Venezuela Oil Sector Sanctions: Market and Trade Impacts

On January 28, 2019, the Trump Administration imposed sanctions on Venezuela's state-owned oil company, Petroleos de Venezuela, S.A. (PdVSA), adding to existing Venezuela sanctions. The Department of the Treasury determined that persons (e.g., individuals and companies) operating in Venezuela's oil sector are subject to sanctions in order to apply economic pressure on the government of Nicolas Maduro and facilitate a transition to democracy. Subsequently, Treasury's Office of Foreign Assets Control (OFAC) added PdVSA—including all entities in which PdVSA has a 50% or more ownership position—to its Specifically Designated Nationals (SDN) list. This designation blocks PdVSA's U.S. assets and prohibits the company from dealing with U.S. persons. These sanctions will affect several areas in which U.S. companies have business interests (e.g., debt/financial transactions and oil field services) and will effectively terminate U.S.-Venezuela petroleum (crude oil and petroleum products) trade. Potential economic impacts of these sanctions on Venezuela could be significant, but are beyond the scope of this product.

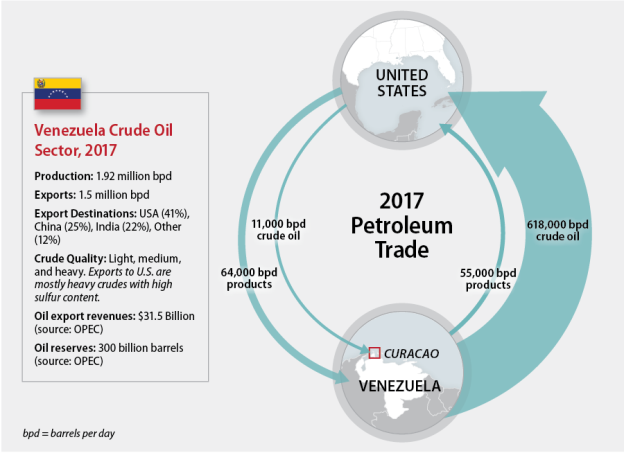

U.S.-Venezuela Petroleum Trade

Petroleum trade between the United States and Venezuela has been characterized by imports of heavy Venezuelan crude oil to U.S. refineries (see Figure 1), mostly to the Gulf Coast. In 2017, U.S. refineries imported 618,000 barrels per day (bpd) of Venezuelan crude oil—approximately 8% of total crude imports during the year. U.S. importers also purchased 55,000 bpd of Venezuelan petroleum products. U.S. exports to PdVSA consisted of 64,000 bpd of petroleum products directly to Venezuela and 11,000 bpd of crude oil to Curacao, where PdVSA has operated a refinery and petroleum storage facility. U.S. light oil and petroleum products are typically used as a diluent for blending with Venezuelan heavy crude oil as a means of reducing viscosity and facilitating transportation and marketing.

|

|

Source: CRS, data from the Energy Information Administration and, where noted, the Organization of the Petroleum Exporting Countries (OPEC). Notes: EIA export data indicate that U.S. suppliers have not exported crude oil to Curacao since April 2018. The Curacao refinery was temporarily idled in mid-2018 due to a legal dispute between PdVSA and ConocoPhillips. |

Petroleum Market and Trade Impacts

Prohibiting petroleum trade and related financial transactions between the United States and PdVSA will create a constraint within the global oil logistics system that will result in adjustments to global trade flows. The oil sector sanctions do not explicitly prevent non-U.S. entities from purchasing crude oil from or supplying petroleum products to Venezuela. However, OFAC-issued Frequently Asked Questions (FAQs, #657) indicate that petroleum purchases by non-U.S. entities involving "any other U.S. nexus (e.g., transactions involving the U.S. financial system or U.S. commodity brokers)" are prohibited following a 90-day wind-down period.

PdVSA will need to secure alternative buyers for crude oil and petroleum product volumes that might otherwise be delivered to U.S. refiners as well as alternative suppliers for diluents previously sourced from the United States. U.S. refiners, on the other hand, will be required to identify alternative crude oil suppliers and U.S. petroleum exporters will have to locate other buyers for petroleum products that might have been destined for Venezuela.

Adjusting to these sanctions-related supply constraints may take some time as alternative buyers and suppliers are located. Price levels for the affected petroleum commodities will also likely change as a means to facilitate alternative trade routes (e.g., U.S. refiners may have to incur price premiums to attract substitute crudes and PdVSA may have to accept price discounts in order to attract alternative buyers). Trade flow adjustments could potentially influence the magnitude of price impacts.

U.S. Petroleum Exports to Venezuela

Petroleum exports (e.g., diluents) from the United States to Venezuela are prohibited as of January 28, 2019. As a result, PdVSA will have to replace volumes purchased from U.S. suppliers. While there are alternative global suppliers, acquiring replacement diluents may result in delayed deliveries due to potentially longer trade routes. Since diluents are necessary to transport and market Venezuela's heavy crude oil, a temporary diluent shortage could potentially reduce PdVSA's crude oil production and export volumes until replacement diluents are acquired. U.S. petroleum product suppliers will need to find alternative customers for volumes previously destined for Venezuela.

Venezuela Petroleum Exports to the United States

Crude oil and petroleum product exports from Venezuela to the United States are also prohibited, although OFAC issued general licenses (7 and 12) allowing two U.S.-based PdVSA subsidiaries, including CITGO, as well as U.S. companies to continue purchasing and importing crude oil and petroleum products from PdVSA until April 28, 2019. Any payment made for petroleum imports from PdVSA during the wind-down period must be deposited into a U.S.-based blocked account, which will likely result in those transactions being stopped immediately. PdVSA will likely seek alternative non-U.S. cash buyers. However, PdVSA petroleum sales to non-U.S. buyers could be complicated due to OFAC's indication that any such transactions involving the U.S. financial system are prohibited.

U.S. crude oil imports from Venezuela—the largest trade element between the two countries—have declined since 2017 and averaged 511,000 barrels per day in November 2018. U.S. refiners will need to secure alternative supply sources to replace crude oil imports from PdVSA. Table 1 shows the companies that purchased Venezuelan crude oil and the states where oil was delivered during November 2018.

|

California |

Louisiana |

Mississippi |

Texas |

Total |

Percentage |

|

|

Chevron |

220 |

2,793 |

3,013 |

20% |

||

|

CITGO |

2,705 |

1,507 |

4,212 |

28% |

||

|

Houston Refining |

495 |

495 |

3% |

|||

|

Marathon |

660 |

660 |

4% |

|||

|

Motiva |

458 |

458 |

3% |

|||

|

Paulsboro |

1,392 |

1,392 |

9% |

|||

|

Valero |

329 |

1,577 |

3,196 |

5,102 |

33% |

|

|

Total |

549 |

6,334 |

2,793 |

5,656 |

15,332 |

100% |

|

Percentage |

4% |

41% |

18% |

37% |

100% |

Source: Energy Information Administration, Company Level Imports, with data for November 2018, available at https://www.eia.gov/petroleum/imports/companylevel/, accessed February 6, 2019.

Notes: Citgo is majority-owned by PdVSA. Russian oil company Rosneft holds 49.9% of Citgo as loan collateral.

Other refiners purchase Venezuelan crude throughout the year, most located in the Gulf Coast.