European Energy Security: Options for EU Natural Gas Diversification

As a major energy consuming region, Europe faces a number of challenges in addressing its future energy needs. For member states of the European Union (EU), challenges include rapidly rising global demand and competition for energy resources from countries such as China and India, tensions with Russia, efforts to integrate the EU’s internal energy market, and a growing need to shift fuels in keeping with the EU’s climate change policy goals. As a result, energy supply security has become a key concern for the EU. European energy security is also of significant interest to the United States.

While energy policy in the EU has long been a strongly guarded competence of national governments, the EU’s role in energy policy has expanded over the last few decades. An important element of the EU’s energy supply strategy has been to shift to a greater use of natural gas and renewables and to move away from nuclear and coal. Russia is the most important of the EU’s natural gas suppliers, holding the top spot since 2014. The EU’s natural gas consumption is projected to grow as EU member states’ natural gas production continues to decline. If trends continue as projected, dependence on Russia as a supplier is likely to grow. Although some countries in the EU are exploring alternative sources for their natural gas needs, it is uncertain whether the EU as a whole can, or is willing to, replace a significant level of imports from Russia. Some EU member states that feel vulnerable to Russian energy supply manipulation are working hard to achieve supply diversification and energy sector integration.

Meanwhile, Russia has sought to protect its share of the EU natural gas market. It has attempted to stymie European-backed alternatives by proposing competing pipeline projects and attempting to increase its influence with European companies by offering them stakes in these and other projects.

Successive U.S. Administrations and Congresses have viewed European energy security as a U.S. national interest. In recent years, promoting diversification of EU natural gas supplies has been a focal point of U.S. energy policy in Europe and Eurasia. The Trump Administration has opposed new Russian gas projects as tools to maintain EU dependence on Russia. At the end of 2019, Congress passed the FY2020 National Defense Authorization Act (P.L. 116-92), which included sanctions related to the construction of the Nord Stream 2 and TurkStream pipelines. The Further Consolidated Appropriations Act, 2020 (P.L. 116-94) includes the European Energy Security and Diversification Act of 2019, which seeks to promote the diversification of Central and East European energy sources and supply routes.

Although the United States and the EU have sought to promote the export of piped natural gas from the Caspian Region and liquefied natural gas (LNG) from the United States, this is not being achieved in volumes sufficient to counter Russian exports. Regions such as North Africa and the Eastern Mediterranean have potential as alternative suppliers but are constrained in their ability to increase exports.

European Energy Security: Options for EU Natural Gas Diversification

Jump to Main Text of Report

Contents

- Introduction

- U.S. Perspective and Related Issues

- Congressional Interest

- Sanctions-Related Issues

- Main Sources of EU Natural Gas

- Natural Gas Production in the EU and Norway

- Natural Gas Imports from Russia

- Russia's Reliability as a Supplier: European Debate

- Russian Natural Gas Routes to the EU

- Natural Gas Contracts

- Natural Gas Storage

- Developments in EU Energy Policy

- Liberalization and Integration

- EU Support for Energy Projects

- From the "European Energy Union" to the "European Green Deal"

- Alternatives to Russian Natural Gas Imports

- Expanding EU Production

- Opportunities for Shale?

- North Sea Future

- North Africa: Diminished but Consistent Suppliers

- Qatar and Other Liquefied Natural Gas Exporters

- Rising U.S. LNG

- EU LNG Importers

- Azerbaijan and the Southern Gas Corridor

- Central Asia and the Caspian Sea

- Eastern Mediterranean and the Arctic: On the Horizon

- Conclusion: Prospects for Diversification

Figures

Summary

As a major energy consuming region, Europe faces a number of challenges in addressing its future energy needs. For member states of the European Union (EU), challenges include rapidly rising global demand and competition for energy resources from countries such as China and India, tensions with Russia, efforts to integrate the EU's internal energy market, and a growing need to shift fuels in keeping with the EU's climate change policy goals. As a result, energy supply security has become a key concern for the EU. European energy security is also of significant interest to the United States.

While energy policy in the EU has long been a strongly guarded competence of national governments, the EU's role in energy policy has expanded over the last few decades. An important element of the EU's energy supply strategy has been to shift to a greater use of natural gas and renewables and to move away from nuclear and coal. Russia is the most important of the EU's natural gas suppliers, holding the top spot since 2014. The EU's natural gas consumption is projected to grow as EU member states' natural gas production continues to decline. If trends continue as projected, dependence on Russia as a supplier is likely to grow. Although some countries in the EU are exploring alternative sources for their natural gas needs, it is uncertain whether the EU as a whole can, or is willing to, replace a significant level of imports from Russia. Some EU member states that feel vulnerable to Russian energy supply manipulation are working hard to achieve supply diversification and energy sector integration.

Meanwhile, Russia has sought to protect its share of the EU natural gas market. It has attempted to stymie European-backed alternatives by proposing competing pipeline projects and attempting to increase its influence with European companies by offering them stakes in these and other projects.

Successive U.S. Administrations and Congresses have viewed European energy security as a U.S. national interest. In recent years, promoting diversification of EU natural gas supplies has been a focal point of U.S. energy policy in Europe and Eurasia. The Trump Administration has opposed new Russian gas projects as tools to maintain EU dependence on Russia. At the end of 2019, Congress passed the FY2020 National Defense Authorization Act (P.L. 116-92), which included sanctions related to the construction of the Nord Stream 2 and TurkStream pipelines. The Further Consolidated Appropriations Act, 2020 (P.L. 116-94) includes the European Energy Security and Diversification Act of 2019, which seeks to promote the diversification of Central and East European energy sources and supply routes.

Although the United States and the EU have sought to promote the export of piped natural gas from the Caspian Region and liquefied natural gas (LNG) from the United States, this is not being achieved in volumes sufficient to counter Russian exports. Regions such as North Africa and the Eastern Mediterranean have potential as alternative suppliers but are constrained in their ability to increase exports.

Introduction

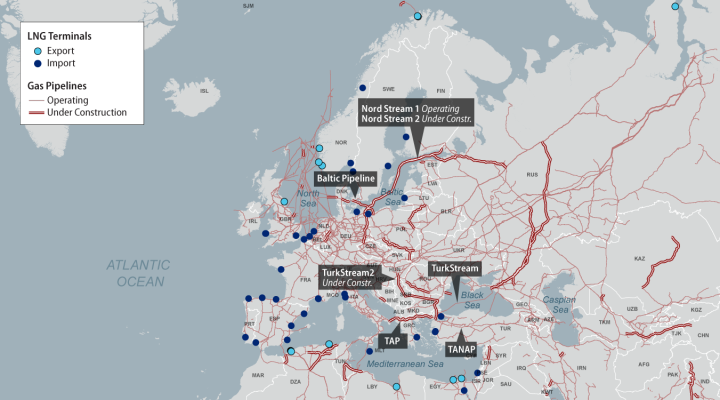

The 27-member European Union (EU) has been a major natural gas consumer and importer for decades.1 As EU member states' natural gas production has declined, their dependence on natural gas imports has increased. This has left them more dependent on their main supplier, Russia, which many observers believe has long been willing to use its energy resources, especially natural gas, for political ends (see Figure 1 for key natural gas infrastructure in the EU and surrounding region).

For almost 15 years, the EU and several member states have advocated for increased European energy supply diversification in order to mitigate the potential for cutoffs or curtailments of Russian natural gas supplies to Europe. At present, most Russian natural gas exports to the EU arrive via pipelines that pass through Ukraine and Belarus. Russian disputes with Ukraine have at least twice resulted in significant interruptions in the flow of natural gas to some EU members (in 2006 and 2009). Some member states in Central and Eastern Europe rely entirely or almost entirely on Russian imports for their natural gas supplies and thus are especially vulnerable to such interruptions. Since 2014, Russian aggression in Ukraine has not resulted in a cutoff of natural gas supplies to EU members, but it has increased concerns about the reliability of Russia as a supplier.

To increase reliability, some EU member states have sought to strengthen their energy ties to Russia by developing new supply routes for Russian gas that they view to be less vulnerable to potential Russian cutoffs. Since 2012, an increasing share of Russian gas imports has transited directly from Russia to Germany (and on to other EU member states) via the Nord Stream pipeline, a joint venture between Russia and several European energy companies. The new Nord Stream 2 pipeline, if completed, will increase the amount of Russian natural gas that transits directly to the EU. Although several member states support Nord Stream 2, others in the EU oppose the new pipeline project, as does the United States.

At the same time, many in the EU have sought to diversify the sources of their natural gas imports. One such diversification effort involves the so-called Southern Gas Corridor to transport natural gas to the EU from Azerbaijan and, potentially, Central Asia via Turkey. The centerpiece of this strategy in the early 2000s, the proposed Nabucco natural gas pipeline, eventually was deemed not to be commercially viable and was replaced by a smaller-scale Trans-Anatolian natural gas pipeline (TANAP). TANAP connects to the Trans Adriatic Pipeline (TAP), scheduled to open in 2020, to bring natural gas into Italy and onward, via Greece and Albania.

In recent decades, EU officials have sought to build an integrated internal energy market and improve network connectivity as part of a broader agenda of facilitating cross-border gas trade, improving consumer prices, and mitigating the impact of interruptions and overdependence on a single supplier. In response to potential supply instability from Russia, the EU has strengthened its internal energy regulations, diversified its suppliers and fuel mix, and invested in energy infrastructure, including gas storage. In February 2019, the EU amended a 2009 directive on natural gas regulations in an attempt to clarify and strengthen them.

Energy policy also is a key component of the EU's broader climate change agenda, as the production and use of energy account for approximately 75% of the EU's greenhouse gas emissions.2 Under the EU's 2015 "Energy Union" initiative, member states committed to energy efficiency and renewable energy targets by 2020 and 2030. Although some EU members are expected to miss their 2020 targets, the European Commission (the EU's executive) has proposed a broad climate policy blueprint, the "European Green Deal," which could set more ambitious energy targets by 2021.3 In this context, natural gas could play a critical, but potentially temporary, role in transitioning away from coal.

Despite its dependence on Russian natural gas, some analysts argue that the EU is well positioned geographically to benefit from recent changes in global natural gas development. Potential alternatives to Russian natural gas include increases in European production, new exports from the Eastern Mediterranean, which includes EU member Cyprus, imports from North Africa and the Caspian Sea region (Azerbaijan and Central Asia), and liquefied natural gas (LNG), including from the United States. U.S. LNG exports began in earnest in 2016 because of the rise in its natural gas production from shale formations, although imports of U.S. LNG to the EU have been limited thus far.

Nonetheless, challenges to developing alternative sources of natural gas for Europe persist. Some potential alternatives present complications, such as political and geopolitical obstacles, corruption, technical limitations, environmental concerns, and financial constraints. There also are certain limitations in the use, trade, and transport of natural gas. Unlike oil, which can be easily purchased on the spot market and transported via rail, truck, or ship, natural gas is relatively expensive in world markets, technologically challenging to transport, and not as easily traded. The natural gas market is becoming more global, especially with more LNG available, but additional changes need to happen for it to reach the same level as the oil market. The ease of trading oil has contributed to its greater insulation from geopolitical tensions and other challenges.

|

|

Source: Compiled by the CRS's Geospatial Information Systems. |

U.S. Perspective and Related Issues

The Trump Administration's attention to EU natural gas has focused primarily on two issues: promoting the expansion of U.S. LNG exports to the EU, as part of a larger effort to diversify European energy imports, and opposing the Nord Stream 2 pipeline, which Russia is constructing to expand capacity to supply natural gas directly to Europe via Germany (bypassing Ukraine). The TurkStream pipeline, Russia's second natural gas pipeline to Turkey that opened in January 2020, also has attracted some U.S. policymaker attention. In addition, the United States has encouraged the EU to improve gas infrastructure connectivity, particularly in isolated markets. Finally, a long-standing focus of the United States' European energy policy has been to promote the so-called Southern Gas Corridor for non-Russian and non-Iranian natural gas to flow to Europe, in the near-term from Azerbaijan but potentially also from Central Asia and the Middle East.

Congressional Interest

Congress has long expressed interest in European energy security, especially with respect to natural gas and the Southern Gas Corridor. Legislation related to European energy has been introduced consistently since 2008.

In the 116th Congress, the FY2020 National Defense Authorization Act (NDAA, P.L. 116-92) includes as Title LXXV the Protecting Europe's Energy Security Act of 2019 (PEESA), which established sanctions related to the construction of the Nord Stream 2 and TurkStream pipelines (see "Sanctions-Related Issues" below).4 The Further Consolidated Appropriations Act, 2020 (P.L. 116-94), includes the European Energy Security and Diversification Act of 2019 (Division P, Title XX), which seeks to promote the diversification of Central and East European energy sources and supply routes.

Other bills related to European energy security that have been introduced in the 116th Congress include the Protect European Energy Security Act (H.R. 2023), the Energy Security Cooperation with Allied Partners in Europe Act of 2019 (S. 1830), S.Res. 27 and H.Res. 116 (expressing opposition to the Nord Stream 2 pipeline), and H.Res. 672 (expressing support for energy independence and infrastructure connectivity).

The Countering Russian Influence in Europe and Eurasia Act of 2017 (CRIEEA, P.L. 115-44, Title II), which was enacted during the 115th Congress, states that it is U.S. policy to "continue to oppose the Nord Stream 2 pipeline given its detrimental impacts on the EU's energy security, gas market development of Central and Eastern Europe, and energy reforms in Ukraine." Also during the 115th Congress, the House of Representatives agreed to H.Res. 1035, which called for the cancellation of Nord Stream 2 and the imposition of sanctions with respect to the project.

Sanctions-Related Issues5

Two legislative authorities provide for sanctions related to the development of Russian energy export pipelines; however, no designations have been made under these authorities as of January 2020.

CRIEEA, Section 232 (22 U.S.C. 9526), authorizes (but does not require) sanctions on individuals or entities that invest at least $1 million, or $5 million over 12 months, or engage in trade valued at an equivalent amount for the construction of Russian energy export pipelines. Section 232 was a response to the development of Nord Stream 2.

The Trump Administration has not used Section 232 to oppose the construction of Nord Stream 2. In October 2017, the Administration published guidance noting that Section 232 sanctions would not apply to projects for which contracts were signed prior to August 2, 2017, the date of CRIEEA's enactment.6 Gazprom signed agreements with five European companies to fund 50% of project costs, each up to €950 million (around $1.1 billion), in April 2017.7 Section 232 does not provide for sanctions on financing specifically, although it provides for sanctions on the provision of services and support.

A newer authority providing for sanctions related to the construction of Nord Stream 2 and other Russian energy export pipelines is the Protecting Europe's Energy Security Act of 2019 (PEESA). PEESA requires sanctions on foreign persons who the President determines have sold, leased, or provided subsea pipe-laying vessels for the construction of Nord Stream 2 and TurkStream, or any successor pipeline, since December 20, 2019 (the date of the NDAA's enactment). PEESA provides for a 30-day wind-down period; exceptions for repairs, maintenance, environmental remediation, and safety; and a national security waiver.

PEESA provides for the termination of sanctions if the President certifies to Congress "that appropriate safeguards have been put in place"

- to minimize Russia's ability to use the sanctioned pipeline project "as a tool of coercion and political leverage," and

- to ensure "that the project would not result in a decrease of more than 25 percent in the volume of Russian energy exports transiting through existing pipelines in other countries, particularly Ukraine, relative to the average monthly volume of Russian energy exports transiting through such pipelines in 2018."

As of February 2020, PEESA's impact on completion of the Nord Stream 2 pipeline is uncertain (TurkStream was inaugurated on January 8, 2020). About 100 miles of the approximately 760-mile pipeline reportedly remain to be constructed.8 On December 21, 2019, Allseas, the Swiss-Dutch company laying the pipeline, stated that it had "suspended its Nord Stream 2 pipelay activities [and would] proceed, consistent with the legislation's wind down provision."9 On December 27, 2019, the State Department said that "the United States' intention is to stop construction of Nord Stream 2" and that PEESA's sanctions would be imposed "unless related parties immediately demonstrate good faith efforts to wind-down."10 Russian officials have said that Russia should be able to finish construction of the pipeline. In January 2020, Russian President Vladimir Putin said that he expected the pipeline to be completed no later than the start of 2021.11

Other U.S. and European sanctions that target Russian energy companies and projects could potentially have an impact on Russian natural gas development. In August 2018, Russia's Ministry of Natural Resources said that sanctions against Russian oil and gas companies complicate the development of new projects in Russia, especially offshore and those directed at resources that are hard to extract.12

Main Sources of EU Natural Gas

EU natural gas consumption has increased since 2014, after declining for several years. In 2018, natural gas made up about 23% of the EU's primary energy mix.13 Observers expect EU member states to rely increasingly on natural gas, as they strive to meet targets for reducing carbon dioxide and other greenhouse gas emissions.14 By 2035, some analysts estimate that natural gas may make up almost 30% of the EU's primary energy mix, depending upon market conditions, though it could decline in a "slow development scenario" where natural gas becomes less competitive.15

Most natural gas that EU member states consume comes from imports from countries outside the EU. In 2018, imports accounted for 80% of EU members' natural gas consumption.16 EU dependence on natural gas imports is expected to rise over time given declining fossil fuel production within the EU. Analysts note this decline has been propelled in part by policy decisions, such as Germany's decision to phase out use of nuclear energy (by 2022) and coal (by 2038) and some EU member state prohibitions on shale gas development.17

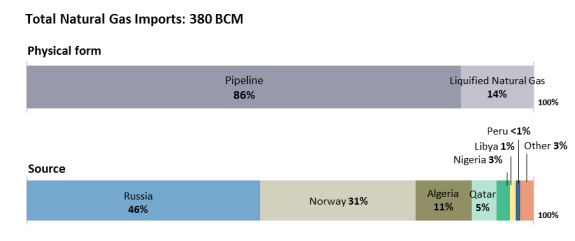

The main source of natural gas imports for EU members is Russia, which accounted for 46% (about 176 billion cubic meters, or BCM) of EU natural gas imports in 2018 (37% of total EU natural gas consumption) (see Figure 2).18 EU member states also import natural gas from non-EU members Norway (31%), Algeria (11%), Qatar (5%), and others.19

EU member states have limited flexibility to change natural gas suppliers or supply routes. Most natural gas imports are transported via pipeline, unlike oil imports (90% of which arrive by sea). In addition, typically natural gas is bought and sold via long-term contracts, whereas oil is sold mainly on the spot market or short-term basis.

|

Figure 2. EU Natural Gas Imports, 2018 Units = billion cubic meters (BCM) |

|

|

Source: Cedigaz, a subscription service statistical database, http://www.cedigaz.org. Notes: The total and percentages do not include trade from one EU country to another. |

Natural Gas Production in the EU and Norway

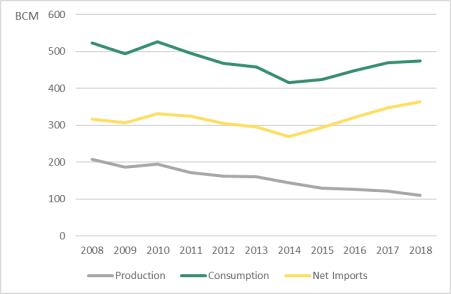

As shown in Figure 3, natural gas production within the EU is relatively low and has generally been in decline since at least 2008. From 2013 to 2018, EU natural gas production decreased by around 31%, while consumption increased by 4%. In 2013, the EU produced 35% of the natural gas it consumed; in 2018, it produced 23% (see Table 1 for 2018 data by country).

|

2008-2018 |

|

|

Source: Cedigaz, a subscription service statistical database, http://www.cedigaz.org. Notes: Units = billion cubic meters (BCM). Net Imports = Gross Imports minus Gross Exports. Although Croatia joined the EU in 2013, its data is included for the entire time period for consistency purposes. |

In 2018, two EU member states, the Netherlands and the United Kingdom (then an EU member), produced significant amounts of natural gas (more than 35 BCM a year). Production in both these countries, however, has declined in recent years. In 2018, nine EU member states produced between 1 to 10 BCM.20 Six produced less than one BCM, and 11 produced none. Of the 23 EU member states that consumed more than 1 BCM of gas in 2018, Denmark, the Netherlands, and Romania produced sufficient (or nearly sufficient) natural gas to meet domestic consumption.

North Sea fields have long been a major source of natural gas for markets in the United Kingdom, the Netherlands, Germany, and Denmark, as well as for Norway. Norway has the largest proven North Sea oil and gas reserves, and is one of the world's leading gas exporters. Norway is not an EU member, but it has a close relationship with the bloc. Almost all of Norway's gas exports go to the EU, via both pipeline and LNG tanker (Norway produced 122 BCM of natural gas in 2018).21

In general, the North Sea is considered to be a mature basin, with natural gas production in decline.22 ConocoPhillips divested from the region in April 2019, selling its British North Sea oil and gas operations for nearly $2.7 billion to North Sea oil producer Chrysaor.23 Other major energy companies, such as Chevron, Marathon, and EOG Resources, have left the area in the last two years, with some citing concerns about remaining supply.24 Danish officials reportedly are considering rescinding an announced oil and gas exploration tender due to pressure from some parties in the current government coalition, which consider exploration to contradict the country's goal of more quickly phasing out fossil fuels.25 Analysts note continuing declines in production in the United Kingdom and the Netherlands, and eventual decline in Norwegian production over the longer term.26

Production in the Netherlands is expected to considerably decline with the Dutch government's recent decision to end production at Groningen gas field by 2022. Groningen is the largest onshore gas field in Europe and was once one of its primary suppliers. Production has dropped since 2013, when it produced almost 54 BCM of gas, due to widespread public concern that drilling activities have been triggering a series of earthquakes.27 Some analysts have raised concern over the impact of halting production on the Dutch Title Transfer Facility, the largest traded gas hub in Europe and a benchmark price setter (see below, "Developments in EU Energy Policy"), as well as impacts on markets in Germany, France, and Belgium that import Groningen gas.

|

Natural Gas Consumption |

Natural Gas Production |

Natural Gas Imports |

|

|

Austria |

8.92 |

1.06 |

7.86 |

|

Belgium |

19.21 |

0.00 |

19.21 |

|

Bulgaria |

2.98 |

0.01 |

2.97 |

|

Croatia |

3.00 |

1.00 |

2.00 |

|

Cyprus |

0.00 |

0.00 |

0.00 |

|

Czech Republic |

9.09 |

0.22 |

8.87 |

|

Denmark |

2.99 |

4.10 |

-1.11 |

|

Estonia |

0.43 |

0.00 |

0.43 |

|

Finland |

2.89 |

0.00 |

2.89 |

|

France |

46.37 |

0.07 |

46.30 |

|

Germany |

94.45 |

5.90 |

88.55 |

|

Greece |

4.68 |

0.01 |

4.67 |

|

Hungary |

8.21 |

1.90 |

6.31 |

|

Ireland |

6.37 |

3.37 |

3.00 |

|

Italy |

71.84 |

5.46 |

66.38 |

|

Latvia |

0.99 |

0.00 |

0.99 |

|

Lithuania |

2.15 |

0.00 |

2.15 |

|

Luxembourg |

0.73 |

0.00 |

0.73 |

|

Malta |

0.50 |

0.00 |

0.50 |

|

Netherlands |

39.52 |

36.50 |

3.02 |

|

Poland |

17.05 |

3.70 |

13.35 |

|

Portugal |

6.64 |

0.00 |

6.64 |

|

Romania |

12.41 |

10.12 |

2.29 |

|

Slovakia |

3.81 |

0.10 |

3.71 |

|

Slovenia |

0.37 |

0.00 |

0.37 |

|

Spain |

32.15 |

0.09 |

32.06 |

|

Sweden |

1.18 |

0.00 |

1.18 |

|

United Kingdom |

75.45 |

37.44 |

38.01 |

|

TOTAL |

474.29 |

111.05 |

363.24 |

Source: Cedigaz, a subscription service statistical database, http://www.cedigaz.org.

Notes: Production data represent marketed natural gas, not gross natural gas production, which includes gases other than methane. Several countries (especially Belgium, Denmark, the Netherlands, and Romania) re-export natural gas imports or export their own production to EU members. Denmark exports more than it imports, which is why its import figure is negative. In this table, imports include natural gas received from other EU countries. Imports equal Consumption less Production.

Natural Gas Imports from Russia

Russia has the largest natural gas reserves in the world, with about 20% of total global reserves.28 It is the leading exporter of natural gas and, in 2018, was the second-largest producer and consumer after the United States. Russia is a founding member of the Gas Exporting Countries Forum (GECF), a cartel-like organization of natural gas producing countries.29

The EU is Russia's largest natural gas trading partner. In 2018, more than 70% of Russia's natural gas exports went to EU member states (about 176 BCM).30 Twenty-three% of Russia's total natural gas exports went to Germany (57 BCM). The next largest importer of Russian gas, volumetrically, was Italy (22 BCM).31

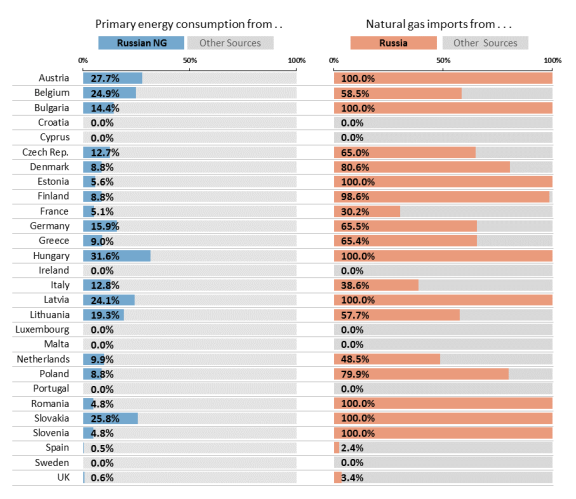

The dependence of EU member states on Russian natural gas varies. Of the 21 EU member states that import natural gas from Russia, 16 relied on Russia for more than half their total natural gas imports in 2018 (see Figure 4). Among these, eight (Austria, Bulgaria, Estonia, Finland, Hungary, Latvia, Slovakia, and Slovenia) were entirely or almost entirely dependent on Russia for natural gas imports (Romania's imports also come only from Russia, but it produces large volumes domestically). Seven EU member states imported no gas from Russia, whether due to low consumption, high production, availability of supplies from North Africa, Norway, or LNG, and/or lack of infrastructure. Two countries, Cyprus and Iceland, did not use any natural gas in 2018.

The reliance of EU member states on Russian natural gas imports depends not only on the share of Russian gas in their total natural gas imports but also on the share of natural gas in their total primary energy mix. Among those EU members that import gas from Russia, five (Austria, Belgium, Hungary, Latvia, and Slovakia) rely on Russian gas for 20% to 35% of their primary energy. Five countries (Bulgaria, Czech Republic, Germany, Italy, and Lithuania) rely on Russian gas for 10% to 20% of their primary energy. Eleven EU member states rely on Russian gas for less than 10% of their primary energy consumption.

|

Figure 4. EU Energy Consumption of Russian Natural Gas, 2018 |

|

|

Source: BP Statistical Review of World Energy—all data, 1965-2018, https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html, and Cedigaz, a subscription service statistical database, http://www.cedigaz.org. Notes: Primary energy is defined as commercially traded fuels, including modern renewables used to generate electricity. Belgium, Denmark, France, Germany, Hungary, Italy, the Netherlands, and Romania import more natural gas than they consume and export the remainder to other EU countries. Although Romania's imports came only from Russia, the country also produces large volumes domestically. |

Russia's Reliability as a Supplier: European Debate

Since at least 2006, the EU and its members have weighed the implications of their heavy reliance on Russian natural gas imports. The main impetus for their concern were two temporary reductions in Russian natural gas supplies via Ukraine in 2006 and 2009. After Ukraine's 2005 Orange Revolution, which led to the rise of a Western-leaning government, Russia clashed with Ukraine on several issues, including natural gas supply volumes, prices, and debt repayment. After gas contract negotiations failed, Russia twice briefly reduced and, in 2009, cut gas exports via Ukraine, leading to temporary dips in supplies to some European countries during the winter.32 As a result, the EU and member states began to more seriously assess the need to diversify their energy sources away from Russia.

Views regarding the EU's dependence on Russian natural gas vary. The European Commission and some member states believe that Russia's willingness to use gas export volumes and prices as tools in its foreign policy means that EU members need more alternatives to Russian gas to diminish the impact of gas reductions and cutoffs or unexpected price increases. Some states, such as Poland (see text box "Poland: Proactive on Natural Gas Diversification," below), have taken more proactive measures than others to reduce their dependence on Russian gas. The EU's 2017 Security of Supply regulation introduced measures aimed at preventing supply crises and safeguarding supply; these include an EU-wide disruption simulation, a requirement that member states cooperate in regional groupings to develop joint Preventive Action Plans and Emergency Plans, and application of the EU's "solidarity principle" to facilitate gas-sharing during crises.33

Other EU member states believe that dependence on Russian natural gas does not pose a major security risk and thus accept growth in Russian natural gas imports. Governments in Germany and Italy at times have expressed that Russia (like the Soviet Union before it) can remain a reliable supplier of natural gas at relatively less expensive prices, despite adversarial relations between Russia and the West. From the perspective of some officials, risks to EU energy security lie more with gas transit routes; projects that bypass Ukraine, such as Nord Stream 2, can provide a check against supply disruption.

Russian involvement in the European energy sector goes beyond its role as an energy supplier. Russian energy companies and their subsidiaries have significant ownership stakes in European energy infrastructure, including pipelines, distribution, and storage facilities.34 According to some reports, Russian-backed groups are suspected of spreading propaganda regarding environmental concerns about unconventional natural gas production in Europe and the United States.35

|

Poland: Proactive on Natural Gas Diversification36 Poland has sought to diversify its energy sources, especially natural gas sources. Polish officials say they are doing so to reduce dependence on Russian natural gas and that they hope to lead in the EU by example. Poland currently is under contract to import 10.24 BCM per year of gas from Russia. The Polish Oil and Gas Company (PGNiG), a state-owned oil and gas company, says that it will not sign another long-term gas deal with Russia after the current contract expires in 2022. Actions taken by Poland fall into two categories: supply diversification, with regard to fuel type and supplier, and infrastructure diversification and security, including gas storage and LNG terminal construction. PGNiG has signed multiple long-term contracts with U.S. and other LNG suppliers (Cheniere, Centrica, Venture Global LNG, and Port Arthur LNG) in an effort to replace volumes they now import from Russia. Poland's first LNG terminal, located in Świnoujście on the Baltic Sea, was completed in 2016. The Świnoujście LNG terminal received its first shipment of U.S. LNG in June 2017; it also processed imports from Qatar and Norway in 2017. In December 2018, the owner and operator of Świnoujście, Polskie LNG, tendered a contract to expand the terminal's annual regasification capacity by 50% by 2021 (the terminal currently utilizes its total capacity of 5 BCM). PGNiG plans to increase LNG purchases after the expansion. The tender also includes construction of a third LNG storage tank at Świnoujście. Natural gas storage can enable Poland to stabilize domestic gas prices and protect itself against shutoffs, and the Polish Government has advocated for new and expanded underground storage facilities. Poland has 3.2 BCM of underground storage capacity (see Table 2) and plans to add another 2.5 BCM by 2021. Poland also has sought to create a more integrated regional energy market. Poland has developed the ability to reverse the flow of natural gas in the Polish section of the Yamal pipeline, which runs from Russia to Germany via Belarus and Poland, to import natural gas from the West in the case of a gas cutoff before 2022 when the Russian contract expires. In addition, Poland has been discussing natural gas pipeline interconnections with the Czech Republic, Slovakia, and Hungary to connect LNG terminals in Poland and possibly Croatia by 2022, thereby creating a North-South Gas Corridor. Poland also is working to integrate with neighboring markets, such as Lithuania, which has its own LNG import terminal at the port of Klaipėda. Finally, Baltic Pipe, a joint project of Energinet (Denmark) and GAZ-SYSTEM (Poland), aims to connect an existing Norway-Germany gas pipeline, Europipe II, to new pipelines and compressor stations in Denmark and Poland. Via Baltic Pipe, Poland is to receive 7 BCM of natural gas annually from Norway starting in 2022. |

Russian Natural Gas Routes to the EU

Russia currently exports natural gas directly to Finland and the Baltic states, as well as via Nord Stream to Germany and, from there, to other EU members. To access the larger integrated EU market, Russia also transits gas via Ukraine and Belarus to Poland, and via Ukraine to Slovakia, Hungary, and Romania, where gas then flows onward. Excluding the export of gas supplies to Finland and the Baltic states, the International Energy Agency has calculated Russia's natural gas transit capacity to EU points of entry at 233.5 BCM per year.37

Nord Stream and Nord Stream 2

The Nord Stream pipeline, in operation since 2011, transits Russian natural gas directly to Germany via the Baltic Sea. Nord Stream has a total capacity of 55 BCM per year. In 2018, it ran at 107% of stated capacity.38 Nord Stream is a joint venture between Russia's largest state-owned energy company Gazprom and four European companies. Gazprom has a 51% stake; the four European companies – Engie (France), Wintershall (Germany), E.ON (Germany), and Gasunie (Netherlands)—own the rest.

Nord Stream 2, currently under construction, is a second Baltic Sea pipeline project that runs parallel to Nord Stream. Nord Stream 2 also is to have a capacity of 55 BCM per year, doubling the system's capacity. Prior to the introduction of U.S. sanctions related to the construction of Nord Stream 2 in December 2019, the pipeline was scheduled for completion in early 2020. The pipeline currently is scheduled for completion by the end of 2020 or early 2021 (see "Sanctions-Related Issues" above).

Unlike Nord Stream, Nord Stream 2 is owned entirely by Gazprom. Half the cost is being financed by five European companies: Engie, OMV (Austria), Shell (Netherlands/UK), Uniper (Germany), and Wintershall.

Supporters of Nord Stream 2, including the German and Austrian governments, argue that the pipeline will enhance EU energy security by increasing the capacity of a direct and secure supply route at a time of rising European demand for gas.39 German officials and others have said that once the gas reaches Germany it could be transported throughout Europe.

Opponents of the pipeline—including, among others, some EU officials, Poland, the Baltic states, Ukraine, the Trump Administration, and many Members of Congress—argue that it will give Russia greater political and economic leverage over Germany and others that are dependent on Russian gas, leave some countries more vulnerable to supply cutoffs or price manipulation by Russia, and increase Ukraine's vulnerability to Russian aggression (see text box below).

|

Ukraine and Nord Stream 240 One concern of Nord Stream 2 opponents is that the pipeline would reduce Ukraine's significance as a transit state for Russian natural gas exports to EU members. Before Nord Stream 1 opened in 2011, most of Russia's natural gas exports to Europe transited Ukraine. Currently, around 40% transit Ukraine. According to Ukrainian oil and gas company Naftogaz, its revenues from gas transit totaled $2.65 billion in 2018. If Nord Stream 2 becomes operational, observers expect it to further reduce transit through Ukraine. On December 30, 2019, Gazprom and Naftogaz negotiated a contract to transit 65 BCM in 2020, a volume equal to about 75% of the 2018 volume of 86.8 BCM, and 40 BCM a year from 2021 to 2024, a volume equal to about 46% of the 2018 volume. Despite the reduction in export volumes, Ukraine's Minister of Energy has said the agreement provides for about $3 billion a year in transit revenue. Many observers consider that reducing Ukraine's role as a transit state would not only deprive Ukraine of revenue but also threaten Ukraine's security. It would not necessarily increase Ukraine's vulnerability to energy supply cutoffs, as Ukraine stopped importing natural gas directly from Russia in 2016. It could, however, increase Ukraine's strategic vulnerability, as Russia's dependence on Ukraine for gas transit would no longer be a potential constraining factor in its policies toward Ukraine. Sources: Interfax-Ukraine, "Ukraine's Income from Gas Transit To Be $15 Bln in Five Years—Energy Minister," December 24, 2019; Naftogaz Group, Annual Report 2018; Vladimir Soldatkin, Andrey Kuzmin, and Natalia Zinets, "Russia, Ukraine Outline Terms for Five-Year Gas Transit Deal To End Row," Reuters, December 21, 2019; Vladimir Soldatkin and Natalia Zinets, "Russia, Ukraine Clinch Final Gas Deal on Gas Transit to Europe," Reuters, December 30, 2019. |

TurkStream

TurkStream is a new natural gas pipeline from Russia to Turkey for which operations officially began in January 2020.41 Along with Nord Stream 2, TurkStream could strengthen Russia's foothold in the European energy market, especially southern Europe. Many analysts view TurkStream as a counter to the U.S.-backed Southern Gas Corridor project for transporting natural gas to Europe from Azerbaijan, and potentially Central Asia (see "Azerbaijan and the Southern Gas Corridor" below). Opponents of the TurkStream project, including the Trump Administration and some Members of Congress, have expressed concern that the project could also further erode Ukraine's transit role for natural gas.

The TurkStream project is to consist of two parallel pipelines with a total capacity of 31.5 BCM per year (15.75 BCM each). The pipelines enter the water in Anapa, Russia, and make landfall in Kiyikoy, close to Turkey's border with Bulgaria. The first pipeline supplies natural gas to Turkey. The second pipeline, for which onshore construction continues, is to transport Russian natural gas from the Turkish landing point to southeastern and central European markets via Bulgaria, Serbia, and Hungary. The European extension (also referred to as "TurkStream 2") comprises new and existing infrastructure.

Natural Gas Contracts

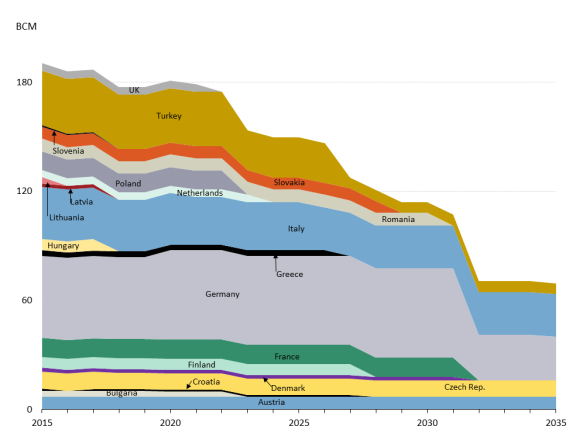

Dependence on Russian natural gas among EU member states that rely on Russian imports is unlikely to be overcome in the near future. Many states have long-term contracts to import Russian gas that specify particular durations, annual volumes, and additional terms (see Figure 5). For example, Germany's five gas contracts with Gazprom all terminate between 2031 and 2035.

As expiration dates approach, contracting parties must either renew the contract or find other counterparts. Depending upon market conditions, the importer or exporter may have a negotiating advantage. For example, contracts promulgated by U.S. LNG export companies have been instrumental in making natural gas a more tradeable commodity like oil. This has given consuming countries leverage in dealing with traditional suppliers. For instance, after Lithuania installed an LNG import terminal, giving it an alternative to Russian pipeline imports, Russia gave Lithuania a more favorable price in its contract renegotiation. Figure 5 shows where Russia, primarily through the state energy company Gazprom, will face shortfalls in its export contracts in the coming years.

|

Figure 5. Russian Contract Volumes for EU Countries and Turkey 2015-2035 |

|

|

Source: Cedigaz, Pipeline Supply Contracts Database, updated October 2018, http://www.cedigaz.org. Notes: Units = billion cubic meters (BCM). |

Natural Gas Storage

In many markets, including the EU (see Table 2), natural gas is pumped into storage for times during the year when production and imports are insufficient to meet demand. Gas is injected into storage facilities during non-peak times of the year, usually in the spring and summer. The peak for natural gas use tends to be in the winter when it is used for heating. In some cases, there is a second, smaller, peak in the summer for electricity generation, especially in locations where temperatures are high.

In 2018, EU members held about 22% of their consumption in storage, a greater percentage than in the United States, according to industry data. Despite having a large amount of storage capacity, some EU members could benefit from having additional or new storage facilities. Expanding storage has been an EU priority since Russia's 2009 gas cutoff. Within the EU, Germany and Italy hold most storage facilities and volumes.

|

Number of Facilities |

Working Gas |

|

|

Austria |

11 |

8.1 |

|

Belgium |

1 |

0.7 |

|

Bulgaria |

1 |

0.6 |

|

Croatia |

2 |

0.6 |

|

Czech Republic |

21 |

3.8 |

|

Denmark |

3 |

0.9 |

|

France |

23 |

11.7 |

|

Germany |

86 |

24.0 |

|

Hungary |

5 |

6.1 |

|

Italy |

25 |

18.4 |

|

Latvia |

2 |

2.3 |

|

Netherlands |

13 |

12.4 |

|

Poland |

16 |

3.2 |

|

Portugal |

2 |

0.2 |

|

Romania |

10 |

3.1 |

|

Slovakia |

4 |

3.6 |

|

Spain |

8 |

2.7 |

|

Sweden |

1 |

0.01> |

|

United Kingdom |

15 |

1.5 |

|

TOTAL |

249 |

103.9 |

Source: Cedigaz, a subscription service statistical database, http://www.cedigaz.org.

Notes: Working gas in storage is the volume that is moved in and out of the facility for sales and reinjection. Base gas is the volume that must always be in the storage for the facility to operate. Base gas volumes are not included in the table. EU countries not listed in this chart do not have any domestic storage facilities.

Developments in EU Energy Policy

Energy policy in the EU has traditionally been a strongly guarded competence of national governments, with member states making their own decisions on national energy mix. In the last few decades, however, the EU's role has expanded in some energy policy areas, due in part to concerns about energy security and consumer protection, as well as public pressure to address climate change. As outlined in EU treaties, the aims and general scope of the bloc's energy policy include ensuring a functioning energy market and supply security, promoting energy efficiency and new and renewable energies, and facilitating network interconnectivity. At the same time, energy policy remains a shared competence between the EU and member states; national governments have the right to make decisions about energy mix and the general structure of energy supply.42

Liberalization and Integration

Historically, European natural gas production and delivery were dominated by large, state-owned monopolies, and gas markets across the bloc's member states were relatively weakly integrated.43 Over the last few decades, the energy sector has gradually been exposed to greater competition, and the EU's regulatory role has expanded in some areas as the bloc seeks to build an integrated, barrier-free internal energy market, promote energy security and efficiency, and aid consumers.44

In 2009, the EU adopted the "Third Energy Package" in an effort to further liberalize and increase competition in the energy sector.45 A key element of the 2009 regulations was to separate ownership and control of gas supply and production activities, on the one hand, and delivery, on the other (also known as "unbundling"), in order to prevent individual companies from dominating gas markets. Network transmission system operators (TSOs) in the EU, which operate the infrastructure through which gas is transported, demonstrate compliance with this requirement by obtaining unbundling certification from national energy regulators.46 The unbundling measure aims to prevent conflicts of interest that, according to EU policymakers, could lead to unfair competition, leverage, and higher prices for consumers.47

The Third Energy Package also introduced the third party access principle, which requires TSOs to grant suppliers non-discriminatory access to networks. Other measures expanded independent regulatory oversight at the national and European levels and introduced mechanisms to harmonize network codes in support of cross-border gas flows. At the same time, national authorities regulate the conditions of network access and may determine the specific unbundling model for TSOs. Regulators also may exempt new gas infrastructure from some of the Third Energy Package requirements under certain conditions (for instance, the Trans Adriatic Pipeline, discussed below, received an exemption from the third party access provision for its initial 10 BCM capacity annually for a 25-year period).48

Concerns about Russia's reliability and dominance as an energy supplier are considered to have prompted some of these rules.49 Russia's ultimately unsuccessful challenge of the Third Energy Package before the World Trade Organization claimed that the rules unfairly discriminated against Gazprom by design and through selective exemption of non-Russian projects from some requirements.50 Pressure from the European Commission is considered to have contributed to Russia's decision to cancel Gazprom's controversial South Stream project in 2014. The commission asserted that intergovernmental agreements signed between Russia and selected EU transit countries did not comply with some EU rules.51

In early 2019, during intra-EU debates over Nord Stream 2 (see "Nord Stream and Nord Stream 2"), the EU amended the Third Energy Package's gas directive to extend its application to pipelines in EU territorial waters. Proponents hoped that the amendment would require Gazprom to adhere to EU unbundling regulations. In November 2019, however, the German parliament ruled that the restrictions would not apply to Nord Stream 2, as the pipeline was already under construction at the time they were agreed.52

Analysts consider EU natural gas market liberalization and integration to have been generally successful, albeit an ongoing process. The extent of market liberalization, integration, and rule implementation varies somewhat across member states. Liberalization and price convergence, for example, are most advanced in northwestern Europe and generally less complete in Southeastern and Southern Europe.53 A growing number of EU member states have established natural gas trading hubs, including the Dutch Title Transfer Facility (TTF), which in recent years has surpassed the UK's National Balancing Point (NBP) to become Europe's largest hub and benchmark price setter.54

The European Commission, as guardian of EU treaties, is tasked with monitoring member state implementation and enforcement of EU laws and regulations. In practice, implementation and enforcement may vary across member states due to different constellations of legal institutions and political interests.55 When the EU identifies potential problems, the response typically involves multiple stages of assessment and dialogue between Brussels and the member state in question, and the entire infringement process may be months or years-long in practice.56 The European Commission has used infringement proceedings to seek member state compliance with energy rule implementation on several occasions.57 For example, in 2013 the European Commission referred Bulgaria, Estonia, and the United Kingdom to the European Court of Justice (ECJ, the EU's top court) for failing to meet a 2011 deadline to incorporate measures in the Third Energy Package into their domestic frameworks. In 2018 and 2019, the European Commission referred Germany, Hungary, and Belgium to the ECJ for incorrectly or incompletely transposing rules.58

|

EU Cases Concerning Gazprom Analysts at times have questioned the extent to which the EU would be willing to pressure Russia and Gazprom to adopt EU principles of competition and adhere to the bloc's rules. EU institutions have addressed concerns about Gazprom as an energy market manipulator in several significant cases (including South Stream, discussed above). Analysts contend that rulings reflect EU assertiveness but also restraint in responding to concerns about Gazprom's practices in EU energy markets. Following a years-long antitrust investigation, in 2015 the European Commission issued a Statement of Objections to Gazprom in which it accused the gas giant of following "an overall abusive [gas supply market] strategy" in eight member states in Central and Eastern Europe that heavily relied on Russian gas.59 In these countries, the commission found that Gazprom had imposed certain restrictions in its supply agreements, including re-export bans and destination clauses. These practices impeded the cross-border flow of gas and resulted in unfair pricing for consumers. A 2018 settlement with Gazprom, which it in part proposed, included binding measures the commission said would "significantly change the way Gazprom operates in Central and Eastern European gas markets"; these measures required Gazprom to lift any contractual restrictions against re-exporting gas, improve supply to isolated markets, and match more competitive Western European benchmark prices upon request. Gazprom welcomed the EU's acceptance of its settlement offer, while some observers noted that it aligned with Gazprom's strategy of moving away from long-term, oil-linked contracts.60 Some member states, particularly Poland, criticized the European Commission for not issuing financial penalties; in contrast, fines were imposed against Google and other firms in different antitrust cases.61 In a separate case, in September 2019, the ECJ overturned a 2016 European Commission decision allowing Gazprom to book over 50% of capacity in the OPAL pipeline connecting Nord Stream to onshore networks.62 Poland, supported by Latvia and Lithuania, had appealed the European Commission decision on the grounds that it would reduce volumes through legacy routes and jeopardize supply security. The ECJ deemed the 2016 Commission decision to be in violation of the "principle of energy solidarity" enshrined in EU treaties by not examining its impact on Poland's energy security.63 The 2019 ruling is expected to reduce Gazprom's access by 12-13 BCM per year. Beyond the OPAL case, the ruling could have implications for other pipeline projects, including Nord Stream 2's Eugal onshore connection, if it is interpreted as setting a precedent for consideration of energy solidarity in future capacity decisions. |

EU Support for Energy Projects

As of early 2020, the European Commission estimates that at least €70 billion (about $78 billion) would be required to upgrade aging gas infrastructure in the EU and develop new infrastructure to improve connectivity.64 Projects that comply with the EU's energy goals may be eligible for funding through several programs under the EU's long-term budget (multiannual financial framework, or MFF), as well as other EU-linked financing sources.65 In some cases, funding decisions are guided by the EU's periodic list of Projects of Common Interest, which are "key cross-border infrastructure projects that link the energy systems of EU countries" and are intended to bring the bloc closer to its energy and climate goals.66

The following programs and institutions may support some natural gas projects, although the list is not necessarily inclusive of all available EU-linked financing:

- In the 2014-2020 MFF, €2 billion ($2.22 billion) in European Regional Development Funds (ERDF) has been allocated for large-scale electricity and gas infrastructure projects. For example, about half of the €300.5 million ($334.3 million) investment in Poland's Pogórska Wola-Tworzeń gas pipeline, expected to be completed in 2020, is co-financed by ERDF. The pipeline is part of the proposed North-South Gas Corridor between Świnoujście LNG terminal in Poland and a planned terminal in Croatia. ERDF also co-financed several other Corridor segments, as well as Świnoujście terminal and a planned upgrade.67

- The Connecting Europe Facility (CEF), an instrument that supports European energy infrastructure, among other areas of investment, made available €5.4 billion ($6 billion) for energy projects under the 2014-2020 MFF. This includes projects that are considered to be of strategic importance but not commercially viable. About €1.3 billion ($1.45 billion) is currently contributed to works projects in natural gas. A planned LNG terminal in Krk, Croatia, was approved for up to €101.4 million ($112.8 million) financing from CEF (just under half of the projected cost).68

- The EU's European Investment Bank (EIB) has provided an estimated €9 billion for natural gas pipelines and distribution network projects since 2013. EIB recently announced, however, that it intends to phase out fossil fuel projects at the end of 2021, which "potentially deals a blow to billions of dollars of [traditional] gas projects in the pipeline."69 It is the first major multilateral lender to phase out natural gas project financing due to climate change concerns.

|

Natural Gas in the Balkans70 Russia is a major gas supplier to most countries in the Balkan region and is the near-exclusive foreign supplier to Bulgaria, Serbia, and North Macedonia. Current production in the Balkans is relatively low, with the exception of Romania, although several countries in the region are considered potential producers amid offshore exploration in the Adriatic and Black Seas.71 Gazprom's planned extension of TurkStream could further regional dependence and serve Russia's purported ambitions of undercutting Ukraine as a transit country (to date, most Russian gas has been transported to the Balkan region via Ukraine and Hungary, or Ukraine and the north-south Trans-Balkan Pipeline).72 In addition, Russian firms have invested in refineries, storage facilities, and other energy assets in the Balkans. More generally, observers consider the energy sector a potential conduit of Russian leverage in some countries.73 The EU supports several proposed projects to connect Balkan gas infrastructure to the Trans Adriatic Pipeline (see below) in hopes of undercutting regional reliance on Russian gas. These projects—some of which have received EU funds—include the Greece-Bulgaria interconnector (up to 3 BCM per year) and the Bulgaria-Serbia interconnector (proposed 1-1.8 BCM per year), as well as the Ionian Adriatic Pipeline (proposed up to 5 BCM per year).74 Other regional initiatives include a proposed transit corridor for Black Sea gas and planned LNG terminals in Croatia and Greece. These and other proposals have been included as EU Projects of Common Interest or as priority projects under the Three Seas Initiative, a U.S.- and EU-backed regional forum aimed at improving interconnectivity in the region between the Adriatic, Baltic, and Black Seas. Some countries in the region import U.S. LNG. Gas markets in the Balkans are generally less liberalized and integrated than in other parts of Europe.75 Analysts attribute delays in opening up the region's gas markets in part to "a lack of political will and continued political intervention."76 European officials have noted that energy rules, even if successfully transposed into legislation, are not always implemented in practice.77 For example, Serbia was recently found to be in "serious and persistent breach" of the Energy Community treaty for failing to unbundle state-owned Srbijagas. In December 2018, the European Commission fined Bulgaria's state-owned Bulgarian Energy Holding and two subsidiaries €77 million (about $85 million) for violating EU competition rules; the subsidiaries were accused of denying rival suppliers access to natural gas infrastructure.78 |

From the "European Energy Union" to the "European Green Deal"

Amid growing environmental activism and public pressure to address climate change, EU energy and environmental policy have become increasingly intertwined.79 Energy use and production account for 75% of emissions in the EU.80 The European Commission envisions natural gas playing a key, albeit perhaps transitional, role in moving away from coal—and thus in the bloc's long-term goal of becoming carbon neutral by 2050.81

In 2015, member state governments and the European Parliament endorsed key elements of the European Energy Union, a flagship initiative of the 2014-2019 European Commission under then-President Jean-Claude Juncker. The Energy Union outlined five core dimensions aimed at advancing energy and climate goals: energy security and solidarity; an integrated European energy market; energy efficiency; "decarbonizing" the economy; and research, innovation, and competitiveness.

Various binding and nonbinding measures were adopted under the banner of the Energy Union. These include the 2017 Security of Supply regulation, which introduced measures aimed at preventing supply crises and safeguarding supply (see "Russia's Reliability as a Supplier: European Debate" above). A regulation adopted in 2018 required member states to submit an "integrated national energy and climate plan" by the end of 2019 (and every ten years subsequently) to outline long-term national strategies to meet climate goals and other EU energy objectives.82

The Energy Union also endorsed more ambitious carbon targets to further the EU's longer-term agenda to address climate change, principally its goal of a carbon-neutral Europe by 2050. A binding "2020 package" (enacted in 2009) set targets of a 20% cut in greenhouse gas emissions relative to 1990 levels, 20% of energy from renewables, and a 20% improvement in energy efficiency. The 2030 targets were revised upwards in 2018, to 40%, 32%, and 32.5%, respectively.83

European Commission President Ursula von der Leyen, who assumed office in December 2019, has pledged to make the "European Green Deal" proposal a hallmark of her 2019-2024 Commission. The European Green Deal is multifaceted. Among other proposals, it envisions increasing the bloc's 2030 targets and codifying in EU law the goal of a climate neutral economy.84 Some analysts believe that some of the new Commission's proposals could face resistance from some countries, such as Poland, that currently rely heavily on coal.85

Alternatives to Russian Natural Gas Imports

Analysts generally agree that EU members have few, if any, alternatives for substantially replacing gas flows from Russia in the short term, especially as natural gas production in the EU is in decline. Over the longer term, EU members could enhance efforts to develop new domestic energy sources, such as shale gas and renewable energy, or increase the use of nuclear energy and enhance efficiency. They also could seek to boost LNG imports from Africa, the Persian Gulf, and the United States. EU members could accelerate efforts to extend and expand pipeline systems that route natural gas to Europe from Azerbaijan and possibly Central Asia. Finally, they could explore the possibility of additional energy sources in the eastern Mediterranean.

Expanding EU Production

As the role of natural gas in the EU's primary energy mix grows, one way to achieve greater energy security would be to produce more natural gas within the EU. Although EU member states do not have the energy resources of the United States or Russia, some of them have access to undeveloped and underdeveloped natural gas resources. However, environmental policies and safety concerns hinder greater production.

Opportunities for Shale?

The development of previously difficult-to-develop "unconventional" natural gas deposits, including shale gas, could increase domestic production. The U.S. Energy Information Administration has assessed the EU's technically recoverable shale gas resources at almost 14 trillion cubic meters, more than 35 years of supply at current consumption levels.86 Multiple member states contain shale gas resources.

However, energy companies seeking to advance shale gas development in the EU have faced considerable public and political opposition to hydraulic fracturing (often referred to as fracking), a method of extracting natural gas and oil from tight formations such as shale. In some countries, such as the Netherlands and Germany, opposition is rooted in long-standing environmental concerns. In other countries—such as Bulgaria and Romania, which currently receive most of their gas imports from Russia—observers assert that Russia may have provided financing and other support to protest groups in hopes of deterring local shale gas development.87

Some governments have passed laws or other measures to restrict fracking. Germany, France, Bulgaria, and Ireland have banned fracking, and the Netherlands enacted a memorandum in 2013 banning the practice until 2020. Other EU member states do not have laws preventing fracking, but the consensus within the EU is that this method of extraction is not viable due to its overwhelming political unpopularity. As a result, international energy companies have halted their exploration and development of shale gas in the EU.88

North Sea Future

Although North Sea gas production has passed its peak, some analysts contend that production may continue longer than current estimates suggest.89 In January 2019, the French company TOTAL and China National Offshore Oil Corporation (CNOOC) announced they had discovered approximately 1,400 BCM of natural gas off the coast of Scotland (part of the United Kingdom, then an EU member). This is the largest gas discovery in the North Sea since 2008. Although the discovery sites are not far from existing infrastructure, further analysis is needed for a reliable timeline for developing and transporting the gas to markets.90 Some Scottish environmental groups have expressed opposition to developing the field.

North Africa: Diminished but Consistent Suppliers

The main natural gas producers and exporters in North Africa are Algeria, Egypt, and Libya.91 In 2018, Algeria was the largest producer and exporter in the region, a position it has held for more than a decade (see Table 3). Each of these states has LNG export infrastructure, and Libya and Algeria also can access EU markets by pipeline. Historical relationships, proximity, price, and import capacity dictate where and at what volumes North African countries can export to the EU. At the same time, multiple factors, including production disruptions, growing domestic consumption, and government intervention, hinder these countries from becoming larger natural gas suppliers to the EU, despite having the resources to increase production and exports. Ongoing security concerns and a difficult business environment have slowed foreign investment and natural gas exploration, especially in Libya.

|

Reserves |

Production |

Exports to EU |

|

|

Algeria |

4,300 |

92.3 |

42.2 |

|

Egypt |

2,100 |

58.6 |

0.8 |

|

Libya |

1,400 |

9.8 |

4.3 |

|

TOTAL |

7,800 |

160.7 |

47.3 |

Source: BP Statistical Review of World Energy 2019.

Notes: Morocco and Tunisia also produce natural gas, but they do not export to the EU or other countries. Algeria's reserves were downgraded by Cedigaz in 2015, after a presidential document was accidentally released. Other organizations, such as the U.S. Energy Information Administration, do not reflect the lower amount as the Algerian government refutes the downgrade.

Qatar and Other Liquefied Natural Gas Exporters

One of the most important developments in energy for the EU has been the growing availability of LNG. LNG imports represent 14% of EU natural gas imports (see Figure 2), a proportion that has remained steady since 2010. Qatar, the EU's fourth largest natural gas supplier, provides the majority of the EU's total LNG imports.92 Qatar has been exporting LNG to the EU since 1997, when its first shipments were delivered to Spain. The construction of new LNG terminals in the EU has allowed for increased imports. In 2018, Qatar exported about 19.5 BCM to Belgium, France, Greece, Italy, the Netherlands, Poland, Portugal, Spain, and the United Kingdom.93 In the last three years, Qatar has signed new LNG contracts with France, the Netherlands, Poland, and the United Kingdom.

The EU imports smaller amounts of LNG from multiple countries in Sub-Saharan Africa, the Caribbean, and South America. These countries—Angola, Brazil, Dominican Republic, Equatorial Guiana, Nigeria, Peru, and Trinidad and Tobago—mainly export to Western European countries with established LNG infrastructure. Combined, these small LNG imports by the EU are up from 4.5 BCM to 7.9 BCM, a 76% increase, from 2014 to 2018.

Rising U.S. LNG

Large-scale U.S. LNG exports from the lower 48 states began in 2016. Since then, exports have increased almost six times and have gone to 35 countries. In the EU, U.S. cargoes have been received by Belgium, Bulgaria (via Greece), France, Greece, Italy, Lithuania, Malta, Netherlands, Poland, Portugal, Spain, and the United Kingdom. Turkey also has received a significant amount of U.S. LNG exports.

As of February 2020, the United States has six operating facilities, including a small export terminal in Alaska, with a total capacity of 76 BCM. An additional 83 BCM is currently under construction. If all these projects become operational, the United States will have the most LNG export capacity in the world, surpassing Australia and Qatar. The United States also has many other projects that have been approved but have not begun construction.

Some European officials have voiced suspicion that U.S. opposition to the Nord Stream 2 pipeline is rooted primarily in a desire to increase U.S. LNG exports to Europe. Usually, LNG, including U.S. LNG, is more expensive than gas from Russia and cannot replace all of Russia's imports. The CRIEEA legislation, in a section that addresses Ukrainian energy security (P.L. 115-44, Section 257), states "that the United States Government should prioritize the export of United States energy resources in order to create American jobs, help United States allies and partners, and strengthen United States foreign policy."

EU LNG Importers

As shown in Table 4, the EU has had more than enough LNG import capacity to meet its annual needs, but import terminals operate at near full capacity during the winter.94 Additional LNG import terminals in certain locations may help countries diversify suppliers and enhance overall EU energy security, particularly if infrastructure interconnectivity is improved.

In 2018, Spain led the EU in LNG imports, followed by France, Italy, and the United Kingdom.95 As seen in Table 4, Spain has the most LNG import terminals and the largest capacity. However, it only utilizes 22% of its 67 BCM capacity, less than the EU average. Spain has invested significantly in its LNG infrastructure, and increased utilization may benefit Spanish and EU markets. However, infrastructure to transit imports into Spain to other countries is lacking.

|

Number of Facilities |

LNG Capacity |

LNG Imports |

Imports as a Percentage of Capacity |

|

|

Belgium |

1 |

9.00 |

2.91 |

32% |

|

Finland |

1 |

0.10 |

0.07 |

11% |

|

France |

4 |

35.00 |

12.59 |

36% |

|

Greece |

1 |

5.00 |

0.94 |

21% |

|

Italy |

3 |

15.00 |

8.23 |

55% |

|

Lithuania |

1 |

4.00 |

0.91 |

23% |

|

Malta |

1 |

0.70 |

0.50 |

83% |

|

Netherlands |

1 |

12.00 |

3.20 |

27% |

|

Poland |

1 |

5.00 |

2.58 |

52% |

|

Portugal |

1 |

8.00 |

3.84 |

48% |

|

Spain |

6 |

67.00 |

14.68 |

22% |

|

Sweden |

2 |

1.00 |

0.33 |

20% |

|

United Kingdom |

3 |

48.00 |

6.74 |

14% |

|

TOTAL |

27 |

212.9 |

57.52 |

27% |

Source: Cedigaz, a subscription service statistical database, http://www.cedigaz.org, and Gas Infrastructure Europe, https://www.gie.eu/index.php/gie-publications/maps-data/lng-map.

Azerbaijan and the Southern Gas Corridor

A stated priority for the EU, supported by the United States, continues to be the development of a natural gas pipeline system from the Caspian Sea region that does not pass through Russia or Iran or rely on Russian or Iranian natural gas. The so-called Southern Gas Corridor has evolved to include three connecting pipelines with an annual capacity of 16 BCM.96 These pipelines are the South Caucasus Pipeline (SCP) running from Azerbaijan to Turkey via Georgia;97 the Trans-Anatolian Pipeline (TANAP) through Turkey; and the Trans Adriatic Pipeline (TAP), under construction from Turkey to Italy, via Greece and Albania.98

Turkey has contracted for 6 BCM from TANAP, and 10 BCM is to continue on to Italy. The first delivery of Azerbaijani gas through TANAP to Turkey was in June 2018. After a new Italian government came to power in 2018, it announced its intention to review, and potentially block or delay, the Italian segment of TAP, but it ultimately allowed the project to proceed.99 TAP is scheduled to come online in the second half of 2020.

Although construction of the TANAP/TAP pipeline network further diversifies imports of natural gas for EU member states, the initial export volume of 10 BCM from Azerbaijan to Italy is not expected to significantly alter EU dependence on Russian natural gas. Although TAP's capacity may be increased to more than 20 BCM, Azerbaijani gas supplies are limited. In 2018, Azerbaijan produced 17.8 BCM of marketed gas. A second phase of gas production in Azerbaijan's Shah Deniz field is expected to add up to 16 BCM per year.100 Azerbaijan's domestic consumption has been stable at between 8 and 11 BCM a year in the last decade.101

Azerbaijan's Shah Deniz field is operated by BP, which owns the largest share (28.8%) of the joint venture that developed the field, which was discovered in 1999. The other members of the Shah Deniz joint venture are Azerbaijan's state energy company SOCAR (16.7%), the Turkish Petroleum Corporation (BOTAŞ) (19%), Petronas from Malaysia (15.5%), Lukoil from Russia (10%), and NaftIran Intertrade Company from Iran (NICO, 10%).102

In its present form, the Southern Gas Corridor is a more modest project than its proponents originally desired. The EU's flagship natural gas initiative was once the proposed Nabucco natural gas pipeline, which was to transport over 30 BCM of Caspian (and potentially Middle Eastern) natural gas per year to the EU via Turkey. However, the Nabucco project was beset by lengthy delays and questions about its economic viability. A key concern was whether Azerbaijan's production capacity alone was sufficient to justify the pipeline. Frustrated by the slow progress of Nabucco, Azerbaijan and Turkey united in 2011 to announce the launch of TANAP, which is jointly owned by SOCAR, BOTAŞ, and BP.

Central Asia and the Caspian Sea

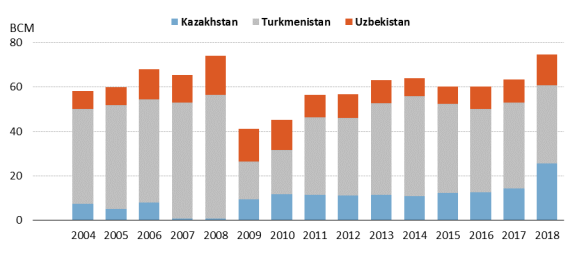

In Central Asia, Kazakhstan, Uzbekistan, and Turkmenistan produce and collectively export large volumes of natural gas (see Table 5 and Figure 6). Many in the United States and the EU have long viewed Central Asian exports as a potential means for EU member states to reduce dependence on Russian gas. However, geography, Russian pressure, and domestic policies have prevented much Central Asian gas trade with EU member states.103 Russia does not allow natural gas to freely move across its pipeline network. Russia has used Central Asian natural gas to meet contract obligations as needed but otherwise its Central Asian neighbors have limited access to the Russian pipeline network.

The majority of Central Asian gas production is consumed domestically.104 As is frequently the case in gas-rich countries, countries in the region often use natural gas inefficiently. For example, Turkmenistan consumes 46.2% of its 80.5 BCM production, an extremely high volume of gas per capita, especially given Turkmenistan's relatively low level of industrialization.

Some experts believe that completion of the TANAP/TAP infrastructure will improve the prospects for the construction of a Trans-Caspian pipeline under the Caspian Sea that could feed Central Asian natural gas into the TANAP/TAP pipeline network. At present, the majority of gas exports from Kazakhstan go to Russia, and most of Turkmenistan and Uzbekistan's gas exports go to China. All three countries export gas to China via the Central Asia-China gas pipeline, which originates in Turkmenistan and crosses Uzbekistan and Kazakhstan.

In August 2018, the five Caspian littoral states—Azerbaijan, Iran, Kazakhstan, Russia, and Turkmenistan—met at the Fifth Caspian Summit and signed the Convention on the Legal Status of the Caspian Sea, a document aimed at regulating legal issues pertaining to the Caspian. The convention stipulates that sovereign waters stretch 15 nautical miles from each border, with exclusive fishing rights extending a further 10 nautical miles. The agreement also bars Caspian nations from allowing any foreign military presence on the sea.

|

Reserves |

Production |

Exports to EU |

|

|

Kazakhstan |

1,000 |

24.5 |

0 |

|

Turkmenistan |

19,500 |

61.5 |

0 |

|

Uzbekistan |

1,200 |

56.6 |

0 |

|

TOTAL |

21,700 |

142.6 |

0 |

Source: BP Statistical Review of World Energy 2019.

For the success of this project, this convention is a long-awaited and necessary step towards the construction of a Trans-Caspian pipeline and, as such, represents an important milestone. However, the convention leaves the key question of delimiting national sectors in the hydrocarbon-rich subsoil seabed unresolved. Its near-term impact on the energy sector, thus, will likely be limited.105

|

Figure 6. Central Asian Natural Gas Exports 2004-2018 |

|

|

Source: Cedigaz, a subscription service statistical database, http://www.cedigaz.org. Notes: The decline between 2008 and 2009 is attributed to the financial crisis. Units = billion cubic meters (BCM). |

Eastern Mediterranean and the Arctic: On the Horizon106