Medicare and Budget Sequestration

Changes from December 18, 2019 to December 2, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction

- Budget Sequestration

- Budget Enforcement Rules

- Budget Control Act

- Statutory PAYGO

- Medicare Overview

- Beneficiary Costs

- Provider and Plan Payments

- Health Care Fraud and Abuse Control Program

- Administrative Spending

- Medicare Sequestration Rules

- Medicare Sequester Execution

- Timing

- Reductions in Benefit Spending

- Parts A and B

- Part C

- Part D

- Health Care Fraud and Abuse Control Program

- Administrative Expenses

- Medicare and the BCA Mandatory Sequester

Figures

Tables

Summary

Medicare and Budget Sequestration

December 2, 2020

Sequestration is the automatic reduction (i.e., cancellation) of certain federal spending, generally by a uniform percentage. The sequester is a budget enforcement tool that was established by

Patricia A. Davis

Congress in the Balanced Budget and Emergency Deficit Control ActA ct of 1985 (BBEDCA, also

Specialist in Health Care

known as the Gramm-Rudman-Hollings Act; P.L. 99-177, as amended) and was intended to

Financing

encourage compromise and action, rather than actually being implementedimp lemented (also known as

triggered). Generally, this budget enforcement tool has been incorporated into laws to either discourage or encourage certain budget objectives or goals. When these goals are not met, either

through the enactment of a law or the lack thereof, a sequester is triggered and certain federal spending is reduced.

Sequestration is of recent interest due to its current use as an enforcement mechanism for three budget enforcement rules created by the Statutory Pay-As-You-Go Act of 2010 (Statutory PAYGO; P.L. 111-139) ) and the Budget Control Act of 2011 (BCA; P.L. 112-25). ). At present, only the BCA mandatory sequester has been triggered. Under the BCA, the sequestration of mandatory spending was originally scheduled to occur in FY2013 through FY2021; however, subsequent legislation, including the Bipartisan Budget Act of 2019 (BBA 2019; P.L. 116-37), including, most recently, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136), extended sequestration for mandatory spending through FY2029. FY2030. (The CARES Act also temporarily suspended the application of this sequestration to Medicare from May 1, 2020, through December 31, 2020.) The Statutory PAYGO sequester and BCA discretionary sequester are current law and can be triggered if associated budget enforcement rules are broken.

Medicare is a federal program that pays for certain health care services of qualified beneficiaries. The program is funded using both mandatory and discretionary spending and is impacted by any sequestration order issued in accordance with the aforementioned laws. Medicare is mainly impacted by the sequestration of mandatory funds since Medicare benefit payments (the majority of Medicare expenditures) are considered mandatory spending. Special sequestration rules limit the extent to which Medicare benefit spendings pending can be reduced in a given fiscal year. This limit varies depending on the type of sequestration order.

Under a BCA mandatory sequestration order, Medicare benefit payments and Medicare Integrity Program spending cannot be reduced by more than 2%. Under a Statutory PAYGO sequestration order, Medicare benefit payments and Medicare Program Integrity spending cannot be reduced by more than 4%. These limits do not apply to mandatory administrative Medicare spending under either type of sequestration order. These limits also do not apply to discretionary administrative Medicare spending under a BCA discretionary sequestration order.

Generally, Medicare'’s benefit structure remains unchanged under a mandatory sequestration order and beneficiaries see few direct impacts. However, Medicare plans and providers see reductions in payments. Due to varying plan and provider payment mechanisms among the four parts of Medicare, sequestration is implemented somewhat differently across the program.

Congressional Research Service

link to page 5 link to page 5 link to page 7 link to page 7 link to page 8 link to page 9 link to page 10 link to page 10 link to page 11 link to page 11 link to page 11 link to page 13 link to page 13 link to page 14 link to page 14 link to page 15 link to page 17 link to page 17 link to page 18 link to page 18 link to page 20 link to page 20 link to page 21 link to page 8 link to page 18 link to page 18 link to page 22 link to page 23 link to page 23 Medicare and Budget Sequestration

Contents

Introduction ................................................................................................................... 1 Budget Sequestration ....................................................................................................... 1

Budget Enforcement Rules.......................................................................................... 3

Budget Control Act............................................................................................... 3 Statutory PAYGO ................................................................................................. 4

Medicare Overview ......................................................................................................... 5

Beneficiary Costs ...................................................................................................... 6 Provider and Plan Payments ........................................................................................ 6 Health Care Fraud and Abuse Control Program .............................................................. 7 Administrative Spending ............................................................................................ 7

Medicare Sequestration Rules ........................................................................................... 7 Medicare Sequester Execution .......................................................................................... 9

Timing ..................................................................................................................... 9 Reductions in Benefit Spending ................................................................................. 10

Parts A and B ..................................................................................................... 10 Part C (Medicare Advantage) ............................................................................... 11 Part D............................................................................................................... 13 Health Care Fraud and Abuse Control Program ....................................................... 13

Administrative Expenses ..................................................................................... 14

Medicare and the BCA Mandatory Sequester..................................................................... 14

Figures Figure 1. Medicare Benefit Payment Amounts as a Percentage of Budget Control Act

Mandatory Sequester Amounts ..................................................................................... 16

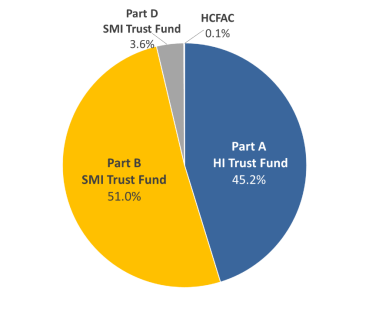

Figure 2. Estimated Source of Sequestered Medicare Benefits in FY2021 .............................. 17

Tables Table 1. Medicare Budget Enforcement Rules Summary ....................................................... 4 Table 2. Mandatory Percentage Reductions Under Budget Control Act Sequestration

Orders ...................................................................................................................... 14

Appendixes Appendix A. Additional CRS Resources ........................................................................... 18 Appendix B. Budget Terminology Definitions ................................................................... 19

Contacts

Author Information ....................................................................................................... 19

Congressional Research Service

Medicare and Budget Sequestration

Congressional Research Service

Medicare and Budget Sequestration

Introduction program.

Introduction

Sequestration is the automatic reduction (i.e., cancellationcancel ation) of certain federal spending, generally general y by a uniform percentage.11 The sequester is a budget enforcement tool that Congress established in the Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA, also known as the Gramm-Rudman-Hollings Act; P.L. 99-177, as amended) intended to encourage compromise and action, rather than actuallyactual y being implemented (also known as triggered).2 Generally2 General y, this budget

enforcement tool has been incorporated into laws to either discourage or encourage certain budget objectives or goals. When these goals are not met, either through the enactment of a law or lack

thereof, a sequester is triggered and certain federal spending is reduced.

Sequestration is of recent interest due to its current use as an enforcement mechanism for three budget enforcement rules created by the Statutory Pay-As-You-Go Act of 2010 (Statutory PAYGO; P.L. 111-139) and the Budget Control Act of 2011 (BCA; P.L. 112-25). Currently, only the BCA mandatory sequester has been triggered and is in effect. (with the exception of May through December 2020 for Medicare).3 However, the Statutory PAYGO sequester and the BCA

discretionary sequester are current law and can be triggered if the budget enforcement rules are broken.

broken.

Medicare, which is a federal program that pays for covered health care services of qualified beneficiaries,3

beneficiaries,4 is subject to a reduction in federal spending associated with the implementation of

these three sequesters, although special rules limit the extent to which it is impacted.

This report begins with an overview of budget sequestration and Medicare before discussing how budget sequestration has been implemented across the different parts of the Medicare program. Additionally, Additional y, this report provides appendixes that include references to additional Congressional Research Service (CRS) resources related to this report and budget terminology definitions, as

defined by BBEDCA.

Budget Sequestration

Under current law, sequestration is a budget enforcement tool that occurs because certain budgetary goals have not been met. When a sequester is triggered, all al applicable budget accounts, unless exempted by law, are reduced by a certain percentage amount for a fiscal year.4 The 5 The 1 Under the Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA; also known as the Gramm -Rudman-Hollings Act; P.L. 99-177) §250(c)(2), sequestration is defined as “ the cancellation of budgetary resources

provided by discretionary appropriations or direct spending law.” Budgetary resources are subject to sequestration unless exempted by law. See Office of Management and Budget (OMB), OMB Circular A-11 (2019), Section 100, at https://www.whitehouse.gov/wp-content/uploads/2018/06/s100.pdf.

2 U.S. Congress, Senate Committee on Finance, Budget Enforcement Mechanisms, Oral and Written T estimony of the Honorable Phil Gramm, 112th Cong., 1st sess., May 4, 2011.

3 §3709 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136) temporarily suspended the application of the Budget Control Act of 2011 (BCA; P.L. 112-25) sequestration to Medicare from May 1, 2020, through December 31, 2020. 4 For more information on Medicare, see CRS Report R40425, Medicare Primer. 5 Sequestration does not apply to every account, since many budget accounts are either exempted from sequestration or governed by special rules under sequestration, the latter of which can vary depending on the sequestration trigger. See BBEDCA §255 and §256, as amended. Since OMB is responsible for the execution and legal interpretations of sequestration orders, some accounts not listed in these sections may also be exempt from sequestration. For a complete list of exempted accounts, see CRS Report R42050, Budget “Sequestration” and Selected Program Exemptions and Special Rules.

Congressional Research Service

1

Medicare and Budget Sequestration

percentage reduction varies between and within budget accounts depending on the categories of

percentage reduction varies between and within budget accounts depending on the categories of funding, as described below, contained within each budget account.

After identifying each category of funding within a budget account, sequestration reductions are spread

applied evenly across all al budget account subcomponents referenced in committee reports, budget justifications, and/or Presidential Detailed Budget Estimates – also known as programs, projects or activities.56 For budget accounts that contain only one category of funding, all al sequestrable funds are reduced by the same corresponding percentage. For accounts that contain multiple categories of funding, the total amount of each category of sequestrable funds is reduced by its

corresponding percentage. The reduced budget resources are usually permanently cancelled.6

usual y permanently cancel ed.7

As currently used, a sequester applies to either discretionary or mandatory spending. Discretionary spending is associated with most funds provided by annual appropriations acts. While all

While al discretionary spending is subject to the annual appropriations process, only a portion of mandatory spending is provided in appropriations acts.78 Mandatory spending is generally general y provided by permanent laws, such as the Social Security Act which made indefinite budget authority permanently available for Medicare benefit payments.89 Some federal programs, such as

Medicare, can receive both discretionary and mandatory funding.

In the event that a sequester is triggered, the Office of Management and Budget (OMB) is responsible for calculating the across-the-board percentage reductions, and calculates separate percentages for Medicare, other nondefense, and defense funding.910 Due to sequestration rules,

which are covered later in this report, mandatory Medicare benefit payments receive a specific

percentage reduction different from other types of federal spending.

The methodologies used to calculate these percentages and the sequestered amounts are published

in a report produced by OMB. Once the President issues a sequestration order, the associated

report is made available to the public and transmitted to Congress.10

11

6 See CRS Report R42972, Sequestration as a Budget Enforcement Process: Frequently Asked Questions, and CRS Report 98-721, Introduction to the Federal Budget Process.

7 “In some circumstances current law allows for budget authority sequestered in one fiscal year to become available to the agencies again in a subsequent fiscal year. OMB refers to these amounts as ‘pop ups.’” See U.S. Government Accountability Office (GAO), 2014 Sequestration Opportunities Exist to Im prove Transparency of Progress Toward Deficit Reduction Goals, GAO-16-263, April 2016, p. 20, at https://www.gao.gov/assets/680/676565.pdf. 8 Some mandatory entitlements are provided through the annual appropriations process and are considered appropriated entitlem ents (e.g., Medicaid). Although these entitlements are appropriated, the federal government is legally obligated to make payments to those deemed eligible for the entitlement. (Medicaid is explicitly exempt from sequestration.)

9 Indefinite budget authority is federal spending that, at the time of enactment, is for an unspecified amount that will be determined at a later date. See GAO, A Glossary of Term s Used in the Federal Budget Process, GAO-05-734SP, September 1, 2005, p. 23, at https://www.gao.gov/assets/80/76911.pdf.

10 All funds are first classified as discretionary or mandatory. Within each of these categories, funds are further classified as Medicare, defense, or nondefense. During a sequest ration order, each subcomponent of discretionary and/or mandatory funds receives a sequestration percentage based on the necessary amount of savings for that category. For sequestration purposes, Medicare benefit payments are defined by BBEDCA as all payments for programs and activities under T itle XVIII of the Social Security Act. See BBEDCA §256(d). Defense and nondefense are referred to in BBEDCA as either “revised security” or “revised nonsecurity,” respectively. “ Revised security” is any funding coded with a budget function of 050, which is effectively the Department of Defense. “ Revised nonsecurity” includes all other government spending. Each of these categories receives a different percentage reduction under a sequestration order.

11 For more information about the methodologies associated with calculating the sequester percentage in a given year, see OMB Report to the Congress on the Joint Com m ittee Reductions for Fiscal Year 2021 , February 10, 2020, at https://www.whitehouse.gov/wp-content/uploads/2020/02/JC-sequestration_report_FY21_2-10-20.pdf.

Congressional Research Service

2

link to page 8 Medicare and Budget Sequestration

Budget Enforcement Rules Budget Enforcement Rules

Currently, there are three budget enforcement rules that can trigger sequestration. Two were

established by the BCA and one was established by Statutory PAYGO. The three rules and their

corresponding sequesters can be summarized as follows (and are presented in in Table 1):

: Budget Control Act

The BCA established a bipartisan Joint Select Committee on Deficit Reduction (Joint Committee), which was responsible for developing legislation that would reduce the deficit by at

least $1.2 trillion tril ion from FY2012 to FY2021.1112 However, the Joint Committee was unable to achieve this goal; therefore, Congress and the President were unable to enact corresponding deficit reduction legislation by a date specified in the law. As a result, two types of spending

reductions were automatically triggered.12

automatical y triggered.13

One automatic spending reduction involved the sequestration of certain mandatory spending from FY2013 to FY2021. Through subsequentSubsequent legislation, including, most recently, the Bipartisan Budget Act of 2019 (BBA 2019; P.L. 116-37), Congress extended this reduction through FY2029.13 (Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136) extended sequestration for mandatory spending through FY2030.14 This reduction is referred to in this report as the "“BCA mandatory sequester".)

Additionally, the BCA

sequester”.

Additional y, the BCA established statutory limits on discretionary spending for FY2012-FY2021.1415 These discretionary spending limits (discretionary caps) restrict the amount of

spending permitted through the annual appropriations process for defense and nondefense programs. Any breach of these discretionary caps results in the sequestration of nonexempt discretionary funding. (This reduction is referred to in this report as the "“BCA discretionary sequester"sequester”.) This was triggered once in FY2013,1516 and can be triggered again if discretionary caps are breached in any fiscal year through FY2021 and Congress does not take action to raise these

caps. Most recently, the Bipartisan Budget Act of 2018 (BBA 2018; P.L. 115-123) increased the discretionary spending caps for FY2018 and FY2019 so they would not be breached, and BBA 2019 increased the caps for FY2020 and FY2021.

the Bipartisan Budget Act of 2019 (BBA 2019; P.L. 116-37) increased the caps for FY2020 and

FY2021.

12 See T itle IV of the BCA. 13 See CRS Report R42050, Budget “Sequestration” and Selected Program Exemptions and Special Rules. 14 Six subsequent pieces of legislation have extended the BCA mandatory sequester. T he Bipartisan Budget Act of 2013 (BBA 2013; P.L. 113-67) extended the sequester through FY2023. A law modifying the cost -of-living adjustment (COLA) for certain military retirees (P.L. 113-82) extended the sequester through FY2024. T he Bipartisan Budget Act of 2015 (BBA 2015; P.L. 114-74) extended the sequester through FY2025. T he Bipartisan Budget Act of 2018 (BBA 2018; P.L. 115-123) extended the sequester through FY2027, and the Bipartisan Budget Act of 2019 (BBA 2019; P.L. 116-37) extended the sequester through FY2029. T he Coronavirus Aid, Relief, and Economic Security Act ( CARES Act; P.L. 116-136) extended the sequester through FY2030. T he CARES Act also temporarily suspended the application of sequestration to Medicare from May 1, 2020 , through December 31, 2020. 15 Four subsequent pieces of legislation have modified the BCA discretionary caps as enacted. BBA 2013 established new discretionary caps under the BCA on defense and nondefense discretionary spending in FY2014 and FY2015. BBA 2015 raised the discretionary caps in FY2016 and FY2017. BBA 2018 raised the discretionary caps in FY2018 and FY2019, and BBA 2019 raised the discretionary caps in FY2020 and FY2021. For more information about the discretionary spending limits established under the BCA, see CRS Report R42506, The Budget Control Act of 2011 as Am ended: Budgetary Effects, and CRS Insight IN11148, The Bipartisan Budget Act of 2019: Changes to the BCA and Debt Lim it.

16 See CRS Report RL34424, The Budget Control Act and Trends in Discretionary Spending .

Congressional Research Service

3

link to page 9 link to page 9 link to page 9 Medicare and Budget Sequestration

Statutory PAYGO

Statutory PAYGO

The Statutory PAYGO Act established a budget enforcement mechanism generallygeneral y requiring that legislation legislation affecting direct (mandatory) spending and revenues does not have the effect of increasing the deficit over a 5- and/or 10-year period. If such legislation were to become law, a sequester of certain mandatory spending would be required. This budget enforcement rule does

not have a sunset date and therefore remains in effect under current law. (This reduction is

referred to in this report as Statutory PAYGO sequester.)

Although Congress has passed legislation that has been estimated to increase the deficit since the

law went into effect, the Statutory PAYGO sequester has never been triggered, as Congress has voted to prohibit the effects of specific legislation from being counted under the normal operations of the Statutory PAYGO Act. A recent example of this is BBA 2019,1617 which included

language to reduce the "scorecards" tallying“scorecards” tal ying the total impact of legislation on the deficit to zero.

Table 1. Medicare Budget Enforcement Rules Summary

Sequester

Funding

Medicare

Percentage

Types

Programs

Sequester

Enforcement Rule

Cap

Current Status

Mandatory

Parts A, B, C,

Statutory

If revenue and/or

4% for benefit

Current law but

and D Benefits;

PAYGO

mandatory spending

payments and

not triggered.

MIP HCFAC;

legislation that projects to

MIP HCFAC.

Non-MIP

increase the deficit over a

None for other

HCFAC;

Table 1. Medicare Budget Enforcement Rules Summary

|

Funding Types |

Medicare Programs |

Sequester |

Enforcement Rule |

Sequester Percentage Cap |

Current Status |

|

Mandatory |

Parts A, B, C, and D Benefits; MIP HCFAC; Non-MIP HCFAC; Administration |

Statutory PAYGO |

|

4% for benefit payments and MIP HCFAC. None for other spending. |

Current law but not triggered. |

|

BCA Mandatory Sequester |

If the Joint Select Committee was unsuccessful at reducing the federal deficit by $1.2 trillion from FY2012-FY2021, mandatory sequestration would be implemented and discretionary limits would be established (with any breaches enforced through sequestration). |

2% for benefit payments and MIP HCFAC. None for other spending.a |

Currently triggered and in effect through FY2029.b |

||

|

Discretionary |

Non-MIP HCFAC; Administration |

BCA Discretionary Sequester |

None. |

|

.c Source: CRS.

Notes: Programs that appear in both categories are funded using mandatory and discretionary spending authority. In addition to the Medicare sequestration cap, other sequestration rules prohibit sequestration effects from being included in the determination of adjustments to Medicare payment rates, and explicitly exempt Part D low-income subsidies, Part D catastrophic subsidies (reinsurance) and Qualified Individual premiums from sequestration. BCA refers to Budget Control Act. Discretionary Administration includes amounts for payments to contractors to process providers' ’ claims, beneficiary outreach and education, and maintenance of Medicare's Medicare’s information technology infrastructure. HCFAC HCFAC refers to the Health Care Fraud and Abuse Control Program, which is responsible for activities that fight health care fraud and waste and is funded through discretionary and mandatory resources. Mandatory Administration

17 P.L. 116-37, §102.

Congressional Research Service

4

Medicare and Budget Sequestration

discretionary and mandatory resources. Mandatory Administration includes, among other things, amounts for quality improvement organizations. Medicare Benefit Payments are defined by BBEDCA as all al payments for programs and activities under Title XVIII of Social Security Act, including the Medicare Integrity Program. MIP HCFAC refers HCFAC refers to the Medicare Integrity Program, which focuses on combating fraud in Medicare. Non-MIP HCFAC refers to all refers to al HCFAC spending other than MIP.

a. The Bipartisan Budget Act of 2019 (BBA 2019; P.L. 116-37 The Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136) specifies that the non-administrative

administrative Medicare sequester percentage cap under the BCA mandatory sequester will wil be 4% during the first six months of the FY2029FY2030 sequestration order and 0% for the nextlast six months of the order. See BBEDCA §251A(6)(C).

b.

b. The Bipartisan Budget Act of 2013 (BBA 2013; P.L. 113-67) extended the BCA mandatory sequester

through FY2023. A law modifying the cost-of-living adjustment (COLA) for certain military retirees ( retirees (P.L. 113-82) extended the sequester through FY2024. The Bipartisan Budget Act of 2015 (BBA 2015; P.L. 114-7474) extended the sequester through FY2025. The Bipartisan Budget Act of 2018 (BBA 2018; P.L. 115-123) ) extended the sequester through FY2027, and BBA 2019 extended the sequester through FY2029.

c. Several the Bipartisan Budget Act of 2019 (BBA 2019; P.L. 116-37) extended the sequester through FY2029, and the CARES Act (P.L. 116-136) extended it through FY2030. The CARES Act also temporarily suspended the sequestration of Medicare from May 2020 through December 2020.

c. Several laws established new caps that were adhered to, thus not requiring any sequestration in the relevant

years. These include BBA 2013 for FY2014 and FY2015: BBA 2015 for FY2016 and FY2017: BBA 2018 for FY2018 and FY2019, and BBA 2019 for FY2020 and FY2021.

For more information on budget sequestration, see CRS Report R42050, Budget "Sequestration" “Sequestration” and Selected Program Exemptions and Special Rules, CRS Report R42972, Sequestration as a Budget Enforcement Process: Frequently Asked Questions, and CRS Report R45941, The Annual

Sequester of Mandatory Spending through FY2029.

Medicare Overview

Medicare, which is a federal program that pays for certain health care services of qualified beneficiaries, is subject to sequestration, although special rules limit the extent to which it is impacted. Due to the varying payment structures of the four parts of the program, sequestration is

applied differently across Medicare.

Medicare was established in 1965 under Title XVIII of the Social Security Act to provide hospital and supplementary medical insurance to Americans aged 65 and older. Over time, the program has been expanded to also include certain disabled persons, including those with end-stage renal

disease. In FY2019FY2020, the program covered an estimated 61 million persons (52 million aged and 9 million disabled).17

63 mil ion persons (54 mil ion aged and 9

mil ion disabled).18

The Congressional Budget Office (CBO) estimatesestimated that total Medicare spending will be about $772 billion in FY2019 and will increase to about $1,500 billion in FY2029.18 Almost all in FY2020

would be about $836 bil ion and wil increase to about $1.7 tril ion in FY2030.19 Almost al Medicare spending is mandatory spending that is primarily used to cover benefit payments (i.e., payments to health care providers for their services), administration, and the Medicare Integrity Program (MIP). The remaining Medicare outlays are discretionary and used almost entirely for

other administrative activities that are described in more detail later in this report.

Medicare consists of four distinct parts:

1.1. Part A (Hospitalskilledskil ed nursing care, hospice care, and some home health services. Most persons aged 65 18 Department of Health and Human Services, Fiscal Year 2020 Budget in Brief, p. 76, at https://www.hhs.gov/sites/default/files/fy-2020-budget-in-brief.pdf. 19 Congressional Budget Office, March 2020 Medicare Baseline, at https://www.cbo.gov/system/files/2020-03/51302-2020-03-medicare.pdf. Congressional Research Service 5 Medicare and Budget Sequestration and older are automatical yand older are automaticallyentitled to premium-free Part A because they or their spouse paid Medicare payroll taxes for at least 40 quarters (about 10 years) on earnings covered by either the Social Security or the Railroad Retirement systems. Part A services are paid for out of the Hospital Insurance Trust Fund, which is mainly funded by a dedicated 2.9% payroll tax on earnings of current workers, sharedequallyequal y between employers and workers.2.2. Part B (Supplementary Medical Insurance, or SMI) covers a broad range of medical services, including physician services, laboratory services, durable medical equipment, and outpatient hospital services. Enrollment in Part B is optional, but most beneficiaries with Part A also enroll in Part B. Part B benefits are paid for out of the Supplementary Medical Insurance Trust Fund, which is primarily funded through beneficiary premiums and federal general revenues.3.3. Part C (Medicare Advantage, or MA) is a private plan option that coversallal Parts A and B services, except hospice. Individuals choosing to enroll in Part C must be enrolled in Parts A and B. About one-third of Medicare beneficiaries are enrolled in MA. Part C is funded through both the HI and SMI trust funds.4.4. Part D is a private plan option that covers outpatient prescription drug benefits. This portion of the program is optional. About three-quarters of Medicare beneficiaries are enrolled in Medicare Part D or have coverage through an employer retiree plan subsidized by Medicare. Part D benefits are also paid for out of the Supplementary Medical Insurance Trust Fund, which isand are primarily funded through beneficiary premiums, federal general revenues, and state transfer payments.

For more information on the Medicare program, see CRS Report R40425, Medicare Primer.

Beneficiary Costs

Beneficiaries are responsible for paying Medicare Parts B and D premiums, as well wel as other out-of-pocket costs, such as deductibles and coinsurance,1920 for services provided under all al parts of the

Medicare program.2021 Under Medicare Parts A, B and D, there is no limit on beneficiary out-of-pocket spending, and most beneficiaries have some form of supplemental insurance through private Medigap plans, employer-sponsored retiree plans, or Medicaid to help cover a portion of their Medicare premiums and/or deductibles and coinsurance. Medicare Advantage has limits on

out-of-pocket spending.

Provider and Plan Payments

Under Medicare Parts A and B, the government generallygeneral y pays providers directly for services on a

fee-for-service basis using different prospective payment systems and fee schedules.21 Under 22 Under

20 A deductible is the amount an enrollee is required to pay for health care services or products before his or her insurance plan begins to provide coverage. Coinsurance is the percentage share that an enrollee in a health insurance plan pays for a product or service covered by the plan.

21 Beneficiaries enrolled in a Medicare Advantage (MA, Part C) plan must pay Part B premiums as well as any additional premium required by the MA plan.

22 Under a prospective payment system (PPS), Medicare payments are made using a predetermined, fixed amount based on the classification system for a particular service. T he Centers for Medicare & Medicaid Services (CMS) uses separate PPSs to reimburse acute inpatient hospitals, home health agencies, hospice, hospital outpatient departments, inpatient psychiatric facilities, inpatient rehabilitation facilities, long-term care hospitals, and skilled nursing facilities.

Congressional Research Service

6

link to page 8 Medicare and Budget Sequestration

Parts C and D, Medicare pays private insurers a monthly capitated per person amount to provide coverage to enrollees, regardless of the amount of services used. The capitated payments are adjusted to reflect differences in the relative cost of sicker beneficiaries with different risk factors

including age, disability, or end-stage renal disease.

Health Care Fraud and Abuse Control Program

The Health Care Fraud and Abuse Control Program (HCFAC) was established by the Health Insurance Portability and Accountability Act (HIPAA; P.L. 104-191) and is responsible for

activities that fight health care fraud and waste.23 HCFAC is funded using both mandatory and discretionary funds and consists of three programs: (1) the HCFAC program, which finances the investigative and enforcement activities undertaken by the Department of Health and Human Services (HHS), the HHS Office of Office of Inspector General, the Department of Justice, and the Federal Bureau of Investigation, (2) Medicaid Oversight, and (3) MIP.

HistoricallyMedicare Integrity Program

(MIP).

Historical y, MIP has focused on combating fee-for-service fraud in Medicare Parts A and B. However, increases in private Medicare enrollment—Parts C and D—have expanded program

integrity efforts into capitated payment systems as well.

wel .

While HCFAC is not a part of the Medicare program, MIP is authorized by the same title of the Social Security Act as Medicare and focuses entirely on the program. As a result, this portion of

HCFAC is treated as a part of Medicare benefit payments under a sequestration order and is

subject to the Medicare mandatory sequestration percentage limits.22

24 Administrative Spending

The administration of Medicare is funded through a combination of discretionary and mandatory resources that are subject to reductions under a discretionary or mandatory sequestration order, respectively. Discretionary administration funding includes amounts for payments to contractors to process providers'’ claims, beneficiary outreach and education, and maintenance of Medicare's ’s

information technology infrastructure. Mandatory administration funding includes amounts for quality improvement organizations and Part B premium payments for Qualifying Individuals

(QI).23

25 Medicare Sequestration Rules

Special rules limit the total effect of budget sequestration on Medicare (seesee Table 1). Most

notably, BBEDCA, as amended by the BCA, prohibits Medicare benefit payments from being reduced by more than 2% under a BCA mandatory sequestration order. Similarly, Statutory A fee schedule is a listing of fees used by Medicare to pay doctors or other providers/suppliers. Fee schedules are used to pay for physician services; ambulance services; clinical laboratory services; and durable medical equip ment, prosthetics, orthotics, and supplies in certain locations. 23 For additional information, see U.S. Department of Health and Human Services, Office of Inspector General, Health Care Fraud and Abuse Control Program Report, at https://oig.hhs.gov/reports-and-publications/hcfac/index.asp.

24 For sequestration purposes, BBEDCA defines Medicare benefit payments as all payments for programs and activities under T itle XVIII of Social Security Act. T his includes the Medicare Integrity Program (MIP). See BBEDCA §256(d).

25 T he Qualifying Individuals (QI) program is a state program that helps pay Part B premiums for people who have Part A and limited income and resources. See CMS, “ Medicare Savings Programs,” at https://www.medicare.gov/your-medicare-costs/help-paying-costs/medicare-savings-program/medicare-savings-programs.html.

Congressional Research Service

7

link to page 14 link to page 8 Medicare and Budget Sequestration

reduced by more than 2% under a BCA mandatory sequestration order. Similarly, Statutory PAYGO prohibits Medicare benefit payments from being reduced by more than 4% under a Statutory PAYGO sequestration order.24 The cap does26 The caps do not apply to Medicare mandatory and discretionary administrative spending, which is subject to the unrestricted percentage reduction

under both BCA and Statutory PAYGO sequestration orders.

Under the current mandatory sequestration order triggered by the BCA, the Medicare sequestration percentage is capped at 2%.2527 Therefore, as OMB determines the percentage reductions for each budget category through FY2029FY2030, Medicare benefit payments cannot be reduced by more than 2%; as such, another budget category may be subject to a higher percentage

reduction in order to achieve the necessary amount of savings.

More specifically

More specifical y, if OMB determines that total nonexempt, nondefense mandatory funds need to be reduced by a percentage larger than 2% in order to achieve necessary savings under a BCA

sequestration order for a given year, then a 2% reduction would be made to Medicare benefit spending, and the uniform reduction percentage for the remaining non-Medicare benefit, nonexempt, nondefense mandatory programs would be recalculated and increased by an amount to achieve the necessary level of reductions. If the uniform percentage reduction needed to achieve the total amount of savings is less than 2%, then the determined percentage would be

applied to Medicare as well wel as to all al other nonexempt non-Medicare nondefense mandatory spending. Of note, if a mandatory sequestration order were triggered by Statutory PAYGO, the process would be the same, but the reduction of payments for Medicare benefits would be capped

at 4%.26

28

In addition to these percentage caps, BBEDCA also prohibits Statutory PAYGO and BCA mandatory sequestration effects from being included in the determination of annual adjustments to Medicare payment rates established under Title XVIII of the Social Security Act.2729 (See "

“Reductions in Benefit Spending".)

Finally”.)

Final y, certain Medicare programs and activities are explicitly exempted from Statutory PAYGO and BCA sequestration orders. SpecificallySpecifical y, Part D low-income subsidies,2830 Part D catastrophic subsidies (reinsurance),2931 and QI premiums cannot be reduced under a mandatory sequestration order.30

Medicare Sequester Execution

Timing

order.32 26 Medicare benefit payments are considered mandatory budgetary resources and would not be subject to a BCA discretionary sequestration order. 27 See BBEDCA §251A(6). In addition, t he CARES Act (P.L. 116-136) specifies that the non-administrative Medicare sequester percentage cap will be 4% during the first six months of the FY2030 sequestration order (i.e., April through September 2030) and 0% for the last six months of the order (i.e., October 2030 through March 2031), so the full budgetary effects will occur within FY2030. See BBEDCA §251A(6)(C) and table note a in Table 1. 28 See BBEDCA §256(d)(2). 29 See BBEDCA §256(d)(6). 30 Medicare Part D provides subsidies to assist low-income beneficiaries with premiums and cost sharing. For more information on Medicare Part D, see CRS Report R40611, Medicare Part D Prescription Drug Benefit. 31 Part D pays nearly all drug costs above a catastrophic threshold, except for nominal beneficiary cost sharing. Medicare subsidizes 80% of each plan’s costs for this catastrophic coverage. For more information on Medicare Part D, see CRS Report R40611, Medicare Part D Prescription Drug Benefit. 32 See BBEDCA §256(d)(7). Congressional Research Service 8 Medicare and Budget Sequestration Medicare Sequester Execution Timing Once a sequester is triggered, OMB issues a sequestration order for, at most, one fiscal year, and subsequent orders are reissued for each fiscal year, as necessary. These orders can be issued either before or during the fiscal year in which they apply, depending on the trigger.

Reductions in budget resources are to be made during the effective period of a sequestration order; however special rules differentiate when a sequestration order is implemented for benefit payments. As a result, sequestration orders are applied to Medicare benefit payments on a

different timeline than other mandatory and discretionary Medicare funds (i.e., Medicare

administration and HCFAC).

Once OMB issues a sequestration order, Medicare benefit payments are sequestered beginning on the first date of the following month and remain in effect for all al services furnished during the following one-year period.3133 In the event that a subsequent sequester order is issued prior to the completion of the first order, the subsequent order begins on the first day after the initial order has been completed.

As an example, the first BCA mandatory sequester order (FY2013) was issued on March 1, 2013, and took effect April 1, 2013. It remained in effect through March 31, 2014.

The FY2014 order was issued on April 10, 2013, (corrected on May 20, 2013) and was in effect

from April 1, 2014, to March 31, 2015.32

All 34

Al other sequestrable funding is reduced only during the fiscal year associated with the sequester report. Using the same example, the first BCA mandatory sequester order (FY2013) reduced appropriate administrative spending from March 1, 2013, to September 30, 2013. The second

order for FY2014 sequestered funds from October 1, 2013, to September 30, 2014.

While OMB uses current law to determine the amount of funds available to be sequestered and corresponding percentage reductions, actual Medicare outlays will wil not be known until after the end of the fiscal year. Since sequestration orders are issued either before or during the fiscal year in which they are applicable, OMB estimates the total sequestrable budget authority for Medicare,

and other accounts with indefinite budget authority, in order to determine necessary sequestration percentages.33

percentages.35

If Medicare outlays exceed the estimated amount included in a sequestration order for that fiscal

year, the additional outlays are sequestered at the established percentage for that fiscal year. If Medicare outlays are determined to be less than the estimated amount, no adjustments are made to the sequestration order. In other words, OMB does not adjust sequestration percentages for any category of budget authority once actuals are realized for accounts with indefinite budget authority. Similarly, OMB does not adjust future orders to account for any previous discrepancies

between estimates and actuals.

33 See BBEDCA §256(d)(1). 34 Under current law, the sequestration of Medicare benefits under the BCA is effectively scheduled to continue through September 30, 2030, due to special rules that cap the Medicare sequester percentage at 0% during the last six months of the FY2030 order. Without this rule, Medicare benefit payments would be reduced for an additional six months, through March 31, 2031 (i.e., reduced by 2% from April 1, 2030, through March 31, 2031, rather than 4% from April through September 2030 and 0% from October 2030 through March 2031). See BBEDCA §251A(6)(C).

35 GAO, 2014 Sequestration Opportunities Exist to Improve Transparency o f Progress Toward Deficit Reduction Goals, GAO-16-263, April 2016, p. 27, at https://www.gao.gov/assets/680/676565.pdf.

Congressional Research Service

9

Medicare and Budget Sequestration

Reductions in Benefit Spending

Reductions in Benefit Spending

Parts A and B

Under Medicare Parts A and B, participating providers, such as hospitals and physicians, are paid by the federal government on a fee-for-service basis for services provided to a beneficiary.

According to guidance issued by the Centers for Medicare & Medicaid Services (CMS), any sequestration reductions are to be made to claims after determining coinsurance, deductibles, and any applicable Medicare Secondary Payment adjustments.3436 Therefore, sequestration applies only to the portion of the payment paid to providers by Medicare; the beneficiary cost-sharing amounts

and amounts paid by other insurance are not reduced.

As an example, if the total allowedal owed payment for a particular service is $100 and the beneficiary has a 20% co-insurance, the beneficiary would be responsible for paying the provider the full $20 in co-insurance. The remaining 80% that is paid by Medicare would be reduced by 2% under the

FY2018 sequestration order, or $1.60 in this example, resulting in a total Medicare payment of $78.40. In total, the provider would receive a payment of $98.40. This reduced payment is considered payment in full and the Medicare beneficiary is not expected to pay higher

copayments to make up for the reduced Medicare payment.35

37

Part A inpatient services are considered to be furnished on the date of the individual'’s discharge from the inpatient facility. For services paid on a reasonable cost basis,3638 the reduction is to be applied to payments for such services incurred at any time during the sequestration period for the portion of the cost reporting period that occurs during the effective period of the order. For Part B

services provided under assignment,3739 the reduced payment is to be considered payment in full and the Medicare beneficiary will wil not pay higher copayments to make up for the reduced amount.38

amount.40

Medicare non-participating providers, which are providers that do not elect to accept Medicare payments on all claims in a given year, are not subject to the same rules. Medicare non-participating providers receive a lower reimbursement rate from Medicare on all al services provided and may charge beneficiaries a limited amount more (balance bill bil charge) than the fee schedule amount on non-assigned claims.3941 In these instances, instead of the Medicare check

being sent to the provider, a check that incorporates the 2% reduction is mailed to the patient. The

36 CMS, Medicare FFS Provider e-News, March 8, 2013, Monthly Payment Reductions in the Medicare Fee-for-Service (FFS) Program – “Sequestration,” at https://www.cms.gov/Outreach-and-Education/Outreach/FFSProvPartProg/Downloads/2013-03-08-standalone.pdf. 37 Ibid. 38 Most providers are paid under a prospective payment system or fee schedule. Some types of providers, such as Critical Access Hospitals, are paid on a reasonable cost basis under which payments are based on actual costs incurred. Reasonable cost is defined at Social Security Act §1861(v).

39 Assignment is an agreement by a doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and no t to bill the beneficiary for any more than the Medicare deductible and coinsurance (if applicable). Providers that don't accept assignment may charge more than the Medicare -approved amount. 40 See CMS, Medicare FFS Provider e-News, March 8, 2013, Monthly Payment Reductions in the Medicare Fee-for-Service (FFS) Program – “Sequestration,” at https://www.cms.gov/Outreach-and-Education/Outreach/FFSProvPartProg/Downloads/2013-03-08-standalone.pdf.

41 CMS, Medicare Provider Utilization and Payment Data: Physician and Other Supplier PUF: Frequently Asked Questions, updated May 23, 2019, p. 4, at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-T rends-and-Reports/Medicare-Provider-Charge-Data/Downloads/Physician_FAQ.pdf.

Congressional Research Service

10

Medicare and Budget Sequestration

being sent to the provider, a check that incorporates the 2% reduction is mailed to the patient. The patient must then pay the provider an amount that incorporates the sequestered amount. More specificallyspecifical y, as payment, the beneficiary is responsible for paying the provider the amount listed on the check, any cost sharing, balance bill bil charges, and the sequestered amounts taken out of the

provider check.40

42

Annual adjustments to Medicare payment rates are determined without incorporating sequestration.4143 However, the Medicare Payment Advisory Commission does incorporate the effects of sequestration when assessing the adequacy of provider payments.4244 The commission uses these annual assessments to develop payment adjustment recommendations to the HHS

Secretary and/or Congress.

Part C

During the temporary suspension of sequestration of Medicare under the CARES Act, fee-for-service provider payments wil not be subject to the 2% reduction in Medicare payments.45 The

suspension is effective for claims with dates of service from May 1, 2020, through December 31,

2020.

Part C (Medicare Advantage)

Under Medicare Advantage, private health plans are paid a per person monthly amount to provide all al Medicare-covered benefits, except hospice, to beneficiaries who enroll in their plan. These

capitated monthly payments are made to MA plans regardless of how many or how few services beneficiaries actuallyactual y use. The plan is at risk if costs for all al of its enrollees exceed program payments and beneficiary cost sharing; conversely, the plan can generallygeneral y retain savings if

aggregate enrollee costs are less than program payments and cost sharing.

With respect to sequestration, reductions are uniformly made to the monthly capitated payments to the private plans administering Medicare Advantage (Medicare Advantage Organizations or MAOs). These fixed payments are determined every year with CMS approval through an annual "

“bid process"” and the amounts can vary depending on the private plan.43

46

In general, CMS payments to MAOs are generallygeneral y comprised of amounts to cover medical costs, administrative expenses, private plan profits, risk adjustments, and plan rebates to beneficiaries.44 47 MAOs have discretion to distribute any sequestration cut across these different components but must still

must stil adhere to their legal obligations.45

48 Due to the temporary suspension of sequestration from May through December of 2020, the 2% payment reduction that would have otherwise 42 CMS, Medicare FFS Provider e-News, March 8, 2013, Monthly Payment Reductions in the Medicare Fee-for-Service (FFS) Program – “Sequestration,” at https://www.cms.gov/Outreach-and-Education/Outreach/FFSProvPartProg/Downloads/2013-03-08-standalone.pdf.

43 BBEDCA §256(d)(6). 44 Medicare Payment Advisory Commission (MedPAC), Medicare Payment Policy Report to Congress, March 2018, p. 60, at http://www.medpac.gov/docs/default -source/reports/mar18_medpac_entirereport_sec_rev_0518.pdf?sfvrsn=0.

45 See April 10, 2020, CMS MLNConnects Newsletter, “ COVID-19: Infection Control, Maximizing Workforce, Updated Q&A, CS Modifier for Cost -Sharing, Payment Adjustment Suspended,” at https://www.cms.gov/outreach-and-educationoutreachffsprovpartprogprovider-partnership-email-archive/2020-04-10-mlnc-se.

46 For more information on the annual bid process, see CRS Report R45494, Medicare Advantage (MA)–Proposed Benchm ark Update and Other Adjustm ents for CY2020: In Brief. 47 A plan rebate is the difference between a plan’s bid and a statutorily specified benchmark amount. It is included in the plan payment and must be returned to enrollees in the form of additional benefits, reduced cost sharing, reduced Medicare Part B or Part D premiums, or some combination of these options.

48 See May 1, 2013, memorandum from Cheri Rice and Danielle Moon, CMS, Additional Information Regarding the Mandatory Paym ent Reductions in the Medicare Advantage, Part D, and Other Program s, at https://www.cms.gov/Medicare/Medicare-Advantage/Plan-Payment/Downloads/PaymentReductions.pdf.

Congressional Research Service

11

Medicare and Budget Sequestration

applied to MAOs wil not be applied during the suspension period. CMS has indicated that the 2% wil also not apply to any future retroactive adjustments made to payments for beneficiaries enrolled within the sequestration suspension period.49 (CMS wil continue to apply sequestration to payments for, and any retroactive adjustments made to payments for, beneficiaries enrolled

outside of the sequestration suspension period.)

Some MAOs have attempted to pass the reduction in their capitation rates onto providers through lower reimbursement rates; however MAOs may be limited in their ability to do so.4650 CMS provided instructions regarding the treatment of contract and non-contract providers that provide

services under Part C. Specifically, "Specifical y, “whether and how sequestration might affect an MAO's ’s payments to its contracted providers are governed by the terms of the contract between the MAO and the provider."47”51 Therefore, in order for MAOs to reduce provider payments by the sequestered amount, specific language within a contract must allowal ow the reduction or the contract would need to be renegotiated.

Similarly, during the May through December 2020 CARES Act suspension of sequestration, the decision to suspend the application of the 2% reduction to

provider payments may depend on the reimbursement language in MAO-provider contracts.52

In certain instances, such as when beneficiaries receive emergency out-of-network care, MAOs

need to reimburse the non-contracted providers; in such cases, the MAOs are required to pay at least the rate providers would have received if the beneficiaries had been enrolled in original Medicare. However, MAOs have the discretion of whether or not to incorporate sequestration cuts into payments to non-contracted providers for those services.4853 Non-contracted providers

must accept any payments reduced by the sequestration percentage as payment in full.

In addition, regulations in the annual bid process restrict MAO'’s potential responses to sequestration. SpecificallySpecifical y, MAOs are limited to "reasonable" to “reasonable” revenue margins and a set Medicare/non-Medicare profit margin discrepancy, among other requirements.4954 Furthermore,

MAOs are restricted from allowingal owing sequestration to impact a beneficiary'’s plan benefits or liabilities,50 55 so it becomes difficult for MAOs to pass an entire sequestration cut onto beneficiaries

through higher premiums or seek to offset lost revenue by increasing non-Medicare profits.

49 See April 22, 2020, memorandum from Jennifer R. Shapiro, CMS, Medicare Advantage/Prescription Drug System (MARx) May 2020 Paym ent Inform ation, at https://www.hhs.gov/guidance/sites/default/files/hhs-guidance-documents/marx%20plan%20payment%20letter_may%204.22.2020_7.pdf .

50 As a result of the initial BCA sequester, some Medicare Advantage Organizations (MAOs) attempted to reduce provider payments by 2%. T he courts ultimately determined that MAOs were subject to the terms in the contracts with providers. See Baptist Hosp. of Miami, Inc. v. Humana Health Ins. Co. of Florida, Inc. and Butler Healthcare Providers et al. v. Highmark Inc. et al. 51 May 1, 2013, memorandum from Cheri Rice and Danielle Moon, CMS, Additional Information Regarding the Mandatory Paym ent Reductions in the Medicare Advantage, Part D, and Other Program s, at https://www.cms.gov/Medicare/Medicare-Advantage/Plan-Payment/Downloads/PaymentReductions.pdf.

52 T wo of the nation’s largest commercial insurers, Aetna and UnitedHealthcare, have indicated that they are temporarily eliminating the 2% sequestration cuts in payments to providers in their Medicare Advantage plans during the suspension period. For both companies, the suspension applies to payments made for dates of service between May 1 and December 31, 2020. Additional detail may be found at https://www.uhcprovider.com/en/resource-library/news/Novel-Coronavirus-COVID-19/covid19-practice-administration/covid19-practice-administration-cares-act.html and https://www.aetna.com/health-care-professionals/covid-faq/billing-and-coding.html.

53 May 1, 2013, memorandum from Cheri Rice and Danielle Moon, CMS, Additional Information Regarding the Mandatory Paym ent Reductions in the Medicare Advantage, Part D, and Other Program s.

54 See CMS, Actuarial Bid Training – 2021, at https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/BidT raining2020 and 42 C.F.R. Part 422, Subpart X. 55 See CMS, User Group Call 05/07/2015, May 7, 2015, at https://www.cms.gov/Medicare/Health-Plans/

Congressional Research Service

12

Medicare and Budget Sequestration

As HHS computes annual adjustments to Medicare payment rates, the Secretary cannot take into account any reductions in payment amounts under sequestration for the Part C growth percentage.5156 In other words, plan payment updates are to be determined as if the reductions under sequestration have not taken place. This results in larger annual adjustments compared to

baselines that incorporate sequestration cuts.

Part D

Under Medicare Part D, each plan receives a base capitated monthly payment, calledcal ed a direct subsidy, which is adjusted to incorporate three risk-sharing mechanisms (low-income subsidies, individual individual reinsurance, and risk corridor payments). While each plan receives the same direct subsidy amount for each enrollee regardless of how many benefits an enrollee actuallyactual y uses, plans receive different risk-sharing adjustments in their monthly payments. With respect to

sequestration, the 2% reductions are made only to the direct subsidy amounts. Part D risk-sharing

adjustments are exempt from sequestration and are therefore not reduced.52

57

During the May through December 2020 CARES Act sequestration suspension period, the 2% payment reductions to Part D plans wil not occur. Payment adjustments during the suspension period for Part D plans wil be applied similarly to payments to MAOs under Medicare Advantage.58 Similarly to provider payments made by MAOs, whether and how sequestration, and its temporary suspension, affects a Part D plan sponsor’s payment to its contracted providers is “governed by the payment terms of the contract between the plan sponsor and its network

pharmacy providers.”59

Part D also contains a Retiree Drug Subsidy Program, which pays subsidies to qualified

employers and union groups that provide prescription drug insurance to Medicare-eligible, retired workers. Instead of a capitated monthly payment, each sponsor receives a federal subsidy at the end of the year to cover a portion of gross prescription drug costs for each retiree during that year.

Under this program, sequestration reductions are applied to the annual subsidy amount.53

60

Similar to Part C, the HHS Secretary is prohibited from taking into account any reductions in

payment amounts under sequestration for purposes of computing the Part D annual growth rate.54

61 Health Care Fraud and Abuse Control Program

As noted, the HCFAC program is not part of Medicare but does receive mandatory and

discretionary funds to ensure the programmatic integrity of the Medicare program. Under a BCA sequestration order of mandatory funds, MIP funds are treated as a part of Medicare benefit

MedicareAdvtgSpecRateStats/Downloads/ActuarialBidQuestions2016.pdf. 56 BBEDCA §256(d)(6)(A). T he Secretary uses an estimate of the growth in overall spending in Medicare when calculating updated payments to MA plans. See CRS Report R45494, Medicare Advantage (MA)–Proposed Benchmark Update and Other Adjustm ents for CY2020: In Brief.

57 T his is different from Medicare Part C risk-sharing adjustments, which are included in the capitated payments and are subject to sequestration. 58 See April 22, 2020, memorandum from Jennifer R. Shapiro, CMS, Medicare Advantage/Prescription Drug System (MARx) May 2020 Paym ent Inform ation, at https://www.hhs.gov/guidance/sites/default/files/hhs-guidance-documents/marx%20plan%20payment%20letter_may%204.22.2020_7.pdf .

59 May 1, 2013, memorandum from Cheri Rice and Danielle Moon, CMS, Additional Information Regarding the Mandatory Paym ent Reductions in the Medicare Advantage, Part D, and Other Program s.

60 CMS, “Mandatory Payment Reduction in CMS’ Retiree Drug Subsidy Reconciliation Payments,” April 19, 2014, at https://www.rds.cms.hhs.gov/sites/default/files/webfiles/documents/mandatorypaymentreduction.pdf. 61 BBEDCA §256(d)(6)(B).

Congressional Research Service

13

link to page 18 Medicare and Budget Sequestration

sequestration order of mandatory funds, MIP funds are treated as a part of Medicare benefit payments and are therefore subject to the Medicare 2% sequester limit. HCFAC mandatory funding that does not exclusively address Medicare is reduced by the nondefense mandatory

sequester rate (5.97% in 20202021), when applicable.

Administrative Expenses

Under either a mandatory or discretionary sequestration order, administrative spending within

nonexempt Medicare and HCFAC programs is reduced by the nondefense rate determined by OMB (5.9% in 2020).

Medicare and the BCA Mandatory Sequester

Since the first BCA mandatory sequester order issued in FY2013

OMB.

Medicare and the BCA Mandatory Sequester With the exception of the CARES Act May through December 2020 suspension, Medicare benefit payments have been subject to the 2% annual reduction limit established by the BCA since the first BCA mandatory sequester order was issued in FY2013. Nondefense mandatory budget

authority reductions, which have applied to mandatory Medicare administrative spending, have

fluctuated between 5.1% and 7.3% from FY2013 through FY2020. (SeeFY2021. (See Table 2.)

Table 2.)

Table 2. Mandatory Percentage Reductions Under Budget Control Act Sequestration Orders

(FY2013–FY2020)

|

FY2013 |

FY2014 |

FY2015 |

FY2016 |

FY2017 |

FY2018 |

FY2019 |

FY2020 |

|

|

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

|

Nondefense Mandatory (Medicare administrative spending and non-MIP HCFAC) |

5.1% |

7.2% |

7.3% |

6.8% |

6.9% |

6.6% |

6.2% |

5.9% |

|

Defense Mandatory |

7.9% |

9.8% |

9.5% |

9.3% |

9.1% |

8.9% |

8.7% |

8.6% |

Source: OMB Reports to Congress on the Joint Committee Sequestration for FY2013 to FY2020.

Notes: Defense Mandatory Table 2. Mandatory Percentage Reductions Under Budget Control Act

Sequestration Orders

(FY2013–FY2021)

FY2013 FY2014 FY2015 FY2016 FY2017

FY2018 FY2019 FY2020

FY2021

Medicare (Benefit Payments and MIP

2.0%

2.0%

2.0%

2.0%

2.0%

2.0%

2.0%

2.0%

2.0%

HCFAC)

Nondefense Mandatory (Medicare administrative spending

5.1%

7.2%

7.3%

6.8%

6.9%

6.6%

6.2%

5.9%

5.7%

and non-MIP HCFAC)

Defense Mandatory

7.9%

9.8%

9.5%

9.3%

9.1%

8.9%

8.7%

8.6%

8.3%

Source: OMB Reports to Congress on the Joint Committee Sequestration for FY2013 to FY2021. Notes: Defense Mandatory is any funding coded with a budget function of 050. Medicare Benefit Payments are defined by BBEDCA as all al payments for programs and activities under Title XVIII of Social Security Act. The Health Care Fraud and Abuse Control Program (HCFAC) is responsible for activities that fight health care fraud and waste. Nondefense Nondefense Mandatory includes all al other government spending not defined as Medicare or Defense Mandatory. MIP refers to the Medicare Integrity Program, which is under HCFAC and focuses on combating fraud in Medicare.

In the FY2020FY2021 sequestration order, mandatory Medicare administrative expenses will wil be sequestered by the nondefense mandatory percentage, 5.97% in FY2020FY2021. The total reduction in Medicare administration budget authority, however, cannot be identified from the data presented

in the OMB sequestration report.55

62

In total, Medicare benefit payments (not including administration) are estimated to account for 9190% of all al Medicare and non-Medicare resources available to be sequestered (sequestrable 62 CMS receives administrative funding for the Medicare program through the Medicare trust funds and the CMS program management account. Since the OMB Report to the Congress on the Joint Com m ittee Reductions for Fiscal Year 2021 shows the amount of mandatory administrative funding sequestered at the account level, and CMS funds other programs through the program management account, the total amount of mandatory administrative funding for the Medicare program cannot be determined from the source.

Congressional Research Service

14

link to page 20 link to page 20 Medicare and Budget Sequestration

budget authority) under the FY2021 BCA budget authority) under the FY2020 BCA mandatory sequester.5663 Of the funds that are sequestered, Medicare benefit payments are estimated to account for 74% of the combined

mandatory defense and nondefense sequestered funds.57

Traditionally64

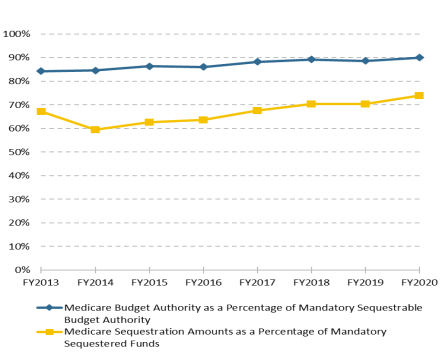

Traditional y, Medicare benefit payments comprise the largest single source of sequestered funds in a given mandatory sequestration order. In FY2020FY2021, Medicare benefit payments are estimated to account for the largest share of sequestrable budget authority and sequestered funds since the first BCA BCA sequestration order was issued for FY2013, as shown in Figure 1.58

in Figure 1.65 (For FY2020, this figure provides percentages based on the FY2020 sequestration order and does not reflect the

CARES Act May through December 2020 suspension of sequestration. CBO estimates that this suspension wil increase Medicare outlays by $4 bil ion in each of FY2020 and FY2021—for a

total increase of $8 bil ion.)66

63 For a list of sequestrable budget authority by budget account, see OMB Report to the Congress on the Joint Com m ittee Reductions for Fiscal Year 2021 , February 10, 2020.

64 Ibid. 65 Since the mandatory BCA sequester went into effect, the total amount of Medicare benefit payments in a fiscal year has generally increased at a fast er rate than other mandatory spending in the corresponding fiscal year. If current trends continue, Medicare benefit payments can be expected to continue to account for larger shares of total sequestered funds through the end of the BCA mandatory sequester in FY20 30. In Figure 1, Medicare benefit payments constituted a higher percentage of all sequestered funds in FY2013 because the American T axpayer Relief Act of 2012 ( P.L. 112-240) reduced the total amount of sequestered funds in FY2013 relative to all other fiscal years under the BCA mandatory sequester.

66 Congressional Budget Office (CBO), Preliminary Estimate of the Effects of H.R. 748, the CARES Act, P.L. 116-136, Revised, April 27, 2020, at https://www.cbo.gov/system/files/2020-04/hr748.pdf. Because the timing of the application of the sequester to Medicare benefit payments is tied to the date of the initial sequestration order (i.e., from April 1 to March 30), the actual sequestration reductions associated with a sequestration order straddle two different fiscal years. CBO therefore projected that the Medicare sequestration suspension would increase direct spending in both FY2020 and FY2021. In addition to the temporary suspension, §3709 of the CARES Act also amends the BCA ( P.L. 112-25) to extend by one year (through FY2030) the sequestration of all nonexempt mandatory spending. CBO scored the net impact of §3709 as decreasing direct spending (outlays) by $19 billion over the 10 -year, FY2020-FY2030, projection period.

Congressional Research Service

15

link to page 21

Medicare and Budget Sequestration

Figure 1. Medicare Benefit Payment Amounts as a Percentage of Budget Control Act

(FY2013-FY2020) |

|

Mandatory Sequester Amounts

(FY2013-FY2021)

Source: CRS analysis of OMB Reports to the Congress

|

This figure does not reflect the CARES Act temporary suspension of sequestration from May through December 2020, in effect during the period of the FY2020 sequestration order.

Figure 2 shows how the FY2020FY2021 BCA sequestration order is estimated to apply to the various parts of Medicare. It is worth noting that although Medicare Part C is sequestered, OMB sequestration orders delineate at the trust fund level and do not distinguish each Medicare part. Part C is funded out of both the Part A and Part B trust funds and is included in these totals. For

reference, in FY2018FY2019, Medicare Advantage accounted for 30% of all al HI Trust Fund benefit payments and 29% of all al SMI Trust Fund benefit payments.5967 These ratios could change in FY2020

FY2021 based on actual spending.

CBO estimates that Medicare benefit payment outlays will increase 95% from FY2019 to FY2029 (from $761 billion to $1,483 billionwil more than double from FY2020 to

FY2030 (from $826 bil ion to $1,712bil ion), the last year of BCA mandatory sequestration.60 68 Most of this expected increase is due to an aging population and rising health care costs per person.61

person.69 Most of this increase would be subject to sequestration.

For more information on the Budget Control Act, see CRS Report R41965, The Budget Control Act of 2011, and CRS Report R42506, The Budget Control Act of 2011 as Amended: Budgetary Effects.

Appendix A.

Effects.

68 Congressional Budget Office, March 2020 Medicare Baseline, at https://www.cbo.gov/system/files/2020-03/51302-2020-03-medicare.pdf. 69 Congressional Budget Office, The 2020 Long-Term Budget Outlook, September 2020, at https://www.cbo.gov/system/files/2020-09/56516-LTBO.pdf.

Congressional Research Service

17

Medicare and Budget Sequestration

Appendix A. Additional CRS Resources Additional CRS Resources

To gain a deeper understanding of the topics covered in this report, readers may also wish to consult the following CRS reports:

CRS Report R40425, Medicare Primer

CRS Report R43122, Medicare Financial Status: In Brief

CRS Report R45494, Medicare Advantage (MA)–Proposed Benchmark Update and Other Adjustments for CY2020: In Brief

CRS Report R40611, Medicare Part D Prescription Drug Benefit

CRS Report 98-721, Introduction to the Federal Budget Process

CRS Report R41965, The Budget Control Act of 2011

CRS Report R42506, The Budget Control Act of 2011 as Amended: Budgetary Effects

CRS Report RL34424, The Budget Control Act and Trends in Discretionary Spending

CRS Insight IN11148, The Bipartisan Budget Act of 2019: Changes to the BCA and Debt Limit

CRS Report R42050, Budget "Sequestration"“Sequestration” and Selected Program Exemptions and Special

Rules

CRS Report R42972, Sequestration as a Budget Enforcement Process: Frequently Asked Questions

CRS Report R45941, The Annual Sequester of Mandatory Spending through FY2029

CRS In Focus IF11332, FY2020 Mandatory Sequester Reduces Medicare $15.3 Billion, Other Mandatory Spending $5.39 Billion

CRS Report R41157, The Statutory Pay-As-You-Go Act of 2010: Summary and Legislative History

CRS Report R41510, Budget Enforcement Procedures: House Pay-As-You-Go (PAYGO) Rule

Appendix B.

CRS Report R41157, The Statutory Pay-As-You-Go Act of 2010: Summary and Legislative

History

Congressional Research Service

18

Medicare and Budget Sequestration

Appendix B. Budget Terminology Definitions Budget Terminology Definitions

As defined by Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA; P.L. 99-177

177, as amended) and simplified where appropriate:

Budget Authority—Authority provided by federal law to enter into financial obligations that will wil

result in immediate or future outlays involving federal government funds.

Budgetary Resources—An amountAmounts available to enter into new obligations and to liquidate them.

Budgetary resources are made up of new budget authority (including direct spending authority provided in existing statute and obligation limitations) and unobligated balances of budget

authority provided in previous years.

Discretionary Appropriations—Budgetary resources (except to fund direct-spending programs) provided in appropriation Acts.

Mandatory Spending—Also known as direct spending, refers to budget authority that is provided in laws other than appropriation acts, entitlement authority, and the Supplemental

Nutrition Assistance Program.

Medicare Benefit Payments—All Al payments for programs and activities under Title XVIII of the

Social Security Act.

Revised Nonsecurity Category—Discretionary appropriations other than in budget function 050, often referred to as nondefense category.

Revised Security Category—Discretionary appropriations in budget function 050, often referred to as defense category.

Sequestration—The cancellationcancel ation of budgetary resources provided by discretionary

appropriations or direct spending laws.

For definitions of other budget terms mentioned in this report but not defined by BBEDCA, see U.S. Government Accountability Office, A Glossary of Terms Used in the Federal Budget

Process, GAO-05-734SP, September 1, 2005, at https://www.gao.gov/assets/80/76911.pdf.

Author Contact Information

Acknowledgments

This report was originally written by Ryan Rosso, Analyst in Health Care Financing.

Footnotes

| 1. |

Under the Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA; also known as the Gramm-Rudman-Hollings Act; P.L. 99-177) §250(c)(2), sequestration is defined as "the cancellation of budgetary resources provided by discretionary appropriations or direct spending law." Budgetary resources are subject to sequestration unless exempted by law. See Office of Management and Budget (OMB), OMB Circular A-11 (2019), Section 100, at https://www.whitehouse.gov/wp-content/uploads/2018/06/s100.pdf. |

| 2. |

U.S. Congress, Senate Committee on Finance, Budget Enforcement Mechanisms, Oral and Written Testimony of the Honorable Phil Gramm, 112th Cong., 1st sess., May 4, 2011. |

| 3. |

For more information on Medicare, see CRS Report R40425, Medicare Primer. |

| 4. |

Sequestration does not apply to every account, since many budget accounts are either exempted from sequestration or governed by special rules under sequestration, the latter of which can vary depending on the sequestration trigger. See BBEDCA §255 and §256, as amended. Since OMB is responsible for the execution and legal interpretations of sequestration orders, some accounts not listed in these sections may also be exempt from sequestration. For a complete list of exempted accounts, see CRS Report R42050, Budget "Sequestration" and Selected Program Exemptions and Special Rules. |

| 5. |

See CRS Report R42972, Sequestration as a Budget Enforcement Process: Frequently Asked Questions, and CRS Report 98-721, Introduction to the Federal Budget Process. |

| 6. |

"In some circumstances current law allows for budget authority sequestered in one fiscal year to become available to the agencies again in a subsequent fiscal year. OMB refers to these amounts as 'pop ups.'" See U.S. Government Accountability Office (GAO), 2014 Sequestration Opportunities Exist to Improve Transparency of Progress Toward Deficit Reduction Goals, GAO-16-263, April 2016, p. 20, at https://www.gao.gov/assets/680/676565.pdf. |

| 7. |

Some mandatory entitlements are provided through the annual appropriations process and are considered appropriated entitlements (e.g., Medicaid). Although these entitlements are appropriated, the federal government is legally obligated to make payments to those deemed eligible for the entitlement. (Medicaid is explicitly exempt from sequestration.) |

| 8. |

Indefinite budget authority is federal spending that, at the time of enactment, is for an unspecified amount that will be determined at a later date. See GAO, A Glossary of Terms Used in the Federal Budget Process, GAO-05-734SP, September 1, 2005, p. 23, at https://www.gao.gov/assets/80/76911.pdf. |

| 9. |