COVID-19: China Medical Supply Chains and Broader Trade Issues

Changes from April 6, 2020 to October 8, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

COVID-19: China Medical Supply Chains and Broader Trade Issues

Contents

- Overview

- U.S.-China Trade and the Impact of COVID-19

- China First Quarter (Q1) 2020 Slowdown Effects on U.S. Industries

- Transportation, Logistics and Broader Considerations

- Prospects for U.S. Exports

- Force Majeure Provisions

- U.S. Reliance on China for Health Care and Medical Products

- China Nationalizes Medical Production and Supply

- Implications of China's Export Constraints: U.S. Shortages and Policy Response

- Global Trade Restrictions

- China's Economic Recovery: Prospects and Implications

- China Positioning to Export

- Steel Overcapacity

- Export VAT Rebate

- China Pushing Ahead in Strategic Sectors

- Issues for Congress

- Dependency of U.S. Health Care Supply Chains on China

- Other U.S. Supply Chain Dependencies

- U.S. Market Competitiveness and Tariff Policy

- Information and Data Gaps

- Unique Role of the U.S. Federal Government

- U.S. Leadership on Global Trade and Health Issues

Figures

Tables

- Table 1. Select U.S. Imports from China in 2019

- Table 2. Change in China's Exports and Imports of Select Medical Products

- Table 3. U.S. Imports from China in 2019: COVID-19 Related Medical Supplies

- Table 4. Recent Section 301 Tariff Exclusions on Select U.S. Imports from China

- Table 5. China's Export VAT Rebates, March 2020 (9%-13%)

- Table B-1. Select U.S. Import and Exports in 2019

- Table B-2. U.S. Imports of Pharmaceuticals and Medical Equipment, Products, and Supplies in 2019

Summary

COVID-19: China Medical Supply Chains and October 8, 2020 Broader Trade Issues Karen M. Sutter, The outbreak of Coronavirus Disease 2019 (COVID-19), first in China, and then Coordinator globally, including in the United States, is drawing attention to the ways in which the Specialist in Asian Trade U.S. economy depends on manufacturing and supply chains based in China. This report and Finance aims to assess current developments and identify immediate and longer range China trade issues for Congress.

Andres B. Schwarzenberg Analyst in International

An area of particular concern to Congress is U.S. shortages in medical supplies—

Trade and Finance

including personal protective equipment (PPE) and pharmaceuticals—as the United

States steps up efforts to contain COVID-19 with limited domestic stockpiles and

Michael D. Sutherland

insufficient U.S. industrial capacity. Because of China'’s role as a global supplier of PPE,

Analyst in International

medical devices, antibiotics, and active pharmaceutical ingredients, reduced export exports

Trade and Finance

from China have led to shortages of critical medical supplies in the United States.

Exacerbating the situation, in early February 2020, the Chinese government nationalized

control of the production and distribution of medical supplies in China—directing all production for domestic use—and directed the bureaucracy and Chinese industry to secure supplies from the global market. Now apparentlyOnce past the initial peak of its COVID-19 outbreak, the Chinese government may selectively releaseappears to have prioritized certain countries and selectively released some medical supplies for overseas delivery, with designated countries selected, according to political calculations.

.

Congress has enacted legislation to better understand and address U.S. medical supply chain dependencies, including P.L. 116-136, The Coronavirus Aid, Relief, and Economic Security (CARES) Act, that includes several provisions to:

- expand drug shortage reporting requirements;

- require certain drug manufacturers to draw up risk management plans;

- require the U.S. Food and Drug Administration (FDA) to maintain a public list of medical devices

that are determined to be in shortage; and

-

direct the National Academies of Science, Engineering, and Medicine to conduct a study of

pharmaceutical supply chain security.

Other potential considerations for Congress include whether and how to further incentivize additional production of health supplies, diversify production, address other supply chain dependencies (e.g., microelectronics), fill information and data gaps, and promote U.S. leadership on global health and trade issues.

The crisis that has emergedmerged for the U.S. economy is defined, in large part, by a collapse of critical supply, as well as a sharp downturn in demand, first in China and now in the United States and globally. As China'’s manufacturing sector recovers, while the United States and other major global markets are grappling with COVID-19, some fear China could overwhelm overseas markets, as it ramps up export-led growth to compensate for the sharp downturn of exports in the first quarter of 2020, secure hard currency, and boost economic growth. China may also seek to make gains in strategic sectors—such as telecommunications, microelectronics, and semiconductors—in which the government undertook extraordinary measures to sustain research and development and manufacturing during the COVID-19 outbreak in China.

Overview

The outbreak of coronavirus disease (COVID-19), first in the People'

Congressional Research Service

link to page 5 link to page 6 link to page 8 link to page 10 link to page 12 link to page 13 link to page 13 link to page 17 link to page 22 link to page 28 link to page 32 link to page 34 link to page 37 link to page 38 link to page 39 link to page 40 link to page 41 link to page 45 link to page 46 link to page 50 link to page 50 link to page 51 link to page 53 link to page 54 link to page 8 link to page 14 link to page 14 link to page 17 link to page 24 link to page 25 link to page 40 link to page 42 link to page 15 link to page 19 link to page 20 COVID-19: China Medical Supply Chains and Broader Trade Issues

Contents

Overview ......................................................................................................................................... 1 U.S.-China Trade and the Impact of COVID-19 ............................................................................. 2

China First Quarter (Q1) 2020 Slowdown Effects on U.S. Industries ...................................... 4 Transportation, Logistics and Broader Considerations ............................................................. 6 Prospects for U.S. Exports ........................................................................................................ 8

Force Majeure Provisions ................................................................................................... 9

U.S. Reliance on China for Health Care and Medical Products ...................................................... 9

China Nationalizes Medical Production and Supply ............................................................... 13 Implications of China’s Export Constraints: U.S. Shortages and Policy Response ................ 18

U.S. Shortages ................................................................................................................... 24

Global Trade Restrictions ........................................................................................................ 28

Domestic Supply: U.S. vs Foreign Made Products ........................................................... 30

China’s Economic Recovery: Prospects and Implications ............................................................ 33

China Positioning to Export .................................................................................................... 34 Steel Overcapacity .................................................................................................................. 35 Export VAT Rebate .................................................................................................................. 36 China Pushing Ahead in Strategic Sectors .............................................................................. 37

Issues for Congress ........................................................................................................................ 41

Dependency of U.S. Health Care Supply Chains on China .................................................... 42 Other U.S. Supply Chain Dependencies ................................................................................. 46 U.S. Market Competitiveness and Tariff Policy ...................................................................... 46 Information and Data Gaps ..................................................................................................... 47 Unique Role of the U.S. Federal Government ........................................................................ 49 U.S. Leadership on Global Medical Trade .............................................................................. 50

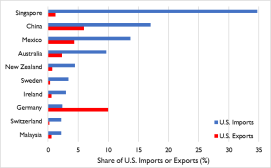

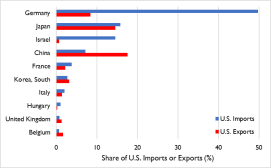

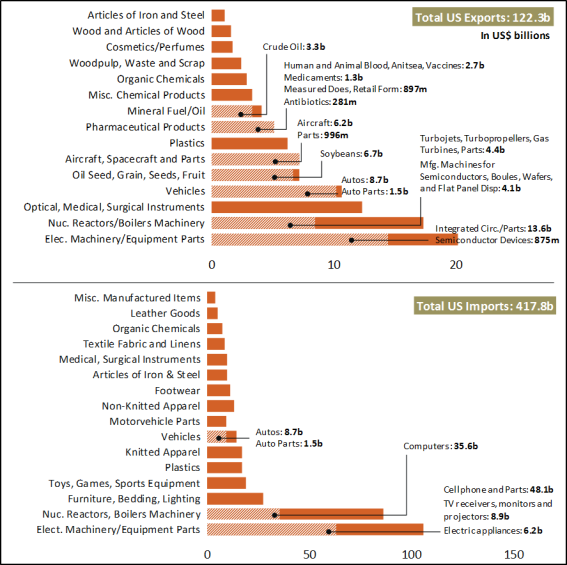

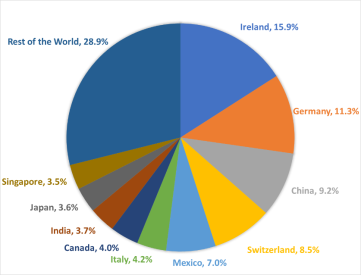

Figures Figure 1. U.S.-China Trade in 2019 ................................................................................................ 4 Figure 2. U.S. Imports of Pharmaceuticals and Medical Equipment, Products, and

Supplies in 2019 ......................................................................................................................... 10

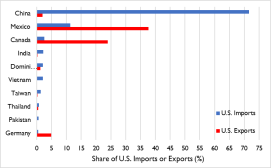

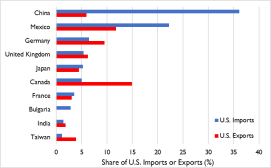

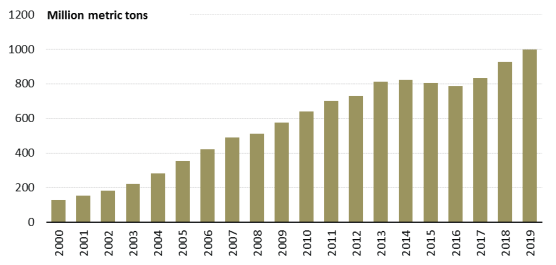

Figure 3. U.S. Import and Exports of Select Medical Products in 2019 ....................................... 13 Figure 4. China’s Export of Select Covid-19-Related Products: Jan.-July 2020 .......................... 20 Figure 5. China’s Exports of Select Covid-19-Related Products: ................................................. 21 Figure 6. China Raw Steel Production (2000-2019) ..................................................................... 36 Figure 7. China’s Industrial Priorities (2015-2025) ...................................................................... 38

Tables Table 1. Select U.S. Imports from China in 2019 ........................................................................... 11 Table 2. Change in China’s Exports and Imports of Select Medical Products .............................. 15 Table 3. U.S. Imports from China in 2019: COVID-19 Related Medical Supplies ...................... 16

Congressional Research Service

link to page 25 link to page 25 link to page 30 link to page 35 link to page 35 link to page 41 link to page 56 link to page 56 link to page 56 link to page 56 COVID-19: China Medical Supply Chains and Broader Trade Issues

Table 4. Top Partners: Value of China’s Exports of Select Covid-19-Related Medical

Goods ......................................................................................................................................... 21

Table 5. Recent Section 301 Tariff Exclusions on Select U.S. Imports from China ..................... 26 Table 6. Estimate of the Imported Share of U.S. Domestic Supply: Select Medical-

Related Manufactured Good Categories in 2018 ....................................................................... 31

Table 7. China’s Export VAT Rebates, March 2020 (9%-13%) .................................................... 37

Table A-1. U.S. Imports of Pharmaceuticals and Medical Equipment, Products, and

Supplies in 2019 ......................................................................................................................... 52

Appendixes Appendix A. U.S. Imports of Select Medical Products ................................................................. 52

Contacts Author Information ........................................................................................................................ 52

Congressional Research Service

COVID-19: China Medical Supply Chains and Broader Trade Issues

Overview The outbreak of Coronavirus Disease 2019 (COVID-19), first in the People’s Republic of China (PRC or China), and now globally, including in the United States, is drawing attention to the ways in which the United States and other economieseconomies depend on critical manufacturing and global value chains that rely on production based in China. Congress is particularly concerned about these dependencies and has passed legislation to better understand and address them. An area of particular concern to Congress in the current environment is U.S. shortages of medical supplies—including personal protective equipment (PPE) and pharmaceuticals—as the United States steps up efforts to contain COVID-19 with limited domestic stockpiles and insufficient U.S. industrial capacity. Because of China'’s role as a global supplier of PPE, medical devices, antibiotics, and active pharmaceutical ingredients (API), reduced exports from China have led to shortages of critical medical supplies in the United States.1

1

Starting in early February 2020, U.S. health care experts began warning of a likely global spread of COVID-19, and early reports of U.S. medical supply shortages began to emerge. At the same time, the Chinese government nationalized control of the production and distribution of medical supplies in China, directing all production for domestic use.22 The Chinese government also directed the national bureaucracy, local governments, and Chinese industry to secure supplies from the global market.33 This effort likely exacerbated medical supply shortages in the United States and other countries, particularly in the absence of domestic emergency measures that might have locked in domestic contracts, facilitated an earlier start to alternative points of production, and restricted exports of key medical supplies. As China'’s manufacturing sector recovers while the United States and other countries are grappling with COVID-19, the Chinese government may selectively release some medical supplies for overseas delivery. Those decisions are likelyprioritize certain countries for overseas delivery of medical supplies. Those decisions appear to be driven, at least in part, by political calculations, as it has done recently with many countries around the world.4

4

1 Finbarr Bermingham and Su-Lin Tan, “Coronavirus: China’s mask-making juggernaut cranks into gear, sparking fears of over-reliance on world’s workshop,” South China Morning Post, March 12, 2020, https://www.scmp.com/economy/global-economy/article/3074821/coronavirus-chinas-mask-making-juggernaut-cranks-gear; U.S. Food and Drug Administration, “Coronavirus (COVID-19) Supply Chain Update,” Press release, February 27, 2020, https://www.fda.gov/news-events/press-announcements/coronavirus-covid-19-supply-chain-update.

2 Zhang Pinghui and Zhou Xin, “Coronavirus: China Shifts Responsibility Over Medical Supplies Amid Mask Shortage, Rising Death Toll,” South China Morning Post, February 3, 2020, updated on February 14, 2020, https://www.scmp.com/economy/china-economy/article/3048744/coronavirus-mask-shortage-prompts-beijing-tweak-authority; Finbarr Bermingham and Su-Lin Tan, “Coronavirus: China’s Mask Making Juggernaut Cranks Into Gear, Sparking Fears of Overreliance on World’s Workshop,” South China Morning Post, March 12, 2020, https://www.scmp.com/economy/global-economy/article/3074821/coronavirus-chinas-mask-making-juggernaut-cranks-gear; Engen Tham, Cheng Leng, and Zhang Yan, “Exclusive: Unilever, 3M on List of Firms Eligible for China Loans to Ease Coronavirus Crisis—Sources,” Reuters, February 19, 2020, https://www.reuters.com/article/us-china-health-lending-exclusive-idUSKBN20D0SQ; Yang Jian, “GM, Wuling Venture Begins Output of Machines to Make Face Masks, Automotive News, February 20, 2020, https://www.autonews.com/china/gm-wuling-venture-begins-output-machines-make-face-masks; and Luffy Liu, “700 Tech Companies in China Have Begun Making Masks,” EE Times, February 13, 2020, https://www.eetimes.com/700-tech-companies-in-china-have-begun-making-masks/. 3 “Circular on Further Facilitating the Import and Export of Technology During the Period of Epidemic Prevention and Control,” PRC Ministry of Commerce, February 4, 2020, http://english.mofcom.gov.cn/article/newsrelease/significantnews/202002/20200202934774.shtml; and “Circular on Actively Expanding Imports to Combat Against Novel Coronavirus Epidemic,” PRC Ministry of Commerce, February 6, 2020, http://english.mofcom.gov.cn/article/newsrelease/significantnews/202002/20200202.

4 Li Yan, “Xi Says China to Send More Medical Experts to Italy,” Xinhua, March 17, 2020, http://www.ecns.cn/m/news/politics/2020-03-17/detail-ifzunmih1236562.shtml934157.shtml, and “’Mask Diplomacy’

Congressional Research Service

1

COVID-19: China Medical Supply Chains and Broader Trade Issues

COVID-19 was identified in China in December 2019 and peaked in late January 2020. In response, China shut down a large part of its economy in an effort to contain the outbreak. A key factor in the sharp economic slowdown in China was the dramatic downturn of both demand and supply after Chinese officials imposed restrictions in the third week of January on movement of people and goods in and out of localities across China. Since the COVID-19 outbreak in China has eased, the Chinese government'’s efforts to restart business activities has been slow and uneven across sectors and locations. Companies have sought to meet new government requirements for virus containment and faced worker and supply shortages as interregional logistics have remained somewhat constrained.55 Resumption of bilateral trade between the United States and China will likely be uneven due to persistent bottlenecks in inputs, locations of containersthe location of container shipments, and logjams in current shipments. U.S. companies typically maintain anywhere from two to ten weeks of inventory, and transportation time for trans-Pacific container shipments is typically three weeks. With this timeframe in mind, initial shortages that U.S. firms faced of deliveries of microelectronics, auto parts, and health and medical products could intensify over the next few months. Thereintensified once inventory was depleted. Depending on the trajectory of the virus, there could be additional shortages in a wide range of imports that transit via container ship (e.g., processed raw materials, intermediate industrial goods, and finished consumer products).

As China'’s economic activities resume, other countries around the world are taking an economic hit. As in China, new restrictions around the world on the movement of people and business operations could triggerprolong sharp new slowdowns in demand, transportation, and logistics worldwide, further dragging down prospects for global trade recovery. Suppressed global demand will likely further complicate efforts to orchestrate a rebound in China's (or global) economic activityeconomic activity in China (or the world). In sectors where China has extensive capacity (maintains excess capacity, such as steel), some fear China could overwhelm overseas markets, as it ramps up export-led growth to compensate for the sharp economic downturn in the first quarter of 2020.

Congress faces current choices that will influence the longer-range U.S. trade trajectory vis-a-vis China. Since the imposition of Section 301 tariffs on U.S. imports from China and China's ’s retaliatory tariffs beginning in 2018, some Members have raised questions about the dependence of U.S. supply chains on China for critical products. There are also concerns some have raised about the potential ramifications of these dependencies, particularly in times of crisis or PRC nationalization of industry. Current demand pressures during the COVID-19 pandemic could increase U.S. reliance on certain medical supplies from China, at least in the short term (provided that the Chinese government is willing to export these supplies to the United States). At the same time, these pressures are also incentivizing diversification efforts.

as governments and firms re-evaluate the risks of basing substantial portions of their supply chains in China. U.S.-China Trade and the Impact of COVID-19

As the United States'’ third-largest trading partner in 2019, bilateral trade with China is important to the U.S. economy, and the recent sharp downturn in activity affects a wide range of U.S. industries. Total U.S. trade with the world (the sum of exports and imports of goods and services)

From Beijing to Change Narrative About COVID-19,” SupChina, March 23, 2020, https://supchina.com/2020/03/23/mask-diplomacy-from-beijing-to-change-narrative-about-covid-19/.

5 Norihiko Sirouzu and Yilei Sun, “As China’s ‘Detroit’ Reopens, World’s Automakers Worry About Disruptions,” Reuters, March 8, 2020.

Congressional Research Service

2

link to page 8 COVID-19: China Medical Supply Chains and Broader Trade Issues

was $5.6 trillion in 2019, equivalent to 26% of U.S. gross domestic product (GDP); China accounts for 11% of U.S. trade.66 Key facts about the relationship include the following:7

China'7 China’s, total merchandise trade with the United States in 2019 amounted to $558.9 billion;-

China is the United States

'’ third largest export market for goods. U.S. goods exports to China in 2019 were valued at $106.6 billion in 2019; - China is the top source of U.S. imports. U.S. goods imports from China reached $452.2 billion in 2019;

- U.S. services exports to China in 2019 were valued at $56.7 billion (mostly travel and transport);

- U.S. services imports from China in 2019 were valued at $18 billion (about half of this amount was travel and transport); and

-

U.S. foreign direct investment (FDI) stock in China in 2018 reached $116.5

billion while China

'’s FDI stock in the United States reached $60.2 billion in 2018. -

Top U.S. exports to China include semiconductor chips, devices, parts and

manufacturing machines; agriculture; aircraft, turbojets, turbo propellers, and gas turbines; optical and medical equipment; autos; plastics; and pharmaceutical products (Figure 1).

. - Top U.S. imports from China include microelectronics (computers and cell

phones) and appliances, furniture, bedding and lighting; toys, games and sports equipment; plastics; knitted and non-knitted apparel, textile fabric, linens, and footwear; auto parts; articles of iron and steel; medical and surgical instruments; and, organic chemicals (including active pharmaceutical ingredients and antibiotics).

6 CRS calculations based on data from the U.S. Department of Commerce, Bureau of Economic Analysis, “Gross Domestic Product, Fourth Quarter and Year 2019 (Second Estimate),” and “U.S. International Trade in Goods and Services, January 2020.” Total U.S.-China trade amounted to $635.3 billion in 2019.

7 The following data is sourced from the U.S. Department of Commerce, Bureau of Economic Analysis’ International Transactions.

Congressional Research Service

3

COVID-19: China Medical Supply Chains and Broader Trade Issues

Figure 1. U.S.-China Trade in 2019

antibiotics).

|

|

Source: Congressional Research Service (CRS) with data from Global Trade Atlas.

|

China First Quarter (Q1) 2020 Slowdown Effects on U.S. Industries

Since Beginning in late January, the outbreak of COVID-19 in China has had a direct economic impact on U.S. firms that operate in China, export to or sell goods and services directly in China, or depend on Chinese goods and services for their operations in the United States and abroad. Some analysts estimate that China experienced a sharp drop in economic growth by as much as 9% in Q1 2020 and a 17.2% drop in exports in January-February 2020, compared to the same period in 2019.8 China'8

8 Ryan Woo, Se Young Lee, David Stanway, and Andrew Galbraith, “Goldman Sees China’s Economy Shrinking 9 Percent in First Quarter Amid Coronavirus Outbreak,” Reuters, March 16, 2020, https://www.reuters.com/article/us-health-coronavirus-china-toll/goldman-sees-chinas-economy-shrinking-9-in-first-quarter-amid-coronavirus-outbreak-idUSKBN21340T.

Congressional Research Service

4

COVID-19: China Medical Supply Chains and Broader Trade Issues

China’s economy is globally connected through trade, investment, and tourism. The economic slowdown and global spread of COVID-19, combined with global travel and transportation restrictions and other effects, are now causingcaused worldwide economic fallout. Indicators in key industries, include:

China has China recorded a sharp downturn in microelectronics production and sales and the United States could experience a similar drop due to a potential gap in availability. Almost half the value of U.S. imports from China in 2019 was-

Foxconn, a Taiwan firm that produces the iPhone for Apple in China, received

formal government permission to reopen its facilities in mid-February, but

hasfaced challenges because of quarantine and transportation restrictions. Foxconn'’s plan to offer $1,000 to each returning worker suggests potential lingering concerns about the risk of infection or other labor constraints. The companymay also facealso may have faced supply constraints of key microelectronics inputs.99 Other companies that use Foxconn for contract manufacturing in China include Amazon, Cisco, Dell, Google, Hewlett Packard, Nintendo, and Sony, as well as Chinese firms Huawei and Xiaomi.10 - 10

The U.S. auto industry and manufacturers in South Korea, Japan, and Germany

quickly faced manufacturing bottlenecks because of the lack of availability of auto parts supplies from China. The spread of COVID-19 to other major auto manufacturing markets, including the United States, Germany, Japan and South Korea

may poseimposed additional constraints on auto manufacturing and sales. China exported $9.6 billion in autopartsparts to the United States in 2019. - .

U.S. manufacturing

facesfaced potential shortages of intermediate inputs for steelmaking and heavy manufacturing, such as refined manganese metal, ferrosilicon, and ferrovanadium. Manganese and ferrovanadium are steel strengtheners that depend on China-based processing. While manganese is mined around the world, China controls 97% of manganese processing. Ferrosilicon is used to extract oxygen from liquid steel, and is mostly produced in China.1111 China exportedalmostalmost $10 billion in iron and steel products to the United States in2019. - 2019.

U.S. retailers, tourism, and service providers that rely on the Chinese consumer

base have also taken a hit in China. Many closed or significantly curtailed operations. U.S. retailers reduced operating hours or shuttered stores in response to COVID-19.

1212 For example, Starbucks closed about half its 4,200 retail outlets in China between late January and late February.1313 Retailers and tourism service providers around the world have seen significantly reduced revenue as fewer 9 “Apple Supplier Foxconn Expects Coronavirus-Hit Labor Shortage in China to Ease,” The Wall Street Journal, March 3, 2020. 10 Duncan Riley, “Apple and Others May Have Avoided Supply Shortages as some Foxconn Plants Reopen in China,” Silicon Angle, February 11, 2020. 11 Alistair MacDonald, “Steelmakers Rely Heavily on China,” The Wall Street Journal, March 6, 2020. 12 Samantha McDonald, “Columbia, Burberry and 12 Other Fashion Firms Are Closing Stores Due to Coronavirus,” Footwear News, February 27, 2020. 13 Hayley Peterson, “Starbucks Reopens Most Stores in China, Citing ‘Early Signs of Recovery,’ From Coronavirus,” Business Insider, February 27, 2020. Congressional Research Service 5 COVID-19: China Medical Supply Chains and Broader Trade Issuesproviders around the world have seen significantly reduced revenue as fewerChinese citizens travel abroadChina'China’s outbound tourism spending in 2018 was $277 billion, of which an estimated $36 billion was in the United States.14

14 Transportation, Logistics and Broader Considerations

Measures to contain the COVID-19 outbreak have significantly curtailed global transportation links. The consequence is the prevention of, preventing the transport of many products and manufacturing inputs. Passenger air traffic has slowed significantly, taking offline significant air cargo capacity for microelectronics and other products that ship by air. Container shipments are also constrained by the current backlog and dependence on domestic trucking and rail transportation, as well as on the ability of countries to staff port operations.

U.S. airlines started suspending flights to China in late January 2020 and have suspended other routes as COVID-19 has spread globally. United Airlines announced steep flight cuts and said in early March 2020 that ticket bookings were down 70% for Asia-Pacific flights, noting that this downturn was magnified by a surge in flight cancellations. The company noted that revenue in April and May could drop as much as 70%.1515 While Federal Express (FedEx) and United Parcel Service (UPS) announced in early March that they continued to run flights in and out of affected countries, they warned that limitations on travel could delay some shipments, although freight carriers are now starting to repurpose passenger flights for cargo which could help expand capacity.1616 Quarantine of aircrew and restrictions on the ground in China with regard to labor, production, supply and logistics likely significantly curtailed shipments. On March 26, 2020, the Civil Aviation Administration of China (CAAC) restricted all airlines running passenger flights in and out of China to one flight per week, further constraining air freight capacity.17

Container shipping from China has faced serious constraints17 In September 2020, CAAC announced the resumption of direct flights to Beijing from eight countries including Cambodia, Canada, Denmark, Greece, Sweden, and Thailand. Additionally, domestic passenger volumes in China appear to have reached 90% of pre-pandemic levels.18 Further recovery in air travel could lead to increased air freight capacity for shipments to and from China.19

Container shipping from China faced serious logjams because of shortages of workers and trucking constraints. These constraints are affectinglogjams affected both U.S. imports to and exports from China. The Port of Los Angeles has announced that shipmentsannounced shipment cuts by 25% that were scheduled from China between February and April 2020February and April 2020 have been cut by 25%. Los Angeles and Long Beach ports project a 15% to 17% drop in cargo volumes in Q1 2020. One in nine Southern California jobs is tied to the ports, including people who work on the docks, drive trucks, and move boxes in warehouses, according to the Executive Director of the Port of Los Angeles.18 The20 In March, the Port Authority of New York and New Jersey has requested $1.9 billion in federal aid to offset a forecasted 30% year-on-year drop in cargo volumes.19

In the immediate term, shipping and logistical constraints are slowing

14 United Nations World Tourism Organization, “Exports from International Tourism Hit USD 1.7 Trillion,” June 6, 2019, https://www.unwto.org/global/press-release/2019-06-06/exports-international-tourism-hit-usd-17-trillion; U.S. International Trade Administration National Travel and Tourism Office, “Fast Facts: United States Travel and Tourism Industry 2018,” October 2019, https://travel.trade.gov/outreachpages/download_data_table/Fast_Facts_2018.pdf. 15 Dawn Gilbertson, “Coronavirus Travel Fallout: American, Delta Cutting Flights as Demand Sinks, Joining United and Other,” USA Today, March 10, 2020. 16 “FedEx, UPS Warn of Delivery Delays, JPMorgan Tests Virus Contingency Plan,” PYMNTS.com, March 3, 2020. 17 Ministry of Foreign Affairs of the People’s Republic of China, “CAAC to Further Reduce International Passenger Flights,” press release, March 27, 2020, https://www.fmprc.gov.cn/mfa_eng/topics_665678/kjgzbdfyyq/t1762623.shtml.

18 Reuters, “Cheap seats give Chinese airlines a much-needed bounce,” September 15, 2020. 19 Reuters, “China will gradually resume direct international flights to Beijing,” September 2, 2020. 20 Margot Roosevelt, “Truckers, Dockworkers Suffer as Coronavirus Chokes L.A., Long Beach Ports Cargo, Los Angeles Times, March 7, 2020.

Congressional Research Service

6

COVID-19: China Medical Supply Chains and Broader Trade Issues

cargo volumes, and in July requested $3 billion to offset revenue losses stemming from a sharp decline in passenger volumes.21

In the immediate term, shipping and logistical constraints slowed U.S. exports to Asia. U.S. exporters of meat, poultry, hay, oranges and other produce are reportingreported in March 2020 that refrigerated containers are in short supply and cold storage facilities arewere overflowing with inventory.2022 U.S. and global manufacturing—including production that recently shifted out of China to other parts of Asia and to Mexico—is still recoveringtook time to recover from disruptions in Chinese supply. Vietnam, Taiwan, Malaysia, South Korea, Japan, Thailand, and Singapore all have strong supply chain links with China and reported Q1 supply shortages.21

23

Even as China'’s production resumesresumed, these Asian countries are now grapplinggrappled with their own COVID-19 outbreaks, further complicating recovery. The situation iswas exacerbated by spread of COVID-19 in other important manufacturing markets such as South Korea, Italy, Germany, and Mexico. Disruptions in Chinese supply chains were initially expected to have a limited macroeconomic effect on developed markets in the short term, but as the outbreak has spread globally and Chinese firms and logistics operations have struggled to return to full capacity, a wide range of U.S. imports from China, including raw materials, intermediate industrial inputs, and consumer products, are likely to be in short supply faced severe supply constraints. U.S. firms with operations in China or that depend on production in China have begun to consider diversification away from China and may face further pressure to establishChina may be prompted to diversify away from China and begin establishing new supply chains. The head of the EU Chamber of Commerce in China said in late February 2020 that the disruption from COVID-19 had driven home the need for foreign companies to diversify away from China.22

24 In April 2020, the Japanese government earmarked $2.2 billion of a broader economic stimulus package to help companies shift production out of China and to production sites in either Japan or Southeast Asia. In July, Japan’s Ministry of Economy, Trade, and Industry announced that 87 firms had agreed to shift production out of China and would receive funding, and in September 2020, added India and Bangladesh to its list of eligible alternative production sites.25 In August 2020, Australia, Japan, and India, announced a collaboration to incentivize companies to diversify supply chains from China for economic and geopolitical reasons.26

21 Port Authority of New York and New Jersey, “Port Authority Urgently Calls for Congress to Act on Request for $3 Billion in Federal Relief Following Precipitous Decline in Passenger Volumes Caused by COVID-19 Pandemic,” press release, July 29, 2020; Lee Hong Liang, “Port Authority of New York and New Jersey seeks $1.9bn bailout amid COVID-19,” Seatrade Maritime News, March 25, 2020; Port Authority of New York and New Jersey, Letter to Members of the New York and New Jersey Congressional Delegations, letter, March 19, 2020, https://www.politico.com/states/f/?id=00000170-fadd-d9d1-a3f3-fbdd91ed0000.

22 Jacob Bunge, “Meat Stockpiles Surge as Coronavirus Epidemic Curbs Exports,” The Wall Street Journal, March 2, 2020.

23 Trinh Nguyen, “The Economic Fallout of the Coronavirus in Southeast Asia,” Carnegie Endowment for International Peace, February 13, 2020.

24 “China virus outbreak threatens global drug supplies: European business group,” Reuters, February 17, 2020. 25 Isabel Reynolds and Emi Urabe, “Japan to Fund Firms to Shift Production Out of China,” Bloomberg, April 8, 2020; “Japan reveals 87 projects eligible for ‘China exit ‘subsidies,” Nikkei Asian Review, July 17, 2020. 26 Ministry of Economy, Trade, and Industry of the Government of Japan, “Australia-India-Japan Economic Ministers’ Joint Statement on Supply Chain Resilience,” September 1, 2020, https://www.meti.go.jp/press/2020/09/20200901008/20200901008-1.pdf; Kiran Sharma, “Japan, India, and Australia aim to steer supply chains around China,” Nikkei Asian Review, September 1, 2020.

Congressional Research Service

7

COVID-19: China Medical Supply Chains and Broader Trade Issues

Prospects for U.S. Exports Prospects for U.S. Exports

Within this context, U.S. firms may find some opportunities to increase exports to China, so long as global port operations resume and current logjams are resolved. Increased U.S. exports could be driven in part by recent tariff liberalization’ resumption of exports to China have depended on the resumption of global port operations and China’s economic recovery. While U.S. exports potentially would benefit from recent tariff liberalization, U.S. exports to China have been slow and uneven in their recovery. As part of the phase one trade deal that the United States and China signed in mid-January 2020 to resolve some issues the United States raised under Section 301, the United States and China agreed, effective February 14, 2020, to cut by 50% the tariffs they imposed in September 2019. China announced a tariff exemption process for 700 tariff lines, including some agriculture, medical supplies, raw materials, and industrial inputs.

With China'’s recovery, the U.S. government could press China to make up for lost time on U.S. purchases. COVID-19 may makehas made it difficult for both sides to meet these targets, however, given the economic fallout in both countries. China’s efforts to diversify import sources for key goods—such as energy and agriculture—have potentially undercut China’s capacity to meet its U.S. commitments. China imported 53.18 million tons of crude oil and replenished its strategic petroleum reserves from non-U.S. sources during the March 2020 collapse in global oil prices.27 The sustained outbreak of African Swine Flu in China has fueled an uptick in China’s pork imports from the United States, but overall agricultural purchases remain below previous years and still fall short of negotiated targets. the economic fallout in both countries. As part of the phase one trade deal, China committed to purchase at least $200 billion above a 2017 baseline amount of U.S. agriculture ($32 billion), energy ($52.4 billion), manufacturing goods ($77.7 billion), and services ($37.9 billion) between January 1, 2020 and December 31, 2021.2328 Regarding agriculture, in November 2019, China's ’s National Development and Reform Commission (NDRC) announced detailed rules for the application and allocation of grain and cotton import tariff-rate quotas for 2020 that specify imports for wheat (9.636 million tons, 90% state-owned trade), corn (7.2 million tons, 60% state-owned trade), rice (5.32 million tons, 50% state trade), and cotton (894,000 tons, 33% state-owned trade).2429 NDRC included in these rules a requirement that companies applying for tariff-rate quotas must have a "“positive record"” in China'’s corporate social credit system.2530 This requirement allows the Chinese government to restrict or impose terms on certain U.S. cotton exporters. China could use this requirement to create counter pressure in response to recent U.S. congressional action to block U.S. imports of textiles and apparel that contain cotton from China'China’s Xinjiang region due to concerns over forced labor there. 26 31 With falling oil prices, China would arguably have to buy a significant larger volume of goods to reach its purchase obligations that are benchmarked by dollar value.

27 Clyde Russell, “Column: China’s record crude oil, copper imports are more history lesson than predictor,” Reuters, July 14, 2020.

28 Office of the United States Trade Representative, “Economic and Trade Agreement Between the Government of the United States of America and the Government of the People’s Republic of China,” January 15, 2020.

29 National Development and Reform Commission of the People’s Republic of China, “关于 2020 年粮食棉花进口关税配额申请和分配细则的公告 2019 年第 9 号 (Announcement Regarding Application and Distribution Rules for Import Tariff Rate Quotas for Grain and Cotton)” September 29, 2019, https://www.ndrc.gov.cn/xxgk/zcfb/gg/201909/t20190930_1181887.html. 30 CRS In Focus IF11342, China’s Corporate Social Credit System, by Michael D. Sutherland. 31 Austin Ramzy, “U.S. Lawmakers Propose Tough Limits on Imports from Xinjiang,” The New York Times, March 11, 2020.

Congressional Research Service

8

link to page 56 COVID-19: China Medical Supply Chains and Broader Trade Issues

Force Majeure Provisions

The crisis also calledForce Majeure Provisions

The crisis is also calling into question China'’s ability to implement the U.S.-China phase one trade deal signed in January 2020. The agreement has a force majeure provision—which allows parties to opt out of contractual obligations without legal penalty because of developments beyond their control—that could give China flexibility in implementing its commitments.2732 The deal was finalized in December 2019 and signed in mid-January 2020, when Chinese officials reportedly knew about the severity of the COVID-19 outbreak in Wuhan, which raises questions about the rationale and timing of the decision to include the force majeure provision. A factor further complicating the potential for resumption and expansion of U.S. exports is Chinese companies' ’ invocation of force majeure certifications. For example, China National Petroleum Company (CNPC) used the outbreak of COVID-19 to declare force majeure in cancelling some liquefied natural gas (LNG) imports, a move followed by a downturn in overall oil and gas demand. The Ministry of Commerce has since provided free certifications to Chinese companies that need to declare force majeure.2833 Chinese companies and courts rely on an interpretation of force majeure that is different from the standard legal interpretation in the United States, which allows both parties to cancel contract terms and revert to a pre-contract baseline. In China, force majeure is used to cancel an obligation by the party invoking the provision while the other party may still be obligated to perform and honor contract terms. For example, if a payment is blocked or forgiven by the Chinese government, the other party may still be expected to perform according to the contract terms without the foreign party being reimbursed for any additional costs incurred. Moreover, Chinese courts are unlikely to allow foreign firms to prosecute Chinese firms that do not perform according to their contracts.29

34

U.S. Reliance on China for Health Care and Medical Products

Products In the midst of the pandemic, Congress is expressing a strong interest in responding to U.S. shortages of medical supplies—including PPE and pharmaceuticals—as the United States steps up efforts to contain and counter COVID-19 with limited domestic stockpiles and constraints on U.S. industrial capacity. Because of China'’s role as a major U.S. and global supplier of medical PPE, medical devices, antibiotics, and active pharmaceutical ingredients (Appendix B)A), reduced exports from China have led to shortages of critical medical supplies in the United States.3035 While some analysts and industry groups have pointed to tariffs as a disincentive to U.S. imports of health and medical products, supply shortages due to the sharp spike in demand, as well as the nationalization and diversion of supply to China, appear to be stronger drivers. According to China Customs data, in 2019 China exported $9.8 billion in medical supplies and $7.4 billion in

32 Office of the United States Trade Representative, “Economic and Trade Agreement Between the Government of the United states of America and the Government of the People’s Republic of China,” January 15, 2020, Article 6.2. 33 Zhou Xin, “Coronavirus: Doubts Raised Over Whether Chinese Companies Can Use Force Majeure to Counter Risks,” South China Morning Post, February 25, 2020, https://www.scmp.com/economy/china-economy/article/3052277/coronavirus-doubts-raised-over-whether-chinese-companies-can.

34 Dan Harris, “Force Majeure in the Time of Coronavirus,” China Law Blog, Harris Bricken, February 27, 2020, https://www.chinalawblog.com/2020/02/force-majeure-in-the-time-of-coronavirus.html.

35 Finbarr Bermingham and Su-Lin Tan, “Coronavirus: China’s mas-making juggernaut cranks into gear, sparking fears of over-reliance on world’s workshop,” South China Morning Post, March 12, 2020, https://www.scmp.com/economy/global-economy/article/3074821/coronavirus-chinas-mask-making-juggernaut-cranks-gear; U.S. Food and Drug Administration, “Coronavirus (COVID-19) Supply Chain Update,” Press release, February 27, 2020, https://www.fda.gov/news-events/press-announcements/coronavirus-covid-19-supply-chain-update.

Congressional Research Service

9

link to page 14 link to page 15

COVID-19: China Medical Supply Chains and Broader Trade Issues

China Customs data, in 2019 China exported $9.8 billion in medical supplies and $7.4 billion in organic chemicals—a figure that includes active pharmaceutical ingredients and antibiotics—to the United States. While there are no internationally- agreed guidelines and standards for classifying these products, U.S. imports of pharmaceuticals, medical equipment and products, and related supplies are estimated to have been approximately $20.7 billion (or 9.2% of U.S. imports), according to CRS calculations using official U.S. data (Figure 2 and Table 1).

See Figure 2 and Table 1). This number likely understates the extent to which the United States relies on China for pharmaceuticals and medical equipment, products, and supplies. Some foreign products may contain Chinese inputs or components, which may or may not have been substantially transformed in other countries. However, they may not always be classified as Chinese in origin when imported into the United States. This is due, in part, to the “substantial transformation” test—used by U.S. Customs and Border Protection (CBP) to determine a product’s country of origin for trade purposes—which some consider to be complex, fact-specific, and subject to interpretation on a case-by-case basis that can be inconsistent and subjective.36 Additionally, there have been reported cases of Chinese-origin products being declared as non-Chinese in origin upon their importation into the United States (e.g., firms in other countries importing products from China and relabeling them for export to the United States to avoid tariffs).37 This number also likely understates U.S. API imports from China because U.S. direct and indirect imports of API from China may not be classified for such manufacturing use when imported into the United States.

Figure 2. U.S. Imports of Pharmaceuticals and Medical Equipment, Products, and

|

|

Supplies in 2019

Source: CRS using the World Customs Organization Notes: The shares presented here cover product categories at the HTS six-digit level. |

China’s 9.2% share of U.S. imports likely understates the extent to which the United States relies on China for pharmaceuticals and medical equipment, products, and supplies because of how these imports are classified. Table 1. Select U.S. Imports from China in 2019

Value (U.S. Dollars) and Share of U.S. Imports (%)

Share of

U.S.

HTS

Value

Imports

Number

Description

(US$)

(%)

30

Pharmaceutical Products

1,560,469,274

1.2

3005.90

Medical Wadding, Gauze, Bandages, and Similar Articles

314,187,928

49.8

3001.90

Heparin and Its Salts

189,703,230

43.1

3005.10

Adhesive Dressing Articles

179,153,921

28.8

3006.50

First-Aid Boxes and Kits

27,482,506

72.4

3006.70

Gel Preparations (Lubricants) for Operations or

7,487,524

20.8

Physical Exams

3002.11

Malaria Diagnostic Test Kits

914,555

57.7

2941

Antibiotics

307,137,836

35.9

2941.30

Tetracyclines and Derivatives

93,302,575

90.1

2941.10

Penicil in and Derivatives

59,093,397

51.8

2941.50

Erythromycin and Derivatives

4,659,438

23.5

2941.20

Streptomycins and Derivatives

4,453,931

30.1

2941.40

Chloramphenicol and Derivatives

921,074

93.2

2941.90

Other Antibiotics (NESOI)

144,707,421

24.0

9018

Medical Instruments, Appliances, and Parts (Including

1,700,501,270

6.2

Electro-Medical and Sight-Testing)

9018.19

Electro-Diagnostic Equipment and other Apparatus For

368,723,243

9.7

Value (U.S. Dollars) and Share of U.S. Imports (%)

|

HTS Number |

Description |

Value (US$) |

Share of U.S. Imports (%) |

|

30 |

Pharmaceutical Products |

1,560,469,274 |

1.2 |

|

3005.90 |

Medical Wadding, Gauze, Bandages, and Similar Articles |

314,187,928 |

49.8 |

|

3001.90 |

Heparin and Its Salts |

189,703,230 |

43.1 |

|

3005.10 |

Adhesive Dressing Articles |

179,153,921 |

28.8 |

|

3006.50 |

First-Aid Boxes and Kits |

27,482,506 |

72.4 |

|

3006.70 |

Gel Preparations (Lubricants) for Operations or Physical Exams |

7,487,524 |

20.8 |

|

3002.11 |

Malaria Diagnostic Test Kits |

914,555 |

57.7 |

|

2941 |

Antibiotics |

307,137,836 |

35.9 |

|

2941.30 |

Tetracyclines and Derivatives |

93,302,575 |

90.1 |

|

2941.10 |

Penicillin and Derivatives |

59,093,397 |

51.8 |

|

2941.50 |

Erythromycin and Derivatives |

4,659,438 |

23.5 |

|

2941.20 |

Streptomycins and Derivatives |

4,453,931 |

30.1 |

|

2941.40 |

Chloramphenicol and Derivatives |

921,074 |

93.2 |

|

2941.90 |

Other Antibiotics (NESOI) |

144,707,421 |

24.0 |

|

9018 |

Medical Instruments, Appliances, and Parts (Including Electro-Medical and Sight-Testing) |

1,700,501,270 |

6.2 |

|

9018.19 |

|

368,723,243 |

9.7 |

|

9018.31 |

Syringes (Including Parts and Accessories) |

106,902,008 |

14.4 |

|

9018.12 |

Ultrasonic Scanning Apparatus |

78,806,780 |

19.9 |

|

9018.20 |

Ultraviolet or Infrared Ray Apparatus (Including Parts and Accessories) |

11,493,518 |

14.6 |

|

9019 |

Mechano-Therapy and Respiration Apparatus, Including Parts and Accessories |

1,386,955,875 |

32.5 |

|

9019.10.20 |

Mechano-Therapy Appliances and Massage Apparatus |

918,922,381 |

58.5 |

|

9019.20.00 |

Medical Ventilators and Other Artificial Respiration Equipment |

449,688,296 |

17.0 |

|

9019.10.60 |

Select Psychological Aptitude Testing Equipment |

12,155,935 |

29.8 |

|

9019.10.40 |

Electrical Psychological Aptitude Testing Equipment |

6,189,263 |

57.9 |

|

9020 |

|

10,002,578 |

4.0 |

|

9020.00.60 |

Breathing Appliances and Gas Masks |

5,448,928 |

3.1 |

|

9020.00.90 |

Parts and Accessories of Breathing Appliances and Gas Masks |

4,124,104 |

7.2 |

|

9021 |

Orthopedic and Other Appliances to Compensate for a Defect, Including Parts and Accessories |

930,437,769 |

6.8 |

|

9021.10 |

Orthopedic of Fracture Appliances |

323,279,299 |

13.1 |

|

9022 |

X-Ray Apparatus and Parts |

492,398,140 |

11.0 |

|

9022.12 |

Computed Tomography (CT) Apparatus |

49,051,037 |

7.2 |

Source: CRS with data from the U.S. International Trade Commission's DataWeb.

China Nationalizes Medical Production and Supply

China Nationalizes Medical Production and Supply In early February 2020, the Chinese government nationalized control of the production and dissemination of medical supplies in China. Concerned about shortages and its ability to contain the COVID-19, the Chinese government transferred authority over the production and distribution of medical supplies from the Ministry of Information Industry and Technology (MIIT) to the NDRC, China'China’s powerful central economic planning ministry. NDRC commandeered medical manufacturing and logistics down to the factory level and has been directing the production and distribution of all medical-related production, including U.S. companies'’ production lines in China, for domestic use.3138 In response to government directives, foreign firms with significant production capacity in China, including 3M, Foxconn, and General Motors, shifted significant elements of their operations to manufacturing medical PPE.3239 By late February 2020, China had 38 Zhang Pinghui and Zhou Xin, “Coronavirus: China Shifts Responsibility Over Medical Supplies Amid Mask Shortage, Rising Death Toll,” South China Morning Post, February 3, 2020, updated on February 14, 2020, https://www.scmp.com/economy/china-economy/article/3048744/coronavirus-mask-shortage-prompts-beijing-tweak-authority. 39 “Exclusive: Unilever, 3M, on list of firms eligible for China loans to ease coronavirus crisis – sources,” Reuters,

Congressional Research Service

13

link to page 19 link to page 20 link to page 19 COVID-19: China Medical Supply Chains and Broader Trade Issues

By late February 2020, China had ramped up face mask production—both basic surgical masks and N95 masks—from a baseline of 20 million a day to over 100 million a day.

China'

China’s nationalization efforts, while understandable as part of its efforts to address an internal health crisis, may have denied the United States and other countries that depend on open and free markets for their health care supply chains timely access to critical medical supplies (See Table 2 and Table 3).33.40 On February 3, 2020, China'’s Ministry of Commerce directed its bureaucracy, local governments and industry to secure critical technology, medical supplies, and medical-related raw material inputs from the global market,3441 a situation that likely further exacerbated supply shortages in the United States and other markets. To ensure sufficient domestic supplies to counter COVID-19, China'’s Ministry of Commerce (MOFCOM) also called on its regional offices in China and overseas to work with PRC industry associations to prioritize securing supplies from global sources and importing these products. The Ministry of Commerce provided a list of 51 medical suppliers and distributors in 14 countries and regions to target in quickly assuring supply. The Ministry also prioritized food security and the need to increase meat imports.3542 China'’s trade data shows that these policies led to steep increases in China'’s imports of essential PPE and medical supplies, including the raw materials needed to make products such as N95 masks. The policies also contributed to sharp decreases in China'’s exports of these critical medical products to the world. (See Table 2.)

On March 29, 2020, the Australian government imposed new temporary restrictions on all foreign investment proposals in Australia out of concern that strategic investors—particularly those of Chinese origin—might target distressed assets. This comes after authorities discovered two instances of Chinese property developers in Australia purchasing large volumes of medical supplies (and precious metals) for shipment to China.3643 Risland—a wholly- owned subsidiary of one of China'’s largest property developers, Country Garden Holdings—reportedly shipped 82 tons of medical supplies from Australia to China on February 24, 2020. The shipment included February 13, 2020, https://www.reuters.com/article/us-china-health-lending-exclusive-idUSKBN20D0SQ; Yang Jian, “GM, Wuling venture begins output of machines to make face masks,” Automotive News China, February 20, 2020, https://www.autonews.com/china/gm-wuling-venture-begins-output-machines-make-face-masks.

40 Zhang Pinghui and Zhou Xin, “Coronavirus: China Shifts Responsibility Over Medical Supplies Amid Mask Shortage, Rising Death Toll,” South China Morning Post, February 3, 2020, updated on February 14, 2020, https://www.scmp.com/economy/china-economy/article/3048744/coronavirus-mask-shortage-prompts-beijing-tweak-authority; Finbarr Bermingham and Su-Lin Tan, “Coronavirus: China’s Mask Making Juggernaut Cranks Into Gear, Sparking Fears of Overreliance on World’s Workshop,” South China Morning Post, March 12, 2020, https://www.scmp.com/economy/global-economy/article/3074821/coronavirus-chinas-mask-making-juggernaut-cranks-gear; Engen Tham, Cheng Leng, and Zhang Yan, “Exclusive: Unilever, 3M on List of Firms Eligible for China Loans to Ease Coronavirus Crisis—Sources,” Reuters, February 19, 2020, https://www.reuters.com/article/us-china-health-lending-exclusive-idUSKBN20D0SQ; Yang Jian, “GM, Wuling Venture Begins Output of Machines to Make Face Masks, Automotive News, February 20, 2020, https://www.autonews.com/china/gm-wuling-venture-begins-output-machines-make-face-masks; and Luffy Liu, “700 Tech Companies in China Have Begun Making Masks,” EE Times, February 13, 2020, https://www.eetimes.com/700-tech-companies-in-china-have-begun-making-masks/. 41 Ministry of Commerce of the People’s Republic of China, “Circular on Further Facilitating the Import and Export of Technology During the Period of Epidemic Prevention and Control,” February 4, 2020, http://english.mofcom.gov.cn/article/newsrelease/significantnews/202002/20200202934774.shtml; and Ministry of Commerce of the People’s Republic of China, “Circular on Actively Expanding Imports to Combat Against Novel Coronavirus Epidemic,” February 6, 2020, http://english.mofcom.gov.cn/article/newsrelease/significantnews/202002/20200202934157.shtml.

42 Ministry of Commerce of the People’s Republic of China, “General Office of the Ministry of Commerce Issued the Circular on Actively Expanding Imports to Combat against Novel Coronavirus Epidemic,” press release, February 6, 2020.

43 Phillip Coorey, “China Spree Sparks FIRB Crackdown,” Financial Review, March 29, 2020, https://www.afr.com/politics/federal/china-spree-sparks-firb-crackdown-20200329-p54exo.

Congressional Research Service

14

COVID-19: China Medical Supply Chains and Broader Trade Issues

tons of medical supplies from Australia to China on February 24, 2020. The shipment included 100,000 medical gowns and 900,000 pairs of gloves.3744 Greenland Australia—a subsidiary of another large Chinese property developer backed by the Chinese government, Greenland Group—implemented instructions from the Chinese government to secure bulk supplies of medical items from the global market. Greenland reportedly sourced from Australia and other countries, 3 million protective masks, 700,000 hazmat suits, and 500,000 pairs of gloves for export to China over several weeks in January and February 2020.38

45

Table 2. Change in China'’s Exports and Imports of Select Medical Products

YTD 2019 (January-February) vs. YTD 2020 (January-February)

World

United States

Exports Imports Exports Imports

HS

%

%

%

%

Code

Description

Change

Change

Change

Change

6210.10

Garments, Made-Up of Fabrics of Felts and

-13

40,582

-21

297,288

YTD 2019 (January-February) vs. YTD 2020 (January-February)

|

HS Code |

Description |

World |

United States |

||

|

Exports % Change |

Imports % Change |

Exports % Change |

Imports % Change |

||

|

6210.10 |

|

-13 |

40,582 |

-21 |

297,288 |

|

6307.90* |

Made-Up Textile Articles* |

-16 |

2,176 |

-19 |

1,615 |

|

2939.80 |

Alkaloids |

13 |

1,019 |

-18 |

- |

|

4015.11 |

Surgical and Medical Gloves |

4 |

210 |

-8 |

93 |

|

3002.14 |

Immunological Products |

-30 |

197 |

121,302 |

626 |

|

3808.94 |

Disinfectants |

46 |

192 |

35 |

155 |

|

6210.30 |

Women's or Girls' Protective Garments |

-35 |

188 |

-48 |

-75 |

|

9004.90 |

Spectacles and Goggles |

-20 |

185 |

-12 |

164 |

|

9019.20 |

Medical Ventilators and Respiration Apparatus |

-20 |

174 |

-35 |

209 |

|

2936.26 |

Vitamin B12 and Its Derivatives |

-6 |

113 |

-21 |

-33 |

|

6506.10 |

Safety Headgear |

-15 |

106 |

-19 |

277 |

|

4015.19 |

Gloves |

-13 |

77 |

-35 |

514 |

|

8419.20 |

Medical, Surgical or Laboratory Sterilizers |

-34 |

66 |

-70 |

317 |

|

3926.20 |

Gloves, Mittens, and Mitts of Plastics |

-15 |

66 |

-13 |

74 |

|

9025.19 |

Thermometers and Pyrometers |

-12 |

65 |

-16 |

15 |

|

9020.00 |

Breathing Appliances and Gas Masks Having Mechanical Parts or Replaceable Filters |

-23 |

34 |

27 |

5 |

|

3005.90 |

Wadding, Gauze, Bandage, and Similar Articles for Medical, Surgical Purposes |

-12 |

27 |

-8 |

131 |

|

3004.20 |

Medicaments Containing Antibiotics |

-11 |

23 |

-18 |

69 |

|

4818.90 |

Bed Sheets and Similar Household or Hospital Articles of Paper |

-12 |

21 |

-7 |

-26 |

|

6505.00 |

Hats and Other Headgear of Textile Fabric |

-22 |

16 |

-24 |

-8 |

|

3702.10 |

X-Ray Film in Rolls |

-43 |

15 |

- |

50 |

|

9022.90 |

|

-11 |

15 |

-17 |

12 |

|

3402.20 |

Surface-Active Preparations, Washing Preparations, and Cleaning Preparations |

-18 |

8 |

-21 |

-18 |

|

9022.30 |

X-Ray Tubes |

-17 |

5 |

115 |

-6 |

|

6116.10 |

Gloves |

-16 |

-11 |

-21 |

-86 |

|

2936.27 |

Vitamin C |

-39 |

-16 |

-37 |

-95 |

|

9025.11 |

Thermometers and Pyrometers |

-31 |

-22 |

-10 |

299 |

|

6216.00 |

Gloves, Mittens, and Mitts |

-27 |

-22 |

-30 |

25 |

|

6210.40 |

Men's Or Boys' Protective Garments |

-25 |

-23 |

-28 |

-63 |

|

9018.31 |

Syringes |

-21 |

-28 |

-50 |

-18 |

|

2847.00 |

Hydrogen Peroxide |

-86 |

-29 |

-100 |

4 |

|

2941.10 |

Penicillin and Derivatives |

-24 |

-34 |

-17 |

- |

|

3004.42 |

Medicaments Containing Pseudoephedrine |

-61 |

- |

- |

- |

|

3003.60 |

Medicaments Containing Antimalarial Active Principles |

-98 |

- |

- |

- |

Source: CRS analysis with data from China Customs and Global Trade Atlas (March 31, 2020).

with data from China Customs and Global Trade Atlas (March 31, 2020). Notes: *N95 and other protective masks have historically been classified under tariff subheading 6307.99.9889, which includes other miscellaneous textile article made from similar materials.

Table 3. U.S. Imports from China in 2019: COVID-19 Related Medical Supplies

Value (U.S. Dollars), Share of U.S. Imports (%), and Change from Previous Year (%)

Share

of U.S.

Change

HS

China's

Imports

2019/18

Category

Product Description

Number

Rank

Value (US$)

(%)

(%)

I. COVID-19 Test

COVID-19 test kits (diagnostic

3822.00

7

212,319,127

5.4

2.7

Kits/Instruments

reagents based on polymerase chain

and Apparatus

reaction nucleic acid test)

Used in Diagnostic Tests

COVID-19 test kits (diagnostic

3002.15

16

21,754,253

0.1

-59.4

reagents based on immunological

reactions)

Congressional Research Service

16

COVID-19: China Medical Supply Chains and Broader Trade Issues

Share

of U.S.

Change

HS

China's

Imports

2019/18

Category

Product Description

Number

Rank

Value (US$)

(%)

(%)

COVID-19 diagnostic test

9027.80

3

155,359,874

9.5

-1.4

Value (U.S. Dollars), Share of U.S. Imports (%), and Change from Previous Year (%)

|

Category |

Product Description |

HS Number |

China's Rank |

Value (US$) |

Share of U.S. Imports (%) |

Change 2019/18 (%) |

|

I. COVID-19 Test Kits/Instruments and Apparatus Used in Diagnostic Tests |

COVID-19 test kits (diagnostic reagents based on polymerase chain reaction nucleic acid test) |

3822.00 |

7 |

212,319,127 |

5.4 |

2.7 |

|

COVID-19 test kits (diagnostic reagents based on immunological reactions) |

3002.15 |

16 |

21,754,253 |

0.1 |

-59.4 |

|

|

9027.80 |

3 |

155,359,874 |

9.5 |

-1.4 |

|

|

II. Protective Garments |

Face and Eye Protection |

|||||

|

6307.90 |

1 |

3,171,956,472 |

71.7 |

6.5 |

|

|

9020.00 |

7 |

10,002,578 |

4.0 |

26.3 |

|

|

Protective spectacles and goggles |

9004.90 |

1 |

503,787,243 |

54.8 |

6.8 |

|

|

Gloves |

||||||

|

Plastic gloves |

3926.20 |

1 |

863,056,388 |

77.2 |

-24.3 |

|

|

Surgical rubber gloves |

4015.11 |

6 |

1,081,073 |

0.3 |

9.6 |

|

|

Other rubber gloves |

4015.19 |

3 |

252,443,610 |

11.0 |

-5.6 |

|

|

Knitted or crocheted gloves which have been impregnated or covered with plastics or rubber |

6116.10 |

1 |

363,733,689 |

53.6 |

11.2 |

|

|

Textile gloves that are not knitted or crocheted |

6216.00 |

1 |

195,084,793 |

54.7 |

1.9 |

|

|

Other |

||||||

|

Disposable hair nets |

6505.00 |

1 |

934,958,363 |

51.9 |

-21.3 |

|

|

Protective garments for surgical/medical use made up of felt or nonwovens |

6210.10 |

1 |

440,561,626 |

54.3 |

-0.7 |

|

|

Other protective garments of textiles of rubberized textile fabrics or woven fabrics |

6210.20 |

1 |

27,688,815 |

64.2 |

15.4 |

|

|

6210.30 |

1 |

55,082,976 |

55.5 |

37.3 |

|

|

6210.40 |

1 |

323,357,757 |

44.8 |

5.0 |

|

|

6210.50 |

1 |

202,474,607 |

45.4 |

8.8 |

|

|

Liquid filled thermometer for direct reading |

9025.11 |

1 |

15,364,796 |

81.0 |

20.6 |

|

Other thermometers |

9025.19 |

1 |

217,189,968 |

36.2 |

-25.5 |

|

|

IV. Disinfectants and Sterilization Products |

Alcohol solution |

2207.10 |

23 |

25,420 |

0.0 |

154.2 |

|

Alcohol solution |

2208.90 |

2 |

40,916,542 |

2.1 |

-20.5 |

|

|

Hand sanitizer |

3824.99 |

2 |

365,615,644 |

15.3 |

-16.7 |

|

|

Hand sanitizer |

3402.20 |

3 |

39,757,125 |

7.6 |

-33.6 |

|

|

Medical, surgical or laboratory sterilizers |

8419.20 |

13 |

1,854,603 |

1.0 |

22.7 |

|

|

Hydrogen peroxide |

2847.00 |

15 |

10,089 |

0.0 |

-61.6 |

|

|

Hydrogen peroxide presented as a medicament |

3004.90 |

15 |

475,162,117 |

0.8 |

19.5 |

|

|

Other chemical disinfectants |

3808.94 |

2 |

8,841,055 |

10.3 |

132.5 |

|

|

V. Other Medical Devices |

Computed tomography (CT) scanners |

9022.12 |

4 |

49,051,037 |

7.2 |

-54.8 |

|

Extracorporeal membrane oxygenation |

9018.90 |

5 |

758,088,695 |

5.8 |

14.6 |

|

|

Medical ventilators and other oxygen therapy apparatus |

9019.20 |

2 |

449,688,296 |

17.0 |

-2.9 |

|

|

Patient monitoring devices |

9018.19 |

4 |

368,723,243 |

9.7 |

-10.1 |

|

|

VI. Medical Consumables |

Wadding, gauze, bandages, cotton sticks and similar articles |

3005.90 |

1 |

314,187,928 |

49.8 |

10.6 |

|

Syringes, with or without needles |

9018.31 |

2 |

106,902,008 |

14.4 |

6.3 |

|

|

Tubular metal needles and needles for sutures |

9018.32 |

8 |

22,465,545 |

2.9 |

11.6 |

|

|

Needles, catheters, cannulae, and the like |

9018.39 |

6 |

229,655,282 |

3.7 |

7.0 |

|

|

Intubation kits |

9018.90 |

5 |

758,088,695 |

5.8 |

14.6 |

|

|

Paper bed sheets |

4818.90 |

1 |

356,642,980 |

74.9 |

9.9 |

Source: CRS using the World Customs Organization's "HS Classification Reference for COVID-19 Medical Supplies" and data from Global Trade Atlas.

data from Global Trade Atlas. Notes: The international Harmonized System (HS) for classifying goods is a six-digit code system, and classification at the eight and ten-digit levels varies by country. The figures presented here may overestimate the actual value of U.S. imports of medical products, as it is not always possible to identify specific, individual products even at the most disaggregated level.

Implications of China'’s Export Constraints: U.S. Shortages and Policy Response

As the United States rampsramped up efforts to contain the spread of COVID-19, reduced production and exports of pharmaceuticals and PPE from China are exacerbatingexacerbated shortages of critical medical supplies. Minnesota-based 3M, a large-scale manufacturer of N95 respirators, for example, told The New York Times that all masks manufactured at its Shanghai factory were sold to meet China'China’s domestic demand; other mask manufacturers, such as Canada'’s Medicom, have stated that the Chinese government has not yet authorized them to export PPE.3946 China'’s Ministry of Commerce

46 Keith Bradsher and Liz Alderman, “The World Needs Masks. China Makes Them—But Has Been Hoarding Them,”

Congressional Research Service

18

COVID-19: China Medical Supply Chains and Broader Trade Issues

s Ministry of Commerce has claimed it is not imposing export restrictions on medical supplies,4047 but this statement may not apply to the current situation as all of China'’s domestic production is controlled by the government and geared toward domestic consumption.

U.S. national and state-level health authorities have been

Subsequently, China’s imposition of new export quality checks for PPE, particularly masks—implemented by China’s National Medical Products Administration (NMPA)—further slowed exports. On March 30, 2020, China’s Ministry of Commerce (MOFCOM) announced new qualifications for medical supply exports.48 It announced that all medical supplies related to COVID-19 would need to obtain qualifications from China’s National Medical Products Administration (NMPA). These new requirements appear aimed at addressing faulty PPE that several foreign government buyers found in large PPE shipments from China. By requiring new certification processes, the measures also appear to have slowed legitimate exports. Even companies producing in China for export that already had FDA approval had to meet these new PRC requirements.49 Related to MOFCOM’s announcement, on March 30, 2020, NMPA issued Regulatory Requirements and Standards for Coronavirus Testing Reagents and Protective Products. These new requirements regulated COVID-19 testing reagents as Class III medical equipment (highest risk level) and regulated medical-use masks and protective gear as Class II medical equipment, requiring producers to obtain licenses from provincial-level regulators prior to production. The NMPA classified regular masks and protective goggles as Class I medical equipment, requiring producers to file with local authorities. The NMPA also released registration information for seven COVID-19 products (testing kits, ventilators, medical protective wears, medical protective masks, medical surgical masks, single-use masks, and infrared thermometers-detectors).50

In addition to these new registration and inspection requirements, some U.S. legal experts observed that China may have used informal measures, such as administrative guidance, to prioritize exports to certain countries ahead of the United States.51 This may have been politically motivated, as China orchestrated publicized PPE deliveries to countries such as Serbia and Italy, which have signed on to China’s One Belt, One Road Initiative and whom China sees as important partners for investment and trade initiatives in Europe.52 China organized a range of government-to-government medical supply agreements around the world that sought to emphasize the importance of relations with China and the government’s goodwill, but ran into problems with many governments due to faulty PPE. In April and May 2020, Canada’s public health authority reported extensive problems with KN95 respirator masks from China that were counterfeit or otherwise failed to meet federal COVID-19 standards for medical use.53 Several

The New York Times, March 16, 2020, https://www.nytimes.com/2020/03/13/business/masks-china-coronavirus.html.

47 “China Imposes No Export Ban on Masks: Commerce Official,” Xinhua, March 5, 2020, http://english.www.gov.cn/statecouncil/ministries/202003/05/content_WS5e60c25dc6d0c201c2cbda0b.html.

48 State Council of the People’s Republic of China, “National Medical Product Administration Announcement No. 5 on the Orderly Export of Medical Products (国家药品监督管理局公告 2020 年第 5 号 关于有序开展医疗物资出口的公告), March 31, 2020, http://www.gov.cn/zhengce/zhengceku/2020-04/01/content_5497878.htm.

49 Kate O’Keefe, Liza Lin, and Eva Xiao, “China’s Export Restrictions Strand Medical Goods U.S. Needs to Fight Coronavirus, State Department Says,” The Wall Street Journal, April 16, 2020. 50 China’s National Medical Products Administration, http://www.nmpa.gov.cn/WS04/CL2590/complete. 51 “Navigating PPE Purchases from China,” Webinar with Harris Bricken Law Firm, April 23, 2020. 52 Eleanor Albert, “How a Pandemic Drew China and Serbia Closer,” The Diplomat, March 27, 2020; Xinhua, “Iron-clad China-Serbia friendship stronger in COVID-19 fight,” April 2, 2020; Reuters, “China sends medical supplies, experts to help Italy battle coronavirus,” March 13, 2020; Alicia Chen and Vanessa Molter, “Mask Diplomacy: Chinese Narratives in the COVID Era,” Stanford Freeman Spogli Institute for International Studies, June 16, 2020. 53 Jim Bronskill, “Federal Government Rejects 8 Million N95 Masks from a Single Distributor,” The Canadian Press,

Congressional Research Service

19

link to page 25

COVID-19: China Medical Supply Chains and Broader Trade Issues

European countries, including the Netherlands and Spain, reported faulty masks and COVID-19 test kits.54 Chinese propaganda efforts tied to the delivery of PPE were criticized in western media and by European Union officials as trying to capitalize on the crisis to try and divide Europe. Chinese media frequently conflated Chinese government-organized and publicized shipments of PPE that had been procured and paid for by foreign governments as aid.55

China’s exports of COVID-19-related PPE experienced a sharp uptick between March and June 2020, before tapering off in July with a particularly pronounced increase in N95 masks that peaked earlier than other products. China appears to have prioritized Europe in its export of N95 masks, a trend that is reflected both in overall increases and shifts in market share as a percentage of total imports. China’s market share as a percentage of EU imports of N95 masks rose by 16%, while its share of U.S. imports declined by 15%. China’s market share for N95 masks in Japan, Australia, and South Korea also declined somewhat. (See Table 4).

Figure 4. China’s Export of Select Covid-19-Related Products: Jan.-July 2020