Oil Market Effects from U.S. Economic Sanctions: Iran, Russia, Venezuela

Economic sanctions imposed by the United States—through enacted legislation and executive action—on Iran, Russia, and Venezuela aim to pressure the ruling governments to change their behavior and policies. Currently, these sanctions aim to either eliminate (Iran) or restrict (Venezuela) crude oil trade of as much as 3.3 million to 4.0 million barrels per day (bpd), roughly 3%-4% of global petroleum supply. Estimated oil production volumes affected to date have been approximately 1.7 million bpd from Iran. Venezuela oil production has also likely been affected, although accurately quantifying volumes is difficult due to monthly oil production declines over a period of years prior to U.S. sanctions affecting oil trade in January 2019. Sanctions imposed on Russia’s oil sector generally target longer-term oil production and to date have not reduced Russian oil supply or trade. Oil production in Russia has increased since oil-sector sanctions began in 2014, although the country has arguably incurred economic costs in order to incentivize and support oil output levels.

Sanctions targeting Iran’s oil sector date back to the 1980s and affect virtually every element of Iran’s oil sector (e.g., investment, shipping, insurance, and exports). Legislation enacted in 2011 (P.L. 112-81) and 2013 (P.L. 112-239), along with subsequent executive orders (E.O.s), created a sanctions framework designed to discourage oil importers—by sanctioning banks that transact with Iran or facilitate oil transactions, as well as entities that buy Iranian oil—from purchasing crude oil and other petroleum and petrochemical products from Iran. Iran oil export sanctions include design elements (e.g., significant reduction exceptions, requirements to certify oil markets are adequately supplied, and coordination with oil-producing countries) intended to minimize oil price escalation that could result from sanctions-related oil supply reductions. Iran oil export sanctions have been applied, waived, and reapplied since 2011. As of November 2019, the Trump Administration’s stated goal has been to reduce Iran’s oil exports to zero. Trade data indicate that observed Iranian crude oil exports declined by approximately 80% between April 2018 and October 2019. Should sanctions affecting Iran’s oil exports be relieved or terminated, the reentry of 1 million to 2 million bpd of crude oil could, depending on market conditions and oil-producing country decisions, contribute to oil market oversupply that could lower oil prices. While U.S. petroleum product consumers may welcome such an outcome, severe and persistently low prices could have adverse effects on U.S. oil producers.

Oil sector sanctions imposed on Russia via E.O. since 2014, and codified (P.L. 115-44) in 2017, apply to certain Russian oil companies and target two activities: (1) accessing debt finance, and (2) accessing oil exploration and production technology for deepwater, Arctic offshore, and shale projects. Near-term Russian oil supply does not appear to have been affected by these sanctions to date; oil production has increased since 2014. Alternative financing, currency devaluation, and Russia’s oil tax and export duty policies have provided Russian companies with capital and incentives to increase oil production and exports. Over the long term, Russian oil output could be affected by oil production technology sanctions, as some European and U.S. companies have terminated participation in certain oil exploration and development projects.

Economic sanctions affecting Venezuela’s oil trade are the product of E.O.s and U.S. Department of the Treasury designations in 2019 prohibiting transactions with Petroleos de Venezuela S.A. (PdVSA). Petroleum trade between the United States and Venezuela has been eliminated. As a result, Venezuela has sought alternative buyers of crude oil previously destined for the United States and alternative suppliers of petroleum products previously sourced from U.S. exporters. Although U.S. economic sanctions do not explicitly prohibit non-U.S. entities from trading oil and petroleum products with PdVSA, Treasury has discretion to take action against foreign entities that provide material support to PdVSA. This sanctions framework element could make it difficult for PdVSA to secure alternative buyers and suppliers. Rosneft, a Russian-controlled oil company, has reportedly facilitated Venezuelan crude oil trade with independent oil refiners in China and has provided Venezuela with petroleum products previously sourced from U.S. suppliers. Enacted legislation in the 116th Congress (P.L. 116-94) requires the Administration to coordinate Venezuela sanctions with international partners and expresses concerns about certain PdVSA transactions with Rosneft.

Sanctions-related oil supply constraints have affected oil production and trade. Oil market characteristics—generally inelastic supply and demand in the short term—could contribute to market conditions that could result in volatile price movements (both up and down) when supply and demand are imbalanced by as little as 1% to 2% for a brief or sustained period. To date, persistently high crude oil prices have been moderated by several factors, including increasing U.S. oil production and exports, trade flow adjustments, expectations of slowing demand growth rates, and sanctions design elements. However, oil trade sanctions have affected price differentials for certain crude oil types (e.g., light vs. heavy).

Oil Market Effects from U.S. Economic Sanctions: Iran, Russia, Venezuela

Jump to Main Text of Report

Contents

- Introduction and Overview

- Scope of Report

- Iran

- Overview of U.S. Sanctions on Iran's Oil Sector

- Sanctions Framework Targeting Iran's Oil Exports

- Significant Reduction Exception (SRE)

- Petroleum Market Assessment and Consideration

- Outreach to Petroleum Producing Countries

- Executive Orders 13622 and 13846

- Oil Export Sanctions Relief and Reimposition

- Oil Supply Impacts

- Russia

- Oil Sector Sanctions Framework

- Directive 2: Access to Debt Finance

- Directive 4: Access to Oil Exploration and Production Technology

- Secondary Sanctions on Special Russian Crude Oil Projects

- Oil Supply Impacts

- Short-Term Supply: 2014-2019

- Longer Term: Beyond 2019

- Venezuela

- Oil Trade Sanctions Framework

- Potential Secondary Sanctions

- Oil Supply Impacts

- Oil Market Impact Observations

- Oil Prices

- Benchmark Prices

- Price Differentials for Certain Crude Oil Types

- Trade Flow Adjustments

- U.S. Crude Oil Exports

- China Oil Imports

- Venezuela-Related Trade

- Policy Considerations

- Iran: Oil Market Impacts Should Sanctions Be Relieved or Eliminated

- Russia: Is the Iran Oil Export Framework Applicable?

- Russia's Oil Pipeline Integration with Europe

- U.S. Institutional Investor Ownership of Russian Oil Companies

- Russia: Introduced Legislation

- S. 1830: Energy Security Cooperation with Allied Partners in Europe Act of 2019

- S. 1060: Defending Elections from Threats by Establishing Redlines Act of 2019

- S. 482: Defending American Security from Kremlin Aggression Act of 2019

- Venezuela: Sanctions Enforcement and Enacted Legislation

- Concluding Remarks

Figures

- Figure 1. Iran Oil Production and Exports

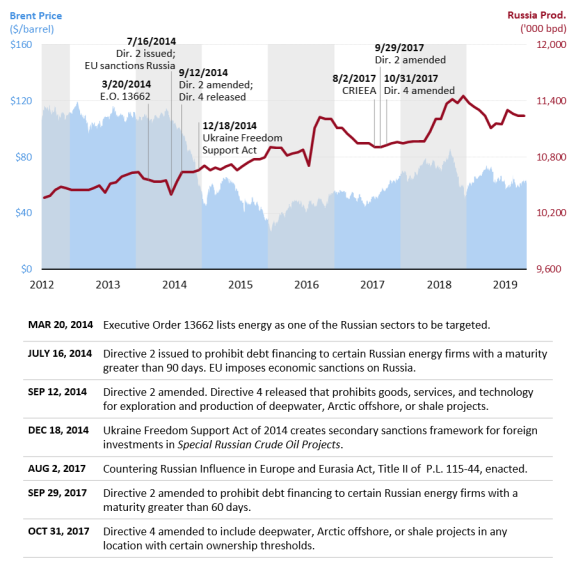

- Figure 2. Russia Oil Production, Oil Prices, and Oil Sector Sanctions

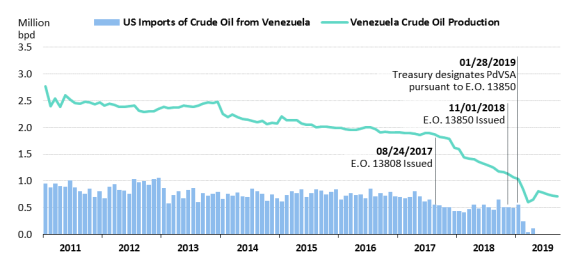

- Figure 3. Venezuela Crude Oil Production and U.S. Imports

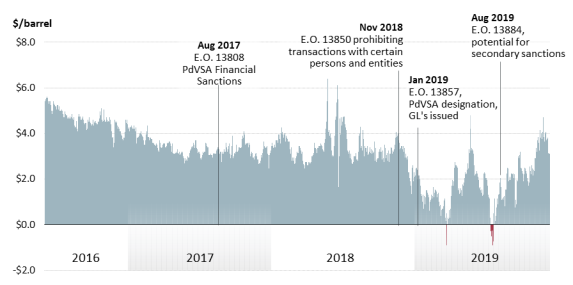

- Figure 4. Brent Crude Oil Price and Selected Oil-Related Sanction Events

- Figure 5. Price Differential: Louisiana Light Sweet (LLS) and Mars Crude Oil

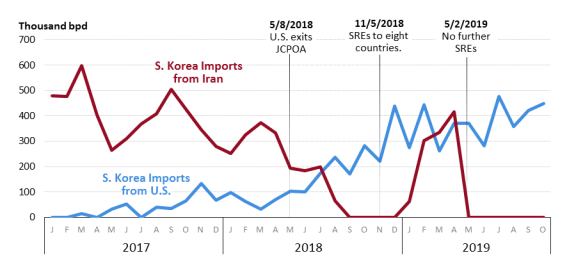

- Figure 6. South Korea Crude Oil Imports from Iran and the United States

- Figure 7. China Crude Oil Imports from the United States, Iran, Russia, and Saudi Arabia

- Figure 8. Venezuela Crude Oil Exports by Destination

Summary

Economic sanctions imposed by the United States—through enacted legislation and executive action—on Iran, Russia, and Venezuela aim to pressure the ruling governments to change their behavior and policies. Currently, these sanctions aim to either eliminate (Iran) or restrict (Venezuela) crude oil trade of as much as 3.3 million to 4.0 million barrels per day (bpd), roughly 3%-4% of global petroleum supply. Estimated oil production volumes affected to date have been approximately 1.7 million bpd from Iran. Venezuela oil production has also likely been affected, although accurately quantifying volumes is difficult due to monthly oil production declines over a period of years prior to U.S. sanctions affecting oil trade in January 2019. Sanctions imposed on Russia's oil sector generally target longer-term oil production and to date have not reduced Russian oil supply or trade. Oil production in Russia has increased since oil-sector sanctions began in 2014, although the country has arguably incurred economic costs in order to incentivize and support oil output levels.

Sanctions targeting Iran's oil sector date back to the 1980s and affect virtually every element of Iran's oil sector (e.g., investment, shipping, insurance, and exports). Legislation enacted in 2011 (P.L. 112-81) and 2013 (P.L. 112-239), along with subsequent executive orders (E.O.s), created a sanctions framework designed to discourage oil importers—by sanctioning banks that transact with Iran or facilitate oil transactions, as well as entities that buy Iranian oil—from purchasing crude oil and other petroleum and petrochemical products from Iran. Iran oil export sanctions include design elements (e.g., significant reduction exceptions, requirements to certify oil markets are adequately supplied, and coordination with oil-producing countries) intended to minimize oil price escalation that could result from sanctions-related oil supply reductions. Iran oil export sanctions have been applied, waived, and reapplied since 2011. As of November 2019, the Trump Administration's stated goal has been to reduce Iran's oil exports to zero. Trade data indicate that observed Iranian crude oil exports declined by approximately 80% between April 2018 and October 2019. Should sanctions affecting Iran's oil exports be relieved or terminated, the reentry of 1 million to 2 million bpd of crude oil could, depending on market conditions and oil-producing country decisions, contribute to oil market oversupply that could lower oil prices. While U.S. petroleum product consumers may welcome such an outcome, severe and persistently low prices could have adverse effects on U.S. oil producers.

Oil sector sanctions imposed on Russia via E.O. since 2014, and codified (P.L. 115-44) in 2017, apply to certain Russian oil companies and target two activities: (1) accessing debt finance, and (2) accessing oil exploration and production technology for deepwater, Arctic offshore, and shale projects. Near-term Russian oil supply does not appear to have been affected by these sanctions to date; oil production has increased since 2014. Alternative financing, currency devaluation, and Russia's oil tax and export duty policies have provided Russian companies with capital and incentives to increase oil production and exports. Over the long term, Russian oil output could be affected by oil production technology sanctions, as some European and U.S. companies have terminated participation in certain oil exploration and development projects.

Economic sanctions affecting Venezuela's oil trade are the product of E.O.s and U.S. Department of the Treasury designations in 2019 prohibiting transactions with Petroleos de Venezuela S.A. (PdVSA). Petroleum trade between the United States and Venezuela has been eliminated. As a result, Venezuela has sought alternative buyers of crude oil previously destined for the United States and alternative suppliers of petroleum products previously sourced from U.S. exporters. Although U.S. economic sanctions do not explicitly prohibit non-U.S. entities from trading oil and petroleum products with PdVSA, Treasury has discretion to take action against foreign entities that provide material support to PdVSA. This sanctions framework element could make it difficult for PdVSA to secure alternative buyers and suppliers. Rosneft, a Russian-controlled oil company, has reportedly facilitated Venezuelan crude oil trade with independent oil refiners in China and has provided Venezuela with petroleum products previously sourced from U.S. suppliers. Enacted legislation in the 116th Congress (P.L. 116-94) requires the Administration to coordinate Venezuela sanctions with international partners and expresses concerns about certain PdVSA transactions with Rosneft.

Sanctions-related oil supply constraints have affected oil production and trade. Oil market characteristics—generally inelastic supply and demand in the short term—could contribute to market conditions that could result in volatile price movements (both up and down) when supply and demand are imbalanced by as little as 1% to 2% for a brief or sustained period. To date, persistently high crude oil prices have been moderated by several factors, including increasing U.S. oil production and exports, trade flow adjustments, expectations of slowing demand growth rates, and sanctions design elements. However, oil trade sanctions have affected price differentials for certain crude oil types (e.g., light vs. heavy).

Introduction and Overview

Economic sanctions are one foreign policy tool that can be used to potentially influence the behavior and actions of political leadership in other countries. Oil-related sanctions are one option that could be used to apply economic pressure on certain countries in order to achieve broader geopolitical and foreign policy objectives. Currently, the United States has active economic sanctions imposed on three major oil-producing and exporting countries: Iran, Russia, and Venezuela. Combined, these countries produced approximately 17.7 million barrels per day (bpd) of oil in 2018—approximately 18% of total world oil production—according to one estimate.1 Only a portion of these supply volumes might be directly affected by U.S. economic sanctions in the near term—potentially ranging from 3.3 million to 4.0 million bpd from both Iran (estimated to be 2.8 million bpd) and Venezuela (estimated to range from 0.5 million to as much as 1.2 million bpd).2 Estimated oil production volumes affected to date have been approximately 1.7 million bpd from Iran.3 Venezuela oil production has likely also been affected, although accurately quantifying volumes is challenging due to monthly oil production declines that had been occurring over a period of years prior to U.S. sanctions affecting oil trade in January 2019.

A sustained global petroleum supply imbalance of 1% to 2% could contribute to market conditions that could result in volatile price movements (both upward and downward) for crude oil and related petroleum products (e.g., gasoline and diesel fuel). To date, oil supply impacts related to economic sanctions have not generally resulted in significant upward price pressure for benchmark oil prices.4 Generally, sanctions-related supply losses have been counterbalanced by increased production and exports from the United States, Russia, and other countries; petroleum trade flow adjustments; indications of slowing global oil demand growth rates; and design elements of oil-related sanctions. Oil sanctions frameworks can include wind-down periods, requirements to consider and certify that global oil supply is adequate to compensate for supply reductions, and engagement with other oil producers before applying certain sanctions. These design elements are intended to mitigate sanctions-related market and price impacts and to build into the sanctions regime multilateral coordination and cooperation.

Oil-related economic sanctions for each respective country discussed in this report differ in terms of design and potential market impacts. As a result, each framework is likely to have a different effect on oil production, trade, and potentially price levels. Generally, each sanctions framework is structured to reduce—either immediately or in the future—oil sales revenue to the subject country. Since 2011, sanctions targeting Iran's oil sector have aimed to eliminate the country's oil export revenue. Sanctions applied to Russia's oil sector5 generally target long-term, high-risk oil production projects. Venezuela sanctions imposed to date prohibit petroleum trade with the United States—historically one of the primary destinations for Venezuela's oil exports—and have the potential to affect Venezuela's petroleum trade with other countries. Table 1 provides a general overview of current oil-sector sanctions imposed on Iran, Russia, and Venezuela.

Table 1. Overview of Oil-Related Sanctions Frameworks and Potential Near-Term Oil Supply Impact Estimates

|

Country |

Current U.S. Oil-Related Sanctions Framework |

Potential Near-Term Oil Supply Impact (Est.)e |

|

Iran |

Target: Oil exports from Iran

|

2.8 million barrels per day (bpd)a (Sanctions tactic: reduce Iran's oil export revenue) |

|

Russia |

Target: Russian oil company access to finance and production technology/services for certain oil production projects

|

0.0 million bpdb |

|

Venezuela |

Target: Access to finance; elimination of U.S.-Venezuela petroleum trade; potential impact on Venezuela's petroleum trade with other countries.

|

0.5 million to 1.2 million bpdc (Sanctions tactic: eliminate U.S.-Venezuela petroleum trade and make it challenging for Venezuela to secure alternative buyers) |

|

Total: |

3.3 million to 4.0 million bpdd |

Source: Congressional Research Service (CRS).

Notes: Sanctions targeting Iran's oil sector have been in place since the 1980s and include sanctions designed to affect investments in Iran's oil sector, U.S.-Iran oil trade, shipments of Iranian oil, among other parts of Iran's oil sector. This table presents information about sanctions imposed on Iran since 2011 that directly target Iran's crude oil exports.

a. 2.8 million bpd is the level of Iranian oil (crude oil and condensate) exports in April 2018, the month before the Trump Administration announced the United States' exit from the Joint Comprehensive Plan of Action (JCPOA or Iran nuclear agreement) and the withdrawal of sanctions waivers for financial institutions that transact with Iranian banks and entities that purchase Iranian petroleum, petroleum products, and petrochemical products.

b. Sanctions targeting Russia's oil sector are generally designed to be long term in nature and are not expected to affect near-term oil supply. Russia's oil production has increased since the United States imposed oil sector sanctions in 2014.

c. 0.5 million bpd is the approximate amount of U.S. crude oil imports from Venezuela in January 2019, when Venezuela oil sector sanctions were announced. Venezuela sanctions could affect oil production levels and oil trade with all countries. 1.2 million bpd is the approximate amount of total Venezuela crude oil exports in January 2019.

d. Actual supply impact could be less than 3.3 million bpd. Some Iranian crude oil may continue to be exported to certain countries through various delivery mechanisms. Venezuelan crude oil is likely to move to non-U.S. destinations should alternative buyers be secured.

e. CRS analysis of Energy Intelligence Group data.

Scope of Report

The scope of this report is to assess the possible impact of current U.S. economic sanctions on oil production in and exports from Iran, Russia, and Venezuela. For each country, this report provides general background and historical information about the oil sector, followed by an overview of each oil-related sanctions framework and a discussion of oil production, supply, and trade impacts resulting from U.S. sanctions. European Union (EU) oil sector sanctions imposed on Iran and Russia are referenced but are not discussed in detail.6 Selected oil market impact observations—specifically price impacts and trade flow adjustments—and policy considerations are discussed. A detailed assessment of how oil-related sanctions might have affected each target country's overall economy and how these effects may have contributed to achieving U.S. foreign policy objectives is beyond the scope of this report.

Iran7

Iran holds the fourth largest proven oil reserves in the world—behind Venezuela, Saudi Arabia, and Canada—with an estimated 156 billion barrels as of the end of 2018.8 A founding member of the Organization of the Petroleum Exporting Countries (OPEC), commercial crude oil production in Iran started in 1913 and Iran has been both an oil producer and exporter for more than a century. Iran's oil industry was nationalized in 1951 by Prime Minister (PM) Mohammed Mossadeq, who expropriated the Anglo-Iranian oil company—today known as BP. Foreign policy concerns about PM Mossadeq's potential pivot toward the Soviet Union resulted in a U.S.- and British-sponsored intelligence operation that removed Mossadeq from power in 1953.9 Following that operation, a consortium of U.S. and European oil companies effectively took control of Iran's oil production and exports.10

Crude oil production in Iran was at its highest historical rate in the 1970s when it ranged between 5 million and 6 million bpd for much of the decade. Diplomatic relations between the United States and Iran in the late 1960s and for most of the 1970s were generally positive, with oil production and trade being one element of the relationship. During this period, the Shah of Iran (Iran's political leader at the time)—in an effort to increase oil revenues for military and domestic policy purposes—requested then-President Nixon to eliminate the Mandatory Oil Import Quota (MOIQ) system that limited U.S. crude oil import volumes from foreign countries.11 In 1969, the Shah also reportedly offered to sell the United States 1 million bpd of crude oil for 10 years at a price of $1/barrel for the United States to create a strategic oil stockpile.12 President Nixon declined the Shah's request and offer. As domestic U.S. oil production levels were not keeping pace with increasing U.S. oil demand, President Nixon replaced MOIQ with an import licensing fee system in April 1973.13

Iran was not party to the October 1973 oil embargo—instituted by members of the Organization of Arab Petroleum Exporting Countries (OAPEC)—an event that contributed to rapidly rising petroleum prices, perceived supply shortages, and the enactment of U.S. laws to ensure domestic availability of oil supply. 14 The oil market situation in late 1973 created an opportunity for Iran to increase oil revenue. U.S. crude oil imports from Iran more than doubled from 1973 to 1978, when imports reached approximately 550,000 bpd.15 However, U.S.-Iran relations changed in 1979 when the Iranian revolution culminated with the Shah abdicating, Iran becoming an Islamic republic, and Ayatollah Khomeini rising to power as Iran's supreme leader. Oil production in Iran started declining in late 1978, due to a labor strike in opposition to the Shah's policies, and the situation led to one of the largest (5.6 million bpd) and longest (nearly six months) supply disruptions in history.16 This supply loss contributed to one of the highest inflation-adjusted annual oil price periods on record.17

Overview of U.S. Sanctions on Iran's Oil Sector

Sanctions imposed on Iran have been a foreign policy tool used by the United States for nearly three decades with the goal of deterring state-supported terrorism, Iran's regional influence, and its nuclear program. Iran's oil sector has been the target of multiple U.S. sanctions initiatives. For example, imports of Iranian crude oil to the United States were prohibited in 1987.18 Prior to the prohibition, U.S. oil buyers imported as much as 550,000 bpd from Iran.19 Additional elements of Iran's oil sector are also subject to sanctions, including investments in Iran's oil production; insurance for Iranian oil entities and for shipping Iranian crude oil; the sale of goods and services that support Iran's oil production; oil transportation; and oil exports. Sanctions targeting Iran's oil sector are the product of enacted laws and issued executive orders (E.O.s) that span multiple Administrations. For a brief overview of relevant oil sanctions legislation, see the text box below titled Enacted Legislation that Affects Iran's Oil Sector: Selected Examples. This section focuses on sanctions legislation enacted in December 2011—National Defense Authorization Act for Fiscal Year 2012 (P.L. 112-81)—and subsequent E.O.s designed to reduce Iran's oil export revenue.

|

Enacted Legislation that Affects Iran's Oil Sector: Selected Examples Sanctions that affect Iran's oil production, transportation, and exports are a result of multiple laws enacted and executive orders (E.O.s) issued since the 1980s. Oil sector sanctions imposed on Iran, which started with a prohibition on U.S. imports of Iranian oil, have expanded over time to include nearly all oil-related activities (e.g., production, transportation, investment, insurance, trade transactions, refining, and exports). The following is a list of selected legislation that directly affects Iran's oil sector. For additional background information and a comprehensive discussion of laws and regulations that impose sanctions on Iran, see CRS Report RS20871, Iran Sanctions, by Kenneth Katzman. International Emergency Economic Powers Act (P.L. 95-223): Authorizes the President to regulate foreign economic transactions when he determines a foreign threat to the United States constitutes a national emergency. In 1995, President Clinton declared a state of emergency—renewed by subsequent Presidents every year—with respect to Iran and issued E.O.s 12957 and 12959 to prohibit all trade with and investment in Iran, to include any transaction (e.g., purchase, sale, swap, or brokering) for Iranian goods and services. These prohibitions prevent U.S. companies from buying, selling, and trading Iranian crude oil for delivery to any destination. Trade and investment prohibitions were subsequently codified by enacted legislation. International Security and Development Cooperation Act of 1985 (P.L. 99-83): Authorizes the President to prohibit U.S. imports of any good or service from any country the government of which supports acts of international terrorism. Authority was exercised in 1987 (E.O. 12613) to prohibit all imports from Iran, including oil. Iran Sanctions Act of 1996 (ISA; P.L. 104-172): Legislation designed to limit foreign (non-U.S.) investment in Iran's oil and gas sector. The ISA allows for "extra-territorial" (also referred to as "secondary") sanctions on entities located in any country. The act also created a menu of sanctions (originally 6, expanded to 12), a selection of which are imposed on entities that exceed investment limits. Subsequent legislation apply ISA sanctions to other elements of Iran's oil sector. (Enacted legislation in 1996 was originally titled the Iran and Libya Sanctions Act (ILSA). Libya was removed from the title in 2006.) Comprehensive Iran Sanctions, Accountability, and Divestment Act of 2010 (P.L. 111-195): Amends the ISA to stipulate investment thresholds in Iran's petroleum sector, sales of goods and services to the sector, or petroleum product sales to Iran. As amended, the act also imposes ISA sanctions for gasoline sales to Iran and sales of equipment or services that would assist Iran with making or importing gasoline (e.g., refinery equipment and port infrastructure). National Defense Authorization Act for Fiscal Year 2012 (FY2012 NDAA; P.L. 112-81): Secondary sanctions designed to reduce Iran's oil export revenue. Financial sanctions—access to the U.S. banking system—on foreign financial institutions that conduct "significant" transactions with Iran's Central Bank or any other sanctioned Iranian bank. Significant reduction exceptions (SREs) can be provided to banks in countries that "significantly reduce" oil purchases from Iran. Sanctions can be waived for 180-day periods for banks in countries that receive an SRE. Iran Threat Reduction and Syria Human Rights Act (P.L. 112-158): ISA sanctions imposed on any entity that provides insurance or reinsurance for the National Iranian Oil Company or the National Iranian Tanker Company. National Defense Authorization Act for Fiscal Year 2013 (P.L. 112-239): Title XII, Subtitle D (The Iran Freedom and Counter-Proliferation Act) applies ISA sanctions to entities transacting in Iran's energy sector, including for the purchase of petroleum or petroleum products. Price and supply considerations are required, and SREs are possible pursuant to the FY2012 NDAA. |

Sanctions Framework Targeting Iran's Oil Exports

Section 1245 of the National Defense Authorization Act for Fiscal Year 2012 (FY2012 NDAA; P.L. 112-81) created a sanctions framework designed to motivate Iran's oil buyers to reduce purchases, with the goal of limiting Iran's oil export revenue. The core element of this framework includes financial sanctions—prohibition on opening and accessing U.S. bank accounts—that are to be imposed on foreign financial institutions that conduct a "significant financial transaction" with Iran's Central Bank or with any sanctioned Iranian bank. However, these transactions can potentially continue should affected countries comply with other elements of the sanctions framework that incentivize oil buyers to reduce imports from Iran while mitigating potential oil supply and price impacts. Other design elements of this framework include the following: (1) a 180-day wind-down period for implementation; (2) a provision that allows for financial institutions to be excepted from sanctions based on reducing Iran oil purchases; (3) a requirement that the Administration consider impacts to global oil prices and supplies; and (4) outreach to other petroleum producing countries.

Significant Reduction Exception (SRE)

Sanctions do not apply to financial institutions under the jurisdiction of countries that the President determines to have "significantly reduced" oil purchases volumes from Iran—significantly is not statutorily defined.20 SREs are valid for 180 days, and countries must continue reducing Iranian oil purchases during this period to receive a subsequent exception. The SRE design element provides the Administration with some discretion to determine the level of economic pressure to apply while considering possible global oil supply and price effects.

Petroleum Market Assessment and Consideration

The President is required to determine—90 days following enactment and every 180 days thereafter—that the price and availability of petroleum from non-Iranian producers are adequate to enable Iran's crude oil buyers to significantly reduce purchase volumes. This determination must be based on petroleum price and availability reports submitted to Congress by the Energy Information Administration (EIA) every 60 days.21 Oil market conditions, should an undersupply situation result in escalated prices, could motivate some degree of sanctions relief even if such an action may not be consistent with sanctions-related policy objectives. However, the term adequate is not defined in enacted sanctions legislation. Therefore, the Administration could have flexibility in determining if oil markets are adequately supplied regardless of price levels.

Outreach to Petroleum Producing Countries

The sanctions framework also requires the President to encourage petroleum-producing countries to increase oil supplies and to minimize sanctions-related oil availability and price impacts.22 U.S. State Department officials reportedly have had discussions with oil-producing countries23 and have indicated that other countries—specifically Saudi Arabia and the United Arab Emirates (UAE)—would provide additional oil supply to compensate for reduced volumes from Iran.24

Executive Orders 13622 and 13846

On July 30, 2012, President Obama issued E.O. 13622 to authorize additional Iran sanctions. The President revoked the E.O. in the course of implementing the U.S. obligations under the Iran nuclear deal, known as the Joint Comprehensive Plan of Action (JCPOA); President Trump reinstated the E.O.'s tenets on August 6, 2018, with the issuance of E.O. 13846. With respect to Iran's oil exports, E.O. 13846 strengthens the NDAA sanctions framework in two primary ways:

- 1. Prohibits access to the U.S. financial system for any foreign financial institution that conducts or facilitates a significant financial transaction with the National Iranian Oil Company or for the purchase of petroleum, petroleum products, or petrochemical products, and

- 2. Authorizes the imposition of Iran Sanctions Act (P.L. 104-172) sanctions on any entity that engages in significant transactions for the purchase of petroleum, petroleum products, or petrochemical products from Iran.25

Financial institutions and entities subject to sanctions contained in E.O. 13846 can continue petroleum and petrochemical transactions if their country of primary jurisdiction receives an SRE (see "Significant Reduction Exception (SRE)" section).

Oil Export Sanctions Relief and Reimposition

International negotiations with respect to Iran's nuclear development program resulted in two multilateral agreements that first relieved then waived FY2012 NDAA sanctions and revoked E.O. 13622 sanctions that target Iran's oil exports. President Trump ended U.S. participation in the agreements and reimposed Iran oil export sanctions. Following is a brief description of the oil-related aspects of the two multilateral agreements and the termination of U.S. participation.

- Joint Plan of Action (JPA): an interim agreement in effect between January 20, 2014, and January 16, 2016, that, among other provisions, removed the requirement on Iran's oil buyers to continue reducing oil purchases to receive an SRE.26 Iran's oil purchasers at that time (China, India, Japan, Republic of Korea, Taiwan, and Turkey) were allowed to continue purchasing oil at the then-current average. Sanctions on insurance, transportation services, and petrochemical exports were suspended.27

- JCPOA: implemented on January 16, 2016, when the Administration waived FY2012 NDAA Section 1245 financial sanctions and revoked E.O. 13622. These actions effectively removed secondary sanctions targeting Iran's oil exports. Buyers could resume importing unrestricted oil volumes from Iran.28

- United States ends JCPOA participation (sanctions reimposed): President Trump announced on May 8, 2018, that the United States would terminate its JCPOA participation and sanctions would be re-imposed following a wind-down period (180 days for sanctions targeting Iran's oil exports). On November 5, 2018, FY2012 NDAA Section 1245 financial sanctions and petroleum, petroleum product, and petrochemical purchase sanctions were reinstated.29 SREs were issued to eight countries in November 2018 (for additional information see Figure 1 notes). However, SREs are no longer allowed as of May 2019.

Oil Supply Impacts

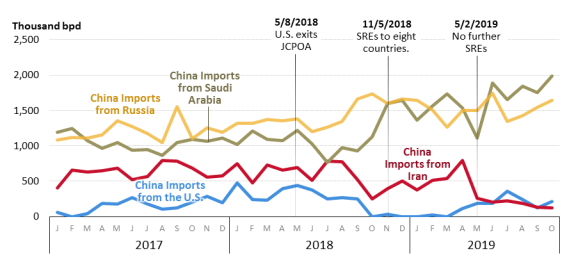

Secondary sanctions that target Iran's oil exports have resulted in a direct and measurable effect on Iran's crude oil production and on observable export volumes of crude oil and condensate.30 As indicated in Figure 1, crude oil and condensate exports declined by approximately 1.2 million bpd—nearly 57%—between December 2011 (upon enactment of the FY2012 NDAA) and July 2012. Iran's oil production volumes followed a similar trajectory.

|

Figure 1. Iran Oil Production and Exports January 2011 – October 2019 |

|

|

Sources: Crude oil production volumes are from Energy Intelligence, Petroleum Intelligence Weekly. Crude oil and condensate exports from January 2011 through June 2015 are from the International Energy Agency. Crude oil and condensate exports from July 2015 to June 2019 are from Bloomberg L.P.'s oil-tanker tracking service, accessed via the Bloomberg Terminal (subscription required). Notes: Crude oil and condensate export volumes reported by Bloomberg L.P. reflect "observable" export volumes that are monitored by obtaining data provided by a vessel's automatic identification system (AIS) transponder. Following the U.S. exit of the Joint Comprehensive Plan of Action in May 2018, Bloomberg L.P. has reported that several Iranian crude oil tankers have disabled their AIS transponders. Bloomberg L.P. export data reflect only volumes that are tracked via the AIS and do not include export volumes on vessels with AIS transponders that have been intentionally disabled. Therefore, actual Iranian export volumes could be higher than reflected in this figure. |

During the JPA effective period (January 2014 to January 2016), Iran's crude oil production and export volumes stabilized, as countries were no longer required to continue reducing imports to receive SREs. With the implementation of the JCPOA, sanctions affecting oil exports were waived and Iran's production and exports returned to pre-FY2012 NDAA levels. Following the United States exiting the JCPOA in May 2018, production and exports declined and then stabilized once SREs were granted to eight countries in November 2018. As of May 2, 2019, it is the Trump Administration's intent to no longer grant SREs.31 According to Bloomberg L.P.'s oil tanker tracking service, observable exports from Iran have declined significantly (see Figure 1 notes for background about data challenges) based on October 2019 volumes. Iran's crude oil exports to certain independent refiners in China have carried on, and some analysts expect this trade relationship to continue.32

Russia

Russia is one of the largest oil producers and exporters in the world. In 2018, crude oil and condensate production in Russia was larger than in any other country, at approximately 11.2 million bpd.33 The United States (11 million bpd) and Saudi Arabia (10.5 million bpd) were ranked second and third respectively.34 As of the end of 2018, Russia held the sixth largest amount of proven oil reserves with approximately 106 billion barrels.35

Commercial oil production in Russia and the former Soviet Union dates back to the 1870s when the first wells were drilled in Baku (today the capital of Azerbaijan). Increasing oil production and exports—along with oil refining to make kerosene for artificial lighting—in the late 1800s resulted in the emergence of a major competitor to the global monopoly held by U.S.-based Standard Oil at that time. The oil industry continued to grow and expand in the Russian Empire and growth continued to develop in the Soviet Union after the 1917 Bolshevik Revolution. Soviet oil policy decisions in the 1920s and 1950s resulted in depressed global oil prices that are credited with motivating two historical oil industry developments. The first was an export campaign in the 1920s that contributed to low prices and the signing of the historic Achnacarry Agreement in 1928 by multiple oil companies with the intent to restrict oil production in order to support oil prices.36 The second was an oil market-share campaign in the 1950s that led to lower prices and was one factor credited with motivating creation of OPEC in 1960.37

By 1987, the Soviet Union was the largest oil producer in the world at nearly 12.5 million bpd, more than twice the production of Saudi Arabia that year.38 Soviet oil production had declined to 10.3 million bpd in 1991, the year the Soviet Union was formally dissolved and the Russian Federation (Russia) established. Oil production in the Russian Federation represented approximately 90% of Soviet oil production in 1991, at 9.3 million bpd. Russia's oil production declined to just over 6 million bpd in 1996 but recovered to 10.8 million bpd by 2013.39 Today, oil is a major element of Russia's economy; approximately 46% of federal revenue came from the oil and gas sector in 2018.40

Oil Sector Sanctions Framework41

Following Russia's invasion and occupation of Ukraine's Crimea region in March 2014, President Obama declared a national emergency (E.O. 13660) with respect to Russia's actions in Ukraine.42 Subsequent E.O.s, Department of the Treasury directives, and enacted legislation created a sanctions framework, elements of which target Russia's oil sector.

Oil sector sanctions imposed on Russia originated in E.O. 13662, which identified Russia's energy sector as an element of Russia's economy that could potentially be sanctioned.43 Sanctions imposed on Russia's oil sector target two general activities by prohibiting certain transactions with U.S. entities: (1) access to debt finance (Directive 2, described below), and (2) access to technology, goods, and services to support complex oil exploration and production projects (Directive 4, described below). Subsequently, the Department of the Treasury published—and has periodically updated—a list (Sectoral Sanctions Identification, or SSI, list) of Russian entities that are subject to these E.O. 13662 sectoral sanctions.44 Directives 2 and 4 issued by the Department of the Treasury, which apply to certain Russian oil companies, describe transactions and activities that are prohibited with entities included on the SSI list. Table 2 contains a list of Russian oil companies and indicates those that are subject to Directive 2 and Directive 4 sanctions.

|

Company |

2018 Oil Production |

Directive 2 SSI List |

Directive 4 SSI List |

|

|

Rosneft |

|

Yes |

Yes |

|

|

Lukoil |

|

No |

Yes |

|

|

Surgutneftegaz |

|

No |

Yes |

|

|

Gazpromneft |

|

Yes |

Yes |

|

|

Tatneft |

|

No |

No |

|

|

Slavneft |

|

No |

No |

|

|

Novatek |

|

Yes |

No |

|

|

Russneft |

|

No |

No |

|

|

PSA Operators |

|

N/A |

N/A |

|

|

Others |

|

N/A |

N/A |

|

|

Total |

|

Source: Oil production data by company for 2018 from Bloomberg L.P. (subscription required), as reported by Russia's Central Dispatching Department of Fuel and Energy Complex (CDU TEK).

Notes: Rosneft oil production includes Bashneft, as reported separately by CDU TEK. Rosneft acquired Bashneft in 2016. PSA = Production Sharing Agreement; SSI = Sectoral Sanctions Identification; N/A= Not Applicable; bpd = barrels per day. Transneft, Russia's oil pipeline company, is also on the Directive 2 SSI list.

The Ukraine Freedom Support Act of 2014 (P.L. 113-272) created a framework that would allow the President to impose secondary sanctions on foreign persons/entities that make significant investments—as determined by the President—in special Russian crude oil projects (i.e., projects that would extract crude oil from deepwater, Arctic offshore, and shale projects located in Russia).

Enactment of the Countering Russian Influence in Europe and Eurasia Act of 2017 (CRIEEA; Title II of P.L. 115-44, the Countering America's Adversaries Through Sanctions Act) in August 2017 codified and strengthened Directives 2 and 4, as described below. CRIEEA also modified the Ukraine Freedom Support Act to require the President to impose sanctions on persons/entities determined to have made significant investments in special Russian crude oil projects.

Directive 2: Access to Debt Finance45

Directive 2 limits the ability of Russian oil companies on the SSI list to borrow from U.S. financial institutions and other lenders. The original version of Directive 2 (July 2014) prohibited access to U.S. debt with a maturity longer than 90 days for certain companies operating in Russia's energy sector.46 CRIEEA modified Directive 2 to prohibit entities on the SSI list from accessing U.S. debt with a maturity longer than 60 days. Some of Russia's largest oil companies, by production volume, are subject to this directive and now have reduced access to debt capital. Limited access to financial markets can potentially result in higher borrowing costs for the affected companies and could make it difficult for these companies to finance company activities. Directive 2 had the potential to affect Russia's near-term oil production. However, according to analyst reports, Russian oil companies on the Directive 2 SSI list were able to secure alternative sources of finance by accessing, through domestic borrowing, Russia's federal financial reserves.47

Directive 4: Access to Oil Exploration and Production Technology48

Directive 4 prohibits the sale and transfer of goods, services, and technology from U.S. entities to Russian companies on the SSI list that would support three types of Russian oil exploration and production projects: (1) deepwater, (2) Arctic offshore, and (3) shale. The original version of Directive 4 (September 2014) stipulated that these oil sector sanctions were applicable to projects located in Russian territory or claimed maritime waters. However, CRIEEA legislation enacted in 2017 expanded the applicability of Directive 4 to include deepwater, Arctic offshore, or shale projects in any location—inside or outside Russia—that are 33% or more owned or are subject to voting control by a sanctioned Russian entity.

Directive 4 sanctions target complex and challenging oil exploration and production projects that are likely part of Russia's long-term oil resource development plans.49 In conjunction with Directive 4 sanctions, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) announced export restrictions on Russia in July 2014 to prohibit the export of certain items that may be used for deepwater, Arctic offshore, and shale projects.50 BIS's announcement of the implementation of these export restrictions indicated the long-term nature of the energy technology sanctions: "While these sanctions do not target or interfere with the current supply of energy from Russia or prevent Russian companies from selling oil and gas to any country, they make it difficult for Russia to develop long-term, technically challenging future projects."51

Secondary Sanctions on Special Russian Crude Oil Projects

Section 4(b) of the Ukraine Freedom Support Act of 2014 (P.L. 113-272) created a framework for secondary sanctions that could be imposed on non-U.S. persons/entities that invest in deepwater, Arctic offshore, and shale projects that extract crude oil—special Russian crude oil projects—located in Russia. The secondary sanctions framework includes a menu of nine sanctions. As amended by CRIEEA, should the President determine that foreign persons or entities have made a significant investment—a term not defined in enacted legislation—in certain Russian crude oil projects, the President is required to impose at least three of the nine sanctions on those foreign persons/entities. To date, secondary sanctions related to investments in these types of Russian crude oil projects have not been imposed.

Oil Supply Impacts

Oil production in Russia has increased since U.S. oil sector sanctions were first imposed in July 2014. Further, this increase occurred during a period of rapidly declining oil prices and Russia's participation in an oil production agreement with OPEC and other non-OPEC oil-producing countries (collectively referred to as OPEC+). Under the current sanctions framework, Russia could continue increasing oil production levels in the near term.52 However, future oil production in Russia is somewhat uncertain due in part to potential impacts that might result from Directive 2 and Directive 4 sanctions, as well as the potential for secondary sanctions that aim to limit foreign investment in certain Russian crude oil production projects.

Short-Term Supply: 2014-2019

On a monthly basis, Russian oil production increased by approximately 1 million bpd between July 2014 (10.4 million bpd) and December 2018 (11.45 million bpd), as illustrated in Figure 2. Annual oil production levels in Russia have been trending up from 2014 to 2018.53 Monthly oil production levels have declined since December 2018 to 11.1 million bpd as of May 2019. Two factors that likely contributed to this observed decline are (1) implementation of a voluntary OPEC+ oil production agreement54 and (2) oil contamination in Russia's Druzhba pipeline that temporarily disrupted oil shipments to Europe.55

Russian oil production increased during periods of low and declining oil prices (see Figure 2) following the imposition of oil sector sanctions. This upward oil production trend during challenging market and price conditions is a result of several factors, including Russian companies securing alternative sources of finance, currency devaluation, and Russia's oil tax and export duty policy.

Alternative Sources of Finance

Directive 2 financial sanctions—in combination with similar EU financial sanctions56—imposed on certain Russian oil companies required those firms to secure alternative sources of capital to manage corporate finance activities. Directive 2 sanctions had the potential to result in financial stress for Russian oil companies on the SSI list and potentially affect short-term oil production levels. However, reports indicate that sanctioned Russian oil companies were able to use Russia's international currency reserves—accumulated, in part, when oil prices were in the $100 per barrel range (2011-2014)—as an alternative source of finance.57 Russia's financial reserves enabled companies like Rosneft, a state-controlled Russian oil company, to borrow money from the domestic bond market to manage debt obligations and fund business operations.58 Additionally, Rosneft has sold minority ownership positions to Chinese and Indian companies as a means of funding oil production activities.59 Finally, Rosneft has raised cash through equity sales and sold a 19.5% ownership position to the Qatari Investment Authority and Glencore for $11.3 billion in 2016.

Currency Devaluation

Following the imposition of sanctions in mid-2014, and as oil prices were declining rapidly, the Russian ruble began to lose value relative to the U.S. dollar. In November 2014, Russia's Central Bank announced it would limit its exchange rate interventions and allow the ruble exchange rate to be determined by the market.60 Weakening of the ruble relative to the dollar—each dollar being worth more rubles—continued. In June 2014, one U.S. dollar could be exchanged for approximately 34 rubles.61 This exchange rate reached 59 in December 2014 and was as high as 75 in January 2016.62 This currency devaluation, while arguably negative for the overall Russian economy, actually supported profitability and cash flow for Russian oil companies. Russian oil export sales are primarily denominated in dollars, and most Russian oil company expenses are denominated in rubles.63 At a given oil price, currency devaluation increases the amount of rubles received for dollar-denominated oil sales. However, the exchange rate does not directly affect ruble-denominated expenses. As a result, ruble-denominated profitability can be supported even when oil prices are relatively low. These factors, along with downward price pressure on oilfield equipment and service contractors following oil price declines in 2014 through early 2016, contributed to the general upward trend of Russia's oil production while oil prices steeply declined.

Tax and Export Duty Policy

Russia's oil tax policy motivates oil companies operating in the country to maintain and increase oil production, even when benchmark oil prices reach levels as low as $20 per barrel (/b).64 Russia's oil tax framework currently consists of two primary elements: (1) mineral extraction tax (MET), and (2) export duty (ED). MET and ED payments are linked to benchmark oil prices. Both are calculated using formulas—modified periodically to incentivize oil production from certain locations—that adjust the tax and duty based on the price of Urals crude oil, Russia's oil price benchmark. The effect of this tax and duty structure is that the Russian government assumes most of the financial risk from low oil prices and receives most of the benefits from high oil prices. Based on analysis of MET and ED base formulas, government tax and duty receipts can be zero at a $10/b oil price and more than $45/b when oil prices reach $70/b.65 Oil company cash flows also fluctuate but to a much lesser extent and are insulated to some degree from oil price fluctuations. As a result, Russian oil companies are motivated to maintain and increase oil production with limited consideration of the market price for crude oil. Russia has also started implementation of its "tax maneuver" that will gradually eliminate the ED and increase the MET by 2024 for crude oil production.66

Longer Term: Beyond 2019

Russia's ability to maintain and possibly increase oil production beyond 2019, should the sector continue to be subject to U.S. and EU sanctions, is uncertain. The International Energy Agency projects that oil production in Russia is likely to continue increasing through 2021 (11.8 million bpd including crude oil, condensate, and natural gas liquids) and then decline slightly by 2024 (11.6 million bpd).67 Russian oil production post-2024 is less certain, with some forecasts indicating that Russian oil companies may need to develop new resources in order to maintain oil production levels in the 11 million bpd range.68

Exploration and production sanctions (Directive 4) imposed in 2014 were intended to affect future Russian oil production. Some specific projects have been affected by U.S. and EU oil sector sanctions. For example, Exxon has withdrawn from joint venture projects with Rosneft that would develop oil resources in deepwater, Arctic offshore, and shale locations.69 Additionally, certain European oil company joint venture projects have been affected by oil sector sanctions. French oil company Total sold its ownership stake in a shale joint venture project with Lukoil.70

According to the Energy Information Administration (EIA), large shale oil resources are present in Russia.71 Several U.S. and European oil companies had been participating in joint venture Russian shale oil projects prior to the 2014 sanctions. However, development of these projects has since slowed.72

Should Directive 4 and similar EU sanctions continue to be imposed, sustaining oil production growth in Russia will likely be a function, largely, of two factors: (1) the ability of Russian oil companies to develop or acquire oil production technology needed to produce resources in deepwater, Arctic offshore, and shale formations; and (2) the successful execution of exploration and development strategies that target oil production in areas outside the scope of sectoral sanctions (e.g., tight oil). Following the imposition of Directive 4 sanctions in 2014, Russia started developing plans to reduce its reliance on imports of oil production equipment.73 Furthermore, Russian oil companies reportedly have been increasing acquisition of oilfield equipment from Chinese suppliers.74

Venezuela

Venezuela holds the largest proven oil reserves in the world, estimated at 303 billion barrels as of the end of 2018.75 A founding member of OPEC, Venezuela has produced oil commercially since 1914.76 U.S. oil companies began seeking agreements—also referred to as concessions—to explore for and produce oil in Venezuela as early as 1919.77 Venezuela was not a participant in the 1973 Organization of Arab Petroleum Exporting Countries embargo of oil shipments to the United States and other countries. However in 1976, consistent with developments in other oil-producing countries during the 1970s, Venezuela nationalized its oil industry and created Petroleos de Venezuela S.A. (PdVSA).78 U.S. oil companies, such as Exxon, reduced investments in the country leading up to nationalization but continued to be active in Venezuela in a limited service-based role following nationalization.79 Oil production in Venezuela was approximately 3.7 million bpd in 1970.80 Production declined 2.1 million bpd (54%) from 1971 to 1988 to reach 1.6 million bpd.81

In the 1990s, PdVSA embarked on a program referred to as the apertura petrolera—or oil opening. As part of this program, international oil companies—including U.S.-firms Chevron, Exxon, and Conoco—were allowed to either control certain oil field operations or establish majority-owned oil production joint ventures with PdVSA.82 Oil production in Venezuela increased to approximately 3.4 million bpd by 1998.83

During his campaign, former Venezuelan President Hugo Chávez—elected in 1998—threatened to reverse the apertura program.84 Subsequently, President Chávez enacted the Hydrocarbons Law of 2001, which restructured Venezuela's petroleum sector by requiring PdVSA to have majority ownership of future oil developments and raising royalty payments on existing projects to the Venezuelan government.85 Throughout the Chávez presidency, oil companies operating in Venezuela were subject to periodic increases in royalty rates and taxes.86 These additional payment requirements reduced the financial attractiveness of investing in Venezuela's oil sector.

In 2007, the Chávez government enacted a law that required existing oil joint ventures to convert into new entities that would be majority-owned by PdVSA.87 Some companies (e.g., Chevron) complied with the new requirement. Other companies (e.g., Exxon and Conoco) ceased operations and sued PdVSA for damages resulting from unilateral changes to contractual agreements.88 Oil production in Venezuela trended a bit lower but was relatively stable from 2007 through 2013, in the range of 2.5 million bpd.89

Following the death of Chávez in 2013, Nicolás Maduro was elected president of Venezuela.90 A series of antidemocratic actions and human rights violations by the Maduro government resulted in sanctions legislation and executive actions by the United States.91 In 2017, President Trump declared a national emergency in E.O. 13808 and the Administration imposed financial sanctions on PdVSA, including limiting PdVSA's access to U.S. debt finance. PdVSA is also prohibited from receiving dividends and cash distributions from its U.S.-based Citgo refining subsidiary. These limitations made it more difficult for PdVSA to purchase oil-related services and oil production equipment.

With the overall U.S. objective to pressure President Maduro to transfer government control, the United States recognized Juan Guaidó as interim president of Venezuela and imposed sanctions in January 2019 aimed at reducing Venezuela's oil revenues. These sanctions effectively terminate U.S.-Venezuela petroleum trade and potentially make it difficult for PdVSA to sell crude oil to and obtain petroleum products from non-U.S. entities.92

Oil Trade Sanctions Framework

U.S. sanctions targeting Venezuela's oil trade are a function of PdVSA being designated to be subject to U.S. sanctions. This designation prohibits U.S. companies from engaging in transactions with PdVSA, including petroleum trade, oilfield service operations, and oil production operations in Venezuela. To date, Congress has not enacted legislation that specifies and requires oil sanctions be imposed on Venezuela. Rather, the sanctions framework is a result of E.O.s issued under national emergency authorities, and Treasury designations and general licenses (GLs) based on that emergency that allow for the wind down or continuation of certain activities—see list of actions below.

E.O. 13850 (November 1, 2018): authorized prohibiting U.S. persons from engaging in certain transactions with any person determined by the Secretary of the Treasury to have supported "deceptive practices or corruption" involving the Government of Venezuela.93

E.O. 13857 (January 25, 2019): amended the "Government of Venezuela" definition in E.O. 13850 to include PdVSA.94

Treasury designates PdVSA (January 28, 2019): the Secretary of the Treasury determined that persons operating in Venezuela's oil sector are subject to sanctions. PdVSA added to the Specifically Designated Nationals (SDN) list.95

GLs issued (January 28, 2019 and subsequent revisions): Office of Foreign Asset Control (OFAC) GLs authorize certain transactions and activities with PdVSA for certain periods, including oil purchases (wind down periods) and oil production operations (continuation).96

E.O. 13884 (August 5, 2019): blocks property and interests in property located in the United States for persons/entities determined to have assisted PdVSA and the Government of Venezuela.

The Secretary of the Treasury's determination and designation affects several areas in which U.S. companies have business interests (e.g., debt and financial transactions, oil field services, and oil production activities) and effectively terminates U.S.-Venezuela petroleum (crude oil and petroleum products) trade.97 GL 12 allowed U.S. companies to continue purchasing and importing crude oil and petroleum products from PdVSA until April 28, 2019.98 However, any payment made for petroleum imported from PdVSA during the 90-day wind-down period must have been deposited in a U.S.-based blocked account. This requirement likely resulted in most of these transactions ending immediately, as PdVSA would have been motivated to seek alternative buyers. Some GLs explicitly stated that exporting diluents—typically light crude oil, condensate, or naphtha that is blended with Venezuelan heavy crude oil to facilitate transportation and processing99—from the United States to Venezuela was prohibited immediately.100

Chevron—currently participating in oil production joint ventures with PdVSA—and four oil service companies (Halliburton, Schlumberger, Baker Hughes, and Weatherford International) have been granted a GL to continue operating in Venezuela.101 This GL has been extended multiple times since January 2019 and is currently set to expire on April 22, 2020.

Potential Secondary Sanctions

Treasury guidance issued in January 2019 and E.O. 13884 create the potential for imposing sanctions on non-U.S. entities that transact with PdVSA.102 Following E.O. 13857, OFAC-issued Frequently Asked Questions (FAQs, #657) indicated that petroleum purchases by non-U.S. entities involving "any other U.S. nexus (e.g., transactions involving the U.S. financial system or U.S. commodity brokers)" are prohibited following the 90-day wind-down period.103 Most oil transactions are denominated in U.S. dollars and this guidance may create some difficulties for PdVSA to secure alternative buyers for crude oil volumes that were previously destined for the United States.

E.O. 13884 provides for the blocking of property and interests in property in the United States for persons and entities determined by the Secretary of the Treasury to have materially assisted—term not defined in the E.O.—PdVSA.104 This potential for sanctions on entities that transact with PdVSA, and have interests in property within U.S. jurisdiction, may further complicate PdVSA's efforts to sell crude oil to non-U.S. buyers and acquire petroleum products from alternative suppliers.

Oil Supply Impacts

Following the 2017 imposition of PdVSA financial sanctions, Venezuela's monthly oil production declined by approximately 50%—between August 2017 and January 2019. Venezuelan oil production had been trending downward in prior years due to aging oil infrastructure and insufficient investment in, and maintenance of, oil production assets.105 As indicated in Figure 3, crude oil production declined from approximately 2.8 million bpd in January of 2011 to approximately 1.9 million bpd in August 2017—when sanctions were imposed on PdVSA. U.S. imports of Venezuelan crude oil also declined by nearly 50%, on a monthly basis, during this period.

Sanctions imposed on PdVSA in 2017 made it difficult for the company to access financial resources from debt markets and to receive cash distributions from PDV Holding—PdVSA's U.S.-based subsidiary that owns Citgo, an oil refining and marketing company. This limitation likely created some operational difficulties for PdVSA with respect to short-term credit that might be needed to pay for oil-related services and acquire oil production and maintenance equipment from U.S. suppliers. Oil production data illustrated in Figure 3 indicate that the production decline accelerated following the 2017 financial sanctions. However, it is difficult to attribute specific production volume declines directly to these sanctions since production had been trending lower since 2014.106

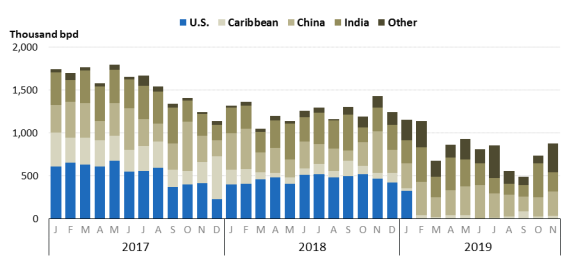

Oil production continued declining and reached approximately 1 million bpd in January 2019, when Treasury's PdVSA determination, designation, and GLs took effect (see Figure 3). U.S. imports of Venezuelan crude oil declined 50% over a one-month period between January 2019 and February 2019, and consistent with the pressure applied under sanctions, have since been reduced to zero.107 Prohibiting petroleum trade between the two countries results in a constraint in the global oil logistics system that can potentially resolve itself as transportation modes, trade routes, and transactions adjust to the sanctions-related constraint. PdVSA has sought alternative buyers such as India and China, countries that historically have been two of the largest destinations for Venezuelan crude oil (see Figure 8 in the "Trade Flow Adjustments").

Ship-tracking information indicates that Venezuela's crude oil exports to India and China increased 49% and 34% respectively between January 2019 and February 2019.108 However, export volumes to these countries in February 2019 were in the range of export volumes that have been observed since 2017. Although PdVSA sanctions do not explicitly prohibit non-U.S. entities from purchasing crude oil and petroleum products from Venezuela, these sanctions prohibit transactions that occur on or after April 28, 2019, that involve the U.S. financial system. Furthermore, E.O. 13884 provides Treasury with discretion to take action against foreign persons/entities that assist PdVSA. These sanctions framework elements may make it difficult for PdVSA to locate alternative buyers for crude oil barrels previously destined for the United States.

Oil Market Impact Observations

Sanctions-related oil supply losses and trade constraints have had an impact on oil markets. These impacts have been observed in the form of Iran and Venezuela supply reductions, as discussed above. Impacts have also been reflected in price relationships for specific crude oil types and adaptive changes to trade flow patterns. In terms of benchmark prices (i.e., West Texas Intermediate and Brent futures contracts that are often quoted in the media), potential price escalation that might be expected from Iran and Venezuela supply reductions appear to have been averted to date by an increase in oil production in other countries, trade flow adjustments, and indications of slowing oil demand growth rates. Higher oil production and export volumes from the United States, Russia, and other oil-producing and exporting countries have contributed toward mitigating potential upward price pressure.109

Oil Prices

Potential effects on oil and petroleum product (e.g., gasoline, diesel fuel, and aviation fuel) prices have been an explicit and implied consideration for sanctions that impact global oil supply and trade. Enacted sanctions legislation targeting Iran's oil exports requires the Administration to consider and certify that the world oil market is adequately supplied when imposing sanctions and to coordinate with other oil-producing countries to minimize price impacts (see "Sanctions Framework Targeting Iran's Oil Exports" and subsequent discussion). Additional policy design elements, such as wind-down periods, provide some time for markets to adjust for sanction-related trade constraints. These design elements serve to minimize potential price increases to oil buyers and petroleum product consumers. At the same time, existing oil-related sanctions policy does not include considerations for possible oil market oversupply—a circumstance that could contribute to market conditions that could result in sharply lower oil prices—should certain sanctions be relieved, waived, or terminated. While such an outcome may be a temporary benefit to U.S. petroleum consumers, a severe oil price decline over a sustained period could have a negative impact on U.S. oil exploration, production, and exports. This topic is discussed further in the "Policy Considerations" section.

Benchmark Prices

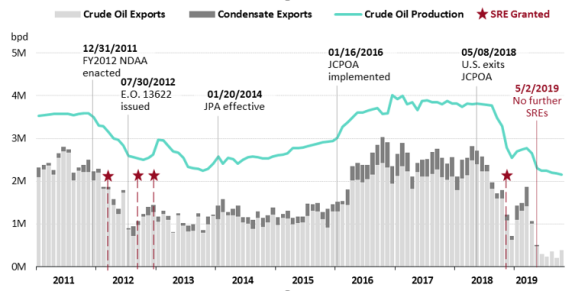

Oil prices that receive the most visibility are front month benchmark futures prices that are regularly reported in the news media. Benchmark prices represent the value of crude oil with certain quality characteristics at a specific location. Buyers and sellers use benchmark prices to establish a baseline oil price that is adjusted for various parameters such as quality differences and transportation costs (e.g., maritime, rail, and pipeline). Brent crude oil, a light/sweet crude oil that represents the price of North Sea (located between the United Kingdom, Norway, and Denmark) crude oil cargoes loaded on to shipping vessels, is one common benchmark price that is generally considered a proxy for global prices.110 As indicated in Figure 4, Brent prices in August 2019 were more than 40% lower than in December 2011, when legislation targeting Iran oil exports was enacted. However, this macro-level pricing behavior does not suggest that oil sanctions imposed since 2011 have contributed to lower prices. Rather, benchmark prices generally reflect near-term expectations of global oil supply—potentially affected by oil-related sanctions—and demand balances that quickly can change due to unplanned production outages, economic and oil demand growth forecasts, supply growth in certain countries, OPEC oil production decisions, and other physical and financial market variables.

|

Figure 4. Brent Crude Oil Price and Selected Oil-Related Sanction Events |

|

|

Sources: Congressional Research Service; daily Brent crude oil prices from Bloomberg L.P. (subscription required). Notes: FY2012 NDAA = National Defense Authorization Act for Fiscal Year 2012 (P.L. 112-81); JPA = Joint Plan of Action; JCPOA = Joint Comprehensive Plan of Action; UFSA = Ukraine Freedom Support Act of 2014 (P.L. 113-272); CRIEEA = Countering Russian Influence in Europe and Eurasia Act (P.L. 115-44, Title II; 22 U.S.C. 9501 et seq.); PdVSA = Petroleos de Venezuela S.A.; SREs = significant reduction exceptions; E.O. = executive order. |

Due to the different factors contributing to benchmark price directional movements, it is difficult to attribute any actual price change to a sanctions event that either reduced supply or allowed curtailed oil volumes to return. However, there was at least one period when uncertainty about sanctions targeting Iran's oil exports arguably contributed to temporary market oversupply and an oil price decline.

When the Trump Administration announced in May 2018 that the United States would exit the JCPOA, general market expectations were that the Administration would not grant SREs to countries that were importing crude oil from Iran. In response to this expectation, Saudi Arabia increased its oil production by approximately 1 million bpd between May 2018 and November 2018.111 Other producers, including Russia, also increased production over this period.112 However, the Administration granted SREs to eight countries in November 2018. A temporary oversupply resulted and arguably contributed to the Brent benchmark price declining by more than $20 per barrel between November 5, 2018, and December 24, 2018. Media reports indicate that the SREs created an oversupplied market condition that required Saudi Arabia, Russia, and other OPEC+ members to manage.113

Price Differentials for Certain Crude Oil Types

Petroleum sanctions imposed on Venezuela prohibit petroleum trade with the United States. The largest element of the U.S.-Venezuela petroleum trade relationship consisted of U.S. imports of Venezuelan crude oil (approximately 500,000 bpd in January 2019). A significant portion of these imports was classified as heavy/sour, indicating the crude oil's gravity and sulfur content. When Venezuela petroleum trade sanctions were announced in January 2019, U.S. refiners began seeking alternative suppliers during the 90-day wind-down period. The resulting price impact was an increase in prices for medium and heavy crude oils relative to light/sweet crude and a narrowing of the price differential between these crude oil types (see Figure 5).

As indicated in Figure 5, the Louisiana Light Sweet (LLS) to Mars spot price differential has been negative on certain days in 2019 following the prohibition of U.S.-Venezuela petroleum trade in January. Lower quality Mars crude oil was temporarily more expensive than LLS crude oil. While this is not the first time this differential has been negative—the LLS/Mars price differential was also negative on certain days in 2009 and 2011—price signals in 2019 are indicative of the oil logistics system adjusting to a sanctions-related trade constraint. U.S. refiners that previously purchased heavy crude oil from Venezuela were required to source substitute crude oil from other suppliers (e.g., Colombia, Canada, Iraq, and Saudi Arabia), modify refinery operations to process other crude oil types, or a combination of both. Operating margins for U.S. refiners that are optimally configured to process heavy/sour crude oil could be adversely affected by a persistently narrow or negative light/heavy price differential.

Trade Flow Adjustments

Sanctions imposed on Iran and Venezuela have resulted in oil export and trade constraints for which the global oil logistics system has had to adjust. For example, Iran's oil buyers have sourced oil from alternative suppliers, and some U.S. refiners have located alternative supplies to replace crude oil previously imported from Venezuela. The United States, Russia, Saudi Arabia, and other countries have provided alternative oil supplies to compensate for sanctions-related oil supply constraints.

U.S. Crude Oil Exports

Crude oil exports from the United States have contributed to "adequate" global oil supply—a statutory requirement of the Iran oil export sanctions framework—that has enabled the Administration to pursue an objective of reducing Iran's oil exports to zero. Growth in U.S. crude oil exports has been enabled by increasing U.S. oil production, the 2015 repeal of a 40-year crude oil export prohibition, and global oil benchmark price differentials that financially motivate crude oil exports.114 Monthly U.S. crude oil export volumes have been as high as 3 million bpd in 2019.115 South Korea, following a U.S. policy decision to exit the JCPOA, provides an example of how U.S. crude oil exports provided an alternative source of oil supply as the country reduced imports from Iran (see Figure 6).

As indicated in Figure 6, South Korea imports of Iranian crude oil declined to zero following the Trump Administration's May 2018 decision to exit the JCPOA in expectation that no SREs would be granted. At the same time, imports of U.S. crude oil to South Korea immediately increased and had more than quadrupled, month-over-month, by December 2018.

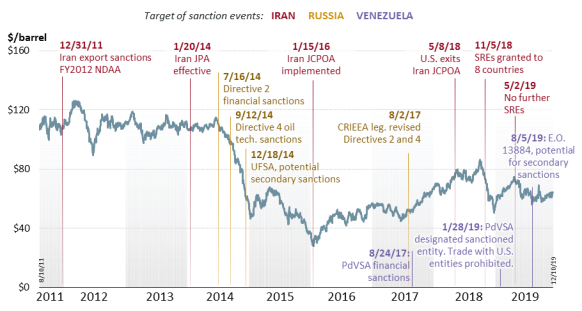

China Oil Imports

China's oil imports provide another example of how oil trade flows have adjusted to sanctions-related constraints. As illustrated in Figure 7, imports of Iranian crude oil to China began to decline following the U.S. JCPOA exit—at a relatively slower pace than South Korea. As imports from Iran began to decline, imports from Saudi Arabia and Russia increased as refineries in China sought alternative oil supplies. China imports of U.S. crude oil declined to as low as zero (March 2019)—likely a result of U.S/China trade negotiations—following the JCPOA exit but have increased since. In September 2019, China imposed a 5% import tariff on U.S. crude oil, which could—in addition to crude oil quality considerations (see Figure 7 notes)—reduce incentives for refineries in China to increase U.S. crude oil purchases as an alternative to Iranian supplies.116

Venezuela-Related Trade

Sanctions imposed on PdVSA have effectively eliminated petroleum trade between the United States and Venezuela. In response to this trade constraint, PdVSA has sought alternative buyers for crude oil that was previously destined for the United States and has sought alternative suppliers of light crude oil and other diluents previously supplied by U.S. exporters. As indicated in Figure 8, Venezuela crude oil exports to the United States immediately stopped following the January 2019 designation of PdVSA as a sanctioned entity. To date, crude oil exports to China and India have remained at levels similar to those observed since 2017. However, oil exports to countries categorized as "other" have trended up since January 2019. Potential secondary sanctions on entities that transact with PdVSA using the U.S. financial system, as well as entities determined to have materially supported the government of Venezuela, could motivate non-U.S. entities to reduce or eliminate purchases of Venezuelan crude oil at some point in the future.

|

Figure 8. Venezuela Crude Oil Exports by Destination January 2017 - November 2019 |

|

|

Source: Bloomberg L.P. tanker tracking service, accessed via the Bloomberg Terminal (subscription required). Notes: Export volumes represent oil volumes that were loaded onto tankers for each month. As a result, export volumes from Venezuela differ from U.S. import volumes indicated in Figure 3, as provided by the Energy Information Administration. |

PdVSA has also been sourcing diluent products from other suppliers. U.S. diluent exports to Venezuela were prohibited immediately in January 2019, with no wind-down period. According to trade reports, PdVSA has sourced diluents from Russia following the imposition of U.S. sanctions.117 However, total Venezuela diluent imports have reportedly been lower compared with import levels prior to January 2019.118 Lower diluent imports could be a leading indicator for lower crude oil production due to blending needs for certain Venezuelan crude oil types.

Policy Considerations