Introduction

This report provides an overview of FY2019 appropriations actions for accounts traditionally funded in the appropriations bill for the Departments of Labor, Health and Human Services, and Education, and Related Agencies (LHHS). This bill provides discretionary and mandatory appropriations to three federal departments: the Department of Labor (DOL), the Department of Health and Human Services (HHS), and the Department of Education (ED). In addition, the bill provides annual appropriations for more than a dozen related agencies, including the Social Security Administration (SSA).

Discretionary funds represent less than one-fifth of the total funds appropriated in the LHHS bill. Nevertheless, the LHHS bill is typically the largest single source of discretionary funds for domestic nondefense federal programs among the various appropriations bills. (The Department of Defense bill is the largest source of discretionary funds among all federal programs.) The bulk of this report is focused on discretionary appropriations because these funds receive the most attention during the appropriations process.

The LHHS bill typically is one of the more controversial of the regular appropriations bills because of the size of its funding total and the scope of its programs, as well as various related social policy issues addressed in the bill, such as restrictions on the use of federal funds for abortion and for research on human embryos and stem cells.

Congressional clients may consult the LHHS experts list in CRS Report R42638, Appropriations: CRS Experts, for information on which analysts to contact at the Congressional Research Service (CRS) with questions on specific agencies and programs funded in the LHHS bill.

Report Roadmap and Useful Terminology

This report is divided into several sections. The opening section provides an explanation of the scope of the LHHS bill (and hence, the scope of this report) and an introduction to important terminology and concepts that carry throughout the report. Next is a series of sections describing major congressional actions on FY2019 appropriations and (for context) a review of the conclusion of the FY2018 appropriations process. This is followed by a high-level summary and analysis of enacted and proposed appropriations for FY2019, compared to FY2018 funding levels. The body of the report concludes with overview sections for each of the major titles of the bill: DOL, HHS, ED, and Related Agencies. These sections provide selected highlights from FY2019 enacted and proposed funding levels compared to FY2018. (Note that the distribution of funds is sometimes illustrated by figures, which in all cases are based on the FY2019 enacted version of the LHHS bill.1)

Finally, Appendix A provides a summary of budget enforcement activities for FY2019. This includes information on the Budget Control Act of 2011 (BCA; P.L. 112-25) and sequestration, budget enforcement in the absence of an FY2019 budget resolution, provisional subcommittee spending allocations, and current-year spending levels. This is followed by Appendix B, which provides an overview of the LHHS-related floor amendments that were offered in the Senate during its consideration of H.R. 6157, an appropriations measure that was amended to contain LHHS appropriations for FY2019.

Scope of the Report

In general, this report is focused strictly on appropriations to agencies and accounts that are subject to the jurisdiction of the Labor, Health and Human Services, Education, and Related Agencies subcommittees of the House and Senate appropriations committees (i.e., accounts traditionally funded via the LHHS bill). Department "totals" provided in this report do not include funding for accounts or agencies that are traditionally funded by appropriations bills under the jurisdiction of other subcommittees.

The LHHS bill provides appropriations for the following federal departments and agencies:

- the Department of Labor;

- most agencies at the Department of Health and Human Services, except for the Food and Drug Administration (funded through the Agriculture appropriations bill), the Indian Health Service (funded through the Interior-Environment appropriations bill), and the Agency for Toxic Substances and Disease Registry (also funded through the Interior-Environment appropriations bill);

- the Department of Education; and

- more than a dozen related agencies, including the Social Security Administration, the Corporation for National and Community Service, the Corporation for Public Broadcasting, the Institute of Museum and Library Services, the National Labor Relations Board, and the Railroad Retirement Board.

Note also that funding totals displayed in this report do not reflect amounts provided outside of the annual appropriations process. Certain direct spending programs, such as Social Security and parts of Medicare, receive funding directly from their authorizing statutes; such funds are not reflected in the totals provided in this report because they are not provided through the annual appropriations process (see related discussion in the "Important Budget Concepts" section).

Important Budget Concepts

Mandatory vs. Discretionary Budget Authority2

The LHHS bill includes both discretionary and mandatory budget authority. While all discretionary spending is subject to the annual appropriations process, only a portion of mandatory spending is provided in appropriations measures.

Mandatory programs funded through the annual appropriations process are commonly referred to as appropriated entitlements. In general, appropriators have little control over the amounts provided for appropriated entitlements; rather, the authorizing statute controls the program parameters (e.g., eligibility rules, benefit levels) that entitle certain recipients to payments. If Congress does not appropriate the money necessary to meet these commitments, entitled recipients (e.g., individuals, states, or other entities) may have legal recourse.3

Most mandatory spending is not provided through the annual appropriations process, but rather through budget authority provided by the program's authorizing statute (e.g., Social Security benefits payments). The funding amounts in this report do not include budget authority provided outside of the appropriations process. Instead, the amounts reflect only those funds, discretionary and mandatory, that are provided through appropriations acts.

Note that, as displayed in this report, mandatory amounts for the Trump Administration's budget submission reflect current-law (or current services) estimates; they generally do not include the President's proposed changes to a mandatory spending program's authorizing statute that might affect total spending. (In general, such proposals are excluded from this report, as they typically would be enacted in authorizing legislation.)

Note also that the report focuses most closely on discretionary funding. This is because discretionary funding receives the bulk of attention during the appropriations process. (As noted earlier, although the LHHS bill includes more mandatory funding than discretionary funding, the appropriators generally have less flexibility in adjusting mandatory funding levels than discretionary funding levels.)

Mandatory and discretionary spending is subject to budget enforcement processes that include sequestration. In general, sequestration involves largely across-the-board reductions that are made to certain categories of discretionary or mandatory spending. However, the conditions that trigger sequestration, and how it is carried out, differ for each type of spending. This is discussed further in Appendix A.

Total Budget Authority Provided in the Bill vs. Total Budget Authority Available in the Fiscal Year

Budget authority is the amount of money a federal agency is legally authorized to commit or spend. Appropriations bills may include budget authority that becomes available in the current fiscal year, in future fiscal years, or some combination. Amounts that become available in future fiscal years are typically referred to as advance appropriations.

Unless otherwise specified, appropriations levels displayed in this report refer to the total amount of budget authority provided in an appropriations bill (i.e., "total in the bill"), regardless of the year in which the funding becomes available.4 In some cases, the report breaks out "current-year" appropriations (i.e., the amount of budget authority available for obligation in a given fiscal year, regardless of the year in which it was first appropriated).5

As the annual appropriations process unfolds, the amount of current-year budget authority is measured against 302(b) allocation ceilings (budget enforcement caps for appropriations subcommittees that traditionally emerge following the budget resolution process). The process of measuring appropriations against these spending ceilings takes into account scorekeeping adjustments, which are made by the Congressional Budget Office (CBO) to reflect conventions and special instructions of Congress.6 Unless otherwise specified, appropriations levels displayed in this report do not reflect additional scorekeeping adjustments.

Status of FY2019 LHHS Appropriations

Table 1 provides a timeline of major legislative actions for full-year LHHS proposals, which are discussed in greater detail below.

|

Subcommittee Approval |

Full Committee Approval |

Resolution of House and Senate Differences |

|||||||

|

House |

Senate |

House |

Senate |

House Initial Passage |

Senate Initial Passage |

Conf. Report |

House Final Passage |

Senate Final Passage |

Public Law |

|

6/15/18 voice vote |

6/26/18 voice |

7/11/18 30-22 |

6/28/18 30-1 |

H.R. 6157, Division B 8/23/18 85-7 |

H.R. 6157, Division B 9/26/18 361-61 |

H.R. 6157, Division B 9/18/18 93-7 |

9/28/18 |

||

Source: CRS Appropriations Status Table.

FY2019 Supplemental Appropriations for the Southern Border

On July 1, the President signed into law P.L. 116-26, an FY2019 supplemental appropriations act focused primarily on humanitarian assistance and security needs at the southern border. The bill was passed by the House on June 27 and by the Senate on June 26. (An earlier version of the bill had passed the House on June 25. A related bill, S. 1900, had been reported by the Senate Appropriations Committee on June 19; this bill was substantially similar to the final version of P.L. 116-26.)

As enacted, the FY2019 border supplemental contained nearly $2.9 billion in emergency-designated LHHS appropriations for the Refugee and Entrant Assistance account at HHS. These funds were primarily intended to support the Unaccompanied Alien Children (UAC) program, which provides for the shelter, care, and placement of unaccompanied alien children who have been apprehended in the United States. According to a letter to Congress from the Office of Management and Budget (OMB), as of May 1 the number of apprehensions referred to HHS had increased by almost 50% from the prior year.7 In this same letter, OMB requested about $2.9 billion in supplemental funds for the UAC program, noting that these funds would provide "critical child welfare services and high-quality shelter care." The letter estimated that these funds would allow HHS to increase shelter capacity to approximately 23,600 beds.

Of the $2.9 billion appropriated to the UAC account, some funds were set aside for designated activities or purposes, such as state-licensed shelters (not less than $866 million); postrelease services, child advocates, and legal services (not less than $100 million); additional federal field specialists and increased case management and coordination services intended to place children with sponsors more expeditiously and reduce the length of stay in HHS custody (not less than $8 million); project officers/program staff and the development of a discharge rate improvement plan (not less than $1 million); and oversight activities conducted by the HHS Office of the Inspector General ($5 million).

In addition to these reservations, the bill also placed a number of conditions on the use of the supplemental funds. For instance, the bill

- directed HHS to prioritize community-based residential care, state-licensed facilities, hard-sided dormitories, and shelter care other than large-scale institutional facilities (§401);

- prohibited funds from being used for unlicensed facilities, except in limited circumstances (e.g., on a temporary basis due to a large influx of children) when specified conditions are met (e.g., comprehensive monitoring for an unlicensed facility operating for more than three consecutive months) (§404);

- required HHS to ensure, when feasible, that certain types of children (e.g., children under age 13, children with special needs, pregnant or parenting teens) are not placed in unlicensed facilities (§406);

- required HHS to reverse any reprogramming within the account that had been carried out pursuant to a notification submitted to the appropriations committees on May 16 (proviso within UAC appropriation);

- prohibited funds from being used to prevent a Member of Congress from visiting a UAC facility for oversight purposes (§407);

- prohibited funds from being used by the Department of Homeland Security (DHS) to detain or remove sponsors (or potential sponsors) of unaccompanied children based on information provided by HHS as part of the sponsor's application, except when specified criteria are met (§409); and

- prohibited funds from being used to reverse or change certain operational directives previously issued by HHS, except in limited circumstances (§403).

The bill also included a number of notification and reporting requirements associated with these funds. For instance, the bill required HHS to

- notify the appropriations committees within 72 hours of conducting a formal assessment of a facility for possible lease/acquisition and within seven days of any acquisition/lease of real property (proviso within UAC appropriation);

- submit to the appropriations committees a discharge rate improvement plan within 120 days of enactment (proviso within UAC appropriation);

- provide specific information to the appropriations committees at least 15 days before opening an unlicensed facility and provide the committees with monthly reports on the children placed at such facilities (§405);

- submit to the appropriations committees (and make public) a monthly report on the number and ages of unaccompanied alien children transferred into HHS care after being separated from parents or legal guardians by DHS, along with the reasons for the separations (§408); and

- submit to the appropriations committees a detailed spending plan of anticipated uses of funds within 30 days of enactment (§410).

FY2019 Supplemental Appropriations for Disaster Relief

Over the course of FY2019, the 115th and 116th Congresses considered supplemental appropriations to several federal departments and agencies for expenses related to various recent wildfires, hurricanes, volcanic eruptions, earthquakes, typhoons, and other natural disasters or emergencies (e.g., H.R. 695 in the 115th Congress; H.R. 268, S.Amdt. 201 to H.R. 268, and H.R. 2157 in the 116th Congress). Each of these bills included appropriations for several accounts typically funded in the LHHS bill.

Ultimately, on June 6, the President signed into law P.L. 116-20, a supplemental appropriations act for FY2019. The bill was passed by the House on June 3 and by the Senate on May 23. (An earlier version of the bill had passed the House on May 10.)

As enacted, the bill included roughly $611 million in emergency-designated LHHS appropriations for accounts at DOL, HHS, and ED. With limited exceptions, the bill explicitly directed the LHHS funds toward necessary expenses directly related to Hurricane Florence, Hurricane Michael, Typhoon Mangkhut, Super Typhoon Yutu, wildfires and earthquakes occurring in calendar year 2018, and tornadoes and floods occurring in calendar year 2019.

The FY2019 supplemental provided the following definite LHHS appropriations:

- $50 million for the dislocated worker assistance national reserve at DOL, of which up to $1 million may be transferred to other DOL accounts for reconstruction and recovery needs and up to $500,000 is to be transferred to the DOL Office of the Inspector General for oversight activities.

- $30 million to the Child Care and Development Block Grant at HHS to support the costs of renovating, repairing, or rebuilding child care facilities.

- $90 million to the Children and Families Services Programs account at HHS for necessary expenses related to the disasters and emergencies referenced by the law. Of the total, $55 million is directed to Head Start programs, $25 million is directed to the Community Services Block Grant, $5 million is directed to the Stephanie Tubbs Jones Child Welfare Services program, and up to $5 million may be used for federal administrative expenses.

- $201 million for the Public Health and Social Services Emergency Fund at HHS for necessary expenses directly related to the disasters and emergencies referenced by the law. Of this amount, HHS is directed to transfer

- not less than $100 million to the Substance Abuse and Mental Health Services Administration (SAMHSA) Health Surveillance and Program Support account for grants, contracts, and cooperative agreements for behavioral health treatment, treatment of substance use disorders, crisis counseling and related helplines, and other similar programs to support impacted individuals;

- $80 million to the Health Resources and Services Administration (HRSA) federal health centers program for alteration, renovation, construction, equipment, and other capital improvements to meet the needs of affected areas;

- not less than $20 million to the Centers for Disease Control and Prevention (CDC) for CDC-Wide Activities and Program Support for response, recovery, mitigation, and other expenses; and

- up to $1 million to the Office of the Inspector General for oversight activities.

- $165 million for Hurricane Education Recovery at ED to assist in meeting the educational needs of affected individuals. Of the total, $2 million is to be transferred to the Office of the Inspector General for oversight activities and up to $1 million may be used for program administration.

In addition, the supplemental provided a combination of definite and indefinite appropriations to the Medicaid program at HHS to support program costs in the Northern Mariana Islands, Guam, and American Samoa.8

FY2019 LHHS Omnibus

During the 115th Congress, on September 28, 2018, the President signed into law the Department of Defense and Labor, Health and Human Services, and Education Appropriations Act, 2019 and Continuing Appropriations Act, 2019 (H.R. 6157, P.L. 115-245). This was the first occasion since the FY1997 appropriations cycle that full-year LHHS appropriations were enacted on or before the start of the fiscal year (October 1). The House and Senate had previously agreed to resolve differences on the measure via a conference committee. (Conferees on the bill were named in the House on September 4 and in the Senate on September 6.) The conference report (H.Rept. 115-952) was adopted by the Senate on September 18, and the House on September 26.

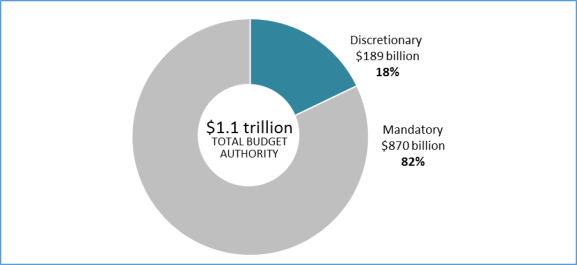

LHHS discretionary appropriations in the FY2019 omnibus totaled $189.4 billion. This amount is 1.5% more than FY2018 enacted and 8.9% more than the FY2019 President's budget request. The omnibus also provided $869.8 billion in mandatory funding, for a combined LHHS total of $1.059 trillion. (Note that these totals are based only on amounts provided by the FY2019 LHHS omnibus and do not include the supplemental funds, which were provided in addition to the annual appropriations.)

See Figure 1 for a breakdown of FY2019 discretionary and mandatory LHHS appropriations.9

|

|

Source: Amounts in this figure are generally drawn from or calculated based on data contained in the conference report (H.Rept. 115-952) on the FY2019 LHHS omnibus (P.L. 115-245). For consistency with source materials, amounts in this figure generally do not reflect mandatory spending sequestration. Notes: Details may not add to totals due to rounding. Amounts in this figure (1) reflect all budget authority appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided for agencies and accounts subject to the jurisdiction of the LHHS subcommittees of the House and Senate appropriations committees; and (4) do not include appropriations that occur outside of appropriations bills. |

Earlier Congressional Action on an LHHS Bill

FY2019 LHHS Action in the House

The House Appropriations Committee's LHHS subcommittee approved its draft bill on June 15, 2018. The full committee markup was held on July 11, 2018, and the bill was ordered to be reported that same day (30-22). The bill was subsequently reported to the House on July 23 (H.R. 6470, H.Rept. 115-862). It did not receive floor consideration in the House.

As reported by the full committee, the bill would have provided $187.2 billion in discretionary LHHS funds, a 0.3% increase from FY2018 enacted levels. This amount would have been 7.6% more than the FY2019 President's request. In addition, the House committee bill would have provided an estimated $869.8 billion in mandatory funding, for a combined total of $1.057 trillion for LHHS as a whole.

FY2019 LHHS Action in the Senate

The Senate Appropriations Committee's LHHS subcommittee approved its draft bill on June 26, 2018. The full committee markup was held on June 28, 2018. The committee approved the bill (30-1) and reported it that same day (S. 3158, S.Rept. 115-289).

Instead of taking up S. 3158, the Senate chose to consider and pass H.R. 6157 on August 23, 2018, by a vote of 85-7. The bill was amended on the Senate floor to contain FY2019 LHHS appropriations in Division B. (Division A contained the appropriations act for the Department of Defense.) The text of Division B that was considered for amendment was the same as S. 3158 (with minor alterations). During floor consideration, the Senate also adopted 31 amendments to the new LHHS division of the bill (see Appendix B for a summary of these amendments).

The Senate-passed bill would have provided $189.4 billion in discretionary LHHS funds. This would have been 1.5% more than FY2018, and 8.9% more than the FY2019 President's request. In addition, the Senate bill would have provided an estimated $869.8 billion in mandatory funding, for a combined total of $1.059 trillion for LHHS as a whole.

FY2019 President's Budget Request

On February 12, 2018, the Trump Administration released the FY2019 President's budget. The President requested $173.9 billion in discretionary funding for accounts funded by the LHHS bill, which would have been a decrease of 6.8% from FY2018 levels. In addition, the President requested $869.8 billion in annually appropriated mandatory funding, for a total of $1.044 trillion for LHHS as a whole.

Conclusion of the FY2018 Appropriations Process

On March 23, 2018, President Trump signed into law the Consolidated Appropriations Act, 2018 (H.R. 1625, P.L. 115-141). The bill was agreed to in the House on March 22 and in the Senate on March 23. The bill provided regular, full-year appropriations for all 12 annual appropriations acts, including LHHS (Division H).

LHHS discretionary appropriations in the FY2018 omnibus totaled $186.5 billion (this total does not include emergency funding provided by an earlier supplemental appropriations act for FY2018, P.L. 115-123). This amount was 7.6% more than FY2017 levels and 25.3% more than the FY2018 budget request from the Trump Administration. The omnibus also provided $817.5 billion in mandatory funding, for a combined FY2018 LHHS total of $1.004 trillion.

Summary of FY2019 LHHS Appropriations

|

Dollars and Percentages in this Report Amounts displayed in this report are typically rounded to the nearest million or billion (as labeled). Dollar and percentage changes discussed in the text are based on unrounded amounts. Unless otherwise specified, appropriations levels displayed in this report refer to the total amount of budget authority provided in an appropriations bill (i.e., "total in the bill"), regardless of the year in which the funding becomes available. Funding levels are generally drawn from (or estimated based on) data contained in the conference report (H.Rept. 115-952) on the FY2019 LHHS omnibus (P.L. 115-245). Throughout this report, the FY2019 House Appropriations Committee-reported LHHS bill and Senate Appropriations Committee-reported LHHS bill are commonly referred to as the House and Senate "committee bills." The version of H.R. 6157 that passed the Senate is referred to as "Senate-passed" or "Senate Floor." Amounts for the FY2019 Senate Floor version integrate the budgetary effects of the LHHS-related floor amendments that were adopted in the Senate during its consideration of H.R. 6157. Enacted totals for FY2018 do not include emergency-designated appropriations provided by the supplemental appropriations act in P.L. 115-123. (For informational purposes, and per the convention of source materials, FY2018 supplemental amounts are displayed separately in tables throughout the report.) Also per the convention of source materials, enacted totals for FY2019 do not include the emergency-designated supplemental appropriations provided in P.L. 116-20 or P.L. 116-26, nor are these amounts shown separately in the tables. (One exception to this rule is made in Table A-1, which includes FY2018 and FY2019 supplemental funds in the "Adjusted Appropriations" totals, as scored by the Congressional Budget Office.) For consistency with source materials, the FY2018 and FY2019 numbers in this report generally do not reflect actual or anticipated postenactment budgetary adjustments, except as noted.10 |

Table 2 displays FY2019 discretionary and mandatory LHHS budget authority provided or proposed, by bill title, along with FY2018 enacted levels. The amounts shown in this table reflect total budget authority provided in the bill (i.e., all funds appropriated in the bill, regardless of the fiscal year in which the funds become available), not total budget authority available for the current fiscal year. (For a comparable table showing current-year budget authority, see Table A-2 in Appendix A.)

Table 2. LHHS Appropriations Overview by Bill Title, FY2018-FY2019

(Total budget authority provided in the bill, in billions of dollars)

|

Bill Title |

FY2018 Enacted |

FY2019 Request |

FY2019 Senate Floor |

FY2019 |

FY2019 Enacted (P.L. 115-245) |

|

Title I: Labor |

13.8 |

12.3 |

13.6 |

13.4 |

13.6 |

|

Discretionary |

12.2 |

10.9 |

12.1 |

11.9 |

12.1 |

|

Mandatory |

1.6 |

1.4 |

1.4 |

1.4 |

1.4 |

|

Title II: HHS |

847.6 |

895.4 |

899.2 |

898.0 |

899.2 |

|

Discretionary |

88.2 |

86.7 |

90.5 |

89.3 |

90.5 |

|

Mandatory |

759.5 |

808.7 |

808.7 |

808.7 |

808.7 |

|

Title III: Education |

74.3 |

66.7 |

74.9 |

74.5 |

75.0 |

|

Discretionary |

70.9 |

63.2 |

71.4 |

71.0 |

71.4 |

|

Mandatory |

3.5 |

3.5 |

3.5 |

3.5 |

3.5 |

|

Title IV: Related Agencies |

68.3 |

69.3 |

71.5 |

71.1 |

71.5 |

|

Discretionary |

15.3 |

13.2 |

15.4 |

15.0 |

15.3 |

|

Mandatory |

53.0 |

56.2 |

56.2 |

56.2 |

56.2 |

|

Total BA in the Bill |

1,004.0 |

1,043.7 |

1,059.2 |

1,057.0 |

1,059.2 |

|

Discretionary |

186.5 |

173.9 |

189.4 |

187.2 |

189.4 |

|

Mandatory |

817.5 |

869.8 |

869.8 |

869.8 |

869.8 |

|

P.L. 115-123 (emergency) |

4.0 |

— |

— |

— |

— |

|

Memoranda: |

|||||

|

Advances for Future Years (provided in current bill)a |

183.3 |

186.1 |

186.7 |

186.7 |

186.7 |

|

Advances from Prior Years (for use in current year)a |

168.9 |

183.3 |

183.3 |

183.3 |

183.3 |

|

Additional Scorekeeping Adjustmentsb |

-7.5 |

-5.2 |

-8.2 |

-8.2 |

-9.4 |

Source: Amounts in this table are generally drawn from or calculated based on data contained in the conference report (H.Rept. 115-952) on the FY2019 LHHS omnibus (P.L. 115-245). Enacted totals for FY2018 do not include emergency-designated appropriations provided by P.L. 115-123. For consistency with source materials, amounts in this table generally do not reflect mandatory spending sequestration, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities.

Notes: BA = Budget Authority. Details may not add to totals due to rounding. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS subcommittees of the House and Senate appropriations committees; and (4) do not include appropriations that occur outside of appropriations bills. No amounts are shown for Title V, because this title consists solely of general provisions.

a. Totals in this table are based on budget authority provided in the bill (i.e., they exclude advance appropriations from prior bills and include advance appropriations from this bill made available in future years). The calculation for total budget authority available in the current year is as follows: Total BA in the Bill, minus Advances for Future Years, plus Advances from Prior Years.

b. Totals in this table have generally not been adjusted for further scorekeeping. (To adjust for scorekeeping, add this line to the total budget authority.)

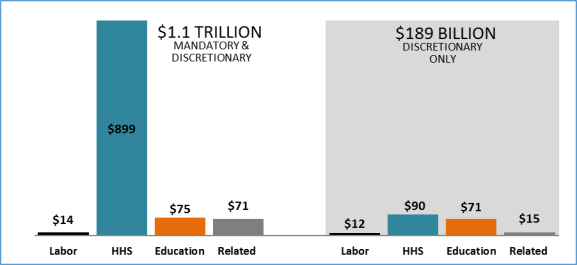

Figure 2 displays the FY2019 enacted discretionary and mandatory LHHS funding levels, by bill title. (While the dollars and percentages discussed in this section were calculated based on the FY2019 enacted amounts, they are generally also illustrative—within several percentage points—of the share of funds directed to each bill title in FY2018 and under the other FY2019 proposals.)

As this figure demonstrates, HHS accounts for the largest share of total FY2019 LHHS appropriations: $899 billion, or 84.9%. This is due to the large amount of mandatory funding included in the HHS appropriation, the majority of which is for Medicaid grants to states and payments to health care trust funds. After HHS, ED and the Related Agencies represent the next-largest shares of total LHHS funding, accounting for 7.1% and 6.7%, respectively. (The majority of the ED appropriations each year are discretionary, while the bulk of funding for the Related Agencies goes toward mandatory payments and administrative costs of the Supplemental Security Income program at the Social Security Administration.) Finally, DOL accounts for the smallest share of total LHHS funds, 1.3%.

However, the overall composition of LHHS funding is noticeably different when comparing only discretionary appropriations. HHS accounts for a comparatively smaller share of total discretionary appropriations (47.8%), while ED accounts for a relatively larger share (37.7%). Together, these two departments represent the majority (85.5%) of discretionary LHHS appropriations. DOL and the Related Agencies account for a roughly even split of the remaining 14.5% of discretionary LHHS funds.

|

|

Source: Amounts in this figure are generally drawn from or calculated based on data contained in the conference report (H.Rept. 115-952) on the FY2019 LHHS omnibus (P.L. 115-245). For consistency with source materials, amounts in this figure generally do not reflect mandatory spending sequestration, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities. Notes: Details may not add to totals due to rounding. Amounts in this figure (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided for agencies and accounts subject to the jurisdiction of the LHHS subcommittees of the House and Senate appropriations committees; and (4) do not include appropriations that occur outside of appropriations bills. |

Department of Labor (DOL)

Note that all amounts in this section are based on regular LHHS appropriations only. Amounts in this section do not include mandatory funds provided outside of the annual appropriations process (e.g., direct appropriations for Unemployment Insurance benefits payments). All amounts in this section are rounded to the nearest million or billion (as labeled). The dollar changes and percentage changes discussed in the text are based on unrounded amounts. For consistency with source materials, amounts do not reflect sequestration or reestimates of mandatory spending programs, where applicable.

About DOL

|

DOL Entities Funded via the Employment and Training Administration (ETA) Employee Benefits Security Administration (EBSA) Wage and Hour Division (WHD) Office of Federal Contract Compliance Programs (OFCCP) Office of Labor-Management Standards (OLMS) Office of Workers' Compensation Programs (OWCP) Occupational Safety and Health Administration (OSHA) Mine Safety and Health Administration (MSHA) Bureau of Labor Statistics (BLS) Office of Disability Employment Policy (ODEP) Departmental Management (DM)11 |

DOL is a federal department comprised of multiple entities that provide services related to employment and training, worker protection, income security, and contract enforcement. Annual LHHS appropriations laws direct funding to all DOL entities (see the text box).12 The DOL entities fall primarily into two main functional areas—workforce development and worker protection. First, there are several DOL entities that administer workforce employment and training programs—such as the Workforce Innovation and Opportunity Act (WIOA) state formula grant programs, Job Corps, and the Employment Service—that provide direct funding for employment activities or administration of income security programs (e.g., for the Unemployment Insurance benefits program). Also included in this area is the Veterans' Employment and Training Service (VETS), which provides employment services specifically for the veteran population. Second, there are several agencies that provide various worker protection services. For example, the Occupational Safety and Health Administration (OSHA), the Mine Safety and Health Administration (MSHA), and the Wage and Hour Division (WHD) provide different types of regulation and oversight of working conditions. DOL entities focused on worker protection provide services to ensure worker safety, adherence to wage and overtime laws, and contract compliance, among other duties. In addition to these two main functional areas, DOL's Bureau of Labor Statistics (BLS) collects data and provides analysis on the labor market and related labor issues.

FY2019 DOL Appropriations Overview

Table 3 generally displays FY2019 discretionary and mandatory DOL budget authority provided or proposed, along with FY2018 enacted levels. The FY2019 LHHS omnibus decreased discretionary appropriations for DOL by 0.8% compared to the FY2018 enacted levels. Similarly, discretionary DOL appropriations would have decreased, compared to FY2018, under the FY2019 President's budget request (-11.1%), as well as the FY2019 House committee bill (-2.4%) and Senate-passed bill (-0.8%). Of the total funding provided in the bill for DOL, roughly 89% is discretionary.

|

Funding |

FY2018 Enacted |

FY2019 Request |

FY2019 Senate Floor |

FY2019 |

FY2019 Enacted (P.L. 115-245) |

|

Discretionary |

12.2 |

10.9 |

12.1 |

11.9 |

12.1 |

|

Mandatory |

1.6 |

1.4 |

1.4 |

1.4 |

1.4 |

|

Total BA in the Bill |

13.8 |

12.3 |

13.6 |

13.4 |

13.6 |

|

P.L. 115-123 (emergency) |

0.1 |

— |

— |

— |

— |

Source: Amounts in this table are generally drawn from or calculated based on data contained in the conference report (H.Rept. 115-952) on the FY2019 LHHS omnibus (P.L. 115-245). Enacted totals for FY2018 do not include emergency-designated appropriations provided by P.L. 115-123. For consistency with source materials, amounts in this table generally do not reflect mandatory spending sequestration, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities.

Notes: BA = Budget Authority. Details may not add to totals due to rounding. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS subcommittees of the House and Senate appropriations committees; and (4) do not include appropriations that occur outside of appropriations bills.

Selected DOL Highlights

The following sections present highlights from FY2019 enacted and proposed appropriations compared to FY2018 enacted appropriations for selected DOL accounts and programs.13

Table 4 displays funding for DOL programs and activities discussed in this section.

Employment and Training Administration (ETA)

ETA administers the primary federal workforce development law, the Workforce Innovation and Opportunity Act (WIOA, P.L. 113-128). The WIOA, which replaced the Workforce Investment Act, was signed into law in July 2014 and authorizes appropriations for its programs through FY2020. WIOA's provisions went into effect in FY2015 and FY2016.

Title I of WIOA, which authorizes more than half of all funding for the programs authorized by the four titles of WIOA, includes three state formula grant programs serving Adults, Youth, and Dislocated Workers. While the FY2019 LHHS omnibus provided the same funding for the three WIOA state formula grant programs compared to FY2018, the President's budget would have reduced funding for all three of the state formula grant programs by $80 million (-2.9%), compared to FY2018 enacted levels.

The FY2019 LHHS omnibus provided $221 million for the Dislocated Workers Activities National Reserve (DWA National Reserve), which was the same level enacted in FY2018. The FY2019 President's budget and the House committee bill would have reduced funding for the DWA National Reserve by $75 million (-34.0%) and $21 million (-9.4%), respectively, while the Senate would have kept DWA National Reserve funding the same as FY2018. Finally, the FY2019 LHHS omnibus maintained a provision in that account (which had originated in the FY2018 omnibus) directing $30 million from the DWA National Reserve toward training and employment assistance for workers dislocated in both the Appalachian and lower Mississippi regions.

The FY2019 LHHS omnibus provided $160 million for the Apprenticeship Grant program, which is $15 million (+10.3%) more than the level enacted in FY2018. The FY2019 President's budget would have increased funding for the Apprenticeship Grant program by $55 million (+37.9%) compared to the FY2018 enacted level.

Finally, four ETA programs for which the FY2019 President's budget proposed no funding—the Native Americans program, the Migrant and Seasonal Farmworkers program, the Community Service Employment for Older Americans (CSEOA) program, and the Workforce Data Quality Initiative—received FY2019 appropriations at roughly the same level as FY2018.

Bureau of International Labor Affairs (ILAB)

The FY2019 LHHS omnibus provided the same funding, $86 million, for ILAB as was provided in FY2018. The Senate-passed bill would also have provided $86 million for ILAB. The FY2019 President's budget and the House committee bill each would have decreased funding by $68 million (-78.5%) for ILAB, which provides research, advocacy, technical assistance, and grants to promote workers' rights in different parts of the world. Language in the FY2019 President's budget indicated that the proposed reduction reflected a "workload decrease associated with the elimination of new grants as well as ILAB's refocusing of its efforts and resources on ensuring that U.S. trade agreements are fair for U.S. workers by monitoring and enforcing the labor provisions of Free Trade Agreements (FTAs) and trade preference programs."14

Labor-Related General Provisions

Annual LHHS appropriations acts regularly contain general provisions related to certain labor issues. This section highlights selected DOL general provisions in the FY2019 LHHS omnibus.

The FY2019 LHHS omnibus continued several provisions that have been included in at least one previous LHHS appropriations act, including provisions that

- direct the Secretary of Labor to accept private wage surveys as part of the process of determining prevailing wages in the H-2B program, even in instances in which relevant wage data are available from the Bureau of Labor Statistics (included since FY2016);15

- exempt certain insurance claims adjusters from overtime protection for two years following a "major disaster" (included since FY2016);16

- authorize the Secretary of Labor to provide up to $2 million in "excess personal property" to apprenticeship programs to assist training apprentices (included since FY2018);17

- authorize the Secretary of Labor to employ law enforcement officers or special agents to provide protection to the Secretary of Labor and certain other employees and family members at public events and in situations in which there is a "unique and articulable" threat of physical harm (included since FY2018);18 and

- authorize the Secretary of Labor to dispose of or divest "by any means the Secretary determines appropriate" all or part of the real property on which the Treasure Island Job Corps Center is located (included since FY2018).19

|

Agency or Selected Program |

FY2018 Enacted |

FY2019 Request |

FY2019 Senate Floor |

FY2019 |

FY2019 Enacted (P.L. 115-245) |

|

ETA—Mandatorya |

790 |

790 |

790 |

790 |

790 |

|

ETA—Discretionary |

9,228 |

7,997 |

9,118 |

9,012 |

9,116 |

|

Discretionary ETA Programs: |

|||||

|

Training and Employment Services: |

3,486 |

3,221 |

3,501 |

3,474 |

3,503 |

|

State Formula Grants: |

2,790 |

2,710 |

2,790 |

2,790 |

2,790 |

|

Adult Activities Grants to States |

846 |

816 |

846 |

846 |

846 |

|

Youth Activities Grants to States |

903 |

873 |

903 |

903 |

903 |

|

Dislocated Worker Activities (DWA) Grants to States |

1,041 |

1,021 |

1,041 |

1,041 |

1,041 |

|

National Activities: |

696 |

511 |

711 |

685 |

713 |

|

DWA National Reserve |

221 |

146 |

221 |

200 |

221 |

|

Native Americans |

54 |

0 |

54 |

55 |

55 |

|

Migrant and Seasonal Farmworkers |

88 |

0 |

88 |

88 |

89 |

|

YouthBuild |

90 |

85 |

90 |

93 |

90 |

|

Technical Assistance |

0 |

2 |

0 |

0 |

0 |

|

Reintegration of Ex-Offenders |

93 |

78 |

93 |

93 |

93 |

|

Workforce Data Quality Initiative |

6 |

0 |

6 |

6 |

6 |

|

Apprenticeship Grants |

145 |

200 |

160 |

150 |

160 |

|

Job Corps |

1,719 |

1,297 |

1,719 |

1,719 |

1,719 |

|

Community Service Employment for Older Americans |

400 |

0 |

400 |

400 |

400 |

|

State Unemployment Insurance and Employment Service Operations (SUI/ESO): |

3,465 |

3,325 |

3,339 |

3,260 |

3,336 |

|

Unemployment Compensation |

2,653 |

2,505 |

2,528 |

2,530 |

2,528 |

|

Employment Service |

686 |

691 |

686 |

606 |

683 |

|

Foreign Labor Certification |

62 |

62 |

62 |

62 |

62 |

|

One-Stop Career Centers |

63 |

67 |

63 |

63 |

63 |

|

ETA Program Administration |

159 |

154 |

159 |

159 |

159 |

|

Employee Benefits Security Administration |

181 |

190 |

187 |

181 |

181 |

|

Pension Benefit Guaranty Corp, (PBGC) program level (non-add)b |

(424) |

(445) |

(445) |

(445) |

(445) |

|

Wage and Hour Division |

228 |

230 |

229 |

226 |

229 |

|

Office of Labor-Management Standards |

40 |

47 |

40 |

42 |

41 |

|

Office of Federal Contract Compliance Programs |

103 |

91 |

103 |

99 |

103 |

|

Office of Workers' Compensation Programs—Mandatoryc |

766 |

642 |

642 |

642 |

642 |

|

Office of Workers' Compensation Programs—Discretionary |

118 |

115 |

118 |

118 |

118 |

|

Occupational Safety & Health Administration |

553 |

549 |

557 |

545 |

558 |

|

Mine Safety & Health Administration |

374 |

376 |

374 |

368 |

374 |

|

Bureau of Labor Statistics |

612 |

609 |

615 |

612 |

615 |

|

Office of Disability Employment Policy |

38 |

27 |

38 |

38 |

38 |

|

Departmental Management |

743 |

630 |

748 |

688 |

751 |

|

Salaries and Expenses |

338 |

261 |

338 |

270 |

338 |

|

International Labor Affairs (non-addd) |

86 |

19 |

86 |

19 |

86 |

|

Veterans Employment and Training |

295 |

282 |

300 |

300 |

300 |

|

IT Modernization |

21 |

0 |

21 |

29 |

23 |

|

Office of the Inspector General |

89 |

88 |

89 |

89 |

89 |

|

Total, DOL BA in the Bill |

13,773 |

12,293 |

13,557 |

13,360 |

13,555 |

|

Subtotal, Mandatory |

1,556 |

1,432 |

1,432 |

1,432 |

1,432 |

|

Subtotal, Discretionary |

12,218 |

10,861 |

12,126 |

11,929 |

12,123 |

|

P.L. 115-123 (emergency) |

130 |

- |

- |

- |

- |

|

Memoranda |

|||||

|

Total, BA Available in Fiscal Year (current year from any bill) |

13,774 |

12,369 |

13,558 |

13,561 |

13,556 |

|

Total, BA Advances for Future Years (provided in current bill) |

1,787 |

1,711 |

1,786 |

1,586 |

1,786 |

|

Total, BA Advances from Prior Years (for use in current year) |

1,788 |

1,787 |

1,787 |

1,787 |

1,787 |

Source: Amounts in this table are generally drawn from or calculated based on data contained in the conference report (H.Rept. 115-952) on the FY2019 LHHS omnibus (P.L. 115-245). Enacted totals for FY2018 do not include emergency-designated appropriations provided by P.L. 115-123. For consistency with source materials, amounts in this table generally do not reflect mandatory spending sequestration, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities.

Notes: BA = Budget Authority. Details may not add to totals due to rounding. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS subcommittees of the House and Senate appropriations committees; and (4) do not include appropriations that occur outside of appropriations bills.

a. Mandatory funding within ETA goes to Federal Unemployment Benefits and Allowances (FUBA) and Advances to the Unemployment Trust Fund (UTF), if any. FUBA funds Trade Adjustment Assistance for Workers (TAA).

b. PBGC funding is provided outside the LHHS Appropriations Act.

c. Mandatory programs in the Office of Workers' Compensation Programs include Special Benefits (comprising the Federal Employees' Compensation Benefits and the Longshore and Harbor Workers' Benefits), Special Benefits for Disabled Coal Miners, Energy Employees Occupational Illness Compensation (Administrative Expenses), and the Black Lung Disability Trust Fund.

d. The funding for International Labor Affairs is included in the Salaries and Expenses total.

Department of Health and Human Services (HHS)

Note that all amounts in this section are based on regular LHHS appropriations only; they do not include funds for HHS agencies provided through other appropriations bills (e.g., funding for the Food and Drug Administration) or outside of the annual appropriations process (e.g., direct appropriations for Medicare or mandatory funds provided by authorizing laws, such as the Patient Protection and Affordable Care Act [ACA, P.L. 111-148]).20 All amounts in this section are rounded to the nearest million or billion (as labeled). The dollar changes and percentage changes discussed in the text are based on unrounded amounts. For consistency with source materials, amounts do not reflect sequestration or reestimates of mandatory spending programs, where applicable.

About HHS

HHS is a large federal department composed of multiple agencies working to enhance the health and well-being of Americans. Annual LHHS appropriations laws direct funding to most (but not all) HHS agencies (see text box for HHS agencies supported by the LHHS bill).21 For instance, the LHHS bill directs funding to five Public Health Service (PHS) agencies: the Health Resources and Services Administration (HRSA), Centers for Disease Control and Prevention (CDC), National Institutes of Health (NIH), Substance Abuse and Mental Health Services Administration (SAMHSA), and Agency for Healthcare Research and Quality (AHRQ).22 These public health agencies support diverse missions, ranging from the provision of health care services and supports (e.g., HRSA, SAMHSA), to the advancement of health care quality and medical research (e.g., AHRQ, NIH), to the prevention and control of infectious and chronic diseases (e.g., CDC). In addition, the LHHS bill provides funding for annually appropriated components of CMS,23 which is the HHS agency responsible for the administration of Medicare, Medicaid, the State Children's Health Insurance Program (CHIP), and consumer protections and private health insurance provisions of the ACA.

The LHHS bill also provides funding for two HHS agencies focused primarily on the provision of social services: the Administration for Children and Families (ACF) and the Administration for Community Living (ACL). ACF's mission is to promote the economic and social well-being of vulnerable children, youth, families, and communities. ACL was formed with a goal of increasing access to community supports for older Americans and people with disabilities.24 Finally, the LHHS bill also provides funding for the HHS Office of the Secretary (OS), which encompasses a broad array of management, research, oversight, and emergency preparedness functions in support of the entire department.

FY2019 HHS Appropriations Overview

Table 5 displays enacted and proposed FY2019 funding levels for HHS, along with FY2018 levels. In general, discretionary funds account for about 10% of HHS appropriations in the LHHS bill. Compared to the FY2018 funding levels, the FY2019 LHHS omnibus increased HHS discretionary appropriations by 2.6%. The House committee bill would have increased HHS discretionary appropriations to a lesser degree, by 1.3%, whereas the Senate proposed a more substantial increase of 2.7%. In contrast, the President requested a 1.6% decrease in discretionary HHS funding.

|

Funding |

FY2018 Enacted |

FY2019 Request |

FY2019 Senate Floor |

FY2019 |

FY2019 Enacted (P.L. 115-245) |

|

Discretionary |

88.2 |

86.7 |

90.5 |

89.3 |

90.5 |

|

Mandatory |

759.5 |

808.7 |

808.7 |

808.7 |

808.7 |

|

Total BA in the Bill |

847.6 |

895.4 |

899.2 |

898.0 |

899.2 |

|

P.L. 115-123 (emergency) |

1.1 |

- |

- |

- |

- |

Source: Amounts in this table are generally drawn from or calculated based on data contained in the conference report (H.Rept. 115-952) on the FY2019 LHHS omnibus (P.L. 115-245). Enacted totals for FY2018 do not include emergency-designated appropriations provided by P.L. 115-123. For consistency with source materials, amounts in this table generally do not reflect mandatory spending sequestration, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities.

Notes: BA = Budget Authority. Details may not add to totals due to rounding. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS subcommittees of the House and Senate appropriations committees; and (4) do not include appropriations that occur outside of appropriations bills.

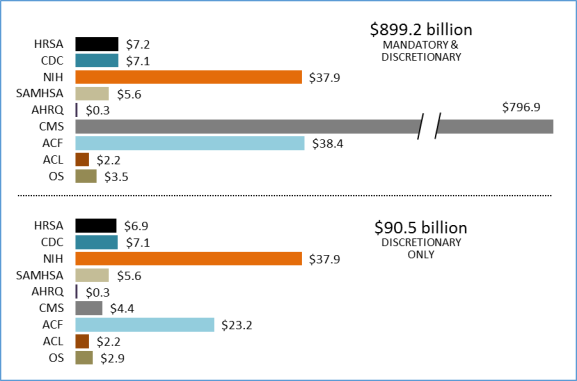

Figure 3 provides an HHS agency-level breakdown of FY2019 enacted appropriations. As this figure demonstrates, annual HHS appropriations are dominated by mandatory funding, the majority of which goes to CMS to provide Medicaid benefits and payments to health care trust funds. When taking into account both mandatory and discretionary funding, CMS accounts for $796.9 billion, which is 88.6% of all enacted appropriations for HHS. ACF and NIH account for the next-largest shares of total HHS appropriations, receiving about 4.2% apiece.

By contrast, when looking exclusively at discretionary appropriations, funding for CMS constitutes about 4.9% of FY2019 enacted HHS appropriations. Instead, the bulk of discretionary appropriations went to the PHS agencies, which account for 63.5% of discretionary appropriations provided for HHS.25 NIH typically receives the largest share of all discretionary funding among HHS agencies (41.9% in FY2019), with ACF accounting for the second-largest share (25.6% in FY2019).

|

|

Source: Amounts in this figure are generally drawn from or calculated based on data contained in the conference report (H.Rept. 115-952) on the FY2019 LHHS omnibus (P.L. 115-245). For consistency with source materials, amounts in this figure generally do not reflect mandatory spending sequestration, where applicable, nor do they reflect any transfers or reprogramming of funds pursuant to executive authorities. Notes: Details may not add to totals due to rounding. The bar representing the combined mandatory and discretionary total for CMS has been abbreviated due to space constraints. When taking into account both mandatory and discretionary funding, CMS receives over 20 times the funding appropriated to either ACF or NIH in the FY2019 LHHS omnibus. Amounts in this table (1) reflect all BA appropriated in the bill, regardless of the year in which funds become available (i.e., totals do not include advances from prior-year appropriations, but do include advances for subsequent years provided in this bill); (2) have generally not been adjusted to reflect scorekeeping; (3) comprise only those funds provided (or requested) for agencies and accounts subject to the jurisdiction of the LHHS subcommittees of the House and Senate appropriations committees; and (4) do not include appropriations that occur outside of appropriations bills. |

Special Public Health Funding Mechanisms

Annual appropriations for HHS public health service agencies are best understood in the context of certain HHS-specific funding mechanisms: the Public Health Service (PHS) Evaluation Set-Aside and the Prevention and Public Health Fund (PPHF). In recent years, LHHS appropriations have used these funding mechanisms to direct additional support to certain programs and activities.

Public Health Service Evaluation Tap

The PHS Evaluation Set-Aside, also known as the PHS Evaluation Tap, is a unique feature of HHS appropriations. It is authorized by Section 241 of the Public Health Service Act (PHSA), and allows the Secretary of HHS, with the approval of appropriators, to redistribute a portion of eligible PHS agency appropriations across HHS for program evaluation purposes.

The PHSA limits the set-aside to not less than 0.2% and not more than 1% of eligible program appropriations. However, LHHS appropriations acts have commonly established a higher maximum percentage for the set-aside and have distributed specific amounts of "tap" funding to selected HHS programs. Since FY2010, and including in FY2019, this higher maximum set-aside level has been 2.5% of eligible appropriations.26 (While the House committee bill would also have maintained the set-aside at 2.5%, the Senate-passed bill and the President's budget each proposed to increase the set-aside to 2.6% and 2.9%, respectively.)

|

Display of Evaluation Tap Transfers Readers should note that, by convention, tables in this report show only the amount of PHS Evaluation Tap funds received by an agency (i.e., tables do not subtract the amount of the evaluation tap from donor agencies' appropriations). That is to say, tap amounts shown in the following tables are in addition to amounts shown for budget authority, but the amounts shown for budget authority have not been adjusted to reflect potential "transfer-out" of funds to the tap. |

Before FY2015, the PHS tap traditionally provided more than a dozen HHS programs with funding beyond their annual appropriations and, in some cases, was the sole source of funding for a program or activity. However, since FY2015 and including in FY2019, LHHS appropriations laws have directed tap funds to a smaller number of programs or activities within three HHS agencies (NIH, SAMHSA, and OS) and have not provided any tap transfers to AHRQ, CDC, and HRSA. This has been particularly notable for AHRQ, which had been funded primarily through tap transfers from FY2003 to FY2014, but has received discretionary appropriations since then.27 The House committee bill and the Senate-passed bill generally would have maintained the current distributional practice for FY2019. However, the President's budget proposed to expand the activities and agencies funded by the PHS tap to include the Public Health Scientific Services at the CDC, while simultaneously proposing to eliminate tap transfers to some other activities.

Since FY2015, LHHS appropriations laws have directed the largest share of tap transfers to NIH.28 The FY2019 omnibus provided $1.1 billion in tap transfers to NIH, a $224 million (+24.3%) increase over the FY2018 level. The FY2019 House committee bill proposed that the NIH transfers be continued at FY2018 levels ($923 million), whereas the Senate-passed bill would have increased the transfer by $95 million (+10.3%). In contrast, the President's request proposed that the transfer be reduced by $182 million (-19.7%).

Prevention and Public Health Fund

The ACA both authorized and appropriated mandatory funding to three funds to support programs and activities within the PHS agencies.29 One of these, the Prevention and Public Health Fund (PPHF, ACA §4002, as amended), was given a permanent, annual appropriation that was intended to provide support each year to prevention, wellness, and related public health programs funded through HHS accounts.

The ACA had appropriated $2 billion in mandatory funds to the PPHF for FY2019, but this amount has been reduced by subsequent laws that decreased PPHF funding for FY2019 and other fiscal years. Under current law, the FY2019 appropriation was $900 million.30 In addition, this appropriation was subject to a 6.2% reduction due to sequestration of nonexempt mandatory spending. (For more information on sequestration, see the budget enforcement discussion in Appendix A.) After sequestration, the total PPHF appropriation available for FY2019 was $844 million, an increase of $4 million relative to FY2018. Of this amount, the LHHS omnibus allocated $805 million to CDC, $12 million to SAMHSA, and $28 million to ACL.31

|

Display of PPHF Transfers Readers should note that the PPHF transfer amounts displayed in the HHS tables in this report are in addition to amounts shown for budget authority provided in the bill. For consistency with source materials, the amounts shown for PPHF transfers in these tables reflect the estimated effects of mandatory spending sequestration; this is not the case for other mandatory spending shown in this report (also for consistency with source materials). |

PPHF funds are intended to supplement (sometimes quite substantially) the funding that selected programs receive through regular appropriations. Although the PPHF authority instructs the HHS Secretary to transfer amounts from the fund to HHS agencies, since FY2014 provisions in annual appropriations acts and accompanying reports have explicitly directed the distribution of PPHF funds and prohibited the Secretary from making further transfers for those years.32

The CDC commonly receives the largest share of annual PPHF funds. The amount provided to the CDC for FY2019, $805 million, was a $4 million (+0.4%) increase relative to FY2018. The House committee bill and the Senate-passed bill each proposed increases to the CDC allocation (to $848 million and $808 million, respectively), while the President's request proposed eliminating the mandatory PPHF appropriation entirely.

Selected HHS Highlights by Agency

This section begins with a limited selection of FY2019 discretionary funding highlights by HHS agency. The discussion is largely based on the enacted and proposed appropriations levels for FY2019, compared to FY2018 enacted levels.33 These summaries are followed by a brief overview of significant provisions from annual HHS appropriations laws that restrict spending in certain controversial areas, such as abortion and stem cell research. The section concludes with two tables (Table 6 and Table 7) presenting more detailed information on FY2018 enacted and FY2019 proposed and enacted funding levels for HHS.

HRSA

The FY2019 LHHS omnibus provided $6.9 billion in discretionary budget authority for HRSA. This was $107 million (+1.6%) more than HRSA's FY2018 discretionary funding level and $2.7 billion (-28.4%) less than the FY2019 President's budget request.

In several cases, the FY2019 President's budget proposed new or increased discretionary budget authority for HRSA programs that had previously been funded exclusively or jointly with mandatory appropriations from authorizing laws, such as the health centers program, the National Health Service Corps, and the Maternal, Infant, and Early Childhood Home Visiting program.34 Simultaneously, the President's budget proposed to eliminate mandatory funding for these programs. However, authorizing law ultimately provided FY2019 mandatory appropriations for each of these programs and the FY2019 LHHS omnibus maintained discretionary appropriations for them at their FY2018 levels, where applicable.35

The FY2019 LHHS omnibus provided $286 million for Title X Family Planning, the same as FY2018. For the fourth year in a row, the House committee bill had proposed eliminating funding for Title X of the PHSA and also prohibiting the use of other HHS funds to carry out Title X. In contrast, the FY2019 Senate-passed bill and the FY2019 President's budget had proposed a flat funding level for Title X from FY2018, and no prohibition on the use of other HHS funds.

The FY2019 LHHS omnibus also continued to fund the Rural Communities Opioids Response program within HRSA's Rural Health account. The program was created in FY2018 to support treatment and prevention of substance use disorders in high-risk rural communities. The omnibus appropriated $120 million for the program, an increase of $20 million (+20.0%) from FY2018. HRSA is directed to use this increase to establish three Rural Centers of Excellence on substance use disorders. The LHHS omnibus provided Healthy Start an increase of $12 million (+10.9%) from FY2018 as part of a new initiative to reduce maternal mortality and increased funding to support maternal mortality reduction efforts under the Maternal and Child Health Block Grant by $26 million (+4.0%).

CDC

The FY2019 LHHS omnibus provided $7.1 billion in discretionary budget authority for CDC. This was $117 million (-1.6%) less than CDC's FY2018 funding level and $1.6 billion (+28.3%) more than the FY2019 President's budget request. The FY2019 LHHS omnibus did not direct any PHS tap funds to the CDC, continuing the practice started in FY2015. (The FY2019 President's budget had requested $136 million in tap funds.) However, the FY2019 LHHS omnibus did supplement discretionary CDC appropriations with $805 million in PPHF transfers to the CDC, which was $4 million (+0.4%) more than FY2018.36 (Unlike FY2018, the FY2019 LHHS omnibus did not direct any transfers from the HHS Nonrecurring Expenses Fund (NEF) to the CDC.)37

A number of CDC accounts contained funding set aside to address the opioid crisis. For example, the HIV/AIDS, Viral Hepatitis, Sexually Transmitted Diseases and Tuberculosis Prevention account received an increase of $5 million (+0.4%) from FY2018; the conference report specified that the increase be used for a new initiative targeting infectious disease consequences of the opioid epidemic.38 With regard to the Injury Prevention and Control account, which was maintained at the FY2018 level of $649 million, the conference report directed HHS to reserve $476 million from this total for the CDC's Prescription Drug Overdose (PDO) activities, noting that these funds should be used to "advance the understanding of the opioid overdose epidemic and scale up prevention activities."39 In addition, $10 million in PDO funding was to be dedicated to a nationwide opioid awareness and education campaign. The Birth Defects and Developmental Disabilities account received an increase of $15 million (+10.7%), of which $10 million was to support monitoring of mothers and babies affected by the Zika virus as well as other emerging health threats, such as opioid use during pregnancy, and $2 million was reserved specifically for activities related to neonatal abstinence syndrome.

NIH

The FY2019 LHHS omnibus provided $37.9 billion in discretionary budget authority for NIH. This was $1.8 billion (+4.9%) more than FY2018 and $4.1 billion (+12.3%) more than the President's FY2019 budget request. In addition, the FY2019 LHHS omnibus directed $1.1 billion in PHS tap transfers to NIH, an increase of $224 million (+24.3%) from FY2018. The entirety of the tap transfer was provided to the National Institute of General Medical Sciences (NIGMS), and was paired with a discretionary appropriation of $1.7 billion. The discretionary appropriation was $137 million (-7.3%) less than FY2018, but when combined with the tap transfer, total funding for NIGMS increased by $87 million (+3.1%) from FY2018.

When accounting for discretionary appropriations and PHS tap transfers, each of the NIH accounts in the LHHS bill received an increase from FY2018 levels. Compared to FY2018, the largest percentage increases went to the National Institute on Aging, which received a total of $3.1 billion (+19.8%), and the Buildings and Facilities account, which received $200 million (+55.2%).40 In line with recent practice, the conference report on the FY2019 LHHS omnibus directed NIH to reserve a specific amount ($2.34 billion) for Alzheimer's disease research, referring to it as an increase of $425 million from FY2018.41 Reserving a specific dollar amount for a particular disease or area of research at NIH is a relatively new practice and constitutes a significant departure from past precedent.42

The FY2019 LHHS omnibus appropriated $711 million to the NIH Innovation Account pursuant to the 21st Century Cures Act (P.L. 114-255), which was equal to the amount authorized to be appropriated in that act.43 The conference report also reiterated the purposes authorized in the act, directing that NIH transfer $400 million to the National Cancer Institute to support cancer research, and $57.5 million each to the National Institute of Neurological Disorders and Stroke and the National Institute of Mental Health to support the Brain Research through Advancing Innovative Neurotechnologies (BRAIN) Initiative. The remaining $196 million was divided between the Precision Medicine Initiative ($186 million) and regenerative medicine research ($10 million).44

SAMHSA

The FY2019 LHHS omnibus provided $5.6 billion in discretionary budget authority for SAMHSA. This amount was $584 million (+11.6%) more than SAMHSA's FY2018 funding level and $2.2 billion (+63.4%) more than the President's FY2019 budget request. In addition, the FY2019 LHHS omnibus also directed $134 million in PHS evaluation tap funding and $12 million in PPHF funding to SAMHSA, which was the same amount as FY2018.

State Opioid Response Grants received $1.5 billion in FY2019, a $500 million (+50%) increase from FY2018, which was the first year in which funding was provided for this program. However, the State Targeted Response to the Opioid Crisis (STR) grants that were appropriated $500 million in each of FY2017 and FY2018 did not receive appropriations in FY2019.45 The FY2019 LHHS omnibus also included an increase of $50 million (+50.0%) from FY2018 for Certified Community Behavioral Health Centers. Mental Health Programs of Regional and National Significance (PRNS) and Substance Abuse Prevention PRNS each had a reduction of $43 million (-10.1% and -17.2%, respectively) from FY2018, while Substance Abuse Treatment PRNS had an increase of $55 million (+13.7) from FY2018.

CMS

The FY2019 LHHS omnibus provided $4.4 billion in discretionary budget authority for CMS. This was $20 million (+0.5%) more than FY2018 and $121 million (+2.8%) more than the FY2019 President's budget request. The LHHS omnibus appropriated $765 million for the CMS Health Care Fraud and Abuse Control (HCFAC) account, 2.7% more than FY2018, and slightly less (-0.6%) than the FY2019 President's request. Of the total amount appropriated for HCFAC, $454 million was effectively exempt from the discretionary budget caps. (See Appendix A for an explanation of the LHHS budget cap exemptions.)

The LHHS omnibus provided the CMS Program Management account with a flat funding level of $3.7 billion. This account supports CMS program operations (e.g., claims processing, information technology investments, provider and beneficiary outreach and education, and program implementation), in addition to federal administration and other activities related to the administration of Medicare, Medicaid, the State Children's Health Insurance Program, and private health insurance provisions established by the ACA. The FY2019 appropriation was the same amount that was proposed by the Senate-passed bill, but more than the amounts proposed by the President's budget (+3.6%) and the House committee bill (+4.8%). The omnibus maintained a general provision (§227), included in LHHS appropriations acts since FY2014, authorizing HHS to transfer additional funds into this account from Medicare trust funds. The terms of the provision required that such funds be used to support activities specific to the Medicare program, limited the amount of the transfers to $305 million, and explicitly prohibited such transfers from being used to support or supplant funding for ACA implementation. The House committee bill would have eliminated this provision.

ACF

The FY2019 LHHS omnibus provided $23.2 billion in discretionary budget authority for ACF. This was $357 million (+1.6%) more than FY2018 and $7.8 billion (+50.6%) more than the FY2019 President's budget request. The President's budget would have decreased ACF discretionary funding by roughly one-third relative to the prior year (-32.5%). The President's budget would have achieved much of its proposed reduction by eliminating certain programs within ACF, such as the Low Income Home Energy Assistance Program (LIHEAP), Preschool Development Grants (PDG), and the Community Services Block Grant (CSBG). Funding for these three programs was sustained or increased in the FY2019 LHHS omnibus: LIHEAP received $3.7 billion, PDG $250 million, and CSBG $725 million.

The LHHS omnibus provided $1.9 billion for the Refugee and Entrant Assistance programs account, an increase of $40 million (+2.2%) relative to FY2018. The LHHS omnibus retained a provision, included in LHHS appropriations since FY2015, authorizing HHS to augment appropriations for the Refugee and Entrant Assistance account by up to 10% via transfers from other discretionary HHS funds.

The conference report on the omnibus directed the majority of the appropriation for Refugee and Entrant Assistance programs toward the Unaccompanied Alien Children (UAC) program ($1.3 billion, the same as FY2018). The UAC program provides for the shelter, care, and placement of unaccompanied alien children who have been apprehended in the United States. The LHHS omnibus also included several new general provisions related to the UAC program. For instance, the law authorized HHS to accept donations for the care of UACs (§232), required HHS to submit a report on reunification of children with parents who are no longer in the United States (§233), and prohibited HHS appropriations from being used to prevent a Member of Congress from visiting a UAC facility for oversight purposes (§234). In addition, the conference report on the LHHS omnibus expressed an expectation that HHS would adhere to certain general provisions that had been included in the House committee bill (H.R. 6470), specifically provisions relating to sibling placement (§235), monthly reporting (§236), a report on preliterate children in custody (§541), a report on the mental health needs of children separated from their parents (§542), and a sense of the Congress that immigrant children should not be separated from their parents and should be reunited immediately (§539).

A number of new directives and reporting requirements on the UAC program were also included in the conference report itself, as well as reports on the earlier committee-reported FY2019 LHHS bills. The conferees noted that HHS was expected to adhere to the requirements laid out in all three reports (unless a particular requirement in a committee report had been superseded by the LHHS omnibus or its conference report). These requirements addressed a range of topics related to, for instance, the administration of medication, questioning children about religion, sharing information on the whereabouts of children and parents, protecting genetic material, the provision of qualified and independent legal counsel, and expectations for communication with appropriations committees on various UAC issues.

AHRQ

The FY2019 LHHS omnibus provided $338 million in discretionary budget authority to AHRQ. This was 1.2% more than the FY2018 level of $334 million. The FY2019 LHHS omnibus did not direct any PHS tap transfers to AHRQ, which is in keeping with practices since FY2015 but contrasts with earlier years (FY2003-FY2014) in which AHRQ had been funded primarily with tap transfers.46 The FY2019 omnibus continued to fund AHRQ as its own operating division, declining the President's proposal to consolidate AHRQ into NIH. The FY2019 President's request had proposed zero funding for AHRQ, proposing instead to continue funding many of AHRQ's activities through a new National Institute for Research on Safety and Quality (NIRSQ) in the NIH.47

ACL