Prioritizing Waterway Lock Projects: Barge Traffic Changes

Congress faces decisions about prioritizing new lock construction projects on the inland waterway system. As both houses debate differing versions of water resources and development bills (S. 2800, H.R. 8) and the FY2019 Energy and Water Development Appropriations bill (S. 2975, H.R. 5895), the decision about which of these projects could be undertaken first will likely be among the most controversial issues.

The inland waterway system supports barge transportation of heavy raw materials such as grain, coal, petroleum, and construction aggregates. The new locks are needed, according to the Army Corps of Engineers (USACE) and barge shippers, where existing locks are in poor condition, requiring frequent closures for repairs, and/or because a lock’s size causes delays for barge tows. The total estimated cost for the 21 planned lock projects is several billion dollars (many of the individual projects have a cost estimate of between $300 million and $800 million). However, available funding for these projects is about $200 million per year. This is because of limited appropriations and cost-sharing capabilities. Under current cost-share arrangements, the barge industry pays half the cost of construction projects. It does this by paying a $0.29 per gallon fuel tax, which annually generates around $100 million.

Significant changes in traffic levels through particular locks may affect the benefits that were estimated as expansion projects were advanced. The calculation of benefits is critical to advancing a project: the Office of Management and Budget (OMB) will not request funding for a project unless the estimated economic benefit is at least 2.5 times the expected cost. The lock projects are clustered in three regions, each facing different economic conditions that are affecting barge traffic

in the agricultural heartland, record corn and soybean harvests have reversed the long-term downward trend of cargo volumes on the Upper Mississippi River;

in the Ohio and Tennessee River Valleys, the domestic natural gas boom has reduced the demand for coal by barge to power plants by nearly half;

along the Texas and Louisiana intracoastal waterway, tank barge traffic is still in a state of flux as the petrochemical industry makes longer-term investments related to the Texas shale oil boom.

The U.S. Department of Agriculture (USDA) is expecting corn and soybean exports to increase slightly over the next decade, but this projection could be affected by possible Chinese tariff increases on U.S. agricultural goods, including soybeans. The closing of additional coal-fired electric power plants along the Ohio, Monongahela, and Tennessee Rivers would reduce waterway use, as the power plants generate 75% or more of the barge traffic through many of the locks on these rivers. The loss of coal traffic is significant for other commodities as well, as it could lead to more empty repositioning of barges, reducing economies of density for barge transport on the rivers. New pipeline construction and the lifting of the crude oil export ban at the end of 2015 are two factors that could influence barge demand over the long-term on the Gulf Intracoastal Waterway.

Prioritizing Waterway Lock Projects: Barge Traffic Changes

Jump to Main Text of Report

Contents

- Introduction

- The Inland Waterway System

- Background on Inland Barge Transportation

- Upper Mississippi and Illinois Waterway Project

- Upper Ohio River Project

- The "Lower Mon" Project

- Tennessee River—KY and Chickamauga Locks

- Gulf Intracoastal Waterway

- Inner Harbor Navigation Canal Lock

- Calcasieu Lock

- Brazos and Colorado River Floodgates/Locks

- Legislation

Figures

- Figure 1. Proposed New Lock Projects on the Inland Waterways

- Figure 2. Mississippi River Locks 20, 21, 22, 24, 25

- Figure 3. Peoria and LaGrange Locks, Illinois Waterway

- Figure 4. Ohio River; Emsworth, Dashields, and Montgomery Locks

- Figure 5. Locks 2, 3, and 4 on the Monongahela River

- Figure 6. Kentucky Lock on the Tennessee River

- Figure 7. Chickamauga Lock on the Tennessee River

- Figure 8. Inner Harbor Navigation Canal Lock

- Figure 9. Calcasieu Lock, Louisiana

- Figure 10. Brazos and Colorado Rivers, East and West Locks

Summary

Congress faces decisions about prioritizing new lock construction projects on the inland waterway system. As both houses debate differing versions of water resources and development bills (S. 2800, H.R. 8) and the FY2019 Energy and Water Development Appropriations bill (S. 2975, H.R. 5895), the decision about which of these projects could be undertaken first will likely be among the most controversial issues.

The inland waterway system supports barge transportation of heavy raw materials such as grain, coal, petroleum, and construction aggregates. The new locks are needed, according to the Army Corps of Engineers (USACE) and barge shippers, where existing locks are in poor condition, requiring frequent closures for repairs, and/or because a lock's size causes delays for barge tows. The total estimated cost for the 21 planned lock projects is several billion dollars (many of the individual projects have a cost estimate of between $300 million and $800 million). However, available funding for these projects is about $200 million per year. This is because of limited appropriations and cost-sharing capabilities. Under current cost-share arrangements, the barge industry pays half the cost of construction projects. It does this by paying a $0.29 per gallon fuel tax, which annually generates around $100 million.

Significant changes in traffic levels through particular locks may affect the benefits that were estimated as expansion projects were advanced. The calculation of benefits is critical to advancing a project: the Office of Management and Budget (OMB) will not request funding for a project unless the estimated economic benefit is at least 2.5 times the expected cost. The lock projects are clustered in three regions, each facing different economic conditions that are affecting barge traffic

- in the agricultural heartland, record corn and soybean harvests have reversed the long-term downward trend of cargo volumes on the Upper Mississippi River;

- in the Ohio and Tennessee River Valleys, the domestic natural gas boom has reduced the demand for coal by barge to power plants by nearly half;

- along the Texas and Louisiana intracoastal waterway, tank barge traffic is still in a state of flux as the petrochemical industry makes longer-term investments related to the Texas shale oil boom.

The U.S. Department of Agriculture (USDA) is expecting corn and soybean exports to increase slightly over the next decade, but this projection could be affected by possible Chinese tariff increases on U.S. agricultural goods, including soybeans. The closing of additional coal-fired electric power plants along the Ohio, Monongahela, and Tennessee Rivers would reduce waterway use, as the power plants generate 75% or more of the barge traffic through many of the locks on these rivers. The loss of coal traffic is significant for other commodities as well, as it could lead to more empty repositioning of barges, reducing economies of density for barge transport on the rivers. New pipeline construction and the lifting of the crude oil export ban at the end of 2015 are two factors that could influence barge demand over the long-term on the Gulf Intracoastal Waterway.

Introduction

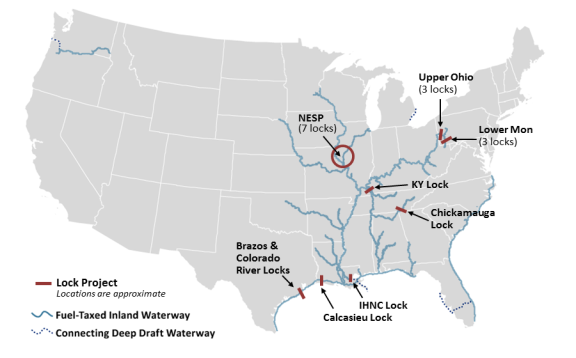

Congress faces decisions about prioritizing lock construction projects on the inland waterway system (Figure 1). It has authorized 20 such projects for construction, and has authorized preconstruction studies of one other. As both houses debate differing versions of water resources and development bills (S. 2800, H.R. 8) and the FY2019 Energy and Water Development Appropriations bill (S. 2975, H.R. 5895), the decision about which of these projects could be undertaken first will likely be among the most controversial issues.

In recent years, a single project, the Olmsted Lock and Dam project on the Ohio River, has absorbed much of the available funding. As the time and cost to complete the project have far exceeded initial estimates,1 other lock construction has been deferred. The Olmsted Lock and Dam is expected to be completed during FY2019, making it likely that funds will be available to begin some, but not all, of the other 21 lock projects a federal advisory board has identified as priorities.2 Consideration of which projects should move ahead comes at a time when traffic volumes on inland rivers are changing significantly, likely reducing the economic benefits of some potential projects while increasing the benefits of others.

The Inland Waterway System

The fuel-taxed inland waterway system consists of 11,000 miles of navigation channels with 186 lock sites and 225 lock chambers.3 River lock sites typically include a dam.

This system is designed to allow for barge transportation, which is particularly useful for transporting heavy raw materials (e.g., grain, coal, petroleum, construction aggregates). On the network shown in Figure 1, barge operators pay a $0.29/gallon federal fuel tax that covers half the cost of new construction and major rehabilitation projects (defined as lock repairs costing more than $20 million) through a special fund in the Treasury, the Inland Waterways Trust Fund (IWTF).4 The other half is covered by general funds.

Over the last five years, the trajectory of cargo volume through the locks under consideration has changed significantly. These recent changes often post-date the initial analyses that were conducted to calculate the expected economic benefits of the individual lock improvement projects. As individual lock construction projects can take many years, the U.S. Army Corps of Engineers (USACE), which oversees the inland waterways and supervises lock construction, requires that the costs and benefits be reevaluated periodically. The Office of Management and Budget (OMB) will not request funding for a project unless the measured economic benefit is at least 2.5 times the expected cost.5

The 21 proposed projects are clustered in three regions, each facing different economic conditions that are affecting barge traffic

- in the agricultural heartland, record corn and soybean harvests have reversed the long-term downward trend of cargo volumes on the Upper Mississippi River (seven locks);

- in the Ohio and Tennessee River Valleys, the closure of coal-fired generating plants has reduced the demand for moving coal by barge to power plants by nearly half (eight locks);

- along the Texas and Louisiana intracoastal waterway, tank barge traffic is in a state of flux as the petrochemical industry makes longer-term investments related to the Texas shale oil boom (six locks).

Additional factors are relevant when considering project priorities. Preliminary work has already been completed on some of the projects (see Table 1). For instance, a cofferdam (a temporary concrete wall) has been built around one planned construction site so that the river water can be pumped out and construction of a new lock can take place on dry ground. In some cases this preparatory construction work is already under way or completed, and represents $200 million to $400 million of invested capital. Another consideration is the physical condition of a lock and the likelihood of a major failure that could delay river commerce or even shut it down when a lock must be closed for repair. A related consideration is a lock's economic importance—how much traffic transits the lock and the commodities involved. Additional capacity is a motivation underlying many lock projects.

Congress authorizes new navigation construction projects, modifies existing projects, and sometimes deauthorizes projects in periodic water resources bills. It also sometimes uses a Water Resources Development Act (WRDA) as a means to require reviews or broader changes in Army Corps policies. After a lock project is authorized, construction can begin only when funds have been appropriated.6 Party rules in both houses that prohibit earmarks restrict legislative proposals that would direct a specific amount to a specific project.

|

Project |

Status |

Estimated Cost ($m) |

Authorization |

|

Chickamauga Lock and Dam |

Ongoing |

$499 (remaining) |

WRDA 1996 (P.L. 104-303) |

|

Kentucky Lock and Dam |

Ongoing |

$752 (remaining) |

WRDA 1996 (P.L. 104-303) |

|

Lower Monongahela Locks and Dams 2, 3, and 4 |

Ongoing |

$392 (remaining) |

WRDA 1992 (P.L. 102-580) |

|

Brazos and Colorado River (GIWW)a |

Awaiting Construction |

TBD |

Construction not authorized. |

|

Calcasieu Lock (GIWW) |

Awaiting Construction |

$17 |

WRDA 2016 (P.L. 114-322) |

|

Inner Harbor Navigation Canal Lock |

Awaiting Construction |

$1,400 |

WRDA 2007 (P.L. 110-114)b |

|

Dashields Lock (Upper Ohio River) |

Awaiting Construction |

$801 |

WRDA 2016 (P.L. 114-322) |

|

Emsworth Lock (Upper Ohio River) |

Awaiting Construction |

$737 |

WRDA 2016 (P.L. 114-322) |

|

Montgomery Lock (Upper Ohio River) |

Awaiting Construction |

$782 |

WRDA 2016 (P.L. 114-322) |

|

LaGrange Lock (Illinois Waterway) |

Awaiting Construction |

$358 |

WRDA 2007 (P.L. 110-114) |

|

Peoria Lock (Illinois Waterway) |

Awaiting Construction |

$359 |

WRDA 2007 (P.L. 110-114) |

|

Upper Mississippi River Lock 20 |

Awaiting Construction |

$323 |

WRDA 2007 (P.L. 110-114) |

|

Upper Mississippi River Lock 21 |

Awaiting Construction |

$450 |

WRDA 2007 (P.L. 110-114) |

|

Upper Mississippi River Lock 22 |

Awaiting Construction |

$373 |

WRDA 2007 (P.L. 110-114) |

|

Upper Mississippi River Lock 24 |

Awaiting Construction |

$434 |

WRDA 2007 (P.L. 110-114) |

|

Upper Mississippi River Lock 25 |

Awaiting Construction |

$543 |

WRDA 2007 (P.L. 110-114) |

Source: CRS, based on data from Inland Waterways User Board, 2017 Annual Report.

Notes: WRDA=Water Resources Development Act.

a. "Brazos High Island" and "Brazos River to Port O'Connor," listed in the Inland Waterway Users Board's (IWUB's) 2017 Annual Report, are not discussed in this report as they do not involve locks but rather realignment of channels.

Background on Inland Barge Transportation

A standard size barge is 195 feet in length and 35 feet in width, and can hold up to 1,570 tons of cargo. On the busier, main stems of the locked segments of rivers, 15 barges are tied together in a single tow, usually three barges wide and five barges in length. The barges are pushed by a towboat (also known as a pushboat) that is typically between 117 feet and 200 feet in length. Thus, a 15-barge tow is about 105 feet wide and can be just under 1,200 feet in length.

The largest locks on the system, which are 1,200 feet by 110 feet, can accommodate these tows.7 However, many of the locks are half this length (600 feet), requiring a 15-barge tow be broken up into two sections to pass through a lock. One lockage can take 45 minutes to an hour as the barges enter the lock chamber, the chamber is filled or emptied, and the barges exit. Thus, a 15-barge tow attempting to pass through a 600-foot lock will require two lockages taking about two hours. After it pushes both segments of the tow through the lock, the towboat will reassemble them into a single tow.

On less busy tributaries, some locks are 360 feet by 56 feet, large enough for only one barge at a time to lock through. However, on these river segments, tows may consist of only four or six barges. The width and curvature of rivers also dictates allowable tow sizes. The 15-barge tows are most often carrying grain or coal. Tows carrying other dry goods often consist of a smaller number of barges and may contain a mix of commodities. Tows of tank barges carrying liquid cargo (petroleum, chemicals) typically consist of one to three barges. "Jumbo" barges whose dimensions are 290 feet x 50 feet can also be found on the system. The Mississippi River between St. Louis and New Orleans has no locks, and 30 to 50 barges are often tied together in tows. One of these tows carries about as much cargo as an oceangoing ship.

Tows travel about 3 to 5 mph. On multiday voyages, barges operate day and night with two crews rotating six-hour shifts. A voyage between Pittsburgh and St. Louis will take about 18 days, a voyage between Peoria, IL, and New Orleans about 16 days.8 Both drought and floods may limit the size of tows or restrict transport to daylight hours only, causing lengthy delays. Some northern portions of the system are either closed entirely in winter or are open but susceptible to delays due to ice, especially around locks. Winter closure allows the Corps to perform major lock repairs without disturbing traffic, although not under ideal weather conditions.

The nature of river transport generally caters to shippers of low-value commodities that ship in large lot sizes and can afford to stockpile their product in anticipation of unfavorable river conditions. The main competition for barges is railroads, which cost more but generally provide faster and more reliable transport. For petroleum products, pipelines are the predominant choice on specific routes, but are costly to alter if origin or destination changes. Most barge shippers are committed to river transport, especially insofar as they have located their facilities along a river for this purpose and cannot readily switch to rail or pipeline transport when there are problems with river transport.

The Army Corps of Engineers maintains a depth of at least 9 feet throughout the inland waterway system. This depth is accomplished by dams that create pools (lakes) and that moderate river currents and water supply, as well as by dredging. Deepening is not an element of most of the lock improvement projects. Various "training structures" also funnel the current and help prevent shoaling in the middle of a river. The Corps operates locks 24 hours a day, seven days a week at locations with at least 1,000 commercial lockages per year (an average of about three per day). Below this level, locks may be closed at night.

Reliability has been a persistent issue, with both scheduled and unscheduled repair work requiring barge operators to work around lock closures or utilize a typically smaller auxiliary lock. While age is frequently cited as justification for constructing a new lock, many locks have undergone major rehabilitation since their initial construction. The rehabilitation work is not always reflected in USACE reports.9

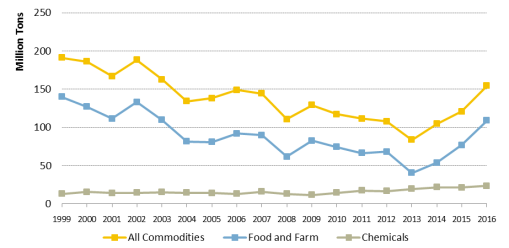

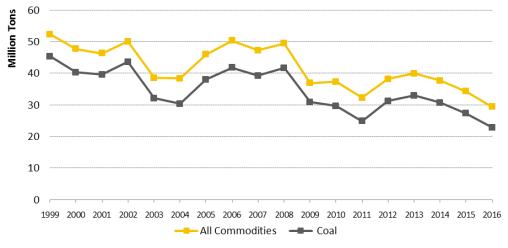

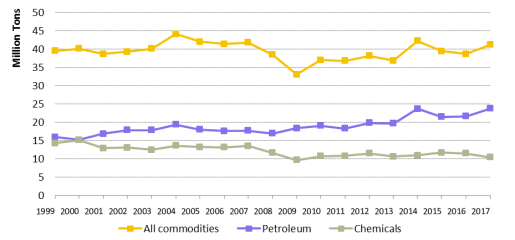

Upper Mississippi and Illinois Waterway Project

Barge operators and agricultural shippers in the upper Midwest have long sought to increase the size of a series of locks above St. Louis (Locks 20, 21, 22, 24, and 25)10 on the Mississippi River, as well as the last two locks on the Illinois Waterway (Peoria and LaGrange). This project is now referred to as the Navigation and Ecosystem Sustainability Program (NESP; see Figure 1).11 Corn and soybeans, and to a lesser extent, wheat, are the dominant commodities in terms of tonnage shipped through these locks (see Figure 2 and Figure 3). Once on the river, these products are typically bound for the New Orleans region to be loaded on ships for export. Fertilizer, moving upbound, is also a significant commodity being shipped through these locks.

All seven of these locks are currently 600 feet in length and 110 feet in width, which means that the 15-barge tows typically found on the river moving grain for export must be split into two sections to pass through. By increasing the length of the lock to 1,200 feet, a 15-barge tow could pass through the lock in one lockage. The two southernmost locks on the Mississippi (Melvin Price Lock and Lock 27, in the vicinity of St. Louis) and Lock 19 (located upriver from locks 20-25 on the Mississippi at Keokuk, IA) are already 1,200 feet.

Congress authorized expansions of the seven NESP locks in WRDA 2007 (P.L. 110-114, Title VIII). It has provided appropriations for their engineering and design work, but not for construction.12 Tonnage passing through these locks fell by half between 1999 and 2013, raising questions about the economic justification for enlarging the locks. The steady decline culminated in the catastrophic drought year of 2012, when corn production fell 13% (see Figure 2 and Figure 3). A 2012 Army Corps study found that these river segments had adequate capacity through 2020.13 However, the expansion in corn-based ethanol production, which caused corn to be transported by truck within the Midwest rather than being shipped by barge for export,14 slowed after 2010 as the amount of ethanol blended into gasoline nationally reached the minimum level required by law, limiting further growth in demand.15

The more recent increase in barge transport of corn and soybeans (since 2013) coincides with exceptionally large harvests. Annual harvests from 2013 through 2017 were record or near record harvests for both crops.16 The slight increase in chemical tonnage, a good portion of which is fertilizer (moving upbound), coincides with the record harvest years. Although Army Corps data for 2017 are not readily available for all of these locks, preliminary data for the LaGrange Lock and Mississippi Lock 25 indicate that record harvests in 2017 resulted in strong volumes of agricultural products through these locks last year also, with tonnage only slightly lower than in 2016.17

Will the recent growth in cargo volumes on the Mississippi continue? The U.S. Department of Agriculture (USDA) projects U.S. corn exports, which were essentially flat between 1990 and 2010, will increase slightly through 2027. Soybean exports are also projected to increase slightly through 2027, continuing a trend since 1990.18 A portion of this increase could be shipped through these seven locks. However, corn and soybean exports also enter the river below these locks, move by rail to Gulf Coast ports, or move by rail to West Coast ports. If China's recent announcement concerning possible tariffs on U.S. soybeans or other crops leads to the imposition of import restraints, future traffic volumes could be adversely affected. Although the opening of new locks in the Panama Canal in 2016 allows larger ships to carry grain and soybeans between New Orleans and Asia, potentially reducing transport costs, freight rates for dry bulk ships are notoriously volatile, and rate increases could make the rail option to the West Coast more attractive. These are just some of the variables that could influence future traffic through these locks.

|

Figure 2. Mississippi River Locks 20, 21, 22, 24, 25 (aggregated tonnage through all five locks) |

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. Note: Chemicals includes fertilizers. |

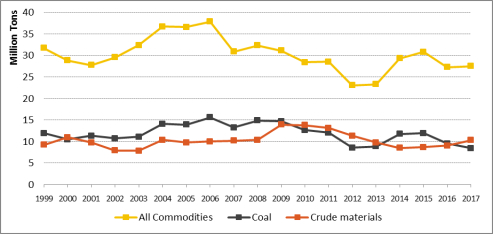

Agricultural products also account for the bulk of the tonnage passing through the last two locks on the Illinois Waterway, although the commodity mix is more diverse than that through the five Mississippi River locks discussed above. Although not indicated in Figure 3, the tonnage through LaGrange lock, which is the southernmost lock on the Illinois Waterway, is about a third larger than through Peoria and is more heavily concentrated in corn and soybeans.

|

Figure 3. Peoria and LaGrange Locks, Illinois Waterway (aggregated tonnage of both locks) |

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. Note: Chemicals includes fertilizers. |

Although one might expect that seasonal volumes on these two rivers might be heavily concentrated in the fall, after harvest, in actuality tonnages can be more distributed throughout the year. Shipment timing is influenced by corn and soybean prices, and volumes may peak right before the harvest season, as elevators need to make room for the next crop.

During their busiest months, these seven locks each average about 10 tows per day. In comparison, Lock 27, farther south on the Mississippi River, averages about 23 tows per day during its busiest months. Section 8003 of WRDA 2007 called on the Army Corps to develop and test an appointment system to help barge operators avoid bunching their arrivals at the same lock. Barge operators insist that scheduling or a lock appointment system is not practical for river travel, but whether it is even necessary for a lock handling 10 tows per day is unclear. Debate continues over whether more efficient use of the infrastructure already in place would make lock extensions unnecessary.

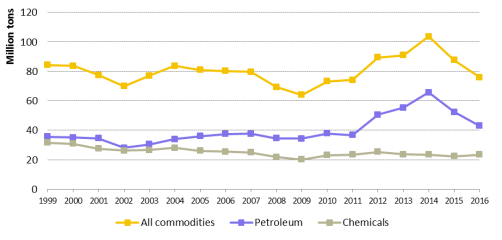

Upper Ohio River Project

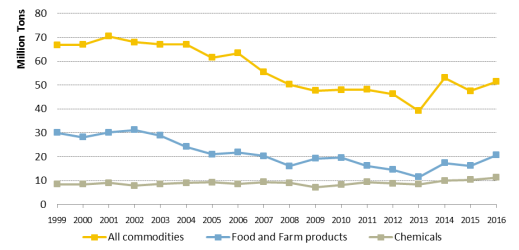

As important as corn and soybeans are for the Mississippi and Illinois Waterways, coal is the dominant commodity on most of the Ohio River System. The Ohio Valley is dotted with riverfront coal-fired power plants that are supplied largely from mines within the region. Unlike corn and soybeans on the Mississippi/Illinois Waterway, which typically are moved long distances to export terminals, coal on the Ohio River and its tributaries is typically moved for relatively short distances, either upbound or downbound, and requires passage through relatively few locks per trip.

On the Ohio River, all 20 lock sites have two parallel lock chambers. Most of the lock sites have both a 1,200-foot chamber and 600-foot chamber, both with widths of 110 feet. However, three lock sites located on the lower half of the river, McAlpine, Smithland, and Olmsted,19 each have two 1,200-foot lock chambers.

The three sites farthest upriver, near Pittsburgh, have smaller locks, a 600-foot chamber and an auxiliary 360-foot chamber that is 56 feet wide and fits only a single barge at a time. The smaller locks are used if the larger lock needs to close for repairs, a common occurrence in recent years particularly at the Montgomery Lock, where the main chamber was closed for the equivalent of 200 days in 2016 and 320 days in 2015, much of it for unscheduled repair work. Congress authorized replacement of these three locks, Emsworth, Dashields, and Montgomery, in the Water Resources Development Act of 2016 (P.L. 114-322, §1401). The auxiliary locks would be replaced with 600-foot locks, giving each site two 600-foot chambers.

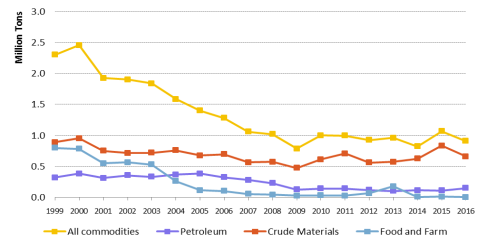

As Figure 4 indicates, the availability of natural gas has greatly reduced demand for barge movement of coal through the Emsworth, Dashields, and Montgomery locks. Of the 18 riverfront coal-fired electric plants that utilized these locks, half have closed since 2012, and the closure of at least a couple of more may be imminent.20 Limestone is the second largest commodity carried through the locks, but this commodity is also dependent on the existence of the electric generating plants, as it is used in the pollution control units.

There is no indication that other commodities carried through the locks might increase in volume, replacing coal traffic. Barges have not been heavily utilized to carry "frac sand," pipes, or wastewater to support the shale gas drilling activity in the region, nor has a renaissance in energy-intensive manufacturing occurred as of yet.21 The decline of coal traffic can affect other commodities, as it could mean more empty backhaul movements of barges on the waterway, reducing overall efficiency. Army Corps data indicate that the ratio of empty barges to loaded barges moving on the Ohio River has increased from about 50% in the early 2000s to 60% to 65% over the last five years,22 while the average size of tows passing through the three locks proposed for enlargement has decreased by more than one and a half barges.23 This implies that tows now require less time, on average, to pass through these locks, reducing the time savings that would come from lock enlargement.

|

Figure 4. Ohio River; Emsworth, Dashields, and Montgomery Locks (aggregated tonnage through the three locks) |

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. Note: Coal may include lignite and coal coke. |

Despite the long-term downward trend in traffic levels, and its downward acceleration since 2013, a 2016 Army Corps study calculated the economic benefit of expanding the locks based on a forecast that tonnage would rise from 35 million tons in 2016 to 78 million in 2020 and 98 million in 2040.24 In other words, by 2020 aggregated tonnage through the three locks was projected to more than double from 2016. By 2040, tonnage was projected to be one-fifth higher than in the peak year, 1996.25 This was its "middle range" forecast; the Army Corps also calculated higher and lower forecast scenarios that were deemed less likely to occur.26 The projection of increased tonnage was based on a 2013 U.S. Energy Information Administration (EIA) projection of increased coal production in the Northern Appalachia region,27 and appears to assume that all coal produced in this region moves by river. However, only 20% to 25% of Pennsylvania and northern West Virginia coal moves out by river, with the rest moving by rail.28 This year, EIA revised its forecast, and now foresees Northern Appalachia coal production to be about half as much as it projected five years earlier and to decline over the coming decades.29 The Corps is planning to release an economic update for this project in May 2020.30

Two recent transactions may signify the decline of coal shipping on the Ohio River system. In 2015, American Electric Power sold its barge line to an independent operator. In March 2018, Jeffboat Inc., the largest barge builder, which was located on the Ohio River across from Louisville, KY, shut down its operations.

The "Lower Mon" Project

Upriver from Pittsburgh, on the Monongahela River, USACE is in the process of rebuilding structures at Lock and Dam 2, 3, and 4 as authorized in the Water Resources Development Act of 1992 (P.L. 102-580). This project has received about $1 billion in funding to date. The need for Lock 3 is to be eliminated by raising the depth of the pool. Two new, wider lock chambers (increasing width from 56 feet to 84 feet) are to be built at Lock 4, the Charleroi Locks, to match the width of the six lock sites upriver. This is designed to allow tows two barges wide to pass through.31 Completion of the projects at Locks 3 and 4 will depend on further funding. A new dam was completed at Lock 2 in 2004, but a plan to enlarge the smaller of the two lock chambers at this lock site was canceled, as the larger of the two locks is larger than the locks upriver.

Coal accounts for about 80% of the tonnage passing through these locks, and as Figure 5 indicates, the volume of coal passing through is now about half what it was in the late 1990s. Of the four operating coal-fired electric power plants located on the river, three closed between 2013 and 2017. The remaining power plant states that it uses about 2.8 million tons of coal per year (which passes through Lock 4).32 Although 2017 tonnage data for all three locks is not currently available, preliminary 2017 data for Lock 4 indicate that tonnage was down slightly from 2016, to 7.9 million tons. This translates to 839 fully loaded six-barge tows (with each barge loaded to 1,570 tons), or an average of 2.3 six-barge tows passing through the locks per day. The dimensions of the two new locks at Lock 4, 720 feet in length and 84 feet in width, would allow six-barge tows to pass through, providing far more capacity than required based on the current volume of cargo.

|

Figure 5. Locks 2, 3, and 4 on the Monongahela River (aggregated tonnage through all 3 locks) |

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. Note: Coal may include lignite and coal coke. |

Tennessee River—KY and Chickamauga Locks

The Tennessee River is navigable from Knoxville and empties into the Ohio River at Paducah, KY. Of the nine lock sites on the river, two are slated for improvements, with preliminary components already constructed or under way: the Kentucky Lock and the Chickamauga Lock, authorized in WRDA 1996 (P.L. 104-303). Neither the Trump Administration nor the Obama Administration requested funds for these two lock construction projects.

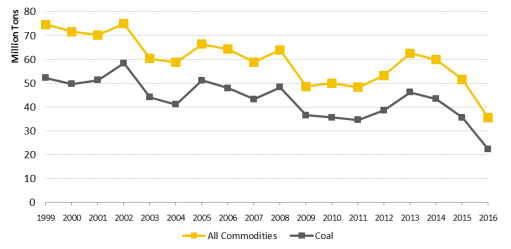

The last lock on the Tennessee River is the Kentucky Lock, 22 miles from the mouth, where a new parallel lock 1,200 feet in length is planned alongside the existing 600-foot lock.33 The Kentucky Lock also attracts barge tows from the nearby Cumberland River via the Barkley Canal, and, as Figure 6 indicates, is a fairly busy lock in terms of tonnage. Traffic is somewhat more diversified than on other parts of the Ohio navigation system, with both coal and crude materials (which appear to be mostly limestone and sand and gravel) making up the two largest commodity groups in terms of tonnage. Of the 10 coal-fired electric plants located on the Tennessee and Cumberland Rivers or on nearby stretches of the Ohio River, four closed between 2011 and 2017. However, the decline of coal tonnage through the Kentucky Lock has not been as severe as at other locks, as the two power plants located nearest the lock have remained open (the four closed plants are located upriver from the lock). Sand and gravel shipments have also helped to steady the tonnage through this lock.

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. 2017 data from "Key Lock Report." Note: Coal may include lignite and coal coke. |

The Chickamauga Lock is about 450 miles upriver from the Kentucky Lock at Chattanooga. This lock is small, 360 feet in length and 60 feet in width, so only one barge at a time can pass through. The lock has had a long-standing problem with its concrete, raising concerns about its reliability. The existing plan is to build a parallel lock 600 feet in length (a cofferdam is already in place). The lock's present size is suitable for its traffic, with recreational boats outnumbering barge tows by about seven to one. Upriver from the lock and dam site is Chickamauga Lake. As Figure 7 indicates, the tonnage through this lock is far smaller than through the other locks discussed in this report. In 2016, about 900,000 tons of commodities passed through, about half the tonnage of 15 years earlier. The drop in cargo volume is mostly due to the loss of food and farm product shipments. Barge tows average about one per day. This is below the Corps' threshold for 24-hour lock operation; the lock is closed from 3-7 a.m.

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. Note: Petroleum includes refined products. |

Gulf Intracoastal Waterway

The Gulf Intracoastal Waterway (GIWW) is the third-busiest inland waterway in terms of tonnage after the Mississippi and Ohio Rivers. The GIWW is a coastal waterway from Brownsville, TX, to the panhandle of Florida that is protected by barrier islands and marshland. The waterway allows flatwater barges, as opposed to seagoing vessels, to engage in coastal transport in this region. The traffic is dominated by tows of one to three tank barges carrying liquid petroleum or chemical products. Despite being a tidal waterway, the GIWW and connecting channel require about 15 locks or gates, usually at intersecting rivers, to provide lift or control river and tide currents entering GIWW channels. The three primary proposed IWTF projects on the GIWW are discussed in more detail below.

Inner Harbor Navigation Canal Lock

The Inner Harbor Navigation Canal (IHNC) Lock is a lock in the vicinity of the Port of New Orleans that provides a connection between the GIWW (this segment is also called the Industrial Canal), the Mississippi River, and Lake Pontchartrain. The lock is needed because there is a difference in water elevation between the Mississippi River and the canal. The lock formerly was connected to the Mississippi River Gulf Outlet, or MRGO, a ship canal built as a second and shorter route between the Port of New Orleans and the Gulf of Mexico. Congress ordered closure of MRGO in WRDA 2007 (P.L. 110-114, §7013) due to controversy over its role in neighborhood flooding during Hurricane Katrina. The lock site also involves drawbridges, as it is located in a densely populated area.

The Army Corps has plans to build a larger replacement lock farther east on the same canal, principally to widen the lock so that tows two barges wide can pass through. The cost estimate is $1.4 billion. Congress originally authorized lock expansion in 1956 (P.L. 84-455), and then reauthorized the project in WRDA 1986 (P.L. 99-662). WRDA 1996 (P.L. 104-303) authorized a Community Impact Mitigation Plan for the expansion, which was modified in WRDA 2007 (§5083).34 In 2017, the Army Corps held public meetings and accepted public comments on its lock replacement plan.35 The surrounding residential community opposes the project.36

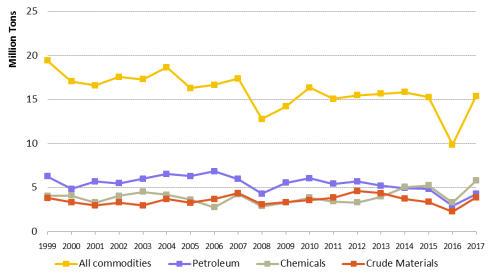

The Corps states that the present lock causes significant delays because tows can lock only one barge at a time, and the present lock has experienced significant down time for repairs. Corps data indicate that tows arriving at this lock have to wait far longer than at any other lock in the country to begin locking through, between 12 and 24 hours on average over the last several years. In 2016, the lock was closed for the equivalent of 185 days (4,440 hours) due to repairs. A bypass route through the Baptiste Collette Bayou and Chandeleur Sound was available through most of the closure, but it is much longer and somewhat unprotected from the open sea. In 2008, the lock was closed the equivalent of 115 days (2,752 hours) for repairs. As Figure 8 indicates, this affected tonnage passing through the lock in those years. As the figure indicates, shippers of petroleum and chemical products and crude materials, in terms of tonnage, are the largest users of the lock.

|

Figure 8. Inner Harbor Navigation Canal Lock (on the Industrial Canal in New Orleans) |

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. 2017 data from "Key Lock Report." Note: Petroleum includes refined products. |

Calcasieu Lock

The Calcasieu Lock is located on the GIWW in southwestern Louisiana in proximity to the Port of Lake Charles. The lock provides no lift; its purposes are to keep saltwater from intruding into rice-producing areas and flood control. The water control function at times conflicts with barge movement on the GIWW. The Army Corps has plans to build a bypass canal with a gate that would perform the water control function, leaving the lock to principally serve navigation purposes. The project was authorized in WRDA 2016 (P.L. 114-322, §1401) at a cost of $17.4 million. As Figure 9 indicates, the lock is fairly busy, handling around 40 million tons per year, with a slight increase in petroleum products in recent years.

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. 2017 data from "Key Lock Report." Note: Petroleum includes refined products. |

Brazos and Colorado River Floodgates/Locks

On the Texas portion of the GIWW, between Freeport and Matagorda, six lock or gate structures are slated for improvement. These structures keep the Brazos and Colorado Rivers, during high river flows, from depositing sediments in the GIWW channel where they intersect. According to the Corps, the structures are too narrow, causing swift currents in the GIWW at these points and causing tows to sometimes swipe channel walls. The Corps has plans to widen three of the structures from 75 feet to 125 feet and eliminate the remaining three gates. The wider structures would allow tows two barges wide to pass through, rather than locking through each barge one at a time. The elimination of the other gates would require the Corps to perform more dredging of deposited silt. At the May 2017 and July 2017 IWUB meetings, barge operators stressed that the navigation problems were at the Brazos River Floodgates, not the Colorado River Locks.37 Congress authorized Army Corps studies of this project in WRDA 2007 and WRRDA 2014, but it has yet to be authorized for construction.38

Tonnage through these structures, as Figure 10 indicates, has recently been in flux, likely due to the hydraulic fracturing oil boom in Texas. While tonnage was initially rising, petroleum shippers may have switched to pipeline transport, which might explain the falloff in volumes since 2015. Another factor that would seem to reduce the demand for domestic barge transport of oil along this waterway is the lifting of the crude oil export ban in 2015. Although the concurrent boom in natural gas production has led to an uptick in chemical production in the Gulf Coast region (natural gas is a major feedstock to many chemical production processes), it does not appear to have resulted in an increase in barge movement of chemicals through these locks or at the Calcasieu Lock.

Preliminary 2017 tonnage data indicate that the downward slide continued into last year.39

|

Figure 10. Brazos and Colorado Rivers, East and West Locks (aggregated tonnage through four locks) |

|

|

Source: CRS, data from USACE, Navigation Data Center, Public Lock Commodity Report; http://www.navigationdatacenter.us/lpms/lpms.htm. Note: Petroleum includes refined products. |

Legislation

S. 2800 (§3101), reported by the Committee on Environment and Public Works, calls on the Government Accountability Office (GAO) to report on the progress and obstacles to implementing the lock expansions for the seven locks on the Upper Mississippi River and Illinois Waterway (as well as the ecosystem restoration aspect of the project). The bill (§2312) calls on the Army Corps to expedite a review study for deepening the Baptiste Collette Bayou—the bypass route around the IHNC lock. The bill (§1003) also asks the GAO to review and compare the benefit-cost analysis procedures performed by the Army Corps with those performed by OMB. The same GAO study is called for in the bill ordered to be reported by the House Committee on Transportation and Infrastructure (H.R. 8).

Waterway lock projects have also been discussed and funded in recent annual Energy and Water Development appropriations legislation. For instance, the FY2017 enacted bill funded construction expenditures for several projects in addition to the Olmsted Project (which was still ongoing at the time), including Kentucky Lock and Dam ($39.5 million) and the locks on the Lower Mon ($82 million). Allocations under the FY2018 enacted bill (P.L. 115-141) are expected to provide additional funding for waterways projects, but have yet to be made. In May 2018, the House Committee on Appropriations reported a bill (H.R. 5895, H.Rept. 115-697) to fund the Army Corps Civil Works program for FY2019. The report expresses the desire that an economic update for the NESP project, if conducted, be completed by the end of 2019. The Senate-reported appropriations bill (S. 2975, S.Rept. 115-258) requests that the Army Corps report on its plans for updating a benefit-cost analysis of the NESP project and recommends funds for further investigation of the Brazos and Colorado River Floodgates/Locks project. Both appropriations bills would make full use of the barge fuel taxes collected for inland waterway construction projects.

Author Contact Information

Footnotes

| 1. |

U.S. Government Accountability Office (GAO), Army Corps of Engineers: Factors Contributing to Cost Increases and Schedule Delays in the Olmsted Locks and Dam Project, GAO-17-147, February 2017; https://www.gao.gov/assets/690/682825.pdf. |

| 2. |

Inland Waterways Users Board 30th Annual Report, December 2017 (2017 Annual Report), p. 7; http://www.iwr.usace.army.mil/Missions/Navigation/Inland-Waterways-Users-Board/Annual-Report-to-Congress/. The Inland Waterways Users Board (IWUB) is an 11-member advisory committee made up of barge operators and shippers established by WRDA 1986 to advise the Army Corps and Congress on construction and rehabilitation priorities. The IWUB quarterly meeting minutes and presentations provide status reports on its priority lock projects; http://www.iwr.usace.army.mil/Missions/Navigation/Inland-Waterways-Users-Board/Board-Meetings/. |

| 3. |

The Soo Locks site in the Great Lakes is also under consideration for a new lock, but it is not part of the fuel-taxed inland waterway system. For economic conditions affecting the Soo Lock site, see CRS Report R44664, The Great Lakes-St. Lawrence Seaway Navigation System: Options for Growth, by John Frittelli. |

| 4. |

CRS In Focus IF10020, Inland Waterways Trust Fund, by Charles V. Stern and Nicole T. Carter. |

| 5. |

USACE, "BCRs and Economic Updates," IWUB Meeting #70, January 14, 2014; http://www.iwr.usace.army.mil/Portals/70/docs/IWUB/board_meetings/meeting70/4_Hammond_BCRs_and_Update_Process_Hammond_09_Jan_2014.pdf. |

| 6. |

CRS Report R41243, Army Corps of Engineers: Water Resource Authorizations, Appropriations, and Activities, by Nicole T. Carter and Charles V. Stern. |

| 7. |

For a listing of lock dimensions by waterway, see http://www.navigationdatacenter.us/lpms/pdf/lkgenrl.pdf. |

| 8. |

According to transit times posted by American Commercial Barge Lines; http://www.acltrac.com/transit_all.asp. |

| 9. |

Appendix C, Transportation Research Board, Special Report 315, Funding and Managing the U.S. Inland Waterways System: What Policy Makers Need to Know, 2015; http://www.trb.org/Main/Blurbs/172741.aspx. The Corps does not indicate when rehabilitation work was performed in its "Lock Characteristics General Report"; USACE, Navigation Data Center; http://www.navigationdatacenter.us/lpms/pdf/lkgenrl.pdf. |

| 10. |

There is no lock 23. |

| 11. |

USACE, Rock Island District, NESP Program History; http://www.mvr.usace.army.mil/Missions/Navigation/NESP/Program-History/. |

| 12. |

USACE, Rock Island District, NESP Program Status; http://www.mvr.usace.army.mil/Missions/Navigation/NESP/Program-Status/. |

| 13. |

USACE, U.S. Port and Inland Waterways Modernization: Preparing for Post-Panamax Vessels, June 20, 2012; http://www.iwr.usace.army.mil/Portals/70/docs/portswaterways/rpt/June_20_U.S._Port_and_Inland_Waterways_Preparing_for_Post_Panamax_Vessels.pdf. |

| 14. |

USDA, Transportation of U.S. Grains: A Modal Share Analysis, periodically updated; https://www.ams.usda.gov/services/transportation-analysis/modal. |

| 15. |

CRS In Focus IF10377, USDA Initiative Is Funding New Ethanol Infrastructure, by Mark A. McMinimy. |

| 16. |

USDA, Quick Stats, Corn and Soybean production measured in bushels; https://quickstats.nass.usda.gov/results/F9199E1E-CDE3-30A5-8BEE-9769BB166119?pivot=short_desc. |

| 17. |

USACE, Navigation Data Center, Key Lock Report; http://www.navigationdatacenter.us/lpms/keylock/keyl17r.html. |

| 18. |

USDA, Agricultural Projections to 2027, pages 78 and 88; https://www.ers.usda.gov/publications/pub-details/?pubid=87458. |

| 19. |

As discussed previously, Olmsted is expected to be operational in late 2018. |

| 20. |

U.S. Energy Information Agency (EIA), Monthly Electric Generator Inventory, 860M database, as of February 2018; https://www.eia.gov/electricity/data/eia860m/. |

| 21. |

S. 1075 and H.R. 2568 call for a federal study on the viability of an ethane storage hub in this region. |

| 22. |

USACE, Navigation Data Center, Public Lock Usage Report; http://www.navigationdatacenter.us/lpms/lpms.htm. |

| 23. |

USACE, Navigation Data Center, Public Lock Usage Report; http://www.navigationdatacenter.us/lpms/lpms.htm. |

| 24. |

USACE, Upper Ohio Navigation Study, Pennsylvania: Draft Feasibility Report, Appendix B, Project Economics, pages 66-74; http://www.lrp.usace.army.mil/Portals/72/docs/UpperOhioNavStudy/App_Economics-Updated%208Sep16.pdf?ver=2017-11-03-113428-483. The final report uses the same forecast as in the draft report but the draft report contains more detailed analysis. |

| 25. |

In 1996, tonnage was slightly higher than in 1999 and 2002. |

| 26. |

USACE, Upper Ohio Navigation Study, Pennsylvania: Final Feasibility Report and Integrated Environmental Impact Statement, October 2014 (Revised August 2016); http://www.lrp.usace.army.mil/Portals/72/Tab%202%20UONS%20Final%20Report%20Revised%20Aug%202016_signed.pdf?ver=2016-12-12-123417-567. See Attachment 7: Economic Update and Analysis, February 19, 2014. |

| 27. |

U.S. EIA, Annual Energy Outlook 2013, Table 68 – Coal Production By Region and Type; https://www.eia.gov/outlooks/aeo/data/browser/#/?id=95-AEO2013®ion=0-0&cases=ref2013&start=2010&end=2040&f=Q&linechart=ref2013-d102312a.2-95-AEO2013&sourcekey=0. |

| 28. |

U.S. EIA, Coal Distribution Report; https://www.eia.gov/coal/data.php#imports. |

| 29. |

U.S. EIA, Annual Energy Outlook 2018, Table 67 – Coal Production By Region and Type; https://www.eia.gov/outlooks/aeo/data/browser/#/?id=95-AEO2018®ion=0-0&cases=ref2018&start=2016&end=2050&f=Q&linechart=ref2018-d121317a.2-95-AEO2018&sourcekey=0. |

| 30. |

Minutes of IWUB Meeting No. 85, Vicksburg, MS, November 3, 2017, pages 19-23; http://www.iwr.usace.army.mil/Portals/70/docs/IWUB/board_meetings/meeting85/UB85_Minutes_Final_030118.pdf?ver=2018-03-15-093210-033. |

| 31. |

USACE, Pittsburgh District, Lower Mon Project Fact Sheet, June 2013; http://www.lrp.usace.army.mil/Portals/72/docs/HotProjects/LMPJune2013.pdf. |

| 32. |

MonPower, Fort Martin Power Station; https://www.firstenergycorp.com/content/dam/corporate/generationmap/files/FE-Ft%20Martin%20Fact%20Sheet.pdf. |

| 33. |

The project was authorized in WRDA 1996 (P.L. 104-303), USACE Nashville District; http://www.iwr.usace.army.mil/Missions/Navigation/Inland-Waterways-Users-Board/Board-Meetings/meeting86/. |

| 34. |

USACE, New Orleans District, IHNC Lock Replacement; http://www.mvn.usace.army.mil/About/Projects/IHNC-Lock-Replacement/. |

| 35. |

USACE, New Orleans District, Press Release 17-011, March 21, 2017; http://www.mvn.usace.army.mil/Media/News-Releases/Article/1125513/corps-to-host-ihnc-lock-replacement-public-meeting-open-house/. |

| 36. |

Presentation by Sean Mickal, USACE New Orleans District, IWUB Meeting No. 86, Chattanooga, TN, March 1, 2018; http://www.iwr.usace.army.mil/Missions/Navigation/Inland-Waterways-Users-Board/Board-Meetings/meeting86/. |

| 37. |

IWUB, May 2017 and July 2017 meeting minutes; http://www.iwr.usace.army.mil/Missions/Navigation/Inland-Waterways-Users-Board/Board-Meetings/. |

| 38. |

USACE, Review Plan, Gulf Intracoastal Waterway Brazos River Floodgate and Colorado River Lock Feasibility Study, August 2016; http://cdm16021.contentdm.oclc.org/utils/getfile/collection/p16021coll7/id/5873/rec/1. |

| 39. |

USACE, Navigation Data Center, Lock Performance Monitoring System, Tonnage Report; http://corpslocks.usace.army.mil/lpwb/f?p=121:1:18614001730832:::::.. |