities. Beginning in FY1989, the value of bonus foods dropped substantially as federal acquisitions and stocks waned, and commodities purchased specifically for TEFAP became the majority of the commodities in the program according to requirements in law (see Appendix B, "Legislative History of TEFAP").

TEFAP expenditures increased in FY2009 and FY2010, largely as a result of additional funding for entitlement commodities and administrative costs provided by the American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5). The 2008 farm bill (P.L. 110-246) also increased funding for TEFAP's entitlement commodities. Since FY2011, spending on bonus and entitlement commodities has fluctuated between approximately $500 million and $600 million (inflation-adjusted).

|

|

|

State Allocation Formula

TEFAP'State Allocation Formula TEFAP’s entitlement commodity and administrative funds are allocatedal ocated to states based on a statutory formula that takes into account poverty and unemployment rates.82 Specifically84 Specifical y, USDA calculates each state'’s share of the total national number of households with incomes below the federal poverty level and each state'’s share of the total national number of unemployed individuals. A state'’s share of households in poverty is then multiplied by 60% and its share of

unemployed individuals is multiplied by 40% to calculate the state'’s share of TEFAP commodities and funds. For example, if a state has 4% of all al households in poverty and 2% of all al unemployed individuals, it would receive (4% x 60% = 2.4%) + (2% x 40% = 0.8%) = 3.2% of TEFAP funds.8385 As noted previously, states may carry over any extra food or administrative funds

for one fiscal year (e.g., from FY2019 to FY2020).

FY2020 to FY2021).

84 7 C.F.R. §251.3(h). Administrative funds use the same formula as commodities according to Section 204 of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7508). 85 T his explanation draws upon Appendix B of C. Cabili, E. Eslami, and R. Briefel, White Paper on the Emergency Food Assistance Program (TEFAP), prepared by Mathematica for the Office of Policy Support, Food and Nutrition Service, U.S. Department of Agriculture, August 2013 , https://fns-prod.azureedge.net/sites/default/files/

Congressional Research Service

15

The Emergency Food Assistance Program (TEFAP): Background and Funding

State Funding State Funding

States must match any administrative funds that are not allocatedal ocated to emergency feeding

organizations or expended by the state on behalf of such organizations.8486 In practice, most states use 80% to 100% of their administrative funds to support emergency feeding organizations,

resulting in a small smal state match requirement.85

87

Beyond the state match, 14 states reported supplying additional state funds "“to support the TEFAP program either directly or indirectly" in the 2015” in a national survey conducted by the Washington

Washington State Department of Agriculture survey (discussed previously).86 in 2015.88

There is also a maintenance of effort requirement in TEFAP, meaning that states cannot reduce their own funding or commodity support for recipient agencies below the level that they were supporting such organizations at the program'’s inception or FY1988 (when the maintenance of

effort went into effect)—whichever is later.87

89

Role of TEFAP During Disasters and Emergencies There are two main ways TEFAP can be deployed in disaster response: (1) transferring TEFAP foods to disaster response organizations for distribution to households (Disaster Household Distribution programs) and (2) adjusting TEFAP program rules and/or distributing additional aid through TEFAP. Both of these approaches have been used during the COVID-19 pandemic

(discussed in the next section).

During a presidential y declared disaster or emergency, USDA may approve state requests to operate Disaster Household Distribution programs and repurpose USDA Foods (largely from TEFAP) for direct distribution to households in areas affected by an emergency or disaster.90

USDA later replenishes or reimburses TEFAP and federal nutrition assistance programs for the reprogrammed foods.91 Disaster Household Distribution facilitates faster distribution to households by reducing administrative requirements (e.g., removing eligibility determinations); however, it temporarily results in lower USDA Foods inventory for TEFAP and other federal nutrition assistance programs. USDA authorized Disaster Household Distribution using TEFAP

foods in several states in recent years, including during the COVID-19 pandemic.92

T EFAPWhitePaper.pdf.

86 Section 204 of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7508). 87 USDA, FNS, “Percentage of T EFAP Administrative Funds Passed T hrough from State Agencies to Emergency Feeding Organizations (EFO): FY2019,” https://www.fns.usda.gov/tefap/percentage-tefap-administrative-funds-passed-through-state-agencies-emergency-feeding. Note that territories are exempt from the matching requirement if it is under $200,000 (7 C.F.R. §251.9).

88 See Washington State Department of Agriculture, The Emergency Food Assistance Program (TEFAP): Distribution National Survey 2015, AGR 609-574.

89 Section 215 of the Emergency Food Assistance Act of 1983 (codified at 7 U.S.C. §7516). 90 7 C.F.R. §250.69; USDA, FNS, Food Distribution Division, “USDA Foods Program Disaster Manual,” revised September 2017, https://fns-prod.azureedge.net/sites/default/files/fdd/disaster-manual.pdf; USDA, FNS, “ USDA Foods Disaster Assistance,” https://www.fns.usda.gov/disaster/usda-foods-disaster-assistance. Note that households cannot receive both disaster SNAP benefits and disaster USDA Foods. USDA Foods for household consumption are most often obtained from inventories intended for T EFAP, the Commodity Supplemental Food Program, and the Food Distribution Program on Indian Reservations.

91 7 C.F.R. §250.69(g). 92 For example, foods intended for T EFAP were used for disaster response in Florida, T exas, and Puerto Rico following

Congressional Research Service

16

link to page 13 link to page 19 link to page 23 The Emergency Food Assistance Program (TEFAP): Background and Funding

Additional foods may also be distributed through TEFAP to aid in disaster and emergency response, and additional flexibilities may be provided. For example, USDA and/or states may adjust certain program rules during a disaster or emergency (e.g., by amending state plans). In addition, Congress may provide supplemental funding for disaster or emergency feeding through TEFAP, as was the case during the COVID-19 pandemic and during hurricanes and wildfires in

recent years.93

COVID-19 Pandemic Response TEFAP has been involved in responding to the COVID-19 pandemic both in terms of transferring foods to Disaster Household Distribution programs and distributing a higher volume of foods

through TEFAP.

During the COVID-19 pandemic, USDA authorized some states’ requests to use TEFAP foods for Disaster Household Distribution. Following the presidential emergency declaration for COVID-19, USDA approved requests from 21 states, Guam, and 33 tribal nations to repurpose TEFAP foods for Disaster Household Distribution during the early months of the pandemic.94 These

approvals had different timeframes but typical y ended by July 2020.

There was also additional federal aid distributed through TEFAP as a result of funding provided by COVID-19 pandemic response acts. Specifical y, supplemental appropriations for TEFAP were provided by FFCRA ($400 mil ion), the CARES Act ($450 mil ion), and the Consolidated

Appropriations Act, FY2021 ($400 mil ion).95 In addition, the Biden Administration announced its intent to use funds provided by the Consolidated Appropriations Act, FY2021 ($500 mil ion) and ARPA ($500 mil ion) for TEFAP (1) entitlement food purchases with priority for smal , women-owned, minority-owned, and veteran-owned businesses and to continue a fresh produce box initiative announced earlier in the year;96 (2) cooperative agreements with state and tribal

governments or other local entities to purchase local and regional foods and foods from social y disadvantaged producers, and (3) infrastructure grants for emergency feeding organizations, with an emphasis on those in “underserved communities and communities of color.”97 TEFAP funds available in FY2021 are displayed in Table 1. FFCRA and CARES Act funds expended in

FY2020 are included in Figure 3 and Table A-1.

Hurricanes Irma, Harvey, and Maria in 2017. For a list of FNS’s disaster response by state, see USDA, FNS, “ State by State FNS Disaster Assistance,” https://www.fns.usda.gov/disaster/state-by-state. 93 For example, the Bipartisan Budget Role of TEFAP During Disaster Response

States have the authority to distribute existing inventories of USDA Foods to disaster relief organizations when the President issues a disaster declaration.88 This includes foods from TEFAP inventories and other food assistance programs such as the National School Lunch Program.89 For example, foods intended for TEFAP were used for disaster response in Florida, Texas, and Puerto Rico following Hurricanes Irma, Harvey, and Maria in 2017.90 TEFAP foods used for disaster assistance are replenished by USDA, so the overall level of commodities in the program is not affected and program operations continue in the aftermath of a disaster.

At times, Congress may appropriate additional funds for TEFAP for the purposes of disaster relief. Most recently, the Bipartisan Budget Act of 2018 (P.L. 115-123) provided $24 million in supplemental funding for TEFAP for T EFAP commodities and administrative funds to jurisdictions that received a major disaster or emergency declaration related to the consequences of Hurricanes Harvey, Irma, and Maria or wildfires in 2017.

94 USDA, FNS, “ Disaster Household Distribution,” June 11, 2020, https://www.fns.usda.gov/usda-foods/covid-19-disaster-household-distribution. 95 FFCRA (P.L. 116-127, Division A, T itle I); CARES Act (P.L. 116-136, Division B, T itle I); Consolidated Appropriations Act, 2021 (P.L. 116-260, Division N, T it le VII, §711). T hese laws also specified the proportion of funding could be used for administrative/food distribution costs.

96 USDA, FNS, “T EFAP Fresh Produce,” March 30, 2021, https://www.fns.usda.gov/tefap/fresh-produce. 97 USDA, “ USDA to Invest $1 Billion to Purchase Healthy Food for Food Insecure Americans and Build Food Bank Capacity,” June 4, 2021, https://www.usda.gov/media/press-releases/2021/06/04/usda-invest -1-billion-purchase-healthy-food-food-insecure-americans.

Congressional Research Service

17

link to page 19 link to page 19 The Emergency Food Assistance Program (TEFAP): Background and Funding

USDA also encouraged states to make policy changes within TEFAP to facilitate safe food distribution, such as expanding eligibility rules for participants and waiving signature

requirements for the receipt of TEFAP foods.98

The 2018 Farm Bill The 2018 Farm Bill

In addition to reauthorizing and extending TEFAP'’s funding, the 2018 farm bill bil (§4018 of P.L. 115-334) made policy changes to TEFAP. The law authorized Farm to Food Bank Projects (as