Trends in Social Security Disability Insurance Enrollment

The Social Security Disability Insurance (SSDI) program pays cash benefits to non-elderly workers and their dependents provided that the workers have paid into the Social Security system for a sufficient number of years and are determined to be unable to continue performing substantial work because of a qualifying disability. The total number of disabled-worker beneficiaries was approximately 2.7 million in 1985, peaked at approximately 9.0 million in 2014, and then declined over the last three years by nearly 0.3 million. In December 2017, 8.7 million disabled workers received SSDI benefits.

Multiple factors have contributed to the growth in the SSDI enrollment between 1985 and 2014. Some of the main factors are (1) the increased eligibility and rising disability incidence among women, (2) the attainment of peak disability-claiming years (between age 50 and full retirement age) among baby boomers (people born between 1946 and 1964), (3) the increase in full retirement age (FRA) from 65 to 66, (4) fewer job opportunities during economic recessions, and (5) the legislative reform that expanded the eligibility standard in SSDI.

Some factors may have prolonged effects on SSDI benefit receipt. For example, the increase in the FRA from 65 to 66 has resulted in a larger proportion of SSDI beneficiaries who are ages 65 and older, and this proportion is likely to increase further as the FRA increases from 66 to 67 between 2020 and 2027. Another example is the consequence of the expansion in the eligibility criteria, which has resulted in more than half of the disabled-worker beneficiaries being enrolled into the program based on mental disorders or musculoskeletal disorders (typically back pain or arthritis). This trend is likely to persist in the future.

However, some of the effects on the growth in SSDI enrollment are likely to diminish over time. For example, the rise in labor force participation among women resulted in more women becoming eligible for SSDI benefits during the 1980s and the 1990s, but its positive effect on SSDI rolls became smaller as the female labor force participation rate stabilized and the disability incidence rate of women approached that of men.

In addition, some factors may have started to work in opposite directions. One example is the change in age distribution of the population. As the baby boomers reach their FRA (gradually increased from 65 to 66) between 2012 and 2031, there is expected to be a growing proportion of disabled workers who terminate disability benefits due to the attainment of FRA. About the same time, the lower-birth-rate cohorts (people born after 1964) started to enter peak disability-claiming years in 2015, which would likely reduce the size of the insured population between age 50 and the FRA and, consequently, result in a lower number of disability applications. Another example is the availability of more jobs during the post-Great Recession period. The increasing opportunity in employment may have made working more attractive than disability benefits for people who could qualify for SSDI, thus reducing the disability applications and awards after 2010. These factors are likely to contribute to a decline in the number of disabled-worker beneficiaries.

In addition to the change in the population age distribution and the availability of jobs in the market, some other factors may also be acting to decrease SSDI rolls in the recent three years. These factors are likely to include the prevalence of the Affordable Care Act (ACA) and the decline in the allowance rate (i.e., the share of applicants who are awarded disability benefits). The nationwide effects of the ACA on disability benefit receipt and the cause of the decreasing allowance rate are as yet unclear.

Trends in Social Security Disability Insurance Enrollment

Jump to Main Text of Report

Contents

- Introduction

- Trends in SSDI Enrollment

- Factors Affecting SSDI Enrollment

- Changes in the Demographic Characteristics of the Insured Population

- Female Labor Force Participation

- The Change in Age Distribution of the Population

- The Change of the FRA

- Changes in Employment and Compensation

- Business Cycle and Unemployment Rate

- The Value of SSDI Benefits Relative to Earnings

- Availability of Health Insurance Coverage

- Changes in Policy Rules and Implementation

- Policy Changes in Eligibility Criteria

- Changes in Program Integrity Workloads

- Changes in Allowance Rates

- Explaining the Recent Decline in SSDI Enrollment

- The Decrease in New Disability Awards

- The Increase in Disability Terminations

Figures

- Figure 1. Number of Social Security Disabled-Worker Beneficiaries, 1985-2017

- Figure 2. Terminations and Awards to Disabled Workers, 1985-2017

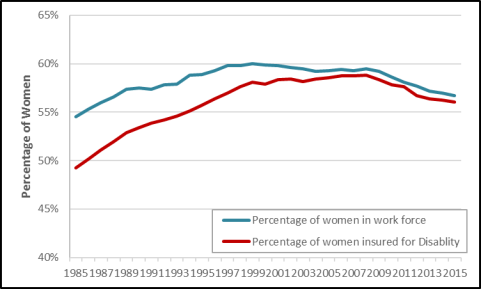

- Figure 3. Percentages of Women in the Workforce and Percentages of Women Insured for Disability, 1985-2015

- Figure 4. Termination of Benefits Among Disabled Workers, 2000-2017

- Figure 5. Gross and Adjusted Incidence Rates, 1985-2017

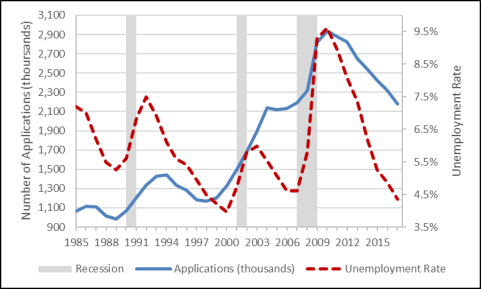

- Figure 6. Annual SSDI Applications and Unemployment Rate, 1985-2017

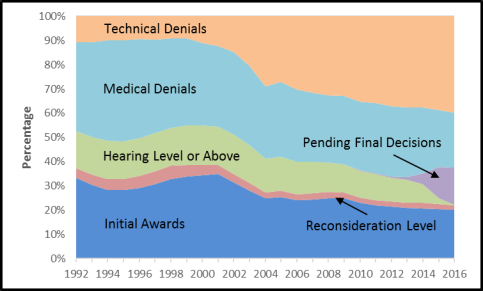

- Figure 7. Final Outcome of Disabled-Worker Applications, 1992-2016

Summary

The Social Security Disability Insurance (SSDI) program pays cash benefits to non-elderly workers and their dependents provided that the workers have paid into the Social Security system for a sufficient number of years and are determined to be unable to continue performing substantial work because of a qualifying disability. The total number of disabled-worker beneficiaries was approximately 2.7 million in 1985, peaked at approximately 9.0 million in 2014, and then declined over the last three years by nearly 0.3 million. In December 2017, 8.7 million disabled workers received SSDI benefits.

Multiple factors have contributed to the growth in the SSDI enrollment between 1985 and 2014. Some of the main factors are (1) the increased eligibility and rising disability incidence among women, (2) the attainment of peak disability-claiming years (between age 50 and full retirement age) among baby boomers (people born between 1946 and 1964), (3) the increase in full retirement age (FRA) from 65 to 66, (4) fewer job opportunities during economic recessions, and (5) the legislative reform that expanded the eligibility standard in SSDI.

Some factors may have prolonged effects on SSDI benefit receipt. For example, the increase in the FRA from 65 to 66 has resulted in a larger proportion of SSDI beneficiaries who are ages 65 and older, and this proportion is likely to increase further as the FRA increases from 66 to 67 between 2020 and 2027. Another example is the consequence of the expansion in the eligibility criteria, which has resulted in more than half of the disabled-worker beneficiaries being enrolled into the program based on mental disorders or musculoskeletal disorders (typically back pain or arthritis). This trend is likely to persist in the future.

However, some of the effects on the growth in SSDI enrollment are likely to diminish over time. For example, the rise in labor force participation among women resulted in more women becoming eligible for SSDI benefits during the 1980s and the 1990s, but its positive effect on SSDI rolls became smaller as the female labor force participation rate stabilized and the disability incidence rate of women approached that of men.

In addition, some factors may have started to work in opposite directions. One example is the change in age distribution of the population. As the baby boomers reach their FRA (gradually increased from 65 to 66) between 2012 and 2031, there is expected to be a growing proportion of disabled workers who terminate disability benefits due to the attainment of FRA. About the same time, the lower-birth-rate cohorts (people born after 1964) started to enter peak disability-claiming years in 2015, which would likely reduce the size of the insured population between age 50 and the FRA and, consequently, result in a lower number of disability applications. Another example is the availability of more jobs during the post-Great Recession period. The increasing opportunity in employment may have made working more attractive than disability benefits for people who could qualify for SSDI, thus reducing the disability applications and awards after 2010. These factors are likely to contribute to a decline in the number of disabled-worker beneficiaries.

In addition to the change in the population age distribution and the availability of jobs in the market, some other factors may also be acting to decrease SSDI rolls in the recent three years. These factors are likely to include the prevalence of the Affordable Care Act (ACA) and the decline in the allowance rate (i.e., the share of applicants who are awarded disability benefits). The nationwide effects of the ACA on disability benefit receipt and the cause of the decreasing allowance rate are as yet unclear.

Introduction

Social Security Disability Insurance (SSDI)1 is a federal social insurance program that provides monthly cash benefits to non-elderly disabled workers and their eligible dependents provided the worker paid into the system for a sufficient number of years2 and is determined to be unable to perform substantial work because of a qualifying disability.

In the past three decades, the total number of disabled-worker beneficiaries continually increased from 2.7 million in 1985 to 9.0 million in 2014 and then started to decline to approximately 8.7 million in December 2017.3 The size of the beneficiary population has a strong impact on SSDI expenditures and thus the solvency of the program's trust fund.

Multiple factors have contributed to the change in the number of SSDI beneficiaries over time. Understanding the importance of each competing factor helps inform predictions of SSDI solvency status and analysis of related legislation. This report analyzes the relative importance of factors affecting SSDI benefit receipts and terminations over the past 30 years.

Trends in SSDI Enrollment

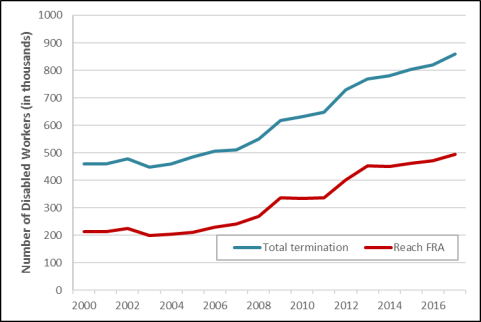

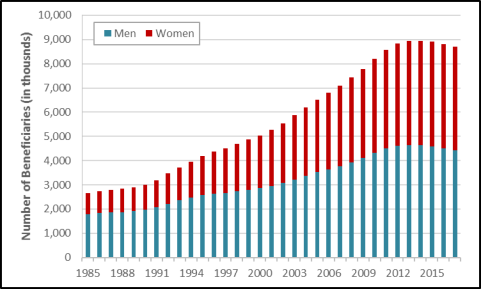

Figure 1 shows that between 1985 and 2017 the total number of disabled-worker beneficiaries continually increased before 2014 and has declined for the last three years. The number of Social Security disabled-worker beneficiaries has experienced different growth rates in the last three decades. The disability rolls increased relatively slowly between 1985 and 1989 and then went through two faster-growing periods, 1989-1997 and 2000-2010. The number of disabled-worker beneficiaries grew slowly again after 2010 and has declined since 2014. Among disabled workers, the proportion of female beneficiaries increased from 33% in 1985 to nearly 50% in 2017.

|

Figure 1. Number of Social Security Disabled-Worker Beneficiaries, 1985-2017 (in thousands) |

|

|

Source: Social Security Administration, Annual Statistical Supplement 2018, Table 5.D3, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/5d.html#table5.d3. |

The number of disabled-worker beneficiaries in current payment status increases with new disability awards and declines with benefit terminations. In general, to qualify for SSDI, workers must be (1) insured in the event of disability, (2) statutorily disabled,4 and (3) younger than Social Security's full retirement age (FRA), which is 65-67, depending on the year of birth.5 A disabled worker's SSDI benefits are terminated when they (1) die, (2) attain FRA (the age at which unreduced Social Security retired-worker benefits are first payable),6 (3) medically improve (i.e., no longer meet the statutory definition of disability), or (4) return to work.

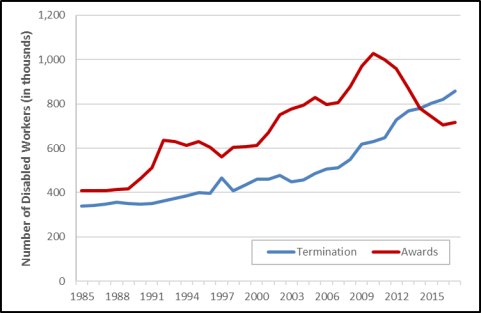

The main reason for the decline in the number of SSDI beneficiaries is the decrease in disability benefit awards, which dropped down below the number of terminations starting in 2014 (see Figure 2). The number of new awards to disabled workers in the SSDI program grew from approximately 416,100 in 1985 to more than 1 million in 2010. However, this trend was reversed in 2011, with a gradual decline in new disability awards to approximately 716,000 in 2017. From 1985 to 2017, the number of disabled-worker beneficiaries whose benefits were terminated rose from 340,000 to 859,000, which was higher than the number of new disability awards in the recent three years. Multiple factors may have contributed to the trends in SSDI benefit receipts and terminations. The following sections examine the effects of different factors and discuss the relative importance of competing factors at different time periods.

|

Figure 2. Terminations and Awards to Disabled Workers, 1985-2017 (in thousands) |

|

|

Source: Social Security Administration, Annual Statistical Supplement 2018, Table 6.C2 and Table 6.F1, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/6c.html#table6.c2, and https://www.ssa.gov/policy/docs/statcomps/supplement/2018/6f.html#table6.f1. |

Factors Affecting SSDI Enrollment

Several factors may affect the change in the number of SSDI disabled-worker beneficiaries, including changes in demographic characteristics of the insured population, changes in employment and compensation, and changes in program rules and implementation. This section discusses the impact of those factors on SSDI benefit awards and terminations, as well as the roles they have played over time.

Changes in the Demographic Characteristics of the Insured Population

The number of SSDI disabled-worker beneficiaries depends in part on the size of the working-age population who are disability insured—the workers who have paid into the Social Security system for a sufficient number of years. From 1985 to 2017, the SSDI insured population grew from 109 million to 155 million at an average rate of about 1.6% per year during 1985-2007 and 0.4% per year in the more recent 10 years.7 Two factors—increased eligibility among female workers and the aging of the workforce—may play important roles in the relatively faster growth in the insured population between 1985 and 2007. However, because the share of women in the workforce was no longer increasing and the baby boom generation (people born between 1946 and 1964) was aging out of the disability insurance program, the growth in the insured population slowed after 2007.8 Starting in 2003, the increase in full retirement age, combined with the aging of the baby boomer generation, also contributed to the growth of the disability-insured population.

Female Labor Force Participation

Some studies have shown that increased eligibility for the SSDI program and the rising incidence of disability among women played an important role in disability benefit receipt during the 1980s and the 1990s.9 Some experts attribute the increase in beneficiaries to increased labor force participation of women, which resulted in more women becoming potentially eligible for SSDI.10 Between 1985 and 2005, the proportion of women who participated in the labor force increased from 54% to 60%, and the proportion of women who were insured for disability increased from 49% to 59% (see Figure 3). During this period, the female proportion of disabled worker beneficiaries increased from 33% to 46% (see Figure 1).

|

Figure 3. Percentages of Women in the Workforce and Percentages of Women Insured for Disability, 1985-2015 |

|

|

Source: Bureau of Labor Statistics, "Women in the Labor Force: A Databook," April 2017, Table 2, https://www.bls.gov/opub/reports/womens-databook/2016/home.htm; and Social Security Administration, Annual Statistical Supplement 2018, Table 4.C2, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/4c.html#table4.c2. |

The SSDI incidence rate—the ratio of new disability awards to the number of disability insured who are not already receiving benefits (i.e., disability-exposed population)—increased substantially for women, from 2.97 per 1,000 disability-insured women in 1985 to 5.89 in 2005 (see Table 1). During the same time, the incidence rate for men has been relatively steady after adjusting for the population age distribution and the business cycle. The difference between SSDI incidence rates for men and women became negligible in and after 2005 (see Table 1). In 1984, approximately 1½ non-elderly males were receiving SSDI for every non-elderly female. By 2008, this ratio was close to parity.11

Table 1. SSDI Disability Incidence Rates, by Sex and Age Group, Selected Years

(awards per 1,000 disability-exposed population)

|

1985 |

1995 |

2005 |

2017 |

|

|

Total |

3.76 |

4.97 |

5.70 |

4.63 |

|

Sex |

||||

|

Men |

4.51 |

5.51 |

6.05 |

4.95 |

|

Women |

2.97 |

4.70 |

5.89 |

4.87 |

|

Age Group |

||||

|

Less than age 50 |

1.23 |

1.66 |

1.71 |

1.10 |

|

Age 50 and above |

7.73 |

7.83 |

6.56 |

5.02 |

Source: CRS calculation using Social Security Administration, Annual Statistical Supplement 2018, available at https://www.ssa.gov/policy/docs/statcomps/supplement/2018/.

Notes: Disability-exposed population is the number of disability insured who are not already receiving benefits. Because of differences in data sources and calculation methods, statistics reported in this table may differ from those reported by the Social Security Trustees Report 2018, Figure V.C3.

The effect of female labor force participation on the growth in SSDI enrollment diminished after 2010. The female labor force participation rate remained relatively stable for 10 years between 2000 and 2010 and then started to go down after the conclusion of the Great Recession in 2010 (see Figure 3). The share of women among disabled-worker beneficiaries and the share of women in the workforce both stabilized around 46% after 2005.12 The incidence rate for women peaked in 2010 and then declined to 4.7 in 2017.13 Some argue that those developments have contributed to slower growth in SSDI enrollment in recent years.14

The Change in Age Distribution of the Population

Another factor that contributes to the trends in SSDI enrollment is the aging of the workforce. The aging of the baby boom generation (people born between 1946 and 1964) has an effect on the composition of the overall working-age population. Some argue that as baby boomers reached their peak disability-claiming years (usually considered between age 50 and FRA),15 the number of disability beneficiaries rose,16 and as baby boomers convert from disability benefits to retirement benefits and are replaced by lower-birth-rate cohorts in the peak disability-receiving ages, the disability enrollment rates will likely fall.17

The baby boom generation reached the age of 50 between 1996 and 2014, during which time the share of disabled workers between age 50 and FRA increased from 56% to 73%.18 As the baby boomers continue to reach their FRA between 2012 and 2031, there is expected to be a growing proportion of disabled workers who terminate disability benefits due to the attainment of FRA. Since 2000, between 7% and 10% of disabled worker beneficiaries have been terminated from the SSDI rolls each year.19 The overall number of disabled worker terminations increased from 460,351 to 859,020 between 2000 and 2017 (an increase of 87%), while the number of disabled workers who attained FRA more than doubled during this period (from 212,948 to 494,651). Before 2012, the proportion of disabled workers terminated due to attainment of FRA stayed relatively constant at approximately 50%. However, starting in 2012, the proportion gradually rose, reaching approximately 58% at the end of 2017 (see Figure 4). Statistics from the Social Security Administration (SSA) show that the share of new disability insurance awardees who are between age 50 and FRA started to decline in 2017.20

In addition to the reason of attaining FRA, there was a declining proportion of disabled workers who terminated benefits due to death, medical improvement (i.e., no longer meeting the statutory definition of disability), or returning to work. Among these terminations, death accounted for about one-third of the overall terminations, with the proportion decreasing from 36.7% in 2000 to 29.3% in 2017, and medical improvement and returning to work accounted for approximately 10% of all the terminations between 2010 and 2017.21

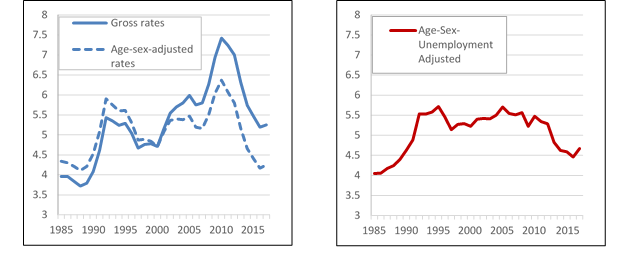

The aging of the population also impacts the incidence rate (i.e., the ratio of new awards to the disability-exposed population) of the SSDI program. The left graph of Figure 5 shows the gross and age-sex-adjusted incidence rate from 1985 to 2017. The gross incidence rate is unadjusted, which was affected by the changing age-sex distribution of the disability-exposed population, while the age-sex-adjusted incidence rate assumes that the age and the sex distributions of the population were constant at its 2000 level. The age-sex-adjusted incidence rate was higher than the gross incidence rate between 1985 and 2000 as the baby boom generation swelled the size of the younger-age population, whose disability incidence is generally lower than that in older populations. After 2000, the age-sex-adjusted rate was lower than the gross rate as the baby boom generation moved into an age range where disability incidence peaks. SSA projects that the gross incidence rate will generally decline as the baby boom generation moves above the FRA and the lower-birth-rate cohorts of the 1970s enter prime disability ages (50 to FRA).22

The right graph of Figure 5 shows the age-sex-unemployment-adjusted incidence rate from 1985 to 2017, which is the predicted age-sex-adjusted incidence rate, under the counterfactual assumption that unemployment rates were constant at the 1985-2017 mean value of 6.02% for the entire period.23 Compared with the age-sex-adjusted incidence rate, the age-sex-unemployment-adjusted incidence rate appeared to be relatively stable after 1992. The effect of business cycles on the disability incidence rate will be discussed in the section "Business Cycle and Unemployment Rate."

The Change of the FRA

Under the scheduled increases enacted by Social Security Amendments of 1983 (P.L. 98-21), the FRA increases gradually from 65 to 67 for workers born in 1938 or later. Between 2003 and 2009, the FRA gradually increased in two-month increments until it reached 66 for workers born between 1943 and 1954, and then between 2020 and 2027, it will gradually increase again until it reaches 67 for workers born in 1960 and later.

Raising the FRA increased the size of the SSDI program. From 2002 (the year prior to the FRA increase) to 2017, the number of new awards for workers ages 65-FRA increased from 750 to 6,136, and the share of SSDI beneficiaries who were ages 65-FRA increased from 1% to 11%.24 In December 2017, there were about 495,600 disabled workers between ages 65 and FRA.25

In addition, the rise in the FRA increased the value of SSDI cash benefits relative to early retirement benefits. When a worker claims benefits before the FRA, there is an actuarial reduction in monthly benefits.26 The earliest a worker can claim retirement benefits is age 62. For a worker with an FRA of 65, claiming benefits at 62 results in a 20% reduction in the monthly benefit. The reduction rises to 25% if the FRA is 66 and will be 30% for a FRA of 67. Since SSDI benefits are approximately the same as full retirement benefits,27 the SSDI program has become relatively more attractive for the later birth cohorts whose FRA—and penalty for early retirement benefits—is larger. Although some studies suggest that an increase in the value of disability benefits relative to early retirement benefits induces more individuals to apply for SSDI benefits, researchers are divided over whether such individuals are actually awarded benefits.28

In summary, many researchers show that demographic changes account for the bulk of the SSDI program's growth. Although results may differ in the measure of time period and calculation methods, most analysis suggests that more than half of the growth in SSDI enrollment before 2014 stems from factors of a growing share of working women eligible for DI, an aging population, and the increase in Social Security's full retirement age.29

Changes in Employment and Compensation

The opportunity of employment and the relative value of compensation over disability benefits may also contribute to the change in SSDI enrollment. In deciding whether to apply for SSDI benefits, workers typically compare the value of SSDI benefits (cash payments, health coverage, and the amount of leisure and family time) with their opportunities for work and compensation. This section discusses how employment opportunities and the earnings and benefits associated with working are likely to affect SSDI benefit receipts.

Business Cycle and Unemployment Rate

Figure 6 displays the number of SSDI applications (left axis) and the national unemployment rate (right axis) for each year between 1985 and 2017. The shaded areas mark the three economic recessions that took place July 1990-March 1991, March 2001-November 2001 and December 2007-June 2009 as dated by the National Bureau of Economic Research. In all three cases, SSDI applications rose during the recession and peaked after the official end of the recession.

|

Figure 6. Annual SSDI Applications and Unemployment Rate, 1985-2017 |

|

|

Source: SSA, Annual Statistical Supplement, 2018, Table 6.C7, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/6c.html; and Bureau of Labor Statistics, Unemployment Rate retrieved on July 31, 2018, https://data.bls.gov/pdq/SurveyOutputServlet. |

One explanation for these business cycle effects is that they are driven by conditional disability applicants—those who would prefer to remain in the labor force but would apply for SSDI benefits if they lost their present jobs.30 When opportunities for employment are plentiful, some people who could qualify for disability insurance benefits find working more attractive, and when employment opportunities are scarce, some of those people apply to the SSDI program instead of looking for work.31 Some studies find that SSDI applications during recessions have higher past earnings and more recent work experience than those during other time periods.32 Researchers also find that the percentage of claims that are allowed drops under conditions of high unemployment.33

Despite the higher number of denials among disability insurance applications, the incidence rates (both gross and age-sex-adjusted) generally increase during and after economic recessions (see the left graph of Figure 5). The right graph of Figure 5 displays the predicted incidence rate under the assumption that unemployment rates were constant at 6.02% for the entire period, the mean value between 1985 and 2017. Compared with the fluctuation in the gross and age-sex-adjusted incidence rates, the relatively stable unemployment-adjusted incidence rate after 1990 indicates that business cycles are likely to explain some of the trends in the SSDI enrollment.

The Value of SSDI Benefits Relative to Earnings

Some studies show that average preapplication earnings of disability insurance applicants have been declining over time relative to nonapplicants.34 A possible reason might be that more low-wage earners are incentivized to apply for SSDI since the value of disability insurance benefits relative to earnings has been steadily rising for low-wage workers.35 The initial amount of SSDI benefits is tied to the growth in average national earnings, which are growing faster than earnings for low-wage workers. Historical data show that the cumulative growth in real wages from 1979 to 2017 was 34.3% for the 90th percentile (high-wage earners), 6.1% for the 50th percentile (middle-wage earners), but 1.2% for the 10th percentile (low-wage earners).36

Availability of Health Insurance Coverage

One possible reason for people to apply for the disability insurance program might be the availability of Medicare to participants in SSDI (after a two-year waiting period).37 Some studies show that Medicare availability has encouraged some people to apply for disability insurance benefits, because many people with disabilities did not have access to health insurance coverage otherwise.38

Beginning in 2014, the Affordable Care Act (ACA) provided more options for people with disabilities to obtain insurance. By enabling access to private health insurance and expanding access to subsidized public health insurance, the ACA may alter disability claiming decisions. The effect of the ACA on SSDI enrollment is not yet clear.39

Some researchers find that people who have an alternative source of health insurance coverage (from a spouse's employer or retiree coverage) are more likely to apply for SSDI benefits.40 They argue that the Medicare's two-year waiting period for SSDI beneficiaries may deter disability applications from workers who have health insurance through their jobs but no alternative source of health coverage after leaving work. The availability of the ACA improves coverage options for those with disabilities, which may cause the number of disability applications to rise. In addition, by providing greater access to health care, the ACA may make it easier for people to obtain the documentation necessary to prove they have a disability, thus resulting in more people applying for disability insurance or an increase in the acceptance rate.41

Others suggest that by creating good health insurance opportunities, the ACA may lower the value of the disability program, causing fewer people to apply for disability and more SSDI beneficiaries to return to work. Although the actual effect of the ACA on disability applications is hard to examine due to the short length of time since implementation, some studies using state-level data show that disability applications are likely to decrease with the introduction of the ACA.42 Researchers suggest that the ACA, with reasonable health care costs through the income-adjusted premium, may reduce dependency on health insurance coverage (i.e., Medicare) for some disabled-worker beneficiaries and allow them to return to work, thus reducing the number of people receiving disability benefits.43 Some analytical results also indicate that the ACA may cause SSDI recipients to be healthier, which has the potential to lower the likelihood that people become disabled while at work44 and increase their likelihood of exiting the disability rolls.45

Changes in Policy Rules and Implementation

Some of the observed trends in SSDI enrollment were the result of changes in policies. This section examines how changes in eligibility criteria for disability determination and continuing disability reviews (CDRs) affected SSDI benefit awards and terminations.

Policy Changes in Eligibility Criteria

In 1984, the Disability Benefits Reform Act (P.L. 98-460) expanded the ways in which a person could medically qualify for disability insurance benefits. Some researchers argue that, under this legislation, the SSA relaxed its screening rules of mental disorders and placed more weight on applicants' reported pain and discomfort.46 Applicants were able to qualify on the basis of the combined effect of multiple medical conditions, each of which might not have met the criteria if considered alone.47 Some studies claim that these changes made it easier for some applicants to qualify for benefits due to certain difficult-to-verify impairments, such as back pain or depression.48

One study shows that eligibility standards expanded significantly after the 1984 legislation but have been relatively stable since the early 1990s.49 The age-sex-unemployment-adjusted incidence rate increased from 4.1% in 1985 to approximately 5.6% in the early 1990s, and there has been no increase since then (see the right graph in Figure 5). After controlling for the effect of rising incidence among women and the aging of the workforce, analysis shows that the 1984 legislative reform still contributed a significant proportion of the increase in the incidence rate from 1985 to the early 1990s.50

The 1984 act has resulted in some compositional changes in the SSDI beneficiary population. First, the change in eligibility criteria has contributed to a shift in the types of disabilities for which beneficiaries qualify. The share of disabled-worker beneficiaries with mental disorders or musculoskeletal system and connective tissue disorders (typically back pain or arthritis) has increased from 30% of newly awarded disabled workers in 1983 (the year before the legislation was enacted) to 52% in 2004 and remained around this level for more than 10 years from 2005 to 2016.51 Researchers argue that in conjunction with labor market developments that increased the incentive for low-wage workers to apply for benefits,52 these new program rules likely led to an increase in disability receipts, although the extent of the increase is unclear.53

Second, because mental disorders may have an early onset54 and low age-specific mortality, SSDI beneficiaries with those diagnoses are likely to experience relatively long durations on the program.55 The proportion of disabled workers who died in 1983 was 4.9%; 2.9% died in 2017.56 Although it is conceivable that medical progress has reduced mortality for a wide range of conditions, researchers claim that it seems likely that a portion of the decline in mortality rates among SSDI recipients is the result of a change in the composition of the beneficiary population.57

Third, incidence rates at younger ages have increased relative to rates at older ages. Table 1 shows that the difference between the incidence rates of disabled workers below and above age 50 became smaller over time. One possible explanation is that young disabled workers are more likely to be on the rolls due to mental disorders, which tend to have an early onset.58 Some statistical results show that successive birth cohorts have been increasingly entering SSDI at younger ages, and, combined with a declining mortality rate, the average duration of disability benefit receipts has lengthened.59 These phenomena are likely to result in a further increase in SSDI rolls and program spending.

Changes in Program Integrity Workloads

Continuing disability reviews (CDRs) are periodic reviews conducted by SSA to determine whether SSDI beneficiaries continue to meet the definition of disability under the Social Security Act. Disabled beneficiaries whose medical conditions are determined to no longer be disabling are generally terminated from the SSDI rolls.

Due to the high number of initial disability applications since 2003, SSA dedicated resources to processing initial applications rather than conducting CDRs. As a result, SSA has had a backlog of full medical CDRs60 since FY2002. Between 2003 and 2009, the backlog increased to about 1.5 million full medical CDRs.61 With increased program integrity funding from FY2014 to FY2018, SSA has increased the number of full medical CDRs completed, and the backlog decreased to about 64,000 cases at the end of FY2017.62 SSA completed all available CDRs, eliminating the backlog, by the end of FY2018.63 This is a possible reason that the number of disabled workers who no longer meet the medical requirement in 2017 was more than 150% higher than in 2014.64 The recovery rate (medical improvement and return to work) was 18.2 per 1,000 beneficiaries for 2017 and projected to go down to 11.0 per 1,000 beneficiaries with the elimination of the backlog.65

Changes in Allowance Rates

The total allowance rate is the proportion of SSDI claimants who are ultimately allowed benefits (excluding applicants disqualified for nonmedical reasons—that is, technical denials).66 The initial disability determination is made by the Disability Determination Services. Individuals who are dissatisfied with SSA's initial determination may request a further review, an appeals process that is generally composed of three levels: (1) reconsideration of the case by a reviewer who did not participate in the initial determination, (2) a hearing before an administrative law judge (ALJ), and (3) a request for review by the Appeals Council.67

Figure 7 shows the final outcome of disabled-worker applications from 1992 to 2016. The allowance rate at all adjudicative levels (the initial determination and the appeals process) reached a peak of 62% in 2001 and then declined steadily to 48% in 2016. Considered separately, the allowance rate for disabled-worker applicants at the initial determination level decreased from 40% to 33% between 2001 and 2016, the allowance rate at the reconsideration level declined from 13% to 9%, and the allowance rate at the hearing level or above declined from 73% to 46% during the same time period.68

|

Figure 7. Final Outcome of Disabled-Worker Applications, 1992-2016 |

|

|

Source: Social Security Administration, Annual Statistical Report on the SSDI Program, 2017, at https://www.ssa.gov/policy/docs/statcomps/di_asr/2017/sect04.html, Table 60-63. Notes: Technical denials include both nonmedical decision technical denials and medical decisions that were subsequently denied for technical (nonmedical) reasons. Because a number of applications remain pending for more recent years, the allowance rates will change over time. Cases can be pending at the initial or appeal levels and can include either medical or technical issues. |

Thus far, it is unclear what causes the decline in the total allowance rate among disabled-worker applications. Some researchers claim that the total allowance rate is generally countercyclical: SSDI applications increase when the unemployment rate rises but the allowance rate generally falls after one to two years of recession, likely because a larger share of the applications filed during a recession is motivated by financial hardship. Those researchers suggest that the decline in allowance rates since 2001, and particularly after 2009, is attributable to fluctuations in the unemployment rate.69 Some others believe that the persistent low total allowance rates would indicate a "regime shift" in the SSDI determination process, and they also show that more recent cohorts of ALJs at the hearing level have lower allowance rates than did earlier ALJ cohorts with the same level of experience.70

Explaining the Recent Decline in SSDI Enrollment

The number of SSDI beneficiaries has experienced large growth in the past 30 years, but the trend was reversed starting in 2014. The decline in SSDI rolls was driven by two forces: the decrease in new disability awards since 2011 and the continuous increase in the termination of disability benefits. Based on the previous discussion, this section summarizes the possible causes of the recent decline in SSDI enrollment.

The Decrease in New Disability Awards

Since 2010, new awards to disabled workers have decreased every year, dropping from 1 million to 762,100 in 2017. Although there has been no definitive cause identified, four factors may explain some of the decline in disability awards.

- 1. Availability of jobs. The unemployment rate was as high as 9.6% in 2010 and then gradually decreased every year to about 4.35% in 2017. The opportunities for employment make working more attractive than disability benefits for people who could qualify for SSDI. If the unemployment rate were kept at 6.02%—the average level between 1985 and 2017—the age-sex-adjusted incidence rate would have been 3.5% (0.35 per 1,000 disability-exposed population) higher in 2016. Thus about 50,000 more disabled-worker benefits would have been awarded in that year.71

- 2. Aging of lower-birth-rate cohorts. The lower-birth-rate cohorts (people born after 1964) started to enter peak disability-claiming years (usually considered ages 50 to FRA) in 2015, replacing the larger baby boom population. This transition would likely reduce the size of the insured population who are ages 50 and above, as well as the number of disability applications. As the baby boomers reached age 50 between 1996 and 2014, the growth rate of the insured population ages 50 to FRA has been consistently around 5% from 1997 to 2008. The growth rate started to decrease in 2009, dropped down below 1% in 2014, and became negative (no growth) in 2018.72

- 3. Availability of the Affordable Care Act (ACA). The ACA expanded health insurance opportunities beginning in 2014. The availability of health insurance under the ACA may lower the incentive to use SSDI as a means of access to Medicare, thus reducing the number of disability applications. The nationwide effect of the ACA on disability benefit receipt is still unclear.

- 4. Decline in the allowance rate. The total allowance rate at all adjudicative levels declined from 62% in 2001 to 48% in 2016. While this decline may in part reflect the impact of the Great Recession (since SSDI allowance rates typically fall during an economic downturn),73 the Social Security Advisory Board Technical Panel suspects that the declining initial allowance rate may be a result of the change in the SSDI adjudication process.74

In addition to the factors contributing to a decline in SSDI applications and awards, some others may have the opposite effect of pushing disability benefit receipt upward. Some of those factors may include the increase in the FRA, the growth in applications from low-wage workers, and higher incidence rates among young applicants resulting from an expansion of SSDI eligibility rules. But the effect of those factors was smaller than the ones that decreased new SSDI awards between 2011 and 2017.

The Increase in Disability Terminations

The number of benefit terminations among disabled workers has been increasing from 2001 to 2017 (see Figure 2), and the share of total disabled-worker beneficiaries who terminated benefits also increased from 8% to almost 10%. The following factors are likely to contribute to the increase in disability terminations.

- Baby boomers reached FRA. As the relatively large baby boomer population reaches its FRA (gradually increased from 65 to 66) between 2012 and 2031, there is expected to be a growing proportion of disabled workers who terminate disability benefits due to the attainment of FRA. As shown in the previous section, the proportion of terminations that were due to attainment of FRA was about 50% before 2012, but the ratio gradually increased to nearly 60% in 2017. The potential increase in the number of terminations may slow down due to the scheduled increase in the FRA from 66 to 67 between 2020 and 2027, which will result in fewer disabled workers exiting the SSDI program due to the attainment of FRA.

- Efforts in CDRs. With increased program integrity funding in recent years, SSA has increased the number of full medical CDRs completed, and the backlog was reduced to about 64,000 cases at the end of FY2017. Between 2013 and 2017, about 147,000 benefits were terminated after CDRs.75 The effect of CDRs on SSDI terminations will become relatively smaller, as the SSA eliminated the backlog by the end of FY2018.

- Availability of the ACA. The prevalence of the ACA after 2014 is likely to cause some SSDI recipients to return to work for two reasons. First, the ACA may reduce beneficiary reliance on SSDI as a path to Medicare access. Second, the ACA may improve the health conditions of disabled-worker beneficiaries. The actual magnitude of the effect awaits further analysis.

Some factors may work in the opposite direction to decrease disability terminations. Examples include the scheduled further increase in FRA from 66 to 67 and the declining mortality rate among disabled-worker beneficiaries.76

Author Contact Information

Footnotes

| 1. |

For more information, see CRS In Focus IF10506, Social Security Disability Insurance (SSDI). |

| 2. |

To achieve insured status, individuals must have worked in jobs covered by Social Security for about 10 years and for at least 5 of the 10 years immediately prior to the onset of disability. However, younger workers may qualify with less work experience based on their age. |

| 3. |

Benefits were also paid to 1.7 million dependents of disabled workers in December 2017. Social Security Administration, Annual Statistical Supplement 2018, Table 5.D3, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/5d.html#table5.d3. |

| 4. |

To meet the statutory test of disability, insured workers must be unable to engage in any substantial gainful activity (SGA) due to any medically determinable physical or mental impairment that is expected to last for at least one year or result in death. The Social Security Administration (SSA) uses a monetary threshold to determine whether an individual's work activity constitutes SGA, which is adjusted annually for earnings growth. In 2018, the SGA earnings limit for most workers is $1,180 per month. |

| 5. |

The FRA increases gradually from 65 to 67 for workers born in 1938 or later. Under the scheduled increases enacted in 1983 (P.L. 98-21), the FRA increases to 65 and two months for workers born in 1938. The FRA continues to increase by two months every birth year until it reaches 66 for workers born in 1943-1954. Starting with workers born in 1955, the FRA increases again in two-month increments until it reaches 67 for workers born in 1960 or later. |

| 6. |

At FRA, SSDI beneficiaries are transferred from the Disability Insurance (DI) program to the Old-Age and Survivors Insurance (OASI) program. |

| 7. |

CRS calculation based on SSA, Annual Statistical Supplement 2018, Table 4.C2, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/4c.html#table4.c2. |

| 8. |

The economic recession between December 2007 and June 2009 may also contribute to the slower growth in the insured population after 2007. |

| 9. |

Jeffrey B. Liebman, "Understanding the Increase in Disability Insurance Benefit Receipt in the United States," Journal of Economic Perspectives, vol. 29, no. 2 (2015), pp. 123-149; see also Congressional Budget Office (CBO), Social Security Disability Insurance: Participation and Spending, June 2016, https://www.cbo.gov/publication/51443 (hereinafter "CBO SSDI Report 2016"). |

| 10. |

Testimony of Virginia P. Reno, "Securing the Future of the Social Security Disability Program," House Committee on Ways and Means, Subcommittee on Social Security, December 2, 2011, https://waysandmeans.house.gov/UploadedFiles/Reno_Testimonyss122.pdf; and CBO SSDI Report 2016. |

| 11. |

Report to the Social Security Advisory Board, "2015 Technical Panel on Assumptions and Methods," September 2015, http://www.polsim.com/SSAB-TP15.pdf#page=37. |

| 12. |

CRS calculation using Bureau of Labor Statistics, "Women in the Labor Force: A Databook," April 2017, Table 2, and SSA, Annual Statistical Supplement 2018, Table 6.C2. |

| 13. |

CRS calculation using SSA, Annual Statistical Supplement 2018, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/. |

| 14. |

CBO SSDI Report 2016. |

| 15. |

In December 2017, 76% of disabled workers were between age 50 and FRA. CRS calculation using SSA, Annual Statistical Supplement 2018, Table 5.D4, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/4c.html#table4.d4. |

| 16. |

Reno, "Securing the Future of the Social Security Disability Program." |

| 17. |

CBO SSDI Report 2016 and Social Security Board of Trustees, 2018, The 2018 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, https://www.ssa.gov/OACT/TR/2018/index.html (hereinafter "Social Security Trustees Report 2018"). |

| 18. |

SSA, Annual Statistical Report on the Social Security Disability Insurance Program 2016, released October 2017, Table 39, https://www.ssa.gov/policy/docs/statcomps/di_asr/2016/sect03c.html#table39. |

| 19. |

CRS calculation using Annual Statistical Supplements (2001-2018) from SSA. |

| 20. |

SSA, Annual Statistical Supplement 2018, Table 6.C2, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/6c.html#table6.c2. |

| 21. |

The proportion of disabled workers who terminated benefits due to medical improvement and returning to work remained slightly above 10% during 2000 to 2006, dropped down below 10% between 2007 and 2014, and then went up above 10% after 2015. See Annual Statistical Supplements (2001-2018) from SSA. |

| 22. |

Social Security Trustees Report 2018, p. 133. |

| 23. |

The predictions use coefficients obtained from regressing the annual incidence rate on the contemporaneous unemployment rate and a one-year lag in the unemployment rate using a methodology similar to that from Liebman, "Understanding the Increase in Disability Insurance Benefit Receipt in the United States." The method is also similar to that of the Social Security Technical Advisory Panel, Technical Panel on Assumptions and Methods, 2011, https://www.ssab.gov/Details-Page/ArticleID/216/2011-Technical-Panel-on-Assumptions-and-Methods-A-Report-to-the-Board-September-2011. |

| 24. |

SSA, Annual Statistical Supplement 2018, Table 6.C2, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/6c.html#table6.c2. |

| 25. |

SSA, Annual Statistical Report on the SSDI Program 2016, Table 4, https://www.ssa.gov/policy/docs/statcomps/di_asr/2016/sect01b.html#table4. |

| 26. |

See CRS Report R44670, The Social Security Retirement Age. |

| 27. |

SSDI benefits are based on the highest earnings in the applicable computation period (up to five of the lowest-earning years can be dropped), while full retirement benefits are based on highest 35 years of covered earnings. See CRS Report R44948, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI): Eligibility, Benefits, and Financing, and CRS Report R43542, How Social Security Benefits Are Computed: In Brief. |

| 28. |

See Norma B. Coe and Kelly Haverstick, "Measuring the Spillover to Disability Insurance Due to the Rise in the Full Retirement Age," Center for Retirement Research at Boston College, December 2010, pp. 9-14, http://crr.bc.edu/working-papers/measuring-the-spillover-to-disability-insurance-due-to-the-rise-in-the-full-retirement-age/. In addition, see Mark Duggan et al., "Aching to Retire? The Rise in the Full Retirement Age and its Impact on the Disability Rolls," National Bureau of Economic Research, Working Paper 11811, December 2005, http://www.nber.org/papers/w11811. Using aggregate data, Duggan et al. found that the 1983 amendments increased SSDI enrollment by 0.58 percentage points for men (ages 45-64) and 0.89 percentage points for women (ages 45-64) between 1983 and 2005. Using disaggregate data, Coe and Haverstick found that a one percentage point decrease in the ratio of retirement to disability benefits resulted in a 0.28 percentage point increase in the two-year SSDI application rate for individuals born between 1938 and 1943. However, the researchers found no evidence that the increase in the FRA resulted in a rise in the incidence of SSDI receipt among individuals ages 55-FRA born between 1938 and 1941. (The 1942 and 1943 cohorts had not reached FRA.) |

| 29. |

Statement of Stephen C. Goss, Chief Actuary, SSA, before the House Committee on Ways and Means, Subcommittee on Social Security, March 14, 2013, https://www.ssa.gov/legislation/testimony_031413a.html; David Pattison and Hilary Waldron, "Growth in New Disabled-Worker Entitlements, 1970-2008," Social Security Bulletin, vol. 73, no. 4 (2013), https://www.ssa.gov/policy/docs/ssb/v73n4/v73n4p25.html; Kathy A. Ruffing, "How Much of the Growth in Disability Insurance Stems From Demographic Changes?," Center on Budget and Policy Priorities, 2014, https://www.cbpp.org/sites/default/files/atoms/files/1-27-14ss.pdf; and Mary C. Daly et al., "The Future of Social Security Disability Insurance," Economic Letter, Federal Reserve Bank of San Francisco, 2013, https://www.frbsf.org/economic-research/publications/economic-letter/2013/june/future-social-security-disability-insurance-ssdi/. |

| 30. |

David H. Autor and Mark G. Duggan, "The Rise in the Disability Rolls and the Decline in Unemployment," Quarterly Journal of Economics, vol. 118, no. 1 (2003), pp. 157-206. |

| 31. |

CBO SSDI Report 2016. |

| 32. |

Norma B. Coe and Matthew S. Rutledge, "How Does the Composition of Disability Insurance Applicants Change Across Business Cycles?," Center for Retirement Research at Boston College, Working Paper 2013-5, 2013; and Stephan Lindner and Clark Burdick, "Characteristics and Employment of Applicants for Social Security Disability Insurance over the Business Cycle," Center for Retirement Research at Boston College, Working Paper 2013-11, 2013. |

| 33. |

Stephen C. Goss et al., "Disabled Worker Allowance Rates: Variation Under Changing Economic Conditions," SSA, Office of the Chief Actuary, August 2013, https://www.ssa.gov/oact/NOTES/pdf_notes/note153.pdf. |

| 34. |

Till von Wachter et al., "Trends in Employment and Earnings of Allowed and Rejected Applicants to the Social Security Disability Insurance Program," American Economic Review, vol. 101, no. 7 (2011), pp. 3308-3329. |

| 35. |

CBO SSDI Report 2016. |

| 36. |

See CRS Report R45090, Real Wage Trends, 1979 to 2017. |

| 37. |

See CRS Report RS22195, Social Security Disability Insurance (SSDI) and Medicare: The 24-Month Waiting Period for SSDI Beneficiaries Under Age 65. |

| 38. |

Alice R. Levy et al., "The Potential Employment Impact of Health Reform on Working-Age Adults with Disabilities," Journal of Disability Policy Studies, vol. 24, no. 2 (2013), pp. 102-112. The study argues that employer-sponsored health insurance may not be available to many people with disabilities who work in low-skill or part-time employment. In addition, private health insurance plans are less likely to offer comprehensive benefit packages for people with disabilities, and the premiums are likely to be high for persons with disabilities. |

| 39. |

Marcus Dillender, "The Potential Effects of Affordable Care Act on Disability Insurance and Workers' Compensation," in The Economics of Health, pp. 81-102, https://research.upjohn.org/up_press/238/. |

| 40. |

Jonathan Gruber and Jeffrey Kubik, "Health Insurance Coverage and the Disability Insurance Application Decision," National Bureau of Economic Research, Working Paper No. 9148, 2002. |

| 41. |

Dillender, "The Potential Effects of Affordable Care Act on Disability Insurance and Workers' Compensation." |

| 42. |

Nicole Maestas et al., "Effects of Health Care Reform on Disability Insurance Claiming," RAND Corporation, RB-9769, 2014, https://www.rand.org/pubs/research_briefs/RB9769.html. |

| 43. |

Norma Coe and Kalman Rupp, "Does Access to Health Insurance Influence Work Effort among Disability Cash Benefit Recipients?," Center for Retirement Research at Boston College, Working Paper 2013-10, 2013. |

| 44. |

Charles J. Courtemanche and Daniela Zapata, "Does Universal Coverage Improve Health? The Massachusetts Experience," Journal of Policy Analysis and Management, vol. 33, no. 1 (2014), pp. 36-69. |

| 45. |

Robert R. Weathers II and Michelle Stegman, "The Effect of Expanding Access to Health Insurance on the Health and Mortality of Social Security Disability Insurance Beneficiaries," Journal of Health Economics, vol. 31, no. 6 (2012), pp. 863-875; and Charles Michalopoulos et al., "The Effects of Health Care Benefits on Health Care Use and Health: A Randomized Trial for Disability Insurance Beneficiaries," Medical Care, vol. 50, no. 9 (2012), pp. 764-771. |

| 46. |

David H. Autor and Mark G. Duggan, "The Growth in Social Security Disability Rolls: A Fiscal Crisis Unfolding," Journal of Economics Perspectives, vol. 20, no. 3 (2006), pp. 71-96, http://dx.doi.org/10.1257/jep.20.3.71. |

| 47. |

CBO SSDI Report 2016. |

| 48. |

Liebman, "Understanding the Increase in Disability Insurance Benefit Receipt in the United States"; and Wachter et al., "Trends in Employment and Earnings of Allowed and Rejected Applicants to the Social Security Disability Insurance Program." |

| 49. |

Liebman, "Understanding the Increase in Disability Insurance Benefit Receipt in the United States." |

| 50. |

Liebman, "Understanding the Increase in Disability Insurance Benefit Receipt in the United States." |

| 51. |

Social Security Administration, Annual Statistical Report on the Social Security Disability Insurance Program, 2016, October 2017, Table 40, at https://www.ssa.gov/policy/docs/statcomps/di_asr/2016/sect03c.html#table40. |

| 52. | |

| 53. |

Autor and Duggan, "The Growth in Social Security Disability Rolls." |

| 54. |

Ronald C. Kessler et al., "Age of Onset of Mental Disorders: A Review of Recent Literature," Curr Opin Psychiatry, vol. 20, no. 4 (2007), pp. 359-364. The study shows that roughly half of all lifetime mental disorders in most studies start by the mid-teens and three-fourths by the mid-20s. |

| 55. |

Autor and Duggan, "The Growth in Social Security Disability Rolls." |

| 56. |

CRS calculation using Annual Statistical Supplements (1983-2005) from SSA. |

| 57. |

Liebman, "Understanding the Increase in Disability Insurance Benefit Receipt in the United States." |

| 58. |

Testimony of Stephen C. Goss, Chief Actuary, SSA, "The Foreseen Trend in the Cost of Disability Insurance Benefits," July 24, 2014, https://www.ssa.gov/legislation/testimony_072414a.html. |

| 59. |

Yonatan Ben-Shalom et al., "Trends in SSDI Benefit Receipt: Are More Recent Birth Cohorts Entering Sooner and Receiving Benefits Longer?," Mathematica Policy Research, Working Paper 55, February 2018. |

| 60. |

SSA considers the cases for which it does not conduct a timely (three-year) periodic CDR as backlogged until the CDR for those cases can be initiated. |

| 61. |

SSA, Office of the Inspector General, The Social Security Administration's Completion of Program Integrity Workloads, p. 8, http://go.us.gov/cQpz9. |

| 62. |

SSA, Office of the Inspector General, Fiscal Year 2017 Inspector General Statement on the Social Security Administration's Major Management and Performance Challenges, https://www.ssa.gov/finance/2017/OIG%202017%20Mgmt%20Challenges.pdf. |

| 63. |

Social Security News, "We Can't Answer Our Phones but We're Up to Date in Cutting People Off Benefits," August 22, 2018, https://socsecnews.blogspot.com/2018/08/we-cant-answer-our-phones-but-were-up.html. |

| 64. |

CRS calculation using Annual Statistical Supplement (2015-2018) from SSA, Table 6.F2. |

| 65. |

Social Security Trustees Report 2018, p. 135. |

| 66. |

Nonmedical factors in disability insurance decisions may include insured status, the SGA test, and the claimant's relationship to certain family members. |

| 67. |

20 C.F.R. §§404.900, 416.1400. |

| 68. |

The allowance rate at each adjudicative level is defined as the proportion SSDI claimants at each level who are allowed benefits, excluding applicants disqualified for nonmedical reasons. Because a number of applications remain pending for more recent years, the allowance rates will change over time. Cases can be pending at the initial or appeal levels and can include either medical or technical issues. |

| 69. |

Goss et al., "Disabled Worker Allowance Rates." |

| 70. |

Report to the Social Security Advisory Board, "2015 Technical Panel on Assumptions and Methods," pp. 37-40. |

| 71. |

CRS calculation based on predicated incidence rates in Figure 5 and the numbers of the insured population and SSDI beneficiaries from SSA 2018 Annual Statistical Supplement. |

| 72. |

CRS calculation using SSA 2018 Annual Statistical Supplement, Table 4.C2, https://www.ssa.gov/policy/docs/statcomps/supplement/2018/4c.html#table4.c2. |

| 73. |

Kalman Rupp, "Factors Affecting Initial Disability Allowance Rates for the Disability Insurance and Supplemental Security Income Program: The Role of the Demographic and Diagnostic Composition of Applicants and Local Labor Market Conditions," Social Security Bulletin, vol. 72, no. 4 (2012). |

| 74. |

Report to the Social Security Advisory Board, "2015 Technical Panel on Assumptions and Methods," p. 37. |

| 75. |

SSA Data for Periodic Continuing Disability Reviews Cases Processed and Backlog, https://www.ssa.gov/open/data/Periodic-Continuing-Disability-Reviews.html. |

| 76. |

In the Social Security Trustees Report 2018, the Office of the Chief Actuary at SSA estimates that the death rates among disabled beneficiaries will continue to decline through 2095. |