Deficit Financing, the Debt, and “Modern Monetary Theory”

Explaining persistently low interest rates despite large deficits and rising debt has been one of the central challenges of macroeconomists since the end of the Great Recession. This dynamic has led to increasing attention to Modern Monetary Theory (MMT), presented as an alternative to the mainstream macroeconomic way of thinking, in some fiscal policy discussions. Such discussions are at times restricted by a difficulty, expressed by policymakers and economists alike, in understanding MMT’s core principles and how they inform MMT’s views on fiscal policy. MMT suggests that deficit financing can be used without harmful economic effects in circumstances of low inflation rates and low interest rates, conditions that currently exist despite indications that the country is at full employment.

This report surveys the available MMT literature in order to provide a basic understanding of the differences (or lack thereof) between the defining relationships established in MMT and mainstream economics. It then explores how such distinctions may inform policy prescriptions for addressing short- and long-run economic issues, including approaches to federal deficit outcomes and debt management. Included in this analysis are observations of how policy recommendations from MMT and mainstream economics align with current U.S. economic and governance systems.

In mainstream macroeconomic models, the asset market is characterized by the sensitivity of investment to interest rates, a determinant of investment returns. Money is typically defined as cash and close substitutes, and used for transactions and held as an asset. In the short run, the capital stock (equipment and other factors of production outside of labor) is assumed to be fixed, and output is dictated by the employment level. Fiscal and monetary policy decisions can be used to expand or contract the short-run economy (with distinct effects for each), and those decisions help to inform growth, the stock of capital and labor, and other decisions in the long run. In general, expansionary fiscal policies, including stimulus policies and other programs that increase net deficits and debt, are thought to be helpful when addressing negative shocks in demand, but they may crowd out private investment and reduce long-term growth if used when the economy is otherwise in balance. Persistent increases in real debt (which occurs when the stock of debt grows more quickly than the economy) are viewed as unsustainable, as they would eventually lead to a lack of real resources to borrow against.

Though some MMT adherents have disputed the notion that the model can be viewed through the basic macroeconomic framework, efforts to do so reveal a few key distinctions. In the MMT model of short-run behavior, investment decisions are insensitive to interest rates, and are instead a function of current consumption levels. MMT holds a much broader view of money, asserting that monetary value can be created by financial institutions in a way that renders monetary policy ineffective in dealing with short-run economic fluctuations. MMT supporters therefore prefer a larger fiscal policy role in managing business cycles than mainstream economists, generally claiming that fiscal borrowing constraints are less imposing than mainstream economists believe in countries with a sovereign currency, and call for direct money financing of fiscal policy actions by the central bank. The translation of the MMT approach to long-run output is unclear, though a jobs guarantee supported by MMT adherents would likely change the nature of the relationship between employment and output levels.

Full alignment with the economic and political system supported by MMT would likely involve a dramatic shift in the roles and powers of U.S. fiscal institutions. Adopting an MMT framework would involve much more fiscal policy to account for a reduced monetary policy role. Policymakers would also likely need to execute fiscal policy decisions more quickly than has been done in the past in assuming an increased role in economic management.

Projections of future debt growth due to spending pressures from social programs have led to a current concern about deficit financing, recognizing the institutional challenges in conducting tax and spending fiscal policy. MMT is largely focused on short-run management of the economy, with tax and spending policies aimed at maintaining a fully employed economy without inflation. The MMT approach appears to implicitly assume that a high level of debt will not be problematic because it can be financed cheaply by maintaining low interest rates. Underlying this policy is the assumption that Congress can act quickly to counteract deficit-driven inflation with tax increases or spending cuts that would allow the economy to maintain low interest rates on public debt.

Deficit Financing, the Debt, and "Modern Monetary Theory"

Jump to Main Text of Report

Contents

- Introduction

- Explaining Mainstream Economic Views

- Short Run: The Business Cycle

- Extensions of the Basic Model: Open Economy

- Extensions of the Basic Model: Investment and the Accelerator

- Extension of the Model: Consumption and Labor a Function of the Interest Rate, and Rational Expectations

- The Long Run: Economic Growth

- Modern Monetary Theory

- Money Supply and Demand (LM)

- Determination of Output and Interest Rates

- Demand and Supply (AD-AS)

- The Open Economy

- Does MMT Justify Deficit Financing?

- Applying MMT to Federal Institutions

- References

Figures

- Figure 1. Expansionary Fiscal Policy in IS-LM

- Figure 2. Expansionary Monetary Policy in IS-LM

- Figure 3. Monetary Policy Options in IS-LM

- Figure 4. Monetary Policy Options in IS-LM

- Figure 5. Monetary Policy Options in IS-LM

- Figure 6. Aggregate Demand, Aggregate Supply, and Output

- Figure 7. Aggregate Demand, Aggregate Supply, and Output

- Figure 8. IS-LM Curves in an MMT Model

Summary

Explaining persistently low interest rates despite large deficits and rising debt has been one of the central challenges of macroeconomists since the end of the Great Recession. This dynamic has led to increasing attention to Modern Monetary Theory (MMT), presented as an alternative to the mainstream macroeconomic way of thinking, in some fiscal policy discussions. Such discussions are at times restricted by a difficulty, expressed by policymakers and economists alike, in understanding MMT's core principles and how they inform MMT's views on fiscal policy. MMT suggests that deficit financing can be used without harmful economic effects in circumstances of low inflation rates and low interest rates, conditions that currently exist despite indications that the country is at full employment.

This report surveys the available MMT literature in order to provide a basic understanding of the differences (or lack thereof) between the defining relationships established in MMT and mainstream economics. It then explores how such distinctions may inform policy prescriptions for addressing short- and long-run economic issues, including approaches to federal deficit outcomes and debt management. Included in this analysis are observations of how policy recommendations from MMT and mainstream economics align with current U.S. economic and governance systems.

In mainstream macroeconomic models, the asset market is characterized by the sensitivity of investment to interest rates, a determinant of investment returns. Money is typically defined as cash and close substitutes, and used for transactions and held as an asset. In the short run, the capital stock (equipment and other factors of production outside of labor) is assumed to be fixed, and output is dictated by the employment level. Fiscal and monetary policy decisions can be used to expand or contract the short-run economy (with distinct effects for each), and those decisions help to inform growth, the stock of capital and labor, and other decisions in the long run. In general, expansionary fiscal policies, including stimulus policies and other programs that increase net deficits and debt, are thought to be helpful when addressing negative shocks in demand, but they may crowd out private investment and reduce long-term growth if used when the economy is otherwise in balance. Persistent increases in real debt (which occurs when the stock of debt grows more quickly than the economy) are viewed as unsustainable, as they would eventually lead to a lack of real resources to borrow against.

Though some MMT adherents have disputed the notion that the model can be viewed through the basic macroeconomic framework, efforts to do so reveal a few key distinctions. In the MMT model of short-run behavior, investment decisions are insensitive to interest rates, and are instead a function of current consumption levels. MMT holds a much broader view of money, asserting that monetary value can be created by financial institutions in a way that renders monetary policy ineffective in dealing with short-run economic fluctuations. MMT supporters therefore prefer a larger fiscal policy role in managing business cycles than mainstream economists, generally claiming that fiscal borrowing constraints are less imposing than mainstream economists believe in countries with a sovereign currency, and call for direct money financing of fiscal policy actions by the central bank. The translation of the MMT approach to long-run output is unclear, though a jobs guarantee supported by MMT adherents would likely change the nature of the relationship between employment and output levels.

Full alignment with the economic and political system supported by MMT would likely involve a dramatic shift in the roles and powers of U.S. fiscal institutions. Adopting an MMT framework would involve much more fiscal policy to account for a reduced monetary policy role. Policymakers would also likely need to execute fiscal policy decisions more quickly than has been done in the past in assuming an increased role in economic management.

Projections of future debt growth due to spending pressures from social programs have led to a current concern about deficit financing, recognizing the institutional challenges in conducting tax and spending fiscal policy. MMT is largely focused on short-run management of the economy, with tax and spending policies aimed at maintaining a fully employed economy without inflation. The MMT approach appears to implicitly assume that a high level of debt will not be problematic because it can be financed cheaply by maintaining low interest rates. Underlying this policy is the assumption that Congress can act quickly to counteract deficit-driven inflation with tax increases or spending cuts that would allow the economy to maintain low interest rates on public debt.

Introduction

Traditional macroeconomic theory addresses two main questions. First, macroeconomic theory and policy seek to mitigate short-term economic fluctuations (or stabilize the economy) that leave productive resources idle for a time. Second, macroeconomists seek to recommend public policies that maximize living standards (economic growth) over the long term, while keeping debt at sustainable levels. The role of monetary policy and the maintenance of a stable price level are embedded in both issues.

In the past few years, the U.S. economy has experienced persistently low interest rates despite near-full employment and federal deficits and debt significantly above their historical averages. These characteristics have led to debate over the optimal trajectory of long-term federal debt in an economic environment with relatively low borrowing costs. Recently, an economic theory outside of mainstream economic views, called Modern Monetary Theory (MMT) by its proponents, has been receiving attention in the public debate.1 Interest in this theory may in part reflect concerns about the deficit financing needed for new spending programs in health, education, infrastructure, and other areas. MMT suggests that deficit financing can be used without harmful economic effects in circumstances of low inflation rates and low interest rates, conditions that currently exist despite indications that the country is at full employment.2

This report first explains mainstream macroeconomic theory. It then surveys the available MMT literature to provide a basic understanding of the differences (or lack thereof) between the defining relationships established in MMT and mainstream economics. It next discusses whether MMT can be used to justify deficit financing. Finally, it discusses how existing government institutions may present barriers in adopting the prescriptions of MMT for managing the economy.

Unlike mainstream macroeconomic theory, where consensus has been reached on how core relationships translate into mathematical equations, there is no comparative mathematical statement of MMT. Some academic economists have translated MMT into a mathematical framework, and the explanation of the differences between mainstream and MMT theory are based on those discussions.3 Proponents of MMT do not necessarily accept that framework, however.

Explaining Mainstream Economic Views

Although basic macroeconomic models vary in many ways, any macroeconomic model that allows for fiscal and monetary policy to influence the economy has three relationships in the economy that must be in balance: (1) the asset market where investment equals saving (called the IS curve), (2) the money relationship where the supply and demand for money must equate (commonly called the LM curve), and (3) the economy-wide relationship where aggregate demand equals aggregate supply. The first two of these equations compose what is referred to as the IS-LM model. These three relationships, in turn, determine output, prices, and the interest rate in the economy.4 Macroeconomic models formalize the relationship between economic variables, allowing researchers to quantify the effect of a change in one variable on the rest of the system (also called comparative statics) and to observe how economic patterns align with model predictions.

The IS-LM model is characterized by a limited role of expectations of future economic conditions and sticky prices.5 While there are a number of different macroeconomic models, especially those that add expectations, this section uses the simplified model, which forms the core of forecasting models as well as models used by government agencies in projecting the economy. More sophisticated forecasting models of the economy have many equations that capture variation in types of goods, investments, and assets, but this simplified model can be used to explain the standard model and provide a foundation for interpreting MMT.

Most academic research is directed toward more complex models (sometimes referred to as modern macroeconomics), which are discussed briefly below. The basic IS-LM model is useful for illustrating the differences in MMT and mainstream models.

Short Run: The Business Cycle

In mainstream macroeconomic models, the short run is characterized by fixed capital investment, or that the equipment and nonlabor resources available to firms are fixed. Output decisions are therefore a function of productivity, employment, and IS-LM outcomes.

The Investment-Savings Balance (IS)

The IS curve begins with the recognition that output (or income) is the sum of its components: private consumption, investment, and government spending. For simplicity, this models a closed economy; in an open economy there would be a fourth component, net exports. If consumption and government spending are subtracted from output, the result is saving; thus, this relationship could be restated as savings equals investment.

Consumption is a fraction of disposable income, which is income minus taxes. Therefore, consumption rises when disposable income rises (which occurs when income rises and/or taxes fall). While consumption depends on income and taxes, investment depends on the interest rate, rising when interest rates fall and declining when they rise. As a result, there are a series of pairs of income levels and interest rates where this relationship is in balance, and income is higher when interest rates are lower.6

It is through this relationship that fiscal policy can be used to expand or contract the economy. If government spending is increased, or if taxes are decreased (which increases disposable income and therefore increases consumption), demand increases. The recipients of these increased amounts of income then spend a portion of that income, which leads to successive rounds of spending that are called multipliers.

Money Supply and Demand (LM)

Another critical relationship is that between money supply and money demand, which must be equal for markets to clear. Money is composed of cash, including checking accounts, and its close substitutes. Holding prices constant for the moment, and with a fixed money supply, there are two uses of money. First, some money is needed to carry out transactions in the economy, and thus more money is demanded as income (output) increases. Second, money is needed as a liquid form of asset holdings, and the higher the interest rate, the less money is held because it earns no interest and is exchanged for other forms of assets that earn interest. Similar to the IS curve, this relationship also creates pairs of interest rates and output levels where money supply and demand balance traces out a curve (the LM curve), this time with income higher as interest rates increase. In this case, however, a fixed amount of money demand occurs when both output and interest rates are high or when both are low. When interest rates are high, less money is desired as an asset and more is freed up to support a higher level of transactions (and therefore income).

Determination of Output and Interest Rates

Where the IS and LM relationships intersect is where income and interest rates will be determined in the economy, holding prices constant. With significant unemployment, any fiscal or monetary stimulus would be transmitted into output effects, moving the economy closer to the output achieved under full employment.

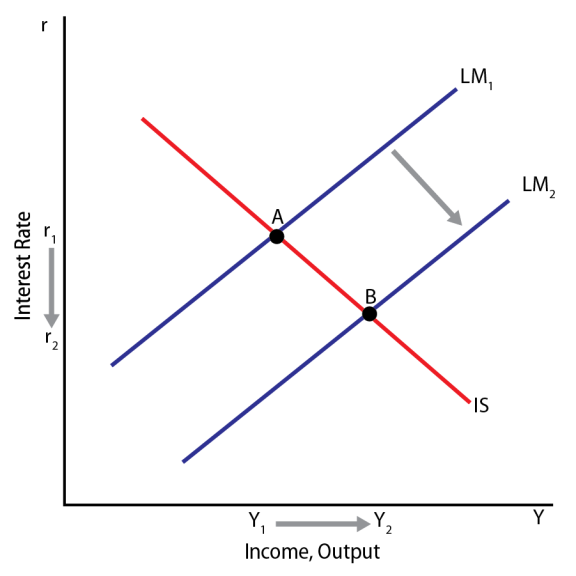

The effects of expansionary fiscal policy in the IS-LM model are shown in Figure 1. When expansionary fiscal policy—through increased spending, decreased taxes, or some combination of the two—occurs (IS1 to IS2) and the money supply remains fixed (LM), interest rates (r) will rise (point A to point B). This rise occurs because when more money is needed for transactions, money held as an asset must be reduced and interest rates must be higher. This rise in interest rates offsets some of the effects of increased income by reducing investment. Thus, holding money supply fixed, increases in income (Y) that would have occurred if interest rates were fixed is now reduced as investment decreases.

|

|

Notes: Interest rates (r) are measured on the y-axis, and output (Y) is measured on the x-axis. The IS curve depicts the combination of interest rates and output levels consistent with the investment-savings relationship, while the LM curve shows the combination of interest rates and output levels consistent with the money supply and money demand relationship. |

The monetary policy implications in an IS-LM model are illustrated in Figure 2. With expansionary monetary policy (LM1 to LM2), more money is available to support income and transactions at every interest rate (point A to point B). However, that level of income is inconsistent with the level of income that balances the investment–savings (IS) relationship, and interest rates fall, leading to more investment, with some of the increased money supply used to hold more money as a liquid asset. That is, by interacting with the investment–savings (IS) relationship, output and interest rates fall below the amount implied by the money expansion alone. Output (Y) is higher than it was previously, and interest rates are lower. Thus, a monetary expansion increases output and lowers interest rates.

|

|

Notes: Interest rates (r) are measured on the y-axis, and output (Y) is measured on the x-axis. The IS curve depicts the combination of interest rates and output levels consistent with the investment-savings relationship, while the LM curve shows the combination of interest rates and output levels consistent with the money supply and money demand relationship. |

Note that while the basic model uses monetary supply as the primary monetary policy tool, due to difficulties in measuring the money supply, monetary authorities generally target interest rates when making policy choices.

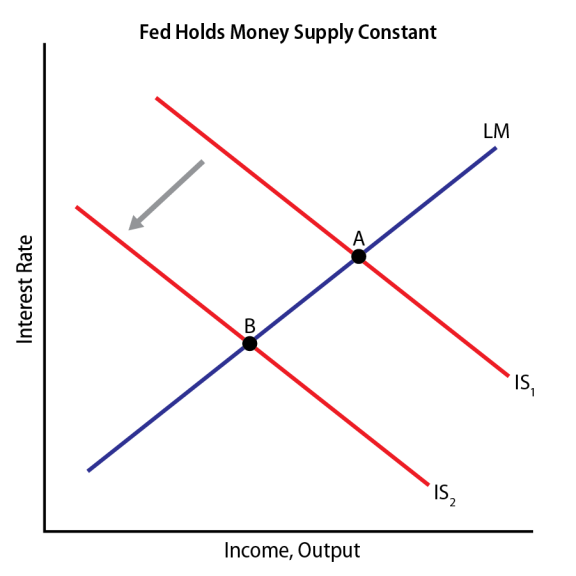

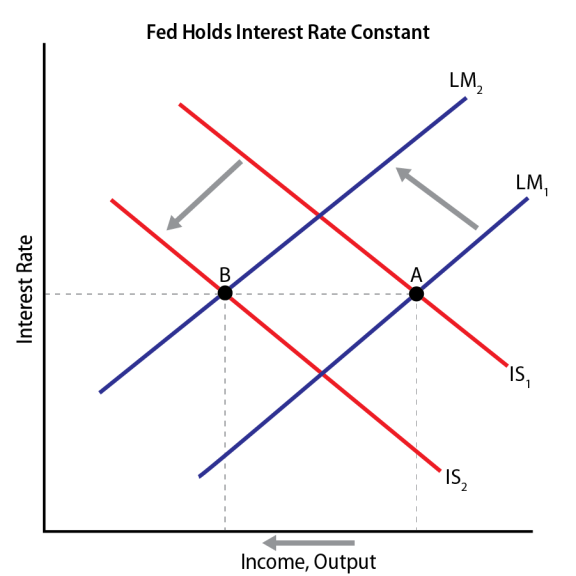

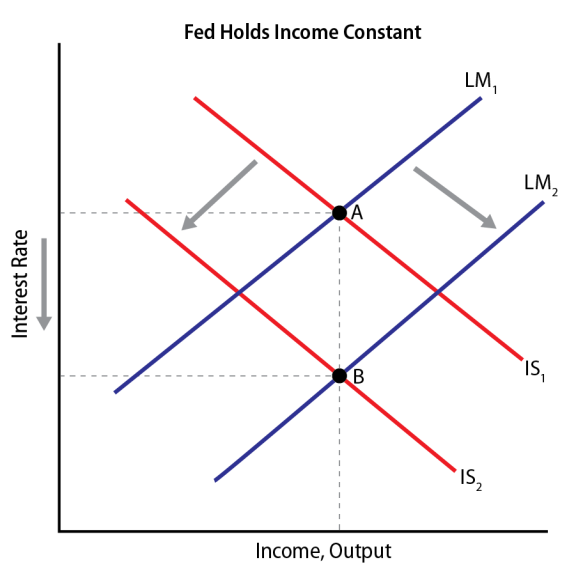

Figure 3, Figure 4, and Figure 5 show the basic ways monetary policy can respond to a fiscal policy shift (in these examples through a contractionary fiscal policy shift) in an IS-LM model.

- Monetary policy may be neutral (Figure 3) with respect to a fiscal contraction (IS1 to IS2) if there is no change in the money supply, so that some of the output effect is mitigated (point A to point B) relative to an accommodating policy.

- Monetary policy may be accommodating (Figure 4) if the money supply also contracts (LM1 to LM2) to keep the interest rate constant, allowing maximum output effects (in this case, reducing output) to occur (point A to point B).

- Monetary policy may be offsetting (Figure 5) if the money supply expands (LM1 to LM2) to return output to its original level (point A to point B).

Demand and Supply (AD-AS)

The LM curve actually has a third variable, the price level. The real money supply depends on the price level; if prices rise and nominal money supply is fixed, the real money supply falls. Thus, there is a third relationship in the system.

This relationship requires an equilibrium between aggregate demand and aggregate supply (AD-AS). In the short run, the capital stock is fixed, and the output in the economy depends on hiring unemployed labor. (There is also an underlying labor supply and labor demand relationship.) The effects are captured in the aggregate supply equation. As prices rise, the supply of output increases and the demand decreases. Thus, this relationship shows an equilibrium aggregate price level and output in the economy.7

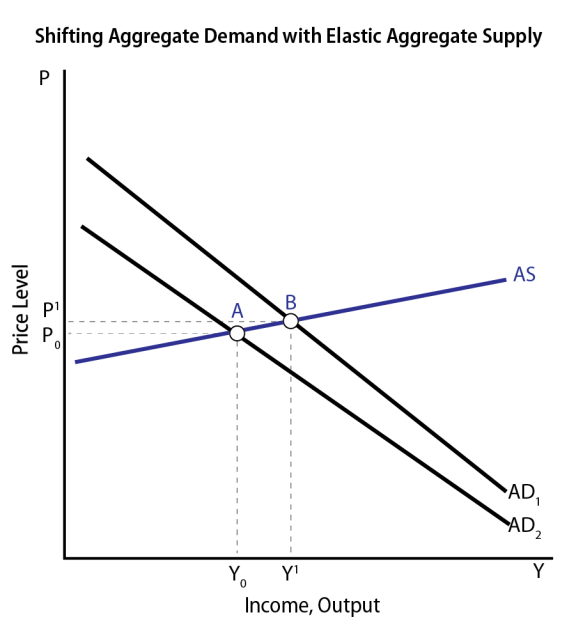

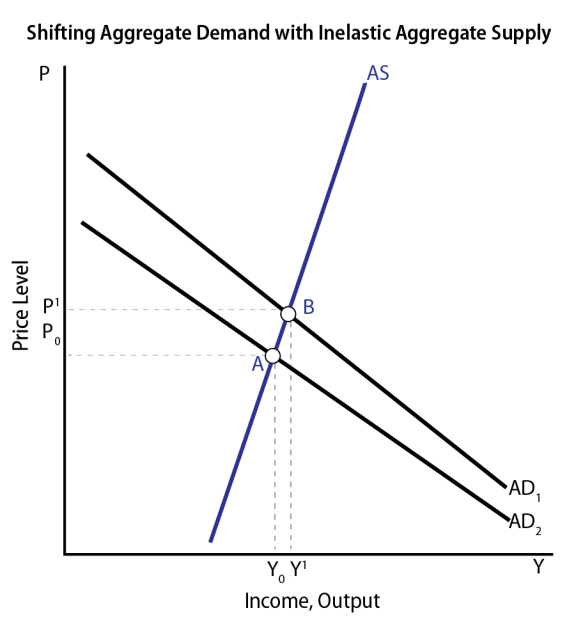

As shown in Figure 6 and Figure 7, the effect of fiscal and monetary policies on output (Y) and the price level (P) is a function of aggregate supply and demand. Either a fiscal or monetary expansion will shift the aggregate demand curve toward more output at every price level. The supply curve is relatively flat when there is significant underemployment in the economy, meaning that output can increase without affecting prices. When the economy is at full employment the supply curve is almost vertical, and a shift in the demand curve will increase prices and not output.

|

|

Notes: The price level (P) is measured on the y-axis, and output (Y) is measured on the x-axis. The AD curve represents the combinations of prices and output consistent with aggregate demand, while the AS curve represents the combination of prices, and output consistent with aggregate supply. |

|

|

Notes: The price level (P) is measured on the y-axis, and output (Y) is measured on the x-axis. The AD curve represents the combinations of prices and output consistent with aggregate demand, while the AS curve represents the combination of prices and output consistent with aggregate supply. |

An increase in the price level will decrease the real money supply. If the initial stimulus were a fiscal stimulus, the real money supply would contract, at full employment, to restore the old output level, but with higher interest rates. In effect, the fiscal stimulus would have substituted consumption or government spending for investment (referred to as crowding out). If the stimulus were originally a monetary stimulus, the real money supply would shift back to its old position and neither the output nor its composition would change. Continual attempts to provide stimulus at full employment would result in a continually increasing price level and, in the case of a fiscal stimulus, continued crowding out of investment.

Extensions of the Basic Model: Open Economy

This basic model can be expanded in many ways with increased complication and detail. As suggested above, multiple sectors, multiple types of investments, and other details can be introduced.

One important element is to allow for an open economy, with exports and imports, foreign investment in the United States, and U.S. investment in foreign countries. Expanding the model in this way, in its simplest form, requires a new relationship, the balance of payments, which requires equal supply and demand for U.S. dollars. This additional relationship requires a new variable, the exchange rate. It also requires net exports in addition to consumption, investment, and government spending, to be added to the IS equation.

An open economy tends to diminish the effect of fiscal stimulus. As interest rates rise in the United States, foreign capital is attracted into the United States. To make those investments, foreigners demand dollars and supply foreign currency. The increased dollar demand increases the price of the dollar in foreign currency, and this higher price makes exports more costly and imports less costly. This results in a decrease in net exports, reducing the increase in output. In the extreme, if international capital were perfectly mobile and the United States were a small country, any effect of a fiscal stimulus would theoretically be completely offset, leading to a substitution of consumption and government spending for net exports. Because capital is not perfectly mobile and the United States is a large country, fiscal policy should still be effective in stimulating or restraining the economy.

Monetary policy theoretically becomes more powerful in an open economy: as an increase in the money supply causes the interest rate to fall, capital flows out of the country, causing net exports to rise.

Extensions of the Basic Model: Investment and the Accelerator

Another modification to the model is to recognize that investment can respond to expected demand. With this extension, as the economy expands and that expansion is expected to be sustained, firms will increase investment in capital goods (known as the accelerator effect), thereby increasing their capacity. The rate at which capital accumulates in an expanding economy will therefore reflect the rate at which capital investment increases in response to output and the rate of capital depreciation (or how much capital value is lost in any one period) over time.8

Extension of the Model: Consumption and Labor a Function of the Interest Rate, and Rational Expectations

Economists had long been concerned that the IS-LM model does not fully account for expectations of future behavior, and lacked the microeconomic foundations where individuals allocate consumption and leisure over time. One way to incorporate such an idea is to make consumption determined by the interest rate as well as disposable income, reflecting the idea that as the interest rate rises individuals want to save more (and consume less). This effect has also been extended to the allocation of leisure and labor, and is most formally contained in dynamic stochastic general equilibrium (DSGE) models.9 DSGE models include a demand block, a supply block, and a monetary policy relationship. In general, while modifications could easily allow consumption to depend on interest rates, use of a full-blown DSGE model is more common among academics than among private forecasters or government forecasters.10 The model has been criticized by a number of mainstream academics.11

The Long Run: Economic Growth

Over the long run, economic business cycle models converge into economic growth models. Economic growth in the longer term is assumed to be at full employment, and the economy grows with the labor force, capital accumulation, and technological advances. The long run, unlike the short run (where the economy can gain from reducing unemployment), is characterized by fixed resources and tradeoffs. What is most relevant to fiscal and monetary stimulus is that mainstream economic theory suggests that using fiscal stimulus may be good for growth in the short run, but can be harmful in the long run. If fiscal deficits allow consumption to increase at the expense of investment, as would be the case with running the deficit that causes the debt to grow faster than GDP, the economy will continually experience slower growth as the capital stock fails to grow at a quick enough pace. Excessive monetary stimulus, meanwhile, would lead to price level increases that, if followed persistently would lead to an inflationary spiral.

The most common growth model is one that reflects a more or less steady-state growth (although that growth pattern may reflect growth in the labor supply).12

Modern Monetary Theory

This section explores MMT's basic macroeconomic principles and distinctive characteristics and discusses how to interpret the model into the more conventional IS-LM framework. Because MMT is an emerging ideology, definitively identifying the research that encapsulates it can be difficult. Publications and other works from both proponents of MMT and mainstream economists used in this report are listed in the references section. Though some MMT proponents have expressed caution in viewing MMT through a traditional macroeconomic framework, this approach is consistent with work found both elsewhere in the MMT literature and in mainstream economic analysis, including research with theoretical elements aligning with some of MMT's central assertions.13

MMT's theory does not take into account self-imposed constraints (i.e., those other than resource constraints), such as lack of a sovereign currency, or of other institutions, such as independence of the monetary authority (the Federal Reserve in the United States) and the Treasury that allows the creation of money to finance government spending. As will be discussed subsequently, U.S. institutions may limit the application of MMT to the management of the economy.

As with all macroeconomics, some of the theory is about description and some about prescription, but MMT varies by including prescriptive points that restrain monetary policy to keep a fixed interest rate (this policy will leave fiscal policy as the only tool to address the business cycle). According to the model, when fiscal stimulus produces no inflation, there are still unused resources in the economy, and when fiscal stimulus leads to inflation, the stimulus will be reduced or reversed, thereby reducing the deficit or converting it to a surplus.

The Investment-Savings Balance (IS)

Just as with the basic macroeconomic model, analysis of MMT's macroeconomic principles may begin by accounting for all the choices available with output in a closed economy, which are private consumption, investment, and government spending.14 In equilibrium (when aggregate expenditures are equal to output), this accounting identity can be reframed to show that the difference between national saving and investment is equal to the difference between government spending and government taxes (or the federal budget deficit), which can also be found in the basic approach.

One notable distinction between MMT and the basic macroeconomic structure is that MMT assumes private investment levels are insensitive to changes in the interest rate (or the rate of return that investment would offer), at least when the economy is below capacity.15 The insensitivity of investment to interest rates means that unlike the basic model, where there are a series of output and interest rate combinations where the investment and savings levels are in balance, with MMT desired investment and savings are equivalent at a single level of output, regardless of the interest rate. This relationship alone (which may be described as having a vertical IS curve) is possible in certain permutations of the basic macroeconomic model. As with the basic approach, consumption may be a positive function of income with the MMT investment and interest rate assumption.

Fiscal policy may still be used to influence economic outcomes in the short run with an investment–savings relationship consistent with MMT. In the basic model, the effect of expansionary fiscal policy (or an increase in the deficit, or spending more than received in taxes) would, all else equal, increase interest rates, which would thereby reduce private investment and influence present and future saving and consumption patterns. Under the MMT condition, investment levels would be unaffected by the change in interest rates caused by the shift in government activity. Expansionary fiscal policy (as seen in Figure 1) would therefore still increase income and output in a given period, with a decrease in government deficits having the opposite effect.

Even if the IS curve is sensitive to interest rates, the same outcome could be achieved by an accommodating money supply response that keeps the interest rate fixed (which is also a part of the MMT approach, as discussed below), although this outcome would be the result of a policy choice rather than of fundamental economic factors.

Money Supply and Demand (LM)

As with mainstream macroeconomic theory, equilibrium in MMT requires equivalence between money supplied and money demanded. The concept of money, however, is applied differently in MMT than in mainstream macroeconomics, which has ramifications for money's relationship with other economic variables and how it may be managed by monetary and fiscal policy.

Rather than taking money as the cash and close substitutes created by a central bank, MMT proponents believe that money in a financial system is legitimized as the government accepts it as payment for taxes. In this view, government spending may be thought of as "creating" the money that circulates in an economy. At the simplest level, assuming the Federal Reserve and the Treasury are the same entity (ignoring self-imposed constraints), the monetary authority provides the money to finance government spending (i.e., by depositing money in the Treasury checking account) which injects money into the economy which is, in turn, used to pay taxes. In a more complex model where the Federal Reserve supports the aims of the Treasury, the money would be lent to the Treasury, directly or indirectly, and thus some discussions also speak of the government lending money into existence.

This distinction in the concept of money alone does not generate differences in the beliefs about the viability of long-term deficit financing (which is discussed further below). MMT proponents assert that the interaction of market operations undertaken by banking institutions and Federal Reserve actions that are designed to meet interest rate targets effectively allow banking institutions to make their own lending choices independent of reserve requirements and other restrictions. In their view, this greatly restricts the ability of the Federal Reserve (or any central bank) to control the supply of money, even if they can influence market interest rates. Assuming the central bank affects interest rates without direct control over the money supply is not necessarily inconsistent with the mainstream macroeconomic approach.

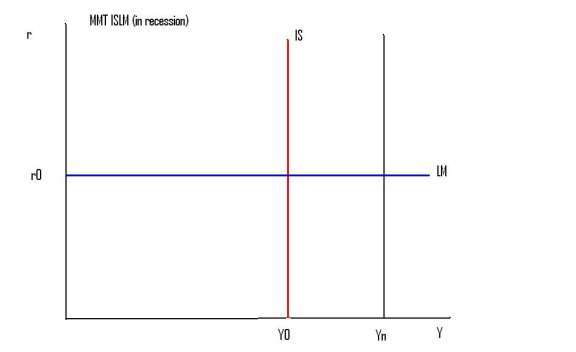

The LM curve is horizontal because the target is the interest rate, although even if the interest rate changed, it would not affect output (Figure 8 may be used as a reference). The central bank can set any rate, but could set a low rate, perhaps near or at zero, which would lower the cost of government borrowing (in situations where the central bank cannot directly add funds to the government's checking account).16Again, the LM curve is not necessarily horizontal because it is naturally that way (MMT discussions do not present a formalized LM curve), but it is horizontal if a fixed interest rate is targeted. The level of that fixed interest could be chosen at any rate, although many adherents support a zero nominal interest rate. Such an interest rate could be made consistent with a low and stable rate of inflation by changing fiscal policy (e.g., if inflation is increasing, taxes should be increased and spending cut). Setting a determinable price level requires a contractionary fiscal policy when demand exceeds potential output to prevent continuing inflation.

MMT's notion that monetary policy can maintain any chosen interest rate over an extended time period is a significant deviation from mainstream monetary theory. That assertion requires the absence of any other significant economic force influencing interest rates, including the effects of expected inflation. The existence and impact of inflation expectations is well documented and supported in the economic literature.17 If there are such nonmoney influences, the adoption of a chosen interest rate may only be maintained with constant injections of money that cause consequent inflationary pressures. Contractionary fiscal policy may not by itself be able to constrain these pressures. The notion that a sovereign government can generate as much money as it chooses without inducing inflation is another notable deviation of MMT from conventional economic analysis.

In examining writings by MMT proponents, it is not always clear whether the reliance on fiscal policy (rather than monetary policy) to address an underemployed economy is descriptive (only fiscal policy works) or prescriptive (only fiscal policy should be used because it is too difficult to undertake monetary policy). Proponents appear to believe that the monetary authorities can influence interest rates, including through the buying and selling of bonds as well as directly setting certain interest rates. It is also not clear whether the vertical IS curve is relevant only in an underemployed economy. If the rule for monetary policy is not prescriptive and investment is always insensitive to interest rates, it is difficult to square the theory with the use of monetary policy in the early 1980s to contract the economy and squeeze out inflation, an event widely accepted by economists and consistent with mainstream theory.

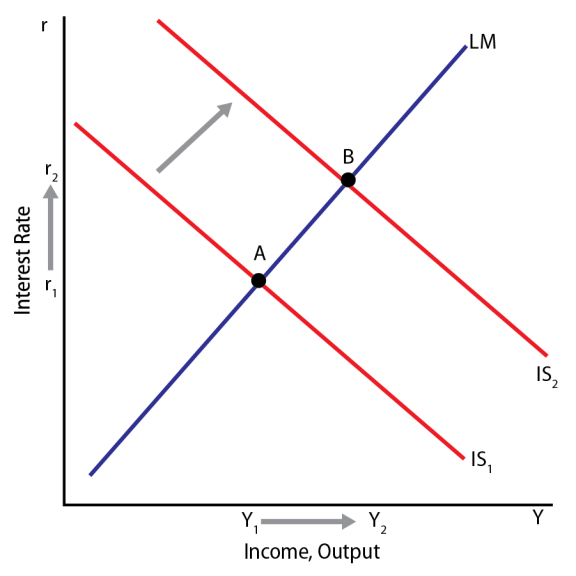

Determination of Output and Interest Rates

The MMT assumption of investment being insensitive to interest rates means that only fiscal policy can be used to shift an underperforming economy to full output in the short run. Under those assumptions, deficit financing in a recession would be an effective way of closing the corresponding gap in output and income, and the Federal Reserve would be tasked with restraining any subsequent increase in interest rates. This combination has been described as an "extreme Keynesian" approach in the mainstream literature.18 The IS-LM curves generated by MMT assumptions are shown in Figure 8.

|

|

Source: Nick Rowe, "Reverse-Engineering the MMT Model," A Worthwhile Canadian Initiative (blog), 2011, at https://worthwhile.typepad.com/worthwhile_canadian_initi/2011/04/reverse-engineering-the-mmt-model.html. Notes: Interest rates (r) are measured on the y-axis, and output (Y) is measured on the x-axis. The figure depicts an IS-LM relationship in a recession, where actual output (Y0) is lower than output would be at full employment (Yn). Interest rates are assumed to be a policy variable, thus there is no difference between actual interest rates (r0) and those at full employment (rn). |

Because under the MMT model the selection of an interest rate plays no role in investment or consumption decisions, proponents call for an interest rate that is more or less fixed at a lower level than current targets. Providing for a low level of interest would reduce federal borrowing costs, although fixing rates too close to zero raises questions about how the government and other borrowers would convince creditors to lend money when the relative costs of holding more liquid assets are lowered.19

Demand and Supply (AD-AS)

With interest rates assumed to be fixed and monetary policy largely taken out of business cycle management, the MMT equilibrium output where aggregate demand meets aggregate supply is a function of total factor productivity (as before, the capital stock is assumed to be fixed), fiscal policy choices, and employment. If fiscal stimulus occurs in an underemployed economy, output will increase. If the economy is at full employment, fiscal stimulus will not increase real output, but rather induce inflation, which is a signal to undertake contractionary fiscal policy. With no investment sensitivity to interest rates, or if the interest rate is fixed by the monetary authorities, a fiscal stimulus at full employment will under the MMT model theoretically lead to an inflationary spiral. This effect means that it would be crucial to be able to exert fiscal discipline if inflation appears. Again, these effects are a function of MMT's IS and LM assumptions and mirror the fiscal policy findings in the "extreme Keynesian" mainstream view.

Unlike the mainstream model, where an increase in demand at full employment leads to a contraction of the real money supply which chokes off demand (leaving the level of demand fixed but its mix changed), there is no link between the IS-LM curve and AD-AS curve that produces an equilibrium in prices and output. Instead, excess demand produces an increase in the price level that must be met with a contractionary fiscal policy in MMT. (In effect, explicit action must also be taken in the mainstream model where the Federal Reserve is managing business cycles, but the Federal Reserve targets interest rates rather than money aggregates. The Fed must recognize the inflationary pressure and take explicit action to offset it with higher interest rates.)

Proponents of MMT also advance a federal job guarantee. A job guarantee is not integral to the MMT theory described above, because such a theory would presumably hold, according to MMT advocates, regardless of the presence of the job guarantee. Nevertheless, it is widely advocated by MMT proponents.

Although how the jobs guarantee is structured is largely undefined, such a policy would likely reduce the fluctuation in employment levels across business cycles and increase government deficit financing. It would presumably be designed to largely eliminate certain types of unemployment (circumstances where individuals willing to work cannot find a job at a reasonable wage either because of the business cycle or a mismatch of skills and labor demand), although frictional unemployment (where individuals are engaged in job searches) would remain.

The specific characteristics and implementation process of any job guarantee would likely play a significant role in determining its ultimate effect on output, employment, and price levels. Because there is cyclical fluctuation in unemployment, the size of the guaranteed job workforce would fluctuate, making a match between workers and needed tasks difficult. Unlike the market economy that determines jobs and products based on consumer demand, the assignment of work and output would have to be determined largely by fiat. When goods provided by the government are not explicitly based on the needs for collective goods or goods with public spillovers (such as a military force or highways), misallocation of resources may be more likely to occur. Some resources would, theoretically, be diverted from the private sector with a higher effective minimum wage through the government job alternative.

The job market in the United States is not uniform, presenting additional challenges for a proposed job guarantee. For example, there could be considerable difficulties satisfying the guarantee in sparsely populated rural areas, filling jobs requiring background checks, or because some applicants may not be suitable for certain jobs (such as home health care or child care). There are also issues about how to treat workers who violated the terms of employment (such as persistent tardiness). Finally, jobs may need capital inputs (e.g., construction equipment) and supplies, and workers in rural areas may have problems finding transportation.

The Open Economy

With an open economy the IS curve contains an additional element, net exports, which is sensitive to interest rates. Mainstream economic theory postulates that if interest rates rise, capital investment in the United States rises, increasing the demand for dollars, raising the price of the dollar, and decreasing net exports (by both a decrease in exports, which are more costly to foreigners, and an increase in imports). Applied to the MMT model, this would mean that the IS curve would no longer be vertical because investment activity would respond to interest changes. In that case, monetary policy that allowed the interest rate to rise would offset a fiscal stimulus. However, the same output effects of fiscal policy as in the closed economy would occur if the monetary authorities kept the interest rate fixed.

An open economy means that some U.S. debt is held by foreigners and adds to concerns that the relatively low interest rates may make the financing of the debt more difficult, since the central bank and the Treasury are independent. The low interest rates would make Treasury debt less attractive to investors. This is important because Treasury must raise funds by selling bonds if tax revenues are insufficient for expenditures, and the Federal Reserve cannot lend directly to the Treasury under current law.20

Does MMT Justify Deficit Financing?

Much of the analysis in MMT literature and related research focuses on its application in the short-term, or in managing business cycles. Less discussed is how the MMT model applies to long run economic variables, including growth and debt sustainability. This section discusses MMT's generally short-term view of deficit financing and contrasts it with mainstream economics, which is usually focused on the longer term.

Mainstream economics does not call for balanced federal budgets, and is broadly supportive of deficit financing in managing sufficiently large economic shocks. It does, however, recognize limits on the amounts that the federal government (or any economic actor) may borrow: constraints determined by the availability and willingness of investors to finance its borrowing needs at normal interest rates. In the mainstream view, this borrowing is constrained by the total amounts available for investment (savings in dollars) at a given point in time and the attractiveness of other borrowing options available on the market. In the long term, this constraint means that the amount of federal debt relative to output cannot rise indefinitely. In a basic macroeconomic model this constraint is violated when the long-term interest rate exceeds the long-term economic growth rate, as the general return on investments generated from expansionary policy will be smaller than the interest payments required to finance that activity.

MMT proponents have generally called for a more active fiscal policy role in managing negative economic shocks. Moreover, the MMT claim that sovereign governments that issue debt in their own currency (like the United States) cannot be forced to default leads to the general perception that an MMT-driven economic structure would involve larger deficits and higher debt levels than those experienced in an economic structure shaped by mainstream economic thinking. This belief is supported by the call for a central bank that consistently sets interest rates near or at zero, which, all else equal, would support deficit financing at lower economic growth rates rather than with higher interest rates if mainstream economic thinking was applied.

The notion that a sovereign government cannot be forced to default appears to be a central tenet of MMT because of the view that money creation can substitute for taxes or borrowing to finance government. There have been, however, many instances of sovereign governments defaulting explicitly, or implicitly either by inflating the currency, renegotiating terms, or using other measures to address a difficulty in financing debt.21 These other options might be considered default by another name.22

While the United States does not appear to face any current concerns about the ability to sell its debt, were a collapse in the market to occur, it might be impossible or at least extremely costly to undertake the needed measures (higher taxes to stem the inflation appearing with money creation). In meeting its statutory mandate of minimizing long-run federal borrowing costs, Treasury may redeem and reissue debt at levels that far exceed the amounts required strictly from new deficit-financing activity. For example, Treasury issued $11.7 trillion in marketable debt in FY2019, which represented more than 70% of the federal marketable debt portfolio.23 Any dramatic increase in interest rates accompanying a debt crisis would thus likely generate higher interest rates not only for debt generated by new federal deficits, but also for a significant portion of the existing debt stock that is redeemed and reissued. For example, net interest payments during the Greek debt crisis (described below) increased by amounts equivalent to roughly $200 billion in FY2019 dollars, which would require significant tax rate increases, base broadening, or both if needed to meet a sudden change in interest obligations.24

If the federal debt position were viewed by the market to be unsustainable, it could lead to a collapse in the demand for Treasury securities that would cause a "debt cycle." In this case, an observation by some investors to sell or avoid federal debt issuances before they defaulted would raise federal interest rates, which would require more federal borrowing and could lead to further investor avoidance and interest increases. Beyond the significant effects on the federal borrowing position, such a process could also have ramifications elsewhere in the financial markets, as federal securities are often used as a currency substitute for overnight interbank lending and other activities central to general financial operations.

MMT proponents also claim that government deficits must be small enough to limit inflation. It is unclear how this claim distinguishes MMT in a practical sense from the mainstream view, as mainstream macroeconomics would also support fiscal or monetary intervention to avoid significant increases in interest rates in response to rising debt. In the mainstream and MMT case, there is concern that by the time actors identify an urgent debt sustainability problem, it may be difficult to address. Such a situation would likely be accompanied by a negative economic shock that would make immediately raising taxes (net of spending) difficult, while increasing the money supply risks entering a debt spiral. In the MMT case, such a concern does not arise because of the assumption that the Federal Reserve could finance spending (an assumption at odds with institutional constraints discussed in the next section).

Further questions arise when examining the applicability of MMT policies to the United States and other nations that already have relatively high real debt levels. In its most recent long-term budget outlook, the Congressional Budget Office (CBO) estimated that federal debt held by the public would rise from 78% of GDP in FY2019 to 92% of GDP in FY2029 and 144% of GDP in FY2049, well beyond the historical peak.25 It is possible that a high existing debt stock could practically restrict the availability or effectiveness of MMT-supported fiscal policies in managing business cycles, given the institutional constraints discussed in the next section. However, currently there are no signs that the federal borrowing capacity is near exhaustion in the short term or medium term, as interest rates remain below Fed-targeted levels.

Recent international experiences speak to the complexity of borrowing capacity. Both Greece and Japan experienced rapid growth in government debt in the past decade. Organisation for Economic Co-operation and Development (OECD) data on general government debt (including municipal government debt) indicate that Greek debt rose from 115% of GDP in 2006 to 189% of GDP in 2017, while Japanese debt rose from 180% of GDP to 234% of GDP over the same time period. A loss in market confidence in Greek debt led to a severe recession there, with GDP contracting by 9 percentage points in 2011, and long-term interest rates reaching 22% in 2012. Japanese borrowing was viewed to be more sustainable despite being higher, with relatively flat GDP levels and long-term interest rates close to zero in recent years.

Applying MMT to Federal Institutions

When weighing the merits of structural changes, it may be useful to consider the characteristics of the institutions with power to address business cycles in the current system. Members of the Federal Reserve Board of Governors have typically been chosen without regard to political affiliation. The Federal Reserve's Federal Open Market Committee meets at least every six weeks to adjust open market operations as needed, allowing for a relatively quick and efficient way of implementing monetary policy modifications.26 Fiscal policy decisions managing business cycles are largely made through enactment of new legislation, and thus may be affected by the legislative calendar and other political considerations.27 In practice, these factors may make the evidential threshold for a fiscal policy response higher than that for action by the Federal Reserve. The Emergency Economic Stabilization Act of 2008 (P.L. 110-343), for instance, was enacted in part to alleviate effects of the Great Recession in October 2008, 10 months after the start of the recession as identified by the National Bureau of Economic Research.28 In contrast, the Federal Reserve also undertook significant action in fall 2008, but was also able to begin taking countercyclical actions as early as September 2007.29

One may also wish to be mindful of the current independence of the Treasury and the Federal Reserve. In MMT, these groups are treated as a single entity, which is equivalent to assuming that the Federal Reserve can make funds available to the Treasury to spend as it needs. Present laws prohibit the Federal Reserve from lending or allowing overdrafts to the Treasury, so the Treasury must sell bonds at whatever interest rate prevails when revenues are inadequate to finance spending. The Federal Reserve faces no statutory limits on how much federal debt it may purchase in the secondary market, however, so that it can lend indirectly. The degree of independence between the Federal Reserve and the Treasury has varied over time, however, with periods of relatively high cooperation.30

Even if the Federal Reserve can lend indirectly to the Treasury, it has different objectives than cheap financing of the debt. The Federal Reserve acts under a statutory mandate of "maximum employment, stable prices, and moderate long-term interest rates."31 If the Federal Reserve determines, for instance, that such a mandate warrants contractionary policy, it has the authority to enact contractionary policy, even if such actions would negate expansionary fiscal policy efforts. It is possible, therefore, that MMT-supported policies may need the support of both federal policymakers and Federal Reserve actors to take full effect. Economists have justified delegating this authority to the Federal Reserve on the ground that an insulated institution is more likely to choose policies consistent with low inflation. If correct, subordinating the Federal Reserve could result in a choice of policies under the MMT framework that removes this check against high inflation.32

References

Barro, Robert J. "On the Determination of the Public Debt." Journal of Political Economy 87, no. 5 (October 1979): 940.

Bell, Stephanie. The Hierarchy of Money. The Jerome Levy Economics Institute, Working Paper Series 231, April 1998.

——. "Do Taxes and Bonds Finance Government Spending?," Journal of Economic Issues 34, no. 3 (September 2000): 603.

Blanchard, Oliver J. Public Debt and Low Interest Rates. National Bureau of Economic Research, NBER Working Paper No. 25621, February 2019.

Chick, Victoria. The Theory of Monetary Policy, vol. 5. London: Gray-Mills Publishing Limited, 1973.

Chinn, Menzie D. Notes on Modern Monetary Theory for Paleo-Keynesians, Spring 2019, at https://www.ssc.wisc.edu/~mchinn/mmt_add2.pdf.

Fullwiler, Scott. "Functional Finance and the Debt Ratio-Part I." New Economic Perspectives (blog), December 2012, at http://neweconomicperspectives.org/2012/12/functional-finance-and-the-debt-ratio-part-i.html.

Lerner, Abba P. "Functional Finance and the Federal Debt." Social Research, no. 1 (February 1943): 38.

Palley, Thomas K. Money, Fiscal Policy and Interest Rates: A Critique of Modern Monetary Theory. The Hans Boeckler Foundation, IMK Working Paper No. 109, January 2013.

Rachel, Lukasz, and Lawrence H. Summers. On Falling Neutral Real Rates, Fiscal Policy, and Secular Stagnation. Brookings Papers on Economic Activity, March 2019, at https://www.brookings.edu/bpea-articles/on-falling-neutral-real-rates-fiscal-policy-and-the-risk-of-secular-stagnation/.

Rogoff, Kenneth. "Modern Monetary Nonsense." Project Syndicate, March 2019, at https://www.project-syndicate.org/commentary/federal-reserve-modern-monetary-theory-dangers-by-kenneth-rogoff-2019-03?barrier=accesspaylog.

Rowe, Nick. "Reverse-Engineering the MMT Model." A Worthwhile Canadian Initiative (blog), 2011, at https://worthwhile.typepad.com/worthwhile_canadian_initi/2011/04/reverse-engineering-the-mmt-model.html.

Sharpe, Timothy P. "A Modern Money Perspective on Financial Crowding-Out." Review of Political Economy 25 (November 2013): 586.

Shiller, Robert. "Modern Monetary Theory Makes Sense, Up to a Point." The New York Times, March 29, 2019, at https://www.nytimes.com/2019/03/29/business/modern-monetary-theory-shiller.html.

Tcherneva, Pavlina R. "The Role of Fiscal Policy." International Journal of Political Economy 41, no. 2 (Summer 2012): 5.

Wray, L. Randall. Modern Monetary Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. 2nd ed. New York: Palgrave Macmillan, 2015.

Author Contact Information

Footnotes

| 1. |

The editors of a recent journal issue devoted to MMT identify the following individuals as major proponents of MMT: Stephanie Kelton, L. Randall Wray, William F. Mitchell, Eric Tymoigne, Dirk Ehnts, Scott T. Fullwiler, Fadel Kaboub, Pavlina R. Tcherneva, and Warren Mosler. See "Introduction: Whither MMT?" Real-World Economics Review, Issue No. 89, 2019, at http://www.paecon.net/PAEReview/issue89/FullbrookMorgan89.pdf. Stephanie Kelton's earlier papers were published under her former name, Stephanie Bell. |

| 2. |

For a discussion of reasons for low interest rates, see CRS Insight IN11074, Low Interest Rates, Part 3: Potential Causes, by Marc Labonte. For a discussion of reasons for low inflation rates, see Juan M. Sanchez and Hee Sung Kim, "Why is Inflation So Low?" Regional Economist, First Quarter 2018, Federal Reserve Bank of St. Louis, at https://www.stlouisfed.org/publications/regional-economist/first-quarter-2018/why-inflation-so-low; and Tyler Durden, "Why Does Inflation Remain So Low: Goldman Answers," Zero Hedge (blog), February 10, 2019, at https://www.zerohedge.com/news/2019-02-10/why-does-inflation-remain-so-low-goldman-asnwers. The Goldman analysis suggests one reason may be lower price increases for health care. CRS Insight IN11074, Low Interest Rates, Part 3: Potential Causes, by Marc Labonte. |

| 3. |

See Menzie D. Chinn, Notes on Modern Monetary Theory for Paleo-Keynesians, Spring 2019, at https://www.ssc.wisc.edu/~mchinn/mmt_add2.pdf; and Nick Rowe, "Reverse-Engineering the MMT Model," A Worthwhile Canadian Initiative (blog), 2011, at https://worthwhile.typepad.com/worthwhile_canadian_initi/2011/04/reverse-engineering-the-mmt-model.html. |

| 4. |

There are numerous presentations of IS-LM and aggregate demand and supply graphs available on the internet. See, for example, Diptimai Kari, "Derivation of Aggregate Demand Curve (With Diagram), IS-LM Model," at http://www.economicsdiscussion.net/demand/aggregate-demand-curve/derivation-of-aggregate-demand-curve-with-diagram-is-lm-model/15826. |

| 5. |

Sticky prices refer to prices charged for certain goods and services that are relatively resistant to change in response to changes in input costs or demand patterns. |

| 6. |

This pair of interest rate and output levels results, when graphed, is a downward sloping curve. This curve is normally drawn with interest rates on the y (or vertical) axis and income or output on the x (or horizontal) axis. |

| 7. |

Drawn on a graph, with price on the y (vertical axis) and output on the x (horizontal) axis, the aggregate demand curve is downward sloping and the aggregate supply curve is upward sloping. |

| 8. |

For more on this model extension, see Dale W. Jorgenson, "Capital Theory and Investment Behavior," American Economic Review, vol. 53, no. 2 (May 1963), p. 247. |

| 9. |

The DSGE model is related to another class of models called real business cycle models (RBC). RBC models have infinitely lived individuals, which limits the power of monetary and fiscal policy. For example, a cut in taxes will have to be paid in higher taxes in the future, and infinitely lived individuals will therefore save those taxes. Money does not exist in such a model, and business cycles are caused by individuals voluntarily shifting their labor supply over time. The DSGE model is augmented to allow policy effects. See Jose-Victor Rios-Rull, "Life Cycle Economies and Aggregate Fluctuations," The Review of Economic Studies, vol. 63, no. 3 (July 1996), pp. 465-489. |

| 10. |

For a discussion, see N. Gregory Mankiw, "The Macroeconomist as Scientist and Engineer," Journal of Economic Perspectives, vol. 20, no. 4 (Fall 2006), pp. 29-46. This paper also a history of the development of macroeconomic modeling. |

| 11. |

See Paul W. Romer, "The Trouble with Macroeconomics," September 2016, at https://paulromer.net/the-trouble-with-macro/WP-Trouble.pdf; and Joseph E. Stiglitz, "Where Modern Macroeconomic Went Wrong," Oxford Review of Economic Policy, vol. 34, iss.1-2 (Spring-Summer 2018), pp. 70-106, at https://academic.oup.com/oxrep/article/34/1-2/70/4781816. These criticisms reflect, in part, concerns that the stringent assumptions of the model are not consistent with observed behavior. |

| 12. |

This model is commonly referred to as a Solow growth model, although it can be modified to allow supply side responses such as labor supply that is responsive to the wage rate or consumption that is responsive to the interest rate. The growth version of the model connected with a DSGE model is a Ramsey model, again where the economy is composed of a single, infinitely lived, perfectly informed, and optimizing agent. Related to the Ramsey model is the life cycle model, where individuals live finite lifetimes and generations die and are born, but are still agents characterized by perfect foresight. |

| 13. |

See Menzie D. Chinn, "Notes on Modern Monetary Theory for Paleo-Keynesians," Spring 2019, at https://www.ssc.wisc.edu/~mchinn/mmt_add2.pdf; Nick Rowe, "Reverse-Engineering the MMT Model," A Worthwhile Canadian Initiative (blog), 2011, at https://worthwhile.typepad.com/worthwhile_canadian_initi/2011/04/reverse-engineering-the-mmt-model.html; and Victoria Chick, The Theory of Monetary Policy, vol. 5 (London: Gray-Mills Publishing Limited, 1973). The first two of these resources are available online and provide graphical presentations. |

| 14. |

MMT adherents have expressed caution in analyzing the theory through this macroeconomic framework, due to concerns that it does not accurately capture economic activity with unique financial flows (present in markets like housing). There are also concerns about the treatment of income that doesn't fit cleanly into such a "stock and flow" model, like unrealized capital gains—although that activity would be recorded as income when realized, it is possible that it influences household behavior when held. Mainstream economists have made similar criticisms of the limitations of this basic macroeconomic structure. It is unclear how accounting for that activity would affect the core findings of the model presented here. |

| 15. |

This view appears to be based on the idea that when the economy is below capacity, firms are unwilling to make investments because of lower interest rates (although whether that argument should apply to investments in owner-occupied housing is not clear). See Bill Mitchell, "Why Investment Expenditure is Insensitive to Monetary Policy," at http://bilbo.economicoutlook.net/blog/?p=31206. |

| 16. |

See, for example, M. Forstater and W. Mosler, "The Natural Rate of Interest is Zero," Journal of Economic Issues, vol. 39, no. 535 (2005), at http://www.moslereconomics.com/wp-content/graphs/2009/07/natural-rate-is-zero.PDF; and Bill Mitchell, "The Natural Rate of Interest is Zero," August 29, 2009, at http://bilbo.economicoutlook.net/blog/?p=4656. |

| 17. |

Examples of such literature include John Y. Campbell and Robert J. Shiller, "The Dividend-Price Ratio and Expectations of Future Dividends and Discount Factors," Review of Financial Studies, vol. 1 (1988), 195; and John Faust et. al., "The High-Frequency Response of Exchange Rates and Interest Rates to Macroeconomic Announcements," Journal of Monetary Economics, vol. 54 (2006), 1051. |

| 18. |

Victoria Chick, The Theory of Monetary Policy, vol. 5, (London: Gray-Mills Publishing Limited, 1973). |

| 19. |

Under an MMT model with no institutional constraints, the federal government may not need to sell bonds in all cases. However, the statutory independence of the Federal Reserve and Treasury (discussed further below) would require federal bond issuances under current law. |

| 20. |

Though the Federal Reserve can and does purchase Treasury Securities, the Federal Reserve Act (12 U.S.C. §226) stipulates that it may only do so in the open market. For more information on this process, see Board of Governors of the Federal Reserve System, "Why Doesn't the Federal Reserve Just Buy Treasury Securities Directly from the U.S. Treasury?," August 2, 2013, at https://www.federalreserve.gov/faqs/money_12851.htm. |

| 21. |

See David Beers and Jamshid Mavalwalla, The BoC-BoE Sovereign Default Database Revisited: What's New in 2018?, Bank of Canada, Staff Working Paper 2018-30, at https://www.bankofcanada.ca/wp-content/uploads/2018/07/swp2018-30.pdf. |

| 22. |

For more information, see CRS Report R44704, Has the U.S. Government Ever "Defaulted"?, by D. Andrew Austin. |

| 23. |

U.S. Treasury, "Debt Position and Activity Report, September 2019," September 30, 2019, at https://www.treasurydirect.gov/govt/reports/pd/pd_debtposactrpt.htm. |

| 24. |

World Bank, "Interest Payments (Current LCU)—Greece), accessed October 11, 2019, at https://data.worldbank.org/indicator/GC.XPN.INTP.CN?locations=GR&view=chart. |

| 25. |

Congressional Budget Office, The 2019 Long-Term Budget Outlook, June 25, 2019, at https://www.cbo.gov/publication/55331. |

| 26. |

For more information on the Federal Reserve, see CRS In Focus IF10054, Introduction to Financial Services: The Federal Reserve, by Marc Labonte. |

| 27. |

Examples of political influences on fiscal policy responses can be found in Andrea Louise Campbell and Michael W. Sances, "State Fiscal Policy During the Great Recession: Budgetary Impacts and Policy Responses," The Annals of the American Academy of Political and Social Science, vol. 650 (November 2013), p. 252. |

| 28. |

National Bureau of Economic Research, "US Business Cycle Expansions and Contractions," September 2010, at https://www.nber.org/cycles.html. |

| 29. |

Board of Governors of the Federal Reserve System. "The Great Recession: December 2007-June2009," November 2013, at https://www.federalreservehistory.org/essays/great_recession_of_200709. |

| 30. |

For further discussion of this relationship, see Stephen Slivinski, "The Evolution of Fed Independence," Region Focus (Fall 2009), Federal Reserve Bank of Richmond, p. 5. |

| 31. |

§2A of the Federal Reserve Act, 12 U.S.C. §225a. |

| 32. |

For more information on this topic, see CRS Report RL30354, Monetary Policy and the Federal Reserve: Current Policy and Conditions, by Marc Labonte. |