The Potential Decline of Cash Usage and Related Implications

Electronic forms of payment have become increasingly available, convenient, and cost efficient due to technological advances in digitization and data processing. Anecdotal reporting and certain analyses suggest that businesses and consumers are increasingly eschewing cash payments in favor of electronic payment methods. Such trends have led analysts and policymakers to examine the possibility that the use and acceptance of cash will significantly decline in coming years and to consider the effects of such an evolution.

Cash is still a common and widely accepted payment system in the United States. Cash’s advantages include its simplicity and robustness as a payment system that requires no ancillary technologies. In addition, it provides privacy in transactions and protection from cyber threats or financial institution failures. However, using cash involves costs to businesses and consumers who pay fees to obtain, manage, and protect cash and exposes its users to loss through misplacement, theft, or accidental destruction of physical currency. Cash also concurrently generates government revenues through “profits” earned by producing it and by acting as interest-free liabilities to the Federal Reserve (in contrast to reserve balances on which the Federal Reserve pays interest), while reducing government revenues by facilitating some tax avoidance.

The relative advantages and costs of various payment methods will largely determine whether and to what degree electronic payment systems will displace cash. Traditional noncash payment systems (such as credit and debit cards and interbank clearing systems) involving intermediaries such as banks and central banks address some of the shortcomings of cash payments. These systems can execute payments over physical distance, allow businesses and consumers to avoid some of the costs and risks of using cash, and are run by generally trusted and closely regulated intermediaries. However, the maintenance and operation of legacy noncash systems involve their own costs, and the intermediaries charge fees to recoup those costs and earn profits. The time it takes to finalize certain transactions—including crediting customer accounts for check or electronic deposits—can lead to consumers incurring additional costs. In addition, these systems involve cybersecurity risks and generally require customers to divulge their private personal information to gain system access, which raises privacy concerns.

To date, the migration away from cash has largely been in favor of traditional noncash payment systems; however, some observers predict new alternative systems will play a larger role in the future. Such alternative systems aim to address some of the inefficiencies and risks of traditional noncash systems, but face obstacles to achieving that aim and involve costs of their own. Private systems using distributed ledger technology, such as cryptocurrencies, may not serve the main functions of money well and face challenges to widespread acceptance and technological scalability. These systems also raise concerns among certain observers related to whether these systems could facilitate crime, provide inadequate protections to consumers, and may adversely affect governments’ ability to implement or transmit monetary policy. The potential for increased payment efficiency from these systems is promising enough that certain central banks have investigated the possibility of issuing government-backed, electronic-only currencies—called central bank digital currencies (CBDCs)—in such a way that the benefits of certain alternative payment systems could be realized with appropriately mitigated risk. How CBDCs would be created and function are still matters of speculation at this time, and the possibility of their introduction raises questions about the appropriate role of a central bank in the financial system and the economy.

If the relative benefits and costs of cash and the various other payment methods evolve in such a way that cash is significantly displaced as a commonly accepted form of payment, that evolution could have a number of effects, both positive and negative, on the economy and society. Proponents of reducing cash usage (or even eliminating it all together and becoming a cashless society) argue that doing so will generate important benefits, including potentially improved efficiency of the payment system, a reduction of crime, and less constrained monetary policy. Proponents of maintaining cash as a payment option argue that significant reductions in cash usage and acceptance would further marginalize people with limited access to the financial system, increase the financial system’s vulnerability to cyberattack, and reduce personal privacy. Based on their assessment of the magnitude of these benefits and costs and the likelihood that market forces will displace cash as a payment system, policymakers may choose to encourage or discourage this trend.

The Potential Decline of Cash Usage and Related Implications

Jump to Main Text of Report

Contents

- The Once, But Perhaps Not Future, King

- Part I: Analysis of Cash and Noncash Payment Systems

- Physical Currency—Cash

- Overview

- Advantages and Costs of Cash

- The Potential Decline of Cash Usage

- Traditional Noncash Payment Systems

- Overview

- Advantages and Costs of Traditional Noncash Payment Systems

- Alternative Electronic Payment Systems

- Private Payment Systems Using Distributed Ledgers

- Central Bank Digital Currencies

- Part II: Potential Implications of a Reduced Role for Cash

- Potential Benefits of a Reduced Role for Cash

- More Efficient Payments

- Impediment to Crime

- Elimination of a Monetary Policy Constraint

- Potential Costs and Risks of a Reduced Role for Cash

- Lack of Financial Access for Certain Groups

- Loss of Safety Provided by Cash

- Privacy Concerns

- Prospectus

Figures

Appendixes

Summary

Electronic forms of payment have become increasingly available, convenient, and cost efficient due to technological advances in digitization and data processing. Anecdotal reporting and certain analyses suggest that businesses and consumers are increasingly eschewing cash payments in favor of electronic payment methods. Such trends have led analysts and policymakers to examine the possibility that the use and acceptance of cash will significantly decline in coming years and to consider the effects of such an evolution.

Cash is still a common and widely accepted payment system in the United States. Cash's advantages include its simplicity and robustness as a payment system that requires no ancillary technologies. In addition, it provides privacy in transactions and protection from cyber threats or financial institution failures. However, using cash involves costs to businesses and consumers who pay fees to obtain, manage, and protect cash and exposes its users to loss through misplacement, theft, or accidental destruction of physical currency. Cash also concurrently generates government revenues through "profits" earned by producing it and by acting as interest-free liabilities to the Federal Reserve (in contrast to reserve balances on which the Federal Reserve pays interest), while reducing government revenues by facilitating some tax avoidance.

The relative advantages and costs of various payment methods will largely determine whether and to what degree electronic payment systems will displace cash. Traditional noncash payment systems (such as credit and debit cards and interbank clearing systems) involving intermediaries such as banks and central banks address some of the shortcomings of cash payments. These systems can execute payments over physical distance, allow businesses and consumers to avoid some of the costs and risks of using cash, and are run by generally trusted and closely regulated intermediaries. However, the maintenance and operation of legacy noncash systems involve their own costs, and the intermediaries charge fees to recoup those costs and earn profits. The time it takes to finalize certain transactions—including crediting customer accounts for check or electronic deposits—can lead to consumers incurring additional costs. In addition, these systems involve cybersecurity risks and generally require customers to divulge their private personal information to gain system access, which raises privacy concerns.

To date, the migration away from cash has largely been in favor of traditional noncash payment systems; however, some observers predict new alternative systems will play a larger role in the future. Such alternative systems aim to address some of the inefficiencies and risks of traditional noncash systems, but face obstacles to achieving that aim and involve costs of their own. Private systems using distributed ledger technology, such as cryptocurrencies, may not serve the main functions of money well and face challenges to widespread acceptance and technological scalability. These systems also raise concerns among certain observers related to whether these systems could facilitate crime, provide inadequate protections to consumers, and may adversely affect governments' ability to implement or transmit monetary policy. The potential for increased payment efficiency from these systems is promising enough that certain central banks have investigated the possibility of issuing government-backed, electronic-only currencies—called central bank digital currencies (CBDCs)—in such a way that the benefits of certain alternative payment systems could be realized with appropriately mitigated risk. How CBDCs would be created and function are still matters of speculation at this time, and the possibility of their introduction raises questions about the appropriate role of a central bank in the financial system and the economy.

If the relative benefits and costs of cash and the various other payment methods evolve in such a way that cash is significantly displaced as a commonly accepted form of payment, that evolution could have a number of effects, both positive and negative, on the economy and society. Proponents of reducing cash usage (or even eliminating it all together and becoming a cashless society) argue that doing so will generate important benefits, including potentially improved efficiency of the payment system, a reduction of crime, and less constrained monetary policy. Proponents of maintaining cash as a payment option argue that significant reductions in cash usage and acceptance would further marginalize people with limited access to the financial system, increase the financial system's vulnerability to cyberattack, and reduce personal privacy. Based on their assessment of the magnitude of these benefits and costs and the likelihood that market forces will displace cash as a payment system, policymakers may choose to encourage or discourage this trend.

The Once, But Perhaps Not Future, King

Because of technological advances in digitization and data processing, electronic forms of payment have become increasingly available, convenient, and cost efficient. Established technologies, such as credit and debit cards, have long been a popular payment option. In addition, new payment methods (e.g., PayPal's Venmo app and Square's point-of-sale hardware, among others) use underlying traditional banking and payments systems to make electronic payments less expensive and more available to individuals and small businesses. Newer digital currencies, such as cryptocurrencies, offer alternative (though not yet widely adopted) options that have a high degree of independence from traditional systems.1

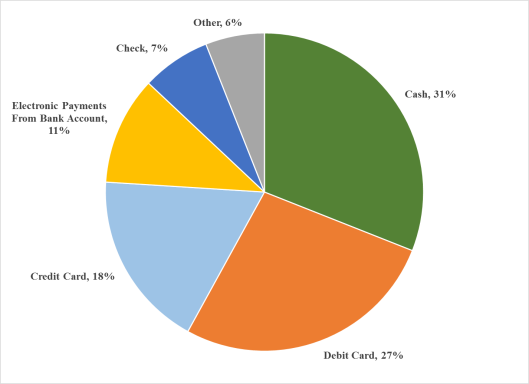

Although cash remains an important method of payment in the United States (see Figure 1), anecdotal reporting suggests that various electronic payment systems have become so effective and inexpensive relative to cash payments that some U.S. businesses—even those at which sales generally have a low dollar value—are increasingly choosing not to accept cash.2 In some developed countries, such as Sweden, cash payments are becoming relatively scarce.3 In addition, a number of central banks worldwide are examining the possibility of issuing government-backed digital currencies that exist only electronically.4 These trends suggest that due to buyer or seller preference or government policy, the role of cash in the payment system may continue to decline, perhaps significantly, in coming years.5

Some observers have examined the consequences of an evolution away from cash.6 Proponents of reducing the use of physical currency (or even eliminating it all together and becoming a cashless society) argue that it will generate important benefits, including potentially improved efficiency of the payment system, a reduction of crime, and less constrained monetary policy.7 Proponents of maintaining cash as a payment option argue that significant reductions in cash usage and acceptance would further marginalize people with limited access to the financial system, increase the financial system's vulnerability to cyberattack, and reduce personal privacy.8 Given developments and debate in this area, Congress may consider policy issues related to the declining use of cash relative to electronic forms of payment.

|

|

Source: Shaun O'Brien, Understanding Consumer Cash Use: Preliminary Findings from the 2016 Diary of Consumer Payment Choice, Federal Reserve Bank of San Francisco, Fednotes, November 28, 2017. |

This report is divided into two parts. The first part analyzes cash and noncash payment systems, and the second analyzes potential outcomes if cash were to be significantly displaced as a commonly accepted form of payment. Part I describes the characteristics of cash and the various electronic payment systems that could potentially supplant cash. The noncash payment systems include traditional electronic payment systems (such as credit cards or payment apps) and alternative electronic payment systems, focusing on private systems using distributed ledger technology (such as cryptocurrencies) and central bank digital currencies (which are only under consideration by central banks at this time). Part I also examines the advantages and costs specific to each payment system and the potential obstacles to the adoption of alternative electronic payment systems. Part II of this report analyzes the potential implications of a reduced role of cash payments in the economy, including potential benefits, costs, and risks.9 The report also includes an Appendix that presents two international case studies of economies in which noncash payment systems rapidly expanded.

Part I: Analysis of Cash and Noncash Payment Systems

This section provides analysis of cash, traditional noncash payment systems, and potential alternative payment systems. It describes the characteristics, presents usage data, and analyzes the advantages and costs of each system. It also includes a discussion on the potential decline in cash usage and a short inset on the legality of businesses' refusing to accept cash.

Physical Currency—Cash

Overview

How well something serves as money in a payment system depends on how well it serves as (1) a medium of exchange, (2) a unit of account, and (3) a store of value. To function as a medium of exchange, the thing must be tradable and agreed to have value. To function as a unit of account, the thing must act as a good measurement system. To function as a store of value, the thing must be able to purchase approximately the same value of goods and services at some future date as it can purchase now.10

Currently, cash continues to serve the three functions of money well as part of a robust, physical payment system. Physical currency can be carried easily in a pocket and thus is tradeable. Each unit of currency (e.g., a dollar) is identical and can be divided into fractions (e.g., cents) of the whole, making dollars effective units of account. A bill or coin, when well cared for, will not degrade substantively for years, meaning it can function as a store of value.

In the United States, paper currency and coins are produced by the Bureau of Engraving and Printing (BEP) and the United States Mint, respectively, both of which are units within the Department of the Treasury (Treasury). The Federal Reserve (the Fed) distributes the currency and coin to banks, savings associations, and credit unions upon request, and the banks in turn make the cash available to their customers. When a bank orders cash, the Fed deducts the amount from the bank's Fed account.11 The revenues and costs to the government from this system are examined in the "Cash Effects on Government" section below.

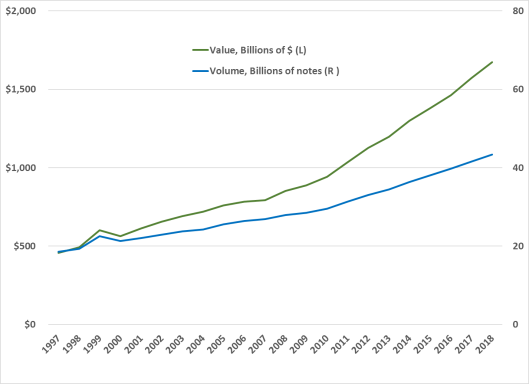

Data suggests that the demand for cash in the United States has continued to grow despite the introduction of new payment services and systems. Fed data indicates that the amount of currency in circulation has increased steadily over at least the past 20 years (see Figure 2). As of December 31, 2018, there were more than 43 billion notes (more commonly called bills) worth over $1.67 trillion in circulation.12 The Fed determines how many new notes "are needed to meet the public's demand [, which]…reflects the Board's assessment of the expected growth rates for payments of currency to and receipts of currency from circulation."13

|

|

Source: The Federal Reserve Currency and Coin Services, at https://www.federalreserve.gov/paymentsystems/coin_data.htm, April 29, 2019. |

This growth in demand is not wholly surprising, because demand for cash would be expected to grow as does the economy, the population, and price levels. In addition, the demand for cash is growing because certain people may be increasingly using it solely as a store of value or safe investment (imagine the proverbial risk-averse saver keeping money under the mattress), rather than to make purchases.14 In addition, there remains a high demand for U.S. currency abroad, both as a store of value and medium of exchange.15

Some evidence suggests people are using cash for payments less often. For example, according to preliminary findings of a Fed survey, cash transactions in the United States fell from 40.7% of all transactions in 2012 to 32.5% in 2015.16 Taken together with data from the triennial Federal Reserve Payment Study, these survey results suggest the number of cash transactions during that time fell from roughly 84.8 billion per year to 69.4 billion.17 However, Fed economists have subsequently noted that significant changes in the survey methodology and unaccounted for effects from economic conditions means the eight-point decline in the share of transactions "almost surely does not accurately reflect actual changes in consumer preferences for cash."18 After making adjustments to account for these factors, those economists estimated the decline in the percentage of transactions that were in cash was roughly half of the initially estimated decline in the share of cash transactions.19

The most recent data indicates that Americans used cash for 31% of their transactions in 2016, with stronger cash preference for small, in-person transactions (60% of in-person transactions under $10).20

Advantages and Costs of Cash

Cash Advantages for Consumers and Businesses

One of the main benefits of cash is that it is a simple, easy, robust payment mechanism that requires no ancillary technologies.21 Payers and payees validate and settle transactions simply by physically exchanging the currency; the consumer needs no magnetic-stripe card or mobile device, and the seller does not need a card-reading machine or other payment-receiving device. Relatedly, some observers assert cash provides a security against potential disruptions to electronic payment systems. For example, in the event of a significant cyberattack or extended power outage, cash could continue to serve the functions of money while electronic payment systems could not.

Cash also acts as a safe asset in which to invest savings and its usage can involve a high degree of privacy, features that will be examined in more detail in the "Potential Costs and Risks of a Reduced Role for Cash" section below. In addition, holding cash might impart other psychological benefits to a consumer, such as feelings of greater control over budgeting and associations with wealth.22

Cash Costs for Consumers and Businesses

Using and accepting cash involves certain costs to consumers and businesses. For example, consumers may have to pay fees to withdraw cash from automatic teller machines (ATMs). Banks with more than $1 billion in assets are required to report their revenue from ATM fees, and a Congressional Research Service (CRS) analysis indicates those banks collected at least $1.9 billion in ATM fees in 2018.23 Other costs—including consumer losses through theft, misplacement, or accidental destruction of cash—are more difficult to estimate.

Businesses must pay for cash management services, such as cash delivery with armored trucks (an industry with estimated annual U.S. revenues of $2.8 billion) and security systems to dissuade thieves or robbers from attempting to steal cash kept on the retailer's premises.24 Despite these efforts, U.S. businesses lose about $40 billion in employee cash thefts per year.25 Similar to consumer's costs, quantifying all the costs of cash to businesses presents challenges, as certain costs are not straightforward and easily measurable.26 For example, some portion of retail staff and managers' paid time is spent counting cash and reconciling tills.

Cash Effects on Government Revenues

In addition to its impacts on consumers and businesses, cash directly affects government revenues through three main mechanisms: (1) seigniorage (i.e., the "profit" the government makes by producing cash), (2) Federal Reserve remittances to the Treasury, and (3) tax evasion. Two of these mechanisms—seigniorage and remittances—increase government revenues. The third mechanism—tax evasion, facilitated by the anonymous and difficult-to-trace nature of cash transactions—decreases government revenue.

Revenue Generating: Seignoriage. In general, the value of the physical currency produced by the government exceeds the cost incurred to produce it. For example, a $100 bill costs about 14 cents to print, generating revenues $99.86 greater than cost.27 The profit generated by this difference is called seigniorage, and this income would decrease if demand for cash were to fall.28 In FY2017, the U.S. Mint generated $391.5 million in net income from circulating coins29 and the U.S. Bureau of Engraving and Printing generated revenues $693 million greater than expenses.30

Revenue Generating: Fed Remittances. The second source of cash-generating revenue is remittances, which are transferred from the Fed to the U.S. Treasury. Any income the Fed earns after expenses and dividends paid to member banks, it remits to the Treasury (in 2017, the amount was $80.6 billion), and hence becomes a source of revenue for the federal government. A significant expense for the Fed is the interest it pays on depository institutions' deposits held in their Fed accounts. Such payments accounted for $28.9 billion of the Fed's $35.4 billion total expenses in 2017.31 However, currency is a Fed liability on which it pays no interest.32 Recall that when a bank orders cash from the Fed, the Fed deducts the amount from the bank's account. Thus, the more cash that is in circulation, the less interest the Fed must pay, and the greater its remittances to Treasury.

In January 2019, there was approximately $1.7 trillion of currency in circulation,33 and the Fed (as of this publication) paid an annual interest rate of 2.4% on reserve balances.34 By these measures, if all currency were instead bank reserve balances held at the Fed, it could increase Fed expenses (and thus reduce government revenues) by more than $40 billion a year. If interest rates on reserves (which change when the Fed alters monetary policy) rose or fell, then expenses would increase or decrease, respectively, in this scenario.

Revenue Reducing: Tax Evasion. Because cash leaves no electronic record, wage earners and businesses are able to underreport (in general, illegally) how much cash they receive in order to reduce their tax payments. Thus, cash contributes to the tax gap—the difference between what the government is owed and what is actually paid. The most recent Internal Revenue Service estimate released in 2016 examined the tax gap for the years 2008-2010, and found that the gap due to underreporting averaged $387 billion a year.35 This estimate does not directly measure how much underreporting is facilitated by cash payments, and the figure for recent years is likely to be different. However, it provides a general context for how much tax revenue the government does not collect due to underreporting that is at least in part made possible by cash transactions.

The Potential Decline of Cash Usage

Businesses have long set conditions under which they would not accept cash. For example, certain businesses refuse to accept high-denomination bills.36 However, according to anecdotal reporting, retail businesses are increasingly deciding that the costs of transacting in cash are high enough that they would rather not accept it at all.37 Notably, this is occurring at businesses at which transactions are typically in-person for small dollar amounts—traditionally viewed as the type of transactions for which cash is the least costly option. If these stories are in fact indicative of a sustained trend, widespread non-acceptance of cash could have a variety of effects on consumers, businesses, as well as society and the economy at large. One particular effect that has drawn significant attention, as well as litigation, is that non-acceptance of cash could potentially marginalize those that have limited access to the financial system or mobile technological devices. This issue is examined in the "Lack of Financial Access for Certain Groups" section later in the report.

|

The Legality of Refusing Cash38 Federal law provides that U.S. coins and currency "are legal tender for all debts, public charges, taxes, and dues."39 Although cash is accordingly "a valid and legal offer of payment" for pre-existing debts, federal law does not require that private businesses accept cash as payment for goods and services.40 Recently, an increasing number of restaurants and retailers have taken advantage of the absence of a federal requirement to accept cash by requiring their customers pay using credit or debit cards.41 This trend has led some commentators to worry that such "no cash" policies disadvantage many low-income consumers who lack access to bank accounts and credit cards.42 A number of states and localities have responded to this concern by enacting laws that require certain types of businesses to accept cash.43 Accordingly, although federal law does not require businesses to accept cash, some states and localities require that certain types of businesses accept cash when engaging in certain types of transactions. |

Traditional Noncash Payment Systems

Overview

Were cash to decline as a payment system, the most likely replacement—at least at the current time—would appear to be traditional noncash, electronic payment systems, such as debit cards, credit cards, or payment mobile apps.

In traditional noncash payment systems like those that are prevalent today, participants hold their money in an account at a bank or other financial intermediary that maintains accurate ledgers of how much money each customer has available. To make a payment, the payer instructs (using a physical check or an electronic message) the intermediary to transfer money to the recipient's account. If the recipient holds an account at a different intermediary, those intermediaries will send messages to each other via messaging networks connecting them, instructing each to make the necessary changes to their ledgers. The intermediaries validate the transaction, ensure the payer has sufficient funds for the payment, deduct the appropriate amount from the payer's account, and add that amount to the payee's account.44 For example, in the United States, a retail consumer may initiate an electronic payment by swiping a debit card, at which time an electronic message is sent over a network instructing the purchaser's bank to send payment to the seller's bank. Those banks then make the appropriate changes to their account ledgers (possibly using the Fed's payment system) reflecting that value has been transferred from the purchaser's account to the seller's account.45

As with physical currency, digital entries in account ledgers can serve the three functions of money well for use in payments. Instructions to change entries in a ledger can easily be sent, making the values in the ledger easily tradable. Numerical entries can be denominated in identical and divisible units, making them good units of account. Because numbers in a ledger can remain unchanged during periods when no transactions are made, they can serve as a store of value.

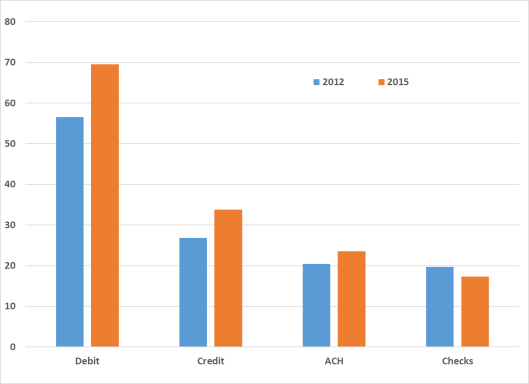

According to the most recent complete Federal Reserve Payment Study on noncash payments, the number of traditional noncash payments made in the U.S. totaled more than 144 billion transactions with a value of almost $178 trillion in 2015.46 These included payments via debit cards (69.5 billion transactions worth $2.56 trillion), credit cards (33.8 billion transactions worth $3.16 trillion), automated clearing house payments (ACH; 23.5 billion transactions worth $26.83 trillion),47 and check payments (17.3 billion payments worth $26.83 trillion). Between 2012 and 2015, the number of transactions of the three electronic systems, debit, credit, and ACH, grew at annual rates of 7.1%, 8.0%, and 4.9%, respectively. Their values grew by 6.8%, 7.4%, and 4.0%, respectively. Check payments declined by an annual rate of 4.4% by number and 0.5% by value. According to a recent supplement to that study, both the growth of electronic payments and the decline of check payments accelerated in 2017.48

|

|

Source: Federal Reserve System, The Federal Reserve Payments Study 2016, December 2016, p. 12, at https://www.federalreserve.gov/newsevents/press/other/2016-payments-study-20161222.pdf. |

Advantages and Costs of Traditional Noncash Payment Systems

Traditional Noncash Payment System's Advantages

Payment based on physically exchanging currency has some notable shortcomings that can be addressed by a payment system based on maintaining account ledgers. One is that physical currency requires both the payer and the payee to either (1) be physically near each other, allowing the physical currency to pass from the possession of the former into the possession of the latter; or (2) have a sufficient trust in each other that the payee believes an assurance that he or she will receive the currency later. Another shortcoming is that holders of physical currency may have little recourse if it is lost, stolen, or accidentally destroyed. If, instead, money is exchanged by making valid changes in ledgers maintained by trusted intermediaries, the exchange can be accomplished without the risk of lost, stolen, or damaged currency.49

In addition, noncash systems can make payments fast, easy, and convenient. Using them decreases the need for people to make regular estimations of how much cash they need to have on a particular day, the frequency of trips to the bank or ATM to get cash, and the amount of time waiting for cashiers to make change. Instead, a plastic card or an app on a mobile device can replace those activities with a card swipe or button push.

As information technology has progressed, the convenience has increased and the option to use electronic payments has become nearly ubiquitous. Until fairly recently, it was not uncommon for a retail establishment to reject card payments. Now, services such as Venmo, Apple Pay, and Google Pay, and card-reading devices, such as those made by Square, have made electronic payment options increasingly available, even for individuals to accept electronic payments from other individuals. The previously mentioned anecdotal reporting suggests there is a growing number of establishments that only accept electronic payments.50

For these systems to work well, participants must trust that banks and other intermediaries are keeping accurate ledgers that are changed only for valid transfers. Otherwise, an individual's money could be lost or stolen if a bank records the account as having an inaccurately low amount or transfers value without his or her permission. Another advantage of systems using traditional intermediaries is that they have a number of features that generate a high degree of trust and accuracy. Banks and other intermediaries have both a market and governmental incentive to be accurate. A bank or financial intermediary that does not have a good reputation for protecting a customer's money and processing transactions accurately would likely lose customers. In addition, governments typically subject banks to laws and regulations designed in part to ensure that banks are well run and that the money they hold is safe.51 As such, banks take substantial measures to ensure security and accuracy.

In addition, intermediaries generally are required to provide certain protections to consumers involved in electronic transactions, in part to protect them from losses resulting from unauthorized transfers. For example, the Electronic Fund Transfer Act (P.L. 95-630) limits consumers' liability for unauthorized transfers made using their accounts.52 Similarly, the Fair Credit Billing Act (P.L. 93-495) requires credit card companies to take certain steps to correct billing errors, including when the goods or services a consumer purchased are not delivered as agreed.53 Both laws also require financial institutions to make certain disclosures to consumers related to the costs and terms of using an institution's services.54

Traditional Noncash Payment System's Costs

Significant costs and physical infrastructure underlie systems for electronic money transfers to ensure the systems' integrity, performance, and availability. For example, payment system providers operate and maintain robust digital networks to connect retail locations with banks. The Fed operates and maintains electronics networks to connect banks to itself and each other.55 These intermediaries store and protect huge amounts of data. Because these intermediaries are generally highly regulated, they incur regulatory compliance costs. Intermediaries recoup the costs associated with these systems and regulations and earn profits by charging fees directly when the system is used (such as the fees a merchant pays to have a card reading machine and "swipe fees" on each card transaction) or by charging fees for related services (such as checking account fees).

It is difficult to quantify how much traditional noncash payment systems cost and what portion of those costs is passed on to consumers and businesses. Performing a quantitative analysis is beyond the scope of this report.56 What bears mentioning here is that certain costs of traditional payment systems—and, in particular, the fees intermediaries in those systems charge—have at times been high enough to raise policymakers' concern and elicit policy responses.

For example, in response to businesses' assertions that Visa and MasterCard had exercised market power in setting debit card swipe fees at unfairly high levels, Congress included Section 1075 in the Dodd-Frank Consumer Protection and Wall Street Reform Act (Dodd-Frank Act; P.L. 111-203)—sometimes called the Durbin Amendment.57 Section 1075 directs the Fed to limit debit card swipe fees charged by banks with assets of more than $10 billion.58

In addition, studies on unbanked and underbanked populations cite the fees associated with traditional bank accounts, a portion of which may be the result of providing payment services, as a possible cause for those populations' limited interaction with the traditional banking system.59

Although electronic payment systems protect customers from physical theft and are subject to a complex and sometimes overlapping array of state and federal laws, regulators, and regulations related to cybersecurity, they could nevertheless expose individuals to cyber-theft and identity theft. In addition, the systems themselves could be susceptible to disruption from cyberattacks.

The occurrence of successful hacks of banks and other financial institutions, wherein huge amounts of individuals' personal information are stolen or compromised, illustrates cyber-related risks. For example, in 2014, JPMorgan Chase, the largest U.S. bank, experienced a data breach that exposed financial records of 76 million households.60 However, no consensus exists on how best to reduce the occurrence of such incidents, and whether current cybersecurity measures and regulatory frameworks are effective and efficient in mitigating cybersecurity risk is an open question.61 For a more detailed examination of cybersecurity at financial institutions, see CRS Report R44429, Financial Services and Cybersecurity: The Federal Role, by N. Eric Weiss and M. Maureen Murphy.

In addition, although the traditional electronic payment system is sufficiently fast and convenient to complete many transactions, other transactions can involve problematic delays. One such delay that can be particularly costly for consumers is the lag between when a payment (such as a paycheck) is deposited and when the full amount of the funds are available to the individual. Depending on factors related to which networks the payer's and payee's bank uses to process payments, it can take up to two business days (or more under certain circumstances) after a deposit is made for banks to fully validate, process, and settle the deposit.

Settlement delays can create a situation in which an individual has made a deposit that would give sufficient funds to pay a bill that is due, but nevertheless may overdraw the account because the deposit is awaiting processing. In such a situation, the individual faces a choice between costly outcomes—a late payment penalty on the bill, an overdraft fee on the bank account, or a fee from a check cashing or payday lending service. These costs are likely disproportionately borne by low- or moderate-income individuals who typically have low balances in their bank accounts. Faster or immediate payment processing could potentially reduce or eliminate costs incurred by individuals facing this situation.62

While delays in the payment system may seem anachronistic at a time when digital messages can be sent and data processed nearly instantaneously, the fact remains that aspects of the systems, networks, and infrastructures used today (including those operated by the Fed) were developed and deployed decades ago. Both the Fed and private institutions are working to increase system speed and efforts are underway to make real-time payments in the United States the norm.63 However, payment system operators arguably have little incentive to achieve faster or real-time payments because (1) they are in compliance with the current requirement facing banks pursuant to the Expedited Funds Availability Act of 1987 (P.L. 108-100) to generally make most types of deposits available by the second business day, (2) updating legacy systems is costly for the institutions that operate them, and (3) banks are generating revenue through overdraft fees.64

Alternative Electronic Payment Systems

Currently, it appears that the traditional noncash payment systems described above likely would replace cash payments should cash usage significantly decline. However some observers, citing the various costs and disadvantages associated with those systems—including delays in processing as well as reliance on traditional financial intermediaries—point to alternative electronic payment systems as potential dominant payment systems of the future.

Cryptocurrency, such as Bitcoin, is the most well-known of these alternatives. Described in more detail below, cryptocurrencies use blockchain technology and public or "distributed" ledgers to achieve validated transfers of digital representations of value.65 The use of these systems to make payments is quite rare relative to cash and traditional systems, and the role they will play in the future is speculative. Nevertheless, their potential to significantly affect the usage of cash and traditional systems for payments has drawn the attention of central banks. Some central banks are examining whether they should create a comparable payment system of digital currencies to offer the advantages of those systems themselves and to avoid being bypassed in the future.

This section briefly describes (1) existing private alternative electronic payment systems and (2) possible future central bank-run systems. With respect to alternative electronic payment systems, the section examines their potential advantages, costs, and obstacles to their widespread adoption. With respect to a potential central bank-run system, which is more speculative at this time, the section examines potential advantages and obstacles to their widespread adoption and uncertainties they present.

Private Payment Systems Using Distributed Ledgers

Overview

In general, private electronic payment systems using distributed ledgers allow individuals to establish an account identified by a string of numbers and characters (often called an address or public key) that is paired with a password or private key known only to the account holder.66 A transaction occurs when two parties agree to transfer digital currency (perhaps in payment for a good or service) from one account to another. The buying party will "unlock" the currency used as payment with her private key, allowing some amount to be transferred from her account to the seller's. The seller then "locks" the currency in her account using her own private key.67 From the perspective of the individuals using the system, the mechanics are similar to authorizing payment on any website that requires an individual to enter a username and password. In addition, companies offer applications or interfaces that users can download onto a device to make transacting in cryptocurrencies more user-friendly.

Many digital currency platforms use blockchain technology to validate changes to the ledgers.68 In a blockchain-enabled system, payments are validated on a public or "distributed" ledger by a decentralized network of system users and cryptographic protocols.69 In these systems, parties that otherwise do not know each other can exchange something of value (i.e., a digital currency) not because they trust each other but because they trust the platform and its protocols to prevent invalid changes to the ledger. A notable feature of transfers using blockchain is that they require no centralized, trusted intermediary such as a bank, government central bank, or other financial or government institution. Proponents envision these systems could achieve instantaneous transfers, although they currently require minutes or hours to finalize transfers.

The decentralized nature of digital currencies and their recent proliferation poses challenges to performing industry-wide analysis of their use in payments. For example, as of August 27, 2018, one industry group purported to track trading prices of 1,890 cryptocurrencies alone.70 For brevity and clarity, this report uses statistics on Bitcoin—the first and most well-known cryptocurrency, the total value of which accounts for more than half of the industry as a whole71—as an illustrative example of a digital currency's use in payments.

In January 2017, the price of a Bitcoin on an exchange was about $993.72 The price surged during the year, peaking at about $19,650 in December 2017, an almost 1,880% increase. However, the price then dramatically declined. Overall, the price of Bitcoin has experienced a high degree of volatility. On March 12, 2018, the price of Bitcoin was $3,860, down 80% from its peak. More recently, the price rebounded and was $5,948 on May 8, 2019.

Although price data on Bitcoin illustrates the public interest in and overall demand for this cryptocurrency, it is a poor indicator of how often it is being exchanged for goods and services (i.e., how often it is being used as money). Certain analyses appear to show that digital currencies are not being widely used and accepted as payment for goods and services, but rather as investment vehicles.73

The number of Bitcoin transactions may serve as a better indicator—though a flawed one—of the use of Bitcoin as a payment system. This number reveals how many times Bitcoins are transferred between accounts each day, and data indicates the number of transactions is miniscule compared with those of traditional systems. For example, in 2019 through March 12, the Bitcoin system averaged about 310,000 transactions per day globally, a pace that would result in about 113 million transactions per year.74 Recall that in the United States alone, more than 144 billion traditional (nearly 1,275 times as many) noncash payments were made in 2015. Moreover, one problem with this measure it that it is a count of how many times two parties have exchanged Bitcoin, not a count of how many times Bitcoin has been used to buy something. Some portion of those exchanges, possibly a significantly large portion, is driven by investors giving fiat currency to an exchange to buy and hold the Bitcoin as an investment. In those transfers, Bitcoin is not acting as money (i.e., not being exchanged for a good or service).

Potential Advantages, Obstacles, and Costs to Private Payment Systems Using Distributed Ledgers

Advantages of Private Payment Systems Using Distributed Ledgers. As discussed in an earlier section, traditional electronic payment systems involve a number of intermediaries, such as government central banks and private financial institutions. To carry out transactions, these institutions operate and maintain extensive electronic networks and other infrastructure, employ workers, and require time to finalize transactions. To meet costs and earn profits, these institutions charge various user fees. Cryptocurrency advocates anticipate that a decentralized payment system operated through the internet could be less costly than traditional payment systems and existing infrastructures.75 However, whether such efficiencies can or will be achieved remains an open question.

In addition, opening a bank account or otherwise using traditional electronic payment systems generally requires an individual to divulge to a financial institution certain basic personal information, such as name, Social Security number, and birthdate. Financial institutions store and may analyze or share this information. In some instances hackers have stolen personal information from financial institutions, causing concerns over how well these institutions can protect sensitive data.76 Individuals seeking a higher degree of privacy or control over their personal data than that afforded by traditional systems may choose to use an alternative digital currency system that provides a degree of pseudonymity or anonymity.

Although inflation in the United States and other developed economies has been low in recent decades, some individuals may nevertheless believe that nontraditional digital money may maintain its value better than government-backed money in traditional systems. The dollar and most modern currencies are fiat money—that is, money that derives value based solely on government decree. Historically, incidents of hyperinflation in certain countries have seen government-backed currencies lose most or nearly all of their value. Thus, some individuals may judge the probability of their fiat money losing a significant portion of its value to be undesirably high. These individuals may place greater trust in the ability of a decentralized network using cryptographic protocols that limit the creation of new money to maintain stable value of money than in the ability of government institutions to do so.77

Obstacles to Widespread Adoption of Private Payment Systems Using Distributed Ledgers. Several characteristics of cryptocurrency undermine its ability to serve the functions of money in a payment system. Currently, a relatively small number of businesses and individuals use or accept cryptocurrency for payment. As discussed above, Bitcoin transactions have averaged about 310,000 per day globally.78 Cryptocurrency may be used as a medium of exchange less frequently than traditional money for several reasons. Unlike the dollar and most other government-backed currencies, cryptocurrencies are not legal tender, meaning creditors are not legally required to accept them to settle debts.79 Consumers and businesses also may be hesitant to place their trust in these systems because they have limited understanding of them.80 Relatedly, consumers and businesses may have sufficient trust in and be generally satisfied with traditional payment systems.

The recent high volatility in the price of many cryptocurrencies undermines their ability to serve as a unit of account and a store of value. Cryptocurrencies can have significant value fluctuations within short periods of time; as a result, pricing goods and services in units of cryptocurrency would require frequent repricing and likely would cause confusion among buyers and sellers.81

Whether cryptocurrency systems are scalable—meaning their capacity can be increased in a cost-effective way without loss of functionality—is uncertain.82 At present, the systems underlying cryptocurrencies do not appear capable of processing the number of transactions that would be required of a widely adopted, global payment system. One concern involves the significant energy consumption required to run and cool the computers that validate the transactions on these platforms.83

Costs of Private Payment Systems Using Distributed Ledgers. As the energy consumption of a digital currency system demonstrates, these systems are not costless. In addition to energy, they require computer hardware and facilities. Often making payments on these platforms involves paying fees. Whether these direct economic costs of using the system are fixed or—as they develop and mature—become less than existing systems is an open question.

Digital currency systems, at least as currently designed and regulated, also might impose other costs on society. Some critics of these systems fear their pseudonymous, decentralized nature may provide a new avenue for criminals to launder money, evade taxes, or sidestep financial sanctions. For example, Bitcoin was the currency used on the internet-based, illegal drug marketplace and Bitcoin escrow service called Silk Road. This marketplace facilitated more than 100,000 illegal drug sales from approximately January 2011 to October 2013, at which time the government shut down the website and arrested the individuals running the site.84

Consumer groups and other observers are also concerned that digital currency users are inadequately protected against unfair, deceptive, and abusive acts and practices. The way cryptocurrencies are sold, exchanged, or marketed can subject cryptocurrency exchanges or other cryptocurrency-related businesses to generally applicable consumer protection laws,85 and certain state laws and regulations are being applied to cryptocurrency-related businesses.86 However, other laws and regulations aimed at protecting consumers engaged in electronic financial transactions may not apply.

For example, the Electronic Fund Transfer Act of 1978 (EFTA; P.L. 95-630) requires traditional financial institutions engaging in electronic fund transfers to make certain disclosures about fees, correct errors when identified by the consumer, and limit consumer liability in the event of unauthorized transfers.87 Because no bank or other centralized financial institution is involved in digital currency transactions, EFTA generally has not been applied to these transactions.88 In addition, the laws and regulations that do apply generally have not been implemented specifically to address digital currencies or related businesses. Whether the current regulatory regime applied to digital currency transactions, but originally implemented for different financial activities (e.g., traditional money transmission), is effective and efficient is a debated issue.

Finally, some central bankers and other experts and observers have speculated that the widespread adoption of cryptocurrencies could affect the ability of the Fed and other central banks to implement and transmit monetary policy. The Fed conducts monetary policy with the goals of achieving price stability and low unemployment. Like other central banks it achieves its goals by, putting it simply, controlling the amount of money in circulation in the economy. If one or more additional currencies that the government did not control the supply of were also prevalent and viable payment options, it could limit central banks' ability to transmit monetary policy to financial markets and the real economy. In this scenario, central banks likely would have to make larger adjustments to the fiat currency they do control to have the same effect as previous adjustments. Another possibility is that they would have to start buying and selling the digital currencies themselves in an effort to affect the availability of these currencies.89 These risks have led some central banks and other observers to suggest that perhaps central banks could issue their own digital currencies.90

Central Bank Digital Currencies

Overview

The risks and challenges posed by private digital currencies have led some observers to suggest that perhaps central banks should offer their own central bank digital currencies (CBDCs) to realize certain hoped-for efficiencies in the payment system in a way that would be "safe, robust, and convenient."91 To date, no country has successfully created a CBDC for payment use by the general public.92

The extent to which a central bank could or would want to create a new, digital-only payment system likely would be weighed against the consideration that these government institutions already have trusted digital payment systems in place. Because of such considerations, the exact form that CBDCs would take could vary across a number of features and characteristics.93 Nevertheless, some central banks are examining the idea of CBDCs and the possible benefits and issues they may present.94

For the purposes of this discussion, this report examines a CBDC that would be available to consumers for retail payments. Some proposals would limit CBDCs to wholesale payments between banks and other financial institutions.

Potential Advantages, Obstacles, and Uncertainties of CBDCs

Potential Advantages of CBDCs. Proponents of CBDCs generally argue they could provide efficiency gains over traditional legacy systems and contend that central banks could use the technologies underlying digital currencies to deploy a faster, less costly government-supported payment system.95

Observers have speculated that a CBDC could take the form of a central bank allowing individuals to hold accounts directly at the central bank. Advocates argue that a CBDC created in this way could increase systemic stability by imposing additional discipline on commercial banks. Because consumers would have the alternative of safe deposits made directly with the central bank, commercial banks likely would have to offer interest rates and limit risks at levels necessary to attract deposits above any deposit insurance limit.96

In addition, CBDCs could increase government revenue through a seignoriage-like mechanism. A more expansive definition of seignoriage is the income government obtains from having government liabilities act as money. Physical money—because it is liquid and low-risk—earns no interest rate and carries a cost to produce. Money—both physical and electronic in the traditional system—is also a balance sheet liability to the issuing authority, such as the Fed or other central banks.97 If the Fed allowed individuals to hold accounts directly with the Fed, the Fed would issue low- or no-interest liabilities to individuals (as electronic entries in a ledger produced at less cost than physical currency). Then, as happens now, the Fed would use those liabilities to fund purchases of assets that earn a higher interest rate than what the Fed pays on liabilities. This would produce income, perhaps greater income than is earned through traditional seignoriage.

Potential Obstacles to Creation of CBDCs. One of the main arguments critics—including various central bank officials—make against CBDCs is that there is no "compelling demonstrated need" for such a currency, because central banks and private banks already operate trusted electronic payment systems that generally offer fast, easy, and inexpensive transfers of value.98

Opponents also argue that a CBDC in the form of individual direct accounts at the central bank would reduce the role of private banks in financial intermediation and potentially expand the role of government central banks inappropriately. A portion of consumers likely would shift their deposits away from private banks toward central bank digital money, which would be a safe, government-backed liquid asset. Deprived of this funding, private banks likely would have to reduce their lending, leaving central banks to decide whether or how they should support lending markets to avoid a reduction in credit availability.99

In addition, skeptics of CBDCs object to the assertion that these currencies would increase systemic stability, arguing that CBDCs would create a less-stable system because they would facilitate runs on private banks. These critics argue that at the first signs of distress at an individual institution or the bank industry, depositors would transfer their funds to this alternative liquid, government-backed asset.100

Uncertainty: CBDCs' Potential Effects on Monetary Policy. Observers also disagree over whether CBDCs would have a desirable effect on central banks' role and abilities in carrying out monetary policy. Proponents argue that, if individuals held a CBDC on which the central bank set interest rates, the central bank could directly transmit a policy rate to the macroeconomy, rather than achieving transmission through the rates the central bank charges banks and the indirect influence of rates in particular markets.101 In addition, if holding cash (which in effect has a 0% interest rate) were not an option for consumers, central banks potentially would be less constrained by the zero lower bound.102 The zero lower bound is the idea that the ability of individuals and businesses to hold cash and thus avoid negative interest rates limits central banks' ability to transmit negative interest rates to the economy.

Critics argue that taking on such a direct and influential role in private financial markets is an inappropriately expansive role for a central bank. They assert that if CBDCs were to displace cash and private bank deposits, central banks would have to increase asset holdings, support lending markets, and otherwise provide a number of credit intermediation activities that private institutions currently perform in response to market conditions.103

Part II: Potential Implications of a Reduced Role for Cash

As discussed above, although cash remains a frequently used payment system, other payment systems continue to develop that offer their own advantages and costs. Various trends suggest that due to market preference or government policy, the role of cash in the payment system has begun to decline and may continue to decline, perhaps significantly, in coming years. If the relative benefits and costs of cash and the various other payment methods evolve in such a way that cash is significantly displaced as a commonly accepted form of payment, that evolution could have a number of effects, both positive and negative, on the economy and society. This section of the report describes a number of potential benefits of a reduced role for cash in the U.S. economy and the various risks and costs that may occur. Many of the factors discussed below may not occur wholly as a benefit, risk, or cost; rather, a potential benefit may bring with it a risk, and vice versa.

Potential Benefits of a Reduced Role for Cash

Some observers argue that reducing or eliminating cash payments in the U.S. economy will produce certain beneficial outcomes, including improved efficiency in payments, reduced criminality, and improved ability for the Fed to implement certain monetary policy. As discussed below, although these outcomes generally may be beneficial, that does not mean that there are not certain costs, or drawbacks, that may counterbalance these positive effects.

More Efficient Payments

Proponents of noncash payment systems assert that net economic benefits from the use and maintenance of a cash payment system are (or will become as technology advances) less than the net benefits of using and maintaining noncash systems. Put another way, they argue that the resources, labor, and capital that go into the cash system—for example, producing currency; stocking and maintaining ATMs; safely transporting cash; protecting businesses from theft and robbery—make it less efficient than noncash systems.104 If true—and absent policy interventions—market forces likely will result in the displacement of cash by other payment methods as businesses increasingly choose not to accept cash and consumers increasingly prefer not to use it.

Under this scenario, although the payment system on net may be more efficient, it would not necessarily be true that all people would benefit, as is discussed in the "Potential Costs and Risks of a Reduced Role for Cash" section.

Impediment to Crime

Proponents of cashless societies assert that the elimination of cash would reduce crime by making operating an illegal enterprise more difficult and certain crimes, such as robbery and burglary, less remunerative.105 These proponents argue that criminals are more likely to conduct business in cash and to hold cash as an asset, in large part because cash is anonymous and allows them to avoid establishing relationships with and generating records at financial institutions that may be subject to anti-money laundering reporting and compliance requirements.106 Accordingly, they assert that the elimination of cash would be beneficial on net, because operating a criminal enterprise would become more difficult.

Certain studies have shown that the prevalence of cash is correlated with the incidence of crime.107 In addition, the amount of "strong" currencies (i.e., highly valuable and highly stable currencies) in circulation exceeds what many people would consider a reasonable amount needed for typical consumer transactions. For example, with the U.S. population at approximately 329 million,108 the $1.6 trillion of currency in circulation equates to about $4,900 per person. Proponents of a cashless society assert that this number is inflated due in part to the cash demand of criminals (although part is also due to demand for the U.S. dollar from abroad).109

Although a robust analysis of this question is beyond the scope of this report, arguments that cash facilitates crime and even that reducing cash may reduce crime appear in certain cases to be well founded.110 However, when analyzing the net benefit to society of going cashless, reduced crime should be weighed against any cost that a reduction in cash would impose on legitimate cash users. One such legitimate group is examined in more detail in the "Lack of Financial Access for Certain Groups" section below. The effect a reduction in cash payments would have on crime should not be overstated, as criminals likely would seek other ways to commit and hide their crimes. For example, the prevalence of cybercrime may increase.

Elimination of a Monetary Policy Constraint

Another benefit (from a macroeconomic perspective) of a cashless society cited by economists would be the potential elimination of the practical inability of central banks, such as the Fed, to implement negative interest rates. When an economy is in recession or otherwise performing poorly, one monetary policy response is to lower interest rates. Lower interest rates can spur companies to borrow in order to invest and spur consumers to borrow in order to make additional purchases, thus boosting economic activity and mitigating the impact of recessions. However, many economists believe that policymakers are constrained by a zero lower bound—that whatever policy rate they may set, interest rates in many markets will not fall below zero.111 The reason is that holding cash offers a zero interest rate. Thus, if the Fed attempted to implement negative interest rates, individuals could avoid those rates by transferring their funds into cash. If holding cash was not an available option, it would be easier for negative interest rates to be transmitted to more financial markets.

However, any benefit provided by increasing policymakers' ability to affect the macroeconomy with negative interest rates should be weighed against the cost it would impose on the individual savers whose account balances would decrease in value during a period of negative interest rates.

Potential Costs and Risks of a Reduced Role for Cash

Skeptics of reducing or eliminating the role of cash in the economy assert that cash serves a number of beneficial purposes, and argue that eliminating it would have adverse effects on certain financially vulnerable groups, eliminate an asset that provides safety against cyber vulnerabilities and financial crises, and reduce individuals' privacy. As with potential benefits to a reduction in cash, many of the factors discussed below may not occur wholly as a risk or cost, and they must be weighed against potential benefits when considering their overall impact.

Lack of Financial Access for Certain Groups

If the United States were to move toward becoming a cashless society that required consumers to use noncash, electronic payment services, it could present difficulties for those segments of the population who lack access to the financial system or to an electronic network. Access to electronic payments typically requires an account with some financial institution, usually a bank. Often—and increasingly—it also involves using or accessing a device connected to the internet. However, these factors can present hardships and obstacles for certain vulnerable groups. The Federal Deposit Insurance Corporation reported that in the United States in 2015, 9 million households were unbanked, meaning that no member had a bank account. Of these, 37.8% reported that the main reason was that they do not have enough money to keep in an account, 9.4% reported that fees were too high, and 1.9% reported fees were unpredictable.112 In total, this indicates almost half of the total unbanked, or roughly 4.5 million households, do not access banking services due to economic obstacles.

Sweden has been at the forefront of the move away from cash (see Appendix), and observers there, including Stefan Ingves, governor of Sweden's central bank, have voiced some of these concerns about going cashless.113 In addition, anecdotal reporting indicates that retirees in Sweden are finding the change difficult and costly.114

In the United States, many assert that it would be beneficial to bring the unbanked into the banking system. Nevertheless, if the unbanked engaged with the banking system at a relatively high cost only because cash (which was a less expensive option for them) was no longer available, it would likely be a detrimental outcome for this group. Conversely, if the move to a cashless system led to less costly financial access for this group, they may stand to benefit.

Loss of Safety Provided by Cash

Proponents of cash often cite the robustness of physical currency as a payment system. Once in an individual's possession, cash does not rely on financial institutions or information technology (IT) based payment networks.115 These proponents argue that if payments became entirely electronic, events such as power outages, hacker attacks, or (in the event of future cyber war) a state-sponsored attack would be capable of shutting down the most simple financial transaction—the exchange of money for goods and services. The financial system is already exposed to these threats to varying degrees, but the argument is that the elimination of cash amplifies those risks.

Because it functions well as a store of value, cash is a relatively safe asset in which to invest savings with no risk of losses resulting from a decline in a securities value or the failure of financial institutions or other entities.116 The perceived safety of cash and its non-reliance on financial institutions also makes it desirable in times of financial turmoil or distress, when confidence in such institutions decreases. During these periods, many people prefer assets that are free from credit risk. For some of these individuals, deposit insurance guarantees may not wholly eliminate their fear of losses, whereas the safety of physical currency would.117 Holding cash, then, could also provide a sense of security to risk-adverse people that may mistrust the financial system.

Privacy Concerns

Opening a bank account or otherwise using traditional noncash payment systems generally requires an individual to divulge certain basic personal information, such as name, Social Security number, and birthdate, to a financial institution. Financial institutions store this information and information about the transactions linked to this identity. Under certain circumstances, they may analyze or share this information, such as with a credit-reporting agency. In some instances hackers have stolen personal information from financial institutions, causing concerns over how well these institutions can protect sensitive data. Finally, provided it follows proper legal procedures, the government also can access this information under certain circumstances.118 Similarly, although new alternative payment systems may offer a degree of anonymity or pseudonymity, these systems still generate an unalterable record of transactions between parties.

Cash, by contrast, can be used anonymously, and people may wish to use cash for legitimate purposes to ensure their privacy. Certain consumers who are uncomfortable divulging and generating private information—even basic information that a transaction occurred—may prefer cash to any electronic payment methods.119

Prospectus

Cash has a number of advantageous features that has made it a simple and robust payment system throughout most of human history. It is difficult to imagine conditions under which cash would be replaced entirely, and disappear from the economy, at least in the near future. Nevertheless, its hegemony as a payment system appears to have come to an end, as electronic payment systems have gained popularity, and the ubiquity of cash acceptance for in-person purchases also seems precarious. If noncash payment systems significantly displace cash and cash usage and acceptance significantly declines, there would be a number of effects (both positive and negative) on the economy and society. Now or in the near future, policymakers may face decisions about whether to impede or hasten the decline of cash and consider the implications of doing so.

Appendix. International Case Studies

Two countries provide interesting case studies of market forces drastically changing the way a society makes payments.

Sweden

In recent years, the use of cash in Sweden has quickly and substantially declined, dropping from 40% to 13% of transactions between 2010 and 2018.120 In many cases, businesses no longer accept cash, and one survey indicated that two-thirds of small businesses planned to stop accepting cash. Anecdotal reporting indicates that about 5% of bank branches accept cash deposits or offer cash withdrawals.121 Furthermore, Sweden's central bank is examining the possibility of creating registered accounts for the purpose of issuing currency electronically.122 Reportedly, many Swedes are generally in favor of the trend (the displacement of cash is due largely to consumer preference), though some have voiced concerns about financial access issues that the change causes for certain groups, such as the elderly.123

Observers have put forward a number of explanations for the Sweden's growing preference for electronic payment methods such as cards and mobile app enabled payments. One argument asserts that Sweden is an especially technology savvy country. As such, Swedes are comfortable using electronic payment systems, and Swedish companies have developed fast and easy payment technologies, such as iZettle and Swish. Some observers also have suggested that Swedes are especially trusting of institutions and thus have fewer privacy concerns. Some have noted that the timing of the start of the decline in cash use among Swedes coincided with the start of a transition to new Swedish banknotes and coins. They suggest that this spurred people and businesses to make a switch not to the new bills and coins but instead to electronic payment methods.124

Kenya

In 2007, a company named Safaricom—Kenya's largest mobile phone network operator—introduced a "mobile money" service called M-Pesa ("M" stands for "mobile" and "pesa" is the Swahili word for money). Users of the service download a phone application and deposit cash with M-Pesa employees called "agents." They can then transfer money into any other M-Pesa account using their phone. Originally intended as a service for Kenyans who had moved to a city to earn money to send back home to rural areas, the service became tremendously popular as a general use payment system.125 By 2016, there were approximately 31.6 million mobile money accounts in Kenya,126 which had a total population of 47.6 million in 2017.127

Many observers identify the combination of lack of access to traditional banking services and the proliferation of mobile phones in Kenya as a driving factor for the expansion of M-Pesa and subsequent mobile money services. These observers argue that in Kenya, as with many developing and largely rural nations, both consumers and banks view financial and bank services as a business need of the rich. In 2006, before the introduction of M-Pesa, just 19% of Kenyans had bank accounts and there was 1.5 bank branches for every 100,000 people. However, 54% of Kenyans had their own mobile phone or access to one.128

Another explanation for the rise of mobile money is that Safaricom successfully identified a large, profitable, and previously untapped market in Kenya. Available mobile technology and its proliferation among the population meant low-cost money transfers could be profitably offered to lower-income consumers.129 Certain observers assert that the success of M-Pesa has caused Kenyan financial institutions to reevaluate their business models, shifting their focus to offering services to lower-income groups than they previously targeted, and cite the increase in bank accounts and the decline of the average account balances as evidence of this change. As a result, the portion of the Kenyan population with access to some type of formal financial services has grown from 27% in 2006 to 75% in 2017.130

Although mobile money appears to have filled a market need, the degree to which it has displaced cash should not be overstated. An official at Safaricom estimated in February 2018 that as many as 8 out of 10 transactions are still cash transactions, as Kenyans still reportedly prefer cash for small, in-person purchases because of convenience and using M-Pesa generally involves fees.131 In addition, workers are still generally paid in cash.132

Author Contact Information

Footnotes

| 1. |

Cryptocurrencies and virtual currencies are alternative, often decentralized, electronic payment systems using money that generally is not backed by government fiat. The "Private Payment Systems Using Distributed Ledgers" section in this report describes them in more detail. For a more detailed examination of cryptocurrencies, see CRS Report R45427, Cryptocurrency: The Economics of Money and Selected Policy Issues, by David W. Perkins. |

| 2. |

For example, see Andy Newman, "Cash Might Be King, But They Don't Care," The New York Times, December 25, 2017, at https://www.nytimes.com/2017/12/25/nyregion/no-cash-money-cashless-credit-debit-card.html. |

| 3. |

Maddy Savage, "Why Sweden Is Close to Becoming a Cashless Economy," BBC News, September 12, 2017, at https://www.bbc.com/news/business-41095004. |

| 4. |

Central bank digital currencies are a potential new form of digital central bank money that is different from reserves or settlement balances held by commercial banks at central banks. The "Central Bank Digital Currencies" section in this report describes them in more detail. |

| 5. |

Speculating on the role each of these forces may play in a potential future decline in cash usage or acceptance is beyond the scope of this report. Instead, two international case studies are discussed in the Appendix of this report. |

| 6. |

For example, see Kenneth S. Rogoff, Costs and Benefits to Phasing Out Paper Currency, National Bureau of Economic Research, Working Paper no. 20126, May 2014, at https://www.nber.org/papers/w20126.pdf. Hereinafter Kenneth S. Rogoff, Costs and Benefits to Phasing Out Paper Currency. |

| 7. |

Kenneth S. Rogoff, Costs and Benefits to Phasing Out Paper Currency, pp. 1-6, 10-11. |

| 8. |

James J. McAndrews, "Should We Move to a Mostly Cashless Society?" Wall Street Journal, September 24, 2017, at https://www.wsj.com/articles/should-we-move-to-a-mostly-cashless-society-1506305220, and Laurens Cerulus and Cat Contiguglia, "Central Bankers Warn of Chaos in a Cashless Society," Politico, August 14, 2018, at https://www.politico.eu/article/central-bankers-fear-cybersecurity-chaos-in-a-cashless-society/. |

| 9. |