Concurrent Receipt of Military Retired Pay and Veteran Disability: Background and Issues for Congress

Changes from January 17, 2019 to March 25, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Concurrent Receipt of Military Retired Pay and Veteran Disability: Background and Issues for Congress

Contents

- Introduction

- Background

- Military Retirement and VA Disability Compensation

- Military Retirement

- Reserve Retirement

- Disability Retirement

- Temporary Early Retirement Authority (TERA)

- VA Disability Compensation

- Interaction of DOD and VA Disability Benefits

- Combat-Related Special Compensation (CRSC)

- CRSC for Military Disability (Chapter 61) and TERA Retirees

- The

"Special Rule"for Disability Retirees - CRSC for Reserve Retirees

- CRSC Eligibility Summary

- Concurrent Retirement and Disability Payments (CRDP)

- CRDP for Temporary Early Retirement Authority (TERA) Retirees

- Concurrent Receipt and Blended Retirement System Lump Sum Payments

- CRSC and CRDP Comparisons and Costs

Issues andOther Compensation for Injuries or Deaths Related to Military Service- Claims Brought by Veterans

- Claims Brought by Active Servicemembers

Other Options for Congress- Eliminate or Sunset Concurrent Receipt Programs

- Allow Concurrent Receipt for Combat-related Disabilities Only

Extend CRDP to AllExtend CRDP toChapter 61 Disability Retireeswith Less Than 20 Years of Service- Modify or Eliminate the Special Rule

- Split Compensation by Agency for Longevity and Disability

- Extend CRDP to Those with a 40% or Less VA Disability Rating

- Modify or Eliminate the Special Rule

Figures

Summary

Concurrent receipt refers to the simultaneous receipt ofin the military context typically means simultaneously receiving two types of federal monetary benefits: military retired pay andfrom the Department of Defense (DOD) and disability compensation from the Department of Veterans Affairs (VA) disability compensation. Prior to 2004, existing laws and regulations dictated that a military retiree could not receive two payments from federal agencies for the same purpose; military retired pay and VA disability compensation were considered to fall under that restriction. As a result, military retirees with physical disabilities recognized by the VA would have theirhad their (taxable) military retired pay offset , or reduced dollar-for-dollar, by the amount of their nontaxable(nontaxable) VA compensation. Legislative activity on the issue of concurrent receipt began in the late 1980s and culminated in the provision for Combat-Related Special Compensation (CRSC) in the Bob Stump National Defense Authorization Act for Fiscal Year 2003 (P.L. 107-314). Since then, Congress has added Concurrent Retirement and Disability Payments (CRDP) for those retirees with a disability rated at 50% or greater, extended concurrent receipt to additional eligible populations, and further refined and clarified the program.

There are two common criteria that define eligibility for concurrent receipt: (1) all recipients must beConcurrent receipt is applicable only to persons who are both (1) military retirees and (2) they must also be eligible for VA disability compensation. An eligible retiree cannot receive both CRDP and CRSC. The retiree mustmay choose whichever is most financially advantageous to him or her and may change the type of benefit to be receivedmake benefit changes during an annual open season.

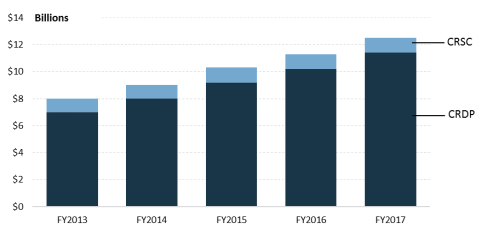

In FY2017FY2018, approximately one-third36% of the retired military population was receiving either CRSC or CRDP at a cost of $12.414 billion. Nevertheless, there are also military retirees who receive VA disability compensation but are not eligible for concurrent receipt. Determining whether to make some or all of this population eligible for concurrent receipt remains a point of contention in Congress. The Congressional Budget Office (CBO) has estimated that to extend benefits to all veterans who would be eligible for both disability benefits and military retired pay would cost $30 billion from 2015 to 2024. In 2016, CBO estimated that eliminating concurrent receipt would save the government $139 billion between 2018 and 2026.

|

Figure 1.Annual Concurrent Receipt Payments FY2013- |

|

|

Source: Department of Defense (DOD) Office of the Actuary, Statistical Reports on the Military Retirement System. |

Introduction

Concurrent receipt refers to the simultaneous receipt of two types of in the military and veterans context typically means simultaneously receiving two types of federal monetary benefits: military retired pay andfrom the Department of Defense (DOD) and disability compensation from the Department of Veterans Affairs (VA) disability compensation. With several separate programs, varying eligibility criteria, and several eligibility dates, some observers find the subject complex and somewhat confusing. There are, however, two common criteria: first, all recipients are military retirees; second, they are alsoHowever, concurrent receipt is applicable only to persons who are both (1) military retirees and (2) eligible for VA disability compensation. This report addresses the two primary components of the concurrent receipt program: Combat-Related Special Compensation (CRSC) and Concurrent Retirement and Disability Payments (CRDP). It reviews the possible legislative expansion of the program to additional populations and provides several potential options for Congress to consider.

Background

In 1891, Congress first prohibited payment of both military retired pay and a disability pension under the premise that it represented dual or overlapping compensation for the same purpose. The original law was modified in 1941, and the present system of VA disability compensationCongress modified that law in 1941, and in 1944 adopted a system of offsetting military retired pay was adopted in 1944with VA disability compensation. Under this system, retired military personnel were required to waive a portion of their retired pay equal to the amount of VA disability compensation, a dollar-for-dollar offset.1 If, for example, a military retiree received $1,500 a month in retired pay and was rated by the VA as 70% disabled (and therefore entitled to approximately $1,000 per month in disability compensation), the offset would operate to pay $500 monthly in retired pay and the $1,000 in disability compensation. TheThus, the retiree still received a total of $1,500 per month, but the advantage for the retiree was that the VA disability compensation portion was not taxable. For many years some military retirees and advocacy groups sought a change in law to permit receipt of all, or some, of both payments without offset. Opponents of concurrent receipt frequently referred to it as double dipping, maintaining that it represented two payments for the same condition.

In the FY2003 NDAA (P.L. 107-314) Supporters of concurrent receipt argued that the two payments were for different purposes: retired pay was deferred compensation for a career of service, while disability compensation was to account for loss future earning power.

In the FY2003 NDAA, Congress created a benefit known as Combat Related Special Compensation (CRSC). CRSC provided, for2 For certain disabled retirees whose disability is combat-related, CRSC provides a cash benefit financially identical to what concurrent receipt would provide them. The FY2004 NDAA (P.L. 108-136) authorized, for the first time, the phase-in of actual concurrent receipt (now referred to as Concurrent Retirement and Disability Payments or CRDP), and for certain retirees, along with a greatly expanded CRSC program.3 The FY2005 NDAA (P.L. 108-375) further liberalized the concurrent receipt rules contained in the FY2004 NDAA and authorized immediate concurrent receipt for those rated by the VA totaling 100%. The FY2008 NDAA (P.L. 110-181)with VA disability ratings totaling 100%.4 In 2007, as part of the FY2008 NDAA, Congress expanded concurrent receipt eligibility to include those who are 100% disabled due to unemployability and provided CRSC to those who were medically retired or retired prematurely due to force reduction programs prior to completing 20 years of service.5 The CRDP phase-in was fully implemented by 2014, allowingand currently allows retirees with a VA disability rated at 50% or greater to receive both full retired pay and full VA disability compensation without anany offset.

Military Retirement and VA Disability Compensation

An understanding of military retirement, VA disability compensation, and the interaction of these two elementsbenefits is helpful inwhen discussing concurrent receipt.

Military Retirement

An active duty servicemember becomes entitled to retired pay, an event frequently referred to as vesting, upon completion of 20 years of service, regardless of age. A member who retires is immediately paid a monthly annuity based on a percentage of their final base pay or the average of their high three years of base pay, depending on when they entered active duty.26 Retired pay accrues at the rate of 2.5% per year of service for those who have entered the service prior to January 1, 2018, and 2.0% for those entering service on or after January 1, 2018. An alternative retirement option, known as "Redux," was also available for certain active duty servicemembers, depending on their date of entry.3that date.7

Reserve Retirement

Reserve component servicemembers also become eligible for retirement upon completion of 20 years of qualifying service, regardless of age. However, their retired pay calculation is based on a point system that results in a number of "equivalent years" of service.48 In addition, a reserve component retiree does not usually begin receiving retired pay until reaching age 60.5

Disability Retirement

While retirementretired pay eligibility at 20 years of service is the norm for active component members and age 60 for reserve component members, there are some circumstances that result in earlier retirementearlier eligibility is possible under some circumstances. Servicemembers found to be unfit for continued service due to physical disability may be retired if the condition is permanent and stable and the disability is rated by DOD as 30% or greater.610 These retirees are generally referred to as Chapter 61 retirees, a reference to Chapter 61 of Title 10, which covers disability retirement. As a result, some disability retirees are retired before becoming eligible for longevity retirement while others have completed 20 or more years of service.

A servicemember retired for disability may select one of two available options for calculating their monthly retired pay:

- 1. Longevity Formula. Retired pay is computed by multiplying the years of service times 2.5% or 2.0% (

respectivelybased on a date of entry into service before or after Jan 1, 2018)and, thentimesmultiplying that result by the pay base.

Monthly Retired Pay= (years of service x 2.5% or 2.0%) x (pay base) - 2. Disability Formula. Retired pay is computed by multiplying the DOD disability percentage by the pay base.

7

11Monthly Retired Pay= disability % x (pay base)

The maximum retired pay calculation under eitherthe disability formula cannot exceed 75% of base pay.8 The retired pay computed under the disability formula is fully taxed unless the disability is the result of a combat-related injury. 12 Since the disability percentage method usually results in higher retired pay, it is most commonly selected. Generally, military retired pay based on longevity is taxable. In certain instances, a portion of disability retired pay may be tax-free.

Temporary Early Retirement Authority (TERA)

Personnel retired due to force management requirements and before completing 20 years of service are generally referred to as "TERA retirees" because the National Defense Authorization Act for Fiscal Year 1993 granted Temporary Early Retirement Authority (TERA) as a manpowerforce-sizing tool to entice voluntary retirements during the drawdown of the early 1990s.9 This authority was in effect from 1992 to 2001. 13 TERA retired pay is calculated in the same way as longevity retirement, but there is a retired pay reduction of 1% for every year of service below 20.

VA Disability Compensation

To qualify for VA disability compensation, the VA must make a determination that the veteran sustained a particular injury or disease, or had a preexisting condition that was aggravated, while serving in the Armed Forces.1014 Some exceptions exist for certain conditions that may not have been apparent during military service but which are presumed to have beenbe service-connected. The VA has a scale of 10 ratings, from 10% to 100%, although there is no direct arithmeticarithmetical relationship between the amounts of moneybenefits paid forat each step. Each percentage rating entitles the veteran to a specific level of disability compensation.1115 In a major difference from the DOD disability retirement system, a veteran receiving VA disability compensation can ask for a medical reexamination at any time (or a veteran who does not receive disability compensation upon separation or retirement from service can be examined or reexamined later).

All VA disability compensation is tax-free, which makes receipt of VA compensation desirable, even with the operation of the offset. As a general rule of thumb, DOD pays for longevity while the VA pays for disability.

Interaction of DOD and VA Disability Benefits12

As veterans, military retirees can apply to the VA for disability compensation. A retiree may (1) apply for VA compensation any time after leaving the service and (2) have his or her degree of disability changed by the VA as the result of a later medical reevaluation, as noted above. Many retirees seek benefits from the VA years after retirement for a condition that may have been incurred during military service but that does not manifest itself until many years later. Typical examples include hearing loss, some cardiovascular problems, and conditions related to exposure to Agent Orange.

The DOD and VA disability rating systems have much in common, but there are also significant differences. DOD makes a determination of eligibility for disability retirement only once, at the time the individual is separatingseparates from the service. Although DOD uses the VA rating schedule to determine the percentage of disability, DOD measures disability, or lack thereof, against the extent to which the individual can or cannot perform military duties. Military disability retired pay, but notunlike VA disability compensation, is usually taxable, unless related to a combat disability.

As a result of the current disability process, a retiree can have both a DOD and a VA disability rating and, but these ratings will not necessarily be the same percentage. The percentage determined by DOD is used to determine fitness for duty and may result in the medical separation or disability retirement of the servicemember. The VA rating, on the other hand, was designed to reflect the average loss of earning power. Studies over the past several years have consistentlyTwo major studies published in 2007 recommended a single, comprehensive medical examination that would establish a disability rating that could be used by both DOD and the VA.1316

The National Defense Authorization Act for Fiscal Year 2008 required a joint DOD and VA report on the feasibility of consolidating disability evaluation systems to eliminate duplication by having one medical examination and a single-source disability rating.1417 As a result, DOD and the VA initiated a one-year pilot program, now called the Integrated Disability Evaluation System (IDES), at the Walter Reed Army Medical Center, the National Naval Medical Center at Bethesda, and the Malcolm Grove Medical Center at Andrews Air Force Basetwo military bases. The program was expanded to other sites in 2009 and 2010, and since September 2011 all new disability retirement cases at facilities worldwide have been processed through IDES.15

As IDES streamlinedwas designed to streamline the disability evaluation process, DOD and VA now focus on improvingtrying to improve health care data and records sharing, a process deemed "vital to Service members who are leaving the DOD system with complex medical issues and ongoing health care needs."1619 In September 2018, DOD and VA issued a joint statement indicating their commitment to implement an integrated electronic health system that willin an effort to allow for seamless sharing of health care data between both departments and aid the disability rating process.1720

Combat-Related Special Compensation (CRSC)

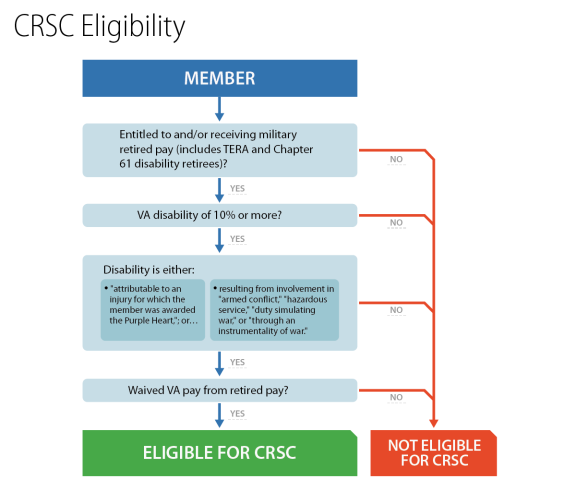

The FY2003 NDAA,1821 as amended by the FY2004 NDAA,1922 authorized Combat-Related Special Compensation (CRSC). Military retirees with at least 20 years of service and who meet either of the following two criteria are eligible for CRSC:

- A disability that is "attributable to an injury for which the member was awarded the Purple Heart," and is not rated as less than a 10% disability by the VA; or

- A disability rating resulting from involvement in "armed conflict," "hazardous service," "duty simulating war," or "through an instrumentality of war."

2023

This liberal definition of combat-related encompasses disabilities associated with any kind of hostile force; hazardous duty such as diving, parachuting, or using dangerous materials such as explosives; and individual training and unit training and exercises and maneuvers in the field; and "instrumentalities of war."21

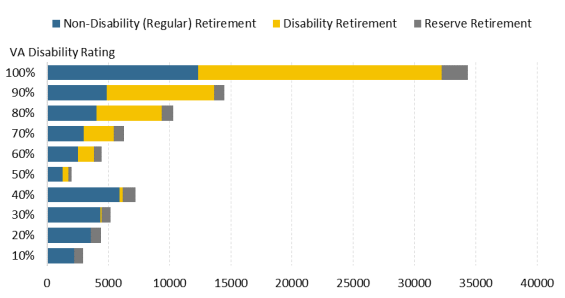

Retirees must apply for CRSC to their parent service, and the parent service is responsible for verifying that the disability is combat-related. This process is not automatic; it is application-driven. CRSC payments will generally be equal to the amount of VA disability compensation that has been determined to be combat-related. The legislation does notnot end the requirement that the retiree's military retired pay be reduced by the amount of the total VA disability compensation the retiree receives. Instead, CRSC beneficiaries are to receive the financial equivalent of concurrent receipt as "special compensation," but the statute states explicitly that it is not retired pay per se. CRSC payments are paid from the Department of DefenseDOD Military Retirement Fund.2224 As of September 20172018, a total of 90,74093,106 retirees were receiving CRSC (see Figure 12).

CRSC for Military Disability (Chapter 61) and TERA Retirees

Servicemembers with a permanent DOD disability rating of 30% or greater may be retired and receive retired pay prior to completing 20 years of service. These retirees are generally referred to as "Chapter 61" retirees, a reference to Chapter 61, Title 10, which governs disability retirement. In addition to the Chapter 61 retirees with less than 20 years of service, those who voluntarily retired under the Temporary Early Retirement Authority (TERA) during the military drawdown of the early to mid-1990s also have less than 20 years of service. The original CRSC legislation excluded those active duty members who retired with less than 20 years of service.

However, theThe FY2008 NDAA expanded CRSC to include Chapter 61 and active duty TERA retirees effective January 1, 2008.2326 Eligibility no longer requires a minimum number of years of service or a minimum disability rating (other than the 30% noted above for disability retirement); a 10% VA rating may qualify if it is combat-related. Eligible retirees must still apply to their parent service to validate that the disability is combat-related.

The FY2008 NDAA included almost all reserve disability retirees in the eligible CRSC population except those retired under 10 U.S.C. 12731b, a special provision which allows reservists with a physical disability not incurred in the line of duty to retire with between 15 and 19 creditable years of service.

The "Special Rule" for Disability Retirees

As noted earlier, an individual generally cannot receive two separate lifelong government annuities from federal agencies for the same purpose or qualifying event, for example, disability retired pay and VA disability compensation. To preclude this, there is a "special rule" for Chapter 61 disability retirees. Application of the special rule caps the CRSC at the level to which the retiree could have qualified based solely on years of service or longevity. In some instances, the special rule could limit or completely eliminate the concurrent receipt payment. In other instances, application of the rule may not result in any changes. Each situation is unique (rank, years of service, DOD and VA disability ratings, and the disability percentage attributable to combat) and requires independent calculations.

It appears that those most vulnerable to theThose most likely to see a reduction of CRSC due to the special rule would beare active duty servicemembers with a disability retirement, who have significantly less than 20 years of service, and a high VA disability rating. Others potentially impacted would be reserveReserve members with little active duty could also be impacted.

CRSC for Reserve Retirees

When CRSC was originally enacted in 2002, it required all applicants to have at least 20 years of service creditable for computation of retired pay. As a result, reserve retirees had to have at least 7,200 reserve retirement pointspoints (which converts to 20 years of equivalent service) to be eligible for CRSC. As noted earlier, a reservist receives a certain number of retirement points for varying levels of participation in the reserves, or active duty military service. The 7,200-point figure was extraordinarily high; it could only have been attained by a reservist who had many years of active duty military service in addition to a long reserve career. Initially this law, as enacted, effectively denied CRSC to almost all reservists.

However, a provision in the FY2004 NDAA clarifiedrevised the service requirement for reserve component personnel. It specified that personnel who qualify for reserve retirement by having at least 20 years of duty creditable for reserve retirement are eligible for CRSC. While eligible for CRSC, reserve retirees must be drawing retired pay (generally at age 60) to actually receive the CRSC payment.

CRSC Eligibility Summary

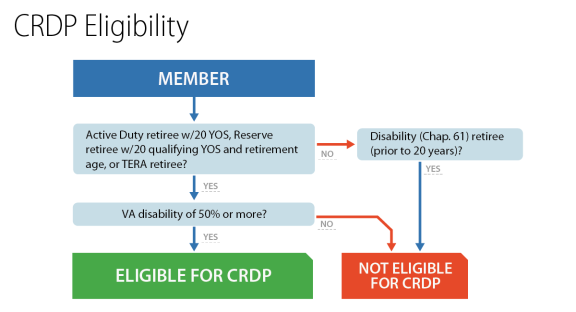

Essentially, with the exception of reserve component members injured while not in a duty status, all military retirees who have been awarded a Purple Heart or all military retirees who have combat-related disabilities compensable by the VA are eligible for CRSC (see Figure 23). Military retirees with service-connected disabilities which are not combat-related as defined by the statute are not eligible for CRSC, but may be eligible for CRDP as discussed below.

Concurrent Retirement and Disability Payments (CRDP)

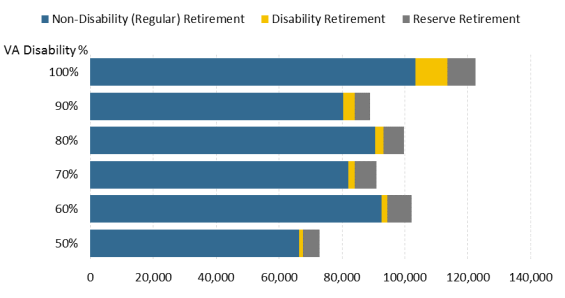

The FY2004 NDAA authorized, for the first time, actual concurrent receipt of retired pay and veteran disability compensation for retirees with at least a 50% disability, regardless of the cause of disability.24 However, the27 The amount of concurrent receipt was to be phased in over a 10-year period, from 2004 to 2013, except for 100% disabled retirees, who became entitled to immediate concurrent receipt effective January 1, 2005. Depending on the degree of disability, the initial amount of retired pay that the retiree could have restored would vary from $100 to $750 per month, or the actual amount of the offset, whichever was less. In 2014, all offsets ended and; military retirees with at least a 50% disability became eligible to receive their entire military retired pay and VA disability compensation. In FY2017FY2018 there were 577,399625,765 retirees receiving CRDP.

A retiree cannot receive both CRSC and CRDP benefits. The retiree may choose whichever is more financially advantageous to him or her and may change the type of benefit to be received during an annual open season to maximize the payments received. There are currently two groups of retirees who are not eligible for CRDP benefits (see Figure 45). The first group is nondisability military retirees with service-connected disabilities that have been rated by the VA at 40% or less. The second group includes Chapter 61 disability retirees with service-connected disabilities of 100% or less and withand less than 20 years of service.

|

|

Source: CRS, Title 10 of the United States Code. Notes: "Member" refers to a retired member of the Armed Forces. Temporary Early Retirement Authority (TERA) retirees are those retired with less than 20 years of service due to force management requirements. Disability ratings are awarded in 10% increments. |

CRDP for Temporary Early Retirement Authority (TERA) Retirees

The National Defense Authorization Act for Fiscal Year 1993 granted temporary authority (which expired on September 30, 2001) for the services to offer early retirements to personnel with more than 15 but less than 20 years of service.25 29 This authority was extended in subsequent authorization bills. TERA was used as a manpowerforce-sizing tool to entice voluntary retirements during the post-Cold War drawdown. TERA retired pay was calculated in the usual way except that there is an additional reduction of 1% for every year of service below 20. Part or all of this latter reduction could be restored if the retiree worked in specified public service jobs (such as law enforcement, firefighting, and education) during the period immediately following retirement, until the point at which the retiree would have reached the 20-year mark if he or she had remained in the service.

TERA retirees are eligible for CRSC and CRDP even though they have less than 20 years of service. The "special rule" for disability retirees (discussed belowsee "The Special Rule for Disability Retirees") does not apply to TERA retirees since TERA wasis not a disability retirement, but rather a regular retirement but for those with less than 20 years of service.

Concurrent Receipt and Blended Retirement System Lump Sum Payments

The Blended Retirement System (BRS), effective for all servicemembers joining on or after January 1, 2018, offers servicemembers the option to select a lump sum payment of a portion of their military retired pay in lieu of a monthly annuity.2630 If a member retiring under the BRS is eligible for CRDP and elects the lump sum payment of retired pay, the individual willis to continue to receive a monthly VA disability payment. If the member electing the lump sum payment is not eligible for CRDP (i.e., the retired pay offset applies), the VA willis to withhold disability payments until the sum of the amount withheld over time equals the gross amount of the lump sum payment.2731 If the member is eligible for CRSC, the procedures for withholding VA disability payments relate to the combat-related portion of the total VA entitlement.28

CRSC and CRDP Comparisons and Costs

CRSC and CRDP share some common elements, but are unique benefits. Table 1 summarizes some of the similarities and differences between CRSC and CRDP.

|

CRSC |

CRDP |

|

|

Classification |

Special compensation |

Military retired pay |

|

Qualified disabilities |

Combat- |

Service-connected disabilities |

|

Enrollment |

Must apply to parent service for verification that disability is combat-related |

Automatic, initiated by DFAS |

|

Type of Compensation |

Special compensation (not retired pay) |

Restored retired pay |

|

Tax Liability |

Nontaxable |

Taxable |

|

Subject to Division with a Former Spouse |

No |

Yes (longevity retired pay portion only)a |

|

Subject to Garnishment for Alimony and/or Child Support |

Yes |

Yes (longevity retired pay portion only) |

Source: Derived from Defense Finance and Accounting Service (DFAS) chart at http://www.dfas.mil/retiredmilitary/disability/comparison.html.

Note: Under 10 U.S.C. §1408, the amount of retired pay related to the individual's disability is not subject to division with a former spouse or subject to alimony payments. For more information on division of retired pay with former spouses, see CRS Report RL31663, Military Benefits for Former Spouses: Legislation and Policy Issues, by Kristy N. Kamarck.

CRDP and CRSC are paid from the DOD Military Retirement Fund.2933 Costs have been rising every year as a consequence of the phased implementation and a rise in the number of eligible recipients.3034 As of September 2017, one-third2018, 36% of all military retirees collecting retired pay were receiving either CRDP or CRSC.3135

Table 2. Number of Concurrent Pay Recipients and Estimated Annual Payments

FY2005-FY2017

|

Fiscal Year |

CRDP |

CRSC |

|||||||||||||

|

Number of Recipients |

Annual Payments (billions) |

Number of Recipients |

Annual Payments (billions) |

% of Total Retirees Receiving |

|||||||||||

|

FY2017 |

|

|

|

|

|

||||||||||

|

FY2016 |

|

|

|

|

|

||||||||||

|

FY2015 |

|

|

|

|

|

||||||||||

|

FY2014 |

|

|

|

|

|

||||||||||

|

FY2013 |

|

|

|

|

|

||||||||||

|

FY2012 |

|

|

|

|

|

||||||||||

|

FY2011 |

|

|

|

|

|

||||||||||

|

FY2010 |

|

|

|

|

|

||||||||||

|

FY2009 |

|

|

|

|

|

||||||||||

|

FY2008 |

|

|

|

|

| ||||||||||

|

FY2007 |

|

|

|

|

| ||||||||||

|

FY2006 |

|

|

|

|

| ||||||||||

|

FY2005 |

|

|

|

|

| ||||||||||

Source: DOD Office of the Actuary Statistical Reports on the Military Retirement System.

Notes: Some retirees may be eligible for both CRSC and CRDP but can only receive one or the other. Annual payments are made from the DOD Military Retirement Fund.

Issues and Options for Congress

Veteran advocacy groups continue to lobby for changes to the concurrent receipt programs that would expand benefits to a larger population of retirees. Other groups have pressed Congress to offset or streamline duplicative benefits, contending that the dual receipt of VA and DOD payments amounts to double-dipping, or in some cases triple-dipping for those veterans also eligible for Social Security Disability Insurance (SSDI) from the Social Security Administration.3255

Some of the factors that Congress might consider regarding potential changes include program costs, program efficiencies, individual eligibility requirements, and interaction with other servicemembers' and veterans' benefits and programs. Below are some options to change concurrent receipt programs that have been proposed or considered.

Eliminate or Sunset Concurrent Receipt Programs

The Congressional Budget Office has estimated that eliminating the CRDP program would save the government $139 billion between 2018 and 2026.3356 While achieving significant cost savings, eliminating or sunsetting concurrent receipt programsCRDP, CRSC, or both could be unpopular among servicemembers, veterans, and their families. PreviousSome previous efforts to reduce benefits to servicemembers have typically included a grandfather clause that would allow all current servicemembers and retirees to maintain existing benefits while the law would only apply to those who would have joined the service after a specific date.

One option could be to eliminate concurrent receipt for noncombat-related disabilities. This option would essentially repeal CRDP and expand CRSC to allow for any retired member to receive concurrent DOD and VA payments, but only for the amount of the disability determined to be combat-related under existing law or other defined criteria. A member could continue to receive VA disability payments and retired pay, but the offset would be applied to the portion of VA disability compensation not related to combat. This would have the effect of reducing or eliminating the concurrent benefit for some military retirees with rated disabilities of 50% or greater that are not related to combat.

Extend CRDP to All Chapter 61 Disability RetireesAs previously discussed, the FY2008 NDAA extended CRSC eligibility to Chapter 61 retirees who retired due to combat-related physical disability prior to completing 20 years of service. However, Chapter 61 retirees with service-connected disabilities rated less than 50% or with less than 20 years of service are not eligible for CRDP. Congress could expand the CRDP provision to include this cohort. Some observers may note that eliminating or modifying the special rule would result in paying for the same disability twice, by DOD and by VA.

Extend CRDP to Chapter 61 Disability Retirees with Less Than 20 Years of Service

As previously discussed, the FY2008 NDAA extended CRSC eligibility to Chapter 61 retirees who retired due to combat-related physical disability prior to completing 20 years of service. However, Chapter 61 retirees with service-connected disabilities rated less than 50% or with less than 20 years of service are not eligible for CRDP. Congress could expand the CRDP provision to include this cohort. This option would extend CRDP eligibility to approximately 100,000 additional disability retirees at an estimated 10-year cost of $5.8 billion.34

Extend CRDP to Those with a 40% or Less VA Disability Rating

At present, those military retirees with service-connected disabilities rated at 50% or greater are eligible for CRDP. Congress could revise the concurrent receipt legislation to include the entire population of military retirees with service-connected disabilities. In 2014, CBO estimated that to extend benefits to all veterans who would be eligible for both disability benefits and military retired pay would cost $30 billion from 2015 to 2024.35

Modify or Eliminate the Special Rule

With the extension of CRSC to Chapter 61 disability retirees, the special rule factors significantly into the concurrent receipt calculations. For those whose CRSC payment is limited or eliminated by the special rule, there may be a perceived inequity between CRSC recipients with 20 or more years of service (longevity retirees) and Chapter 61 (disability retirees who generally have less than 20 years of service) retirees.

To resolve this potential issue, Congress could modify or eliminate the special rule or limit its application to specific military operations. However, some observers may note that Again, eliminating or modifying the special rule would result in a situation that could be perceived as paying for the same disability twice, by DOD and by VA. It might also complicate future initiatives to simplify and streamline postservice compensation

Split Compensation by Agency for Longevity and Disability

Another option would be to completely overhaul the military retirement and disability system whereby DOD would only compensate for years of service and the VA would only compensate for disability, as recommended by the Dole/-Shalala commission.36

Author Contact Information

At present, those military retirees with service-connected disabilities rated at 50% or greater are eligible for CRDP. Congress could revise the concurrent receipt legislation to include the entire population of military retirees with service-connected disabilities. In 2014, CBO estimated that to extend benefits to all veterans who would be eligible for both disability benefits and military retired pay would cost $30 billion from 2015 to 2024.58

Author Contact Information

Footnotes

| 1. |

38 U.S.C. §§ 5304- | ||||||||||||||||||||||||||||||||||||||||||

|

CRS Report RL34751, Military Retirement: Background and Recent Developments, by Kristy N. Kamarck, for a detailed description of active duty retirement. |

|||||||||||||||||||||||||||||||||||||||||||

| 3. | Redux is a reduction of 1% in the multiplier for each year the retirement is less than 30 years of service. This results in 40% of base pay at 20 years of service, 57 ½% at 25 years of service, but the full 75% at 30 and 100% for 40 years of service. After retirement, the annual COLA is also reduced by 1% each year but, there is a recomputation at age 62 when both the multiplier and COLA are adjusted to equal the "High Three" system. To compensate for the reduced annuity and lower COLA rate, members who elect Redux at their 15th year of service receive a taxable $30,000 Career Retention Bonus that can be paid in lump sum or spread over six annual increments. |

||||||||||||||||||||||||||||||||||||||||||

|

See CRS Report RL30802, Reserve Component Personnel Issues: Questions and Answers, by Lawrence Kapp and Barbara Salazar Torreon. |

|||||||||||||||||||||||||||||||||||||||||||

|

Section 614, P.L. 109-163, January 6, 2006, reduced the age for receipt of retired pay for reserve component members by three months for each aggregate of 90 days of certain types of active duty performed after January 28, 2008. Attempts since then to make this benefit retroactive to September 11, 2001, have not been successful. |

|||||||||||||||||||||||||||||||||||||||||||

|

10 U.S.C. §1201. |

|||||||||||||||||||||||||||||||||||||||||||

|

10 U.S.C. §1401. |

|||||||||||||||||||||||||||||||||||||||||||

|

10 U.S.C. §1401. |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

While |

|||||||||||||||||||||||||||||||||||||||||||

|

All VA disability compensation rates are available at http://www.benefits.va.gov/COMPENSATION/.resources_comp01.asp. |

|||||||||||||||||||||||||||||||||||||||||||

| 12. |

For a full discussion of the similarities and differences between the DOD and VA disability rating systems, see CRS Report RL33991, Disability Evaluation of Military Servicemembers, by Christine Scott and Don J. Jansen. |

||||||||||||||||||||||||||||||||||||||||||

|

The President's Commission on Care for America's Returning Wounded Warriors (commonly referred to as the Dole-Shalala commission) and the Independent Review Group on Rehabilitative Care and Administrative Processes at Walter Reed Army Medical Center and National Naval Medical Center both contained similar recommendations concerning disability processing. |

|||||||||||||||||||||||||||||||||||||||||||

|

Section 1612(a), P.L. 110-181, January 28, 2008. |

|||||||||||||||||||||||||||||||||||||||||||

|

U.S. Government Accountability Office, Military Disability System; Improved Monitoring Needed to Better Track and Manage Performance, GAO-12-676, August 2012. |

|||||||||||||||||||||||||||||||||||||||||||

|

Military Compensation and Retirement Modernization Commission (MCRMC), Final Report of the MCRMC, January 2015, p. 133, https://apps.dtic.mil/dtic/tr/fulltext/u2/a625626.pdf. |

|||||||||||||||||||||||||||||||||||||||||||

|

Statement of the Secretary of Defense and Secretary of Veterans Affairs, Electronic Health Record Modernization Joint Commitment, September 26, 2018, https://www.va.gov/opa/publications/docs/EHRM-Joint-Commitment-Statement.pdf. |

|||||||||||||||||||||||||||||||||||||||||||

|

Section 636, P.L. 107-314, December 2, 2002. |

|||||||||||||||||||||||||||||||||||||||||||

|

Section 642, P.L. 108-136, November 24, 2003. |

|||||||||||||||||||||||||||||||||||||||||||

|

The FY2003 NDAA required that the disability be rated at least 60%. This requirement was repealed by the FY2004 NDAA. |

|||||||||||||||||||||||||||||||||||||||||||

| 21. |

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

Section 641, P.L. 110-181, January 28, 2008. |

|||||||||||||||||||||||||||||||||||||||||||

|

Section 641, P.L. 108-136, November 24, 2003. |

|||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||

| 29.

|

|

P.L. 102-484§4403. |

For more information on the BRS, see CRS Report RL34751, Military Retirement: Background and Recent Developments, by Kristy N. Kamarck. |

||||||||||||||||||||||||||||||||||||||||

|

Deputy Secretary of Defense, |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

Although CRSC is paid from the Military Retirement Fund, it is not technically considered retired pay. |

|||||||||||||||||||||||||||||||||||||||||||

|

The number of veterans eligible for disability pay has been increasing in part due to policy changes that have increased outreach, improved claims processing and designated additional conditions for benefit eligibility. Increases in VA disability claims have also been attributed to the specific types of injuries suffered by veterans of the Iraq and Afghanistan conflicts. |

|||||||||||||||||||||||||||||||||||||||||||

|

Department of Defense, FY2017 DOD Statistical Report on the Military Retirement System, Office of the Actuary, July 2018. |

|||||||||||||||||||||||||||||||||||||||||||

|

|

See, e.g., FDIC v. Meyer, 510 U.S. 471, 475 (1994) ("Absent a waiver, sovereign immunity shields the Federal Government and its agencies from suit."). 37.

|

|

28 U.S.C. §§ 1346(b), 2671–80. 38.

|

|

Id. For more about the FTCA, including exceptions to the general rule that are not discussed herein, see CRS Report R45732, The Federal Tort Claims Act (FTCA): A Legal Overview, by Kevin M. Lewis. 39.

|

|

As discussed below, the status of active military servicemembers is different from veterans, who are no longer in active military service. See, e.g., Bush v. Secretary of Dep't of Veterans Affairs, 2014 WL 127092, at *6 (S.D. Ohio Jan. 13, 2014). 40.

|

|

See, e.g., Levin v. United States, 568 U.S. 503 (2013) (permitting a suit under the FTCA brought by a veteran who suffered injuries as a result of cataract surgery performed by a Navy doctor at a military hospital). 41.

|

|

38 U.S.C. § 1151(b)(1). 42.

|

|

Id.; see also 28 U.S.C. § 2672 (discussing administrative settlement of claims). 43.

|

|

28 U.S.C. § 2680(j). 44.

|

|

Feres v. United States, 340 U.S. 135, 146 (1950). 45.

|

|

The FTCA defines "employee of the government" to include "members of the military or naval forces of the United States." 28 U.S.C. § 2671. 46.

|

|

Feres, 340 U.S. at 136-37. The case involved three plaintiffs: the executrix of a servicemember who died in a barracks fire, alleging that the government should have known the barracks was unsafe; a servicemember in whose stomach a military surgeon allegedly left a 30-inch by 18-inch towel; and the executrix of a servicemember who allegedly died because of negligent treatment by army surgeons. Id. All three claims were dismissed because of the United States' sovereign immunity, which the Supreme Court held that Congress had not waived. Id. at 146. 47.

|

|

E.g., Daniel v. United States, 889 F.3d 978, 982 (9th Cir. 2018), cert. denied, 139 S.Ct. 1713 (2019) ("If ever there were a case to carve out an exception to the Feres doctrine, this is it. But only the Supreme Court has the tools to do so."). For more see CRS In Focus IF11102, Military Medical Malpractice and the Feres Doctrine, by Bryce H. P. Mendez and Kevin M. Lewis. 48.

|

|

P.L. 116-92, § 731 (codified at 10 U.S.C. § 2733a). 49.

|

|

50.

|

|

This approach was not adopted in enacted law. See, e.g., Rep Speier's Bill Amending the Feres Doctrine to Allow Servicemembers to Sue for Medical Malpractice Included in House Defense Bill (July 10, 2019), https://speier.house.gov/2019/7/rep-speier-s-bill-amending-feres-doctrine-allow-servicemembers-sue. 51.

|

|

S. 2451, 116th Cong. (2019); H.R. 2422, 116th Cong. (2019). The House version of the FY2020 NDAA likewise took this approach. H.R. 2500 § 729, 116th Cong. (2019). 52.

|

|

This section provides that federal agencies may, in accordance with regulations prescribed by the Attorney General, settle tort claims against the United States that meet the same guidelines as claims permitted under the FTCA (e.g., the injury or loss must be caused by the negligent or wrongful act or omission of a federal employee acting within the scope of his employment). 53.

|

|

See "Claims Brought by Veterans," supra; 38 U.S.C. § 1151(b)(1) (providing that individuals who settle a claim under 28 U.S.C. § 2672 "by reason of a disability or death treated pursuant to this section as if it were service-connected" shall have their veterans benefits withheld until the withheld benefits equal the amount of the settlement). 54.

|

|

It is unlikely that an agency would settle through the FTCA's administrative process any claim that the Feres doctrine would bar from success in court. 55.

|

|

Boccia, Romina, Triple-Dipping: Thousands of Veterans Receive More than $100,000 in Benefits Every Year, The Heritage Foundation, November 6, 2014, https://www.heritage.org/social-security/report/triple-dipping-thousands-veterans-receive-more-100000-benefits-every-year. For more information on SSDI benefits see, CRS Report R44948, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI): Eligibility, Benefits, and Financing, by William R. Morton. 56.

|

|

Congressional Budget Office, Options for Reducing the Deficit: 2017 to 2026: Option 11, Eliminate Concurrent Receipt of Retirement Pay and Disability Compensation for Disabled Veterans, Washington, DC, December 8, 2016. 57.

|

|

Boccia, Romina, Triple-Dipping: Thousands of Veterans Receive More than $100,000 in Benefits Every Year, The Heritage Foundation, November 6, 2014, https://www.heritage.org/social-security/report/triple-dipping-thousands-veterans-receive-more-100000-benefits-every-year. For more information on SSDI benefits see, CRS Report R44948, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI): Eligibility, Benefits, and Financing, by William R. Morton. |

| 33. |

Congressional Budget Office, Options for Reducing the Deficit: 2017 to 2026: Option 11, Eliminate Concurrent Receipt of Retirement Pay and Disability Compensation for Disabled Veterans, Washington, DC, December 8, 2016. |

||||||||||||||||||||||||||||||||||||||||||

| 34. |

This cost estimate was provided by the Comptroller, Office of the Secretary of Defense. |

||||||||||||||||||||||||||||||||||||||||||

| 35. |

Congressional Budget Office, Veterans' Disability Compensation: Trends and Policy Options, Washington, DC, August 2014. |

||||||||||||||||||||||||||||||||||||||||||

| 36. |

|