Shipping Under the Jones Act: Legislative and Regulatory Background

The Jones Act, which refers to Section 27 of the Merchant Marine Act of 1920 (P.L. 66-261), requires that vessels transporting cargo from one U.S. point to another U.S. point be U.S.-built, and owned and crewed by U.S. citizens. The act provides a significant degree of protection for U.S. shipyards, domestic carriers, and American merchant sailors. It is a subject of debate because some experts argue that it leads to high domestic ocean shipping costs and constrains the availability of ships for domestic use. The Jones Act has come into prominence amid debates over Puerto Rico’s economic challenges and recovery from Hurricane Maria in 2017; in the investigation into the sinking of the ship El Faro with 33 fatalities during a hurricane in 2015; and in discussions about domestic transportation of oil and natural gas. The law’s effectiveness in achieving national security goals has also been the subject of attention in conjunction with a congressional directive that the Administration develop a national maritime strategy, including strategies to increase the use of short sea shipping and enhance U.S. shipbuilding capability. Defense officials have stated that while the Jones Act helps preserve a baseline of shipyard capability, the dwindling size of the fleet indicates a need to reassess current policy. However, the U.S. Maritime Administrator has credited the law for ensuring the employment of the majority of U.S. merchant mariners.

The Jones Act of 1920 was not the first law requiring that vessels transporting cargo domestically be U.S.-built, owned, and crewed. It restated a long-standing restriction that was temporarily suspended during World War I. Since 1920, Congress has enacted provisions that could be said to tighten Jones Act requirements as well as provisions that exempt certain maritime activity from the requirements. In 1935, Congress forbade Jones Act-qualified vessels that were sold to foreign owners or registered under a foreign flag to subsequently requalify as Jones Act-eligible (P.L. 74-191). This provides additional protection from competition for Jones Act carriers if coastal shipping demand increases, because it can take around two years to construct a new ship. In 1940, Congress expanded the Jones Act to include towing and salvage vessels (P.L. 76-599). In 1988, Congress specified that waterborne transport of valueless material required use of a Jones Act-qualified vessel, such that transport of dredged material would fall under the law (P.L. 100-329). Generally, dredging and towing vessels, as well as Great Lakes ships, have occasioned less debate about the Jones Act than oceangoing ships and offshore supply vessels.

Congress has enacted numerous exemptions or exceptions to the Jones Act. In some cases, Congress has enacted an exemption if there are no Jones Act-qualified carriers interested in serving a particular market (e.g., passenger travel to and from Puerto Rico). Congress has allowed waivers of the Jones Act for national defense reasons, which most often have been executed to speed fuel deliveries to a region after a natural disaster disrupted normal supply lines.

Regulatory interpretations of the Jones Act have been significant in defining what constitutes a “U.S.-built” vessel, what constitutes “transportation” between two U.S. points, and what are “U.S. points.” The Coast Guard has determined that a U.S.-built vessel can be assembled with major foreign components such as engines, propellers, and stern and bow sections. This interpretation has been consistent from the late 1800s. Customs and Border Protection (CBP) has determined that cruise ship voyages that involve visits to foreign ports in addition to a domestic port are not domestic transportation and therefore not subject to the Jones Act. This interpretation also dates to the late 1800s. CBP’s interpretations of what constitutes domestic transportation and U.S. points are significant to the offshore oil industry, as some of the vessels supporting that industry must be Jones Act-compliant while others need not be.

By long-standing agreement, the military is to utilize U.S.-flag commercial ships for sealift before it utilizes government-owned vessels in its reserve fleet. Jones Act mariners are expected to crew sealift ships when needed, and thus the decades-long shrinkage of the oceangoing Jones Act fleet and mariner pool has been raised as a concern. The Department of Defense plans to recapitalize the reserve fleet by building new vessels in domestic shipyards, repairing ships in the current fleet to extend their service life out to 60 years, and purchasing used, foreign-built ships. Cost and time considerations may influence the relative weight of each of these approaches.

Much of the commercial fleet is relatively old, raising safety concerns in certain cases. Some commercially useful types of ships are missing from the Jones Act-qualified fleet, and, to some extent, the design needs for commercial ships have diverged from those for sealift vessels. Both situations may appear inconsistent with policy goals established by Congress, which include having a merchant marine “sufficient to carry the waterborne domestic commerce” and “capable of serving as a naval and military auxiliary in time of war or national emergency.”

Shipping Under the Jones Act: Legislative and Regulatory Background

Jump to Main Text of Report

Contents

- Introduction

- Legislative Context

- Shipbuilding Costs Debated

- Statement of U.S. Maritime Policy

- What the Jones Act Requires

- Regulatory Background

- "U.S.-Built" Vessel Defined

- Passenger Vessel Itineraries

- Offshore Oil and Gas Vessels

- Offshore Wind Farms

- Foreign Blending Ports

- The Jones Act Since 1920

- Actions to Expand Jones Act Applicability

- Precedents for Exempting the Jones Act

- Waivers for Specifically Named Vessels

- Administrative Waivers in the Interest of National Defense

- The Jones Act Fleet

- Oceangoing Ships

- Ship Designs Missing from the Oceangoing Fleet

- Seagoing Barges

- Fleet Age

- The Great Lakes Fleet

- Inland River Fleet

- The Dredging Fleet

- Offshore Supply Vessels

- The Jones Act and Sealift Capability

- Sealift Crews

- Sealift Ships

- Divergence in Design of Commercial and Sealift Ships

- Shipbuilding and Repair Industrial Base

Tables

Appendixes

Summary

The Jones Act, which refers to Section 27 of the Merchant Marine Act of 1920 (P.L. 66-261), requires that vessels transporting cargo from one U.S. point to another U.S. point be U.S.-built, and owned and crewed by U.S. citizens. The act provides a significant degree of protection for U.S. shipyards, domestic carriers, and American merchant sailors. It is a subject of debate because some experts argue that it leads to high domestic ocean shipping costs and constrains the availability of ships for domestic use. The Jones Act has come into prominence amid debates over Puerto Rico's economic challenges and recovery from Hurricane Maria in 2017; in the investigation into the sinking of the ship El Faro with 33 fatalities during a hurricane in 2015; and in discussions about domestic transportation of oil and natural gas. The law's effectiveness in achieving national security goals has also been the subject of attention in conjunction with a congressional directive that the Administration develop a national maritime strategy, including strategies to increase the use of short sea shipping and enhance U.S. shipbuilding capability. Defense officials have stated that while the Jones Act helps preserve a baseline of shipyard capability, the dwindling size of the fleet indicates a need to reassess current policy. However, the U.S. Maritime Administrator has credited the law for ensuring the employment of the majority of U.S. merchant mariners.

The Jones Act of 1920 was not the first law requiring that vessels transporting cargo domestically be U.S.-built, owned, and crewed. It restated a long-standing restriction that was temporarily suspended during World War I. Since 1920, Congress has enacted provisions that could be said to tighten Jones Act requirements as well as provisions that exempt certain maritime activity from the requirements. In 1935, Congress forbade Jones Act-qualified vessels that were sold to foreign owners or registered under a foreign flag to subsequently requalify as Jones Act-eligible (P.L. 74-191). This provides additional protection from competition for Jones Act carriers if coastal shipping demand increases, because it can take around two years to construct a new ship. In 1940, Congress expanded the Jones Act to include towing and salvage vessels (P.L. 76-599). In 1988, Congress specified that waterborne transport of valueless material required use of a Jones Act-qualified vessel, such that transport of dredged material would fall under the law (P.L. 100-329). Generally, dredging and towing vessels, as well as Great Lakes ships, have occasioned less debate about the Jones Act than oceangoing ships and offshore supply vessels.

Congress has enacted numerous exemptions or exceptions to the Jones Act. In some cases, Congress has enacted an exemption if there are no Jones Act-qualified carriers interested in serving a particular market (e.g., passenger travel to and from Puerto Rico). Congress has allowed waivers of the Jones Act for national defense reasons, which most often have been executed to speed fuel deliveries to a region after a natural disaster disrupted normal supply lines.

Regulatory interpretations of the Jones Act have been significant in defining what constitutes a "U.S.-built" vessel, what constitutes "transportation" between two U.S. points, and what are "U.S. points." The Coast Guard has determined that a U.S.-built vessel can be assembled with major foreign components such as engines, propellers, and stern and bow sections. This interpretation has been consistent from the late 1800s. Customs and Border Protection (CBP) has determined that cruise ship voyages that involve visits to foreign ports in addition to a domestic port are not domestic transportation and therefore not subject to the Jones Act. This interpretation also dates to the late 1800s. CBP's interpretations of what constitutes domestic transportation and U.S. points are significant to the offshore oil industry, as some of the vessels supporting that industry must be Jones Act-compliant while others need not be.

By long-standing agreement, the military is to utilize U.S.-flag commercial ships for sealift before it utilizes government-owned vessels in its reserve fleet. Jones Act mariners are expected to crew sealift ships when needed, and thus the decades-long shrinkage of the oceangoing Jones Act fleet and mariner pool has been raised as a concern. The Department of Defense plans to recapitalize the reserve fleet by building new vessels in domestic shipyards, repairing ships in the current fleet to extend their service life out to 60 years, and purchasing used, foreign-built ships. Cost and time considerations may influence the relative weight of each of these approaches.

Much of the commercial fleet is relatively old, raising safety concerns in certain cases. Some commercially useful types of ships are missing from the Jones Act-qualified fleet, and, to some extent, the design needs for commercial ships have diverged from those for sealift vessels. Both situations may appear inconsistent with policy goals established by Congress, which include having a merchant marine "sufficient to carry the waterborne domestic commerce" and "capable of serving as a naval and military auxiliary in time of war or national emergency."

Introduction

The Jones Act, which refers to Section 27 of the Merchant Marine Act of 1920 (P.L. 66-261),1 requires that vessels transporting cargo from one U.S. point to another U.S. point be U.S.-built, and owned and crewed by U.S. citizens.2 The act provides a significant degree of protection from foreign competition for U.S. shipyards, domestic carriers, and American merchant sailors3, while seeking to address potential national security concerns. The Jones Act seeks to maintain "a merchant marine of the best equipped and most suitable types of vessels sufficient to carry the greater portion of its commerce and serve as a naval or military auxiliary in times of war or national emergency" by supporting

- a U.S.-controlled commercial fleet to supplement the military sealift fleet;

- a U.S. merchant marine workforce qualified to crew reserve military sealift vessels; and

- domestic shipbuilding and repair capacity.

In seeking to accomplish these goals, the Jones Act constrains the availability of a greater variety and number of ships and contributes to both increased domestic shipping and shipbuilding costs in requiring merchant vessels to be built in U.S. shipyards rather than in shipyards abroad. It has been an issue in recent Congresses, coming into prominence amid debates over Puerto Rico's economic challenges and recovery from Hurricane Maria in 2017; in the investigation into the sinking of the 40-year-old ship El Faro with 33 fatalities during a hurricane in 2015;4 and in discussions about domestic transportation of oil and natural gas.5

The law's effectiveness in achieving national security goals has also been the subject of attention in conjunction with a congressional directive that the Administration develop a national maritime strategy, including strategies to increase the use of short sea shipping and enhance U.S. shipbuilding capability.6 At a March 2018 House Armed Services Committee hearing, the general in charge of military sealift testified:7

The Merchant Marine Act of 1920, or the Jones Act, and the Cargo Preference Act [see below] are intended to ensure a baseline of ongoing business to support our inter-coastal shipping capacity and maintain a market for U.S. industrial shipyard infrastructure to build, repair, and overhaul U.S. vessels. However, the dwindling size of the domestic U.S. inter-coastal shipping fleet demands that we reassess our approach to ensure that the U.S. retains critical national security surge sealift capabilities. We also may need to rethink policies of the past in order to face an increasingly competitive future.

At the same hearing, the Maritime Administrator, who leads the Department of Transportation agency charged with promoting the U.S.-flag merchant ship fleet, testified:8

U.S. coastwise trade laws, commonly referred to as the Jones Act, help support national security priorities. Jones Act requirements support U.S. shipyards and repair facilities, as well as the supply chains that produce and repair American built ships, and ensure that intermodal equipment, terminals and other domestic infrastructure are available to the U.S. military in times of war or national emergency. This requirement results in the employment of the majority of U.S. mariners.

In May 2018, the Office of Management and Budget requested public comment on federal requirements that could be modified or repealed to increase efficiency and reduce or eliminate unnecessary or unjustified regulatory burdens in the maritime sector.9 Although the Jones Act is a statutory and not a regulatory provision, many of the comments received discuss the act.10

Legislative Context

The Jones Act of 1920 was not the first law requiring that vessels transporting cargo domestically be U.S.-built, owned, and crewed. Rather, it was a restatement of a long-standing restriction that was temporarily suspended during World War I by P.L. 65-73, enacted October 6, 1917.

Laws favoring a U.S.-flag fleet over a foreign fleet were initiated by the third act of the First Congress (1 Stat. 27, enacted July 20, 1789), which assessed lesser duties on vessels built and owned domestically than on those foreign-built and -owned. On September 1 of the same year, Congress specified that only a U.S.-built vessel owned by U.S. citizens and with a U.S. citizen captain could register as a U.S. vessel (1 Stat. 55).11 In 1817, Congress enacted a precursor to the Jones Act by disallowing any vessel wholly or partially foreign-owned from transporting domestic cargo between U.S. ports (3 Stat. 351). In 1886, this prohibition was extended to vessels transporting passengers domestically (24 Stat. 81).

The early United States had a comparative advantage in shipbuilding due to its ample supplies of large timber. During the second half of the 1800s, it lost that advantage as wooden sailing ships gave way to iron steamships, with the advantage shifting to Scotland and England. Congress began debating how to respond to the steep drop-off in the share of U.S. foreign trade carried by U.S. vessels. The fall-off in domestic coastwise transport was less severe, but railroads began offering competition to coastal shipping. Proposals to allow foreign-built vessels to sail under the U.S. flag became known as the "free ship" movement. Opponents of the free ship movement argued that the higher cost of U.S. crews in and of itself would prevent a resurgence of trade carried by U.S. vessels even if foreign-built ships were allowed. While bills that would have allowed foreign-built vessels to qualify for U.S.-flag international service were reported by House and Senate committees in the late 1800s, it was in 1912 that Congress enacted such a measure (P.L. 62-33, 37 Stat. 562). Thus, since 1912, the domestic build requirement has principally applied to vessels making domestic voyages.12

In the late 1800s, Congress considered but did not pass bills that would have allowed foreign-built ships in domestic trade. Rather, Congress tightened the language concerning coastwise transport in response to shippers' attempts to avoid high-cost U.S. vessels. For instance, in 1891 a shipper loaded 250 kegs of nails at the Port of New York with an ultimate destination of Los Angeles (Redondo).The shipper loaded the merchandise on a foreign-flag ship bound for Antwerp, Belgium, where the goods were transferred to another foreign-flag ship bound for Los Angeles. Despite the circuitous routing and extra port charges, the freight charges were apparently less than they would have been using a U.S.-built and U.S.-owned ship to carry the nails directly between New York and Los Angeles. A court found that the shipper had acted legally.13 Similarly, shipments from Seattle to Alaska often were routed via Vancouver, Canada, so shippers could use foreign-flag ships for both legs. Congress amended the coastwise law in 1893 (27 Stat. 455) and again in 1898 (30 Stat. 248) to prohibit shippers from routing cargo through a foreign port so as to avoid coastwise laws.

Nonetheless, U.S. shippers continued to use foreign-flag vessels in the Alaska trade by moving cargo between the United States and Vancouver, Canada, by rail. In the Merchant Marine Act of 1920, Senator Wesley Jones of Washington, chair of the Commerce Committee, sought to stop this practice by requiring Alaska-bound cargo to move through the Port of Seattle by amending the coastwise language to cover shipments "by land and water" and replacing shipments between "U.S. ports" with shipments between "U.S. points." These amendments remain current law.14

Shipbuilding Costs Debated

Requirements under the Jones Act seek to maintain U.S. shipbuilding capacity to reduce U.S. reliance on foreign shipyards in the event of military conflict. The Merchant Marine Act of 1970 (P.L. 91-469) added as an additional objective of U.S. maritime policy to have a merchant marine "supplemented by efficient facilities for building and repairing vessels." To some extent, the Jones Act treats the comparatively high cost of domestic shipbuilding as necessary to maintain such capacity for national security reasons. The relative cost of building ships in the United States versus foreign countries was part of the debate leading up to passage of the Jones Act. Four years earlier, in the Shipping Act of 1916, Congress had requested annual reports on the subject from the federal agency in charge of maritime transportation.15 The minority report to a 1919 House committee report to the bill that would become the Jones Act expressed the view that banning foreign-built ships would result in more costly domestically built ships:16

… in order to build up and sustain an American merchant marine it is absolutely necessary to remove every restriction against American merchants acquiring ships, whether built in the United States or out of the United States, at the lowest possible price, in order to enable them to compete with other nations in the transportation of the commerce of the world. If our merchants are allowed to buy ships in the open world market and place them under American registry with the privilege of using them both in the coastwise and overseas trade, it will inevitably follow that ships under the American flag will be bought as cheaply as ships under other flags.

On the other hand, if the American merchant shall be permitted to buy ships only from American builders in order to engage in our coastwise trade, it necessarily follows that every ship built in the United States will command a higher price than any foreign-built ship.

Our American iron and steel manufacturers were unable to compete until they had to. When they had to they did compete successfully. Our shipbuilders can and will do likewise.

A 1922 government report on shipbuilding concluded that U.S.-built ships cost 20% more than those built in foreign yards.17 The cost differential increased to 50% in the 1930s.18 In the 1950s, U.S. shipyard prices were double those of foreign yards, and by the 1990s, they were three times the price of foreign yards.19 Today, the price of a U.S.-built tanker is estimated to be about four times the global price of a similar vessel,20 while a U.S.-built container ship may cost five times the global price, according to one maritime consulting firm.21 Some 91% of the 911 vessels built in U.S. shipyards between 2007 and 2017 were sold domestically, suggesting that U.S. shipyards compete infrequently with foreign shipyards on price or vessel characteristics.22

The cost differential with respect to oceangoing ships is an issue for Department of Defense officials in charge of military sealift ships. As discussed later in this report, the military has modified a plan to build sealift ships domestically, finding it costly, and instead intends to buy more used foreign-built cargo ships.

However, as was argued in the late 1800s, shipbuilding costs are not the only cost factor. U.S. crewing costs are higher than those of foreign-flag vessels. U.S.-flag ships have an operating cost differential estimated to be over $6 million per ship per year compared to foreign-flag ships. While crewing is the primary cost element, this estimate also includes insurance and ship maintenance costs.23 A 2011 study by the U.S. Maritime Administration (MARAD) found that in 2010, the average operating cost of a U.S.-flag ship was 2.7 times greater than a foreign-flag ship,24 but MARAD estimates that this cost differential has since increased.25

Despite the cost issues, the Jones Act ensures that the United States maintains enough shipbuilding capacity and maintenance capability to support a domestic merchant fleet. This capacity is available to the U.S. military in times of war or national emergency.

Statement of U.S. Maritime Policy

A main thrust of the Merchant Marine Act of 1920 concerned the sale of a surplus of government cargo ships constructed for World War I. A second important and enduring aspect of the bill is its statement of maritime policy. The policy goals stated in the 1920 act, which appear in Section 27, have continued to the present day (46 U.S.C. §50101). The law stated the following:

That it is necessary for the national defense and for the proper growth of its foreign and domestic commerce that the United States shall have a merchant marine of the best equipped and most suitable types of vessels sufficient to carry the greater portion of its commerce and serve as a naval or military auxiliary in times of war or national emergency, ultimately to be owned and operated privately by citizens of the United States; and it is hereby declared to be the policy of the United States to do whatever may be necessary to develop and encourage the maintenance of such a merchant marine.

This statement reflects the United States' status as an emerging power at that time. When World War I began in 1914, European nations utilized their ships for the war effort or kept them in harbors for fear of submarine attacks, leaving the United States with a shortage of ships for carrying its foreign trade. The Merchant Marine Act therefore emphasized that the United States should have its own merchant marine so as not to be dependent on any other nations' merchant vessels. Congress has subsequently adopted additional maritime policy goals on several occasions.

What the Jones Act Requires

The Jones Act applies only to domestic waterborne shipments. It does not apply to the nation's international waterborne trade, which is almost entirely carried by foreign-flag ships.26 The U.S. citizen crewing requirement means that the master, all of the officers, and 75% of the remaining crew must be U.S. citizens. If the U.S. owner of a Jones Act ship is a corporation, 75% of the corporation's stock must be owned by U.S. citizens.

Regarding U.S. territories, the U.S. Virgin Islands, America Samoa, and the Northern Mariana Islands are exempt from the Jones Act. Therefore, foreign-flag ships can transport cargo between these islands and other U.S. points. Puerto Rico is exempt for passengers but not for cargo. Vessels traveling between Guam and another U.S. point must be U.S.-owned and -crewed but need not be U.S.-built. The Jones Act is applicable to the State of Hawaii.

Regulatory Background

The Coast Guard is in charge of enforcing the U.S.-build requirement for vessels (46 C.F.R. §§67.95-67.101), U.S. ownership of the carriers (46 C.F.R. §§67.30-67.43), and U.S. crewing (46 C.F.R. §10.221)—essentially, the licensing of Jones Act operators. It enforces these requirements when an operator seeks a "coastwise endorsement" (46 C.F.R. §67.19) from the agency. The terms "coastwise qualified" and "Jones Act qualified" are synonymous. Customs and Border Protection (CBP) is primarily responsible for determining what maritime activity falls under the act, namely defining what constitutes "transportation" and whether the origin and destination of a voyage are "U.S. points" (19 C.F.R. §§4.80–4.93). Agency interpretations of domestic shipping restrictions have been consistent since the late 1800s and early 1900s, as discussed further below.

"U.S.-Built" Vessel Defined

A significant element of the Jones Act is the requirement to use only "U.S.-built" vessels. Competing freight transportation modes have no requirement to purchase only domestically built equipment. Congress has not defined what constitutes a U.S.-built vessel, leaving this determination to the Coast Guard. Coast Guard regulations deem a vessel to be U.S.-built if (1) all "major components" of its hull and superstructure are fabricated in the United States, and (2) the vessel is assembled in the United States.27 The "superstructure" means the main deck and any other structural part above the main deck (e.g., the bridge, forecastle, pilot house).

The Coast Guard holds that propulsion machinery (the ship's engine), other machinery, small engine room equipment modules, consoles, wiring, piping, certain mechanical systems and outfitting have no bearing on a U.S.-build determination.28 Consequently, for oceangoing ships, U.S. shipyards typically import engines from foreign manufacturers. This is allowed because engines are deemed components that are attached to the hull rather than an integral part of the hull's structure. A ship part or component that is self-supporting and independent of the vessel's structure and does not contribute to the overall integrity of the vessel or compromise the watertight envelope of the hull can be manufactured in a foreign country. However, the part or component must be attached or joined to the vessel in a U.S. shipyard, not an overseas yard.29

The Coast Guard's test for "major components" of the hull or superstructure is based on weight; up to 1.5% of the steel weight of hull and superstructure components can be manufactured abroad. By this reasoning, the propeller, stern bulb, bulbous bow, some rudders (depending on their design), and watertight closures used in U.S.-built vessels are often imported, as long as they (in the aggregate) do not exceed the steel weight limit.30 The Coast Guard also permits steel products in standard forms ("off the shelf") to be imported with no limit on their weight, but any shaping, molding, and cutting of the steel that is custom to the design of the vessel must be performed in a U.S. shipyard.

Shipyards typically seek confirmation from the Coast Guard that incorporating certain foreign-built components in construction of a vessel will not disqualify the vessel from the Jones Act trade. These "determination letters" written by the Coast Guard detail which and to what extent foreign components are permissible.31 In the Coast Guard Authorization Act of 2018 (P.L. 115-282, §516) Congress directed the Coast Guard to publish these letters.32

Shipyard unions refer to ships built in this manner as "kit ships."33 They sued the Coast Guard in 2007, arguing that the Coast Guard's interpretation of the statute violated the Administrative Procedure Act. The U.S. District Court for the Eastern District of Pennsylvania sided with the Coast Guard, noting in part that the Coast Guard's interpretation is rooted and consistent with the Treasury Department's interpretation dating to at least the late 1800s (the Treasury Department was the agency of jurisdiction at that time), as well as U.S. Attorney General interpretations dating to the early 1900s.34 The shipyard unions' lawsuit was prompted by a Philadelphia shipyard's partnership with a South Korean shipbuilder, begun in 2004, to use the Korean builder's ship designs and other procurement services to build a series of Jones Act tankers. This partnership continues today and also includes container ships built in the Philadelphia shipyard. Since 2006, General Dynamics NASSCO of San Diego, another builder of Jones Act oceangoing ships, has partnered with Daewoo Shipbuilding of South Korea to procure vessel designs, engineering, and some of the materials for the commercial ships it has since built for Jones Act carriers.

The extent to which foreign-built components may be used in a U.S.-built ship highlights the tension between the national security aims of the Jones Act and the cost effects arising from it. Importing engines and other major ship components may undermine the Jones Act policy objective of supporting a domestic shipbuilding capability independent of foreign yards. In the court case cited above, the shipyards argued that not allowing use of such foreign components would increase the cost of ships further. They asserted this would reduce orders for new ships and harm the domestic fleet.35

Passenger Vessel Itineraries

The United States is the largest cruise ship market, but most Americans board foreign-flag cruise ships. This is because CBP has determined that a cruise ship serving a U.S. port does not have to be Jones Act-compliant as long as it has visited a distant foreign port (any port outside North and Central America, Bermuda, the Bahamas, and the Virgin Islands). Thus, for example, if a cruise ship includes Aruba or Curaçao in its itinerary, it does not need to be Jones Act-compliant. The reasoning is that the main objective of such a cruise itinerary is to visit such foreign ports, not to transport passengers from one U.S. port to another U.S. port. This reasoning was articulated in a 1910 Attorney General's opinion.36

Another significant regulatory interpretation allowing for the prevalence of foreign cruise ships at U.S. ports is a 1985 rulemaking by the U.S. Customs Service (the predecessor of CBP). In this rulemaking, Customs allowed foreign-flag cruise ships to make round trips from a U.S. port and to visit other U.S. ports as long as they also include a visit to a nearby foreign port (such as those in Canada, Mexico, or Bermuda). All passengers must continue with the cruise until the cruise terminates at the same dock at which it began. Again, the reasoning is based on the primary intent of the cruise voyage; if the main purpose of the voyage is not domestic transportation of passengers then the Jones Act is not violated.37

Another type of passenger vessel excursion involves visits to no other ports. The purpose of the voyage could be whale watching, recreational diving, gambling, duty-free shopping, or deep-sea fishing, for example. These are so-called "voyages to nowhere" since passengers do not visit any other ports besides the one at which they embark and disembark. In these cases, CBP has determined that if such vessels stay within the 3-mile zone of U.S. territorial waters they must be Jones Act-compliant since CBP considers any places within such waters as "U.S. points." This interpretation is based on Treasury Decision 22275, issued in 1900. However, CBP has determined that if the vessel journeys beyond 3 miles from shore (into international waters), then it does not need to be Jones Act-compliant. This determination is based on a 1912 Attorney General opinion.38 But the policy regarding charter fishing boats differs from that regarding other passenger vessels. If charter fishing boats venture into international waters, they still must be Jones Act-compliant. This determination is by virtue of a 1936 ruling by the Bureau of Navigation and Steamboat Inspection (Circular Letter No. 103, June 3, 1936), and affirmed by Treasury Decision 55193(2) in 1960.

Another element of CBP's interpretation of the Jones Act with respect to passenger vessels is its definition of a passenger. According to CBP, a passenger need not be a paying customer (such as a tour boat or cruise ship ticket holder); rather, the term encompasses anyone aboard a vessel who is not a member of the crew or an owner of the vessel.39 Thus, for example, an owner of a yacht who chooses to entertain business clients aboard his or her vessel must comply with the Jones Act. A construction company transporting construction workers to a construction site must use a Jones Act-compliant vessel.

Offshore Oil and Gas Vessels

In the offshore oil market, CBP's interpretations of the Jones Act have affected "lightering" (the transfer of oil offshore from an oil tanker too large to transit a harbor to a smaller vessel)40 and offshore supply vessels (OSVs) used to supply oil platforms. CBP has determined that if a tanker to be lightered is anchored to the seabed and within 3 nautical miles of shore (which are U.S. territorial waters), it is a "U.S. point." Many lightering areas in the Gulf of Mexico are 60 to 80 miles offshore and therefore the lightering vessels can be foreign-flagged. Lightering operations in the Delaware Bay and elsewhere are within the 3-mile zone, and therefore lightering vessels operating in these areas must be Jones Act-compliant (in which case tank barges rather than ships are typically used as lighters).

Regarding OSVs, two factors determine whether these vessels must be Jones Act-compliant in servicing offshore oil rigs. By virtue of the Outer Continental Shelf Lands Act of 1953 (P.L. 83-212), U.S. waters extend 200 miles offshore strictly for purposes related to the exploration, development, and production of offshore natural resources. CBP has determined that within this zone, only oil rigs attached to the seabed (anchored or submerged to) are "U.S. points."41 Another type of oil rig is not attached to the seabed: some mobile offshore drilling units (MODUs) are semisubmerged and can hold their positions with the use of propellers. CBP had determined that MODUs not attached to the seabed are not "U.S. points," and therefore foreign-flagged vessels were permitted to service these units. However, in 2008, Congress required that OSVs servicing MODUs be U.S.-owned and -crewed, but need not be U.S.-built (P.L. 110-181, §3525), which is the same requirement applied to U.S.-flag vessels engaged in international voyages.

A second factor determining whether OSVs must be Jones Act-compliant is whether the OSV is transporting supplies or workers to the oil rig, or if the vessel is involved in installing equipment necessary for the operation of the rig. CBP defines "vessel equipment" as anything "necessary and appropriate for the navigation, operation or maintenance of a vessel or for the comfort and safety of persons on board."42 Consequently, a vessel laying cable or pipeline in U.S. waters does not need to be Jones Act-compliant. Similarly, while OSVs transporting supplies and rig workers must be Jones Act-compliant (if the rig is attached to the seabed), vessels involved in installing rig equipment or conducting geophysical surveying or diving inspections can be foreign-flagged, as well as "flotels," which are vessels that provide living quarters for construction workers. The distinction can be unclear. In 2017, CBP proposed that most or all activities performed by OSVs fall under the Jones Act, but after reviewing comments, the agency withdrew the proposal.43

Offshore Wind Farms

Some question whether the Outer Continental Shelf Lands Act, and therefore the Jones Act, applies to offshore wind farms located beyond 3 miles from shore.44 Currently, wind farm developers are being guided by CBP's interpretations of the Jones Act with respect to OSVs and oil rigs. The Department of Energy has noted that the nonavailability of Jones Act-compliant "Tower Installation Vessels" (TIVs) can be a hindrance to offshore wind farm development, especially for installations in deeper water.45 In Europe, TIVs not only install the towers but also transport the equipment from shore to the offshore site. Since there are no Jones Act-compliant TIVs, U.S. wind developers either transport the equipment from foreign countries or use Jones Act-compliant vessels to transport the equipment to the site from a U.S. port alongside non-Jones Act-compliant TIVs to install the equipment.46 According to press reports, the first Jones Act-compliant barge to support installation of offshore wind towers is expected to enter service by the end of 2019. The barge was converted from an older Jones Act-compliant vessel.47

Foreign Blending Ports

A third CBP interpretation of the Jones Act has been significant in shaping coastal maritime activity. CBP determined that if merchandise is transformed (manufactured or processed) into a new and different product at an intermediate foreign port, then the vessels transporting the original product from a U.S. port to this foreign port and transporting the transformed product from the foreign port to a U.S. port do not need to be Jones Act-compliant.48 For example, a Texas oil producer has shipped a gasoline product to a Bahamian storage facility where its product is blended with a different imported petroleum product to produce a final gasoline product that is shipped to New York. Foreign-flag tankers are allowed to make all of these shipments even though it could be argued that a portion of the cargo is being shipped between two U.S. points (Texas and New York).49 The transformation of the product into a new and different product at an intermediate foreign port distinguishes this case from the 1891 kegs-of-nails case mentioned above. This interpretation has precedent in a 1964 Customs Service ruling involving California rice being processed in the U.S. Virgin Islands (exempt from the Jones Act) before being shipped to Puerto Rico, with both shipment legs involving foreign-flag ships.50

The Jones Act Since 1920

Since 1920, Congress has enacted provisions that could be interpreted as tightening Jones Act requirements, as well as provisions that exempt certain maritime activities from the requirements.

Actions to Expand Jones Act Applicability

In 1935, Congress forbade Jones Act-qualified vessels sold to foreign owners or registered under a foreign flag to subsequently requalify as Jones Act-eligible (P.L. 74-191), meaning that they could never again be used in U.S. domestic trade. This provides additional protection from competition for Jones Act carriers if coastal shipping demand increases, because it can take two years to construct a new ship. In 1940, Congress expanded the Jones Act to cover towing vessels, such as river tugs that push barge tows and harbor tugs that assist larger ships, and salvage vessels operating in U.S. waters (P.L. 76-599). In 1988, Congress specified that waterborne transport of valueless material, such as dredge spoil or municipal solid waste, requires use of a Jones Act-qualified vessel (P.L. 100-329).51

Precedents for Exempting the Jones Act

Congress has enacted numerous exemptions or exceptions to the Jones Act. A list of these legislated exemptions and exceptions can be found in the Appendix.

It has waived the Jones Act's restrictions when finding that no Jones Act-qualified operator was interested in providing service in a particular market, reasoning that the waiver thus would bring no harm to the domestic maritime industry. For instance, in 1984, Congress exempted passenger travel between Puerto Rico and any other U.S. port as long as no Jones Act-qualified operator was able to provide comparable service (P.L. 98-563). This exemption remains in force, allowing foreign-flag cruise ships to carry passengers between the U.S. mainland and the island. On two occasions, in 1996 (P.L. 104-324) and again in 2011 (P.L. 112-61), Congress has permitted certain foreign-flagged liquefied natural gas (LNG) tankers to provide domestic service because none existed in the Jones Act fleet; no ship owners have made use of these exemptions (see Table A-1).

Congress has also enacted exemptions due to a sudden spike in demand for Jones Act-qualified vessels. To address a vessel shortage, Congress enacted an exemption for iron ore carried on the Great Lakes during the 1940s that was related to a surge in steelmaking for the war effort. It did the same for a bumper grain harvest in 1951 (see Table A-1). In 1996, Congress enacted an exemption for vessels participating in oil spill cleanup operations when an insufficient number of Jones Act-qualified vessels are available.

Congress has enacted Jones Act waivers for two innovations in vessel designs used in foreign trade but whose cargo operations included domestic legs that would otherwise fall under the Jones Act. One concerned a ship designed to carry river barges on international voyages, a technology known as Lighter Aboard Ship (LASH). In 1971, Congress exempted these specific barges from the Jones Act (P.L. 92-163). The exemption is no longer relevant, as this type of shipping is not now in use.

In 1965, as container ships were about to come into use internationally, Congress exempted the movement of empty containers between U.S. ports from the Jones Act (P.L. 89-194). This exemption is restricted to containers used for international shipments, thus allowing the foreign-flagged container carriers to reposition their empty equipment along U.S. coastlines. Once loaded, containers of imports are discharged from a ship in a U.S. port, Jones Act-compliant vessels must be used if they are transshipped by water to other U.S. ports. This distinction between carriage of loaded and unloaded containers has ramifications for the development of marine highways or short sea shipping routes. Transshipment of international containerized cargo by feeder ships is prevalent abroad, but the practice does not exist in the United States. Instead, essentially all movement of containers between ports in the contiguous United States, including import and export containers, occurs by truck or train.52

Waivers for Specifically Named Vessels

In addition to authorizing exemptions to the Jones Act under certain circumstances, Congress has enacted exemptions for specific vessels identified by name and identification number (a registration number with a state government, the Coast Guard, or International Maritime Organization). Typically, the legislative language does not indicate why a waiver was needed or describe the kind of vessel, its size, or its function. A search of the statutes at large under the terms "coastwise" and "endorsement" and "certificate of documentation" indicates that since 1989, at least 133 specific vessels have been granted Jones Act waivers by Congress in 16 separate legislative acts.53

These waivers typically appear in maritime-related legislation, such as a Coast Guard authorization bill. One act contains waivers for 67 vessels and another for 35 vessels. It appears in most cases that these vessels are not commercially significant—for instance, that they are not large or even moderately sized cargo or passenger vessels. Some of them are owned by nonprofit entities. One exception was the previously mentioned 2011 granting of waivers to three LNG tankers built in the United States in the late 1970s that subsequently became foreign-registered (P.L. 112-61). In many cases, it appears the vessel needs a waiver because of a technicality in meeting Jones Act requirements; for example, the U.S.-citizen ownership history may be missing some records. In many cases, the statute granting the waiver places specific conditions on how the vessel can be used.

Administrative Waivers in the Interest of National Defense

While the Jones Act intends to maintain a merchant marine to serve as a military auxiliary in times of war or national emergency, Congress has also authorized waivers of the Jones Act in the interest of national defense. As noted previously, the domestic shipping restrictions were waived during World War I. They were waived again in preparation for World War II (P.L. 77-507, 1942). In 1950, after the Korean War began, Congress enacted a provision allowing the executive branch to issue waivers "in the interest of national defense" (P.L. 81-891). This authority is still in effect, as the language did not specify that it was intended only for the conduct of that war.54 In 1991 and 2011, waivers were granted on national defense grounds to expedite oil shipments from the Strategic Petroleum Reserve in response to the Persian Gulf War and a conflict in Libya, respectively.55

In addition to military conflicts, the executive branch has waived the Jones Act for fuel resupply in the aftermath of natural disasters. This so-called "national defense waiver" authority has been the basis for recent waivers granted in the aftermath of major hurricanes, beginning with Hurricane Katrina in 2005 up to and including Hurricanes Harvey, Irma, and Maria in 2017 (see Table A-2). In 2008 (P.L. 110-417), Congress inserted a role for MARAD to check on the availability of any Jones Act-qualified vessel before granting certain waivers.56

The lack of heavy-lift vessels in the Jones Act fleet has also prompted national defense waivers: in 2005 to allow a foreign-flag heavy-lift vessel to transport a radar system from Texas to Hawaii and in 2006 to allow an oil company to use a Chinese-flagged heavy-lift vessel to transport an oil rig from the Gulf Coast to Alaska.57 The national defense justification for the oil rig waiver was apparently based on addressing a fuel shortage in that region of Alaska. Other requests related to heavy-lift vessels have not been approved. In 1992, Customs denied a waiver request to use a foreign-flag heavy-lift vessel to transport replicas of Christopher Columbus's Niña, Pinta, and Santa Maria vessels from Boston to San Francisco.58 A specific type of heavy-lift vessel is used in the construction of offshore oil rigs, but CBP has denied Jones Act waivers for these vessels notwithstanding the Coast Guard and the Bureau of Safety and Environmental Enforcement in the Department of the Interior advising that not granting a waiver created a safety hazard for these operators.59

CBP has stated that the "national defense" justification is a high standard and that national defense waivers would not be issued for economic reasons such as commercial practicality or expediency.60 Consistent with this view, while CBP has issued national defense waivers in circumstances involving fuel shortages, it has not issued waivers that would merely favor domestic supply lines over offshore ones, even though some might argue the latter is a national security issue. For instance, in 1976, arguing that offshore supply lines are more vulnerable, some Members of Congress representing Gulf Coast states sought to have the Jones Act extended to the U.S. Virgin Islands. At the time, the largest refinery in North America was located in the U.S. Virgin Islands, and the refinery supplied petroleum products to the U.S. Northeast on foreign-flagged tankers.61 In 2014, northeast refineries reportedly contemplated seeking a Jones Act waiver to ship crude oil from Texas.62 These refineries import much of their crude oil. In 2018, the United States exported between 40 million and 80 million barrels of crude oil per month on foreign-flag tankers, imported about 150 million barrels per month from overseas sources on foreign-flag tankers, and shipped about 15 million barrels per month domestically on Jones Act tankers.63

A similar situation is occurring with liquefied natural gas: the United States has begun exporting substantial quantities by ship while continuing to import LNG by ship, but no LNG is shipped domestically. No LNG tankers are in the Jones Act fleet, and it is unclear why shippers have not utilized the 1996 or 2011 waivers for LNG tankers mentioned above.64 Puerto Rico, which currently imports LNG from Trinidad and Tobago, has sought a 10-year waiver of the Jones Act to receive bulk shipments of LNG from the U.S. mainland.65

The Jones Act Fleet

The Jones Act applies to any type of commercial vessel. Recent controversies have concerned the oceangoing ship and offshore supply vessel sectors. The law also covers ships on the Great Lakes, river barges, harbor tugs, dredging vessels, and various kinds of passenger vessels. The Jones Act oceangoing ship fleet, in particular, has certain shortcomings compared to the merchant fleet desired by the drafters of the 1920 act as they described it in the aforementioned statement of U.S. maritime policy.

Oceangoing Ships

As of March 2018, there were 99 oceangoing ships in the Jones Act-compliant fleet,66 employing about 3,380 mariners. The largest category of oceangoing Jones Act ships is tankers. Of the 57 tankers in the fleet, 11 carry Alaskan crude oil to refineries on the West Coast, 44 are medium-sized product tankers that mostly carry refined products along the Atlantic Coast, and 2 are chemical or asphalt tankers. The dry cargo fleet includes 24 small to medium-sized container ships, 7 ships that have ramps for carrying vehicles (known as roll on/roll off vessels), and 2 dry bulk vessels designed to carry such commodities as grain and coal in bulk form. The fleet also includes 9 relatively small general-cargo vessels supplying subsistence harbors along Alaska's coast.

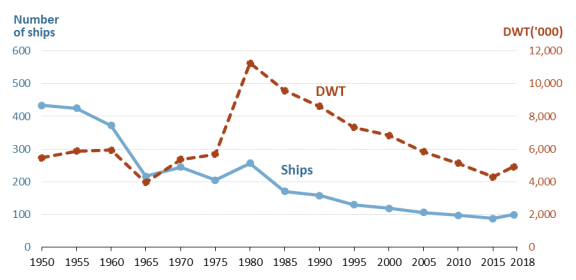

As Figure 1 indicates, the number of oceangoing ships in the Jones Act fleet has shrunk from 434 in 1950 to 99 in 2018. The ships are much larger today than they were then, but their aggregate carrying capacity (DWT) is still less than in 1950.

|

|

Source: CRS using data from U.S. Maritime Administration (MARAD). Note: DWT = deadweight tonnage, a measure of ship cargo capacity. |

As shown in the figure, there was a pronounced drop in the size of the fleet in the late 1950s and early 1960s. At a time of concern about the availability of sealift during the Vietnam war, the Lyndon B. Johnson Administration called for the repeal of the Jones Act.67 It appears to be the only Administration in the modern era that has done so. Subsequently, in the late 1960s and 1970s, additional oceangoing ships with greater cargo capacity joined the Jones Act fleet, increasing the overall available tonnage. In the 1970s, this included large tankers for carrying Alaska crude oil domestically.

While domestic ships are carrying fewer tons of freight today than they did in the 1950s, their most direct competitors, railroads and pipelines, are carrying more.68 Domestic ships have lost market share to land modes even though ships have certain economic advantages. Ocean carriers do not need to acquire and maintain rights-of-way like railroads and pipelines. They can move much more cargo per trip and per gallon of fuel than trucks and railroads. Although ships are slower than truck and rail modes, many shippers are willing to sacrifice transit time for substantially lower costs, as long as delivery schedules are reliable.69

The oceangoing Jones Act fleet is almost entirely engaged in domestic trade routes where overland modes are not an option, serving Alaska, Hawaii, and Puerto Rico.70 In other words, it operates in markets where shippers have little alternative. The Jones Act appears to have preserved a nucleus of a U.S. maritime industry, but not to have fully attained its stated goal of having a U.S. merchant marine "sufficient to carry the waterborne domestic commerce." Nor is the current Jones Act fleet arguably capable of providing "shipping service essential for maintaining the flow of the waterborne domestic … [commerce] at all times."71

Ship Designs Missing from the Oceangoing Fleet

Not all ship designs are represented in the oceangoing Jones Act fleet. "Project cargo" or "heavy-lift" vessels are often used to carry oversized pieces of equipment such as smaller vessels,72 ship engines and modules, wind turbine parts, and power generation equipment. They would be useful for moving dredging fleets to project sites. There have not been any such vessels in the Jones Act fleet in recent decades. The Department of Defense has used "national defense" waivers of the Jones Act to move radar systems and newly built vessels on foreign-flag heavy-lift vessels. This type of cargo typically does not generate regular shipments in any one region; thus these ships would likely need to extend their market reach beyond the United States to include the international market. However, the higher cost structure of Jones Act operators is an obstacle to competing for international shipments.

Other ship designs have small representation in the oceangoing Jones Act fleet. Two dry bulk ships are in the oceangoing Jones Act fleet, and they appear to be mostly inactive, possibly because they are nearly 40 years old. This is twice the economic life of a ship in the global fleet (where ships are typically sent for scrapping between 15 and 20 years of age). The sole Jones Act-qualified chemical tanker was built in 1968. No LNG tankers are in the Jones Act fleet despite new domestic markets as a result of the shale gas boom. The lack of sufficient Jones Act-qualified tanker capacity to move booming shale oil production coastwise was one of many factors considered regarding lifting the crude oil export ban in 2015.73

Seagoing Barges

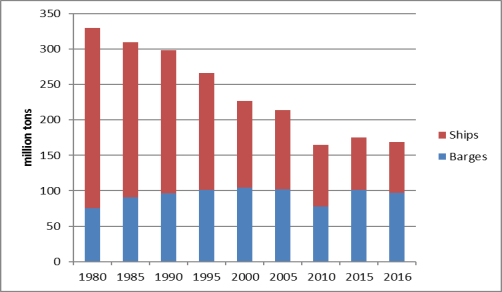

In response to the high cost of U.S.-built and U.S.-crewed ships, the U.S. market has developed a unique vessel design, a seagoing barge called an articulated tug barge (ATB). MARAD estimates that over 150 ATBs are operating in the Jones Act trades.74 While ATBs are more capable than flatwater barges in handling sea swells (with a hinge between the tug and barge), they are less capable than ships in handling heavy sea states. They are less reliable and less efficient over longer voyages because they are slower and smaller than tanker ships, and the notch between the barge and tug creates more resistance through the water than a single hull. Since ATBs sail closer to the coasts, they could pose a higher risk of grounding and provide less time to prevent spilled oil from reaching shorelines.75 ATB crews are not qualified to sail sealift ships. ATBs now carry more cargo tonnage (predominantly oil) on coastal voyages than does the ship fleet (see Figure 2).76

|

|

Source: U.S. Army Corps of Engineers, Waterborne Commerce Statistics, National Summaries, Table 1-12. |

Fleet Age

The oceangoing Jones Act fleet today is relatively young compared to its prior composition because of shipbuilding undertaken after the large increase in shale oil production and before the lifting of the oil export ban. In part, new ships were needed to comply with tighter emissions requirements in the newly created North American emission control area. Today, just over one-third of the Jones Act oceangoing fleet (35 ships) is 21 years old or older, down from two-thirds (64 ships) in 2007.77

The Jones Act general cargo ship El Faro sank in a hurricane in 2015. Because the ship was built in 1975, it was required to have only open lifeboats rather than the closed lifeboats with auto launchers required on ships built since 1983.78 After its sinking, the Coast Guard forbade its sister ship of the same age from sailing, and in congressional testimony noted concern about the condition of the rest of the U.S.-flag fleet:79

We looked a little further beyond this particular incident, caused us to look at other vessels in the fleet and did cause us concern about their condition.… And the findings indicate that it is not unique to the El Faro. We have other ships out there that are in substandard condition.… You know, some of our fleet—our fleet is almost three times older than the average fleet sailing around the world today. Just like your old car, those are the ones likely to breakdown. Those are the (inaudible) one—the ones that are more difficult to maintain and may not start when I go out, turn the key.

In the Merchant Marine Act of 1936 (P.L. 74-835, Section 101), Congress added having a domestic fleet of the "safest" vessels to the policy goals of Jones Act. The Coast Guard's concern suggests that the law may not be accomplishing this purpose.80

The Great Lakes Fleet

Domestic commerce on the Great Lakes is particularly important to the steel industry in Michigan, Indiana, and Ohio. Jones Act-compliant Great Lakes ships are much narrower for their length compared to the global dry bulk fleet because of the dimensions of the Soo Locks in Michigan. It appears that the cost of shipping of iron ore and other commodities on the Great Lakes is competitive with other modes of transport, in part because some vessels are designed to be "self-unloaders" that do not require landside workers to deliver their cargo. The Jones Act assures that this domestic trade is carried entirely on U.S.-registered ships.

Jones Act-compliant vessels operating in the Great Lakes are considerably older than the oceangoing fleet. The Great Lakes fleet consists of 33 dry bulk ships and several large barges carrying mostly iron ore, limestone, and coal used in steelmaking, and cement. The U.S. fleet of 1,000-foot freighters, the largest ships operating on the Great Lakes, was built between 1972 and 1981. The second-largest class of ships, around 700 feet in length, is older, with some of the vessels having originally been built in the 1940s or 1950s; a number of these were rebuilt in the 1970s. According to the U.S. Lake Carriers Association, ships operating in freshwater, such as the Great Lakes, can have longer lives than oceangoing vessels. Domestic tonnage on the Great Lakes has declined steadily since the 1950s. It is now about half what it was then, due to the increased use of scrap metal as a replacement for iron ore in steel manufacturing and to the development of single-cargo "unit trains" that help railroads compete with vessels in domestic transport of grain and coal.81

The Canadian Great Lakes fleet illustrates the effect that vessel import policy can have on a domestic fleet. Canada's fleet was of similar age as the Jones Act fleet, with the youngest ship having been built in 1985, before Canada imposed a 25% tariff on newly constructed imported ships. While this import tariff was in effect, no new ships were added to the Canadian fleet. In 2010, Canada repealed the import tariff, and since then over 35 new dry bulk ships have been constructed in other countries specifically for service on the Great Lakes.82 These vessels cannot carry cargo between U.S. points.

Inland River Fleet

Thousands of tugs and barges carry mostly dry and liquid bulk commodities on the nation's inland rivers. The fleet includes several thousand Jones Act-compliant tugs or pushboats that push the barge tows, about 20,000 dry cargo barges, and several thousand tank barges that carry liquid bulk cargoes.83 Tonnage is dominated by the export of corn and soybeans and domestic movement of coal; few cargo containers move domestically by barge. Since 1990, overall tonnage on the system has been flat or declining slightly. One of the two leading manufacturers of river barges ceased operation in April 2018 in response to the fall-off in demand for coal deliveries by barge.84

The inland river fleet offers economic benefits by providing competition to trains in the long-distance movement of bulk cargo. However, it does not directly address national security issues considered in the Jones Act, such as the ability of the merchant marine to support military sealift needs. The distinct nature of the inland river fleet highlights the complexities of addressing all types of waterborne transportation within the framework of the Jones Act.

The Dredging Fleet

The Dredging Act of 1906 (P.L. 59-185, 34 Stat. 204) requires that vessels engaged in dredging in U.S. waters be U.S.-built, -operated, and -crewed. The 1906 act was prompted by dredging work then being carried out in Galveston Bay, TX, after a calamitous 1900 hurricane. It required all dredge vessels henceforth to be U.S.-built. In 1988, Congress amended the Jones Act to define "merchandise" transported domestically by vessel to also include any valueless material (P.L. 100-329). This change effectively required that dredged material be transported in Jones Act-qualified vessels.

According to U.S. Army Corps of Engineers figures, while federal spending on navigation dredging has increased over the last decade, the spending increase has not resulted in a larger volume of material being dredged from U.S. harbors.85 Multiple factors are believed to have contributed to the increased cost per cubic yard: changes in dredged material disposal, mobilization costs, cost inflation of inputs (fuel and steel), environmental factors, and relatively little competition for dredging contracts.86 The relative significance of each is unclear.

According to the U.S. Army Corps of Engineers, hopper dredges are generally the most efficient vessels for dredging coastal harbors.87 The availability of hopper dredges in the U.S. fleet is limited. The private hopper dredge fleet is relatively old, with 11 of the 15 vessels reportedly in service for more than 20 years.88 When the Corps of Engineers bids harbor work requiring a hopper dredge, Corps data indicate that one of four U.S. firms is the sole bidder over a third of the time.89

When the Corps schedules dredging projects for an upcoming year, it has periods when an insufficient number of dredges can perform the work.90 In addition to the dredge vessel, dredging projects involve a number of support vessels. One study found that mobilization and demobilization of the equipment in the U.S. market can amount to more than one-third of total project costs.91 Foreign firms use semi-submersible heavy-lift vessels to transport their dredge fleets between projects. As indicated earlier, no such vessels are available in the Jones Act fleet.

Offshore Supply Vessels

In 2017, the offshore supply vessel fleet consisted of about 1,800 vessels, working mainly in the Gulf of Mexico. Over the last decade, annual construction averaged 32 vessels, but ranged between 4 and 53 vessels.92 The Jones Act-compliant fleet transports crews and supplies to offshore rigs. Vessels engaged in construction of offshore rigs need not be Jones Act-compliant. Foreign-built vessels are relied upon for construction of rigs in deeper waters. These vessels need dynamic positioning propulsion systems to keep the vessel in place while performing the construction work, as the waters are too deep for anchoring. As mentioned above, similar vessels are lacking in the Jones Act fleet for installing wind towers in deeper waters.

The Jones Act and Sealift Capability

As indicated above, one purpose of the Jones Act is to provide a trained maritime workforce that can be called upon to crew sealift vessels in a military emergency. As with the commercial aspirations stated in the maritime policy of the Jones Act, there are also perceived shortcomings with respect to the domestic fleet's ability to serve as a naval auxiliary in times of war or national emergency (as per 46 U.S.C. §50101(a)(2)). Since 1920, Congress has enacted programs that designate other fleets for sealift support, but the merchant mariners crewing Jones Act ships are still identified as contributing to the pool of mariners available to crew the sealift fleet. The shrinking size of the U.S. mariner pool puts in doubt its ability to sufficiently crew a reserve sealift fleet, as discussed further below. In 2014 (P.L. 113-76), Congress directed the Department of Transportation and the Department of Defense to develop a national sealift strategy. This has yet to be issued.

Sealift Crews

The crews of Jones Act oceangoing ships are arguably the most salient and immediate element that could be called upon to support military sealift. Jones Act mariners typically have six months of shore leave per year, and those mariners on shore leave would be expected to be available to crew a reserve fleet of government-owned cargo ships kept on standby for military sealift purposes (the Ready Reserve Force, or RRF). About 3,380 merchant mariners serve aboard Jones Act-qualified oceangoing ships, which is about 29% of the total pool of 11,678 mariners that MARAD estimates would be required to crew the government-owned reserve fleet while concurrently being able to operate the commercial fleet.93 The remaining requirement for mariners would be met from (1) the U.S.-flag privately owned international fleet enrolled in the Maritime Security Program (MSP), consisting of 60 ships and 2,386 commercial mariners, and (2) the Military Sealift Command (MSC) fleet of government-owned ships consisting of about 120 ships and 5,576 mariners.94

According to 2019 testimony by the Commander of the U.S. Transportation Command before the House Committee on Armed Services, Subcommittees on Seapower and Projection Forces and Readiness,

Commercial industry plays a critical role for DOD sealift by augmenting capacity, providing access to global trade networks, and generating a supply of qualified private sector Merchant Mariners essential to crew every surge sealift ship. Although the U.S. Merchant Mariner pool is currently sufficient to crew the surge sealift fleet, long-term, sustained conflicts could overstress the commercial industry's supply of contract mariners needed for sustainment operations.95

MARAD estimates that there is a sufficient commercial mariner pool to crew the reserve sealift fleet during a surge lasting up to 180 days. A more prolonged sealift effort would start to entail crew rotations, and MARAD estimates a shortfall of about 1,800 mariners in that scenario.96 That the mariner pool could sustain an immediate surge but is insufficient for a longer sealift effort has been a consistent finding of sealift officials for decades, even in previous periods when the mariner pool was much larger than it is today. For instance, this was the same finding by the Department of Defense Transportation Command (TRANSCOM) in 2004, when the RRF consisted of 59 ships and the mariner pool was 16,900.97 And in 1991, when the RRF consisted of 96 ships and the mariner pool was 25,000 (more than twice the size that it is today), the then MARAD Administrator testified that the mariner pool was barely sufficient to crew the reserve sealift fleet.98

Sealift Ships

While the Jones Act's statement of maritime policy indicated a desire for a commercial fleet that also could provide sealift in times of war, since then three other fleets of ships have been established for purposes of military sealift: the RRF, MSC, and MSP. These ships are predominantly foreign-built. The RRF, a concept that originates in a 1954 act of Congress (P.L. 83-608),99 today consists of 46 ships that can sail upon either 5 or 10 days' notice and are on standby with a skeleton crew of about 600 commercial mariners (13 per ship), but would require an additional 1,200 mariners to sustain its operation once activated.100 The MSC fleet is controlled by TRANSCOM and has a subset of about 50 ships that carry military cargoes in port-to-port voyages similar to those undertaken by commercial ships. MSC ships are mostly crewed by civilian mariners who are federal employees. The MSP ships, a fleet established by Congress in 1996 (P.L. 104-239), receive an operating subsidy of about $5 million per vessel per year to cover the additional cost of American crews and rely heavily on government cargoes (military and food aid) that pursuant to "cargo preference" law are reserved for them.101 As per long-standing agreements between MARAD, acting as advocate for the U.S. maritime industry, and the Department of Defense, the military is to utilize MSP ships and exhaust that capacity before it utilizes MSC ship capacity.102

While Jones Act operators are required to purchase more costly U.S.-built ships, the military sealift fleet is largely composed of more economical foreign-built ships. Jones Act operators are competing in the commercial marketplace while the sealift fleet is not. Instead of relying on the Jones Act commercial fleet to provide oceangoing shipbuilding capability, the sealift fleet could be required to be built domestically. The higher cost of the domestically built sealift fleet would be shared nationally, as is the case with other defense assets. Lower-cost coastwise ships would be more price-competitive with railroads, pipelines, and ATBs, thereby enlarging the mariner pool available for sealift support and increasing repair and maintenance work for U.S. shipyards. The sealift ships could also be designed to military specifications rather than be in conflict with commercial needs (see below).103

Divergence in Design of Commercial and Sealift Ships

The military seeks cargo ships with flexible capabilities: ships not so large that they could face draft restrictions in some overseas harbors, ships with ramps or onboard cranes so that they can still unload cargo at underdeveloped or damaged ports, and ships that can carry a wide variety of cargo types and sizes. The majority of the military sealift fleet consists of product tankers for carrying fuel and roll-on/roll-off (Ro/Ro) ships that have ramps for moving tanks, trucks, and helicopters. It also consists of container ships used for moving ammunition and other supplies.

The military's preference for versatility is in conflict with the commercial fleet's trend toward more specialized and larger ships, a trend driven by the need for ships with the lowest operating cost. General cargo and break-bulk ships capable of carrying a wide variety of cargo types and sizes and that were typically equipped with their own onboard cranes have been largely replaced by container ships without onboard cranes. If Congress wishes to have self-unloading general-purpose cargo ships available for military sealift purposes, it may need to subsidize their construction and operation directly, as there seems likely to be only limited future demand for such vessels for domestic commercial use.

The largest container ships require 45 to 50 feet of water below the waterline, far more depth than many ports can provide. Ro/Ro ships have been replaced by "pure car carriers" that maximize the number of passenger cars they can carry, but may be less useful for military purposes. Cost pressures have induced commercial carriers to install engines that minimize fuel costs by operating at lower speeds and cannot achieve the higher speeds generally desired for military sealift ships. In addition, more stringent sulfur emission regulations recently enacted have prompted ship operators to convert to LNG-fueled engines, a fuel not globally available, or to install scrubbers, equipment that takes up cargo space and has no military utility. Licensing of engine crews is specific to engine type. Thus, a growing disparity exists between the military's ideal vessel designs and those of commercial carriers.

Shipbuilding and Repair Industrial Base

Besides the deep-sea ship crews, another desired Jones Act contribution to military sealift is preservation of a shipyard industrial base with the knowledge and skills to build and repair ships. As mentioned above, the Merchant Marine Act of 1970 (P.L. 91-469) added as an additional objective of U.S. maritime policy to have a merchant marine "supplemented by efficient facilities for building and repairing vessels." U.S. shipyards typically build only two or three oceangoing ships per year, and none for export, so they do not achieve economies of scale. There may be gaps of several years in between orders for container ships. In recent years, the demand has been sufficient to sustain one shipyard that builds only commercial ships. As of October 2019, this yard had no vessels under construction or on order but was repairing two sealift ships belonging to the military.104 The other shipyard that builds commercial ships also relies heavily on Navy orders.

A larger number of shipyards build smaller vessels such as tour boats, ferries, tugs, barges, and offshore supply vessels. U.S. shipyards appear to be relatively efficient in building barges, in part because they enjoy economies of scale: around 1,000 barges are built in a typical year. These vessels fall under the Jones Act domestic build requirement.

However, the shipyards building smaller vessels lack dry docks of sufficient size to repair large ships. The government-owned sealift fleet is 44 years old on average, and many of the vessels are in need of repair. According to the Maritime Administrator, there is an insufficient number of large dry docks to service the sealift fleet, delaying their readiness to sail.105 Some of the reserve fleet has failed Coast Guard safety inspection; statistics on the reasons for failure are not available. Some ships have too much steel rusted from their hulls to be seaworthy. For example, while sailing to a readiness exercise, one of the ships was found to have a hole in its hull.106

According to TRANSCOM, the Navy's plan to recapitalize the reserve fleet includes building new vessels in domestic shipyards, repairing ships in the current fleet to extend their service life out to 60 years, and purchasing used, foreign-built ships. The Navy has found that repairing the vessels has thus far been three times more expensive and has taken twice as long as originally projected, although it has not released detailed data. The Navy is contemplating accelerating the purchase of used foreign-built ships because building new ships in U.S. yards is estimated to be 26 times more expensive than purchase of a foreign-built used ship.107

In addition to the Jones Act, the Tariff Act of 1930108 is intended to support U.S. shipyards by assessing a 50% duty on the price of any nonemergency repairs on U.S. flag ships done in foreign shipyards. A 2011 MARAD study109 found that many U.S.-flag international trading ships have repairs performed in foreign yards because, even with the 50% duty, the total cost is less than if the repairs were performed in a domestic shipyard. A U.S.-flag operator confirms that this was still the case in 2018.110

Appendix. Exemptions and Waivers

|

Year |

Public Law # |

Purpose of Exemption |

|

1938 |

Pub. Res. No. 89 |

Allowed Canadian vessels to transport passengers between two New York State ports on Lake Ontario until such time as a U.S. operator stepped forward to offer the service. |

|

1941 |

P.L. 77-90 |

Canadian vessels allowed to transport iron ore between U.S. ports on the Great Lakes this shipping season (subsequent amendments allowed same through 1952). |

|

1941 |

P.L. 77-134 |

Canadian vessels allowed to transport members of American Legion between Cleveland and Milwaukee for their annual convention. |

|

1947-1959 |

P.L. 80-277, P.L. 81-258, P.L. 81-584, et al. |

Allowed passengers and certain commodities to be transported either on foreign or Canadian vessels between certain Alaska ports and other U.S. ports, if no Jones Act-qualified operator offering such service. |

|

1951 |

P.L. 82-162 |

Allowed Canadian vessels to transport grain between U.S. ports on the Great Lakes during that year's harvest season. |

|

1962 |

P.L. 87-877 |

Allowed temporary exemption to ship lumber from the U.S. Pacific Northwest to Puerto Rico in order to compete with Canadian sourced lumber. |

|

1965 |

P.L. 89-194 |

Allows foreign-flagged container carriers to reposition their empty containers along U.S. coastlines. |

|

1971 |

P.L. 92-163 |

Exempted Lighter Aboard Ship (LASH) barges, which are loaded barges carried aboard ships on international voyages, on their domestic leg between ship and river ports. LASH barges are no longer in use. |

|

1984 |

Exempts passenger travel between Puerto Rico and any other U.S. port as long as no Jones Act qualified operator is able to provide comparable service. |

|

|

1988 |

Exempts certain kinds of vessels used in the construction of offshore oil rigs. |

|

|

1996 |

Exempts vessels participating in oil spill clean-up operations. |

|

|

1996 |

Allowed certain foreign-flagged or foreign-built tankers, believed to number 37 in total, to transport LNG to Puerto Rico from any U.S. port. (These ships have not done so.) |

|

|

1998 |

Authorizes the Maritime Administration to grant waivers to small passenger vessels carrying no more than 12 passengers if it finds no adverse effect on U.S. vessel builders or operators. (MARAD has granted an average of 100 waivers per year.) |

|