Alternative Fuel and Advanced Vehicle Technology Incentives: A Summary of Federal Programs

Changes from February 26, 2019 to September 13, 2021

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Alternative Fuel and Advanced Vehicle Technology Incentives: A Summary of Federal Programs

Contents

- Introduction

- Factors Behind Alternative Fuels and Technologies Incentives

- Developing Domestic Ethanol Production

- Establishing Other New Alternative Fuels

- Encouraging the Purchase of Nonpetroleum Vehicles

- Reducing Fuel Consumption and Vehicle Emissions

- Supporting U.S. Motor Vehicle Manufacturing

- Highway Funding and Fuels Taxes

- Structure and Content of the Report

- Current Federal Incentives

- Department of the Treasury

- Department of Energy

- Department of Transportation

- Environmental Protection Agency

- Department of Agriculture

Tables

Summary

Alternative Fuel and Advanced Vehicle

September 13, 2021

Technology Incentives: A Summary of

Lynn J. Cunningham

Federal Programs

Senior Research Librarian

A wide array of federal incentives supports the development and deployment of

Bill Canis

alternatives to conventional fuels and engines in transportation. These incentives include Specialist in Industrial

tax deductions and credits for vehicle purchases and the installationinstal ation of refueling

Organization and Business

systems, federal grants for conversion of older vehicles to newer technologies, mandates for the use of biofuels, and incentives for manufacturers to produce alternative fuel

Melissa N. Diaz

vehicles. The current array of incentives for alternative fuels and related technologies

Analyst in Energy Policy

does not reflect a single, comprehensive strategy, but rather an aggregative approach to a range of discrete public policy issues, including goals of reducing petroleum

Brent D. Yacobucci

consumption and import dependence, improving environmental quality, expanding

Section Research Manager

domestic manufacturing, and promoting agriculture and rural development.

Alternative fuels programs can be general y classified into seven categories, some of

which overlap: increasing the penetration of electric vehicles (EVs) in the automotive market; expanding domestic biofuel production and use; establishing other alternative fuels; encouraging the purchase of nonpetroleum vehicles; reducing fuel consumption and greenhouse gas emissions; supporting U.S. vehicle manufacturing; and funding U.S. highways.

Current federal programs are administered by five key agencies: Department of the Treasury (Treasury), Department of Energy (DOE), Department of Transportation (DOT), Environmental Protection Agency (EPA), and the U.S. Department of Agriculture (USDA). The incentives and programs described in this report are organized by the responsible agency.

-

Treasury (through the Internal Revenue Service, IRS) administers tax credits and deductions for

alternative fuel and advanced technology vehicle purchases, expansion of alternative fuel refueling infrastructure, and incentives for the production and/or distribution of alternative fuels. Many of these incentives have expired in recent years.

- DOE (mainly through the Office of Energy Efficiency and Renewable Energy, EERE) administers research and development (R&D) programs for advanced fuels and transportation technology, grant programs to deploy alternative fuels and vehicles, and a loan program to promote domestic manufacturing of high-efficiency vehicles.

-

DOT (mainly through the Federal Highway Administration, FHWA, and Federal Transit

Administration, FTA) administers grant programs to deploy

"“clean fuel"” buses and other alternative fuel vehicles. DOT (through the National Highway Traffic Safety Administration, NHTSA) also administers federal Corporate Average Fuel Economy (CAFE) standards, which include incentives for production of alternative fuel vehicles. - EPA (mainly through the Office of Transportation and Air Quality, OTAQ) administers the Renewable Fuel Standard, which mandates the use of biofuels in transportation. EPA also administers grant programs to replace older diesel engines with newer technology.

- USDA (mainly through the Rural Business-Cooperative Service, RBS) administers grant, loan, and loan guarantee programs to expand agricultural production of biofuel feedstocks, conduct R&D on biofuels and bioenergy, and establish and expand facilities to produce biofuels, bioenergy, and bioproducts.

Introduction

A range of federal incentives supports

Congressional Research Service

link to page 5 link to page 6 link to page 7 link to page 7 link to page 7 link to page 8 link to page 8 link to page 8 link to page 9 link to page 9 link to page 10 link to page 10 link to page 10 link to page 10 link to page 10 link to page 11 link to page 12 link to page 12 link to page 12 link to page 13 link to page 14 link to page 15 link to page 15 link to page 15 link to page 16 link to page 16 link to page 17 link to page 17 link to page 18 link to page 18 link to page 19 link to page 19 link to page 20 link to page 21 link to page 21 link to page 21 link to page 22 link to page 22 link to page 23 link to page 23 link to page 23 link to page 24 link to page 24 link to page 25 link to page 26 Alternative Fuel and Advanced Vehicle Technology Incentives

Contents

Introduction ................................................................................................................... 1 Factors Behind Alternative Fuels and Technologies Incentives ............................................... 2

Expanding Electric Vehicle Use ................................................................................... 3 Developing Domestic Biofuel Production and Use.......................................................... 3 Establishing Other New Alternative Fuels ..................................................................... 3 Encouraging the Use of Nonpetroleum Vehicles ............................................................. 4 Reducing Fuel Consumption and Vehicle Emissions ....................................................... 4

Supporting U.S. Motor Vehicle Manufacturing ............................................................... 4 Highway Funding and Fuels Taxes ............................................................................... 5

Structure and Content of the Report ................................................................................... 5 Current Federal Incentives................................................................................................ 6

Department of the Treasury ......................................................................................... 6

Vehicle Incentives ................................................................................................ 6

Alternative Motor Vehicle Credit (Fuel Cell Vehicles) .......................................... 6

Plug-In Electric Drive Vehicle Credit ................................................................. 6 Plug-In Two-Wheeled Electric Vehicle Credit ..................................................... 7 Idle Reduction Equipment Tax Exemption .......................................................... 8

Fuel/Infrastructure Incentives—General................................................................... 8

Motor Fuel Excise Taxes .................................................................................. 8 Incentives for Alternative Fuel and Alternative Fuel Mixtures ................................ 9

Alternative Fuel Refueling Property Credit ....................................................... 10

Fuel/Infrastructure Incentives—Biofuels ................................................................ 11

Biodiesel or Renewable Diesel Mixture Excise Tax Credit and Income Tax

Credit ....................................................................................................... 11

Smal Agri-Biodiesel Producer Credit .............................................................. 12

Second Generation Biofuel Producer Credit ...................................................... 12

Department of Energy .............................................................................................. 13

Advanced Technology Vehicles Manufacturing Loan Program (ATVM) ................ 13 Bioenergy Technologies Office (formerly the Biomass and Biorefinery

Systems R&D Program) .............................................................................. 14

Clean Cities Program..................................................................................... 15 Hydrogen and Fuel Cell Technologies Office .................................................... 15 Vehicle Technologies Office (VTO) ................................................................. 16

Department of Transportation .................................................................................... 17

Alternative Fuel Corridors.............................................................................. 17

Congestion Mitigation and Air Quality Improvement Program ............................. 17 Corporate Average Fuel Economy Program Alternative Fuel Vehicle Credits.......... 18 Low or No Emission Vehicle Program.............................................................. 18

Environmental Protection Agency .............................................................................. 19

National Clean Diesel Campaign ..................................................................... 19 Renewable Fuel Standard ............................................................................... 19

Department of Agriculture ........................................................................................ 20

Bioenergy Program for Advanced Biofuels ....................................................... 20 Biomass Crop Assistance Program (BCAP; §9011) ............................................ 21 Biomass Research and Development (BRDI) .................................................... 22

Congressional Research Service

link to page 26 link to page 26 link to page 27 link to page 6 link to page 32 link to page 40 link to page 42 link to page 43 link to page 29 link to page 31 link to page 44 Alternative Fuel and Advanced Vehicle Technology Incentives

Biorefinery, Renewable Chemical, and Biobased Product Manufacturing

Assistance Program (formerly the Biorefinery Assistance Program) ................... 22

Rural Energy for America Program (REAP) Grants and Loans............................. 23

Figures Figure 1. U.S. Greenhouse Gas Emissions from Transportation and Electric Power ................... 2

Tables

Table B-1. Federal Programs by Agency ........................................................................... 28 Table B-2. Federal Taxes and Incentives for Alternative Fuels .............................................. 36 Table B-3. Federal Incentives for Alternative Fuel and Advanced Technology Vehicles ............ 38 Table B-4. Selected Expired/Repealed Programs by Agency ................................................ 39

Appendixes Appendix A. Selected Expired or Repealed Programs ......................................................... 25 Appendix B. Summary Tables ......................................................................................... 27

Contacts Author Information ....................................................................................................... 40

Congressional Research Service

link to page 6 Alternative Fuel and Advanced Vehicle Technology Incentives

Introduction Since the early years of the automobile, petroleum-fueled combustion engines have dominated the vehicle market. Alternatives, including battery-powered electric vehicles (EVs) and alcohol-fueled combustion vehicles, have existed since the automobile’s infancy, but their adoption was limited for a variety of reasons, including abundant, inexpensive gasoline and diesel fuel, a refueling infrastructure network dedicated to petroleum, and differences in vehicle performance

and capability. Interest in alternatives to petroleum has grown over time, driven by factors such as concerns over U.S. reliance on imported petroleum, pollutant emissions and subsequent health effects, and climate change resulting from the use of fossil fuels. Congress has considered and debated the role of petroleum and other transportation energy sources for decades, and that discussion continues as the nation considers legislation to address aging infrastructure and

meeting the needs of modern society.

A range of federal incentives support the development and deployment of alternatives to conventional fuels and engines in transportation. These incentives include tax deductions and

credits for vehicle purchases and the installationinstal ation of refueling systemsinfrastructure, federal grants for conversion of older vehicles to newer technologies, mandates for the use of biofuels, and incentives for manufacturers to produce alternative fuel vehicles. Some of these incentives have expired and subsequently been reinstated, in many cases retroactively. Further, in some cases this

retroactive extension has happened multiple times.

expired in recent years when their authorizations expired.

Many of the policy choices presented for alternative fuel and advanced vehicle technologies originated as a response to the nation'’s interest in reducing petroleum imports, a goal first articulated at the time of the two oil embargoes imposed by the Organization of Petroleum

Exporting Countries (OPEC) in the 1970s. While President Richard Nixon is often cited as the first President to call for "cal for “energy independence,"” successive Presidents and Congresses have

made efforts to reduce petroleum import dependence as wel .

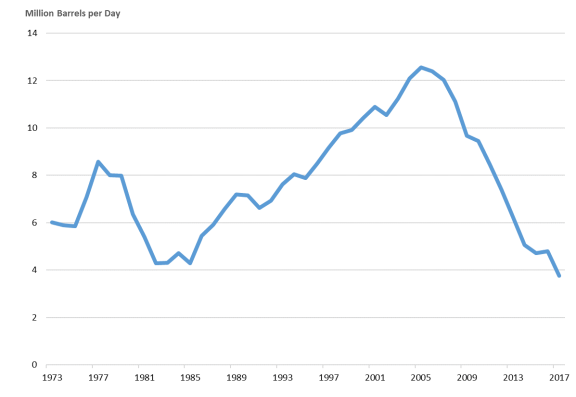

However, concern over import dependence among some stakeholders has waned, particularly since the mid-2000s. Driven largely by the advent of inexpensive dril ing techniques once considered “unconventional,” domestic crude oil production increased 145% from 2008 and 2020,1 while net U.S. petroleum (crude oil and products) imports peaked in 2005 and became negative (i.e., net exports) in 2020.2 Since the mid-2000s, other considerations have played a

larger role, including an increasing share of U.S. greenhouse gas (GHG) emissions coming from transportation—while total U.S. emissions fel 11% from 2005 to 2019, transportation emissions increased from 27% of the total to 29% (Figure 1). The majority of those transportation emissions come from the combustion of gasoline and diesel fuel in cars, trucks, buses, and other

automobiles.

1 U.S. Energy Information Administration (EIA), U.S. Field Production of Crude Oil, Washington, DC, July 30, 2021, https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpus1&f=a. 2 EIA, U.S. Net Imports of Crude Oil and Petroleum Products, Washington, DC, July 30, 2021, https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MT TNTUS2&f=A.

Congressional Research Service

1

Alternative Fuel and Advanced Vehicle Technology Incentives

Figure 1. U.S. Greenhouse Gas Emissions from Transportation and Electric Power

Mil ion Metric Tons Carbon Dioxide Equivalent (MMT CO2 Eq.)

Source: U.S. Environmental Protection Agency (EPA), Inventory of U.S. Greenhouse Gas Emissions and Sinks 1990-2019, EPA 430-R-21-005, Washington, DC, April 14, 2021, Tables ES-6 and ES-7, https://www.epa.gov/ghgemissions/inventory-us-greenhouse-gas-emissions-and-sinks-1990-2019. Notes: In this figure, emissions from electric power for transportation are included in the transportation sector, as wel as in total electric power emissions. In 2005, electric power contributed 33% of U.S. emissions, decreasing to 25% in 2019, while transportation emissions increased from 27% to 29% during the same time frame. Excludes U.S. territories.

Federal incentives to promote alternative fuels and advanced vehicle technologies do not reflect a single, comprehensive strategy but rather an aggregative approach to a range of discrete public policy issues, including improving environmental quality, expanding domestic manufacturing,

and promoting agriculture and rural development.

Factors Behind Alternative Fuels and Technologies Incentives While a reliance on foreign sources of petroleum was an overriding concern for much of the past

50made efforts to reduce petroleum import dependence as well.

As shown in Figure 1, since peaking in 2005, net U.S. oil imports have fallen by 70%. Factors in this reversal include the last recession, which reduced domestic demand, followed by a rise in the supply of U.S. oil and oil alternatives due to increased private sector investment and federal incentives, some of which are cited in this report. In addition, the United States has become a net exporter of petroleum products (while it remains a net importer of crude oil). With declining U.S. import dependence, reliance on petroleum and petroleum products may be less of a factor in promoting alternative fuels and alternative fuel vehicles in the future.

In addition to concerns over petroleum import dependence, other factors also have driven policy on alternative fuels and advanced vehicle technologies. Federal incentives do not reflect a single, comprehensive strategy but rather an aggregative approach to a range of discrete public policy issues, including improving environmental quality, expanding domestic manufacturing, and promoting agriculture and rural development.

Annual Average |

|

|

Factors Behind Alternative Fuels and Technologies Incentives

While a reliance on foreign sources of petroleum was an overriding concern for much of the past 40 years, other factors, such as rural development, promotion of domestic manufacturing, and environmental concerns, have also shaped congressional interest in alternative fuels and technologies. A variety of programs affecting the development and commercialization of alternative fuels and technologies have been proposed and enacted, each with its own benefits and drawbacks.3 Alternative fuels programs can be general y classified into seven categories, some of

which overlap: increasing the penetration of EVs in the automotive market; expanding domestic biofuel production and usedrawbacks. (This report does not evaluate the effectiveness of alternative fuel programs and incentives.) Alternative fuels programs can be generally classified into six categories: expanding domestic ethanol production; establishing other alternative fuels; encouraging the purchase of nonpetroleum vehicles; reducing fuel consumption and greenhouse gas emissions; supporting

U.S. vehicle manufacturing; and funding U.S. highways.

Developing Domestic Ethanol Production

Ethanol has

3 T his report does not evaluate the effectiveness of alternative fuel programs and incentives.

Congressional Research Service

2

Alternative Fuel and Advanced Vehicle Technology Incentives

Expanding Electric Vehicle Use Many stakeholders see EVs as a key strategy in addressing transportation-related pollutant GHG

emissions. A plug-in battery electric vehicle (BEV) has no direct emissions of conventional pollutants4 or GHGs.5 The same is true for a plug-in hybrid electric vehicle (PHEV) when operating in al -electric mode. Sales of plug-in vehicles have increased: in 2015, plug-in vehicles represented roughly 0.8% of the new passenger vehicle market, and in 2018, that share had increased to 2.2%.6 However, while infrastructure to recharge plug-in vehicles has grown over the

same time, the number of publicly available charging stations remains smal relative to the

number of retail gasoline stations in the United States.

Developing Domestic Biofuel Production and Use Biofuels, particularly corn-based ethanol, have been seen as a homegrown alternative to imported oil. A number of programs were put in place to encourage itstheir domestic development (instead of importing from other ethanolbiofuel producers, such as Brazil). To spur establishment of this domestic industry, Congress has enacted a number of laws, which are beneficial to states that have a large

concentration of corn and soybean growers (corn and soybeans being the raw material feedstock feedstocks in most U.S. ethanolbiofuels). Many of the incentives for ethanolbiofuel production have been included in farm-related legislation and appropriations acts and hence have been administered by the U.S. Department of Agriculture (USDA), or in tax provisions administered by the Internal Revenue Service (IRS). Service (IRS). The volumetric ethanol excise tax credit (VEETC) provided a tax credit to gasoline suppliers who blended ethanol with gasoline. The small ethanol producer tax credit provided a limited additional credit for small ethanol producers. Both credits expired at the end of 2011. Since 2005, petroleum refiners and importers have been required to supply biofuels as a share of their gasoline and diesel supply.7 This mandate, the Renewable Fuel

Standard (RFS), has been an impetus for expanded production and use of ethanol and other biofuels.

Within and outside of the RFS, specific policies support the development of biodiesel and other renewable diesel fuels and biofuels produced from cel ulose, farm and municipal waste, and/or algae. These include specific carve-outs within the RFS mandates and targeted tax credits

for biofuels other than conventional ethanol.

Establishing Other New Alternative Fuels Establishing Other New Alternative Fuels

In addition to ethanolbiofuels, Congress has sought to spur development of other alternative fuels, such as as biodiesel, cellulosic biofuel, hydrogen, liquefied petroleum gas (LPG), compressed natural gas (CNG), and liquefied natural gas (LNG). Some of these fuels have been supported through tax credits (such as the biodiesel tax credit), federal mandates (mainly the RFS), and R&D programs (such as the Biomass Research and Development Initiative, which provides grants for new technologies leading to the commercialization of biofuels).

Encouraging the Purchase, vehicle purchase mandates (mainly on federal and state fleets), and R&D programs (e.g., for hydrogen fuel and

fuel cel vehicles).

4 E.g., particulate matter (PM), volatile organic compounds (VOCs), and nitrogen oxides (NOx), which pose direct health impacts or contribute to the formation of other atmospheric compounds that affect human health or welfare.

5 Often referred to as zero emission vehicles (ZEVs) because of the lack of direct emissions, the use of EVs may still result in upstream emissions from the production of the vehicle and its components, as well as from the generation of electricity (if, for example, that electricity comes from fossil fuel combustion). For more information on EVs, see CRS Report R46231, Electric Vehicles: A Prim er on Technology and Selected Policy Issues, by Melissa N. Diaz. For more information on EV lifecycle emissions relative to conventional vehicles, see CRS Report R46420, Environm ental Effects of Battery Electric and Internal Com bustion Engine Vehicles, by Richard K. Lattanzio and Corrie E. Clark .

6 International Energy Agency (IEA), Global EV Outlook 2021, April 2021, https://www.iea.org/reports/global-ev-outlook-2021.

7 For further discussion, see CRS Report R43325, The Renewable Fuel Standard (RFS): An Overview, by Kelsi Bracmort .

Congressional Research Service

3

Alternative Fuel and Advanced Vehicle Technology Incentives

Encouraging the Use of Nonpetroleum Vehicles of Nonpetroleum Vehicles

Congress has enacted laws which seek to boost consumer adoption by providing tax credits for

the purchase of some vehicles that consume far less petroleum than conventional vehicles, or that do not consume petroleum at allal . These tax credit programs generallygeneral y are limited in duration as a way to encourage early adopters to take a risk on new kinds of vehicles. The proponents contend that once a significant number of such new cars and trucks are on the road, additional buyers would be attracted to them, the increased volume would result in lower prices, and the tax credits

would no longer be needed. Currently, a credit is available for the purchase of plug-in electric vehicles. Expired credits include incentives for hybrid vehicles, fuel cell cel vehicles, advanced lean burn technology vehicles,18 and certain alternative fuel vehicles. Congress has also enacted tax credits to spur the expansion of infrastructure to fuel such vehicles, although these credits have likewise expired.

and to incentivize the sale of alternative fuels. Reducing Fuel Consumption and Vehicle Emissions

Several agencies, including the Environmental Protection Agency (EPA) and the Department of

Transportation (DOT), have been mandated by statute to address concerns over fuel consumption and vehicle emissions through programs for alternative fuels. The most significant and long-standing program to reduce vehicle fuel consumption is the Corporate Average Fuel Economy (CAFE) program administered by DOT.29 Under CAFE, each manufacturer'’s fleet must meet specific miles-per-gallongal on standards for passenger vehicles and light trucks. If a manufacturer fails to do so, it is subject to financial penalties. Manufacturers can accrue credits toward meeting

CAFE standards for the production and sale of certain types of alternative fuel vehicles. A joint rulemaking process between DOT and EPA links future CAFE standards with greenhouse gas (GHG)GHG standards promulgated under EPA'’s Clean Air Act authority. DOT also established the Congestion Mitigation and Air Quality Improvement Program (CMAQ) to fund programs that intended to reduce emissions in urban areas that exceed certain air quality standards. At EPA, the Diesel

Emission Reduction Act (DERA) was implemented with a goal of reducing diesel emissions by funding and implementing new technologies. In addition, EPA'’s RFS mandates the use of renewable fuels for transportation.310 Under the RFS, some classes of biofuels must achieve GHG

emission reductions relative to gasoline.

Supporting U.S. Motor Vehicle Manufacturing

The Department of Energy (DOE), in partnership with U.S. automakers, federal labs, and academic institutions, has funded and overseen research and development programs on alternative

vehicles and vehicle electrification for decades, in particular research focused on how to produce economical batteries that extend electric vehicle range. These R&D programs were supplemented in the American Recovery and Reinvestment Act (ARRA; P.L. 111-5) to include grants to U.S.-based companies for facilities to manufacture advanced battery systems, component manufacturers, and software designers to boost domestic production and international

competitiveness. The Advanced Technology Vehicles Manufacturing (ATVM) loan program at

8 For the most part, these are advanced diesel vehicles. 9 For further discussion, see CRS Report R45204, Vehicle Fuel Economy and Greenhouse Gas Standards: Frequently Asked Questions, by Richard K. Lattanzio, Linda T sang, and Bill Canis.

10 For further discussion, see CRS Report R43325, The Renewable Fuel Standard (RFS): An Overview, by Kelsi Bracmort .

Congressional Research Service

4

link to page 29 link to page 31 link to page 32 link to page 40 link to page 40 link to page 42 link to page 43 Alternative Fuel and Advanced Vehicle Technology Incentives

DOE, established by the Energy Independence and Security Act of 2007 (P.L. 110-140), has supported manufacturing plant investments to enable the development of technologies to reduce petroleum consumption, including the manufacture of electric and hybrid vehicles,411 although no

new loans have been approved since 2011.

Highway Funding and Fuels Taxes

As described below (see "Motor Fuel Excise Taxes"“Incentives for Alternative Fuel and Alternative Fuel Mixtures”), one of the earliest fuels-related federal programs is the motor vehicle fuels excise tax first passed in the

Highway Revenue Act of 1956 to fund construction and maintenance of the interstate highway system. OriginallyOriginal y, only gasoline and diesel were taxed, but as newer fuels became available (such as ethanol and compressed natural gas), they were added to the federal revenue program, but often at lower tax rates than gasoline or diesel. Lower tax burdens for some fuels or vehicles may effectively incentivize those choices over conventional options. However, lower tax burdens for these vehicles and fuels could compromise federal highway revenue. The vehicles responsible

for lower tax revenues include traditional internal combustion engine vehicles with higher

mileage per gallon as well gal on as wel as new technology electric and hybrid cars.

Structure and Content of the Report

The federal tax incentives and programs discussed in this report aim to support the development and deployment of alternative fuels. There is no central coordination of how these incentives interact. In general, they are independently administered by separate federal agencies, including five agencies: Department of the Treasury, DOE, DOT, EPA, and USDA.

This report focuses strictly on programs that directly support alternative fuels or advanced

vehicles. It does not address more general programs (e.g., general manufacturing loans, rural development loans), or programs that have been authorized but never funded. The programs are presented by agency, starting with those that generallygeneral y address the above factors, followed by those that are fuel- or technology-specific. Programs that expired or were repealed on or after December 31, 2017, are included in Appendix A, Recently Expired or Repealed Programs.5in Appendix A.12 Congress may explore whether to reinstate

these expired programs or establish similar programs.

Appendix B contains four tables:

1.1. a summary of the programs discussed in the body of the report, listed by agency (Table B-1);2.; 2. a listing of programs and incentives for alternative fuels, by fuel type (Table B- 2); 3.;3.a listing of programs and incentives for advanced technology vehicles, by vehicle type (Table B-3); and4.4. a listing of recently expired programs by agency (Table B-4). 11 For more information, see CRS Report R42064, The Advanced Technology Vehicles Manufacturing (ATVM) Loan Program : Status and Issues, by Bill Canis and Brent D. Yacobucci. 12 For a list and description of programs that expired or were repealed before December 31, 2017, please see Version 17 of this report, dated November 20, 2018. Congressional Research Service 5 Alternative Fuel and Advanced Vehicle Technology Incentives(Table B-4).

Current Federal Incentives

Department of the Treasury

Vehicle Incentives

Alternative Motor Vehicle Credit (Fuel Cell Vehicles)13

Administered by

IRS

Authority

Established by the Energy Policy Act of 2005, (P.L. 109-58, §1341(a)). Amended by P.L. 109-135, Title IV, §§ 402(j) and 412(d), P.L. 110-343, Division B, Title II, § 205(b), P.L. 111-5, Division B, §1141-1144; P.L. 112-240, Title I, § 104(c)(2)(H), and P.L. 113-295, Division A, Title II, §§ 218(a) and 220(a). The Consolidated Appropriations Act of 2016 (P.L. 114-113) extended through 2016 (retroactive for 2015) the alternative motor vehicle credit for qualified fuel cel motor vehicles only; the credit for qualified fuel cel vehicles has expired and subsequently been extended retroactively on multiple occasions since 2016, most recently through 2021 by the Consolidated Appropriations Act, 2021 ( P.L. 116-260, Division EE, Title 1, §142).14

Annual Funding

Joint Committee on Taxation (JCT) estimated budget effect for FY2021: $4 mil ion. JCT budget effect for FY2021-FY2025: $6 mil ion.15

Termination Date

December 31, 2021, for fuel cel vehicles; expired December 31, 2010, or earlier for al other vehicles.

Description

Enacted in the Energy Policy Act of 2005, the original provision included separate credits for four distinct types of vehicles: those using fuel cel s, advanced lean burn technologies, qualified hybrid technologies, and qualified alternative fuels technologies. Currently, only qualified fuel cel motor vehicles are eligible for the tax credit.

Qualified Applicant(s)

Taxpayers purchasing a qualified vehicle. For taxpayers who sel vehicles to tax-exempt entities (e.g., government agencies, schools), those taxpayers may claim the credit if they disclose to the purchaser their intent to claim the credit.

Applicable

Qualified fuel cel vehicles

Fuel/Technology For More Information See IRS Form 8910: Alternative Motor Vehicle Credit; Instructions for IRS Form 8910;

IRS Notice 2008-33; and the Alternative Fuels Data Center’s (AFDC’s) entry for the Fuel Cel Motor Vehicle Credit on its “Federal Laws and Incentives” web page.

Related CRS Reports

CRS Report R46451, Energy Tax Provisions Expiring in 2020, 2021, 2022, and 2023 (“Tax Extenders”), by Mol y F. Sherlock, Margot L. Crandal -Hol ick, and Donald J. Marples

Plug-In Electric Drive Vehicle Credit16

Administered by

IRS

13 26 U.S.C. §30B. 14 In the past, Congress has acted regularly to extend expired or expiring temporary tax provisions. Collectively, these temporary tax provisions are often referred to as “tax extenders.” 15 U.S. Congress, Joint Committee on T axation, “ Estimated Budget Effects of the Revenue Provisions Contained in the ‘Consolidated Appropriation Act, 2021,’” 116th Cong., 2nd sess., December 21, 2020, JCX-24-20 (Washington, DC: GPO, 2020).

16 26 U.S.C. §30D.

Congressional Research Service

6

Alternative Fuel and Advanced Vehicle Technology Incentives

Authority

Established by the Energy Improvement and Extension Act of 2008, 26 U.S.C. 38(b)(35), 30D, P.L. 110-343, Div. B, Title II, §205(a). The American Recovery and Reinvestment Act of 2009 (P.L. 111-5, §141) amended Section 30D effective for vehicles acquired after December 31, 2009.

Annual Funding

JCT estimated tax expenditure for FY2021: $0.6 bil ion; JCT estimated tax expenditure for FY2020-FY2024: $3.0 bil ion.17

Scheduled

Phased out separately for each automaker when that automaker has sold a total of

Termination

200,000 qualified vehicles.18

Description

Purchasers of plug-in electric vehicles may file to obtain a tax credit of up to $7,500 per vehicle, depending on battery capacity. The vehicle must be acquired for use or lease and not for resale. Additional y, the original use of the vehicle must commence with the taxpayer and the vehicle must be used predominantly in the United States. For purposes of the 30D credit, a vehicle is not considered acquired prior to the time when title to the vehicle passes to the taxpayer under state law.

Qualified Applicant(s)

Taxpayers purchasing a qualified vehicle. For taxpayers who sel vehicles to tax-exempt entities (e.g., government agencies, schools), those taxpayers may claim the credit if they disclose to the purchaser their intent to claim the credit.

Applicable

Plug-in electric vehicles

Fuel/Technology For More Information See the IRS web page for the Plug-In Electric Drive Vehicle Credit (IRC 30D); and

AFDC’s web page for the Qualified Plug-In Electric Vehicle (PEV) Tax Credit.

Related CRS Reports

CRS In Focus IF11017, The Plug-In Electric Vehicle Tax Credit, by Mol y F. Sherlock

Plug-In Two-Wheeled Electric Vehicle Credit19

Administered by

IRS

Authority

American Recovery and Reinvestment Act, P.L. 111-5, §1142 amended by the American Taxpayer Relief Act of 2012 (P.L. 112-240 §403). This temporary credit has expired and subsequently has been extended retroactively on multiple occasions. The credit lapsed completely for 2014 (no vehicles qualified). Most recently the credit was extended for two-wheeled vehicles through 2021 by the Consolidated Appropriations Act, 2021 (P.L. 116-260).

Annual Funding

JCT estimated budget effect for FY2021: Less than $500,000. JCT estimated budget effect for FY2021-FY2025: $2 mil ion.20

Termination Date

December 31, 2021, for two-wheeled vehicles. Expired December 31, 2013, for three-wheeled vehicles and December 31, 2011, for low speed two- or three-wheeled vehicles.

Description

Internal Revenue Code Section 30D provided a tax credit for qualified plug-in electric vehicles. The credit was equal to 10% of the cost of a qualified plug-in electric vehicle and limited to $2,500. Qualified vehicles included vehicles that have two or three wheels. The vehicle must have been acquired for use or lease and not for resale. The original use of

17 For JCT tax expenditure estimates, see U.S. Congress, Joint Committee on T axation, “Estimates of Federal T ax Expenditures for Fiscal Years 2020-2024,” 116th Cong., 2nd sess., November 5, 2020, JCX-23-20 (Washington: GPO, 2020). 18 Estimated cumulative sales for selected automakers as of June 2020 were: T esla, 605,373; General Motors, 234,523; Nissan, 144,913; T oyota Motor Corporation, 127,593; Ford Motor Company, 123,030; BMW Group, 99,481 (EVAdoption.com, “Federal EV T ax Credit Phase Out T racker by Automaker” (EV Sales beginning Jan 1, 2010 through June 2020), 2020 (specific date not listed), https://evadoption.com/ev-sales/federal-ev-tax-credit-phase-out-tracker-by-automaker/).

19 26 U.S.C. §30D. T his credit formerly applied to both two- and three-wheeled vehicles, as well as low-speed vehicles. 20 U.S. Congress, Joint Committee on T axation, “ Estimated Budget Effects of the Revenue Provisions Contained in the ‘Consolidated Appropriation Act, 2021,’” 116th Cong., 2nd sess., December 21, 2020, JCX-24-20 (Washington: GPO, 2020).

Congressional Research Service

7

Alternative Fuel and Advanced Vehicle Technology Incentives

the vehicle had to commence with the taxpayer and the vehicle had to be used predominantly in the United States.

Qualified Applicant(s)

Taxpayers purchasing a qualified vehicle. For taxpayers who sel vehicles to tax-exempt entities (e.g., government agencies, schools), those taxpayers may claim the credit if they disclose to the purchaser their intent to claim the credit.

Applicable

Two-wheeled plug-in electric vehicles

Fuel/Technology For More Information See IRS Notice 2013-67 and IRS form 8936; and AFDC’s web page for the Qualified Two-

Wheeled Plug-In Electric Drive Motor Vehicle Tax Credit.

Related CRS Reports

CRS Report R46451, Energy Tax Provisions Expiring in 2020, 2021, 2022, and 2023 (“Tax Extenders”), by Mol y F. Sherlock, Margot L. Crandal -Hol ick, and Donald J. Marples

Idle Reduction Equipment Tax Exemption21

Administered by

IRS

Authority

Established by the Energy Improvement and Extension Act of 2008 (P.L. 110-343), Division B, Title II, §206(a).

Annual Funding

N/A22

Scheduled

No expiration date23

Termination Description

Department of the Treasury

Idle Reduction Equipment Tax Exemption6

|

Administered by |

IRS |

|

Authority |

Established by the Energy Improvement and Extension Act of 2008 (P.L. 110-343), Division B, Title II, §206(a). |

|

Annual Funding |

Joint Committee on Taxation (JCT) estimated budget effect for FY2018: $17 million7 |

|

Scheduled Termination |

No expiration date8 |

|

Description |

Section 4053 of the U.S. tax code exempts certain vehicle idling reduction devices from the federal excise tax on heavy trucks and trailers. |

|

Qualified Applicant(s) |

|

|

Applicable Fuel/Technology |

|

|

For More Information |

|

|

Related CRS Reports |

None |

Motor Fuel Excise Taxes10

Plug-In Electric Drive Vehicle Credit15

|

Administered by |

IRS |

|

Authority |

Established by the Energy Improvement and Extension Act of 2008, 26 U.S.C. 38(b)(35), 30D, P.L. 110-343, Div. B, Title II, §205(a). The American Recovery and Reinvestment Act of 2009 (P.L. 111-5, §141) amended Section 30D effective for vehicles acquired after December 31, 2009. |

|

Annual Funding |

JCT estimated tax expenditure for FY2017-2021:16 $6.9 billion17 |

|

Scheduled Termination |

Phased out separately for each automaker when that automaker has sold a total of 200,000 qualified vehicles18 |

|

Description |

Purchasers of plug-in electric vehicles may file to obtain a tax credit of up to $7,500 per vehicle, depending on battery capacity. The vehicle must be acquired for use or lease and not for resale. Additionally, the original use of the vehicle must commence with the taxpayer and the vehicle must be used predominantly in the United States. For purposes of the 30D credit, a vehicle is not considered acquired prior to the time when title to the vehicle passes to the taxpayer under state law. |

|

Qualified Applicant(s) |

Purchasers of qualified vehicles |

|

Applicable Fuel/Technology |

Plug-in electric vehicles |

|

For More Information |

See the IRS web page for the Plug-In Electric Drive Vehicle Credit (IRC 30D); and the Qualified Plug-In Electric Vehicle (PEV) Tax Credit web page on the U.S. Department of Energy's (DOE's) Alternative Fuels Data Center (AFDC) website. |

|

Related CRS Reports |

CRS Report R41769, Energy Tax Policy: Issues in the 112th Congress, by Molly F. Sherlock and Margot L. Crandall-Hollick (available to congressional clients upon request) |

Department of Energy

Department of Energy

Advanced Technology Vehicles Manufacturing Loan Program (ATVM)

Administered by

Loan Programs Loan Program (ATVM)

|

Administered by |

Loan Programs Office (LPO) |

|

Authority |

Office (LPO)

Authority

Authorized by the Energy Independence and Security Act of 2007 §136 |

|

Annual Funding |

|

|

Scheduled Termination |

Facilities funded must be placed in service by the end of 2020. The Trump Administration recommended in its FY2019 budget that the ATVM program be eliminated and administration expenses reduced to $1 million; Congress did not approve the budget rescission. |

|

Description |

The Advanced Technology Vehicles Manufacturing (ATVM) Loan Program was established in 2007 to help automakers |

|

Qualified Applicant(s) |

The Biden Administration has said that it would like to utilize these funds for expanding the U.S. electric vehicle battery supply chain.

Qualified Applicant(s)

An automotive manufacturer satisfying specified fuel economy requirements |

|

Applicable Fuel/Technology |

|

|

For More Information |

|

|

Related CRS Reports |

ATVM 1-Page Summary

Related CRS Reports

CRS Report R42064, The Advanced |

Bioenergy Technologies Program Office (formerly the Biomass and Biorefinery Systems R&D Program)

Administered by

Office of Energy Efficiency and Renewable Energy (EERE)

Authority

Federal Nonnuclear Energy Research and Development R&D Program)

|

Administered by |

Office of Energy Efficiency and Renewable Energy (EERE) |

|

Authority |

) Energy Policy and Conservation Act of 1975 (EPCA; P.L. Energy Conservation and Production Act of 1976 (ECPA; P.L. Department of Energy Organization Act of 1977 (P.L. 95-91 ) Energy Tax Act (P.L. 95-618 ) National Energy Conservation Policy Act of 1978 (NECPA; P.L. 95-619 ) Powerplant and Industrial Fuel Use Act of 1978 (P.L. 95-620 ) Energy Security Act of 1980 (P.L. 96-294 ) National Appliance Energy Conservation Act of 1987 (P.L. 100-12 ) Federal ) Renewable Energy and Energy Efficiency Technology Competitiveness Clean Air ) Solar, 575) Energy Policy Act of 1992 (EPACT; P.L. 102-486 ) Biomass ) Farm Security and Rural Investment Act of 2002 (P.L. 107-171 ) Healthy Forest ) Energy Policy Act of 2005 (EPACT 2005; P.L. 109-58 ) Energy Independence and Security Act of 2007 (EISA; P.L. 110-140

) American |

|

Annual Funding |

$203.6 million for FY2018 |

|

Scheduled Termination |

None |

|

Description |

|

|

Qualified Applicant(s) |

Universities and businesses |

|

Applicable Fuel/Technology |

Biofuels |

|

For More Information |

|

|

Related CRS Reports |

CRS Report R41440, Biopower: Background |

Clean Cities Program

|

Administered by |

EERE and sponsored by the Vehicle Technologies Program |

|

Authority |

CRS In Focus IF10288, Overview of the 2018 Farm Bil Energy Title Programs, by Kelsi Bracmort; and CRS Report R45943, The Farm Bil Energy Title: An Overview and Funding History, by Kelsi Bracmort

Clean Cities Program

Administered by

EERE and sponsored by the Vehicle Technologies Program

Authority

Established by the Alternative Motor Fuels Act of 1988 (P.L. 100-494), and amended by the Energy Policy Act of 1992 ( |

|

Annual Funding |

$37.8 million for FY2018 |

|

Scheduled Termination |

None |

|

Description |

|

|

Qualified Applicant(s) |

Qualified Applicant(s)

Businesses, |

|

Applicable Fuel/Technology |

|

|

For More Information |

|

|

Related CRS Reports |

None |

Hydrogen and Fuel Cell Technologies Program

|

Administered by |

EERE |

|

Authority |

) Federal ) Energy Policy and Conservation Act of 1975 (EPCA; P.L. Electric and Hybrid Vehicle Research, Development ) Department of Energy Organization Act of 1977 (P.L. 95-91 ) Automotive ) Methane Transportation Research, Energy Security Act of 1980 (P.L. 96-294 ) Alternative ) Spark M. Matsunaga Hydrogen Research, Development, ) Energy Policy Act of 1992 (EPACT; P.L. 102-486 ) Hydrogen Future Act of 1996 (P.L. 104-271 ) Energy Policy Act of 2005 (EPACT 2005; P.L. 109-58 ) Energy Independence and Security Act of 2007 (EISA; P.L. 110-140

|

|

Annual Funding |

$100.3 million for FY2018 |

|

Scheduled Termination |

None |

|

Description |

|

|

Qualified Applicant(s) |

|

|

Applicable Fuel/Technology |

Hydrogen, fuel cells |

|

For More Information |

|

|

Related CRS Reports |

[Archived] CRS Report R40168, Alternative Fuels and Advanced |

Vehicle Technologies Program (VTP)

|

Administered by |

EERE |

|

Authority |

Authorized by the Energy Independence and Security Act of 2007 §136 ( P.L. 110-140), funded by the Consolidated Security, |

|

Annual Funding |

|

|

Scheduled Termination |

None |

|

Description |

|

|

Qualified Applicant(s) |

Qualified Applicant(s)

Universities, |

|

Applicable Fuel/Technology |

Applicable

Advanced batteries, power electronics |

|

For More Information |

|

|

Related CRS Reports |

; and DOE’s Vehicle Technologies Office – Funding Opportunities.

Related CRS Reports

CRS Report R42064, The Advanced |

Department of Transportation

Congestion Mitigation and Air Quality Improvement Program

|

Administered by |

Federal Highway Administration (FHWA) and Federal Transit Administration (FTA) |

|

Authority |

Established by the Intermodal Surface Transportation Efficiency Act (ISTEA) of 1991 ( P.L. 102-240); reauthorized multiple times, |

|

Annual Funding |

$2.40 billion in FY2018; $2.45 billion requested for FY2019 |

|

Scheduled Termination |

Reauthorized through FY2020 |

|

Description |

|

|

Qualified Applicant(s) |

State departments of transportation and metropolitan |

|

Applicable Fuel/Technology |

Applicable

Any transportation project or technology that can lead to reductions in congestion or

Fuel/Technology

help improve |

|

For More Information |

See FHWA's CMAQ website. |

|

Related CRS Reports |

CRS Report R44388, Surface Transportation Funding and Programs Under |

Corporate Average Fuel Economy Program Alternative Fuel Vehicle Credits

|

Administered by |

Congressional Research Service

17

Alternative Fuel and Advanced Vehicle Technology Incentives

Corporate Average Fuel Economy Program Alternative Fuel Vehicle Credits

Administered by

National Highway Traffic Safety Administration |

|

Authority |

Corporate Average Fuel Economy (CAFE) program established |

|

Annual Funding |

N/A |

|

Scheduled Termination |

No expiration for dedicated vehicles; after model year (MY) 2019 for dual fueled vehicles |

|

Description |

|

|

Qualified Applicant(s) |

Automakers that produce vehicles for sale in the United States |

|

Applicable Fuel/Technology |

|

|

For More Information |

See NHTSA's CAFE website. |

|

Related CRS Reports |

CRS Report R45204, Vehicle Fuel Economy and Greenhouse Gas Standards: |

Bil Canis

Low or No Emission Vehicle Program

Administered by

Federal Transit Administration (FTA)

Authority

Established by the Fixing America’s Vehicle Program

|

Administered by |

Federal Transit Administration (FTA) |

|

Authority |

|

|

Annual Funding |

$55 million per year through FY2020. An additional $29.5 million was appropriated for FY2018 for a total of $84.5 million |

|

Scheduled Termination |

End of FY2020 |

|

Description |

|

|

Qualified Applicant(s) |

Eligible applicants include direct recipients |

|

Applicable Fuel/Technology |

Applicable

Proposed vehicles must make greater reductions in energy consumption and harmful

Fuel/Technology

emissions, |

|

For More Information |

See FTA's Low or No Emission Vehicle Program website. |

|

Related CRS Reports |

CRS Report R44388, Surface Transportation Funding and Programs Under the Fixing America's Surface Transportation Act (FAST Act; P.L. 114-94), coordinated by Robert S. Kirk |

Act (FAST Act; P.L. 114-94), coordinated by Robert S. Kirk Environmental Protection Agency

National Clean Diesel Campaign

Administered by

Clean Diesel Campaign

|

Administered by |

Office of Transportation and Air |

|

Authority |

Established in 2005 by the Energy Policy Act of 2005 (P.L. 109-58), §§791-797; amended in 2008 by P.L. 110-255, §3; |

|

Annual Funding |

$59.6 million for FY2018 |

|

Scheduled Termination |

None (last authorized through FY2016, but the program is still active and receiving funding) |

|

Description |

|

|

Qualified Applicant(s) |

Manufacturers, fleet operators, |

|

Applicable Fuel/Technology |

governments

Applicable

Technologies that significantly reduce emissions |

|

For More Information |

|

|

Related CRS Reports |

None |

Renewable Fuel Standard

|

Administered by |

OTAQ |

|

Authority |

Established in 2005 by the Energy Policy Act of 2005, §1501 (P.L. 109-58); expanded by the Energy Independence and Security Act of 2007, §202 ( |

|

Annual Funding |

N/A |

|

Scheduled Termination |

None |

|

Description |

P.L. 110-140)

Annual Funding

N/A

Scheduled

None

Termination Description

The Energy Policy Act of 2005 established a renewable fuel standard (RFS) for automotive fuels. The RFS was expanded by the Energy Independence and Security Act of 2007. The RFS requires

In certain circumstances, |

|

Qualified Applicant(s) |

|

|

Applicable Fuel/Technology |

All biofuels (conventional ethanol, biodiesel, renewable diesel, cellulosic biofuels, advanced biofuels) |

|

For More Information |

See EPA's Renewable Fuel Standard (RFS) website. |

|

Related CRS Reports |

Renewable Fuel Standard (RFS) website. Related CRS Reports

CRS Report R43325, The Renewable Fuel Standard |

Department of Agriculture19

Bioenergy Program for Advanced Biofuels20

|

Administered by |

Rural Development |

|

Authority |

Bioenergy Program for Advanced Biofuels44

Administered by

Rural Development

Authority

Established by the Farm Security and Rural Investment Act of 2002 (P.L. 107-171). Most recently amended by Title IX, Section 9005 of the Agriculture Improvement |

|

Annual Funding |

).

Annual Funding

Mandatory: The 2018 farm Discretionary: Discretionary funding of $20 million annually for FY2014-FY2023 is authorized to be appropriated. No discretionary funding has been appropriated for the Bioenergy Program for Advanced Biofuels through FY2018. |

|

Scheduled Termination |

Authorized through FY2023 |

|

Description |

) authorized mandatory funding of $7 mil ion annual y for FY2019-FY2023 to remain available until expended. $7 mil ion was appropriated annual y for FY2019, FY2020,45 and FY2021. Discretionary: The 2018 farm bil authorized discretionary funding of $20 mil ion annual y for FY2019-FY2023. No discretionary funding was appropriated through FY2021.

Scheduled

Authorized through FY2023

Termination Description

The purpose of the program is to support and ensure an expanding production of advanced biofuels by providing payments to eligible |

|

Qualified Applicant(s) |

Producers of advanced biofuels |

|

Applicable Fuel/Technology |

|

|

For More Information |

from cel ulosic biomass.

For More Information See the USDA program website and program number 10.867 on the |

|

Related CRS Reports |

SAM.gov website.

Related CRS Reports

CRS Report R40913, Renewable Energy and Energy Efficiency Incentives: A Summary |

Biomass Crop Assistance Program (BCAP; §9011)21

|

Administered by |

Farm Service Agency (FSA) |

|

Authority |

Agency (FSA)

Authority

Established by the Food, Conservation, and Energy Act of 2008 (P.L. 110-246). Most recently amended by Title IX, Section 9010 of the Agriculture Improvement |

|

Annual Funding |

).

Annual Funding

Mandatory: The 2018 farm

|

|

Scheduled Termination |

Authorized through FY2023 |

|

Description |

BCAP provides assistance to support the production of eligible |

|

Qualified Applicant(s) |

Producer of an eligible crop in a BCAP project area; Person with the right to collect or harvest eligible material. |

|

Applicable Fuel/Technology |

|

|

For More Information |

See program number 10.087 on the |

|

Related CRS Reports |

SAM.gov website. Related CRS Reports

CRS Report R40913, Renewable Energy and Energy Efficiency Incentives: A Summary |

Biomass Research and Development (BRDI)22

|

Administered by |

National Institute of Food and Agriculture (NIFA) |

|

Authority |

|

|

Annual Funding |

).

Annual Funding

Mandatory: The 2018 farm

|

|

Scheduled Termination |

Authorized through FY2023 |

|

Description |

|

|

Qualified Applicant(s) |

Qualified Applicant(s)

Institutions of higher learning ( |

|

Applicable Fuel/Technology |

Biomass; biofuels |

|

For More Information |

See the USDA program website. |

Biorefinery, Renewable Chemical, and Biobased Product Manufacturing Assistance Program (formerly the Biorefinery Assistance Program)48

Administered by

Rural Development

Authority

Assistance Program)24

|

Administered by |

Rural Development |

|

Authority |

Established by Title IX of the Farm Security and Rural Investment Act of 2002 (FSRIA, P.L. 107-171). Most recently amended by Title IX Section 9003 of the Agriculture |

|

Annual Funding |

|

|

Scheduled Termination |

Authorized through FY2023 |

|

Description |

|

|

Qualified Applicant(s) |

mil ion.

Qualified Applicant(s)

Individuals, entities, Indian tribes, state or local governments, |

|

Applicable Fuel/Technology |

entities

Applicable

Technologies being adopted in a viable commercial-scale |

|

For More Information |

For More Information See the USDA program website; and program number 10.865 on the |

Rural Energy for America Program (REAP) Grants and Loans25

|

Administered by |

Rural Development |

|

Authority |

SAM.gov website.

Related CRS Reports

CRS Report R40913, Renewable Energy and Energy Efficiency Incentives: A Summary of Federal Programs, by Lynn J. Cunningham; CRS In Focus IF10288, Overview of the 2018 Farm Bil Energy Title Programs, by Kelsi Bracmort; and CRS Report R45943, The Farm Bil Energy Title: An Overview and Funding History, by Kelsi Bracmort

Rural Energy for America Program (REAP) Grants and Loans51

Administered by

Rural Development

Authority

Established by Title IX, Sections 9005 and 9006 of the Farm Security and Rural Investment Act of 2002 (FSIRA, P.L. |

|

Annual Funding |

).

Annual Funding

Mandatory: The 2018 farm

|

|

Scheduled Termination |

Authorized with no expiration |

|

Description |

REAP promotes energy efficiency and renewable energy for agricultural producers and rural small businesses through the use of (1) grants for energy audits and renewable energy development assistance, and (2) financial assistance for renewable energy systems and energy efficiency improvements. The 2018 farm bill added new funding for equipment that exceeds energy efficiency standards and capped funding for this category of loan guarantees at 15% of total funds. The 2014 farm bill excluded the use of REAP funds for installing retail energy dispensing equipment, such as blender pumps. |

|

Qualified Applicant(s) |

Eligible entities to receive grants to provide energy audits and renewable development assistance to agricultural producers and rural small businesses include state, tribal, or local governments; land-grant colleges or other institutions of higher education; rural electric cooperatives; public power entities; councils; and other similar entities. Agricultural producers and rural small businesses are eligible to receive direct financial assistance for energy efficiency improvements and renewable energy systems. |

|

Applicable Fuel/Technology |

Biofuels (see description above), among other technologies. |

|

For More Information |

See the USDA program website; and program number 10.868 on the beta.SAM.gov website. |

|

Related CRS Reports |

CRS Report RL31837, An Overview of USDA Rural Development Programs, by Tadlock Cowan; CRS Report R40913, Renewable Energy and Energy Efficiency Incentives: A Summary of Federal Programs, by Lynn J. Cunningham |

Appendix A.

Recently Expired or Repealed Programs26

Alternative Fuel Refueling Property Credit27

|

Administered by |

IRS |

|

Authority |

Established by the Energy Policy Act of 2005 (P.L. 109-58), Title XIII, §1342(a). Amended by P.L. 109-135, Title IV, §402(k), 412(d), P.L. 110-172, §6(b), P.L. 113-295, and P.L. 115-141. The temporary alternative fuel refueling property credit has expired and subsequently has been extended retroactively on multiple occasions, most recently through 2017 by the Bipartisan Budget Act of 2018 (P.L. 115-123). |

|

Annual Funding |

JCT estimated budget effect for FY2018: $49 million. JCT estimated budget effect for FY2018-FY2022: $63 million.28 |

|

Termination Date |

December 31, 2017 |

|

Description |

Consumers or businesses who installed qualified fueling equipment received a 30% tax credit of up to $30,000 for properties subject to an allowance for depreciation and $1,000 for all other properties. |

|

Qualified Applicant(s) |

Consumers or businesses who installed qualifying equipment/property. |

|

Applicable Fuel/Technology |

Natural gas, liquefied petroleum gas, hydrogen, electricity, E85, or diesel fuel blends containing a minimum of 20% biodiesel. |

|

For More Information |

See IRS Form 8911. |

|

Related CRS Reports |

CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick |

Alternative Motor Vehicle Credit29

|

Administered by |

IRS |

|

Authority |

Established by the Energy Policy Act of 2005 (P.L. 109-58 §1341(a)), American Recovery and Reinvestment Act of 2009 (P.L. 111-5, Div. B, §1141-1144). The Consolidated Appropriations Act of 2016 (P.L. 114-113) extended through 2016 (retroactive for 2015) the alternative motor vehicle credit for qualified fuel cell motor vehicles only; further extended by the Bipartisan Budget Act of 2018 (P.L. 115-123) through 2017 |

|

Annual Funding |

JCT estimated tax expenditure for FY2017-2021: $100 million30 |

|

Termination Date |

December 31, 2017, for fuel cell vehicles; expired December 31, 2010, or earlier for all other vehicles. |

|

Description |

Enacted in the Energy Policy Act of 2005, the provision included separate credits for four distinct types of vehicles: those using fuel cells, advanced lean burn technologies, qualified hybrid technologies, and qualified alternative fuels technologies. |

|

Qualified Applicant(s) |

Taxpayers purchasing a qualified fuel or technology |

|

Applicable Fuel/Technology |

Hybrid gasoline-electric; diesel; battery-electric; alternative fuel and fuel cell vehicles; and advanced lean-burn technology vehicles |

|

For More Information |

See IRS Form 8910: Alternative Motor Vehicle Credit and IRS Notice 2008-33. |

|

Related CRS Reports |

CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick |

Biodiesel or Renewable Diesel Income Tax Credit31

|

Administered by |

IRS |

|

Authority |

Established in 2005 by the American Jobs Creation Act of 2004, §302 (P.L. 108-357); extended by the Energy Policy Act of 2005, §1344 (P.L. 109-58); amended by the Energy Improvement and Extension Act of 2008 (P.L. 110-343, Division B), §202-203; The temporary income tax credits for biodiesel and renewable diesel fuels have expired and subsequently have been extended retroactively on multiple occasions, most recently through 2017 by the Bipartisan Budget Act of 2018 (P.L. 115-123) |

|

Annual Funding |

JCT estimated budget effect for FY2018: $3.25 billion32 |

|

Termination Date |

December 31, 2017 |

|

Description |

Producers, blenders, or retailers of biodiesel, renewable diesel,33 or "agri-biodiesel"34 (biodiesel produced from virgin agricultural products such as soybean oil or animal fats) could claim a per-gallon income tax credit through the end of 2017 for fuel sold or used by the taxpayer, whether delivered pure or in a qualified mixture. The credit was valued at $1.00 per gallon. Before amendment by P.L. 110-343, the credit was valued at $1.00 per gallon of agri-biodiesel or 50 cents per gallon of biodiesel produced from previously used agricultural products (e.g., recycled fryer grease). |

|

Qualified Applicant(s) |

Biodiesel producers and blenders |

|

Applicable Fuel/Technology |

Biodiesel, renewable biodiesel, agri-biodiesel |

|

For More Information |

See IRS Publication 510, Chapter 2: Fuel Tax Credits and Refunds; and AFDC's entry for the Biodiesel Mixture Excise Tax Credit on its "Expired, Repealed, and Archived Incentives and Laws" web page. |

|

Related CRS Reports |

CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick |

Biodiesel or Renewable Diesel Mixture Tax Credit35

|

Administered by |

IRS |

|

Authority |

Established in 2005 by the Energy Policy Act of 2005 (P.L. 109-58), §1346; amended by the Energy Improvement and Extension Act of 2008 (P.L. 110-343, Division B), §202-203. The temporary excise tax credits for biodiesel and renewable diesel fuels have expired and subsequently have been extended retroactively on multiple occasions, most recently through 2017 by the Bipartisan Budget Act of 2018 (P.L. 115-123) |

|

Annual Funding |

JCT estimated budget effect for FY2018: $3.25 billion36 |

|

Termination Date |

December 31, 2017 |

|

Description |

Biodiesel and renewable diesel blenders (or producers of diesel/biodiesel blends) could claim a $1.00 per gallon tax credit through the end of 2017 for biodiesel or renewable diesel used to produce a qualified biodiesel mixture. The credit was claimed as a credit against the blender's motor fuels excise taxes; any excess credit beyond the taxpayer's excise tax liability was claimed as direct payments from the IRS. |

|

Qualified Applicant(s) |

Biodiesel, renewable biodiesel, and agri-biodiesel producers and blenders |

|

Applicable Fuel/Technology |

Biodiesel, renewable biodiesel, agri-biodiesel |

|

For More Information |

See IRS Publication 510, Chapter 2: Fuel Tax Credits and Refunds; and AFDC's entry for the Biodiesel Mixture Excise Tax Credit on its "Expired, Repealed, and Archived Incentives and Laws" web page. |

|

Related CRS Reports |

CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick |

Incentives for Alternative Fuel and Alternative Fuel Mixtures37

|

Administered by |

IRS |

|

Authority |

Established by the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA; P.L. 109-59); Section 5 of the Tax Technical Corrections Act of 2007 (P.L. 110-172) modified the rules for filing excise tax refund claims for alternative fuel mixtures and the definition of alternative fuels relating to hydrogen and carbon resources. The temporary excise tax credits for alternative fuels and alternative fuel mixtures have expired and subsequently been extended retroactively on multiple occasions, most recently through 2017 by the Bipartisan Budget Act of 2018 (P.L. 115-123)38 |

|

Annual Funding |

JCT estimated budget effect for FY2018: $555 million39 |

|

Termination Date |

December 31, 2017 |

|

Description |

The Alternative Fuel Excise Tax Credit was a 50-cents-per gallon excise tax credit for certain alternative fuels used as fuel in a motor vehicle, motor boat, or airplane, and a related provision established a 50-cents-per-gallon credit for alternative fuels mixed with a traditional fuel (gasoline, diesel, or kerosene) for use as a fuel. |

|

Qualified Applicant(s) |

Taxpayers who supplied or mixed qualifying fuel types |

|

Applicable Fuel/Technology |

Liquefied petroleum gas, P Series fuels, compressed or liquefied natural gas, any liquefied fuel derived from coal or peat, liquefied hydrocarbons derived from biomass, liquefied hydrogen. (Ethanol, methanol, and biodiesel do not qualify for the alternative fuel or alternative fuel mixture credit.) |

|

For More Information |

See IRS Publication 510 and IRS Forms 637, 720, 4136, and 8849 on the IRS website. |

|

Related CRS Reports |

CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick |

Plug-In Electric Vehicle Credit (Two- or Three-Wheeled)40

|

Administered by |

IRS |

|

Authority |

American Recovery and Reinvestment Act, P.L. 111-5, §1142 amended by the American Taxpayer Relief Act of 2012 (P.L. 112-240 §403). This temporary credit has expired and subsequently has been extended retroactively on multiple occasions, most recently through 2017 by the Bipartisan Budget Act of 2018 (P.L. 115-123) |

|

Annual Funding |

JCT estimated budget effect for FY2018: Less than $50 million |

|

Termination Date |

Expired December 31, 2017 for two-wheeled vehicles. Expired December 31, 2013 for three-wheeled vehicles. |

|

Description |

Internal Revenue Code Section 30D provided a tax credit for qualified plug-in electric vehicles. The credit was equal to 10% of the cost of a qualified plug-in electric vehicle and limited to $2,500. Qualified vehicles included vehicles that have two or three wheels. The vehicle must have been acquired for use or lease and not for resale. The original use of the vehicle had to commence with the taxpayer and the vehicle had to be used predominantly in the United States. |

|

Qualified Applicant(s) |

Taxpayers purchasing qualifying vehicles |

|

Applicable Fuel/Technology |

Two- or three-wheeled plug-in electric vehicles |

|

For More Information |

See IRS Notice 2013-67 and IRS form 8936. |

|

Related CRS Reports |

CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick |

Repowering Assistance Program41

|

Administered by |

Rural Development |

|

Authority |

Established by the Food, Conservation, and Energy Act of 2008 (P.L. 110-246). Repealed by the Agriculture Improvement |

|

Annual Funding |

).

Annual Funding

Mandatory: Under the 2014 farm Discretionary: |

|

Termination Date |

Termination Date

Repealed on December |

|

Description |

The Repowering Assistance Program |

|

Qualified Applicant(s) |

Qualified Applicant(s)

Eligible biorefinery. |

|

Applicable Fuel/Technology |

Renewable Biomass |

|

For More Information |

See the USDA program website; and program number 10.866 on the beta.SAM.gov |

|

Related CRS Reports |

website.

Related CRS Reports

CRS Report R43416, Energy Provisions in the 2014 Farm |

Second Generation Biofuel Producer Credit (previously the Credit for Production of Cellulosic and Algae-Based Biofuel)42

|

Administered by |

IRS |

|

Authority |

|

|

Annual Funding |

2020 by the Further Consolidated Appropriations Act, 2020 (P.L. 116-94).

Annual Funding

JCT estimated tax expenditure for |

|

Termination Date |

December 31, 2017 |

|

Description |

Producers of cellulosic biofuel could claim a tax credit of $1.01 per gallon. For cellulosic ethanol producers, the value of the production tax credit was reduced by the value of the volumetric ethanol excise tax credit and the small ethanol producer credit; the credit was last valued at $1.01 cents per gallon (the offsetting tax credits have expired). P.L. 112-240 amended the credit to include noncellulosic fuel produced from algae feedstocks. The credit applied to fuel produced after December 31, 2008. |

|

Qualified Applicant(s) |

Cellulosic biofuel producers and algae-based biofuel producers |

|

Applicable Fuel/Technology |

Cellulosic biofuels and algae-based biofuels |

|

For More Information |

See AFDC's entry for the Second Generation Biofuel Producer Tax Credit on its "Expired, Repealed, and Archived Incentives and Laws" web page; and IRS Publication 510 and IRS Forms 637 and 6478, which are available via the IRS website. |

|

Related CRS Reports |

CRS Report R42122, Algae's Potential as a Transportation Biofuel, by Kelsi Bracmort; and CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick |

Small Agri-Biodiesel Producer Credit43

|

Administered by |

IRS |

|

Authority |

Established in 2005 by the Energy Policy Act of 2005, §1345 (P.L. 109-58); amended by the Energy Improvement and Extension Act of 2008 (P.L. 110-343, Division B), §202-203. This temporary credit has expired and subsequently has been extended retroactively on multiple occasions, most recently through 2017 by the Bipartisan Budget Act of 2018 (P.L. 115-123). |

|

Annual Funding |

JCT estimated tax expenditure for FY2017-2021: JCT has not estimated this expenditure44 |

|

Termination Date |

December 31, 2017 |

|

Description |

The small agri-biodiesel producer credit was valued at 10 cents per gallon of "agri-biodiesel" (see Biodiesel Tax Credit, above) produced. The credit could be claimed on the first 15 million gallons of ethanol produced by a small producer in a given year through the end of 2017. Agri-biodiesel is defined as biodiesel derived solely from virgin oils, including esters derived from virgin vegetable oils from corn, soybeans, sunflower seeds, cottonseeds, canola, crambe, rapeseeds, safflowers, flaxseeds, rice bran, mustard seeds, and camelina, and from animal fats. |

|

Qualified Applicant(s) |

Any agri-biodiesel producers with production capacity less than 60 million gallons per year |

|

Applicable Fuel/Technology |

Biodiesel |

|

For More Information |

See IRS Publication 510, Chapter 2: Fuel Tax Credits and Refund; and IRS Form 8864, and Instructions for Form 8864. |

|

Related CRS Reports |

CRS Report R41631, The Market for Biomass-Based Diesel Fuel in the Renewable Fuel Standard (RFS), by Brent D. Yacobucci; and CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick |

Special Depreciation Allowance for Second Generation (Cellulosic and Algae-Based) Biofuel Plant Property45

|

Administered by |

IRS |

|

Authority |

Established in 2006 by the Tax Relief and Health Care Act of 2006 (P.L. 109-432), §209; amended by the Energy Improvement and Extension Act of 2008 (P.L. 110-343, Division B), §201; modified by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312), §401; amended by the American Taxpayer Relief Act of 2012 (P.L. 112-240, §410). This temporary credit has expired and subsequently has been extended retroactively on multiple occasions, most recently through 2017 by the Bipartisan Budget Act of 2018 (P.L. 115-123). |

|

Annual Funding |

JCT estimated tax expenditure for FY2017-FY2021: Less than $50 million total |

|

Termination Date |

December 31, 2017 |

|

Description |

|

|

Qualified Applicant(s) |

|

|

Applicable Fuel/Technology |

Cellulosic and algae-based biofuels |

|

For More Information |

|

|

Related CRS Reports |

|

Appendix B.

Crandal -Hol ick

Congressional Research Service

26

link to page 32 link to page 40 link to page 42 link to page 43 Alternative Fuel and Advanced Vehicle Technology Incentives

Appendix B. Summary Tables Summary Tables

Appendix B contains four tables

- Table B-1 provides a summary of the programs discussed in the body of the report, listed by agency;

- Table B-2 lists programs and incentives for alternative fuels, by fuel type;

- Table B-3 lists programs and incentives for advanced technology vehicles, by vehicle type; and

-

Table B-4 lists programs by agency that have expired or were repealed since

December 31, 2017.

Congressional Research Service

27

Table B-1. Federal Programs by Agency

FY2021 Appropriation

or JCT Estimated

Eligible Fuels or

Program

Description

Expenditure

Expiration Date

Technologies

Internal Revenue Service

Vehicle Incentives

Alternative Motor

This provision included separate credits for four distinct

$4 mil ion

December 31, 2021, Hybrid gasoline-electric;

Vehicle Credit (Fuel

types of vehicles: using fuel cel s, advanced lean burn

for fuel cel vehicles

diesel; battery-electric;

Cel Vehicles)

technologies, qualified hybrid technology, or qualified

alternative fuel and fuel cel